2 minute read

WHAT’S IT COST?

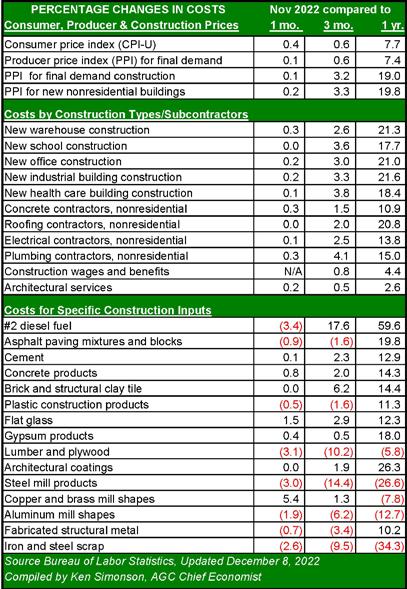

Aslowing economy and restrictive Federal Reserve Bank monetary policy are bringing the pace of inflation lower, according to the most recent reports from the Commerce Department. Consumer prices (CPI) were 7.7 percent higher in November 2022 than November 2021, a decline from the 7.9 percent pace of September. Core CPI – stripped of energy and food prices – was 6.3 percent higher year-over-year, lower than the 6.6 percent clip a month earlier. This evidence of disinflation was encouraging news for policymakers. The impact of slowing inflation has yet to be felt significantly in construction, although there were several optimistic shifts in trend. a difficult winter without consuming Russian oil and gas, but the end of winter, and potentially the war in Ukraine, means that supplies of oil will be higher. The slower global economy will demand less oil and gas. While the West cannot expect the politics of the major suppliers of oil to change and increase production, the constraints on demand should lead to lower prices. Among the construction materials seeing major declines in prices, steel (down 26.6 percent), copper (down 7.8 percent), aluminum (down 12.7 percent), and lumber (down 5.8 percent) fell the furthest. BG

November’s data showed a five-percentage point drop from the September peak in the producer price index (PPI) for new nonresidential buildings, from 24.1 to 19.8 percent year-overyear. That is likely the result of the lagged response of contractors’ bid prices during the month. Contractors have typically raised bid prices 12 months or so after material input prices escalate. A similar lag occurs when input prices fall. Input prices peaked in June 2021 and began to decline in March 2022. Similarly, the price squeeze on contractors – the period in which the increase in input costs exceeds the increase in bid prices – typically lasts two years. In the current cycle, the reversal in November followed a 19-month squeeze. The Bureaus of Labor Statistics November report on producer prices confirmed that peak of input and bid price inflation has likely passed. Moreover, November’s report showed that more inputs were declining month-to-month (although most were still higher than the year before by double-digits), meaning that the input escalation was confined to a few notable categories. Among these were flat glass (up 12.0 percent), cement (up 12.9 percent year-over-year), gypsum products (up 18.0 percent), architectural coatings (up 26.3 percent), and #2 diesel (up 59.6 percent). Diesel’s impact is, unfortunately, multiplied throughout the construction supply chain. Diesel is an oil derivative, as are asphalt, roofing, lubricants, and plastics. Diesel is the primary fuel used in construction equipment and in transportation, of which construction is a heavy consumer. Unlike in the winter of 2022, there are currently reasons for optimism about the price of diesel and oil. The European Union is enduring