NURTURING THE BUSINESS AND STARTUP ECOSYSTEM NEIL PETCH / GEORGE HOJEIGE / GEOFF RAPP News, Reviews and Analysis. May - June Issue 2021 News, Reviews and Analysis. February Issue 2024 Elevating Achievements: The 2024 Aviation Achievement Awards Over 6.6 million subscribe to Unemployment Insurance Scheme 81% of UAE Residents Advocate for Major Lifestyle Shifts for Climate Action, Reveals Human8 Report More than 4 out of 5 UAE residents surveyed in the report shared concerns about the state of our planet for future generations. 6 32 20

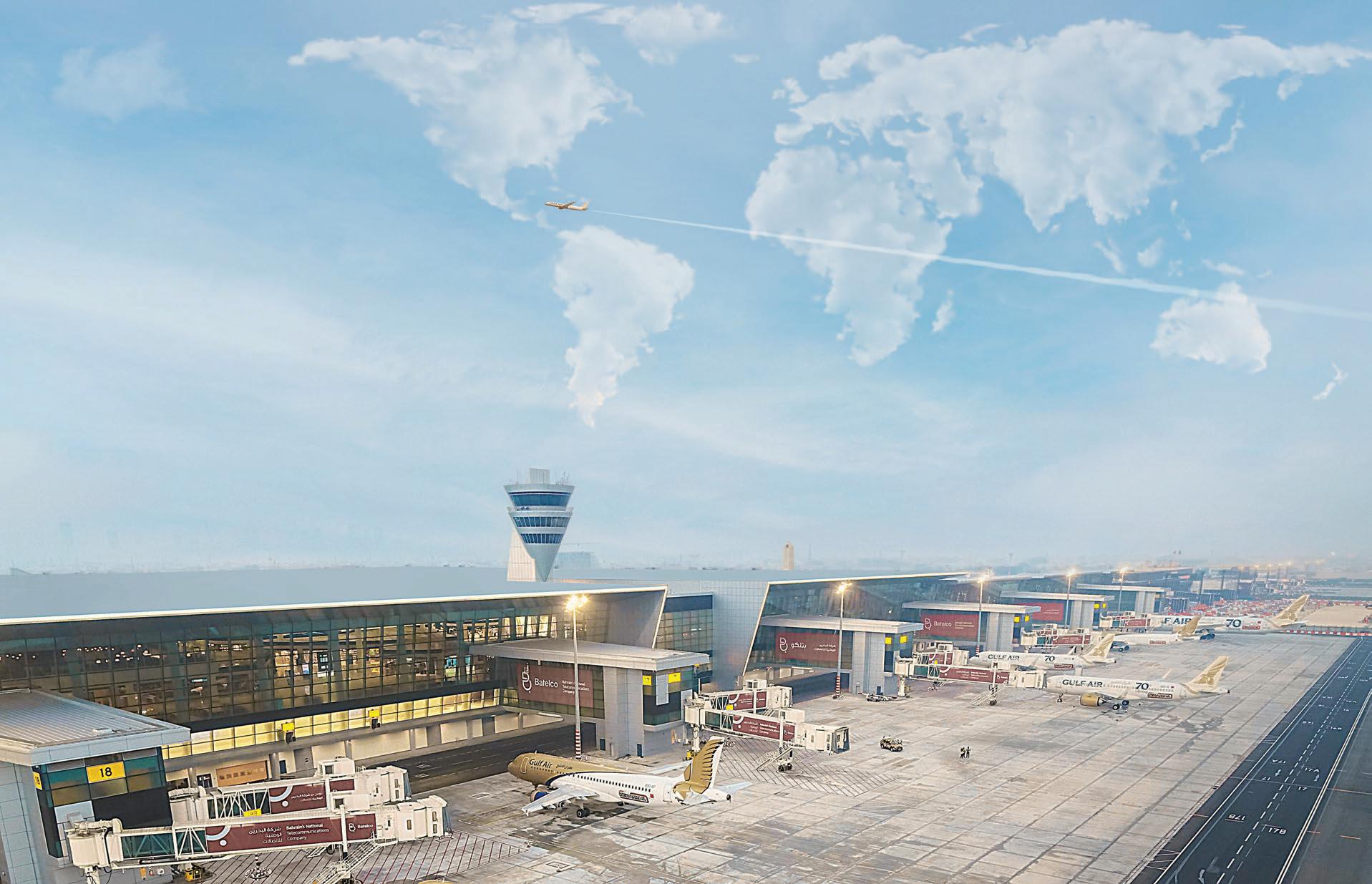

WORLD-CLASS EXPERIENCES FOR THE ENTIRE WORLD TAKES FLIGHT IN BAHRAIN

A state-of-the-art hub for the region and the globe, BIA is a world-class boutique airport that’s designed to create innovative and technology-driven experiences. Visit us as we take off to great new heights.

bahrainairport.bh

Introduction

The editorial staff of MEA Business are committed to reporting the as highlighting the business opportunities that already exist in the two regions.

We also want to provide a platform for business leaders to share ideas, engage in constructive debates and form strategic partnerships. Our ultimate aim is to equip business leaders and professionals with the practical and tactical skills to thrive in the Middle East and Africa. With an emphasis on positive news stories, case studies and inspirational interviews, MEA business will inspire readers towards personal development and overall business success.

The magazine is arranged to provide clear and concise informative sections including news sections on the Middle East and Africa, CEO interviews and market updates. The magazine and news service we offer are available on a variety of platforms, these include our printed magazine, e-magazine, website and social media. Furthermore, we include augmented reality elements in some of our features to provide our readers with unparalleled coverage on the latest developments.

MA Business also publishes several sector specials throughout the year. These special issues are produced to coincide with important industry exhibitions and events. This month's issue is an Aviation Awards special. I hope you will also join me in congratulating all the winners.

Kenneth Mitchen Publisher, MEA Business

Kenneth Mitchen Publisher, MEA Business

CONTENTS

SUSTAINABILITY

06 81% of UAE Residents Advocate for Major Lifestyle Shifts for Climate Action, Reveals

The World of Talent Acquisition in 2023 and What’s in Store for 2024

What We All Can Learn About Leadership from HRH Sheikh Zayed bin Sultan Al Nahyan.

Prioritising Skills for Digital Transformation in

The Future of Talent Acquisition – How to Capitalize on The Changing Landscape.

HR EMPLOYEE BENEFIT

Employee Benefits Critical for Talent

MEA Business

WEB: www.mea-biz.com

www.mea-hr.com

EMAIL: info@cme-media.com

PUBLISHED BY: Creative Middle East Media FZ LLE, 19th Floor, Creative Tower, Fujairah Creative City, PO Box 4422, Fujairah, UAE

EXECUTIVE DIRECTOR AND PUBLISHER : Kenneth Mitchen

Email: ken.mitchen@mea-finance.com

18

Approaching the Event Horizon

During an evening with Chairman of Valhalla the Father of Quantitative Easing Oscar Wendel misunderstandings about the nature of CBDCs could lead to their centralising the banking system to an economic point of no

Retention in Evolving Middle East Workforce – Zurich Survey Reports HR NEWS - LEGAL 20 Over 6.6 million subscribe to Unemployment Insurance Scheme HR NEWS - DIVERSITY & INCLUSION 22 UAE Prioritises Gender Balance Commitment to Fulfilling National Aspirations HR NEWS - COMPENSATION & BENEFITS 23 How to Calculate your End-ofService Gratuity GLOBAL OUTLOOK 24 Heads or Tails CYBERSECURITY 28 Covering all Bases LEADERSHIP SERIES 32 Taxing Times DIGITAL BANKING TRENDS 34 Coming Soon OPINION PIECE 36 Approaching the Event Horizon AVIATION AWARDS 38 Elevating Achievements: The 2024 Aviation Achievement Awards 38 32 Banking and Finance news in the MEA market

OPINION PIECE 36 22

81% of UAE Residents Advocate for Major Lifestyle Shifts for Climate Action, Reveals Human8 Report

More than 4 out of 5 UAE residents surveyed in the report shared concerns about the state of our planet for future generations.

Drastic consumption changes required to ensure positive climate action, 81%

81% of people in the UAE say we owe it to future generations to make drastic changes to the way we are living, as reported by the What Matters 2024 report from Human8, the human-centric and insight-driven consultancy. The report was created in collaboration with Space Doctors, its strategic cultural and creative specialist team.

Drawing on qualitative conversations from a global insight community across 10 markets and a quantification with more than 13,000 consumers across 17 markets, the 2024 edition of the What Matters report provides a cultural framework of positive transformation that lays out four dimensions critical to driving positive change. It also suggests eight codes for transformation, which provide meaningful paths to adopting a regenerative mindset and identifying powerful, systemic solutions that will not just benefit humanity, but the global economy as well.

More than 4 out of 5 UAE residents surveyed in the report shared concerns about the state of our

The Sustainable City

planet for future generations, and over 80% agreed that the time has come to transition from “preventing further damage” to “reversing damage already done”, 88% feel brands must take responsibility in helping to safeguard the future of the people and planet as they can’t make the world a better place on their own.

Gareth Lewis, Co-Managing Director at Space Doctors, says: “The results of the report reveal that we need to take a clear stance for change. We need proactive action that goes beyond narratives of protecting the

planet and sustaining the status quo of causing less harm into actively encouraging regeneration, restoration, and reimagining everything.”

The study also showcases how only 20% of UAE residents are confident that they live a sustainable lifestyle, although this is much higher than their peers in other EMEA markets such as France (7%), Germany (10%), South Africa (16%) and the UK (7%).

Tom De Ruyck, Partner & Chief Growth Officer, Human8, says: “UAE residents have recognized that moving away from a consumption-

Business News for the MEA region 06 MEABUSINESS Sustainability

More than 80% of those surveyed also subscribed to the notion that a single, focused action can release a wave of change

driven lifestyle is essential to safeguarding and restoring the planet. This echoes the historic UAE Consensus agreement signed by 198 nations, which aligns on a move away from fossil fuels, a new target to triple renewables and double energy efficiency by 2030, and a decision to build momentum towards new architecture for climate finance.”

Strengthening climate-positive initiatives through inclusivity and collaboration – another key decision taken at COP28 – was also echoed by UAE residents in the Human8 report. Almost 6 in every 10 people surveyed in the UAE said that would like to see more diversity and inclusion. More than 20% of people stated that they translate this belief by consciously buying from inclusive brands.

UAE residents surveyed also voiced that they would move to adopt more sustainable lifestyles if such options

were more easily available or if these alternative options offered the same quality; and if the positive impacts of such choices were made clear, thus, placing the onus back on brands to do so.

The report also turns the spotlight to a “say-do gap”, highlighting the difference between how people associate with climate-related problems and how they actually act on it. As an example, the Human8 report points to the traditional coral reefs once popular among those living in the UAE. The nation has already begun taking positive steps in this regard. The Environment Agency Abu Dhabi, or EAD, has been rehabilitating and restoring corals since 2021, when reefs off the UAE’s coast faced their second bleaching event in just five years. According to the EAD, more than 90 per cent of the gorgeous coral reefs in Abu Dhabi and Dubai were lost in the severe coral bleaching events reported in 1996 and 1998.

Referencing the UAE National Pavilion’s ‘coral house’ wetland exhibit at the Venice Biennale of Architecture in 2021, the report delved into how the UAE is innovating implementable solutions to save the environment. The ground-breaking cement presented at the pavilion was offered as an alternative to construction companies. Made from brine extracted during industrial desalination, this cement has the strength and durability to be used in modern architecture in standard brick shape. Simultaneously, this solution reduces the amount of brine runoff from re-entering the Persian Gulf, thus protecting the UAE’s coral reefs.

The report concludes that sustainability remains high on the

agenda, with 45% of UAE residents sharing their belief that it is not too late to reverse the damage done to global ecosystems. More than 80% of those surveyed also subscribed to the notion that a single, focused action can release a wave of change – sharing their willingness to learn and understand what concrete actions they can take to create a better future for people and the planet.

Other key report findings for the UAE include:

• Consumers look to brands for inspiration and vision to move them towards positive change: 83% believe making the world a better place isn’t something they can do on their own. It requires people, organizations and brands with a clear vision to take the lead and drive change. Moreover, 88% feel brands must take responsibility in helping to safeguard the future of the planet.

• Moving the needle on sustainability: Availability (45%), quality (42%) and clear impact of choice (41%) of/on sustainable options would help consumers adopt a more sustainable lifestyle.

• Brands need to be more transparent about sustainability efforts: Nine out of 10 people say brands need to provide more information about sustainability efforts, with 60% saying that brands that don’t communicate about sustainability aren’t sustainable.

To access the full 2024 What Matters report that includes worldwide data and examples, visit www. wearehuman8.com/reports/whatmatters-report-2024/.

mea-biz.com 07

Milind Trivedi

Tell us about you, your experience, and your time in the Middle East.

I moved to Dubai from Mumbai in May 2004 and still remember being welcomed with the scorching heat and humidity of summer. With a job in hand, I landed to take advantage of the opportunities in the bustling city of Dubai, and 19 years on I am still learning and enjoying life. I haven’t looked back since then.

There have been challenges with global economic slowdown and recently Covid-19, but knowing Dubai and the vision of UAE’s leadership you can rest assure the region will thrive. There have also been challenges with cultural changes to deal with when you relocate, but once you adapt, Dubai is the place to be. I am here with my family, and we make the most of the outdoors and spend most weekends either trekking, camping, beach clean-ups, and exploring neighbouring regions. Except for the humidity, this place is awesome, it’s where we learnt tolerance, to embrace cultural similarities, differences and inclusiveness.

How would you describe the culture of your business?

The culture of our business, guided by Ramco’s core values, is defined by a strong commitment to putting the customer first. We prioritize understanding and addressing the needs of our customers, ensuring their satisfaction and success. Simultaneously, we maintain an employee-centric approach, recognizing that our team is integral to our achievements. Our culture values innovation as a driving force, encouraging creative thinking which ensures staying at the forefront of

industry advancements. We constantly strive for excellence, setting high standards in our processes and services to deliver exceptional value to our customers and stakeholders. Overall, our culture is a dynamic blend of customer focus, employee empowerment, innovation, and a relentless pursuit of excellence.

How easy is it for you to get direct access to the decision-makers in your company?

Gaining direct access to decisionmakers is generally straightforward. Decision-makers recognize the significance of compliance in payroll processes along with its impact on overall organizational performance and employee satisfaction.

What are your biggest challenges in the next 5 years?

Over the next five years, I anticipate several significant challenges. The shift towards more flexible and diverse workforce models, including remote work and gig employment, poses challenges in accurately managing various compensation structures. The integration of advanced technologies, and increasing automation brings efficiency but requires strategic implementation to ensure seamless operation and data security. Additionally, addressing the aftermath of the pandemic and managing uncertainties in a dynamic global environment, including economic fluctuations and potential regulatory changes, presents an added layer of complexity. Balancing these considerations while meeting employee expectations for real-time and personalized payroll experiences will be crucial in shaping payroll strategy for the future.

What are the skills and competencies that you would need to train in order to meet the region’s talent requirements?

Training programmes must prioritize essential skills such as local compliance, language proficiency, and adaptability to regulations. Additionally, there must be a strong focus on digital literacy, specifically in AI-based technology solutions. Equipping the workforce with knowledge and proficiency in leveraging advanced payroll software, data analytics tools, and emerging AI technologies should be emphasized. With a commitment to cross-border payroll, client-centric approaches, data security, and a global payroll perspective, these initiatives aim to fortify the payroll team to effectively navigate the evolving challenges in the Middle Eastern payroll landscape.

Milind Trevedi, Director of Sales, Ramco, Dubai, shares his experiences of his move from Mumbai to Dubai

Business News for the MEA region 08 MEABUSINESS Spotlight

Milind Trivedi, Sales Director, Ramco, Dubai

We are reducing our environmental footprint

Considering the continued growth of the aviation industry and related carbon emissions, our sector needs to become more sustainable. So as KLM, we are taking responsibility for making our business more sustainable. How? By flying on sustainable fuel, with more efficient routing, with cleaner planes and by recycling our waste.

Learn more about our journey to more sustainable aviation on klm.com/flyresponsibly

The World of Talent Acquisition in 2023 and What’s in Store for 2024.

CEO

covered in other articles.

1. Employee Experience and The Rise of the Candidate-Centric Approach: With the talent pool having shrunk, companies were still forced to prioritize employee experience at every stage of the recruitment journey, from crafting compelling Employer Value Propositions (EVPs) to offering flexible work arrangements and fostering inclusive work environments.

Big trends in 2023

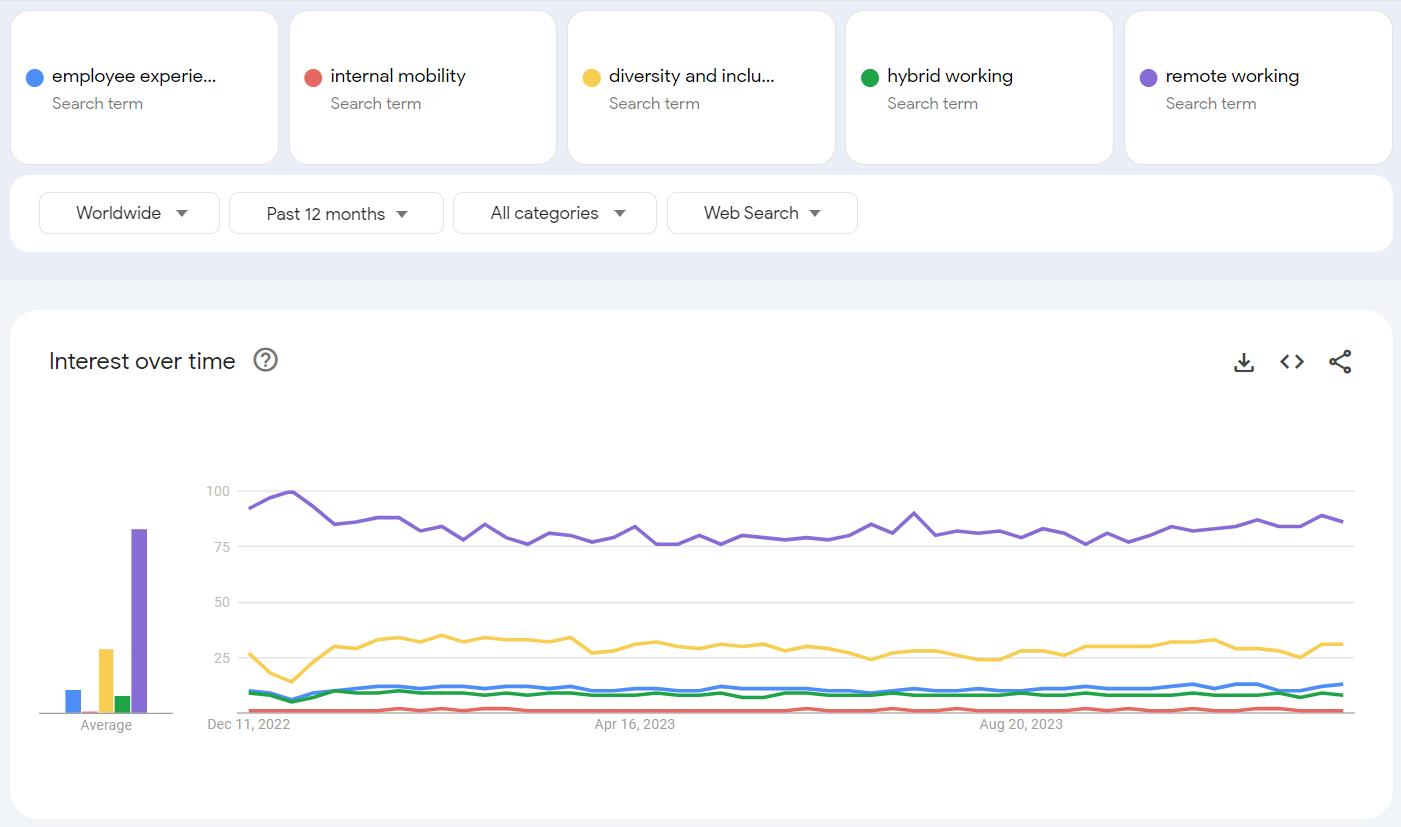

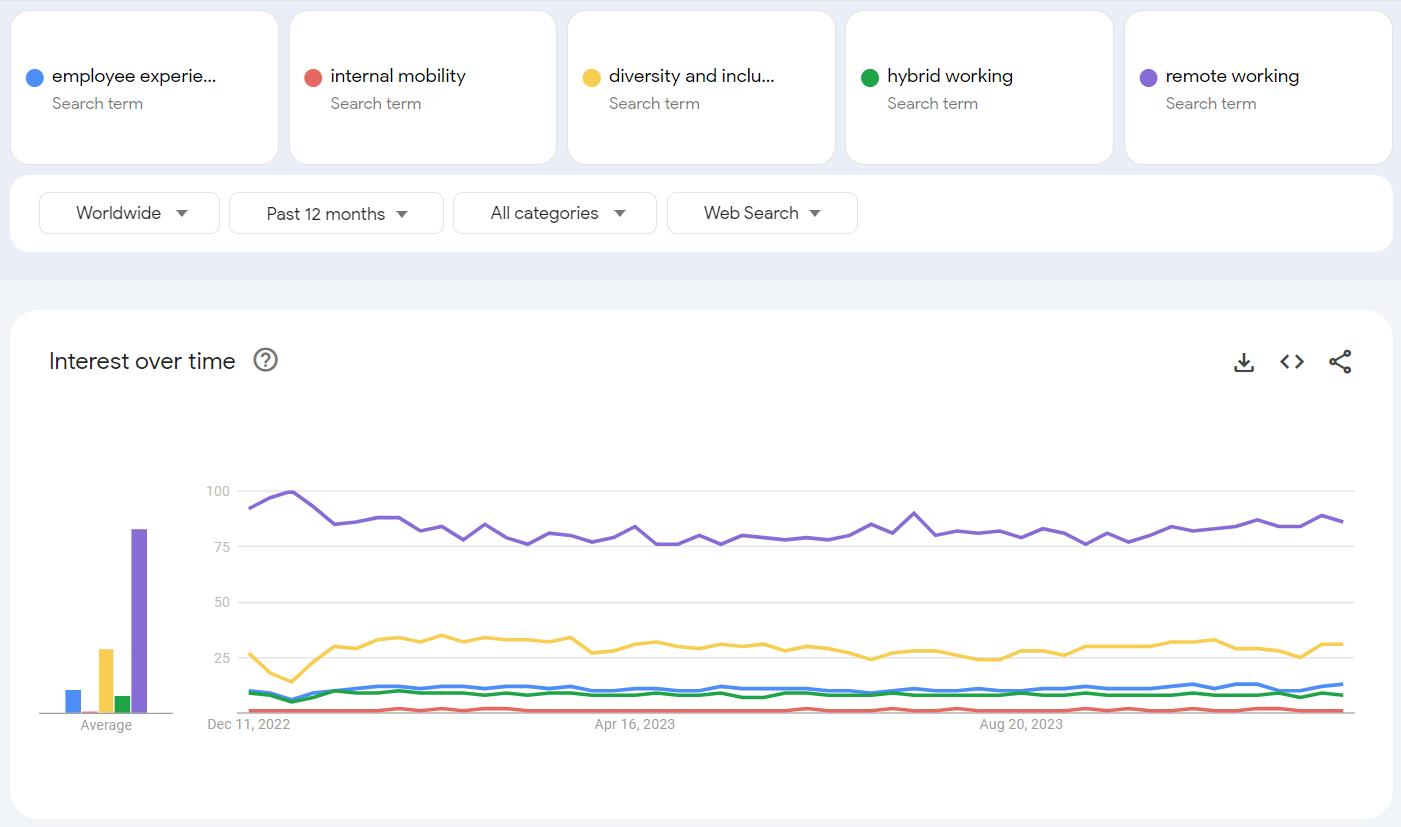

2023 was a fascinating year with the greatest trend dominating all the news being artificial intelligence and its usage in talent acquisition and sourcing. Apart from artificial intelligence, there were a number of other key trends that are worth mentioning. To understand how important each trend is, we turned to Google Trends, to understand what was being searched for online. We compared five terms that we’ll explore across different parts of this article:

Evan ShellShear, CEO, Ubidy

Evan ShellShear, CEO, Ubidy

be attributed to the holiday season in many Western countries. All search terms picked up again after December 2022.

2. Internal Mobility Increased in Importance: As talent acquisition budgets tightened, companies saw the value in developing existing talent. Internal mobility programs gained traction, with organizations investing in upskilling and reskilling initiatives to fill open positions with qualified individuals already familiar with their culture and values.

The Remote and Hybrid Work Model Maintained Importance: The COVID-19 pandemic’s lasting impact saw the rise of hybrid work models, offering employees greater flexibility and autonomy. This trend required companies to adapt their recruitment strategies to attract and retain talent across geographical boundaries.

It was interesting to note in the trends that the remote working trend ended the 2022 year on a high and slowly dropped during 2023 with hybrid working, diversity and inclusion and employee experience all dropping at the end of 2022 in December. This trend can probably

However, employee experience and diversity and inclusion both fell out of favour during the year but picked up towards the end of 2023 leading them to look significant trends for 2024.

We’ve highlighted in bold the above trend terms searched for below to show how they fit into the bigger picture. The below focuses on nonAI trends as these have been well

4. Upskilling and Reskilling for the Future of Work: The rapid pace of technological change highlighted the need for a workforce equipped with future-proof skills. Companies emphasized training and development programs to bridge the talent gap and ensure their employees remained adaptable and competitive in the evolving

Opinion Piece

1. Employee experience

2. Internal mobility

3. Diversity and inclusion

4. Hybrid working

5. Remote working

Evan ShellShear,

Ubidy, reviews 2023 for the Talent Acquisition industry and provides Predictions for 2024

Business News for the MEA region 10 MEABUSINESS

job market.

Predictions for 2024

It was interesting to note in the trends that the remote working trend ended the 2022 year on a high and slowly dropped during 2023 with hybrid working, diversity and inclusion and employee experience all dropping at the end of 2022 in December.

1. Employee Experience and Personalized Recruitment Experiences: Building on the candidate-centric trend, 2024 will see companies personalize the recruitment experience to attract and engage top talent.

2. The Continued Growth of Remote Work: While some companies may encourage a return to the office, remote work is expected to persist in many industries. This will necessitate further adaptation of recruitment processes to attract and manage talent across geographically dispersed teams.

3. Increased Focus on Diversity and Inclusion: Companies will

prioritize building diverse and inclusive workforces to foster innovation, creativity, and a stronger sense of belonging for all employees. This will require actively promoting equal opportunities for all talent segments especially addressing mature aged candidates as populations age in many countries worldwide.

Looking ahead

In 2024, the talent acquisition landscape will continue to evolve, driven by both technological advancements such as AI and changing workforce expectations. Companies that prioritize candidatecentric approach, allow remote working, and embrace diversity and inclusion will attract and retain top talent in the competitive year

mea-biz.com 11

What We All Can Learn About Leadership from HRH Sheikh Zayed bin Sultan Al Nahyan

Rohit Bassi, ROI TALKS, Dubai, takes a look at lessons on Leadership from The founding father of the UAE, Sheikh Zayed bin Sultan al Nahyan

H.R.H. Sheikh Zayed bin Sultan Al Nahyan was the founding father of the United Arab Emirates and a champion of human development, sustainability, wisdom, and respect. His vision and leadership played a critical role in transforming the UAE from a desert landscape to a modern, prosperous, and diverse society. Let’s take a closer look at each of the four pillars of leadership:

Human Development: He believed that people were the most valuable resource of any nation and that investing in their education, health, and well-being was essential for achieving sustainable development. He championed universal access to quality education, healthcare, and social services, and recognized the important role of women and youth in driving social and economic progress.

Rohit Bassi, CEO, ROI Talks, Dubai

Rohit Bassi, CEO, ROI Talks, Dubai

and understanding. The country has established the Dubai International Peace Convention, which brings together religious leaders from around the world to promote peace and understanding. In addition, the UAE has launched a number of initiatives to promote cultural preservation and heritage, including the establishment of museums, art galleries, and cultural centres.

Respect: He was a strong advocate of human rights, equality, and social justice. To this end, the UAE has made significant progress in promoting human rights and equality.

According to the World Bank, the UAE has made significant progress in human development over the past few decades, achieving a literacy rate of 94.8% for both sexes, and the female literacy rate has increased from 79.2% in 1995 to 95.8% in 2019.

He was a strong supporter of women’s empowerment and recognized the important role of women in driving social and economic progress. As a result, the UAE has made significant progress in gender equality, including in areas such as education, healthcare, and political participation.

Sustainability: He recognized the importance of preserving the environment and natural resources for future generations. He was a pioneer of sustainable development and led efforts to protect the UAE’s natural heritage, including the establishment of

protected areas, wildlife reserves, and marine sanctuaries. He also promoted sustainable development practices in agriculture, energy, and infrastructure. Establishing 44 protected areas, covering around 14% of the total land area, and instigated a renewable energy goal of 50% of its energy mix from renewable sources by 2050. The UAE has made huge progress in sustainable agriculture, promoting organic farming, hydroponics, advanced irrigation systems, and improved farming practices.

Wisdom: He was known for his wisdom and foresight, and for his ability to balance tradition and modernity in the pursuit of progress. He believed that sustainable development required not only economic growth, but also social progress and cultural preservation. He emphasized the importance of dialogue, tolerance, and mutual respect among people of different cultures and faiths.

The UAE has made significant progress in promoting intercultural dialogue

His legacy is one of human development, sustainability, wisdom, and respect. His vision and leadership continue to inspire the UAE and the world to pursue a more just, equitable, and sustainable future for all.

In conclusion, his vision and leadership have had a significant impact on the development of the UAE and continue to inspire positive change around the world. The UAE has been actively working towards achieving the SDGs, and in 2020, it became the first country in the Arab world to submit its Voluntary National Review (VNR) to the United Nations, outlining its progress towards achieving the SDGs.

Sheikh Zayed bin Sultan Al Nahyan’s vision and leadership continue to inspire the UAE and the world to pursue a more just, equitable, and sustainable future for all. His focus on human development, sustainability, wisdom, and respect provides a roadmap for achieving sustainable development, and his legacy reminds us of the important role that leadership plays in driving positive change.

Business News for the MEA region 12 MEABUSINESS Opinion Piece

WWW .. AII.S.AERO i:nifo@als CHHO @)11 #ALSLogisticSolutlons

Prioritising Skills for Digital Transformation in the Middle East

Mathew Lambert, Regional Sales Director, Middle East, Salesforce, says, “It’s time to prioritise skills for digital transformation.”

The Middle East is one of the world’s fastest-growing regions for technology and digital transformation. Never has it been more important to prioritise skills for digital transformation. Increasingly business competitiveness, employee performance and satisfaction, and customer experience rely on the combination of technological advancements and skills readiness. Yet although many citizens around the world are hopeful for technological change, confidence in their capability to make the most of these opportunities over the coming years is weaker.

Digital skills are key to unlocking prosperity

Our new digital-first world revolves around everyone having the skills to participate. A global commitment to bridging widening digital skills gaps – prioritising skills for digital transformation – is fundamental to our world’s future success and prosperity.

A key part of this must include differentiating between everyday and workplace digital skills, preparing the workforce for new jobs that will emerge, and reimagining the role business can play in cultivating a culture of continual digital learning.

As public and private sector organisations look to invest in digitisation to tap these opportunities, it’s clear that there is a vital part of the equation in need of attention – skills. As most of us involved in the tech sector will attest –finding young people with the right skills to drive digitisation is not easy, as there is a shortage of IT professionals with the nuanced knowledge required to join the industry, pick up the baton, and run

with it.

According to Salesforce research, 8 in 10 global workers already use digital skills in their day-to-day work but few expand their horizons beyond collaboration technology, digital administration and project management.

Nearly a quarter (22%) of global workers rank AI skills as among the top three most important digital skills right now. This number rises when asked about the importance of these skills over the next five years.

Despite its importance to their future skill set, only 1 in 10 workers say their day-to-day role currently involves AI. A mere 14% say their role involves other, related digital skills like encryption and cyber security, and a smaller 13% claim to use coding and app development skills.

The industry indexing the highest for AI skills, specifically, is the technology industry, but even for this industry, less than a third of employees (27%) use AI skills within their roles today.

Fortunately, companies seeking to boost emerging technology skills and focus on skills-based hiring have something going for them.

Addressing the skills for digital transformation challenge, together

At Salesforce, we are optimistic that this skills for digital transformation challenge can be addressed, by actively engaging with regional stakeholders including governments and universities, fostering the skills most in demand.

We started engaging with partners in the Middle East about two years ago and we are now working with 14 universities across six countries in the region,

Mathew Lambert, Regional Sales Director, Middle East, Salesforce

Mathew Lambert, Regional Sales Director, Middle East, Salesforce

including the UAE, KSA, Jordan and Lebanon, where we provide students with training via our Trailhead platform and internships with Salesforce partners and customers, with benefits for all.

We’re proud of the early successes of the program and are excited about ramping it up by engaging more stakeholders and working with a growing number of students across the region.

With technology advancing at such a rapid pace, it’s vital that all parties involved in the sector collaborate to ensure the next generation is well prepared to drive the next wave of transformation, helping MENA governments to deliver their national strategies and bringing new levels of efficiency and innovation to help organisations thrive amid rapid change.

Now more than ever, businesses must work closely with governments and community stakeholders, to ensure that training and recruitment scale up to match digital demand, reach all aspects of society, and accelerate recovery and growth. Together, we can rethink digital transformation and life-long education, ensuring a digital-first mindset to help close digital skills gaps more efficiently

Opinion Piece

Business News for the MEA region 14 MEABUSINESS

The Future of Talent Acquisition – How to Capitalize on The Changing Landscape.

Sanjeev Tirath, Co-Founder and CEO of Pyramid Consulting, Inc. shares the challenges of Talent Acquisition post- covid and sets out his solutions.

The last few years have been testing as the massive hit of COVID-19 initiated a chain reaction of challenges across industries. Inflation reached record highs, the demandsupply balance went into turmoil, and economic headwinds made the already tight market even more unpredictable. The wrath of the Market Gods fell upon boththe employees and the employers, Safe to say, it’s tough to be a staffing leader today amidst the current market conditions!

Despite the economies exhibiting signs of improvement, the demand for staffing and workforce solutions remains weak. On top of that, labour shortage still prevails as the primary concern, and the great resignation- which has now turned to Quite Quitting - has further created huge turnovers and recruitment challenges for organizations across industries. Given the weak demand and changing expectations of the employees, what does the future of talent acquisition look like?

Here are some sneak peeks.

Sanjeev Tirath, Co-Founder and CEO of Pyramid Consulting, Inc.

Sanjeev Tirath, Co-Founder and CEO of Pyramid Consulting, Inc.

augment recruitment

AI-backed predictive analytics can help audit employee skillsets, shortlist internal candidates, fill difficult-to-fill roles, and create personalized career pathways based on goals and interest areas.

As per Gartner, HR and recruiting leaders are actively determining areas where AI can be applicable and which use cases make sense for organizations. Moreover, generative AI will make reskilling a norm. While many view it as a threat, in my opinion, it is essential for the workforce of tomorrow.

The future of talent acquisition demands honesty

1. Employee preferences and the nature of opportunities are changing

Employee preferences have changed, and they emphasize flexibility more than stability. For instance, employees of all age groups today are leaving their fulltime jobs to pursue interim or contractbased work, in order to escape the normal corporate culture.

The respective trend has not gone unnoticed as organizations plan to increase the use of contract workers in the coming years, while another significant change in view is that employees are moving around the organization but not out of the organization, helping companies develop diverse pipelines, and fill roles to meet critical needs amid stalled hiring.

2. Learning and development for retention and bridging skill gaps

Today, employees look forward to more personal and professional development opportunities as a crucial factor when working for or joining an organization. As per a report by Lorman, 70% of employees are likely to leave their current jobs to join an organization known for investing in employee development and learning, highlighting the importance of learning and development in the attraction factor.

Despite the benefits of investment in learning being key to talent acquisition and closing the skills gaps, things don’t look in their best shape today. Many organizations today are not equipped to provide the appropriate learning and development opportunities that an employee demands.

A LinkedIn Workplace report, merely 29% of employees feel “very satisfied” with the current career advancement opportunities available within their organization. Unfortunately, HR and L&D managers are unable to address the issue of development opportunities, and a change of approach is needed.

3. Increasing the applicability of AI to

Here is a fascinating insight from a survey by ResumeBuilder.com. 36% of hiring managers lie to job candidates. 75% lie during interviews, 52% lie in job descriptions, and 24% lie in the offer letter. Moreover, 40% said they did so about the role’s responsibilities, 39% about growth opportunities at the company, 38% about career development opportunities, and others lied about the company culture, benefits, and company commitment to social issues.

This culture of lying must end for the eventual betterment of the future of talent acquisition. Honesty upholds an organization’s reputation and is critical for cultivating success eventually.

Conclusion

In my opinion, change governs the future of talent acquisition today. HR leaders must treat talent acquisition as a more strategic function. They must innovate in their retention approaches and provide personal development opportunities to retain and attract top talent and up our game by harnessing the power of artificial intelligence

Opinion Piece

Business News for the MEA region 16 MEABUSINESS

Ad Get corporate tax ready from AED 249/month or get 20% off when you pay upfront UAE CORPORATE TAX LAWS APPLY TO ALL COMPANIES Outsource your tax and accounting services to FTA-approved experts and ensure your tax compliance. Dedicated accountant Corporate tax registration Accounting services Tax filings Top-quality accounting software Visit taxready.ae SCAN ME

Employee Benefits Critical for Talent Retention in Evolving Middle East Workforce – Zurich Survey Reports

One in Four employees in the UAE & KSA have navigated job transitions within the past year seeking financial wellness and career advancements

The evolving state of the work landscape in the Middle East, particularly in the United Arab Emirates (UAE), is undergoing significant changes. With one in four employees switching jobs in the past year, retaining talent is becoming a top priority for employers. New research, commissioned by Zurich International Life in the Middle East and conducted by market research company Radius Insights, highlights the vital role of employee benefits in retaining and attracting talent in a competitive market.

The research, surveyed 2,507 respondents in the UAE and KSA, of which 1,255 were employers and 1,252 employees. It aims to shed light on how central aspects of the work landscape, such as talent shortage, employee benefits and workplace culture, have evolved in the region over the past year.

opportunities. This trend is gaining momentum, with most employees expressing a strong intent to explore new job opportunities in the next 12 to 18 months.

Factors Driving Job Change

A remarkable 25% of employees in the UAE and KSA have changed jobs in the last year, drawn by better remuneration, enhanced employee benefits, and professional advancement

Flexibility, diverse workforce and addressing pay gaps, within the workplace emerge as key factors when it comes to attracting and retaining talent, from both an employer and employee perspective. With a clear call

for action and strategy to retain talent, the UAE government is also contributing with a range of initiatives to solidify its standing as a preferred destination for global talent.

Some of the notable reforms introduced, include an investmentrelated end-of-service benefit scheme for private sector employees, unemployment insurance, the adoption of a

HR Employee Benefit Survey

Business News for the MEA region 18 MEABUSINESS

Adam Watterson, Senior Executive Officer, Zurich Workplace Solutions

The immense revelation for employers in the UAE and KSA is the remarkable transformation in employee motivation, where enhanced employee benefits now surpass competitive pay as the key driver for talent attraction and retention.

condensed working week and new categories of leaves.

Talent Shortage Looms Amid Dissatisfaction with Employee Benefits

Both the UAE and KSA are grappling with a significant talent shortage, standing at approximately 24% and 30%, respectively. This shortage is most pronounced in the Operations and Logistics sectors in both countries, with new Emiratization laws for the private sector further complicate the talent acquisition landscape.

When it comes to employee benefits, there’s a clear gap between what employers offer and what employees desire. More than one-third of employees expressed dissatisfaction with their current benefits packages, especially concerning workplace savings, financial wellbeing education, life insurance, child education allowances and critical illness cover.

Understanding Employee Priorities

Employee benefits remain central to establishing long-term relationships between employers and employees, with nearly 9 out of 10 employees surveyed considering employee benefits an extremely important pillar, often surpassing the importance of salary.

The Role of Employee Benefits

The research underscores the pivotal role of employee benefits in attracting and retaining talent. An overwhelming 84% of employees surveyed stated they would willingly change jobs for a new role with the same pay but better employee benefits. Employers must thus adapt to changing needs by introducing employee benefits that address critical goals valued most by employees.

Adam Watterson, Senior

Executive Officer at Zurich Workplace Solutions, said: “Employee benefits have taken centre stage and are rapidly evolving, pushing employers to adopt a holistic approach to talent retention. One of the trending areas is workplace savings and pensions for expatriates concerned about their retirement planning. End-of-service benefits will play a pivotal role in drawing talent from international markets and fostering financial stability. The global pandemic drove both employers and employees to rethink priorities, and employers have become more accommodative to include mutually beneficial retention policies.”

The immense revelation for employers in the UAE and KSA is the remarkable transformation in employee motivation, where enhanced employee benefits now surpass competitive pay as the key driver for talent attraction and retention. Employers must proactively reassess and elevate their employee benefits packages, with a laser focus on critical aspects such as workplace savings, financial wellbeing education, life insurance, child education allowance and critical illness cover. The shift in employee priorities does not only gives employers an opportunity to position themselves as an employer of choice but also helps them build enduring mutually beneficial relationships with employees in a fiercely competitive job market.

Read more on the report, follow our website: www.Zurich.com

mea-biz.com 19

Over 6.6 million subscribe to Unemployment Insurance Scheme

The Ministry of Human Resources and Emiratisation (MoHRE) revealed the figures on Wednesday, saying, “The

rising number of subscribers reflects the success of the Scheme and the high awareness of the insured.”

The Scheme, which came into effect on 1 January 2023 ensures a social protection for workers – citizens and residents - in the federal government and private sectors, as it provides three-month compensation amounts for the insured in the case of unemployment and until they find a job.

The deadline for enrolling in the Unemployment Insurance Scheme had expired in October, and non-subscribers are required pay a AED400 fine, in accordance with Cabinet Resolution 97 for 2022 on regulations and mechanisms of the Unemployment Insurance Scheme, which also stipulates a AED200 fine facing subscribers who are not complied with paying scheduled subscription fees.

The Ministry had announced in June 2023 the postponement of imposing fines on non-subscribers from 1 July 2023 to 1 October 2023 to give more time to those included to subscribe.

“Administrative measures will be taken against those who fail to pay fines, including not granting them new work permits until fines are paid, as well as deducting the fine amount from their salaries or end-of-service gratuities,” it explained.

Unsubscribed workers can check the amount of the fines they have incurred and make payments through the MoHRE smart application, its website, or by visiting one of the authorised business service centres. Digital channels also offer the option to submit requests to allow for fines to be paid in instalment, aiming to reduce burden on customers. The Ministry accepts appeals for exemption from fines if all supporting documents are provided, and the

decisions on appeals are made within 15 working days of submission through the MoHRE official channels.

“We call on subscribers to comply with the agreed upon payment schedule and pay their insurance fees on time,” MoHRE said. “Non-payment on time results in a AED200 fine as well as the cancellation of the insurance policy.”

Employees in private sector establishments who have issued their work permits after 1 October 2023 must subscribe to the Unemployment Insurance Scheme within four months, the Ministry explained, noting that those who fail to enrol within the specified period will incur a AED400 fine.

Certain groups are exempt from registering in the Unemployment Insurance Scheme, including, investors (business owners who own and manage their establishments), domestic workers, temporary employees, juveniles under the age of 18, citizens who are eligible for retirement, and retirees who receive pension and have joined a new employer.

Subscription can be proceeded by visiting the Involuntary Loss of Employment (ILOE) Insurance Pool website (www.iloe. ae), the ILOE smartphone application, designated physical self-service kiosks, ATMs, business service centres, exchange companies (such as Al Ansari Exchange), banking applications, telecom companies’ bills, and SMS.

The Unemployment Insurance Scheme is divided into two categories: the first covering those with a basic salary of AED16,000 or below, where the insurance premium for the insured employee in this category is set at AED5

Ministry of Human Resources & Emiratisation, UAE

per month (AED60 annually), and the maximum monthly compensation is set at AED10,000.

Meanwhile, the second category includes those with a basic salary exceeding AED16,000, where the insurance premium is AED10 per month (AED120 annually). The monthly compensation for this category is capped at AED20,000.

The insurance compensation can be claimed as long as the insured (employee) has been subscribed to the Unemployment Insurance Scheme for at least 12 consecutive months.

The insured’s right to compensation is forfeited if he/she leaves the country or joins a new job. The claim to compensation is processed within two weeks of submission.

The compensation is paid for a maximum of three months from the date of unemployment, provided the employee in question was not terminated for disciplinary reasons, and has not voluntarily resigned.

The compensation amount is calculated at the rate of 60% of the average basic salary in the last six months before unemployment.

HR News - Legal

Business News for the MEA region 20 MEABUSINESS

ROADMAP TO EMBARK ON THE GLOBAL HORIZONS

As one of the leading business banking partners in the UAE, National Bank of Fujairah takes pride in being the best Trade Finance Bank in the region to provide tailored trade finance solutions, helping our clients to grow their business on the world map. With nearly four decades of expertise, we provide innovative banking solutions using our digital platforms that are designed to complement your business and offer banking services that meet your working capital and term financing requirements in a simplified manner

SERVICES TAILORED TO YOUR NEEDS

Structured trade & commodity nancing

Con rmation of export Letters of Credit (LCs)

Treasury & corporate advisory

Other services:

• Global connectivity through our correspondent network

• Working capital & term financing, and more

TRADE FINANCE

WHOLESALE BANKING

Call 8008NBF(623) to start our partnership nbf.ae

UAE Prioritises Gender Balance Commitment to Fulfilling National Aspirations

H.H. Sheikh Mansour bin Zayed Al Nahyan launches National Platform for Gender Balance with participation of local governments

His Highness Sheikh Mansour bin Zayed Al Nahyan, Vice President, Deputy Prime Minister and Chairman of the Presidential Court, launched the “National Platform for Gender Balance.”

This innovative platform serves as a unifying force, providing essential data on gender balance at both federal and local government levels.

The platform’s unveiling took place on Tuesday, 7th November, among the secretaries and officials of the executive councils of the UAE and members of the UAE Gender Balance Council (UAE GBC), highlighting the Council’s commitment to furthering gender equality within the annual meetings of the UAE government in Abu Dhabi.

of crafting impactful and influential policies. These policies will further elevate the global standing of the UAE in the realm of gender equality and contribute to realising the 2030 Sustainable Development Goals, particularly the fifth goal, which concerns gender balance and the empowerment of women and girls.

The platform has been meticulously designed in alignment with the UAE government’s performance system for managing and governing performance data indicators. These projects are integral to the UAE GBC’s endeavours to leverage them in formulating and advancing influential policies that bolster the UAE’s global standing in this domain.

H.H. Sheikh Mansour bin Zayed Al Nahyan

His Highness Sheikh Mansour bin Zayed Al Nahyan has set a visionary course, directing the UAE GBC to undertake new collaborative endeavours and elevate gender equality within the private and involving it into the National Gender Balance Platform to align its gender balance initiatives with the accomplishments realised in the government sector.

His Highness said, “The private sector is a pivotal partner in perpetuating the UAE’s ongoing development. It has been a dynamic contributor to the UAE’s vision and strategies for many years, and now, we aspire for it to play a vital role in our aim for gender

balance, thus elevating the UAE to a global leader in this field.”

Initially launched in November last year by His Highness Sheikh Mohammed bin Rashid Al Maktoum, Vice President, Prime Minister and Ruler of Dubai, this platform signifies a bold new vision and a national action plan.

Sheikha Manal bint Mohammed emphasised that the platform’s role extends to effectively measuring and monitoring gender balance data and projects within federal and local governments.

The UAE GBC aims to leverage the strengths of this system in its pursuit

Al Marri highlighted that the collaborative workshops introduced a framework for measuring the gender balance index’s results at the federal government level and explored how it can be applied to local government environments. Developing performance metrics related to gender at the local government level will significantly contribute to advancing gender balance across the nation. She stressed the importance of seamless cooperation between federal and local government agencies, as this collaboration is pivotal to achieving national goals and enhancing the UAE’s global competitiveness and leadership.

Mona Al Marri emphasised, “The platform features a central display panel for gender balance data at federal and local government levels, along with a governance system for performance data, projects, and targets. Each Emirate will have its dedicated display panel to update its data. This initiative propels the UAE’s government to new heights, further cementing its reputation as a leading nation offering the highest living standards for all residents, making it an ideal destination to live, work, and prosper.”

HR News - Diversity & Inclusion

Business News for the MEA region 22 MEABUSINESS

How to Calculate your End-of-Service Gratuity

GPSSA explains steps to calculate retirement pension, endof-service Gratuity

The General Pension and Social Security Authority (GPSSA) explained ways by which insured individuals working in government and private sector entities can calculate their retirement pension and end-of-service gratuity as per the UAE Federal Pension and Social Security Law.

As an initial step, registered employees need to be aware of how their contribution salaries are calculated each month.

For government sector employees, the calculation method is based on five elements, namely: basic salary (including monthly bonus and allowance specified by the UAE Pension Law), cost of living allowance, children allowance, the insured’s social

For the private sector contribution, salaries are calculated based on details stipulated in the employment contract with up to a maximum of AED50,000.

The second step includes deducting and calculating the average contribution account salary over the last three years of employment amongst government sector employees or for the entire contribution period if the service years are less than that.

The account salary for private sector employees is calculated over the last five working years or for the entire contribution period if the service years are less than that.

The average contribution account salary is calculated for each of the last

months. The amount is then collected and divided by 36 months for government sector employees and 60 months for private sector employees. The final step includes calculating the pension account salary or endof-service gratuity, whereby the pension is calculated based on the average contribution account salary according to the years of service.

A service period of 20 years grants the pension to the insured at a rate of 70% of the average contribution account salary, and the insured is given an increase of 2% for each year exceeding 20 years, while there are some cases by which the pension is granted at a rate of 60% for a period over 15 years, and at a maximum rate of 100% when the insured spends 35 years in service.

The insured is granted a bonus of three salaries from the pension account for any year exceeding 35 years in service.

Calculating a government and private sector employee’s end-of-service gratuity is based on the average salary for calculating the gratuity, similar to the average salary for the contribution account that was extracted when calculating the pension, resulting in the insured receiving a bonus at the rate of 1.5 months’ worth salary for each year of the first five years of service from the average salary; while calculating the gratuity at the rate of two months for each year for the following five years of service, and at a rate of three months for each additional year.

The employee is eligible to receive their bonus starting from one to 19 years and 11 months of employment. If an additional day is spent working, they will be eligible to receive the same pension amount since working for less than a month is calculated and considered as working one full month as per the UAE pension law

mea-biz.com

23 HR News - Compensation & Benefits

Heads or Tails

The jury is out on the future well-being of the global economy and with both negative and positive influences vying for the outcome, it is hard to tell on which side the coin will settle

The world economy looks vulnerable. It is still recovering from sticky core inflation rates that were exacerbated by the war in Ukraine in 2022 and another conflict in the energy-producing Middle East region could rekindle inflation. The impending economic downturns in the US and Europe and a dramatic economic slowdown in China are sounding alarm bells across the world.

The resilience of the global economy has been remarkable, but the International Monetary Fund (IMF) cautioned that diverging growth trends meant ‘mediocre’ medium-term prospects.

“Despite war-disrupted energy and food markets and unprecedented monetary tightening to combat decades-high inflation, economic activity has slowed but not stalled,” the IMF said in its latest World Economic Outlook in October.

Economists are expecting global growth to slow in 2024 as high-interest rates percolate through credit channels to the real economy. Meanwhile, inflation is set to continue to cool amid slowing demand next year as global central banks maintain a tight policy stance.

Moody’s analysts forecasted three broad but related types of risk – energy or food price shocks could cause inflation to rebound; geopolitical, cyber and climate risks all add uncertainty to the outlook; and high-interest rates could weaken growth and financial stability.

As generative AI (Gen AI) makes great inroads into many industries, the milliondollar question is whether this innovative technology will be an economic blessing or a curse.

Global consultancy firm McKinsey in June estimated that GenAI, such as applications like ChatGPT and Midjourney, have the potential to deliver substantial economic benefits to the global economy, valued as much as up to $4.4 trillion annually.

14 Banking and Finance news in the MEA market

GLOBAL OUTLOOK

Business News for the MEA region 24 MEABUSINESS

Furthermore, despite the dramatic demises of three US regional banks and Credit Suisse Group earlier this year, the global banking industry has had a pretty good 18 months. McKinsey’s said the past year-and-a-half have been “the best period for global banking” since before the 2007/09 financial crisis, as rising interest rates have boosted profits.

Bringing it closer to home, Fitch Ratings said in September that GCC banks are benefitting from strong operating conditions supported by high oil prices and contained inflation and rising interest rates.

Meanwhile, the cryptocurrency market is starting to bounce back a year after the collapse of crypto exchange Sam Bankman-Fried’s crypto exchange firm FTX and other big players in 2022 crushed prices, tarnished the industry and prompted a regulatory crackdown.

This year has perhaps been one of the most challenging in modern times and it is hard to downplay the scale of the geopolitical and economic uncertainties that the world is facing—from individual households to governments to businesses.

A financial perspective

The global banking sector has had to chart a challenging course over the past three years, during which institutions faced disruptive digital technologies and new competitors, liquidity woes and some bank failures.

The failure of three US banks and Swiss banking giant Credit Suisse is a wake-up call for the global financial service sector to improve balance sheet modelling, pressure tests their contingency playbooks and to better understand risk silos and asset monetisation capabilities.

The IMF said events that took place in Q1 2023 are a powerful reminder of the challenges posed by the interaction between tighter monetary conditions and the vulnerabilities built up since the global financial crisis in 2008.

A tighter monetary policy is challenging banks’ effective risk management in

securities portfolios and loan exposures after years of low interest rates. Between March 2022 and July 2023, the US Federal Reserve enacted a run of 11 rate hikes, taking interest rates from a target range of 0%-0.25% to 5.25%-5.5%.

Global central banks that mimic the Federal Reserve have since held at that level, prompting markets to mostly conclude that rates have peaked and to begin speculating on the timing and scale of future cuts.

The US central bank held interest rates at a 22-year high for a second straight meeting in November but left the door open to another hike to tame inflation.

of FTX, on fraud charges stemming from the blowup of the exchange platform came at a conspicuous time for the crypto market — right when prices are flying high again following a rout in 2022 that wiped out $2 trillion from the value of digital assets.

With global central banks planning to keep interest rates high and geopolitical tensions threatening financial stability, crypto analysts say adding bitcoin to an investment portfolio can be a good way to diversify. However, other wealth management advisors who are sceptical of the industry are taking a much tougher line, arguing that the demise of FTX confirms crypto as a sector riddled with

DESPITE WAR-DISRUPTED ENERGY AND FOOD MARKETS AND UNPRECEDENTED MONETARY TIGHTENING TO COMBAT DECADESHIGH INFLATION, ECONOMIC ACTIVITY HAS SLOWED BUT NOT STALLED

– The International Monetary Fund

However, the situation is different in the Gulf region, where net interest income –the difference between interest revenues earned from lending activities and interest paid to depositors – at GCC banks has soared over the past year as lenders are passing rate increases on to customers.

The region’s top five lenders – Saudi National Bank, Al Rajhi Bank, Qatar National Bank, First Abu Dhabi Bank and Kuwait Finance House – posted a combined net profit of $8.3 billion in the three months to September 30.

Moody’s said banks in the GCC region are resilient to the distress in the US and European banking sectors owing to broad franchises and their sovereign footprint.

Long Live Crypto?

The conviction of former crypto verse billionaire Sam Bankman-Fried, the founder

weaknesses that attract cybercriminals, hackers and rogue states.

Meanwhile, UAE financial regulators have introduced measures to attract some of the world’s biggest crypto firms over the years by developing virtual or digital assets regulation and enabling payments via cryptocurrencies.

Earlier in November, the Registration Authority (RA) of Abu Dhabi Global Market unveiled the Distributed Ledger Technology (DLT) Foundations Regulations 2023, marking a significant milestone in the evolution of digital assets regulatory frameworks across the region and at an international level.

The new regime is designed to provide a comprehensive framework for DLT Foundations and Decentralised Autonomous Organisations (DAOs), enabling them to operate and issue

mea-biz.com 1525 mea-finance.com

tokens recognising the unique needs of the blockchain industry.

Similarly, the UAE’s Securities and Commodities Authority started receiving licence applications from companies that seek to provide virtual asset services in April, ensuring that all companies offering virtual assets-related products and services are fully regulated.

Considering the growing interest in digital assets from institutional and individual investors alike, the UAE’s openness and willingness to build a regulatory environment for virtual assets make the country “the Wall Street of the crypto market”.

Global economic growth

The global economy is limping along, not sprinting. It is projected to record average growth in 2023, but the deepening slump in China’s property market is casting a shadow over global growth prospects, just as monetary tightening increasingly weighs on the demand outlook in the US and Europe.

“World economic growth will slow from 3.5% in 2022 to 3% this year and 2.9% next year, a 0.1 percentage point downgrade for 2024 from July,” Pierre-Olivier Gourinchas, IMF’s Economic Counsellor & Director of Research said in a note in October, adding that the trajectory remains well below the historical average.

Though the economy is showing signs of resilience and has not been knocked out by the big shocks it experienced over the past three years, it is not doing too great either as more geo-political issues

GENERATIVE AI, SUCH AS APPLICATIONS LIKE CHATGPT AND MIDJOURNEY, HAVE THE POTENTIAL TO DELIVER SUBSTANTIAL ECONOMIC BENEFITS TO THE GLOBAL ECONOMY, VALUED AS MUCH AS $2.6–$4.4 TRILLION ANNUALLY

– McKinsey

with the potential to disrupt the world economy or even tip it into recession have imposed their grip on the world’s attention. Such conflicts can send tremors through the world economy, especially when in proximity to heavily trafficked trade routes or the location of key natural resources.

However, “Headline inflation continues to decelerate, from 9.2% in 2022 on a yearover-year basis, to 5.9% this year and 4.8% in 2024,” the IMF said in October. The fund cautioned that most countries are not likely to return inflation to target until 2025.

Meanwhile, the adoption of the electric motor starting in the late 1800s, and personal computing in the 1970s proved transformational. Economists say something similar could happen with GenAI if it enters our lives in such a way that the touted benefits are enjoyed by the many rather than the few.

GenAI has had a significant and ongoing impact globally and regionally. The innovative technology’s impact on

productivity could add trillions of dollars in value to the global economy.

Strategy& projected that for every $1 invested in GenAI, the GCC region could expect around $9.9 of economic growth. This indicates a potential overall economic impact of $23.5 billion annually by 2030 in the GCC region.

GenAI will have a significant impact across all industry sectors. Banking, hightech, and life sciences are among the industries that could see the biggest impact as a percentage of their revenues from generative AI.

“Across the banking industry, the technology could deliver value equal to an additional $200 billion to $340 billion annually if the use cases were fully implemented. In retail and consumer packaged goods, the potential impact is also significant at $400 billion to $660 billion a year,” according to the World Economic Forum.

The era of generative AI is just beginning, but a full realisation of the technology’s benefits will take time, and governments and regulators still have considerable challenges to address.

WORLD ECONOMIC GROWTH WILL SLOW FROM 3.5% IN 2022 TO 3% THIS YEAR AND 2.9% NEXT YEAR, A 0.1 PERCENTAGE POINT DOWNGRADE FOR 2024 FROM JULY

– Pierre-Olivier Gourinchas, IMF’s Economic Counsellor & Director of Research

Meanwhile, global economic growth is set to slow even further in 2024 due to high-interest rates, increased energy prices and a slowdown in the world’s biggest economies. Economists are generally agreeing that the world will avoid falling into recession, but geopolitical risks could also contribute to a worsening global financial outlook.

16 Banking and Finance news in the MEA market

GLOBAL OUTLOOK Business News for the MEA region 26 MEABUSINESS

Covering all Bases

Dan Woods Global Head of Intelligence at F5, the multi-cloud and application security specialist, tells MEABusinessabout the latest threats and vulnerabilities banks and financial institutions in the region should be aware of,

and why managing people is just as important as technology when it comes to cybersecurity.

What are some of the key cybersecurity challenges facing financial services organisations?

As in other parts of the world, credential stuffing, in which attackers use bots to

gain unauthorised access to a protected account by using compromised credentials – usually login and password details from other accounts purchased off the dark web – remains a problem in this region. Criminals try to gain access using these details in the hope that

24 Banking and Finance news in the MEA market

Dan Woods, Global Head of Intelligence at F5

CYBERSECURITY

Business News for the MEA region 28 MEABUSINESS

the victim uses the same password and login for multiple accounts. Many banks, especially in the Middle East, use mandatory two-factor authentication (2FA) in the belief that it prevents credential stuffing, but it sometimes fails to do so because of the way it’s implemented.

Typically, banks implement 2FA by getting the customer to enter the username and password, click submit, and then enter the second factor code, such as a text message or an email. However, with some banks, if you enter the wrong username and password, you are not asked to enter the second factor of authentication – and this effectively tells the bad actor whether the username and password were correct, which for them is valuable information.

If the bad actors have 10 million username and password pairs and they launch a credential stuffing attack against a 2FA protected application, they could leave with about 800 known good username and password pairs. Then they partner with somebody who specialises in defeating 2FA and share their illegal proceeds.

How do bad actors circumnavigate 2FA?

Defeating 2FA happens in many ways, including social engineering attacks, one time password (OTP) bots, and SS7 compromises. None of them are easy, but when cybercriminals have 800 known good username password pairs, and the 2FA text message or email is the only thing keeping them from taking over the account, they tend to be well motivated.

Social engineering is when the bad actor uses impersonation and trickery, perhaps via a message or phone call, to persuade an innocent victim to provide private information such as 2FA details, login credentials, bank account information, or other sensitive data. Attackers sometimes use OTP bots to defeat 2FA. These bots call the victim and relay an automated message to trick them into sending the OTP for their bank

IT IS ALSO NOT UNCOMMON TO SEE LEADERSHIP AND CULTURAL CHALLENGES WITHIN AN ORGANISATION, WHICH CAN CAUSE SECURITY VULNERABILITIES

account. For example, the bot informs victims of a suspicious transaction, and gives them the option to cancel it, by pressing 1 or 2 on their phone. It will also ask them to verify their identity by sharing an OTP code that has just been sent to them. The problem is that the OTP is being sent legitimately by their bank, but only because the bad actor has the victim’s login details and has just tried to log in. When the unsuspecting victim sends the OTP code back in the belief that they are cancelling a suspicious transaction, they are in fact handing over their 2FA to a fraudster and giving them access to their account.

advantage of a weakness in the design of the SS7 mobile signaling system to enable data theft and eavesdropping.

How is AI changing the threat landscape?

AT TACKERS SOMETIMES USE OTP BOTS TO DEFEAT 2FA

If the bad actor is unable to defeat 2FA through social engineering, they may move on to port outs or sim swaps. Port outs are when the fraudster tries to move the victim’s mobile number to a new service provider, potentially giving them access to their OTP codes, while SIM swaps involve the criminal attempting to hijack a user’s mobile number, netting them a potential treasure trove of information, from email login details and access to SMS messages - including 2FA codes.

Another technique used by cyber criminals is SS7 attacks, which take

Cybercriminals are adept at using new technology, such as generative AI and voice cloning technology, to assist them. Generative AI is already proving highly effective for bad actors staging phishing attempts, by drafting fraudulent emails such as messages purporting to be from family or friends asking for money. Thanks to generative AI, these emails are becoming increasingly persuasive and are free from the type of spelling and grammatical errors that would once have served as red flags. Criminals are also using generative AI to help write more effective messages to target potential victims by phone. This is being taken to the next level with voice cloning, where bad actors use AI-based programs to copy a person’s voice and then send a message or call a friend or family member of that person to request money, often with a plausible story about some type of emergency.

The best way to avoid falling for this is to ensure that the person asking for money is really who they say they are. Every family should have a pre-arranged code that only they know - it could be about a childhood memory, a favorite car, a date, or holiday destination – something memorable that can be used as a simple verification method.

Bringing third parties into the fold

Many banks also contend with automated logins from third parties that have access

29 mea-biz.com 25 mea-finance.com

to customers’ usernames and passwords – with the permission of the customer – to log into their account and retrieve information. These third parties are usually aggregation services that subscribers sign up for and use to help gain visibility across their various accounts, including banks, credits cards and store cards. These aggregators should actually access account information through a standard called OAuth 2 API, which many banks use and make available to third parties via their Application Programming Interface (API). Unfortunately, many of these third parties view this as an unnecessary hassle and fail to use it, instead opting to use bots to scrape the information from accounts. This creates problems including additional traffic at the application login.

This is particularly important for banks and their customers because when the third parties bypass the API and scrape accounts, they have access to all the information they want from the account – from the user’s name and personal information to their account number and transaction history. However, when they use the API, the bank can set the parameters and ensure the third party only has access to certain information.

F5 gives banks visibility and control over this type of traffic and enables them to force third parties to follow the rules and use the banks’ APIs. Some banks in the US have started charging for access to the API, which enables them to turn a former problem into a new source of revenue.

But the problem with third parties is not just unwanted traffic on the login application, they can also create security vulnerabilities. Instead of targeting the login application, some cybercriminals open accounts with these third parties and attempt to use them as a staging post to steal username and password information and gain access to bank accounts.

While third party aggregators are not necessarily malicious, banks, and indeed customers, should be concerned about the integrity of some of these players.

While there are large, well-established aggregators, there are also hundreds, if not thousands, of smaller aggregators, many of which are less reputable. I maintain that eventually we are going to learn that one or more of these were never legitimate businesses and that their real intention was to collect usernames and passwords and monetise them in an illegal way.

Another good reason to control and mitigate the bots deployed by third parties and cybercriminals, is that collectively,

Another common issue is complexity due to using too many third-party vendors for cybersecurity, which creates integration issues and is difficult to manage and maintain. This sometimes occurs because the company has opted for bolt-on solutions to solve different problems, which over time translates into a plethora of solutions. Mergers and acquisitions can also lead to IT complexity.

It is also not uncommon to see leadership and cultural challenges within an organisation, which can cause

WHILE THIRD PARTY AGGREGATORS ARE NOT NECESSARILY MALICIOUS, BANKS, AND INDEED CUSTOMERS, SHOULD BE CONCERNED ABOUT THE INTEGRITY OF SOME OF THESE PLAYERS.

they put pressure on and slow down the network for legitimate users, which can harm a business. For example, if customers are applying for a credit card and abandon it due to the website lagging, it›s no different to abandoning a cart on an e-commerce site. By working with a partner to adequately monitor the signals on the site, the bank can shed light on this and gain a greater understanding of the impact of friction on the site.

What other security challenges do banks face?

The key challenge that many banks face is a lack of visibility about what’s happening on their network and across their systems, from bots and hacks to shadow IT, where IT professionals within the organisation may be using their own APIs in an attempt to increase their productivity, but inadvertently create a security vulnerability.

security vulnerabilities. We see fiefdoms all the time in enterprises, with a complete lack of communication and cooperation between teams who should be working closely together.

What should banks be doing to mitigate these challenges and improve their security profile?

All these challenges can be addressed. Banks can rein in complexity by consolidating the number of vendors they work with, and that’s why F5 has a platform offering a full range of protection, covering everything from APIs to bots and WAF all on one platform. Banks can ingest our monitoring and control tools into their own tools to identify and mitigate the bad actors, whether bots or humans.

Meanwhile, to improve the way teams communicate it is imperative to get the right leaders in place and to inculcate a culture of openness and cooperation.

26 Banking and Finance news in the MEA market

CYBERSECURITY Business News for the MEA region 30 MEABUSINESS

EMBRACE THE FUTURE OF BANKING WITH MODERN BUSINESS ARCHITECTURE

Clo u d - Ba s ed Sol ut ion s | A rt i icial In t elli ence | Blockchain | A I - D r i v en A r chi t ec tur e

Da t a Anal yt ic s & Bi Da t a | C y be r Sec ur i ty | Mobile & Di i t al Bankin | Io

A ut oma t ion | mnichannel Bankin

In t oda y ' s a st - chan in inancial land s ca p e , emb r acin t echnolo y i s n ' t ust im p o rt an t — i t ' s c ru cial . Bank s need mode r n a r chi t ec tur e s t o com p e t e , inno v a t e , and t h r i v e di i t all y.

GBM u nde rst and s t he challen e s bank s ace ur e xp e rts w o r k w i t h y o u t o t ailo r s ol ut ion s , o pt imi z e o p e r a t ion s , enhance c ust ome r e xp e r ience , and im pr o v e s ec ur i ty and com p liance .

Di s co v e r ho w GBM can hel p y o u st a y ahead , ada pt t o ma r ke t s hi ts , and achie v e r o wt h gbmdubaimarketing@gbmme.com www.gbmme.com

31 mea-biz.com

Emarat Atrium Block B - 3rd Floor, Dubai UAE

Taxing Times

While highlighting the impending tax obligations for all businesses in the UAE, George Hojeige Group CEO of Virtugroup explains how they are leading efforts to ensure that startups, SMEs and entrepreneurs are eased into readiness for this important change to the national business landscape

Why is it important for SMEs and businesses to understand & comply with the new corporate tax regulations?

It’s crucial for them to understand tax regulations and compliance. First, the

obvious answer is that non-compliance could lead to fines which would be detrimental to a company’s finances.

The second thing is it creates a level playing field when everybody has corporate tax applied. It enhances the national economy and it gives you a lot

more credibility both as a company and as an economy. Obviously, corporate tax is a worldwide initiative and we’ve often been criticised in this part of the world for not having corporate tax. Well, now we do. So, there’s no more excuse not to come here.

Who will be affected by Corporate Tax Laws?

Well, that’s an interesting question. Our survey has showed that 80% of companies here are not sure if they are affected or not. The reality is that every single business that exists is affected by corporate tax laws for a very simple reason. Whether you’re taxable or not, whether you’re in a free zone or you’re not, whether you’ve made transactions or made profits or not, you are actually concerned by the corporate tax law.

30 Banking and Finance news in the MEA market

George Hojeige, Group CEO of Virtugroup

LEADERSHIP SERIES Business News for the MEA region 32 MEABUSINESS

So every company, regardless of where they are, regardless of their size, must keep proper books. So aside from proper accounting, they must register for corporate tax and must file their corporate taxes at the end of the year even if they have zero tax to pay. And this is something that we’ve realised that the general public is not aware of.

What prompted Virtuzone to invest over Dh50 million ($13.6 million) in offering free corporate tax and accounting services?

We’ve always been pioneers in the SME entrepreneurship startup sector here in the UAE and we realised that 80% of corporates or small businesses were not aware of what they needed to do for taxation. So we felt that it was our responsibility to go out there and help them get ready for tax as we’ve always done with previous initiatives. And we decided to invest 50 million dirhams to go out and give 10,000 companies, obviously the smaller companies, a tax ready package for absolutely free.

So basically what that encompasses is that we will do their accounting till the

we hope that these companies that we help for free enjoy our services and then we have them as long-term customers and are able to serve them and grow our customer base that way.

WE’VE ALWAYS BEEN PIONEERS IN THE SME ENTREPRENEURSHIP STARTUP SECTOR HERE IN THE UAE AND WE REALISED THAT 80% OF CORPORATES OR SMALL BUSINESSES WERE NOT AWARE OF WHAT THEY NEEDED TO DO FOR TAXATION

end of the year, we will register them for tax and we will have them ready to be able to do their books in 2024 in order to file for taxes at the end of that year.

So, it enhances our thought leadership in the market; it enhances our position as the leading agency in helping these SMEs and we’re very happy to do it. Obviously,

How will Virtuzone’s free tax-ready service help SMEs in complying with the new corporate tax rules?

What we’re doing is we’re offering a service where we will do their accounting and their books till the end of 2023. We will register them for tax, and we will have their books absolutely ready to be maintained