Solution manual for International Trade 4th Edition Feenstra

Taylor 1319061737

9781319061739

Download full solution manual at: https://testbankpack.com/p/solution-manual-for-international-trade-4thedition-feenstra-taylor-1319061737-9781319061739/

Download full test bank at: https://testbankpack.com/p/test-bank-for-international-trade-4th-editionfeenstra-taylor-1319061737-9781319061739/

4 Trade and Resources: The Heckscher–OhlinModel

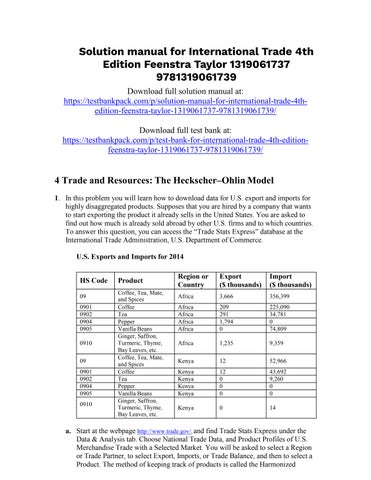

1 In this problem you will learn how to download data for U.S export and imports for highly disaggregated products. Supposes that you are hired by a company that wants to start exporting the product it already sells in the United States. You are asked to find out how much is already sold abroad by other U.S firms and to which countries. To answer this question, you can access the “Trade Stats Express” database at the International Trade Administration, U.S. Department of Commerce.

a. Start at the webpage http://www trade gov/,and find Trade Stats Express under the Data & Analysis tab. Choose National Trade Data, and Product Profiles of U.S. Merchandise Trade with a Selected Market. You will be asked to select a Region or Trade Partner, to select Export, Imports, or Trade Balance, and then to select a Product. The method of keeping track of products is called the Harmonized

System (HS). On this page, the HS codes for products can have 2 digits or 4 digits, so choose 4 digits. Change the product from HS-total to any particular product that you find interesting out of the 99 HS codes that are shown, from HS 01 to HS 99. For the product that you have selected, choose a region of the world, and write down in a table the exports to that region of the 2-digit and detailed 4digit products that are shown (see an example for HS 09 in the table)

Answer: The argument depends on the chosen countries and the trade pattern within the United States. The below argument is an example based on the table provided.

Because the United States is relatively abundant in skilled labor and scarce in unskilled labor, as predicted by the Heckscher–Ohlin model, the United States imports unskilled-labor-intensive goods such as the ones listed in the table. One exception is pepper, whose production may depend on machines that are abundant in the United States.

b. Repeat the same exercise for the imports to the United States from that region for the 2-digit and detailed 4-digit products that are shown (see table on the previous page).

Answer: Answers will vary.

c. Now choose at least one specific country in the region that you have chosen, and write down the U.S. exports and imports for the same 2-digit and 4-digit HS products (see table on the previous page)

Answer: Answers will vary.

d. Do you think that the U S exports and imports for this region/country/products you have chosen support the predictions of the Heckscher–Ohlin theorem? Explain why or why not. Do you think that there is potential for the U.S. firm that hired you to begin exporting these products? Explain.

Answer: Answers will vary.

2. This problem uses the Heckscher–Ohlin model to predict the direction of trade. Consider the production of handmade rugs and assembly line robots in Canada and India

a. Which country would you expect to be relatively labor-abundant, and which is capital-abundant? Why?

Answer: Given Canada’s relatively small population (approximately 30 million compared with more than 1 billion in India) and level of development, it is a safe assumption that ����������������⁄���������������� <

. That is, there is more capital per worker in Canada, making it capital-abundant compared with India. Similarly, India would be labor-abundant.

b. Which industry would you expect to be relatively labor-intensive, and which is capital-intensive? Why?

Answer: Given the amount of capital required to produce robots and the amount of labor required to produce rugs, one would expect that

making robots capital intensive and rugs labor intensive.

c. Given your answers to (a) and (b), draw production possibilities frontiers for each country Assuming that consumer preferences are the same in both countries, add indifference curves and relative price lines (without trade) to your PPF graphs. What do the slopes of the price lines tell you about the direction of trade?

Canada’s no-trade production and consumption of robots and rugs corresponds to a relative price of robots that is lower than that in India This is shown by the flatter-sloped relative price line in Canada.

d. Allowing for trade between countries, redraw the graphs and include a “trade triangle” for each country. Identify and label the vertical and horizontal sides of the triangles as either imports or exports.

Answer: See the following figures.

e. Using the PPF graphs from (c) and relative prices under autarky and trade, explain how both countries gain from trade?

Answer: See figures below. The dashed lines represent the budget line and obtained utility under autarky, while solid lines are for free trade. Under free trade, both countries reach the indifference curve with higher utility.

3. Leontief’s paradox is an example of testing a trade model using actual data observations. If Leontief had observed that the amount of labor needed per $1 million of U.S. exports was 100 person-years instead of 182, would he have reached the same conclusion? Explain.

Answer: If the amount of labor required for $1 million of U.S. exports were 100 person-years instead of 182, then the capital/labor ratio for exports would have been $25,500 per person. Because this is larger than the corresponding ratio for imports, this test would have provided support for the Heckscher–Ohlin theorem. That is, the United States (which was assumed to be capital-abundant in both cases) would have been shown to export capital-intensive goods. In actuality, however, Leontief’s test showed exactly the opposite

Work It Out

Suppose that there are drastic technological improvements in shoe production in Home such that shoe factories can operate almost completely with computer-aided machines. Consider the following data for the Home country:

Computers: Sales revenue = ���������������� =100

Payments to labor = ������������ =50

Payments to capital = ������������ =50

Percentage increase in the price = ∆��������⁄�������� =0%

Shoes: Sales revenue = ���������������� =100

Payments to labor = ������������ =10

Payments to capital = ������������ =90

Percentage increase in the price = ∆��������⁄�������� =40%

a. Which industry is capital-intensive? Is this a reasonable question, given that some industries are capital-intensive in some countries and labor-intensive in others?

Answer: ������������⁄������������ >������������⁄������������ (and thus ��������⁄�������� >��������⁄��������) implies that shoes are capital-intensive. This is certainly possible as shown in the New Balance

application. In reality, shoes are labor-intensive in India with different production technology. This is factor intensity reversal.

b. Given the percentage changes in output prices in the data provided, calculate the percentage change in the rental on capital.

Substituting the computer equation into the shoes equation:

This implies:

=

c. How does the magnitude of this change compare with that of labor?

Answer: As seen in the percentage change calculation for the rental of capital in the shoe industry, the magnitudes of the changes are equal (with opposite sign)

d. Which factor gains in real terms, and which factor loses? Are these results consistent with the Stolper–Samuelson theorem?

Answer: Because the increase in capital returns (+50%) exceeds the price changes in both industries, capital gains in real terms. Similarly, because there is a decrease in wage ( 50%) and the prices of the outputs stayed the same for computers or increased for shoes, labor loses in real terms. This is consistent with the Stolper–Samuelson theorem: In the long run, when all factors are mobile, an increase in the relative price of a good will cause the real earnings of labor and capital to move in opposite directions, with a rise in the real earnings of the factor used intensively in the industry whose relative price went up and a decrease in the real earnings of the other factor.

4. Using the information in the chapter, suppose Home doubles in size, while Foreign remains the same size. Show that an equal proportional increase in capital and labor in Home will change the relative price of computers, wage, rental on capital, and the amount traded but not the pattern of trade.

Answer: An equal proportional increase in Home’s capital and labor does not change its relative factor endowments, so the labor/capital ratio is unchanged. With constant factor prices, your graph should show that the no-trade equilibrium doubles. Further, the no-trade equilibrium in Foreign is unaffected because its size remained unchanged. At the original world relative price of computers, the quantity exported by Home exceeds the quantity Foreign wants to import, leading to a drop in the relative price. The lower free-trade relative price of computers decreases the rental on capital. However, labor is better off in real terms as a result of the decrease in the relative price of computers from free trade. The pattern of trade remains the same, although

the amount traded has increased. The pattern of trade is consistent with the Heckscher

Ohlin theorem. Despite the proportional increase in its endowments, Home is still capital-abundant, and it continues to export capital-intensive goods.

�� ��

5. Using a diagram similar to Figure 4-12, show the effect of a decrease in the relative price of computers in Foreign. What happens to the wage relative to the rental? Is there an increase in the labor–capital ratio in each industry? Explain. Answer: With free trade the labor-abundant Foreign country will increase production of the labor-intensive good (shoes), leading to a rightward shift of the relative demand ∗ ∗ ∗ curve from ��������1 to ��������2. At the new equilibrium point ���� , computers are weighted less, a fall in (����∗⁄����∗),whereas the shoe industry is weighted more, a rise in ∗ ∗ (���� ����⁄����) As a result of the rise in the relative demand for labor in the shoe industry, the relative wage increases, which in turn lowers the labor/capital ratio in both industries.

6. Suppose when Japan opens to trade, it imports rice, a labor-intensive good.

a. According to the Heckscher–Ohlin theorem, is Japan capital-abundant or laborabundant? Briefly explain.

Answer: Japan is capital-abundant because it imports the labor-intensive good.

b. What is the impact of opening trade on the real wage in Japan?

Answer: Japan will specialize in the capital-intensive product, which will lead to an increase in the relative demand for capital in the capital-intensive industry This causes an increase in the relative rent. The higher relative rent cuts the number of capital hired per unit of labor in the capital-intensive industry, thereby decreasing the capital/labor ratio. By the law of diminishing returns, the decrease in the capital/labor ratio leads to an increase in the marginal product of capital in both industries. Thus, the real rent will increase in Japan following trade

c. What is the impact of opening trade on the real rental on capital?

Answer: The real rental on capital willincrease because the world relative price of riceis lower than Japan’s no-trade relativeprice More specifically, the marginal product of capitalincreases, sothe realrental on capital rises. Based on the Stolper–Samuelson theorem, the abundant factor gains from trade, whereas the scarce factor loses from trade Japan is labor-scarce and imports labor-intensive goods, so the real rental on capital increases as a result of trade.

d. Which group (capital owner or labor) would support policies to limit free trade? Briefly explain.

Answer: The labor group will support policies to limit free trade because they

suffer a loss due to the decrease in the relative price of rice when Japan engages in trade.

7. In Figure 4-3, we show how the movement from the no-trade equilibrium point A to a trade equilibrium at a higher relative price of computers leads to an upward-sloping export supply, from points A to D in panel (b)

a. Suppose that the relative price of computers continues to rise in panel (a), and label the production and consumption points at several higher prices.

Answer: See the following figure.

b. In panel (b), extend the export supply curve to show the quantity of exports at the higher relative prices of computers.

Answer: Refer to the following diagram. At the no-trade price of (��������⁄��������)���� =0.5, Home exports 0 units of computers, which is the starting point for the Home export supply curve in panel (b). As the world relative price of computers rises, the exports of computers initially must rise on the export supply curve, as illustrated by Home’s exports of 10 units when the world price is (��������⁄��������)����1 =1, with production at B1 and consumption at C1. But for higher prices, it is possible that the export supply curve bends backward, as illustrated by the world price of (��������⁄��������)����2 =15, where the export supply is less than 10 units, with production at B2 and consumption at C2. At these points, consumption of computers is 30 units and production is below 40 units, say 39 units, so exports are 9 units. Ultimately, at the corner solution, the world relative price of computers will be completely vertical, meaning the ��������⁄�������� = infinity

c. What happens to the export supply curve when the price of computers is high enough? Can you explain why this happens? Hint: An increase in the relative price of a country’s export good means that the country is richer because its terms of trade have improved. Explain how that can lead to fewer exports as their price rises.

Answer: As the world-relative price for computers rises, this is a terms-of-trade gain for the Home country, which exports computers. From the point of view of Home consumers, it is like a rise in income, so they consume more of both computers and shoes (the income effect). On the other hand, the rise in the relative price of computers leads them to substitute away from this good (the substitution effect). When the income effect dominates the substitution effect, as will occur for sufficiently high increases in the terms of trade, then exports of computers will fall due to increased Home demand.

8. On March 2, 2013, Tajikistan successfully negotiated terms to become a member of the World Trade Organization. Consequently, countries such as those in western Europe are shifting toward free trade with Tajikistan. What does the Stolper–Samuelson theorem predict about the impact of the shift on the real wage of lowskilled labor in western Europe? In Tajikistan?

Answer: According to the Stolper–Samuelson theorem, the real wage of unskilled labor in western Europe will experience a decrease in real earnings because western Europe is skilled-abundant relative to Tajikistan and will specialize in the skilledintensive good. By trading with Tajikistan, the relative price of the skilled-intensive good will rise. In western Europe, this leads to an increase in the real earnings of skilled labor and a decrease in the real wage of unskilled labor The situation would be opposite in the Tajikistan, where the real wage of unskilled labor would increase.

9. Following are data for soybean yield, production, and trade for 2010–2011:

Data from: Food and Agriculture Organization.

Suppose that the countries listed in the table are engaged in free trade and that soybean production is land-intensive. Answer the following:

a. In which countries does land benefit from free trade in soybeans? Explain.

Answer: Landowners in the United States, Brazil, and Canada benefit from free trade since the production of soybeans intensively uses land as a factor of production, since these countries export more soybeans than they import.

b. In which countries does land lose from free trade in soybeans? Explain.

Answer: As net importers of soybeans, landowners in China, Mexico, Japan, Russia, and France lose from free trade because the world-relative price of soybeans is lower than each country’s no-trade equilibrium price.

c. In which countries does the move to free trade in soybeans have little or no effect on the land rental? Explain.

Answer: The move to free trade in soybeans is likely to have little or no effect on the land rental in Australia, since its import and export of the product is about equal.

10. According to the Heckscher–Ohlin model, two countries can equalize wage differences by either engaging in international trade in goods or allowing high-skilled and low-skilled labor to freely move between the two countries. Discuss whether this is true or false, and explain why

Answer: Allowing skilled workers to migrate to skilled-labor-scarce countries and unskilled workers to migrate to unskilled-labor-scarce countries reduces the ratio of skilled/unskilled workers in the skilled-labor-abundant country and raises it in the unskilled-labor-abundant country This increases the wage ratio between skilled and unskilled labor in the skilled-labor-abundant country and lowers it in the unskilledlabor-abundant country.

When the two countries trade in goods that embody these factors, the skilled-laborabundant country will export the skilled-labor-intensive good. By doing so, it effectively sends a lot of skilled workers and a few unskilled workers to the unskilledlabor-abundant country. Likewise, when it imports the unskilled-labor-intensive good, it effectively imports a few skilled workers and a lot of unskilled workers. The net effect is skilled workers in the unskilled-labor-abundant country see a fall in their wage relative to unskilled labor and unskilled workers experience a rise in their relative wage, similar to that of migration.

When all the strict assumptions of the Heckscher–Ohlin model are satisfied, we can get this factor price equalization theory: Trade leads to equalization of returns to factors across countries. As product prices in two countries converge to the same world price level, the difference in the factor prices narrows, and ultimately disappears. But this theory should not be viewed as Holy Grail, as it requires “extraordinarily demanding” assumptions that are not quite satisfied in the reality.

11. According to the standard Heckscher–Ohlin model with two factors (capital and labor) and two goods, the movement of Turkish migrants to Germany would decrease

the amount of capital-intensive products produced in Germany. Discuss whether this is true or false, and explain why.

Answer: An increase in a factor of production raises the production of the good that uses that factor intensively and reduces the production of the other good. So as labor flows from Turkey to Germany, labor endowment increases in Germany. The production of labor-intensive goods relative to capital-intensive goods will increase in Germany.