International Journal for Port Management J A N UA RY / F E B R UA RY 2 0 2 3 W O R L D P O R T D E V E L O P M E N T I n t h i s i s s u e : O C R U p d a t e B e n e l u x Po r t S u r v e y M ex i c a n Po r t s W W W. W O R L D P O R T D E V E LO P M E N T. CO M Q u a y s i d e K P I s High-t ec h r eac hes new heights Po r t C r a n e S e c u r i t y Co n t a i n e r C r a n e D e s i g n S t r a d d l e C a r r i e r Po r t S u s t a i n a b i l i t y Po r t Co n s t ru c t i o n High-t ec h r eac hes new heights

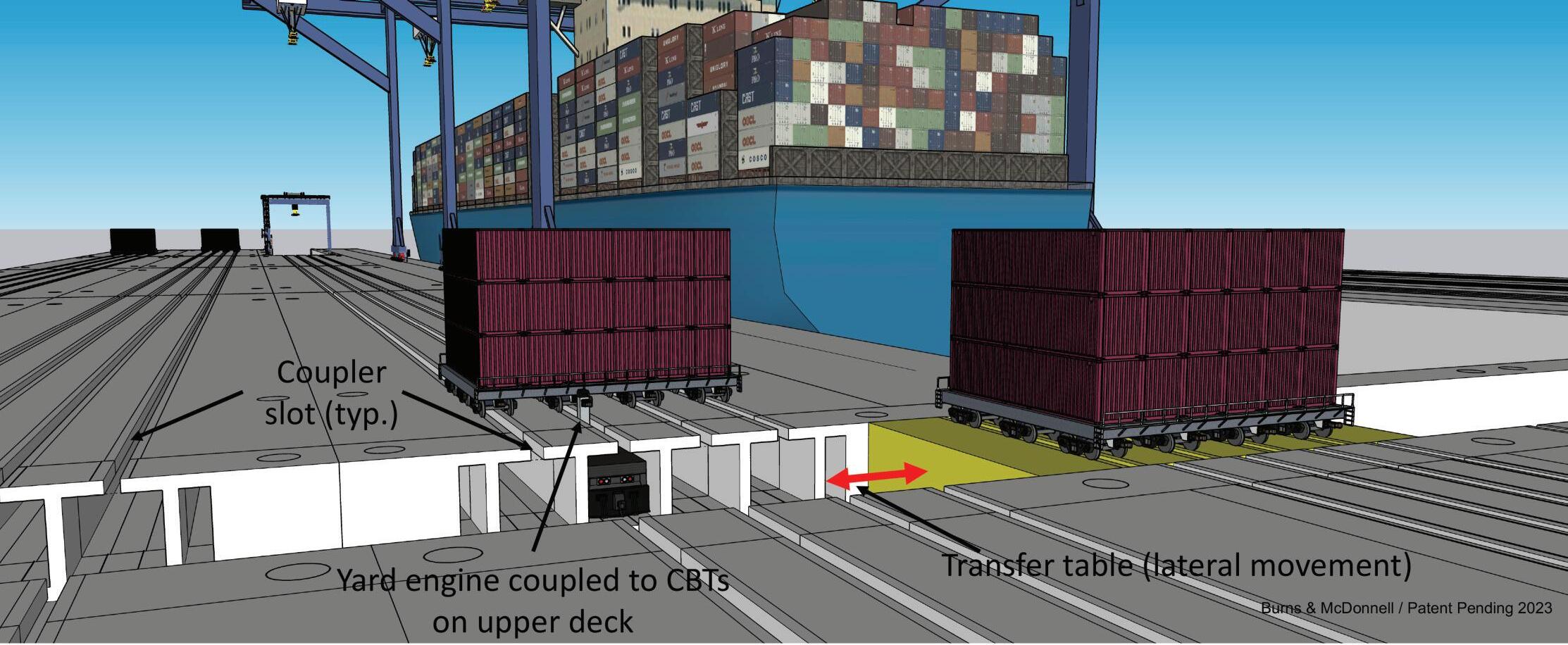

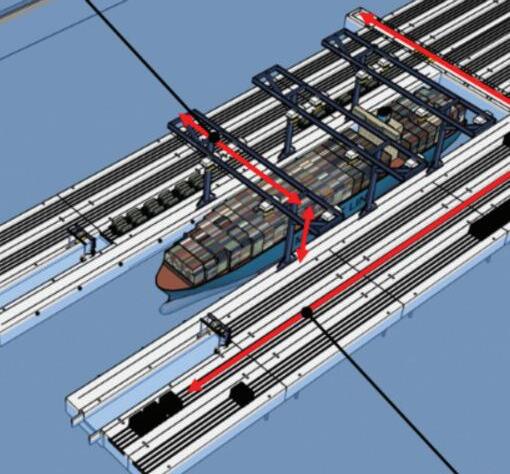

January/February 2023 World Port Development 1 contents visit our website -- www.worldpor tdevelopment .com 16 Unshakeable tenacity in uncertain times Claire Instone brings reader s insight into how Benelux ports remain stable 18 Mexico’s ports are moving up a gear Gordon Feller reports on recent developments and global maritime trade in Mexican ports... 21 Problems ahead? Proposed new US legislation might affect the US crane industry Thomas Francis reports… 26 How to improve quayside KPIs John Lund tak es a look at how advancements in OCR and GOS are changing quayside operations... 32 OCR: much more than data alone Certus Automation gi ves an update on the OCR industry and its future... 38 A floating container terminal Reece Shaw looks at a new design for a floating automated ship-to-shore container terminal... 3 Viewpoint 4 News from around the globe 20 Creating global momentum for sustainable shipping 23 High-tech reaches new heights 30 Hybrid is the buzz word... for now 34 Bedeschi outlines future trends for the stacker/reclaimer 42 Striving to be best-in-class In conversations with terminal operators about Straddle Carriers the word electrification pops up constantly along with reduction of carbon footprint ... Bedeschi provides their outlook on the market for stacker/reclaimers WPCAP has contributed to the faster adoption of sustainability standards and measures in the wider shipping industry The port industry continues to be served by crane manufacturers that listen and deliver Thomas Francis reports Claire Instone reports on the latest from the port construction industry

Published

Consulting Editor : Sheila Moloney sheila@worldportdevelopment.com

Editor : Claire Instone claire@worldportdevelopment com

Editorial Consultants: Gordon Feller gordon@worldportdevelopment com

Thomas Francis info@worldportdevelopment com

Commercial Director : Peter van Schie peter@worldportdevelopment com

Business Development: Selina Palmer info@worldportdevelopment com

Production Manager : Helen White info@worldportdevelopment com

Unshakeable tenacity in uncertain times

Our Januar y/Februar y issue kicks off 2023 with a bang delving straight into the latest developments and insights from across the por t industr y - from the future of OCR to trends in the por ts of Benelux and Mexico.

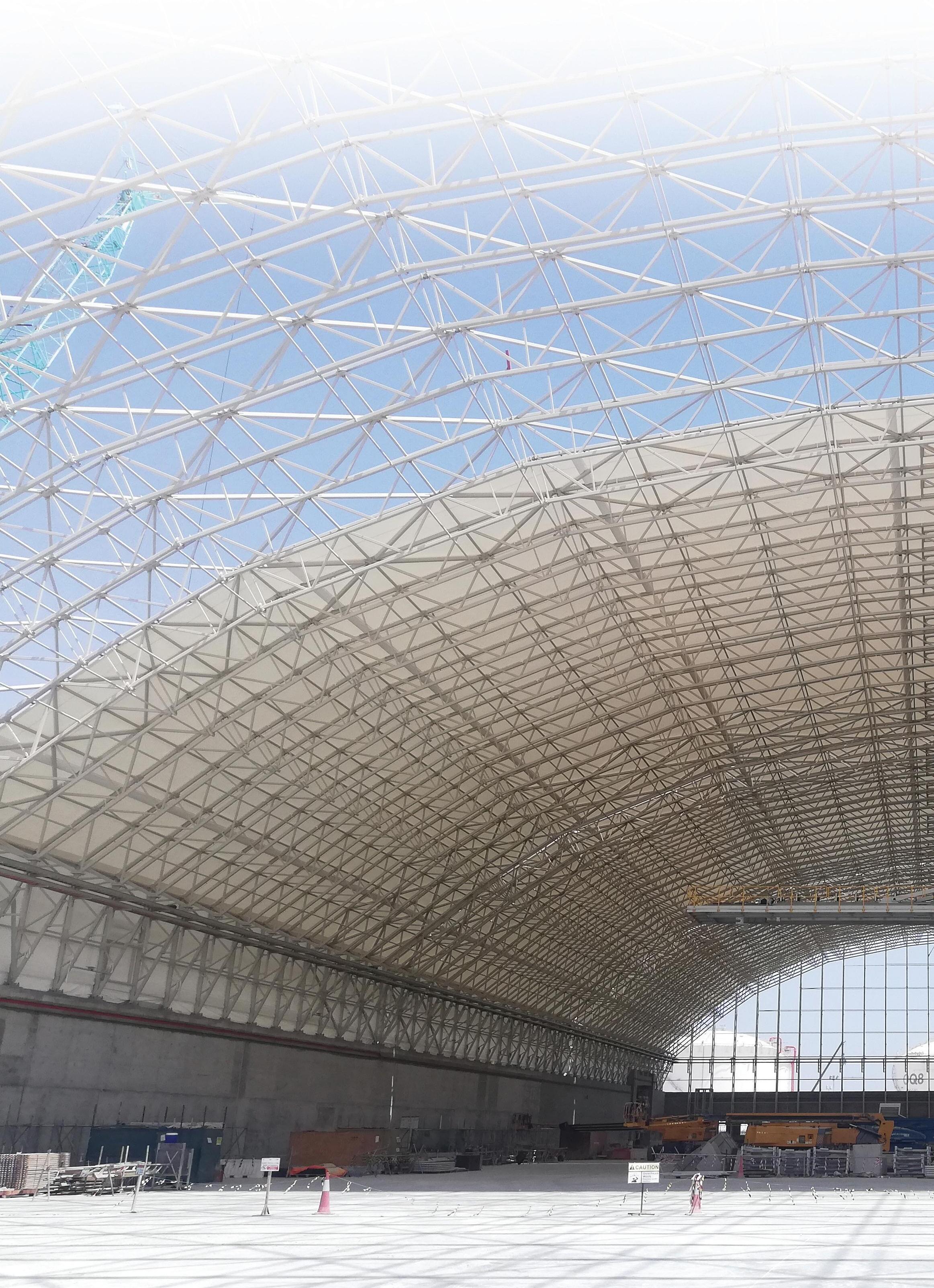

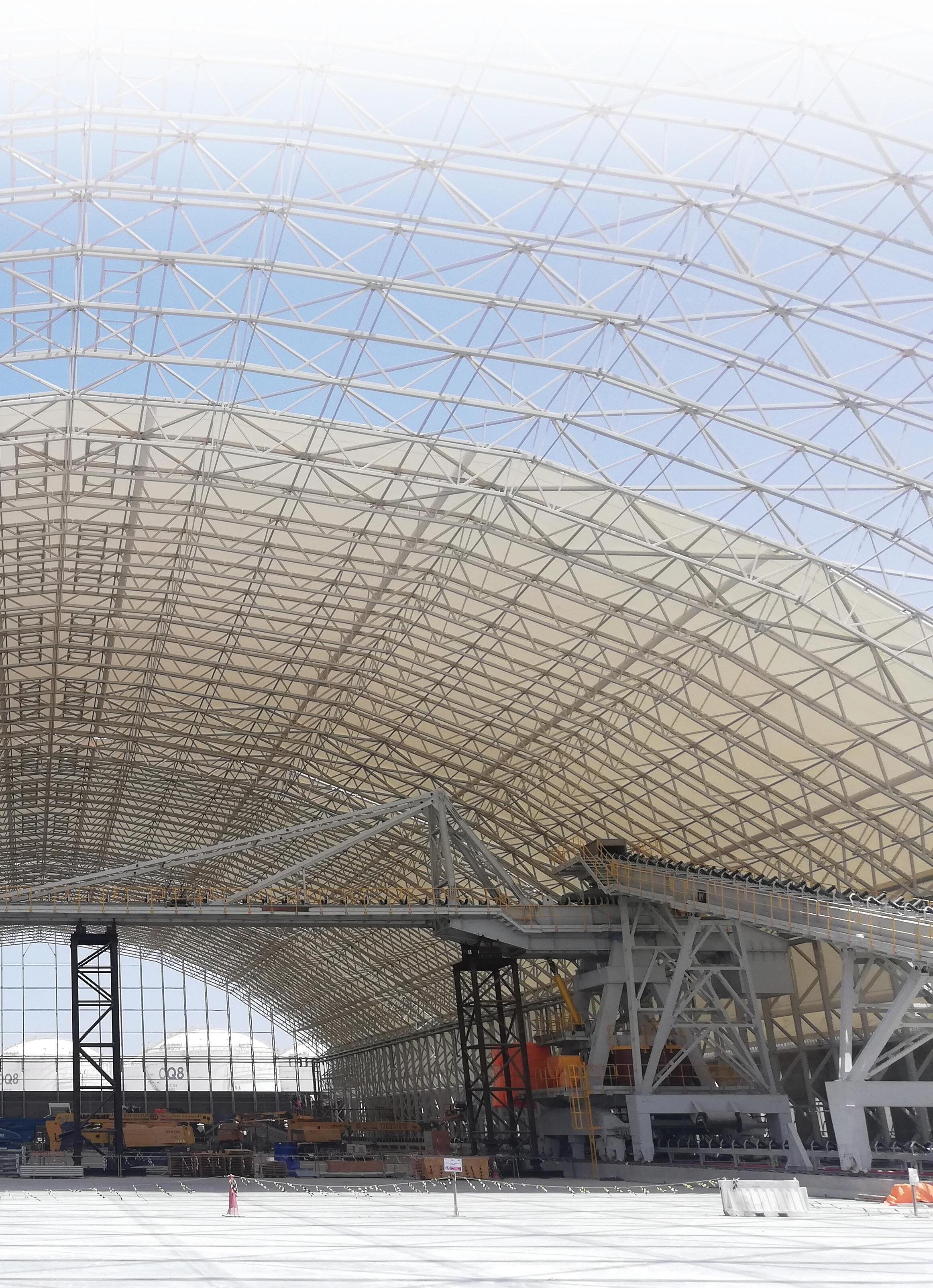

After the disruption of recent years, shipping lines and cargo owners are looking for capacity, reliability and growth oppor tunities and that’s what operators and por t authorities are striving to provide This is the focus in our first por t construction round-up of the year provided by myself Turn to page 42 to find out more about the projects underway to expand and improve infrastructure and create brand new best-in-class facilities.

One por t in par ticular that is ‘moving up a gear ’ is the Por t of Manzanillo The Pacific’s biggest por t is leading the way in terms of expansion and redevelopment, as are many other Mexican por ts as Gordon Feller discovers on page 18.

The por ts of the Benelux are also under the microscope in our inaugural 2023 issue WPD brings readers an insight into how maritime facilities in this region have kept throughput performance stable despite difficulties of the war in Ukraine , sanctions against Russia, and the changes in global energ y flows

As always, the industr y must not only focus on how to get bigger, but how to do this in a manner which is environmentally-friendly Creating global momentum for sustainable shipping is a topic this month’s issue hones in on as we detail the highlights from WPC AP’s latest meeting of por ts for sustainable shipping on page 20.

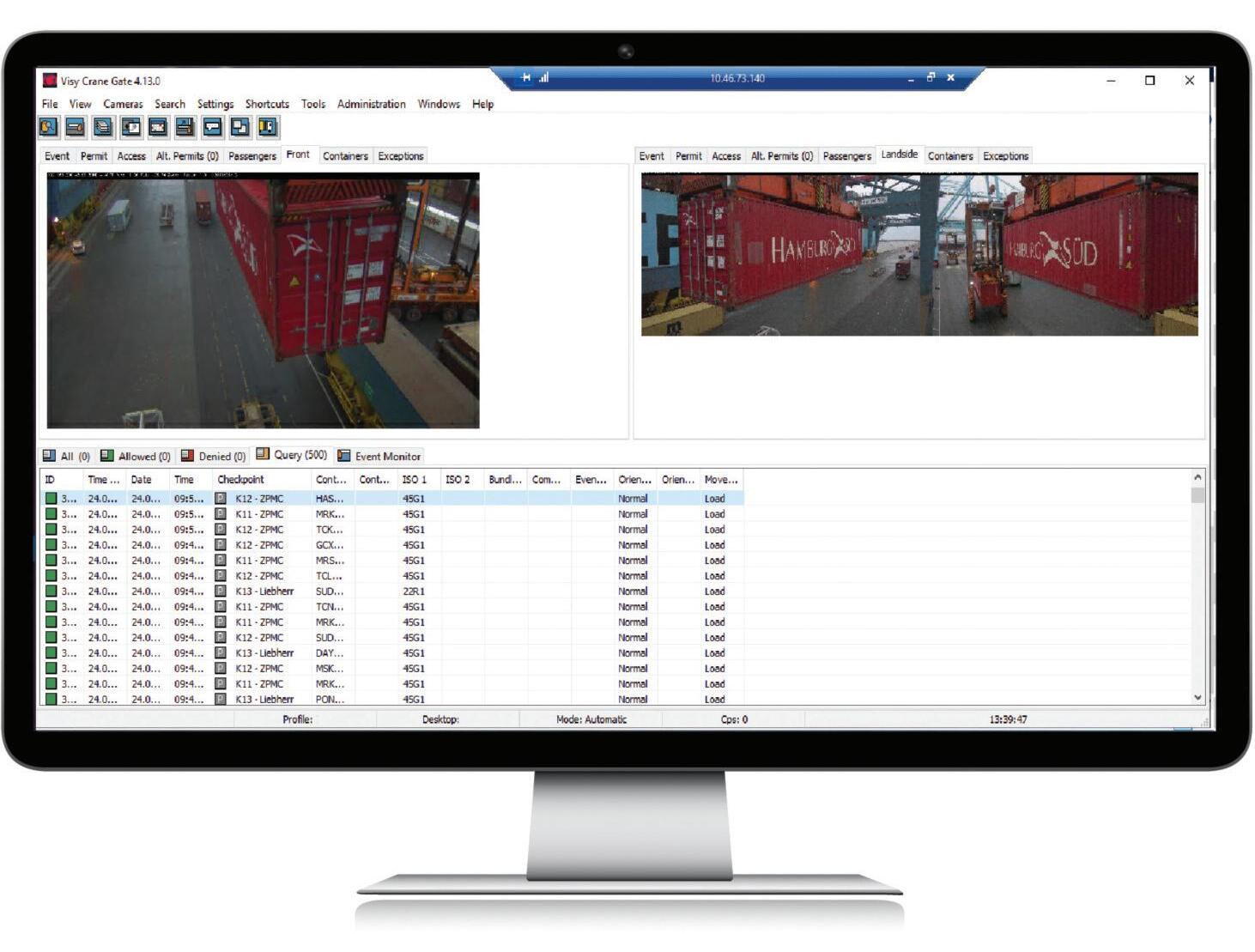

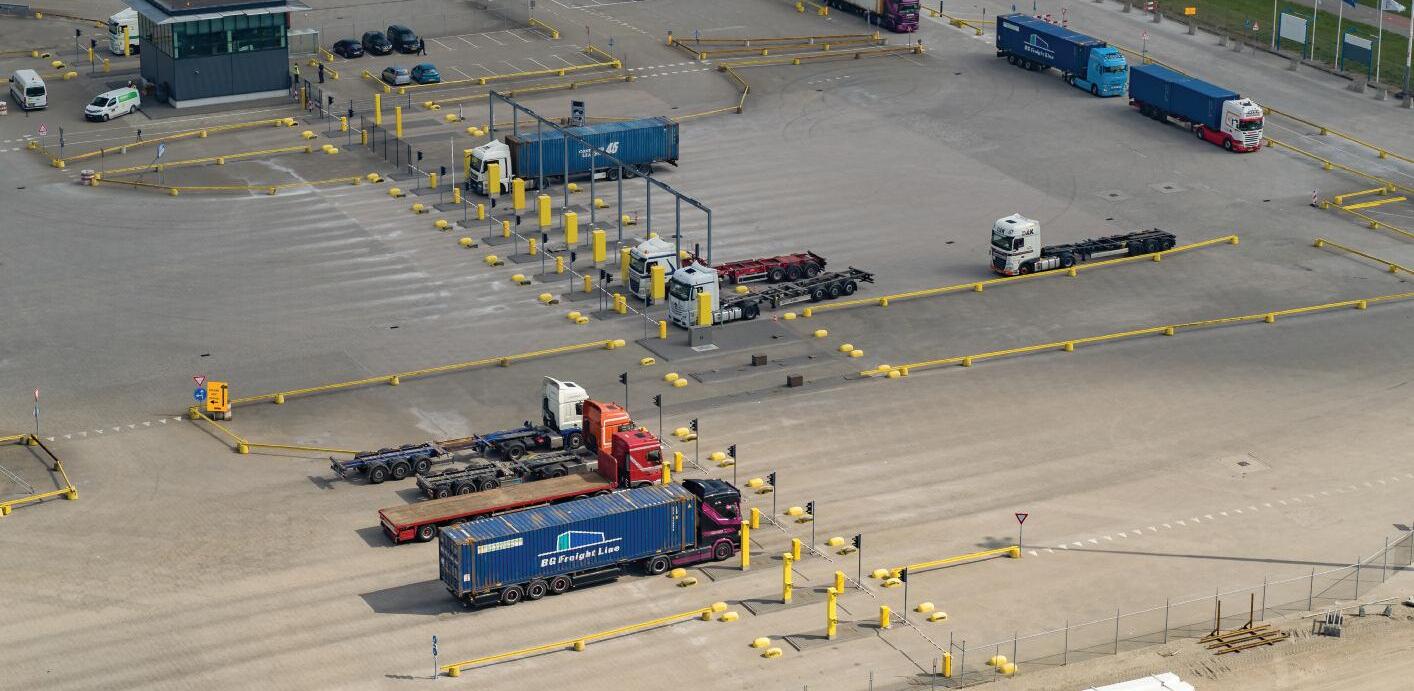

As promised, as par t of our Jan/Feb offering, we proffer up the latest on the OCR market. We are delighted to welcome editorial on how to improve quayside KPIs from Visy Oy as well as an ar ticle from Cer tus Automation explaining how OCR is more than just data alone See pages 26, and 32, respectively

Email: info@worldportdevelopment.com

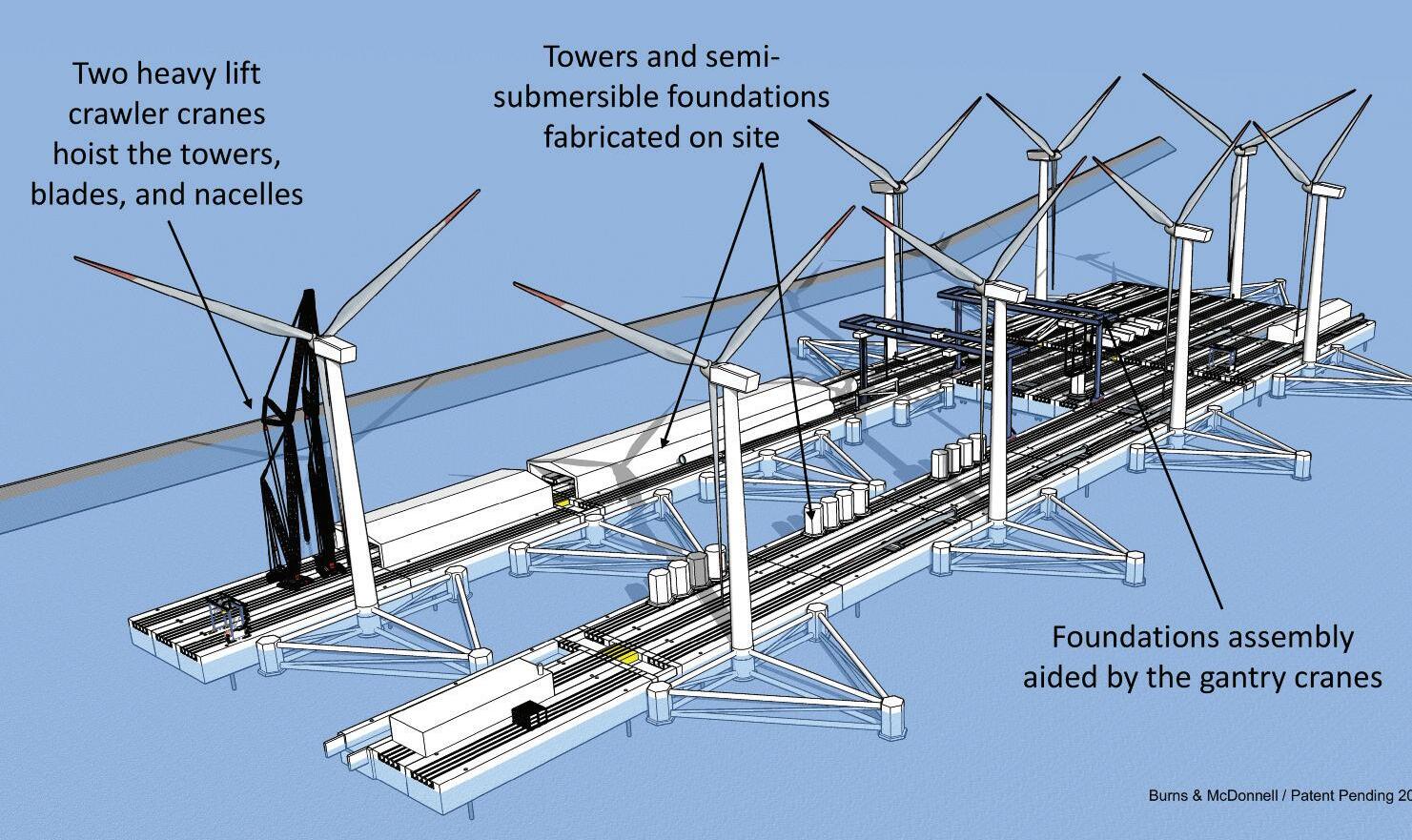

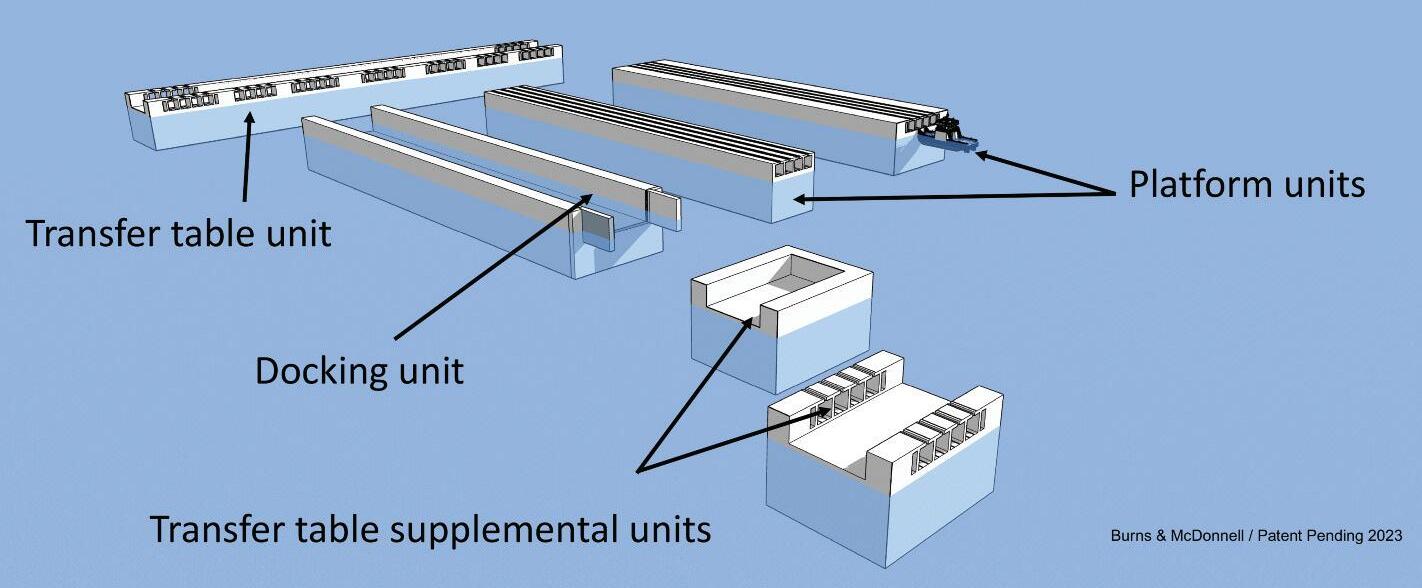

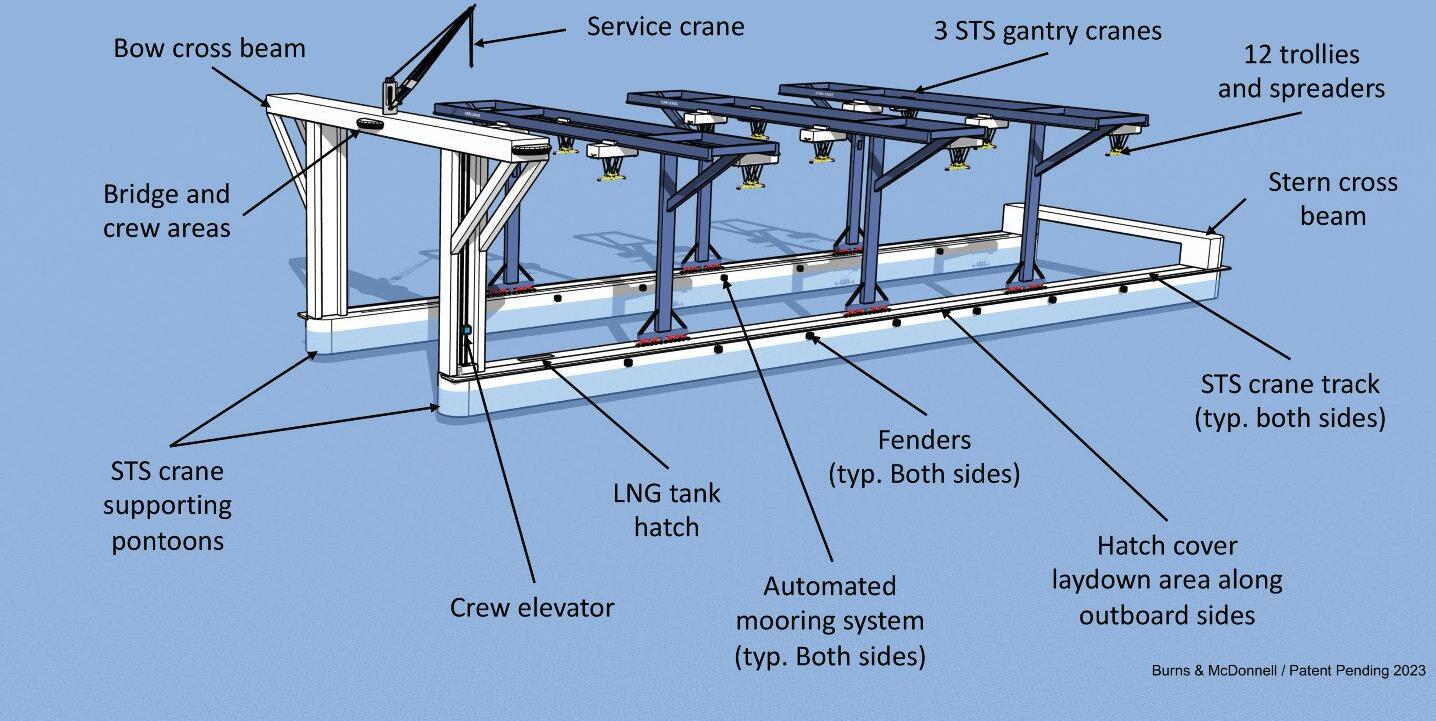

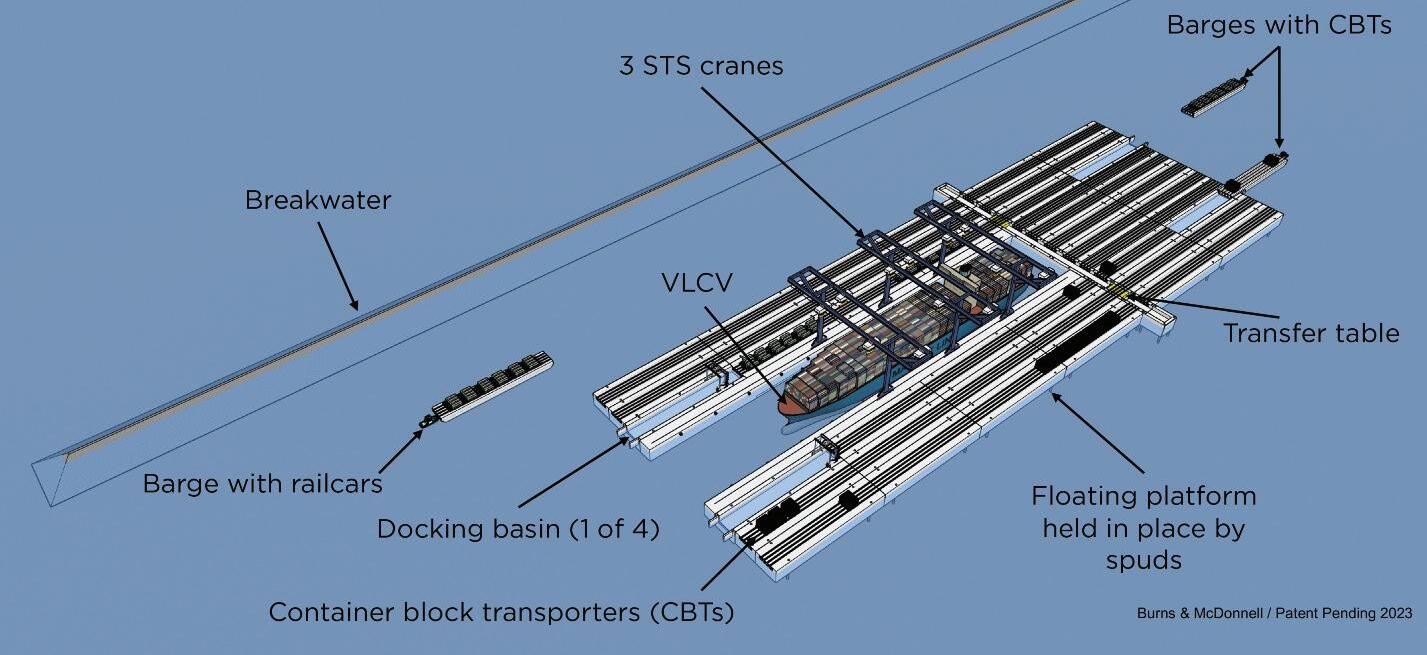

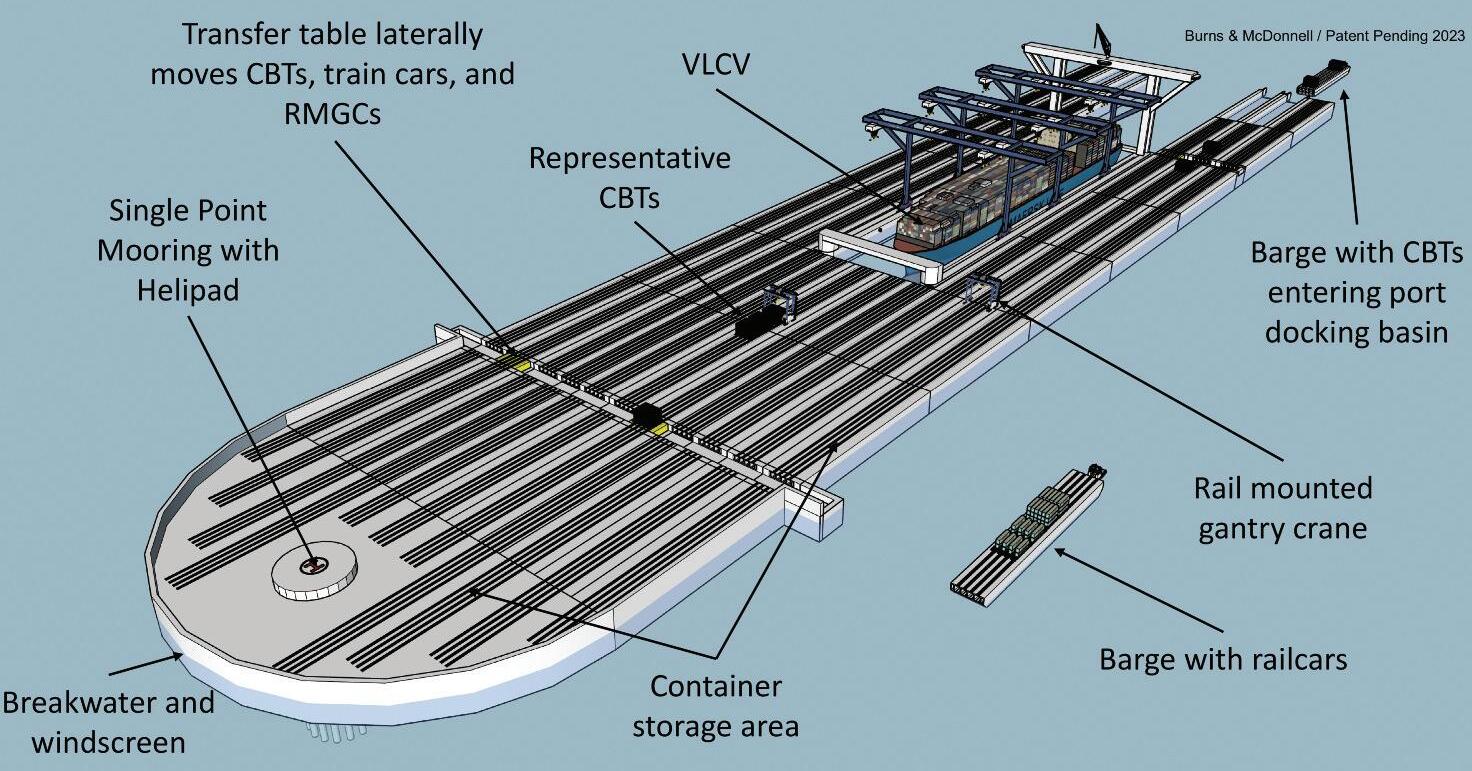

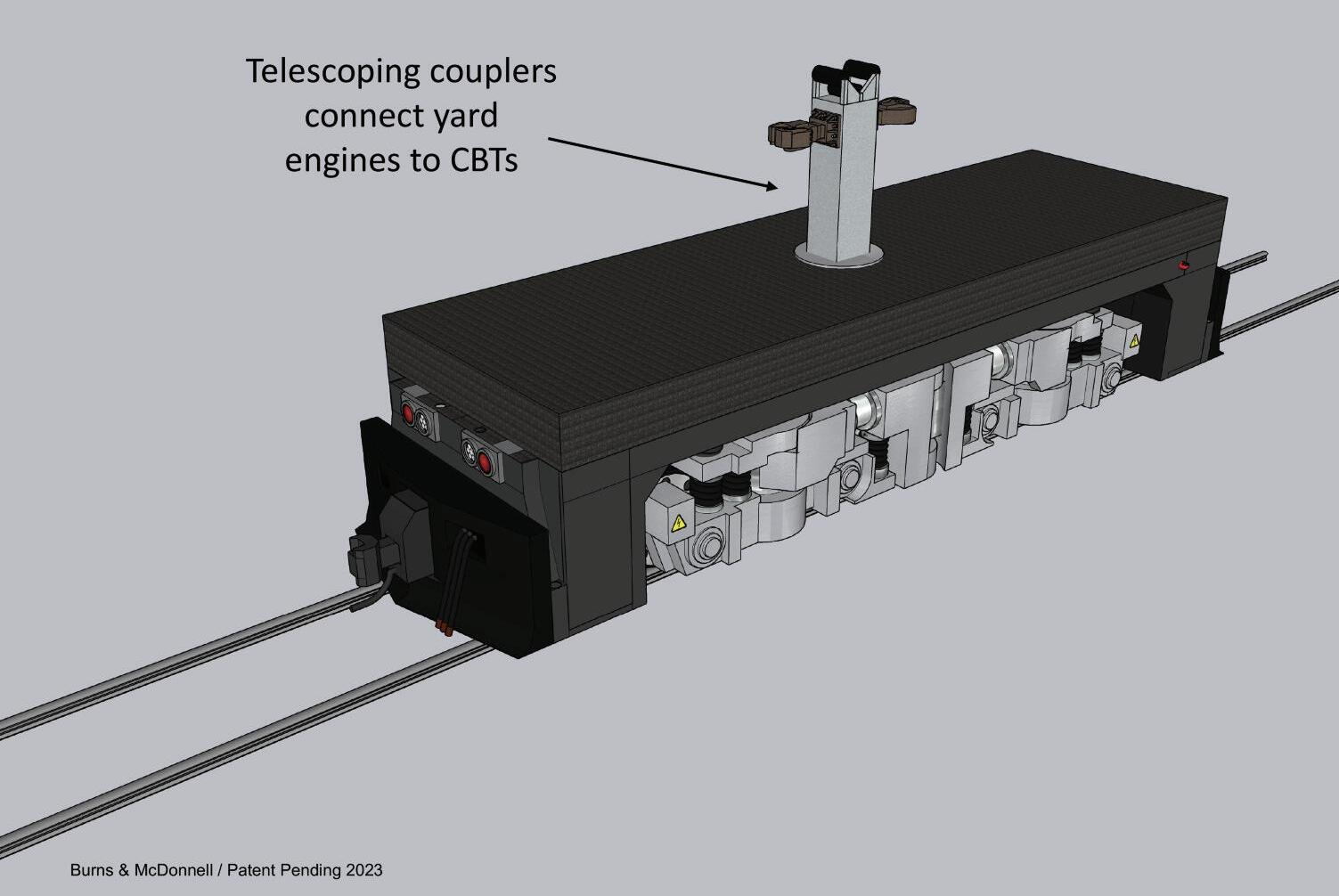

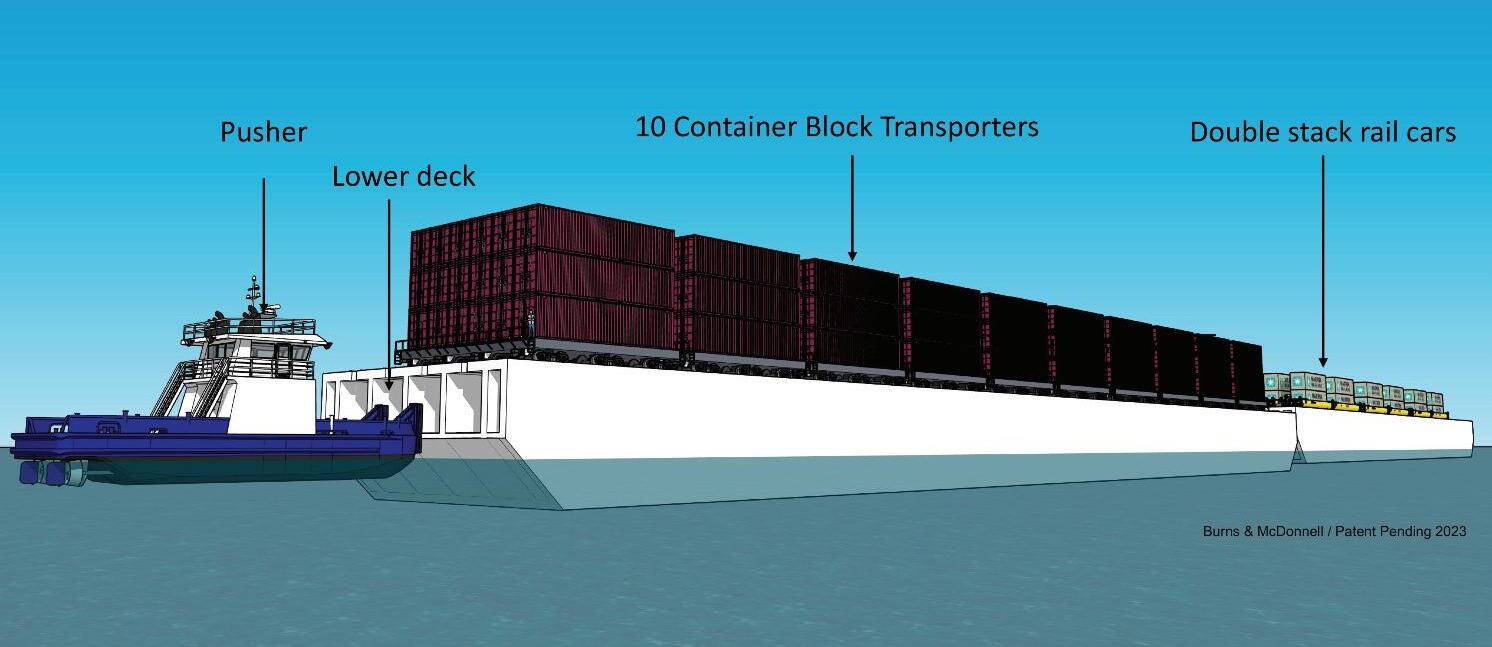

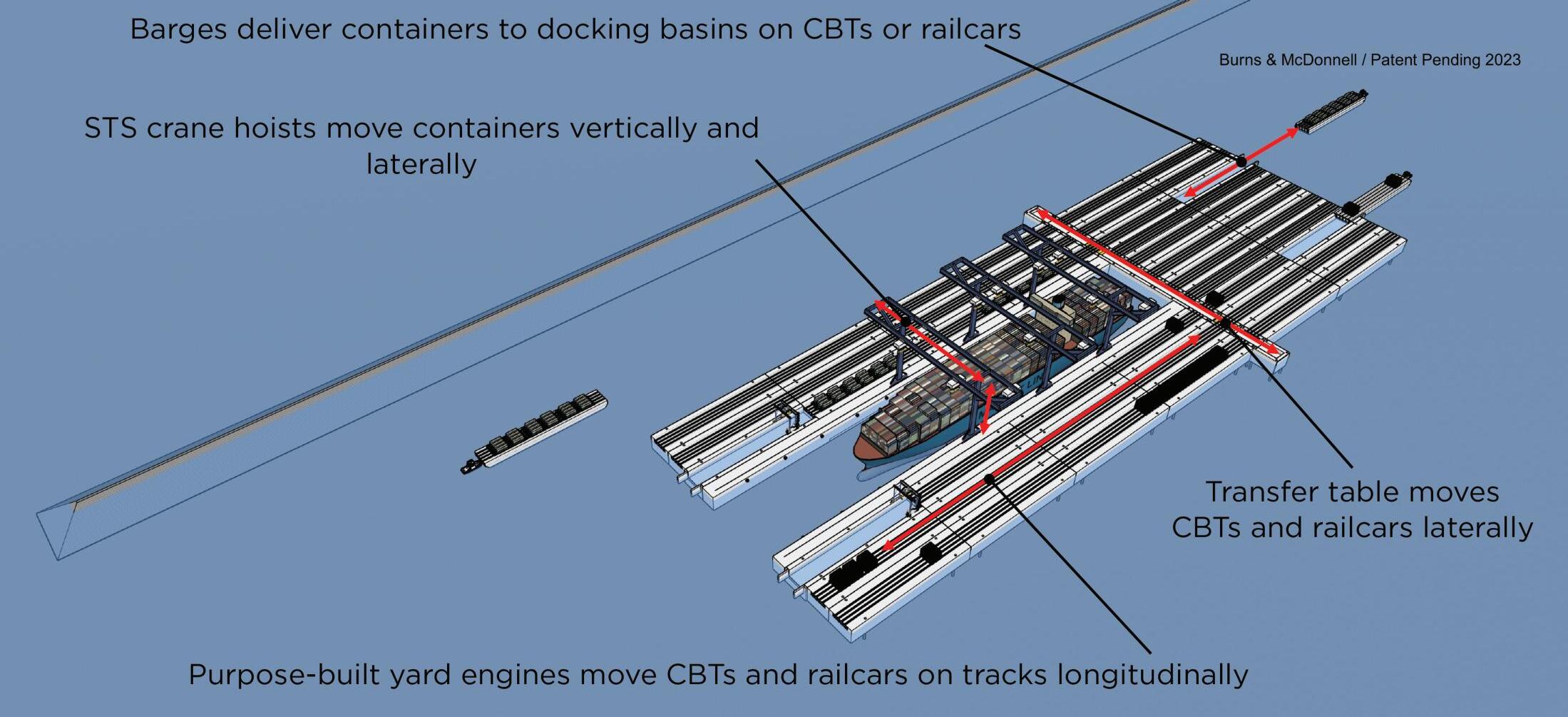

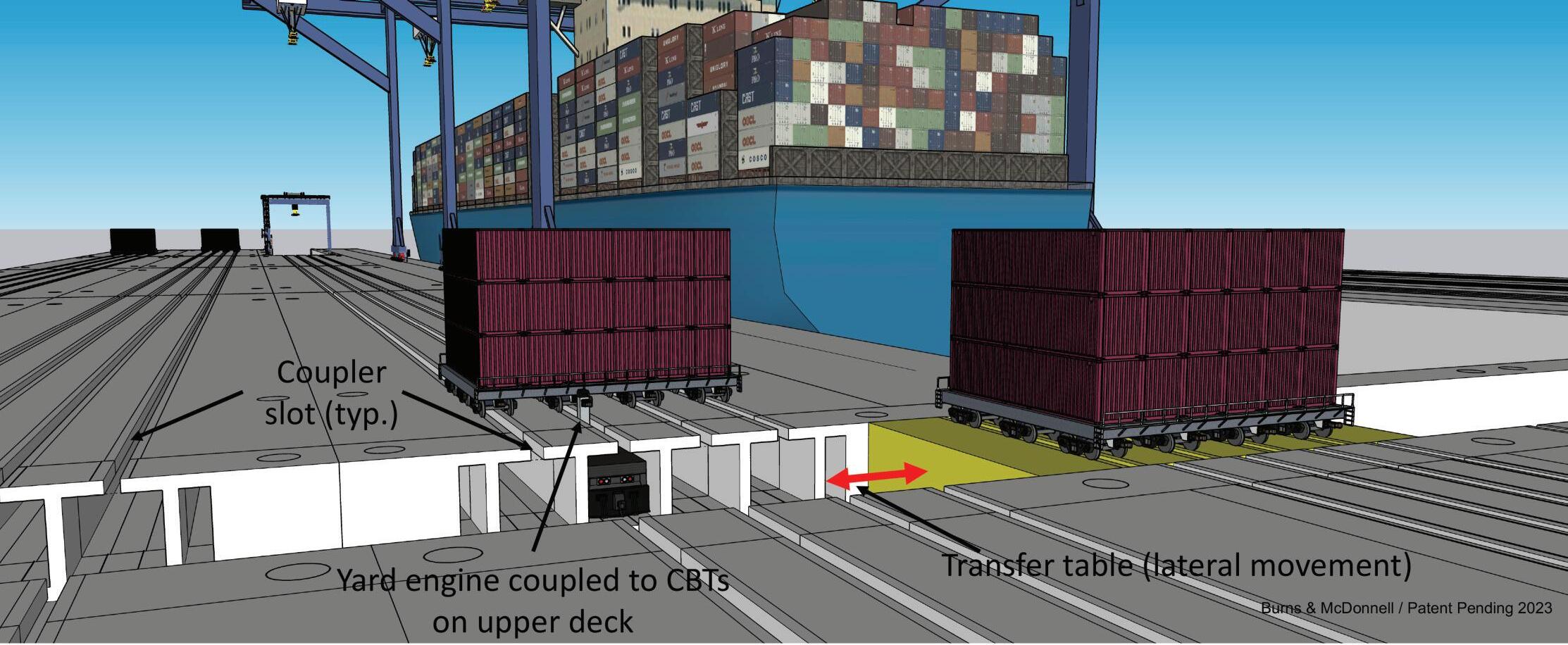

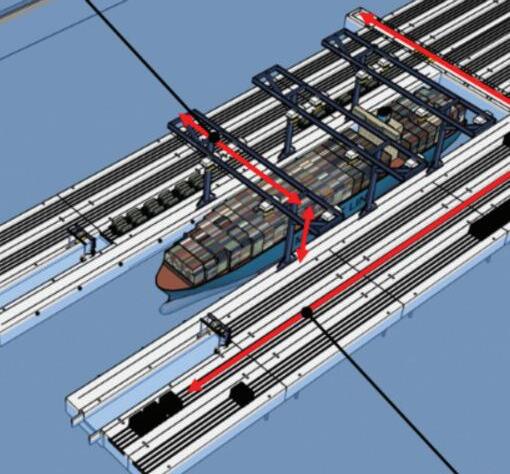

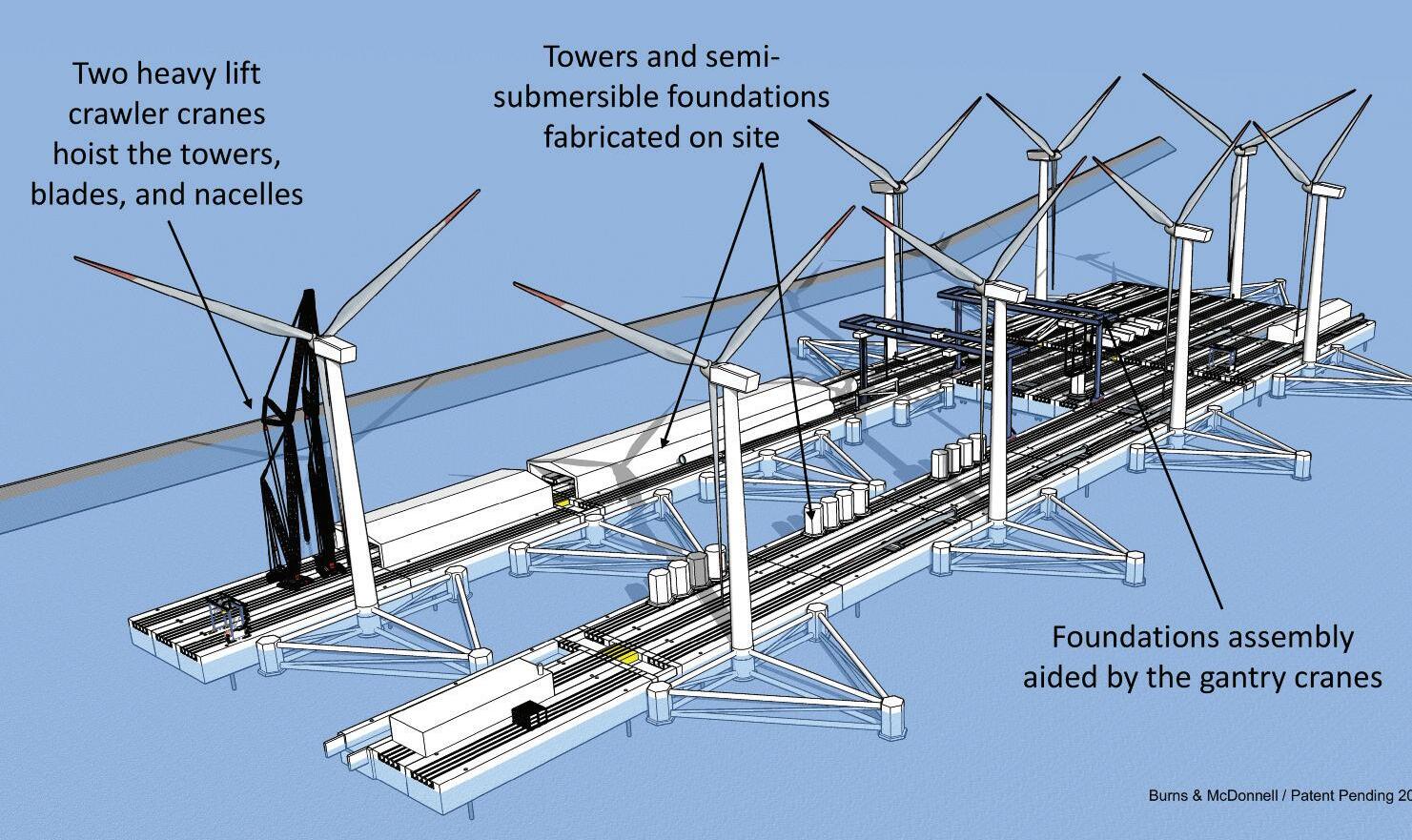

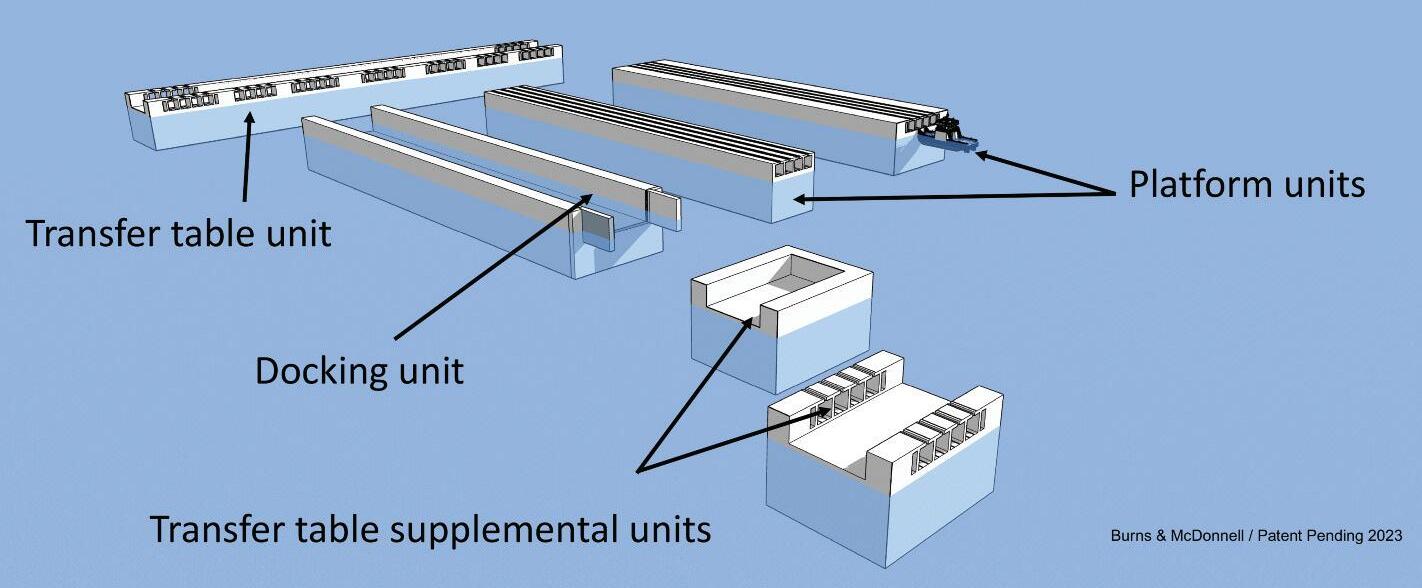

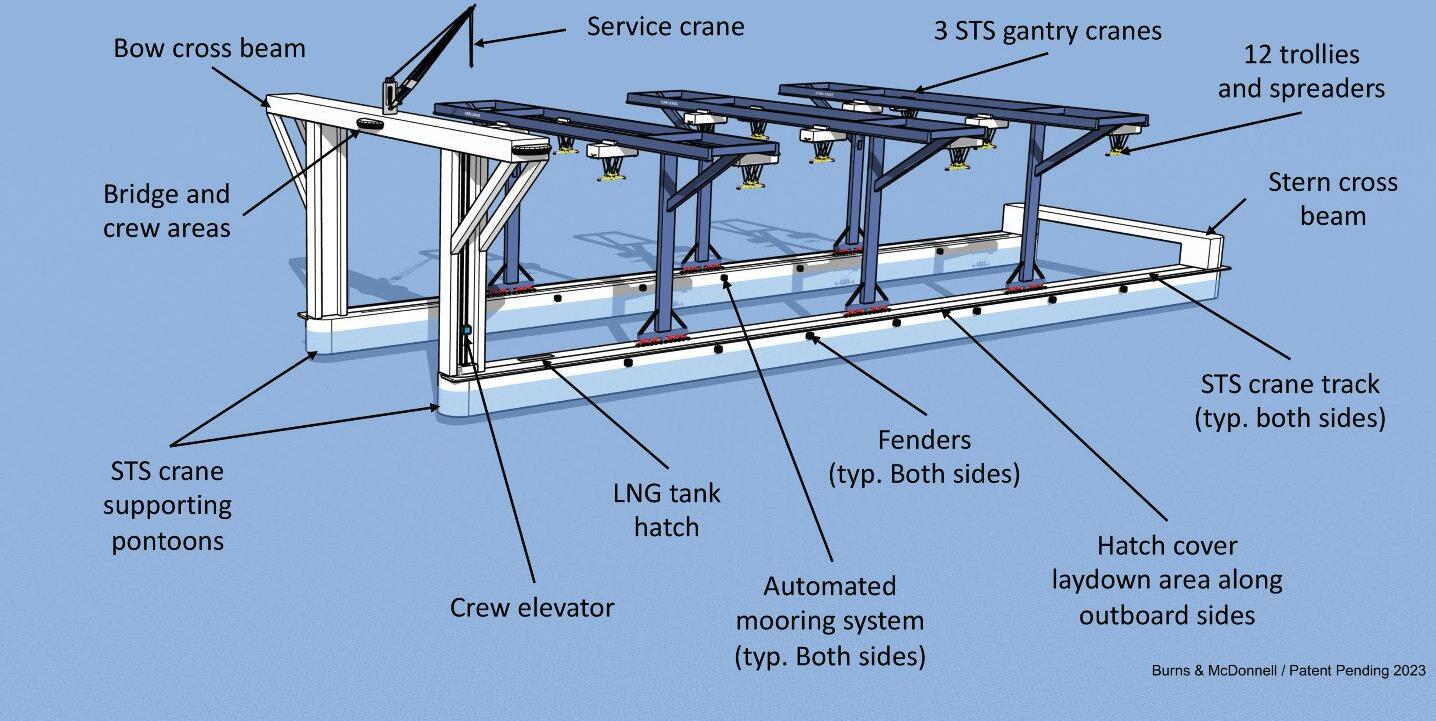

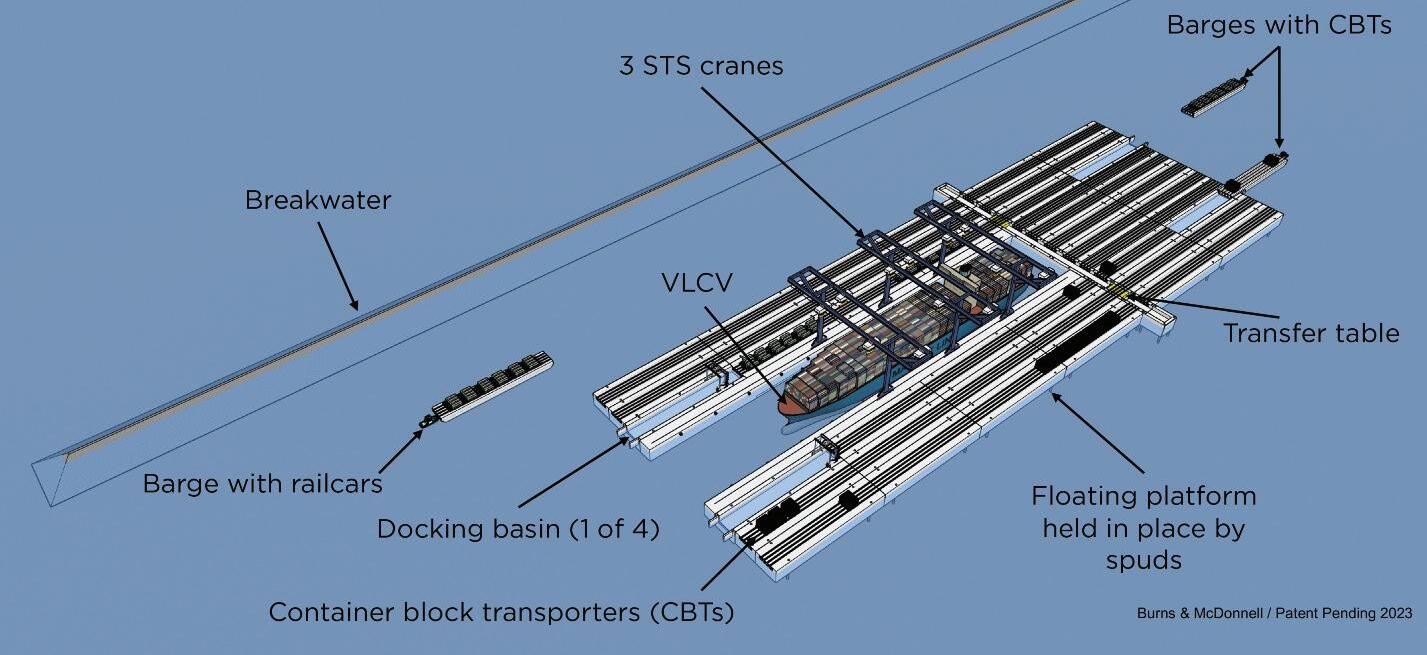

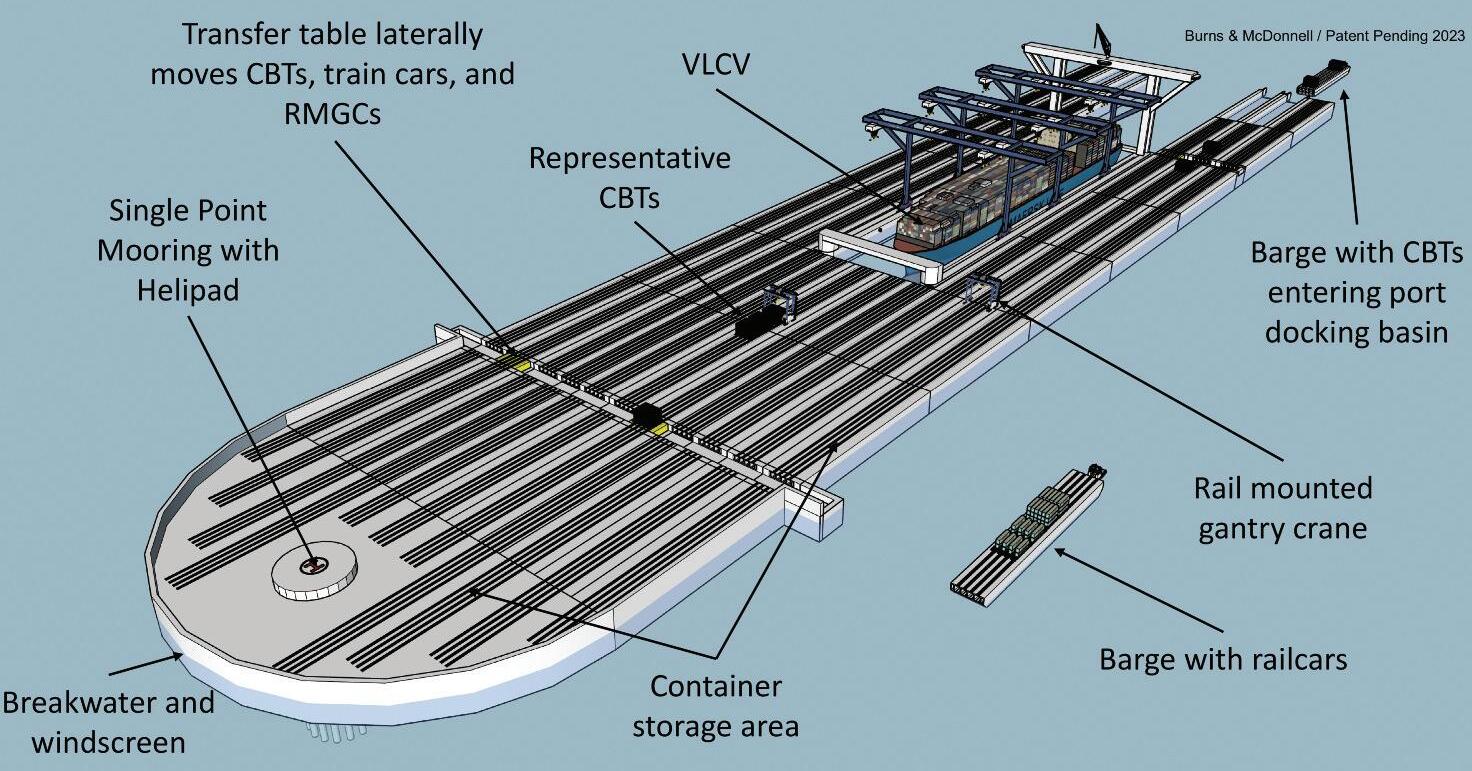

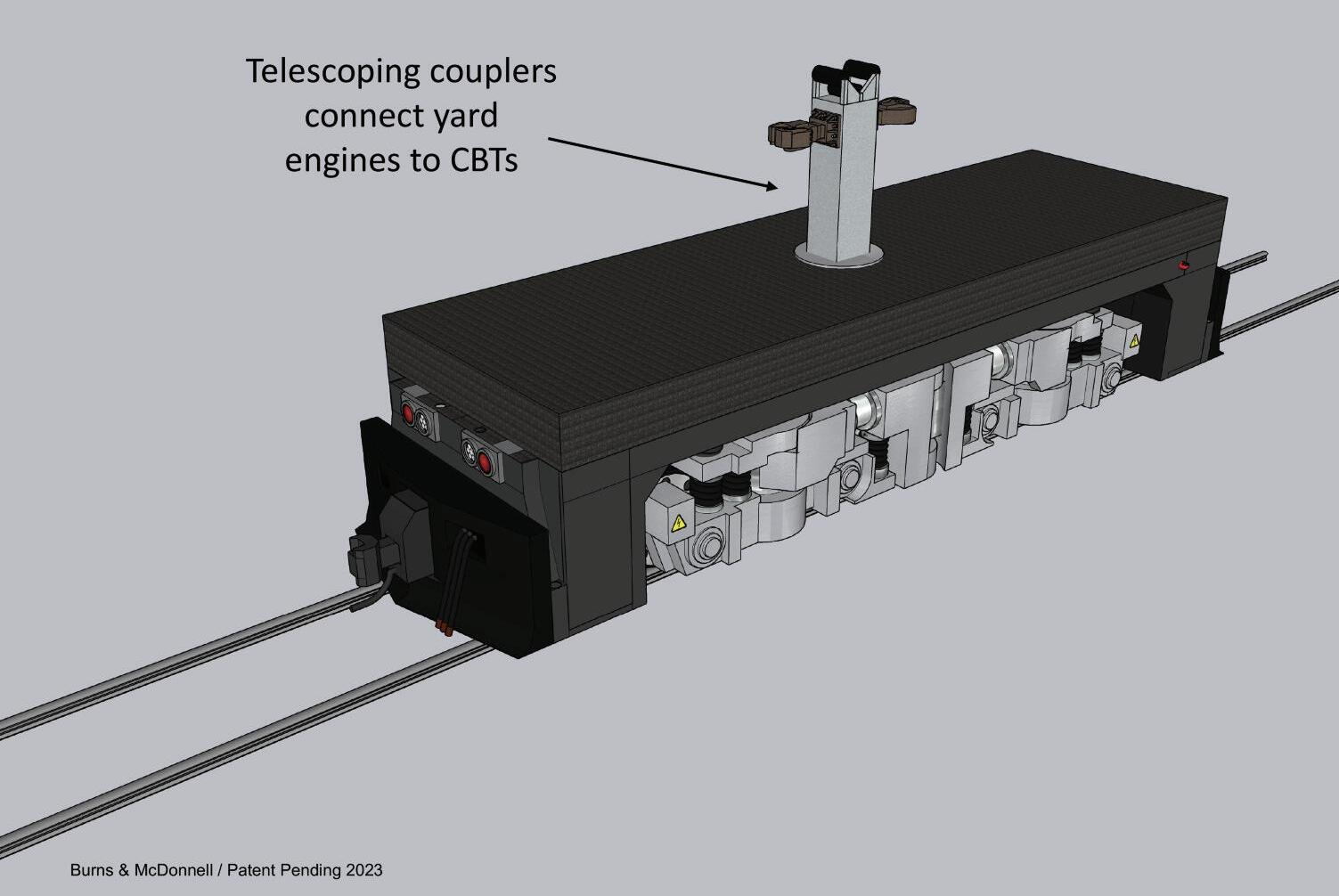

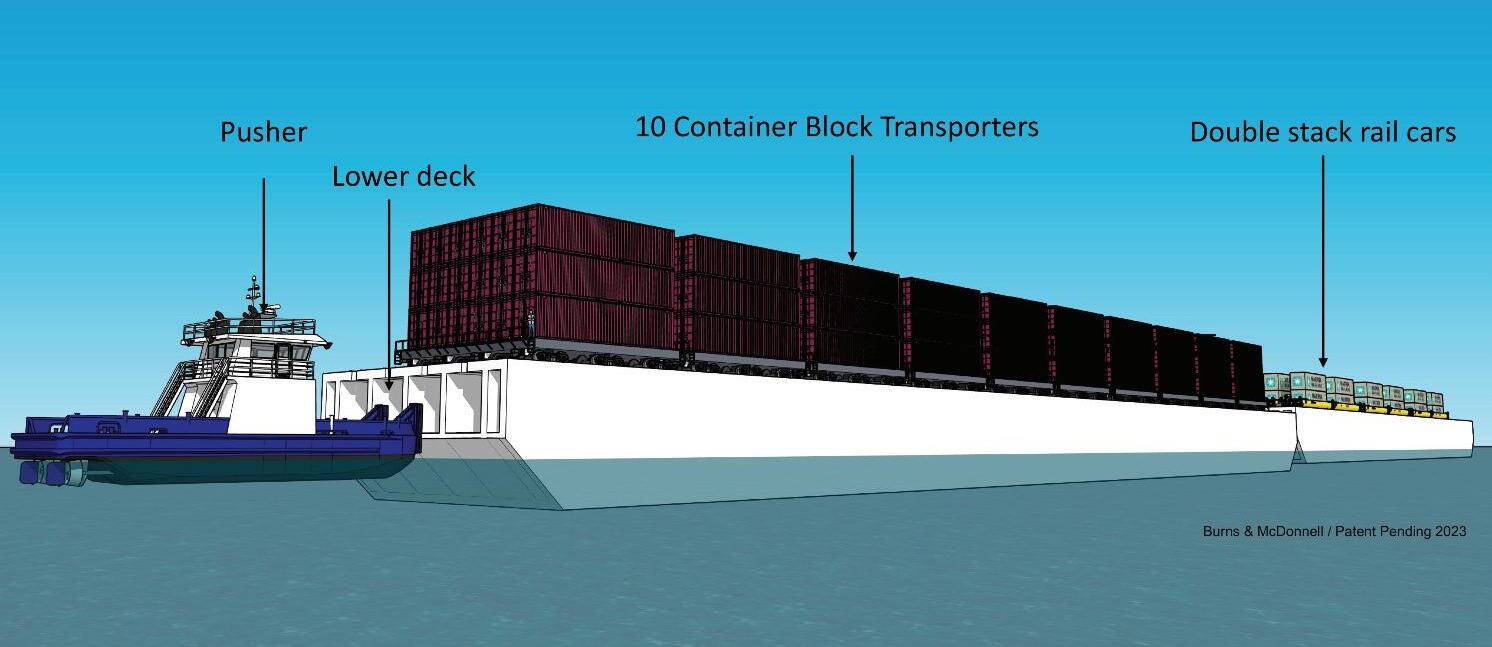

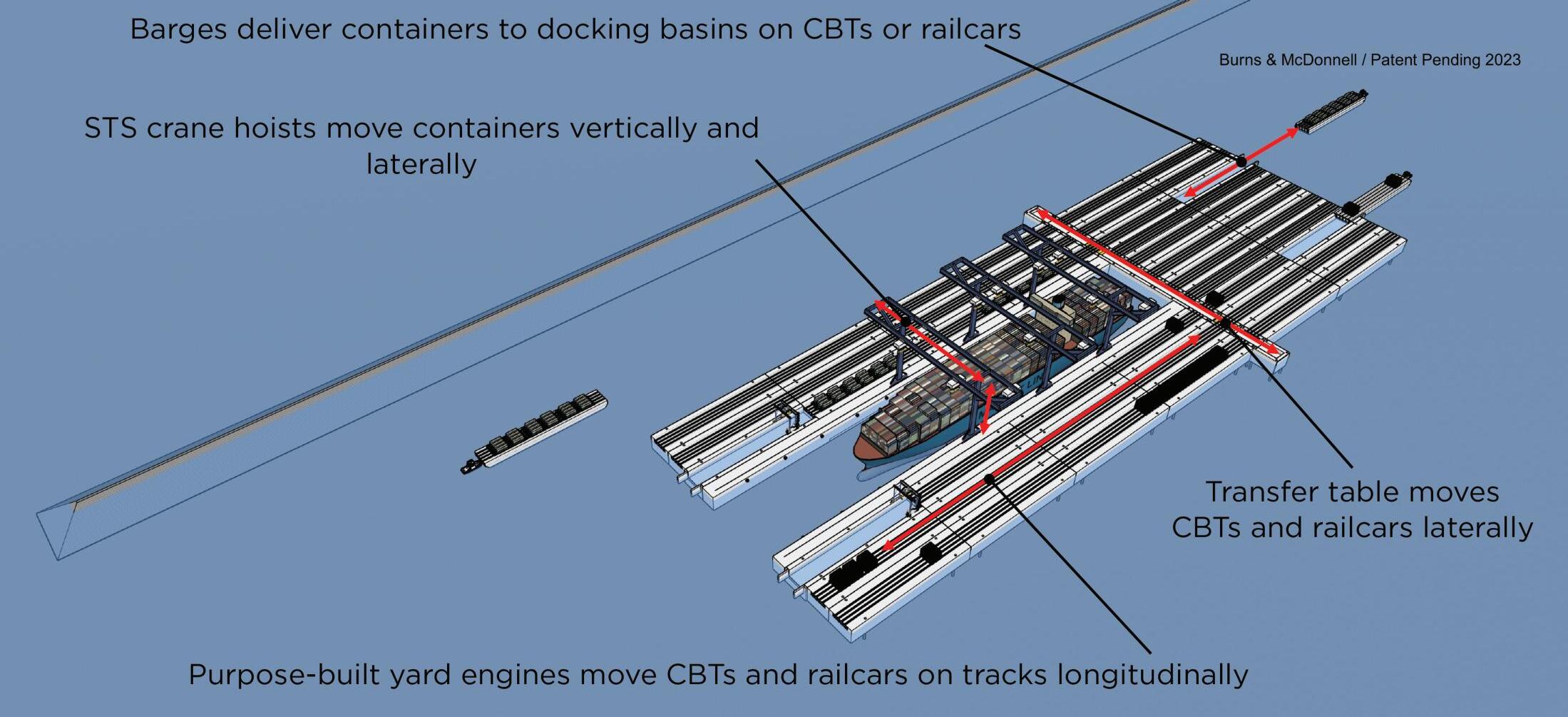

If you are interested in the latest in innovation then look no further than page 38 which offers up a detailed look at a proposed floating container transfer/offshore wind turbine fabrication and assembly terminal as delivered by Reece Shaw of Burns & McDonnell

In our market round-up section this edition of WPD delves into the future trends and challenges for the stacker/reclaimer industr y, while Thomas Francis examines the most recent news from the straddle carrier market

Claire Instone Editor

Claire Instone Editor

January/February 2023 World Port Development 3

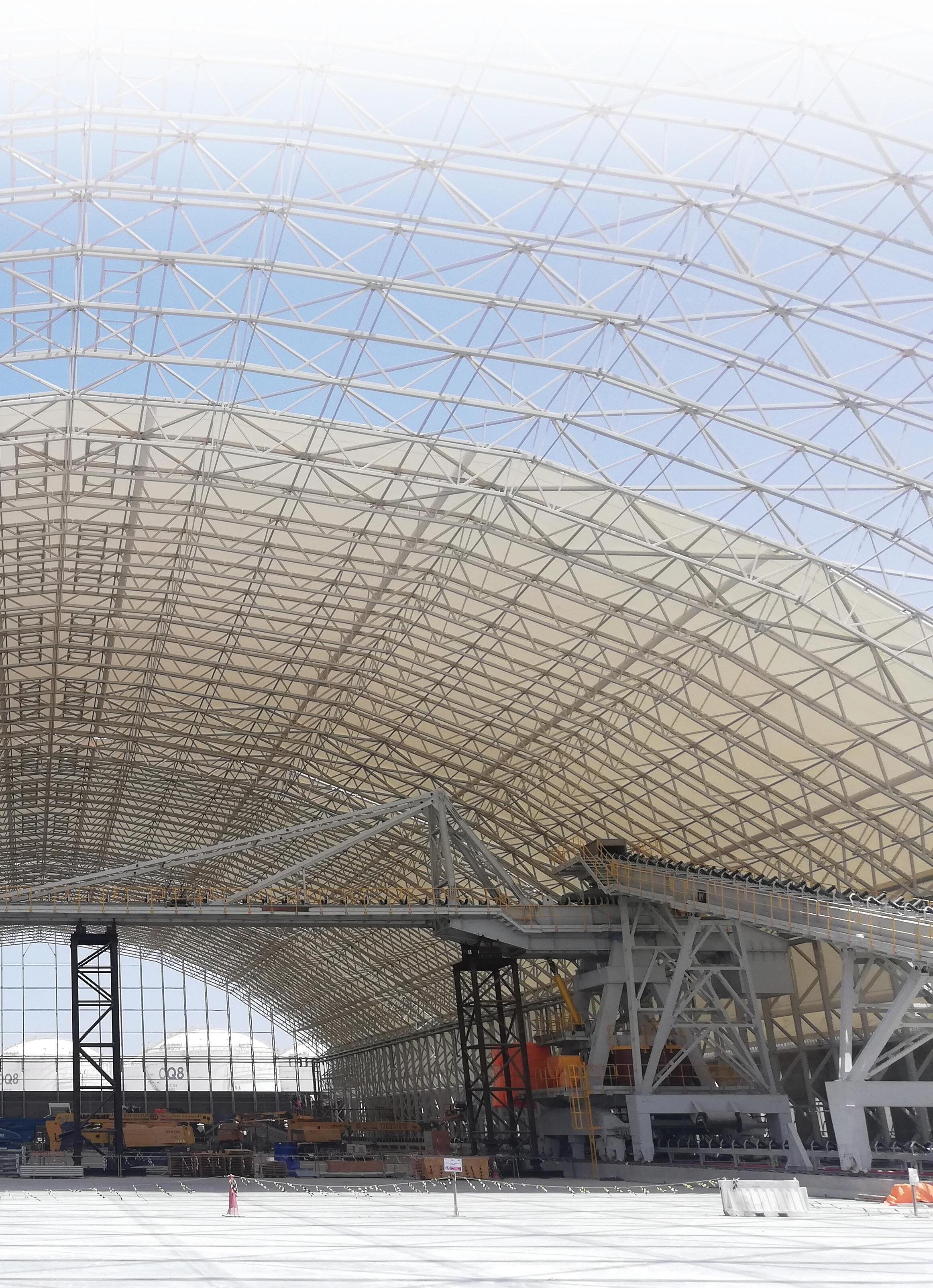

viewpoint

1/2

for non receipt of issues must be made within 4 months of publication of the issue or they will not be honoured without charge

Volume 23 Number

Claims

DEVELOPMENT

Court

WORLD PORT

Suite 11 - Maple

Grove Business Park White Waltham Berkshire SL6 3LW United Kingdom Tel: +44 (0)1628 820 046 Fax: +44 (0)1628 822 938

Por t Development is published 6 times per year at an annual subscription rate of UK£175 00 by MCI Media Limited Registered address: “Chantr y House”, 156 Bath Road, Maidenhead Berkshire SL6 4LB England Ever y care is taken in compiling the contents of the magazine, but the publishers assume no responsibility in the effect arising therefrom All views expressed in this magazine are those of the respective contributors and are not necessarily the opinions of the publisher, neither do the publishers endorse any of the claims made in the articles or the advertisements © 2000-2023 World Port Development A l rights reserved No part of this publication may be reproduced stored in a retrieva system or transm tted n any form or by any means, electronic , mechanical, photocopying, recording or otherwise, without the prior perm ssion of the copyright owner

Website: www worldportdevelopment com World

The Georgia Ports Authority has announced that the Port of Savannah handled a record 5 9 million TEUs in 2022 - an increase of 5% compared to 2021

EUROGATE Group and Konecranes celebrate 53 years and 530 SCs

EUROGATE Group and Konecranes celebrate 53 years and 530 SCs

One sign of a successful human relationship is how long it lasts

The relationship between the EUROGATE Group and Konecranes goes back to 1970, when the Konecranes straddle carrier factor y in Germany delivered EUROGATE’s first straddle carriers to the Por t of Hamburg. Since then, 530 Konecranes Noell Straddle Carriers have been delivered to the EUROGATE Group, which has grown steadily over the years to become indispensable to European container traffic In 2022 many straddle carriers of the Konecranes Noell hybrid type NSC 644 EHY were delivered to EUROGATE’s German container terminals. This type stacks 1-over-3 with Konecranes Noell twin-lift spreaders NTS 62 F. For EUROGATE it was of paramount impor tance to advance decarbonisation in connection with efficiency goals With the new machines, emissions can be reduced by up to 30% or approximately 80 tons of CO2 per year compared to the CO2 emissions of the existing straddle carriers The hybrid Konecranes Noell Straddle Carrier NSC 644 EHY carries on the tradition of the diesel-electric straddle carrier with a downsized power train/genset. It uses a batter y pack instead of brake resistors, giving uncompromised performance in comparison with diesel-driven machines The relationship with EUROGATE is an excellent example of Ecolifting, Konecranes’ continuous work to decrease the carbon footprints of its customers

Imaginative solutions drive environmental goals

Imaginative initiatives will drive the Por t of Long Beach’s goal to become the world’s first zero-emissions seapor t, Executive Director Mario Cordero said during the first in-person State of the Port address since 2020 Cordero committed to supporting state and federal efforts to increase renewable energ y sources as he declared 2023 as the “Year of Imagination ” Among the innovative projects planned, Cordero announced the por t’s bid to assemble and manufacture offshore wind turbines that will increase the state’s supply of renewable energ y and reduce greenhouse gas emissions The por t is also establishing a Zero Emissions, Energy Resilient Operations Programme to invest in projects aimed at reducing the impacts of operations and improving air quality

NWSA has record-breaking year for breakbulk

At 342,351 metric tons, 2022 was a record-breaking year for breakbulk cargo handled at NWSA-operated breakbulk terminals. Across all facilities, breakbulk cargo volumes grew 30 7% for 478,455 metric tons in 2022 Auto volumes were 172,979 units, up 6 5% over 2021 In other news, Washington United Terminals (WUT) will be receiving two additional super post-Panamax cranes in the second quarter of 2023 These new ZPMC cranes will boast a 24-wide container row reach, a lift above crane rail of 175 feet, and a lift capacity of 65 long-tons using a spreader and 100 long-tons with a cargo beam The cranes are due to be operational in mid-July following a commissioning period This investment will fur ther expand WUT’s capability to handle larger vessels

n e w s p o r t & t e r m i n a l World Port Development January/February 2023 4

CEDA releases new findings on energ y efficiency

The quest to improve the energ y efficiency of dredging projects and equipment has been a constant goal within the industr y, par ticularly as fuel prices rise and the IMO’s greenhouse gas emissions strategy comes under revision this year. The CEDA working group on energy efficiency (WGEE) has released an information paper about ‘ energ y efficiency considerations for dredging projects and equipment’ aimed at raising awareness and suppor ting informed decision-making by members. The paper promotes sustainable and cost-effective measures in suppor t of energ y efficiency Through the exploration of concepts such as the life-cycle of infrastructure projects, alternative fuels, and technical improvements, the paper determines that for energ y efficiency to be sustainable , it needs to factor in both environmental practices and the economy This creates a business case for owners of dredging equipment to be early adopters of new technologies for their fleet to keep pace with market trends The authors argue that investing in new technology to optimise energ y efficiency can help reduce inefficiencies within operational procedures, ensure regulator y compliance, and reduce costs by using less fuel Thus, dredging companies making these investments will see benefits The paper also highlights the impor tance of reducing a dredging project’s impact on air quality (local) and climate (global)

To implement this, managers must take into account the phases of life-cycle infrastructure projects to address energy efficiency of dredging campaigns

DP World repor ts ahead of market volume growth

DP World Limited handled 79 0 million TEUs across its global portfolio of container terminals in full year 2022, with gross container volumes increasing by 1 4% year-on-year on a repor ted basis and up 2 8% on a like-for-like basis On a Q4 2022 basis, DP World handled 19 5m TEUs, up 2.4% on a like-for-like basis. 2022 gross volume growth was broad based with Asia Pacific , Middle East & Africa, Australia, and Americas regions all delivering like-for-like growth At an asset level, Jebel Ali (UAE), Jeddah (Saudi Arabia), Angola (Angola), Sokhna (Eg ypt), London Gateway (UK), Constanta (Romania), Caucedo (Dominican Republic), Posorja (Ecuador), DP World Santos (Brazil) and all DP’s por ts in Australia (Brisbane , Sydney, Fremantle and Melbourne) delivered a solid performance . Group Chairman and Chief Executive Officer, Sultan Ahmed Bin Sulayem, commented: “We are delighted to repor t another solid volume performance with like-for-like growth of 2 8% in 2022, which is once again ahead of industr y forecast of a marginal decline of -0 5% This outperformance continues to demonstrate that we are in the right locations and our strategy to offer integrated supply chain solutions to beneficial cargo owners is bearing fruit As expected, growth rates moderated in the final quar ter of 2022 due to the more challenging economic environment Looking ahead to 2023, we expect our por tfolio to continue to deliver growth, but the outlook remains somewhat uncer tain due to rising inflation, higher interest rates and geopolitical uncer tainty ”

Increased freight volumes at the Por t of Gothenburg

The strained situation in the global transport system that has prevailed over the year has been managed well at the Por t of Gothenburg

The por t has also increased the freight volume handled in total, and is also winning market shares in all segments. Container handling via the por t continues to increase The final quar ter of 2022 saw an increase of 8%, which means the por t is seeing growth in container volume for the ninth successive quar ter. Around 885,000 TEUs were handled at Gothenburg in the full year 2022, an increase of 7% Most of the port’s container volumes are handled by the terminal operator APM Terminals

ICTSI outlines its vision for Australia’s biggest por t

ICTSI has outlined a significant proposal for the expansion of the Victoria International Container Terminal (VICT), its 100 percent owned subsidiar y in the Por t of Melbourne , Australia. The proposal would increase efficiencies and pave the way for larger ships to ber th ICTSI could invest over AUD500 million (approx USD343m) in addition to the more than AUD700 million (approx. USD480m) it has already

invested in Victoria since the establishment of VICT in 2014 Under the proposal, ICTSI would under take a phased development of the Webb Dock North Container Terminal and integrate its operations with VICT The development would increase VICT’s capacity to 3.7m TEUs.

n e w s p o r t & t e r m i n a l January/February 2023 World Port Development 5

Market Intelligence Market Intelligence

Nor t h America

* Softened consumer spending, increased prices driven by inflation and a shift in trade routes contributed to a dip in shipments moving through the Por t of Long Beach in Januar y. The facility processed 573,772 TEUs, down 28 4% from Januar y 2022, which was the por t’s busiest Januar y on record Impor ts decreased 32.3% to 263,394 TEUs and expor ts declined 14 2% to 105,623 TEUs Empty containers moving through the por t were down 29% to 204,755 TEUs “We are taking aggressive steps to meet a new set of challenges for the new year, ” said Por t of Long Beach Executive Director Mario Cordero “I remain optimistic that we will recapture market share and develop projects that will enhance our long-term growth, sustainable operations and the reliable movement of goods through the Por t of Long Beach ”

* Por ts of Indiana has named Jody Peacock as the new CEO Peacock has ser ved in various leadership positions for the Por ts of Indiana since 2001, and is moving up from the position of Senior Vice President for Business Development. Peacock’s experience with the Por ts of Indiana spans over 22 years, where he has led business development effor ts to attract millions of dollars in private investment to Indiana’s por ts, expand the state’s foreign-trade zone and financing programmes, and secure multiple federal grants for new infrastructure projects.

* The Por t of Montreal has earmarked more than C A$335 million ($247 million) in its new five-year investment plan for its infrastructure on the island of Montreal

The por t is aiming to invest massively in its infrastructure on the island which extends over 26 kilometres between Cité-du-Havre and the east of the island, as the por t approaches its full container handling capacity

These investments are intended to pursue four main objectives: develop and sustain por t infrastructure to accommodate the growth of trade; strengthen, optimise , and streamline the supply chain of Greater Montreal; accelerate the decarbonisation of por t activities and the energ y transition; and improve the city-por t interface Projects include the optimisation of rail capacity, with the addition of 6-kilometer tracks to improve the fluidity of rail transport and storage space , and the modernisation of whar ves to accommodate ships in complete safety.

* The Por t of Savannah’s loaded container expor ts grew by 21 percent in Januar y The nation’s busiest por t for US goods handled 110,305 TEUs of expor ts, an increase of 19,419 TEUs “We’re excited to suppor t a strong month for American farms and factories at the Por t of Savannah,” said Griff Lynch, Executive Director of the Georgia Por ts Authority “We achieved par ticularly robust growth last month in expor t trade lanes to Europe and the Mediterranean ” Compared to pre-pandemic numbers, the Por t of Savannah’s Januar y trade of 421,714 TEUs in total cargo showed 11 7 percent improvement over Januar y 2020, in which GPA handled 377,671 TEUs.

* The Por t of Virginia is posting its most productive year on record having processed more than 3 7 million TEUs in 2022, an increase of 5.1%. “We made real progress in 2022 and it was another ver y solid year for volumes,” said Stephen Edwards, CEO and Executive Director of the Virginia Por t Authority.

“Our ser vice and performance levels continue to improve and each quar ter our truck, chassis, rail and vessel performance metrics advanced.” The por t achieved three of its top four months for container volume in 2022, with trade volumes peaking in May at an

all-time high of 341,611 TEUs The por t’s focus on its sustainability programme and becoming a net-zero carbon emissions operation by 2040 also advanced New capital projects using electric equipment coupled with power purchase agreements from exclusively clean energ y production has the por t on track - and in some areas ahead of schedule - to meet is 2040 goal.

Sout h America

* As par t of its strategic objective of global representation and to develop oppor tunities in Argentina, The Bahamas Maritime Authority (BMA) has signed a Memorandum of Understanding (MoU) with Argenmar SA, an independent shipping group established in Argentina in 1992 that provides specialised shipping and logistics ser vices in Argentina and Latin America The MoU relates to future business oppor tunities within the Argentine maritime sector and the broader Latin America region. Argentina, which is a member of the Acuerdo Latinoamerico Vina del Mar MoU on por t state control within Latin America, had over 10,000 ships calling at its por ts and operating within the River Plate region in 2021 This figure , which includes Bahamas flagged ships, covers a wide diversity of ships ranging from oil, container, bulk, passenger and general cargo vessels When combined with maritime traffic through the Hidrovias Waterway, this results in more than 100,000 tons of cargo movement annually The MoU was signed during a meeting held in Argentina in conjunction with the VII Community of Latin American and Caribbean states (CELAC)

* In Q3 2022, two port operating companies in Guyana - Muneshwers Ltd and John Fernandes Ltd - made a joint order for two Generation 6 Konecranes Gottwald mobile harbour cranes to build up cargo handling

n e w s p o r t & t e r m i n a l World Port Development January/February 2023 6

terminals in the capital Georgetown When the cranes arrive in Q2 2023 they will be the ver y first mobile harbour cranes in Guyana, and Konecranes Gottwald MHCs will be present in all coastal states of South America The two Generation 6 cranes have a working radius of 49m and a capacity of 125 tonnes to ser ve container ships up to Panamax class They will be used for container handling mainly, but their flexibility allows them to handle general cargo when needed

* ZIM Integrated Shipping Ser vices Ltd has announced the launch of ZIM Colibri Xpress (ZCX) - a new premium line from South America West Coast to US East Coast, commencing on the coming weeks from Chile. ZCX will operate on the following rotation: San Antonio (Chile), Callao (Peru), Guayaquil (Ecuador) – Car tagena (Colombia) –Kingston (Jamaica) – Philadelphia - Miami, Kingston (Jamaica) - Buenaventura (Colombia – Guayaquil (Ecuador) – Callao (Peru) - San Antonio (Chile). ZCX will offer a superior competitive ser vice for refrigerated cargo from Chile , Ecuador, Peru and Colombia, with the fastest transit time to Philadelphia - as a first por t of call in the US East coast - and competitive transit time to additional US ports ZIM Colibri Xpress (ZCX), operated independently by ZIM, will deploy 6 x 1700-TEU vessels on a weekly ser vice with increased capacity for reefers It will offer excellent connection between the por ts of West Coast of South America and the US East Coast with ver y shor t transit time between major por ts in the region.

Europe

* Logistics ser vice provider, Schweizerzug, has started a direct train connection between Basel, Zürich and Rotterdam The 650-meter shuttle operates on this route three times a week and has a capacity of 96 TEUs.Matthijs van Doorn, Commercial Director at the Por t of Rotterdam Authority, said: “ We are ver y pleased with the decision of Swissterminal and DP World to launch this direct rail ser vice , which will fur ther enhance the ties between Switzerland and the Netherlands Supply chains have been under tremendous pressure in the past few years This supplementar y ser vice will make them more resilient, and it is a great additional option for clients.”

* Kalmar, par t of Cargotec , has secured a large order to supply PSA Italy with a total of eight Kalmar Eco reachstackers for deployment at its Genova Pra’ and SECH container terminals The order was booked in Q1 2023 and the machines are scheduled for deliver y in Q2

They will include Kalmar Insight, a performance management tool that turns data into actionable and impactful insights, along with a variety of add-on safety features including a fire-suppression system It offers an improved overall driving experience with smoother acceleration and less cabin noise

* Valenciaport has reported a fall in container throughput in January this year In terms of TEUs, the facility reached 4.9 million indicating a decrease of 11 5% Transit declined 28 1% and unloading by 32 3%, while expor t container throughput contracted by 10.2%. The total goods traffic stands at 5 7 with a dip of 15 95%

* On April 5, the shipping company Samskip will call at APM Terminals in the Por t of Gothenburg for the first time The traffic will ser ve the container terminal ever y week and then sail on to Faroese Runavik and Reykjavik in Iceland, then arriving in Rotterdam four days later Samskip is a Dutch logistics company with a focus on intra-European traffic within multiple modes of transpor t.

* The year has just begun and Konecranes has already introduced two exciting technical developments to their lift trucks range: reachstackers to handle heavier empty containers and spreaders with an increased capacity Not all containers are fully loaded when stuffed for transit or completely emptied when they reach their destination

So Konecranes has introduced the SMV 128 TC6 reachstacker for semi-laden and empty containers that can handle up to 12 tons Moreover, a new, stronger combi spreader, for the handling of laden ISO containers and trailers, is now available for Konecranes reachstackers designed for intermodal operations

* The Por t of Barcelona has processed over 3.5 million TEUs in 2022. The por t saw an increase in impor t containers by 3 4% and a rise in transit containers by 4 5% On the otherhand, export containers went down 5.9%. The Por t of Barcelona passed the 70 9 million-tonne mark in total traffic last year, representing growth of 6.9% from 2021.

* Italian logistics and transpor t company Grimaldi Group has acquired strategic assets in the Amerikahaven area of the Por t of Amsterdam through its subsidiar y Amsterdam Multipurpose Terminal (AMT)

The purchased assets cover a surface area of over 200,000 square metres and include storage areas, warehouses, logistics areas, and two quays The 20-year concession obtained by AMT in the Por t of Amsterdam aims to improve the ser vices offered to the Dutch market and businesses while also developing the port’s potential as a multimodal logistic hub

* Associated British Ports (ABP) has become the first por ts group to be approved by the Institute of Environmental Management and Assessment (IEMA) to act as a training provider for IEMA courses From Januar y of this year, ABP employees have star ted to par take in the IEMA-accredited course: Environmental Sustainability Skills for the Workforce The IEMA is the global professional body for individuals and organisations working, studying, or interested in the environment and sustainability “This concentrated one-day course provides a practical introduction to environmental sustainability, equipping our workforce with the knowledge, understanding and motivation to make a positive difference within their role at ABP,” Kerr y Thompson, ABP Group Head of Academy

Asia

* The government of Sri Lanka is set to invest $132 million in por t development projects using revenue generated from por t operations. According to repor ts, the Eastern Container Terminal is to receive over $100 million, while Jaya Container Terminal will get $32 million. Both terminals are fully owned by the Sri Lanka Por ts Authority Moreover, the government plans to develop the Trincomalee harbour for bulk cargo operations and Galle harbour for tourism purposes The latter will be developed to facilitate yacht ser vices and accommodate large ships. These investments are par t of Sri Lanka’s broader aim to become a logistics and transpor t hub in the Indian Ocean and a boost economic activity.

* On 11 Februar y an incident occured in the Long Tau river in Ho Chi Minh City (HCMC), southern Vietnam, when the 2,038-TEU Wan Hai 288 and 920-TEU Resurgence collided leaving both vessels damaged Resurgence crashed into the por t bow of Wan Hai 288 and caused damage to a number of containers. According to repor ts, the vessel underwent inspection operations after travelling to Cat Lai Terminal in HCMC following the accident. Wan Hai 288 was making its way towards a por t in HCMC while carr ying around 1,383 containers The Resurgence was repor tedly carr ying over 600 containers and travelling in the opposite direction

* A new freight ser vice connecting Asia and Europe via Jeddah Islamic Por t has been announced Saudi Ports Authority (MAWANI) and Saudi shipping giant Bahri have jointly announced the addition with the route’s first ship due in Februar y 2023 The new route will help grow Bahri’s shipping network

n e w s p o r t & t e r m i n a l January/February 2023 World Port Development 7

n e w s p o r t & t e r m i n a l World Port Development January/February 2023 8

THEMONTHINPICTURES

Long Beac h closes 2022 wit h second-busies t year

Por t of Long Beach marked its second-busiest year on record by moving 9.13 million TEUs in 2022, allowing for a return to normal operations while once again ser ving as the nation’s leading expor t seapor t The por t ended 2022 with 9,133,657 TEUs moved, down 2.7% from 2021, which remains the por t’s most active year in its 112-year histor y Impor ts declined 4 9% to 4,358,789 TEUs, while expor ts totalled 1,414,882 TEUs, -1 6% Despite the slight decline , the Por t of Long Beach remained the nation’s leading expor t por t for a second consecutive year, for loaded TEUs.

High volumes at Por ts of Stoc kholm

Despite a declining economy, goods volumes remained high at Por ts of Stockholm across 2022. At Sweden’s newest por t, Stockholm Nor vik, container traffic was up 8 5 percent and RoRo-traffic increased by 16.5 percent in comparison to the previous year Stockholm Nor vik Por t had 2,400 vessel calls in total during 2022, which is 34 percent more than in 2021

2. Jordi Torrent, Head of Strategy at Port of Barcelona, was appointed secretary general of the Mediterranean ports’ association MEDPorts 3. The first ship of the year for the Port of Sept-Iles was M/V Cape Alexandros, which arrived at 11:00am on January 4, 2023, from Rotterdam in the Netherlands 4. The Georgia Ports Authority has named Flavio Batista as its new Vice President of Sales and Marketing Batista comes to

GPA from the Wallenius Wilhelmsen Group, an ocean carrier focused on developing sustainable shipping and logistics solutions 5. Freeport East has appointed Steven Wilson as its new Head of Innovation He will lead engagement with universities, R&D centres, large and small businesses and a range of public and private funders and investors to ensure Freeport East builds an innovation cluster that supports local businesses and communities and helps position the region for greater inward investment 6. A jack-up rig sporting legs more than 200 metres in height has become the largest ever vessel to visit Port of Aberdeen The Noble Innovator offshore rig arrived for maintenance

SPOTTED SOMETHING OF INTEREST?

If you have seen something unusual or something of interest for inclusion in this column make a photograph of it and send it by email to: yourpicture@worldportdevelopment com

“It is really pleasing to see that Ports of Stockholm shows strong figures for both the amount of goods and number of passengers Shipping is an efficient and sustainable mode of transpor t that creates good oppor tunities for the entire region to continue growing,” says Clara Lindblom, Chair of the Board at Por ts of Stockholm. The number of ferr y passengers increased significantly, and the recover y following the pandemic has been ver y good

January/February 2023 World Port Development 9

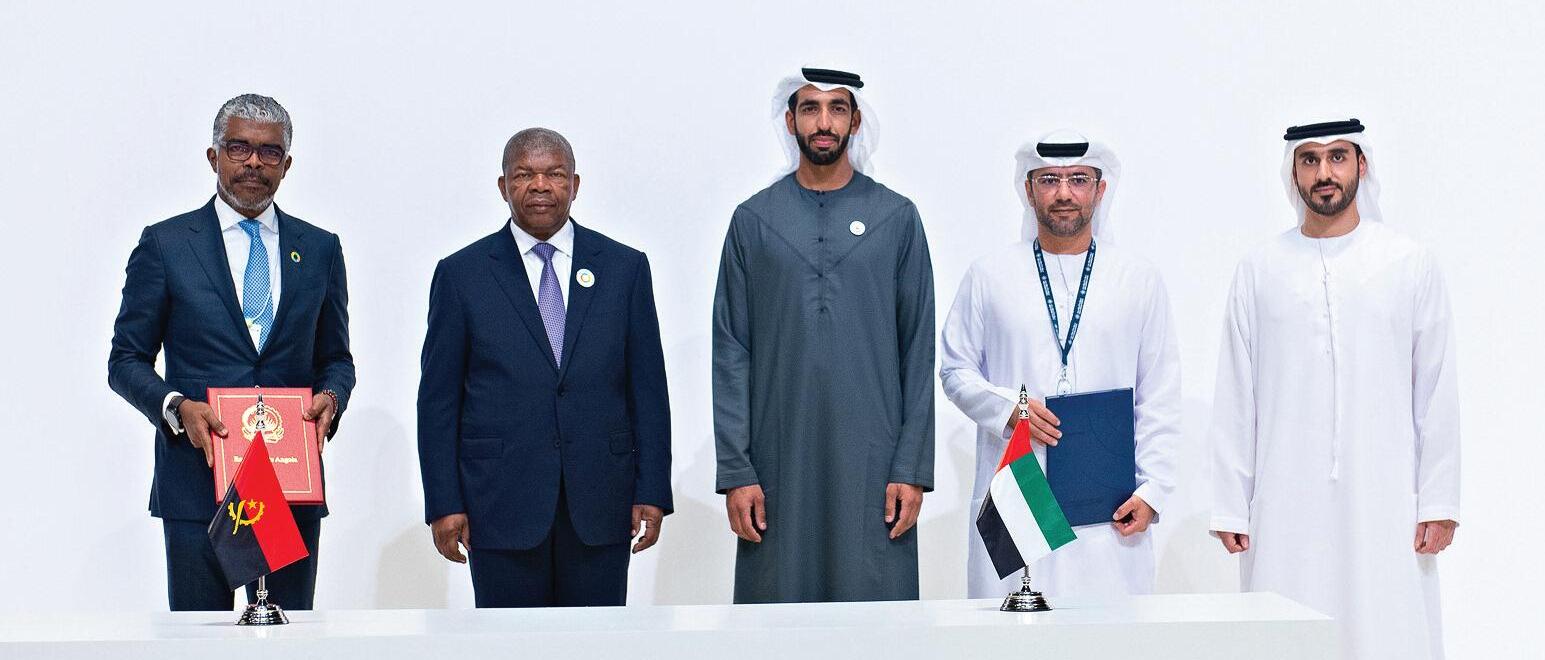

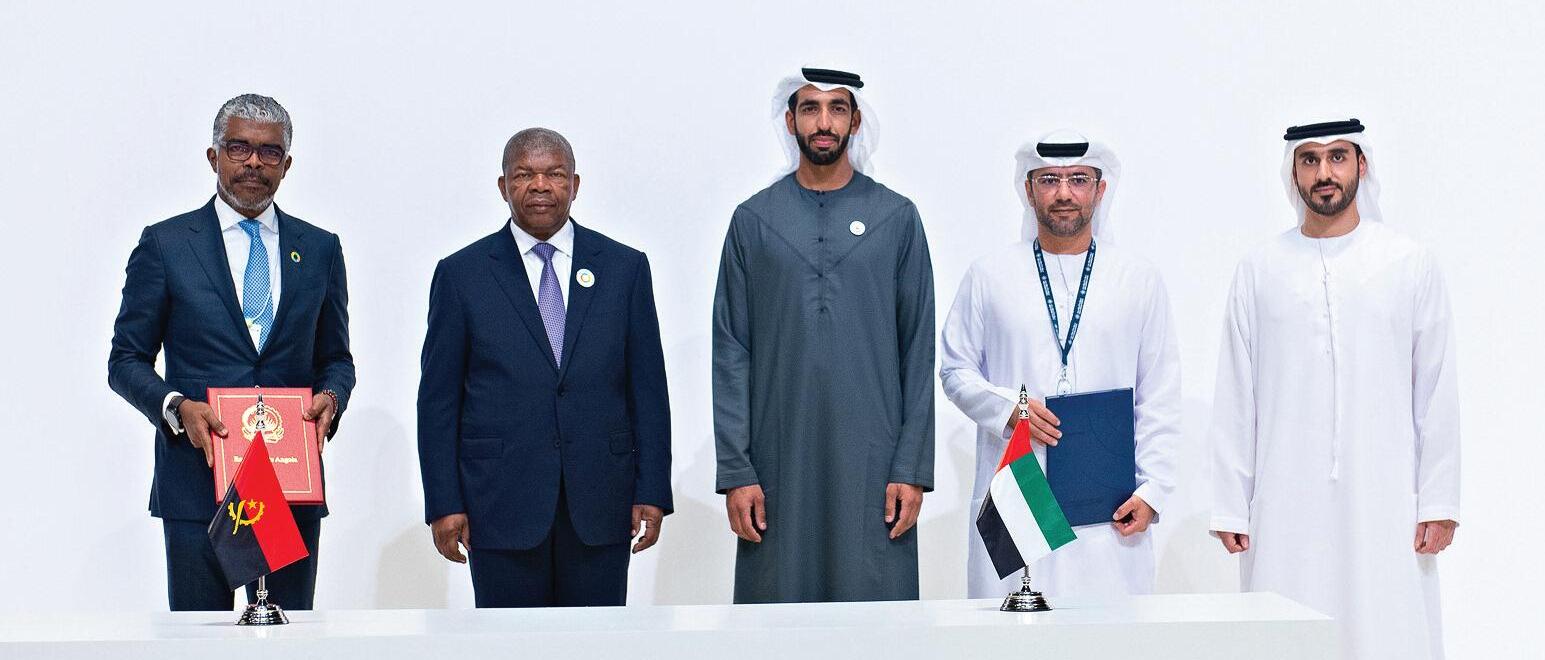

1. During Abu Dhabi Sustainability Week 2023, AD Ports Group entered into a framework agreement with the Ministry of Transport of the Republic of Angola to begin collaboration on the development of maritime services and infrastructure across the country

2 1 4 3 5 6

n e w s p o r t & t e r m i n a l

Salerno adds LHM 600

The Gallozzi Group - parent company of SCT - and Liebherr are building upon a par tnership that began around 2017 as Salerno Container Terminal (SCT) adds a new LHM 600 to its fleet. The new LHM 600 HR strengthens an existing fleet of four other Liebherr mobile harbour cranes The new addition will focus on container operations and is planned for 24/7 operation. The crane ’ s reliability and flexibility, as well as trust in the provided ser vice , were cited among the main reasons for the customer to continue investing in Liebherr equipment Salerno Container Terminal is a maritime gateway connecting worldwide container shipping networks to South and Central Italy’s impor t and expor t markets It operated the first container vessel at the por t of Salerno in 1977 and today ranks among the top Italian por t facilities, supplying more than 40% of the countr y ’ s consumer population. SCT already benefits from a variety of Liebherr por t equipment and mobile harbour cranes, including two LHM 800 and two LHM 600, both in the High Rise or HR version. The new crane is outfitted with a tower extension of 12 meters Cranes of this variety benefit from a better view of the cargo/containers, thanks to a higher cabin, which is at 37 1 meters in case of the new crane The pivot point is also higher, allowing for larger ships to be ser ved. With the crane ’ s extended range , more container rows can be accommodated The new crane also features VDL twin-lift spreaders with a capacity of 2 x 32 5 tonnes The crane is thereby strong enough to lift two containers simultaneously. This allows for notably efficient operations in container handling This shipment also achieved a remarkably fast turnaround time , with the order being completed in November and the crane being delivered to SCT on December 29, 2022

GPA handles nearly 6 million TEUs in 2022

The Georgia Por ts Authority (GPA) handled a record 5.9 million TEUs in Calendar Year 2022, an increase of 5 percent over 2021 “It was a challenging year, but collaborative effort across Georgia’s supply chain ensured cargo movement remained fluid,” said GPA Executive Director Griff Lynch “I want to thank our Board for approving new infrastructure that allowed us to handle more cargo. ” The Por t of Savannah achieved four of its top five months for container volume in CY2022, with trade volumes peaking in August at an all-time high of 575,500 TEUs “We’re excited about the possibilities ahead, with major infrastructure projects delivering greater capacity and efficiency for our customers,” said GPA Board Chairman Joel Wooten “At Georgia Ports, we ’ re bringing to market faster vessel service, quicker turn times for trucks and more room to grow business.” In addition to record container cargo in 2022, GPA achieved a 16 percent increase in breakbulk tonnage to nearly 3 3 million tons last year, an improvement of 443,000 tons compared to 2021 In Roll-on/Roll-off cargo, Colonel’s Island Terminal in Brunswick handled 651,101 units of autos and heavy machiner y. Ocean Terminal in Savannah moved another 19,630 Ro/Ro units, for a total of 670,731, an increase of 0 4 percent Total tonnage crossing all GPA docks reached 42 4 million tons last year, an increase of about 2 percent or nearly 760,000 tons.

Electric trucks now in use for container traffic at the Por t of Gothenburg

Skaraslättens Transpor t is Sweden’s biggest provider of container transport on the roads, hauling 850-900 containers daily to all Swedish container por ts The lion share goes to the Por t of Gothenburg, and the haulage company has deployed two electric trucks on container flows to the por t - with a third truck joining them shor tly “We don’t want to be standing on the side-line when the transition takes place - we want to be leading the way, and we ’ re also seeing our customers increasingly requesting sustainable transpor t operations With that in mind, this was a pretty easy decision to make,” says Johan Söderström, CCO at Skaraslättens Transpor t The trucks represent an important milestone for Gothenburg, yet they are just the beginning of a development that will accelerate during 2023, with more haulage and freight companies preparing to deploy electric heavy trucks

n e w s p o r t & t e r m i n a l

Shor t Sea boost for London Thamespor t

The range of shor t sea container ser vices available from Hutchison Por ts London Thamespor t is to be increased following the announcement by Viasea Shipping of a new ser vice from the South East UK por t

Commenting on the new sailing, Mark Taylor, Director, London Thamespor t, said: “London Thamespor t is already well established as one of the leading shor t sea container por ts in the South East of England and offers excellent ser vice levels in both quayside and landside operations We are delighted that Viasea Shipping has chosen Thamesport as its gateway into the region. The addition of their UK-Norway ser vice complements the regular and reliable connections we already have to Nor thern and Southern Europe We look forward to working with them over the coming years to increase the range , frequency and reliability of options for shippers.” Norwegian-owned Viasea Shipping, established in 2016, is an independent shor t sea operator connecting Norway with the UK, Europe and the Baltic states The new ser vice from London Thamespor t will call weekly with connections to Moerdijk and the Norwegian por ts of Oslo, Moss and Kristiansand, with onward connections into the Baltic and Poland

COSCO launches China Electric Ship Innovation Alliance

COSCO Shipping Corporation Limited and COSCO Shipping Development have par tnered up to form the China Electric Ship Innovation Alliance This alliance officially began on 8 Februar y, following its founding conference which held over 80 companies in attendance . These companies included the National Development and Reform Commission of China, the Water Transpor t Bureau of the Ministr y of Transpor t, the Center for International Economic and Technological Cooperation, and the Yangtze River Maritime Safety Administration to name just a few A strategic collaboration agreement for the Green Water Zero Carbon Project was also inked during the event China Energ y Engineering, China Cheng Tong, China Merchants Capital, and COSCO Shipping Development have all signed a cooperative agreement

HHLA Next invests in FERNRIDE - joint pilot project in Tallinn

HHLA Next, Hamburger Hafen und Logistik AG’s innovation unit, is investing in Munich-based star t-up FERNRIDE. A pilot project for highly automated and electric container logistics is being launched at the HHLA TK Estonia terminal in Tallinn in par tnership with HHLA International. The goal of the project is to develop solutions for the gradual automation of trucks within live operations

HHLA Next is investing in FERNRIDE's innovative solution to drive forward automation and sustainability in logistics and to address the lack of truck drivers En route to automated transpor t logistics, the unique approach of FERNRIDE lies in the gradually increasing autonomy of trucks and tractor units The combination of autonomous driving technology of the vehicles and human exper tise in remote operation already offers a reliable ser vice available now in live operations This creates an immediate added value and speeds up the journey towards more sustainable logistics

Simone Lode , Managing Director of HHLA Next: “ We see great potential in autonomous driving solutions With FERNRIDE, we are investing in a company that has already implemented a viable solution with a par tner network of respected companies from industr y and logistics with ver y good results ”

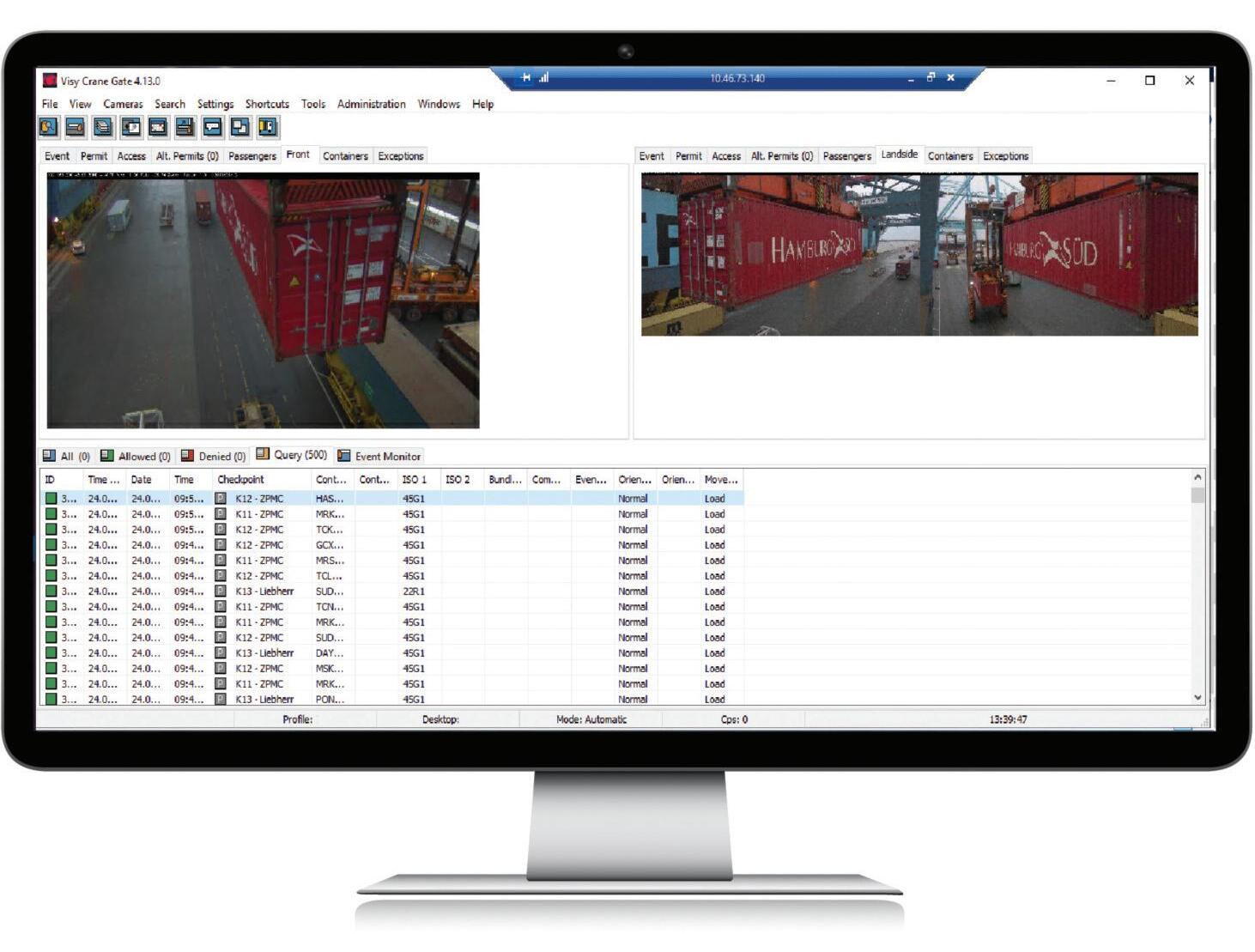

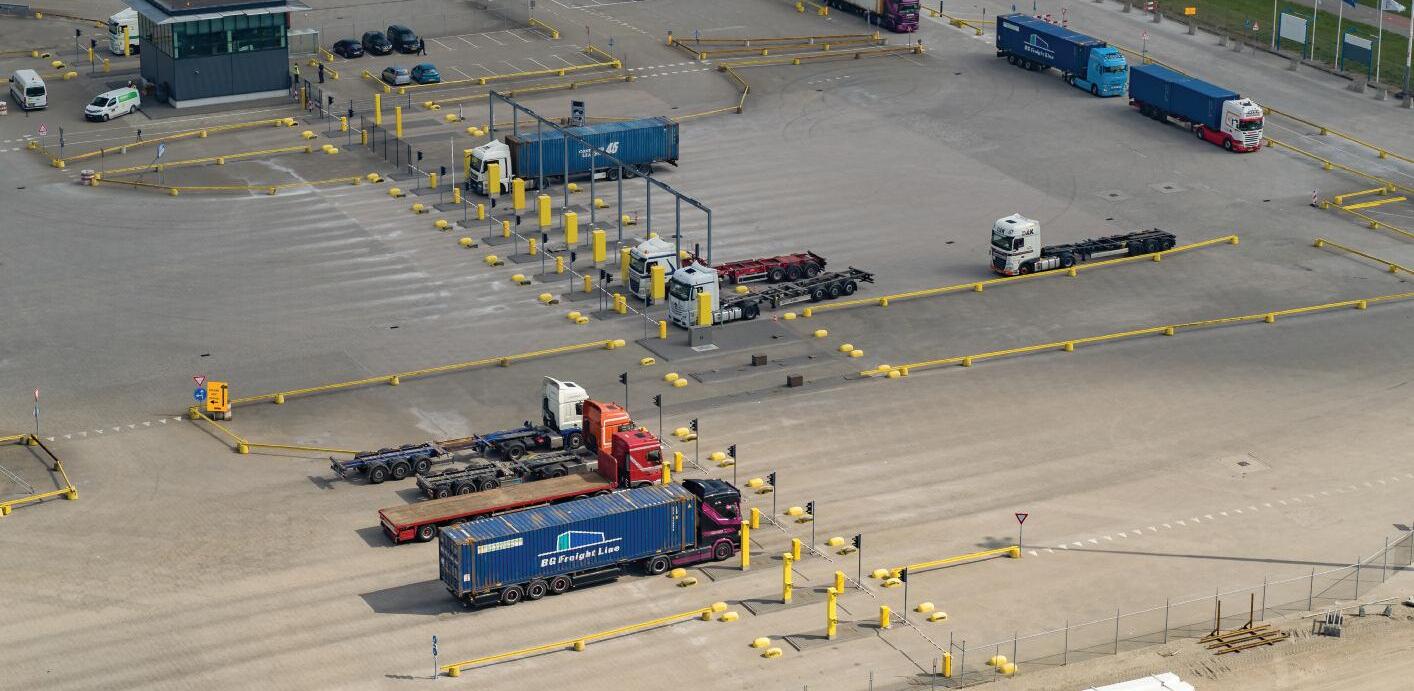

Visy crane OCR system to be delivered to Baltic Hub

Visy is ver y pleased to announce that its par tner Autepra has been awarded the quayside automation contract for 14 STS cranes at Baltic Hub (DCT Gdansk) The system will include Visy TopView (spreader OCR) and Visy LaneView with terminal tractor matching. The system will image containers in flight and automatically recognise container codes and other attributes to expand the terminal’s process automation capabilities By automating quay operations with the addition of Visy OCR, Baltic Hub will improve KPIs such as operational capacity and ber th productivity, while enhancing the accuracy and safety of the container handling process The project scope includes system deliver y, integration with Navis TOS, and suppor t and maintenance ser vices

n e w s p o r t & t e r m i n a l January/February 2023 World Port Development 11

New facility at Por t of Vancouver gets green light

The Rober ts Bank Terminal 2 Project at the Por t of Vancouver has had the go-ahead from Canada’s Federal Minister of Environment and Climate Change. Minister Steven Guilbeault has deemed the project to have sufficient information to suppor t government decision-making His approval comes after the Vancouver Fraser Port Authority (VFPA) provided additional information in response to a government request regarding potential effects of the project on fish and fish habitat, salinity, and Indigenous people The VFPA demonstrated that the project could be completed in an environmentally responsible nature and included measures for mitigation and adaptive management as well as increased monitoring The project is set to increase Canada’s West Coast container terminal capacity by 30% and is viewed as a critical piece in meeting the countr y ’ s growing trade needs, suppor ting economic prosperity, and ensuring access to goods for Canadian consumers and businesses

End of 2M alliance

terminal in Savona,

Italy.

order was booked December 2022 and will be delivered in June 2023 “We have high expectations for our material handling cranes, and Konecranes has fulfilled them all They’ve offered us an easily adaptable , high-performance hybrid solution that will bring a new level of productivity to our terminal while helping us to cut our carbon emissions and fuel consumption,” says Ettore Campostano, Owner and CEO of CG The

Por t of Los Angeles container throughput down in Januar y

The Por t of Los Angeles processed 726,014 TEUs in Januar y of this year, a 16% decrease from the previous Januar y ’ s all-time record. “We expect softer global trade throughout the first quar ter, par ticularly compared to last year ’ s record-breaking start,” Executive Director Gene Seroka told journalists during a media briefing “Many factories in Asia have had extended Lunar New Year closures, retailers continue to discount products to clear warehouses and inflation-led economic concerns remain top of mind for Americans. With capacity on our docks today, we ’ re ready to unlock new levels of value and ser vice at the Por t of Los Angeles ” Seroka was joined at the briefing by John Padgett, President of Princess Cruises Padgett discussed plans for Princess to expand operations in LA after a strong 2022. The por t had 229 cruise calls last year and expects cruise demand to continue to increase . Januar y 2023 loaded impor ts reached 372,040 TEUs, down 13% compared to the previous year Loaded expor ts came in at 102,723 TEUs, up 2 5% compared to last year

Mediterranean Shipping Company (MSC) and A P Moller – Maersk (Maersk) have mutually agreed to terminate the 2M alliance and is due to be complete by Januar y 2025 In a statement, the CEOs of both companies, acknowledged that the shipping industry has undergone significant changes since the alliance was established, and that discontinuing 2M would allow both companies to pursue their own individual strategies. The 2M alliance was star ted in 2015 as a strategic par tnership that allows for the sharing of shipping routes and resources to enhance efficiency and reduce expenses The decision will not have any immediate impact on the ser vices provided to customers currently using the 2M trades

n e w s p o r t & t e r m i n a l World Port Development January/February 2023 12

Italy’s Cam pos tano Anc hor updates its f leet Italy’s Cam pos tano Anc hor updates its f leet

Campostano Anchor, part of the Campostano Group (CG), has ordered a Generation 6 Konecranes Gottwald mobile harbour crane for general cargo and bulk material handling to update their existing fleet at their

nor thern

The

new crane has a working radius of 49m and a lifting capacity of 125 tonnes to ser ve vessels up to Panamax class.

Construction on Saudi Arabia’s largest Integrated Logistics Park begins

A.P. Moller - Maersk (Maersk) and the Saudi Ports Authority (MAWANI) have star ted work on Saudi Arabia’s largest Integrated Logistics Park at Jeddah Islamic Por t Located on an area of 225,000 square meters, the greenfield project will be the first of its kind at the Jeddah Islamic Por t, offering myriad solutions aimed at simplifying the supply chains of Maersk’s customers in the Kingdom The ground breaking ceremony was attended by the President of the Saudi Por ts Authority, Danish Ambassador to Saudi Arabia, CEO of Zamil Construction, and the Managing Director of Maersk Saudi Arabia Cited to create more than 2,500 direct and indirect jobs in Saudi Arabia, the $346 million investment will be 100% powered by solar energ y generated from rooftop solar panels spread over 65,000 square metres Moreover, the trucks used for transpor tation at the park will also be fully electric vehicles Plans also include a dedicated eCommerce fulfilment centre to cater to the rapid growth of eCommerce in Saudi Arabia.

Hull terminal storage capacity upped with £4.8 million investment

ABP Humber has recently completed an extension to its Humber Container Terminal at the Por t of Hull in the UK The facility at the Por t of Hull welcomes around 12 vessels per week from Rotterdam, Amsterdam, and Ghent, ser ving customers Samskip, iMotion, and BGF

An investment of £4 8 million has enabled an additional 17,600 square meters of heavy-duty paving to expand the terminal’s storage capacity This adds to the 15 vessels ser ved by the Humber Container Terminal at the Por t of Immingham Simon Bird, Director, Humber, said: “Having completed a £50 million investment at the start of 2021, the Humber’s provision to ser ve the container sector goes from strength to strength with these ongoing investments The extra space and equipment is fur ther evidence of the growing value the terminals have in the economic life of the Nor th of England and the Midlands.” Clearance works for the extension were carried out by Stoneledge , and the construction works were completed by CR Reynolds

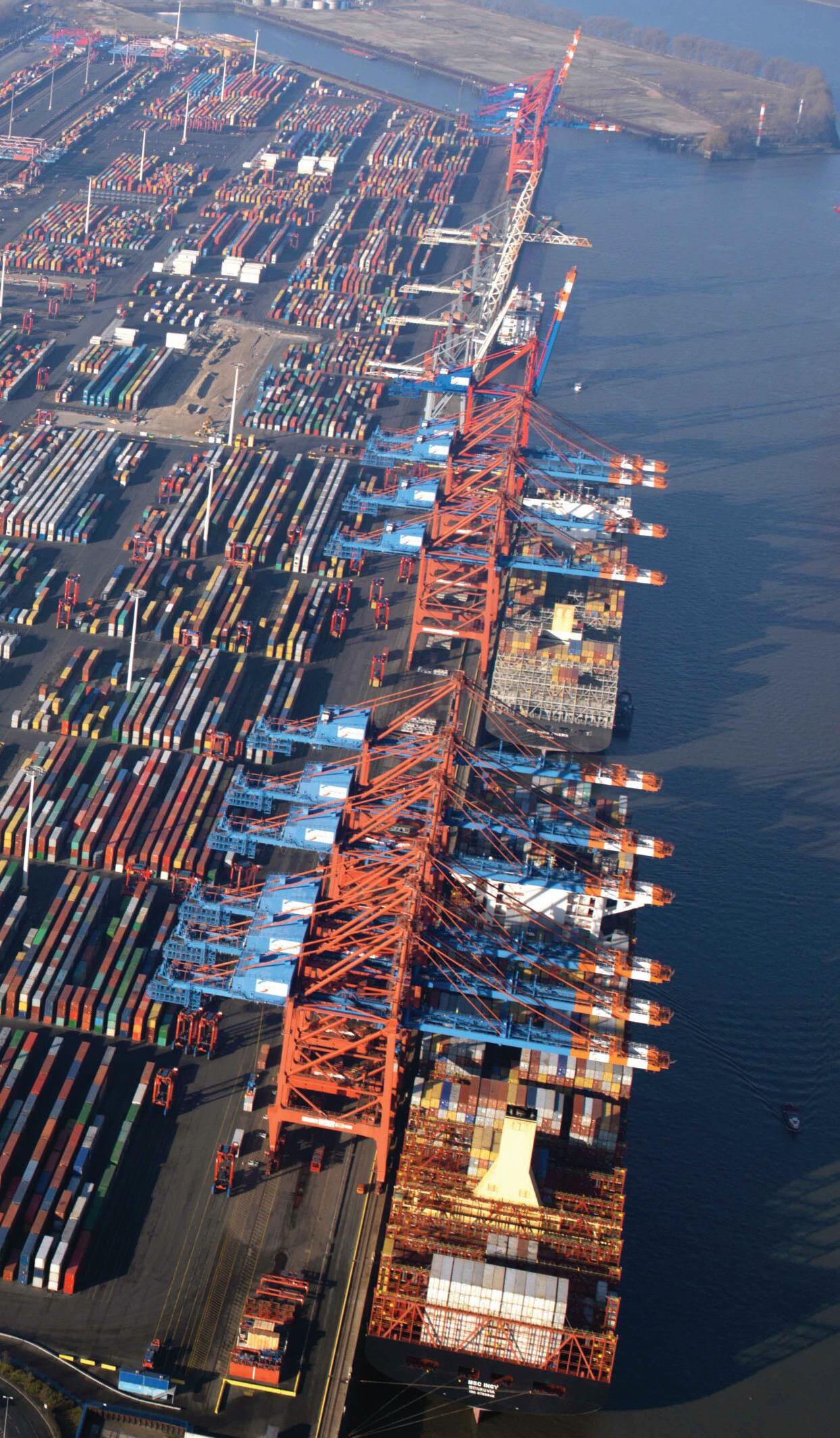

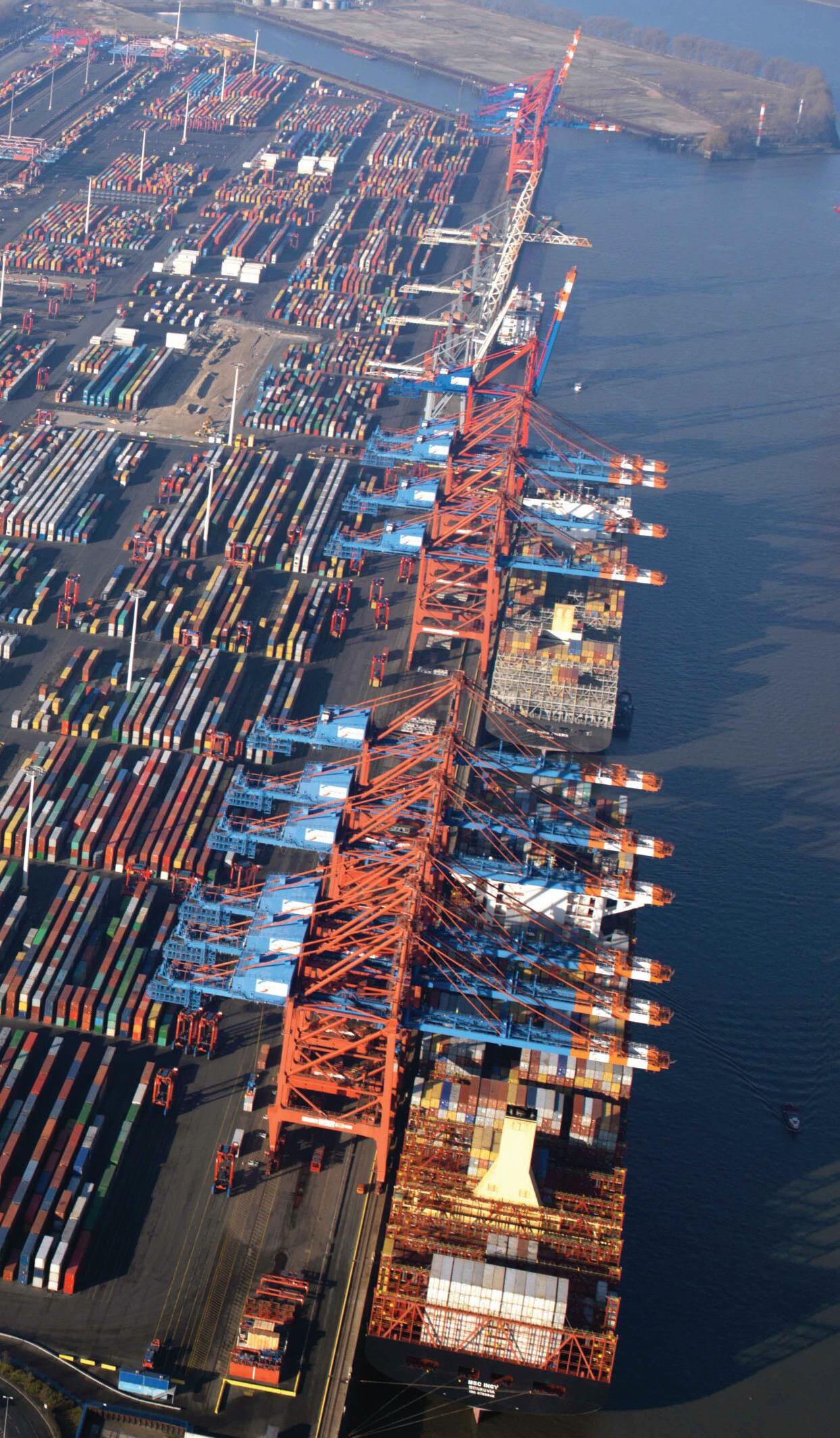

Por t of Hamburg TEUs down during 2022

The Port of Hamburg processed a total of 8 3 million TEUs during 2022, reflecting a 5 1% decrease from itsr volume in 2021 Hamburg terminals handled 119.9 million tonnes in 2022 showing a 6.8% decrease from the previous year Impor ts came in at 4 2 million TEUs, 6 1% lower than in 2021 The por t expor ted 4 1 million TEUs, a 4 1% drop from the year prior. The Port of Hamburg attributed much of its 2022 annual results to geopolitical issues, par ticularly the Ukraine-Russia conflict

n e w s p o r t & t e r m i n a l January/February 2023 World Port Development 13 Spr eader s T he latest mar ket news and pr oduct developments... PLUS US East Coast por ts Pneumatic shipunloader s Floating cranes Ter minal lighting Fender s A round-up of the latest news... International Journal for Port Management W O R L D P O R T D E V E L O P M E N T NEXT MONTH Don’t miss out . To make sure you get the next issue of World Por t Development subscribe TODAY. Email subscribe@worldportdevelopment .com

Courtesy: SFT

Courtesy: VDL

Courtesy: GPA

n e w s p o r t & t e r m i n a l World Port Development January/February 2023 14

VIP begins 2023 with cleanenerg y resources

Virginia Inland Por t (VIP) is fulfilling all of its operational electricity needs from clean energ y resources and in doing so moves The Por t of Virginia forward with its goal of reducing emissions and becoming carbonneutral by 2040 The inland por t gets its power from Rappahannock Electric Cooperative and through a new agreement the cooperative will provide clean electricity to VIP from Virginia-based solar installations. The clean energ y began flowing on Jan 1; VIP is the first of the por t’s six general cargo terminals to get 100% of its electricity from renewable sources “We have a clearly-stated goal of getting away from fossil fuel use and this is another impor tant step forward,” said Stephen Edwards, CEO and Executive Director of the Virginia Por t Authority (VPA)

“This por t is a modern, worldclass operation and we are overlaying it with a twenty-first century approach to sustainability This move helps reduce our contribution to global climate change and will help make us a leader among our US East Coast peers in terms of environmental sustainability ”

SC Por ts has record 2022 SC Por ts has record 2022

SC Por ts moved nearly 2 8m TEUs in 2022, a 1 5% increase over 2021. When accounting for containers of any size , SC Por ts moved more than 1 5 million pier containers in 2022, a 1% increase from 2021 “South Carolina’s excellent por t team and maritime community efficiently handled record cargo volumes and exper tly navigated supply chain challenges to keep freight moving for our customers,” SC Por ts President and CEO Barbara Melvin said Inland Por t Greer and Inland Por t Dillon handled a combined 167,147 rail moves in 2022, enabling more companies throughout the Southeast to quickly move goods to and from the por t via rail

HOPA Por ts records strong season despite

At the conclusion of the 2022 shipping season, Hamilton-Oshawa Por t Authority (HOPA) saw 10,366,810 metric tonnes (MT) of cargo transiting the por ts of Hamilton and Oshawa combined

A total of 628 vessels visited its two por ts during the season, 569 in Hamilton and 59 in Oshawa

In 2022, 9.8 million MT transited the Port of Hamilton Meanwhile, in Oshawa, 481,318 MT were recorded in 2022, moderately lower than 2021 totals as a result of lower finished steel and fer tiliser totals In 2022, HOPA completed major maintenance dredging at Oshawa, while also kicking off a major capital improvement project, which will see more than USD32 million invested

Everglades receives grant

for

sea rise infrastructure

Por t Everglades was awarded a USD32 million grant to mitigate environmental threats from flooding and sea level rise and ensure continued access for vessels The por t will use the money to replace bulkheads in the nor thern par t of the facility, to assist in reducing the impacts of climate change to the por t

Contecon Manzanillo is Mexico’s first carbon-neutral port Contecon Manzanillo S.A. de C .V. (Contecon Manzanillo), a business unit of International Container Terminal Ser vices, Inc (ICTSI) and concessionaire of the Specialised Container Terminal of the North Zone of the Por t of Manzanillo (TEC-II), is the first organisation across the Mexican por t industr y to be cer tified carbon neutral The Carbon Neutrality UNE-14064-3:2019 cer tification recognises Contecon Manzanillo’s commitment to global initiatives to combat climate change, promote renewable energ y and decarbonise por ts and maritime transpor t The carbon neutrality cer tificate highlights the company ’ s effor ts to offset greenhouse gas (GHG) emissions through reduction and compensation practices. José Antonio Contreras, Contecon Manzanillo CEO, explained the cer tification’s relevance not only for Mexico’s por t sector but also for industrial activity in general: “We are proud to be the first terminal in Mexico verified under this regulation. At Contecon, we are quite clear about maintaining an agenda aligned with our business in which climate change is combatted and the use of renewable energ y is encouraged More impor tantly, we are moving firmly towards the decarbonisation of por ts and maritime transpor t of Mexico Having this type of certification portrays us as an organisation that demonstrates commitment, talent and a real position for change in the face of environmental problems.”

n e w s p o r t & t e r m i n a l January/February 2023 World Port Development 15

Claire Instone brings readers insight into how Benelux ports remain stable.

When reporting on the performance of Benelux por ts across 2021 in our last regional sur vey, we noted the por ts of Belgium and the Netherlands had pushed on through and achieved growth despite numerous challenges, from post-pandemic losses and Brexit to the British driver shortage and congestion problems. The expectation for 2022 was that any losses of the previous two years would be made up for, and - for the most par t - they have been.

The fact that the por ts of Antwerp-Bruges and Rotterdam achieved stable results, and Nor th Sea Por t experienced its best year since the merger back in 2018, is outstanding considering they have had to fight through a fresh new wave of difficulties including the fallout from the war in Ukraine, the sanctions against Russia, and the changes in global energy flows With no figures available at the time of print for the Por t of Amsterdam we are unable to share an update on the North Holland facility, however keep reading to see how other ports of the Benelux have remained steadfast despite myriad shocks to world trade in what continues to be uncer tain times

Antwerp-Bruges, Belgium

2022 was a big year for the por ts of Antwerp and Zeebrugge with the two facilities merging to form the Por t of Antwerp-Bruges. The agreement, finalised in April of last year, makes Antwerp-Bruges Europe’s largest expor t por t - with 147m tonnes per yearmaking it a global heavyweight Moreover, it is a leading container port by tonnage processing around 159m tonnes annually

“The fact that, despite the challenges, we also achieved so many successes in 2022 makes me ver y proud. 2022 was the year of the merger and therefore a historic year, ” says Dirk De fauw, Mayor of the City of Bruges and Vice President of Port of Antwerp-Bruges. Reflecting on the facility’s performance across 2022 shows it was a year of challenges, however Antwerp-Bruges held its own amid geopolitical difficulties, the energ y crisis and ongoing disruptions in supply chains

“2022 was, once again, an eventful year. As a world por t, we are at the centre of this drama and are holding up well With our strong international position, we can make a difference in challenges such as the energ y transition Together with our par tners and thanks to financial suppor t, such as the

impor tant European funding of 500 million euros for the Antwerp and Kairois@C projects, we can live up to our pioneering role , ” states Jacques Vandermeiren, the CEO of Por t of Antwerp-Bruges Despite the issues faced, throughput was only down 0.7% year-on-year to 286 9 million tonnes of cargo The challenges were most palpable in container traffic Global disruptions within container shipping, and the resulting congestion with peak call sizes and delays, put pressure on volumes throughout the year In addition, the conflict in Ukraine caused a decrease in Russia-related traffic by 59% And while operational challenges at container terminals and congestion have been slowly easing since the third quar ter, high energ y prices and economic uncer tainty have caused a slowdown in demand for container traffic As a result, container throughput fell 8.6% in tons and 5.2% in TEUs in 2022, compared with a strong 2021, back to pre-pandemic levels

The war in Ukraine , the sanctions against Russia and the energ y crisis greatly changed the energ y landscape and flows in Europe , which translated into strong growth in bulk Dry bulk throughput increased 13 8% in 2022 The liquid bulk segment grew 10%, mainly due to a 61.3% increase in demand for LNG as an alternative to natural gas via pipelines from Russia After record figures in 2021, conventional breakbulk (+1.1%) held up well in the first half of the year due to growth in the throughput of steel As for roll-on/roll-off, traffic saw a rise of 6.5%.

As for what the coming year has in store , a flood of new investments and projects since the merger confirms the attractiveness and added value of the unified por t The resilience of both por t platforms has allowed impor tant steps to be taken in projects that contribute to the por t’s sustainable growth and role in the energ y transition The projects are ready to be further rolled out this year. The hydrogen strategy to make the port a European hydrogen hub for the impor t, local production and throughput of green hydrogen and hydrogen carriers will be fur ther refined.

Moreover, the completion of the first par t of the NextGen District, the future hotspot for the circular economy, is almost complete and the first spade will go into the ground soon In addition, as par t of the por t’s ‘greening’ of its fleet, the Hydrotug and Methatug, the world's first hydrogen and methanol-fuelled tugs, are making an appearance

World Port Development January/February 2023 16 p o r t s u r v e y b e n e l u x U n s h a k e a b l e t e n a c i t y i n u n c e r t a i n t i m e s

And the Digital Twin, the digital copy of the por t area with real-time info via sensors, drones and smar t cameras, will be deployed on both platforms in the coming months to fur ther build a smar t, safe and smoothlyoperated port. “We are confident that in 2023 we can continue to focus on sustainable economic growth; certainly thanks to the many investments announced by our companies,” confirms Annick De Ridder, Vice-Mayor of the City of Antwerp and President of the board of directors of Port of Antwerp-Bruges The port is cer tainly well on its way to anchoring its position as a green energy hub and shaping the energy transition towards a sustainable future

Rotterdam, the Netherlands

At the time of print, full year statistics for 2022 for the Por t of Rotterdam were not available

However, we know from the por t’s state of address and figures from the first nine months of last year that Europe’s largest seaport had an extraordinary year with level throughput results.

“We are proud that - despite all the disruption - the por t of Rotterdam has continued to thrive in close cooperation with our clients and partners Our investments have increased, with the focus on, among other things, fur thering the use of renewable energ y sources such as hydrogen and biofuels. With the reclamation of 55 hectares of new land on Maasvlakte 2, we are creating space for sustainable companies,” confirms Allard Castelein, CEO “It is wonderful that we have been able to demonstrate our flexibility and resilience as a por t complex.”

Despite seeing major changes in goods flows, throughput at Rotterdam remained at the same level as last year for the first nine months of the year - 351 million tonnes (+0 3%) However, there were some major underlying differences, especially due to the war in Ukraine , the sanctions against Russia, and the changes in global energ y flows For instance , considerably higher volumes of coal and LNG were impor ted as alternatives to Russian gas Container trans-shipment decreased, especially as a result of the loss of trade with Russia

“The total volume makes it seem as if it is business as usual in the port, but the big changes, especially with respect to LNG and coal, indicate that the energy landscape has changed dramatically With the high energ y prices the energy-intensive chemical industry in particular is going through hard times. A faster energ y transition makes us less dependent on geopolitical developments in the long term,” states Castelein

Looking at other segments shows dr y bulk experienced a drop of -17 9% in iron and scrap, as did the throughput of agribulk (-14.8). On the flip side, coal volume increased (+24 8%), while other bulk, such as raw materials and building materials, also jumped sharply (+22.6%). As for liquid bulk, the overall increase was 3 9% As for containers, the segment dropped 8 6% in total weight and 4 4% in terms of TEUs in the first nine months. As a consequence of the sanctions, container traffic between Russia and Rotterdam has almost come to a standstill In the past few years, about 8% of container traffic was related to Russia The difference between tonnes (-8 6%) and TEUs (-4 4%) is because proportionally more empty containers found their way via Rotterdam

As for trans-shipment, the Por t of Rotterdam expects volumes for 2022 to be of the same level as that of the year prior One thing that is for cer tain when it comes to figures for 2022 is Rotterdam’s position as Europe’s leading bunker por t Last year, maritime shipping bunkered significantly more fuel in Rotterdam; 10.8 million compared to 10.2 million up to 2021 With that, demand for fuel oil, gas oil, methanol and LNG was 6 3 percent higher than in 2021

With an eye on the future,Vivienne de Leeuw, CFO Por t of Rotterdam Authority, believes the por t’s robust financial position is essential to continue investing in traditional hardware such as quay walls and jetties in the years ahead, but particularly in infrastructure for the energy transition “By maintaining our position as a por t with world-class infrastructure , we are ensuring that we remain an attractive location for companies to invest in the transition.”

Nor th Sea Por t, Belgium and the Netherlands

With 73 6 million tons of cargo trans-shipment from maritime shipping (+7%) and 64 5 million tons from inland shipping (+7%) in 2022, companies in Nor th Sea Por t experienced their best year since the merger in 2018 Moreover, dr y bulk continues to increase and the US replaced Russia as the biggest trading par tner

“With another record year, Nor th Sea Por t is cementing its position as the number ten por t in Europe That’s pretty remarkable after Brexit, two years of the pandemic , the impact of the Ukraine-Russia war and the energ y crisis,” states Daan Schalck, CEO of Nor th Sea Por t

Five years ago, Zeeland Sea Por ts (Vlissingen and Terneuzen) in the Netherlands and the Flemish/Belgian Por t of Ghent merged to form a single por t Nor th Sea Por t became the new brand name of the 60-kilometer-long cross-border Dutch-Flemish por t. It instantly became one of Europe’s top ten por ts

“Our aim was to grow in various areas to make sure we could maintain that position as a newly established por t, and indeed to continue our development into a top European por t. With a new record year since the merger five years ago, the companies in the por t have fur ther cemented that,” continues Schalck.

Nor th Sea Por t has traditionally always been a bulk por t Dr y bulk continues to show marked growth, even compared to the pre-Covid period Liquid bulk and general cargo remain below their pre-Covid levels In 2022, dr y bulk again accounted for more than half of seaborne cargo trans-shipment: 54% (39 9m tons, +10% compared to 2021) Liquid bulk accounted for 24% of the total (17 6 million tons, +5%) Meanwhile , the share of break bulk was 14% (10 million tons, +5%) with roll on/roll off growing 5% (3 7 million tons, +2%).

As for containers, they made up 3% of seaborne cargo trans-shipment (2.6 million tons, -9%) There was also a fall in terms of TEUs to 230,000 (-31,000 TEUs) Setting a new record last year was inland navigation trans-shipment coming in at 64 5 million tons, up 7% (on top of a 9% increase in 2021) Impor ts increased by 8%, expor ts by 7% The impor t-expor t ratio was 41%-59%. With a seaborne trans-shipment volume of 73 6 million tons and 64 5 million tons of cargo trans-shipped via inland navigation, North Sea Port recorded a total trans-shipment of 138 1 million tons in 2022, compared to 129.1 million tons in 2021.

As for its forecast and outlook for 2023, Nor th Sea Por t expects it to be less of a bumper year, but still a solid one , with seaborne cargo trans-shipment experiencing similar volumes in the four quar ters, well above 70 million tons. The hope is that energ y prices will fall and that investment will continue at a similar level

In a world transformed by Brexit, corona, war and energ y prices, por ts of the Benelux are showing unshakeable tenacity

January/February 2023 World Port Development 17 p o r t s u r v e y b e n e l u x

por ts are moving up a gearand the biggest Pacific por t is leading the way

Mexico’s por ts are moving up a gearand the biggest Pacific por t is leading the way

Gordon Feller reports on Mexican Ports.

Boasting close to 6,000 miles of coastline , with 102 por ts and 15 terminals, Mexico is the world’s 11th-leading expor ter The countr y ’ s por ts and terminals are connected to more than 145 countries, bolstered by Mexico’s free trade agreements with over 40 countries, including China, the EU, the US, Japan and Israel.

Some of Mexico’s leading por ts are now undergoing expansions and redevelopment. One impetus for this wave of activity was a series of legislative changes promoted by Mexican President Andres Manuel Lopez Obrador. It was in 2021 that his moves aimed to prevent a continuation of the mismanagement, corruption, and smuggling

which was occurring at customs.The government decided to transfer the management of por ts from the Ministr y of Communications and Transpor t (SCT) to the Secretariat of the Navy (SEMAR) It was in June of 2021 that “inter-secretarial cooperation mechanisms” were established for the operation of the National Por t System (SPN) to facilitate the transfer of power

The resources of the General Coordination of Por ts and Merchant Marine (CGPMM) of the former SCT were subsequently passed to SEMAR, which now grants por t concessions as the regulatory authority It approves master plans ever y five years, and obtains six percent of revenues which flow to the ASIPONAS (Mexico’s port managers). These can be owned by the federal or state government They are constituted as “priority public companies” -

and they are responsible for managing the awarded operating rights; implementing master plans, programming; development; use and exploitation of the por t within the framework of a concession They are designed to (ideally) be self-sufficient, and productive , and competitive .

According to the central government’s 2022 Federal Expenditure Budget Project, ASIPONAS will have a budget of MX$2.4 billion (approximately US$118 4 million), 10 percent below the budget approved for last year. ASISPONAS currently have 48 open projects for the development and conser vation of infrastructure with public resources Business lines mainly include fluids, petroleum, containers, automotive , agricultural and mineral bulk, general cargo and cruise

World Port Development January/February 2023 18 p o r t s u r v e y m e x i c o

Mexico’s

SSA Mexico, one of the Pacific coast’s major operators, has announced plans to invest $30 million in eight new cranes for its container terminal at the Por t of Manzanillo. This one terminal traffic accounted for 30% of traffic handled at all of Mexico’s Pacific por ts, with an annual growth rate of 10%.

The Por t of Manzanillo is located in Mexico’s State of Colima It ranks first amongst all of the Mexican por ts, with the highest throughput in 2022, having handled roughly 2 68 million metric tons of cargo As Mexico’s largest container por t, Por t of Manzanillo ser ves as the primar y threshold for international trade with Mexico, the por t handles an average cargo tonnage of 2.2 million TEUs. The facility opened in 1825 and became a city in 1873. Economic growth in the area expanded, and especially so with the completion of a railroad

to Colima in 1889. In 1908 the city was officially designated as a por t of entr y to the countr y Interestingly, the city had a brief stint as the Capital of Mexico, for less than a month in 1915, while Pancho Villa’s troops threatened to capture the City of Colima

The modern histor y of The Port of Manzanillo begins in 1971, after Mexico’s government created the National Commission for Por t Coordination in order to improve the relationship with workers

To suppor t these effor ts, the National Commission took charge of increasing the por t’s handling speeds by obtaining new equipment. Subsequently, productivity has improved significantly, and in the last 40 years, the Por t of Manzanillo has seen unprecedented efficiency

As a result, it was in 2017 that Mexico’s shipping por ts, including Manzanillo, were growing at a faster pace than both the US and Canada. This makes Mexico’s ports the fastest-growing in Nor th America This trend of rapid growth continued. The Por t of Manzanillo’s strategic location on the Pacific coast makes it a prime gateway for Asian impor ters and expor ters Additional expor ts from this por t go to the US, Canada, Guatemala, Colombia, Chile , Spain, Russia, and Germany

The por t’s most recent expansions include both a new Specialised Container Terminal and a Multi-Purpose Terminal These terminals feature capacities of 13.6 million tons and 2 46 million tons, respectively Additionally, a new railway tunnel enabling 24-hour direct railroad access, the Manzanillo Freight tunnel, opened in June of 2018.

Manzanillo is considered the most impor tant and active multipurpose por t in Mexico due to its specialised terminal for containers, general cargo, agricultural and bulk minerals, vehicles, perishables, and cruise ships. As the leading Latin American container por t in the Pacific Ocean, the port has specialised terminals to receive sixth-generation container ships up to 360 meters in length, with a capacity of 13,400 TEUs Terminals and facilities are entrusted to national and foreign private companies for an average of 20 years.

The main por t ser vices that will be required are ser vices to vessels to carr y out their operations internally, as well as por t manoeuvering ser vices and general ser vices The port’s master plan runs from 2021 to 2026, with a projected MX$11.3 billion (US$540 million) budget

The ser vice goals specified in the budget include the following: optimising the por t structure and equipment; expanding the por t’s concession for the development of new por t facilities and terminals’ promoting socially and environmentally sustainable development; maintenance; monitoring and upgrade of navigation channels; urban planning development; fnancial and legal feasibility studies aimed at developing private par ticipation processes - through public-private par tnerships

The Por t of Manzanillo’s growth, as well as its contributions to Mexico’s economy, has cemented its place as a major player in the global container shipping landscape

January/February 2023 World Port Development 19 p o r t s u r v e y m e x i c o

Port of Manzanillo

World Port Development reports.

The World Por ts Climate Action Programme (WPCAP) is a cooperation between the ports of Antwerp - Bruges, Barcelona, Gothenburg, Hamburg, HAROPA

PORT (Le Havre - Rouen - Paris), Long Beach, Los Angeles, New York / New Jersey, Rotterdam, Valencia, Vancouver and Yokohama

‘In addition to helping its 12 member por ts decarbonise , WPC AP has contributed to the faster adoption of sustainability standards and measures in the wider shipping industr y ’ That was the main take away from the four th meeting of CEO’s and working group members of WPCAP, which was founded almost 5 years ago to accelerate actions to combat climate change in the maritime sector

“Back then we felt it was unjust that the shipping industr y did not take par t in the Paris climate agreement and to address this, we star ted WPC AP together ” said Allard Castelein, CEO of the Por t of Rotterdam

“Today, this issue of climate change is top of mind with industr y leaders and other stakeholders alike and I am proud of the initiatives that we have implemented in the past years. I believe these have helped speed up the transition of the industr y at large and are testimony to our collaborative effor ts ”

The meeting focused on the work done to improve efficiency, aid the adoption of shore power, and accelerate the transition to clean shipping fuels. Members also discussed the decarbonisation of cargo-handling equipment, noting in par ticular the potential of hydrogen fuel cells as a zero-emission technolog y as this can deliver high performance with relatively low additional requirements for infrastructure investments.

Still large potential for global efficiency gains

Efficiency continues to be seen as low-hanging fruit for decarbonisation effor ts, and the significant progress made in setting standards to improve efficiency has elicited positive responses from both WPC AP members and the wider shipping community The WPC AP working group focused on the top efficiency measures identified in a sur vey among almost 600 exper ts from more than 100 countries Members collaborated with the IMO to calculate

the CO2 impact of different efficiency measures and developed a guide and standards for ports to implement just-in-time arrivals and deliver significant fuel savings In addition, the members worked with the International Hydrographic Organization (IHO) and other bodies to develop a platform for sharing nautical data between ports, improve ship-berth compatibility and fur ther improve efficiency

Ben van Scherpenzeel, Chairman of the Efficiency Working Group and Director Nautical Developments at the Por t of Rotterdam, noted that both the IMO and ship operators welcomed the measures as they help with planning operations more efficiently, saving fuel costs and reducing emissions He concluded that that there is still a lot of potential for fur ther efficiency gains by rolling out the new tools beyond the WPC AP network, at por ts across the globe

Shore power adoption continues to rise

Of all the topics discussed, shore power saw perhaps the biggest change in attitude in the shipping industr y in the past five years, thanks in part to the work done by WPCAP members. Jarl Schoemaker, Chair of the Power-to-Ship Working Group and Senior Advisor Environmental Management at the Por t of Rotterdam, noted that while shore power has been around for a long time , the roll-out was traditionally hampered by high investment cost due to low adoption rates

To help create a breakthrough in shore power adaption, WPCAP members made an inventory of available technolog y and exchanged best practices and demonstrated the benefits of collaboration which resulted in an MoU on the use of shore power for container vessels and cruise ships by 2028 They also commissioned a joint study, which showed that even with the rise of alternative fuels from renewable sources, shore power is likely to remain the best option to reduce emissions from large vessels

Jarl noted that shore power is increasingly recognised by regulators and policy makers as a key instrument for reducing emissions and improving air quality, including in the EU, leading to higher adoption rates and lower cost. This provides an oppor tunity to fur ther team-up with IAPH in engaging with IMO to address remaining challenges and stimulate a progressive worldwide roll-out of shore power

Port readiness for clean shipping fuels

The transition towards clean shipping fuels was a big topic for all WPC AP members and is expected to be the main focus of multiple initiatives in the coming years, including Green Corridor projects launched by several WPCAP members across the globe .Barriers to wider adoption of clean fuels include uncer tainties around fuel availability, concerns about infrastructure and the technical readiness at individual por ts To address this, members joined forces with the IAPH Clean Marine Fuels working group to develop an assessment and communications tool to align global conversations about the availability of clean fuels at por ts

“It is impor tant for por ts to be able to say to ship owners: ‘ we will be ready with this fuel, at this time , and this is what you can expect from us ’ - and this tool does just that,” said Namrata Nadkarni, Chair of the Working Group on Sustainable Marine Fuels and Founder of Maritime Consultancy Intent Communications. “The Por t Readiness Framework allows you to communicate to all stakeholders where you are in the journey to supply new sustainable fuels or allow vessels using these fuels to bunker - from the research phase, to development and finally, deployment and bunkering of new fuels ”

The group is now focused on providing additional guidance and assessment sheets for ports to apply the framework to their efforts. Beyond this, an online tool can be development for voluntary self-assessment of port readiness In the long run, the working group also sees potential for cer tification according to the new standards, although more thinking would be required on the exact implementation first WPC AP members commented the new tool is a unique instrument and has the potential to significantly accelerate the transition to clean fuels, starting around specific Green Corridors.

Force for good

Castelein concluded that WPC AP has helped to create the momentum needed to address climate change in the industr y He invited all members to meet in Rotterdam in May 2023, to discuss the future of the WPCAP programme. “We tr y to move faster by collaborating, exchanging best practices with other por ts, and reaching out to others outside our network. If we continue to work together, are vocal and show our aspirations, we have the opportunity to be a force for good,” he said

World Port Development January/February 2023 20 p o r t s u r v e y s u s t a i n a b i l i t y

W P C A P : C r e a t i n g g l o b a l m o m e n t u m f o r s u s t a i n a b l e s h i p p i n g

Proposed new US legislation might affect the US crane industry. Thomas Francis reports….

At the end of January 2023, Republican US Representative Carlos Gimenez, whose district is south of the Por t of Miami, introduced the Por t Crane Security and Inspection Act of 2022 to Congress, which was referred to the Committee on Homeland Security, and might cause severe disruptions at US Por ts

Although the Bill did not receive a vote , its provisions could become law by being included in another Bill. It is common for legislative text to be introduced concurrently in multiple Bills (called companion Bills), re-introduced in subsequent sessions of Congress in new Bills, or added to larger Bills (sometimes called omnibus Bills) The Bill must be passed by both the House and Senate in identical form and then be signed by the President to become law.

This new Bill proposes strict new prohibition on the purchase and operation of the world’s most popular container cranes It effectively bans container cranes sold under contracts with countries considered a foreign adversar y, which includes China, the world’s largest manufacturer of STS container cranes, from operating at US Por ts

In addition, within five years after the law is enacted, operators of such cranes already in the US would be required to remove any software manufactured by countries covered under the ban that connects the cranes to the por ts’ cyber infrastructure

The legislation also states that cranes purchased from China that had been scheduled for deliver y at US por ts and determined by the US Depar tment of Homeland Security “to be of high risk to por t security or maritime transportation security” must be inspected by the Cybersecurity and Infrastructure Security

Agency (CISA) for “potential security vulnerabilities” before they can begin operating