Privacy

Guardian

Workforce

Create

Safety Stay

Schedule

St A ff Directory

Robert O’Koniewski, Esq. executive Vice President rokoniewski@msada.org

Jean Fabrizio Director of Administration jfabrizio@msada.org

Auto De A ler MAg A zine

Robert O’Koniewski, Esq. executive editor MSADA o ne McKinley Square Sixth f loor Boston, MA 02109

Subscriptions provided annually to Massachusetts member dealers. All address changes should be submitted to MSADA by e-mail: jfabrizio@msada.org

Auto Dealer is published by the Massachusetts State Automobile Dealers Association, inc. to provide information about the Bay State auto retail industry and news of MSADA and its membership. AD Directory complyAuto, 2 ethos group, 35 Marcum, 27 Merchant Advocate, 36 national grid, 25 ocD tech, 45 PlugStar/Plug in America, 33 reynolds & reynolds, 30 Sprague energy, 52 Withum, 55 ADVertiSing rAteS inquire for multiple-insertion discounts or full Media Kit. e-mail jfabrizio@msada.org

us on X at @MassAutoDealers

By Jeb Balise, MSADA President

I want to thank all our dealers who took the time out of your busy schedules to attend this year’s MSADA Annual Meeting on November 1 at the Encore Hotel and Casino in Everett. And for those who brought along a GM or another key manager, thank you doubly for that commitment.

From the feedback I have heard, you enjoyed a thought-provoking and engaging program with your fellow dealers with the support of our associate members as well.

I also extend my thanks on behalf of the Association to our Annual Meeting sponsors, who we have also recognized in this month’s issue.

And as always, my sincere thanks to Executive Vice President Robert O’Koniewski and Jean Fabrizio on our Association team who put together another fantastic event. We heard a lot of valuable information, ideas, and opinions in one of the most luxurious spots in the area.

moments when we are all in the same room are too few, and it is a crucial reminder that, while we compete day in and day out, we need to present a united front to face

the challenges coming at us from all directions.

Those moments when we are all in the same room are too few, and it is a crucial reminder that, while we compete day in and day out, we need to present a united front to face the challenges coming at us from all directions.

The uncertainties of those challenges were highlighted in the following week’s election results. As of this writing, the GOP secured control of the White House, with the return of the 45th President, Donald Trump, as now the incoming 47th, the U.S. Senate, and the House of Representatives. We can expect a different direction from the incoming administration on all matters related to our industry. The specifics of what that may entail will be interesting to find out.

Finally, November also represents the start of the holiday season when our commitment to community and family is enhanced. Dealers are a giving lot and the first to be called upon to help at food banks, community centers and shelters, and hospitals to assist the less fortunate in our cities and towns during the Thanksgiving, Christmas, and Hanukah seasons.

So many benefit from all you do in your hometowns, at your dealerships, and for your association throughout the year. I am looking forward to ending 2024 on a strong note as we prepare for an exciting 2025.

Barnstable County

Brad tracy, tracy Volkswagen

Berkshire County

Brian Bedard, Bedard Brothers Auto Sales

Bristol County richard Mastria, Mastria Auto group

Essex County

William Deluca iii, Bill Deluca family of Dealerships

Paul Bertoli, Priority chryslerJeep Dodge ram

Franklin County [open]

Hampden County

Jeb Balise, Balise Auto group

Hampshire County

Bryan Burke, Burke chevrolet

Middlesex County frank Hanenberger, MetroWest Subaru

Norfolk County

Jack Madden, Jr., Jack Madden ford charles tufankjian, toyota Scion of Braintree

Plymouth County

christine Alicandro, Marty’s Buick gMc isuzu

Suffolk County [open]

Worcester County

Steven Sewell, Westboro chrysler Dodge ram Jeep

Steve Salvadore, Salvadore Auto

Medium/Heavy-Duty Truck Dealer

Director-at-Large [open]

Immediate Past President

chris connolly, Jr., Herb connolly chevrolet

NADA Director

Scott Dube, Mcgovern Hyundai rt.93

OFFICERs

President, Jeb Balise

Vice President, Steve Sewell

Treasurer, Jack Madden, Jr.

Clerk, c harles tufankjian

ACV Auctions

Steve Sirko (856) 381-3914

ADESA

Elizabeth Morich (508) 270-5400

Albin, Randall & Bennett

Barton D. Haag (207) 772-1981

Allied Recycling Center

Joseph Castaneda (781) 316-7180

American Fidelity Assurance Co.

Kathleen Weisenbach (402) 523-5945

America’s Auto Auction Boston

Chris Colocousis (774) 218-8930

ArentFox LLP

Paul Marshall Harris (617) 973-6179

Sarah Decatur Judge (617) 973-6184

Armatus Dealer Uplift

Joe Jankowski (410) 391-5701

Assurant Dealer Services

Sean Skinner (603) 660-3647

Auto Auction of New England

Steven DeLuca (603) 437-5700

Bank of America Merrill Lynch

Dan Duda and Nancy Price (781) 534-8543

BCI Financial Corp.

Timothy Rourke (860) 302-7127

Bellavia Blatt

Leonard Bellavia (516) 873-3000

Broadway Equipment Company

Fred Bauer (860) 798-5869

Brown & Brown Dealer Services

Jason Bayko (508) 624-4344

Cambridge Trust

David Sawyer (617) 620-3484

CBIZ

Nichole Rene (203) 781-9690

CDK Global

Rob Steele (508) 564-1346

Clifton Larson Allen

Rick Parmelee (860) 982-9307

Cooperative Systems

Scott Spatz (860) 250-4965

Cox Automotive

Polly Penna (303) 981-1298

Creative Resources Group

Charlie Rasak (508) 726-7544

CVR

John Alviggi (267) 419-3261

Dave Cantin Group

Woody Woodward (401) 465-7000

Dealer Alchemist

Jeremy Wilson (804) 564-5740

Dealer Pay

Shannon Wischmeyer (636) 293-8038

Downey & Company

Paul McGovern (781) 849-3100

Andrew Prussack {631) 842-7549

Driving Dealer Performance

Kimberly Guerin (978) 760-0322

EasyCare New England

Greg Gomer (617) 967-0303

Electric Supply Center

Jennifer Williams (781) 265-4272

Ethos Group, Inc.

Drew Spring (617) 694-9761

F&I Direct

Sean Wiita (508) 414-0706

Michelle Salas (508) 599-0081

Federated Insurance

Kevin Sundberg (559) 547-9694

Fisher Phillips LLP

Joe Ambash (617) 532-9320

Jeff Fritz (617) 532-9325

Josh Nadreau (617) 532-9323

Freedom Solar Power

Ryan Ferrero (970) 214-4433

GW Marketing Services

Gordon Wisbach (857) 404-0226

Hilb Group

James Pietro (508) 791-5566

Huntington National Bank

Mark Flibotte (781) 724-3749

iHeart Media

Paul Kelley (757) 328-1431

JM&A Group

Chris “KC” Hwang (954) 415-6961

JM Electrical Co.

Christopher Cedrone (781) 581-3328

John W. Furrh Associates Inc.

Pamela Barr (508) 824-4939

Key Bank

Tom Flynn (716) 998-6247

KPA

Abe Cohen (503) 902-6567

M & T Bank

John Federici (401) 642-5622

McWalter Volunteer Benefits Group

Shawn Allen (617) 483-0359

Merchant Advocate, LLC

Dan Giordano (973) 897-2778

Mintz Levin

Kurt Steinkrauss (617) 542-6000

Murtha Cullina

Thomas Vangel (617) 457-4000

Nancy Phillips Associates, Inc.

Nancy Phillips (603) 658-0004

National Business Brokers

Peter DiPersia (603) 881-3895

National Grid

Nicole Caruso-Carlin (347) 426-6331

NEAD Insurance Trust

Charles Muise (781) 706-6944

Northeast Dealer Services

Johna Cutlip (401) 243-7331

OCD Tech

Michael Hammond (844) 623-8324

Performance Brokerage Services

Jacob Stoehr (847) 323-0014

Performance Management Group, Inc.

Dale Ducasse (508) 393-1400

Piper Consulting

Jim Piper (207) 754-0789

Plug In America

Joel Levin (237) 925-1364

Portfolio

J. Gregory Hoffman (800) 761-4546

Priority Payments Local

Andrew Pollina (732) 372-4352

Pullman & Comley LLC

James F. Martin, Esq. (413) 314-6160

Reynolds & Reynolds

Austin Ziske (802) 505-0016

Rockland Trust Co.

Joseph Herzog (508)-830-3241

Santander Bank

Richard Anderson (401) 432-0749

Chris Peck (508) 314-1283

Schlossberg, LLC

Michael O’Neil, Esq. (781) 848-5028

Shepherd & Goldstein CPA

Ron Masiello (508) 757-3311

Southern Auto Auction

Joe Derohanian (860) 292-7500

Sprague Energy

Steve Borelli (508) 768-5252

The Towne Law Firm P.C.

James T. Towne, Jr. (518) 452-1800

TrueCar

Lauren Bailey (703) 909-1625

Truist

Andrew Carmer (401) 409-9467

Twelve Points Wealth Management

Taylor Duffy (978) 318-9500

US Bank

Vincent Gaglia (716) 649-0581

Wells Fargo Dealer Services

Rich DeFreitas (857) 205-2780

Withum

Kevin Carnes (617) 471-1120

Zurich American Insurance Company

Steven Megee (774) 210-0092

By Robert O’Koniewski, Esq.

MSADA Executive Vice President

rokoniewski@msada.org

Follow us on X (formerly Twitter) • @MassAutoDealers

Each year probably the most important event for your Association is our Annual Meeting of the Members. At that time, our member dealers and associate members convene as a group and set aside their competitive spirits for a few hours. We do this to listen to a roster of interesting speakers offering varied perspectives on our industry and the current political atmosphere. We also enjoy the camaraderie of our fellow businessmen and women facing the shared challenges today’s economic and political climates present to us. For this one event, we all can truly say we are united as a body to promote the franchised auto dealer system.

On Friday, November 1, your Association convened its Annual Meeting at the Encore Boston Harbor Hotel and Casino in Everett – a fantastic venue that matches the quality and allure of its sister facility in Las Vegas.

This year we had a successful turnout of members, and attendees heard from a diverse group of speakers, including:

• Your MSADA President, Jeb Balise;

• Massachusetts NADA Director Scott Dube;

• Lt. Governor Kim Driscoll, our featured speaker;

• Mark Strand, Senior Director, Economic and Industry Insights, at Cox Automotive, provided an economic outlook for the short- and long-term situations;

• The Registrar of Motor Vehicles, Colleen Ogilvie, provided an update on current happenings at the RMV and answered questions from dealer attendees regarding various matters. RMV COO Niren Sirohi and EVR Director Liz Rizzuto also spoke;

• Shean Kirin, Founder/CEO, Dealer Alchemist, presented on “Revitalize Your Reach – A Proactive Marketing Strategy for Auto Dealers”;

• Jeff Latessa, Stakeholders Liaison Officer for the IRS, and John Fitzmaurice, Mass. MOR-EV

Program Outreach Specialist for Dealerships, did a joint presentation, “Tax Incentives for Clean Vehicles”;

• Don Giordano, Business Development, Merchant Advocate, with whom MSADA has an executed endorsement agreement for assisting dealers in addressing credit card costs and fees;

• Richard Parmelee, CPA, Principal at CliftonLarsonAllen, presented on “Upcoming Tax Law Changes – Start Your Planning Today”;

• Shawn Allen of McWalter Benefits Group, spoke on “Reducing Health Care Costs at Your Dealership”;

• Steve Borelli, energy portfolio manager at Sprague Energy, an MSADA endorsed partner, presented on “Take Control of Your Dealership’s Energy Costs”;

• Ryan Ferrero, solar energy expert on auto industry electrification at Freedom Solar, spoke on “Micro-Gridding Your Dealership”; and

• I gave a government affairs report on several legislative and regulatory matters dealers should be aware of for the end of 2024 and heading into 2025. Following the meeting, attendees adjourned to our cocktail reception sponsored by Downey & Company to refresh and rejuvenate before hitting the Encore’s restaurants and gaming tables. We cannot have such successful events without the strong support of our sponsors. We owe a huge “thank you” to this year’s event sponsors:

• ACV Auctions – Bronze Sponsor

• Arent Fox Schiff – Gold Sponsor

• Armatus Dealer Uplift – Silver Sponsor

• Bank of America – Platinum Sponsor

• Cambridge Trust – Bronze Sponsor

• CliftonLarsonAllen – Platinum Sponsor

• Cooperative Systems – Silver Sponsor

• Cox Automotive – Platinum Sponsor

• CVR – Welcome Gift Sponsor

• DealerPay – Silver Sponsor

• Downey & Company – Cocktail Reception Sponsor

• GW Marketing Services – Bronze Sponsor

• Huntington Bank – Silver Sponsor

• McWalter Volunteer Benefits Group –Bronze Sponsor

• Merchant Advocate – Gold Sponsor

• Murtha Cullina LLP – Break Station Sponsor

• OCD Tech – Bronze Sponsor

• Performance Brokerage Services – WiFi Sponsor

• Reynolds & Reynolds – Silver Sponsor

• Santander – Silver Sponsor

• Sprague Energy – Platinum Sponsor

• TrueCar – Diamond Sponsor

• Withum – Gold Sponsor

• Zurich – Welcome Reception Sponsor

Check out more from our annual meeting on page 16.

Tuesday, November 5 – Election Day –the day which would decide who would occupy the White House for the next four years and which party would control the U.S. House of Representatives and Senate for the next two. Pundits were predicting toss-ups on all three.

Come dawn of the following morn, clarity emerged to show that the 45th President of the United States – Donald Trump – was to become the 47th President of the United States, with the Senate flipping to Republican control, as the GOP picked up four Democrat-held seats and lost no sitting incumbents on the way to a 53-47 majority. The House, on the other hand, took a little bit longer to figure out, as the GOP held onto a lead – albeit a continuation of the current thin margin – to eventually get past the 218-hump needed to secure claim on the Speakership.

Here in Massachusetts, Sen. Elizabeth Warren vanquished her Republican opponent, and all nine House Democrat representatives were returned to office, seven of them not facing any opposition on election day.

As for our State House, all 200 seats –160 House and 40 Senate – were on the

November 5 ballot. But what is becoming a national embarrassment, Massachusetts voters were presented with the least competitive electoral prospects in the country for the fifth consecutive election cycle, and in six out of the last eight, based on an analysis conducted by Ballotpedia.

Given the lack of competition, the Democrats were in no danger of losing their super-majority in either chamber. (The Democrats presently hold the corner office; Gov. Maura Healey does not stand for re-election until 2026.) Democrats were on the ballot in 38 out of 40 Senate districts and 142 out of 160 House districts this time around, while Republicans challenged only 13 Senate districts and 47 House districts. Just 29 House districts and 11 Senate districts featured both a Democrat and a Republican, a 20 percent rate that was the lowest in the country.

One contributing factor to the lack of overall GOP challengers was strategic – a financially strained state GOP focused its resources on a number of specifically targeted seats in which it believed to have a real chance of winning.

To a degree that strategy paid off as the GOP Senate caucus grew to five as Kelly Donner beat Joe Pacheco in an open Taunton-based Senate district that was held by a Democrat for over 25 years. Two sitting GOP incumbents won re-election, including Peter Durant who flipped an open Democrat seat earlier this year in a special election. The other two GOP senators ran unopposed.

On the House side, after all is said and done, the chamber mix will remain the same – 134 Democrats, 25 Republicans, and one independent. However, as no sitting GOP incumbent lost, two Democrats did claim victory in open House seats currently held by retiring Republicans, and two other GOP candidates won in districts now or recently held by Democrats. One of the Republican wins included a victory over long-time incumbent Rep. Patricia Haddad, who several years ago once served as the Speaker Pro Tempore under former House Speaker Robert DeLeo.

Once all the counting was complete, the Massachusetts GOP chairwoman was hap-

py to point out that, with the party flipping three Democrat seats this time around, in the previous 40 years only one GOP candidate had turned a legislative district during a presidential election: William Crocker won a House seat on Cape Cod in 2016 which had been a Democrat seat for 20 years.

As for the man who will retake the country’s helm on January 20, 2025, Trump, like he did in every county around the country, expanded his share of the vote throughout the Commonwealth. Where Vice President Harris fell short of President Biden’s numbers from 2020, Trump received about a half-million more votes to increase his share to 36.4 percent, including leading in at least 80 of the state’s 351 cities and towns.

According to The State House News Service, “Much of Trump’s support here came from Southeastern Mass., Hampden County, and the semicircle of towns to the south and west of Worcester. The town that leaned most heavily in Trump’s favor was Acushnet, where about 72 percent of the more than 8,000 voters there supported the Republican.

“Between his 2020 defeat and this year’s national victory, Trump appears to have improved his standing with voters in practically every Massachusetts city and town. In Boston alone, the Republican went from 15.38 percent support in the 2020 contest to 20.4 percent support in 2024, according to the AP. His vote share also increased this year in the four next most populated municipalities: Worcester (from 29.4 percent in 2020 to 34.8 percent this year), Springfield (from 24.93 percent four years ago to 32.2 percent in 2024), Cambridge (from 6.39 percent in 2020 to 8.6 percent in 2024), and Lowell (from 31.67 percent in 2020 to 37.2 percent in 2024).

“Trump also appears to have flipped nearly two dozen Massachusetts towns he lost in 2020, including a cluster around Worcester (Sutton, Uxbridge, Webster, Millbury, Northbridge, West Brookfield, Rutland, Barre, and Hardwick), a pair of towns in northern Worcester County (Athol and Orange), a grouping of South Shore towns (Hanover, Pembroke, Rockland, Whitman, Bridgewater, and Raynham), and a few on

the South Coast (Fall River, Westport, and Somerset). North of Boston, Trump flipped Saugus, Lynnfield, and Salisbury into his column from four years ago.

“Harris performed best in Suffolk and Middlesex counties, racking up 76.9 percent of the votes cast in Boston, 87.6 percent from Cambridge, and 84.4 percent in Somerville. Cape Cod also went for the Democrat, with support ranging from as much as 91.4 percent in Provincetown to a more narrow 51.9 percent support in Bourne. The college towns of Hampshire County and rural towns of Franklin County also voted overwhelmingly for the Vice President, with Harris taking 87.9 percent of the vote in Amherst and 85.2 percent in Northampton.”

Finally, Massachusetts voters decided five ballot questions:

• Question #1: State Auditor’s authority to audit the Legislature – Approved

• Question #2: Elimination of MCAS as high school graduation requirement –Approved

• Question #3: Unionization for transportation network drivers – Approved

• Question #4: Limited legalization and regulation of certain natural psychedelic substances – Rejected

• Question #5: Regulating how tipped service workers were to be paid minimum wage – Rejected

Here is a list of the incoming legislators – three new senators-elect and 19 new representatives-elect – for the 2025-2026 session starting on January 1 (based on information from The State House News Service):

• Kelly Dooner (R), Taunton: A Taunton City Councilor, Dooner won a close Senate race to flip the district held for more than three decades by retiring Democrat Sen. Marc Pacheco. She will become the first Republican woman in the Massachusetts Senate since Jo Ann Sprague, who left office in 2004. Dooner said she wants to reduce the state’s 6.25 percent sales tax to 5 percent, opposes open road tolling, and sharply criticized the state’s approach to sheltering migrants.

• William Driscoll (D), Milton: Driscoll is one of two state representatives who

will move down the hall for the new term. He spent four terms in the House, and currently co-chairs the Joint Committee on Emergency Preparedness and Management. Driscoll won a three-way Democratic primary for the open Senate seat, which Sen. Walter Timilty (D) is vacating and then did not face an opponent in the general election.

• Dylan Fernandes (D), Falmouth: Like Driscoll, Fernandes joined the House in 2017, and like Driscoll, he is now trading that job for the Senate. He defeated a Republican colleague, Rep. Mathew Muratore, to keep in the Democrat column the Senate district currently represented by departing Sen. Susan Moran. Fernandes spent this term as Vice Chair of the Legislature’s Environment and Natural Resources Committee.

• Michelle Badger (D), Plymouth: Badger’s win was one of four partisan seat flips in the House, which effectively canceled each other out and left the chamber with the same Democrat-Republican split (134-25-1) as the beginning of the current term. She beat Republican Jesse Brown in the race to succeed GOP Rep. Mathew Muratore. Badger chairs the Plymouth School Committee, and she works as Vice President of institutional advancement at Massasoit Community College. Her priorities include making higher education more affordable, creating more housing units, and expanding access to mental health care.

• Leigh Davis (D), Great Barrington: The westernmost communities of Massachusetts have a new state representative for the first time in more than two decades. Davis defeated independent candidate Marybeth Mitts and will succeed Rep. Smitty Pignatelli of Lenox, who first joined the House in 2003. She’s a member of Great Barrington’s Select Board, and she works as communications director at affordable nonprofit Construct. Before she settled in Massachusetts, Davis was a film and television editor in Los Angeles and department chair of the film and television program at the Galway-Mayo Institute of Tech-

nology in Ireland. She pledged to fight for improvements to boost housing affordability and transportation connections, including East-West Rail, and to invest in renewable energy and decarbonization efforts.

• Dennis Gallagher (D), Bridgewater: In another flip, Gallagher eked out a win over Republican Sandra Wright for the district now held by retiring GOP Rep. Angelo D’Emilia. The U.S. Navy veteran works as director of the town of Braintree’s retirement system, and he previously served as a town councilor in his hometown of Bridgewater. On his campaign site, Gallagher said he would not focus on “partisan politics,” and listed unspecified changes to the so-called right to shelter law and more funding for roads, bridges, and sidewalks as priorities.

• John Gaskey (R), Carver: Alongside Tara Hong, Taskey is the only other representative-elect to unseat an incumbent. In the September primary, he defeated Rep. Susan Williams Gifford, who died October 22 from cancer. A Coast Guard veteran, Gaskey made immigration the central theme of his campaign, saying on his website he wants to direct local law enforcement to cooperate with federal immigration authorities, “end the sanctuary status of Massachusetts and return our shelters back to its veterans and citizens.”

• Homar Gomez (D), Easthampton: Gomez is one of the two newcomers with a route to the Legislature that essentially could not have been easier: he was the only candidate to make the ballot in both the primary and general elections. Gomez, who will succeed Rep. Daniel Carey, was first elected to the Easthampton City Council in 2017, and he has been the council president since 2022. He was born and raised in Puerto Rico. His top issue areas are economic growth and job creation, education and youth development, health care, and “environmental stewardship.”

• Tara Hong (D), Lowell: Hong will enter the Legislature with two accolades: at the age of 24, he will become the youngest member of the House, and he is one of only two newcomers to defeat a sitting in-

cumbent en route to the 2025-2026 term. The Lowellian defeated Rep. Rady Mom in the primary, and he cruised against unenrolled candidate David Ouellette in the general election. Hong pledged during the primary cycle to prioritize constituent services and to increase transparency on Beacon Hill, including by making all votes public records.

• Hadley Luddy (D), Orleans: Similar to Gomez, Luddy strolled to his House win without even encountering an opponent. She spent the past eight years as CEO of the Homeless Prevention Council on Cape Cod, during which the organization grew fivefold to support more than 2,300 local residents with housing needs, according to her campaign. Luddy also chairs the Barnstable County Regional Network on Homelessness Policy Board, and she previously worked for Big Brothers Big Sisters of Cape Cod & the Islands and Community Connections. She described housing as the “number one threat to the financial stability of our community,” and also called for action to boost access to affordable child care, improve wastewater infrastructure, and expand clean energy options.

• Thomas Moakley (D), Falmouth: Moakley held for Democrats the House district that Fernandes gave up to challenge for Senate. He is an Assistant District Attorney for the Cape and Islands and has prosecuted cases in Martha’s Vineyard Juvenile Court and Edgartown District Court. Moakley said on his campaign site that he is “particularly proud” of working with District Attorney Rob Galibois to establish the Vineyard’s first Recovery Court, “which addresses the root cause of repeat offenders struggling with addiction and represents a holistic approach to public safety.” After defeating Arielle Reid Faria in the primary, Moakley did not face an opponent in the general election.

• Bridget Plouffe (D), Brockton: Plouffe won a three-way race for the seat that her longtime boss, Democrat Rep. Gerard Cassidy is giving up. She began working for Cassidy in 2016 as an aide and rose to chief of staff. Now, she is chief of staff

for the Veterans Affairs Committee that Cassidy co-chairs. One of her self-described top priorities is reinforcing the state’s health care system, and Plouffe warned that her region has been “ground zero” for upheaval following the temporary closure of Brockton Hospital and the Steward Health Care collapse. “If elected I plan to get to work right away to figure out a plan to ensure that what has happened with Steward cannot happen again while also ensuring that Boston Medical Center, the new owner of Good Samaritan, is accountable to the local residents who depend on their care,” she wrote.

• Sean Reid (D), Lynn: Reid is familiar with Beacon Hill: he works as legislative director for Sen. Brendan Crighton of Lynn. Now, he will get a chance to represent most of Lynn and all of Nahant himself after winning a Democratic primary and cruising through the general election with no opponent. Reid is a member of the Lynn School Committee, and he also serves on the boards of the YMCA of Metro North and My Brother’s Table. Some of his priority topics are housing and public transportation, climate and coastal resiliency, and addressing the opioid crisis.

• Amy Sangiolo (D), Newton: Sangiolo is one of two former Newton City Councilors who are about to join the Legislature. She spent 20 years on that elected panel, and, in 2022, she co-founded the community news platform Fig City News. Sangiolo now works in the attorney general’s office assisting Bay Staters facing eviction and foreclosure. After a landslide win in the primary, Sangiolo easily defeated Republican Vladislav Yanovsky in the general. She identified housing, public transportation, gun violence prevention and criminal justice, among others, as top areas of focus.

• Greg Schwartz (D), Newton: Another former Newton City Councilor, Schwartz spent eight years on the panel, partly overlapping with his now soon-to-be-legislative colleague Sangiolo. He has been a primary care physician for nearly 25 years and points out that he will be the only medical doctor in the Legislature. Schwartz topped a three-way Democrat-

ic primary to succeed Rep. Ruth Balser, whose endorsement he earned, and then did not have a general election opponent.

• Ken Sweezey (R), Pembroke: Sweezey will give the Sixth Plymouth District its first House representation in nearly a year, and its first Republican in more than a decade. He defeated Democrat Rebecca Coletta to flip the district last represented by Rep. Josh Cutler, who resigned from the House seat in February to take a job in the Healey administration. Sweezey worked as a fingerprint examiner for the St. Louis Metropolitan Police Department and now works at a local biotech company, SPT Labtech. Sweezey touted a plan to rein in state spending on shelters by creating a residency requirement, and he argued that the MBTA Communities Law “poses a threat to many of our communities.”

• Mark Sylvia (D), Fairhaven: Sylvia, who won the race to succeed longtime South Coast Rep. William Straus, will arrive with experience in the public sector. He spent four years as town manager in Plymouth and served as an energy undersecretary in the Patrick administration. For the past nine years, he has worked at solar and battery storage developer BlueWave, first as managing director and then as chief of staff. He highlighted affordability concerns as a major issue plaguing families across the state, and said he would work to protect reproductive rights.

• Josh Tarsky (D), Needham: Tarsky’s resume stretches across the military, education, and legal worlds. He works today as principal of the Holbrook Middle-High School, and he is also a judge advocate general (JAG) for the Massachusetts National Guard. Soon after the September 11, 2001, terrorist attacks, Tarsky joined the U.S. Army and received honors for his service in Operation Enduring Freedom. He will succeed Rep. Denise Garlick in the House. Tarsky’s priorities include allowing districts to ban cellphones in schools, boosting incentives for using public transit, providing developers with incentives to build new green, middle-class housing, and “improving political discourse.”

• Justin Thurber (R), Somerset: In one of the biggest Election Day surprises, Thurber toppled 12-term Rep. Patricia Haddad (D) to flip the district that grazes the Rhode Island border. Thurber is an Air Force veteran whose top priorities include immigration, “parental rights in education and health decisions,” and education. He also campaigned aggressively against the onetime Speaker Pro Tempore -- his website has a tab titled “Haddad’s voting record.”

• Richard Wells (D), Milton: When Rep. Driscoll shifts to the Senate, Wells will step into his House seat. He will add to the Legislature’s law enforcement ranks after spending more than three decades with the Milton Police Department, including nine years as its chief. Wells has been a member of the Milton Select Board for seven years and has served as its chair since May.

• Michael Chaisson (R), Foxborough: Chaisson won one of the closest races this cycle, appearing to edge out Democrat Kostas Loukos to keep the seat being vacated by Rep. Jay Barrows in Republican hands. He owns Chaiss Construction, which focuses on residential remodeling, and sits on Foxborough’s Advisory Committee, which provides reports to Town Meetings about budgetary items and other municipal issues. Chaisson during his campaign called out “rising costs and reckless spending on Beacon Hill,” and listed the state’s response to a sharp increase in migrants seeking shelter here as one of his top priorities.

• Steven Ouellette (D), Westport: [Recount Pending] Ouellette, who is currently Vice Chair of the Westport Select Board, emerged from the most crowded field of the general election by narrowly defeating Republican Christopher Thrasher and three independent candidates. But there is still a chance the outcome changes: down by 143 votes, Thrasher said he plans to pursue a hand recount in the Eighth Bristol District’s five communities. They’re vying for an open district held by Rep. Paul Schmid, who opted against seeking reelection.

When the Legislature completed its formal sessions well past the midnight deadline of July 31 this year, it had not taken action on at least 10 of a dozen major matters still on its plate, incurring the wrath of the media, citizens groups, and advocacy organizations who had vested interests in those items. •

Deciding to ignore its own rules, legislative leaders in both chambers decided to set aside their differences and work on these lingering bills to seek some level of common ground that could be approved and sent to the Governor. It was an ambitious plan, given that the Legislature would need to suspend various rules and come back into session to hold roll calls to pass any controversial bills, but made easier by a lack of a substantial GOP caucus that really could do very little to derail any legislative effort.

Internal negotiations took place throughout the Summer and past the September 9 primary election. In the end, one legislative piece of interest to us did emerge – the House and Senate cobbled together a 319page Economic Development conference committee agreement which includes the creation of a 14-person advisory board, including a member selected by MSADA, to review the auto body labor rates matter and report its findings and recommendations to the Legislature and the Division of Insurance by December 31, 2025.

Dealers with auto body shops have suffered for decades from a repressed reimbursed labor rate at the hands of the insurance companies for insurance-paid repairs. We have been a part of two special legislative commissions that reviewed this issue, the most recent completed its work in April 2022. During the 2022 and 2023 budget processes, Senate language supporting the body shops did not make it through budget conference committees.

This time around, the Senate language has stuck. The legislation – section 292 of House 5100 – has been sent, on November 15, to the Governor, who has ten days to review the bill and sign it. We will keep you posted as developments occur.

& NCDPAC

We appreciate the contributions we receive from our member dealers who answer our calls for donations to our PACs.

Each year MSADA expresses itself politically through NADA’s federal PAC, NADAPAC, and through our state PAC, the New Car Dealers Political Action Committee (NCDPAC). We depend on contributions from our dealers to keep these PACs strong, as we need to have an active voice in Washington and on Beacon Hill. Contributions to our PACs are an inexpensive insurance policy. Since by law we cannot use our membership dues or other association revenues for political contributions, the PACs help us to remain strong politically as we advocate for our dealers’ interests in the political process.

Even though we are past Election Day, legislators will continue to hold fundraisers through to the end of the year, either to pay off campaign debts or squeeze out dollars not yet donated in the calendar year. Since their requests never cease, neither will our PAC fundraising.

If you have not yet given to the PACs this year, please contact me at rokoniewski@msada.org and we can make sure your contributions happen. Thank you.

Our “Coffee with Coopsys” webinar series from our associate member, Cooperative Systems, continues with our next instalment on December 10. Coopsys works with businesses to increase their IT knowledge and understanding. The “Coffee with Coopsys” program is a series of brief webinars we provide to our members to expand upon and improve their experiences regarding IT issues and dealership best practices.

Our final “Coffee” webinar for 2024 is scheduled for Tuesday, December 10, at 10:00 a.m.: What Is A CISO And Why Does My Dealership Need One?

You can register at https://coopsys.com/ msada/.

S151

H331

H290

H329

S204

H270

H289

S150

H351

Sen Crighton Rep Hunt

Rep Finn

Rep Howitt

Sen O’Connor

Rep Chan

Rep Finn

Sen Crighton

Rep Lewis

Amendments to Ch. 93B, the auto dealer franchise law.

RTR law amendments to fix Model Year start date and consumer notice.

Creates process to appeal improperly issued Class 1 license.

Modernize on-line vehicle purchase process.

S199 Sen Moore Amends definition of heavy-duty trucks in RTR law.

S220 H400 Sen Velis Rep Walsh Open safety recalls notifications.

H354 Rep Linsky Allows an OEM to open a factoryowned store, without a dealer, if there is no same line-make dealer in the state.

(The so-called “Tesla Exemption.”)

Joint Committee on Consumer Protection held public hearing on July 17, 2023; placed into study.

Joint Committee on Consumer Protection held public hearing on July 17, 2023; placed into extension order.

Joint Committee on Consumer Protection held public hearing on July 17, 2023. H270 reported favorably on Jan. 25, 2024; sent to House Ways and Means.

Joint Committee on Consumer Protection held public hearing on July 17, 2023. H351 reported favorably on Jan. 25, 2024; sent to House Steering & Policy Committee; House ordered to third reading on 2/12/24.

SUPPORT Joint Committee on Consumer Protection held public hearing on July 17, 2023; placed into extension order.

SUPPORT Joint Committee on Consumer Protection held public hearing on July 17, 2023. Redraft H4277 reported favorably on January 25, 2024; sent to House Ways and Means.

OPPOSE Joint Committee on Consumer Protection held public hearing on July 17, 2023; placed into study.

S688

H1095

H1118

S639

H1121

H995

Sen Moore

Rep McMurtry

Rep Philips

Sen Feeney

Rep Puppolo

Rep Donahue

Creates process to increase the insurance reimbursed labor rate paid to auto body repairers.

Protects consumer choice in vehicle service contracts.

S2219 H3255 Sen Cronin Rep Arciero Eliminates initial state inspection for new vehicle.

Joint Committee on Financial Services held public hearing on October 3, 2023; reported redraft H4412 favorably and sent to House Ways and Means.

Joint Committee on Financial Services held public hearing on October 3, 2023; H995 reported favorably and sent to House Steering & Policy Committee.

SUPPORT Joint Committee on Transportation held public hearing on Jan. 24, 2024; placed into study.

H3348 Limit doc prep fee amounts. OPPOSE Joint Committee on Transportation held public hearing on Jan. 24, 2024; reported favorably and sent to House Ways and Means Committee. Rep Howitt

S2210

Sen Crighton

Sen Creem Rep Carey

Safety shutoff for keyless ignition technology.

Joint Committee on Transportation held public hearing on October 17, 2023; reported favorably.

S25 H60 Personal data privacy and security. OPPOSE Joint Committee on Advanced Information Technology, the Internet and Cybersecurity held public hearing on October 19, 2023. On 5/13/24, Committee reported redrafts S2770 and H4632 favorably; each sent to respective Ways and Means committee.

S227 Sen Finegold Mass. Info Privacy & Security Act. OPPOSE Joint Committee on Economic Development and Emerging Technologies held public hearing on October 19, 2023. Bill sent to AITIC Committee on November 2, 2023.

S171 H311 Sen Feeney Rep Gonzalez Protect consumers in auto transactions. OPPOSE Joint Committee on Consumer Protection held public hearing on July 17, 2023; reported S171 favorably on 1/25/24 and referred to Senate Ways and Means. SWM reported redraft S2736 favorably on 4/22/24. Senate engrossed on 4/25/24.

Following a casual luncheon sponsored by Zurich to start the day, MSADA President Jeb Balise and MSADA Executive Vice President Robert O’Koniewski kicked off the speakers’ lineup highlighted by a keynote address from Massachusetts Lieutenant Governor Kim Driscoll.

Gathered in the Picasso Rooms of the Encore Hotel and Casino in Everett on November 1, your MSADA, celebrating its 84th year representing franchised new-car and truck dealers, convened its Annual Meeting of the Members that included a slate of speakers representing all facets of the auto industry.

MSADA Executive Vice President

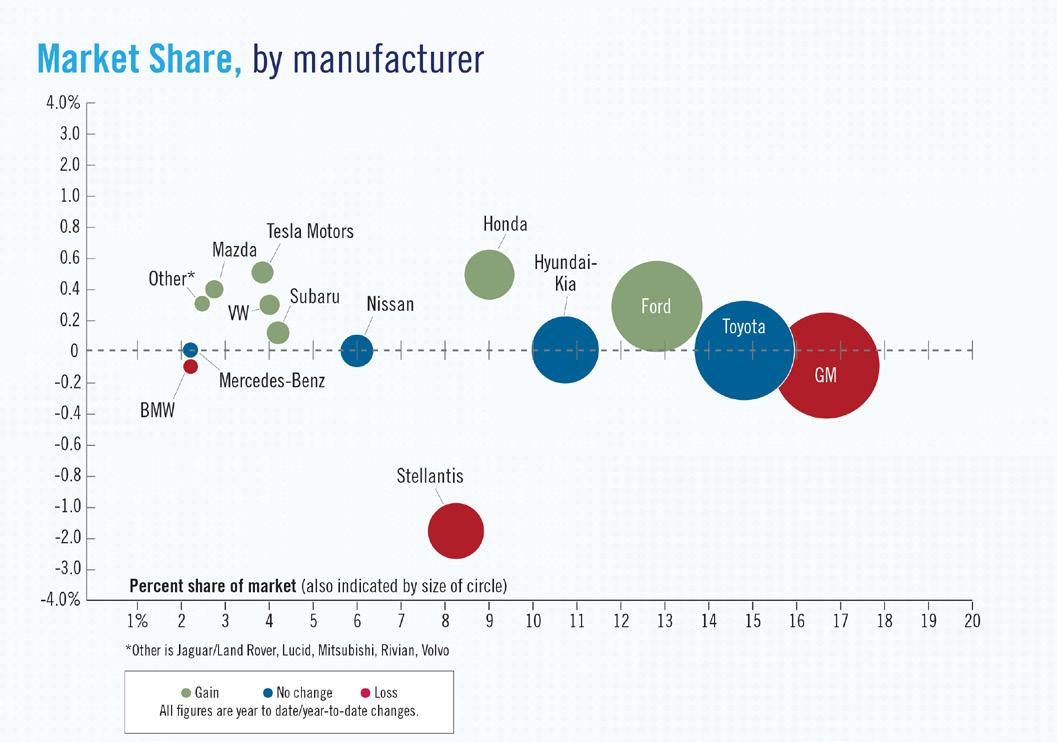

vehicle MaRKet uPDate anD

OutlOOK

Mark Strand

Cox Automotive – Senior Director, Economic and Industry Insights

naDa RePORt

Scott Dube

McGovern Hyundai Rt. 93, Massachusetts

NADA Director

Revitalize YOuR

Reach – a PROactive MaRKeting

StRategY fOR autO DealeRS

Shean Kirin Founder/CEO – Dealer Alchemist

uPcOMing tax law changeS – StaRt YOuR Planning tODaY”

Richard Parmelee

CPA – Principal, CliftonLarsonAllen

tax incentiveS fOR clean vehicleS

Jeff latessa

IRS – Stakeholders Liaison Officer

John fitzmaurice

Mass. MOR-EV Program, Dealership Outreach Specialist

RMv uPDateS

colleen Ogilvie Registrar, Massachusetts Registry of Motor Vehicles

the Silent equitY

PaRtneR YOu neveR

Knew YOu haD

Don giordano

Business Development, Merchant Advocate

MaSSachuSettS lieutenant gOveRnOR

Kim Driscoll

MicRO-gRiDDing YOuR DealeRShiP

Ryan ferrero

Freedom Solar – National Director, Auto Industry

Electrification

taKe cOntROl Of YOuR DealeRShiP’S eneRgY cOStS

Steve Borelli Energy Portfolio Manager, Sprague Energy

ReDucing health caRe cOStS at YOuR DealeRShiP

Shawn allen Managing Principal, McWalter Benefits Group

The day concluded with cocktails and light fare sponsored by Downey & Company as a prelude to attendees’ hitting the Encore’s restaurants and gaming tables that evening.

DiaMOnD SPOnSOR TrueCar

PlatinuM SPOnSORS Bank of America

Clifton Larson Allen Cox Automotive Sprague Energy

gOlD SPOnSORS

Arent Fox Schiff Merchant Advocate Withum

SilveR SPOnSORS

Armatus Dealer Uplift

Cooperative Systems DealerPay

Huntington Bank

Reynolds & Reynolds Santander

BROnze SPOnSORS

ACV Auctions

Cambridge Trust

GW Marketing

McWalter Benefits Group

OCD Tech

welcOMe RecePtiOn SPOnSOR

Zurich

welcOMe gift SPOnSOR

CVR

BReaK StatiOn SPOnSOR Murtha Cullina

cOcKtail RecePtiOn SPOnSOR Downey & Co.

wi-fi SPOnSOR

Performance Brokerage Services

Ronald McDonald House of Springfield is holding its Fourth Annual Trees of Hope holiday celebration from November 8-22 at Gary Rome Hyundai in Holyoke.

Trees of Hope is a joyful fundraising event that provides vital support for the Ronald McDonald House of Springfield’s mission to bridge the gap between specialized medical care and children in need. Now in its thirty-third year, the Ronald McDonald House of Springfield continues to play a crucial role in facilitating access to essential medical treatment for children from near and far by providing lodging, meals, and daily essentials to families in need.

This year’s event showcases imaginative holiday trees, dream gifts, and displays generously donated by local businesses, individuals, and community organizations. The Gary Rome Hyundai showroom will be an amazing holiday wonderland. The event is a wonderful family holiday outing, and admission is free. Each display will be raffled off using an online system that allows both in-person and virtual participation.

“I’m so excited to welcome Trees of Hope back to the dealership,” says owner Gary Rome. “Ronald McDonald House of Springfield is an essential resource for families in need, especially during these challenging times. It is my hope that the community will join us in supporting this fantastic cause. After all, there’s no place like Rome for the holidays!”

Ronald McDonald House Charities of Connecticut and Western Massachusetts’ Chief Executive Officer, Michelle D’Amore,

says, “We are incredibly grateful to partner with Gary Rome and his team at Gary Rome Hyundai to ensure we continue serving every family that walks through our doors. We owe special thanks to our Presenting Sponsor, Hyundai Motor America, for their continued support of the Ronald McDonald House of Springfield.”

On October 21, Village Automotive Group’s Ray Ciccolo hosted a fundraiser for Gov. Maura Healey at his home in Lexington.

Country Nissan is proud to announce that Heather Petricevich has been honored as the Service Advisor of the Year for the Chris Collins Top Dog Award, recognized nationwide within the Asian League. Heather recently returned from Los Angeles, where she received this prestigious accolade, celebrating her exceptional customer service, expertise, and dedication to excellence in the automotive industry.

“I am truly humbled and honored to receive this award,” said Petricevich. “This achievement is a reflection of the incredible support from my team and the wonderful relationships I have built with our customers. I’m passionate about providing the best service possible, and I’m grateful to work in such a supportive environment at Country Nissan.”

Heather’s recognition highlights her commitment to fostering

Herb Chambers recently announced the grand opening of its newly relocated and enhanced Mercedes-Benz dealership. Strategically designed with customers in mind, the new location at 141 Boston Post Road, Rte. 20, Sudbury, is six miles away from its previous home and promises to elevate the luxury automotive experience to new heights.

The dealership’s modern, sophisticated aesthetics include contemporary architecture featuring sleek lines, glass facades, and high-end materials that mirror the qualities of the Mercedes-Benz brand. Customers enter the dealership into a spacious showroom meticulously crafted to highlight multiple vehicles, allowing ample room for exploration and an up-close view of the latest models.

Luxurious waiting areas offer premium seating, complimentary refreshments, and entertainment options such as large-screen TVs and Wi-Fi access. Interactive digital displays throughout the showroom present a dynamic way for customers to explore various Mercedes-Benz models, configurations, and advanced features. This location is the ultimate in comfort and convenience for all Mercedes-Benz enthusiasts.

tailored consultations, informative vehicle demonstrations, and customized financing options to meet each guest’s unique needs with precision and care.

The dealership’s climate-controlled service center is equipped with advanced diagnostic tools and technology,

Herb Chambers prides itself on personalized service for buyers interested in a wide range of inventory, including the latest models, AMG performance cars, or certified pre-owned vehicles. The dealership’s dedicated team members provide

strong relationships with customers, ensuring their needs are met with the highest level of professionalism and care. Her dedication has made a significant impact not only on her clients but also on the entire Country Nissan family.

“Our team is incredibly proud of Heather,” said Chris Moreno, Service Manager at Country Nissan. “Her hard work, dedication, and exceptional customer service set a benchmark for excellence in our industry. She embodies the values we strive for at Country Nissan, and her achievement inspires us all to continue raising the bar.”

By Brett Foote, Ford Authority

In recent years, with inventory dropping to near record lows and prices rising to record highs for years amid the COVID-19 pandemic, we’ve seen more than one longtime Ford dealer close

capable of handling maintenance and repair needs for both passenger vehicles. The dealership strategically features an expansive 3-lane drive-in service reception area that will provide a welcoming area equipped to cater to the needs of the dealership’s growing service clientele. Master Certified technicians who specialize in Mercedes-Benz vehicles, upholding the highest standards of service excellence, will be on-hand to overcome even the most complex repairs exhibiting a true passion for their craft.

up shop, unfortunately. That list includes Hillier Ford in Escalon, California, which shut down last year after 50 years in business, as well as Worthington Ford in Southern California, a famous and beloved Ford dealer that rose to fame thanks to its humorous advertisements. Now, another Ford dealer has shut down after a full century in operation, too.

That dealer is Sunnyside Ford in Holden, Massachusetts, according to Spectrum News 1, a business that just celebrated 100 years of operation back in March. Sunnyside originally opened up as a service shop for the Model T and other vehicles way back in 1923, and, one year later, became a full-fledged Ford dealer. Unfortunately, changing times recently prompted President Dan Harrington to make the difficult decision to close a business that’s lived under the care of three generations of family ownership.

“It’s definitely been more complicated in the last 10 years or so, but I’m 74, so it’s time to retire,” said Harrington. “I remember the times, you know, you get in the car, you turn the key and boom, you forget your left gear and nothing jumps forward. Well, now they won’t do that on you. A lot of safety features that are

great, some are a pain, I know a lot of people don’t like them, but they’re for the benefit of everybody.”

Thus, Sunnyside Ford won’t live on to see a fourth generation of ownership, it seems, as its last day of operation will be November 22. It’s a sad and unfortunate end to a century-old business, but as we’ve seen on numerous occasions over the past couple of years, changing times have prompted several others to make similar decisions as well.

Groups representing U.S. auto dealers said in October they plan to challenge a decision by Volkswagen’s Scout Motors to sell directly to consumers, bypassing independent retailers.

The National Automobile Dealers Association said it and state associations “will challenge this and all attempts to sell direct in courthouses and statehouses across the country.”

Scout had announced in mid-October it would join electric vehicle manufacturers like Tesla in forgoing a traditional independent dealer network in favor of directly selling and servicing vehicles, and it pledged full transparency on price and a speedy sales process.

Scout did not immediately respond to a request for comment.

NADA CEO Mike Stanton said the decision by VW “to attempt to sell Scout vehicles direct to consumers and compete with its U.S. dealer partners is disappointing and misguided, and it will be challenged.”

Scout Motors CEO Scott Keogh told Reuters that he expects the brand will have around three dozen U.S. retail centers when sales begin in 2027, eventually rising to 100. Other EV sellers like

Rivian and Lucid have direct sales models as well.

“I think it’s critical moving into the future in unstable environments to control your customer, control your margin, control your operational excellence,” Keogh said, referring to the direct sales plan.

State laws bar automakers with independent dealer networks from selling directly to consumers. Tesla has sued Louisiana, challenging its ban on direct vehicle sales to consumers.

Scout plans to begin producing up to 200,000 EV trucks and SUVs annually starting in 2027 from its $2 billion South Carolina plant, which is under construction. The automaker disclosed that it will offer extended-range variants that include a small gasoline engine.

Bloomberg News

Toyota Motor Corp.’s North American chief operating officer criticized the US’s policies promoting speedy adoption of electric vehicles, calling them “de facto mandates” out of sync with consumer demand.

Noting government support for EVs has been a hotly debated issue in the US presidential election, Toyota North America COO Jack Hollis said sales of all-electric vehicle should grow organically, without rules penalizing gas-powered car sales.

“The whole EV ecosystem is ahead of the consumer,” Hollis told reporters, pointing to tailpipe emission rules from the Environmental Protection Agency and California. “It’s not in alignment with consumers. It’s just not.”

In March, the EPA set stringent emission limits that compel automakers to accelerate sales of battery-electric and plug-in hybrid models over the next few years to cap carbon dioxide at 85 grams per mile by 2032. That Joe Biden-Kamala Harris administration policy was a frequent target of President-elect Donald Trump in the run-up to the November 5 election.

California, the nation’s largest auto market, has even tougher regulations designed to phase-out all new gas-burning cars by 2035, and many states adopt these rules. Hollis, who also serves as Toyota’s US sales chief, said that they contribute to an affordability crisis because EVs tend to be pricier than gas-powered vehicles.

But he declined to speculate on whether Toyota would join any potential effort by the incoming Trump administration to block California’s zero-emission vehicle rules. “I hope it doesn’t come to that. That’s not an area I’m willing to go into” at this point, he said.

Toyota was among the last automakers to withdraw support for an effort under the first Trump administration to prevent California from continuing to set its own emissions standards.

Toyota plans to roll out a pair of American-made EVs in 2026 in addition to two all-electric models it currently sells in the US. That’s part of its incrementalist approach to an industrywide shift to EVs, sales of which have slowed globally.

Hollis said the Japanese company is mulling a possible future adjustment in the ratio of fully-electric to hybrid-electric batteries produced at a new plant in North Carolina. The facility, which is expected to open next year, was built with 10 production lines for batteries for fully-electric or plug-in models, and four lines dedicated to hybrid batteries.

October was Breast Cancer Awareness Month, and dealerships across the country took action to help increase awareness and raise funds to find a cure. Since Breast Cancer Awareness Month first began in 1985, the ability for early detection and the likelihood of survival for this terrible disease have both drastically improved.

Despite the progress, there is still a long way to go, and local franchised dealerships are chipping in to make life easier for those impacted and raise money and awareness to better detect and treat

breast cancer. Here are just a few examples of how dealers are stepping up:

• R.M. Stoudt Ford in Jamestown, North Dakota, participated in the 16th annual Running of the Pink in Jamestown to raise money for women’s health programs. The dealership helped raise more than $50,000 in this year’s race.

• Brandon Tomes Subaru in McKinney, Texas, delivered 80 blankets to Cancer Center Associates as part of the Subaru Loves to Care program. These gifts were accompanied by personalized messages of hope written by the customers and staff at Brandon Tomes Subaru.

• Stan McNabb Chevrolet Cadillac in Columbia, Tennessee, wrapped their building in pink to help raise awareness for Breast Cancer Awareness Month. Stan McNabb wraps their building in pink every October to honor those who have been affected by breast cancer.

If you have any news regarding your dealership or auto group, including your charitable and community giving efforts, please email it to Auto Dealer at rokoniewski@msada. org.

By Barton Haag CPA, Albin Randall & Bennett

Having just gone through the witching season, we all know that not all Halloween tricks are harmless fun. October often brings a spike in vandalism, especially around Halloween, with pranks and mischief leading to costly damage. For automobile dealerships, vandalism is a yearround concern that can disrupt operations and hurt profitability. Preventing these incidents and addressing their financial consequences is critical for dealership owners.

Dealerships that do not manage vandalism risks effectively may struggle with the negative financial ramifications. Vandalized inventory can require costly work before they can be sold. Graffiti or broken windows diminish a dealership’s appearance and impact its professional image. Frequent vandalism claims can raise insurance premiums and may lead to denied coverage.

Additionally, vandalism creates liability risks, especially with customer vehicles. Cars vandalized while at the dealership for service can result in legal disputes and strained client relationships. Safeguarding both dealership and customer property is essential to avoiding lawsuits and extra costs and maintaining a positive reputation.

Preventing Vandalism

To effectively mitigate the risk of vandalism, dealerships can implement a range of security measures designed to deter potential criminals and protect both their inventory and facilities, including:

• Surveillance Systems: Installing quality cameras covering all areas acts as both a deterrent and a tool to identify vandals.

• Physical Barriers: Fencing, gates, and re-

stricted access points make it harder for vandals to enter, especially after hours.

• Lighting: Bright, motion-activated lighting deters vandals who prefer to operate in the dark.

• Security Personnel: On-site or remote monitoring provides additional protection. Visible security measures discourage criminal activity.

These security measures may require a substantial upfront investment. The longterm benefits far outweigh the costs, as reducing the likelihood of vandalism is significantly less expensive than repeatedly repairing damaged inventory and facilities.

When vandalism does occur, it calls for prompt action. Dealerships must immediately notify affected customers, provide transparent information about the damage, and outline repair options. That makes comprehensive insurance coverage essential. While Vandalism and Malicious Mischief (VMM) insurance typically covers intentional property damage, dealerships must ensure protection extends to both facilities and vehicles.

Commercial property policies often include vandalism coverage, but business owners should verify their specific terms. For customer vehicles, garage keepers’ liability insurance protects businesses like auto dealerships from financial losses by covering damages to customer vehicles while they are in the dealership’s care.

Vandalism can cause a range of damage, from minor cosmetic issues to irreparable harm, requiring dealerships to navigate the repair and sale processes carefully to ensure compliance with regulations. As MSADA has reported in the past, dealerships selling vandalized vehicles must comply with consumer protection laws, including the Used Car Warranty Law and the Lemon Law. These laws require dealerships to provide a written warranty for any used vehicle with fewer than 125,000 miles, covering defects that impair its use or safety. However, de-

fects from vandalism may not be covered if they don’t affect the vehicle’s fundamental operation or safety.

Massachusetts law prohibits selling vehicles “as-is,” meaning that even a vandalized car must meet operational standards. If the vandalism impairs the vehicle’s safety or use, the dealership must repair it under the warranty. Failing to disclose relevant damage or neglecting required warranty repairs can result in the buyer seeking arbitration or legal recourse through state consumer protection laws.

Vandalism often is not confined to one business; it is a community-wide issue. Promoting a sense of mutual responsibility through strong relationships with the local community helps prevent vandalism. Dealership owners should participate in business networks and crime prevention programs to share information on suspicious activity. Neighbors and nearby businesses can work together to monitor potential threats.

If vandalism occurs, quick coordination with law enforcement and the community is key. Surveillance footage or eyewitness reports from nearby businesses can assist in identifying suspects. A united effort improves the likelihood of resolving the issue and holding vandals accountable. By looking out for each other, local businesses can reduce risk and create a safer environment where everyone is better positioned to thrive.

For automobile dealerships, vandalism presents financial, legal, and reputational risks. Investing in strong security measures, maintaining comprehensive insurance coverage, and building community relationships are key steps in reducing these risks. By taking a proactive approach, dealerships can protect their assets, preserve their reputation, and ensure long-term profitability. Consult with a financial advisor to make sure your business is properly protected this Halloween and throughout the year.

By Alysha Webb Withum Consultant

Buying a dealership requires much more capital than many dealers have access to through traditional channels. A growing number are partnering with investment firms that provide that capital to grow. Those firms often take an equity stake in the growing dealership group.

“We have seen a surge of interest in an equity investor,” says Stuart McCallum, a Withum partner and dealership services practice leader.

Such arrangements can be beneficial to both parties if the partnership is correctly structured. The right structure ensures even a dealer with one or two franchises can expand without taking on an unreasonable amount of risk.

An equity investor could shoulder $2 million of that $7 million, he explains. Now, the dealer only needs to contribute $2 million. “I may have that in used car inventory,” McCallum says. “Now, if I am successful, I still get the fruits, but if I fail it doesn’t kill me.”

Dealers often bring Withum in to review the terms of the offered structure. Without a properly structured agreement, bringing on an equity partner might not kill a dealer, but it could weaken them financially. A well-structured agreement makes the arrangement a great way to grow stronger, however.

In a poorly structured agreement, a dealer could get hit with a huge tax bill

kinds of partnerships can help a small dealer grow. Halim owned several Chrysler Dodge Jeep Ram stores in California and wanted to acquire the Sierra Auto Group, which included a Honda, a Chevrolet, and a Subaru dealership in Monrovia, east of Los Angeles.

With just two CDJR stores, Halim was “maybe on his way to buying a third store but probably not,” says Batchelor. Certainly not the Sierra Auto Group.

So, Rinaldi contacted Open Road, which contributed cash to buy the three stores, taking a majority stake. It also took a majority stake in Rinaldi’s two CDJR stores.

Today, Sierra Auto Group has 11 rooftops including 14 franchises and a commercial truck center. Rinaldi used his own cash flow to buy more stores after he doubled the cash flow of the original three stores in a few months. “He has doubled his net worth as a result,” Batchelor says.

Given the rise in the amount of capital needed to buy the most desirable stores, bringing in outside capital will only become more attractive

Many of those interested in equity investment partners are first-time dealers looking to grow, McCallum says. The problem? Even the smallest dealership acquisition is going to require at least $7 million to get off the ground, McCallum says. “There are very few first-time buyers who have access to that.”

For a first-time buyer, coming up with that kind of capital to acquire another store represents an “existential risk,” he says. But not with an equity investor, who can allow a dealer to take a “reasonable” risk.

even though he or she did not pocket the cash, McCallum says. Withum can show the dealer the true value of the offer with a “waterfall analysis” that shows the waterfall of the profits based on who gets paid when in the capital structure.

Equity investment can take different forms depending on the client’s needs, says Tim Batchelor, co-founder and managing director of Open Road Capital. Open Road takes minority and majority stakes in dealerships.

Open Road’s partnership with Rinaldi Halim is a good example of how these

For Open Road, there is a “big disparity” between good dealers and not good dealers. Before it partners with a dealer it does extensive due diligence to ensure that dealer is a good one. “Assets are important, but the partner is more important,” says Batchelor.

Before it invests in a dealership, Open Road assesses the potential partner to ensure he or she will fit well into Open Road’s collaborative company culture. A good partner has ethics and fairness in their perspective, says Batchelor.

Open Road spends a “good deal” of time with a potential partner before making an investment. And it asks questions

Bringing in an equity investor can help make owning that desirable store a reality.

in the industry. “There is almost nobody we can’t find out about by asking around,” says Batchelor.

That kind of carefulness is crucial because the major downside risk to the equity investment model is a mismatch between the two partners. Dealers like to be their own bosses, McCallum says. But once you invite an equity investor in, “you went from being single and now you are married and have a roommate,” he says.

No longer can a dealer have a good month and decide to buy a corporate jet. “You will get questions from your financial overlord,” McCallum says.

That is why including an “eject button” in an agreement is crucial. Withum has had to play marriage counselor more than once. McCallum recommends both parties agree to a mechanism that allows them to split up if absolutely necessary.

But the “eject button” must be designed so that one partner doesn’t unfairly benefit. For example, one partner could get bought out and the computation has that

partner getting paid a “ton of cash” while the other is now an operator with no money and a store that is a poor performer, McCallum says.

Open Road also works with family-owned dealerships where one or more family member wants to exit the business, and the other stakeholders need money to buy out the exiting shareholders. Open Road provides that capital. Then, another capital need arises – capital to buy more stores. “Whoever is running the business now wants to put their own stamp on it and grow,” says Batchelor.

While a few of the deals Withum works on involve family buy-outs, says McCallum, “It’s a growth story no matter how you slice it.”

The family members looking to buy out another family member usually want to do so because that family member is not on-board with acquiring more stores at the pace the remaining stakeholders would

like, he says.

Given the rise in the amount of capital needed to buy the most desirable stores, bringing in outside capital will only become more attractive, McCallum predicts. And it makes sense. Even for dealerships with a lot of cash flow, expansion can be difficult considering the rising cost of real estate.

Bringing in an equity investor can help make owning that desirable store a reality.

Some dealers settle for less because they believe it is their only option for growth. However, partnering with an equity investor increases their options. For example, a dealer looking to expand could either purchase a lower-performing store to sell inexpensive cars or partner with an equity investor to own a stake in a high-performing store selling luxury models. Equity investors offer dealers various choices, and we provide the necessary analysis to help them make the most profitable decision, says McCallum.

There are over 1,500 attorneys in the United State who focus on legal actions against car dealers.

Who reviews your F&I documents for legal or regulatory changes?

What if your dealership had access to a complete suite of documents needed in F&I?

Only the LAW F&I Library™ provides:

A complete set of state-specific F&I documents in both pre-printed and electronic formats.

An industry leading team of in-house and outside legal resources reviewing forms for legally required and best practice updates.

A trained team of compliance consultants who can work with you to manage your compliance risks.

By Attorneys Tom Vangel, Jamie Radke, and Lindsey McComber of Murtha Cullina LLP

On October 24, Scout Motors debuted its new Terra pickup and Traveler SUV, which are both EVs set to launch in 2027. With its announcement, the company reported that the revived brand will not rely on a traditional franchised dealer network to sell these vehicles but, instead, will implement a direct-to-consumer model which Scout believes will make the buying experience “transparent, super-fast, and super easy.”

Many Volkswagen dealers across the country are outraged and believe that this move violates state franchise laws. Automobile dealers’ associations across the country plan to challenge this model with the support of NADA CEO Mike Stanton, who has said that Volkswagen’s attempt to sell direct to consumers and compete with U.S. dealer partners is “disappointing and misguided,” and “will be challenged.”

Scout Motors was an American vehicle brand which sold trucks and SUVs from 1961 to 1980. In 2021, Volkswagen acquired the Scout trademark and name following the acquisition of Navistar International, which was a successor of Scout’s original owner. Scout Motors was revived in May 2022 to produce off-road capable EVs. Volkswagen has attempted to establish Scout Motors as an independent company managed separately from Volkswagen. However, automotive dealers across the country reject the claim that Scout is independent of Volkswagen and believe that this effort is “contradictory to all the efforts made to reinvigorate the [Volkswagen] brand with new models.”

With its announcement of its new EVs, Scout announced that it plans to begin producing up to 200,000 EV trucks and SUVs annually starting in 2027. It expects that the brand will have around three dozen retail centers across the U.S. by the time sales begin in 2027, and it plans to use batteries from Volkswagen’s joint venture battery cell manufacturer in Canada. Scout has also revealed that it plans to use an app to

handle reservations, sales, and delivery in order to reduce the cost of retail and simplify the EV buying process.

Similar to Tesla, Rivian, and Lucid, the newly revived Scout Motors is attempting to sell its EV models directly to consumers. Although Tesla has had some success in avoiding certain state franchise laws nationally because it was an independent startup not affiliated with an established manufacturer, Scout is likely to face more difficulty due to its relationship with Volkswagen.

Despite objections from Volkswagen dealers across the country, Scout CEO Scott Keogh has said that Scout is “a 100 percent separate brand, separate entity, separate structure, separate everything[.]” Also, when asked about the direct sales model, Keogh stated, “I think it’s critical moving into the future in unstable environments to control your customer, control your margin, control your operational experience[.]”

Scout Motors’ relationship with Volkswagen could give rise to a legal challenge from Volkswagen dealers in Massachusetts. Under Section 4(c)(10) of Chapter 93B of the Massachusetts General Laws, manufacturers are prevented from owning or operating “either directly or indirectly through any subsidiary, parent company or firm, a motor vehicle dealership located in the commonwealth of the same line make as any of the vehicles manufactured, assembled or distributed by the manufacturer or distributor.” Chapter 93B, Section 15 gives dealers who suffer from an unfair method of competition or deceptive act or practice at the hands of a manufacturer standing to bring an action for damages and equitable relief.

Several decades ago, the Massachusetts Supreme Judicial Court held that Chapter 93B, Section 15 does not confer standing on a motor vehicle dealer to maintain an action for violation of Section 4(c)(10) against a manufacturer with which the dealer is not affiliated. With this decision, the Court

ruled that the “purpose of Chapter 93B historically was to protect motor vehicle dealers from a host of unfair acts and practices historically directed at them by their own brand manufacturers and distributors.”

By eliminating standing for dealers who are not affiliated with the subject manufacturer, the SJC has essentially prevented any dealer from challenging the illegal operation of a company store by a manufacturer who has no franchised dealers. Although the Massachusetts Attorney General has standing to enforce Chapter 93B, 15 years ago the then AG refused to do so in the Tesla context despite repeated requests from the MSADA to the AG to enforce Section 4(c)(10). Presently we have a different Attorney General than 15 years ago. It is, therefore, unknown whether the AG will be of any assistance to Massachusetts dealers in the Scout Motors context.

However, it is questionable whether Scout Motors will be able to do the same as Tesla given its affiliation with Volkswagen, as Scout’s attempt to sell vehicles directly to consumers and bypass the existing Volkswagen dealership network arguably constitutes an “unfair method of competition” under Chapter 93B. The inevitable legal challenge will provide an interesting test case as to whether established auto manufacturers can avoid state franchise laws simply by establishing a separate legal entity and brand.

Volkswagen’s attempt to use Scout Motors to circumvent its established dealer network serves as an important reminder that dealers need to vigorously assert their rights as manufacturers attempt to marginalize their role in the sale and servicing of motor vehicles.

Tom Vangel and Jamie Radke are partners and Lindsey McComber is an associate with the law firm of Murtha Cullina LLP in Boston who specialize in automotive law. They can be reached at 617-457-4072.

By Jeff Fritz, Esq., and Joshua Nadreau, Esq., Fisher Phillips LLP

Employment law in Massachusetts, and nationally, is an ever-developing area. It is important for employers to keep abreast of changes in the law to ensure compliance and avoid sometimes extremely draconian penalties and/or legal exposure. This article focuses on some recent developments in Massachusetts Paid Family and Medical Leave law and Sick Time.

Since 2021, Massachusetts has allowed employees to take paid time off work for qualifying family or medical reasons. The program is funded by both employer and employee contributions. While similar to the federal Family and Medical Leave Act, there are significant differences, including (1) PFML provides employees with up to 26 weeks of job-protected and paid family and medical leave each benefit year; (2) every Massachusetts business may be subject to PFML, even if not subject to FMLA; (3) employees may not be required to exhaust other forms of paid leave before utilizing PFML benefits; (4) PFML expands the definition of “family” to include parents-in-law, domestic partners, grandchildren, grandparents, and siblings; and (5) no employee tenure requirement exists for eligibility.

In 2024, the Department of Paid Family and Medical Leave increased the required contribution rate to 0.88% of eligible wages. For employers with twenty-five or more covered individuals, the family leave contribution is 0.18% of eligible wages (up to 100% of which may be withheld from the employee’s eligible wages), and the medical leave contribution is 0.70% of eligible wages (up to 40% of which may be withheld from the employee’s eligible wages, with the rest being the employer’s responsibility). For employers with fewer than twenty-five covered individuals, the total contribution is 0.46% of eligible wag-

es (0.18% for family leave and 0.28% for medical leave), all of which may be withheld from the employee’s eligible wages, with no contribution from the employer.

While initial forecasts anticipated yearover-year increases as high as 20% during the program’s early years, the DPFML recently confirmed the contribution rates will remain the same in 2025, a positive development for employers and perhaps a suggestion that the PFML program is stabilizing. That said the maximum weekly benefit rate (i.e., the amount of money an employee receives through the program) has increased, albeit modestly.

The Massachusetts Executive Office of Labor and Workforce has announced important updates to state employment benefits for 2025, including an increase in the State Average Weekly Wage, at which PFML benefits are pegged, from $1,796.72 to $1,829.13. This slight $32 increase breaks from previous trends where annual SAWW increases reached as high as 13%. Notably, this change impacts more broadly than PFML; it also impacts unemployment insurance and workers’ compensation programs.

While case law relating to PFML is only just starting to develop (as it takes time for issues to work their way through the courts), we note the Massachusetts Supreme Judicial Court recently clarified that, while the law affords employees job protection, including returning to the same or equivalent position, with the same pay, benefits, and seniority as when they began their leave (and maintenance of health insurance while on leave), it does mean they continue to earn or accrue benefits such as vacation or sick time while on leave.