Tagetik: Experience & Business Simplexity

Simplify how people work together, manage business processes and deliver value

Why Disclosure Management & XBRL Reporting keep CFOs up at night

VP Advanced applications

Simplify how people work together, manage business processes and deliver value

Why Disclosure Management & XBRL Reporting keep CFOs up at night

VP Advanced applications

100% FOCUS ON PM AND FG

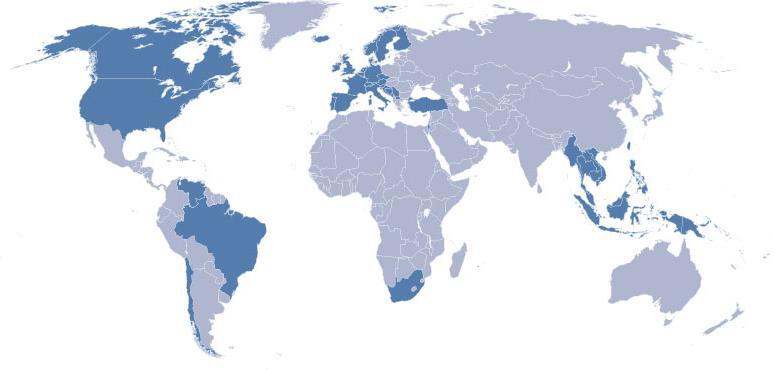

GLOBAL PRESENCE

SINCE 2001: DOUBLE DIGIT GROWTH

400+ WORLDWIDE CUSTOMERS IN ALL VERTICALS

STRATEGIC PARTNERSHIP WITH MICROSOFT

ANALYST VALIDATION:

Laser-focused on financial process excellence according to FORRESTER

Visionary Vendor according to GARTNER's Magic Quadrant for CPM Suites 2010

LARGE PARTNER NETWORK

The ‘Last Mile’ represents the final hurdle of financial reporting and regulatory disclosure, covering all of the tasks post-consolidation leading up to the delivery of internally or externally published results in whatever presentation format they are required. Whereas the earlier (pre-consolidation) phase of the financial reporting supply chain is concerned primarily with the flow of transactions (more usually balances) the post-consolidation phase is mostly about the flow of documents. But effortless document production sits uneasily with the corporate finance function because of the variety of stakeholders that need to be satisfied, the diversity of end-user tools deployed in document creation, as well as the lack of process support and poor integration.

Disclosure and Reporting has become “Top-of-Mind” for Finance

“In 2010 <there was> a rejuvenated focus in financial consolidation and close, financial disclosure, financial governance, <and the> last mile of finance.” Increasingly burdensome regulatory requirements, such as IFRS, fueled this trend.”

- Gartner Market Share Analysis: CPM Suites, Worldwide, 2010, May 13, 2011

Corporate reputation is on the line with each filing

Disclosure and compliance requirements continue to expand

Finance resources are diverted from strategic activities by disclosure

The cost of outsourcing XBRL increases with each year of filing

CFOs want more control, visibility, and accountability into disclosure

Disclosure and Reporting has become “Top-of-Mind” for Finance

• Multiple Stakeholders / Collaboration: This represents a serious challenge as information is passed from one functional area to another (corporate finance, investor relations, public relations, internal audit, external audit, complaicne, legal counsel, printers, ...):

• Versioning

• Process control/workflow (approval, rejections) and Audit Trail: Multiple people working simultaneously on the same document with however separate responsibility for different document sections

• Variety of final documents (10Q/10K, Annual report, Press Releases, Board Book, CSR Report, Management Reports, ...) all presenting the same data in different formats/layouts and with different comments

Disclosure and Reporting has become “Top

-of-Mind” for

Finance

• Lack of integration, lack of process support and heavily manual: In contrast to the well developed processes of the pre-consolidation phase, the «Last Mile» is seriously under-served with no workflow between stakeholders and no integration between source systems (ERP, Financial Consolidation and Datawarehouse) and outputs.

• Proliferation of spreedsheets

• Cumbersome process to collect the comments/inputs from the various stakeholders and consolidate them in one version only

• Long Time spent chasing that $1 due to rounding effects

• Very inefficient process: always start from scratch and retype/re-link all comments and tables

• Error and Delay prone

• No visibility on process status

• No control that required checks and authorizations have been issued

• Last Minute Changes: Difficulty in ensuring that changes in the underlying system are correctly reflected in the financial statements

Disclosure and Reporting has become “Top-of-Mind” for Finance

• Variety of end-user tools

Report Object

Financial Tables and schedules Financial Results and comparatives

XBRL Regulatory filings XBRL and iXBRL

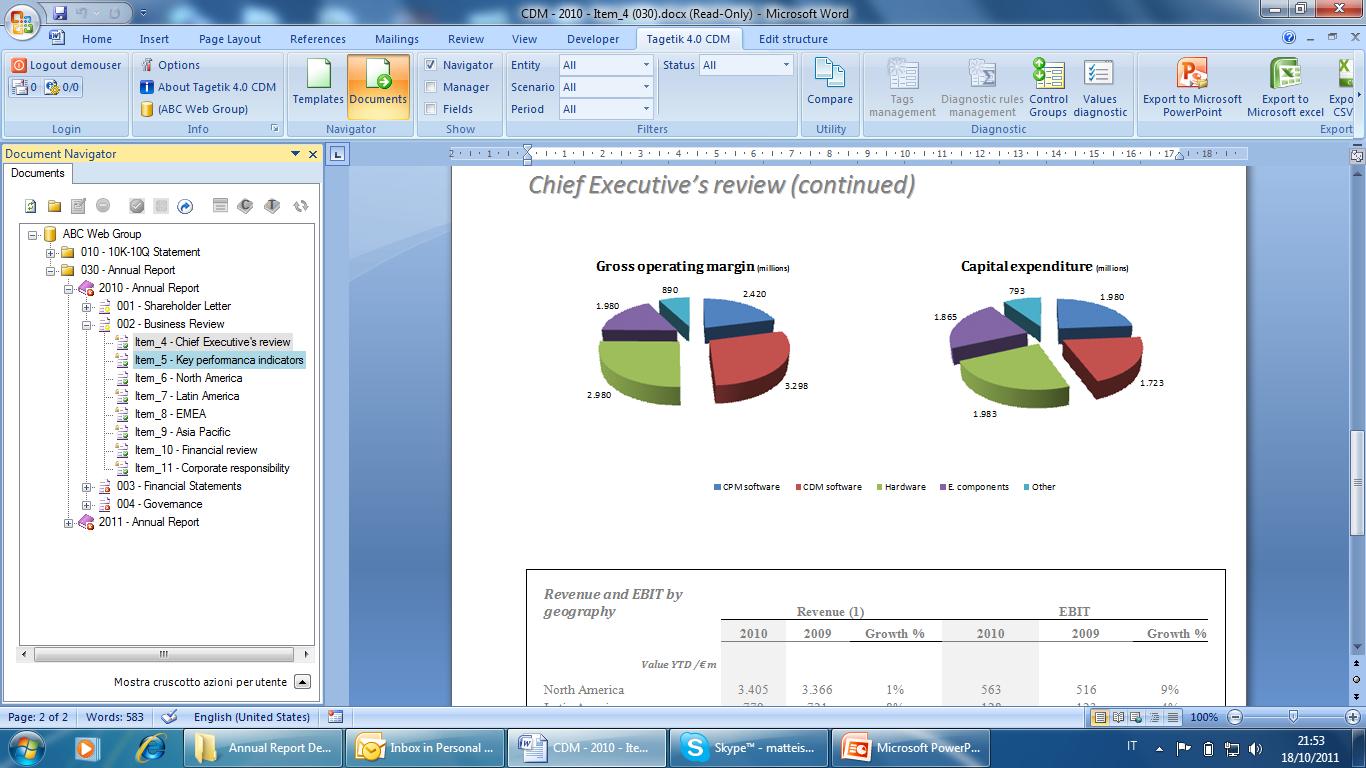

Bar charts and pie charts Turnover, profit, volumes, segmental analysis, market share, ... Excel

Diagrams Internal processes,... Power Point

Photographs Products, Employes, Plants, Offices, ... Bit map or jpeg

Internal Reporting

Board Books

Flash Reporting

Management Reporting

Regulatory Reporting

Reporting to Federal (State/local agencies)

SEC Filings (10K, 10Q, etc.)

Solvency II / Pillar 3

External Reporting

Investor Relations

Statutory Reporting

CSR Reports

Press Releases

Annual Report

Legal

Notes & Exhibits to Statutory Filings

Proxy Statements

CDM solution

10Q – 10K document creation: - Data Refresh - Commentary - Round./Bal.

- Excel Workook - Other unstructured Files. Legal Consolidation in HFM. BOFC, BOBPC, Cognos

Transactional Systems

Full CPM solution

- Legal Consolid.

- Financial Reporting

- 10Q-10K Reporting

Transactional Systems

Connection to External Source Data via ETL

Legal Consolidation in HFM. BOFC, BOBPC, Cognos

Unstructured

Consolidation Planning Reporting

When it comes to the quality of your company’s financial reporting, your credibility and reputation are on the line. It’s critical to win the RACE to integrity by making your disclosure process:

Repeatable Accountable Credible Efficient.

Collaborative Disclosure Management solution helps you win that RACE

• Ensure disclosure accuracy, quality and accountability by making it a parallel process.

• Allows contributors across the organization to collaborate on disclosure documents in real time, directly within Microsoft Office.

• Reduces the time, effort and cost of publishing annual reports, 10Ks/Qs, XBRL and board books.

• Link to different data sources

• Collection of supplementar details

• Supporting multiple document formats

• Ability to attach supporting documents

• Maintaining multiple versions

• Built-in financial intelligence

• Workflow and collaboration

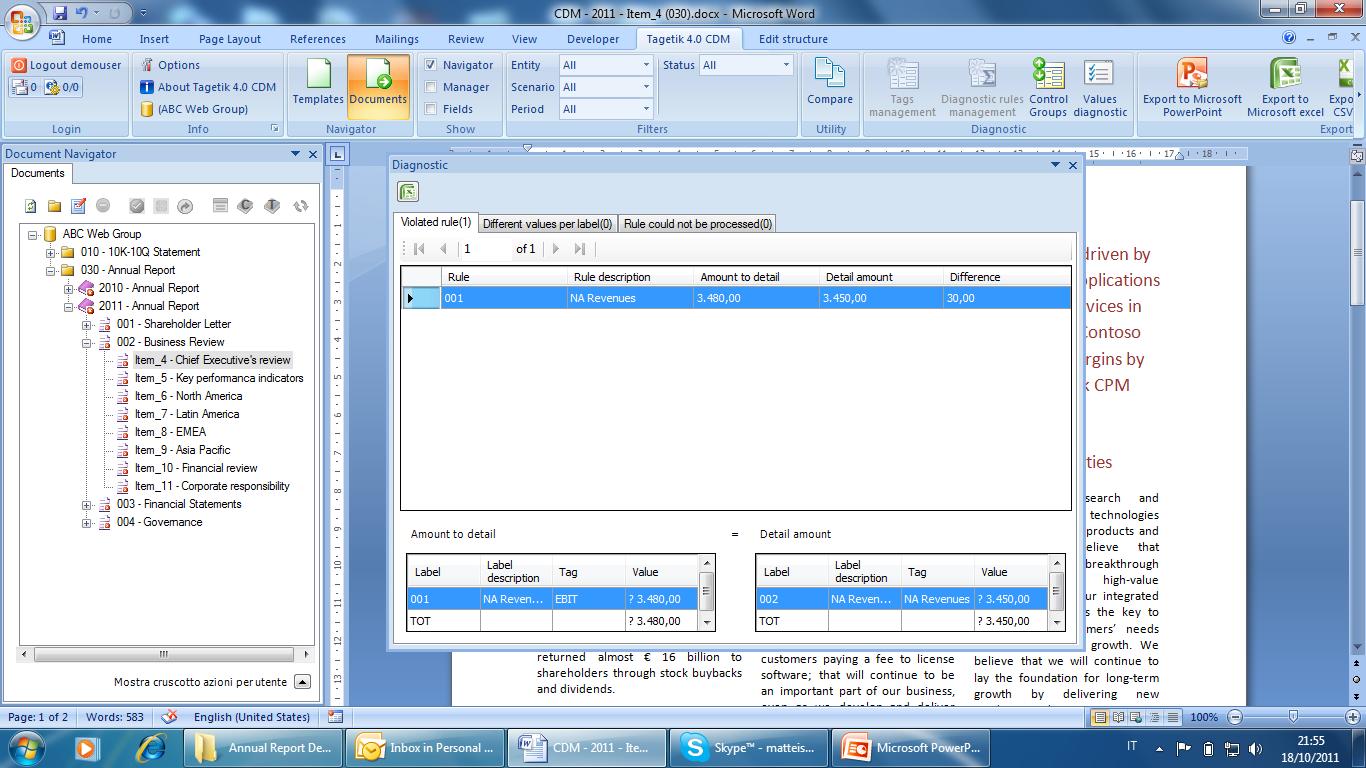

• Validation rules

• Data Rounding

• Full audit trail of all changes

• Automated XBRL tagging and submission