5 minute read

Record year for global wind power

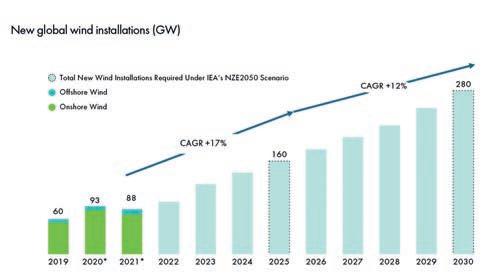

GLOBAL WIND POWER GROWTH MUST TRIPLE OVER NEXT DECADE TO ACHIEVE NET ZERO

2020 WAS A RECORD YEAR FOR THE GLOBAL WIND POWER INDUSTRY, BUT THE 16TH GLOBAL WIND REPORT PUBLISHED BY GWEC WARNS THAT THE WORLD NEEDS TO INSTALL NEW WIND POWER CAPACITY THREE TIMES FASTER OVER THE NEXT DECADE TO ACHIEVE GLOBAL CLIMATE TARGETS.

Advertisement

ALL IMAGES COURTESY OF GWEC, UNLESS STATED OTHERWISE.

Steady growth in Europe was led by the Netherlands which installed nearly 1.5GW of new offshore wind in 2020. In the Netherlands, Ørsted’s 752MW Borssele 1 & 2 offshore wind farm was commissioned end of 2020.

Photo courtesy of Ørsted/Sky Pictures.

The global wind industry installed a record 93GW of new capacity in 2020 – a 53% year-on-year increase, showing strong resilience in the face of COVID-19. Total global wind power capacity is now up to 743GW, helping the world to avoid over 1.1t billion of CO2 annually – equivalent to the annual carbon emissions of South America. However, the world needs to be installing a minimum of 180GW of new wind energy every single year to avoid the worst impacts of climate change, meaning that the industry and policymakers need to act fast to accelerate deployment. GWEC is calling on policymakers to take a true ‘climate emergency’ approach to allow a faster ramp up including: • Eliminatng red tape and reforming administratve structures to speed up and streamline licensing and permitng for projects. • Carry out a massive increase in investments in grid, ports and other infrastructure needed to allow the ramp up in installatons. • Re-vamp energy markets to ensure that they account for the true social costs of pollutng fossil fuels and facilitate a rapid transiton to a system based on renewable energy.

Cost-competitive

Through technology innovatons and economies of scale, the global wind power market has nearly quadrupled in size over

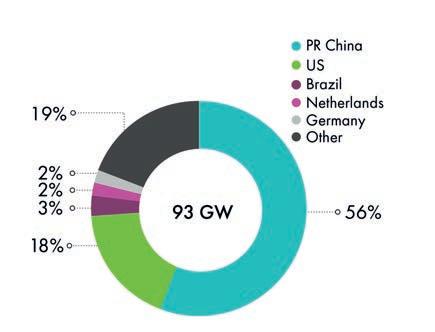

the past decade and established itself as one of the most cost-compettve and resilient power sources across the world. In 2020, record growth was driven by a surge of installatons in China and the US – the world’s two largest wind power markets – who together installed 75%. The world’s top fve markets in 2020 for new installatons were next to the US and China completed by Brazil, the Netherlands and Germany. These fve markets combined made up 80.6% of global installatons last year.

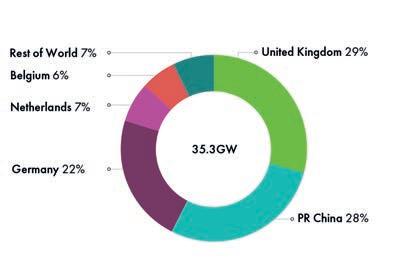

Second-best year for offshore wind

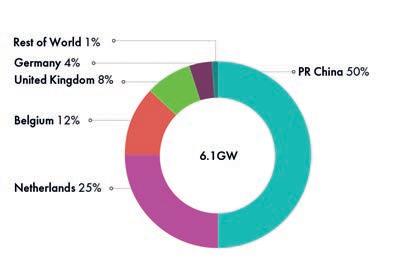

Despite the impact of COVID-19, the global ofshore wind industry had its second-best year ever in 2020 installing over 6GW of new capacity, keeping growth on track. China led the world in new annual ofshore wind installatons for the third year in a row with over 3GW of new ofshore wind capacity in 2020. Steady growth in Europe accounted for most of the remaining new capacity, led by the Netherlands which installed nearly 1.5GW of new ofshore wind in 2020, making it the second-largest market

NEW WIND POWER CAPACITY IN 2020 AND SHARE OF TOP FIVE MARKETS (%).

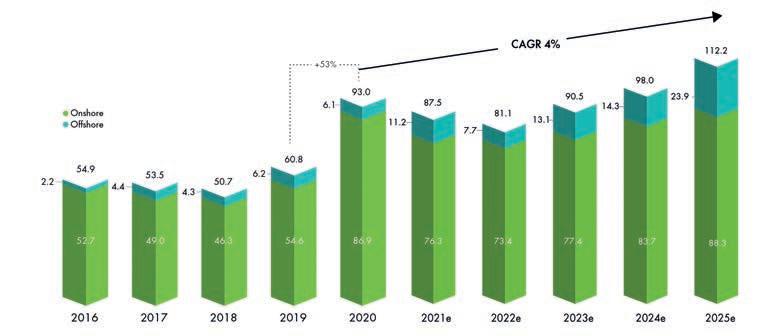

NEW WIND POWER INSTALLATIONS 2016-2025 (GW).

Mogamki diwo kjdalk d akk a Down akdoi skdow.

in 2020, followed by Belgium (706MW). The UK and Germany installed 483MW and 237MW respectvely, making them the number 4 and number 5 markets in new installatons in 2020. The slowdown of growth in the UK is due to the gap between the executon of projects in the Contracts for Diference (CfD) 1 and CfD 2

rounds. In Germany, the slowdown is primarily caused by unfavourable conditons and a lower level of short-term ofshore wind project pipeline. Outside of China and Europe, two other countries recorded new ofshore wind installatons in 2020: South Korea (60MW) and the US (12MW).

Although awarded offshore wind capacity was relatively low compared to 2019, more than 7GW of offshore wind auction/ tenders were launched in 2020

China has overtaken Germany

The UK remains in the top spot globally in terms of cumulatve ofshore wind capacity, while China has now overtaken Germany to become the world’s second largest ofshore wind market. Last year, only 1,005MW ofshore wind capacity was awarded worldwide through auctoning, of which 759MW is from the Netherlands and the remainder from China. A consortum of Shell and Eneco won the right to build the 759MW Hollandse Kust North project in the Netherlands. The project is the third so called zero-priced bid, meaning that the project will only receive the wholesale price of electricity and no further support/payment.

Accelerated pace

Although awarded ofshore wind capacity was relatvely low compared to 2019, more than 7GW of ofshore wind aucton/ tenders were launched in 2020, of which 5.5GW is through state issued solicitatons in New Jersey, New York and Rhode Island in the US. The rest of the capacity is from Denmark (800-1,000MW) and Japan – representng its frst aucton for both foatng and botomfxed ofshore wind. The ofshore wind market has grown from 2.2GW in 2016 to 6.1GW 2020, bringing its market share in global new installatons from 4% to 7%, which is 3% lower than 2019 due to the strong growth spurt of onshore in 2020. GWEC Market Intelligence expects the global ofshore wind market to contnue to grow at an accelerated pace.

Offshore forecast

The volume of annual ofshore wind installatons is expected to quadruple from 6.1GW in 2020 to 23.9GW in 2025, bringing its share of global new installatons from today’s 6.5% to 21% by 2025. In Asia, China will remain the largest contributor in the next fve years, followed by Taiwan, Vietnam, Japan and South Korea. In Europe, ofshore wind will contnue to grow, especially when the big CfD 3 projects come online in the UK from 2023 and with new projects to be installed by Eastern European countries from 2024. In the US, under the support of the Biden Administraton, commissioning the frst utlity-scale ofshore installatons (more than 800MW) by 2023 is becoming feasible and mult-GW level of new installatons are expected to be built thereafer.