International Economics 4th Edition

Feenstra Solutions Manual

Full download at link:

Solution Manual: https://testbankpack.com/p/solution-manualfor-international-macroeconomics-4th-edition-feenstra-taylor1319061729-9781319061722/

Test Bank: https://testbankpack.com/p/test-bank-forinternational-macroeconomics-4th-edition-feenstra-taylor1319061729-9781319061722/

3 Gains and Losses from Trade in the Specific-FactorsModel

1. In the chapter, we learned that workers displaced by import competition are eligible for compensationthrough the Trade Adjustment Assistance program Firms are also eligible for support through Trade Adjustment Assistance for Firms, a federal program that provides financial assistance to manufacturers affected by import competition. Go to http://www.taacenters.orgto read about this program, then answer the following:

a. Describe the criteria a firm has to meet to qualify for benefits.

Answer: Accordingto the website, manufacturersarequalified to receivebenefits from the TAA if imports have contributed to declines in their employment and salesor production.

b. What amount of money is provided to firms, and for what purpose? Describe one of the “success stories,” in which a firm used financial assistance to improve its performance.

Answer: Under the “50/50 cost sharing” program, the TAA pays up to $75,000 for projects to improve a manufacturer’s competitiveness.The funds go toward the cost of hiring industryexperts,includingconsultants, engineers, and designersfor projects.

c. Provide an argument for and an argument against the continued funding of this federal program

Answer: Opponents of TAA would argue that the program is costly The following figure showsthe total expendituresof the program from 1995 to 1999, when more than half of the cost was administrative and operationsrelated. Proponents of TAA

would draw on the positive effect the assistance program has on the manufacturing industryand localeconomy.

2. Why is the specific-factors model referred to as a short-run model?

Answer: It is a short-run model because land and capital are specific to a particular sector and only labor is mobile between the sectors. In the long run, all factors of production will be mobile across sectors.

3. Figure 3-7 presents wages in the manufacturing and services sectors for the period 1974 to 2014 Is the difference in wages across sectors consistent with either the Ricardian model studied in Chapter 2 or the specific-factors model? Explain why or why not.

Answer: The difference in wages across the sectors implies that the theoretical assumption of equalized earnings between the different industries is a simplification of the Ricardian and specific-factors models.

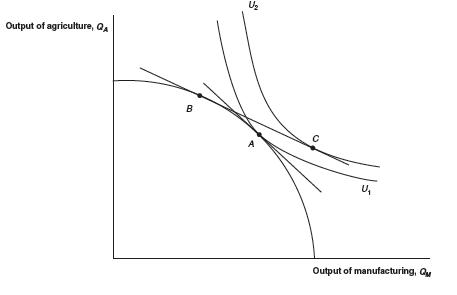

4. In the gains from trade diagram in Figure 3-3, suppose that instead of having a rise in the relative price of manufactures, there is a fall in that relative price.

a. Starting at the no-trade point A in Figure 3-3, show what would happen to production and consumption.

Answer:

As seen in this diagram, a fall in the relative price of manufactures is shown by the smaller slope (in absolute value) of the international price line. The country produces at point B, at which the international price line intersects its PPF. The higher relative price of agriculture attracts workers into that sector such that the output of agriculture increases and the output of manufactured goods decreases. Now the highest level of utility is achieved where the highest possible indifference curve is tangent to the new price line (at C). The increase in utility signified by the higher indifference curve is a measure of gains from trade.

b. Which good is exported and which is imported?

Answer: The decrease in the relative price of manufactures in the trade equilibrium (compared with autarky) also means that the country is importing manufactured goods and exporting agricultural goods.

c. Explain why the overall gains from trade are still positive.

Answer: Overall gains from trade are still positive because the country is able to sell agriculture at a higher price and buy manufactured goods at a lower price than it could have in autarky. The fact that the relative price (of manufactured goods) fell with trade indicates that the foreign country’s autarky relative price was lower. That is, in this case the country has a comparative advantage in agriculture. In Figure 3-3, the case illustrated is one in which the country has a comparative advantage in manufacturing goods and thus their export leads to an increase in their relative price.

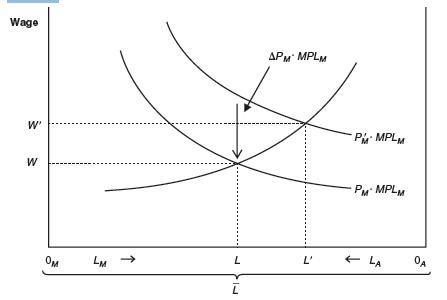

5. Starting from equilibrium in the specific-factors model, suppose the price of manufactured goods falls so that wages fall from W to W in Figure 3-5.

a. Show that the percentage fall in the wage is less than the percentage fall in the price of manufacturing so that the real wage of labor in terms of manufactured goods goes up.

Answer:

As seen in the diagram, both the price of manufactured goods and the wages decrease. The key to this exercise is to realize that the vertical distance of the decrease in wage is * less than the vertical distance of PM MPLM Therefore:

P * MPLM > W

where W represents the change in wage. Dividing both sides by the initial wage (W = * PM MPLM): PM/PM > W/W

This is the desired result: The percentage fall in the wage is less than the percentage fall in the price of manufacturing so that the real wage of labor in terms of manufactured goods goes up.

b. What happens to the real wage of labor in terms of agriculture?

Answer: Because the wage decreases and the price of agricultural goods remains the same, the amount of agricultural goods that can be bought by labor decreases. That is, real wage decreases in terms of agriculture.

c. Are workers better off, worse off, or is the outcome ambiguous?

Answer: Because the real wage increases with respect to manufactured goods and decreases with respect to agriculture, the outcome will be ambiguous for workers. For some, who prefer to purchase a lot of agriculture, the price change means an overall loss in terms of how much they can buy Others, who prefer to buy mainly manufactured goods, gain in terms of how much they can buy

Use the following information to answer the questions below:

Manufacturing: Sales revenue = PM QM = 150

Payments to labor = W · LM = 100

Payments to capital = RK · K = 50

Agriculture: Sales revenue = PA QA = 150

Payments to labor = W LA = 50

Payments to land = RT T = 100

Holding the price of manufacturing constant, suppose the increase in the price of agriculture is 20% and the increase in the wage is 10%.

a. Determine the impact of the increase in the price of agriculture on the rental on land and the rental on capital.

Answer: Rental on land can be calculated as follows:

Recalling that the price of manufacturing remained constant, we get the rental on capital as

b. Explain what has happened to the real rental on land and the real rental on capital.

Answer: Because of the 20% increase in the price of agriculture, the real rental on land rose, whereas the real rental on capital fell. Therefore,landowners are better off because the percentage increase in the rental on land is greater than the percentage increase in the price of agriculture, whereas the price of manufacture is constant. Capital owners are worse off in terms of their ability to purchase both manufacture and agriculture because the rental to capital has fallen.

6. If, instead of the situation given in the Work It Out problem, the price of manufacturing were

to fall by 20%, would landowners or capital owners be better off? Explain How would the decrease in the price of manufacturing affect labor? Explain.

Answer: Capital owners would be worse off since the decrease in rental on capital (40%) is greater than the drop in the price of manufacturing (20%). Landowners would be better off in terms of manufacturing goods as the rental on land decreases less (5%) than the drop in the price of manufacturing, and they would be worse off in terms of agriculture. The effect on labor is ambiguous because while the percentage of wage decrease is less than the percentage fall in the price of manufacturing, labor loses in terms of their availability to purchase agriculture.

The rental on capital is found by calculating the following:

7. Read the article by Grant Aldonas, Robert Lawrence, and Matthew Slaughter, available online at: https://www.hks.harvard.edu/fs/rlawrence/fsf adjustment assistance_plan.pdf. Then answer the following questions.

a. What is the name of the new program that these authors propose, and from what three programs in the United State would it combine elements?

Answer: The authors propose the Adjustment Assistance Program (APP), which combines the best element of UI, TAA, and training programs by the Workforce Investment Act (WIA).

b. What is the authors’ specific proposal for wage-loss insurance?

Answer: They propose the immediate adoption of similar new wage-loss insurance program proposed in the Worker Empowerment Act of 2007, but with eligibility for all workers aged 45 and older.

c. What is their specific proposal for health insurance?

Answer: They propose reducing the gap in health insurance by having the UI system pay for any COBRA health insurance payment incurred while receiving UI income benefits.

d. What is their specific proposal for giving workers access to savings?

Answer: They propose providing new relief from penalties for withdraws from common tax-preferred saving accounts to allow workers to tap their own savings to assist in their transition

e. Would the program they propose depend on a worker losing his or her job because of trade competition or a shift of production facilities overseas?

Answer: They propose to eliminate TAA’s requirement that a worker be required to shown nexus to trade or shift of production overseas as the basis for providing assistance. Instead, they would make a training stipend available to every UI-eligible worker

f. What would their proposed program cost annually, and how does that compare with the annual cost of the Trade Adjustment Assistance program?

Answer: The total annual cost of the new programs would be about $22 billion: $10 billion for the health insurance program; $5 billion for tax-related supports for education, training, and relocation; and $7 billion for the wage-loss insurance. The total annual cost would be more than 20 times the resources currently spent on TAA.

8. In the specific-factors model, assume that the price of agricultural goods decreases while the price of manufactured goods is unchanged (Δ

0 and

= 0). Arrange the following terms in ascending order:

Hint: Try starting with a diagram like Figure 3-5, but change the price of agricultural goods instead

Answer: It helps to separate this exercise into two parts. The first part is to arrange the percentage changes in wages and goods prices. This part is similar to problem 4 except that now it is the price of agriculture that is decreasing. By similar logic, the percentage change in the price of agricultural goods is larger than the percentage change in wage, which in turn is larger than the percentage change in the price of manufactured goods (zero). Thus,

For the second part, adding the percentage changesin specific-factors rental rates, recall that in thismodel, althoughthe real return to laboris ambiguous (which means that more agricultural products but fewer manufacturedgoods can be purchasedby labor),the real return to capital and land can both be determined and move in opposite directions. The

general rule for the specific-factors model is that a decrease in the relative price of an industry leadsto a real lossof the factor specificin that industry, anda real return to the specific factor in the other industry. This means that the percentagechange in losses to land is greater than both price changesand that the percentagechangein returns to capital isgreater than both price changes, which is equivalent to sayingthat fewer of both goods can be purchasedby landowners, although more of both goodscan be purchased by capital owners, respectively

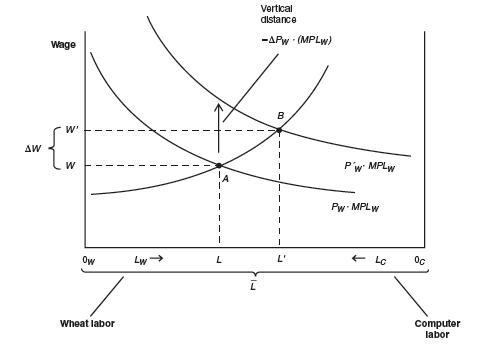

9. Suppose two countries, Canada and Mexico, produce two goods: timber and televisions. Assume that land is specific to timber, capital is specific to televisions, and labor is free to move between the two industries. When Canada and Mexico engage in free trade, the relative price of televisions falls in Canada and the relative price of timber falls in Mexico

a. In a graph similar to Figure 3-5, show how the wage changes in Canada due to a fall in the price of televisions, holding constant the price of timber. Can we predict that change in the real wage?

Answer: As shown by the following figure, real wage falls but by less than the percentage decrease in the price of televisions.

b. What is the impact of opening trade on the rentals on capital and land in Canada? Can we predict that change in the real rentals on capital and land?

Answer: Because capital is specific to the television sector, the drop in the relative price of televisions will lead to a fall in the rental on capital. With Canada exporting timber, rental on land will rise because land is specific to the timber industry

c. What is the impact of opening trade on the rentals on capital and land in Mexico? Can we predict that change in the real rentals on capital and land?

Answer: Through the exports of televisions, the relative price of televisions will rise in Mexico, which will lead to an increase in the rental on capital. By contrast, the rental on land will fall.

d. In each country, has the specific factor in the export industry gained or lost and has the specific factor in the import industry gained or lost?

Answer: In both cases, the specific factor in the export industry (i.e., land in Canada and capital in Mexico) gained, whereas the factor specific to the import industry (i.e., capital in Canada and land in Mexico) loses when the two countries engage in trade.

10. Home produces two goods, computers and wheat, for which capital is specific to computers, land is specific to wheat, and labor is mobile between the two industries. Home has 100 workers and 100 units of capital but only 10 units of land.

a. Draw a graph similar to Figure 3-1 with the output of wheat on the vertical axis and the labor in wheat on the horizontal axis. What is the relationship between the output of wheat and the marginal product of labor in the wheat industry as more labor is used?

Answer: See the following graph.

As more labor is added to the production of wheat, the marginal product of labor declines so that although the output of wheat continues to increase, the output is increasing at a decreasing rate.

b. Draw the production possibilities frontier for Home with wheat on the horizontal axis and computers on the vertical axis.

Answer: See the following graph.

c. Explain how the price of wheat relative to computers is determined in the absence of trade.

Answer: In the absence of international trade, the relative price of wheat is the slope of the line tangent to the PPF and Home’s indifference curve. At this tangency, wages are equal in wheat and computer industries.

d. Reproduce Figure 3-4 with the amount of labor used in wheat, measuring from left to right along the horizontal axis, and the amount of labor used in computers moving in the reverse direction.

Answer: See graph below.

e. Assume that due to international trade, the price of wheat rises. Analyze the effect of the increase in the price of wheat on the allocation of labor between the two sectors.

Answer:

The increase in the price of wheat shifts the PW MPLW curve upward to PW MPLW so

that the new equilibrium is at point B The amount of labor used in wheat increases from 0WL to 0WL ,although the amount of labor devoted to computers decreases from 0CL to 0CL Although the wage rises from W to W ,the increase is less than the vertical shift of the PW MPLW curve given as PW MPLW.

11. Similar to Home in Problem 10, Foreign also produces computers and wheat using capital, which is specific to computers; land, which is specific to wheat; and labor, which is mobile between the two sectors. Foreign has 100 workers and 100 units of land but only 10 units of capital. It has the same production functions as Home.

a. Will the no-trade relative price of wheat be higher in Home or in Foreign? Explain why you expect this outcome.

Answer: The no-trade relative price of wheat will be higher in Home than Foreign because Foreign has more units of land relative to Home. In other words, with more capital available for labor than land, the marginal product of labor in wheat is lower than the marginal product of labor in computersat Home. Because wages are equalized across the sector, price must be higher in the wheat industry:

The situation would be opposite for the foreign country, which has more land than capital. In this case, the price of capital is higher relative to the price of wheat without trade.

b. When trade is opened, what happens to the relative price of wheat in Foreign and to the relative price of wheat in Home?

Answer: When the two countries engage in trade, Home will export computers, so the relative price of wheat decreases at Home, whereas Foreign will export wheat, which will increase the relative price of wheat in Foreign

c. Based on your answer to (b), predict the effect of opening trade on the rental on land in each country, which is specific to wheat What about the rental on capital, which is specific to computers?

Answer: With Home exporting computers,the rental on capital will increase while the rental on land will decrease Because Foreign exports wheat, landowners will experience an increase in the rental on land, whereas capital owners will lose because of the decrease in the rental on capital.