Q: I’m getting ready to retire and my financial planner has suggested I look into something called “reverse mort gages.” What can you tell me about them?

A: Reverse mortgages are popular as an estate planning device for seniors.

In a nutshell, here’s how it works.

Many seniors own their homes free and clear. There are companies who are willing to, essentially, purchase homes one month at a time.

In other words, instead of the senior making house pay ments to a lender until the house is paid off, the bank makes payments to the senior. The pay

ments become a lien against the

the debt has to be paid out of the sale of the property, which could leave little or no equity to pass down to your kids. That’s a quandary for people who care about such things.

senior can live in the home and

option for seniors who live on a

tial downside if the senior lives a nice, long life. Upon their death

My advice is that you find a good loan broker who sells reverse mortgages. They would have the details regarding the various programs. But if you have an estate planning attorney who has created a will or trust for you, I wouldn’t commit to anything without talking with them first since it might require a rethink of your ultimate estate plan.

Q: My mother is a widow and will soon need to go into a nursing home. Medi-Cal will pay

for it. She owns a small home in Fairfield that’s fully paid for. I understand that when she passes away Medi-Cal can put a lien on the property to recoup the money they’ve spent. What can we do, if anything, to protect the house? Should we sell it?

A: As a real estate attorney, I get this question all the time.

Unfortunately, I’m not the right lawyer to speak to about this issue, or any issue regarding Medi-Cal.

Over the past several decades, a new specialty known as “elder law” has established itself in the legal profession. Also, many estate planning attorneys are proficient in the technical aspects of Medi-Cal reimbursement.

Elder law specialists deal with legal problems unique to aging. And attempting to legally protect assets, as you describe, is one of those areas.

I suggest you ask around for the name of a good elder law or estate specialist. If you can’t find one, you might try searching the website Lawyers.com or calling the legal referral hotline of your local county bar association.

Tim Jones, Esq., is a real estate attorney in Fairfield. If you have any real estate legal questions you would like to have answered in this column, you can send an email to AllThingsRealEstate@ TJones-Law.com.

As you read this, it will almost be National Poinsettia Day, which is Dec. 12. The day honors Joel Poinsett, the first U.S. ambassador to Mexico. He is credited with introducing this beloved Christmas plant to the United States.

The Garden Guy is writing about it now in hopes that you will help end the holiday affliction known as Poinsettias Without Partners. OK, I am smiling too!

Proven Winners initiated a program 18 years ago to put an end to the Poinsettia Lonely Hearts Club by showing all of us an incredible combination. The event was known as the California Pack Trials. There, we were all introduced to the concept of a Poinsettia Pal. This combo featured Poinsettias and Diamond Frost euphorbia.

Oh my gosh, what could be more beautiful than a red poinsettia giving the appearance of sitting on a layer of frost? Not only did I love it but as a horticulturist, I found extra meaning in

See Winter, Page 8

Paying your mortgage on time is good for your financial health in many different ways, including helping you build equity in your home and improving your credit score.

Here’s an overview of the various ways you can make a mortgage payment, plus tips on how to pay on time, every time.

Your mortgage payments are due each month, though you can choose to make payments more frequently. To keep on top of the schedule, it’s important to use the payment method that works best for you. Here are five ways to pay your mortgage and what you should know about each method.

Pro: Fast, flexible option that allows you to make payments at your convenience

Con: Must have reliable computer, phone or tablet access to pay this way

The easiest option for most homeowners is to pay their mortgage via their lender or loan servicer’s website. Making an online mortgage payment is fast, free and efficient. Plus, paying online means you can decide when you want to make the payment, maintain a record of when you made it and ensure that you pay it by the due date. Some lenders also have free mobile apps where you can access your account online and pay your mortgage from your phone.

“Logging on to your lender’s payment portal every month to make your payment puts you in

control of the timing,” says Jeff Ostrowski, Bankrate housing market analyst. “The disadvan tage is that it’s one more thing for you to remember to do each month.”

Pro: Prevents for getting or accidentally missing payments

Con: Potential for overdrafts if money for payment is not in the account

ADOBE

Your mortgage payments are due each month, though you can choose to make payments more frequently. To keep on top of the schedule, it’s important to use the payment method that works best for you.

Choosing automated withdrawals pulled from your checking or savings account is another easy option to make sure you pay your mortgage on time each month.

This means your lender automatically withdraws the mortgage payment from your bank account on a specific day each month.

“The easiest way to pay your mortgage each month is by setting up an automatic payment by ACH withdrawal,” says Ostrowski. “You don’t have to think about or remember anything. The only downside is that if you don’t keep enough of a cash cushion in your account, you could be hit with overdraft fees.”

Setting up automated withdrawals can also help homeowners who want to make additional or biweekly payments to pay off a mortgage early and cut the total interest they pay over the loan term.

Pro: Potential to earn credit card rewards

Con: Might have to pay a service fee

Making mortgage payments by credit card can be tempting, especially if your card offers great rewards or substantial cash back. Unfortunately, though, many mortgage lenders do not allow this option.

“For consumers amassing points, mortgage payments are the holy grail,” says Ostrowski. “Alas, most lenders don’t accept credit card payments for the monthly mortgage payment. And those that do tend to hit you with a service fee that overwhelms the value of any points or rewards you earn.”

Pro: Payments are credited to your account quickly

Con: Might have to pay a service fee

Making a mortgage payment over the phone is another option, especially if you forgot to mail in your payment before the due date or have not set up a payment process online.

You can find the phone number to call on your monthly bill or online. Before dialing, be prepared with your mortgage account number and your banking information, such as the routing and account numbers.

Payments over the phone are typically credited to your account quickly. Before you make the payment, though, ask your servicer if there is a charge for this

Pro: Computer, phone or tablet access not needed

Con: Mail can be delayed; paper checks can be impacted by fraud

If your mortgage servicer is local, the company might accept payments by check or money order in person at a brick-andmortar branch.

Money orders are secure, since they do not include any personal information. But they have one major drawback: The amount is often limited to less than $1,000. Another option is to use a certified check or a cashier’s check, which do not have limits.

When mailing a check, make sure you include your mortgage account number. Just having your home address may not be sufficient, even if it matches the address your servicer has on file. Sending a payment by mail, however, means you have to consider the time it takes to arrive at its destination and be processed by the servicer.

“Once upon a time, paper checks were the tried-and-true way to pay,” says Ostrowski. ”Those days are gone, though –

paper checks have become a target of fraudsters, and you have to pay for stamps. The fastest, most convenient way to pay the mortgage is with an electronic payment.”

Paying down your mortgage faster can help you save on interest over the life of your loan. Early payoff isn’t always the smartest choice, though; for example, if you have other high-interest debt, it might be better to use extra funds to pay down that debt first.

Paying off your mortgage faster comes down to paying more of your mortgage principal. You can do this in various ways, including:

•Making biweekly payments: If you have the extra cash, making biweekly mortgage payments –which amounts to 13 full monthly payments per year instead of 12 – can help you pay off your loan faster and save on interest costs.

•Paying every four weeks: If you pay every four weeks instead of every month, you’ll make roughly an extra mortgage payment every year. This small change can add up over time.

•Paying extra on your monthly payment: If you have a little extra every month, you can tack it onto your mortgage payment and pay down your loan faster.

•Making a lump sum payment: If you’ve received a large sum of money, such as a bonus or an inheritance, you can put it toward your mortgage balance.

One caveat here: Before you make any extra payments, make sure that your servicer will apply them toward your principal. Also, look at your mortgage contract to see if there’s an early payment fee. Some lenders charge a pre-

See Mortgage, Page 4

These are the local homes sold recently, provided by California Resource of Lodi. The company can be reached at 209.365.6663 or CalResource@aol.com.

TOTAL SALES: 2

LOWEST AMOUNT: $725,000

HIGHEST AMOUNT: $2,100,000

MEDIAN AMOUNT: $1,412,500

AVERAGE AMOUNT: $1,412,500

112 Inverness Court - $725,000

10-23-25 [3 Bdrms - 1428 SqFt - 1972 YrBlt]

1182 West K Street - $2,100,000

10-20-25 [4 Bdrms - 3592 SqFt - 1982 YrBlt], Previous Sale: 09-10-10, $874,500

TOTAL SALES: 3

LOWEST AMOUNT: $610,000

HIGHEST AMOUNT: $679,000

MEDIAN AMOUNT: $620,000

AVERAGE AMOUNT: $636,333

1316 Bello Drive - $620,000

10-20-25 [4 Bdrms - 2185 SqFt - 2005 YrBlt], Previous Sale: 04-15-21, $580,000

945 Monique Way - $679,000

10-23-25 [3 Bdrms - 1999 SqFt - 1985 YrBlt]

570 Syracuse Lane - $610,000

10-22-25 [3 Bdrms - 1697 SqFt - 2018 YrBlt], Previous Sale: 03-23-18, $417,000

TOTAL SALES: 19

LOWEST AMOUNT: $240,000

HIGHEST AMOUNT: $820,000

MEDIAN AMOUNT: $530,000

AVERAGE AMOUNT: $542,289

3088 Balance Circle - $665,000

10-20-25 [4 Bdrms - 2023 YrBlt], Previous Sale: 06-13-23, $711,000

224 Columbus Drive - $535,000

10-21-25 [3 Bdrms - 1124 SqFt - 1977 YrBlt], Previous Sale: 04-03-25, $350,000

2215 Cunningham Drive - $549,000

10-20-25 [4 Bdrms - 1396 SqFt - 1972 YrBlt], Previous Sale: 12-09-21, $575,000

230 Empire Place - $475,000

10-24-25 [3 Bdrms - 985 SqFt - 1952 YrBlt], Previous Sale: 05-13-25, $335,000

2049 Harte Court - $515,000

10-20-25 [4 Bdrms - 1618 SqFt - 1973

YrBlt]

1986 Larchmont Circle - $530,000

10-24-25 [3 Bdrms - 1763 SqFt - 1986 YrBlt], Previous Sale: 04-17-25, $435,000

1200 Maryland Street - $240,000

10-23-25 [3 Bdrms - 1034 SqFt - 1950 YrBlt]

1407 Minnesota Street - $439,000

10-24-25 [3 Bdrms - 1000 SqFt - 1954

YrBlt], Previous Sale: 03-25-13, $180,500

1730 New Hampshire Street$432,500

10-20-25 [3 Bdrms - 1285 SqFt - 1955 YrBlt], Previous Sale: 06-28-18, $340,000

367 East Pacific Avenue - $465,000

10-20-25 [3 Bdrms - 960 SqFt - 1966 YrBlt], Previous Sale: 08-01-16, $145,000

225 Pennsylvania Avenue #A1$312,000

10-24-25 [3 Bdrms - 1084 SqFt - 1986

YrBlt], Previous Sale: 03-24-20, $256,000

2006 Robin Drive - $450,000

10-20-25 [4 Bdrms - 1300 SqFt - 1964 YrBlt], Previous Sale: 06-16-17, $350,000

2231 Silver Fox Circle - $689,000

10-23-25 [3 Bdrms - 2560 SqFt - 1989

YrBlt], Previous Sale: 08-20-09, $270,000

960 Suffolk Way - $780,000

10-22-25 [4 Bdrms - 2938 SqFt - 1989

YrBlt], Previous Sale: 00/1989, $220,000

5122 Tawny Lake Place - $700,000

10-20-25 [4 Bdrms - 2023 SqFt - 2001

YrBlt], Previous Sale: 11-06-13, $350,100

2415 Tea Court - $599,000

10-24-25 [3 Bdrms - 1712 SqFt - 1988

YrBlt], Previous Sale: 03-02-22, $675,000

2033 Thrush Way - $485,000

10-24-25 [3 Bdrms - 1300 SqFt - 1966

YrBlt], Previous Sale: 05-14-09, $137,000

2350 White Drive - $623,000

10-22-25 [4 Bdrms - 2214 SqFt - 2019

YrBlt], Previous Sale: 11-12-19, $500,000

3245 Winged Foot Drive - $820,000

10-24-25 [4 Bdrms - 3045 SqFt - 1989 YrBlt]

TOTAL SALES: 2

LOWEST AMOUNT: $505,000

HIGHEST AMOUNT: $510,000

MEDIAN AMOUNT: $507,500

AVERAGE AMOUNT: $507,500

320 Birch Ridge Drive - $510,000

10-21-25 [2 Bdrms - 2126 SqFt - 2014

YrBlt], Previous Sale: 06-19-14, $332,000

301 Edgewood Drive - $505,000

10-20-25 [3 Bdrms - 1864 SqFt - 2000

YrBlt], Previous Sale: 12-11-02, $310,000

TOTAL SALES: 2

LOWEST AMOUNT: $565,000

HIGHEST AMOUNT: $685,500

MEDIAN AMOUNT: $625,250

AVERAGE AMOUNT: $625,250

521 Blue Wing Drive - $565,000

10-21-25 [4 Bdrms - 1678 SqFt - 1978

YrBlt], Previous Sale: 00/1989, $133,000

1309 Hall Lane - $685,500

10-20-25 [4 Bdrms - 2970 SqFt - 2001

YrBlt], Previous Sale: 08-13-12, $296,000

TOTAL SALES: 18

LOWEST AMOUNT: $390,000

HIGHEST AMOUNT: $850,000

MEDIAN AMOUNT: $644,500

AVERAGE AMOUNT: $620,167

214 Albany Avenue - $450,000

10-22-25 [3 Bdrms - 1402 SqFt - 2022 YrBlt], Previous Sale: 03-11-22, $563,000

725 Arabian Circle - $799,000

10-24-25 [5 Bdrms - 2366 SqFt - 1990 YrBlt], Previous Sale: 09-06-19, $565,000

525 Boone Drive - $850,000

10-22-25 [6 Bdrms - 4029 SqFt - 2001 YrBlt], Previous Sale: 11-25-08, $460,000

598 Crownpointe Circle - $675,000

10-23-25 [4 Bdrms - 2431 SqFt - 1992 YrBlt], Previous Sale: 01-13-23, $617,000

406 Gatehouse Drive - $750,000

10-23-25 [4 Bdrms - 2668 SqFt - 1988 YrBlt], Previous Sale: 09-26-23, $755,000

165 Glacier Circle - $390,000

10-24-25 [2 Bdrms - 1372 SqFt - 1979 YrBlt]

2321 Marshall Road - $639,000

10-24-25 [4 Bdrms - 1943 SqFt - 1989 YrBlt], Previous Sale: 05-21-19, $465,000

121 Mckinley Circle - $425,000

10-23-25 [2 Bdrms - 1043 SqFt - 1964 YrBlt]

4665 Midway Road - $725,000

10-24-25 [4 Bdrms - 1768 SqFt - 1965 YrBlt]

913 Mustang Trail - $650,000

10-23-25 [3 Bdrms - 1633 SqFt - 1989 YrBlt], Previous Sale: 11-25-02, $295,000

160 Oak Creek Court - $750,000

10-21-25 [4 Bdrms - 2193 SqFt - 1989 YrBlt], Previous Sale: 10-27-17, $479,000

309 Saybrook Avenue - $590,000

10-22-25 [4 Bdrms - 1767 SqFt - 1985 YrBlt], Previous Sale: 09-21-22, $590,000

348 Trellis Lane - $470,000

10-23-25 [2 Bdrms - 1222 SqFt - 1997

YrBlt], Previous Sale: 05-01-03, $292,000

880 Trysail Court - $402,000

10-22-25 [4 Bdrms - 1417 SqFt - 1973 YrBlt]

212 Via Del Sol - $700,000

10-24-25 [4 Bdrms - 2272 SqFt - 2010

YrBlt], Previous Sale: 08-28-19, $540,000

256 Vine Street - $760,000

10-20-25 [4 Bdrms - 3072 SqFt - 1975

YrBlt], Previous Sale: 07-08-21, $830,000

107 White Sands Drive - $510,000

10-24-25 [2 Bdrms - 1329 SqFt - 1988 YrBlt], Previous Sale: 05-11-15, $354,000

From Page 3

400 Wick Court - $628,000

10-24-25 [3 Bdrms - 1809 SqFt - 1999 YrBlt], Previous Sale: 11-22-99, $210,000

TOTAL SALES: 17

LOWEST AMOUNT: $245,000. HIGHEST AMOUNT: $710,000

MEDIAN AMOUNT: $450,000

AVERAGE AMOUNT: $447,206

130 12th Street - $390,000

10-20-25 [2 Bdrms - 940 SqFt - 1940 YrBlt], Previous Sale: 05-21-15, $182,000 849 5th Street - $500,000

10-24-25 [4 Bdrms - 1665 SqFt - 1960 YrBlt]

164 Calhoun Street - $300,000 10-23-25 [3 Bdrms - 988 SqFt - 1978 YrBlt], Previous Sale: 12-03-11, $50,000 60 D Street - $482,500 10-23-25 [2 Bdrms - 1397 SqFt - 1936 YrBlt], Previous Sale: 11-28-16, $250,000

337 Falcon Drive - $380,000

10-21-25 [3 Bdrms - 1772 SqFt - 1965 YrBlt], Previous Sale: 05-21-99, $115,000 1201 Glen Cove Parkway #1714$280,000

10-23-25 [1 Bdrms - 665 SqFt - 1992 YrBlt], Previous Sale: 03-12-19, $240,000 1415 Illinois Street - $499,000 10-24-25 [2 Bdrms - 1754 SqFt - 1936 YrBlt]

425 Lexington Drive - $710,000

10-22-25 [4 Bdrms - 1950 SqFt - 1976 YrBlt]

491 Lighthouse Drive - $245,000

10-23-25 [2 Bdrms - 840 SqFt - 1988 YrBlt], Previous Sale: 11-10-14, $140,000

410 Newcastle Court - $675,000

10-21-25 [4 Bdrms - 1963 SqFt - 1989 YrBlt], Previous Sale: 07-17-09, $295,000

901 Point Reyes Court #1 - $545,000 10-21-25 [3 Bdrms - 1414 SqFt - 1990 YrBlt], Previous Sale: 07-18-19, $432,500 456 Pomona Avenue - $450,000

10-22-25 [3 Bdrms - 1188 SqFt - 1961 YrBlt], Previous Sale: 10-15-04, $348,000

111 Spencer Street - $450,000

10-24-25 [3 Bdrms - 1280 SqFt - 1955 YrBlt], Previous Sale: 06-05-20, $400,000

106 Springs Road - $351,000

10-24-25 [2 Bdrms - 1068 SqFt - 1966 YrBlt], Previous Sale: 12-09-99, $125,000

393 Starfish Drive - $560,000

10-23-25 [3 Bdrms - 1258 SqFt - 1987

YrBlt], Previous Sale: 08-10-04, $415,000 542 Starr Avenue - $435,000

10-21-25 [3 Bdrms - 1894 SqFt - 1938 YrBlt]

223 Wedgewood Court - $350,000 10-20-25 [3 Bdrms - 1008 SqFt - 1955 YrBlt], Previous Sale: 00/1991, $132,000

payment penalty, so be sure to review the terms of your loan to find out if this fee is charged and how much it will cost you.

•What is the structure of a mortgage payment? Your mortgage payment is made up of four parts: principal, interest, taxes and insurance. This is often referred to by the acronym PITI. The I refers specifically to homeowners insurance, but if you have a conventional loan and put down less than 20 percent of the home’s purchase price as a down payment, you’ll also need to pay for private mortgage insurance (PMI). An FHA loan also requires mortgage insurance premiums that vary based on your down payment size.

•What if I’m late making a mortgage payment? There is typically a 15-day grace period during which you can make your late payment without incurring penalties or fees. If the grace period passes without payment, the lender charges you a late fee. If you know you’ll be late making a mortgage payment, reach out to your servicer as soon as possible to discuss your options. If you’re experiencing financial hardship, you might be able to get mortgage forbearance or a loan modification.

• Can you make a mortgage payment with Venmo, PayPal or Zelle? It’s possible, but unlikely. PayPal does offer a bill payment feature that allows users to link, pay and manage their bills from the PayPal app. However, your mortgage servicer may not allow payments that way. Similarly, you’ll need to check with your servicer to see if Venmo or Zelle are approved methods to pay your mortgage.

•You can make your mortgage payment through your lender’s website or mobile app, in person, by mail or over the phone.

•If you’re worried about remembering to make payments each month, setting up automated withdrawals can be a good solution.

•There are options for paying off your mortgage faster, such as making biweekly payments or putting a lump sum toward the principal amount.

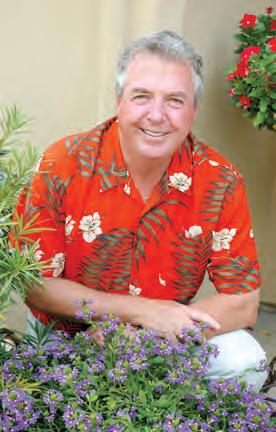

ABOVE: The Garden Guy created his own Christmas Combo with red poinsettia and ColorBlaze Mini Me Chartreuse

From Page 2

the fact that the poinsettia and the euphorbia were related, same family! It was botanically symbolic of families getting together at Christmas.

I know I am stretching it a little, but I am a plant geek. I have seen them at the garden center from time to time and even more so at fine florist shops, but the idea really is a good one and needs a shot in the arm.

Last year I fell in love with a new color called ColorBlaze Mini Me Chartreuse. Though its nature is shorter and compact, it forms branch upon branch of lime-green foliage that is the perfect texture to pair with a poinsettia.

Even just hours after having stuck cuttings around the poinsettia, it was already photo-worthy. The room where the poinsettias reside has tall windows and so far, it has been a delight for getting anthuriums and Christmas cactus to rebloom. So, it is probably perfect for coleus and poinsettias.

The dark gold color of a poinsettia variety named Gold Rush is the latest to steal my heart. I just want to try a combo or two with it, but alas, they are rare. I am sure the retailers think no one wants a gold poinsettia, but I do!

There are some other great opportunities for combinations with the Hippo Polka Dot plants. The Polka Dot plants are known botanically as Hypoestes phyllostachya, which is where the cute Hippo variety-name originates. They come in red, rose and white. The white with the green variegation is showy and of high contrast, perfect with red poinsettias.

Jenny Simpson with Creekside Nursery in Dallas, North Carolina, created a partnership with Heart to Heart Snowdrift caladiums and red poinsettias, which has great promise though

already be growing in the best potting soil, you don’t have to fret; just add a good mix to your new planter and take care of the poinsettia. Everyone else will be happy. Choose a container that allows you to add partner plants.

Last year I started off with a smaller poinsettia and planted it and the coleus cuttings in a bowl.

This year I am planting Lemon Coral sedum, letting it

deadlines but please follow me on my Facebook page @NormanWinterTheGardenGuy for more photos, garden inspiration and my push to end Poinsettias Without Partners.

Norman Winter is a horticulturist, garden speaker and author. He receives complimentary plants to review from the companies he covers.

ience.

or refinance

VA & Conventional. Ask me about 100% financing.

$1,650,000

Before you make improvements... Our home improvement strategy is intended to maximize return on investment. DON’T waste your money! Schedule online today!