Disclaimer

All advertisements in this magazine are placed with no liability accepted by the publisher for the material content therein. No responsibility is accepted by the publisher for omission or error or non-insertion of any advertisements. All advertisements and material in this magazine are subjected to approval by the publisher and are not necessary the opinion of the publisher. No liability is accepted for advertisements that are placed or any information that might be criminally connected. All information is checked to the best of our knowledge and is reliant upon the material submitted not being in contravention of all relevant laws and regulations and within the provisions of the Trade Practices Act.

Reproduction Prohibited

Maritime Matrix Today will not be responsible for the views expressed by contributors in their personal capacity. All rights reserved. Reproduction in part or whole without the permission of the Editor is prohibited.

Readers are recommended

To make appropriate enquiries before sending money, incurring expenses or entering into any commitment in relation to any advertisement published in this publication. Maritime Matrix Today does not vouch for any claims made by the Advertisers of Products and Services. The Printer, Publisher, Editor and Owner of Maritime Matrix Today shall not be held liable for any consequences, in the event such claims are not honoured by the Advertisers.

War has far-reaching and devastating economic effects, impacting both participating and non-participating nations.

Apparently, geopolitics have become the major challenge for supply chains. During last three years majority of logistics challenges were connected to military conflicts and political instability, including the war in Ukraine, Red Sea crisis, Israel-Hamas war, potential China-Taiwan crisis.

Houthi attacks on container vessels in the Red Sea disrupted navigation through Suez Canal; a route that accounts for 10-15% of world trade, adding to a delay of minimum 10-15 days to a journey and increasing fuel costs by over 40%.

Israel-Hamas war severely affected the operations of major ports in MENA, such as Ashdod and Haifa in Israel, and Rafah and Gaza in the Palestinian territories. Potential China-Taiwan crisis poses threat to navigation through the Taiwan Strait. This route is important for global trade as almost half of the global container fleet passes through it.

The war in Ukraine equally disrupted supply chains. In the beginning of the war Russian military forces blocked shipping in Black Sea. As a result, 100 ships could not leave Ukrainian seaports. Ukraine could not export 120 mln tons of goods by sea annually, as before the war.

The ramifications of war on shipping extend beyond immediate disruptions. The war’s impact on shipping has significantly altered global trade routes, forcing companies to adapt to new challenges. Conflicts in regions such as the Middle East, Ukraine, and Russia have disrupted maritime traffic.

One would agree to the fact that the volatile security situation in conflict-affected areas has made it challenging for businesses to operate and transport goods with any amount of certainty. As a result, the movement of goods and services within and across borders has been severely hampered, leading to increased costs, delays, and reduced trade volumes.

Recent tensions, particularly between Iran and Israel, now pose a risk to India’s oil supply, especially since Iran’s parliament backs blocking Strait of Hormuz after the recent US attacks.

While I personally think it’s simply not possible to block the straits, Iran’s parliamentary action has prompted Indian refiners to diversify their sources to avoid potential price spikes and shortages. Though India imports limited oil directly from Iran, its reliance on global oil markets covering 85% of its domestic demand, makes it vulnerable.

India, it is learnt, is actively exploring alternative oil sources globally due to rising geopolitical tensions and to mitigate potential supply disruptions.

While the West African nations are being considered as a potential source of additional crude oil supplies, India is making significant strides in blending ethanol with petrol, aiming for E20 (20% ethanol) fuel by end 2025. This initiative is expected to save India billions of rupees annually on oil imports and reduce its carbon footprint.

Hope, good sense prevails globally!

Kamal Chadha Group CEO kamal@marexmedia.com

Shirish Kirtane

HOD Graphics shirish@marexmedia.com

Radhika Vakharia CEO radhika@marexmedia.com

Santosh Nivalkar Sr. Graphic Designer santosh@marexmedia.com

Padmesh Prabhune Editor padmesh@marexmedia.com

Manish Malve Graphic Designer manish@marexmedia.com

Delphine Estibeiro Editorial Coordinator delphine@marexmedia.com

Bhavna Pimpale Coordinator bhavna@marexmedia.com

Jagdamba Pandey Manager, Business and Promotion jagdamba@marexmedia.com

Following up recently signed EFTA TEPA agreement Union Commerce and Industry Minister Shri Piyush Goyal visited Switzerland marking a significant step in strengthening the India–Switzerland economic partnership. Goyal’s meetings with Swiss leadership between June 9-13, 2025 were focused on innovation, regulatory cooperation, and investment facilitation. His keynote at the 18th Swissmem Industry Day in Zurich drew attention to India’s strengths in talent, infrastructure, and manufacturing, inviting Swiss firms to co-create technologies for global markets. A swift facilitation of land for Endress+Hauser near Pune was a

In a significant step towards strengthening bilateral maritime cooperation, India’s Minister of Ports, Shipping and Waterways, Shri Sarbananda Sonowal, met Morten Bodskov, Denmark’s Minister of Industry, Business and Financial Affairs, during his official visit to Copenhagen on June 5–6, 2025. The leaders reviewed ongoing maritime collaboration under the IndiaDenmark Green Strategic Partnership and reaffirmed commitments under the 2024 MoU on Maritime Affairs, including the establishment of the Centre of Excellence (CoE) in Green Shipping that aims to enhance efficiency, quality, and sustainability in maritime operations, aligning with India’s Amrit Kaal Vision 2047 and its ambition to become a global green shipping hub. A pre-feasibility study for these corridors will be conducted by the Mærsk Mc-Kinney Moller Centre for Zero Carbon Shipping, using its

standout example of India’s responsive governance. Engagements included sectoral roundtables, discussions with Swiss businesses, and dialogue

with ICAI’s Switzerland chapter. The visit concluded with Swiss industry reaffirming confidence in India as a strategic partner.

proven methodology. Recalling that the establishment of green corridors has further been defined as a priority from the Government of India, the ministers agreed that the Indo-Danish CoE will contribute to the development

of green corridors through the conduction of a pre-feasibility study. The meeting marked a concrete step in scaling up Indo-Danish cooperation in sustainable maritime innovation and carbon-neutral trade routes.

Kochi’s port is expected to serve as the new shore support base for offshore oil exploration activities. Oil India and the Cochin Port Authority have formally agreed, opening the door for the construction of vital port-based infrastructure that is suited to offshore drilling requirements. A full support facility will be established within the port premises in order to assist Oil India’s offshore operations, which are expected to start later this year. It is anticipated that the facility will function as a high-efficiency logistics center, simplifying the transportation, storage, and refueling of the ships and supplies needed for offshore drilling. To enable round-the-clock operations, the future infrastructure will comprise a dedicated warehouse, a dry bulk handling facility, and an exclusive jetty.

To ensure smooth vessel turnaround and operating uptime, they will be complemented by integrated systems for potable water, shore electricity, and other necessary utilities. The KeralaKonkan Basin, while rich in reserves, remains largely underexplored. Having

a well-equipped logistics node in Kochi is expected to reduce dependency on distant support facilities, optimise response time, and potentially bring down the carbon footprint of offshore supply chains.

VO Chidambaranar Port Authority has cancelled the tender for a ₹7,055.95 crore container terminal at its outer harbour after both initial bidders failed to meet technical eligibility. The project aimed to develop a 4 million TEU capacity terminal in Thoothukudi, Tamil Nadu, through private investment. Citing “administrative reasons” for the cancellation the port authority refrained from detailing the decision. Vedanta and Sharjah-based Premier Science and Technology FZE were the only applicants. Industry sources noted that both firms lacked experience in container terminal operations, leading to disqualification. Concerns had been raised during the bidding process over unrealistic cost estimates, particularly regarding dredging and breakwater construction, which were prepared

by IIT Madras’ NTCPWC. The port’s reliance on a low Viability Gap Funding (VGF) model and a capped support of ₹1,950 crore further discouraged investor participation. The project that involves developing an outer harbor

on a DBFOT (Design, Build, Finance, Operate, and Transfer) basis, with a total handling capacity of 4 million TEUs per annum, to be achieved in two stages. is now being considered for restructuring.

Air cargo demand is experiencing a surge, particularly in the Asia-Pacific region, with global demand up 5.8% in April 2025. This growth is fueled by increased e-commerce activity, the need for time-sensitive goods like pharmaceuticals, and a rise in Indian exports. International operations saw an even stronger rise of 6.5%, according to new data released today by the International Air Transport Association (IATA). Capacity also expanded, with available cargo tonnekilometres (ACTK) up by 6.3% year-on-year (6.9% for international operations), indicating record levels of available spaceThe industry is also seeing advancements in technology and sustainability initiatives, such as the use of sustainable aviation fuel.

is

a

in the air cargo market, contributing to the overall surge. Asia-Pacific carriers saw a 10% growth in air freight demand, driven by seasonal shipping and a reduction in jet fuel prices. The

need for fast and reliable delivery of high-value and time-sensitive goods, like pharmaceuticals and electronics, is boosting air cargo.

Mahindra Logistics has unveiled a new warehousing facility in Phaltan, Maharashtra, strengthening its partnership with Cummins India. Spanning over 3 lakh sq. ft., the warehouse is now fully operational and will serve as a consolidated hub for Cummins, aimed at optimising supply chain functions by bringing products from various sources under one roof. The facility will support a range of services including inbound and outbound logistics, warehouse management, last-mile dispatch, and agile manufacturing support. In line with Cummins India’s global sustainability benchmarks, the

warehouse is powered by renewable energy and features solar panels and advanced water treatment systems. The development is expected to generate

over 500 employment opportunities for the local community.

Varanasi, in Uttar Pradesh is all set to become a logistics hub in near future with the new multi modal park. Designed to integrate road, rail, air, and waterways, the project aims to streamline transportation, lower logistics costs, and drive economic growth in eastern India. The National Highways Logistics Management Limited, under the Union Ministry of Road Transport and Highways (MoRTH) and Inland Waterways Authority of India (IWAI), under the Union Ministry of Shipping and Waterways signed an MoU to develop a Multi-Modal Logistics Park (MMLP) in Varanasi, Uttar Pradesh. The 150-acre park will strategically connect to NH7 via a 650m access road and is just 1.5 km from the NH7-NH2

junction, MoRTH said in a statement. It will also seamlessly integrate with the Eastern Dedicated Freight Corridor through a 5.1 km railway line from Jeonathpur Station and National Waterway-1 and is located 30 km from Lal Bahadur Shastri Airport,

the statement added. An IWAI official said the economic survey had said currently the cost of logistics across sectors is around 20%. “The aim of the government is to make it at 7-8%. Projects like this will help in this regard.”

The Maharashtra Logistics Policy 2024 is set to transform the state’s logistics sector, creating opportunities for logistics companies and warehousing providers, particularly in highdemand regions like Mumbai, Navi Mumbai, and Pune

Earlier in March this year Union Minister of Road Transport and Highways, Nitin Gadkari, announced Nagpur’s designation as India’s potential ‘Logistics Capital’ during the inauguration of the Multimodal Logistics Park at Sindhi Railways, that is expected to begin with initial exports likely to Bangladesh using a riverine transport route.

Highlighting Nagpur’s central location and robust infrastructure, Gadkari emphasised its pivotal role in industrial expansion. Under the PM Gati Shakti initiative, the Multi Modal Logistics Park (MMLP) at Nagpur, Maharashtra began commercial operations to

boost seamless connectivity and reduce travel time across transport modes.

Following its Master Plan the Maharashtra government later in May 2025, signed a Memorandum of Understanding (MoU) with Blackstone Group’s subsidiaries, XSIIO Logistics Parks and Horizon Industrial Parks, which will bring Rs 5,127 crore FDI and is expected to create over 27,510 jobs.

The MoU was signed at the Sahyadri Guest House between Industries Secretary Dr P. Anbalagan and president of Horizon Industrial Parks R K Narayanan. According to

a statement from the Chief Minister’s Office (CMO), this MoU aims to develop modern logistics and industrial parks across Maharashtra’s key industrial and multimodal logistics hubs.

As per the agreement, over 10 modern industrial and logistics parks will be developed on 794.2 acres of land, with construction planned on 1.85 cr square feet land. The projects are expected to bring in foreign direct investment (FDI) of Rs 5,127 crore and will generate approximately 27,510 direct and indirect employment opportunities, it said.

These logistics parks will be developed in key locations, including Nagpur, Bhiwandi (Thane district), Chakan (Pune), Sinnar (Nashik) and Panvel (Raigad). The parks will be aligned with the Maharashtra Logistics Policy 2024, and will feature green, digitally-enabled infrastructure focused on sustainable development and job creation.

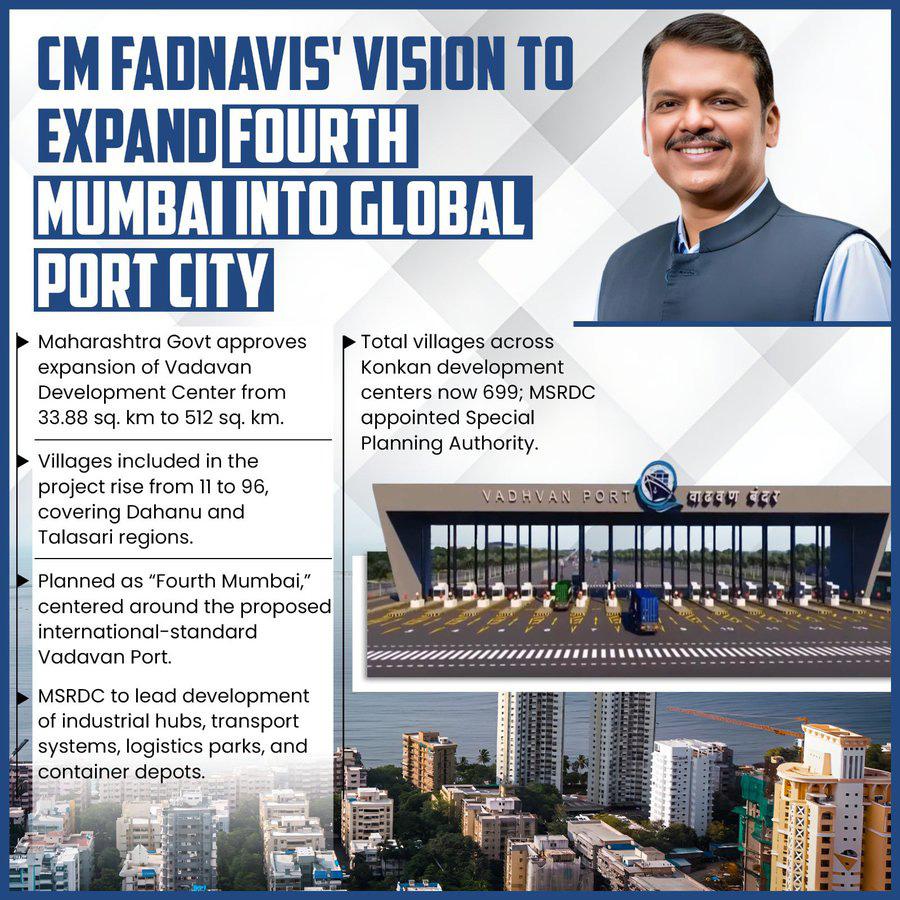

With all due considerations, the MoU represents one of the largest FDI-backed investments in Maharashtra’s logistics and industrial sector in recent times. Apart from these, CM Fadnavis signed MoU’s with the University of York and the University of Western Australia, aiming to make Maharashtra an education hub and and boost global academic collaboration at the World Audio Visual and Entertainment Summit (WAVES) 2025, in Mumbai. According to officials around 100 acres of land in Navi Mumbai have been demarcated exclusively for educational institutions. This zone close to Navi Mumbai airport will be called the edu-hub, where a minimum of ten renowned foreign universities will set up their full-fledged campuses.

“Each university – the University of York and the University of Western Australia is investing Rs 1500 core each, which will also generate thousands of jobs. These universities are already in the process of seeking permission from the University of Grand Commission (UGC).

Thanks to the power of e-commerce everything from high-end electronics to weekly groceries can be purchased with just a few clicks and to keep up with the growing demand for fast deliveries and customer satisfaction, warehousing & logistics companies are at the forefront of this transformation. Recognising the logistics sector’s critical role, the Maharashtra State Government approved the Maharashtra Logistics Policy 2024 in August that will establish a robust foundation for manufacturing, warehousing and supply chain excellence in India.

The Maharashtra Logistics Policy 2024 is set to transform the state’s logistics sector, creating opportunities for logistics companies and warehousing providers, particularly in high-demand regions like Mumbai, Navi Mumbai, and Pune. Drafted with recommendations from the State Economic Advisory Council, this policy aims to drive exponential growth in the sector over the next decade.

The policy is expected to create 5,00,000 direct and indirect jobs, generate around ₹30,573 crore in revenue, and span more than 10,000 acres of logistics infrastructure. This growth promises to enhance economic activity and strengthen India’s logistics capabilities across key regions.

Key objectives include:

• Reduction of logistics costs by 4-5% from the current 14-15%.

• Streamlining logistics operations to reduce turnaround time.

• Decreasing carbon emissions with sustainable practices.

• Integration of cutting-edge technologies such as blockchain, AI, and sustainable designs.

• Attracting significant domestic and foreign investments.

• Establishing Maharashtra as a global logistics hub.

Emphasizing multimodal connectivity, Maharashtra aims to enhance logistical efficiency and will be contributing significantly to India’s overall economic development. Maharashtra Logistic Policy 2024 has set the objective of developing 10,000 acres of logistic infrastructure network in the state.

For the systematic and planned growth across the state by keeping integrated approach and holistic development of the sector, the logistics parks and related logistic infrastructure / facilities are planned to establish across the state.

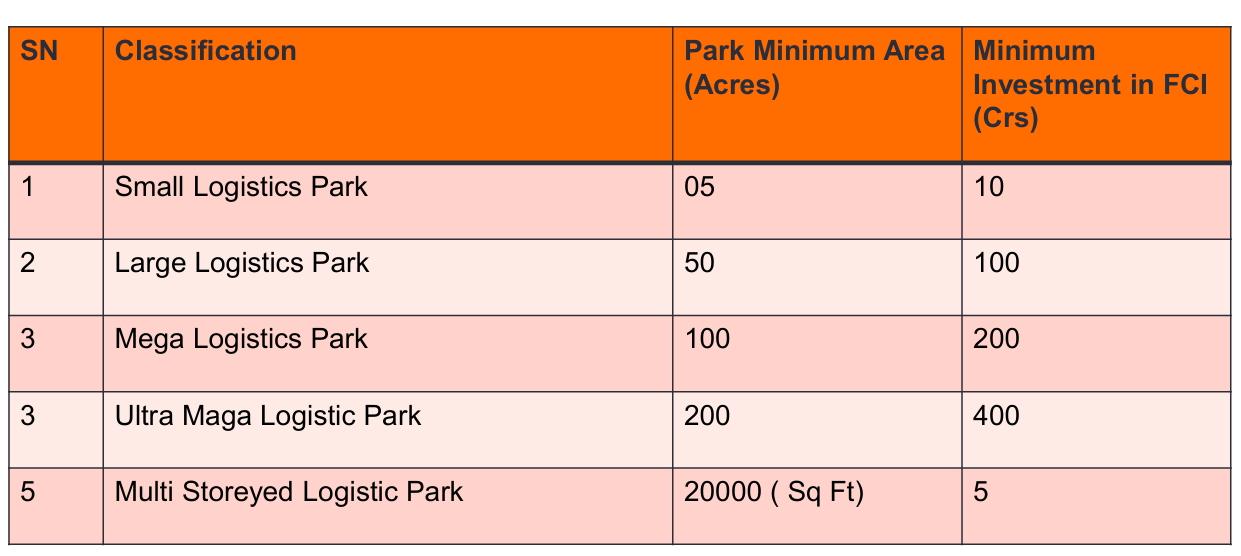

The parks and facilities will be setup by private investments with state support. The parks are classified as Multistoreyed Logistic Park, Small Logistic Park, Large Logistics Park, Mega Logistic Park and Ultra Mega Logistic Park.

The various types of parks will continue to function as integrated projects providing various service facilities in the logistics sector.

Classification of Logistics Park –

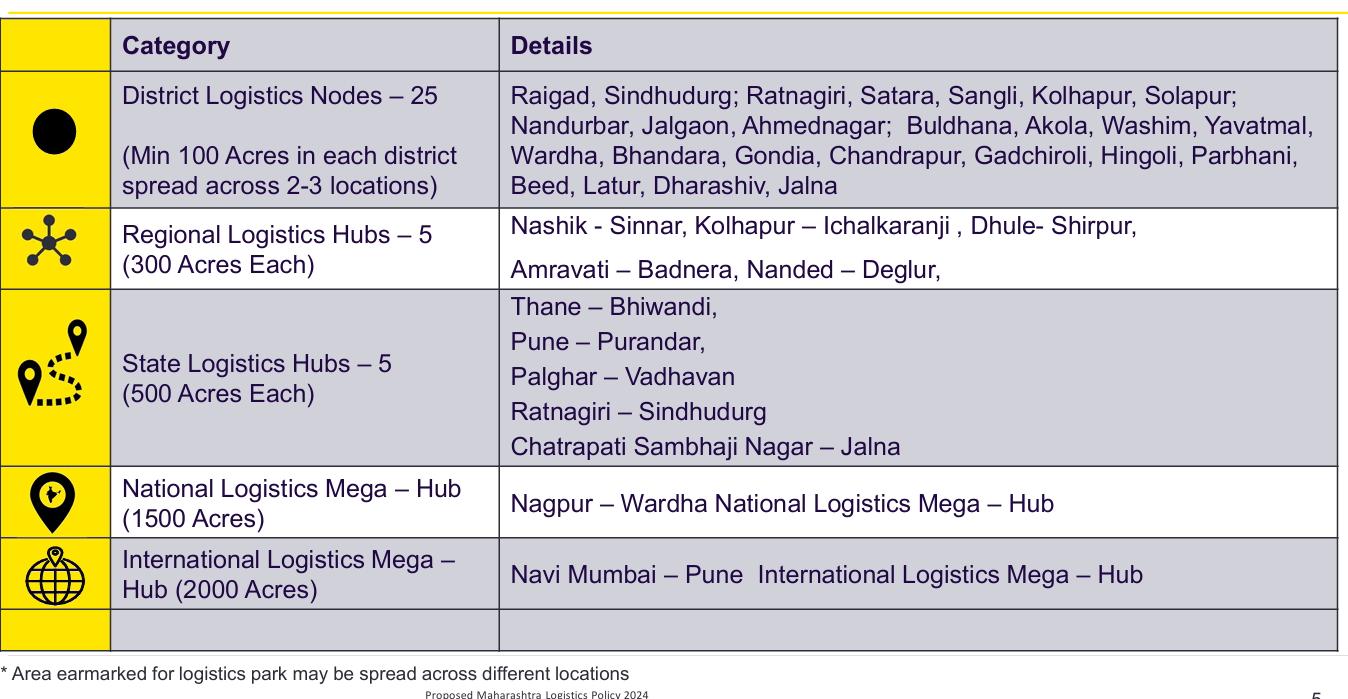

The ‘International Mega Logistics Hub’ will cover 2,000 acres in the Navi Mumbai-Pune corridor, strategically connected to Panvel’s new international airport, with an investment of ₹1,500 crore.

Meanwhile, the ‘National Mega Logistics Hub’ will span 1,500 acres in the Nagpur-Wardha region, linked to the Mumbai-Nagpur Expressway, also supported by a ₹1,500 crore investment.

Areas with a minimum of 20,000 sq. ft. and an investment of at least ₹5 crore will be designated as ‘Multi-Storey Logistics Parks,’ enhancing logistics infrastructure in key regions.

A total of ₹2,500 crore has been allocated for the development of five logistics hubs, each spanning 500 acres, in regions including Chhatrapati SambhajinagarJalna, Thane-Bhiwandi, Ratnagiri-Sindhudurg, PunePurandar, and Palghar-Wadhawan.

Additionally, ₹1,500 crore has been earmarked for five hubs of 300 acres each, to be established in Nanded-Deglur, Amravati-Badnera, Kolhapur-Ichalkaranji, Nashik-Sinnar, and Dhule-Shirpur, further expanding the state’s logistics infrastructure across strategic locations.

The first 100 logistics parks will benefit from financial

incentives, including interest subsidies, stamp duty exemptions, and support for technology improvements. These incentives aim to encourage early development, boost efficiency, and modernise logistics infrastructure across the country.

Twenty-five district logistics nodes will be developed, each featuring 2-3 major industry and trade hubs, covering 100 acres. Additionally, MIDC areas will allocate 15% of their space for private logistics nodes, fostering collaboration between public and private sectors to strengthen the logistics network.

Logistics sector in India represents 14% percent of India’s Gross Domestic Product (GDP) and employs 2.2 crore people. India handles 4.6 billion tonnes of products annually at an overall cost of INR 9.5 lakh crores and Maharashtra has a major share in this.

Maharashtra has a vast network of infrastructure including 17,757 km long national highways and 28,461 km long State highways. Also, the State has a railway network of 11,631 km under which 548 railway goods sheds are included. Under sea and air connectivity, the State has a competent infrastructure of 2 major and 48 minor ports, 53 inland container depots and container freight stations, 8 private cargo terminals and 11 air cargo terminals.

The State has a warehousing capacity of 2.23 MMTPA, a cold storage facility of 1.03 MTPA and a port capacity of 1320 million tonnes.

There are more than 116 logistics training centres in the State for skill development.

The total freight traffic in India is expected to grow at 9.7% per annum to reach over 13 trillion ton‐kilometres (ton‐km) in 2031-32 from about 2 trillion ton‐km in 2011-12.

One of the important elements of the Maharashtra Logistics Policy 2024 is the ‘Maharashtra Integrated Logistics Master Plan’ which is a precise mapping of logistics areas, having connectivity details and relevance with geographical

spread of logistics infrastructure. The prime objective of Maharashtra Logistics Policy 2024 is to reduce time and Cost of logistics through a comprehensive integrated logistics master plan considering next 10-year growth.

The Masterplan has defined as district, regional, state, national and international mega logistics hubs across the state to have the systematic and planned logistics development considering the strength of each area of the state and expected economic development. Having registered an overall growth, Maharashtra aims for becoming $1 trillion economy by 2028 and in all its likelihood Maharashtra Logistic Policy 2024 will play a pivotal role for holistic development of logistic sector across the state and give boost to the economy.

Maharashtra is now rapidly moving forward to take a leading role.

While freight transportation remains a crucial revenue source contributing nearly 65% of Indian Railways’ total revenue, it further aims to achieve 3,000 MT in freight loading by 2027

The Indian Railways has the fourth largest rail network in the world carrying over 23 million passengers daily. With a total track length of approximately 126,366 km, it serves 7,335 stations and operates over 13,523 passenger trains daily. While primarily known for passenger transport, Indian Railways also handle a significant amount of freight traffic. According to report in 2023- 2024 Indian Railways operated 11,234 freight trains on an average daily and transported 1588.06 MT (Million Tonnes) of freight.

Railways-a Crucial Link

Indian Railways is crucial for transporting bulk commodities which are essential for industry and energy; coal for power plants, iron ore, coking coal and Limestone for Steel industries, finished steel for manufacturing and construction, cement, food grains for national distribution, fertilizers for agriculture, and petroleum products. For long distances and bulk goods, rail transport has been more economical than road transport. This helps reduce overall logistics costs for businesses,

making Indian goods more competitive domestically and internationally.

Following the National Railway Plan, with a vision to develop Indian Railways as a world class system which shall be able to cater to the demand by keeping pace with growth and compliment the economic development, the Ministry of Railways has been consistently, upgrading the railways along with the expansion of Dedicated Freight Corridors (DFCs) that has help enhancing the speed and

efficiency of freight operations. The NRP is aimed to formulate strategies based on both operational capacities and commercial policy initiatives to increase modal share of the Railways in freight to 45%.

Freight Traffic Growth

Freight transport remains the backbone of the Indian Railways, contributing significantly to its revenue and overall operations. Specifically, freight transportation accounts for

nearly 65% of the Indian Railways’ total revenue. Coal, iron ore, and cement are the major commodities that drive this freight loading and revenue generation.

Indian Railways, through entities like Container Corporation of India (CONCOR) and Central Warehousing Corporation (CWC), operates container trains across the country. According to reports Indian Railways is seeing a resurgence in both passenger and freight traffic and is gradually progressing towards its ambitious target of 3,000 MT of freight loading by 2027.

During FY 2024-25, Indian Railways achieved approximately 1617.38 MT of originating freight loading, as compared to 1590.68 MT achieved during FY 2023-24, registering an incremental loading of 26.70 MT up 1.68%.

Loading for domestic Coal registered growth of 7.4% whereas loading for Domestic Container recorded growth of 19.72%. Loading for fertilizer recorded growth of 1.25%. POL loading registered growth of 0.61%. Gunny sacks, Hot Rolled coils, Ceramic Tiles, Wall care putty and Rice are five major commodities in domestic container loading.

In terms of loading achieved by Zonal Railways, Eastern Railway achieved growth of 16.11% followed by South

East Central Railway (SECR) that achieved growth of 7.28%. While the Northeast Frontier Railway achieved growth of 4.21% the Northern Railway achieved growth of 3.89%.

On the other hand, the East Central Railway achieved growth of 2.82% whereas, South Central Railway achieved growth of 2.14%.

The East Coast Railway achieved growth of 1.19%. Southern Railway achieved growth of 0.80%. South Eastern Railway achieved growth of 0.36%.

Moreover, stock at power houses in India reached an all-time high at 57 MT, thanks to impressive loading of Coal by Indian Railways.

Indian Railways is leveraging technology and innovation to streamline freight operations and improve the overall logistics experience. Several major railway projects have been recently approved or are underway in India in 2025, including multi-tracking projects, line doubling, and the expansion of the freight corridor network. These projects aim to enhance capacity, improve port connectivity, and boost the efficiency of Indian Railways.

On June 11, the Cabinet Committee on Economic Affairs (CCEA), chaired

• Indian Railways is progressing towards its ambitious target of 3,000 MT of freight loading by 2027.

• Expansion of Dedicated Freight Corridors (DFCs) has enhanced the speed and efficiency of freight operations.

• During FY 2024-25, Indian Railways achieved 1617.38 MT of originating freight loading, registering a growth of 1.68%.

• The East Coast Railway continues to lead in freight transportation, followed by the South East Central Railway and South Eastern Railway.

• Coal, iron ore, and cement are major commodities transported by Indian Railways, accounting for over 60% of total freight loading and revenue generation.

• Passenger traffic has also seen a rise, with a 5% increase in reserved class travel.

• Indian Railways operates a variety of rolling stock and handles a diverse range of commodities, including various types of chemical manures, iron and steel products, petroleum products, and automobiles.

• The “Super Vasuki,” India’s longest and heaviest freight train with 295 Coaches, measuring an astonishing 3.5 kilometres in length and driven by six electric locomotives, is an example of the scale of operations, carrying coal over a long distance.

• Indian Railways is also focusing on digitization and cashless transactions, with initiatives like e-demand registration systems.

by Prime Minister Modi, approved two multi-tracking projects across the Indian Railways network, entailing an investment of 6, 405 crore rupees in Jharkhand and Karnataka to boost connectivity, commerce, sustainability. The two projects covering seven districts across the states of Jharkhand, Karnataka and Andhra Pradesh, will increase the existing network of Indian Railways by about 318 km and are expected to generate direct employment for about 108 lakh human-days during construction.

While, the first project relates to the doubling of the 133 km KodermaBarkakana railway line, which passes through a major coal-producing area of Jharkhand. The second project involves doubling of the 185 km BallariChikjajur railway line, which traverses through Ballari and Chitradurga districts of Karnataka and Anantapur district of Andhra Pradesh.

Similarly, the Cabinet approved two multitracking projects across Indian Railways in Maharashtra and Madhya Pradesh, earlier on May 28 this year. The projects include third and fourth rail line project between Ratlam and Nagda, and fourth rail line project between Wardha- Balharshah. The total estimated cost of the projects is Rs 3,399 crore (approximately) and will be completed upto 2029-30.

The two projects covering four Districts

across the states of Maharashtra, and Madhya Pradesh, will increase the existing network of Indian Railways by about 176 Kms. The proposed multi-tracking project will enhance connectivity to approximately 784 villages, which are having a population of about 19.74 lakh.

According to Union Minister for Railways, Shri Ashwini Vaishnaw, the recently approved third and fourth rail line project between Ratlam and Nagda,

sanctioned at a cost of ₹1,018 crore, is a critical step towards decongesting existing rail lines and drastically improving freight and passenger traffic efficiency.

The 41.4 km four-lined section, part of the High-Density Network, will slash line capacity utilisation from 116% to a more efficient 65%. This strategic development will significantly enhance freight connectivity from Madhya Pradesh to key West Coast ports including Kandla, Mundra, Pipavav, Hazira, Dahej, JNPA, and the upcoming Vadhavan Port.

This upgrade is crucial for boosting access for central and northern economic zones and will directly benefit major industrial hubs like Indore SEZ, Chhindwara SEZ, Delhi–Mumbai Industrial Corridor, and the Nagda Thermal Power Plant.

Minister Vaishnaw highlighted that this infrastructure upgrade will enable faster and more efficient transportation of vital freight such as agricultural commodities, coal, containers, and petroleum products. The project

Amrit Bharat Station Scheme: Over 1,300 railway stations are being transformed under the Amrit Bharat Station Scheme, with 103 stations inaugurated in May 2025.

National Rail Plan (NRP): The NRP aims to formulate strategies to increase the Railways’ modal share in freight to 45% by 2030.

Dedicated Freight Corridors (DFCs): Expansion of DFCs is underway, with a focus on AI-powered traffic management and digital connectivity.

Gati Shakti Cargo Terminals: Strengthening of Gati Shakti Cargo Terminals with AI, IoT, and automation is also in progress.

Tirupati-Pakala-Katpadi Line Doubling: The doubling of the 104 km Tirupati-Pakala-Katpadi railway line was approved at a cost of ₹1,332 crore.

Reorganization of Waltair Railway Division: The Waltair railway division was reorganized, with part of the division becoming a new division under the East Coast Railway, with headquarters at Rayagada.

is projected to deliver substantial environmental benefits, including saving 38 crore kilograms of CO₂ and 7.5 crore litres of diesel in the first year alone. Furthermore, freight traffic is forecasted to surge from 7 MTPA in the first year to an astounding 76.4 MTPA by the 11th year, postcommissioning of Vadhavan Port, significantly bolstering India’s logistics and industrial competitiveness.

In addition to this major freight initiative, the minister also informed the media about the redevelopment of 80 railway stations in Madhya Pradesh under the Amrit Bharat Station Scheme and the launch of three new passenger train services to meet growing demand.

These are essential routes for transportation of commodities such as coal, cement, clinker, gypsum, fly ash, containers, agriculture commodities, and Petroleum products etc. The capacity augmentation works will result in additional freight traffic of magnitude 18.40 MTPA (Million Tonnes Per Annum).

The Railways being environment friendly and energy efficient mode

of transportation, will help both in achieving climate goals and minimizing logistics cost of the country, reduce oil import (20 Crore Litres) and lower CO2 emissions (99 Crore Kg) which is equivalent to plantation of 4 Crore trees. The projects will also generate direct employment for about 74 lakh human-days during construction.

These initiatives will improve travel convenience, reduce logistic cost, decrease oil imports and contribute to lower CO2 emissions, supporting sustainable and efficient rail operations.

The projects are the result of the PMGati Shakti National Master Plan for multi-modal connectivity, which has been made possible through integrated planning and will provide seamless connectivity for the movement of people, goods and services.

While the Indian Railways has been consistently delivering the best, it has its share of constraints. The parliamentary standing committee on railways has asked the national transporter to diversify beyond staple

bulk commodities like coal, iron ore, and cement to better its freight performance, and recommended a service model similar to the passenger system. It is also of the view that there is an urgent need to improve the average speed of freight trains which has been 25 km/h during 2023-24.

Additionally, industry experts suggest that the Railways should be prioritising Dedicated Freight Corridors (DFCs) development and usage to ease congestion on highdensity routes and improve freight efficiency. Also considering the current market dynamics, Railways should adapt a commercially viable, market-driven approach, with a focus on diversification beyond bulk commodities and to introduce a freight service model, similar to the passenger segment, offering customised / varied options based on cost, speed and service levels.

Capt Sailesh Tiwari, Director at Alba Marine Services Pvt Ltd., holds a PhD in Ship Operation and Management, complemented by an MBA in Shipping Operations. A seasoned master mariner with extensive experience aboard chemical tankers, Capt Tiwari transitioned ashore after a dynamic sailing career. Prior to joining Alba Marine Services, he served with distinction at several esteemed organizations, including Wallem Group, Epic Gas Ltd., and Fleet Management Ltd.

Beyond his impressive professional trajectory, Capt Tiwari is known for his grounded, health-conscious lifestyle and values the time he spends with family and friends. Driven by a clear and ambitious vision, he is committed not only to advancing his organization but also to contributing meaningfully to the broader maritime industry. He aspires to see India rise among the global leaders in seafarer representation.

Over an engaging chat with Ms Delphine Estibeiro of Marex Media, Capt. Tiwari shared his insights on raising crewing standards, embracing digital transformation, building a resilient workforce, and fostering a culture rooted in safety and responsibility—all vital elements in shaping the future of maritime excellence.

Navigating Leadership with Purpose and Precision…

My experience in this role has been incredibly rewarding, albeit not without its challenges. While we anticipated some obstacles, others were unforeseen. As the Director at Alba Marine Services, I have a multifaceted role that encompasses overseeing the entire recruitment process from hiring and retaining officers and crew members to appointing and supervising port agents. My responsibilities also extend to managing appointments, preparing budgets, and overseeing the training and development of both seafarers and office staff, ensuring that every team member is equipped to grow professionally.

Elevating Crewing Standards through Strategic Foresight…

The maritime industry continues to grapple with the persistent challenge of balancing supply and demand. At Alba Marine Services, our objective extends beyond merely

filling positions; we strive to ensure that we have highquality officers and crew on board. To effectively address crewing and manning issues, a multifaceted approach is necessary. This includes implementing robust recruitment and training programs, fostering efficient communication, and prioritizing safety and wellbeing.

Another significant challenge we face is the apparent lack of motivation among some crew members to pursue selfimprovement. In an industry where continuous learning and personal development are crucial, it’s concerning that some individuals seem content with their current roles and show little desire to advance or upskill. Addressing this issue is essential to maintaining a skilled and adaptable workforce.

I’m pleased to share some exciting developments. We’re already adapting to new technologies and applications in the maritime sector. Gone are the days of relying on memory to recall complex requirements, which can be a significant source of stress. Digitalization and automation are set to significantly redefine the crewing landscape— driven by the goals of boosting efficiency, reducing operational costs, and enhancing safety. While digital tools help optimize processes, automation allows for faster, more accurate task execution. In turn, this evolution may lead to a reduced need for traditional crew sizes, calling for a strategic rethinking of workforce deployment and skill development.

The maritime industry is undergoing a profound transformation, propelled by digital innovation, evolving sustainability goals, and shifting regulatory landscapes. At Alba Marine Services, we are well-equipped to navigate these waves of change. Currently operating a robust fleet of nearly 30 bulk carriers for our in-house owners, Lila Global and Kyra Global Marine Service, we are primed for expansion. In the coming quarters, we aim to scale up to 50 vessels—and within five years, we envision a fleet nearing 100 ships. Or as our seafarers would put it: Full speed ahead.

Building a Resilient Crewing Framework for Sustainable Growth…

Establishing a stable and scalable crewing department requires a comprehensive, people-first approach that prioritizes the identification, development, and retention of exceptional talent. This strategy hinges on forwardthinking recruitment, inclusive training programs, and a work culture that champions engagement and fosters longterm loyalty.

To attract and retain top-tier professionals, it’s vital to cultivate a strong employer brand, offer competitive compensation packages, emphasize continuous career growth, and create a supportive, value-driven workplace. Leveraging employee referrals and harnessing the reach of social media further strengthens outreach efforts, making it easier to connect with like-minded, high-performing individuals.

At LG, KGMS, and AMSPL, we are united by an unwavering commitment to a safety-first culture—one that places the well-being of every employee at the heart of our operations. For us, safety is not merely a compliance requirement but

a core value woven into every layer of our organizational fabric.

Our approach goes beyond meeting regulatory standards; it reflects a proactive mindset where safety is embedded in daily practice. This culture is upheld by a shared belief that safety is everyone’s responsibility, with each individual actively safeguarding their own well-being and that of their colleagues. It is this collective vigilance that defines and strengthens our operational excellence.

To all aspiring seafarers, I’d like to share a timeless quote from Martin Luther King Jr: “Whatever your life’s work is, do it well. A man should perform his duties so exceptionally that the living, the dead, and the unborn could not do it any better.” As we build upon the foundations laid by previous generations, who have worked tirelessly to pave the way, let us strive to excel in our endeavours. Together, let’s cultivate a culture of diligence and commitment, making our efforts worthwhile and creating a brighter future for all.

Marine’s New Office - January 14, 2025

The twelve days of Israel and Iran have taught a great lesson to the world economy, exposing external vulnerabilities, particularly in energy security and trade logistics

“Weak.” “Expected.” “Effectively countered.”

That’s’ how Donald Trump described Iran’s attack. However, over the time his tone seems to be bit pacified as he thanked Iran “for giving us early notice” and said they had “gotten it all out of their ‘system’.”

He continued; “Perhaps Iran can now proceed to Peace and Harmony in the Region, and I will enthusiastically encourage Israel to do the same.”

And finally, to conclude in the late hours of June 23, he wrote: “CONGRATULATIONS WORLD, IT’S TIME FOR PEACE!”

While the fact remains, it was only on June 25, Prime Minister Benjamin Netanyahu announced that Israel has halted all attacks on Iran after a call with Trump.

Earlier the Iranian President Masoud Pezeshkian, on June 24, said, Tehran was ready to resolve issues with the U.S. based on international frameworks, in comments in a phone call with Saudi Crown Prince Mohammed bin Salman, as reported by Iran’s official news agency IRNA.

Pezeshkian insisted, however, that Iran would continue to “assert its legitimate rights” to the peaceful use of atomic energy.

According to The Times of Israel, Iran’s ballistic missile attacks on Israel during the 12 days of war that began on June 13, claimed the lives of 28 people and wounded over 3,000 people whereas, according to Iran’s health ministry, more than 600 Iranian people lost their lives and 5,332 people were injured

On Friday the 13th, June 2025, Israel attacked Iran launching attacks on dozens of targets with the stated aim of stopping the expansion of Iran’s nuclear program.

The US attacked three key Iranian nuclear facilities on early Sunday June 22, 2025. President Donald Trump claimed the operation “obliterated” the

sites, but officials are still assessing how significant of a blow it dealt to Tehran’s program.

The Operation Midnight Hammer with its B-2 stealth bombers dropped more than a dozen massive “bunker-buster” bombs on Iran’s Fordow and Natanz facilities, while Tomahawk missiles struck Isfahan, according to a US timeline of the attack.

Tehran denounced the US and Israel at an emergency UN Security Council meeting and voiced scepticism about the potential for diplomacy.

Are the Tensions Over

With Pezeshkian insisting to continue to “assert its legitimate rights” to the peaceful use of atomic energy and Israel seeing Iran as an existential threat, has the storm faltered in the Middle East?

The twelve days of Israel and Iran have taught a great lesson to the world economy, and the tensions in the Middle East are far from over! Any further (US) strikes on Iran could damage global economic growth, the head of the International Monetary Fund has warned.

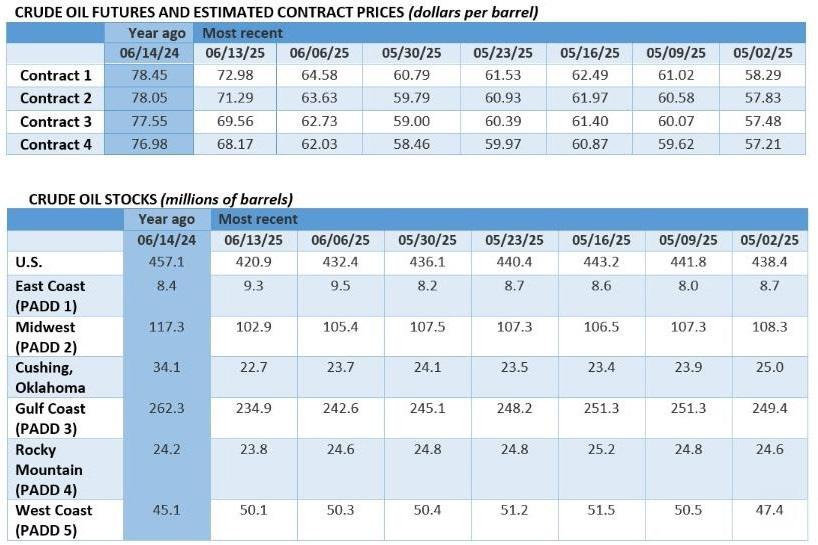

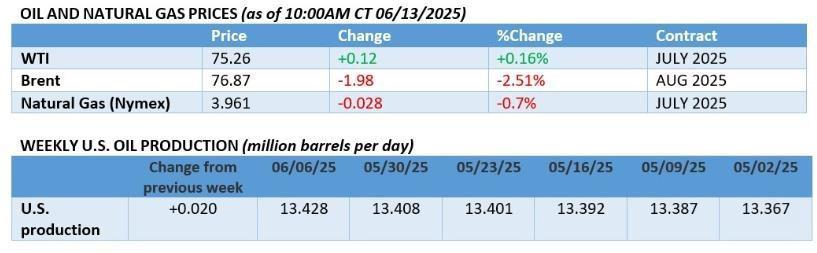

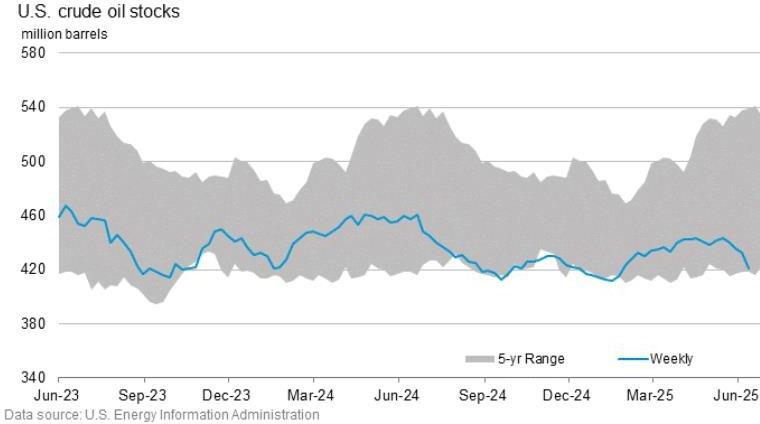

Director Kristalina Georgieva in a media interaction stated that the IMF was watching energy prices closely, warning a rise in oil prices could have a ripple effect throughout the global economy.

“There could be secondary and tertiary

impacts,” she said. “Let’s say there is more turbulence that goes into hitting growth prospects in large economies – then you have a trigger impact of downward revisions in prospects for global growth.”

The recent 12-day conflict between Israel and Iran has exposed India’s external vulnerabilities, particularly in energy security and trade logistics. While the cease fire seems to be enforced, the scepticism looms large.

Any further conflict between Iran and Israel would be a major concern for India’s foreign trade sector, especially importers and exporters dealing in energy and high-tech goods. “With both countries able to engage in missile exchanges and the threat of wider regional is always looming large.”, said an exporter on the condition of anonymity.

According to experts, Indian markets have faced inflation and trade disruptions as the war resulted in rising freight costs, anticipating disruptions in trade routes through the Strait of Hormuz, and volatility in crude oil markets, which pose immediate challenges to India’s inflation management and current account stability. Any further geopolitical triggers could reignite tensions, placing pressure on exporters, MSMEs, and key sectors dependent on Middle East trade. It calls for a proactive policy response including energy

import diversification, rupee-based trade settlements, and targeted support for vulnerable industries.

While India imports limited oil directly from Iran, its reliance on global oil markets covering 85% of its domestic demand, makes it vulnerable. Crude oil prices have already surged by over 11%, which could impact fuel costs and widen the trade deficit.

Indian exporters, particularly in agriculture, engineering goods, and chemicals, face higher freight and marine insurance costs. The Middle East accounts for a sizable share of India’s exports, and even temporary disruptions are affecting MSME margins and delivery timelines.

India, it is learnt, is actively exploring alternative oil sources globally due to rising geopolitical tensions and to mitigate potential supply disruptions. West Africa is a key area of focus for Indian refiners seeking to secure additional fuel supplies. Furthermore, India is investing in renewable energy sources like ethanol blending to reduce its reliance on imported oil.

This initiative is expected to save India billions of rupees annually on oil imports and reduce its carbon footprint. Beyond ethanol, India is also exploring other renewable energy sources and technologies to reduce its dependence on fossil fuels.

The Indian government, through bodies like the Petroleum Planning & Analysis Cell (PPAC), is actively involved in collecting, analyzing, and disseminating data related to the oil and gas sector. This includes mapping of sedimentary basins, contract areas, and producing fields.

Finally, it’s a truce! As they say, all well that ends well.

The criminalisation of seafarers is a growing and serious issue that ranks alongside crew abandonment as one of the most pressing challenges facing seafarers these days

Conversation around seafarers’ rights and welfare seems to have increased in the past five years. Bigger global companies are doing more to look after crews onboard their ships. Big charterers are doing more human rights due diligence. But there are still many players in the industry who fall short of good or even acceptable or legal standards.

There have been many recent instances of seafarers facing detention and legal issues, highlighting challenges faced by seafarers in the maritime industry. These challenges include substandard shipping practices, criminalization after maritime accidents, and abandonment by shipowners. In such cases, seafarers have often been detained and denied access to normal rules of fair play and justice.

Some industry leaders are indeed leading from the front, but there needs to be more effective implementation of the Maritime Labour Convention (MLC) across all vessels – by flag states and port states, as well as by companies with responsibilities for seafarers direct or indirect.

Taking the cause head-on, global maritime leaders have reaffirmed commitment to fair treatment, due process, and coordinated action to protect seafarers’ rights.

At a joint event on a session on Criminalisation of Seafarers, held on June 16,2025, at IMO Headquarters in London, United Kingdom, a high-level participants from the International

Maritime Organization (IMO), International Labour Organization (ILO), International Chamber of Shipping (ICS), and International Transport Workers’ Federation (ITF), have urged that Seafarers detained in connection with their professional duties must be treated fairly and with dignity, with full respect for their human rights.

The participants urged commitment to due process and the fair treatment of seafarers to allow them to be swiftly repatriated to their families in accordance with the recently updated IMO/ILO Guidelines on ‘Fair Treatment of Seafarers detained in Connection with alleged Crimes, acknowledging that unfair criminalization of seafarers continues to be of significant concern to seafarers and the wider industry, and reduces industry confidence.

IMO and ILO, with the support of industry partners in the ILO–IMO

Tripartite Working Group, have adopted Guidelines on Fair Treatment of Seafarers Detained in Connection with Alleged Crimes. The guidelines that were approved by the IMO Legal Committee (LEG 112) in April, cover issues related to due process, protection from arbitrary detention, coercion or intimidation, and ensuring that wages, medical care and repatriation rights should remain intact during any legal proceedings. They aim to improve coordination among countries, including port States, flag States, coastal States, States of which the seafarer is a national, as well as shipowners and seafarers.

Hearing to the case studies at the session from people directly involved in cases including from the seafarer, port, supply chain and shipowner perspective, the global participants urged further practical and concrete outcomes, including robust policies, targeted training programmes, enhanced

enforcement and monitoring, along with sharing of best practices across jurisdictions, be encouraged.

IMO Secretary-General Arsenio Dominguez said, “Global trade depends on the people - the seafarers – who are onboard ships day in, day out. The well-being of seafarers must remain a shared global priority. Stronger legal protections, increased awareness, and continued collaboration across the maritime community are essential.”

“Ratification and enforcement of the MLC are crucial to protect seafarers against criminalization. Let’s continue to join forces to ensure that good practices on the implementation of the

IMO/ILO guidelines are shared and prosecutors and judges are made aware of the particularities of the work of seafarers, essential to ensure their fair treatment. ILO remains committed to use all the mechanisms at its disposal to support seafarers faced with these dreadful situations.” said Ms Corinne Vargha, ILO Director, International Labour Standards Department.

“I look forward to carrying on the vital work that my predecessor Guy Platten has been leading and continuing to collaborate with our partners at the IMO, ILO and ITF – it is of the utmost importance. Strengthened cooperation across the maritime industry is vital to

safeguard our seafarers against unfair criminalisation – seafarers should not be the victims of such actions and must be supported. This is for the betterment of the whole maritime sector and the movement of global trade,” said Thomas Kazakos, Secretary General of the International Chamber of Shipping.

“Seafarer criminalisation is a growing crisis that demands urgent and coordinated action. We need to move beyond policy and into implementation because while the Guidelines exist, too many governments are still falling short. As industry leaders, we have a shared responsibility to push for enforcement, to collect the data, and to hold the industry accountable. This crisis demands joint, sustained action from all industry stakeholders to ensure seafarers are treated fairly and protected. The power to protect seafarers lies in our joint voice, with the IMO, ILO, ICS and ITF united – we can drive the change that seafarers need and deserve,” said Mr Stephen Cotton, ITF General Secretary.

Addressing to the seafarer abandonment and detention-related costs, there was strong consensus that seafarers - key workers essential to global trade - must not bear the burden of legal uncertainty, detention, or abandonment due to systemic gaps or negligence.

i) Judiciary Engagement: Recognizing that many judicial systems may lack the expertise to handle maritime cases swiftly and fairly, participants encouraged the training of judicial authorities in maritime law and seafarers’ rights to ensure timely and just outcomes.

ii) Stronger Industry Coordination: Emphasis was placed on greater coordination between Member States and industry to enable

consistent implementation of legal protections and to support the rapid release and repatriation of detained seafarers.

iii) Role of Insurers: Insurers, including P & I Clubs, were urged to provide legal support coverage and uphold seafarers’ welfare in cases of unfair treatment of seafarers.

iv) Logistics and supply chain stability: Participants highlighted how seafarer criminalization

disrupts crew changes, undermines maritime reliability, and creates reputational and operational risks throughout the global supply chain.

v) Maritime and logistics companies were urged to: Support clear protection protocols; Advocate for consistent treatment across jurisdictions; Invest in awareness and welfare initiatives across shipping and port networks.

ATPI, a global leader in marine travel and maritime logistics services, has announced a significant expansion of its operations across India to capitalize on the country’s surging demand for corporate travel, marine crew logistics, and specialised maritime services. This strategic move comes at a time when India’s Business travel sector is seeing an impressive rebound, with projected expenditure expected to touch USD 38.2 billion in 2024—an 18.3% year-on-year increase (source).

In line with this surge, ATPI has reinforced its presence across the country with new offices in Ahmedabad, Gurgaon, Hyderabad, and Bangalore, while significantly strengthening

operations in Chennai. These hubs are designed to deliver seamless, client-first travel management services to a wide array of industries, including shipping and logistics, offshore energy, electronics manufacturing, IT & ITeS, automobile manufacturing, agri and processed food, and textiles.

The Chennai office plays a pivotal role in supporting Southern India’s thriving maritime corridor. With dedicated account teams offering deep domain expertise, the office enables clients to manage complex, global travel operations with efficiency and agility—making it a key enabler of the region’s blue economy transformation.

The expansion is also in line with ATPI’s continuing investment in their commitment to provide seamless, safetyfirst marine travel and maritime logistics solutions across varied industries. The company’s distinctive, proprietary offerings encompass comprehensive vessel management, maritime safety protocols, and sustainable travel practices that include:

• ATPI Next-Gen Online Booking Tools - ATPI partners cutting-edge booking technology providers to deliver an integrated travel and expense platform which automates workflows, provides comprehensive spending visibility and delivers an intuitive, frictionless experience

• ATPI Travel Hub: a single-platform dashboard for organisations to manage Marine travel

• ATPI TTS: Travel Tracking System helps travel manager track the travellers’ location.

• ATPI Halo: CO2 measurement, reduction and compensation services for sustainability

• ATPI Alerts: empowers Marine travel managers with pertinent information, enabling them to swiftly respond to unforeseen travel crises and strategically plan for optimal efficiency

Vishal Sawant, Chief Commercial Officer, ATPI India, said: “As Indian Marine businesses scale and expand their global footprint, their travel needs are evolving rapidly. Our

expanded footprint is a response to this growth—we’re not just managing travel; we’re enabling efficiency, agility and smarter decision-making. From Marine companies to highgrowth tech start-ups to legacy manufacturing companies, we’re helping our clients move forward with confidence. ATPI’s strength lies in our ability to combine global best practices with local expertise, and that’s what sets us apart.”

Ali Hussain, Managing Director, ATPI Asia said: “Our growth underlines ATPI’s longstanding commitment to Asia’s rapidly evolving travel and events landscape. The new markets are of strategic importance as they permit us to fully cater to our regional clients, share our know-how on domestic market essentials and support them with customised, industryleading solutions”.

“Our expanded presence in Asia enables us to sharpen our objective and ensure our strengths and strategies are in line with any challenges and opportunities that lie ahead. They allow us to be closer to our clients and be ideally positioned to meet regional business travel needs with agility, precision and confidence.”

Designed for dust-free, fully mechanised operations from unloading and storage to ship loading the facility will enhance turnaround times, improve worker safety, and offer greater predictability in cargo movements setting new benchmarks for green logistics

Hindalco Industries, the metals arm of the Aditya Birla Group, has signed an agreement with Vizag Multipurpose Terminal (a JV between India Potash and J M Baxi Ports & Logistics) to construct India’s first fully automated alumina handling terminal at the EQ-07 berth of Visakhapatnam Port.

Considered as a major initiative towards developing smart and sustainable logistics, the project is expected to cut approximately 7,350 MTCO₂e in greenhouse gas emissions annually, setting new benchmarks for green logistics in the metals sector.

The state-of-the-art facility, with a capacity of 1 million tonnes per annum, will eliminate the need for manual cargo handling through complete mechanisation,from unloading to storage to ship loading, ensuring seamless, dust-free operations and significantly faster turnaround times. This fully mechanised and designed for dual operations terminal will handle both alumina exports and fertiliser imports.

The terminal is located on the Vizag port at the East Quay 07 (EQ-07) berth with a quay length of 255 meters. It has an available draft of 14.5 meters and is capable of handling Panamax vessels of up to 70,000 DWT and 240 meters LOA.

A key sustainability feature is the transition from road-based to railbased transport, moving alumina from Hindalco’s Odisha refinery directly to

the port, thus enhancing operational efficiency and reducing emissions. Also, as a multipurpose bulk cargo terminal, it will be capable of handling all dry bulk cargo, including a state-of-the-art mechanised fertiliser handling facility. The automatic conveying, bagging and rail loading facility will make the fertiliser import handling system efficient and environmentally friendly. The construction, which involves India’s first fully automated alumina handling terminal, is underway and is expected to be completed in 2025.

According to industry stalwarts, this landmark development not only boosts worker safety and cargo predictability but also aligns with India’s growing emphasis on future-ready infrastructure. Once operational, it will bolster Visakhapatnam Port’s role as a

premier cargo gateway on the eastern coast and strengthen Hindalco’s export capacity.

The Visakhapatnam Port was among the top-performing ports during AprilMarch 2024-25, handling a significant volume of cargo. The Visakhapatnam Port Authority (VPA) handled 82.62 MMT (Million Metric Tonnes) of cargo during the fiscal year 2024-25, including containers. In March 2025, the port handled 7 container rakes in a single day, surpassing its previous record.

• China’s got the world in a rare earth choke hold Beijing’s dominance in strategically crucial minerals gives it major leverage in trade talks.

As Beijing asserts itself amid global trade tensions, it is playing an ace it has kept up its sleeve for decades: control over the flow of minerals Western countries desperately need to fuel their green, digital and defence ambitions.

When U.S. President Donald Trump last week hailed a draft “framework” with Beijing to end their trade dispute, he singled out China’s export controls on seven rare earth elements — minerals deemed “critical” because they are used in the production of high-tech products such as magnets used in cars.

“Our deal with China is done, subject to final approval with [Chinese] President Xi and me,” Trump wrote in a post on Truth Social. “Full magnets, and any necessary rare earths, will be supplied, up front, by China.”

In return, the U.S. agreed to drop plans to revoke Chinese student visas. But the situation remains tense — at the G7 summit in Canada, European Commission President Ursula von der Leyen accused China of “weaponizing” its leading position in producing and refining critical raw materials.

At the summit, Western leaders were expected to pledge to implement a “G7 critical minerals action plan.” But their statement didn’t namecheck China, instead obliquely mentioning “non-market policies and practices in the critical minerals sector.”

“China has the upper hand in the short term,” said Philip AndrewsSpeed, senior research fellow at the Oxford Institute for Energy Studies. Beijing’s export controls are “much more powerful than a tariff that Trump is putting on,” he added.

Those controls — initially imposed in April and framed as a response to Trump’s tariffs — sparked outrage and alarm among industry bosses and officials in the U.S. and across the EU. They apply to all countries, requiring companies to be granted a license for each shipment.

Trade Commissioner Maroš Šefčovič earlier this month called the situation “alarming” for the European car industry as well as for industry more broadly. “Rare earths and permanent magnets are absolutely essential for industrial production,” he argued, with the

magnets an essential component in everything from smartphones, TVs and computers to car and wind turbine engines and defence applications.

• What if Iran tries to close the Strait of Hormuz?

Israeli aerial bombardment has wiped out much of Iran’s ballistic missile capability and decapitated its military command, but Supreme Leader Ali Khamenei has refused to stop fighting, even promising “irreparable damage” to the US if it intervenes in the conflict in support of its staunch ally.

This has stoked speculation that Iran’s leadership may reach for another way to pressure its enemies to relent – to shipping.

This narrow waterway at the mouth of the Persian Gulf handles around a quarter of the world’s oil trade.

The Strait of Hormuz – a narrow, indispensable artery through which nearly a fifth of the world’s oil and a third of its liquefied natural gas (LNG) flows– stands on a cliff. As geopolitical tensions intensify across the Middle East, fuelled by escalating Iran-Israel tensions and the shadow of direct United States (U.S.) involvement, the onceunthinkable threat of its closure looms larger than ever with Iran’s threat to close or block the Strait. In spite of the catastrophic global implications of such an act, the volatile depths of this potential crisis will be explored, unravelling the motives that could push Iran to choke this global lifeline, exposing the monumental security and geopolitical fallout, and revealing the catastrophic economic shockwave that would consume nations far beyond the region.

Hormuz: A Strategic Chokepoint

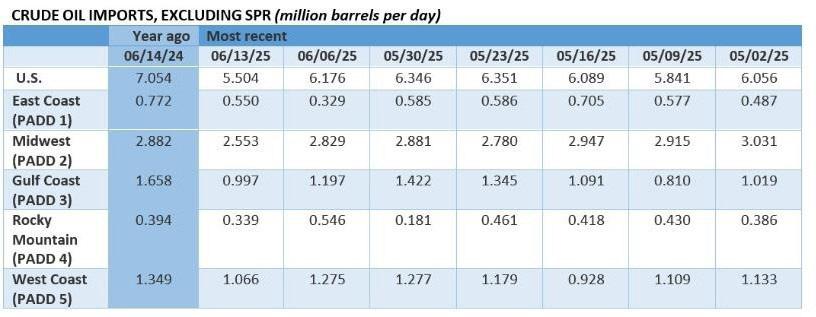

One of the world’s most important, strategic and vital oil transport gateways, the strait of Hormuz, located between Oman and Iran, connects the Arabian Gulf with the Gulf of Oman and the Arabian Sea and is considered one of the world’s most important and strategic locations for international trade. It plays a role in handling the passage of some of the world’s largest crude oil tankers as it is characterized by its depth and width. The Strait of Hormuz plays a critical role in maintaining the stability and efficiency of the international energy market and is considered a major global lifeline. Approximately 20% to 25% of total global oil consumption, which translates to 20 million barrels per day (b/d), travels through this unique waterway. Reflecting on numbers, oil flow through the Strait in 2024 averaged 20 million (b/d), or the equivalent of about 20% of global petroleum liquids consumption. These numbers encompass a substantial portion of crude oil originating from major oil-exporting nations, including Saudi Arabia, Iraq, the United Arab Emirates (UAE), Kuwait, Iran, and Qatar. The economies of Gulf states rely heavily on these vast energy exports, as they are considered the primary source of funding for national budgets, enabling these states to continuously develop their infrastructure, sustain social welfare programs, and maintain the wellbeing of their respective populations.

On the other hand, fast-growing economies, particularly in China, India, Japan and South Korea, among others, which are characterized by their rapid industrialization process, depend heavily on a consistent and affordable means of energy flow for the Middle East via Hormuz strait, this is to fuel their industries and to drive up their economic

growth.

According to the U.S. Energy Information Administration (EIA), in 2024, 84% of crude and condensate) oil, as well as 83% of LNG which travelled through the Strait of Hormuz were primarily directed toward the countries mentioned above, which amounted for a combined 69% of all Hormuz crude oil and condensate flows. Any disruptions in supplies within the Hormuz Strait will have a lasting impact on these markets. The Strait, beyond its crucial role in the transport of crude oil, also plays a pivotal role in LNG transport where Qatar, one of the world’s largest LNG exports, relies almost entirely on this waterway to provide international markets with its gas, reflecting the importance the Strait plays not just for the delivery of global crude oil but rather for the diversification of global energy delivery.

The Strait’s economic significance goes beyond oil and gas, as it also serves as a vital corridor for broader international trade and maritime shipping. While a significant portion of the Strait’s traffic is energyrelated, the Strait also handles large volumes of non-energy cargo, as large container ships loaded with manufactured goods, raw materials, and essential food supplies travel through the Strait. It also supports major ports in the Arabian Gulf. Ports like UAE’s Jebel Ali and Abu Dhabi’s Khalifa Port are among other key trade hubs linking this part of the world and the region to global supply chains, connecting markets within the Middle East to parts of Asia, Europe, and Africa. The lack of alternative routes makes the Strait even more economically critical to many parts of the world. Despite the presence of different pipeline alternatives in Saudi Arabia and UAE, however, their combined capacity falls short of the volume of crude oil that usually travels through the Strait. Hence, having these routes handle only a smaller volume underscores the Strait’s continued strategic importance.

Can the Strait of Hormuz be Closed?

In June 2025, Tehran issued a threat to close the Strait of Hormuz in retaliation for Israeli strikes on its military and nuclear facilities. The decision to close this vital waterway is fraught with complex strategic, political, and economic considerations. While the possibility of closure can’t be entirely dismissed, its actual implementation hinges on several key factors, including:

Iran’s economy is profoundly reliant on its energy sector, with oil export revenues accounting for approximately 85% of all Iranian government revenue. Nearly all of Iran’s oil export terminals are situated within the Arabian Gulf, making the Strait of Hormuz an indispensable lifeline for the nation’s economic well-being. Furthermore, due to insufficient domestic refining capacity, Iran also heavily depends on the Strait for critical gasoline imports. Recent developments have seen Israeli strikes increasingly target Iranian energy infrastructure. This includes significant facilities such as the South Pars gas field, oil refineries, the Shahran oil depot, and various fuel tanks. These attacks represent a dangerous escalation in the conflict, moving beyond traditional military targets to encompass critical economic infrastructure.

Iran will aim to transform the conflict into a wider economic struggle, leveraging the inherent vulnerability of regional energy security as a coercive tool. In this context, closing the Strait of Hormuz would serve not only as a direct retaliatory strike against those attacking Iran’s energy assets but also as a potent coercive measure. This action would aim to pressure states, who are themselves heavily reliant on the Strait for their energy exports, to either disengage from or condemn actions perceived as hostile to Iran.

Iran has consistently accused the U.S. of direct involvement in the ongoing conflict with Israel, claiming to possess “solid evidence” that American forces and bases in the region are actively supporting Israeli military actions. It has explicitly threatened to target the U.S. and other foreign forces if they assist Israel against Iranian missile and drone attacks. Israeli Prime Minister Benjamin Netanyahu recently acknowledged the U.S. Air Force’s role in shooting down Iranian

drones, underscoring the close military cooperation. Also, the Pentagon swiftly moved to accelerate the deployment of an additional aircraft carrier and other naval assets in the region, signalling heightened U.S. commitment.

U.S. officials have warned Iran not to target American troops, drawing a clear “red line,” yet Iran has vowed to retaliate against any Western forces aiding Israel. The substantial U.S. military movements and ongoing defensive actions increase the likelihood of miscalculated incidents that could rapidly escalate, potentially prompting Iran to close the Strait of Hormuz in retaliation and drawing the U.S. into a broader regional war it initially sought to avoid.

As the Supreme Leader, Ayatollah Ali Khamenei holds the highest position in Iran’s political and military power structure, exercising near- absolute authority over all state affairs, including foreign policy and command of the armed forces. His position is central to the cohesion and legitimacy of the Islamic Republic, making him an irreplaceable figure in Iran’s governance. Recent intelligence and reports have revealed that Israel has developed contingency plans targeting Khamenei for assassination, reflecting the heightened tensions and strategic calculations in the region. Israeli officials have publicly hinted that Khamenei remains a high-value target, especially in light of previous successful operations against top Iranian military commanders and nuclear scientists, which have already disrupted the regime’s internal command and control networks and exacerbated political instability.

The assassination of Iran’s Supreme Leader would be seen by Tehran as an existential threat, prompting the regime to abandon strategic restraint. Iran would likely respond forcefully and immediately, regardless of economic or diplomatic costs, almost certainly employing its ballistic missile arsenal and escalating proxy attacks. The regime could also resort to a prolonged closure of the Strait of Hormuz, aiming to exert maximum pressure on global energy markets and reassert deterrence. Such an escalation might also accelerate Iran’s nuclear weapons development. The assassination of Khamenei would thus lead to an extremely unstable situation with severe global repercussions, including major economic disruptions, increased military conflict, and a significant shift in the Middle East’s political landscape.

Domestic Pressures and Diversion

The Iranian regime faces significant and multifaceted internal challenges. These include persistent economic problems, growing domestic alienation, heightened tensions with Israel, and a broader crisis of legitimacy. The recent deaths of high-ranking officials have created a leadership vacuum and exposed potential power struggles within the regime’s elite, further exacerbating internal fragility. In such a precarious domestic environment, the regime’s primary concern is survival and the maintenance of internal cohesion.

A common geopolitical pattern suggests that regimes grappling with severe internal pressures may resort to externalising conflict. This tactic aims to divert public attention away from domestic grievances, consolidate power around a perceived external threat, and foster a “rally around the flag” effect among the populace.

In this context, closing the Strait of Hormuz, an action with profound global ramifications, would immediately shift both international and domestic focus onto an external crisis. This suggests that internal fragility, rather than solely external provocation, could paradoxically increase the likelihood of a drastic external action like Strait closure. The regime might prioritise its own survival and internal cohesion over the severe economic and international repercussions of such a move, viewing it as a desperate, yet potentially effective, diversionary tactic to manage internal dissent and consolidate its position. The potential closure of the Strait of Hormuz amid escalating Iran-Israel tensions would profoundly disrupt regional power dynamics and provoke complex global responses. The feasibility and catastrophic global impact of such a diversionary tactic by the Iranian regime are underscored by the unparalleled strategic and economic importance

of the Strait.

Implications of the Strait’s Closure

Closing the Strait of Hormuz would have profound economic, strategic, and security implications at the regional and international levels. Such an action would disrupt maritime traffic passing through it, threatening global energy supplies and sharply raising oil and gas prices. A closure could also escalate geopolitical tensions, negatively impacting regional security.

An economic shockwave with catastrophic global implications would have immediate effects on the temporary or prolonged closure of the Strait, with global energy markets suffering the most from such repercussions, triggering a significant disruption in international oil and gas supplies worldwide. Key exporting players in the world would be severely impacted by these disruptions, leaving them unable to deliver their energy products through this main maritime route. This would result in sharp spikes in oil prices, potentially exceeding $100 per barrel. At the same time, some analysts predict a higher figure of $120 per barrel, which is subject to an increase depending on the duration and nature of the disruption. The impacts above, causing a sudden worldwide cut in energy supplies, would drive global markets into a state of panic, resulting in a supply-and- demand imbalance. Consequently, many nations that rely heavily on Gulf energy imports, particularly the U.S., Europe, and parts of Asia would face severe energy shortages, disrupting industrial production, straining transportation networks, and affecting daily life.

Such disruption would likely drive prices up on a global scale, sending shockwaves through energy markets and making it more expensive to transport goods, ultimately leading to a rise in the overall cost of living worldwide. Central banks would be caught in complex policy dilemmas, as inflation would rise sharply in nations that import energy, leaving them with two difficult choices: either to raise interest rates to combat inflation, or tighten monetary policy amid slowing economic growth, risking stagflation—a dangerous mix of stagnant output and rising prices. Additionally, many economies are expected to suffer from a deep recession, which would impact millions of jobs and the overall economic activity of these nations. On different stock market levels, the world would experience severe drops and devastating losses.

On a parallel level, the closure will not only trigger severe disruptions within the energy sector but also in global shipping and trade, as ships carrying goods would have to reroute their trips around the entire Arabian Peninsula, which will increase their fuel consumption and cost due to the thousands of nautical miles added to their trips, delaying the delivery of goods for several days or even weeks, consequently skyrocketing freight rates due to increased operational costs. An additional impact would also potentially cause slowdowns in manufacturing processes worldwide, as well as a scarcity of goods, making them increasingly difficult to obtain. The Arabian Gulf ports will eventually be cut off from the rest of the world’s maritime trade, adding more layers to this unprecedented logistical crisis. Vessels and ships traveling through or near conflict and war zones would have to upgrade and increase their insurance policies at significantly higher costs to account for the increased risks they face.

The economic damage would be especially severe for regional economies. The Gulf countries, whose economies heavily depend on oil and gas exports, would experience an immediate and significant decline in their primary sources of income.

Severe budget deficits, currency devaluations, widespread economic contraction, and hardship would be some of the immediate consequences of these revenue halts, potentially triggering widespread social and political instability. Ironically, Iran, the country most likely to consider such a shutdown, would also suffer severe economic repercussions. It’s oil and gas revenues, which are vital and driving forces for its fragile and struggling economy, would be halted, and its ability to import necessary goods, such as food and refined petroleum

products, would be significantly restricted, causing further instability for its regime.