Ray's Retire Right Report

Retire Right Retire Smart!

Raymond T. Martin, Retirement Coach and Medicare Planning

June 2025

Fathers and father figures, Happy Father’s Day! The first day of summer is June 21st (although it feels like it began on Memorial Day.) June is "Beautiful in Your Skin Month"

June 13th – 21st is "Worldwide Knit & Crochet in Public Week"

And June 4th is "Audacity to Hope Day"

Lucky Finds

1993 Carl Rice began buying paintings at thrift stores and estate sales hoping to find something valuable by a famous artist. Each new find was photographed and sent to Christie’s New York auction house for evaluation. Each time, he received a letter back saying his latest find was worthless. In 1996 Rice owned 500 paintings and couldn’t afford to buy more. Yet he went to another estate sale where he noticed two paintings he was drawn to. One was a 6-by-12 picture of roses, the other a 15-by-24 picture of flowers. He couldn’t resist and purchased the two for $60. He and his wife looked up the artist’s name, Martin Johnson Heade, and found he was a well-known 19th century painter. They sent a photo to Christie’s but this time they sent their vice president to authenticate the paintings. They were real. At the auction they sold for over a million dollars! Patience paid off!

Whose TV contract stipulated that she look frumpier and weigh more than the show’s star?

(See the Answer Area.)

With summer just around the corner, many of our clients are making exciting travel plans whether it’s visiting family across the country or exploring new destinations abroad. As you prepare for your trip, it’s important to understand what your Medicare coverage does and doesn’t include when it comes to medical care while traveling.

Original Medicare typically does not cover emergency care outside of the United States, which can come as a surprise to many travelers. Fortunately, if you have a Medicare Supplement (Medigap) plan, most include coverage for foreign travel emergencies. These plans generally pay 80% of the cost of emergency medical care abroad after a small deductible, up to a $50,000 lifetime maximum. This benefit can be a financial lifesaver if you experience an unexpected health issue while overseas.

If you’re enrolled in a Medicare Advantage plan, many of these plans also offer some coverage for emergency care during foreign travel, though the specifics can vary by plan. It’s a good idea to check with your plan or give us a call if you're unsure about your current benefits.

For those seeking more comprehensive travel protection, especially for extended trips or more adventurous travel, standalone travel insurance may be a smart option. We offer travel insurance solutions designed with Medicare clients in mind. You can view available options and learn more by visiting:

martinassociatesmedicare.com/services

Wherever you’re headed this summer travel safe and stay covered!

Presidential Fathers

Grover Cleveland was the first president whose child was born in the White House.

John Tyler fathered fifteen children, more than any other president,

Harry S. Truman threatened to punch a reporter who criticized his daughter’s singing.

Five presidents had no natural, legitimate children (Madison, Jackson, Polk, Buchanan and Harding)

Following the death of President Harding, Calvin Coolidge took the oath of office from his father, who was a justice of the peace.

President William Henry Harrison’s father was a signer of the Declaration of Independence.

Gerald Ford was born Leslie Lynch King, Jr. but changed his name to that of his stepfather.

The Nose Knows

In 1981 Ruth Clarke, 23 of London England, had an operation to correct a lifelong breathing problem. After the surgery the doctor presented her with a Tiddlywink game piece that had been removed from her nose. She vaguely recalled losing it as a toddler. Her breathing improved greatly after its removal!

Flag Day Facts

We celebrate Flag Day on June 14th because on that day in 1777 the continental Congress approved a resolution to create a national flag. However they did not specify the size or how to arrange the stars. As more states were added, the variety of flags grew. An investigation in 1912 found flags of 66 different sizes and proportion were flown at federal offices alone. That confusion was ended once and for all just after Alaska and Hawaii became states. President Eisenhower issued an executive order that took effect July 4, 1960, and the flag has not been changed since.

On June 14, 1951, Univac 1, the world’s first commercial electronic computer was unveiled in Philadelphia. It was installed at the Census Bureau and utilized a magnetic table unit as a buffer memory. "Reading gives us someplace to go when we have to stay where we are."

Mason Cooley

How to solve sudoku puzzles

To solve a Sudoku, you only need logic and patience. No math is required. Simply make sure that each 3x3 square region has a number 1 through 9 with only one occurrence of each number. Each column and row of the large grid must have only one instance of the numbers 1 through 9.

Chicago has the second largest Polish population, exceeded only by Warsaw, Poland.

You can buy horseradish ice cream in Tokyo.

The average American uses 730 crayons by the age of 10.

In 1912 the Archbishop of Paris declared dancing the tango a sin.

The blood vessels of a blue whale are wide enough for an adult trout to swim through.

The top speed of an abalone is 5 yards per minute.

Humuhumunukunukuapua’a is Hawaii’s state fish.

Checkers used to be known as “chess for ladies.”

A group of jellyfish is known as a smack.

The Phoenicians invented the world’s first phonetic alphabet in 2000 B.C.

The largest cast ever assembled for a film scene was 300,000 for the funeral scene in Gandhi.

It took 14 years to build the Brooklyn Bridge.

In the game of bridge, there are 635,013,559,600 different possible hands.

It takes 12 bees their entire lifetime to make a tablespoon of honey.

Elvis Pressley never once gave an encore.

Lori Verst

Craig Kennedy

Dave Hart

Keith McCarthy

Stan Salah

Joseph Martin Matt Leone Staff Directory

Elliott Martin Mohan Martin Tessa Behr Joe Chow

who take care of chickens are literally chicken tenders.

The Answer Area

Trivia Teaser: Vivian Vance who played Ethel Mertz on I Love Lucy

People

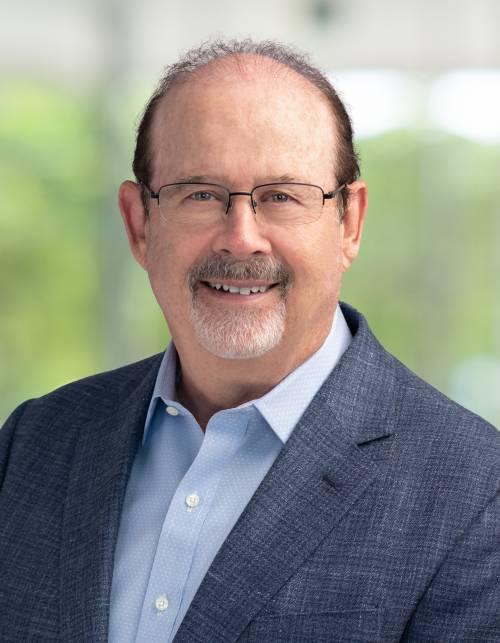

Ray Martin Martin & Associates

Ray Martin specializes in Personal Finance, Investor Coaching, Medicare Planning and is the author of . . .

New ClientsAccepted!

The finest compliment I can receive is a referral from a satisfied client like you. Thank you for the trust you have placed in me with your retirement needs. Please send your friends and family to me knowing that I will care for them as I have cared for you!

Fay W., Steve F., Stephen C., Megan M., Karen S., Dave D., Kathy D., Bruce R., Mike M., Susan M., Kelly F., John M.

Andy N., Gail G., Craig I., Trevor R., Chris H., Dalene J., Dave J., Ellen L., Russ W., Robert S., and Mark J.

Need a Speaker forYour Group?

Invite Ray Martin to be a guest speaker at your next club meeting, retreat or gathering for an informative presentation on Medicare or Social Security, crucial for a successful retirement. Ray is a frequent speaker at local colleges, school districts and major corporations. To schedule an available date for your group, call Ray or Lori today at (800) 464-4941 or email ray@WeRetireSmart.com

Funding 35-40 Years of Retirement

If you live to 100, can you avoid outliving your money?

Will you live to 100?

Your odds of becoming a centenarian may be improving. Earlier this year, the Centers for Disease Control reported that the population of Americans aged 100 or older rose 44% between 20002014. The Pew Research Center says that the world had more than four times as many centenarians in 2015 as it did in 1990.

If you do live to 100, will your money last as long as you do?

What financial steps may help you maintain your retirement savings and income? Consider these ideas.

Keep investing in equities.

The S&P 500 does not automatically gain 10% or more each year, but it certainly has the potential to do so in any year. Ivestments are not producing anything close to double-digit returns. Some fixed-rate vehicles are even failing to keep up with the current inflation rate. Turning away from equity investments in retirement may seriously hinder the growth of your savings and your level of income.

Arrange some kind of pension-like income.

If you can retire with a pension, great; if not, you may want other income streams besides Social Security and distributions from investment accounts Renting out

some property may provide it; although, the cost of third-party management can cut into your revenue. Dividends can function like a passive income stream, albeit a highly variable one.

Hold off filing for Social Security.

If you are in reasonably good health and think you may live into your 90s or beyond – and that could prove true for you – then retiring later and claiming Social Security later can make great financial sense. If you wait to claim your benefits at Full Retirement Age (which will range from 66 to 67, depending on your birthdate), you will have fewer years of retirement to fund than if you left work at 62 and claimed benefits immediately By continuing to work, you are also allowing your retirement savings a few more years to potentially grow and compound when they are at their greatest – so this might be the wisest step of all.

If your savings are large enough, try living only off interest.

If your invested assets equal $1 million and your investments return 5% in a year, could you live on that $50,000 plus Social Security or your pension in the succeeding year? You may be able to do that, perhaps easily depending on where you choose to live in retirement You would not be able to do that every year, of course – you would have to dip

into your principal if your portfolio returned almost nothing or took a loss. For every year you manage to live off the equivalent of your investment returns, however, your principal goes untouched.

Funding 35 or 40 years of retirement will be a major financial challenge.

The earlier you plan and invest to meet that challenge, the better.

We are all financially challenged by increasing longevity.

Assuming we need 30+ years of retirement income is not unorthodox, merely pragmatic From that assumption, we can plan for our futures with an understanding of how much money we may need to live comfortably and pursue our dreams. Let me know how I can help you.

BEFORE you make any financial move, call with your “Here’s what I’m thinking about doing…” as opposed to the dreaded, “Guess what I just did. .” announcement! We offer a one-hour Complimentary Consultation.

Ray Martin is an Investor Coach and Investment Advisor Representative for Martin Wealth Management, LLC Schedule a phone appointment at www.SpeakWithRay.com or call (800) 464-4941 or email Ray@WeRetireSmart.com Registered Investment Advisor © 2018-2025 All rights reserved.

Get This Book FREE BY MAIL!

This 62-page book is a quick, easy read (about an hour) yet is chock full of vital information that you NEED TO KNOW for a stress-free retirement, such as:

How can you plan for health AND wealth? (Page 2)

How can you spot and avoid bad advice that wrecks your retirement savings plan? (Page 7)

What is the "Efficient Market Hypothesis" (It won a Nobel Prize for Economics!) and can YOU use it when picking a stock or mutual fund? (Page 12)

What are the totally-legal tax-savings strategies your CPA may never show you? (Page 24)

What are the "mind tricks" that sabotage portfolio self management? (Page 36)

How can you collect 57% more Social Security benefits with a simple strategy available to everyone? (Page 47)

What are the 10 questions that you absolutely MUST consider for a stress-free retirement plan? (Page 54)

FREE Book Reply Coupon

To get the book, "Stress-Free Retirement: 8 Secrets to Secure Your Money and Peace of Mind" free by mail, simply provide the information on this form by email, fax or regular mail. There is zero cost to you and absolutely NO obligation to buy anything. (And we will never, ever share your contact information. Period!)

Name Date of birth

Spouse Date of birth

Mailing Address

City State Zip

Phone ( ) Email address

Email to ray@raymartinadvisors.com (the form itself or the information requested in the body of your email.) Mail to Martin Wealth Management, 30 Executive Park, Suite 250, Irvine, CA 92614 Return by Fax to (949) 266-9508

If you have questions, please call Ray Martin at (800) 464-4941 © 2025 by Ray Martin. All Rights Reserved.