That’s right folks, this buyer’s market is like how real estate was back when Richie and the Fonz were living during “Happy Days.”

A buyer can purchase their forever dream home without seven other bidders trying to rip it out of their hands. Can you imagine finding the perfect house and the seller telling you, “sure, we will give you 45 days to close escrow” or better yet, “sure, we will give you 30 days to sell your old house.”

That’s right, there are opportunities that exist today that have not been available in years. Now is the time to get serious about buying a house. Just look at the stock market today and see what is happening with the home builders and companies like Rocket Mortgage. The experts see the residential real estate market improving and maybe even booming in 2026. Wait and compete or buy now and negotiate.

Jim Porter, NMLS No. 276412, is branch manager and senior loan adviser of Solano Mortgage, NMLS No. 1515497, a division of American Pacific Mortgage Corporation, NMLS No. 1850, licensed in California by the Department of Financial Protection and Innovation under CRMLA / Equal Housing Opportunity. Jim can be reached at 707-449-4777.

As the theme of “home holistic wellness” has expanded over the last year, distinct trends are leading the direction of interior design.

Moen, North America’s leading consumer faucet brand, has identified the top three trends as: creative expression, personal wellbeing and biophilic design. Based on her visits to trade shows like Paris Maison et Objet and Milan Salone del Mobile; research from Moen’s internal consumer market insights team; and observations from fashion, interior design and pop culture, Moen’s senior creative style manager and trend forecaster, Danielle DeBoe Harper, uncovers how these trends reflect the cultural, social and technological shifts happening today.

As people continue seeking design choices that align with their distinctive personalities, the trend of creative expression emphasizes customization, transformation and versatility. It’s built on empowering consumers to select fixtures, paint colors, furniture and décor accents that authentically reflect their own inspired style and individuality.

“Homeowners and designers can foster a greater sense of personal identity and belonging through imaginative and expressive design,” says DeBoe Harper. “Elements of this design direction include statement details like bold colors, mixed metals and dramatic proportions; era-mixing for a dynamic maximalist feel; surrealist-inspired pieces that challenge conventional boundaries; and rugs, furniture and other accents that reflect high levels of craftsmanship to bring a feeling of authenticity to a space.”

Available in an array of customization options, the Moen Cambium bathroom suite features a unique blend of raw elements

and soft modern design that creates a bold and unforgettable look ideally suited for this trend. The suite highlights a captivating combination of machine textures, fluted patterns, and a new mixed polished/brushed nickel finish that all work together to enhance the bathroom aesthetic.

The trend of personal wellbeing reflects the growing societal emphasis on mental and physical health, with design approaches that prioritize comfort and rejuvenation.

“Your home is a sanctuary –a place of peace and relaxation,” says DeBoe Harper. “Personal wellbeing, as a design trend, embodies décor and style elements that embrace coming home to that sense of comfort and mental tranquility. This can be achieved through soft color palettes; opting for literal comfort pieces, such as oversized sofas and chairs paired with shag rugs; or embracing joyful design through playful, brightly colored aesthetic choices.”

Some also find comfort in

support a healthier lifestyle.

Humans have an innate desire to connect with the outdoors. The biophilic design trend welcomes the wish to create healthier, more sustainable and more harmonious living and working environments that bring people and nature together.

“Biophilic design goes beyond incorporating plants into your space,” says DeBoe Harper. “Invoking the sky, desert and sea in furniture, lighting, rugs and even curtain choices can elevate the sense of being in the natural world within your own four walls. We see this trend through design choices like cloud motifs or florals, applications of geological shapes and textures, and creating movement through splashes of water.”

nostalgia, pulling design inspiration from everything from old English country houses to Art Deco and even the 1970s; while others ensure wellbeing through thoughtful fixture and appliance choices. One example is installation of a robust water filtration solution like Moen’s Whole Home Water Filtration systems. The whole home systems help remove chemicals and contaminants from every drop of water in the home to

Sustainability is a large part of this trend as well. Investing in high-quality pieces crafted from recycled or reclaimed materials, responsibly sourced wood, or rapidly renewable resources like bamboo, helps create beautiful, durable and functional spaces that not only enhance daily life, but also actively support conservation efforts and lessen your ecological footprint.

For more information on design trends, visit moen.com.

FRUSTRATED with your current Lender fumbling your Purchase or Refinance, Bring your loan to us so we can get you locked at a GREAT RATE and Finish it up QUICKLY! We don’t mess around, We Get it DONE, We are Local and we DELIVER!

When we write your Pre-Approv al Letter to present to the seller, You WILL Close the Deal with us!

George R. Kalis Broker/Owner

Q: I read your column all the time, but I now find myself in a situation that I’ve never seen you write about before and I hope you can help me. My wife and I bought this house, our first, in 2019. About a year ago, we had a pipe break while we were on vacation and it caused a great deal of damage to the flooring and walls. The insur ance company paid us almost $80,000 to repair the damage.

Shortly thereafter, my wife left me and our divorce became final last month. Because of the problems in our lives, we used the insurance money for other things and never made the repairs. As part of our divorce settlement, we were ordered to sell the house. But when I went to put it on the market with a Realtor, I discovered that I owed more on the house than I can sell it for because of all the damage. What do we do now?

A: It goes without saying, but I’ll say it anyway, you’ve got a big problem.

Back in the 1990s and again by 2008, it wasn’t uncommon for someone to owe more on their house than its present value, since home prices dropped during those recessions.

Today it’s almost unheard of.

Fifteen years ago I would have told you to talk with the bank about allowing you to shortsell the house. In other words, get the bank to agree to accept less than the full amount owed on the mortgage in return for allowing you to sell the property.

Unfortunately, your problem, and the date in which you find yourself, are very different.

Fifteen years ago it wouldn’t have been your fault that you couldn’t sell the house for enough money to pay off the mortgage. The situation was caused by the poor real

The only reason you can’t sell your house right now is because were supposed to use to repair the property. That $80K really -

insurance company would payence the insurance companies want to keep a very close eye on the repairs to ensure the money is being used for what it’s supposed to be used for.

My suspicion is that if you contact your mortgage company, you’re not going to find a sympathetic ear.

OK, you know what you did wrong, now what can you do to fix it?

There are two options, depending upon how you feel about trying to protect your credit rating.

Option number one would be to make an offer to your mortgage company that if they will allow the home to be sold, you will guarantee payment of any amounts still owing after the sale.

Should the mortgage company accept this offer you would be accepting, in essence, the obligation of a personal loan upon which you can negotiate interest rates and minimum payment amounts.

See Jones, Page 5 3 Beds | 2 Baths | 1,319 Sq. Ft.

leslie.blevins@cbs electre.com

leslie-blevins.cbs electre.com

TOTAL SALES: 5

LOWEST AMOUNT: $710,000

HIGHEST AMOUNT: $1,339,000

MEDIAN AMOUNT: $950,000

AVERAGE AMOUNT: $984,800

1440 East 3rd Street - $1,125,000

06-26-25 [4 Bdrms - 2123 SqFt - 1951 YrBlt], Previous Sale: 06-29-21, $925,000

407 Gerald Court - $950,000

06-26-25 [4 Bdrms - 2714 SqFt - 1981 YrBlt]

266 Marina Village Way - $710,000

06-26-25 [3 Bdrms - 1544 SqFt - 1981 YrBlt], Previous Sale: 07-21-21, $688,000

439 Mckenna Court - $1,339,000

06-24-25 [5 Bdrms - 4233 SqFt - 2005 YrBlt], Previous Sale: 01-31-14, $730,000

483 Rinconada Court - $800,000

06-26-25 [4 Bdrms - 1524 SqFt - 1977 YrBlt], Previous Sale: 12-02-24, $650,000

TOTAL SALES: 5

LOWEST AMOUNT: $250,000

HIGHEST AMOUNT: $740,000

MEDIAN AMOUNT: $458,000

AVERAGE AMOUNT: $505,900

1330 Blackberry Court - $442,500

06-23-25 [2 Bdrms - 1339 SqFt - 1980 YrBlt]

355 Holly Court - $639,000

06-25-25 [3 Bdrms - 1816 SqFt - 1990 YrBlt], Previous Sale: 06-04-21, $625,000

426 La Esperanza Drive - $458,000

06-26-25 [3 Bdrms - 1370 SqFt - 1998 YrBlt], Previous Sale: 04-14-21, $425,000

795 North Lincoln Street - $250,000

06-27-25 [4 Bdrms - 1619 SqFt - 1976 YrBlt] 1410 Valley Glen Drive - $740,000

06-23-25 [4 Bdrms - 2443 SqFt - 2004 YrBlt], Previous Sale: 07-14-15, $450,000

TOTAL SALES: 23

LOWEST AMOUNT: $265,000

HIGHEST AMOUNT: $1,749,000

MEDIAN AMOUNT: $550,000

AVERAGE AMOUNT: $605,913

2152 Allston Place - $545,000

06-25-25 [4 Bdrms - 1618 SqFt - 1976 YrBlt],

Previous Sale: 04-10-15, $225,000

1760 Autumn Meadow Drive - $610,000

06-23-25 [4 Bdrms - 1402 SqFt - 1996 YrBlt],

Previous Sale: 10-04-19, $450,000

410 Begonia Boulevard - $565,000

06-24-25 [3 Bdrms - 1213 SqFt - 1967 YrBlt],

Previous Sale: 09-24-21, $440,000

819 Bridle Ridge Drive - $1,749,000

06-25-25 [4 Bdrms - 4023 SqFt - 2005 YrBlt], Previous Sale: 11-09-11, $690,000

730 Capricorn Circle - $370,000

06-26-25 [3 Bdrms - 1433 SqFt - 1986 YrBlt], Previous Sale: 11-05-09, $190,000

2942 Cashew Court - $438,000

06-27-25 [3 Bdrms - 1953 SqFt - 1983 YrBlt]

1619 Centennial Drive - $475,000

06-26-25 [3 Bdrms - 1692 SqFt - 2007 YrBlt],

Previous Sale: 07-16-20, $380,000

2436 Chuck Hammond Drive - $850,000

06-26-25 [5 Bdrms - 3177 SqFt - 2012 YrBlt],

Previous Sale: 03-27-18, $648,000

2196 Clyde Jean Place - $673,000

06-26-25 [4 Bdrms - 2465 SqFt - 2012 YrBlt],

Previous Sale: 09-02-20, $580,000

333 Dahlia Street - $430,000

06-26-25 [4 Bdrms - 1555 SqFt - 1971 YrBlt]

240 Del Loma Court - $265,000

06-24-25 [2 Bdrms - 997 SqFt - 1971 YrBlt],

Previous Sale: 02-14-19, $171,000

2120 Mecca Court - $820,000

06-23-25 [4 Bdrms - 3000 SqFt - 1985 YrBlt], Previous Sale: 08-27-15, $670,000

701 Nevada Street - $475,000

06-27-25 [3 Bdrms - 1034 SqFt - 1950 YrBlt]

1529 Northwood Drive - $570,000

06-27-25 [3 Bdrms - 1485 SqFt - 1992 YrBlt]

225 Pennsylvania Avenue #B1$317,000

06-23-25 [2 Bdrms - 930 SqFt - 1986 YrBlt],

Previous Sale: 07-26-17, $170,500

3002 Poplar Court - $665,000

06-25-25 [4 Bdrms - 2261 SqFt - 1986 YrBlt],

Previous Sale: 01-20-16, $355,000

2909 Quail Hollow Drive - $850,000

06-24-25 [4 Bdrms - 2726 SqFt - 1991 YrBlt],

Previous Sale: 08-06-14, $645,000

884 Sunset Court - $535,000

06-24-25 [4 Bdrms - 1907 SqFt - 1985 YrBlt],

Previous Sale: 01-05-17, $343,000

1648 Sycamore Drive - $465,000

06-25-25 [3 Bdrms - 1296 SqFt - 1959 YrBlt]

33 Twin Creeks Drive - $550,000

06-26-25 [3 Bdrms - 1934 SqFt - 1978 YrBlt],

Previous Sale: 00/1989, $240,000

1104 Utah Street - $470,000

06-27-25 [3 Bdrms - 1034 SqFt - 1951 YrBlt]

2730 Vista Alta - $660,000

06-25-25 [4 Bdrms - 1924 SqFt - 1978 YrBlt],

Previous Sale: 09-26-18, $517,500

2763 Woodmont Court - $589,000

06-24-25 [4 Bdrms - 1889 SqFt - 1988 YrBlt], Previous Sale: 11-05-01, $265,000

TOTAL SALES: 3

LOWEST AMOUNT: $397,000

HIGHEST AMOUNT: $570,000

MEDIAN AMOUNT: $535,000

AVERAGE AMOUNT: $500,667

1001 Linda Vista Way - $570,000

06-27-25 [4 Bdrms - 2265 SqFt - 1990 YrBlt],

Previous Sale: 09-17-21, $575,500

501 Three Rivers Court - $397,000

06-27-25 [2 Bdrms - 1172 SqFt - 2011 YrBlt],

Previous Sale: 12-16-14, $235,000

468 Wallace Street - $535,000

06-23-25 [4 Bdrms - 1617 SqFt - 2001 YrBlt],

Previous Sale: 04-01-19, $360,000

TOTAL SALES: 4

LOWEST AMOUNT: $235,000

HIGHEST AMOUNT: $515,000

MEDIAN AMOUNT: $483,500

AVERAGE AMOUNT: $429,250

244 Cloverleaf Circle - $482,000

06-25-25 [3 Bdrms - 1158 SqFt - 1993 YrBlt],

Previous Sale: 11-18-21, $491,000

505 Kinglet Court - $515,000

06-24-25 [3 Bdrms - 1320 SqFt - 1978 YrBlt]

1106 Main Street - $235,000

06-24-25 [3 Bdrms - 1008 SqFt - 1954 YrBlt]

514 Woodlark Drive - $485,000

06-27-25 [3 Bdrms - 1138 SqFt - 1977 YrBlt],

Previous Sale: 09-13-02, $245,000

TOTAL SALES: 22

LOWEST AMOUNT: $239,000

HIGHEST AMOUNT: $1,690,000

MEDIAN AMOUNT: $582,500

AVERAGE AMOUNT: $641,500

491 Aberdeen Way - $555,000

06-27-25 [2 Bdrms - 1344 SqFt - 1983 YrBlt],

Previous Sale: 03-16-23, $545,000

218 Ballindine Drive - $780,000

06-25-25 [3 Bdrms - 2296 SqFt - 1987 YrBlt]

3030 Belden Court - $800,000

06-24-25

104 Birch Street - $500,000

06-25-25 [3 Bdrms - 1359 SqFt - 1948 YrBlt],

Previous Sale: 12-17-19, $350,000

100 Bryce Way - $380,000

06-25-25 [2 Bdrms - 1388 SqFt - 1981 YrBlt]

745 Burgundy Street - $840,000

06-23-25 [4 Bdrms - 2022 YrBlt], Previous Sale: 11-25-22, $826,500

1402 Callen Street #C - $239,000

06-23-25 [2 Bdrms - 952 SqFt - 1972 YrBlt],

Previous Sale: 10-07-09, $64,000

407 Corte Majorca - $680,000

06-26-25 [4 Bdrms - 2368 SqFt - 1974 YrBlt],

Previous Sale: 09-25-06, $510,000

1007 Countrywood Lane - $615,000

06-27-25 [4 Bdrms - 2328 SqFt - 2002 YrBlt], Previous Sale: 03-06-12, $225,000 524 Deodara Street - $525,000

06-25-25 [3 Bdrms - 1290 SqFt - 1956 YrBlt],

Previous Sale: 09-15-14, $302,000

2001 Eastwood Drive #16 - $268,000

06-23-25 [2 Bdrms - 902 SqFt - 2001 YrBlt],

Previous Sale: 02-12-19, $240,000 584 Greenwood Drive - $549,000

06-23-25 [3 Bdrms - 1246 SqFt - 1974 YrBlt],

Previous Sale: 04-07-22, $560,000

324 Lance Drive - $630,000

06-26-25 [4 Bdrms - 1799 SqFt - 1974 YrBlt]

122 Laurel Street - $560,000

06-27-25 [3 Bdrms - 1040 SqFt - 1948 YrBlt],

Previous Sale: 09-08-06, $265,000

2085 Newcastle Drive - $685,000

06-27-25 [4 Bdrms - 1981 SqFt - 2012 YrBlt],

Previous Sale: 07-27-20, $545,000

156 Olympic Circle - $420,000

06-27-25 [2 Bdrms - 1403 SqFt - 1964 YrBlt],

Previous Sale: 08-27-18, $317,500

201 Red Pheasant Drive - $955,000

06-25-25 [5 Bdrms - 3709 SqFt - 2004

YrBlt], Previous Sale: 07-07-16, $620,000

719 Sage Court - $550,000

06-27-25 [3 Bdrms - 1509 SqFt - 1988 YrBlt]

797 Sage Drive - $590,000

06-27-25 [3 Bdrms - 1592 SqFt - 1988 YrBlt]

291 San Leon Drive - $575,000

06-23-25 [3 Bdrms - 1225 SqFt - 1994 YrBlt],

Previous Sale: 03-22-21, $560,000

473 Stanford Street - $727,000

06-24-25 [4 Bdrms - 2366 SqFt - 1990 YrBlt], Previous Sale: 09-21-10, $328,000 6121 North Vine Street - $1,690,000

06-26-25 [4 Bdrms - 3510 SqFt - 2003 YrBlt], Previous Sale: 12-13-17, $960,000

TOTAL SALES: 24

LOWEST AMOUNT: $230,000

HIGHEST AMOUNT: $800,000

MEDIAN AMOUNT: $567,500

AVERAGE AMOUNT: $536,729

166 Amherst Avenue - $485,000

06-24-25 [4 Bdrms - 1741 SqFt - 1965 YrBlt], Previous Sale: 06-02-09, $110,000

271 Antigua Way - $735,000

06-23-25 [4 Bdrms - 2589 SqFt - 1987 YrBlt], Previous Sale: 05-18-00, $368,000

181 Belvedere Court - $605,000

06-27-25 [4 Bdrms - 1684 SqFt - 1985 YrBlt],

Previous Sale: 02-23-09, $225,000

16 Brighton Drive - $600,000

06-27-25 [3 Bdrms - 1769 SqFt - 1985 YrBlt],

Previous Sale: 09-29-09, $275,000 468 Britannia Drive - $655,000

06-23-25 [4 Bdrms - 2157 SqFt - 1987 YrBlt], Previous Sale: 12-18-13, $295,000 1455 North Camino Alto #135$230,000

06-26-25 [2 Bdrms - 986 SqFt - 1973 YrBlt], Previous Sale: 10-06-23, $282,500

206 El Sendero - $299,500

06-24-25 [3 Bdrms - 1050 SqFt - 1954 YrBlt] 2127 Georgia Street - $564,000

06-26-25 [5 Bdrms - 1950 SqFt - 1938 YrBlt]

317 Glenn Street - $320,000

06-27-25 [2 Bdrms - 1102 SqFt - 1925 YrBlt],

Previous Sale: 12-21-07, $220,000

157 Hilltop Drive - $665,000

06-26-25 [4 Bdrms - 1909 SqFt - 1980 YrBlt]

141 Hillview Drive - $800,000

06-25-25 - 2472 SqFt - 1978 YrBlt], Previous Sale: 10-01-19, $565,000

1005 Legend Circle - $680,000

06-23-25 [5 Bdrms - 2325 SqFt - 1996 YrBlt], Previous Sale: 10-04-16, $500,000

1637 Lemon Street - $434,000

06-25-25 [2 Bdrms - 1513 SqFt - 1934 YrBlt],

Previous Sale: 04-07-25, $330,000

427 Longridge Drive - $655,000

06-24-25 [3 Bdrms - 1590 SqFt - 1988 YrBlt]

1589 Magazine Street - $450,000

06-27-25 [3 Bdrms - 1246 SqFt - 1953 YrBlt],

Previous Sale: 04-25-12, $60,500

459 Maple Avenue - $535,000

06-26-25 [3 Bdrms - 1578 SqFt - 1964 YrBlt]

171 Nautical Court - $325,000

06-26-25 [2 Bdrms - 848 SqFt - 1985 YrBlt],

Previous Sale: 03-31-14, $139,000

243 Reynard Lane - $792,000

06-23-25 [4 Bdrms - 2627 SqFt - 1984 YrBlt], Previous Sale: 06-19-18, $603,500

225 Riverview Drive - $615,000

06-26-25 [4 Bdrms - 1894 SqFt - 1983 YrBlt]

220 Sandy Neck Way - $675,000

06-25-25 [4 Bdrms - 1993 SqFt - 1988 YrBlt], Previous Sale: 05-11-16, $455,000

213 Sperry Avenue - $415,000

06-26-25 [2 Bdrms - 740 SqFt - 1920 YrBlt],

Previous Sale: 09-11-08, $50,900

712 Springs Road - $271,000

06-23-25 [2 Bdrms - 1093 SqFt - 1934 YrBlt], Previous Sale: 09-19-16, $232,500

137 Webster Street - $505,000

06-27-25 [4 Bdrms - 1532 SqFt - 1942 YrBlt]

160 Wood Court - $571,000

06-24-25 [4 Bdrms - 1480 SqFt - 1980 YrBlt], Previous Sale: 02-13-15, $345,000

If you have large or unexpected expenses on the horizon, you may have access to an untapped resource: your home. You could use some of the equity you’ve built up in your house to meet financial goals, depending on how much equity you have and how you use it.

Here’s a guide from the experts at Navy Federal Credit Union to explain how home equity loans work and when you should – or shouldn’t – use your home’s equity.

In basic terms, a home equity loan is money you’re borrowing using your home as collateral. The equity in your home equals how much of your home’s value you actually own (not counting the mortgage you’re still paying off).

Home equity loans are frequently offered at lower interest rates than other loans, so they may be a great option for consolidating debt on higher interest credit cards, or large home improvement projects.

You can determine how much equity you have in your home, and how much your home equity loan payments are likely to be, using online calculators.

Fixed-rate equity loan: This is a lump sum amount you’ll draw from your home’s equity, paying back monthly at a fixed interest rate for the life of the loan, so you’ll know exactly what to expect. Fixed-rate home equity loans are typically used for:

• Home improvements/repairs

• Debt consolidation

• Large purchases

• Life events

Home equity line of credit (HELOC): This is a line of credit secured by the home, which lets you borrow funds if and when needed, up to a set maximum credit limit. You only have to repay the funds you borrow. HELOCs are typically used for:

• Home improvements

• Emergency funds

• Medical expenses

• Debt consolidation

The best use of a home equity loan or home equity line of credit is when the money you borrow increases your home’s value via renovations or repairs, as this continues building the equity you’re borrowing against. You may also have tax benefits for using the loan toward home improvements, so it’s recommended to consult a tax professional.

Because these loans use your home as collateral, remember that you’ll want to be sure you can stay on track with loan repayments. For this reason, financial experts advise against using home equity to borrow for things including: A car purchase: An auto loan is usually a better choice for purchasing a new or used vehicle.

See Loans, Page 11

divorce documents.

From Page 3

You should discuss this option with your family law attorney. There is probably no reason why you alone should be liable for the payoff shortfall and you may want to have this obligation shared between yourself and your ex-wife. If this type of deal can be negotiated, you’ll have to have it memorialized in the

The other option is to simply walk away from the property. Or, in the alternative, turn the property over to the mortgage company so they don’t have to incur the time and expense of foreclosing.

Since you’ve had the property such a short period of time I assume you’ve never refinanced. In California, if the house is foreclosed upon under the loan you first used to buy it, the mortgage company can not, as a matter of

law, sue you for the difference between the foreclosure price and the amount owing.

In other words, if you never refinanced, you can walk away, let the bank have it, and the only penalty you would suffer is the ding on your credit report.

Tim Jones is a real estate attorney in Fairfield. If you have any real estate questions you would like to have answered in this column, you can send an email to AllThingsRealEstate@ TJones-Law.com.

MEAGHAN HUNT BANKRATE.COM

The U.S. residential real estate market remains a challenging environment for prospective buyers in 2025. While conditions are cooling somewhat and inventory is growing, it remains a hot seller’s market in most parts of the country. If you’re shopping for homes, you may see properties listed for sale “as-is” in response to limited inventory.

While that might suggest the advantage is all on the seller’s side, an as-is home can be a boon to homebuyers, too, though the caveats can be considerable. Here are some of the key pros and cons to consider.

When you buy a house as-is, you’re getting a property that typically needs repairs and updates, with the asking price reflecting the current condition. Don’t ask for bargaining, changes or fixes: What you see is what you get.

Although the home may not be in perfect condition, the level of fixes and improvements needed can vary. An as-is home may have minor cosmetic issues, such as chipped paint or an appliance that needs replacement. However, in some cases, more serious issues may arise, such as water leaks, roof damage or mold.

An “as-is” home isn’t necessarily the same as a “fixer-upper,” though there’s overlap between the two. “Fixer-uppers are properties that need significant repairs and renovations, while as-is homes may just need some cosmetic updates or minor repairs,” says Rinal Patel, co-founder of We Buy Philly Home in Philadelphia.

Sellers offer homes as-is for a variety of reasons. For instance, the home may have recently gone through a foreclosure, or the previous owner may have died and their heirs are attempting to sell it to avoid the cost and time involved. The current owner may also need to sell quickly or want to avoid negotiations.

Sellers offer homes as-is for a variety of reasons. For instance, the home may have recently gone through a foreclosure, or the previous owner may have died and their heirs are attempting to sell it to avoid the cost and time involved. The current owner may also need to sell quickly or want to avoid negotiations.

No matter the seller’s motives, as-is home sales can offer several advantages for the buyer.

Cheaper sale price

As-is homes are priced to sell. And since the current owner is unlikely to make repairs or negotiate, the buyer can usually obtain it for a bargain price. “This could save you money in the long run, especially if the repairs aren’t too significant,” says Patel. If they are

renovations you can DIY, even better. And of course, paying less upfront could potentially mean more appreciation in your pocket if/when you come to sell the home.

Faster transaction

When you’re buying a home as-is, you can usually complete the transaction faster than usual. There are no prolonged negotiations over the purchase agreement or contract details. Since “the buyer knows what they are getting, and so does the seller in terms of what’s expected of them, [you] get a quick sale most of the time and an expedited closing timeline,” says Robert J. Fischer, a real estate agent in the Greater Austin, Texas area.

Less competition from other buyers

Many buyers shy away from as-is homes, assuming they’ll be serious fixer-uppers at worst, or dated and in need of updates at best. So you’re less likely to get into a bidding war with other pro-

spective buyers or be knocked out of the running by a more aggressive offer at the last minute.

More money for remodeling

It’s rare for a home not to require some customization. But if you pay top-dollar for a new or fully up-to-date property, you may not have the funds to make renovations or other changes.

With an as-is home sale, you can use the savings from the lower sale price to tailor the home to your tastes while also building equity.

While there are advantages, there are also disadvantages to buying a home as-is.

The home might have major hidden problems

The biggest concern is that the home will require significantly more work than you anticipated.

That could mean your bargain purchase is now a costly problem you must pay to fix as its new owner. Even if a home inspection uncovers issues before you close, you still might be stuck going through with the deal, depending on what those issues are (more on that later).

Financing could be a challenge

Financing an as-is home purchase can be tricky. If the property turns out to have serious structural problems that affect health or safety, your initial plans for financing may fall through.

“If the buyer is getting a mortgage through FHA or VA and even some conventional products, certain repairs must be completed prior to closing,” says Kristen Conti, broker-owner at Peacock Premier Properties in Englewood, Florida.

FHA and VA loan property requirements

•Be structurally sound

•Be safe and healthy for people to live in

•Have working heat

•Have a sound roof

•Be free of rot, mold and fungus growth

•Be free of any known hazards associated with lead-based paint

You could be caught between a rock and a hard place if the lender-mandated inspection reveals such issues, the seller won’t fix them, and you can’t obtain the loan without them. For this reason, many as-is homebuyers opt to pay with cash or hard money loans, rather than traditional mortgage financing.

Sellers are typically inflexible

As-is home sellers tend not to be open to contingencies, counter-offers or contract negotiations – that’s the whole point of offering the house as-is. You can always try, of course, but don’t count on much wiggle room or flexibility.

~ August 16th & 17th ~

OPEN HOUSE

Open House : Sunday 1-3PM 1201 Glen Cove Park way #602, Vallejo

Welcome

Your

Sylvia Cole & As sociates RE ALTOR® DRE#01386900 (707) 330-8923

Open House : Sunday 12-2PM 953 Cashel Circle, Vacaville

Brown’s Valley Home on a corner lot! Absolutely stunning, 5 bedroom 2.5 bath home on a corner lot in the desirable Browns Valley communit y. It of fers the per fect blend of modern elegance and ever yday comfort with a bright open floor plan. $800,000

Juli Paschal & Amanda Cooper RE ALTORS® DRE#01946153, 02238957 (707) 592-2124, (707) 903-0947

Open House : Sunday 1-4PM 3114 Lomita Cour t, Fairfield

Two homes on one lot! Main 4BD/4BA custom estate with canyon views, pool/spa, chef’s kitchen & 3-car garage. Detached custom 1BD/1BA guest house with full kitchen & private driveway. Nearly 1 acre! $1 ,300,000

Monique Kenner RE ALTOR® DRE#01475803 (707) 297-9266

Stunning Modern Retreat

2405 Sparrow Cour t, Davis

Discover refined living in this beautifully transformed single -story home, exper tly remodeled from top to bottom by Morse Remodel and Custom Homes. Boasting 3 spacious bedrooms and 2 elegantly updated bathrooms, this home seamlessly blends contemporar y design with lasting quality. $780,200

Leslie Blevins RE ALTOR® DRE#01337516 ( 530 ) 304-6867

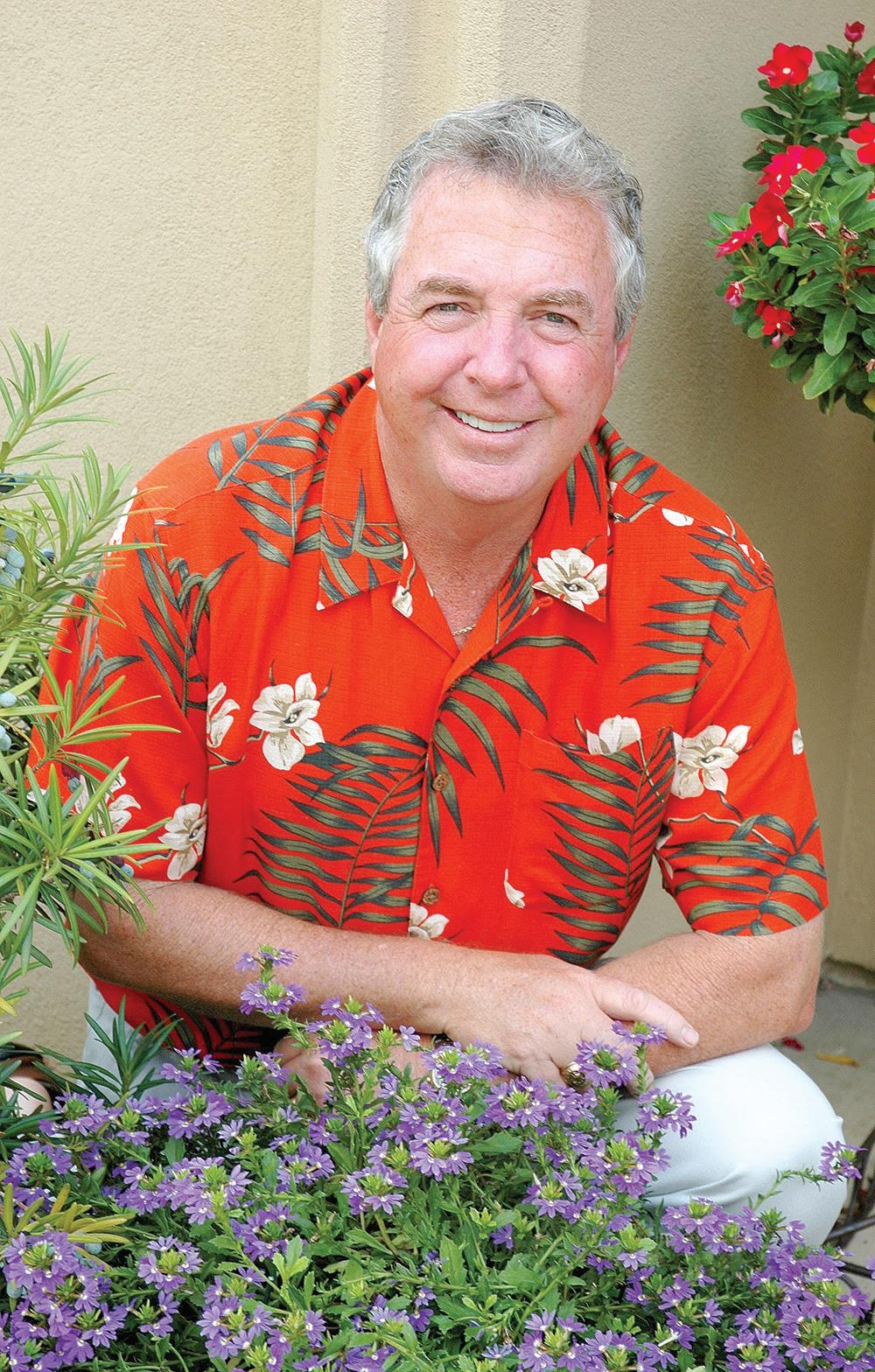

One of the best things about being involved in plant trials is being proven wrong. People who are evaluating plants at the university level, garden writers and even industry pros are all guilty of judging a plant the day we take it out of the box or off the truck. A lot of those judgments are on aesthetics or beauty.

I’ll skip writing a column on my failures via early judging and tell you about an ornamental sweet potato that is hitting it out of the park. This jewel is known as Sweet Caroline Sweetheart Shadowstorm.

If there was ever a more mys terious name for a sweet potato, I don’t know what it would be. Sweet Caroline has become the name synonymous with awardwinning ornamental sweet potatoes. Sweetheart gives you a clue to the heart shape of the leaf. I’m sure you are wondering what the word Shadowstorm refers to. My spellcheck has it underlined every time I write it.

I put mine in large self-watering AquaPots with the new Surefire Cascade Red begonias, ColorBlaze Mini Me Chartreuse coleus and Graceful Grasses Queen Tut papyrus. I really

Neighbors Dave and Cynthia used some in hanging baskets with the Surefire Cascade Red begonia and Stardiva Blue scaevola and they are simply beautiful. James Winter and the Eden Estate Management Team took theirs on the road to Kim and Joey Mixon’s in Phenix City, Alabama.

and flower where it looks like a happy ivy.

The Sweet Caroline Sweetheart Shadowstorm is easy maintenance. Like other ornamental sweet potatoes, they can overtake some not so vigorous companions. On the other hand, there has never been an easier plant to cut back to keep in an allotted space or to redirect growth.

Occasionally you may find that some new growth is a solid green and doesn’t go variegated. It’s suggested you can snip that off, but I can tell most gardeners will look at that as a bonus.

If my Sweet Caroline Sweetheart Shadowstorm plants do it, I am keeping it! Just make sure you put it at the top of your list for 2026 and for now follow me on my Facebook page, @Norman WinterTheGardenGuy for more photos and garden inspiration.

The leaves are indeed green and chocolate mahogany. So, I suppose the dark is the shadow of a storm over the green. If you are like me, you are wondering if this variegation really can enhance mixed containers or stun tumbling over a rock wall.

Yes it can, and the look is one of elegance and mystery when your mixed container comes to fruition. I assure you all your friends and neighbors will think about everything but sweet potatoes.

The tag will tell you about 12 inches tall and with a spread of 24 inches. I’m suspecting this girl can go 36 inches, maybe 48. I am already trimming but relishing every minute. You’ll want good potting soil and plenty of sunshine for it to dazzle. I’ve got Sweet Caroline Light Green falling over my rock wall and wish I would have saved a couple of Sweet Caro-

The Sweet Caroline Sweetheart Shadowstorm was used in a large ceramic pot with a podocarpus or Japanese yew and a Supertunia Mini Vista Yellow petunia. In another area, the Sweet Caroline Sweetheart Shadowstorm has merged with a sea of foliage

Norman Winter is a horticulturist, garden speaker and author of ““Captivating Combinations: Color and Style in the Garden.” He receives complimentary plants to review from the companies he covers.

No one enjoys being in cramped quarters. Whether a person battles a legitimate case of claustrophobia when confined in tight spaces or simply prefers a place to stretch out, there’s no denying the appeal of a little extra room. That’s particularly so at home, where cramped spaces can make it hard to unwind.

When homeowners feel their walls are closing in on them, many choose to build space via a room addition. Room addition projects are extensive and expensive undertakings, with the home renovation experts at Angi estimating the average add-on costs $48,000. But Angi estimates such projects can cost as much as $72,600, or even more depending on the size of the space and the features chosen.

The financial commitment when adding a room is significant, but homeowners and residents also will need to prepare for a potentially lengthy disruption to their daily routines. Various online resources, including Angi, suggest room addition projects typically take around three to four months. With so much at stake, homeowners who think they might benefit from a room addition can look for various signs to help them determine if such a project is right for them.

Cramped quarters without much space for people are perhaps the most notable sign that residents can benefit from some additional space in a home. Cluttered spaces suggest homeowners may have run out of room for their stuff, and a custom addition can provide that extra room while

contributing to a more calming ambiance in common spaces that may no longer be overwhelmed by papers, toys and other items that can quickly take over a home that lacks space.

Millions of homeowners like to entertain friends and family, and that’s more manageable for some

than it is for others. If interior or exterior spaces do not accommodate hosting, a room addition that expands an existing kitchen or living room might be the ideal renovation project.

A home that no longer has enough space to meet your needs is another sign a room

addition might be in order. This very issue emerged for millions of professionals during the Covid-19 pandemic and has remained a challenge ever since. Indeed, an increase in days spent working remotely has left many homeowners grateful to work from home but desirous of a designated remote work space. A room addition to accommodate a home office can be just what remote workers need to restore fully functional status to their homes.

While the sticker price of a home addition may (or may not) raise an eyebrow, the project is almost certain to prove more costeffective than moving. According to data from the U.S. Census Bureau and the U.S. Department of Housing and Urban Development, the average sale price of a home in the United States reached $503,800 in January 2025. While that marked a roughly $16,000 decrease from a year earlier, it’s still a high figure that many homeowners aren’t willing to pay. A cost comparison detailing the price to move versus the price to build an addition may indicate that the latter option is a homeowner’s best bet.

A room addition could be the perfect renovation project for homeowners who need more space but still prefer to stay put.

From Page 5

Interest rates on auto loans tend to be similar or lower than home equity loans, and auto loans usually require little paperwork and fewer fees.

Vacations: It’s better to save up for near-term wants like vacations

or large-screen TVs than using your home’s equity for something offering no financial return.

College: Consider all options –including federal student loans, scholarships, grants and private student loans - before tapping into home equity. A home equity loan may be a consideration if current mortgage rates are significantly lower than federal student loan rates, especially for graduate or professional degrees. But unlike

federal student loans, if you use home equity to pay for college, you won’t qualify for incomedriven repayment plans or loan forgiveness programs.

Starting a business: Your best bet for launching a business is a business loan through a financial institution or the U.S. Small Business Administration (SBA). If your business fails and you have a home equity loan or HELOC you can’t repay, you’re putting

your home on the line.

Recurring expenses: Using home equity to cover everyday bills can be a slippery slope. Consider your long-term ability to repay the loan. Since your home is your collateral, missed payments could lead to foreclosure.

Your home equity is a valuable resource for managing

your finances. Planning ahead and understanding your repayment responsibilities is crucial for making the best use of a home equity loan or home equity line of credit. For more information and to explore your home equity options, visit NavyFederal. org/equity. Navy Federal is federally insured by NCUA. Equal Housing Lender.

$664,500

$499,000 1198 Pear Tree Ln Napa 2 3/0 1,301 0.01 325056798

$598,000 520 Country Club Lane Napa 3 2/0 1420 0.2500 325019935

$750,000 140 Harrison Avenue Napa 3 2/0 1319 5,249 325072850

$750,000 2561 Dorset St Napa 4 2/0 1,199 0.14 325055167

$777,000 2148 S Terrace Drive Napa 3 2/0 1746 6,991 325064044

$441,253 2274 Stars Dr Rio Vista 2 2/0 1,686 0.12 325001895

$399,900 565 E Wigeon Way Suisun City 4 2/0 1,678 0.13 325062435

$475,000 321 Ridgecrest Cir Suisun City 2 2/0 1,058 0.09 325071112

$540,000 603 Charles Way Suisun City 4 3/0 1,652 0.16

$550,000 400 Morgan St Suisun City 4 2/1 2,402 0.11

$555,000

$559,000 216 Morgan St Suisun City 4 2/1 2,500 0.11

325067601

$579,950 1621 Savannah Lane Suisun City 3 2/0 1580 6,534 325068176

$599,999 128 Clownfish St Suisun City 3 3/0 1,877 0.09 325071441

$639,900 752 Chula Vista Way Suisun City

One of the hardest parts of home remodeling can be simply getting started. With so many styles, colors and materials to choose from, it’s all too common to experience “decision paralysis.” Rather than put off your exterior renovation further, consider these tips and tools for nailing down the details:

Online tools can both help you bring your vision to life – and decide what that vision is. ProVia’s Design Center is an innovative tool that lets you browse and save colors, coordinating palettes and product images. As you explore the Color Palettes page, which features color wheels representing unique palettes, along with suggested product colors and inspirational imagery, keep these factors in mind:

Architectural style. Understanding the features that define your home’s design style is

From Page 6

Bear these suggestions in mind before embarking on an as-is purchase.

Ask questions

Even with an as-is home sale, you can ask questions, including why the house is being sold as-is: It’s an estate sale, the owners need funds fast to buy another home, they just don’t want the work of making a place move-in ready, etc. Perhaps your real estate agent could get the skinny from the seller’s agent. “This could provide some insight into the home’s condition and whether

essential in color selection. For instance, a colonial-style home may look best with classic, neutral colors, while a modernstyle home might benefit from bold, vibrant accents.

Landscaping and surroundings. Look to your surroundings for inspiration, selecting colors that harmonize with your landscape to create a cohesive and visually appealing look.

Color psychology. Colors have the power to evoke specific emotions and moods. Think about what you want guests to feel when they come to your front door, or what you want to feel each time you pull into your driveway. For instance, warm colors like red and yellow can create a welcoming and energetic feel, while cool colors like blue and green can create a sense of calm and tranquility.

Signing up for a My Design Account at provia.com/register allows you to create and save your own vision boards, so you can compile your favorite ideas in one place.

or not the repairs needed are significant,” says Patel.

Don’t disregard disclosures

In most states, “the seller must disclose anything they know is wrong with the home, unless the property is a rental or an inheritance,” says Jimmy Hughes, a broker with JMR Realty in Edmond, Oklahoma. Selling a home as-is doesn’t relieve the homeowner of this legal obligation, especially when it comes to serious issues.

According to Tomas Satas, founder and CEO of Windy City HomeBuyer, “Disclosure laws usually cover all major systems of the home, [including] infestations of any kind, the roof, the foundation and the presence of toxic substances such as lead paint, asbestos or radon.”

Verify with a local real estate agent which codes and health and

“In addition to any color palette images you’ve saved, you can ‘favorite’ other images on the site by clicking the heart in the upper right corner. Use your saved images to create whatever you want, whether it’s a board with just entry door ideas, or a board to visualize your favorite colors together,” advises Jennifer Kline, digital experience supervi-

safety disclosures are required in the state where the property is located. If you do discover problems with the home, you could ask the seller to address them, the as-is status notwithstanding (or walk away from the deal).

Know what to put in the contract

“A home purchase contract should clearly state which items are included in the sale of the property as-is,” including furnishings, fixtures and appliances, says Boyd Rudy, associate broker at Boyd Rudy’s MiReloTeam. “Including a complete and accurate list of items in the contract also helps to protect both parties in the event that something is damaged or goes missing after the sale is final.”

Get a home inspection and/or contractor evaluation

Even if your lender doesn’t require one, a home inspection is

sor at ProVia.

Are you more of a big-picture person, preferring to see how all the parts fit together as a whole? It can be hard to imagine how your home will look by holding up a siding color swatch or trying to visualize a new metal

something all our expert sources agree is a necessity when buying a home as-is. A home inspection is more thorough, but costs more, while a contractor’s evaluation is cheaper but might not be as comprehensive.

Although as-is sellers likely won’t be enthusiastic to oblige, insist on making a home inspection part of a non-negotiable contingency clause. This way, you can back out of the contract if the inspector reveals major problems, like a cracked foundation. Although you’ll be out the cost of the inspection – which averages $343 nationally – it’s worth it if it allows you to avoid any expensive renovations.

There’s some debate over whether a home warranty is worth it, or even a possibility, in an as-is home sale. “Buyers can

roof to replace your worn-out asphalt shingles. This inability to “see” the finished result in your mind’s eye can be frustrating. Fortunately, the ProVia Visualizer tool enables you to preview colors and styles on your home, so you know exactly how it will turn out. Simply upload a photo of your house and then experiment with products. Get creative with door and window configurations, siding styles and shades, stone profiles and grout colors, and metal roofing options.

“Purchasing home exterior products is a big decision, which is why it’s nice to visually try before you buy. The ProVia Visualizer lets you preview different design and product selections so you can move forward with your project with confidence,” says Kline.

While the endless possibilities of a home renovation can be exciting, they can also make it seem overwhelming. Fortunately, increasingly sophisticated digital tools can help you define your style and see your vision through.

ask for a home warranty, but on as-is homes, it’s typically assumed this will not be included,” says Hughes. Still, it doesn’t hurt to ask the seller to purchase one for you. Alternatively, there are other ways to obtain coverage for appliances, such as using a credit card with warranty perks.

• Buying a home “as-is” means purchasing the property in its current condition, with no repairs or improvements made by the seller.

• A home might be listed for sale “as-is” for a number of reasons, including foreclosure or the seller wanting a quick sale.

• “As-is” homes can present a good buying opportunity, but the home may have major problems and you might have trouble acquiring financing.