The editorial staff of MEA Business are committed to reporting the positive business developments in the Middle East and Africa, as well as highlighting the business opportunities that already exist in the two regions.

We also want to provide a platform for business leaders to share ideas, engage in constructive debates and form strategic partnerships. Our ultimate aim is to equip business leaders and professionals with the practical and tactical skills to thrive in the Middle East and Africa. With an emphasis on positive news stories, case studies and inspirational interviews, MEA business will inspire readers towards personal development and overall business success.

The magazine is arranged to provide clear and concise informative sections including news sections on the Middle East and Africa, CEO interviews and market updates. The magazine and news service we offer are available on a variety of platforms, these include our printed magazine, e-magazine, website, and social media. Furthermore, we include augmented reality elements in some of our features to provide our readers with unparalleled coverage on the latest developments.

MEA Business also publishes several sector specials throughout the year. These special issues are produced to coincide with important industry exhibitions and events. This month’s issue is a Technology Achievement Awards special. I hope you will also join me in congratulating all the winners.

Kenneth Mitchen Publisher, MEA Business

Kenneth Mitchen Publisher, MEA Business

MEA Business WEB: www.mea-biz.com EMAIL: info@cme-media.com

PUBLISHED BY: Creative Middle East Media FZ LLE, 19th Floor, Creative Tower, Fujairah Creative City, PO Box 4422, Fujairah, UAE EXECUTIVE DIRECTOR AND PUBLISHER: Kenneth Mitchen Email: ken.mitchen@mea-finance.com

Etihad Cargo has been awarded CEIV Pharma Recertification by IATA following a rigorous audit process. Etihad Cargo’s compliance to CEIV Pharma standards spans operations in its existing and upcoming facilities, including the carrier’s state-of-the-art, 3,000-square-metre pharmaceutical hub, which will double the carrier’s cool chain capacity once launched

Etihad Cargo, the cargo and logistics arm of Etihad Aviation Group, has been awarded Center of Excellence for Independent Validators (CEIV) Pharma recertification by the International Air Transport Association (IATA). The carrier is one of only 37 airlines to hold IATA CEIV Pharma certification globally.

The UAE’s national carrier first achieved IATA CEIV Pharma certification in 2019 in conjunction with its hub at Abu Dhabi International Airport and Etihad Airport Services Cargo. Etihad Cargo went on to become the first airline in the Middle East and only the third globally to hold the trilogy of CEIV Pharma, CEIV Fresh and CEIV Live Animals certifications.

Etihad Cargo achieved IATA CEIV Pharma recertification following an audit by independent validators that assessed the carrier’s capacity to control and enhance its processes through a checklist that focused on Etihad Cargo’s Quality Management System that incorporates supplier management, training programmes, processes and procedures, audit programmes, and quality enhancement, among others. Achieving recertification demonstrates Etihad Cargo’s and

its dedicated pharmaceutical transportation product PharmaLife’s full compliance with specific pharmaceutical regulations, including IATA Temperature Control Regulations (TCR), Good Distribution Practices (GDP), a quality system for warehouses and distribution centres dedicated to medications and life sciences products.

Martin Drew, Senior Vice President –Global Sales & Cargo at Etihad Aviation Group, said, “Etihad Cargo is proud to achieve IATA CEIV Pharma recertification following an extensive audit. This industry-wide standard ensures Etihad Cargo’s operations and staff comply with all applicable standards, regulations and guidelines expected from

pharmaceutical manufacturers. The benefits of CEIV Pharma certification extend to Etihad Cargo’s customers, who can be assured the carrier’s dedicated pharma cargo management constantly monitor and analyse the quality and safety of Etihad Cargo’s PharmaLife product performance.

“Etihad Cargo fully supports Abu Dhabi’s vision of becoming a life sciences and pharmaceutical hub. Achieving recertification and providing worldclass pharmaceutical logistics solutions demonstrates Etihad Cargo’s capabilities in seamlessly transporting life-saving medicines and the latest treatments around the world from the carrier’s Abu Dhabi hub.”

Frederic Leger, IATA, Senior Vice President Commercial Products and Services, said, “Organisations holding CEIV certification and their customers recognise that CEIV Pharma certification is a key differentiator, highlighting the additional efforts taken to improve service quality and enhance the customer experience. We congratulate Etihad Cargo on achieving CEIV Pharma recertification. Pharmaceuticals represent one of the world’s fastest-growing freight markets, their transportation is critical but challenging. Shippers such as pharmaceutical companies welcome such certification as it gives them confidence in air transport. Etihad Cargo’s efforts in achieving recertification support the vision of having a global standard for the safe transportation of pharmaceuticals.”

Building on the carrier’s IATA CEIV Pharma-certified status, Etihad Cargo has committed to raising standards across the pharma supply chain. As a founding member of the HOPE Consortium, Etihad Cargo partnered with Abu Dhabi Airports Company (ADAC), Brussels Airport Company and Pharma.Aero to launch Pharma Corridor 2.0 between Brussels and Abu Dhabi. This initiative aims to provide the highest levels of assurance in the quality of handling to pharmaceutical shippers and forwarders through the establishment of pharma corridors between airports with cargo handling communities certified under the CEIV Pharma programme.

Automechanika Dubai, the Middle East’s largest international trade show for the automotive aftermarket industry, recently hosted AfriConnections a dedicated conference that focused on the growing African Automobile market

“Africa is huge and diverse, which is in itself an opportunity,” said Deitersen. “The continent has plenty of urban areas with more than a million habitants and with growth in population comes growth in manufacturing.

“IMF figures show that Africa is set to overtake Asia, the growth engine of the world, by 2027. We have already seen a 2.8 per cent of growth in income from the year 2000, whereas growth in the aftermarket has seen a nine per cent improvement in automotive parts, three per cent in heavy vehicles and eight per cent in light vehicles over the same period.”

Automechanika Dubai, the Middle East’s largest international trade show for the automotive aftermarket industry, concluded its three-day run on the 24 November 2022 at the Dubai World Trade Centre (DWTC). The event hosted 1,145 exhibitors from 53 countries, indicating a 98 per cent increase from last year’s edition, with a vast showcase of present and future products, services, technologies, and insights from industry experts.

The last day shifted focus towards the African market with AfriConnections, a dedicated conference stream and networking area aimed at uniting businesses and dealers from Africa with the rest of the world. According to a recent report commissioned for Automechanika Dubai, Africa’s rising population is a key

growth driver, with the continent expected to be home to 2.4 billion by 2050. Africa’s working-age population, a key economic growth enabler, is expected to increase exponentially and, by 2050, will outstrip that of China and be three times that of the European Union.

The report also predicts Africa’s current vehicle fleet of around 50 million units will grow substantially over the next decade, with the vehicle parc in key markets more than doubling until 2040 when the majority of the growth continues to come from imported vehicles.

Speaking at the opening session of AfriConnections at Automechanika Academy, Erik Deitersen, Director at AfriCon, discussed what future opportunities look like in a changing African automotive aftermarket:

Throughout the last three days, sustainability and how it is changing the face of the industry have been addressed through conference streams and exhibitor products. Returning for his 10th edition, Ahmed Alhussaini, Managing Director at O2 Proformance, marks this edition with his biggest participation yet; “As we mark a decade of being exhibitors at Automechanika Dubai this year, we have developed to be bigger and better each edition. Every year we showcase innovative products and introduce something different, and this year is no different as we launched a smart washer that works on a process called bioremediation. The machine converts oil and grease into CO2 and H2O and constantly cleans itself. It also turns itself off after 10 minutes assisting with the preservation of electricity”.

“The attendance this year, across all categories, has been truly special. As we close the doors this year and look towards our 20th-anniversary edition in 2023, I would like to take the opportunity to thank all of our stakeholders, exhibitors and visitors for making this year one of the Automechankia Dubai’s largest-ever outings to date; said Mahmut Gazi Bilikozen, Show Director of Automechanika Dubai.

The World Travel & Tourism Council Summit saw 55 Government Ministers, 250 Tourism CEOs and 60 Ambassadors meet in Riyadh

– and it’s going to grow here. This country is going to end up with more visitors than the USA.”

Paul Griffiths is CEO of Dubai Airports International and said: “We are facing a new reality with the urgent need to embed sustainability practices into everything we do. The end product that we should all be striving to achieve is the delight of the customer, usually achieved by ensuring the interface with our products is as brief as possible.”

From a host nation perspective, Fahd Hamidaddin, CEO and Member of the Board at Saudi Tourism Authority said. “The domestic impact and the WTTC committing to $10.5bn is definitely a clear win-win for both Saudi and these businesses that are looking for growth opportunities across the world”

The leaders of the global travel and tourism industry left the Saudi capital of Riyadh and the biggest ever World Travel & Tourism Council Summit last night with a renewed sense of optimism, shared future goals and a stronger commitment to collaborative cross-border strategies to drive a successful future for the sector.

The three-day summit attracted decision makers from every corner of the world as host nation Saudi Arabia hosted 55 Government Ministers, 250 travel and tourism CEOs and 60 ambassadors who were among nearly 3000 delegates from 140 countries. It is the largest gathering of tourism leaders and professionals that the Summit has ever hosted.

The Riyadh Summit had twice the number of delegates as the last major

pre-Covid Summit in Seville and nearly three times as many countries represented with 140 compared to over 50 in Seville in 2019.

Closing the Summit, HE Ahmed Al Khateeb, Minister of Tourism, Kingdom of Saudi Arabia said:

“This event has been the perfect example of collaboration, of great conversations that have led to meaningful action. I hope you have all experienced the real meaning of Saudi hospitality. In the Kingdom we call hospitality Hafawah. We understand that hospitality has the power to unlock authentic experiences that set us apart.”

Thanking the host nation, Julia Simpson, President and CEO, World Travel & Tourism Council, “The passion, the people, the hospitality we have had has been incredible here in Saudi Arabia. This sector is growing

Qusai Al Fakhri, Chief Executive Officer, Tourism Development Fund added: “One of the main aims of our tourism focus is to create jobs and drive GDP. Up to 60% of Saudis are below the age of 35. By their very nature they are digital natives and therefore it makes sense to develop projects with a clear technological dimension.”

The Summit saw a series of MOUs and agreements signed during the Summit and the announcement of new awards. One of those was the new Hafawa, or Hospitality awards that were announced by Saudi Arabia Minister of Tourism HE Ahmed Al-Khateeb. His Excellency also signed formal MOUs with Djibouti Spain Costa Rica and Bahamas to further strengthen Saudi Arabia’s growing international partnerships and collaboration.

The event organisers stated that the Summit had a global impact with over 7 million livestreams of the keynote speeches, panel discussions and presentations.

The Aviation Annual Gala Evening (AAGE), the region’s leading invite only event for Senior Aviation will take place on the 7th December 2022. The event will again take place on an exclusive 220ft megayacht berthed outside Pier 7, Dubai Marina. The deluxe venue is lavishly designed with custombuilt interiors and first-class amenities. Guests will enjoy an amazing cruise along Dubai’s shoreline, with captivating views of the famous Palm Island, the Dubai skyline and Iconic buildings such as the Burj Al Arab. Guests will also be entertained

throughout the evening by a live band and special entertainment.

The Aviation Innovation Awards which also takes place during the Gala Evening will recognize some of the region’s most outstanding aviation individuals and organizations. The awards will honour exceptional technological, operational and sustainability innovations. The Gala Evening and Awards attracts a wide variety of leaders from the Middle East and internationally. For more information on the event visit www.aviationgala.com or contact ken@cme-media.com

Ali Ahmed Alnaqbi, Founding and Executive Chairman of MEBAA - the Middle East & North Africa Business Aviation Association, and Tim Hawes, Managing Director of Tarsus Group, outlined exciting new features of this year’s MEBAA Show 2022, during a virtual press conference held today.

Ali Ahmed Alnaqbi, Founding and Executive Chairman of MEBAA - the

Middle East & North Africa Business Aviation Association, said: “We’re excited to host this year’s MEBAA show, with just one week to go until representatives from across the industry gather to lay out the roadmap for business aviation in the future. The tremendous rise of business aviation is a trend we are not only witnessing in the Middle East, but in key international markets, and we are committed to supporting this growth and taking the industry to new heights.

“The MEBAA Show has already established itself as the ideal place to meet and build relationships with regional and international professionals from across business aviation, and this year we are proud to see many of our long-term exhibitors return for another show, as well as welcome many new ones to highlight the latest innovations shaping the industry.”

“Our 2022 show will also see the introduction of brand new features, including the BizAv Talks conference, where we’re excited to hear from over 45 industry experts from across the globe during a series of insightful debates and presentations on the trends shaping the business aviation industry. We’ll also be encouraging attendees to download our newly launched AI-powered MEBAA Show Connect app, which will

facilitate business connections between exhibitors and visitors and pre-schedule meetings in advance, all in line with our aim to take networking to the next level.”

Tim Hawes, Managing Director of Tarsus Group, said: “We are always looking for ways to take the MEBAA show to the next level and support the continued growth and innovation in the industry. As we return with our most impressive show to date, we are excited to welcome a huge number of exhibitors to showcase the latest aircraft, innovative technologies and solutions to drive the industry forward. Attendees can expect to see the latest in digital platforms for business and private aviation, blockchainbased assets, and the most advanced technologies from leading manufacturers.”

Now in its ninth edition, this year’s MEBAA show will gather members of the international business aviation industry for its most impressive edition to date. The event will address key themes including future aviation, sustainability, emerging markets and regulations, and there will be a major focus on digitalisation, with many global exhibitors showcasing the latest technologies and solutions to drive the industry forward.

Further highlighting the show’s position as a global platform for the business

aviation industry, this year’s show has seen a surge in international visitor registrations, with over 69% being key decision makers from across the sector. There will also be increased presence from major markets including Asia and Europe.

At the brand new BizAv Talks conference, visitors will hear from global industry leaders and specialists on the trends shaping the industry, with key speakers including Holger Ostheimer, Managing Director at DC Aviation Al-Futtaim, Eymeric Segard, CEO at Luna Aviation Group, and Frederic Aguettant, Founder and President of Helipass. Visitors will also witness cutting-edge products and solutions from returning and new exhibitors, including Mirai Flights, Emperor Aviation and VOO, meanwhile a range of new aircraft will be on display, including the Airbus ACJ 320 NEO, Royal Jet BBJ 737-700, ASM FZE Learjet 60XR, Boutsen Aviation G650 and Cirrus Aircraft Vision SF50.

To be held under the patronage of H.H. Sheikh Ahmed bin Saeed Al Maktoum, President of the Dubai Civil Aviation Authority, Chairman of Dubai Airports, Chairman and Chief Executive of Emirates Airline and Group, the MEBAA Show 2022 will take place at DWC, Dubai Airshow site, from 6-8 December.

technology that can enhance pilot efficiency. Its easy-to-use features deliver benefits of modern cockpit and air traffic management, improving safety, trimming flight time and reducing fuel consumption.

Advancing innovation in avionics also keeps flights moving efficiently. Display panels help pilots to enhance situational awareness and operational safety through enhanced navigation and datalink communications, airport approaches and more. As an example, Honeywell’s EASy IV integrated flight deck’s features largelandscape flat-panel displays, intuitive navigation and patented graphical flight planning functionality for modifying flight plans quickly and safely, and monitoring weather, terrain and air traffic.

Honeywell’s 31st annual Global Business Aviation Outlook forecast has shown strong growth with an increase in purchase plans. An increase in first-time users and buyers partly due to changing habits brought on by the COVID-19 pandemic is helping to drive this growth. Surveyed operators reported new jet purchase plans on par with 2019 levels, with fleet addition rates doubling from last year’s reported intentions. The business aviation sector is expected to recover to 2019 delivery and expenditure levels by 2023, much sooner than previously anticipated.

Sustainability remains at the front of the agenda for the industry. While operators plan to either adopt or increase methods for more environmentally friendly operations in the future, sustainable aviation fuel – a low-carbon alternative to conventional,

petroleum-based jet fuel – is seen as a method for lowering carbon emissions. Advancements in electric power-generation and distribution systems, fuel cells and electric propulsion systems also hold enormous potential for reducing the environmental impact of aviation.

But as we look ahead to 2023, it is not just energy efficiency that will be important. Investment in this area will need to be balanced by an immediate need to reduce operating costs, maintain fleet availability and improve overall operating efficiency. Technology, like Honeywell’s IntuVue RDR-7000 weather radar system, gives pilots clear and timely information to make safer, faster and more informed decisions to optimize routes and to reduce diversions and time on wing, helping in operational cost savings. Honeywell’s flight management system 6.1 provides another example of

Operators continue to invest in new connected technologies to increase efficiencies. This includes increasing bandwidth to harness more operational data. Honeywell Forge, Honeywell’s nextlevel connectivity solution, uses advanced data analytics to deliver a comprehensive portfolio of services on a single seamless platform to help manage data use and cost, access flight planning and flight efficiency services. Honeywell is also developing the next generation of its tail mounted JetWave satellite communications system to lower the cost of inflight, high-speed broadband connectivity while also significantly increasing connection speeds.

We are also going to see continued strong demand for aftermarket services that help operators extend the lifecycle and uptime of their existing fleets. Our latest forecast shows purchase plans for used jets remains high. Honeywell’s maintenance service plans can help to deliver a cost-efficient means to maintaining assets optimally and ensuring high dispatch availability, allowing operators the flexibility to choose from a range of coverage options.

2023 is going to be a year of efficiency – both in terms of sustainability and operational performance. Operators are looking for pragmatic solutions to help them deliver this balance across existing fleets and new purchase plans, to ensure operations are sustainable for the long term.

The International Air Transport Association (IATA) recently announced that the continued market recovery in air travel. Total traffic in October 2022 (measured in revenue passenger kilometers or RPKs) rose 44.6% compared to October 2021. Globally, traffic is now at 74.2% of October 2019 levels. Domestic traffic for October 2022 slipped 0.8% compared to the year-

ago period as stringent COVID-related travel restrictions in China dampened global figures. In total, October 2022 domestic traffic was at 77.9% of the October 2019 level. Domestic forward bookings remain at around 70% of prepandemic level. International traffic climbed 102.4% versus October 2021. October 2022 international RPKs reached 72.1% of October 2019 levels with all

markets recording strong growth, led by Asia-Pacific. Forward bookings for international travel increased to around 75% of pre-pandemic levels, following the re-openings announced by multiple Asian economies.

Asia-Pacific airlines had a 440.4% rise in October traffic compared to October

The International

Association (IATA) recently announced that the recovery in

continued in October

AIR PASSENGER MARKET DETAIL-OCTOBER 2022 WORLD SHARE1

RPKASKPLF(%-PT)2 PLF(LEVEL)3

Total Market 100%44.6%23.9%11.8%82.0%

Africa 1.9%81.1%48.0%13.3%72.6%

Asia Pacific 27.5%36.8%13.9%12.7%75.5%

Europe 25.0%48.7%28.1%11.8%84.8%

Latin America 6.5% 40.0% 36.2%2.3%83.3%

Middle East 6.6%106.5%51.1%21.2%79.1%

North America 32.6%31.2%16.3%9.8%86.4%

1) % of industry RPKs in 2021 2) Year-on-year change in load factor 3) Load Factor Level

OCTOBER 2022 (% YEAR-ON-YEAR) WORLD SHARE1

RPKASKPLF (%-PT)2 PLF (LEVEL)3

Domestic 62.3%-0.8%-7.4%5.5%81.9%

Domestic Australia 0.8%292.9%143.2%33.2%87.2%

Domestic Brazil 1.9% 9.7% 17.0%-5.3%78.9% Domestic China P.R.17.8%-58.7%-56.3%-3.8%65.2% Domestic India 2.0%22.7%16.0%4.5%81.5% Domestic Japan 1.1%77.4%43.2%13.9%72.0% Domestic US 25.6%12.1%3.8%6.5%87.8% 1) % of industry RPKs in 2021 2) Year-on-year change in load factor 3) Load Factor Level

OCTOBER 2022(% CH VS

2021, easily the strongest year-over-year rate among the regions, but off a very low 2021 base. Capacity rose 165.6% and the load factor climbed 39.5 percentage points to 77.7%.

European carriers’ October traffic climbed 60.8% versus October 2021. Capacity increased 34.7%, and load factor rose 13.8 percentage points to 84.8%, second highest among the regions.

Middle Eastern airlines saw a 114.7% traffic rise in October compared to October 2021. Capacity increased 55.7% versus the year-ago period, and load factor climbed 21.8 percentage points to 79.5%.

North American carriers reported a 106.8% traffic rise in October versus the 2021 period. Capacity increased 54.1%, and load factor climbed 21.4 percentage points to 83.8%.

Latin American airlines posted an 85.3% traffic rise compared to the same month in 2021. October capacity climbed 66.6% and load factor increased 8.7 percentage points to 86.0%, the highest among the regions.

African airlines’ traffic rose 84.5% in October versus a year ago. October 2022 capacity was up 46.9% and load factor climbed 14.5 percentage points to 71.3%, the lowest among regions.

“People are enjoying the freedom to travel, and businesses recognize the importance of air transport to their success. A recent survey of European business leaders doing business across borders showed that 84% could not imagine doing so without access to air transport networks and 89% believed being close to an airport with global connections gave them a competitive advantage. Governments need to pay attention to the message that air travel is fundamental to how we live and work. That reality should drive policies to enable aviation to operate as efficiently as possible while supporting the industry’s 2050 Net Zero emission goals with meaningful incentives to encourage the production of Sustainable Aviation Fuels,” said Walsh.

Seamless connectivity at DXB: Customers enjoy seamless check-in, efficient baggage transfers, passenger access to Emirates’ lounges at Terminal 3 and the flydubai lounge at Terminal 2, reduced connection times as both airlines expand their flight schedules, and convenient connections to 33 flydubai destinations operated from Emirates Terminal 3 in DXB.

November 2022, marked five years since Emirates and flydubai activated their extensive partnership and joined forces to offer customers unrivalled travel options to every corner of the globe. They’ve certainly delivered on their promise. The carriers’ joint route network has significantly expanded, enabling more than 11 million customers to connect on over 250,000 flights and benefit from seamless travel since the partnership launched in 2017.

The innovative partnership goes beyond the standard codesharing model and today includes integrated network collaboration, schedule optimisation, seamless connectivity at Dubai International airport (DXB) between Terminals 2 and 3, baggage transfers on a single itinerary, as well as reciprocal loyalty benefits under the joint loyalty programme, Emirates Skywards.

Here’s five key highlights of Emirates and flydubai’s partnership and the benefits it offers to customers:

Joint network offers unrivalled choice: Today, customers have access to 215 destinations across 98 countries, with over 250 codeshare flights to choose from on an average day. Emirates customers can book flights to over 80 unique flydubai destinations and flydubai customers can choose from over 99 Emirates destinations. Popular customer favourites, whether travelling for business or leisure include: Kathmandu, Kuwait, the Maldives, Tel Aviv, and Zanzibar.

Joint loyalty programme maximising customer rewards: More than 8.5 million members have been able to enjoy joint Emirates and flydubai frequent flyer programme benefits, earning 150 billion Skywards Miles in the last five years through the partnership.

Continued network growth: New travel opportunities are being created for the 270,000 passengers who connect between both airlines each month as Emirates and flydubai continue to add more flights to their schedules. This offers customers more flexibility with multiple daily flight departures to destinations like Bahrain, Kuwait, Karachi, the Maldives, key cities in Saudi Arabia and Tel Aviv. Both airlines also continue to expand their networks, with Emirates recently reinstating flights to Rio de Janeiro and Buenos Aires. In 2022, flydubai’s network has grown bigger than ever, launching flights to Al Ula, Namangan, Osh, Pisa and Samarkand, to name a few. flydubai has also announced services to Gan in the Maldives, Cagliari and MilanBergamo in Italy, Corfu in Greece and Krabi and Pattaya in Thailand from 2023 as well as the resumption of flights to Abha, Ha’il, Hofuf and Tabuk in Saudi Arabia.

Continued investment in enhancing the customer experience: Emirates will retrofit 120 aircraft with Premium Economy seats starting this month as part of a $2 billion investment which also includes elevated dining options and more sustainable choices. flydubai has debuted a new Business Class recliner seat offering customers more comfort on its short and medium haul flights. flydubai has grown its fleet to 70 Boeing 737 aircraft and will retrofit a number of its existing aircraft, as well as equip its future aircraft, with its new Business Class seats.

Emirates and flydubai celebrate five years of partnership. Five things to know about how they’re delivering more benefits for travellers

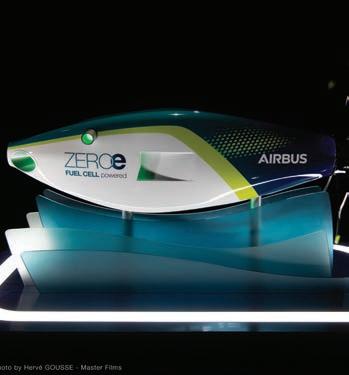

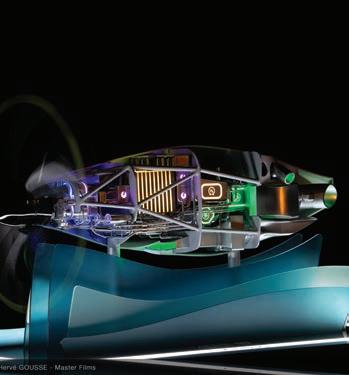

Aircraft, Airbus. “At scale, and if the technology targets were achieved, fuel cell engines may be able to power a one hundred passenger aircraft with a range of approximately 1,000 nautical miles. By continuing to invest in this technology we are giving ourselves additional options that will inform our decisions on the architecture of our future ZEROe aircraft, the development of which we intend to launch in the 2027-2028 timeframe.”

Airbus identified hydrogen as one of the most promising alternatives to power a zero-emission aircraft, because it emits no carbon dioxide when generated from renewable energy, with water being its most significant by-products.

There are two ways hydrogen can be used as a power source for aircraft propulsion. First via hydrogen combustion in a gas turbine, second, by using fuel cells to convert hydrogen into electricity in order to power a propeller engine. A hydrogen gas turbine can also be coupled with fuel cells instead of batteries in a hybrid-electric architecture.

Airbus has revealed that it is developing a hydrogen-powered fuel cell engine. The propulsion system is being considered as one of the potential solutions to equip its zero-emission aircraft that will enter service by 2035.

Airbus will start ground and flight testing this fuel cell engine architecture onboard its ZEROe demonstrator aircraft towards the middle of the decade. The A380 MSN1 flight test aircraft for new hydrogen technologies is currently being modified to carry liquid hydrogen tanks and their associated distribution systems.

“Fuel cells are a potential solution to help us achieve our zero-emission ambition

and we are focused on developing and testing this technology to understand if it is feasible and viable for a 2035 entryinto-service of a zero-emission aircraft,” said Glenn Llewellyn, VP Zero-Emission

Hydrogen fuel cells, especially when stacked together, increase their power output allowing scalability. In addition, an engine powered by hydrogen fuel cells produces zero NOx emissions or contrails thereby offering additional decarbonisation benefits. Airbus has been exploring the possibilities of fuel cell propulsion systems for aviation for some time. In October 2020, Airbus created Aerostack, a joint venture with ElringKlinger, a company with over 20 years of experience as both a fuel cell systems and component supplier. In December 2020, Airbus presented its podconcept which included six removable fuel cell propeller propulsion systems.

Hydrogen fuel cells, especially when stacked together, increase their power output allowing scalability

Considering the continued growth of the aviation industry and related carbon emissions, our sector needs to become more sustainable. So as KLM, we are taking responsibility for making our business more sustainable. How? By flying on sustainable fuel, with more efficient routing, with cleaner planes and by recycling our waste. Learn more about our journey to more sustainable aviation on klm.com/flyresponsibly

The winners of the MEA Business Technology Achievement Awards 2022 were recently announced. The awards recognise exceptional excellence in the technology sector. The Award winners’ presentations took place during GITEX Technology Week from the 10 – 14th October 2022

Ground-breaking products/services (Achievement Award)Telecoms

Nexign Revenue Management

Exceptional Products/Services (Achievement Award) Digital Transformation Protiviti

Ground-breaking products/services (Achievement Award)Ecommerce Tech Mahindra

New Technology (Achievement Award) Digital Marketplace Solutions Tech Mahindra

Exceptional Leadership - (Personal Achievement Award) Digital Transformation Ram Ramachandran, SVP and Head – MEA, Tech Mahindra

Outstanding Sector Leadership and Growth (Achievement)Telecommunications Mobily

Exceptional Leadership - (Personal Achievement Award)Telecommunications Alaa Malki, CTO, Mobily

New Technology (Achievement Award) Satellite Services Eutelsat Quantum

Ground-breaking products/services (Achievement Award)Hardware Nokia - FP5 Network Processer

Exceptional Products/Services (Achievement Award) Sustainability

Nokia - Liquid Cooling for Base Station

Telecommunications Nokia - 5G Edge Slicing in Next Generation VPN New Technology (Achievement Award) Mobile Services China Mobile International

New Product/Service Launch (Achievement)

Innovative Collaborations and Partnerships (Achievement Award)

Telecommunications China Mobile International

Ground-breaking products/services (Achievement Award) Open Nomination Award ZainTech

Innovative Collaborations and Partnerships (Achievement Award) Cloud Services ZainTech

Exceptional Products/Services (Achievement Award) Security and Cyber Security ZainTech

Exceptional Products/Services (Achievement Award) Telecoms Syniverse Exceptional Products/Services (Achievement Award) Metaverse 5dVR

New Technology (Achievement Award) Software Avaya

Exceptional Products/Services (Achievement Award) Software

Exceptional Leadership - (Personal Achievement Award) Digital Transformation

Outstanding Sector Leadership and Growth (Achievement Award) Cloud Services

Ministry of Islamic Affairs, Dawah and Guidance

Dr. Layla Al-Qasem, Undersecretary for planning and digital transformation, Ministry of Islamic Affairs

CISCO - IOT Control Center, Cloud Service

CISCO - IoT portfolio New Technology (Achievement Award) Hardware CISCO - Routed Optical Networking

Ground-breaking products/services (Achievement Award)Hardware

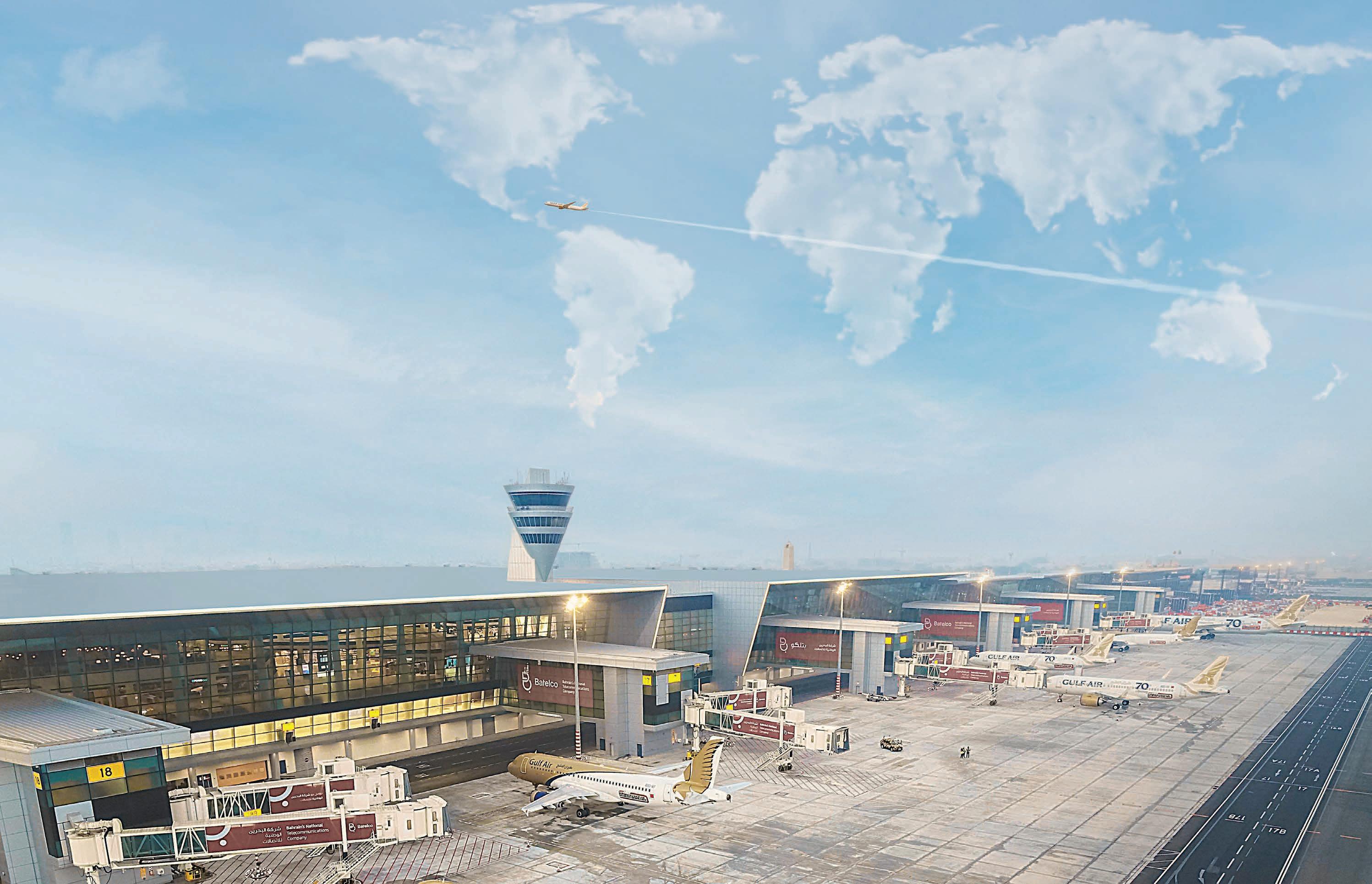

Outstanding Sector Leadership and Growth (Achievement Award) 5G Services Batelco

Exceptional Products/Services (Achievement Award) Smart Cities

Batelco - Sustainability Programmes

New Technology (Achievement Award) Ecommerce Batelco - Omni-Channel eCommerce Experience New Technology (Achievement Award) ERP Software Epicor

Exceptional Products/Services (Achievement Award) Cyber Security Dragos

Ground-breaking products/services (Achievement Award)Financial Services Magnati

Innovative Collaborations and Partnerships (Achievement Award) Sustainability Microsoft

Ground-breaking products/services (Achievement Award)Robotics Tesla

New Technology (Achievement Award) Financial Services stc Bahrain (stc pay)

Best New Product/Service Launch (Achievement Award)Cloud Services

Aruba, a Hewlett Packard Enterprise company

this problem by allowing the necessary fallback, while maintaining the ability for roamers to utilize both voice and data services at the service level they expect.

Testing in today’s dynamic telecom industry is extremely important to assure the quality of the international roaming services provided to customers, especially for operators who implement VoLTE services.

By Brian Beach, Product Owner- Sr Director SyniverseWith the telecom industry moving to new mobile platforms, large operators are taking steps to decommission their legacy circuit switch networks, such as 3G. This move frees up spectrum that can accommodate the increasing 4G and 5G bandwidth demands of mobile devices and Internet of Things (IoT) devices.

This approach is not without its challenges, however. There are still a significant number of operators around the globe that have yet to implement VoLTE or VoLTE roaming. This creates an issue for roamers on these legacy networks who travel into regions where 2G and 3G have been retired. The ability for these devices to fallback to legacy networks to establish voice and data connections is unavailable while roaming.

For mobile operators worldwide that still do not support VoLTE roaming, implementing

Syniverse’s Evolved Mobility 3G to VoLTE roaming solution, will ensure that roaming subscribers using VoLTE-enabled devices can seamlessly connect when roaming onto a visited operator’s network, even if their 3G networks have been retired or decommissioned. Implementing this solution ensures a better customer experience by avoiding disruptions when traveling for those subscribers who do not have VoLTE roaming support.

Syniverse Evolved Mobility is an effective 3G to VoLTE roaming solution that allows both the visited and home networks to maintain the method of roaming that suits them to meet the needs of both operators and end users. This solution facilitates voice and short message service (SMS), clearing, settlement, and near-trade, thus providing full end-to-end capabilities for all parties.

Allowing fallback to 2G may seem like a feasible alternative, but it is minimal bandwidth allocation and inability to handle both simultaneous voice and data services will inevitably leave roamers frustrated. Syniverse’s Evolved Mobility can alleviate

One cost-effective solution is for operators to utilize a full-service partner equipped to support an operator through the steps of implementing a VoLTE roaming network, while developing strong VoLTE roaming relationships with a global network of operators. Backed by a knowledgeable team of experts and cloud-based services, an operator can expedite a successful VoLTE implementation from network architecture design to roaming launch. Every step of the launch process can be supported with an experienced partner, including the fast and effective creation of roaming agreements, IREG and TADIG testing, billing and charging through TAP or BCE, and clarifying common challenges including lawful intercept.

By implementing a fully outsourced solution that provides a unique customer experience through one-stop shop services to provide complete international roaming testing and operations, both small and large operators can outsource their roaming coverage to overcome the complexities of managing back-end roaming. This allows them to successfully achieve CAPEX/OPEX reduction, quicker rollouts, and faster time to market for a global reach delivering enhanced customer satisfaction and revenue growth.

Visit www.syniverse.com/products/ evolved-mobility for more information.

Airlines from around the world rely on us for a comprehensive range of aircraft maintenance solutions, from base maintenance to major modifications, connectivity and more, for most commercial aircraft types including the A350, the B787 Dreamliner and the A380.

We are the first Middle Eastern MRO service provider to receive the approval for major cabin design and modifications from the European Union Aviation Safety Agency (EASA) and have extensive cabin and back-shop capability, as well as Production Organisation Approval from EASA.

Our state-of-the-art MRO facility adjacent to Abu Dhabi International Airport is spread across 500,000 sqm, with heavy-maintenance hangars, dedicated aircraft painting facilities and 140,000 sqm of aircraft parking and preservation space onsite.

We serve a wide range of customers from the world’s leading flag carrier airlines to low-cost carriers as well as OEMs and lease operators, with a capacity of up to 20 lines.

Our dedicated Customer Focus Team is committed to adding value to your airline business with customised solutions, ensuring complete customer satisfaction from the start of every project to timely delivery and beyond.

Welcome aboard!

Follow us on LinkedIn: http://bit.ly/EYEngLinkedIn

Visit our website: www.etihadengineering.com

The UAE’s Ministry of Human Resources and Emiratisation announced recently that an Unemployment Insurance Scheme for employees of the federal government and the private sector has come into force.

The Decree-Law on Unemployment Insurance Scheme stipulates that the insured will be compensated with a cash amount for a specified period of time if they lose their job until they find another employment opportunity, which is subject to terms and conditions.

The new system provides a “social security scheme that ensures the sustainability of a decent life for Emiratis and resident employees during their unemployment period, while reducing business risks,” the ministry said. “It aims to enhance the competitiveness of UAE nationals, boost the attractiveness of the UAE’s job market to attract both international and national talents - building a competitive knowledge-based economy that is among the best globally.”

Compensation will be paid monthly, calculated at 60 percent of the employee’s subscription salary and subject to a

maximum of AED20,000 per month, for a period of no more than three months from the date of their unemployment.

Dr Abdulrahman Al Awar, Minister of Human Resources and Emiratisation, said: “The decree reflects the UAE government’s approach in developing the business environment and enhancing the UAE’s position as a preferred destination to work and live, which is confirmed by global indices. Reports show the preference of people from all over the world to work and settle in the UAE because of the advantages it provides in terms of security, safety, job benefits, as well as the level of education, health, and quality of life.” This contributes to enhancing the stability and prosperity of society, which is among the top priorities of our wise leadership.”

The terms and conditions of the new law apply to all employees in the federal government and the private sector in the UAE, excluding investors, domestic helpers, part-time employees, juveniles under the age of 18, and retirees.

To be eligible for compensation, employees must have been insured for

no less than 12 continuous months, and should not have been dismissed from work.. Furthermore, the compensation claim should not be through fraud or deception and penalties shall apply to both the employer and the insured.

The insured may agree on additional benefits with the service providers – the insurance companies licensed by Central Bank of the UAE and fulfil the conditions for providing unemployment insurance, which are issued by the UAE Cabinet after consulting with the Central Bank of the UAE. Also, service providers may include other government entities assigned by the UAE Cabinet to provide unemployment insurance services.

The compensation to which the insured is entitled to under this Decree-Law shall not influence any other compensation or entitlements outlined under any other legislation in force in the UAE.

Over the last two decades and across 5 continents, I have been privileged to be exposed to both the good and bad of Leadership at the C suite level. I feel it’s necessary to experience both spectrums of the Leadership continuum to appreciate what GOOD truly looks and feels like.

Here are the 3 top traits I believe world class CEO’s must have: the nonnegotiables!

There is no doubt that the position of CEO is full of problems and opportunities. The problems that land on your desk as CEO, typically arrive there as no-one else in your business is able to or willing to solve them.

Making decisions that impact entire teams, organisations and customers is a critical competency and comes from a combination of knowledge, experience and skills. Being able to make decisions quickly (rather than suffering paralysis by analysis) with limited information is what makes this challenging. It’s relatively easy to make decisions when you have all the relevant information on hand.

Here you need: relevant knowledge, skills and experience in a timely manner in alignment to where the organisation is heading, not just for the short term. This requires a sense of risk taking with quality information and support from those around you! You need agility and daring to increase the value to those who believe in our business, from the employees through to your customers.

Drive is passion, conviction, energy and motivation. When these elements are

demonstrated by the CEO, obstacles are more likely to be overcome, bringing higher levels of positivity and success.

Research shows that the “happiness chemical” Seratonin is released, improving communication efficacy at all levels.

Simply by undertaking work you are more passionate about and being exposed to leaders who demonstrate this drive, can result in higher levels of Serotonin being released.

Understanding what drives your people, your teams and organisation, allows CEO’s to lead effectively and to push the buttons required to achieve the most out of the organisation in a sustainable manner.

Ensuring people want to come to work is about creating a culture of inclusion. CEO’s should be authentic about who they are and employees should be able to genuinely behave and trust that their uniqueness, quirkiness and diversity brings increased value to the organisation.

Valuing diversity is not easy as it requires a willingness to listen to points of views that are not necessarily aligned to your own and to be open minded to suggestions that are different. As a leader, we must accept that we don’t have all the answers but trust that they can be found through the people around us.

I have worked with many CEO’s looking to grow their business who hire great people but then stunt the business growth by then putting these same people into a box, and only listening to them when convenient. Using a ‘growth mindset’ and accepting that diversity in thinking and style is critical for success will help generate greater returns. Park the ego and intensify listening!

What are the non-negotiable traits you believe world class CEO’s should demonstrate to get the maximum return for their people and businesses?

Author: Gaj Ravichandra gaj@ kompassconsultancy.com

Ensuring people want to come to work is about creating a culture of inclusion

Step 01 Step02 Step 03 Contact NBF's investment team to discuss your investment requirement. That’s it, you are all set! Our qualified Asset Managers take charge and keep you updated on a regular basis on your portfolio performance.

• Conservative • Moderate • Aggressive Call 8008NBF(623) to start our partnership nbf.ae Your next investment decision is just three simple steps away: our th

Choose your investment option: • Lump sum: Starting From 10,000USD • Systematic Investment: Starting from$1000 (Monthly or Quarterly basis) Terms and conditions apply

Select the investment category to determine your exposure:

designed for maximal automation, security and scalability.

Digitalisation in the banking sector is swiftly changing the field of play where incumbents are facing increasing competition from non-traditional entrants who are billing on customer experience as their point of sale.

The outbreak of the pandemic more than two years ago was an unprecedented catalyst for digital banking across the globe. Banks in the Middle East are accelerating and strengthening their digital channels as evolving customer preferences together with pressure to reduce operational costs and boosts efficiency are leaving financial institutions with no option but to adopt new banking technologies.

Many organisations across different industries have struggled to keep pace with the demand for digitisation, especially during the height of the pandemic, when consumers accelerated their adoption of digital channels. However, the financial services industry has historically had mixed success in technology.

McKinsey said that the artificial intelligence-bank (AI) capability stack combines core systems and AI-and-analytics capabilities in a unified architecture

Meanwhile, banks in the MENA region have been exploring technological innovations and new business models that include digital banking, open banking, predictive banking and modernisation of payment systems to enhance customer experience and personalisation of products while they keep an eye on increasing cybersecurity concerns.

The radical transformation in the era of Industrial revolution 4.0 is being driven by

Spurred on by recent events, what once were predictions of distant changes to banking and banking processes are with us, here and now.

the advancement in digital technologies as previously closed industrial systems have become networked and open.

The financial services sector is no alien to this and Banking as a Service (BaaS), Banking as a Platform (BaaP) and Open Banking are few of an array of new technological innovations that are expected to change the customer experience.

“The business transformation towards a platform-based open banking ecosystem will provide the opportunity to define a courageous ambition that goes beyond incremental change and deliver breakthrough value,” said Deloitte.

BaaS is a clear opportunity for financial institutions in the Middle East to capture and tap into new value streams at a low cost. It is being enabled by the seamless integration of financial services and products into other kinds of customer activities, typically on non-financial digital platforms including e-commerce, travel, retail and health.

Capgemini said BaaS is helping incumbent banks to create new revenue modes, allowing them to monetise their banking stack such as data capabilities and infrastructure through revenue sharing agreements, subscription fees or one-time set up charges.

Meanwhile, BaaP enables fintech and non-financial companies to provide services to banking institutions. Traditional banks’ operating models impedes their efforts to meet the need for continuous innovation, but BaaP allows financial institutions to focus on their core business while delivering new innovative products and services.

“The AI-first bank of the future will need a new operating model for the organisation, so it can achieve the requisite agility and speed and unleash value across the other layers,” said McKinsey. Open banking is shifting the financial services industry toward hyper-relevant, platformbased distribution while offering banks a window to expand their ecosystems and extend their reach.

facilitate data sharing, or in mandating security standards.

New York-based Tiger Global Management led a $12 million funding round for Tarabut Gateway in November 2021 as the firm seeks to expand its Open Banking platform into Saudi Arabia and North Africa. Tarabut Gateway was licensed by the Dubai Financial Services Authority to carry out account information

– McKinseyBahrain is implementing a Europeanstyle regulation-driven approach and the UAE has adopted an Americanstyle market-driven approach under the guidance of the Abu Dhabi Global Market and Dubai International Finance Centre.

Saudi Arabia is also implementing a market-driven strategy, but the Gulf state’s approach is inclined towards a more formal regulatory framework though its regulations do not follow Bahrain in requiring the opening up of application programming interfaces (APIs)—which

services and payment initiation services activities in April. The Middle East is one example of an emerging global openbanking microcosm.

Since the outbreak of the pandemic, customers’ lifestyle habits are increasingly being motivated and directed by the speed and simplicity of online services; the same applies to how they want to bank. The implementation of an automated customer onboarding process is an essential feature that determines whether a financial institution can obtain new customers.

Data onboarding is the first contact that a new user has with the bank and the process should be intuitive, seamless, secure, responsive and efficient. Ernst & Young said that customer onboarding has become an even greater area of focus amid changing regulations, innovative technologies, the rise of challenger banks and the closure of physical bank branches.

Cloud computing has opened countless doors for financial services firms, giving them the freedom and flexibility to innovate, without the time and resource commitments that are unavoidable with on-premises systems

The artificial intelligence-bank capability stack combines core systems and AI-andanalytics capabilities in a unified architecture designed for maximal automation, security and scalability

Customer onboarding is the guidance of customers in the first steps of platform accessibility and a critical step in a customer’s journey with a financial institution as it leaves a long-lasting impression in the clients’ minds about how they perceive a financial institution.

Standard Chartered’s fintech investment arm, SC Ventures, launched Appro, a fintech start-up that digitises the retail banking user journey in the UAE in August. The platform will initially allow applications for credit cards and personal loans with plans to expand its offerings to include mortgage loans, car loans, current and saving accounts and wealth management products in 2023.

RAKBANK launched its digital onboarding platform for SME loans in April which allow customers to apply for business loans, term and working capital finance and asset-based finance.

KPMG identified three approaches that banks should adopt in their digital customer onboarding journey: Protect – which entails the development of in-house processes and standards to ensure compliance with jurisdictional requirements in terms of data privacy and API guidelines.

Compete – that is investing in strategic enablers both in-house and externally including internal data usage (e.g. unstructured, big data) and external (e.g. mobile app, social media).

Innovative – products and services offered through the building of strategic partnerships with nonfinancial services players to enhance user experience.

Digital customer onboarding is a critical part of the overall customer experience and industry experts say financial institutions shouldn’t let bottlenecks, complications and barriers be the first impressions customers have with their services.

Cloud adoption is the backbone of digital innovation, and it is shaping the future of the financial services sector. It gives banks access to on-demand resources—such as

networks, servers, storage and APIs—that can be rapidly provisioned and released with minimal management or service provider interaction.

“Cloud computing has opened countless doors for financial services firms, giving them the freedom and flexibility to innovate, without the time and resource commitments that are unavoidable with on-premises systems,” said PwC.

“The cloud is the only place where customer data gains scale, agility and the power to drive reinvention so a business can soar,” said Accenture. With several cloud solution providers from Microsoft to Oracle to Amazon Web Service expanding their footprint in the region, banks are tapping into the cloud to boosts operational efficiency while improving their ability to partner, source and collaborate with fintechs.

The advancements in fintech and the booming development of new APIs are increasingly driving banking to the cloud as the industry is looking to adopt the agility, speed and innovation more commonly found in the technology sector.

Cloud technology has the potential to bring about profound changes to banks and the entire financial services sector given that the innovation offers unprecedented opportunities to capture value by leveraging customer data. The cloud offers financial institutions vast opportunities including easier customer data analytics and sharing, improved marketing time, cost reduction and enhanced flexibility and operational efficiency.

Banks that are adopting the cloud are bringing new capabilities to market more quickly, innovate more easily and scale more efficiently while addressing surging cybersecurity risks. Financial institutions can choose a cloud strategy by service type including backend as a service (BaaS), infrastructure as a service (IaaS), platform as a service (PaaS) and software as a service (SaaS).

The emergence of new technologies is offering the financial services sector a window to be more innovative and efficient in service delivery, but it is also opening the door to new entrants such as fintechs, global retail giants as well as card networks and challenger banks.

The business transformation towards a platform-based open banking ecosystem will provide the opportunity to define a courageous ambition that goes beyond incremental change and deliver breakthrough value

– Deloitte

Customer onboarding has become an even greater area of focus amid changing regulations, innovative technologies, the rise of challenger banks and the closure of physical bank branches

– Ernst & Young

The outbreak and spread of the pandemic over the last two years planted multiple seeds of disruption which are setting a dynamic new horizon of growth for the asset management industry in the coming decade. Boston Consulting Group said in May that the asset management industry continued its unprecedented growth trajectory in 2021, with global assets under management (AuM) rising by 12% to $112 trillion, significantly above the 20-year growth average of 7%.

AuM in the Middle East, which increased by 52% since the end of 2019, has been rising consistently and analysts expect them to expand further driven by soaring energy prices and a spectacular rebound in the property market.

“Middle East-based managers had seen a contraction in AUM in 2015 and 2016 following the oil price slump that started in 2014,” alternative assets industry data and analytics firm Preqin said in May adding that AuM in the region has rebounded over the last years increasing with the share of assets taken by the largest two markets Saudi Arabia and the UAE recording improvements.

The sector is being challenged by changes wrought by market forces, growing sophistication, increasing competitive pressure and significant emerging trends, but asset managers in the region expect increased flows in the near future with AUM driven by strong retail markets

The global asset management industry is evolving and the market within the Middle East region is no exception. The changes in demographics, technology, environment and social behaviors have set the ground for rapid transformation in the asset management industry.

“The pandemic has been a watershed event for the wealth industry, accelerating dramatic changes in investor attitudes, behaviors and expectations,” said ThoughtLab.

A study that was conducted by Moody’s in September 2021 showed that asset managers in Gulf countries expected increased inflows over the next 12 months amid growing demand for Islamic and environmental, social and governance (ESG)-compliant investments. The industry is being confronted with the challenge of transforming itself through a combination of market forces and megatrends.

Traditionally viewed as a source of capital, the Middle East is now being seen as a region with promising investment opportunities. The asset management industry continued its unprecedented growth trajectory in 2021, with AuM in the Middle East rising by 16% to $1.2 trillion significantly above the 10-year growth average, Boston Consulting Group said in May.

Growth in AuM in the region is being driven by strong performance in retail markets. Over the past two years, retail investors have increasingly become one

of the most important investor segments, outpacing institutional AuM as a source of capital growth, at 9% of total AuM.

The Middle East financial services sector is ripe for mergers. Regional governments are supportive of consolidations because robust banking systems able to finance new industries are seen as key to boosting the dynamism of the private sector and accelerating growth.

management firm’s special purpose acquisition company (SPAC) was listed in New York in April 2022. The $100 million SPAC or blank-check firms will focus on identifying and merging with technology or tech-enabled financial services business in the Middle East.

A survey by Oliver Wyman showed that consolidation appetite in the GCC region is high, reflecting the asset management

– Boston Consulting GroupSaudi Arabia completed the tie-up between National Commercial Bank and Samba Financial Group into Saudi National Bank (SNB) in April 2021. The merger led to the creation of SNB Capital, the biggest asset management firm in the Middle East region with $81.8 billion in assets under management at the end of Q1 2022.

UAE-based SHUAA Capital merged with Abu Dhabi Financial Group in August 2019. The merged entity, SHUAA Capital, registered $13.1 billion in assets under management in 2021. The asset

sector’s growing sophistication as well as mounting competitive pressure.

The burgeoning demand for net-zero compliance by investors is driving some asset management firms to develop sustainable investing strategies as public attention toward the global sustainability agenda is also rising.

BNP Paribas said that clients have become increasingly demanding in the complex world of asset management, driven by younger investors such as NextGen and Gen Z clients. The increasingly growing demand for sustainable investing from investors is evident in the pledges by institutions and increased flow into sustainable mutual funds and exchangetraded funds (ETFs).

“With $100 trillion to $150 trillion in global capital deployment required to reach net-zero goals by 2050, demand for sustainable investments represents an opportunity that will dominate the sector in both the short and long term,”

The asset management industry continued its unprecedented growth trajectory in 2021, with global assets under management rising by 12% to $112 trillion, significantly above the 20year growth average of 7%

said Boston Consulting Group. Additional growth is expected to come from the rise of climate-tech unicorns and the private investment flows into decarbonisation that became widespread last year.

Conscious investing was slowly building momentum through the support of corporate social responsibility, but with COVID-19, the need for action on ESG topics by governments and corporations alike has never been higher. ESG is increasingly becoming an integral part of how the global financial services sector operates.

The pandemic also placed the Islamic finance industry back on ESG investors’ radar. S&P Global said that as regulators and policymakers around the world seek to establish a more sustainable, stakeholderfocused and socially responsible financial system for the future there are certain similarities between Islamic finance and sustainable finance.

Shariah-compliant financial instruments offer a framework that embodies the social and ethical values of ESG investing, offering asset managers the opportunity to adopt more sustainable and conscious investment strategies while tapping into the potential value of impact investing. Sustainable investing has come a long way and had over the years gained more interest amongst institutional investors.

The global push to achieve net-zero carbon emissions by 2050 is both mission critical for the planet and presents several opportunities for the asset management industry. Meanwhile, the hosting of the next two rounds of the United Nations climate summit, Conference of Parties (COP), by Egypt and the UAE in 2022 and 2023 respectively is a boon for the asset managers and it is expected to drive rapid social and economic changes in the region.

The profound shift in the asset management sector that was accelerated by the pandemic has overturned conventional wisdom about investors. ThoughtLab said that digital is no longer just the domain of the millennial retail market; it is now preferred by older and richer investors.

Asset management firms have remained largely on the sidelines in an industry where digitalisation has transformed much of the financial services and products. The industry is typically seen as embodying old-fashioned values and providing discrete, tailored service attributes that remain valuable parts of the business, but McKinsey said for many clients, these qualities are “no longer sufficient”.

The outbreak of the pandemic forced wealthy clients to accelerate their adoption of digital technologies and seems certain to lead to permanent changes in the behaviour of both firms and investors. “Asset managers are unlikely to be able to

and lifting compressed margins,” McKinsey added.

Once a laggard in the adoption of technology, wealth management is accelerating digitalisation, deploying artificial intelligence (AI), Big Data, robotics and other technologies to enhance client’s experience and trust—which is central to private banking relationships.

The growth of “automated wealth managers” or Robo-advisors is revolutionising the asset and wealth management industry with unprecedented force. By leveraging algorithms to offer financial advice for a fraction of the price of a real-life client advisor, Robo-advisors

– Oliver Wymanserve modern clients effectively without a digitised operating model,” said McKinsey.

Digitalisation in the asset and wealth management sector is being driven in part by changes among clients. Though the typical client in a developed market today is around the age of 65 years and is fairly comfortable with digital technology, shifting demographics, evolving client behaviours, the rise in new innovative technologies and emerging disruptive competition are all reshaping the industry.

A coherent digital transformation plan will give asset management firms a head starts in leveraging stronger client relationships, reduced operating costs and enhanced risk management and regulatory compliance capabilities. “The changes are helping firms meet their regulatory obligations, boosting the productivity of relationship managers

for the MEA region

are growing at a rapid pace, doubling their assets under management every few months.

Kenneth Research projected that the Robo-advisory market in the Middle East and Africa will grow at an overall compound annual growth rate (CAGR) of 55.9% to $3.8 billion by 2023. Roboadvisory platforms in the region are quickly taking off, with several homegrown players having recently joined the onrush.

The shift to digitisation is inevitable and industry experts expect it to radically transform the industry in the coming decade. To succeed in MENA’s transformed and competitive market, wealth and asset management firms need to revise their strategies and switch from a productcentric to a customer-centric approach— one focused on personal requirements not the demographic.

Consolidation appetite in the GCC region is high, reflecting the asset management sector’s growing sophistication as well as mounting competitive pressure

MEBAA Show, the Middle East’s leading business aviation event is back again this December - bringing the business aviation community together in person to take advantage of the enormous growth predicted for this sector.

for the industry to streamline as well as strengthen processes and practices to broaden the appeal of Shariah-compliant financial products.

Islamic banks are accelerating and strengthening the digitalisation of complex processes as well as end-to-end customer journeys in lockstep with their conventional peers. According to S&P Global, “accessing bank services digitally, issuing Sukuk on a digital platform using blockchain technology and enhancing cybersecurity will be the three main factors to help improve the industry’s resilience.”

The Islamic finance sector continues to demonstrate considerable growth globally, driven by continued standardisation of the industry, the robust appetite for Shariah-compliant products and the alignment of its financial instruments with environmental, social and governance (ESG) values.

The war in Ukraine has disrupted commodity supply chains, driving up consumer prices and fuelling inflation worldwide while hawkish interest rate hikes by the US Federal Reserve to cool down inflation is driving other central banks to raise their policy rates despite the risk of

derailing growth. However, “the economies of GCC countries, Malaysia and Indonesia will remain strong in 2023 because of the high prices of oil and other commodities that boost both corporate and government coffers,” said Moody’s.

The growth in the Middle East, Africa and South Asia (MEASA) region on the back of soaring prices of crude oil and other commodities and the relaxation of pandemic-related restrictions is projected to remain strong over the next 12 to 18 months.

The standardisation of the global Islamic finance legal and regulatory framework represents a huge opportunity

Meanwhile, the alignment of certain Islamic financial products with environmental, social and governance (ESG) factors has thrust the industry back on the radar of conscious investors while encouraging the streamlining of the sector to boost its attractiveness. ESGlinked Islamic bonds will likely remain a key issuance theme in core Islamic finance markets supported by government initiatives focusing on sustainability and economic diversification.

The high crude and palm oil revenues are creating positive spill over effects on the other sectors of the economy where

The improved operating environment in the MEASA region, and growing interjurisdictional cooperation will sustain the growth of Islamic banks’ assets and liquidity position as the lenders are expected to continue outperforming their conventional peers

Islamic banks do most of their lending. Meanwhile, inflation across most Islamic banking markets will remain moderate relative to the US as governments are providing substantial subsidies to offset inflationary pressure.

The improved operating environment in the MEASA region will sustain the growth of Islamic banks’ assets and liquidity position as the lenders are expected to continue outperforming their conventional peers. S&P Global projected that the global Islamic finance industry will see doubledigit expansion again in 2022-2023 after a 10.2% growth in total assets in 2021.

Over the longer term, Islamic banks in the Gulf region will benefit from the economic diversification agendas of countries, which aim to promote higher employment levels among citizens in the private sector.

The profitability of Shariah-complaint banks will also improve this year as provisioning needs decline and net profit margins widen. “After declining in 2020 when the pandemic first struck, the return on average assets for most Islamic banking systems improved in 2021 partly because of lower provisioning needs as economies recovered,” Moody’s said in September adding that the provisions will drop to pre-pandemic levels in 2022-23—which will further boost profits.

The retail focus of most Islamic banks will likely help preserve their asset quality going forward as retail asset quality is particularly resilient, thanks to the high proportion of borrowers who work in the public sector, prudent regulations and established credit bureaus.

However, the current operating environment is likely to put more pressure on GCC Islamic banks and lead to more tie-ups to create new national or regional champions. “We expect further merger and acquisition (M&A) activity as many Islamic banks have weaker franchises which lack strong competitive advantages, particularly in pricing, cost of funding and growth opportunities,” said Fitch Ratings.

Over the years, all M&A deals in the GCC region involved at least one Islamic

bank. Kuwait Finance House (KFH) closed its four-year acquisition of Bahrain’s Ahli United Bank for $11.6 billion—a rare crossborder merger that will make KFH the second-largest Islamic bank globally by assets behind Saudi Arabia’s Al Rajhi Bank. “This transaction will position KFH as a dominant bank in the GCC as the addition of AUB’s solid corporate banking franchise complements its large and strong domestic retail customer base,” said Moody’s.

Bahrain’s Al Salam Bank completed the acquisition of Ithmaar Bank’s consumer banking division and several other assets in July in a deal valued at $2.2 billion. The integration of the two banks is expected to be completed within the second half of the year.

Oman’s Sohar International Bank is in talks for a potential merger with Bank Nizwa—no timeline was provided for the expected finalisation of the deal. Islamic banking has evolved over the year and so too have the product structures as the sector moves to offer tailored features to meet the needs of a growing investor base.

The pandemic demonstrated how the capacity of a bank to shift its business online is critical for its continuity. For the Islamic finance sector, banks and Sukuk, digitalisation and increased collaboration with fintechs could help strengthen the industry’s resilience and open new avenues for growth.

“Offering digital banking services, issuing Sukuk on a digital platform using blockchain technology and enhancing cyber

security will be the three main factors for industry resilience,” said S&P Global.

Sukuk issuance, which bans interest payments and pure monetary speculation, has been gathering steam outside of core Islamic finance centers such as Luxembourg and London. However, the industry remains largely fragmented and plagued with several challenges including high costs and the probability of human error due to multiple intermediaries that are involved in the issuance process.

To address high costs, lack of transparency and the probability of human error, industry experts say blockchain could be the missing link. The tokenisation of Islamic bonds by leveraging blockchain technology is expected to reduce the various costs associated with the issuance process—potentially opening the field to start-ups and small and medium enterprises (SMEs).

Blockchain technology has the potential to accelerate and unlock the long-term potential of the Islamic finance sector while enhancing its appeal beyond its traditional borders. It allows for all transactions to be unalterably timestamped and uniquely cryptographically signed—increasing operational efficiency, cost reduction and enhancing transparency.

Meanwhile, digital banks are emerging in Islamic finance markets because of new licensing frameworks introduced by financial authorities in core Islamic markets in line with global trends. “More digital banks will emerge given that the central bank in Kuwait will also issue digital banking licenses by the end of 2022,” said Moody’s.

Accessing bank services digitally, issuing Sukuk on a digital platform using blockchain technology and enhancing cybersecurity will be the three main factors to help improve the industry’s resilience

– S&P Global

Leading Shariah-compliant digitalexclusive banks in the MEASA region include the UAE’s Zand, Saudi Arabia’s D360 Bank and STC Bank and Bank Fama and Bank Allo. Islamic banks have ample liquidity to support their expansion thanks to strong inflows of deposits.

The UAE is leading the charge in developing a unified global Islamic finance legal and regulatory framework. Islamic finance, which bans interest payments and pure monetary speculation, continues to expand across key markets in the MEASA region but the industry has remained largely fragmented with the uneven implementation of its rules.

Muslims make up about a quarter of the world’s population and are said to be the fastest-growing religious cohort and as such, the potential market for Islamic financial services is enormous. S&P Global forecasted that Sukuk issuance will decline in 2022 after a stabilisation at $147.4 billion last year versus $148.4 billion in 2020.

The plunge in issuance is attributed to lower financing needs for some countries and corporates in the MEASA region due to high commodity prices. However, more issuers are tapping the conventional markets where it is easier and quicker to get the funds.

Sukuk instruments remain more complex and time-consuming for issuers than conventional bonds. Most Sukuk issuers are facing the challenge of implementing Standard 59 of the Accounting and Auditing Organisation for Islamic Financial Institutions (AAOIFI) without changing the credit characteristics of the transaction. With the adoption of Standard 59, the traditional Murabaha structure is no longer held to be Shariah-compliant by the Bahrain-based organisation and compliance became an obligation throughout the lifetime of the transaction.

S&P Global said that the market for hybrid Sukuk that combine a commodity Murabaha with tangible assets almost froze in early 2021 when the standard came into force in the UAE. The risk of

tangibility events is present for Sukuk issuers (mainly non-sovereigns) with limited tangible assets and low headroom.

“The amount that can be raised through the issuance of Islamic bonds can be capped by the value of an obligor’s tangible assets,” Fitch Ratings said adding that a built-in cap on leverage could be negative for issuers with limited tangible assets, asset-light firms and highly indebted issuers—for whom it could restrict access to funding.

While gaps remain, some standardisation has been achieved in language relating to tangibility events, delisting events, indemnity payments and partial-loss events. Standardisation is expected to make Sukuk issuance comparable with conventional instruments from a cost and effort perspective that it will gain prominence among both issuers and investors.