Now that we’ve officially kicked off seminar season, I’m excited for the months ahead and hopeful that I’ll get to see many of you in person Forthosejoiningusvirtually,thankyou Yourengagementinourwebinarshelpskeepourcommunitystrong,nomatterwhere you’retuninginfrom

Asyou’velikelynoticedinthenewmemberportal,accessingyourcourseshasbecomeeveneasier UnderUpcomingCourses&Events and then My Events, you can view everything you’re registered for, dates, times, downloadable manuals, and now direct links to join yourwebinarsrightfromyourportal We’rethrilledtoofferthisaddedconvenienceaspartofourcommitmenttomakingyourlearning experienceseamless

WearealsoapproachingthestartofMaryland’sLegislativeSession acriticaltimeforourprofession.Lastyear,MSATPsuccessfully fought the proposed 25% sales tax on services, protecting the tax and accounting community from a measure that would have impactedpractitionersandclientsacrossthestate.

GivenMaryland’scurrentdeficit,werecognizethatsimilarproposalscouldreturntothetable.Pleaseknow:

Weareprepared.

Wearewatching

Wearereadytoprotectyou,yourclients,andalltaxandaccountingprofessionalsinMaryland

To do this work well, we also need you This season, we are seeking advocacy volunteers to help us read and review bills as they are introduced If you’re interested in lending your expertise and adding your voice to our legislative efforts, please email ghawkins@msatporg

Your involvement strengthens our advocacy and ensures that the real-world impact on practitioners is front and center in every conversation

Asweheadintotaxseason,Ihopeyoufeelprepared,supported,andconfident andthatyouknowMSATPisrightbesideyouevery stepoftheway.Together,wecontinuetobuildacommunitythatlearns,grows,andthrives.

TheHiddenVillain:CortisolandtheStressLoop

Financial anxiety produces cortisol, the body’s primary stress hormone Over time, cortisol reinforces the amygdala’s fear responses and suppresses hippocampal function This neurochemicalimbalancetrapsclientsinasurvivalloop:

1CortisolhyperchargestheAmygdala,heighteningreactivity andfear-baseddecision-making

2Cortisol suppresses the Hippocampus, limiting rational thoughtandmemoryformation

"Theresult:evenclientswho‘knowbetter’can’tdobetter,until thestresscycleisinterrupted"

Think about all the words that you use in a given week Perhaps you use words such as, tech-stack, sync-status, app, QBID, going viral (not the medical kind), tweet (not the ornithological kind), like-share-subscribe (as a single word), influencer, tablet (not the medicinal kind), password locker, WiFi, browser (not in the non-committal shopper kind), remote server (not the inattentive waiter kind), or any noun used as a verb, or any word that intentionally omits vowels And this list just deals with electronic and industry jargon We won’t cover, beyond listing as examples, some of this current generation’s emerging vernacular; words like brain-rot, skibidy, riz, and the like

Having thought of your list, I now have a question for you: How far back in time would you have to travel to utterly confuse anyone that would speak with you?

If you could travel back 40 years, do you think that the people around you would comprehend these terms, or the emotional and social baggage (not to mention the professional liability) that comes with these terms? By the way, 40 years ago, Back to the Future [i] had its original screening Consider that Marty McFly and Doc Brown travelled back only 30 years to 1955, and forward in the sequel to 2015 [ii] We are beyond the future portrayed in that series of films!

In this context, let us now consider the word, meme

The term has been around for at least a half century [iii] – as long as your humble narrator Though there is evidence that it is possibly twice as old [iv] There is an entire scientific discipline called ‘memetics’, though most of us experience this term in the form of an image taken from pop culture with ironic text superimposed on it These images –many as JPGs, PNGs, or GIFs; memes in the parlance of our day are shared, many virally so (How is that for a sentence that would fail you out of a 1980s era English class?)

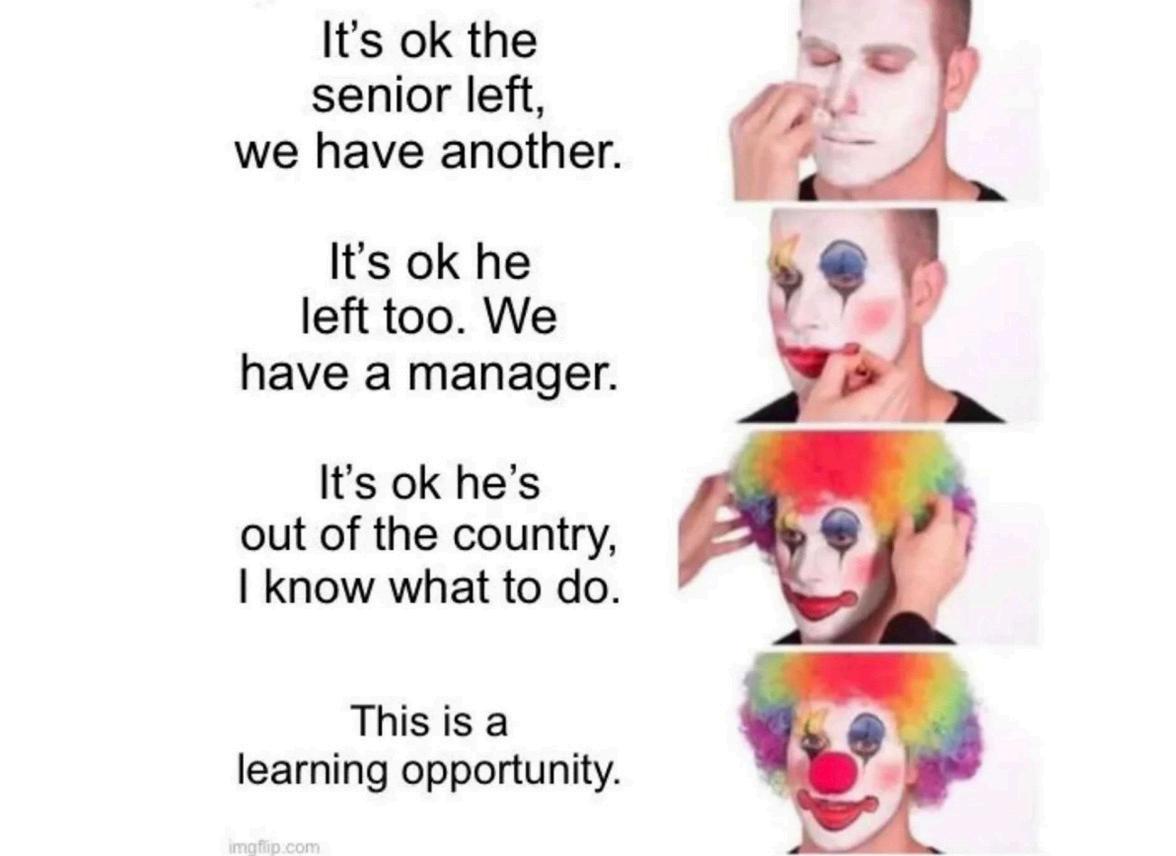

There is one meme in particular that is relevant to our industry and stands out for discussion. The meme consists of 4 images presenting a young man adorning his face with clown makeup The first image shows him applying a base coat of white makeup The second image shows him coloring his eyes and lips The third image shows him donning a rainbow wig The fourth image shows him fully decked out with a clown nose

In his book, The Comic Toolbox: How to be Funny Even If You’re Not, author John Vorhaus noted that comedy is equal parts truth and pain [v]

Gazing at these memes will make you want to laugh and cry; they must be comedy gold!

And you thought assets equals liabilities plus equities was simple

This article was drafted a couple days after Bob Jennings delivered his two-day Business Tax Law Updates seminar, of which I attended (virtually, naturally) Before that, there was the eight-hour OBBBA deep dive and the eight-hour 1041s for Estates and Trusts seminars

We spend so much of our life; our best energies and highest ideals, in learning the regulations and guiding our clients towards compliance We are prohibited from advising clients based on the likelihood of being audited; the law is the law –comply with it [vi]

I don’t know about you, but ninety years from now, when I can finally retire, I fully expect my sole mumblings to consist of exhortations about needing both total mileage and business mileage. (Daddy, why does Great-Grandpa Johnny keep asking me for my mileage log?)

And why?

Why have we spent all this time adhering to these needlessly complex rules and advising others to do same when no one is looking?

A couple of quarters ago, I wrote about guiding two clients through Schedule C audits “They’re ba-ack!” [vii] Now with the politics of our moment, no one is minding the store. As professionals we are supposed to remain impartial, and also, we are supposed to serve the public trust

When we complete a return or prepare a financial statement, we are affirming that something happened Someone purchased a computer and depreciated it Someone paid an employee Someone took a distribution These things happened and we documented it and signed our name as such

Under the QBID rules, we are excluded as service providers [viii] Though we may not be the engine of the economy, we are most certainly the oil that allows the engine to operate properly Our work is what allows people to transact with confidence

This high-minded talk evaporated when the taxpayers simply said, “No ” As in, I don’t care whether or not I get audited, I’m not going to ” And then the government gutted its tax enforcement ranks [ix] And then the government shut down its operations [x] (hopefully they are restored by the time this article is published) And before that, the government simply shredded millions of 1099 forms because they couldn’t get to processing them [xi]

It's been nine days since the 15th October deadline and the next tax season is looming And we are having conversations with our clients about the need to document their deductions and their eligibility for the EIC, the CTC/ACTC/ODC, the AOC, and/or the HOH status [xii] We are preparing our business clients for the 1099-NECs that will be due in about ninety-nine days from now

It’s hard not to feel like the clown in that meme One can imagine the script:

Image 1 – putting on the base layer of white makeup: Entered the tax industry; “it’s easy!”, they said “You’ll never want for work!”, they said

Image 2 – painting the eyes and lips: Got my certification (EA/CPA/JD, etc) “Now you can charge the big bucks!”, they said

Image 3 – donning the rainbow wig: Sat through hours and hours of CPE and even paid attention! “Now you ’ re ready for tax season!”, they said

Image 4 – fully clowned up with a red nose: “Do you have your mileage log? Is your home office regular and exclusive? Did you make your quarterly estimated payments like I told you?”, we asked with bated breath

The government doesn’t care and neither do the taxpayers, but we ’ re fully liable to both Neat!

To say burn-out is an issue is an understatement

Trying to end on a positive note, I’ll invoke the image of the orchestra performing on the Titanic as she sunk [xiii] The phrase, “ and the band played on ” is a touchstone in our society for grace and professionalism under dark times [xiv]

Ok that’s not exactly a positive note

How about this: “Doing the right thing means doing something that is morally correct even without the promise of reward or the threat of punishment ” [xv]

In other words, we should be good for goodness’ sake, for our own sake, even if no one is watching

Jonathan Rivlin is a CPA practicing in the Baltimore metropolitan area He has been a member of the MSATP since 2002 and served on the Society's Board of Directors from 2018-2024

[i] https://www imdb com/title/tt0088763/ [ii] https://www imdb com/title/tt0096874/?ref =ttfc ov bk [iii] https://en wikipedia org/wiki/Meme [iv] http://cfpm org/jom-emit/1999/vol3/laurent j html [v]https://www goodreads com/book/show/596322 The Comic Toolbox [vi] https://www irs gov/pub/irs-pdf/pcir230 pdf [vii] Free State Accountant, MSATP’s Quarterly Journal, Summer 2024, pages 8–9 [viii] https://www irs gov/newsroom/tax-cuts-and-jobs-act-provision11011-section-199a-qualified-business-income-deduction-faqs

[ix] https://www cbsnews com/news/irs-doge-cuts-layoffs-31-percentauditors-tax-revenue-impact/

https://www icij org/news/2025/03/the-irs-unit-that-audits-billionaireshas-lost-38-percent-of-its-employees-since-january-new-data-shows/ [x] https://www cpapracticeadvisor com/2025/10/08/irs-begins-tofurlough-employees-says-most-operations-closed/170517/ [xi]

https://www currentfederaltaxdevelopments com/blog/2022/5/11/tigtareports-irs-destroyed-an-estimated-30-million-information-returns [xii] https://www irs gov/pub/irs-pdf/f8867 pdf

[xiii] https://en wikipedia org/wiki/Musicians of the Titanic [xiv] https://voyis com/the-band-played-on-the-musical-legacy-oftitanics-orchestra

[xv] https://knowledge wharton upenn edu/article/doing-the-rightthing-when-moral-obligation-is-enough/

Asweinchclosertobusyseasonandthelongdaysthatcomewithit,manyofus startlookingforanythingthatcansimplifyourevenings.Betweenclientcalls, deadlines,andlast-minutedocument“surprises,”dinnercaneasilybecomean afterthought orworse,anotherstressoronafullplate.

Tomakelifealittleeasier,wewantedtoshareamealthat’sperfectfortaxand accountingprofessionalsduringthebusiestmonthsoftheyear:Slow-Cooker ShortRibs.

Thisrecipeisthedefinitionofsetitandforgetit Doalittleprepinthemorning,let theslowcookerdotheheavyliftingallday,andwalkintoyourkitchenat dinnertimewithdinneralreadydone Comforting,hearty,andabsolutely delicious it’sfuelforthelongnightsahead.

Whetheryou'reworkingfromhomeorheadingbacklatefromtheoffice,thisis oneofthosemealsthewholefamilywilllove andyoubarelyhavetoliftafinger at6p.m.

AI promises efficiency, but it also brings new vulnerabilities. For financial professionals, staying informed isn’t optional it’s essential to protecting your work and the people who rely on you.

RACHEL MACE

Artificial intelligence isn’t going anywhere, and it will rapidly change the business landscape as we know it There are endless positive possibilities on how to leverage AI to be more efficient However, it’s important to stay informed and exercise caution when leveraging this powerful tool Your clients, colleagues, and peers trust you to make informed decisions Ensure that your information is always correct, your processes always include appropriate review, and that you are always using good judgment with technology Even if it’s built into the platforms you trust and use every day

As we gear up for tax season, many of us are tightening up operations, reviewing our tech stack, and making sure our workflows are ready for the rush

One person who has become a go-to resource in this space is Jason Staats, a CPA known for his thoughtful, practical reviews of the software and apps that power modern accounting and tax firms

Why Jason Staats Matters in Our Space

Jason has carved out a unique lane by evaluating tools the way real practitioners use them not the way software companies market them Across his YouTube channel, social posts, and community conversations, he breaks down everything from workflow solutions to automation tools to AI-driven tax assistants.

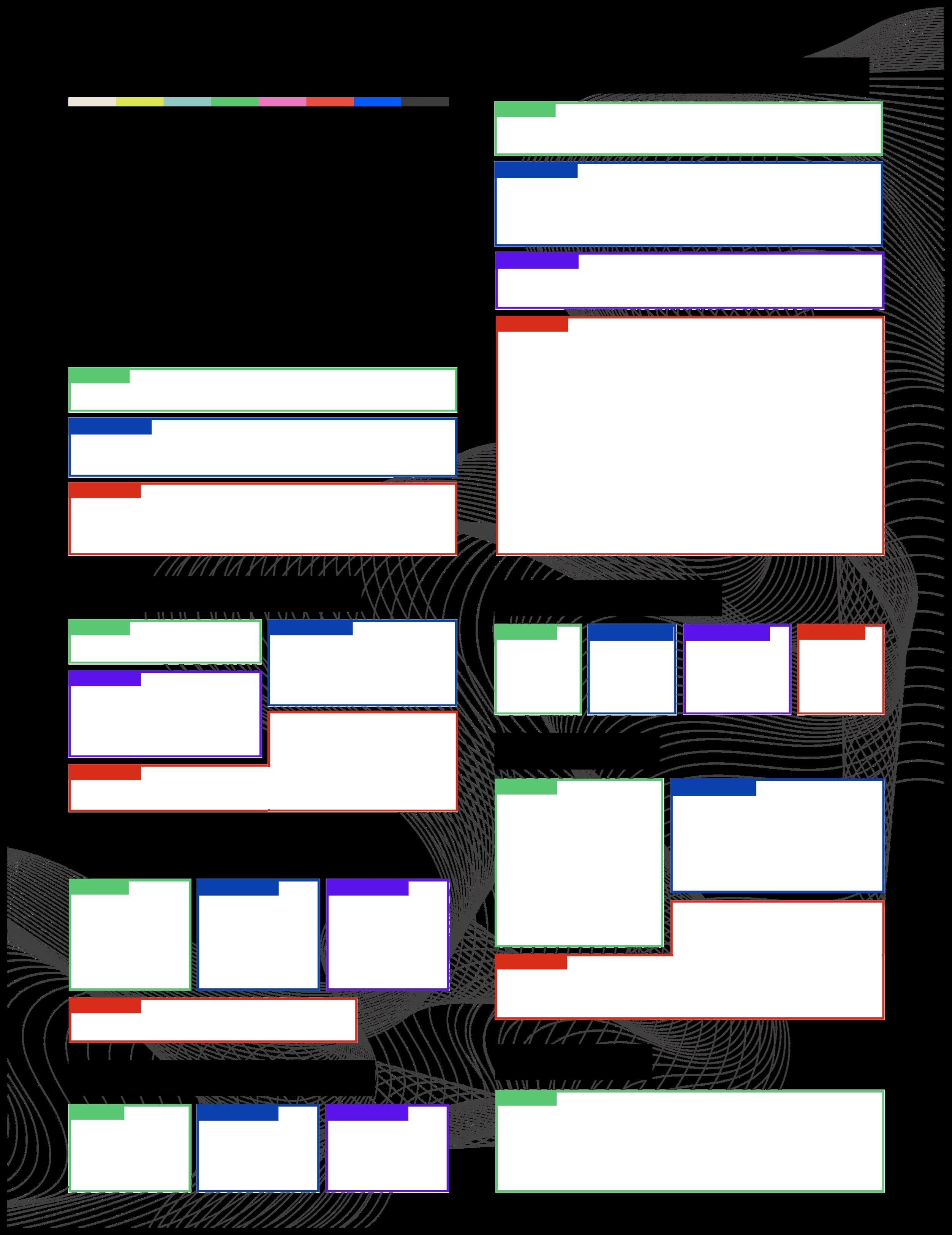

What makes his work trusted is his honesty He calls out what’s worth your time and what’s not As he recently put it: “136 apps for accounting firms, 90% of which aren’t worth touching Here’s a breakdown of the only apps worthy of your consideration ”

He shines a light on what integrates well, where the gaps are, and how certain tools actually impact profitability and capacity inside a firm It’s the kind of guidance that helps practitioners make smart decisions before busy season hits

A One-Page Resource Worth Grabbing

One of the tools he recently shared is a one-page PDF summarizing every app worth considering for accounting firms, complete with working links It’s a clean, visual way to scan the landscape quickly perfect as we map out operational needs for tax season

(On the next page)

By pairing Jason’s reviews with the app spreadsheet we ’ re sharing, our community gets:

A curated list of tools with real practitioner insight

A central place to compare features, experiences, and peer feedback

A chance to build shared knowledge around what actually works for small and mid-sized firms

A helpful starting point when evaluating workflow updates, automations, and resource gaps

As we move into the busiest stretch of the year, this combination of expert review and community collaboration helps everyone make smarter, more confident decisions.

1.Explore the spreadsheet of tools and Jason’s notes

2.Use the PDF as your quick-glance map for options worth considering

3.Share your insights with other MSATP members so we lift each other up heading into tax season

Together, we build stronger systems and that’s how we thrive as a community

Download the App Spreadsheet Here

FREE access to Verifyle Platinum If you haven't done so already, it’s time to safeguard your client’s information and enhance your practice’s efficiency Verifyle Platinum is an ultra-secure document storage and communication platform designed with professionals like you in mind It offers a space to share, store, and communicate securely.

Earmark CPE

With Earmark's Unlimited Subscription, members can enjoy unlimited free CPE courses every week, an ad-free experience within the app, and the option to skip sponsor messages during registration for sponsored courses It's a game-changer for professionals in small firms, providing a convenient and affordable education

As a NASBA-approved CPE sponsor and IRS-approved CE provider, Earmark offers a vast range of courses covering accounting, tax, technology, fraud detection, personal development, practice management, and more Our CPAs, CMAs, and EAs can now meet their continuing education requirements simply by tuning in to insightful podcasts We're particularly excited about the exclusive Federal Tax Updates podcast, which provides biweekly federal tax news and analysis.

CCH TaxAware

Quickly and easily get answers to all your federal and state tax questions in one place! Don’t waste time searching various resources for crucial news and information that you need quickly

Housed on the powerhouse platform, CCH® IntelliConnect®, the Wolters Kluwer TaxAware Center has all the state and federal tax news, information, and tools necessary for today’s tax professionals

Blue J is a cutting-edge software platform that specializes in tax research and predictive analytics, using artificial intelligence (AI) to streamline complex tax decision-making It helps tax professionals, including solo practitioners and small firms, save time by automating research tasks and offering predictive insights based on the latest tax laws and case rulings