TheGreatRecessionand Marx’sCrisisTheory

By ANDREW KLIMAN*

ABSTRACT.TohelpunderstandwhytheGreatRecessionoccurred,this articlefocusesonitsunderlyingcausesandemploysKarlMarx’stheory ofcapitalisteconomiccrisis.ItshowsthatU.S.corporations’rateof returnonfixedassetinvestmentfellthroughoutthehalf-century precedingtherecession,andthatthisfallaccountsfortheentiredecline intheirrateofcapitalaccumulation(productiveinvestment).The investmentslowdownledtoadeclineintherateofeconomicgrowth, whichwasamaincauseofrisingdebtburdens,aswerestimulativefiscal andmonetarypoliciesthatdelayedbutexacerbatedtheeffectsofthe underlyingeconomicproblems.Thearticlealsorefutestheclaimthat therateofprofitcouldnotreallyhavefallenbecausemassive redistributionofincomefromwagestoprofitstookplace,anditargues thatitisunlikelythatmajorcrisesofcapitalismcanbeeliminated.

Introduction

WhydidtheGreatRecessionoccur?What—ifanything—canprevent theoutbreakofmajorcapitalisteconomiccrisesinthefuture?

Myanswertothefirstquestionissimpleandratherprosaic.Ithighlightsseverallong-termweaknessesthatallowedthefinancialcrisisof 2007–2008totriggeradeepdownturninthe“real”economyandprolongedsluggishnessoncetheGreatRecessionofficiallyended.

TherateofprofitofU.S.corporationstrendeddownwardthroughout almostallofthepost-WorldWarIIperiod.Thepersistentfallinprofitabilityledtoapersistentfallintheirrateofcapitalaccumulation(rate ofgrowthofinvestmentinproduction).Thisisnotsurprising;the generationofprofitiswhatmakespossibletheproductiveinvestment

*ProfessorEmeritus,PaceUniversity,E-mail:akliman@pace.edu.ThisarticleisdedicatedtothememoryofA.J.Jaffe,whowasmyfather-in-lawandanassociateeditor ofthisjournal.

AmericanJournalofEconomicsandSociology,Vol.74,No.2(March,2015).

DOI:10.1111/ajes.12094

V C 2015AmericanJournalofEconomicsandSociology,Inc.

ofprofit,andtheinducementtoinvestisbluntedifprofitabilityhas fallenandbusinessesdonotanticipatearosierfuture.Thedeclineinthe rateofaccumulationled,inturn,toadeclineintherateofgrowthof outputandincome,andtheslowdowningrowthwasamaincauseof risingprivateandpublicdebtburdens(i.e.,debtasapercentageof income).

AnothermaincauseoftheGreatRecessionwasthattheU.S.governmentandtheFederalReserverepeatedlytriedtomanageorreversethe fallinprofitability,investment,andgrowthbymeansofstimulativefiscal andmonetarypoliciesthatweresuccessfulintheshorttermbutthatexacerbatedthedebtproblemsbyaddingtothedebtbuild-up.Theresult wasaseriesofdebtcrisesandbubblesthatburst.Thishelpstoexplain whythefinancialcrisiserupted,thoughseveralotherimportantfactors werealsoatwork,andIsuggestthatthiscomplexoflong-termandunresolvedstructuralproblemsexplainswhythefinancialcrisistriggered suchadeepdownturninthenon-financialeconomyandwhytheeconomyfailedtoreboundoncethefinancialcrisiswasresolved.

Manypointsinthisaccountarenotcontroversial,soIwillnotdwell onthem.Instead,Iwillfocusonthepointsthattherateofprofitfell andneverrecoveredinasustainedmannerandthatthisaccountsfor thefallintherateofcapitalaccumulation.Also,inthenextsection,I willbrieflydiscussonekeyinstanceinwhichgovernmentpolicymanagedstructuralproblemsintheshorttermatthecostofexacerbating theminthelongterm—theFed’sresponsetothecollapseofthedotcombubbleofthe1990s,whichcontributedtoandprolongedthe home-pricebubbleoftheperiodthatfollowed.Thegovernment’s long-standingimplicitguaranteethatitwould,ifnecessary,repaydebts incurredbyFannieMaeandFreddieMac,thegiantmortgagelenders andmortgage-loanguarantors,isanotherobviousexampleofitsrolein thedebtbuildup.OthergovernmentactionsalsoledtotheGreatRecession,butImentiontheroleofgovernmenthereonlytomakeonepoint clear:thefallintherateofprofitwasanimportantcauseoftheGreat Recession,butnotthe sole cause.

Thenextsectionofthearticlewillelaborateonmyviewthat,ifwe wishtounderstandwhytherecessionanditsprolonged aftermathoccurred,itisinsufficienttofocusonthefinancialcrisisand itscauses. TheGreatRecessionandMarx’sCrisisTheory

237

TheAmericanJournalofEconomicsandSociology

Inthethirdsection,IwillsurveyKarlMarx’sfalling-rate-of-profit theory,andthelinksbetweenitandhistheoryofcapitalistcrisis,in ordertohelpexplainwhytherateofprofitfellandtherolethisplayed inthebuilduptothecrisisandrecession.Imakenoclaimthatall,or evenany,ofcapitalism’slarge-scaleeconomiccrisespriortothe1970s canbeproperlyunderstoodintermsofthistheory;theavailabledata aretoosparseandinadequatetotestthathypothesis.However,U.S. corporations’rateofprofitdidfallthroughoutthehalf-centurythatprecededtheGreatRecession.Iwilldocumentanddefendthisfindingin thefourthsectionofthearticle,whereIwillalsoarguethat,inthis instance,Marx’stheoryofwhytherateofprofittendstofallfitsthefacts remarkablywell.

ThefifthsectionwillshowthattheentirefallinU.S.corporations’ rateofaccumulationoffixedassetsbetween1948and2007isattributabletothefallinthecorporations’rateofprofit.Thisfindingrunscountertotherathercommonbeliefthatthefallintherateofaccumulation duringthe“neoliberal”erawasdueto“financialization”—specifically, thediversionofprofitfrominvestmentinproductiontowardfinancial uses—sothefifthsectionwillalsoexplainwhythatbeliefismistaken.

Inthesixthsection,Iwilladdresswhathasproventobethemain sourceofresistancetoseriousconsiderationofevidencethattherateof profitfell—agamutofallegedfactsthatsupposedlyimplythatamassive redistributionofincomefromwagestoprofitstookplaceunderneoliberalismandthattherateofprofitthereforecouldnotreallyhavefallen.

Finally,Iwilltakeupthesecondquestionposedatthestartofthe article:What—ifanything—canpreventtheoutbreakofmajorcapitalist economiccrisesinthefuture?Iwillexplainwhytheoryandmyreading ofthehistoricalrecordmakemeextremelydoubtfulthatmajorcrisesof capitalismliketheGreatRecessioncanbeeliminated.

DiggingBeneaththeFinancialCrisis

Theproximatecauseoftherecessionwas,ofcourse,theburstingof thehome-pricebubbleintheUnitedStates,whichultimatelyledtothe financialcrisisof2007–2008.Itseemsthatmanyfactorscausedthebubbletoformandpersist,andthatbothprivate-sectorpracticesandgovernmentmonetaryandregulatorypoliciesaretoblame.

238

Yetitseemsdoubtfulthatthisisthewholestory.TheTroubledAssets ReliefProgram(TARP)bailout,“stresstests”offinancialinstitutions,and otheractionssucceededinquellingtheU.S.financialcrisisbymid-2009 atlatest,yeteconomicgrowthremainedverysluggishformanyyears thereafter.Theeconomyhasstillnotreturnedtonormalanditis unclearwhethertherecentrecoverywillbesustained.TheEurozone economyisinevenworseshape;dataforthefirsthalfof2014indicate thatitsrecoveryhaspeteredout.

Thelackofgrowthofgrossdomesticproduct(GDP)inEuropeis arguablyduepartlytoausteritypolicies,butsuchpoliciescannot accountforthefailureoftheU.S.economytoreboundrobustly.U.S. fiscalandmonetarypolicieshavebeenwildlyexpansionary.Thepublic debtroseby94percentbetweenthestartoftheGreatRecession (December2007)andOctober2014;theextra$8.7trillionofborrowing,usedforincreasedgovernmentspendingandlowertaxes,amounts to$28,000perperson.TheFederalReservehaskeptthefederalfunds ratenearzeroforalmostsixstraightyearsandhasbought$3.7trillion worthofsecuritiessince2008inordertolowerlong-termrates.

Giventhateconomicmalaisehaspersistedsolongafterthefinancial crisiswasresolved,itdoesnotseemplausible—tomeortoagrowing numberofprominentmainstreameconomists—thatonehasreally explainedtheGreatRecessionanditsaftermathbypointingtopredatory lending,excessiveleverage,laxcreditstandards,theextremelyeasy moneypolicyoftheFedduringthebubbleyears,andotherfactorsthat producedthefinancialcrisis.FormerTreasurySecretaryLawrence Summers(2013)madethepointbycomparingthefinancialcrisistoa powerfailurethatcausesacountrytolose80percentofitselectricity.Productionwouldplummet,butoncepowerwasrestored,production wouldquicklybounceback.Indeed,sincethecountrywouldneedto replenishtheinventoriesitdepletedduringthepoweroutage,productionwouldincreaseatafaster-than-normalrate.“Soyou’dactuallyexpect thatoncethingsnormalized,you’dgetmoreGDPthanyouotherwise wouldhavehad,notthatfouryearslater,you’dstillbehavingsubstantiallylessthanyouhadbefore.So,there’ssomethingodd ... if[financial] panicwasourwholeproblem,tohavecontinuedslowgrowth.”

Summersandothereconomists,suchasPaulKrugmanandMartin Wolfofthe FinancialTimes,insteadsuggestthatwemaywellbeina

TheGreatRecessionandMarx’sCrisisTheory 239

periodof“secularstagnation.”Ontheonehand,thesecular(long-term) stagnationthesisisaforecast,oratleastawarning,aboutthefuture.On theotherhand,itisanefforttoexplainthepast—specifically,toexplain whytheGreatRecessionoccurredandwhyrecoverywasdelayedand weakdespitethesuccessfulquellingoffinancialpanicandexceptionally stimulativeeconomicpolicy.Summersandtheotherssuggestthatstagnationmayhavebecomethe“default”stateoftheU.S.economysometime before thefinancialcrisis.Forinstance,Wolf(2013)hasarguedthat thefinancialcrisis“followedfinancialexcesses,whichthemselves maskedor,asIhaveargued,wereevenaresponsetopre-existingstructuralweaknesses.”Krugman(2013)suggeststhatthestagnationtendencybegantodevelopasearlyasthemid-1980s.Thissuggeststhatthe financialcrisiswasmerelyafactorthattriggeredandhelpedtopropagate therecession,whileitsunderlyingcauseswerethefactorsthatproduced “structuralweaknesses”inthenon-financialsectorsoftheeconomy.

IagreewithWolfthatthefinancialexcessesthatcreatedthehomepricebubble,andthatultimatelyledtothefinancialcrisis,werethemselvesa“responsetopre-existingstructuralweaknesses.”TheperformanceoftheU.S.economyandFederalReservepolicyfollowingthe collapseofthe“dot-com”bubbleofthe1990sare,Ibelieve,themost strikingevidenceinsupportofthisview.

U.S.corporations’after-taxrateofprofitdeclinedbymorethantwofifthsbetween1997and2001(from11.4percentto6.7percent,accordingtomyestimate).(Thesefiguresrefertoafter-taxprofitasapercentage ofthenetstockof—thatis,accumulatedinvestmentin—fixedassets, bothnetofdepreciationvaluedathistoricalcost.)Thestockmarket begantocrashattheendof2000;byearly2003,theS&P500indexhad fallenbyalmost50percent.ArecessionbeganinMarch2001.Itwasrelativelyshortandmildinmanyrespects.ItofficiallyendedinNovember eventhoughthe9/11terroristattackshadtakenplaceonlytwomonths before.YetemploymentcontinuedtofallthroughAugust2003.InNovember2002,BenBernanke(2002)warnedthattheUnitedStatesmightexperiencedeflationandaJapanese-style“lostdecade”ofstagnation.

TheFederalReserverespondedwithanexceptionallyexpansionary monetarypolicy.Afteradjustmentforinflation,thefederalfundsrate wasnegativefromthestartof2002throughmid-2005.Thispolicy,and thelooseningofcreditstandards,servedtoprolongandfurtherinflate

240

TheAmericanJournalofEconomicsandSociology

thebubbleintheU.S.housingmarket(and,arguably,bubblesinthe stockandcommercialrealestatemarkets).Inprinciple,theFedcould havemovedtodeflatethebubbleseveralyearsbeforethefinancialcrisiseruptedbut,asBernanke(2010)laternotedintestimonybeforethe FinancialCrisisInquiryCommission,this“wasnotapracticalpolicy option.”TheFed“likelywouldhavehadtoincreaseinterestratesquite sharply,atatimewhentherecoverywasviewedas‘jobless’anddeflationwasperceivedasathreat.”

Whethertheforward-lookingaspectofthesecularstagnationargumentwillprovetobecorrectisuncertain.Idobelievethatthe backward-lookingaspectisright.Butwhydidthetendencytoward stagnationdevelop?Mainstreamproponentsofthehypothesistypically arguethataggregatedemandweakenedtosuchanextentthatfull employmenthadbecomeimpossibleunlessrealshort-terminterest rateswereridiculouslylow(e.g.,–2percentto–3percent).Thisis moreofapolicy-readyformulationthanagenuinetheoreticalargument.Varioustheoreticalargumentsarecompatiblewithit,including theoneIshallofferbelow:thefallintherateofprofitcausedarelative declineintheprofitavailableforinvestmentandperhapsinexpected futureprofitability,whichledtosluggishinvestmentdemandandconstrainedemployment,income,consumptiondemand,andsoforth.

Marx’sTheoryofCrisis

AdamSmith,DavidRicardo,andotherclassicalpoliticaleconomists heldthattherateofprofit—profitasapercentageoftheamountof moneyinvestedinproduction—tendstofallinthelongrun.Theydrew thisconclusionfromempiricalevidencethatinterestrateshadfallen. KarlMarxacceptedtheirconclusion,butnotthetheoriestheyhadput forwardtoaccountforthetendencyofprofitabilitytofall.Heregarded hisown“lawofthetendentialfallintherateofprofit”(Marx1991a: 319)asthefirst“law”(explanatorytheoreticalprinciple)toaccountfor thetendencysuccessfully,andherepeatedlystressedthatitis“themost importantlaw”ofpoliticaleconomy,thesolutionofthecentralpuzzle aroundwhich“thewholeofpoliticaleconomysinceAdamSmith revolves”(Marx1973:748,1991b:104,1991a:319).AsIwilldiscuss below,thelawisofcentralimportancetohistheoryofcapitalist TheGreatRecessionandMarx’sCrisisTheory

241

TheAmericanJournalofEconomicsandSociology

economiccrisis,since“thefallingrateofprofit ... hasconstantlytobe overcomebywayofcrises”(Marx1991a:367).

Thelawandthecrisistheorybasedonithavemanydetractors,even amongthosewhoself-identifyasMarxists.Themostprominentoppositioncomesfromthe“monopolycapital”schoolassociatedwith MonthlyReview magazine,whichdeniesthatMarxhada“fullydevelopedcoherent”theoryofcrisis(MonthlyReview editors2013).This school’salternativetothetheorybasedon fallingprofitability isan underconsumptionist theory.Itclaimsthatthereisanever-present tendency,whicholigopolypricingexacerbates,forworkers’shareof outputtofallundercapitalism.Thisconstrainsconsumptiondemand, andsinceproductiveinvestmentcanallegedlygrownofasterthanconsumptiondemandinthelongrun,totaldemandpersistentlytendsto fallshortofthesupplyofoutput.1 Althoughvarious“externalstimuli” canoffsettheunderconsumptionproblemforatime,recurrenteconomicdownturnsareneededtorestoretheequilibriumbetweensupplyanddemand.(MonthlyReview’sattempttoapplythistheorytothe GreatRecessionwillbediscussedinthesixthsectionofthearticle.)

Marxputforwardhislawofthetendentialfallintherateofprofitin Part3ofthethirdvolumeof Capital.Thelawisthat“[t]heprogressive tendencyfortherateofprofittofallisthussimply theexpression,peculiartothecapitalistmodeofproduction,oftheprogressivedevelopmentofthesocialproductivityoflabor”(Marx1991a:319,emphasisin original).Inotherwords,risingproductivitytendstodepresstherateof profit.Thisconclusionfollowsinafairlystraightforwardmannerfrom thefollowingthreepointsdevelopedearlierinthebook.

(1)Toremaincompetitive,capitalistsmustreducecostsofproduction,andtheydosolargelybyboostinglaborproductivity (theamountofproductperunitoflaborperformed).The productivityincreasesareachievedmainlybyadoptingnew technologiesthatreplaceworkerswithmachines.Thus,what Marxcalledthetechnicalcompositionofcapital,theratioof machinesandothermeansofproductiontothenumberof workersemployed,tendstoriseovertime.

(2)Theamountofnewvalue—and,allelsebeingequal,alsothe surplus-value(profit)—generatedbyeachdollarofcapital

242

TheGreatRecessionandMarx’sCrisisTheory 243

investmenttendstofallasaresult.ThisfollowsfromMarx’s theorythatworkers’laboristheexclusivesourceofnewvalue. Whenworkersarereplacedbymachines,moreofeachdollar investedinproductionisspentonmeansofproductionthatdo notgeneratenewvalue,andlessisspenttohiretheworkers whoselabordoesgenerateit.Thus,theratiobetweenthese twosumsofmoney,whichMarxcalledthevaluecomposition ofcapital,tendstorisealongwiththeriseinthetechnicalcomposition.(Thisisatendencyratherthanaguaranteedoutcome sinceotherfactorsalsoaffectthevaluecomposition.)

(3)Intheeconomyasawhole,whatistrueofvalueandsurplus-value isalsotrueofpriceandprofit.Individualbusinessesandindustries mayobtainpricesthatexceedtheamountsofvaluetheyproduce, andtherebyobtainmoreprofitthanthesurplus-valuetheyproduce, butMarx’stheoryholdsthatsuchgainscomeattheexpenseofand are fullyoffset bylowerpricesandprofitsfortheothercapitalists. Intheaggregate,thepriceofoutputequalsthevalueofoutput, andprofitequalsthesurplus-valueactuallycreatedinproduction. Thus,Marx’slaw,whichpertainstotheaggregateeconomy,isnot affectedbydiscrepanciesbetweensurplus-valueandprofit.

ThebasicideabehindMarx’slawcanthusbeexpressedintermsof priceandprofit,withoutexplicitreferencetotheterminologyofhis valuetheory,asfollows.Whenproductivityincreases,lesslaboris neededtoproduceaproduct,soitcanbeproducedmorecheaply.As aresult,itspricetendstofall.Andwhenpricestendtofall,sodoprofits andtherateofprofit.(Strictlyspeaking,thepricelevelneednotfall;it issufficientthattherateofinflationfalls.)

Thetendencyforpricestofallasaresultoftechnicalinnovationhas beenrecognizedevenbynon-MarxistslikeAlanGreenspan(2000):

[F]asterproductivitygrowthkeepsalidonunitcostsandprices.Firms hesitatetoraisepricesforfearthattheircompetitorswillbeable,with lowercostsfromnewinvestments,towrestmarketsharefromthem.

Indeed,theincreasedavailabilityoflabor-displacingequipmentandsoftware,atdecliningpricesandimprovingdeliverytimes,isarguablyatthe rootofthelossofbusinesspricingpowerinrecentyears.

The“lossofbusinesspricingpower”dueto“labor-displacingequipmentandsoftware”isthecruxofMarx’slaw.Acentralfeatureofitis thedeclineintheratioofcurrenttopastprices.2

Marx(1991a:339)recognizedthatvarious“[c]ounteractinginfluencesmustbeatwork,checkingandcancelling[durchkreuzenundaufheben]theeffectofthegenerallawandgivingitsimplythecharacter ofatendency.”Forinstance,risingproductivityalsotendstocheapen meansofproductionandgoodsthatworkersconsumeandbothof thesefactorstendtoboostprofitability.Marxclearlybelievedthatthe tendencyfortherateofprofittofallprevailsoverthecounteracting factors;afterall,thatwaswhattheempiricalevidenceavailabletohim suggested.However,hislawhasanexplanatoryfunction;itdoesnot assertthatthefallintherateofprofitisinevitable(Klimanetal.2013). Nordoesitsaythattherateofprofitwillexhibitadecliningtrend throughoutthelifetimeofcapitalismasawhole.WhilethatwasbasicallythepositionofSmith,Ricardo,andotherclassicalpoliticaleconomists—whoconsequentlypredictedthatthesystemwouldreacha stationarystate—Marxarguedthatthetendencyoftherateofprofitto fallleadstoboom-and-bustcycles.(Thereseemstobenotextualevidencethatsupportsthelegendthatheclaimedthatthistendency wouldcausecapitalismtocollapseinanautomaticorquasi-automatic manner.)

InMarx’sview,thefallintherateofprofitisonlyanindirectcauseof financialcrisesanddownturns.Heacknowledgedthatitreducescapitalists’willingnesstoinvestinproduction(Marx1991a:349),buthiscrisistheoryisnotoneinwhichafallintherateofprofitcausesafallin therateofaccumulation,whichthencausesaneconomiccrisis,ina mechanicalfashion.

Onthecontrary,hearguedthatthetendencyfortherateofprofitto fallleadstoadownturnintheeconomybyencouragingspeculation, “overproduction”(excesssupply),andafinancialcrisis,andthatthe financialcrisisistheimmediatecauseofthedownturn.

Thelinkbetweenfallingprofitabilityandgreaterspeculationisthat capitalistsdonotresignthemselvestoobtainingthenow-reducedaveragerateofprofit.(Theywanttomaintaintheirexistingrateofprofit,and theymayneedtomaintainitinordertobeabletorepaytheirdebts.) Theythusengagein“newcapitalinvestmentsandnewadventures,to

244

TheAmericanJournalofEconomicsandSociology

securesomekindofextraprofit”(Marx1991a:367).Buttheexcessive leverageassociatedwithheightenedspeculativeactivityaswellas reducedprofitabilityleadtoasituationinwhichasubstantialvolumeof debtcannotberepaid,anditisatthatpointthatafinancialcrisiserupts. Thatcrisisisinturntheimmediatecauseoftheeconomicdownturn:

Thechainofpaymentobligationsatspecificdatesisbrokeninahundredplaces,andthisisstillfurtherintensifiedbyanaccompanying breakdownofthecreditsystem,whichhaddevelopedalongsidecapital. Allthisthereforeleadstoviolentandacutecrises,suddenforcibledevaluations,anactualstagnationanddisruptioninthereproductionprocess, andhencetoanactualdeclineinreproduction.(Marx1991a:363)

AgainstSmith’sstagnationistviewofthelong-termeffectoffalling profitability,Marxarguedthat“[p]ermanentcrisesdonotexist”because thefinancialcrisesanddownturnsthatresultindirectlyfromthefallin therateofprofitleadtothe“destructionofcapitalthroughcrises” (Marx1989:128n,127,emphasisinoriginal).Thatis,aportionofthe capital-valueinvestedinproductionisdestroyedbymeansofbankruptcies,write-offsofbaddebt,fallingpricesofmeansofproduction, idledplantandequipment,andsoon.Newownerscantherefore acquirebusinessescheaplyandwithoutassumingalloftheprevious owners’debts,whichimpliesthattheirrateofprofit—profitasapercentageofthe reduced amountofcapital-value they haveinvested—is greaterthanthepreexistingrate.Thus,thedestructionofcapital-value setsthestageforaneventualrestorationoftherateofprofitandanew phaseofcapitalistexpansion.3

Marx’scrisistheorycanbecharacterizedasanendogenoustheoryof recurrentcrises.Thedownturnisendogenousbecauseitisduetothe dynamicsofcapitalismitself,nottoexternalshocks(alone).Thesubsequentupturnisendogenousbecausethecrisisitselfgeneratesconditionsthatleadtorecovery; adhoc externalstimuliarenotneeded.

TheFallinU.S.Corporations’Profitability

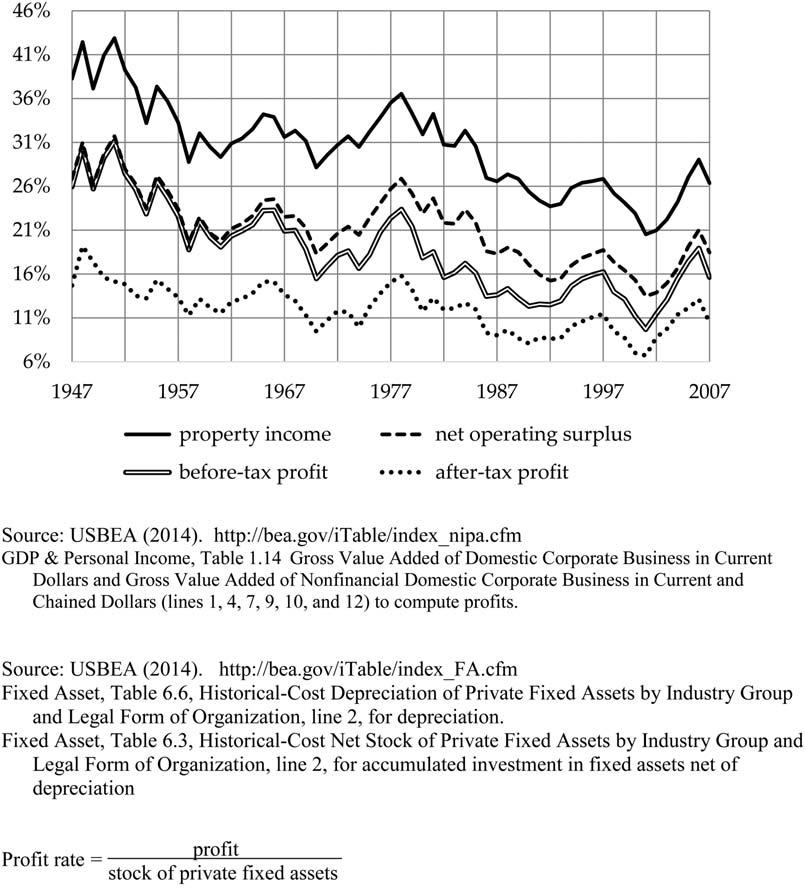

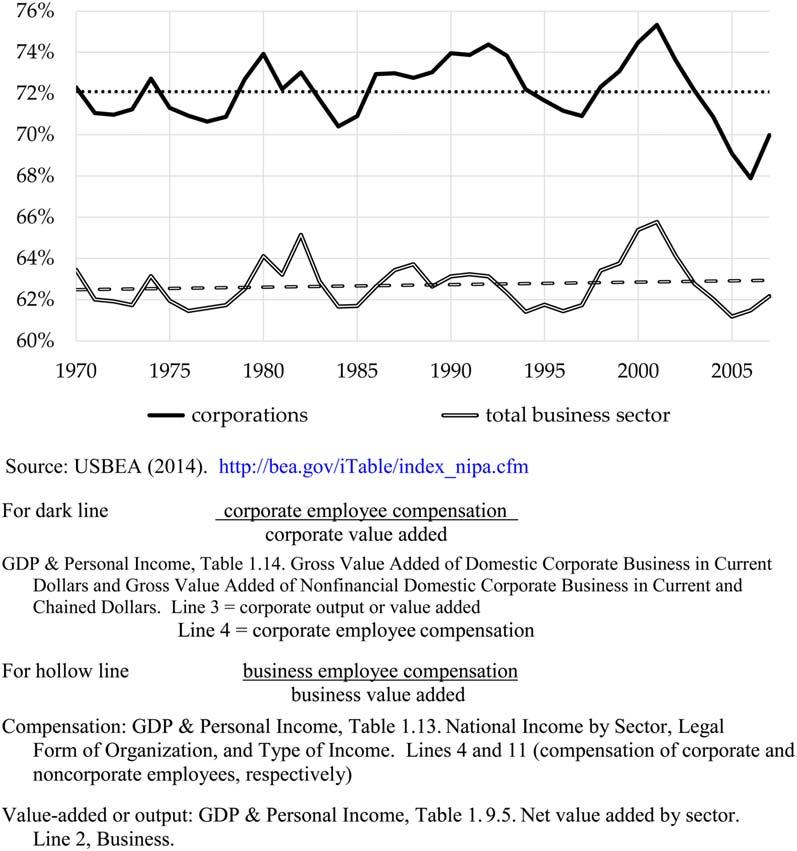

U.S.corporations’rateofprofitfellsubstantiallyfromthemid-1950s untiltheearly1980sanditalsocontinuedtofallundertheneoliberal erathatfollowed.Fourmeasuresoftherateofprofitareshownin

TheGreatRecessionandMarx’sCrisisTheory 245

TheAmericanJournalofEconomicsandSociology

Figure1

U.S.Corporations’RateofProfit(profitasapercentageofnetstockof fixedassets;depreciationvaluedathistoricalcost)

Figure1.Eachexpressescorporations’profitsasapercentageoftheir accumulatedinvestmentin(or“netstockof”)fixedassets.Bothprofit andaccumulatedinvestmentaremeasurednetofdepreciationasvaluedathistoricalcost.ThemostinclusivemeasureofprofitiswhatIcall “propertyincome,”grossvalueaddedminusdepreciationandcompensationofemployees.Netoperatingsurplusexcludes,inaddition,net

246

indirectbusinesstaxes(salestax,etc.).Before-taxprofitisnetoperating surplusminusinterest,transfer,andmiscellaneouspayments,andaftertaxprofitalsoexcludestheportionofbefore-taxprofitthatgoestopay corporateincometaxes.

Allfourmeasuresoftherateofprofitdeclinedsubstantially,andall fourcontinuedtotrenddownwardfollowingthetroughassociated withtherecessionof1981–1982.Thedownwardtrendfromtheearly 1980sonwardisparticularlypronouncedifwecomparetroughsto troughs.Thisisgoodpracticeingeneral,anapples-to-applescomparison,andinthiscaseitisparticularlyhelpfulinordernottoconstruethe sharp—butobviouslytemporary!—spikeintherateofprofitthat occurredintheyearsleadinguptotheGreatRecessionasagenuine returnofthecorporatesectorto“economichealth.”Thehome-price bubbleofthisperiodundoubtedlyboostedprofitabilityartificiallyby stimulatingdemandinanunsustainableway.Forinstance,homeownersfundedexpendituresbyborrowingagainsttheincreasedvalueof theirhomes,loosecreditstandardsandtheFed’sexceptionallyeasy moneypolicyfurtherfueleddebt-financedspending,and,bymaking peoplewealthier—onpaper—risingassetpricesreducedtheincentive tosaveandboostedtheincentivetoconsume.

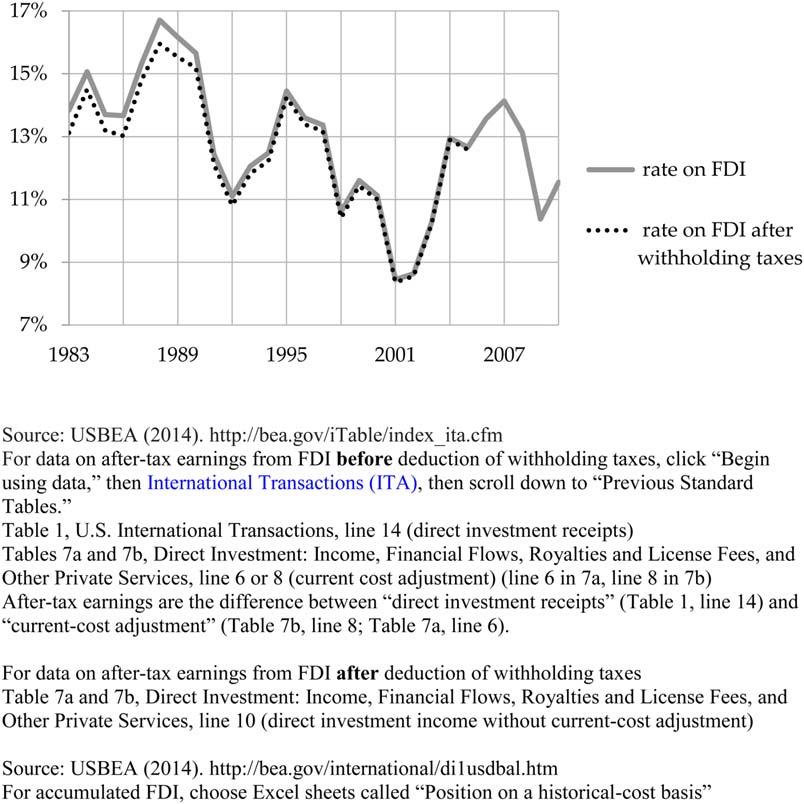

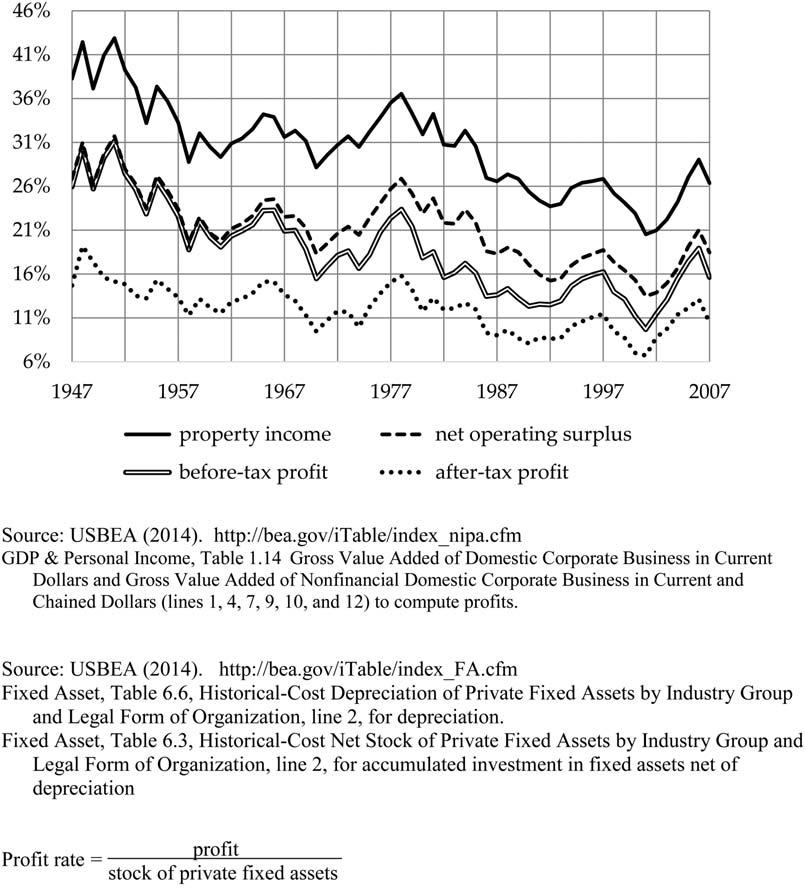

Theratesofprofitabovearefordomesticcorporationsonly;they excludeU.S.multinationalcorporations’investmentabroadandprofits fromabroad.However,datacontainedinadifferentsetofgovernmentaccountsenableustocomputeU.S.corporations’rateofprofit ontheirforeigndirectinvestmentfrom1983onward.Profitismeasuredasincomefromdirectforeigninvestment,netofincometaxes, andoneofthetwoseriesexcludeswithholdingtaxesondividends andinterestaswell.Thedenominatoroftherateofprofitisforeign directinvestmentitself(parentcompanies’equityinvestmentin,net lendingto,andreinvestedprofitinpartlyorwholly-ownedsubsidiaries).AsFigure2shows,thisrateofprofitalsotrendeddownward sharply,especiallywhenwecomparepeakstopeaksandtroughsto troughs.Althoughthedenominatorsofthedomesticandinternational ratesofprofitaresomewhatdifferent,thefactthatbothratesfell meansthatthedomesticrateisnotgivingusadistortedpictureofthe trendinU.S.corporations’profitability.(SeeKliman(2012b)forfurther discussion.)

TheGreatRecessionandMarx’sCrisisTheory 247

TheAmericanJournalofEconomicsandSociology

U.S.Corporations’RateofProfitonForeignDirectInvestment(FDI) (after-taxearningsfromFDIasapercentageofaccumulatedFDI)

Thefactthattherateofprofitcontinuedtotrenddownwardafterthe crisesofthemid-1970sandearly1980sisparticularlyimportant.Ifprofitabilityhadreboundedsubstantially,itwouldbehardtoarguethatits priorfallwasamongtheunderlyingcausesoftheGreatRecession. Moreover,itsfailuretoreboundseriouslycallsintoquestionthe claim—whichhasbeenwidelyacceptedbymuchoftheleft,evenin thewakeoftheGreatRecessionanditsprolongedaftermath—thatthe victoryof“neoliberalism”andthe“financialization”oftheeconomy succeededinputtingcapitalismbackonanewandstableexpansionary

Figure2

248

pathaftertheeconomiccrisesofthemid-1970sandearly1980s.Supposedly,thesmashingofunionsandotherpoliciesandphenomena causedwagestostagnateandworkers’shareoftheproducttoplummet,andthisredistributionfromwagestoprofitsinturnledtoalongterm rise intherateofprofit.

Thepost-1982fallintherateofprofitdepictedabovewouldindeed behighlysuspectifsuchredistributionhadoccurred.However,asI shalldiscussindetailbelow,compensationofemployeesdidnotin factstagnate(onaverage)orfallasashareoftheproduct.Inlightof thesefacts,thefallintherateofprofitisnolongeranomalous.

Yetthereareadditionalreasonswhytherateofprofitiswidely thoughttohaverisen.Thisbeliefislargelybased,directlyandindirectly,ontheworkofGerardDumenilandDominiqueLevy(2005:9, 11,emphasesomitted),whoreportedthattherateofprofitofthe “Corporatesector ... recoveredtoitslevelofthelate1950s ....ConsideringtheevolutionoftheprofitratesinceWorldWarII,therecoveryof theprofitrateappearsnearlycompletewithintheentireCorporate sector.”Thisconclusionwaslargelytheresultofcherrypickingthe data;theycomparedthe trough of1982tothe peak of1997(despitethe availabilityofdatathrough2000).Insubsequentwork,Dumeniland Levy(2011:60,emphasisadded)drasticallyrevisedtheirconclusion, statingthatonly“a slightupwardtrend ofthecorporateprofitrate ala Marx wasestablishedwithinneoliberalismfromthelowlevelsofthe structuralcrisisofthe1970s.”(Thephrase“alaMarx”meansthata broadmeasureofprofit,suchasnetoperatingsurplus,isused).Thisis tantamounttoanadmissionthatneoliberalismwasnotverysuccessful inrestoringprofitability.

Althoughtheirrevisedconclusionismoreinkeepingwiththerateof-profittrendsdepictedabove,adifferenceremains.Thedifferenceis conceptual,notempirical;thefactsarenotseriouslyindispute.Weare measuringtwodifferentthings,notmeasuringthesamethingintwo differentways.WhenIreferto“therateofprofit,”Imeanprofitasa percentageoftheamountofmoneythathasactuallybeeninvestedin production(netofdepreciation).Thisisveryclose,ifnotidentical,to thestandardmeaningoftheterm.However,whatDumenilandLevy (amongothers)meanby“therateofprofit”isprofitasapercentageof thereplacementcost(orcurrentcost)offixedassets,theamountof TheGreatRecessionandMarx’sCrisisTheory

249

moneythatwouldcurrentlybeneededtoreplacethem.Whentherate ofinflationrises(falls),theamountofmoneythatwouldbeneededto replaceallofthefixedassetsinuserises(falls)relativetotheamountof moneythatwasactuallyinvestedtoacquiretheminthepast,andthe replacement-costrateofprofitthereforefalls(rises)inrelationtothe rateofprofitbasedonactualaccumulatedinvestment.Thus,theaccelerationofinflationduringthe1970sdepressedthereplacement-cost rateandthedecelerationofinflationduringthe1980sboostedit,and this—nottheputativeeconomicsuccessofneoliberalism—isthesource ofthedifferenceinthetrajectoriesofthetworatesofprofit.

DumenilandLevy(amongothers)havedefendedtheiruseofthe replacement-costratebyarguingthatitistheexpectedrateofprofit. Thatisnotthecase,however,sincethereplacement-costratecomparesprofitsbasedon current pricestothecurrentcostoffixed assets,whiletheexpectedrateofprofitcomparesprofitsbasedon expectedfuture pricestothecurrentcostoffixedassets.Inanycase,if wewanttoknowwhetherafallintherateofprofitwasamongthe underlyingcausesoftheGreatRecession,weareinterestedinactual economicperformance.Thus,wewanttoknowthetrajectoryofbusinesses’actualrateofreturnonthemoneytheyinvestedinproduction, notthetrajectoryoftheirexpectedrateofreturnandnotthetrajectory ofanimaginaryrateofreturntheywouldhaveobtainediftheyhad investedadifferentamountofmoneyinproductionthantheyactually invested.4

ThemerefactthatU.S.corporations’rateofprofitfellandfailedto recoverinasustainedmannerdoesnotconfirmMarx’slawofthetendentialfallintherateofprofit.Manydifferentandevenconflicting explanationsofthefallarepossible.However,Ihavepresentedevidenceoffallingprofitability,notasatestofthelaw,butinorderto helpaccountfortheGreatRecession.Inthisparticularcontext,thereasonswhyprofitabilityfellmaywellbeofsecondaryimportance. Itisnotreallypossibleto test Marx’slawempirically,partlybecauseit pertainstotheeconomyasawhole.Inourday,thatmeansthatitpertainstotheglobaleconomy,butestimationoftheglobalrateofprofitis notreallypossible;availabledataarequiteinadequate.Itis,however, possibletoinquireintowhetherMarx’sexplanationofwhytherateof profittendstofall fitsthefacts inthisparticularcase.DidU.S. TheAmericanJournalofEconomicsandSociology

250

corporations’rateofprofitfallduringthepostwarperioduptothe GreatRecessionforthereasonshislawsaysthattherateofprofittends tofall?Ifoundthatitdid.

First,Idecomposedmovementsintherateofprofitintothreecomponents,movementscausedby:(1)changesinthedistributionofoutputbetweenprofitsandemployeecompensation;(2)changesinthe rateatwhichthenominalpricelevelrisesinrelationtocommodities’ values(asmeasuredintermsoftheamountsoflaborneededtoproduceaunitofoutput);and(3)otherfactors.Itturnsoutthat,whilethe firsttwofactorshelptoaccountforshort-termvariationsintherateof profit,theyhadonlyanegligibleeffectduringthepostwarperiodasa whole.Butwhenthesetwofactorsaresetaside(heldconstant),the rateofprofitbecomesapureindexoftheratioofemploymenttoaccumulatedinvestment(inlabor-timeterms);itsmovementsdependsolely onmovementsinthisratio.Marx’slawsays,precisely,thattherateof profittendstofallbecausethisratiotendstofall—i.e.,technological progresstendstocauseemploymenttoincreasemoreslowlythan accumulatedinvestment—andthatiswhathappened.Myestimates indicatethatthefallinthisratioaccountsfor94percentofthefallinthe nominal“property-income”rateofprofitbetween1947and2007(Kliman2012a:133–138).

TheFallintheRateofAccumulation5

Therateofcapitalaccumulationistheratioofnetinvestmentinproductiontoadvancedorinvestedcapital.Sincetherateofprofitisthe ratioofprofittoadvanced(invested)capital,therateofaccumulationis equalbydefinitiontotheinvestmentshareofprofit(theratioofnet investmenttoprofit)timestherateofprofit:

rateofaccumulation

Itfollowsfromtheaboveidentitythatthepercentagechangeinthe rateofaccumulationisapproximatelyequaltothesumofthepercentagechangesintheinvestmentshareofprofitandtherateofprofit.If TheGreatRecessionandMarx’sCrisisTheory

netinvestment profit profit advancedcapital

ðinvestmentshareofprofitÞðrateofprofitÞ

251

theinvestmentshareofprofitisroughlyconstantovertime,itspercentagechangewillbesmallandtherateofaccumulationwilltherefore riseandfallbyroughlythesamepercentagethattherateofprofitrises orfalls.

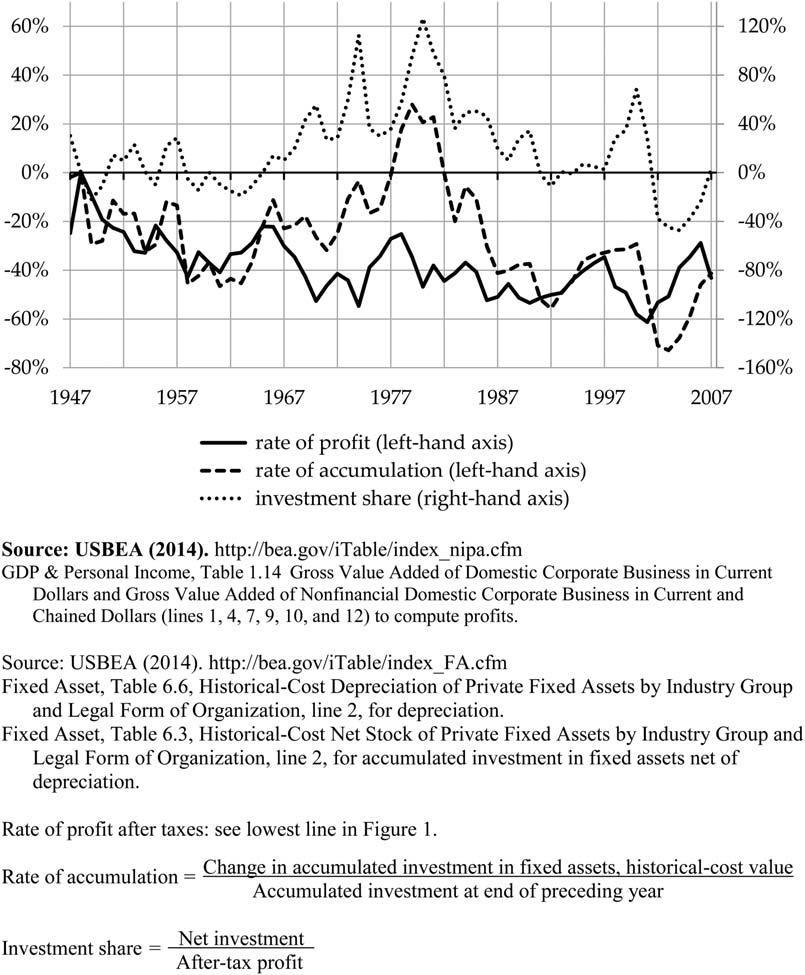

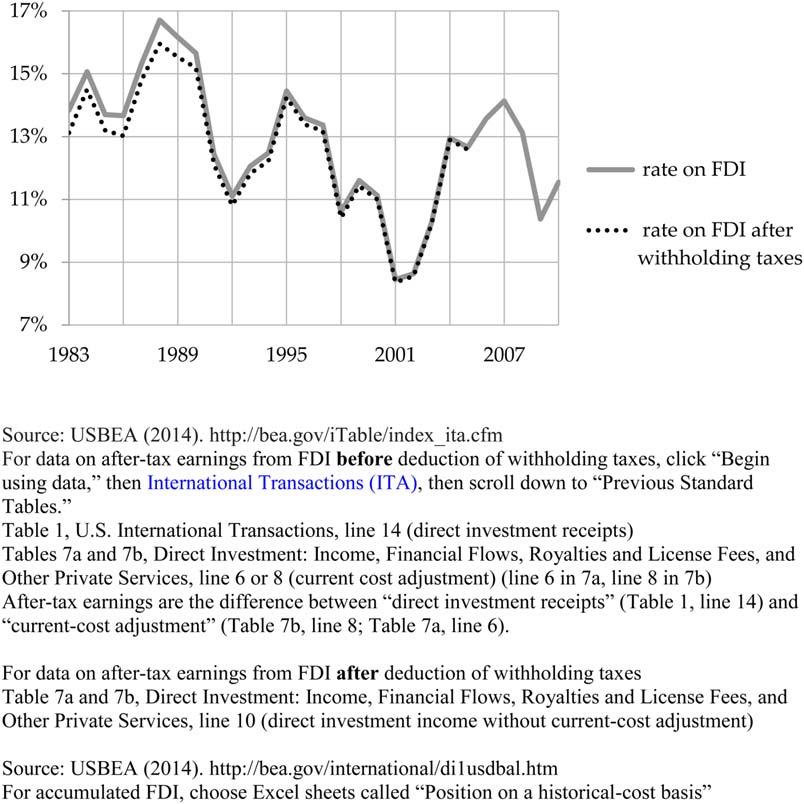

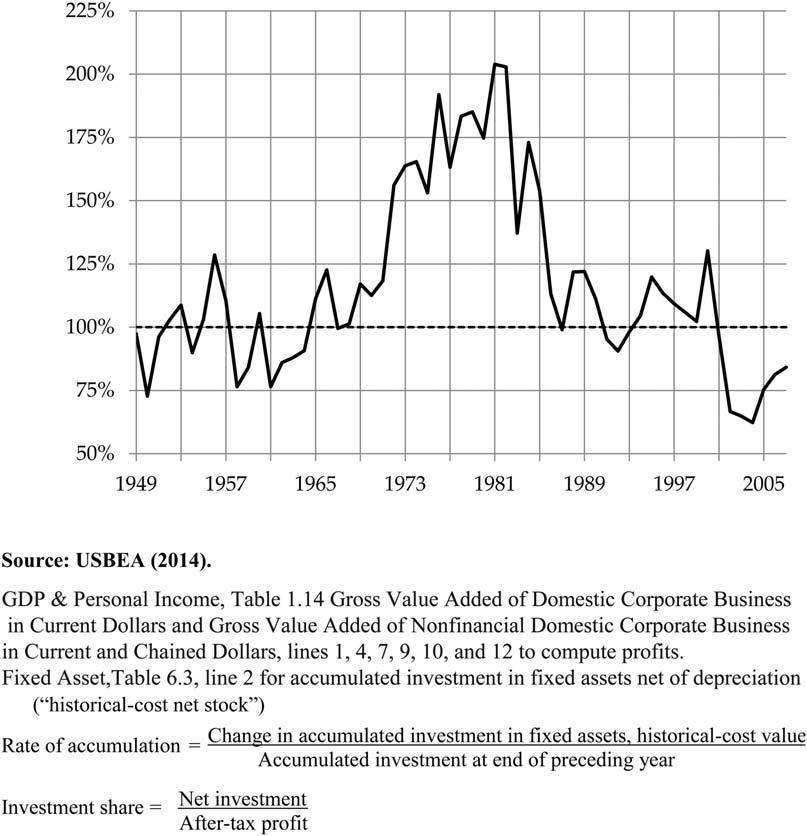

ThisisinfactwhathappenedintheUnitedStatesduringthepostWorldWarIIperiod.Figure3showsthepercentagesbywhichthevariablesdifferedfromtheirvaluesin1948(thefirstyearfollowingthe postwarreconversion-relatedrecession).Theafter-taxrateofprofitis usedhere,sinceitisgenerallythoughtthatdecisionsaboutwhetheror nottoinvestprofitinproductionaredecisionsabouttheuseofaftertaxprofit.

Therateofaccumulationtrackedtherateofprofitfairlycloselyduringthefirsttwodecadesofthepostwarperiod,andagainduringthe lasttwodecades.Whenthe1968–1986periodisomitted,variationsin therateofprofitaccountfor48percentofthevariationintherateof accumulationoneyearlaterand52percentofthevariationintherate ofaccumulationtwoyearslater.After1967,amassiveincreaseinthe investmentshareofprofitoccurred,whichcausedtherateofaccumulationtorisesubstantiallyinrelationtotherateofprofit;yetbecausethe investmentsharerosetounsustainablelevels(asIshalldiscusspresently),itbegantoplummetafter1981,andthisbroughtmovementsin therateofaccumulationbackinlinewithmovementsintherateof profit.Thus,whenallissaidanddone—i.e.,whenweconsiderthe entirepostwarperiod—theinvestmentsharehadverylittletodowith thedeclineintherateofaccumulation.Between1948and2007,the rateofaccumulationfellby41percent,whiletheinvestmentshare actuallyroseslightly,by3percent.The entire fallintherateofaccumulationisthusattributabletothe43percentfallintheafter-taxrateof profit,whichwasonlyoffsetabitbythesmallriseintheinvestment share.

Theslowdowninproductiveinvestmentinturnledtoaslowdown ineconomicgrowth.Andthegrowthslowdown—plusartificiallystimulativegovernmentpoliciesthatwerepursuedinanefforttomanage andmaybereversetheprofitability,investment,andgrowthproblems—contributedtoalong-termbuildupofdebt,recurrentassetbubbles,andultimatelytotheGreatRecessionanditsprolonged aftermath.

252

TheAmericanJournalofEconomicsandSociology

Figure3

PercentageDeviationsfrom1948ValuesofU.S.Corporations’Rateof Accumulation,After-TaxRateofProfit,andInvestmentShareofAfterTaxProfit

Duringtheneoliberalperiod,therateofaccumulationfellevenmore rapidlythandidtherateofprofit.Between1979,whentherateofaccumulationpeaked,and2001,itfellby61percent,whiletheafter-taxrate

TheGreatRecessionandMarx’sCrisisTheory 253

ofprofitfellby41percentandtheinvestmentshareofafter-taxprofit fellby34percent.Thus,about55percent(5 41/[41 1 34])ofthe declineintherateofaccumulationduringthisperiodisattributableto thedeclineintherateofprofit,andtherestisattributabletothedecline intheinvestmentshare.(Therateofaccumulationthenroseby18percentbetween2001and2007,asa47percentriseintherateofprofit wasonlypartlyoffsetbya20percentfallintheinvestmentshare.)

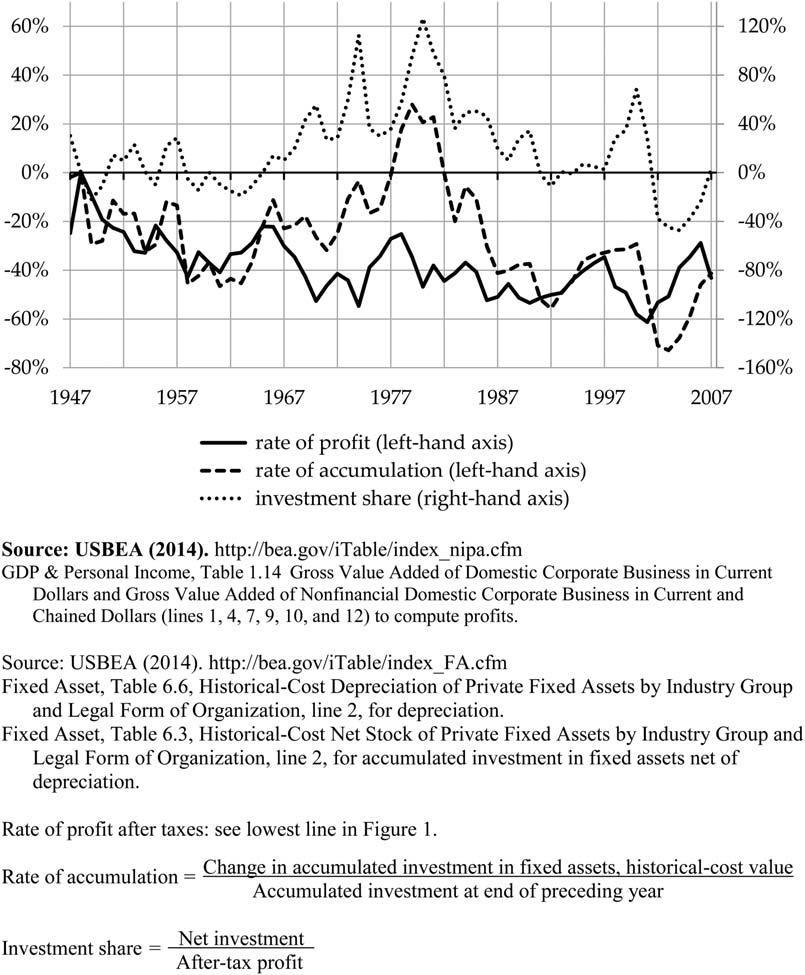

Thefallintheinvestmentshareofprofitduringthisperiodmayseem tosupporttheviewthatthe“financialization”oftheeconomyunder neoliberalismcontributedtotheslowdownintheratesofaccumulation andeconomicgrowththathelpedsetthestagefortheGreatRecession. Itisfrequentlyassertedthatakeyfeatureoffinancializationhasbeen the diversion ofprofitfromproductiveinvestmenttofinancialuses— acquisitionoffinancialassets,stockbuybacks,andincreaseddividend andinterestpayments(Husson2008;Stockhammer2009:11;Wolfson andKotz2010:88;Krippner2011:54).Sincetheinvestmentshareof profitis,ingeneral,agoodmeasureofhowprofitisallocatedbetween productiveinvestmentandfinancialuses,thedeclineintheinvestment shareinitiallyseemstoconstitutecompellingevidencethatdiversion didindeedtakeplace.

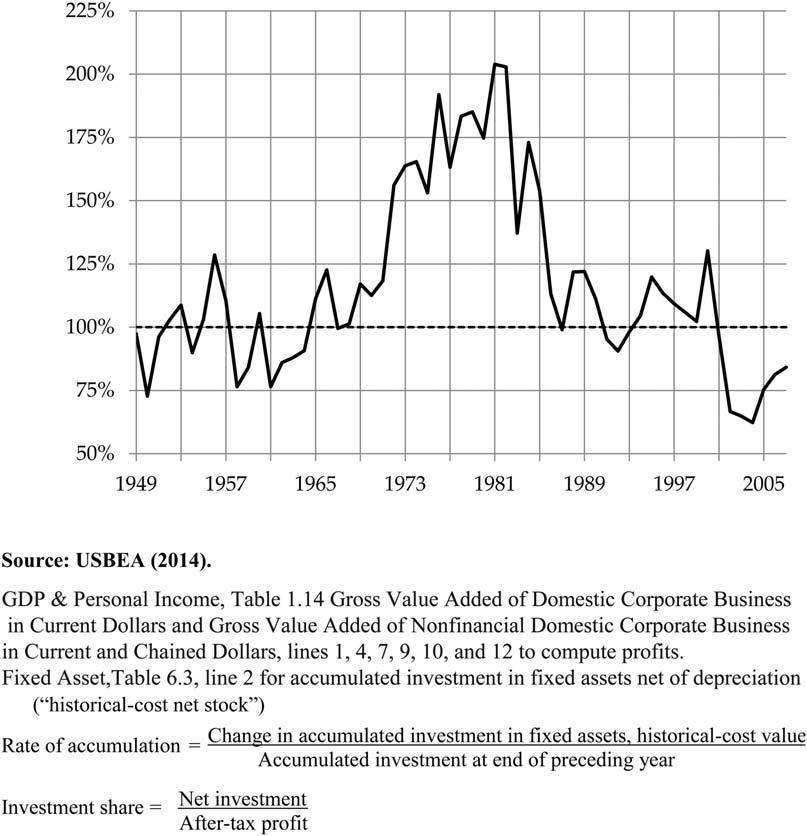

However,itisneitherfairnormeaningfultocomparetheinvestment shareduringtheneoliberalperiodtoits1979peakoritsaverageduring the1970s.Dataseriesthatbeginwiththe1970sorlaterdonotallowus todrawvalidconclusionsabouthowfinancializationandneoliberalism haveaffectedproductiveinvestment;theneoliberalperiodneedstobe comparedtothe whole ofthepre-neoliberalera.AsFigure4makes clear,the1970swereinnowayrepresentativeofthatera.

Thisfiguresuggeststhatmovementsintheinvestmentshareofprofit canbebrokenintofourdistinctperiods:1949–1971,1972–1985,1986–2001,and2002–2007.Inordertodiscusspre-andpost-neoliberaleras, wecanalsosplitthesecondperiodintotwosubperiods,onethatends with1980andanotherthatstartswith1981,theyearinwhichRonald Reaganbecamepresident.

Table1summarizesthedataintermsoftheseperiods.Through 2001,thenetinvestmentshareof(net)profitduringtheneoliberalera exceededthepre-neoliberalinvestmentshare.Moreover,whilethe investmentsharediddeclinemarkedlyaftertheearly1980s,thisdecline TheAmericanJournalofEconomicsandSociology

254

Figure4

U.S.Corporations’InvestmentShareofProfit(aspercentageof1949–1971average;netinvestmentaspercentageofprofittwoyearsearlier) TheGreatRecessionandMarx’sCrisisTheory 255

cannotbeattributedtofinancializationorneoliberalism.Onereasonit cannotisthattheinvestmentsharewasunsustainablyhighatthestart ofthe1980s.Owingtoasharpdeclineinprofitability,the(non-lagged) investmentshareofprofitbetween1979and1982averaged105percent;corporationswereinvestingmoreprofitthantheprofittheyhad. Anotherreasonisthatneoliberalismandfinancializationdidnotcause theinvestmentsharetofallto below-normal levels.Whenitfell,it

InvestmentShareofProfit,U.S.Corporations (investmentaspercentageofprofittwoyearsearlier)

investmentandprofit1949–19711972–19801981–19851986–20012002–20071949–19801981–20011981–2007

Source.USBEA(2014).;FixedAsset,Table6.3,Historical-CostNetStockofPrivateFixedAssetsbyIndustryGroupandLegalFormof Organization,line2,foraccumulatedinvestmentinfixedassetsnetofdepreciation.FixedAsset,Table6.6,Historical-CostDepreciation ofPrivateFixedAssetsbyIndustryGroupandLegalFormofOrganization,line2fornetinvestmentandforafter-taxprofit.Table6.6, line2,shouldbeaddedtodatain6.3,line2,toestimate“grossinvestment”andto“after-taxprofit”(fromFigure1)toestimate“gross profit.”

Table1

52%92%106%59%34%64%70%62% 80%113%115%91%78%89%96%92%

netofdepreciation gross

TheAmericanJournalofEconomicsandSociology 256

returnedtolevelssimilartothosethatweretypicalpriorto1972;during the1986–2001period,theinvestmentshareexceededitsaveragevalue duringthe1949–1971period.

Asharpdeclineininvestmentandalarge,thoughtemporary,spike inprofitabilityoccurredafter2001.Asaresult,theaverageinvestment sharefortheneoliberalperiodasawhole,1981–2007,isslightlyless thantheaverageforthe1949–1980period.However,thisfactcannot beattributedtoneoliberalism;suchanexplanationcannotaccountfor whytheinvestmentshareduringthefirst21yearsofneoliberalism(70 percentfrom1981–2001)wasgreaterthanthepre-neoliberalshare(64 percentfrom1949–1980),butthensuddenlyplummetedto34percent.

Thepost-2001declineintheinvestmentshareseemstohavebeena temporaryresponsetoeventsofthatperiod—perhapseventssuchas theburstingofthe“dot-com”stockmarketbubblethatbeganatthe endof2000,thesharpdeclineintherateofprofitbetween1997and 2001,andthe9/11terroristattacks.After2004,theinvestmentshare reboundedsharply.Forinstance,whileafter-taxprofitwasonly6percentgreaterin2007thanin2004,netinvestmentwas107percent greater.Indeed,netinvestmentincreasedby$240billionwhileafter-tax profitincreasedbyonly$47billion,whichmeansthatcorporations wereinvestinganextra$5foreveryextra$1ofprofit.Thusby2007, the(non-lagged)investmentsharewasslightlyhigherthanin1997. Thesefactsdonotseemconsistentwithanarrativeinwhichneoliberalismiscausingcompaniestodivertprofitfromproductiveinvestmentto financialuses.

Inanycase,onceoneadjustsforchangesintherateofdepreciation, theaverageinvestmentshareofprofitbecomesagooddealgreater duringtheneoliberalperiod,evenwhenthepost-2001yearsare included,thanduringtheperiodthatprecededit.Therateofdepreciationrosemarkedlyafter1960becauseoftheinformation-technology revolution.Investmentininformation-processingequipmentandsoftware,whichdepreciatemuchmorerapidlythandoalmostallother fixedassets,becameagreaterandgreatershareofcorporations’total productiveinvestment,andthiscausedtheoverallrateofdepreciation torise.Neoliberalismandfinancializationareobviouslynotresponsible forthisrise.Thus,tovalidlyassesswhethertheyhaveledtoadiversion ofprofitfromproductiveinvestmenttowardfinancialuses,wehaveto

257

TheGreatRecessionandMarx’sCrisisTheory

abstractfromtheincreaseintherateofdepreciation,controlfor itseffects.

Onewaytodosoistoadddepreciationtobothnetinvestmentand profitandtherebyobtaina“gross”investmentshareof“gross”aftertaxprofit.ItsvaluesforthevarioussubperiodsarereportedinthebottomrowofTable1.Thegrossinvestmentsharewashigherduringthe neoliberalperiod—includingtheyearsafter2001—thanduringthe precedingperiod.Andevenduringthe2002–2007period,theaverage valueofthegrossinvestmentsharewasalmostasgreatasitsaverage valuebetween1949and1971.Thus,theslightdeficitinthenetinvestmentshareofnetprofitoverthewhole1981–2007period(including the2002–2007subperiod),relativetoits1949–1980average,isattributabletotherisingrateofdepreciation,nottoneoliberalismand/or financialization.

TheAllegedRedistributionfromWagestoProfits

TheevidencethatU.S.corporations’rateofprofitfellandneverrecoveredinasustainedmannerhasfrequentlybeendismissedoutofhand becauseafallintherateofprofitseemsincompatiblewithsomewellknownfactsorapparentfactsabouttheriseinprofitsattheexpense ofwages,stagnantwages,risingincomeinequality,andsoforth.In thissection,Iwillexplainwhythefallisreconcilablewiththegenuine factsandwhythefactswithwhichitcannotbereconciledarenot genuine.

The MonthlyReview School

Thelynchpinofthe MonthlyReview school’sattempttoapplyitsunderconsumptionisttheoryofcrisistotheGreatRecessionistheclaimthat therewassubstantialredistributionfromwagestoprofitintheUnited States.Thissupposedfactissaidtobea“keyelementinexplaining” whytheeconomicgrowthofthequarter-centuryprecedingtherecessionwas“unsustainable.”Although“consumptioncontinuedtorise” despitetheredistributionfromwagestoprofitandthelatentunderconsumptionproblemthiscreated,theriseinconsumption“wasonlypossiblebecauseof ... aconstantratchetingupofconsumerdebt”and morehoursofworkperhousehold(FosterandMagdoff2008).Yetthe TheAmericanJournalofEconomicsandSociology

258

riseinconsumerdebthelpedtofuelanunsustainabledebtbubble,and thefinancialcrisisandGreatRecessioneruptedwhenthebubbleburst. Butdidredistributionfromwagestoprofitactuallyoccur? Magdoff andFoster(2013)recentlyattemptedtosubstantiatethisclaim,butall oftheirevidenceiseitherinvalidorirrelevant;noneofitactuallyshows thatprofitsroseinrelationtoworkers’pay.Someofthedefectsintheir empiricalanalysisexemplifymisunderstandingsthatarerelativelycommonandwillbetakenuplaterinthissection.(MagdoffandFoster incorrectlyconstruedthefollowingphenomenaasevidencethatprofits roseattheexpenseofworkers’pay:the“wageandsalary”share (excludingbenefits)fell;dividendandinterestincomeroseinrelation toemployeecompensation;andcompensationfellasashareofGDP.) Here,Iwilldiscussseveraldefectsintheiranalysisthatareuniquetoit, oratleastlesscommon.(SeeKliman(2013a,2013b)forfurther discussion.)

First,MagdoffandFosteroverestimatedthefallinemployeecompensationasashareofGDPbyconstructingtheirownmeasureofcompensationinsteadofusingtheoneprovidedbythegovernment.Theytook compensationofgovernmentemployeesandaddedtoitthecompensationofwhatthey called “privatesector”employees.Thisisfinein principle,buttheir“privatesector”dataareactually business-sector data.Theresultisaninconsistentmish-mash;itexcludescompensation ofprivate-sectoremployeeswhoworkoutsideofthebusinesssector, innonprofitinstitutionsandhouseholds,anddouble-countsthecompensationreceivedbyemployeesofgovernmententerpriseslikethe postalservice,whicharepartofboththegovernmentsectorandthe businesssector.Theneteffectofthiserrorissubstantial.Whilethe compensationshareofGDPactuallyfellby3.0percentagepoints between1982and2007,thefallinMagdoffandFoster’s“alternative” shareis4.5points,morethan50percentmore.(Yeteventhecorrect compensationshareofGDPfailstoaccuratelymeasurethedistribution ofincomebetweenwagesandprofits,asIwilldiscussbelow.)

Second,inanefforttodemonstratethattheshareofoutputreceived by“theworkingclass”—i.e.,non-managerialemployees—felleven moresharply,MagdoffandFosterproducedagraphthatsupposedly showedthattheshareoftotalwagesreceivedby“productionandnonsupervisory”(P&NS)workersfellfrom76percentto55percent

TheGreatRecessionandMarx’sCrisisTheory 259

between1965and2007.However,thegovernmentdataactuallyindicatethatP&NSworkers’shareofwagesin2007was67percent,not 55percent.MagdoffandFosterproducedthelatterfigurebyexpressingP&NSworkers’wagesasapercentageofatotalwagebilltaken fromanotherdataset.Becausetheseconddatasetemploysamuch morecomprehensivedefinitionofwages,itstotalwagebillismuch larger.MagdoffandFosterdidnotadjustP&NSworkers’wagesinlight ofthisdiscrepancy.Ineffect,theyassumedthatthe entire discrepancy betweenthetwototalwagebillsconsistsofadditionalwagesofnonP&NSemployees.Theydidnottrytojustifythatassumption,anditis wildlyoffthemark,asIhaveshownelsewhere(Kliman2013b, 2014b).

Third,notingthattheemployee-compensationdatainclude“the compensationgoingtoCEOsandotherupper-levelmanagement, whichoughttobecountedasincometocapitalratherthanlabor,” MagdoffandFostertriedtoestimatetheportionofcompensationthat legitimatelycountsaslaborincome.Again,theyusedthewagesof P&NSworkers.YettheP&NSdataarewoefullyinappropriateinthis context.ThenumberofP&NSworkersisagooddealsmallerthanthe numberofnon-managerialemployees—in2007,onlyabitmorethan halfofnon-P&NSemployeesweremanagersorsupervisors—andthe wagesofP&NSworkersclearlyundercountnon-managerialemployees’ wagestoanevengreaterextent.YetevenifMagdoffandFosterhad correctlyestimatednon-managerialemployees’wages,theirprocedure isillegitimate,sinceitexcludesfromlaborincomethewagesreceived bythevastmajorityofmanagersandsupervisorswhoarenotpartof “upper-levelmanagement.”Asaresult,theyradicallyunderestimated theportionofemployeecompensationthatisgenuinelaborincome. (Below,Ireportonmyowneffortstoestimateit.)

Finally,theyusedtheCPI-Wpriceindextoadjustwagesforinflation. Thisindexisinconsistent;whenthemethodsusedtocomputenewvaluesofthisindexchange,pastvaluesareleftunrevised.Researchers thereforegenerallynowusetheCPIResearchSeriesUsingCurrent Methods(CPI-U-RS),whicheliminatesthisinconsistency,oranother consistentindex.Itisnoteworthythattheestimatedincreasesinreal wagesandcompensationaresubstantiallysmallerwhenoneusesthe indexthatMagdoffandFosterused.Between1987and2007,for

260

TheAmericanJournalofEconomicsandSociology

example,realaverageweeklyearnings—exclusiveofbenefits— receivedbyP&NSworkersriseby3.2percentwhenoneusestheCPIWtoadjustforinflation,butby6.5percentwhenoneusestheCPI-URSandby12.1percentwhenoneusesthepersonalconsumption expenditurespriceindex.

MoreWidespreadMisunderstandings

Inowturntosomemorewidelysharedmisunderstandingsabout wagesanddistributionthatleadpeopletoimproperlydismissthefindingthatU.S.corporations’rateofprofitfellandfailedtorecoverunder neoliberalism.

Onewidelypublicized“fact”isthatproductivityhasincreasedmuch fasterthanemployees’pay.Forexample,MishelandShierholz(2011) reportthatproductivityincreasednearlythreetimesasfastasaverage hourlycompensationbetween1989and2010,andsuchevidenceis wronglytakentoimplythatsubstantialredistributionofincomefrom wagestoprofithastakenplace:“Ifworkerproductivityriseswhilepay remainsstagnantordeclines,profitsincrease.Thisispreciselywhathas happenedoverthelast30years”(Henwood2014).Thefirstsentence wouldbetrueif“productivity”and“compensation”weredefinedinthe usualmanner,buttheso-calledproductivity/compensationgapis merelyanartifactproducedbyinconsistentadjustmentforinflation. Onepriceindexisusedtodeflateoutputandthusproductivity,whilea differentpriceindexisusedtodeflateemployeecompensation(Kliman 2014a).Sincethelatterindexrisesmorerapidlythantheformerone (becauseconsumerpriceshaverisenmorerapidlythanoutputprices), thisprocedureresultsinlopsidedgrowthofproductivityrelativeto compensation.

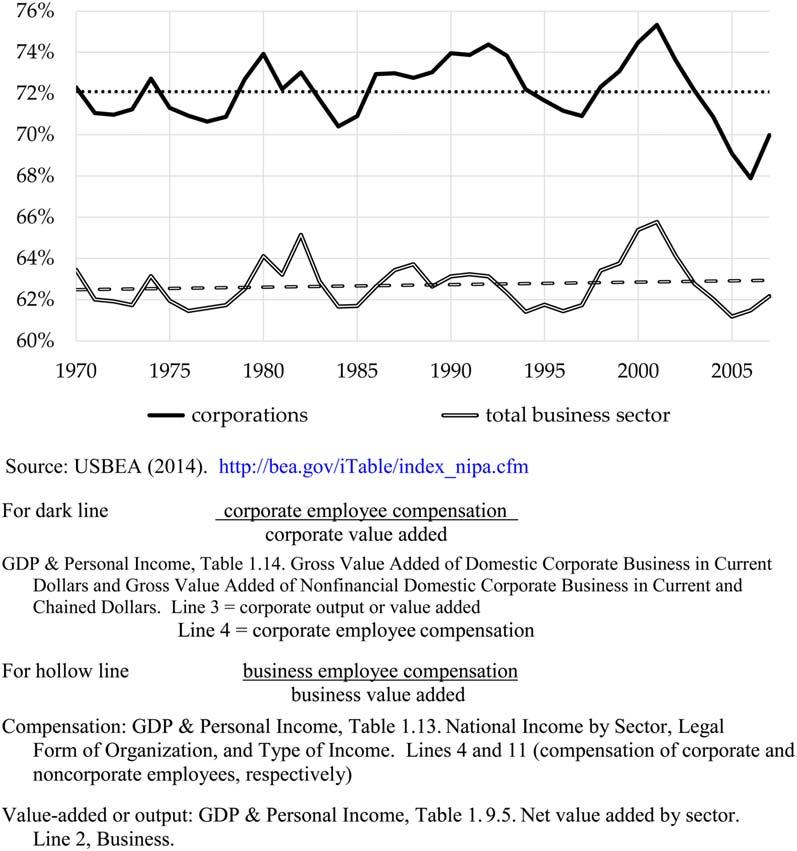

Ifthesamepriceindexisusedtodeflateoutputandemployee compensation,orifonesimplycomparesthenominaloutputandcompensationfigures,asFigure5does,theresultisnotlopsided.Inthe U.S.corporatesectoraswellasthebusinesssectorasawhole,compensationwasbasicallytrendlessasashareofnetoutput(netvalueadded) between1970andtheGreatRecession.Thismeansthatcompensation andoutputbasicallyrosebythesamepercentage,whichinturnimplies thatcompensationperhourandoutputperhour—productivity—also

TheGreatRecessionandMarx’sCrisisTheory 261

TheAmericanJournalofEconomicsandSociology

Figure5

EmployeeCompensationasShareofNetOutput,U.S.Corporateand BusinessSectors

basicallyrosebythesamepercentage.Profit didnot increaseatthe expenseofemployees’pay.

Someotherstudiesseemtoarriveattheoppositeconclusion,but theyactuallyshowonlythatemployeecompensationfellasashareof GDPorsomethingsimilar,notasashareofnetvalueadded.Thereare twomainreasonsthatGDPisaninappropriatedenominatorhere.First, itincludestheoutputofsectorsinwhichthereisnoprofit—theoutput ofgovernment,nonprofitinstitutions,andself-employedpeople,and

262

thevalueof“housingservices”providedbyhomesthattheirowners livein.Arelativeincreaseinsuchoutputlowersthecompensation shareofGDPbutobviouslydoesnotsignifythatprofitroseatthe expenseofwages.Second,asubstantialandrapidlyrisingshareof GDPrepresentsdepreciation,whichisanexpense,notprofitor employeecompensation.Itsinclusioninthedenominatortherefore leadstoseriouslymisleadinginferencesregardingdistribution.Because depreciationrosesubstantiallyasashareofcorporate-sectorGDP,one findsthatthecompensationandprofitsharesofoutput both fell between1955and2007whendepreciationisincludedinoutput.

Asnotedabove,thestabilityofthecompensationsharehasbeenchallengedonthegroundsthatthecompensationdataincludethepayof CEOsandothertopexecutives,whichisarguablyreallyashareofprofit insteadofcompensationreceivedforlaborservicesperformed.Thekey question,however,isquantitative:By howmuch didrisingpayoftop executivescutintothecompensationofotheremployees?In Capitalin theTwenty-FirstCentury,ThomasPiketty(2014:302,315)claimsthatrisingcompensationreceivedby“supermanagers”—thatis,“topexecutives oflargefirmswhohavemanagedtoobtainextremelyhigh,historically unprecedentedcompensationpackagesfortheirlabor”—is“theprimary reasonforincreasedincomeinequalityinrecentdecades.”Thissuggests thattheirpaycutintootheremployees’compensationsubstantially.

However,Pikettyseriouslymisinterpretsthestudy(Bakija,Cole,and Heim2012)onwhichhisclaimisbased.Hestatesthatthestudyfound that60percentto70percentofthoseinthetop0.1percentofthe incomedistributionaresupermanagers(Piketty2014:302),butthestatisticstowhichherefersdonotpertaintosupermanagersalone.They alsoincludefinancialprofessionals—about80percentofwhomarenot managersatall—andowner-managersofclosely-heldnoncorporate businesses,whoreceiverelativelylittleemployeecompensation.(Their businessincomeisnotcountedaspartofcompensationinFigure5.) Althoughitrosesubstantially,thisrisedidnotcutintobusiness-sector employeecompensation;itinsteadroseattheexpenseoftheincomes ofotherbusinessownersandself-employedpeopleandattheexpense oftheinterestreceivedbycreditors(seeKliman2014c:n8).)

Usingunpublisheddatathattheauthorsofthestudykindlyprovided me,Ifoundthatlessthanone-quarterofthoseinthetop0.1percent

263

TheGreatRecessionandMarx’sCrisisTheory

andtop1percentfitPiketty’sdefinitionofsupermanagers.Moreover, myestimateforthe1979–2005periodindicatesthat,althoughgenuine supermanagersinthetop1percentdidreceivearisingshareofnetoutput,therisedidnotseriouslyaffectotheremployees—itdepressed theirshareby only0.6percentagepoints.EvenwhenIassumedthatthe riseintheircompensationoutpacedtheriseintheirtotalincometoan extravagantdegree,Iwasunabletoproduceanestimatedreductionin otheremployees’shareofmorethan1percentagepoint(seeKliman 2014c).

Althoughthe average employee’shourlycompensationfullykept pacewithproductivity,thecompensationreceivedbythe median workergrewconsiderablymoreslowly.Sincerisingcompensationof topexecutivesaccountsforextremelylittleofthisgap,almostallofitis duetoincreasinglyunequalpayreceivedby“real”workers—thatis, employeesotherthansupermanagers.Peopleworkinginmanagerial, financial,andotherbusinessoccupations(veryfewofwhomfitthe supermanagerdefinition)andprofessionalshaveenjoyedincreasesin payfarinexcessoftheaverageincrease,ashavewomenwithatleast somecollegeeducationandmenwithatleastafour-yearcollege degree.Risinginequalityoflaborincomewasparticularlyrapid between1979and1988,afterwhichitmoderatedsubstantially(CongressionalBudgetOffice2011:12,Fig.7).Thisriseininequalityhas nothingtodowithredistributionofincomefromemployee compensationtoprofit.Itisaredistributionofemployeecompensation fromlow-paidtomorehighly-paidworkers.

Itshouldalsobepointedoutthattheratherwidespreadbeliefthat wageshavestagnatedisbasedondatathatcountonlywagesandsalariesinthenarrowsense.Butalargesegmentofworkersalsoreceives health-insuranceandpensionbenefitsfromtheiremployersandalmost allemployerspayhalfofthetaxesthatfundemployees’SocialSecurity andMedicarebenefits.Allofthisiscountedascompensationof employeesintheU.S.nationalaccountsanditisacceptedprocedure internationallyaswell.Andsincetotalhourlycompensationfullykept pacewithproductivity,thestagnationof“wages”was fullyoffset bythe rapidriseinthebenefitcomponentofcompensation.Itispossibleto arguethatadollarofnoncashincome(e.g.,health-insuranceandMedicarebenefits)provideslessutilitythanadollarofcashincome,anditis

264

TheAmericanJournalofEconomicsandSociology

evenpossibletoarguethatitisnot“really”incomeatall.Butthisis irrelevanttothequestionathand—didprofitsriseattheexpenseof whatemployeesreceive?Anextradollarofnoncashbenefitsreceived byanemployeeisnotadditional“wages,”andonecanchoosenotto callitadditional“income,”butitis something additionalthatthe employeereceives,anditreducesthecompany’sprofitsbyafulldollar, justlikeadollarofcashwages.Thestagnationof“wages”issimplynot evidencethatprofitsroseatemployees’expense.

IncomeinequalityintheUnitedStateshasofcourserisen,butitis wrongtoinferfromthisthatprofitshaverisenatworkers’expense.I notedaboveonereasonthisiswrong:asubstantialpartoftherisein equalityisamongworkers.Anotherreasonisthatincomeinequality canincreasesimplybecausealargershareofprofitisdistributedto propertyownersintheformofdividendandinterestincome.Thiscan occureveniftotalprofitdoesnotrise;inthatcase,therisingdividends andinterestarefullyoffsetbyafallintheportionofprofit“retained” bythecorporationsthemselves.Thisisinfactwhatoccurredinthe UnitedStates.Theaveragepercentageofprofit(netoperatingsurplus) thatwasusedtopayinterestanddividendsrosefrom21percent between1947and1968,to30percentbetween1969and1979,andto 47percentbetween1980and2007.Thisrisecameattheexpenseof retainedprofits,notattheexpenseofemployeecompensation.(See Kliman(2014b)forfurtherdiscussion.)

Despiteallofthepointsmadeabove,Iadmitthatitwouldbedifficult toreconciletheinequalitydatawiththefallintherateofprofitandthe stabilityofthecompensationshareofnetoutputiftheriseininequality wereasgreatasoftenseemstobebelieved.However,Ithinkthat when“income”isdefinedinameaningfulandrelevantway,therisein inequalityisagooddealsmaller.Studiesthatreportthemostdramatic increasesininequalityarebasedonthenarrowandratherpeculiardefinitionofincomeemployedbyPikettyandEmmanuelSaez.

Owingtolimitationsofthetax-returndatatheyemploy,theirwork (e.g.,PikettyandSaez2003)doesnotmeasuretheincomesofindividualsorhouseholds,buttheincomesof“taxunits”(individualsormarried couples,plusdependents).Sincemarriagerateshavefallenmoreatthe bottomoftheincomedistributionthanatthetop,thenumberoftax unitsatthebottomhasincreasedmorerapidly.Asaresult,incomeper

265

TheGreatRecessionandMarx’sCrisisTheory

taxunitatthebottomhasrisenlessthanhasincomeperpersonorper household,andthisboostsinequalityasmeasuredbyPikettyandSaez. Moreover,unlikesomeotherresearchers,theydonotadjustforthe declineinhouseholdsize(ortax-unitsize).

Partlybecauseofdatalimitations,theirincomedataalsoexcludeall noncashincome(Medicare,Medicaid,foodstamps,housingassistance, etc.)aswellasallcashtransferpaymentsfromgovernment(SocialSecurity,unemploymentinsurance,welfare,andotherbenefits).NorisSocial Securityincomepaidforbythetaxonemployerscountedwhenitis paid;itissimplyexcluded.Allthisclearlydepressesmeasuredincome growthatthebottomandbooststhemeasuredriseininequality.

Thetax-returndataarealsofarfromidealbecausethedataseriesis notdefinitionallyconsistentovertime.Itchangesalongwithchangesin taxlaw.Aparticularlyimportantinstanceofthisproblemistheriseof morethan50percentintheaverageincomeof“the1percent”between 1986and1988.Thisriseisalargepartofthetotalriseintheincome shareof“the1percent”thatPikettyandSaezreport.Buttheincomeof “the1percent”didnotreallyincreasebymorethanhalfinjusttwo years.Whatactuallyhappenedisthatagreatdealofitsincomewas suddenlyreportedasindividualincomeinsteadofcorporateincome becauseachangeintaxlawreducedthetoptaxrateontheformer belowthetoprateonthelatter.Changesinhowstock-optionincomeis reportedmayperhapsbeanothersignificantproblem.WhileMechling andMiller(2012:1)aregreatlyappreciativeoftheworkthatPiketty andSaezdidtoconstructtheirdataset,theyarguethatthedataset“is bettersuitedtoresearchonincomeshiftingthanitistostudying changesinincomeinequalityovertime.”

Armour,Burkhauser,andLarrimore(2013)showthatthedegreeto whichmeasuredinequalityroseis drastically greaterwhenPikettyand Saez’sdefinitionisusedthanwhenincomeisdefinedastheafter-tax incomeofsize-adjustedhouseholds,inclusiveofbothcashandnoncashtransferpayments.Partofthehugedifferenceisapparentlyspecifictotheirdataset,whichevidentlyfailstocaptureallsourcesof incomereceivedbythoseattheverytopofthedistribution.Yetdata accompanyingarecentCongressionalBudgetOffice(2012)study, whicharebasedonthetax-returndatathatPikettyandSaezusebut thatemployadefinitionofincomelikethatofArmour,Burkhauser,

TheAmericanJournalofEconomicsandSociology 266

TheGreatRecessionandMarx’sCrisisTheory

andLarrimore(whencapital-gainincomeisexcluded),alsosuggest thatthedifferenceindefinitionshasalargeeffectontheresults.

Insum,oncethemisconceptionsareclearedupandfinepointsof thedistributionaldataareappreciated,theevidencethattherateof profitfellnolongerseemsincompatiblewiththedata.

TheFuture

IsitpossibletoeliminatemajorcrisesofcapitalismliketheGreatRecession?Unfortunately,Istronglydoubtit.BenBernanke(2010)shareda similarviewintestimonybeforetheFinancialCrisisInquiryCommission:

ThefindingsofthisCommissionwillhelpusbetterunderstandthe causesofthecrisis,whichinturnshouldincreaseourabilitytoavoid futurecrisesandtomitigatetheeffectsofcrisesthatoccur.Weshould notimagine,though,thatitispossibletopreventallcrises.Agrowing, dynamiceconomyrequiresafinancialsystemthatmakeseffectiveuseof availablesavinginallocatingcredittohouseholdsandbusinesses.The provisionofcreditinevitablyinvolvesrisk-taking.

Ibelievethatthebestevidencethatmajorcrisescannotbeeliminated undercapitalismistheGreatRecessionitself.Itwasnotsupposedtohappen,butitdid.Althoughthebeliefthattheeconomycouldbe“finetuned”hadbeenpassefordecades,policy-orientedeconomistsdidnot expectthatamajordownturnliketheGreatRecessioncouldoccur.As DavidRomer(2011:1–2),adistinguishedmacroeconomistandhusband ofChristinaRomer,formerChairwomanofthePresident’sCouncilofEconomicAdvisers,admitted,

Themacroeconomiccrisisthatbeganin2008hasshatteredsomeofthecore beliefsofmacroeconomistsandmacroeconomicpolicymakers:

Wethoughtwehadmacroeconomicfluctuationswellundercontrol, buttheyarebackwithavengeance.

TheworkhorsenewKeynesiandynamicstochasticgeneralequilibrium (DSGE)modelsonwhichwewereconcentratingsomuchofourattentionhavebeenofminimalvalueinaddressingthegreatestmacroeconomiccrisisinthree-quartersofacentury.

Inshort,wehavealotofreflectiontodo.

267

TheAmericanJournalofEconomicsandSociology

Thisisthestateofmacroeconomicstoday.Perhapssomeonewillyet formulatefiscalandmonetarypoliciesthatcanpreventfuturecrises, butsincedozensupondozensofsuperiorintellectshavebeenworking onthisproblemformorethan80yearsandtheystill“havealotof reflectiontodo,”Iamnotoptimistic.

Butwhataboutfinancialregulation?Canitpreventtherecurrenceof majorcrises?Tohelpanswerthisquestion,itwillbehelpfultotakea lookbackattheU.S.savingsandloan(S&L)crisisofthe1980s,which tookplaceeventhroughtheS&Lswereheavilyregulated.Indeed, the S&Lcrisiswascausedbyregulation.

AfederallawimposedaceilingontheinterestratesthatS&Lscould paydepositors.Abouttwo-thirdsofthestatesalsohadusurylawsthat limitedtheinteresttheycouldchargeonthemortgageloanstheymade (homemortgagelendingwastheirmainbusiness).TheS&Lswere knownasa“3-6-3industry”:bringinfundsbypaying3percenton deposits,lendthemoutat6percent,andbeonthegolfcourseby3 o’clockintheafternoon.Itwasaveryboringbusiness,butsupposedly onethatwasverysafeandstable.

YetabouthalfofallS&Lsinexistencein1986eitherfailedorwere takenoverbyotherinstitutionsbetweenthatyearand1995(Curryand Shibut2000:26).DepositorsoffailedS&Ls,whosedepositswere insuredbythefederalgovernment,hadtobebailedout,andthebailoutcosttotaxpayersduringthe1986–1995periodwas$153billion— notincludinginterestonthebondsthatthegovernmentissuedtopay forthebailout(CurryandShibut2000:31,33).

AlthoughregulationscouldcontroltheinterestratesthatS&Lspaid andcharged,theycouldnotcontrolthespiralinginflationthattook placeinthesecondhalfofthe1970sandearly1980s,aftertheBretton Woodsfixed-exchange-ratesystemcollapsedandtheOrganizationof PetroleumExportingCountries(OPEC)raisedoilprices.Wheninflation accelerated,theinterestthatS&Lsreceivedfromtheirmortgageloans wasgenerallylessthantherateofinflation,soinreal(inflationadjusted)terms,theywerelosingmoney.Moreover,themeagerrateof interestthatthefederalgovernmentallowedthemtoofferdepositors wasevenfurtherbelowtherateofinflation.Depositorswerelosing moneyhandoverfistbyparkingitinS&Ls.Thissituationstimulated therapidgrowthofanunregulatedalternative,money-marketmutual

268

funds,whichwerepayinginterestratesthatmorethanmadeupfor inflation.Depositorswereveryhappytohavethisalternative.Theyfled theregulatedS&Lsandputtheirmoneyinthemoney-marketmutual funds.Thus,regulationandinflationcreatedasituationinwhichnot enoughmoneywascominginandtoomuchmoneywasgoingout.

InanattempttokeeptheS&Lsfromcollapsing,Congresspasseda lawin1980thatnullifiedthestateusurylaws.ThisallowedtheS&Lsto chargeintereston new loansthatexceededtherateofinflation,butit didnotsolvethefundamentalproblem:almostalloftheirincomecame fromintereston already-existing loans—30-yearmortgageloansthey hadextendedinthe1950s,1960s,and1970satlowinterestrates.The interestontheseloanscontinuedtobenegativeinrealterms.The1980 lawalsoallowedtheS&Lstolendmorebyholdinglesscapital,andto engageinsomespeculativerealestateandbusinesslending.Suchlendingwaspotentiallymorelucrativethanhome-mortgagelending,but alsomuchriskier.

Asthecrisiscontinuedtoworsen,Congresstookadditionalmeasures tokeeptheS&Lsfromcollapsing.In1982,itpassedalawthatliftedthe ceilingontheratesthattheS&Lscouldofferdepositors.Thenewlaw alsoallowedthemtoengageinevenmorespeculativelendingandfurtherloosenedcapitalrequirements.Butthiswastoolittle,toolate.And theprovisionsinthe1980and1982lawsthatallowedtheS&Lstotryto recouptheirlossesbymakinghigh-riskrealestateandbusinessloans onlymademattersworse,sincealotoftheseloansneverpaidoff.The endresultwasthelargestbailoutinU.S.historypriortoTARP.

AlthoughderegulationoftheS&Lindustrydealtthefinalblow,itwas afailedefforttofixanalreadycriticalproblem.Theoriginalcausesof theproblemwereregulatedinterestratesandspiralinginflationthat “Keynesian”policiescouldnotprevent.Andthereasonthebailoutcost taxpayerssomuchmoneyisthatthegovernmentguaranteeddepositors’funds.

Ofcourse,onecouldarguethatregulationisstilleffective,sincethe S&Lcrisiswaslimitedtooneindustryinonecountry,whilethelatest financialcrisiswasageneralandworldwideone.Butthereasonthe S&Lcrisishadsuchalimitedimpactisthatthescopeofregulationwas limited.ImaginethatallinterestratesintheUnitedStateshadbeenregulated.Wheninflationaccelerated,moneywouldnotjusthavefledfrom

TheGreatRecessionandMarx’sCrisisTheory 269

theS&Ls,itwouldhavefledfromtheUnitedStatesasawhole.There wouldhavebeenamassivenationwidefinancialcrisis,andamassive crisisintheUnitedStatesmightwellhavetriggeredcriseselsewhere.

Therearealsoacoupleofotherkeyproblemswiththenotionthat regulationscanpreventfinancialcrises.Oneisthatnewregulationsare always“fightingthelastwar.”AsMichaelNiemira,avice-presidentof andchiefeconomistfortheInternationalCouncilofShoppingCenters saidwhentheU.S.SenatepassedtheDodd-Frankfinancialreformbill: “Itisunlikelythatthesourceofthenextfinancialcrisiswillbeidentical tothelast—itrarelyis”(Izzo2010).

Theotherkeyproblemwasneatlysummarizedbyacartoonthat appearedin TheNewYorker (Vey2009)oftwoaccountantsinanoffice. Oneturnstotheotherandsays:“Thesenewregulationswillfundamentallychangethewaywegetaroundthem.”

Thispessimisticviewofregulationisnotexceptional.TheDodd-Frank lawrequiresbankstoholdmorecapital,anditsprovisionswilltendto raisetheircostsandlowertheirprofits.YetwhentheSenateandHouseof Representativeshammeredoutthefinalversionofthelaw,banks’stock pricesjumpedby2.7percent.The NewYorkTimes’ GretchenMorgenson (2010)commentedthatthisreactionwaseither“abitofamystery”orthat “maybeinvestorsarealreadycountingonthebanksdoingwhattheydo best:figuringoutwaysaroundthenewrulesandrestrictions.”

Eventhestaunchestproponentsoftheviewthatregulationsarea solution,suchasJosephStiglitz,acknowledgethatfinancialinstitutions alwaysdofindwaystogetaroundthem.DuringthePanicof2008,he publishedanarticleinwhichheproposedasetofsixreformsthatwere laterincorporatedintotherecommendationsoftheU.N.commission onmonetaryandfinancialreformthathewentontolead(popularly knownastheStiglitzCommission).Althoughthearticlewasentitled “HowtoPreventtheNextWallStreetCrisis,”itsfinalparagraphconcededthat“[t]hesereformswillnotguaranteethatwewillnothave anothercrisis.Theingenuityofthoseinthefinancialmarketsisimpressive.Eventually,theywillfigureouthowtocircumventwhateverregulationsareimposed”(Stiglitz2008).

Sowhyproposesuchregulationsinthefirstplace?Stiglitz(2008, emphasisinoriginal)assuredusthat“thesereforms will makeanother crisisofthiskindlesslikely,and,shoulditoccur,makeitlesssevere

TheAmericanJournalofEconomicsandSociology 270

thanitotherwisewouldbe.”Yetif,ashesaid,thefinancialmarkets “willfigureouthowtocircumventwhateverregulationsareimposed,” theregulationswillnolongerconstrainthemoncetheyhavefigured thisout,andatthatpointthenextfinancialcrisisbecomesjustaslikely asitwouldhavebeenotherwise.Thebestthatcanbesaidfornewregulationsisthattheycan delay thenextcrisis,whilethemarketsarestill findingwaystocircumventthem.Butadelayofthenextcrisismeans moreartificialandunsustainableexpansionoftheeconomythrough excessiveborrowinginthemeantime,sothatthecontractionwillbe more,notless,severewhenthedebtbubbledoesfinallyburst.6

Ibelievethatfortheforeseeablefuture,capitalismhasbecomeless stable,morecrisis-prone,thanitwasbeforethefinancialcrisisof2007–2008,andthatthemainfactorthatquelledthatcrisisis,paradoxically, thesourceoftheincreasedinstability.Iamreferringtothetoo-big-tofail(TBTF)doctrineandtothemoralhazarditcreates.(Moralhazard occurswhenapartyisencouragedtotakeexcessiverisksbecause anotherpartywillbearthecostsifthingsgopoorly.)Duringthecrisis, TBTFwasappliedforthefirsttimetofinancialinstitutionsotherthan commercialbanks,suchasBearStearnsandAIG.LehmanBrotherswas allowedtocollapse,butthatprovedtobeaverycostlymistake,one thatthegovernmentcertainlywillnotrepeat.AsJamesBullard(2010), presidentoftheFederalReserveBankofSt.Louis,putit,“thefinancial crisisrevealedthatlargefinancialinstitutionsworldwideareindeed‘too bigtofail.’ ... Wecanletlargefinancialfirmsfailsuddenly,butthen globalpanicensues.”

Thus,thelatestcrisisandpolicymakers’responsetoithavesignificantlyexacerbatedtheTBTFproblem.Priortothecrisis,itwasnotcompletelyclearthat,in“unusualorexigentcircumstances,”thegovernment wouldpropupanyandallsystemicallyimportantfinancialinstitutions. Now,however,this is completelyclear.Asaresult,moralhazardhas increasedsignificantly.Thosewholendfundstosuchinstitutions,and perhapstheirshareholdersaswell,haveanevengreaterincentivethan beforetoengageinriskybehavior,secureintheknowledgethatthe publicwillsuffertheconsequencesoftheirexcessiverisk-taking.

Itisextremelydoubtfulthatanythingcanbedonewithincapitalism tostopfinancialinstitutionsfrombecomingtoobigtofailortopermanentlydownsizethosethatarealreadytoobig.Economiesofscale

TheGreatRecessionandMarx’sCrisisTheory 271

TheAmericanJournalofEconomicsandSociology

enablebigfirmstoout-competesmallerones.Thisdynamicisespeciallypronouncedinthefinancialindustry,sinceabankneeds nowherenear100timesasmuchlaboror100timesasmanycomputers inordertolendout$100millioninsteadof$1million.Inthe UnitedStates,thebignessand/ornumberofTBTFfirmsislikelyto increaseconsiderably,sinceitsbankingindustryisnotyetnearlyas centralizedasthatofEurope.7 Moralhazard,excessiverisk-taking,and governmentbailoutsarethuslikelytoincreaseconsiderablyaswell.

Finally,Ithinktherearegoodtheoreticalreasonstodoubtthatmajor crisescanbepreventedundercapitalism.Onereasonistheonethat Bernankementioned:“Agrowing,dynamiceconomyrequiresafinancialsystemthatmakeseffectiveuseofavailablesavinginallocating credittohouseholdsandbusinesses.Theprovisionofcreditinevitably involvesrisk-taking.”However,althoughitistruethateverygrowing economywhatsoevermustputadditionalresources(“saving”)touse, notconsumeorhoardthem,afinancialsystemisaspecificallycapitalisticinstitution;andthesortofriskthatBernankehadinmind—borrowerstakingriskswithlenders’funds—isspecifictocapitalismas well.Itexistsonlybecauselendersandborrowersareseparateand opposedentities;itwouldnotexistinacommunalsociety.Indeed,the verynotionofcreditwouldbemeaninglessinsuchasociety.Justasan individualorhouseholdcannotobtaincreditfromitself,repayitself,or defaultonitsobligationtorepayitself—itsimplydecideswhetherto useitsresourcesorholdontothem—neithercouldacommunalsociety.Ofcourse,anydecisiontouseresourcesorholdontothemcarries itsownsetofrisks,butitishardtoimaginethatabaddecisionwould triggeradeepandprolongedeconomicdownturn.Therisksassociated withthecreditsystemaredifferentbecauselossesarenotlimitedtothe resourcesthataresquandered.Theyaremultipliedmanytimesoverby meansofleverage.

Marx’stheoryofcrisisalsomakesmedoubtthatmajorcrisescanbe eliminatedundercapitalism.Othertheoriestracecrisestolowproductivity,sluggishdemand,theanarchyofthemarket,stateintervention, highwages,lowwages,andsoon.Theyallsuggestthatcapitalism’scrisistendenciescaninprinciplebesubstantiallylessenedoreliminated byfixingthespecificproblemthatismakingthesystemperform poorly.ButMarx’stheorysuggeststhatcrisescannotbeeliminated

272

TheGreatRecessionandMarx’sCrisisTheory

becausetheyarenotcausedbyfactorsthatcanbeeliminatedwhile keepingthesystemintact.Hislawofthetendentialfallintherateof profitsuggeststhatcrisesaretheresultofacontradictionbetween physicalproductionandtheproductionofvaluethatisbuiltintothe veryfunctioningofcapitalism—asphysicalproductivityrises,thevalue ofcommoditiesfalls.Theirpricesconsequentlytendtofallaswell,as doestherateofprofit,andthisleadsindirectlytorecurrenteconomic crises.Toeliminatethesecrises,itisthereforenecessarytoeliminate theproductionof“value”andthegoalofaccumulatingever-more “value,”andinsteadproducetosatisfyhumanbeings’needsandmake humanself-developmentthegoalofouractivity.

Notes

1.In MonopolyCapital,BaranandSweezy(1966:81)attempttodemonstratethatinvestmentdemandcannotrisefasterthanconsumptiondemandin thelongrun.Thedemonstrationdependscruciallyonafatallogicalerror.They claimthatpermanentlyfastergrowthofinvestmentdemandimpliesthateconomicgrowthis“explosive”—i.e.,thattherateofgrowthrisesunboundedly— butthatthisis“impossible.”However,BaranandSweezy’sconclusiondepends entirelyonanincorrectinferencethat,ifsomethingrisesforever,ittherefore riseswithoutbound.Permanentlymorerapidgrowthofinvestmentdemand doesimplyacontinuallyrisingrateofgrowth,butitiseasytoshowthatthisrise neednotbeunbounded(Kliman2012a:167–173).

2.Therateofprofitcanbeexpressedas pðpY Þ pK 5p Y K p p ,where p isthe profitshare(ratioofprofittonetvalueadded), pY isnetvalueadded, p isan indexofthecurrentpriceofnetphysicaloutput, Y isanindexofnetphysical output, ^ p isaweightedaverageindexofthepastpricesatwhichadditionsto physicalcapitalhavebeenacquired,and K isanindexofphysicalcapital. Assumethatphysicaloutputandphysicalcapitalgrowatthesamerate(awellknown“stylizedfact”ineconomics),sothat Y K isconstant,andthattheprofit share p isalsoconstant.Therateofprofitwillthentendtofallasaresultoftechnicalprogressif,andonlyif,increasesinproductivityresultingfromtechnical innovationtendtoreduce p p.(ThisconclusionhelpstoclarifywhyMarx’slaw doesnotrequirethatpricesactuallydecline;whatmattersisnotwhetherpis lessthan ^ p,butwhether p p falls.)

3.Thecycledescribedhereshouldnotbeconfusedwithshort-termbusinesscycles.Marxaccountedforthelatterprimarilybyarguingthatwagesrise inrelationtoprofitintheexpansionaryphaseofthecycle,whichleadstoa declineinproductiveinvestment,acontractionofeconomicactivity,andafall inwagesrelativetoprofitsthatsetsthestageforrenewedexpansion.

273

4.Theonlyotherjustificationofthereplacement-costrateisthesupposed factthatitadjustsforinflation,whichtheactualratesofprofitIpresentedabove donot.However,thereplacement-costratedoesnotactuallyadjustforinflation—i.e.,increasesinthe general pricelevel—itadjustsforchangesinthepricesoffixedassets.Icomputedinflation-adjustedratesofprofitandfoundthat theirmovementsdidnotdivergesubstantiallyfrommovementsinthenominal ratesofprofitduringtheperiodfromtheearly1980stotheGreatRecession (Kliman2012a:117–122,82–88).

5.ThissectionofthearticledrawsextensivelyonKlimanandWilliams (2014).

6.TheStiglitz’sCommission’sfinalreportstates:“Thefactthatfirmsare alwaysinventingwaysofcircumventingregulationsmeansthatgovernments havetoviewregulationasadynamicprocess”(CommissionofExperts2009: 63)—thatis,asanever-endingcat-and-mousegameinwhichthemousecontinuallymanagestoeludethecat.Thisisnotarecommendationthatinspires confidenceintheeffectivenessofregulation.

7.In2008and2009,56percentofEurope’sbankassetswereownedbyits 1,000largestbanks,butonly13percentofU.S.bankassetswereownedbyits 1,000largestbanks(IFSLResearch2010:3,Chart7).

References

Armour,Philip,RichardV.Burkhauser,andJeffLarrimore.2013.“Levelsand TrendsinUnitedStatesIncomeanditsDistribution:ACrosswalkfrom MarketIncomeTowardsaComprehensiveHaig-SimonsIncome Approach.”NBERWorkingPaperNo.19110,June.http://www.nber. org/papers/w19110

Bakija,Jon,AdamCole,andBradleyT.Heim.2012.JobsandIncome GrowthofTopEarnersandtheCausesofChangingIncomeInequality: EvidencefromU.S.TaxReturnData,April.https://web.williams.edu/ Economics/wp/BakijaColeHeimJobsIncomeGrowthTopEarners.pdf Baran,PaulA.andPaulM.Sweezy.1966. MonopolyCapital:AnEssayonthe AmericanEconomicandSocialOrder.NewYork:MonthlyReview Press.

Bernanke,BenS.2002.Deflation:MakingSure“It”Doesn’tHappenHere, Nov.21.https://tinyurl.com/4fq2fu ———.2010.CausesoftheRecentFinancialandEconomicCrisis(testimony beforetheFinancialCrisisInquiryCommission),Sept.2.https://tinyurl. com/3buvanz

Bullard,James.2010.St.LouisFed’sBullard:FedistheNation’s“Best Chance”forAvoidingFutureFinancialCrises,Feb.23.http://tinyurl. com/3bnu8qp TheAmericanJournalofEconomicsandSociology

274

TheGreatRecessionandMarx’sCrisisTheory 275

CommissionofExpertsofthePresidentoftheUnitedNationsGeneral Assembly(StiglitzCommission).2009.ReportoftheCommissionof ExpertsofthePresidentoftheUnitedNationsGeneralAssemblyon ReformsoftheInternationalMonetaryandFinancialSystem,Sept.21. http://tinyurl.com/yjos2rt

CongressionalBudgetOffice(U.S.).2011.TrendsintheDistributionof HouseholdIncomeBetween1979and2007.http://www.cbo.gov/ publication/42729

———.2012.TheDistributionofHouseholdIncomeandFederalTaxes, 2008and2009,July10.ReportandSupplementalDataavailableat http://www.cbo.gov/publication/43373

Curry,TimothyandLynnShibut.2000.TheCostoftheSavingsandLoan Crisis:TruthandConsequences, FDICBankingReview 13(2):26–35.

Dumenil,GerardandDominiqueLevy.2005.TheProfitRate:Whereand HowMuchDiditFall?DiditRecover?(USA1948–1997).http://gesd. free.fr/dle2002f.pdf

———.2011. TheCrisisofNeoliberalism.Cambridge,MA:HarvardUniversityPress.

Foster,JohnBellamyandFredMagdoff.2008.FinancialImplosionandStagnation:BacktotheRealEconomy, MonthlyReview 60:7,Dec.http:// monthlyreview.org/2008/12/01/financial-implosion-and-stagnation Greenspan,Alan.2000.TechnologyandtheEconomy,Jan.13.tinyurl.com/ a23za

Henwood,Doug.2014.“AReturntoaWorldMarxWouldHaveKnown.” NewYorkTimes OpinionPages,March30.http://www.nytimes.com/ roomfordebate/2014/03/30/was-marx-right/a-return-to-a-world-marxwould-have-known

Husson,Michel.2008.“ASystemicCrisis,BothGlobalandLong-Lasting.” Workers’Libertywebsite,July24.tinyurl.com/6bk2c29 IFSLResearch.2010. Banking2010.http://tinyurl.com/6ztbhkp Izzo,Phil.2010.“EconomistsSplitOverFinancialOverhaul.” WallStreet Journal blog,July15.tinyurl.com/6g6cfsb Kliman,Andrew.2012a. TheFailureofCapitalistProduction:Underlying CausesoftheGreatRecession.London:PlutoBooks. ———.2012b.“TheFallingProfitabilityofU.S.MultinationalCorporations Abroad:ImplicationsforanUnderstandingofGlobalProfitabilityand theGreatRecession.” Marxism21 9:2,218–56.http://s3.amazonaws. com/zanran_storage/nongae.gsnu.ac.kr/ContentPages/2556441918.pdf ——.2013a.“MonthlyFailuretoReview:EvenWorsethanIThought.” With SoberSenses,May15.http://www.marxisthumanistinitiative.org/ economic-crisis/monthly-failure-to-review-even-worse-than-i-thought.html ——.2013b.“MoreMisusedWageDatafrom MonthlyReview:The OveraccumulationofaSurplusofErrors.” WithSoberSenses,Apr.10.

TheAmericanJournalofEconomicsandSociology

http://www.marxisthumanistinitiative.org/economic-crisis/more-misusedwage-data-from-monthly-review-the-overaccumulation-of-a-surplus-of-errors. html

——.2014a.“AreCorporationsReallyHoggingWorkers’Wages?” Truthdig, Apr.9.http://www.truthdig.com/report/item/are_corporations_really_ stealing_workers_wages_20140409

——.2014b.“IncomeInequality,Managers’Compensation,andtheFalling RateofProfit:ReconcilingtheU.S.Evidence.” CapitalandClass, forthcoming.

——.2014c.“WereTopCorporateExecutivesReallyHoggingWorkers’ Wages?” Truthdig,Sept.18.http://www.truthdig.com/report/item/ were_top_corporate_executives_really_hogging_workers_wages_20140917

Kliman,Andrew,AlanFreeman,NickPotts,AlexeyGusev,andBrendan Cooney.2013.TheUnmakingofMarx’s Capital:Heinrich’sAttemptto EliminateMarx’sCrisisTheory,July22.http://papers.ssrn.com/sol3/ papers.cfm?abstract_id=2294134

Kliman,AndrewandShannonD.Williams.2014.“Why‘Financialisation’ Hasn’tDepressedUSProductiveInvestment.” CambridgeJournalof Economics.http://cje.oxfordjournals.org/content/early/2014/09/23/cje. beu033.full.pdf+html(printversionforthcoming)

Krippner,GretaR.2011. CapitalizingonCrisis:ThePoliticalOriginsofthe RiseofFinance.Cambridge,MA:HarvardUniversityPress. Krugman,Paul.2013.“SecularStagnation,Coalmines,Bubbles,andLarry Summers.” NewYorkTimes blog,Nov.16.http://krugman.blogs.nytimes. com/2013/11/16/secular-stagnation-coalmines-bubbles-and-larry-summers/ ?_r=1

Magdoff,FredandJohnBellamyFoster.2013.“ClassWarandLabor’sDecliningShare.” MonthlyReview 64:10,March.http://monthlyreview.org/ 2013/03/01/class-war-and-labors-declining-share

Marx,Karl.1973. Grundrisse:FoundationsoftheCritiqueofPoliticalEconomy.London:Penguin.

———.1989. KarlMarx,FrederickEngels:CollectedWorks,Vol.32.New York:InternationalPublishers.

——.1991a. Capital:ACritiqueofPoliticalEconomy,Vol.III.London: Penguin.

——.1991b. KarlMarx,FrederickEngels:CollectedWorks,Vol.33.New York:InternationalPublishers.

Mechling,GeorgeandStephenMiller.2012.LookingUndertheLamp-Post: UsingthePiketty-SaezDataSettoUnderstandIncomeInequalityand IncomeShifting,May11.http://publicchoicesociety.org/content/ papers/stephenmiller-679-2014-680.pdf

276

Mishel,LawrenceandHeidiShierholz.2011.“TheSadButTrueStoryof WagesinAmerica.”EconomicPolicyInstituteIssueBrief#297.http:// epi.3cdn.net/3b7a1c34747d141327_4dm6bx8ni.pdf

MonthlyReview editors.2013.“IntroductiontoHeinrich,Michael,CrisisTheory, theLawoftheTendencyoftheProfitRatetoFall,andMarx’sStudiesinthe 1870s.” MonthlyReview 64:11,April.http://monthlyreview.org/2013/04/01/ crisis-theory-the-law-of-thetendency-of-the-profit-rate-to-fall-and-marxsstudies-in-the-1870s