18

Mr Arun Kumar President, Association of Multimodal Transport Operators of India (AMTOI) 17

Vijay Kumar Appointed Secretary of Ministry of Ports, Shipping and Waterway

Congratulations on completing 75 Years

18

Mr Arun Kumar President, Association of Multimodal Transport Operators of India (AMTOI) 17

Vijay Kumar Appointed Secretary of Ministry of Ports, Shipping and Waterway

Congratulations on completing 75 Years

Directorate General of Shipping Ministry of Ports, Shipping and Waterways Government of India

From

08 16 17

Transforming India’s Logistics Landscape 18 Cover Story

14

24 26 27 28 22 The Future of Maritime Cybersecurity with AI

Disclaimer

Maharashtra Approves Freight Corridor Linking Vadhavan Port to Samruddhi Expressway

Tracing the Coastal Shipping Bill, 2025

Jimi John To Helm WISTA India

Redefining Warehousing for Tomorrow’s Demands

India May Allow Large Ships as Loan Collateral to Boost Maritime Financing

Vijay Kumar Appointed Secretary of Ministry of Ports, Shipping and Waterways

The Rise of Container Shipping: A Historical Odyssey The Rise of 3PL’s

All advertisements in this magazine are placed with no liability accepted by the publisher for the material content therein. No responsibility is accepted by the publisher for omission or error or non-insertion of any advertisements. All advertisements and material in this magazine are subjected to approval by the publisher and are not necessary the opinion of the publisher. No liability is accepted for advertisements that are placed or any information that might be criminally connected. All information is checked to the best of our knowledge and is reliant upon the material submitted not being in contravention of all relevant laws and regulations and within the provisions of the Trade Practices Act.

Reproduction Prohibited

Maritime Matrix Today will not be responsible for the views expressed by contributors in their personal capacity. All rights reserved. Reproduction in part or whole without the permission of the Editor is prohibited.

Readers are recommended

To make appropriate enquiries before sending money, incurring expenses or entering into any commitment in relation to any advertisement published in this publication. Maritime Matrix Today does not vouch for any claims made by the Advertisers of Products and Services. The Printer, Publisher, Editor and Owner of Maritime Matrix Today shall not be held liable for any consequences, in the event such claims are not honoured by the Advertisers.

RNI: MAHENG/2013/50159

Published by Marex Media Pvt Ltd C-209, Morya House, New Link Road, Andheri West, Mumbai 400058 Email: info@marexmedia.com

Printed by Young Graphics Printed at Young Graphics, 208 Shankala Industrial Premises, Gogatewadi, Goregaon(E), Mumbai-400 063

U.S. President Donald Trump has announced a plan to match India’s high tariffs, imposing a 50% tariff that took effect on Wednesday, August 27, 2025, on a wide range of Indian goods. This decision has sent shockwaves through India’s export sectors, particularly textiles, gems, and auto parts, as businesses face increased costs and reduced competitiveness in the U.S. market.

Also, Trump’s proposed 50% retaliatory tariff is threatening to turn a loss of $48B in Indian exports to the U.S.

Needless to say, the tariffs in all likelihood could disrupt established supply chains, affecting industries such as automotive and electronics that depend heavily on Indian exports. More importantly, the sixth round of BTA talks, scheduled for August 25–29, 2025, was postponed amid the tariff escalation. Despite the setbacks, both nations have expressed a desire to continue negotiations, with India emphasizing the importance of the strategic partnership beyond trade issues.

The escalating uncertainty and retaliatory measures are undermining global trade growth. The sweeping tariffs introduced by Trump have profoundly disrupted the landscape of global trade and logistics. With far-reaching consequences from North America

to South Asia, the ripple effects are being felt across supply chains, trade alliances, and freight flows. As companies scramble to mitigate tariff impacts, shifting production and routing decisions are becoming par for the course, supply chains are being recalibrated to divert shipments through more tariff-favorable corridors. At the same time, logistics providers report greater difficulty in demand forecasting and inventory planning amid the regulatory unpredictability.

Trump’s sweeping tariffs have injected volatility into global trade, unsettling logistics networks, prompting supply-chain reconfiguration, and escalating costs. While some regions may benefit from re-routing and new partnerships, the overall picture is one of fragmentation with businesses and policymakers scrambling to adapt to an increasingly protectionist era. The WTO estimates that reciprocal tariffs and trade policy instability could cut world merchandise trade volume growth by 1.5 percentage points in 2025.

However, as the two countries engage in ongoing trade talks, the high stakes involved are bound to impart a negative bias to the nation’s logistics sector.

Kamal Chadha

Kamal Chadha Group CEO kamal@marexmedia.com

Shirish Kirtane

HOD Graphics shirish@marexmedia.com

Radhika Vakharia CEO radhika@marexmedia.com

Santosh Nivalkar Sr. Graphic Designer santosh@marexmedia.com

Padmesh Prabhune Editor padmesh@marexmedia.com

Manish Malve

Graphic Designer manish@marexmedia.com

Delphine Estibeiro Editorial Coordinator delphine@marexmedia.com

Bhavna Pimpale Coordinator bhavna@marexmedia.com

Jagdamba Pandey Manager, Business and Promotion jagdamba@marexmedia.com

AI is transforming the way ports and ships work. Smart cranes, autonomous navigation, and digital twins all speed up and make operations safer. But linking more gadgets also makes cyber threats worse. We need strong technology, clear standards, and people who know how to use it to keep secure.

1) AI brings new threats to ships and ports

GPS, radar, cameras, and AIS all give AI information. AI can make bad decisions if attackers change this data.

• GPS/AIS spoofing: Fake signals for position or identification might throw off route planning or port scheduling.

• Adversarial images/waves: Weird patterns or fake radio signals can fool models that look for or detect things.

• Poisoned training data: If the model’s learning set gets bad data, it could “learn” how to act in ways that are dangerous.

• Weak APIs and integrations: Hackers can utilize APIs that aren’t well protected to get from office IT to OT (cranes, pumps, ECDIS).

• Old control devices weren’t made for the internet, and adding AI on top can make them less stable.

2) How AI assists defenders

AI can also keep the port and the ships safe.

• Behavior analytics: Models learn what “normal” looks like for engine commands, crane cycles, logins, and updates, and then they flag anything that seems out of the ordinary.

• Threat intelligence matching: Known attacker tools and recent reports are added to alerts to focus on real threats.

• Edge detection: Ships and equipment use lightweight models to find faults even when there isn’t much bandwidth.

• Safe responses: AI should recommend actions, and people

should confirm measures that affect safety, including moving to manual control.

3) People still matter: training for an AI world.

People are still the last line of defense.

• Realistic drills: Teach crews how to tell the difference between false voices and fake emails that seek for route adjustments or crane overrides.

• Fallback practice: Practice using paper charts, manual steering, and inertial navigation when GPS stops working.

• Procedures and access: Two people check for software/model changes, contractors can only access the system for a limited time, and there are explicit change logs.

• Team drills: The bridge, engine room, and terminal teams all practice together. Cyber incidents impact everyone.

4) Keeping important maritime infrastructure safe

A multilayer defense lowers danger and speeds up recovery.

• Segmentation and zero trust: Keep IT, OT, and safety networks separate, and check every user and device every time.

• Secure AI lifecycle: Sign models and data digitally, keep a “bill of materials” for AI parts, and employ secure boot and TPMs on edge devices.

• Resilient navigation: Use radar and visual means to double-check GPS; discover spoofing/jamming and degrade gracefully.

• OT monitoring: Watch industrial protocols passively and only let approved commands and firmware through.

• Backups you check: Store backups of charts, PLC logic, and port systems offline where they can’t be changed, and practice restoring them.

• Vendor/partner governance: Make sure software vendors and integrators follow security guidelines, change keys regularly, and check shared APIs.

• Safety-aligned incident response: Playbooks that connect cyber steps with safety in navigation and industry so that decisions are quick and clear.

In short, AI may make marine operations smarter and safer, but only if we preserve the data, the models, watch how people act, and train them. In the AI age, cybersecurity is no longer an option; it’s a must.

If you’ve any questions or would like

to have a quick chat on the role of cybersecurity in the maritime world driven by AI, happy to connect at the below email address.

The Author

Srivastava Managing Director

Yodaplus Technologies Pvt Ltd vishrut@yodaplus.com

Union Minister for Ports, Shipping and Waterways

Sarbananda Sonowal on August 7 launched key digital initiatives at the IT Conclave 2025 to modernize India’s maritime sec-tor.Hosted by the Directorate General of Shipping (DGS) with the Company of Master Mari-ners of India (CMMI), the event supported the “Digital India,” “Maritime India Vision 2030,” and “Amrit Kaal Vision 2047” missions. Key highlights included the launch of a revamped DG Shipping website, the first phase of the cloud-native e-Samudra platform, and a digital transformation roadmap.The new website is GIGW 3.0 compliant,multilingual,and mobileresponsive.E-Samudra integrates 60+ services, initially covering vessel chartering approvals, shipbuilding financial aid, digital registration for

multi-modal transport operators, and au-tomated visitor access to DGS offices.

A pilot AI-based digital exam system at MMD Noida was also unveiled.The vision booklet ‘Leveraging Technology

in Maritime’outlines plans for simulation tools, digital archives,ERP systems, a real-time command centre, and cybersecu-rity aligned with the Digital Personal Data Protection Act.

On August 18, the Rajya Sabha passed the Indian Ports Bill, 2025,a landmark reform replac-ing the colonial-era Indian Ports Act, 1908. Proposed by Union Minister of Ports, Shipping & Waterways (MoPSW), Shri Sarbananda Sonowal, the bill was earlier cleared by the Lok Sa-bha and now awaits Presidential assent. The legislation introduces a modern regulatory framework for India’s maritime sector, mandating compliance with international environmental conventions like MARPOL and Ballast Water Management. It also requires ports to maintain emergency preparedness systems. A strong focus on digitalisation includes the in-troduction of a Maritime Single Window and advanced vessel traffic systems to boost effi-ciency, reduce

delays, and lower logistics costs. Shri Sonowal hailed the bill as a “milestone reform” that strengthens Centre–State coordination,encourages port-led development, and enhances investor confidence. He stated, “Ports are not just

gateways for goods; they are engines of growth, employment and sustainable development,positioning India for global maritime leadership.”

Reaffirming their strategic partnership, India and Russia signed a protocol to deepen coop-eration in aluminium, fertilizers, railways, and mining technology at the 11th Session of the India-Russia Working Group on Modernization and Industrial Cooperation held on August 06,2025 at Vanijya Bhawan, New Delhi, under the framework of the India-Russia Intergovernmental Commission on Trade, Economic, Scientific, Technological and Cultural Coopera-tion. From the Indian side, the session was co-chaired by Secretary, Department for Promotion of Industry and Internal Trade (DPIIT), Ministry of Commerce and Industry, Shri Am-ardeep Singh Bhatia, and from the Russian side by Deputy

Minister of Industry and Trade of the Russian Federation, H.E. Mr. Alexey Gruzdev. The two sides welcomed enhanced en-gagement in aluminium, fertilizers, and railway transport, alongside capacity building and technology transfer in mining sector equipment, exploration, and industrial

and domestic waste management. The session saw participation from around 80 delegates representing both sides, including senior government officials, domain experts, and representatives from industry.

Bangalore International Airport Limited (BIAL), operator of Kempegowda International Air-port Bengaluru (BLR Airport), has raised ₹9,000 crore through India’s largest unlisted private placement of non-convertible debentures (NCDs) in the airport sector. The fundraising is split into two tranches: ₹4,362 crore completed on July 25, 2025, and ₹4,638 crore sched-uled for early October. The NCDs, with a 15year tenure, are being used to refinance exist-ing debt, helping BIAL conserve capital and redirect resources toward future expansion. This refinancing lowers borrowing costs by replacing MCLR-linked interest rates with fixed rates and leveraging BIAL’s AAA credit rating. SBICAPs is the sole arranger

for the transaction.The NCD issue saw strong demand from banks,insurance companies, Infrastructure Debt Funds (IDFs), and Public Financial Institutions (PFIs). BIAL stated that the overwhelming investor interest reflects

strong confidence in its governance and long-term development plans, while the extended maturity profile ensures longterm financial stability.

Andhra Pradesh’s Chief Minister N. Chandrababu Naidu has called for the setting up of a Logistics Corporation to facilitate transport of cargo from AP and neighbouring states by sea ports, airports, roads, rail and even through inter-state waterways. Naidu urged integrated development of ports, airports, townships to spur economic growth.The Chief Minister chaired a review meeting on industries and infrastructure with senior officials here on Monday August 18. He proposed changes in the maritime policy to facilitate development of airports

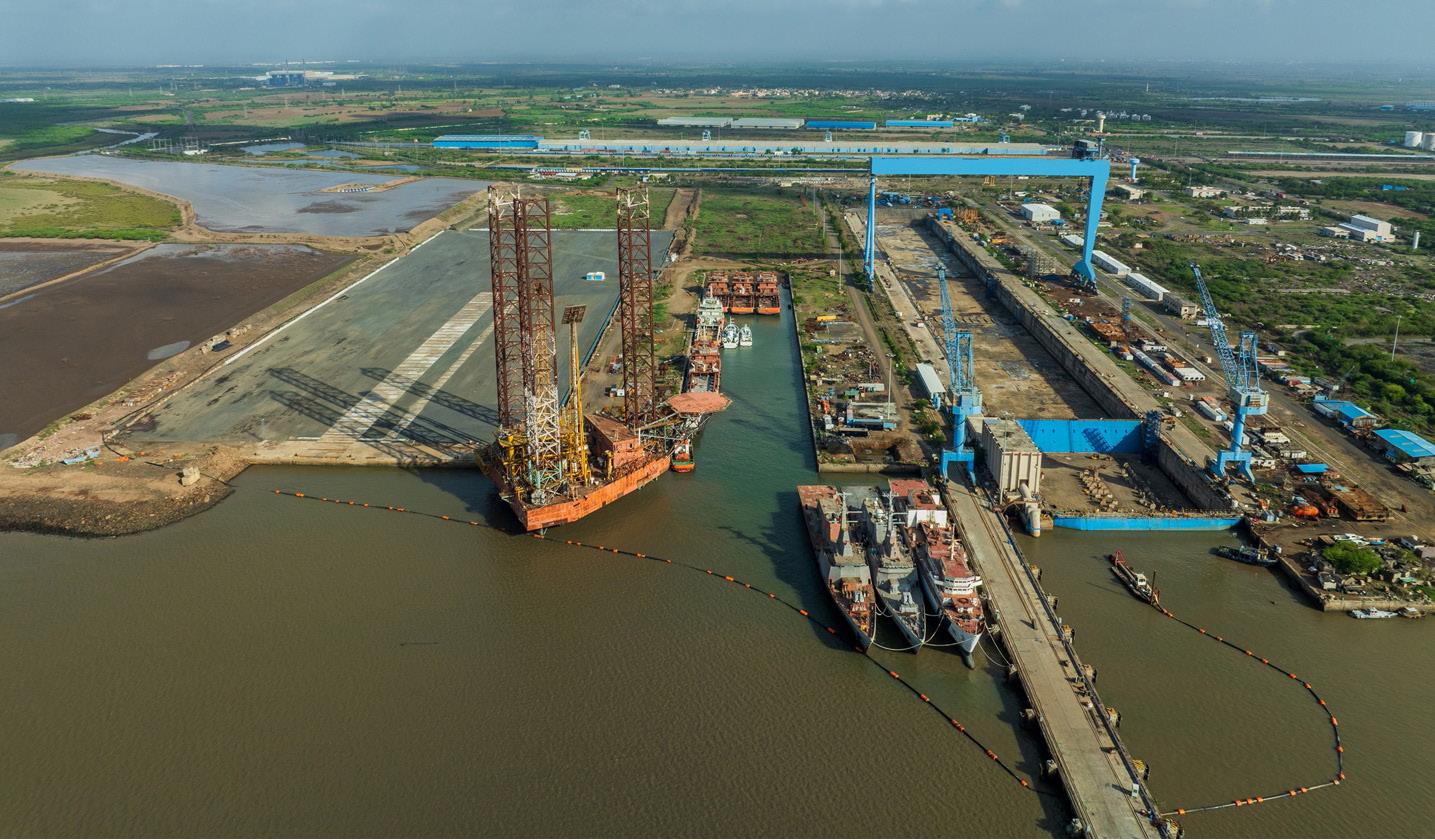

Swan Defence and Heavy Industries (SDHI) and Varex Imaging Corporation, a global leader in linear accelerators and imaging technologies, have partnered to manufacture cargo and vehicle inspection systems in India. According to the deal SDHI will exclusively produce Varex’s high-energy imaging systems at its Pipavav facility in Gujarat. This collaboration aims to support cargo inspections across India’s land and maritime gateways and aligns with the “Make in India” initiative by promoting local manufacturing of critical security equip-ment. The collaboration supports national security priorities and promotes indigenous man-ufacturing under the Make in India initiative. It enables Indian security agencies to access cutting-edge inspection

and ports and to develop the logistics corporation. He said AP was having 20 ports and they were making plans to set up a few more airports wherein huge operations were taking place from the seaports and airports. Naidu felt the need to develop economic cen-tres in the vicinity of every seaport and airport and called for developing satellite townships linking the seaports and airports so that new areas would be developed, resulting in genera-tion of wealth. The CM asked the officials to prepare a blueprint and said these could come up at places where such an integrated development could be taken up.

solutions locally, aligning with efforts to strengthen infrastructure at critical entry points. Spanning an area of overs 662 x 65 metres, i.e. approximately 10.63 acres, the SDHI shipyard houses

the country’s largest dry dock, with a fabrication capacity of 144,000 tonnes per annum.

Om Logistics Supply Chain, a subsidiary of Om Logistics Ltd., has unveiled a ₹150 crore in-vestment plan aimed at fortifying logistics infrastructure across Uttar Pradesh. The initia-tive, spotlighted by Chief Minister Yogi Adityanath during his visit to Unnao on July 26, seeks to: Enhance regional connectivity, strengthen nationwide supply chain efficiency, and pro-vide faster and more reliable logistics solutions to businesses. This strategic move is ex-pected to play a vital role in accelerating economic growth and positioning Uttar Pradesh as a logistics hub.The investment is also expected to generate new employment opportunities and promote industrial development in the region, contributing to national growth. By align-ing with

Uttar Pradesh’s progressive vision, the company is set to play a vital role in the state’s development.With three decades of experience, Om Logistics Supply Chain has emerged as a trusted name in the industry, offering end-to-end

logistics solutions. As part of its national growth strategy, the company continues to expand its network across India to meet the evolving needs of diverse industries.

AAJ Supply Chain Management is set to launch a state-ofthe-art warehousing facility in Tauru, near Gurugram, which will be the tallest warehouse in India at 21 meters. Developed as a Built-To-Suit (BTS) property by Welspun Enterprises, the facility is expected to become operational within this year.Spread across 1 lakh square feet, this Grade A warehouse re-flects AAJ’s commitment to innovation, service excellence, and sustainability. It will fully comply with fire safety norms, structural standards, and all relevant industry regulations. As AAJ’s fifth warehouse in the Delhi NCR region and tenth across India, the expansion strengthens the company’s regional footprint and service capabilities. Strategically located near key consumption centres and transport corridors, the new facility enables

faster last-mile deliveries, improved turnaround times, and greater inventory flexibility. Embracing a vertical warehousing model, the 21-meter height allows multi-tier racking and

denser stor-age, leading to enhanced throughput, better space utilisation, and cost efficiency—especially crucial in space-constrained hubs like Gurugram.

In a major infrastructure push to bolster trade and logistics connectivity in Maharashtra, the state cabinet has approved the development of a 105-kilometre-long expressway that will link the upcoming Vadhavan Transshipment Port in Palghar to the Mumbai-Nagpur Samruddhi Expressway at Bhiwandi in Nashik district. The project, envisioned to streamline the movement of goods and strengthen regional economies, is set to be a key addition to India’s growing multimodal transport network.

The new freight corridor is designed to enhance the state’s transport efficiency by connecting the Vadhavan Port—a strategically located deep-sea transshipment port on the western coast—with the high-speed Samruddhi Expressway. Officially known as the “Hindu Hrudaysamrat Balasaheb Thackeray Maharashtra Samruddhi Mahamarg,” the expressway is a 701-kilometre, six-lane road connecting Mumbai and Nagpur, intended to drastically cut travel time across Maharashtra.

Approved during a state cabinet meeting earlier this week, the project will be implemented by the Maharashtra State Road Development Corporation (MSRDC) . It is estimated to cost approximately ₹2,529 crore. The state has also sanctioned the raising of ₹1,500 crore through a loan from the Housing and Urban Development Corporation (HUDCO) to support the financing of this mega infrastructure initiative.

According to officials, the corridor is expected to be completed within three years , a timeline that aligns with the broader vision of making Vadhavan Port operational in the near future. The proposed route will traverse multiple talukas, including Dahanu, Vikramgad, Jawhar, and Mokhada in Palghar district, as well as Trimbakeshwar and Igatpuri in Nashik district. These areas, many of which are underdeveloped tribal regions, are expected to benefit from enhanced road connectivity and new economic opportunities. Experts also believe that improved connectivity may support tourism growth in areas like Trimbakeshwar,a popular religious

destination, and Jawhar,known for its tribal heritage and natural beauty.

The project’s financial model involves a mix of public funding and institutional borrowing. The ₹1,500 crore loan from HUDCO is a significant part of the funding strategy. In addition, the cabinet-approved allocation of ₹2,529 crore will cover construction, land acquisition, rehabilitation, and associated infrastructure like toll plazas, safety systems, and digital monitoring.

The MSRDC, which has successfully delivered projects such as the Bandra-Worli Sea Link and the Samruddhi Expressway, will oversee execution, including contractor selection, timeline enforcement, and quality control. Given the corporation’s track record, the government hopes the project will progress smoothly and meet its 36-month deadline.

While the approval has been met with optimism, the project may face several challenges on the ground. Land acquisition ,particularly in tribal and forested regions, could be contentious. Ensuring that local communities are adequately compensated and rehabilitated will be crucial to avoiding delays and protests.

Environmental concerns are another key issue. The expressway will pass through eco-sensitive zones ,including hilly and forested areas in Palghar and Nashik. Environmentalists have already raised concerns over potential deforestation, wildlife disruption, and ecological imbalance.

The government has stated that detailed environmental impact assessments (EIAs) will be conducted, and all clearances will be secured before construction begins. Mitigation measures such as wildlife crossings, afforestation, and use of eco-friendly materials are also being planned.

Politically, the move is being seen as part of the Maharashtra government’s broader infrastructure push ahead of the 2025 state elections. The ruling coalition has placed significant emphasis on roads, ports, and logistics as means to revive the post-pandemic economy and boost investor confidence.

Strategically, the freight corridor enhances Maharashtra’s role in the National Logistics Policy and aligns with the PM Gati Shakti initiative, which aims to integrate different modes of transport and improve efficiency across India’s logistics chain.

By linking a major upcoming port with a flagship expressway, the state is positioning itself as a central node in the nation’s

multimodal transport ecosystem, which is vital for reducing logistics costs—currently around 14% of GDP in India, compared to 8-10% in developed economies .

Voices from the Ground

Speaking to local media, officials highlighted the project’s transformative potential. “This expressway will pass through Dahanu, Vikramgad, Jawhar, and Mokhada talukas of Palghar district and Trimbakeshwar and Igatpuri talukas of Nashik district,” an official was quoted as saying. “It will open new avenues of economic growth in tribal regions and give farmers and artisans access to bigger markets.”

Local leaders and panchayat members have expressed cautious optimism. While welcoming development, they have emphasized the need for inclusive planning and local hiring in construction jobs.

The greenlighting of the Vadhavan-to-Samruddhi freight corridor marks a significant step in Maharashtra’s infrastructure journey. It reflects the state’s ambition to create seamless connectivity between its ports and hinterlands, reduce logistical bottlenecks, and empower underdeveloped regions through smart infrastructure investments.

However, as with all major projects, the success of this initiative will depend on transparent implementation, sensitivity to local communities and ecosystems, and timely delivery. If executed well, the corridor could become a model for integrated development—blending economic growth with regional equity and environmental stewardship.

MMT

Genesis: A Push to Reform Coastal Trade (Late 2024)

The bill was formally introduced in the Lok Sabha on December 2,2024.Its aims were ambitious: to eliminate the need for Indian-flagged vessels to obtain a trading licence ,streamline regulatory processes, and bolster domestic coastal shipping. At the time, it was hailed as a transformative step to enhance ease of doing business and unlock India’s latent maritime potential.

Drafted to supersede outdated provisions under Part XIV of the Merchant Shipping Act, 1958 ,it proposed to bring Indian maritime policy in line with global best practices. Provisions included expediting licensing, establishing a National Coastal and Inland Shipping Strategic Plan , and launching a National Database of Coastal Shipping

Lok Sabha Approval: A Strategic Shift (April 3, 2025)

On April 3, 2025,the Lok Sabha passed the Coastal Shipping Bill, 2024, via voice vote. Union Minister Sarbananda Sonowal emphasized its role in federal cooperation, ensuring the law didn’t infringe on state jurisdictions, and integrating global regulatory practices tailored to India’s coastline. He reiterated that the bill excluded fisheries ,set new routes for Indian-flagged vessels, and aimed to grow domestic maritime commerce.

Rajya Sabha Passage: Finalizing from Upper House (August 7, 2025)

On August 7, 2025 , amid protests in Parliament over another

matter (the Bihar electoral roll debate), the Rajya Sabha passed the Coastal Shipping Bill, 202 , by voice vote. Sarbananda Sonowal declared the bill would “reduce compliance burden for Indian ships” and strengthen “supply chain and national security.”

The Act formalizes its definitions: coastal waters include both territorial waters (up to 12 nautical miles) and adjoining 200-nautical-mile maritime zones. It consolidates regulation of Indian vessels, encourages Indian ownership, and ensures compliance aligned with strategic national interests.

This bill marks a landmark transition—from the 1958 colonial-era framework to a contemporary, strategic, and streamlined system that:

• Supports domestic tonnage, encouraging Indian-flagged vessels to dominate coastal trade.

• Integrates coastal and inland waterways under unified policy planning.

• Enhances transparency with a national database and longterm strategic oversight.

• Aligns legal norms with global standards, promoting competitiveness and national security.

While the Coastal Shipping Bill, 2025 is framed as an economic and regulatory reform, its strategic backbone is unmistakable. It lays the groundwork for India to:

• Dominate its own coastal supply chains,

• Harden its logistics infrastructure against external and internal disruptions,

• Assert maritime influence in the region,

• And create a flexible civil-military maritime architecture.

Verdict: This bill is India’s quiet but decisive step toward maritime strategic autonomy—a key pillar in the 21st-century geopolitical chessboard.

- Delphine Estibeiro

The Women’s International Shipping & Trading Association (WISTA) India has marked a new chapter in its journey with the election of Ms Jimi John as its President. A seasoned Advocate and Accredited Arbitrator, Chambers of Jimi John, Advocates, Jimi brings over 22 years of expertise in maritime and commercial law. Her appointment signals a renewed commitment to fostering professional excellence and inclusivity within the maritime sector.

Jimi’s focus will be on building a vibrant platform where knowledge-sharing and professional growth converge, ensuring that WISTA India continues to be a driving force for women in the maritime and allied industries. “I am grateful for the trust and confidence bestowed upon me,” Jimi shared.

Joining Jimi in steering WISTA India forward is a dynamic board of professionals, each bringing distinct expertise and vision. The board includes:

• Ms Sandhya Pillai, Vice President – Advocate and Managing Partner at VMT Legal LLP, known for her specialization in ship arrests, charterparty disputes, and crew claims. She serves on multiple DG Shipping committees, championing regulatory reform and gender equity.

• Ms Arathi Narayanan, General Secretary – Director at ABS Marine Services Ltd, a law graduate with a master’s in Maritime Law from the University of Southampton. She

oversees legal and administrative affairs while driving tech-enabled transformation.

• Ms Kajal Festen-Purohit, Treasurer – Partner at IndiMaritime Solutions LLP and Account Manager (South Asia) at Marine Masters. With over two decades in marine services and market strategy, she excels in navigating complex global environments.

• Ms Sanjam Sahi Gupta, Board Member – Director at Sitara Shipping Pvt Ltd and founder of WISTA India. A globally recognized advocate for diversity in shipping, she continues to lead initiatives that empower women across the industry.

• Ms Manisha Thaker, Board Member – Vice President at Trialliance Global Solutions, EXIM faculty, and logistics expert. With over 25 years of experience, she mentors MSMEs and emerging professionals while promoting gender inclusion on global platforms.

Together, this board represents a powerful blend of legal acumen, strategic foresight, and unwavering commitment to advancing women’s leadership in maritime and trade.

Marex extends its best wishes to the newly elected board for a successful and impactful two-year tenure.

Mr Arun Kumar, President of the of Multimodal Transport Operators (AMTOI), was born in Nainital in 1972. The younger of two sons, he grew up in a family rooted in agricultural science—his father was an agronomist, his mother a homemaker, and his elder brother a statistician in the same field.

Mr Kumar pursued his academic interests in Economics, followed by a postgraduate degree in Business Administration. He is married to a postgraduate in History, and their son, a postgraduate in Aerospace Engineering, is currently employed in the United States.

Mr Kumar’s professional journey in logistics began in 2001. In 2010, he co-founded InSynergy Supply Chain Solutions Pvt. Ltd., and over the years, he has earned certifications in Customs Regulations, IATA Cargo, and IMDG. His association work commenced with the Air Cargo Forum India (ACFI), where he served as a board member, Honorary Treasurer, and currently as Honorary Secretary. Since 2018, he has played a pivotal role in AMTOI, holding positions as Honorary Treasurer, Honorary Secretary, Vice President, and now President.

Outside of work, Mr Kumar is an avid explorer and lifelong learner. His personal philosophy is rooted in humility and curiosity: “While we often take ourselves too seriously, the world rarely does—so it is best to stay humble, curious, and open.”

Mr Arun Kumar

President, Association of Multimodal Transport Operators of India (AMTOI)

He maintains a clear boundary between professional and personal life. At work, his focus is unwavering; at home, he disconnects completely, even setting aside his phone until the next workday. This discipline, he believes, enables him to be fully present in both spheres—delivering undistracted focus at work and undivided attention to family. For him, balance is not about equal time, but about intentional presence.

In conversation with Miss Delphine Estibeiro of Marex Media, Mr Kumar reflects on the evolving landscape of logistics, the challenges of global competitiveness, and the transformative role of multimodal transport in shaping India’s future.

The AMTOI was created with a bold vision, to champion multimodalism and transform logistics into a true enabler of India’s growth story. India, the seventh largest country in the world, covers 3.287 million square kilometres, about 2.4% of the planet’s landmass. With such scale, and a unique socio-economic landscape rooted in diversity and complexity, logistics efficiency is not an option but a necessity. While India has made remarkable progress in recent years, the global benchmarks we aspire to demand that we move faster, smarter, and in a more integrated way.

Over the next five years, AMTOI’s vision is to position India as a global leader in logistics competitiveness. We will work tirelessly to ensure multimodal logistics becomes the backbone of economic growth, not just in rhetoric but in execution. Our goal is to convince policymakers that the industry is not only mature enough to self-regulate but also capable of guiding the government in designing frameworks that accelerate trade, reduce costs, and unlock India’s full economic potential. AMTOI will lead this transformation with confidence, collaboration, and conviction, so that India does not just participate in global supply chains, but sets the benchmark for the world to follow.

In my view, multimodal transport operators in India have historically lagged behind on almost all key enablers— whether it was physical infrastructure, regulatory clarity, standardization, capacity building, or even the recognition that logistics is central to economic growth. Until a decade ago, this was a serious handicap. Fortunately, much has changed. Today, with the National Logistics Policy, growing emphasis on infrastructure, and the development of world-class highways, rail corridors, ports, and airports, we can confidently say that the physical side of logistics is improving at a remarkable pace.

However, the most pressing challenge now lies in the regulatory framework, which has not kept pace with infrastructure growth. Excessive complexity, overlapping jurisdictions, and a lingering colonial mindset continue to create bottlenecks. Instead of enabling trade, regulations often overreach, leading to undue litigations—particularly in taxation—that force operators to spend more time defending themselves than innovating.

Another critical challenge is India’s low maritime tonnage capacity. Unless the government creates an enabling ecosystem that attracts investment into Indian shipping, we risk falling behind in this vital area.

At AMTOI, we consistently engage with policymakers to highlight these issues. While progress is slow, our focus remains on building trust, simplifying regulations, and ensuring India’s multimodal sector becomes both globally competitive and self-sustaining.

Sustainability and green logistics are no longer optional; they are essential for the future of trade and transport. At AMTOI, we recognize that multimodal logistics must align with India’s broader climate commitments and global ESG goals. With this vision, AMTOI has established a dedicated ESG Council, which serves as the focal point for promoting awareness, education, and practical adoption of sustainable practices across our member community. The Council actively engages with stakeholders to highlight the long-term benefits of green operations and supports members in integrating ESG considerations into their dayto-day business strategies.

Our initiatives range from organizing knowledge sessions, workshops, and dialogues with policymakers to advocating for incentives that encourage the use of cleaner fuels, energy-efficient technologies, and digital solutions to reduce carbon intensity. AMTOI also works to spread awareness about global sustainability standards so that Indian multimodal operators remain competitive in international markets where ESG compliance is becoming a critical trade requirement.

We believe that change begins with awareness, but must be reinforced with action. By fostering collaboration between industry, government, and the wider logistics ecosystem, AMTOI is committed to ensuring that sustainability is not just a buzzword but a lived practice, positioning Indian logistics as both environmentally responsible and globally competitive.

Inland waterways and coastal shipping hold immense potential to transform India’s multimodal transport

strategy. Despite having one of the largest navigable river networks in the world and a coastline of over 7,500 kilometres, these modes remain underutilized compared to road and rail. Integrating waterways and coastal shipping can significantly reduce logistics costs, ease congestion on land corridors, and lower carbon emissions, making them both economically and environmentally attractive.

Recent initiatives such as the Sagarmala programme, the Jal Marg Vikas project, and most recently, the Coastal Shipping Bill, represent important steps in the right direction. The Bill, though only a baby step, signals the government’s intent to streamline policies and create a stronger framework for the growth of coastal shipping. Yet, the pace of integration has been slower than desired, hindered by infrastructure gaps, regulatory misalignment, and insufficient investment in vessels and supporting facilities.

To truly unlock the potential of waterways, India must focus on creating efficient last-mile linkages, standardizing multimodal processes, and providing policy incentives that make these modes commercially viable. At AMTOI, we believe that waterways and coastal shipping are not optional but essential pillars of a truly multimodal ecosystem. With sustained commitment, they can be game changers in reducing logistics costs and positioning India as a global leader in sustainable transport solutions.

A Partnership for Growth…

AMTOI believes that constructive engagement with the government is the key to shaping a progressive logistics ecosystem. We interact with government bodies at multiple levels—ranging from on-ground enforcement teams to

the highest offices, including the Prime Minister’s Office. While the Department of Logistics under DPIIT, Ministry of Commerce serves as the nodal body for the sector, our engagement goes much wider. We regularly interact with the Ministry of Railways, Ministry of Ports, Shipping and Inland Waterways, Ministry of Civil Aviation, Ministry of Road Transport and Highways, and most importantly, the Ministry of Finance, ensuring that the industry’s concerns and aspirations are heard across the policy spectrum.

What makes our approach distinct is that we do not limit ourselves to raising issues. We also provide actionable solutions and present a collective vision for the industry’s growth. This proactive stance has helped us establish credibility and foster trust with policymakers. Many of our inputs have already influenced the design and direction of recent logistics policies. Our only wish is that more of our recommendations were implemented with greater urgency, as they represent the voice of the trade. With continued collaboration, we are confident of driving meaningful reforms that will position India’s logistics sector on par with global standards.

The National Logistics Policy and the PM Gati Shakti initiative are landmark steps towards transforming India’s logistics landscape, and AMTOI sees its role as both a catalyst and a partner in their successful implementation. Multimodal logistics lies at the heart of these initiatives, and as the apex body representing multimodal transport operators, AMTOI is uniquely positioned to contribute industry insights, identify on-ground challenges, and propose practical solutions that make the vision a reality.

Through our continuous engagement with government bodies, we aim to ensure that the NLP’s objectives, cost reduction, efficiency improvement, and global competitiveness, are aligned with industry capabilities. PM Gati Shakti’s focus on integrated infrastructure resonates strongly with AMTOI’s vision of seamless multimodality, and we are committed to supporting the creation of synergies between roads, railways, ports, airports, and inland waterways.

Beyond advocacy, AMTOI also plays a knowledge-sharing role by sensitizing its members to policy directions, building awareness about digital integration, ESG compliance, and green logistics, and preparing them to be active participants in this transformation. In essence, AMTOI acts as a bridge, channelling the aspirations of the industry into policy and ensuring that these national initiatives deliver tangible results on the ground for both trade and the economy.

Skill development and training are absolutely vital for building a world-class multimodal logistics ecosystem. However, this is one area where, as AMTOI, we candidly acknowledge that we have not been able to do as much as we would like. While we strongly believe in the importance of upskilling professionals, our limited resources and the pressing need to constantly address day-to-day challenges of the industry have constrained our ability to invest adequately in structured training initiatives.

That said, we have undertaken some steps, such as organizing knowledge-sharing sessions, industry dialogues, and awareness programs, but we recognize these are not enough to meet the scale of need in such a fast-evolving sector. Our aspiration is to play a much larger role in skill development, especially in areas like digital logistics, regulatory compliance, ESG practices, and global standards of multimodality.

As the industry matures and we are able to draw some respite from firefighting operational challenges, we hope to channel more of our time, energy, and resources into creating training modules, certification programs, and partnerships with academic institutions. We see this not only as a responsibility but also as an opportunity to strengthen the professional base that will drive India’s logistics transformation.

It might sound repetitive, but India is uniquely positioned to become a global hub for multimodal logistics. With its vast geography, a 7,500 km coastline, growing infrastructure network, and a rapidly expanding economy, the fundamentals are firmly in place. The National Logistics Policy and PM Gati Shakti have laid a strong foundation by focusing on

integrated infrastructure and efficiency. However, for India to truly emerge as a hub, we must go beyond infrastructure and address softer issues such as regulatory simplification, global standardization, digitization, and ESG compliance. Reducing logistics costs, ensuring seamless interconnectivity between modes, and building maritime capacity will be critical in attracting global trade flows to route through India.

AMTOI plays a central role in this ambition by acting as the collective voice of the multimodal logistics community. We continuously engage with policymakers to advocate for reforms that make India globally competitive, while also spreading awareness among our members about best practices, sustainability, and technology adoption. By fostering collaboration between government and industry, AMTOI ensures that policies are not just visionary but also implementable on the ground. Our ultimate goal is to help India move from being a participant in global supply chains to becoming an indispensable hub, setting benchmarks in efficiency, innovation, and resilience.

To young professionals aspiring to build careers in logistics and transport, my message is simple: you are entering one of the most dynamic and impactful sectors of our economy. Logistics is no longer just about moving goods from one point to another, it is about enabling trade, connecting markets, driving efficiencies, and increasingly, shaping sustainability. With India’s economy expanding rapidly and global supply chains being redefined, the opportunities in this sector are vast and exciting.

However, this is also a field that demands resilience, adaptability, and continuous learning. Technology, policy frameworks, and customer expectations are evolving at an unprecedented pace. Those who embrace innovation, digital tools, and ESG practices will find themselves at the forefront of transformation.

At the same time, logistics is an industry built on collaboration and trust. My advice is to see yourself not just as an employee or entrepreneur, but as a partner in building solutions that can power India’s growth. It is a sector that rewards hard work, creativity, and integrity.

If you are willing to invest your passion and energy, logistics can offer not just a career, but a chance to make a meaningful contribution to India’s journey towards becoming a global leader in trade and connectivity.

Once viewed as a supplementary solution, the Third‑Party Providers are rapidly becoming central strategic partners

The Indian logistics and packaging markets are both experiencing robust growth, driven by increased e-commerce, infrastructure development, and a shift towards technology and sustainability. In recent times one of the key trends in logistics include the rise of third-party logistics (3PL) providers, automation, and multi-modal transportation.

India, as a home to one of the world’s fastest-growing economies and a vibrant digital ecosystem, is undergoing a logistics renaissance. With the government pushing ahead with the National Logistics Policy (NLP), infrastructure upgrades, and a vision to reduce logistics costs from 14% to around 8% of GDP, third-party logistics (3PL) providers are emerging as vital enablers of growth across sectors; from e-commerce to pharmaceuticals to heavy manufacturing.

Third-Party Logistics (3PL) providers are becoming more prevalent, offering integrated services, cost savings, and asset-light models for small and medium-sized businesses. Experts say, “In an era defined by supply chain shocks, economic volatility, and ever-rising customer expectations, businesses; especially in the B2B sphere are turning to third-party logistics (3PL) providers like never before.”

While the fact remains, India has been pursuing the infrastructural push with various policy reforms, the Make in India has started showing its result. With initiatives like ‘Make in India’ and the PLI (Production Linked Incentive) schemes, India is emerging as a global manufacturing hub.

This shift has led to an uptick in industrial logistics needs and 3PLs are stepping up. Providers such as Mahindra Logistics, TCI Supply Chain

Solutions, and Allcargo Logistics are offering integrated freight, customs, and warehouse solutions to manufacturers, particularly in automotive, electronics, and pharma sectors.

A case in point is Mahindra Logistics’ partnership with Bajaj Electricals, where it redesigned their entire supply chain with a consolidated warehouse model that reduced inventory duplication and improved order fill rates by over 15%.

Additionally, 3PLs are now supporting India’s MSMEs, helping them access organized supply chain services at scale. Startups like Shiprocket have democratized shipping for small online sellers, integrating with over 25 courier partners and offering warehousing-asa-service.

India’s logistics transformation is underpinned by a massive infrastructure overhaul. Projects such as the Dedicated Freight Corridors (DFCs), Bharatmala, Sagarmala, and multimodal logistics parks are reducing turnaround times and enabling more

efficient freight movement.

The impact is tangible: according to CBRE India, industrial and logistics leasing hit a record 27.1 million sq ft in H1 2025, with 3PL players accounting for over 37% of this space. Leading the demand were hubs like Delhi-NCR, Mumbai, Pune, and Bengaluru, driven by warehousing needs of e-commerce and FMCG clients. Global firms are also tapping into India’s growth. DHL Supply Chain announced a ₹4,000 crore investment to build 12 mega logistics centers in India by 2027, indicating long-term confidence in the country’s 3PL potential.

Companies outsource to 3PLs to cut capital expenses by leveraging existing infrastructure instead of investing in warehouses, fleets, or logistics systems. This reduces costs on facilities, equipment, and labor, freeing resources for core areas like innovation and customer service. 3PLs also offer economies of scale, better shipping rates, and optimized routes, delivering further cost savings.

Scalability, Flexibility, and Resilience

3PLs enable flexible scaling of logistics without fixed costs, crucial amid fluctuating demand from seasonal peaks or disruptions. Their variablecost models support geographic expansion and product testing. In a post-pandemic world, their value is clear—offering resilience through contingency planning, diverse carrier networks, backup warehousing, and deep operational expertise.

Expertise, Compliance, and Operational Precision

Working around with complex regulatory frameworks; whether around international trade, food logistics, or safety regulations, itself can be adaunting task. 3PL providers employ dedicated experts in regulatory compliance, reducing the risk of fines, delays, or logistical failure. Moreover, they bring deep understanding of large retailers’ requirements providing the innovative packaging solution be it; labelling, barcoding, EDI integration, packaging, and delivery protocols thus helping businesses avoid penalties or lost access to important distribution channels

Beyond compliance, rigorous quality assurance systems say like ISO certifications, inventory auditing, and structured staff training—enhance accuracy and reduce damage or error rates

Technological Leverage and InsightDriven Operations

Modern 3PLs are far more than mere warehousing and transport. They are increasingly powered by data, automation, and connectivity. RFID tracking, robotic picking, and AI-driven warehouse automation are transforming efficiency and throughput. Integration via API and EDI connectivity ensures seamless data exchange, faster order processing, and better compliance management. Real-time visibility via IoT, GPS, dashboards, and mobile tools further ensures transparency and operational agility.

ESG (Environmental, Social, and Governance) considerations are now core business factors. Leading 3PLs

are responding with eco-conscious solutions: electric or hybrid vehicles, route optimization, energy-efficient warehouses, recyclable packaging, and carbon-offset programs. These efforts not only reduce carbon footprints, but also appeal to consumers, governments, and institutional buyers seeking greener supply chains

E-commerce and Reverse Logistics

E-commerce’s rapid growth demands logistics that manage small, fast shipments, omnichannel fulfillment, and efficient returns. 3PLs meet this need with agile last-mile delivery, distributed warehousing, and tailored solutions. They also excel in reverse logistics—handling returns, refurbishment, and recycling— turning high return rates into strategic advantages for online retailers.

India’s e-commerce market, projected to reach $200 billion by 2026, is driving demand for agile, techdriven logistics. 3PL players like Delhivery, Ecom Express, Xpressbees, Shadowfax have scaled rapidly, offering integrated warehousing, last-mile delivery, real-time tracking suited to India’s fragmented geography. While e-commerce giants like Flipkart, Meesho increasingly manage in-house deliveries, they still rely on 3PLs in tier-2, tier-3 cities, rural regions where scaling logistics remains tough. Ecom Express serves 2,700+ towns, uses AI to optimize remote deliveries. Xpressbees, a 2022 unicorn, invests in hub automation, regional fulfillment to meet rising expectations in semi-urban markets.

Localization and Trade Strategy in a Changing World

Geopolitical tensions, tariffs, and consumer expectations for rapid delivery are reshaping logistics strategies. Many global brands are shifting toward local or regional distribution models, often using 3PLmanaged bonded warehouses to bypass tariffs until point of sale.

Globally logistics firms have leased massive U.S. warehouse space— about 20% of new leases through Q3 2024 using 3PL networks to pre-

position stock ahead of regulatory or tariff changes. Meanwhile, in India, industrial logistics space leasing shot up 63% in H1 2025, led by demand from 3PLs across hotspots like Delhi-NCR, Mumbai, and Bengaluru

Competitive Pressures and the Need to Evolve

As 3PLs grow, e-commerce giants like Amazon, Flipkart, and Meesho now handle 82% of deliveries in-house, shrinking standalone 3PL market and driving sector-wide consolidation and innovation.

3PLs have become vital extensions of modern supply chains, offering cost efficiency, scalability, compliance, real-time visibility, data insights, and sustainability while navigating complex retail and trade ecosystems.

Yet, the competitive landscape demands ever-evolving 3PL models. Providers must embrace technology, green practices, tailored services, and integration with clients’ systems. They also need to anticipate moves by large players internalizing logistics, and pivot accordingly.

Leverage 3PLs: To optimize capital allocation; transform fixed spending into scalable, strategic investment.

Go Digital: Demand integrated digital platforms; API/EDI integration, dashboards, and visibility tools must be part of the value proposition.

Prioritize sustainability: Partner with 3PLs that support ESG goals through green logistics.

Flexible Options: Seek flexible, customized offerings especially for e-commerce, omnichannel distribution, and reverse logistics.

Stay geopolitically savvy: Work with 3PLs able to adapt distribution strategies amid tariffs and trade shifts.

The Indian e-commerce market is one of the fastest-growing globally, with significant projected expansion. And India’s e-commerce boom is rewriting the logistics playbook, transforming warehouses from mere storage units to high-tech, customer-centric hubs vital for swift delivery and supply chain agility. Spurred by online retail’s meteoric rise, these modern warehousing facilities are driving infrastructural investment, innovation, and operational excellence.

India’s e-commerce revolution is not just transforming demand rather it’s redefining warehousing. e-commerce is fueling the evolution, driven by

market forces, technological trends, policy support, and strategic expansion by developers and logistics players.The industry is moving from unorganized godowns to tech-enabled, urbancentric hubs engineered for speed, precision, and sustainability.

The case in point is Bhiwandi, once synonymous with textile sheds, has now transformed into Asia’s largest warehousing hub. E-commerce giants like Amazon, Flipkart, Delhivery, and others now operate major facilities close to Mumbai’s port, illustrating how warehousing has evolved from godown clusters to strategic logistics powerhouses.

India’s e-commerce industry driven by giants like Amazon, Flipkart, and a growing cohort of D2C brands continues to surge. As of early 2025, India’s warehousing sector saw an unprecedented leap, with industrial and logistics leasing jumping 63% year-on-year, totaling 27.1 million square feet in H1 alone. This growth is powered significantly by the expansion of e-commerce and 3PL players across key zones like Delhi-NCR, Mumbai, and Bengaluru. Industry experts opines , the upward race extends beyond leasing. The e-commerce warehousing market, estimated at

USD 8.5 billion in 2024, is projected to soar to USD 35.6 billion by 2033, growing at a stunning 17.3% CAGR, according to IMARC Group.

Hyperlocal Warehousing

There is a tremendous opportunity for growth as e-commerce penetration expands into smaller cities and towns, driving demand and business. Traditional “godowns” are being replaced by Grade A facilities; that are well-equipped warehouses with high ceilings, automation, WMS, cold-storage, and more. Driven by e-commerce requirements, these developments are happening in both urban fringes and emerging tier-II and tier-III cities of the likes of Patna, Nashik , Nagpur to name some. Simultaneously, the hyperlocal or quick-commerce boom is reshaping logistics. Platforms like Blinkit, Zepto, Instamart, and BigBasket Now are pushing for a 10–15-minute deliveries via urban mini-fulfilment centers. This has sparked a surge in last-mile micro-warehouses, often tucked into basements or compact plots that rapidly outpacing supply.

Real Estate Infrastructure

The warehouse boom is attracting significant capital. Welspun

One Logistics Parks is investing ₹2,150 crore (~$250 million) to expand its warehousing footprint across Karnataka and Tamil Nadu, addressing rising logistics infrastructure needs in southern India. Similarly, industrial REITs are stepping in: NDR InvIT Trust recently leased 2.35 lakh sq. ft. in Goa to Zomato and SS Supply Chain, highlighting growing appetite from e-commerce and logistics tenants.

On a broader scale, global developers like IndoSpace are boosting investment in Tamil Nadu by 41%, targeting a massive growth in industrial park space, with expectations of warehousing value doubling from $16.4 billion (2023)

to $37 billion by 2032 according to a report.

India’s cold chain market is poised for significant expansion in 2025, driven by government initiatives, e-commerce growth, increased food consumption, and advancements in technology. The focus is shifting from solely potato storage to multi-purpose, modern cold storage facilities, with a particular emphasis on integrating advanced technologies like IoT and AI, upgrading infrastructure, and enhancing last-mile connectivity to meet the demands of the growing food, pharmaceutical, and FMCG sectors, especially during peak summer demand.

The booming e-commerce sector, particularly in food delivery, is increasing demand for scalable cold chain logistics to handle temperaturesensitive products and ensure timely delivery. Furthermore, demand for perishables; pharma, fresh food, QSR supply has spurred a rise in cold chain infrastructure. Providers like Snowman, ColdStar, and Coldman are expanding Grade A cold storage across metros and regional hubs.

Government Policy Setting the Stage

Government policies are fueling transformation. The National Logistics Policy (NLP), PM Gati-Shakti, and GST reforms are streamlining supply chains and making warehousing more viable nationwide

Multi-Modal Logistics Parks (MMLPs) under LEEP aim to integrate warehousing with rail, road, and valueadded services enhancing efficiency, reducing costs, and supporting distribution hubs.

Technology Automation

Digital Twins & Smart Warehousing have become the norms. Digital twin technology, which builds a virtual replica of warehouse operations is

gaining traction acrossthe country. These systems offer real-time simulations, optimize inventory flow, preempt inefficiencies, and boost accuracy reducing the cost thus helping the industry grow in a structured manner.

With the technical advancements

Warehouses now embrace IoT sensors, robotics, blockchain, and predictive analytics for visibility, security, and efficiency. These technologies notably improve order throughput, reduce losses, and ensure seamless operations

Green and Sustainable Warehousing

Green warehousing refers to the implementation of sustainable practices within the warehousing and logistics sector. Businesses can dramatically lower energy costs and reduce their environmental impact by integrating energy-efficient systems, renewable energy sources, and wastereduction practices.Sustainability is increasingly baked into warehousing design. From solar roofs and LED lighting to rainwater harvesting and EV fleets, green logistics is becoming essential—not optional.

e-commerce is transforming Indian logistics by increasing the demand for efficient and technology-driven solutions, especially for last-mile delivery. Driven by developer investments, supportive policy ecosystems, and technological leaps, the logistics sector is witnessing a renaissance for sure.

New Delhi– In a significant move aimed at strengthening the maritime sector, the Indian government is considering a proposal to allow large ships to be used as collateral for securing loans. This initiative is expected to ease the financial bottlenecks faced by shipowners and encourage further investment in the industry.

According to officials from the Ministry of Ports, Shipping and Waterways, using ships as collateral could be a game-changer, particularly for entities operating in offshore and international waters. The plan is in line with broader efforts to promote modernization and fleet expansion in the maritime sector.

The Maritime Development Fund (MDF) and a planned Maritime Development Bank are expected to play key roles in facilitating such financing. These institutions would help provide

structured funding options, especially for ship acquisition and related infrastructure development.

An official noted that financial institutions are generally hesitant to accept ships as collateral due to challenges in asset valuation and liquidity. However, categorizing vessels based on global standards—such as size, type, and operational use—could make the process more viable.

Indian shipowners with overseas operations are likely to benefit most from this new financing model. Ships listed under an approved master list will be eligible, and the initiative will help unlock new streams of capital investment for the shipping industry.

In addition to this proposal, the government is also advancing its ₹1 lakh crore maritime infrastructure

plan, which includes a new shipbuilding subsidy program (SBP4.0). This subsidy will offer financial support of up to 20% to eligible private shipyards, aiming to make Indian shipbuilding more competitive globally.

Finance Minister Nirmala Sitharaman had earlier emphasized the importance of enhancing ease of doing business in the shipping sector and this move aligns with that goal. With India targeting a share of 15% in global shipbuilding by 2030 (up from the current 0.5%), these reforms could play a critical role in reaching that milestone.

The Central Government has appointed Vijay Kumar, a 1992-batch IAS officer of the AGMUT cadre, as the next Secretary of the Ministry of Ports, Shipping and Waterways.

Mr Kumar will initially serve as Officer on Special Duty (OSD) before

formally assuming charge on October 1, succeeding T. K. Ramachandran, who retires on September 30. Currently the Chairman of the Inland Waterways Authority of India, Kumar has spearheaded efforts to expand and modernise India’s inland water transport network, playing a key role in strengthening the nation’s ports and waterways infrastructure.

Born in Delhi, the 54-year-old IAS officer entered the civil services at age 21, clearing the UPSC examination in 1992. His illustrious career includes serving as Sub-Divisional Magistrate in East Delhi, Special Secretary (Cooperation) in Delhi, Principal Secretary (Power) in the Union Territory, Administrator of Lakshadweep, and CEO of Delhi

Jal Board, reflecting a wide-ranging experience across education, trade, excise, water supply, and transport sectors.

Kumar holds a bachelor’s in electronics engineering, an MBA in economic development from MIT, and a diploma in business finance from the Institute of Chartered Financial Analysts of India, equipping him with a strong blend of technical and administrative expertise. this appointment, the ministry anticipates continuity in leadership and renewed focus on modernising India’s ports, shipping, and inland waterways under Kumar’s guidance.

The two countries agreed on an India Japan Joint Vision for the Next Decade and a Joint Declaration on Security Cooperation

Prime Minister Narendra Modi, during his official visit to Japan, witnessed the signing of 13 agreements and memorandums of understanding (MoUs) on cooperation between India and Japan. The agreements cover security, space, clean energy, human resource exchange, digital partnership, and environmental cooperation. The two countries agreed on an IndiaJapan Joint Vision for the Next Decade and a Joint Declaration on Security Cooperation.

An action plan for human resource exchange and an implementing

arrangement between the Indian Space Research Organisation (ISRO) and Japan Aerospace Exploration Agency (JAXA) on joint lunar polar exploration were also signed. Further agreements include a Joint Declaration of Intent on Clean Hydrogen and Ammonia and a Joint Statement of Intent between India’s Ministry of Science and Technology and Japan’s Ministry of Education, Culture, Sports, Science and Technology (MEXT).

Among the MoUs signed, cooperation on a Joint Crediting Mechanism, the India-Japan Digital Partnership

2.0, mineral resources, and cultural exchange were finalised. Other MoUs include those on decentralised domestic wastewater management, environmental cooperation, and collaboration between India’s Sushma Swaraj Institute of Foreign Service and Japan’s Ministry of Foreign Affairs.

The visit highlighted areas of cooperation ranging from technology and energy transition to cultural and institutional partnerships, reinforcing bilateral ties across multiple sectors.

MMT

From revolutionary origins in the 1950s to today’s high‑tech, hyper‑volatile landscape, the container shipping industry has evolved dramatically. It weathered globalization, financial crises, pandemics and now contends with oversupply, geopolitical turmoil, and sustainability imperatives.

The revolution in global trade began in 1956, when Malcolm McLean introduced the modern intermodal shipping container, fundamentally transforming logistics by enabling seam-less transition between ships, trucks, and trains.

By the 1970s, containerization became mainstream. Ports like Singapore and Hong Kong, equipped with automated operations and realtime tracking, ushered in an era of remarka-ble efficiency with mid-size vessels already carrying thousands of TEUs.

The 1980s and 1990s saw globalization accelerate: liberalized trade, offshoring, and China’s emergence as a manufacturing hub expanded volumes dramatically. Shipping alliances formed to optimize routes and cut costs.

After 2001, China’s WTO membership sent global container volumes surging. Carriers ordered larger vessels Post Panamax and beyond and ports invested heavily in infrastructure.

Yet the 2008 global financial crisis triggered demand collapse. A glut of ships ordered pre-crisis flooded the market, triggering overcapacity, collapsing freight rates, and driving carrier consolidation Maersk’s merger with Hamburg Süd being a

The Pandemic Boom and Its Aftermath

The COVID-19 pandemic in 2020 triggered unprecedented disruption. Lockdowns spurred vast shifts in consumer behavior spiking demand for electronics, home goods, and e-commerce. Simultaneously, supply chains jammed, ports congested, and containers piled up in exporting regions. The result: massive freight rate surges from a few thousand

dollars per TEU to well over \$15,000 on some routes and record profits for carriers.

This windfall enabled investments in new vessels, terminal assets, and logistics integration, further reshaping the industry’s landscape.

Early 2025 Snapshot: Volatility, Overcapacity, and Market Fluctuations

By early 2025, the market had shifted into a softening cycle. Key indices like the Shanghai Containerized Freight Index (SCFI) and Drewry’s World Container Index (WCI) plunged: year-on-year declines of ~16% on China–Europe routes, and ~29% on China–Rotterdam. Spot rates dipped to levels reminiscent of pre-COVID times.

Simultaneously, blank sailings surged-up 318% on Asia Med and 449% on Asia–North Eu-rope to counter rampant oversupply.

But then came a surprise twist. A partial U.S.–China tariff easing in April triggered mad restocking. Drewry’s WCI spiked 59% in just four weeks, with Shanghai–New York rates jumping ~67%, and Shanghai–LA by ~89%. Yet analysts viewed this as a short-lived correction, not a sustained revival.

The global container fleet ballooned by ~10% in 2024,adding nearly 2.9 million TEU, espe-cially on Asia–Europe routes (31% capacity jump) due to route diversions caused by the Red Sea.Idle capacity hit an all-time low at 0.6% carriers had no buffer when demand faded, prompting mass blank sailings.

Since late 2023, Houthi attacks in the Red Sea forced carriers to reroute vessels around the Cape of Good Hope adding ~10–14 days, millions in fuel, and disrupting schedules. At one point, container shipping transits plummeted 90% in the Red Sea region. Though security improved modestly in 2025, the crisis has pulled about 8–10% of capacity out of standard routes, aiding utilization but inflating.

Unpredictable U.S. tariff policies, and broader geopolitical turbulence from Red Sea threats to trade tensions have rattled shipping volatility. Analysts warn of unstable freight rates and erratic ordering patterns from shippers. In August 2025, Asia–U.S. spot rates dropped sharply 58% on the West Coast, 46% on the East Coast due to excess capacity and trade uncertainty. Though rerouting helped absorb some supply, blanked sailings became routine.

By July 2025, the average cost to ship a 40-ft container dropped to about US $2,812, less than half the peak $5,901 recorded in mid 2024 highlighting stark volatility. 2025 Outlook:

Persistent oversupply- despite strong demand in pockets, fleet growth continues to outpace trade.

Unstable demand- tariff shifts, slowdown in Europe/ China, and geopolitical volatility weigh heavily.

Operational unreliability- port congestion, longer routes, and schedule disruptions remain high risks.

Regulatory pressures- IMO emissions targets and EU ETS requirements impose compliance costs and favor greener fleets.

Environmental bifurcation- a two-tier vessel market may develop, with compliant carriers commanding premium pricing.

Sustainability investments: Alternative fuels (LNG, biofuels, methanol), automation, and smart containers help carriers reduce emissions and improve efficiency.

Diversification beyond shipping : Forward integration into logistics, terminals, air freight, and inland services adds resilience and revenue diversification.

Regional trade growth: Emerging routes in Latin America, Oceania, South Asia (including India), and Africa offer new growth corridors.

Digital resilience: Advanced analytics, robotics, and predictive logistics afford better de-mand forecasting and buffer planning.

As of mid 2025, the market remains in flux marked by spot rate volatility, stretched capacity, diverted routes, and strategic repositioning. Yet, amid downturns, opportunities emerge for those embracing flexibility, green innovation, and network agility. In the coming years, carriers that can balance cost control, environmental compliance, and demand responsiveness will define the next chapter of this vital global artery.

Ports have always been more than just loading docks they are strategic assets, economic engines, and cultural gateways. As global trade grows and technology advances, the world’s ports will need to adapt rapidly to new demands and challenges. Whether through innovation, sustainability, or enhanced connectivity, the ports of the world will continue to be the lifelines of our globalized future.

In an increasingly interconnected world, ports serve as vital arteries of global commerce, enabling the flow of goods, services, and resources across continents. From ancient harbors of trade like Alexandria to modern mega-ports like Shanghai and Rotterdam, these hubs have not only shaped economic landscapes but also cultural and political histories. As international trade

continues to expand, understanding the role, significance, and evolution of ports becomes essential.

Ports are locations on coastlines or riverbanks where ships load and unload cargo or passengers. They serve as entry and exit points for goods transported by sea, which accounts for approximately 90% of the world’s trade. Without ports, global supply chains would collapse, economies would shrink, and consumer access to international goods would be severely limited.

In essence, ports are logistical powerhouses. They accommodate a variety of vessels—from bulk carriers and container ships to oil tankers and cruise liners. In addition to physical loading and unloading, ports also host customs operations, inspection facilities, and storage yards. This makes them integral not just to maritime transportation but to national security, customs enforcement, and even tourism.

The Port of Shanghai has held the title of the world’s busiest port by cargo tonnage and container traffic for several years. Located at the mouth of the Yangtze River, it is a linchpin in China’s massive export economy. With state-of-the-art terminals and vast automated operations, Shanghai symbolizes the future of port logistics.

As Europe’s largest seaport, Rotterdam plays a central role in connecting Europe with the rest of the world. Its location on the North Sea and direct access to the Rhine River make it a strategic entry point for goods entering Europe. The port is also known for its advanced environmental and digital practices, setting standards in sustainability.

Port of Singapore

Singapore is more than just a country—it’s a global maritime hub. The Port of Singapore is one of the busiest transshipment ports, acting as a midpoint for cargo traveling between the Pacific and Indian Oceans. Its deep-water harbors, efficient customs operations, and geographic location have made it indispensable for international shipping.

Port of Los Angeles and Port of Long Beach, USA

Often referred to as the “San Pedro Bay Port Complex,” these two ports together form the largest gateway for international trade in the United States. Handling nearly 40% of all U.S. imports, these ports are critical to the American economy, especially in trade with Asia.

of Dubai (Jebel Ali)

Jebel Ali is the largest man-made harbor in the world and the busiest port in the Middle East. It serves as a key link in global supply chains and has developed into a major center for maritime trade between the East and the West.

Modern ports are no longer just physical spaces for cargo handling—they are intelligent, digitized ecosystems. Technologies such as blockchain, IoT (Internet of Things), AI (Artificial Intelligence), and automation are transforming how ports operate. For example, automated cranes and driverless trucks reduce human error and increase efficiency. Digital tracking systems allow real-time cargo monitoring, minimizing delays and improving logistics planning.

Moreover, environmental concerns are driving ports to adopt greener practices. Shore power (providing electricity to docked ships to reduce emissions), hybrid cargo handling equipment, and sustainable terminal designs are becoming the norm in leading ports around the world.

Despite their significance, ports face a variety of challenges:

Congestion: As global trade volumes rise, many ports struggle with congestion, leading to delays and increased costs. This was particularly evident during the COVID-19 pandemic.

Environmental Impact: Ports are major sources of air and water pollution. The shipping industry, though efficient, contributes significantly to greenhouse gas emissions.

Geopolitical Tensions: Ports are often caught in the crossfire of international disputes. Blockades, sanctions, and military conflicts can disrupt operations significantly.

Cybersecurity: With increased digitization comes the risk of cyberattacks. Ports must invest in robust cybersecurity systems to protect sensitive data and critical infrastructure.

Looking ahead, the world’s ports are poised to become even more advanced and sustainable. Smart ports—those that integrate digital technology into every aspect of operations— will likely dominate. Automation will continue to improve efficiency, while artificial intelligence will aid in predictive maintenance, cargo forecasting, and energy optimization. There is also a growing push toward green ports, emphasizing renewable energy, electrified terminals, and cleaner fuels for ships. International cooperation will be essential to standardize these changes and ensure that even smaller, developing ports are not left behind.

E‑commerce growth has significantly impacted 3PLs by creating increased demand for their services

India’s e-commerce boom has been nothing short of transformational. As various reports suggest in recent times as online shopping skyrocketed, with markets projected to exceed $100 billion by 2025, the demand for agile, tech-savvy logistics has surged. Thirdparty logistics providers (3PLs) have become indispensable partners, helping brands navigate fulfilment challenges, drive efficiency, and scale operations seamlessly.

In the age of single click purchases and next-day deliveries, e-commerce has become the driving force behind a quiet revolution transforming not just how we shop, but how products are stored, packed, and shipped. The global surge in online retail has fueled unprecedented innovation in logistics and packaging, pushing industries to evolve at breakneck speed.

The shift to omnichannel sales has forced 3PLs to offer more integrated services, including efficient reverse logistics for returns, and has led to growth in the 3PL market as e-commerce companies rely on their expertise to handle complex logistics. If one considers media report then in the first half of 2025 alone, industrial and logistics space leasing soared by 63% year-over-year to a record 27.1 million sq ft, particularly in hotspots like Delhi NCR, Mumbai, and Bengaluru

Industry experts suggest, “Yet, the picture isn’t without turbulence. Major e-commerce players like Amazon, Flipkart, and Meesho now control around 82% of parcel volumes by managing delivery in-house. This trend is forcing standalone 3PLs to adapt rapidly or consolidate.”

E-Commerce Fuels Packaging

Innovation and Sustainability

High delivery volumes, rising customer

expectations, and ESG awareness have sparked serious innovation in packaging, especially driven by 3PLs and partners:

• Alternative materials: Indian entrepreneurs are exploring compostable, mycelium-based, and seaweed-infused packaging solutions. These materials championed by altpackaging pioneers offer scalable, eco-friendly alternatives to plastic.