Does the current Finance function have the right mix of capabilities to meet future priorities

Will the finance leader role fundamentally change as traditional finance tasks are automated or managed in shared service centers

“To be able to set the right course for the future, finance functions must get better at processing—and extracting forward-looking insights from—large amounts of data.”

“By adopting innovative technologies, finance will strengthen it’s business leadership through compliance, accuracy, and efficiency.”

— Amy Hood, CFO Microsoft

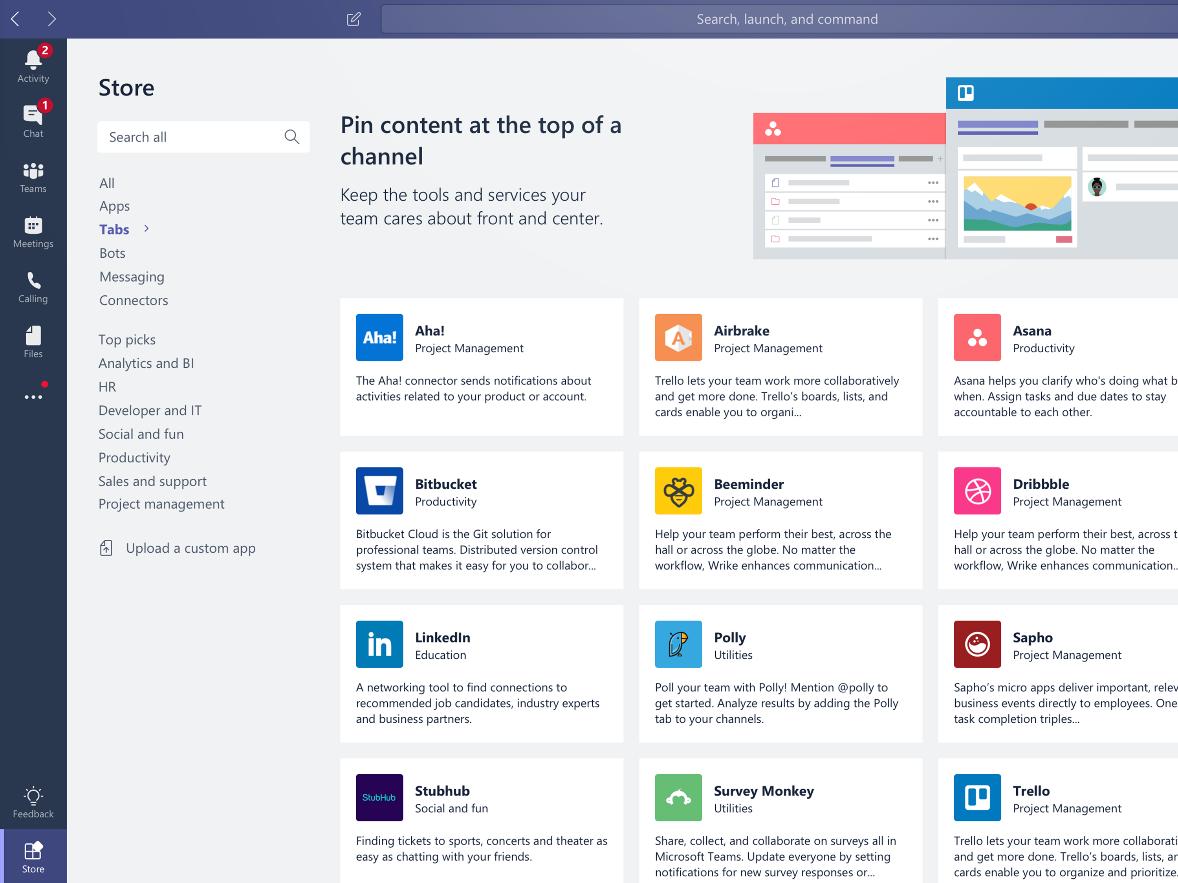

• Email + Calendar

• Chat Messaging

• Skype meetings

• Video Conferencing

• Document sharing

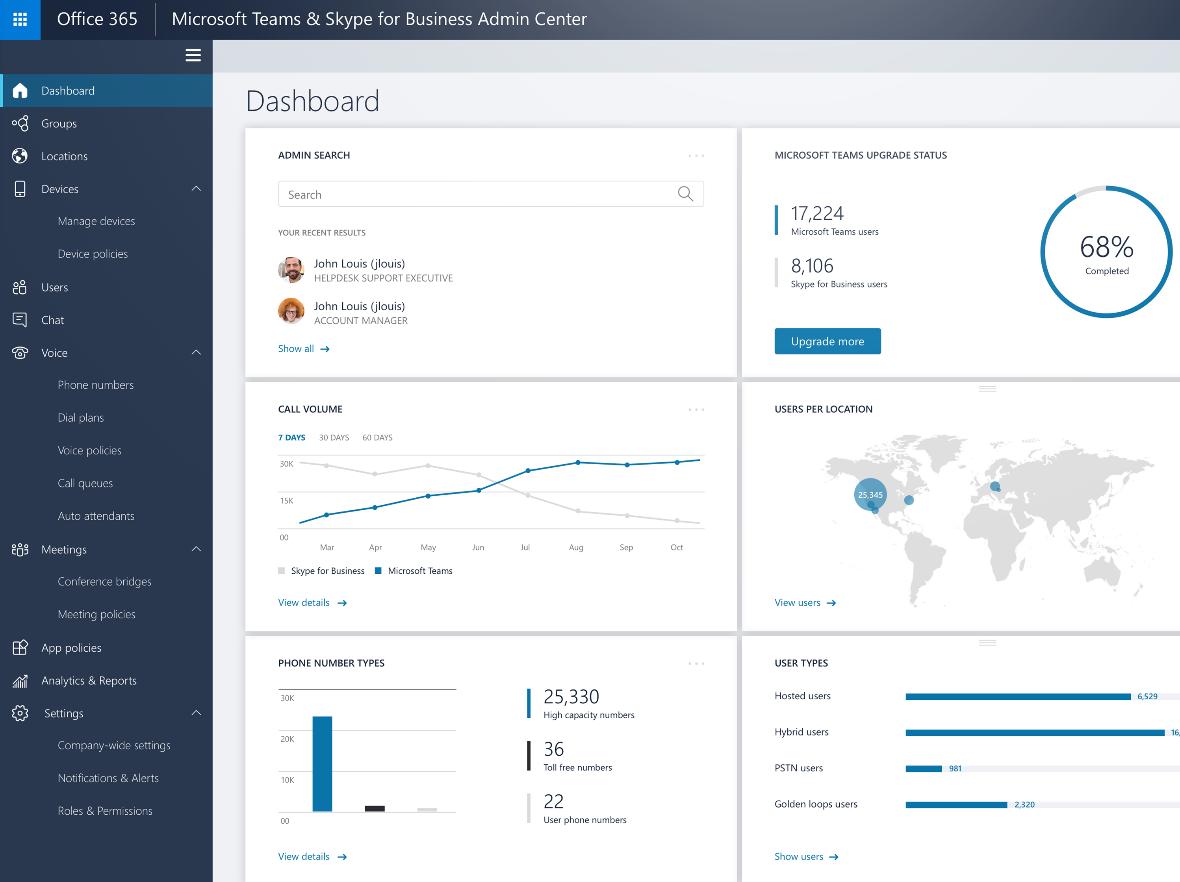

• Revenue

• P&L

• Headcount

• Balance sheet reconciliations

• Stat tool

Electronic approvals - Approval dashboard

• Purchase Orders

• Invoices

• Expense Claims

• Vacations requests

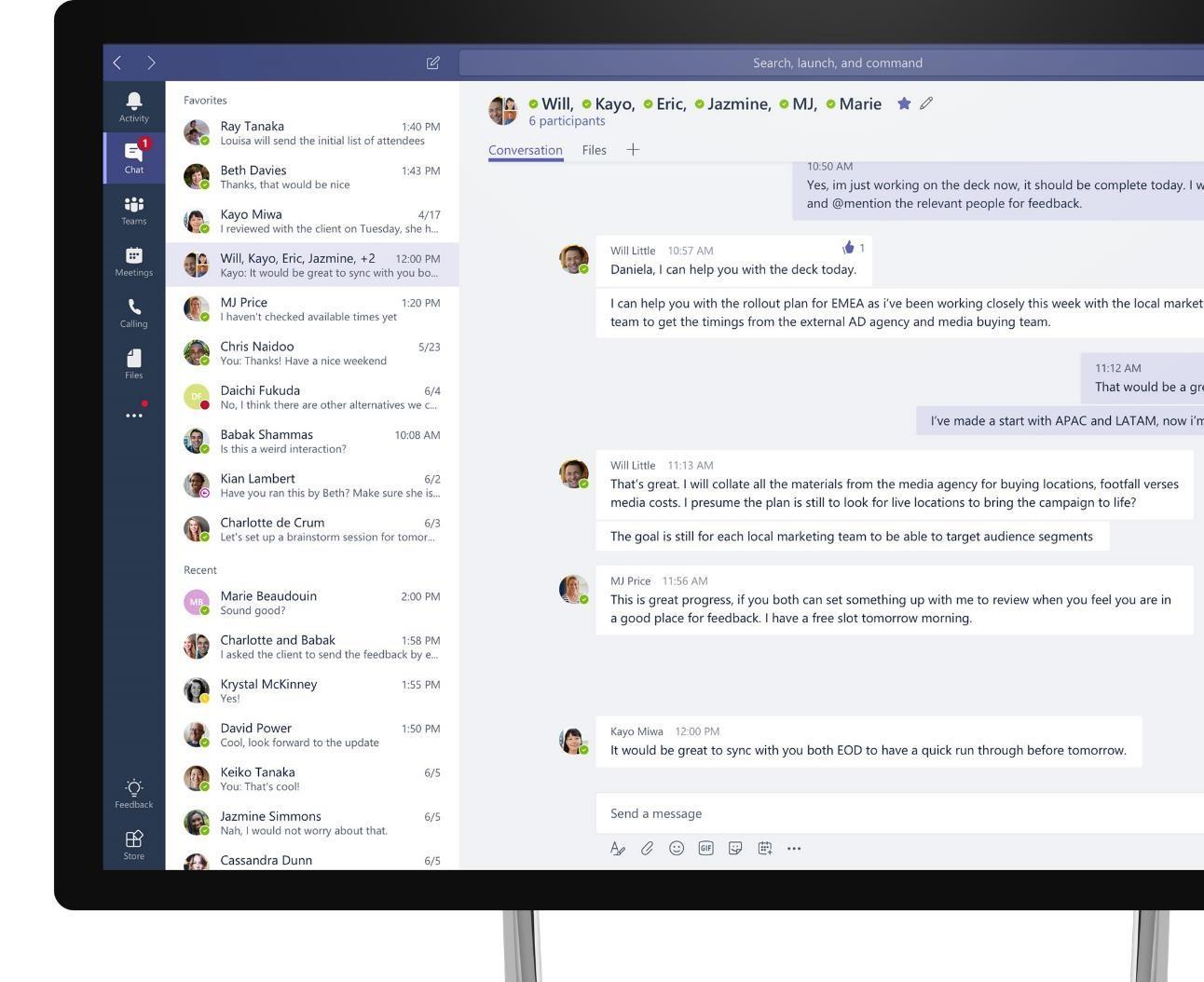

Communicate through chat, meetings & calls

Collaborate with deeply integrated Office 365 apps

Customize & extend with 3rd party apps, processes, and devices

Work with confidence enterprise level security, compliance, and manageability

“a technique of data science that helps computers learn from existing data in order to forecast future behaviors”

- Microsoft

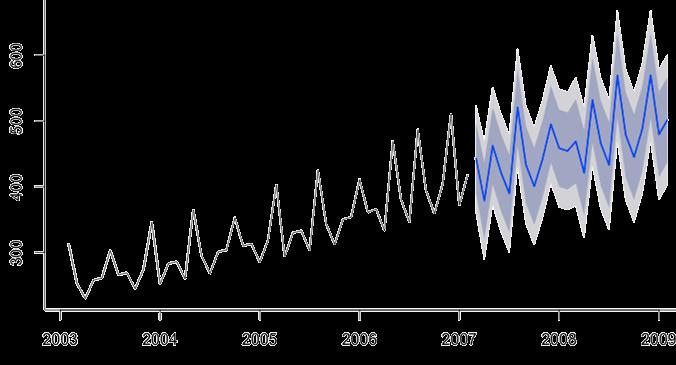

• Complex businesses: B2C and B2B, direct and channel, cloud subscription and software licenses, software and hardware

• Inconsistent definitions, processes, and reports

• Enterprise-wide forecast and consolidation system was spreadsheet-based

• Hundreds of analysts forecasted revenue for 80+ geographies, 8 customer segments, and dozens of product SKUs; 80% of their time compiling data

• Two-to-three week process was required to generate quarterly forecast

• Forecast accuracy was not meeting expectations; poor forecasting leads to P&L volatility

As we have continued to invest time and resources in harnessing the power of Machine Learning for forecasting, we have improved both accuracy and frequency and also had the following insights:

• ML forecasts require a continuous improvement system (new data sources, model refinement, etc.)

• Strong partnership with finance and data scientists with shared goal of accuracy is critical

• Finance has important business insights to help inform feature selection.

• Some one-time events cannot be learned by machine. Critical for business to judge the final forecast.

• The ability to explain results is crucial for adoption. We are spending time educating finance on machine learning.

• 98.4% accuracy with ML vs. 97.1% using traditional methods

Accuracy

• 1.6% mean absolute % error over 6 quarters

• 98.4% accuracy with ML vs. 97.1% using traditional methods

Efficiency

• Real-time, dynamic predictions

Frequency

Ability to respond within one day to requests for updated forecast within the quarter vs. several days in the past

“The machine-learning forecasts from Cortana Intelligence Suite enable us to combine core financial data with additional sources of information including macroeconomic factors, product launches, promotions and Bing search trends. With the improving machine-learning forecast accuracies it is becoming an integral part of our financial planning and budgeting process.”

Amy Hood

Executive Vice President and Chief Financial Officer

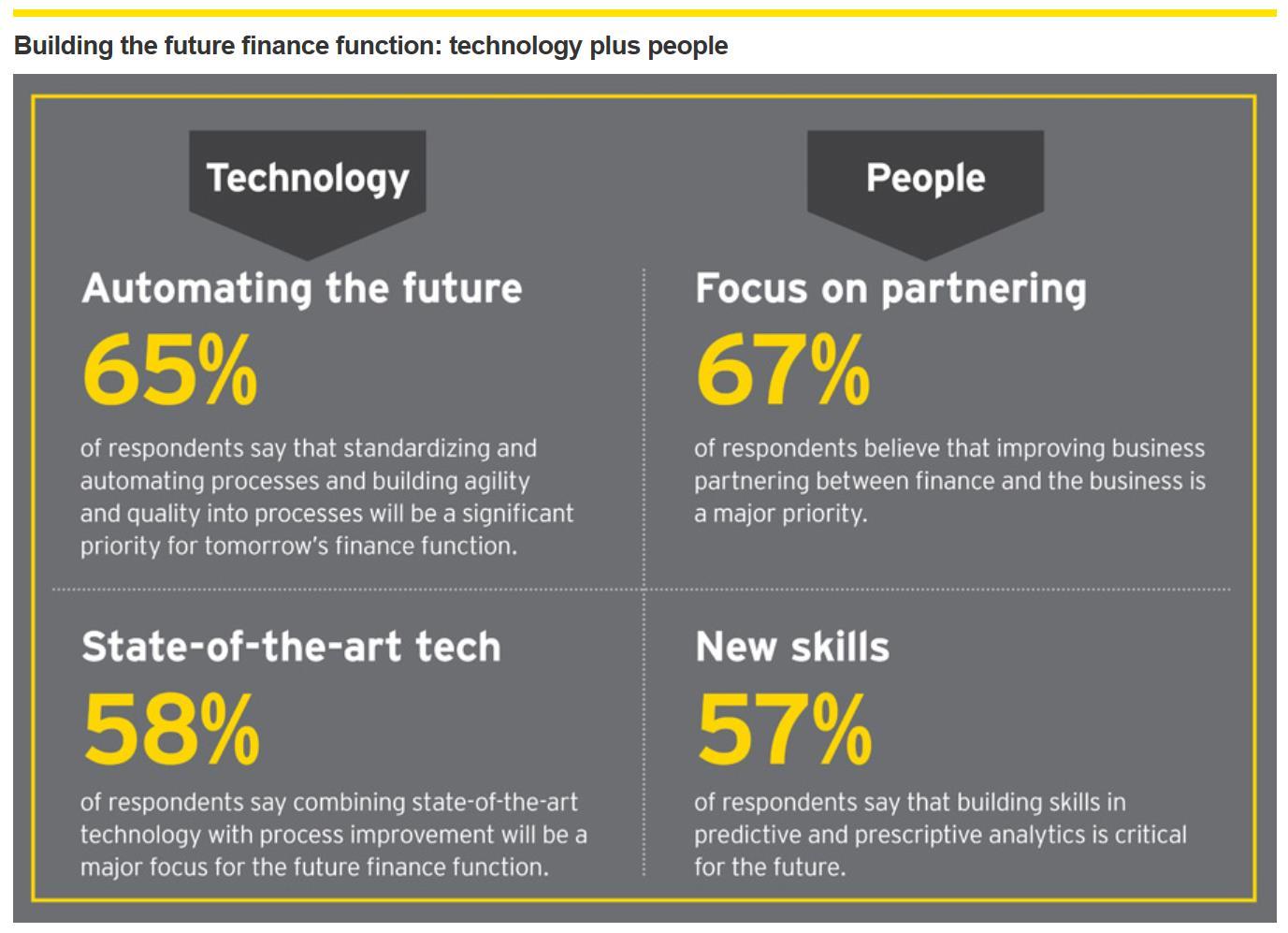

Innovations in IT are rapidly changing the role of Finance

New technologies are an enabler and a strategic asset for Finance organizations:

Drive efficiencies through process automation and productivity increase

Shift focus from accounting to data-driven, strategic decision making

People and people skills are key to the success of future Finance teams:

Communicative business partners with deep analytical knowledge

Tools that allow them to work in their preferred way (Work/Life flexibility)