June2024

TheMysteryofAnonymous InvestmentinUSRealEstate

MatthewCollin,KaranMishra,AndreasØkland

NOTE

Summary

Thisnoteaddressesthesignificantconcernsassociatedwithanonymousrealestateownershipinthe UnitedStates,highlightinghowaconsiderableamountofproperty,includingresidentialrealestate,is heldviacorporateentitiesthatconcealthetrueowners.AnalyzingdatafromthreemajorUScities,New York,MiamiandBoston,werevealthelimitationsofcurrentmethodsinaccuratelyidentifyingforeign ownershipandproposesolutionsforfederalandstateauthoritiestoenhancetransparencyandunderstandingoftheextentofcross-borderrealestateownership.Withoutsuchmeasures,theenigmaof anonymousownershippersists,obstructingourcollectivegraspofitsbreadthandimplications.The factthatthesizeandscopeofforeigninvestmentinUSrealestateremainsamysteryisnotadataproblem,butapolicyone.

Thisworkisfundedbygrantno.QZA-22/0011fromtheNorwegianAgencyforDevelopmentCooperation(NORAD)and grantno.341289fromtheResearchCouncilofNorway.Theviewsexpressedinthisnotearethoseoftheauthorsanddo notnecessarilyreflecttheviewsofourfunders.WethankthemembersoftheEUTaxObservatory,particurlarlyBluebery PlanteroseandGiuliaAliprandi,fortheirhelpfulcommentsandsuggestions.

1 Introduction

Inmid-2022,theUSJusticeDepartment’sOperationKleptoCapturetaskforce raided severalluxury propertiesinNewYorkandMiami.Theunithadrecentlybeenestablishedtorootout,seizeandfreeze theassetsofsanctionedRussianoligarchs,particularlythosethatmayhavebeenattemptingtocircumventthesanctionsregimebyhidingtheirownership.TheJusticeDepartmentlaterrevealedthatthe propertieswereactuallyownedbyViktorVekselberg,aRussian-CypriotbillionairewhohasbeenunderUSsanctionssincelate2017.

WhileKleptoCapturehadsufficientintelligencethatVekselbergownedroughly$70mworthofproperty,theaverageconcernedcitizenwouldhavebeencluelessastothesizeofhisinvestmentsinthe USrealestatemarket.VekselbergisnotlistedastheownerofanypropertiesinNewYorkCity’sAutomatedCityRegisterInformationSystem(ACRIS).Inplaceofhisnamewasan anonymousshellcompany,actuallyregisteredin Panama butwithaMadisonSquaregardenmailingaddress.Inpractice,this combinationofsecretiveownershipstructuresandlimitedfilingrequirementshadkepttheoligarch’s sizablepropertyportfoliooutofview.

Illicitbillionairepropertyportfoliosareparticularlyeye-catching,buttheyrepresentamoregeneral phenomenonthatdemandsmoreattentionbyresearchersandpolicymakersalike:theriseofsecretlyownedrealestateinluxurypropertymarkets,muchofitheldthroughcomplex,opaqueownershipstructures.Realestateestatemarketshavelongbeenaconcernforthoselookingtocrackdownonfinancial crime(FATF, 2007).Becauseitoffersbothastablestoreofwealthandambiguityoverthemarketvalue, realestateisinmanywaysanidealassetclassforthoselookingtolaunderillicitwealth.Inmanyjurisdictions,thetypesofduediligencechecksthatbanksarerequiredtoconductontheircustomersdo notapplytothelawyersandrealestateagentsinvolvedintransactions.Whentheyare,theyareoften poorly-enforced.

Theserisksareamplifiedwhenownershiporiginatesoffshoreortheownershipstructureinvolvesforeigncompanies.Moregenerally,aperson’sownershipofpropertyoverseas,orathomethroughacomplexoffshorestructure,issignificantlymorelikelytogounnoticedbytheirauthoritiesathome,making iteasiertogetawaywith taxevasion or corruption.Thisisbecausewhilemostpropertyregistersare publiclyaccessible,mostjurisdictionsdonotrequirecorporatepropertyownerstofileinformationon whoownstheunderlyingcompany.Furthermore,manyofthethirdpartyreportingrequirementsthat applytoforeignfinancialassetsdonotextendtorealestate,leavingmanyauthorities—bothforeign anddomestic—inthedarkastowhoownswhat.1

Understandingthesizeofcross-borderpositionsinrealestateisthefirststeptoaddressingtheserisks. Despitethis,therehaveonlybeenafewsystematicattemptstodosobyresearchers.2 Arecenteffortby theEUTaxObservatory,knownasthe AtlasoftheOffshoreWorld,publishednewbilateralestimatesof

1Arecentstudyby ? foundthatthoseholdingoffshoreassetsshiftedasizableportionintoUKrealestateinordertocircumventnewrequirementsontheexchangeofbankaccountinformation.ArecentcasestudyinDubairevealedthatmany propertiesbeingheldtherebyNorwegiannationalswerenotreportedtothetaxauthoritybackhome(Alstadsæteretal., 2022)

2Examplesofrecenteffortsatthecountrylevelinclude AlstadsæterandØkland (2022), BomareandLeGuernHerry (2022), Alstadsæteretal. (2022)and Johannesenetal. (2022)

AnonymousRealEstate|3

foreignownershipofrealestateinsixmajorcitiesandareas,includingParis,London,DubaiandSingapore.3 Aswewilldescribeindetailbelow,expandingthecoverageoftheseestimatesrequiresdetailed datathatoffersapathtoobserving,oratleastinferring,theultimateownerofeachrealestateproperty inajurisdiction,aprocesswhichiscomplicatedwhenownershipiscompletelyanonymous.

ThisnotedemonstrateshowasignificantshareofthepropertymarketinkeyUScitiesisownedby anonymouscompaniesandhowthiscorporateownershipopacityhamperseffortstogaugethesize andevolutionofforeignownedrealestateintheUnitedStates.Anecdotally,manyAmericancitiesare primetargetsforillicitwealth,rangingfromRussianoligarchs4 tothoseinvolvedinthe Malaysian1MDB scandal.Arecentstudynotedthatatleast$2.3billionwerelaunderedthroughU.S.realestatebetween 2015and2020,likelyonlyafractionofthetotalamount(GFI, 2021).5 Inrecentyears,concernsover theattractivenessofluxuryrealestatetothoseengagedincorruptionorfinancialcrimehaveledUS policymakerstotargetmanyofitslargestcitieswithnewenforcementordersaimedatgatheringmore infoontheownershipstructuresinvolved(Collinetal., 2021).

Inthisreportwefocusonthreecitiesforwhichthenominalownershipdataforrealestateisreadily available:NewYorkCity,MiamiandBoston.Weshowthattransparencyaroundnominalownership —thenamewrittendowninthepropertyregister—doesnottranslateintotransparencyofultimate ownership.Foreachofthecities,weestablishthefollowing:

• Corporateownershiprepresentsalargeshareofthevalueoftotalresidentialrealestate.

• Thatownershipappearstoo“domestic,”inthatthereisfarlessdirectforeignownershipthanwhat wouldbeexpectedgiventhepopularityofthesemarkets.

• ThemajorityofthatownershipisopaquelyheldthroughcompanieswithnoclearmethodofestablishingwhotheultimateownersofUSpropertiesare.

• Simplified,aggregatereportingbyfederalandstateauthorities,madepossiblebyrecentlegislation,wouldhelpshedsignificantlightonthisproblem.

Therestofthisnoteproceedsasfollows:InSection 2 wehighlighthowwe’veprocessedthedatafor eachofthethreecities.Section 3 providesbackgroundonthedataandbroadtrendsinrealestateinvestmentsinthreemajorcities:NewYork,MiamiandBoston.Wethenanalyzethefaultlinesinthe currentavailabilityofdataonoffshorerealestateinSection 4.Finally,Section 5 positssomerelevant policyimplicationsandoutlinesthescopeforfuturework.

3AtpresenttheAtlascoversthesefourcities,aswellasCôted’AzurandOslo.

4Maybeparadoxically,thereismoretransparencyabouttheinflowofRussianmoneyintotherealestatemarketinthe secretivetaxhavenDubai(UAE)thanintheUS.Thisisduetoleaksfromlocalauthoritiesandorganisations.Theseleaks havebeencoveredextensivelybymediaorganisations(seeDubaiUncoveredandDubaiUnlocked)andhavebeenanalysedin economictermsby Alstadsæteretal. (2022)and Alstadsæteretal. (2024).Themostrecenteffort, Alstadsæteretal. (2024), findsthatRussianownersheldrealestateinDubaiworthUSD3.7billionin2022andthatseveralnewbillionswereinvested afterthenewwavesofinternationalsanctionsin2022.

5Thisamountonlycoveredknowncasesofmoneylaunderingasaresultofcriminalprosecutions.Thismeansitverylikely reflectsonlyasmallfractionofthetotalamount.

AnonymousRealEstate|4

2

ProcessingPublicDataonCorporateOwnership

Aspartofthisanalysis,werelyonpublicdatafromthreeUScities:NewYorkCity,MiamiandBoston. Wechoseeachcitybecauseoftheirrenownforbothbeinghighly-popularwithforeignownersand—in thecaseofNewYorkCityandMiami—forbeingsignificanthotspotsforillicitrealestateactivity.6 All werechosenaspotentialcandidatestobeaddedtotherealestatesectionofthe AtlasoftheOffshore World,thewebsitedevelopedbytheEUTaxObservatorytopresentthemostup-to-dateestimatesof theextentofoffshorewealth,profitshiftingandeffectivetaxrates.

WeobtainedannualdataforNewYorkCityusingannualassessmentvaluationspublishedbytheDepartmentofFinanceaswellasownershipinformationheldinits AutomatedCityRegisterInformation System (ACRIS)system.ForMiami,werelyondatafromthe Miami-DadePropertyAppraiser.Lastly, weretrieveddataforBostonfromtheCityofBoston’sopendatahub, AnalyzeBoston.Ouranalysisfor eachcityisbasedonthelatestdataavailableatthetimewebeganouranalysisforthisnote:2022data forNewYork,2023dataforMiami,and2021dataforBoston.

Inouranalysis,weidentifiedcorporationsbyflaggingownersineachdatasetwhosenamescontain wordsthataremostcommonlyassociatedwithcorporations,suchasLLCorINC.7 Thisallowsusto identifythetotalnumberofpropertiesthatareowned(orpart-owned)bycorporations,aswellasthe totalvalueofthatproperty.

Therearelimitstothisapproach,particularlyforcitiesthatpublishmorelimiteddataonpropertyownership.ForNewYorkCity,wewereabletoidentifyeachowningpartythatwaslistedinACRIS,andlink thatinformationtothecity’sannualvaluationdatasetusingeachpropertyaddress’suniqueidentifier.8

Incontrast,neitherMiaminorBostonpublisheddetailedinformationonallthepartiesthatownaproperty,insteadonlylistingasingleownerintheirvaluationdatabase.Thismaymeanweareunderestimatingtheproportionofcorporateownersinthedatabase.Specifically,inthecontextoftheMiami/Boston datasets,ifwepossessedthesamelevelofdetailregardingallpartiesconnectedtoaproperty’sdeedas isavailableforNewYork,itwouldpotentiallyenableustoidentifyadditionalowners,particularlythose thatarecorporateentities,ofthepropertyinquestion.Wedescribeourexactprocessforcreatingeach datasetintheAppendix.

3 EvaluatingtheScopeofHiddenPropertyOwnershipintheUS:Insights fromNewYorkCity,MiamiandBoston

Inthissection,wedescribethescaleandconcentrationofcorporateownershipintherealestatemarket acrossNewYorkCity,MiamiandBoston.

6Allthreecities,alongwithAtlanta,GeorgiaandAustin,Texas,werehighlightedastopdestinationsforcommercialreal estateinvestmentsina survey conductedbytheAssociationforInternationalRealEstateInvestors. Multiple reports byjournalistsandcivilsocietyorganizationshavehighlightedthedegreetowhichbothNYCandMiamirealestatehavebecome hotspotsfordirtymoney,where thinktankreports havehighlightedsimilarrisksforBoston.

7Weoutlinethefullsetofthese“noisewords”thatwerelyonintheappendix.

8Whenmultiplepartiesownthesameproperty,wesplitthevalueequallybetweenthem.

AnonymousRealEstate|5

Ouranalysisillustratesthreethings:(i)opaquecorporateownershipcomprisesasignificantpartofeach market,(ii)itismorecommonintheluxuryandhigh-endpropertymarket,and(iii)thatitisverylikely thehighdensityofUScorporateownershipeffectivelyhideshowmuchrealestateisactuallyheldby foreignbuyers.

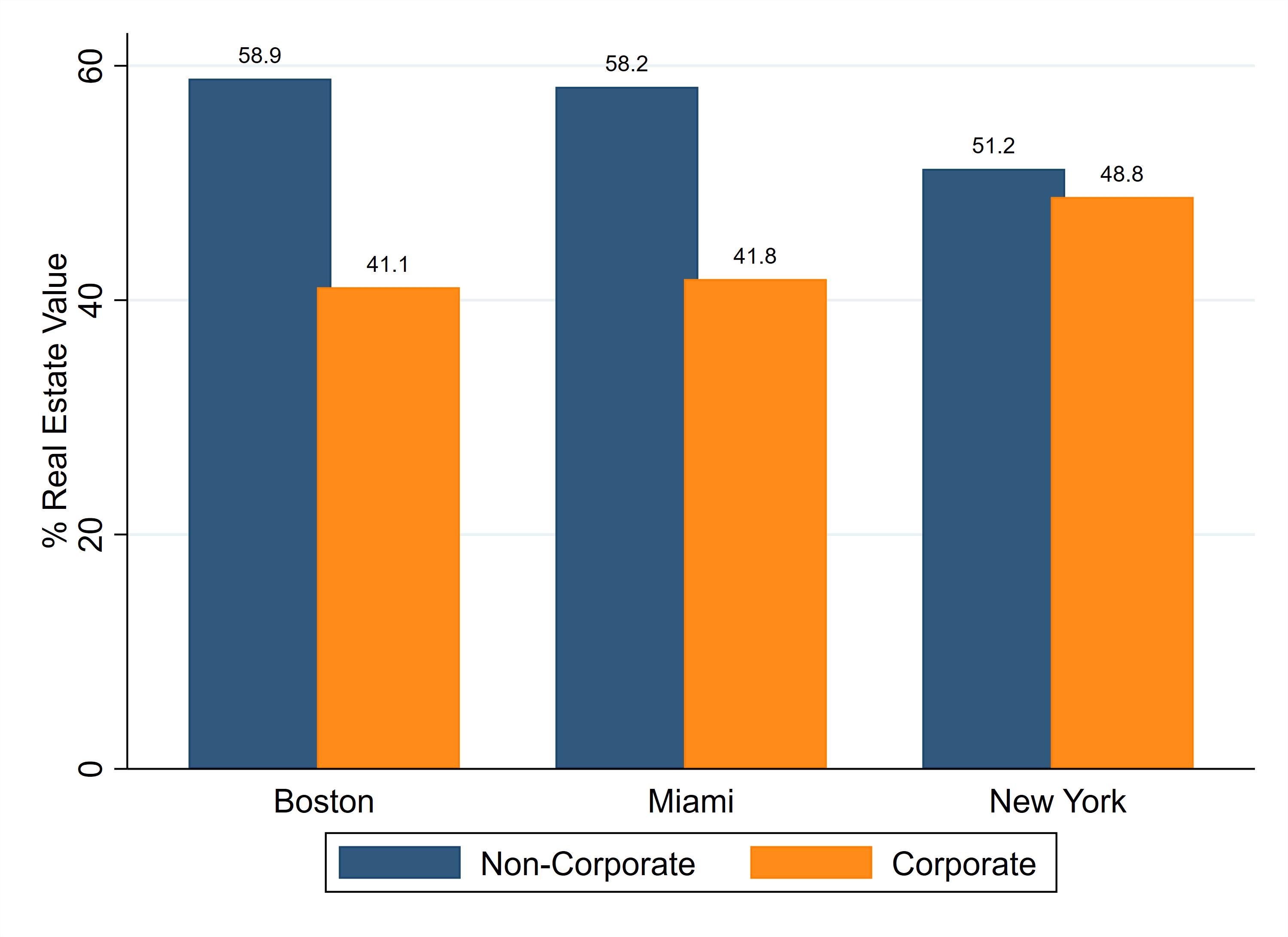

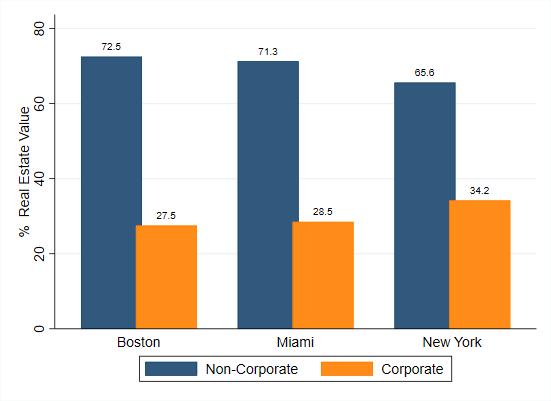

FIGURE1

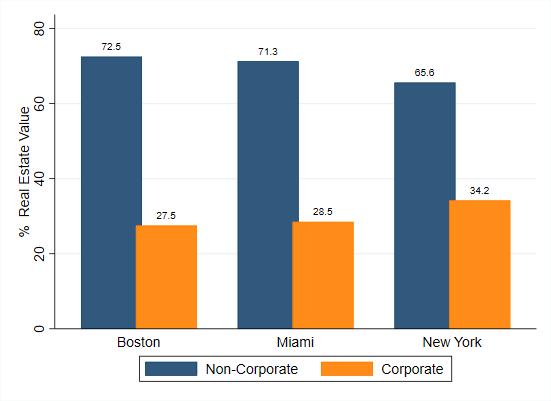

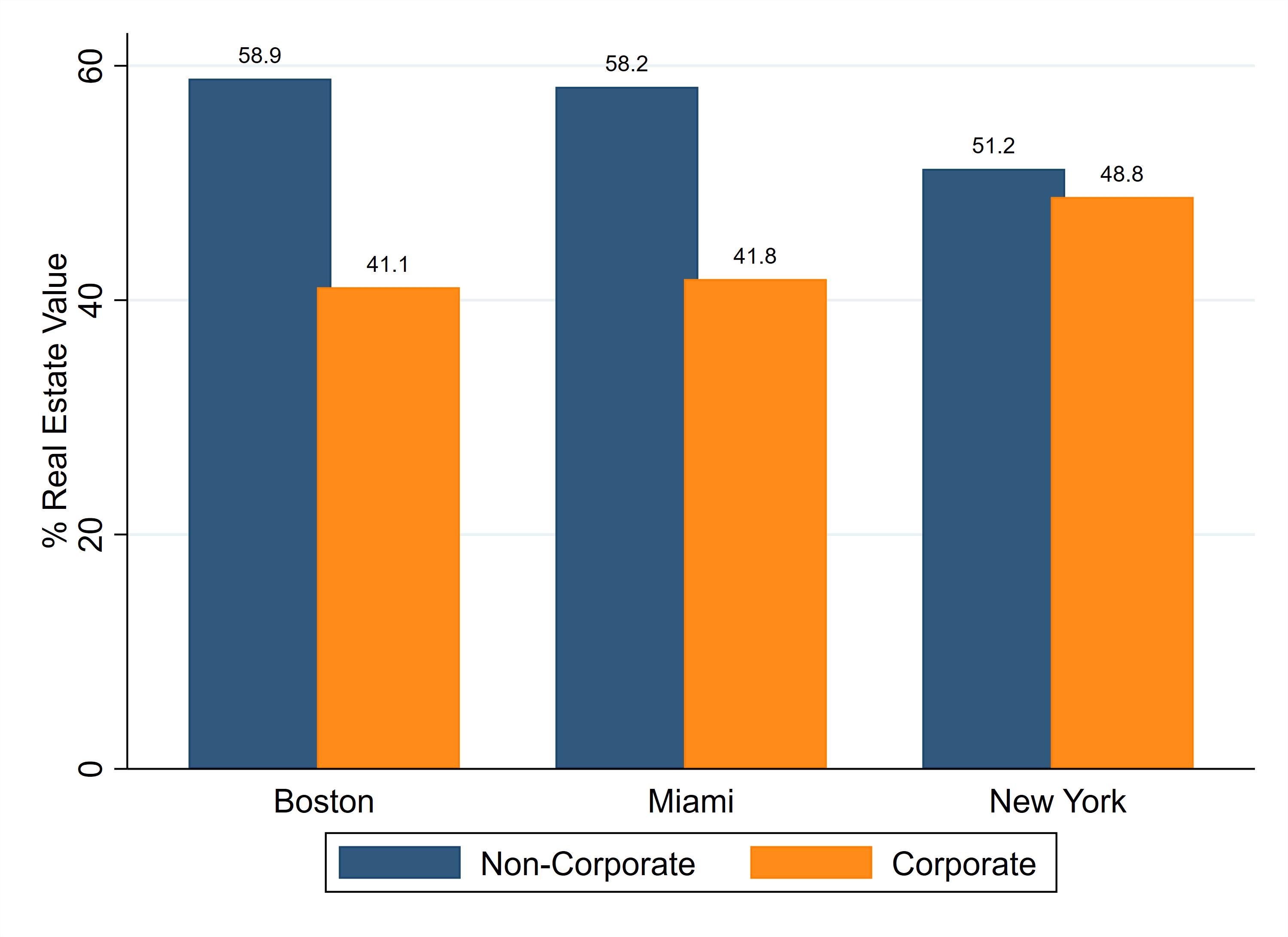

ShareofcorporateownershipinselectedcitiesintheUS

(a) (A)Allproperties

(b) (B)Residentialpropertiesonly

Note: Thefigurepresentstheshareofcorporateownershipof(a)totalrealestatevalueand(b)totalresidentialrealestatevalue inNewYorkCity,MiamiandBoston.NYCestimatesuse2022assessmentvaluationandownershipinformationfromNewYork City’sDepartmentofFinanceanditsAutomatedCityRegisterInformationSystem(ACRIS).Miamiestimatesaretakenfrom Miami-DadePropertyAppraiserpublishedasof2023.Bostonestimatesarederivedfrom2021datapublishedbytheCityof Boston’sAnalyzeBostonopendatahub.Corporateownershipwasidentifiedthroughthepresence“noisewords”associated withcorporatenames.

Result1:Corporateownershipcompriseasubstantialshareofthevalueacrosseachmarket,andarisingshareinNYC

Ourfirstresultisthatcorporateownershiprepresentsasizableshareofthevalueofrealestateacross allthreecities.AsshowninFigure 1,corporateownershipofrealestaterangesfromapproximately41% (inBoston)tonearly49%(inNYC).Someofthisdominanceisduetocorporateownershipofcommercial property,whichismorecommonthaninresidentialmarkets.Whenwerestrictthedatatounitsthatare residential,9 theshareofcorporateownershipdropstobetween25-37%acrossthethreecities.Byour estimates,mostofthisrealestateisheldviamoresecretivelimitedliabilitycompanies(LLC):outofall company-ownedrealestateineachcity,roughly71%,68%and67%ofthevalueisownedviaaLLCin NYC,MiamiandBoston,respectively.

Notonlyiscorporateownershipasubstantialshareoftherealestatemarket,italsoappearstoberising.

9WedistinguishresidentialunitsfromthebroaderrealestatestockbyutilizingthetaxclassificationlaidoutbytheDepartmentofFinance.Specifically,TaxClass1encompassesresidentialpropertiesconsistingofonetothreeunits.Conversely,Tax Class4includesawidearrayofrealpropertytypes,suchasofficebuildings,factories,stores,hotels,andhavebeenclassified asTaxclassification1and2inNewYork(Fig A4 ).Tocompensateforvaryingdatastructuresacrosscities,wedevisedastrategytostandardizepropertyclassification.FollowingtheexamplesetbyNewYorkCity’suseoftaxclassvariables,wecreated asimilarsystemforMiamiandBoston.

AnonymousRealEstate|6

UsingdataforNewYorkCity,wherewecanmoreeasilyobservechangesovertimebyexploitingthe transactionrecords,wefoundthattheshareofallrealestatevaluethatisownedbyacompanyhas risenbynearly10percentagepointsoverthecourseofthe2010s(Figure 2).10 Thisisconsistentwith recentwork byAngelaStovell’sforJustFix,whichalsofindsthatratesofcorporateownershiparerising acrossNYC.

FIGURE2

ThegrowthincorporateownershipofrealestateinNewYorkCity(2011-2022)

Note: ThefiguredisplaysestimatesfortheshareofallrealestateinNYCthatisownedthroughacorporateentityfortheyears2011-2022. TheseestimatescombinetheNewYorkCityDepartmentofFinance’sannualvaluationdatawithend-of-yearownershipinformationtaken fromtheAutomatedCityRegisterInformationSystem(ACRIS).Corporateownershipwasidentifiedthroughthepresence“noisewords”associatedwithcorporatenames.

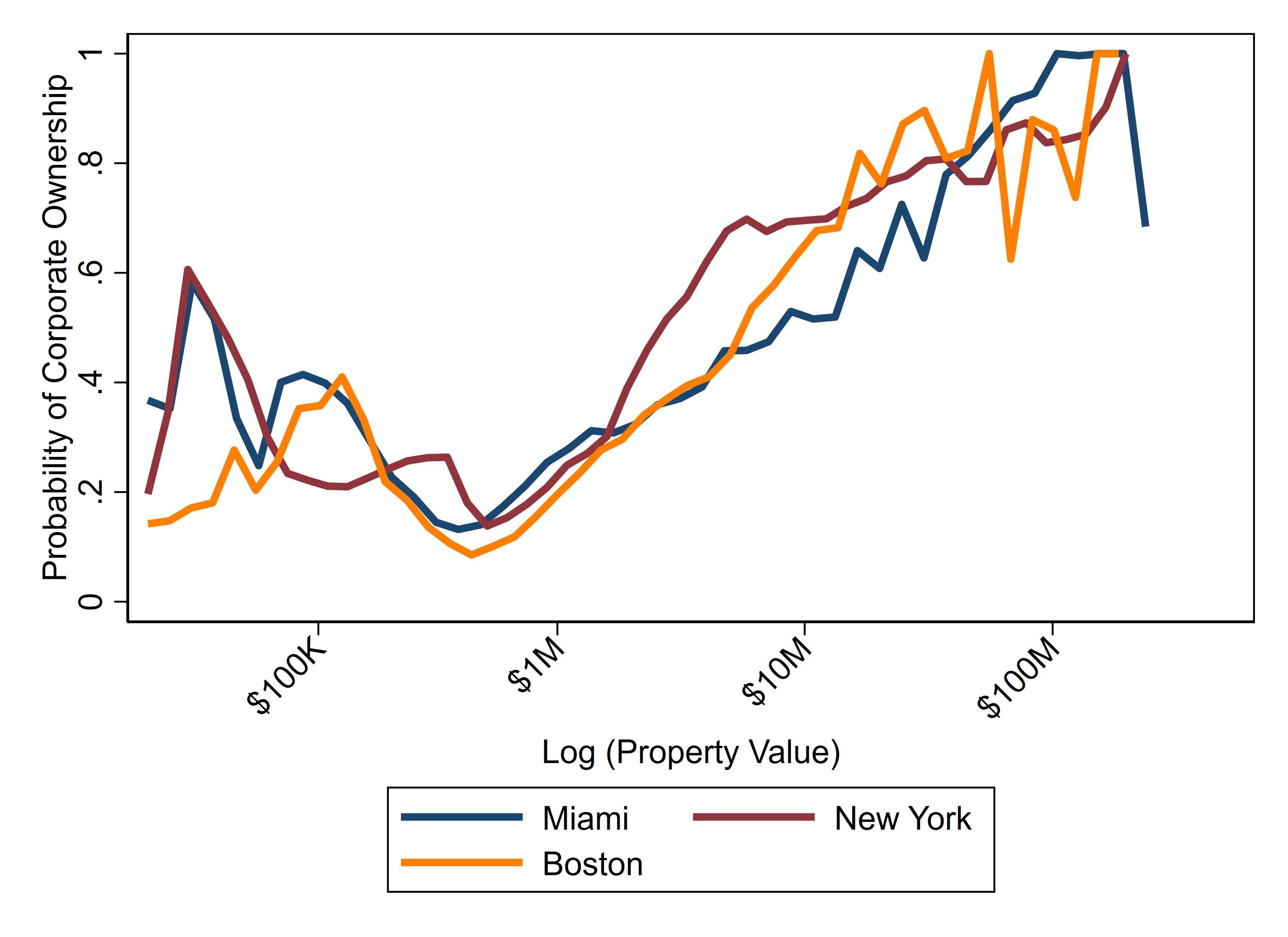

Result2:Corporateownershipismorecommonattheluxury-endofthemarket

Fromthe$30mManhattanpenthouse owned byfugitiveMalaysianbusinessmanJhoLowtoanequally expensiveMalibumansionowned bytheson ofEquatorialGuinea’spresident,manyofthemostegregiouscasesofillicitwealthbeingfunneledintorealestateinvolvetheuseofluxuryproperty.Infact, in itsrecentguidance forapplyingarisk-basedapproachintherealestatesector,theFATF(Financial ActionTaskForce)highlightedthedegreetowhichluxurypropertyismorelikelytobeusedformoney laundering,andthatillicitactorsaremorelikelytouselegalentitiestoobscuretheiridentity(FATF, 2022).

10Thisriseinthecorporateshareisnotdrivenbychangesinvaluationovertime.

AnonymousRealEstate|7

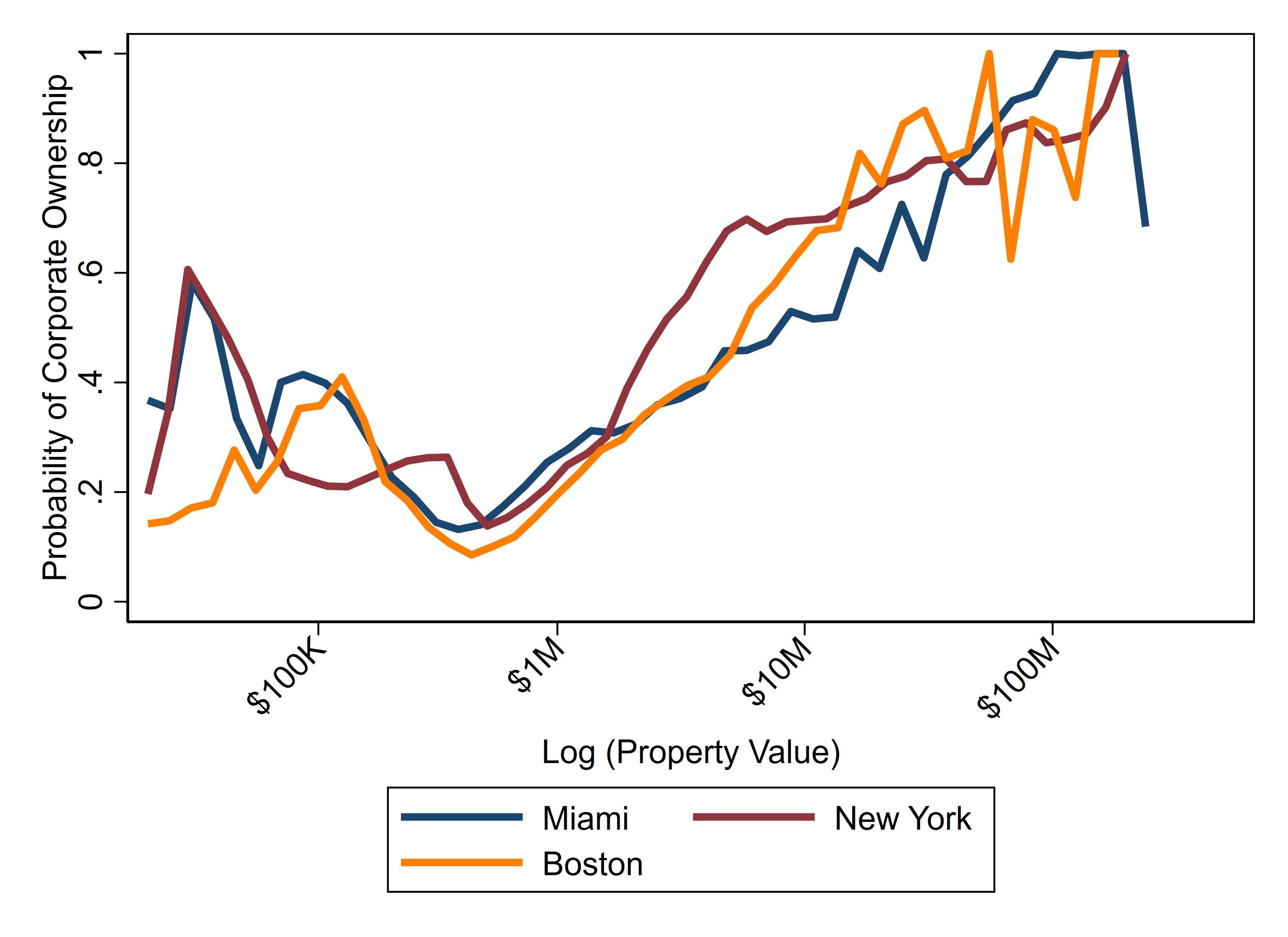

Tounderstandhowmuchmorelikelyopaqueownershipisintheluxurymarket,weestimatedtheprobabilitythatapropertyisownedorco-ownedbyacorporateentityineachofthethreecitieswehave datafor.Wefocussolelyonresidentialpropertyherebecause,whiletherearemanylegitimatereasons forcompaniestoownhigh-endresidentialproperty(suchaspropertydevelopmentcompaniesorlarge scaleleasingfirms,suchasTrumpTower),theincreasinguseofopaqueownershipstructuresisstilla riskfactorforillicitinvestment.

FIGURE3

Thelikelihoodofcorporateownershipincreaseswiththevalueoftheproperty

Note: Thefiguredisplayslocalpolynomialestimatesoftheprobabilitythatapropertyisfully-ownedorpartly-ownedbyacompany,asa functionofthatproperty’sassessedvalue.

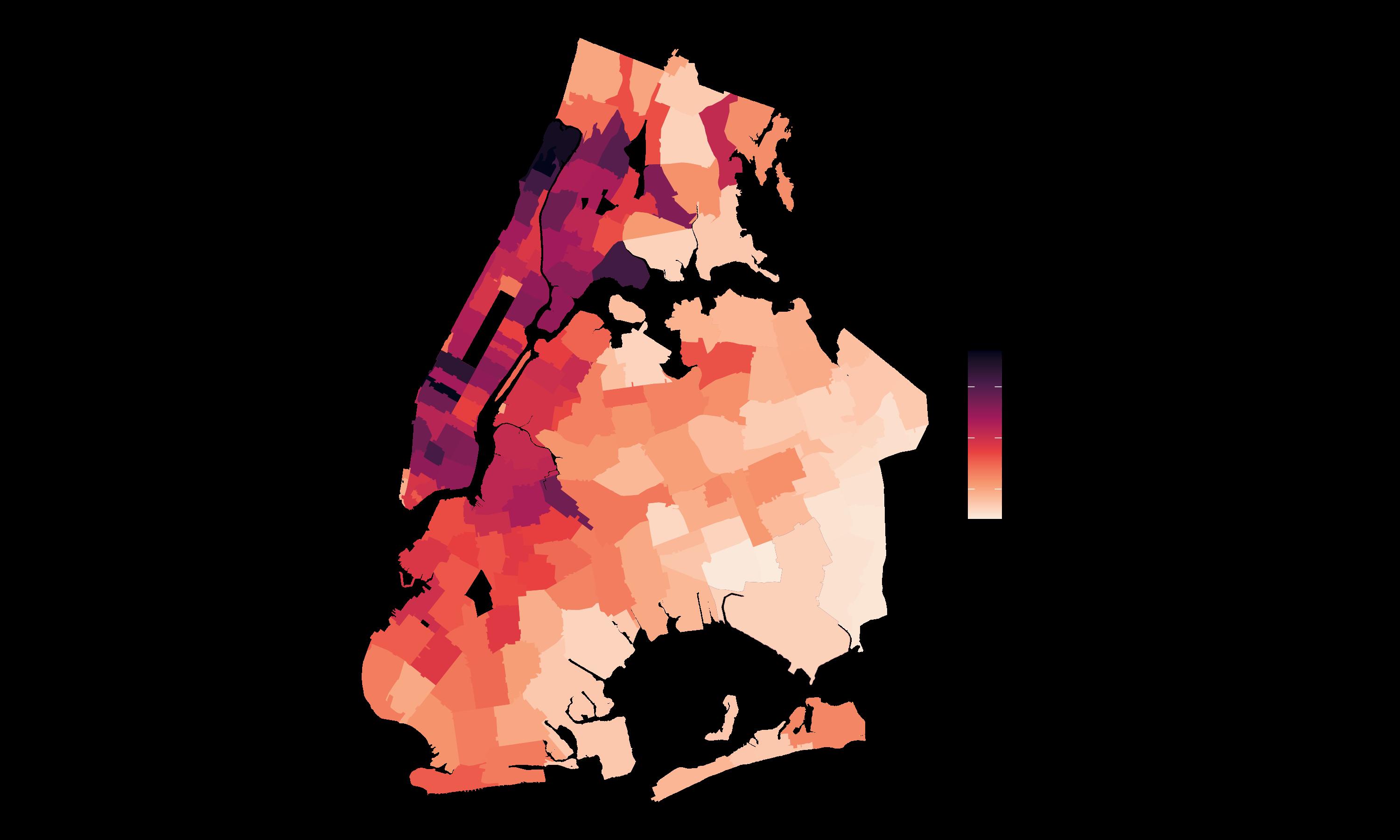

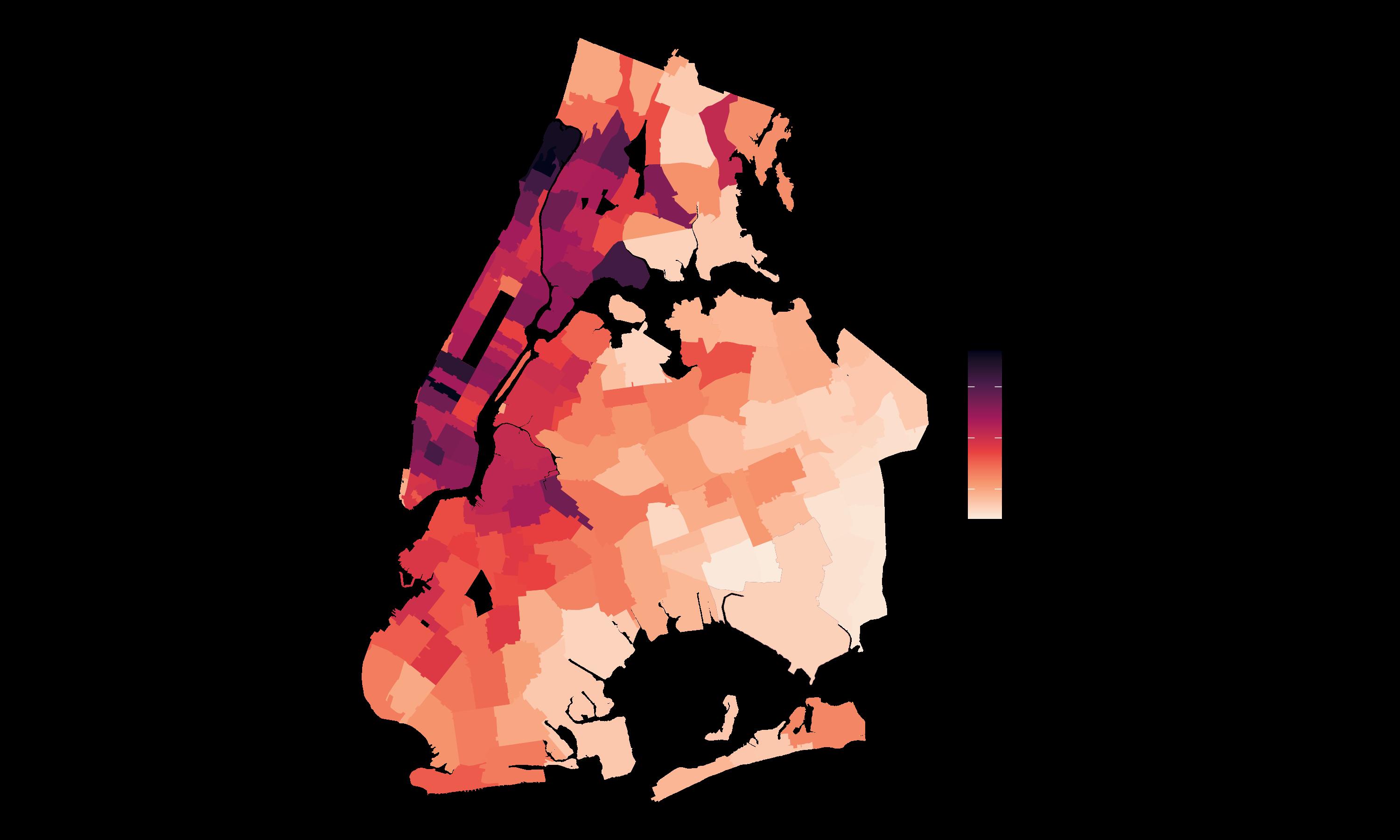

Wefindthatcorporateownershipismorehighlyconcentratedintheluxurymarketineachofourthree cities.AsdemonstratedinFigure 3,wefindthattheprobabilitythatatleastoneownerofaresidential propertyisacorporationincreasesdramaticallyasthepriceofthepropertyexceedsthe$1-2mmark. Forpropertiesthatarevaluedat$10and$100m,respectively,theprobabilitythatacorporateowner isinvolvedexceeds50%and80%,respectively.Luxuryconcentrationalsotranslatesintogeographic translation:whenwemapthedensityofcorporateownershipofresidentialpropertiesforNewYork City,wefindthatManhattanzipcodes(thepartofthecitywiththemostluxuryproperty)havesubstantiallymoredensitythantherestofthecity(Figure 4).11

11TheproportionofallunitsownedbyatleastonecompanytellsasimilarstoryforalltherealestateinNYC(Fig A3).Additionally,Fig A2 presentsanoverviewofgeographicconcentrationofownershipthroughDelaware—astateinfamousforits business-friendlylegalenvironment,especiallyforcorporations.

AnonymousRealEstate|8

ProportionofResidentialUnitsownedbyCorporationsinagivenzip-code

(A)AllResidentialunitsinNYC

(B)ResidentialunitsinManhattan

Note: Thefigurepresents-theproportionofallresidentialpropertiesinagivenzip-codethatareowned,whollyorpartly,by acorporation.

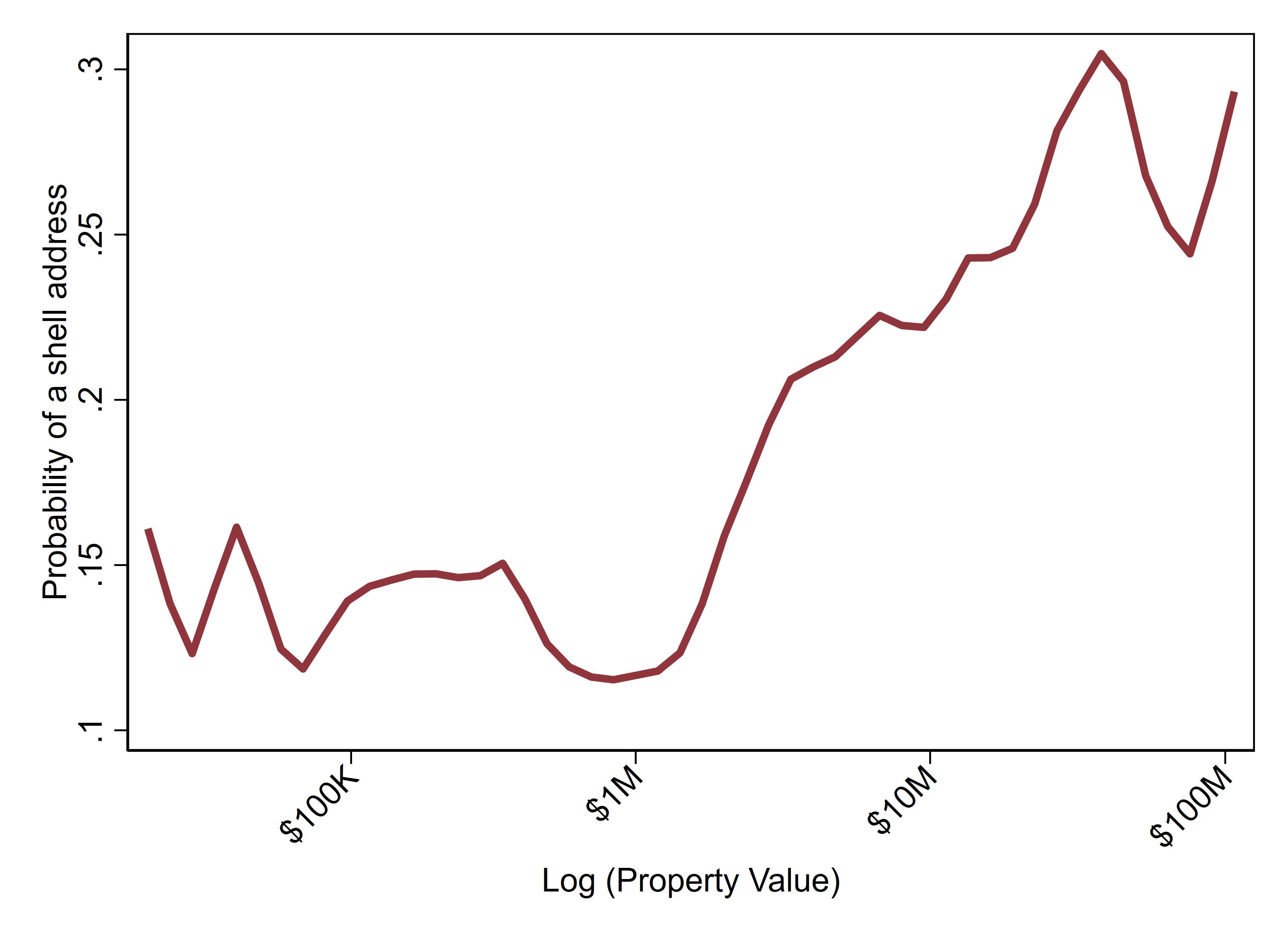

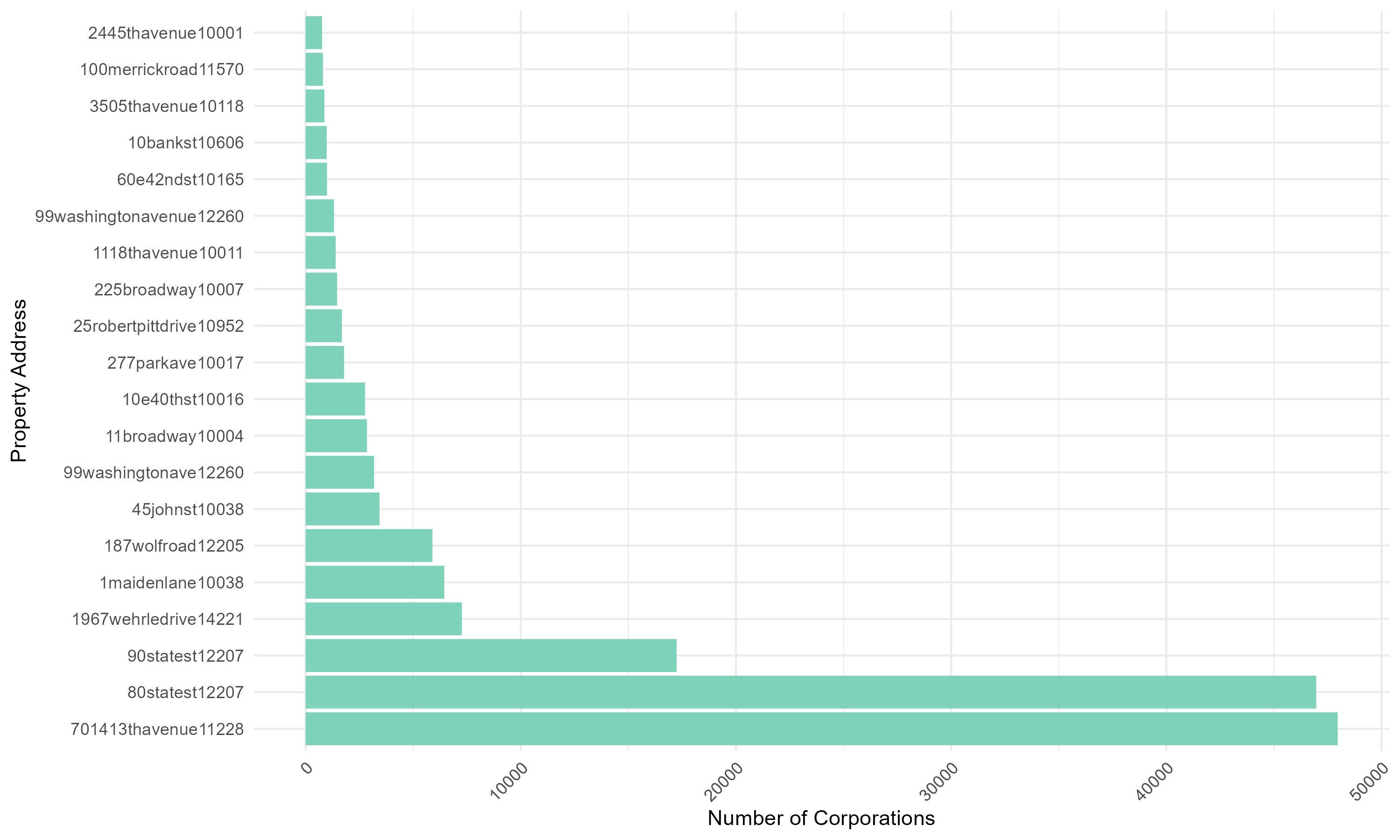

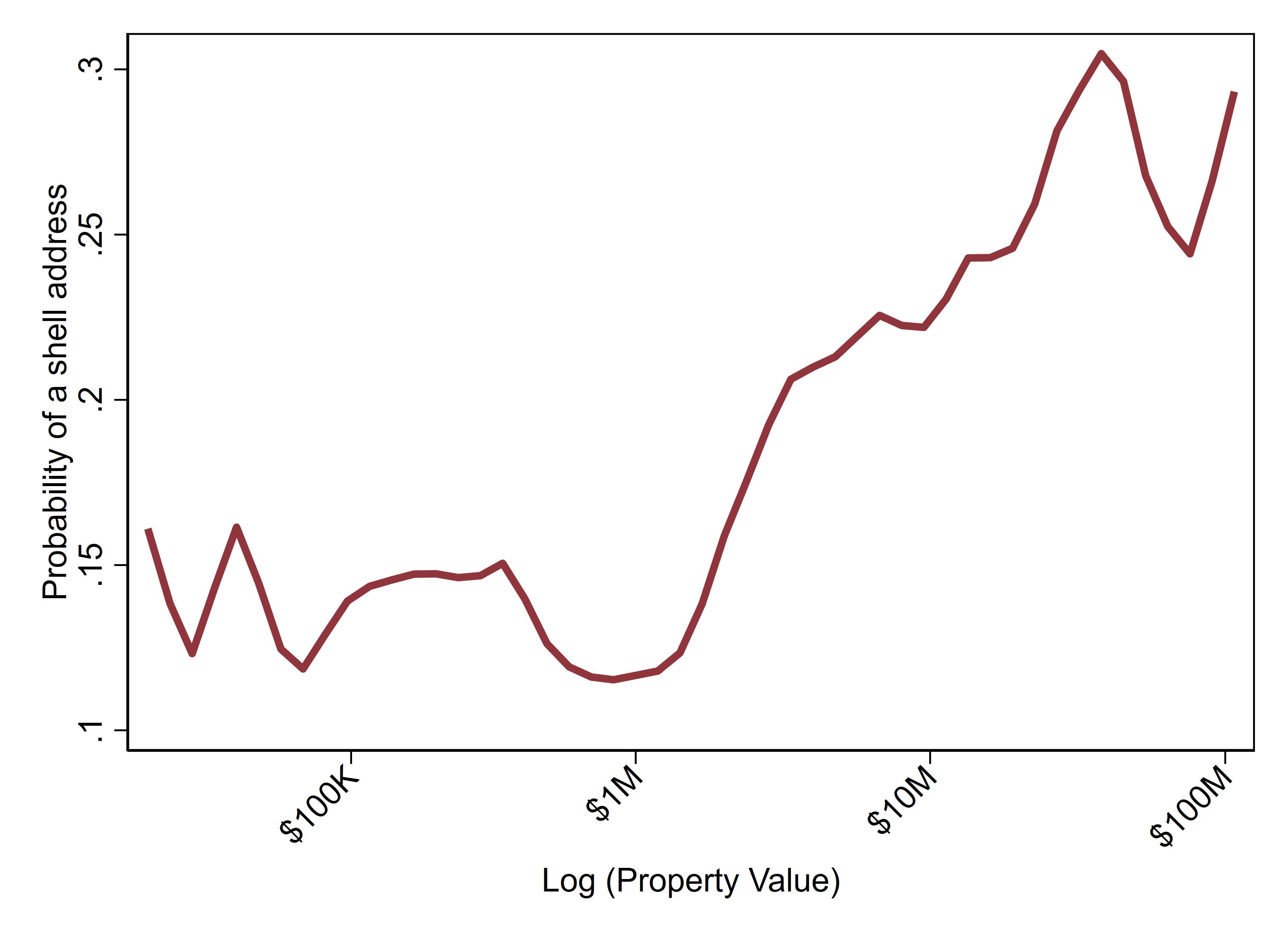

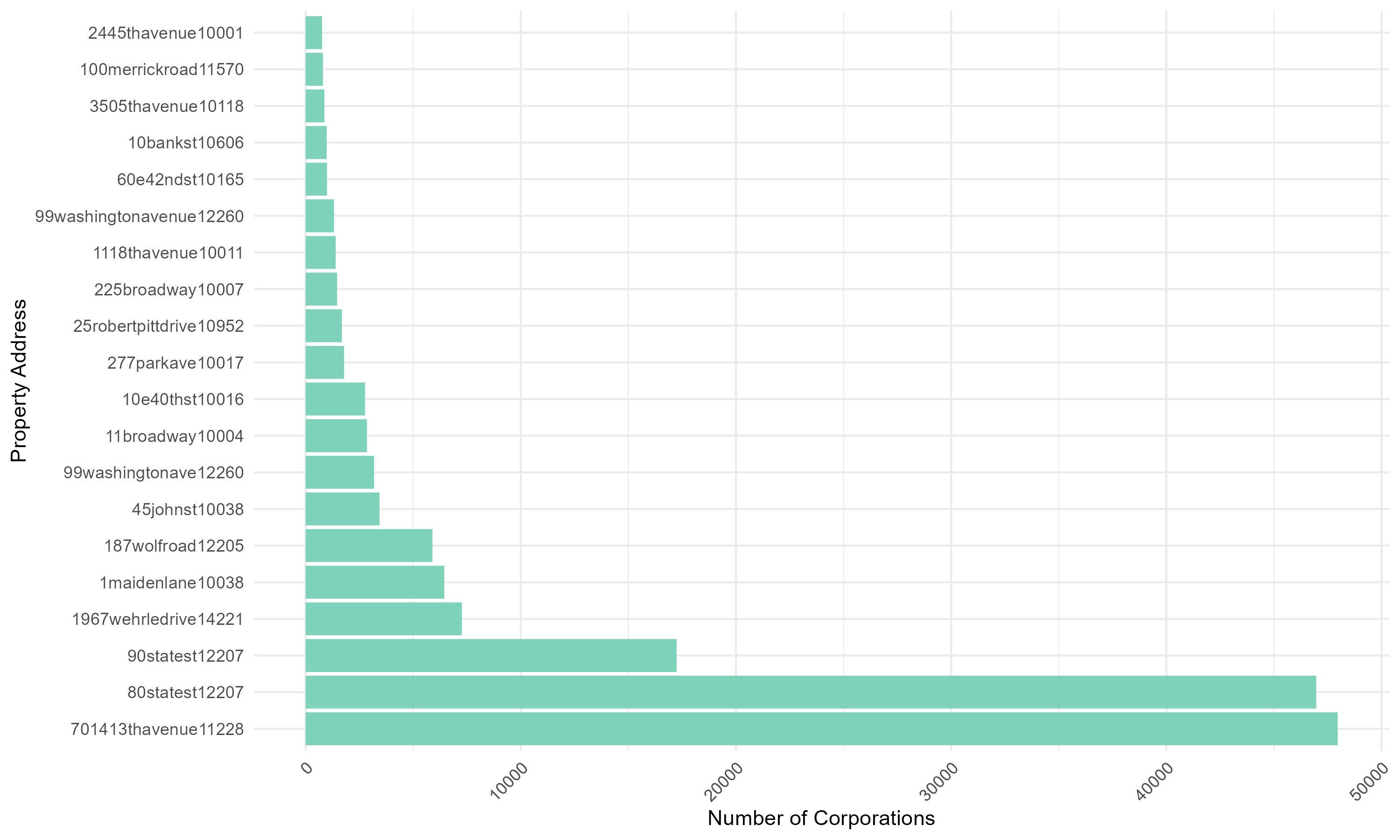

Muchofthisluxuryownershipisnotonlythroughcompanies,butthroughshellcompanieswithlittle-tonoeconomicpresence.Todemonstratethis,werepeattheaboveexerciseforallcompanies,nowdistinguishingbetweenregularcompaniesandthoseweclassifyasthosethatarelikelytobeshellcompanies. Weuseacombinationofthreedifferentmethodstoflagcompaniesasbeingshellcompanies.First,we flagcompaniesiftheyappearintheNewYorkStatecorporateregisterandareregisteredtoanaddress thatisinthetop10%ofaddresseswhenrankedbythenumberofcompaniesregisteredthere.Second weflagcompaniesiftheirmailingaddressasprovidedtotheNewYorkDepartmentofFinanceisinthe

FIGURE4

AnonymousRealEstate|9

FIGURE5

EstimatedProbabilityofcorporate-ownedunitsownedbyshellcompanyentitybasedonproperty value

Note: Thisfigurepresentstheestimatedprobabilityofcorporate-ownedunitsownedbyshellcompanybasedonproperty valueacrossNewYork.Weclassifyacompanyasashellcompanyifitsaddressisamongthetop10percentoftheaddresses intheNewYorkStateRegistryofactivecorporations,thatis,intermsofhowmanycorporationsareregisteredwiththis addressormailingaddressasprovidedtotheNewYorkDepartmentofFinanceisinthetop10%ofaddresseswhenranked bythenumberofothercompaniespresentthereoracompanythatisisregisteredinDelaware,NevadaorWyoming.

top10%ofaddresseswhenrankedbythenumberofothercompaniespresentthere. 12 Finally,weflag companiesasbeinglikelyshellcompaniesifwedeterminetheyareregisteredinDelaware,Nevadaor Wyoming,popular‘secrecystates’thatareknownforhostingalargenumberofshellcompanies(Tuttle, 2020; Aliprandietal., 2023).

Thus,followingthismethodologyFigure 5 illustratesthatshellcompanyownershipisconcentrated amongthemostexpensiveproperties.Shellcompaniesownbothhigh-endandlow-endrealestate,but thepropensityofshellcompanyownershipincreaseswithvalue,evenwithinthesampleofcorporateownedrealestate.Thiscompoundsthetendencyofcompaniesingeneraltobemorelikelytoinvestin high-valuerealestatecomparedtocheaperunits.

12Figure D1 showsapproximatelywhatthetopaddressesbycorporateconcentrationslooklikeinthecorporateregistry. Whereas,Fig D2 depictsthelater-topaddressesbynumberofcorporationsregisteredonthemailingaddressesinNewYork RealEstate.

AnonymousRealEstate|10

Result3:Mostforeign-heldrealestateisnotvisibleinpublicdata

Next,weusedpublicdatatoattempttouncovertheoriginsofUSinvestmentinrealestate.Wedidthis onlyforNewYorkCity,whichaswedescribedabove,hasmorecomprehensivecoverageofproperty owners.TherearetwomainchallengestoidentifyingwheretheownersofNewYorkCityrealestate reside.Thefirstisthesameproblemfacingpolicymakersandinvestigators:forcompanies,wewillonly atbestbeabletoidentifythejurisdictionofregistration,notthebeneficialownersandtheirlocation. Wewillfocusonthejurisdictionofregistration,todemonstratethatthisleadstoestimatesofrealestate thatisforeign-ownedorhaveoffshoreownershiplinkswhichareunrealisticallysmall,givenexistingreporting.ThesecondchallengeisthatNYC’spropertyportal,ACRIS,onlyrecordsthemailingaddressof theowner.Thisismorelikelytobetheactualaddressofresidencewhentheownerisarealperson.But companies,particularlysmallerLLCsthatareregisteredoutofstate(orwhosebeneficialownerslive outofstate),aremorelikelytoreceivemailattheaddressofacorporateserviceproviderthathelps managetheiraffairs,oftenalawfirm.

Toovercomethissecondchallenge,wematchedthenamesandmailingaddressesofLLCstotheNew YorkStateRegistry,whichrequiresallcompaniesthatdobusinessinthestatetoregister,including foreignandout-of-statefirms.Forthecompaniesthatwesuccessfullymatchedtothisdatabase(approximately38%outofthosethatownpropertyinNYC),wewereabletorecoverthejurisdictionof registrationfromtheRegistry.Fortheremainder,werelyonthemailingaddress,despiteitslimitations.

Table 1 displaysourestimatesofthejurisdictionoforiginsforthestockofinvestmentinNYCrealestate,allocatingthatjurisdictionbasedoneitherwhatappearsintheNewYorkStateRegistryorthe listedmailingaddressinACRIS.Relyingpurelyonpublicdata,weareonlyabletoallocate0.27%,about $3.7b,ofthetotalvalueofNYCrealestatetoforeignjurisdictions.Over95%ofthevalueisallocatedto companiesconnectedtoNewYorkState,andtheremaining3.7%didnotcontainenoughinformation toallocateittoajurisdiction.

Takenatfacevalue,thiswouldimplythattheownershipofNewYorkCityrealestateisoverwhelminglylocal,andthatlittleoftherealestateisownedfromabroad.However,weknowfromindustry reportsthatforeignpurchasesinNewYorkState(themajorityofwhichwillbeinthecapital)makeup approximately$2-4.5bannually.13 Thishighlightsthedegreetowhichdomesticcorporateownership canobscuretheactualsizeofforeign-heldrealestate.ItisalsoworthnotingthatanumberoftheforeignjurisdictionsinTable 1 arenotabletaxhavensthatareknownforhostingshellcompanies,including theIsleofMan,BritishVirginIslands,andHongKong.

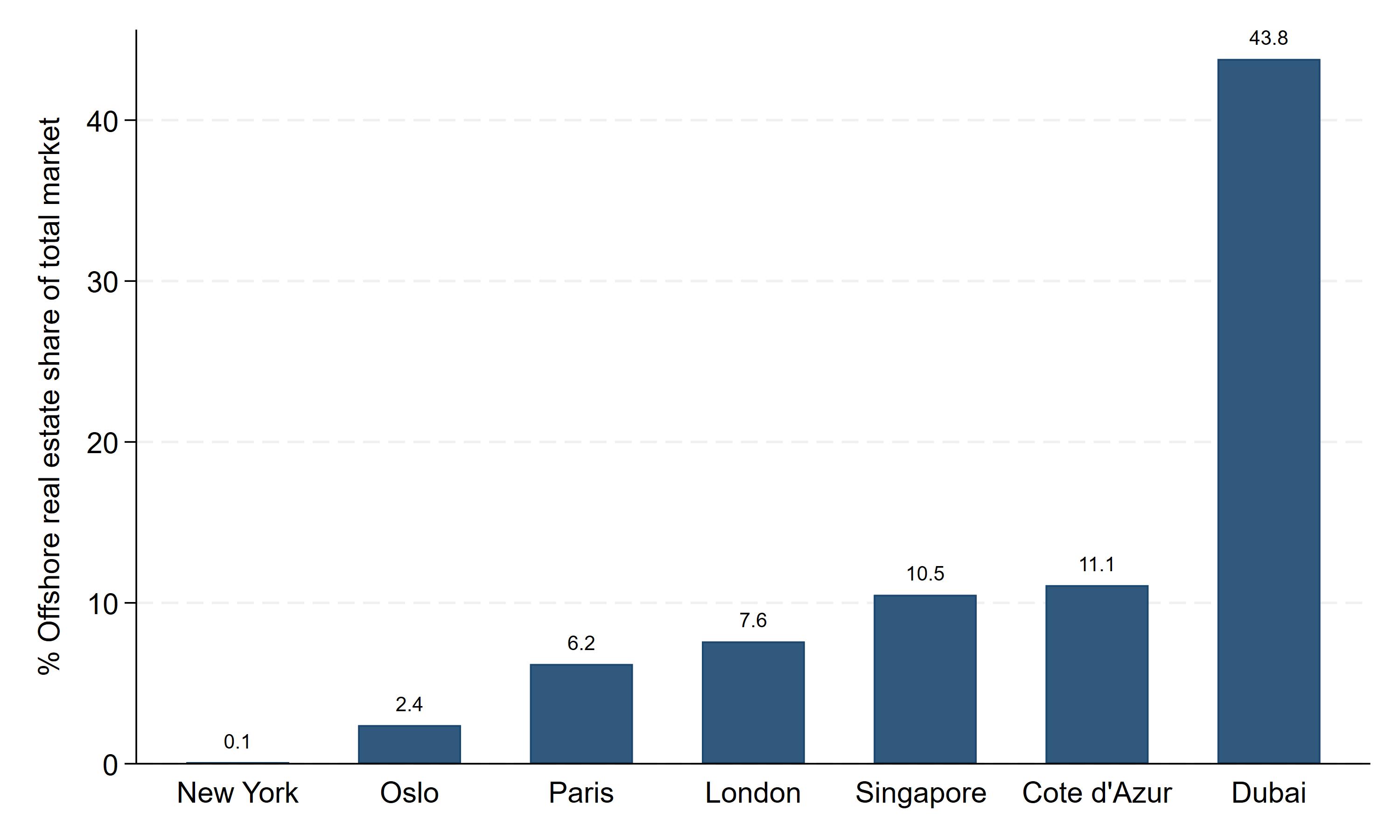

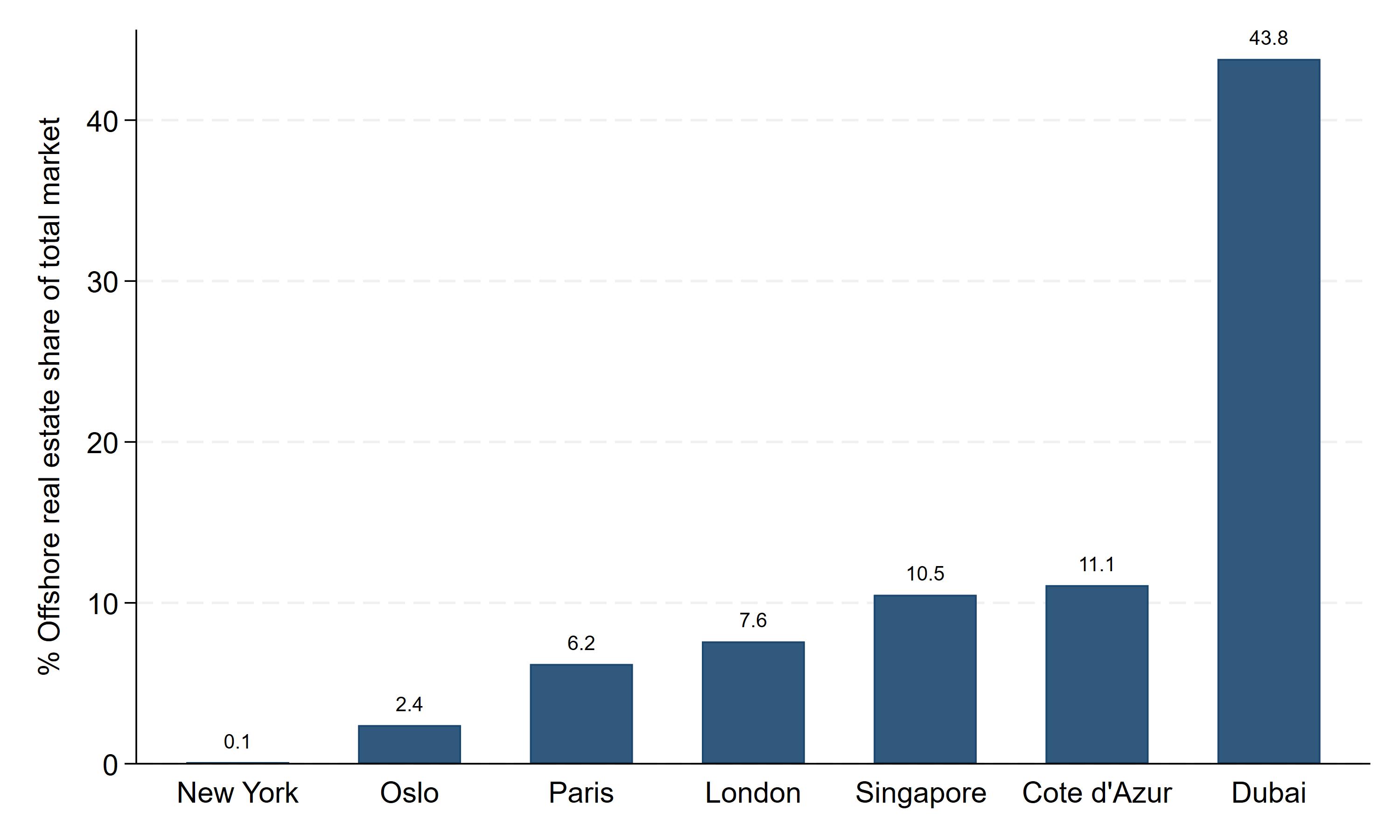

Figure 6 illustrateshowtheobservableoffshoreshareintheNewYorkCityhousingisconspicuously lowcomparedtootherlargecities.ThefigureshowsthattheoffshoreshareintheNewYorkCityresidentialrealestatemarket,0.1percent,isnotonlylowerthaninotherglobalmegacitieslikeLondon (7.6percent)andParis(6.2percent),butalsothefarlessinternationalOslo(2.4percent).

13Seethe NationalAssociationofRealtorsAnnualReportonforeignpurchases,whichprovidesroughestimatesofthetotal dollarvolumeofforeignpurchasesofexistingUShomes,aswellastheirdistributionacrossdifferentUSstates.

AnonymousRealEstate|11

Note: ThistablepresentstopinvestmentsbycountriesintheNewYorkRealEstatein2022.Thecountryoforiginismapped throughtheaddressesofthepartiesinvolvedinagivenpropertytransaction.

AnumberofstudieshavehighlightedtherolethatdifferentUSstatesplayinenablingownershipsecrecy,inparticularstateslikeDelawarewhichareknownforhostingalargenumberofshellcompanies (Aliprandietal., 2023).InTable 2,webreakdownownershipofNYCpropertybythespecificstatea companyisregisteredin.ThevastmajorityofthevalueisstillallocatedtocorporationsbasedinNew Yorkstate.ThisisinpartduetothepopularityofNYLLCsinholding,butalsoalimitationofouruse ofmailingaddressdata.However,thesecondmostpopularlocationweidentifyareDelaware-based companies,whichownatleast$27bofNYrealestate,roughly4%ofthetotalvalueinvestedbycorporations.

Usingpublicly-availabledata,wehaveshownthatmostNewYorkCityrealestateappearstobeowned byindividualsandentitiesbasedinthesamestate.Fromcountlessinvestigativeandindustryreports, weknowthattheshareofrealestateownedbyforeignersislikelytobemuchhigherthanwhatwe reporthere.Publicly,foreign-heldrealestateislargelymissingfromtheequation.Inthenextsection, we’llexplorepopularmethodsthatresearchersusetogetaroundtheopacityofownershipthatplagues realestatemarkets,andexplainwhythosemethodsfallshortintheUScontextduetoinsufficienttransparency.

TABLE1

Country ValueinBillions($)%TotalREWealth UnitedStates 1251.59 96.03 Unreported 48.27 3.70 Canada 0.72 0.06 UnitedKingdom 0.49 0.04 Singapore 0.36 0.03 Qatar 0.30 0.02 China 0.19 0.01 Germany 0.17 0.01 Spain 0.14 0.01 Japan 0.10 0.01 IsleofMan 0.10 0.01 Israel 0.09 0.01 HongKong 0.09 0.01 Switzerland 0.05 <0.01 BritishVirginIslands 0.05 <0.01

TopInvestmentsinNYCRealEstatein2022(byCountry)

AnonymousRealEstate|12

ObservableoffshoreownershipinNewYorkCityandotherrealestatemarketsaroundtheworld

Note: ThisfigurecomparestheobservableoffshoreresidentialrealestateinNewYorkCitywithsixothercitiesandareas aroundtheworld.Allnumbersareforresidentialrealestateonly,withtheexceptionofLondon.Themethodologybehind theestimatesisdocumentedisdocumentedin Alstadsæteretal. (2023),andtheLondonestimatesinmoredetailin Bomare andLeGuernHerry (2022).Thecountry-by-countryestimatesfromthedifferentcitiesareshownandcanbedownloaded from AtlasoftheOffshoreWorld

4 Whydoesthetrailruncold?

Intheprevioussection,wehighlightedhowalargeshareofresidentialrealestateinsomeofthelargest UScitiesareownedbyopaquecorporateowners.Butwhyisitsochallengingtolooppastthatcorporateownershipandestablishwhoaretherealownersofthesecompanies(andthusproperties)?Inthis section,wedescribethefourmaintoolsorsourcesofinformationthatresearchersandcivilsocietyorganizationsusetofindultimateownersandestimateforeign-heldrealestateforajurisdiction,andwhy thosetoolsarelesseffectiveintheAmericancontext.

Beneficialownershipregistries

Manycountriesaroundtheworldhavenowimplementedpublicregistriesofbeneficialownership,eitherfordomesticcompaniesoralso-inthecaseoftheUnitedKingdom-forforeigncompaniesthat holddomesticrealestate.Whiletheyare notperfect (Advanietal., 2023),public-facingregistriesare stillenormouslyusefulbecausetheyallowresearcherstomoreeasilypiercetheveilofcorporatesecrecywhenallocatingrealestatewealthtoforeignowners.Beneficialownershipregistrieswerecrucial indeterminingforeignownershipintheAtlasoftheOffshore’sestimatesforParisandCôted’Azur,as wellasintheUnitedKingdom(?).However,noUSstatecurrentlyhasabeneficialownershipinplace, andthefederalgovernment’scentralizedregisterhasbeenkeptprivate.

FIGURE6

AnonymousRealEstate|13

TABLE2

TopCorporateInvestmentsinNYCRealEstatein2022(byStates)

Note: ThistablepresentstopcorporateinvestmentsbystatesintheNewYorkRealEstate.Thestateoforiginismapped throughthejurisdictioninformationfromtheactivecorporationdatacombinedwiththeaddressofthepartiesinvolvedina givenpropertytransaction.

ORBIS

ORBIS,aproprietarydatabaseownedbyBureauvanDijk(BvD),isperhapsthelargestfirm-leveldatabase intheworld.Asthedatabaseincludesvastinformationonownershipstructure,manyresearchershave usedittostudythebehaviorofmultinationalsacrosstime.Somehavealsousedittoimproveuponestimatesofoffshoreownership,matchingfirmnamesinpublicrealestateregisterstothoseinORBISand usingthelatter’sinformationonultimatebeneficialownershiptobetter-detectforeign-ownedproperty(Johannesenetal., 2022).

However,ORBISsuffersfromtruelimitationsthatmakesitsusefulnessintheUScontextchallenging. ThefirstisthatitreliesentirelyonpublicinformationthathasbeencollectedbyBvD.Thatmeansthat itscoverageofultimateownershipwillbepoorincontextswheretheownershipstructureinvolvesjurisdictionsthatdonotpublishdetailedshareholderorbeneficialownershipinformation.Ifforexample aforeignerownsaDelawareLLCdirectly,andthatLLCownspropertyinMiami,ORBISwouldbeunabletorecordtheforeigner’sownership,becauseDelawaredoesnotpublishthisinformationpublicly. Onlyincircumstanceswherepartoftheownershipstructureistransparent,suchaswhentheparent companyintheownershipchainisregisteredinajurisdictionthatpublishedbeneficialownershipinformation,willORBISbeabletocorrectlyallocatethatownershiptotherightindividual.14

14ORBISisalsoexpensive,makingitadifficulttoolforinterestedpartiestoaccess.Furtherlimitationsincludeduplicate

ValueinBillions($)%TotalCorporateREInvestments NewYork 535.98 84.09 Delaware 27.11 4.25 Unreported 22.20 3.48 NewJersey 9.82 1.54 California 9.39 1.47 Florida 4.23 0.66 Illinois 4.11 0.65 Massachusetts 3.04 0.48 Texas 2.88 0.45 Connecticut 2.67 0.41 Ohio 2.25 0.35 Georgia 2.18 0.34 Colorado 1.77 0.28 Pennsylvania 1.58 0.25 Maryland 1.28 0.20

AnonymousRealEstate|14

Leakeddataonownershipstructures

ManyresearchershaveutilizedleakedownershipinformationpublishedbytheInternationalConsortiumofInvestigativeJournalists(ICIJ),includingthePanamaandPandoraPapers,toshedlightonownershipstructuresthatgovernrealestateinvestments.Thisapproachcanbearfruitwhenthereisa heavydegreeofoverlapbetweenthecoverageofICIJ’sdataandownershipchainsforagivenjurisdiction.Forexample,both ? and Johannesenetal. (2022)usetheICIJ’sOffshoreLeaksDatabaseto improveupontheirallocationofrealestateownershipinEnglandandWalestoforeignjurisdictions. ButtheICIJdatahaspoorcoverageofownershipstructuresthatbeginintheUnitedStates.Thisis becauseleakslikethePandoraandPanamaPapersinvolvedcorporateserviceproviderswhomainly specializedinsettingupshellcompaniesinoffshoretaxhavens.ThefactthatUSLLCsofferthesame secrecyasshellcompaniesinnotorioustaxhavens,whichmeansthatmostUSrealestateisownedby domesticLLCs,limitstheusefulnessofthisapproach.

Officialstatistics

Occasionally,governmentsthemselvescompileandpublishstatisticsontheultimateownershipofpropertyinawaythatcanbeusedtoidentifyhowmuchofthedomesticmarketisownedbyforeigners.For example,usingdatasourcedfromSingapore’sSingstat,thenationalstatisticalagency,andREALIS,a government-ownedrealestateinformationprovider,researchersattheEUTaxObservatoryhavederivedestimatesoftheforeign-ownedshare.15

YetintheUS,nogovernmentagencymakesanefforttocollateandpublishdetailedinformationonthe ultimateownershipofrealestate.PrivatesectorgroupssuchastheNationalAssociationofRealtors dooccasionallyrelease reports detailingtrendsinforeignownership.Butbecausethesestatisticsare basedonsurveysofrealtorsratherthanadministrativedata,theyareunlikelytobewhollyaccurate, eveniftheymightofferasenseoftheorderofmagnitude.

Consolidateddatathatcouldbeusedtopiercetheveilofcorporatesecrecydoesexist,butitisnotcurrentlyavailabletothepublic.Sinceearly2016,theFinancialCrimesEnforcementNetwork(FinCEN), partoftheUSTreasury,hasbeengatheringdataonthebeneficialownershipofresidentialpropertiesin certainpartsoftheUS.TheirGeographicTargetingOrder(GTO)program,whichnowcoversatleast55 countiesacrosstheUS(morethan30%ofthevalueofallrealestatesales),requirestitleinsurancecompanieswhocoverresidentialpropertiespurchasedbycorporationswithoutamortgagetocollectbeneficialownershipinformation.TheGTOprogramnowcoversallofNewYorkCity,MiamiandBoston, aswellasalltransactionsabove$300,000,whichcoversthemajorityofthosethatoccurinthethree cities.TheUSTreasuryisalsomakingplanstoexpandtheGTOprogramnationwide,whichmeansthat namesofforeignentities,andtheinformationitpublishesistypicallyafewyearsold.

15InSingapore,residentialrealestatecomprisespublicandprivatehousingsegments.Publichousingisexclusivelyavailable toSingaporeancitizens,whileprivatehousinghasnonationalityrestrictions.Todetermineforeignownership,weincludepublichousingintheoverallhousingstockdenominator.Weallocateprivatehousingdatatospecificcountriesbasedonhousing purchasestatisticsspanning1995to2019,encompassingdistrict,propertytype,andbuyernationality.Transactionvalues areapproximatedfrompricerangebins,adjustedusingannualpriceindicatorsbypropertytype,andaggregatedbycountry annually.

AnonymousRealEstate|15

FinCENwillsoonhavetherequisitedatatobetterunderstandtheultimateownershipofthemajority ofpropertysalesintheUS.

Similarly,datagatheredundertherecently-introducedCorporateTransparencyAct,whichcentralized thegatheringofbeneficialownershipinformationforallUS-basedentitiesunderthecontrolofFinCEN, couldbeusedtoshedlightontheproblem.However,aswiththeGTOprogram,theinformationgatheredthereisnotpublishedpublicly.Inthenextsection,wewillexplainhowthisinformationcouldbe usedtosolvethemysteryofforeignownershipofUSrealestate.

5 PolicyImplications

ThefactthatthesizeandscopeofforeigninvestmentinUSrealestateremainsamysteryisnotadata problem,butapolicyone.Changestothewaythatfederalandstateauthoritiescollectandpublish informationwouldprovidepolicymakers,researchersandcivilsocietytheabilitytobothestimateand trackinvestmentsacrosstime.

Inthissectionwedescribethepolicychangesthatwouldbenecessaryforthistohappen,startingwith theonesthatwouldhavethebiggestimpact.

Recommendation1:Apublic,machinereadablebeneficialownershipregistry

Inthebeginningof2024,theUSTreasurybeganimplementingtheCorporateTransparencyAct(CTA), thefirst-everefforttomandatethereportingofbeneficialownershipinformationintheUSaswellas centralizeitscollection.TheCTArequiresallcorporateentities(companies,LLCs,LPs,andevenforeigncompaniesregisteredtodobusinessintheUS)tofileultimatebeneficialownershipinformation withFinCEN.Existingbusinesseshaveuntilthebeginningof2025tocomeintocompliance,wherenew entitiescreatedafterJanuary1,2024havetocomplyimmediately.

Bytheendof2024,FinCENwillhaveamalgamatedacomprehensivedatabaseofbeneficialownership ofeverycompanythatdoesbusinessintheUnitedStates.However,theCTAdoesnotprovideany mechanismforthepublictohaveaccesstothatdata.OtherlawenforcementagenciesandtheIRSwill beabletosearchthedatabase,andfinancialinstitutionswillhaveaccesswiththeircustomer’s consent. Buttheseagencieswillnotlikelyhavetheresourcestoconductasystematicanalysisofforeign-owned property.

TheeasiestsolutionwouldbetomakeaccesstoFinCEN’sdatabasepublic,inamachinereadablefashion,muchinthesamewaythattheUK’sCompaniesHousedoeswithitsRegisterofPeoplewithSignificantControl.Thiswouldallowinterestedpartiestolinkstate-levelrealestateregisterstothebeneficial ownershipdatabase,makingamorepreciseestimationofforeign-ownedrealestatepossible.Itwould alsomakethedatabasemoreeffective,byallowingtheinterestedpublictocross-checkandverifythe informationitcontains.

However,thiswouldrequireasignificantamendmenttotheCTA,atatimewhentherehasalreadybeen pushbackagainstpublicbeneficialownershipregistriesduetoprivacyconcerns.AnalternativethataccommodatestheseconcernswouldbetofollowtheEU,whofollowingthe2022 ruling oftheEuropean AnonymousRealEstate|16

CourtofJustice,revisedtheirpoliciesinearly2024tostillrequireultimatebeneficialownershipregistriesandallowaccesstopublicauthoritiesandrelevantstakeholders,likebanksandothercompanies involvedinanti-moneylaunderingworkand“personsofthepublicwithlegitimateinterest”,suchasthe press,researchersandNGOs.

Inthemeantime,NewYorkStatewilltakethefirststepinprovidingthepublicwithaccesstobeneficial ownershipinformation.ThankstotheintroductionoftheNewYorkLLCTransparencyAct(NYLTA), beginningin2025,companiesthatdobusinessinthestatewillhavetobeginfilingsimilarinformation withthelocalDepartmentofState.IncontrasttotheCTA,theNYLTAwillmakesomeoftheinformationgatheredpublic:thenameandmailingaddressofthebeneficialowner.Twokeyprovisionswillbe essentialtomakingthisworkproperly:First,thattheinformationismadepublicinamachine-readable format.Andsecond,thatitincludesthecountryofresidencyorthenationalityofthebeneficialowner. Inthemeantime,otherstatescouldadoptsimilarlawsinordertobypassthelackofpublictransparency intheCorporateTransparencyAct.

Recommendation2:Thepublicationofroutine,publicly-availablestatisticsonforeign ownershipofUSproperty

WhileamendingtheCorporateTransparencyAct(andexpandingtheinformationcollectedunderthe NewYorkLLCTransparencyAct)wouldallowresearchersandotherstothoroughlymonitortheUSreal estatemarket,theUSauthoritiesalreadygatherinformationthattheycanputtoworkandusetoinform thepublic.

Asecond-bestsolutionwouldbefortheUSTreasurytoregularly-publishinformationontheforeign ownershipofpropertyusinginformationitgathersthroughtheGeographicTargetingOrder,whichrequiresthefilingofidentitydocumentationforbeneficialownersofcompaniesthatbuyrealestatewithoutamortgage.Whilenotperfect,thisidentitydocumentationcouldbeusedtoassignthepersontoa probablejurisdictionoforigin.ItwouldbethenstraightforwardforFinCENtoaggregatethevalueof corporate,cashpurchasesgovernedundertheGTOprogrambythejurisdictionofthebeneficialowner andpublishthisinformationonamonthly,quarterlyorannualbasisatthenational,stateorevencounty level.Suchinformationwouldofferonlyapartialpictureoftheflowofnewforeigninvestmentinthe USrealestatemarket,butwouldbesufficientforresearcherstomakeinitialestimatesthatcouldbe extendedtotherestofthecountry,withsomeassumptions.

Ofcourse,FinCENhasallthetoolsonhandtocomeupwithmorecomprehensiveestimates:bycombiningthefilingsmadefortheCorporateTransparencyActwiththerealestateregistriespublishedby citieslikeNYC,MiamiandBoston,FinCENwouldbeabletopublishdetailedestimatesofthestockof foreign-heldrealestateforthemostimportantmarketsinthecountry.Butatpresent,withoutasignificantincreaseintheagency’sresources,adetailedanalysislikethisisunlikelyinthefuture.

OnewaytobridgethisgapwouldbeforFinCENtoembracecollaborationwithacademicresearchers, muchinthesamewaythattheIRSfrequentlydoesinordertoconductpolicy-relevantresearchusing sensitivedata.Suchcollaborationshavebeenfruitfulinthepast,allowingtheIRStobetterunderstand therisksitfacesregardingtaxevasion,bothonandoffshore(Johannesenetal., 2020; Guytonetal.,

AnonymousRealEstate|17

2021).DoingsowouldhelpFinCENexpanditsanalyticalcapacitysubstantiallyatlittlecost.

6 Conclusion

Inthisnote,wehavedescribedthesignificantrisksassociatedwithanonymousrealestateownership, particularlyownershipthatiscrossborderinnature.UsingdatafromthreemajorUScities,wehave demonstratedthatasubstantialportionofbothtotalrealestateandresidentialrealestateisheldthrough corporatevehiclesthatobscureitsultimateownership.Webelievetheseofficialstatisticsdrastically undercountforeignownership,butaswehavedescribed,traditionalmethodsofallocatingtheownershipofrealestatedonotworkwellintheUScontext.

Wehavesuggestedawayforward:iffederalandstateauthoritieswishtoimproveboththepublic’s aswellastheirownunderstandingofhowmuchrealestateownershipiscross-border,theyneedto eithergatherandreleasetheinformationthatresearchersneedtomaketheirestimates,ortheyneed toaggregateandpublishthoseestimatesthemselves.Untilthen,themysteryofanonymousownership ofUSrealestatewillcontinue,andourcollectiveunderstandingofitsscalewillcontinuetosuffer.

AnonymousRealEstate|18

References

Advani,A.,Poux,C.,Powell-Smith,A.,andSummers,A.(2023).Catchmeifyoucan:GapsintheRegister ofOverseasEntities.

Aliprandi,G.,Busschots,T.,andOliveira,C.(2023).MappingtheglobalgeographyofShellCompanies. EUTaxObservatoryNote.

Alstadsæter,A.,Collin,M.,Planterose,B.,Zucman,G.,andØkland,A.(2024).ForeignInvestmentinthe DubaiHousingMarket,2020-2024.Technicalreport.

Alstadsæter,A.andØkland,A.(2022).Increasingcross-borderownershipofRealEstate:Evidencefrom Norway.

Alstadsæter,A.,Zucman,G.,Planterose,B.,andØkland,A.(2022).Whoownsoffshorerealestate? EvidencefromDubai.

Alstadsæter,A.,Collin,M.,Mishra,K.,Planterose,B.,Zucman,G.,andØkland,A.(2023).Towardsan AtlasofOffshoreRealEstate:EstimatesforSelectedAreasandCities.WorkingPaper.

Bomare,J.andLeGuernHerry,S.(2022).WillweeverbeabletotrackOffshoreWealth?Evidencefrom theoffshorerealestatemarketintheUK.EUTaxObservatoryWorkingPaperNo.4.

Collin,M.,Hollenbach,F.,andSzakonyi,D.(2021).Theimpactofbeneficialownershiptransparencyon illicitpurchasesofU.S.property.Technicalreport.BrookingsGlobalWorkingPaper170.

FATF(2007).MoneyLaunderingandTerroristFinancingthroughtheRealEstatesector.Technicalreport,FinancialActionTaskForce.

FATF(2022).GuidanceforRiskBasedApproach:RealEstatesector.Technicalreport,FinancialAction TaskForce.

GFI(2021).AcresofMoneyLaundering:WhyU.S.RealEstateisaKleptocrat’sDream.Technicalreport, GlobalFinancialIntegrity.

Guyton,J.,Langetieg,P.,Reck,D.,Risch,M.,andZucman,G.(2021).TaxEvasionatthetopoftheIncome Distribution:TheoryandEvidence.

Johannesen,N.,Langetieg,P.,Reck,D.,Risch,M.,andSlemrod,J.(2020).Taxinghiddenwealth:The consequencesofUSenforcementinitiativesonevasiveforeignaccounts. AmericanEconomicJournal: EconomicPolicy,12(3):312–346.

Johannesen,N.,Miethe,J.,andWeishaar,D.(2022).HomesIncorporated:Offshoreownershipofreal estateintheUK.

Tuttle,B.(2020).LaboratoriesofSecrecy.

AnonymousRealEstate|19

A AdditionalTablesandFigures

TABLEA1

SummaryStatistics:AllProperties Percentiles,MedianandMean

Note: ThistablepresentssummarystatisticsofvaluesforNewYork,MiamiandBostonpropertiesfromtheadministrative data.Anobservationisauniqueproperty.

TABLEA2

AnIllustrationofJurisdictionMapping

Note: Method1involvesgatheringinformationfrombothCorporateRegistryandACRISParties,whichissubsequently mergedwith2019NewYorkRealEstateDatatoascertaintheultimatejurisdictionofthesecorporateentities.Conversely, Method2involvesextractingdatafromACRISPartiesandthencombiningitwith2019NewYorkRealEstatedatato determinethejurisdictionofcorporateentitiesengagedinpropertytransactions.

No.ofProperties25thMedianMean 75thMax NewYork 1,112,517 Value(USD) 396,085660,0001,443,0761,020,00016.1bn Miami 918,696 Value(USD) 251,160371,200724,715547,682.5587mn Boston 177,091 Value(USD) 313,000511,7001,284,306766,5001.86bn

ValueinBillions($)%TotalCorporateREInvestments Method1 NewYork 479.82 86.22 Method2 NewYork 458.04 82.19

AnonymousRealEstate|20

SummaryStatistics:AllPropertiesbyTaxClass

Note: ThistablepresentssummarystatisticsforvaluesforNewYork,MiamiandBostonpropertiesfromtheadministrative data.For,NYC,Class1:Mostresidentialpropertyofuptothreeunits(familyhomesandsmallstoresorofficeswithoneor twoapartmentsattached),andmostcondominiumsthatarenotmorethanthreestories.Class2:Allotherpropertythatis notinClass1andisprimarilyresidential(rentals,cooperativesandcondominiums).Class3:Mostutilityproperty.Class4: Allcommercialandindustrialproperties,suchasoffice,retail,factorybuildingsandallotherpropertiesnotincludedintax classes1,2or3.Toensureuniformityandenablecomparisonamongdatasetsfromdifferentregions,weemployasimilar consistentTaxClassclassificationsystemfortherealestatemainlyTaxClass1forresidentialandOthersanddatasetsof bothBostonandMiami.Anobservationisauniqueproperty.

TABLEA3

ValueinMillions($) No.ofPropertiesTotalValueAvgValueofPropertyMedianMax NewYork Total 1,112,517 TaxClass1704,284 664,0000.94 0.74594 TaxClass2294,094 386,0001.31 0.331,650 TaxClass3382 40,300105 1.608,070 TaxClass4113,757 547,0004.8 0.4416,100 Miami Total 918,696 TaxClass1815,259 485,0000.59 0.37546 Others103,437 181,0001.75 0.30587 Boston Total 177,091 TaxClass1140,996 115,0000.81 0.59415 Others25,869 126,00048.7 0.231,850

AnonymousRealEstate|21

ActiveCorporationDensitybyZipCodeinNewYork

Note: Thefigurepresents-densityofactivecorporationsbyzipcodelevelinNewYork.TheDepartmentofStatekeepsa recordofeveryfilingforeveryincorporatedbusinessinthestateofNewYork.

ProportionofResidentialUnitsownedbyCorporationsfromDelaware

Note: Thefigurepresents-theproportionofresidentialpropertiesinagivenzip-codethatareowned,whollyorpartly,bya companywithajurisdictionmappedtoDelaware.

FIGUREA1

FIGUREA2

AnonymousRealEstate|22

FIGUREA3

ShareofallpropertiesinaNewYorkCityzip-codethatareownedbyacompany

Note: Thefigurepresents-forNewYorkCity-theproportionofallpropertiesinagivenzip-codethatareowned,whollyor partly,byacompany.

DistinctionbyTaxClassinNewYorkRealEstate

Note: ThefigureillustratesshareofownershipthroughcorporationswithineachtaxclassoftotalrealestatevalueinNew York.Theestimatesuse2022assessmentvaluationandownershipinformationfromNewYorkCity’sDepartmentof FinanceanditsAutomatedCityRegisterInformationSystem(ACRIS).

FIGUREA4

AnonymousRealEstate|23

Note: ThefigurepresentstheshareofownershipthroughlimitedliabilitycompaniesoftotalrealestatevalueinNewYork City,MiamiandBoston.NYCestimatesuse2022assessmentvaluationandownershipinformationfromNewYorkCity’s DepartmentofFinanceanditsAutomatedCityRegisterInformationSystem(ACRIS).Miamiestimatesaretakenfrom Miami-DadePropertyAppraiserpublishedasof2023.Bostonestimatesarederivedfrom2021datapublishedbytheCityof Boston’sAnalyzeBostonopendatahub.Corporateownershipwasidentifiedthroughthepresence“noisewords”associated withlimitedliabilitycompaniessuchas“LLC”,“LP”,etc.

FIGUREA5 ShareofcorporateownershipthoughLimitedLiabilityCorporations

AnonymousRealEstate|24

B.1 KeywordsforFlaggingCorporateOwnershipintheU.SDataset

Comprehensivelistoftermsandabbreviations,carefullycompiledthroughanin-depthanalysisofthe data.Thesetermsarecommonlyusedtoflagcorporationsbasedonownernamesandincludethefollowing:

“LLC”,“L.L.C”,“CORP”,“BANK”,“HOLDING”,“CO”,“INC”,“LL”,“AND”,“LC”,“ASSN”,“ASSOC”,“ASSOCIATION”,“BUSINESSTRUST”,“CHARTERED”,“CHTD”,“CO-OP”,“COMPANY”,“COOPERATIVE”,“CORP.”, “CORPORATION”,“CREDITUNION”,“FCU”,“FEDERALCREDITUNION”,“FEDERALSAVINGSBANK”, “FSB”,“GENERALPARTNERSHIP”,“GMBH”,“INC.”,“INCORPORATED”,“JOINTSTOCKCOMPANY”, “JOINTVENTURE”,“JSC”,“JV”,“LIMITED”,“LIMITEDCOMPANY”,“LIMITEDLIABILITYCOMPANY”, “LIMITEDLIABILITYLIMITED”,“LIMITEDLIABILITYPARTNERSHIP”,“LIMITEDPARTNERSHIP”,“LLC”, “LLLP”,“LLP”,“LP”,“LTD”,“LTDCO”,“MD”,“MDPA”,“MEDICALDOCTOR”,“NATIONALASSOCIATION”, “PARTNERSHIP”,“PLC”,“PLLC”,“PROFESSIONALASSOCIATION”,“PROFESSIONALCORPORATION”, “PROFESSIONALLIMITEDCOMPANY”,“PROFESSIONALLIMITEDLIABILITYCOMPANY”,“REGISTEREDLIMITEDLIABILITYPARTNERSHIP”,“RLLP”,“SAVINGSASSOCIATION”,“SSB”,“TRUST”,“ACQUISITION”,“ENTERPRISES”,“INFRASTRUCTURE”,“PROPERTIES”,“PROPERTY”,“ESTATE”,“INDUSTR”, “OFFICE”,“INVESTMENTS”,“BROTHER’S”,“MANAGEMENT”,“PARTNERS”,“RETAIL”,“GROUP”,“CONSTRUCTION”,“UNION”,“ESTATE”.

Followingthecompilationofthislist,anextensivemanualcleaningprocesswasundertakentoensure thatindividualswiththesekeywordsarenotinadvertentlyincluded.

B.2 PropertyinNYCisdividedinto4broadTaxClasses:

• Class1:Mostresidentialpropertyofuptothreeunits(familyhomesandsmallstoresoroffices withoneortwoapartmentsattached),andmostcondominiumsthatarenotmorethanthreestories.

• Class2:AllotherpropertythatisnotinClass1andisprimarilyresidential(rentals,cooperatives andcondominiums).

• Class3:Mostutilityproperty.

• Class4:Allcommercialandindustrialproperties,suchasoffice,retail,factorybuildingsandall otherpropertiesnotincludedintaxclasses1,2or3.

C DataConstruction

Misc

B

AnonymousRealEstate|25

C.1 NewYork

IntheprocessofextractingandanalyzingdatafromtheNYCAutomatedCityRegisterInformationSystem (ACRIS),wereliedon datasets relatedtoparties,masterrecords,legaldocuments,andvaluation. Ourgoalwastorevealtheintricatepatternsofpropertytransactionsandownershipshifts.Weintersectedthemaster,parties,andlegaldatasetstotrackpropertydealingsinvolvingindividualsandcorporateentities,suchasLimitedLiabilityCompanies(LLCs),andnotedownershipchanges.Althoughthe valuationdatasetcontributedtoourunderstanding,itslimitedinformationoncorporateownershipindicatedanotablegapincapturingcomprehensivecorporatepropertystakes.

Ourmethodologyincludedidentifyingcorporateownershipindicatorswithinpropertydeeds,notably thementionof”LLCs”.Thisapproach,uponvalidation,facilitatedananalysisofresidentialpropertyvaluationsandtransactionsacrossthecity,employingtaxclassificationdistinctions.Wefurtherrefined ouranalysisbyfilteringoutnoisewordsfromownerandpartynamestoflagcorporateownership,uncoveringpotentialinadequaciesinthevaluationdataset’soverallrepresentationofcorporateentities. Additionally,weaddressedownershiparrangementsbyequitabledistributionofeachproperty’svalue, enhancingourinsightintothedistributionofpropertyownership.

WealsoutilizedtheActiveCorporateRegistrytosupplementmissingdata,particularlyconcerningcorporatejurisdictions,andtoanalyzecorporatedensityatthezipcodelevel.ThisapproachaidedinmappingthegeographicaldistributionandpotentialconcentrationofshellcompaniesinNewYork’sreal estatemarket.

C.2 MiamiandBoston

ForouranalysisonMiamiandBoston,wesourceddatafromadministrativepublicdatabases: theMiamiDadePropertyAppraiser andtheCityofBoston’sopendatahub,(AnalyzeBoston).Weusedthemost currentdataavailableattheonsetofourresearch—2023dataforMiamiand2021dataforBoston.

Ourmethodologyinvolvedidentifyingcorporate-ownedpropertiesbyfilteringpropertyrecordsfor ’noisewords’indicativeofcorporateentities(e.g.,LLC,Cooperative).Thisapproachisconsistentwith ouranalysisinNewYorkCity.However,whileBoston’srecordslistonlyoneownerperproperty,Miami’sdatasetallowsforuptotwoownersperproperty.Thisdiscrepancyintroduceschallengesinaccuratelyidentifyingpotentialadditionalstakeholdersinpropertydeeds.Consequently,theabsenceof comprehensivetransactionaldatamayleadtoanunderestimationoftheactualnumberofcorporate propertyownersinMiamiandBoston.

Tocompensateforvaryingdatastructuresacrosscities,wedevisedastrategytostandardizeproperty classification.MirroringNewYorkCity’suseoftaxclassvariables,wedevelopedananalogousvariableforMiamiandBoston.Thiswasachievedbyleveraginglandusecodesandpropertyclassification dataprovidedwithineachcity’sdataset.Thisstandardizationenablesustocategorizepropertiesaseitherresidentialornon-residential.Coupledwithourcorporateownershipidentificationalgorithm,this methodologyaidsindemystifyingtheownershipstructuresofpropertiesinMiamiandBoston,enhancingtransparencyinouranalysisofmysteriousinvestments.

AnonymousRealEstate|26

D ShellAnalysisFigures

FIGURED1

TopAddressesbyCorporationDensityintheActiveCorporateRegistry

Note: Thefigurepresents-top20addressesbynumberofcorporationsregisteredintheActiveCorporateRegistryinNew York.TheDepartmentofStatekeepsarecordofeveryfilingforeveryincorporatedbusinessinthestateofNewYork.Data ActiveCorporations:Beginning1800

AnonymousRealEstate|27

TopAddressesinNewYorkRealEstatebyCorporationDensity

Note: Thefigurepresents-top20addressesbynumberofcorporationsregisteredonthemailingaddressesinNewYork RealEstate.TheaddressesweremappedusingtheNewYorkdatabasefromACRISandthedataofcorporateregistryActiveCorporations:Beginning1800

FIGURED2

AnonymousRealEstate|28