PierreBachas† ,MatthewFisher-Post‡ ,AndersJensen§ ,GabrielZucman¶

May2024 Abstract

Thispaperbuildsandanalyzesanewglobalmacro-historicaldatabaseofeffective taxratesoncapitalandlaborin154countries.Weestablishanewstylizedfact:while effectivecapitaltaxratesfellindevelopedcountriesbetween1965and2018,theyrose indevelopingcountriessince1990.Multipleresearchdesignsatthecountry,sector andfirm-levelsuggestthattradeopennesscontributedtothisrise,byincreasingthe shareofoutputproducedincorporationsandlargerfirms,whereeffectivecapital taxationishigher.Incontrasttoacommonview,globalizationappearsinmany countriestohavesupportedgovernments’abilitytotaxcapital.

∗Thispaperwaspreviouslycirculatedunderthetitle"GlobalizationandFactorIncomeTaxation."The databasebuiltinthispaperisavailableonlineat http://globaltaxation.world.Additionalmaterialis availableintheonlinesupplementaryappendix: linkhere.Weacknowledgefinancialsupportfromthe WeatherheadCenterforInternationalAffairsatHarvardUniversityandtheWorldBankDevelopment Economics’ResearchSupportBudget.ZucmanacknowledgessupportfromtheStoneFoundation.We areindebtedtoElieGerschel,XabierMoriana,RafaelProença,RoxanneRahnamaandAntonReinicke forexcellentresearchassistance.WethanknumerousseminarparticipantsandinparticularPierreBoyer, DamienCapelle,DenisCogneau,MartinFiszbein,JasonFurman,SimonGalle,PinelopiGoldberg,Gordon Hanson,AmitKhandelwal,DavidLagakos,EtienneLehmann,JulianaLondoño-Vélez,BenjaminMarx, SergeyNigai,MathieuParenti,StevenPennings,NamPham,ThomasPiketty,TristanReed,AriellReshef, BobRijkers,DaniRodrik,NicholasRyan,EmmanuelSaez,NoraStrecker,RomainWacziarg,DanielYiXu andRomanZarateforinsightfulcommentsanddiscussions.Thefindings,interpretations,andconclusions expressedinthispaperarethoseoftheauthorsanddonotrepresenttheviewsoftheWorldBankand itsaffiliatedorganizations,orthoseoftheExecutiveDirectorsoftheWorldBankorthegovernmentsthey represent.

†ESSEC-BusinessSchoolandWorldBankResearch,pbachas@worldbank.org

‡ParisSchoolofEconomics,mfp@psemail.eu

§HarvardKennedySchoolandNBER,anders_jensen@hks.harvard.edu

¶ParisSchoolofEconomics,UCBerkeleyandNBER,zucman@berkeley.edu

CapitalTaxation,Development,andGlobalization:

∗

EvidencefromaMacro-HistoricalDatabase

1Introduction

Howhasglobalizationaffectedtherelativetaxationofcapitalandlabor?Hasituniformly erodedtheamountoftaxespaidbycapitalowners,shiftingtheburdentoworkers? Orhavesomecountriesmanagedtoincreaseeffectivecapitaltaxrates,andifsohow? Answeringthesequestionsiscriticaltobetterunderstandthemacroeconomiceffectsand socialsustainabilityofglobalizationinuncertaintimes (Goldberg&Reed, 2023).

Basedonanewlong-runglobaldatabaseofeffectivetaxratesoncapitalandlabor, wedocumentthatindevelopingcountries,effectivecapitaltaxrateshaveincreasedin thepost-1990eraofhyper-globalization.Consistentlyacrossseveralresearchdesigns,we findthatasignificantshareofthisrisecanbeexplainedbytradeopenness.Byexpanding theshareofeconomicactivityoccurringinthecorporatesector,andwithinthecorporate sectorinlargerfirms,ourresultsshowthattradeimprovestheeffectivecollectionoftaxes, particularlycorporateincometaxes.Globalizationhasalsohadwidelynotednegative effectsoncapitaltaxation,duetointernationaltaxcompetitionthatappliesdownward pressureoncorporatestatutorytaxrates.Wefindthatthepositivetaxcapacityeffectof tradeweuncoverprevailedindevelopingeconomies,causingopennesstoincreaseoverall governmenttaxrevenues(asa%ofGDP).Therevenueconsequencesofglobalization havenotbeensystematicallyinvestigatedindevelopingcountriesduetolimiteddata, andconcernsoverpotentialrevenuelosseshavepersistedasakeyobstacletofurther integrationacrossborders (WorldBank, 2020). Incontrasttoacommonview,ourfindings showthatglobalizationhasnotuniformlyerodedgovernments’abilitytoraiserevenue, andinsteadappearstohavesupportedcapitaltaxationinmanycountries.

Toestablishtheseresults,thispapermakestwocontributions.Thefirstistobuild andanalyzeamacro-historicaldatabaseofeffectivetaxratesoncapital(ETRK )andlabor (ETRL)covering154countries,withoverhalfstartingin1965,until2018.Each ETR dividesalltaxescollectedonthefactorbythenationalincomethataccruestoit;byrelying onactualtaxescollected, ETRscapturethenetpasteffectofalltaxrulesand,importantly fordevelopingcountries,taxevasionandavoidance.Complementarytoexisting ETR seriesthatfocusondevelopedcountries,ourdataprovidesaglobalcoveragebydigitizing andharmonizingthousandsofhistoricalandrecentpublicfinancerecordsindeveloping countries.Theglobaldatabaseallowsustosystematicallycharacterizetheevolutionof effectivetaxratesindevelopingcountriesandcomparetrendsacrossdevelopmentlevels.

Anovelfactemergesfromthisdatabase:theevolutionofcapitaltaxationhasbeen asymmetricacrossdevelopmentlevels.Inhigh-incomecountries,effectivecapitaltax ratesdeclined,fromahighof38-39%inthelate1960sto32-33%inthelate2010s.By

1

contrast,indevelopingcountries,effectivecapitaltaxrateshavebeenonarisingtrend sincethebeginningofthe1990s,albeitstartingfromalowlevel.Effectivecapitaltax ratesrosefrom10%in1989to18%in2018,withmorepronouncedincreasesinlarger economies.Forexample, ETRK rosefrom6%to24%inChina,5%to12%inIndia,and 7%to27%inBrazil.Thepositivetrendincapitaltaxationisdrivenbythecorporatesector: theaverageeffectivecorporatetaxraterosefrom12%in1989to20%in2018.

Thisriseofcapitaltaxationinlow-andmiddle-incomecountrieshadnotbeennoted intheliteraturebefore,duetoalackofdataontheevolutionoftaxationglobally.The findingappearsrobust.Itholds:whenweexcludeChinaandoil-richcountries;with otherapproachestocomputingcapitalandlaborincomeinunincorporatedbusinesses (wherefactorsharesarenotdirectlyobservable);andwithalternativewaysofsplitting personalincometaxrevenuebetweencapitalversuslabor.

Oursecondcontributionistoformulateandtestahypothesisthatshedslightonthe riseofcapitaltaxationindevelopingcountries.Wehypothesizethatopennessexertsa positiveeffectondevelopingcountries’capacitytotax,consistentwithtradeleadingtothe expansionoflargerfirmsrelativetosmallerones (Mrázová&Neary, 2018) andfirm-level effectivetaxationrisingwithsize,duetobetterenforcementandhigherstatutorytaxburdens (Almunia&Lopez-Rodriguez, 2018;Best,Shah,&Waseem, 2021).1 Ourhypothesis ismotivatedbytheobservationthattherisein ETRK coincideswithtradeliberalization. Sincethebeginningofthe1990s,manydevelopingcountriesopenedtheirmarketsand reducedtariffs,leadingtoaboomininternationaltradethatreshapedtheeconomiesof Mexico,India,andChinaamongothers (Goldberg, 2023). Bydisproportionatelybenefitinglargerfirms,tradecanincreasetheshareofeconomicactivityincorporationsand moreformalbusinesses,whereeffectivetaxationofcapital(andlabor)ishigher.

Tomotivatethetaxcapacityhypothesis,Figure 1 showsthattheshareofdomestic outputfromthecorporatesector(profitsandemployeecompensation)hasgrownover timeindevelopingcountries,attheexpenseofmixed-income(incomeofself-employed andunincorporatedbusinesses).Whilethecorporatesectoraccountedfor53%ofdomestic outputin1989,priortothehyper-globalizationera,itgrewto62%by2018;mixedincome fellfrom32%to20%overthesameperiod.Thus,developingcountrieshaveexperienced arelocationofactivityfromahard-to-taxsectortoasectorwithstrongereffectivetaxation.

1Highereffectivetaxationinthecorporatesectorstemsbothfromstrongerenforcementandhigherstatutory taxesthaninthenon-corporatesector.Ournotionoftaxcapacityisthattheseco-determinedforcesjointly leadtohigher ETRK withfirmsize(wheresizeismeasuredasfirmoutput,inourcaserevenue).

2

Weestablishthesecondcontributionintwosteps.First,westudytheimpactoftrade ontaxationindevelopingcountries,withafocuson ETRK andcorporatetaxes.Second, westudymechanismsthatlinktradetotaxation,withafocusonthetaxcapacitychannel.

Weimplementthreeresearchdesignstostudyhowtradeimpactstaxation.First,we estimatethenon-parametricassociationwithinacountryovertimebetween ETR and tradeopenness.Second,weanalyzemajortradeliberalizationeventsthatoccurredin sevenlargedevelopingcountries,includingChina’sWTOaccessionin2001,andcaused sharpreductionsintradebarriers (Brandt,Biesebroeck,Wang,&Zhang, 2017;Goldberg& Pavcnik, 2016). Weusesyntheticcontrolmethodsandpresentevent-studyresults.Third, weextendthetradeinstrumentsfrom Egger,Nigai,andStrecker(2019) tooursample.

Allthreedesignsshowthat,indevelopingcountries,tradeleadstoalargeincreasein ETRK ,andasmallerincreasein ETRL.Theeffectissizable:tradeopennesscanaccount for33%ofthedocumentedrisein ETRK since1989.Althoughstudyingmacroeconomic outcomespresentsidentificationchallenges,theresultsareconsistentacrossresearchdesigns,whichdifferintheiridentifyingassumptions,andarerobusttonumeroussensitivity checks.Acrosstheresearchdesigns,wealsofindthattradeleadstoanincreaseintotal taxrevenues(asa%ofGDP).Reflectingtrade’spositiveimpacton ETRK ,overhalfof thisincreasecomesfromhighercorporateincometaxes(CIT),andasmallersharefrom personalincometaxesandpayroll.Indirecttaxes(combiningtariffrevenuesanddomestic consumptiontaxes)slightlyrise,butthecoefficientisnotsignificant.

Wethenturntoinvestigatemechanisms.IntheIVandliberalizationevent-studies, wefindthattradeincreasestheshareofdomesticoutputproducedinthecorporate sector,relativetotheunincorporatedbusinesssector(mixed-income).2 Thus,outputis expandedinthecorporatesectorwhereenforcementisstrongerandeffectivetaxationis higher (Slemrod&Velayudhan, 2018). Moreover,withinthecorporatesectorwefindthat tradeincreasestheaverageeffectivetaxrateoncapital,suggestingtheexpandedcorporate outputaccruestofirmswhose ETRK increaseswiththeiroutput(ourproxyforfirmsize). Thesetwoeffectsoftradeareconsistentwiththetaxcapacitychannel.Simultaneously,we findthattradereducesthestatutorycorporatetaxrate,consistentwithataxcompetition channelwhereglobalizationpushesgovernmentstoreducethestatutorytaxburdenon capital.Onnet,thepositivetaxcapacityimpactoutweighsthetaxratereductionin developingcountries,causingtradetoincrease ETRK atthecountry-level.

Incontrast,wefindnotaxcapacityeffectoftradeindevelopedcountries,butastronger decreaseinstatutorycorporatetaxrates.Theseresultshelpreconciletheasymmetric evolutionofcapitaltaxationindevelopinganddevelopedcountries.

2Tradeleadstoasharpriseincorporateprofitsandaninsignificantchangeinemployeecompensation.

3

Wesharpenourmechanismanalysisbyconductingafirm-levelinvestigationofthetax capacitychannel.WemergemultipleadministrativedatasetsinRwanda,whichallows ustoobserveeachfirm’sintegrationintointernationaltradeandcorporatetaxpayments. Theintegrationmeasureaccountsforthefirm’sindirectexposuretotradethroughits productionnetwork (Almunia,Hjort,Knebelmann,&Tian, 2023). Rwandaprovidesan interestingsetting:startingfromarelativelylowshareofdomesticoutput,thecorporate sectorhasgrownsignificantlysincethe1990s,intandemwithariseintradeopennessand taxcollection.Usingtheshift-sharedesignof Hummels,Jørgensen,Munch,andXiang (2014)foridentifyingvariation,wefindthattradeintegrationincreasesbothafirm’s ETRK anditssize.Thoughlimitedtoasinglecountry,thesefirm-levelresultsprovidemicroevidencefortrade’spositiveimpacton ETRK ,andsupportthetaxcapacitymechanism wherebytrade’simpactismediatedbyapositivefirmsize-ETRK gradient.

Finally,westudysourcesofheterogeneityinthepro-taximpactoftrade.Duringour sampleperiod,developingcountrieshaveinvestedindomestictaxenforcement,suchas largetaxpayerunits (C.Basri,Felix,Hanna,&Olken, 2019). Wefindthattrade’simpacts onthetaxcapacitymechanismandon ETRK holdintheabsenceoftheseenforcement policiesand,moregenerally,outsideofperiodsofsignificantfiscalpressure (Cagé& Gadenne, 2018). Thus,trade’spro-taximpactappearstobeabroadfeatureoftheglobalizationprocesswhichdoesnothingeongovernments’initialenforcementandrevenue needs.Atthesametime,wefindthatopenness’pro-taximpactdependsonthenature ofthetradeshock,inwaysthatareconsistentwithrecenttheoreticalworkontradeand formalization (Dix-Carneiro,Goldberg,Meghir,&Ulyssea, 2021).

Combiningmultipleempiricalstrategies,ourresultsatthecountry,corporatesector, andfirm-levelconsistentlysuggestthattradeopennessincreases ETRK andcontributedto thenewlydocumentedriseof ETRK indevelopingcountriessincetheearly1990s.Based onanewglobaldatabase,ourfindingsshowthatglobalizationhassupportedeffective capitaltaxationandoverallrevenuecollectioninmanycountriesaroundtheworld.

Section 2 discussesrelatedliterature.Section 3 describesthemethodologyanddata. Section 4 presentsfindingsonthelong-runevolutionof ETR.Section 5 analyzestrade’s impacton ETR andSection 6 investigatesthemechanisms.Section 7 concludes.

2RelatedLiterature

Globalizationandtaxstructure

Ourpapercontributestothemacroliteratureonglobalizationandtaxstructure (Alesina&Wacziarg, 1998), reviewedin Adam,Kammas,and Rodriguez(2013). The“racetothebottom”hypothesispositsthatgovernmentsreduce

4

taxesonfactorsthatbecomemoremobile(e.g.,capital)followingtradeliberalization (Slemrod, 2004). Toachieverevenueneutrality,governmentsraisetaxesonlessmobile factors(e.g.,labor).3 The“socialinsurance”hypothesispostulatesthatgovernmentsraise revenuetoinsureworkersdisplacedbyinternationalcompetition,oftenviasocialsecurity andpayrolltaxes (Rodrik, 1998). Thesestudiesmainlyfocusedonhigh-incomecountries. Byexpandingthescopetodevelopingcountries,weformulateandtestanewmechanism, wheretradeincreases ETR byexpandingactivityinfirmswithhighereffectivetaxcollection.Ourresultssuggestthatglobalizationhassupportedtheabilityofgovernments totaxcapitalinmanycountries.

Ourresultsarebasedonanewglobaldatabaseofeffectivetaxrates,whichcomplementsexistingdatasets (includingCarey&Rabesona, 2004;Kostarakos&Varthalitis, 2020;McDaniel, 2007) byexpandingcoveragetodevelopingcountries(detailsinSection 3).4 Ourbackward-looking ETR measureiscomplementarytotheliteratureonforwardlookingcapitaltaxrates (includingDevereux&Griffith, 1999), whichmodelsindetailthe statutorytaxburdenafirmwouldfaceunderdifferentconditions.Thisliteraturefinds thatthestatutorytaxburdenoncapitalhasfallenindevelopedanddevelopingcountries, consistentwiththe’racetobottom’mechanism (includingDevereux,Griffith,&Klemm, 2002;R.Kumar&James, 2022;Steinmüller,Thunecke,&Wamser, 2019).

Effectivetaxationandtradeindevelopingcountries Ourpapercontributestothemicroorientedliteratureontradeandpublicfinanceindevelopingcountries.Manystudiesfocus on bordertaxes andevasion (e.g.,Fisman&Wei, 2004;Javorcik&Narciso, 2017;Sequeira, 2016)orcross-borderincome-shifting(e.g.,Bilicka, 2019;Londoño-Vélez&Tortarolo, 2022; Wier, 2020). Wefocusinsteadontrade’simpactsonthe domestictaxbases ofcapitaland laboranddomesticeconomicstructure.5 Ourresultsareintuitivewhenconsideringthat thetradeliteraturefindspositiveeffectsofopennessondomesticoutcomesincluding marketshares (McCaig&Pavcnik, 2018), firmsize (Alfaro-Ureña,Manelici,&Vasquez, 2022), andlocaldevelopment (Méndez&VanPatten, 2022), whichthepublicfinance literaturehasseparatelyidentifiedasdeterminantsofeffectivetaxation (Besley&Persson,

3WithinlaborinOECDcountries, Eggeretal.(2019) findthatglobalizationinthepost-1994eraledtoa reductioninincometaxesforthetop1%ofworkersandincreasedincometaxesformiddle-classworkers.

4Wecomplementotherworkineconomichistoryontaxation (includingCogneau,Dupraz,Knebelmann,& Mesplé-Somps, 2021), byprovidinglong-runmeasuresoffactoreffectivetaxrates.

5Thetheoreticalliteraturehasfocusedontrade’simpactontheoptimalindirecttaxmixbetweenborder andconsumptiontaxesindevelopingcountries(e.g.EmranandStiglitz,2005)andmainlyabstractedfrom directtaxes. BenzartiandTazhitdinova(2021) studytheimpactofindirecttaxesontradeflows.

5

2014;Bestetal., 2021).6 Wecontributebylinkingthesetwobodiesofworkanddirectly studyingtrade’simpactsondomestictaxbasesatthecountry,sectorandfirmlevel.

Byincorporatingdomestictaxbases,wecancomprehensivelystudythetotaltaxrevenueimpactsofglobalization.Previousstudiesontrade’srevenueimpactindeveloping countrieshaveproducedmixedfindings,possiblyduetodifferencesinsample,methods andtaxbasefocus (includingBaunsgaard&Keen, 2009;Buettner&Madzharova, 2018; Cagé&Gadenne, 2018). Wecontributebyimplementingmultipleidentificationstrategiesinthelargestsampletodateandfindthattrade’simpactsondomestictaxbasesare sufficientlylargethatopennessincreasestotaltaxrevenue(asa%ofGDP).

Theseimpactsoftradearemediatedbythetaxcapacitymechanism,whichisrooted intwodistinctinsightsfromthetradeandthepublicfinanceliteratures.First,alarge classofmodelspredictsthattradeleadstotheexpansionoflargefirmsrelativetosmall firms (Mrázová&Neary, 2018); forempiricalevidence,see Bernard,Jensen,Redding, andSchott(2007). Second,indevelopingcountriessmallfirmsaremainlyinformal, andeffectivetaxationincreaseswithfirmsize(measuredasfirmrevenue)7;thispositive gradientarisesbecauseeffectivetaxcollectionishigherinlargerfirmsandcorporations duetotheirvisibility,complexproductionstructures,andemploymentofmanyworkers (Almunia,Hjort,etal., 2023;Waseem, 2020). Theresultinginformationtrailsimprove enforcement (Naritomi, 2019;Pomeranz, 2015), thoughwithlimits (Carillo,Pomeranz,& Singhal, 2017).8 Thepositivesize-gradientalsoarisesbecausethetaxcodeindeveloping countriesoftenleadstohigherstatutorytaxburdensforlargerfirmsandcorporations (R. Kumar&James, 2022): Bachas,Brockmeyer,Dom,andSemelet(2023) findapositivesizestatutorytaxgradientamongcorporationsin15countries.Ourmechanismismotivated by AbbasandKlemm(2013), whohypothesizethatthecorporatesectorexpansioncould explainwhythereductioninstatutorycorporatetaxburdensindevelopingcountrieshas notledtoareductioninCITrevenue(%ofGDP).9 Themechanismalsorelatestostudiesin high-incomecountriesthatlinkCITcollectiontothecorporatesector’sstatutoryburden, output-shareandprofitability (Clausing, 2007;Griffith&Miller, 2014;Sørensen, 2007).

Wefocusonamechanismbasedonfirmsize,butmanylinksbetweentrade,firm structure,andtaxationremaintobeexplored (Atkin&Khandelwal, 2020;Parenti, 2018).

6Ourresults,whichfocusonthecorporateoutput-share,arecompatiblewithfindingsfromtradeformalizationstudies,whichinsteadfocusontheshareofformalworkersorfirms(Section 6).

7Seealso KopczukandSlemrod(2006), Kleven,Knudsen,Kreiner,Pedersen,andSaez(2011), LaPortaand Shleifer(2014), Bachas,Fattal,andJensen(2019) and Bestetal.(2021).

8IndevelopedcountriesincludingtheUS,thelargecorporatesectorisconsideredanimportantdeterminant ofeffectivetaxcollection (Kleven,Kreiner,&Saez, 2016;Slemrod&Velayudhan, 2018).

9Seealso Quinn(1997), M.M.S.KumarandQuinn(2012) and Abramovsky,Klemm,andPhillips(2014).

6

3ConstructionofEffectiveTaxRates

Thissectionpresentsanewdatabaseofeffectivetaxrates(ETR)onlaborandcapital, whichcovers154countries,startingin1965whenpossible,until2018.Wefirstoutlinethe conceptualframeworktobuild ETR,thenpresentthedatasources,andfinallydiscuss thesamplecoverage.FurtherdetailsareinAppendix B

3.1Methodology

Effectivetaxrates Wecomputemacroeconomiceffectivetaxratesfollowingthemethodologyof Mendoza,Razin,andTesar(1994). Theeffectivetaxrateonlabor,denoted ETRL, isthetotalamountoftaxeseffectivelycollectedonlabordividedbytotallaborincomein theeconomy;similarlyforcapital,denoted ETRK :

Toconstructthenumerators,eachtypeoftaxrevenueisassignedtolabororcapital:

where λj istheallocationtolaborofeachtype j oftax τj .Typesoftaxes j followtheOECD Revenueclassification.Weallocatetaxesasfollows:(1)corporateincometaxes,wealth taxes,andpropertytaxesareallocatedtocapital;(2)payrolltaxesandsocialsecurity paymentsareallocatedtolabor;(3)personalincometaxes(PIT)areallocatedpartlyto laborandpartlytocapital,inacountry-timespecificmanner(detailsbelow).Indirect taxesareneitherassignedtolabornortocapital(butanalyzeddirectlyinSection 5.3). Table B2 providesadetailedallocationsummary.

Toconstructthedenominators,wedecomposenetdomesticproductasfollows:

Laborincome YL equalscompensationofemployees(CE)plusashare ϕ ofmixedincome (operatingsurplusofprivateunincorporatedenterprises, OSPUE ).Capitalincome YK equalstheremainingshare (1 ϕ) ofmixedincome,pluscorporatefirms’profitsnetof

ETRL = TL YL and ETRK = TK YK (1)

TL = j λj τj and TK = j (1 λj ) τj (2)

Y = YL + YK = CE + ϕ · OSPUE YL +(1 ϕ) · OSPUE + OSCORP + OSHH YK (3)

7

depreciation(operatingsurplusofcorporations, OSCORP ),plusactualandimputedrental income(operatingsurplusofhouseholds, OSHH ).10

Wealsomeasuretheeffectivetaxrateoncorporateprofits, ETRK C ,astheratioof corporateincometaxestocorporateprofits.Thisisanaverageeffectivetaxrateatthe corporatesectorlevel;inSection 6,weanalyzethefirm-levelcorporateeffectivetaxrate.

Thesemacroeconomic ETRsrelyonseveralconventionsandassumptions (seeCarey &Rabesona, 2004). First,asisdoneintheliterature,theydonotfactorineconomic incidenceinthattheeconomiccostoftaxesisnot“shifted”fromonefactorofproduction toanother:alllabortaxesareallocatedtolaborandallcapitaltaxesareallocatedtocapital. Second,thetaxrevenuestreamsneedtobecomparabletotheirmacroeconomictaxbases measuredinnationalaccounts.Thisgeneratestwokeychallengesforour ETRs:(i)inthe numerator,whatshareofpersonalincometaxrevenuestoallocatetocapitalversuslabor; and(ii)inthedenominator,whatshareofmixedincometoallocatetocapitalversuslabor. Weoutlinebelowourbenchmarkassumptions(detaileddiscussionisinAppendix B.2). Allocationofpersonalincometaxes(PIT) Themainempiricaldifficultyinassigning taxestolaborandcapitalconcernstheallocationofPIT.Anaiveprocedureallocates70% ofthePITtolaborand30%tocapital,roughlymatchingthelaborandcapitalshares ofdomesticproduct.Inpractice,however,recentworkhighlightsthatnotalllaborand capitalincomeissubjecttoPIT,sincenotallindividualsarerequiredtofilePIT,and exemptionsapplytosomeincometypes (Jensen, 2022). Exemptionsforcapital(e.g., imputedhousingrents,undistributedprofits)aretypicallylargerthanforlabor(e.g., pensioncontributions).Further,laborandcapitalincomemightnotfacethesametax rate:dual-incometaxsystemstaxlaborincomewithprogressiveratesbutcapitalincome withflatrates.IntheUS, Piketty,Saez,andZucman(2018) usedetailedtaxandnational accountsdatatomeasurethat75%oflaborincomeissubjecttoPIT,versus33%ofcapital income.Thissuggestsallocating15%ofPITtocapitaland85%tolabor.11

Startingfromthisbaselinewhere15%ofPITrevenuesderivefromcapital,weperform twocountry-yearadjustments:(i)weraisecapitalrevenuesforcountry-yearswithahigh PITexemptionthresholdintheincomedistribution (Jensen, 2022); (ii)weloweritin country-yearswheredividendsfacelowertaxesthanwages.Theresultingcapitalshare ofPITrevenuevariesbetween7%and32%acrosscountry-years.Overtime,thissharefalls

10Wedecomposenetdomesticproduct(NDP),whichsubtractsconsumptionoffixedcapitalfromgross domesticproduct(GDP).NDPislowerthanGDP,by10%onaverage.Weexcludecapitaldepreciation sinceitdoesnotaccruetoanyfactorofproductionandisusuallytax-exempt.Factorincomesalsoexclude indirecttaxes(whicharealsoexcludedinthenumeratorof ETR).

11If75%oflaborincomeistaxableandlaborincomeis70%ofnationalincome(resp.33%and30%for capitalincome),then 75% × 70%/(75% × 70%+33% × 30%)=84% ofthePITislaborincome.

8

fromaglobalaverageof19%in1965to14%in2018,duetoareductioninPITexemption thresholdsandincreasedprevalenceofdualtaxsystems.

Intheabsenceofdetailedtaxrecordsineverycountryandyear,theseadjustments provideanimperfectapproximationofthetruecapitalshareofPIT.Wethereforeimplementtwosimplerobustnesscheckswheretheshareallocatedtocapitalisfixedovertime ateither0%or30%,representinglowandhigh-endscenarios.

Thelaborshareofmixedincome Thelaborshareofmixedincome(unincorporated enterprises)ishardtomeasure.12 Forourbenchmarkseriesweassume ϕ =75%,i.e., 25% ofmixedincomeisconsideredcapitalincome.13 Intheabsenceofaconsensusover alternativesthisassumptionhastheadvantageofbeingtransparent,thoughfactorshares areunlikelyinpracticetoeverywherebetimeandcountry-invariant.Wethereforeimplementtworobustnesschecks,whichcreatetimeandyearvariationin ϕ.Thefirstmethod, basedon ILO(2019), usesmicro-datatoestimatethecountry-specificlaborincomeofselfemployedbasedontheobservablecharacteristicsoftheseworkersandtheircomparison withemployees.14 Second,weassignto ϕ theobservedcountry-yearlaborshareofthe corporatesector (asinGollin, 2002).

Theexact ETR formulaswhichincludetheaboveadjustmentsareinAppendix B.2. UsefulnessandlimitationsofETR Sincenationalaccountstatisticsarecompiledfollowingharmonizedguidelines, ETRsareconceptuallycomparableovertimeandacross countries,thoughthedatalimitationsdescribedaboveshouldbekeptinmind.Byrelying ontaxesactuallycollected,the ETRsincorporatetaxavoidanceandevasionbehavioras wellasthenetpasteffectsofalltaxpolicies,includingrates,exemptionsandcredits. Thisisparticularlyrelevantinadevelopmentcontext,whereduetowidespreadevasion, knowledgeofstatutorytaxrulesonlyprovidesapartialpictureofeffectivetaxburdens.

The ETRsarebackward-lookingmeasuresthatcomprehensivelycapturehowmuch capitalandlaborhaveeffectivelypaidintaxes.Theyarehelpfulforthreereasons.First, knowinghowmuchrevenuesareeffectivelycollectedfromeachfactorisimportantwhen governmentsfacefiscalpressure (Besley&Persson, 2014): thisischaracteristicofmost

12TheUN’snationalaccountsframeworkoutlinesthecombinationofmultiplemethodstoovercomechallengesofmeasuringthe level ofmixedincomeineconomieswithwidespreadinformality.Whileinformationonthemethodsusedisnotavailableonacountry-yearbasis,aninspectionofthepublished frameworkssuggestsnochangeinmethodologiesformixedincomeovertime.

13Thisisbelowthe30%usedinDistributionalNationalAccounts(DINA)guidelines (Blanchet,Chancel, Flores,&Morgan,2021),butsincetheglobalaverageofthecorporatesector’scapitalshareis27%,assuming alowercapitalshareforunincorporatedenterprisesseemsreasonable (seeGuerriero, 2019).

14DetailsinAppendix B.2.Achallengewiththismethodisthatitcancreateimplausiblylargeestimatesof thelevelofmixedincomecomparedtotheirvaluesinnationalaccounts.Weimplementanadjustmentto helpwiththislimitation,butforthisreasonwechoosetouse ILO(2019) onlyforrobustness.

9

developingcountries,wherepotentialrevenuelossesorgainsisakeypolicydeterminant. Second,thelevelofthe ETR anditsdeviationfromastatutoryrateisfrequentlyaninput intopolicy-makingtounderstandthesizeoftaxgaps(e.g.therecentfocusonthefirmlevel ETR intheglobalminimumtaxagreements).Finally,thetaxburdenleviedoneach factorisanimportantstartingpointtodeterminetheeconomicincidenceofataxsystem.

Alimitationofmacroeconomic ETRsisthattheyareimpactedbyboththetaxcode andeconomicchanges.Thus,studying ETRsismosthelpfullydoneincombinationwith analyzingitsmechanisms,whichwefocusoninSection 6.Related,weemphasizethat the ETR shouldnotbeinterpretedasaproxyforthestatutorytaxburden.Animportant complementarybodyofworkcarefullymeasureslegaltaxburdens (Devereux&Griffith, 1999), byconstructingforward-lookingaveragetaxratesoncapitalbasedonthesimulated presentvalueofreturnsandcostsofanewinvestment.Drivenbydifferingobjectives,the backward-lookingandforward-lookingmeasuresarerelated,yetdistinct.15

3.2Datasources

3.2.1Nationalaccounts

Tomeasurefactorincomesfor154countriessince1965whenpossible,wecreateapanel ofnationalaccountsusingdatafromtheSystemofNationalAccounts(SNA)producedby theUnitedNations.Wefirstusethe2008SNAonlinerepositorythathasglobalcoverage forrecentdecades.Inturn,theUNStatisticsDivisionprovideduswithaccesstothe1968 SNAofflinedatawhichcovershistoricaldatafromthe1960sand1970s.Tothebestof ourknowledge,ourpaperisthefirsttoharmonizeandintegratethe2008-SNAand1968SNAdatasets.16 Estimatingfactorincomesrequiresinformationonallthecomponentsof nationalincome(equation 3).Wheneverwehavenationalincomeforacountry-yearbut informationonacomponentismissing,weattempttorecoveritwithinformationfrom thesecondSNAdataset,aswellasusingnationalaccountingidentitieswithnon-missing valuesfortheotherincomecomponents.Intheremainingcases,weimputecomponent valuesfollowingDINAguidelines (Blanchetetal., 2021) (detailsinAppendix B.1).

3.2.2Taxrevenue

Weconstructanewtaxrevenuedatasetthatdisaggregatestaxesbytypefollowingthe OECDRevenueStatisticsclassificationoftaxes.Ourdatabaseincludesalltaxes—onper-

15Thisisparticularlythecasefor ETR K C :see supplementaryappendix foradetaileddiscussion.Our measureof ETR K C alsorelatestotheCIT-efficiencymeasureby IMF(2014). Inthe supp.apppendix we findthatCIT-efficiencymeasuredwithourdataintherelevantsamplematcheswellthe IMF(2014) series. 16Relativetorecentwork (includingGuerriero, 2019;Karabarbounis&Neiman, 2014), ourdataexpands coverageinspaceandtime,mainlytodevelopingcountries,andsystematicallyattemptstomeasurefactor incomesfortotaldomesticoutput(vs.onlyforthecorporatesector).

10

sonalandcorporateincome,socialsecurityandpayroll,property,wealthandinheritance, consumptionandinternationaltrade—atalllevelsofgovernment.Weensureasystematic separationofincometaxesintopersonalandcorporateincome.Wecollectnewarchival dataandintegrateitwithexistingdatasources.

Whenavailable,OECDRevenueStatisticsdata(link)isthepreferredsource,asitcovers alltypesoftaxrevenuesandgoesbackto1965forOECDcountries.Itaccountsfor2,875 country-yearobservations(42.3%ofthesample).Itsdrawbackisitslimitedcoverage ofnon-OECDcountries,asitcovers93countriesintotalandonlycoversdeveloping countriesmorerecently.WeadddatafromICTD (link).ICTDincludesmostdeveloping countries,withcoveragethatstartsinthe1980s.ICTDsometimescombinespersonaland corporateincometaxes,andsometimeslackssocialsecurity.ICTDadds1,246countryyearobservations(18.3%ofthesample).

Tocomplementtheseexistingsources,weconductedarchivaldatacollectiontodigitize recordsfromgovernmentbudgetsandnationalstatisticalyearbooks.Thisadds2,011new country-yearobservations.17 Wesupplementedthesearchivalrecordswithcountries’ onlinepublications,andofflinedatafromtheIMFGovernmentFinanceStatistics(19721989).Intotal,thisdatacollectionadds2,678observations(39.4%ofthesample).

Buildingadatasetbasedonnewlydigitizedhistoricalsourcesnecessarilyrequires makinganumberofdecisions.Toincreasethecredibilityofourdata,wefollowfour guidingprinciples.First,weseektobuildlonghistoricaltime-seriesthatoverlapinyears withexistingsources.Weaimtoonlyusetwodatasourcespercountry,butusethe overlappingyearsbetweenmultiplesourcestocorroboratethattheyarecomparablein levelsoftaxrevenueandtypesoftaxesinplace.18 Forthisreason,aswitchindatasource rarelyleadstoasignificantchangeintrend.Second,forthehistoricalperiodswithout overlapwithexistingdata,wecorroboratethelevelsoftaxtoGDPwithacademicand policystudies.Third,wedrawonhistoricalstudiestoverifythatlargechangesinrevenues collectedreflectpolicy,economicorpoliticalchangesratherthandataartifacts.Fourth, weaimtobeconservativeandexcludecountriesintimeperiodswhereconcernsexist aboutdataquality,duetotheeconomicandpoliticalcontext.

Tohelpassessourapproach,the supplementaryappendix providesadditionalmaterial.Weprovideatablewhichoutlines,ineachofthe154countries,themainconsiderationsandourchoicesrelatingtothefourguidingprinciples.Thetableemphasizesthe uncertaintysurroundingspecificcountriesandtimeperiods,andflagsinstanceswhere

17ThearchiveswereaccessedintheGovernmentSectionoftheLamontLibrary(websitelink).

18OECDisthepreferredstartingpointandarchivaldataisinitiallysecondinprioritysinceitoftendisaggregatestaxtypesandgoesbackfarintime,butwerevisethisbasedonthesourcethatbestmatches theOECDdata.The supplementaryappendix summarizesthedatasourcesusedforeachcountry.

11

thedataappearsworthyofinclusionbutshouldbeinterpretedwithcaution(allourmain resultsareunchangedifweexcludetheseinstances).Moreover,weprovidein-depthcountrycase-studieswithdirectlinkstotheinitialarchivalsources;thecase-studiescurrently coverallcountrieswithmorethan15millioninhabitantsbutwillultimatelyexpandto coverall154countries.Weinvitecommentsfromresearcherstohelpimprovetheaccuracy oftheseriesaswecontinuouslyupdatethedata.

3.3Datacoverageofeffectivetaxrates

Thefinal ETR samplecontains6,799country-yearobservationsin154countries(Figure A1).Thenumberofcountriesstartsat78in1965andgrowsto110by1975(dueto independenceorcountrycreation).Thekeyjumpincoverage—from117to148— correspondstotheentryofex-communistcountriesin1994,includingChinawhenit arguablybuiltamoderntaxsystem(Appendix B.1).Thedataiseffectivelycomposedof twoquasi-balancedpanels.Thefirstcovers1965-1993andexcludescommunistregimes, accountingfor85-90%ofworldGDP.Thesecondcovers1994-2018andincludesformer communistcountries,accountingfor97-98%ofworldGDP.Figure A1 showscoverageby developmentlevel.WeusetheWorldBankincomeclassificationin2018,classifyinglow andmiddle-incomecountries(LMICs)asdevelopingcountriesandhigh-incomecountries (HICs)asdevelopedcountries.WereferinterchangeablytoLMICsasdevelopingcountries andHICsasdevelopedcountries.Oursamplecontains5,144observationsinLMICsand 1,655observationsinHICs.

Comparisonwithexistingdatasets Ourdatabasecomplementsprevious ETR series byexpandingcoveragetoLMICs.Table B3 summarizesthecoverageofexisting ETR series,whichfocusonHICs (Carey&Rabesona, 2004;Kostarakos&Varthalitis, 2020; McDaniel, 2007;Mendozaetal., 1994). Ourbenchmark ETRsrelyonspecificchoices: Table B3 summarizesthemethodologicaldifferenceswithexisting ETR series,which relatemainlytoallocatingcapitaltobothmixedincomeandPIT.19 Thealternativechoices arecoveredbytherobustnesschecksofSection 3.1,whichareimplementedinSection 4.2.

4StylizedFactsonGlobalTaxationTrends

4.1Evolutionofeffectivetaxratesoncapitalandlabor

Figure 2 documentstheevolutionofeffectivetaxratesoncapitalandlaborfrom1965to 2018.Aggregatesaredollar-weighted,i.e.,theglobaleffectivetaxrateoncapitalequals worldwidecapitaltaxrevenuesdividedbyworldwidecapitalincome.Theseseriescan

19Acomprehensivediscussionofthemethodologicaldifferencesisprovidedinthe supp.appendix.

12

thusbeinterpretedastheaveragetaxrateonadollarofcapitalincomederivedfrom owninganassetrepresentativeoftheworld’scapitalstock.Thetoppanelshowsglobal trendsandthebottompanelsseparateHICsandLMICs.

Globally,effectivetaxratesonlaborandcapitalconvergedbetween1965and2018,due toariseinlabortaxationandadropincapitaltaxation.Theglobal ETRL rosefrom16% inthemid-1960sto25%inthelate2010s,while ETRK fellfrom32%to26%.

Theglobaltrendsmaskheterogeneitybydevelopmentlevels.Whilelabortaxationrose everywhere,thedeclineincapitaltaxationonlyoccurredinHICs:theeffectivecapitaltax ratefellfrom38-39%to32-33%betweenthelate1960sandlate2010s,fueledbyalarge reductionineffectivecorporatetaxrates,whichfellfrom27%to19%.Incontrast,starting fromalowlevel, ETRK increasedinLMICs,withtherisehappeningentirelysincethe beginningofthe1990s. ETRK startedat10%inthemid-1960sandwasatthesamelevel in1989;inbetween,therewasariseanddeclineinthelate1970s,butthistemporary changewasfullydrivenbyresource-richcountries(Figure 4).From10%in1989, ETRK sawasustainedincreaseoverthenexttwodecadeswhichreached18%in2018.Therise incapitaltaxationispartlydrivenbyhighereffectivetaxationinthecorporatesector:the effectivecorporatetaxraterosefrom12%to20%between1989and2018inLMICs.20

4.2Theriseofcapitaltaxationindevelopingcountries

Theseculardeclinein ETRK inHICshasbeendocumentedbefore (Dyreng,Hanlon, Maydew,&Thornock, 2017;Garcia-Bernardo,Janský,&Tørsløv, 2022), buttherisein ETRK inLMICsstartingatthebeginningofthe1990sisnovel.Wethereforeneedto establishthatthisresultisrobusttotheassumptionsweusedtoconstructthe ETR series.

The ETR seriesdependsonfourmainmethodologicaldecisions:(1)howtoassign PITrevenuetocapitalvslabor;(2)howtoallocatemixedincometocapitalvslabor;(3) balancedvs.unbalancedpanel;(4)weightstoaggregatecountries.Ourbenchmarkseries: (1)assignsPITtocapitalvs.laborforeachcountry-yearusingdataonPITexemption thresholdsandthetaxtreatmentofdividendsrelativetowages;(2)allocatesafixed25% ofmixedincometocapital;(3)consistsoftwoquasi-balancedpanelsbeforeandafter1994 (whenChina,Russiaandotherformercommandeconomiesenterthesample);and(4) weighscountriesbytheirshareofworldwidefactorincomeineachyear.Weassesshow resultschangewhenvaryingone,several,orallofthesechoicesatthesametime.

20Figure A2 showsthatbothcorporatetaxrevenuesandcorporateprofitsincreasedsince1989buttheformer outpacedthelatter,causing ETR K C torise.Corporateprofitsandtaxrevenuearethelargestcomponents thatdeterminechangesin ETRK .Smallercontributionsto ETRK ’srisecomefromthedeclineinmixedincome,andthesteadyincreaseinpropertyandwealthtaxes,whichoutpacedincomefromrents,albeit startingfromaverylowlevel(0.3%ofNDPin1989).

13

Figure 3 investigatestherobustnessofthe ETRK trendinLMICs.21 Panel(a)varies theallocationofpersonalincometax(PIT)revenue.Ourbenchmarkfollowsadata-driven country-yearassignment;insteadweconsidertwosimplerscenarioswheretheshare allocatedtocapitalisfixed,ateither0%or30%(lowandhigh-endscenarios).Dueto highPITexemptionthresholdsinLMICs,thebenchmarkcountry-specificassignmentis closerinlevelstothe30%thantothe0%scenario.Thoughthecapitalshareallocatedto PITslightlychangesovertime(Section 3.1),thetime-invariantrobustnessseriestrackthe trendsinthebenchmarkseriesclosely.ThisisbecausethePITremainslimitedinLMICs, suchthatitssplitintolaborversuscapitalisofminorconsequence.

Panel(b)variestheassignmentoffactorsharesinmixedincome.Weimplementtwo robustnesschecks,creatingmixedincomelaborsharesthatvaryatthecountry-levelbased onthe ILO(2019) method,andatthecountry-yearlevelbasedontheobservedcorporate laborshare.Bothalternativeseriesareverysimilartothebenchmark.

Panel(c)quantifiestheeffectofcountryentryintothepanel.Inourbenchmark, China,Russia,andotherformercommandeconomiesenterin1994.Inthisrobustness, webalancethepanelbyimputingmissingobservationsbetween1965and1993;weuse theobserved ETRK valueforthatcountryin1994andthetrendsin ETRK observedfor otherLMICsin1965-1993.Theimputationraises ETRK between1965and1993,because Russiahadbothahigh ETRK andahighweightwhenenteringthesamplein1994.

Panel(d)aggregatescountriesusingnetdomesticproduct(NDP),insteadofcapital incomeweights.TheNDPweightsareeithertime-varyingorfixedin2010.These alternativeweightingproceduressuggestaslightlyhigherincreasein ETRK overtime.

Finally,panel(e)plotsall54combinationsofthefourmethodologicalchoices.Therise in ETRK inLMICsbetween1989and2018isclearlyapparentineachofthe54series.How wideistherangeofincreasesandhowdoesourbenchmarkseriescompare?Computing the1989-2018changeinthe54series,weobtainafairlytightrangeof ETRK increases, between6.4pptand10.3ppt.Ourbenchmarkisat8.7ppt,whichisclosetothemean increaseof9.2ppt;therearelargerincreasesthanourbenchmarkin43seriesandsmaller increasesin10.22 Ourbenchmarkseriescorrespondstoan87%increaseintheeffectivetax rateoncapitalinLMICssince1989,reflectingboththestronggrowthandlowbaseline.

Comparisonwithpreviousstudies Pre-existing ETR seriesmainlycoverHICs,which limitsthecomparisontooursample.InHICs,ourbenchmark ETR trendsarecomparable

21Therobustnessfor ETRL inLMICs,and ETRL and ETRK inHICsareshowninthe supp.appendix

22Setting1989asthebaseyearispartlyarbitrary,butitallowsustofixastartinglevelfor ETRsimmediately beforetheperiodofstrongtradeliberalizationinLMICs.Ifweinsteadcomputethechangein ETRK between2018andthelowestpointinagivenseries,therangeofchangesis6.8-11.3pptacrossthe54series, withameanat9.6pptandourbenchmarkat9.4ppt.

14

topreviousstudies,butthelevelsdifferby16.5%onaverage(Figure B1).Thisdifference isprimarilyduetomethodologicalassumptionsabouttheallocationofcapitaltomixed incomeandPIT(Table B3).However,thealternativemethodologiesfromthepre-existing seriesarecontainedwithintherangeof ETR trendsproducedbyourrobustnesschecks. InHICs,thatrangeof ETRK trendsisindeedwide(duetothequantitativeimportance ofthePIT; ETR seriesin supp.appendix).However,therangeof ETRK trendsin LMICsiscomparativelytighter(Figure 3);thisisbecausetherisein ETRK inLMICsis primarilydrivenbythecorporatesector(Figure A2),whichisnotstronglyaffectedbythe methodologicaldifferencesbetweenourstudyandpre-existingstudies.

4.3Wherehascapitaltaxationrisen?

Figure 4 showsthe ETRK seriesforsubsamplesofcountries.Panel(a)plots ETRK series forthemostpopulousLMICs:Brazil,China,IndiaandIndonesia.Alldisplayamarked ETRK riseovertime.Startingin1989(1994forChina)until2018, ETRK rosefrom7%to 27%inBrazil,6%to24%inChina,5%to12%inIndia,and9%to15%inIndonesia.

China’sweightandfast-risingcapitaltaxationimplythatitplaysakeyroleinthe aggregate ETRK trendinLMICs.Panel(b)showsthat,whenexcludingChina,therisein ETRK ishalfaslarge(from10%to15%)andamoresignificantpartoftheriseoccurred earlierinthe1990s.Panel(c)showsthatoil-richcountries,measuredasderivingmore than7%ofGDPinoilin2018,havebeenonacompletelydistinctpath.Reflectingtheoil commodityshocks,their ETRK roseinthe1970sbutfellinthe1980s,andhavestayed flatsince.Excludingoil-richcountriesyieldsamorepronounced ETRK rise,from9%in 1989to21%in2018,andaflat ETRK seriesfrom1965to1989.IfweexcludebothChina andoil-richcountries,weobservearisein ETRK from9%in1989to17%in2018,which issimilarinmagnitudetothebenchmarkseries.

Panel(d)revealsthat,amongnon-oil-richcountries,the ETRK riseisstrongerinlarge LMICs,definedasthe19countrieswithapopulationabove40millionin2018.Even whenexcludingChina,the ETRK oftheother18mostpopulatedcountriesrosefrom9% to18%between1989and2018;insmallercountries, ETRK rosefrom10to14%overthe sameperiod.The ETRK hasrisenbymorethan5percentagepointsin13ofthe19largest LMICssince1989,andhasonlyfalleninonecountry(Russia).23

Inshort,theriseineffectivecapitaltaxesismorepronouncedinlargercountries, includingChina,butisageneralpatternindevelopingcountries,exceptforoil-richones.

23The supplementaryappendix showstheindividualcountries’ ETRK and ETRL timeseries.

15

4.4Suggestiveevidencefortheroleofglobalization

Wesawthat ETRK fellinHICsbutroseinLMICs.Importantly,theriseinLMICsstarts intheearly1990s,whichcoincideswiththeonsetofthe"hyper-globalization"period thatcouldapriorihavemadecapitalmoremobileandhardertotax.24 Instead,could tradeglobalizationhavecaused ETRK toriseinLMICs?Herewetakeafirstpassat investigatingthisquestion.Wecreate5-yeargrowthrateswithincountriesintradeand ETRs.Weplotbinnedscattersof ETR againsttradeopenness(measuredastheshareof importsandexportsinNDP),afterresidualizingallvariablesagainstyearfixedeffects.

Figure 5 depictsthesewithin-countryassociations,whichconditiononglobaltimetrends. Mirroringtheheterogeneityinlong-runtrends,weobservedifferencesbydevelopment levelintheassociationbetweentradeand ETRK :opennessisassociatedwithincreases in ETRK inLMICs,butwithdecreasesin ETRK inHICs.25 Insum,fromaglobaland historicalperspective,thecorrelationalevidencesuggeststhattrademayhavecontributed tothenewlydocumentedrisein ETRK indevelopingcountries.

Naturally,LMICshaveundergonesignificantdevelopmentsincethe1960sandthis growthislikelytoalsohavecontributedtothelong-runrisein ETRK .Inthe supplementaryappendix,wefindthattheassociationsinFigure 5 holdinLMICswhencontrolling forGDPpercapitagrowth.Thiscorrelationalevidence,combinedwiththeobservation thatwhileglobalizationisamajorprocessinLMICs,itsrevenueimpactsarestillnotestablished(Section 1),motivateustoinvestigatetradeasadeterminantof ETR andstudy itsmechanisms.

5TradeGlobalizationandCapitalTaxation

Inthissection,weimplementtwodistinctresearchdesignstoinvestigatetheimpactof tradeopennessoncapitalandlabortaxationindevelopingcountries.

5.1Event-studiesfortradeliberalization

5.1.1Empiricaldesign

Inthefirstdesign,weimplementeventstudiesoftradeliberalizationpolicyeventsin keydevelopingcountries.Todiscernsharpbreaksfromtrendsinouroutcomes,our selectioncriteriawastoselecteventsthatcausedlargetradebarrierreductionsandwhich

24IndividualtrendsinthefourlargestLMICs(Figure 4)alsosuggestanassociationbetweenliberalization episodesandanuptickin ETRK (Brazilin1988;Chinain2001;Indiain1991;Indonesiainthemid-1980s).

25The supplementaryappendix furthershowsthatearlyglobalizedLMICssawtradeand ETRK risein tandempriortothe1990sandstagnatethereafter.Bycontrast,LMICswhichparticipatedinthesecond waveofglobalizationpost-1990sawariseintradeand ETRK inthe1990-2018period.

16

havebeenstudiedintheliterature.Thisledustoselectthesixeventsfromthereview papersby GoldbergandPavcnik(2007, 2016) (Colombiain1985,Mexicoin1985,Brazilin 1988,Argentinain1989,Indiain1991,Vietnamin2001),andaddthewell-knownevent ofChina’saccessiontoWTOin2001 (Brandtetal., 2017). Theseliberalizationevents ledtolargereductionsintariffs:from59%to15%inBrazil;80%to39%inIndia;and, 48%to20%inChina.Wecanrelyonpre-existingnarrativeanalysestodiscussthreatsto identificationandinterpretationofresults.26 Appendix C.1 providesmoredetailsonour selectioncriteriaandtheliberalizationevents.

Foreachoftheseventreatedcountriesandoutcomes,weconstructasyntheticcontrol country,asaweightedaverageoverthedonorpoolofnever-treatedcountries(Abadie, Diamond&Hainmueller,2010).27 Wematchonthelevelofeachoutcomeinthe10years priortotheevent,whileminimizingthemeansquaredpredictionerrorbetweentheeventcountryandthesyntheticcontrol.28 Weplottheaveragelevelsoftheoutcomefortreated andsyntheticcontrolcountriesbyrelativetimetotheevent.Moreover,weestimatethe event-studymodelin10yearsbothbeforeandaftertheevents:

whereweincludefixedeffectsforevent-time, θt,country κc,andcalendaryear, πYear(t) (thelattercontrolforshocksthatcorrelatewitheventsclusteredincalendartime). Dc is adummyequaltooneifcountry c istreated.Thecoefficient βe capturesthedifference betweentreatedandsyntheticcontrolcountriesineventtime e,relativetothepre-reform year e = 1 (omittedperiod).Sinceinferencebasedonsmallsamplesischallenging,we plot95%confidenceboundsusingthewildbootstrap,clusteredatthecountryeventlevel. InTable A1 weestimatethesimpledifference-in-differences,whichcapturestheaverage treatmenteffectinthe10yearspost-liberalization,andtheimputedtreatmenteffectbased on Borusyak,Jaravel,andSpiess(2021), whichaddresseschallengesfromtwo-wayfixed effectsandheterogeneousevent-times.

5.1.2Event-studyresults

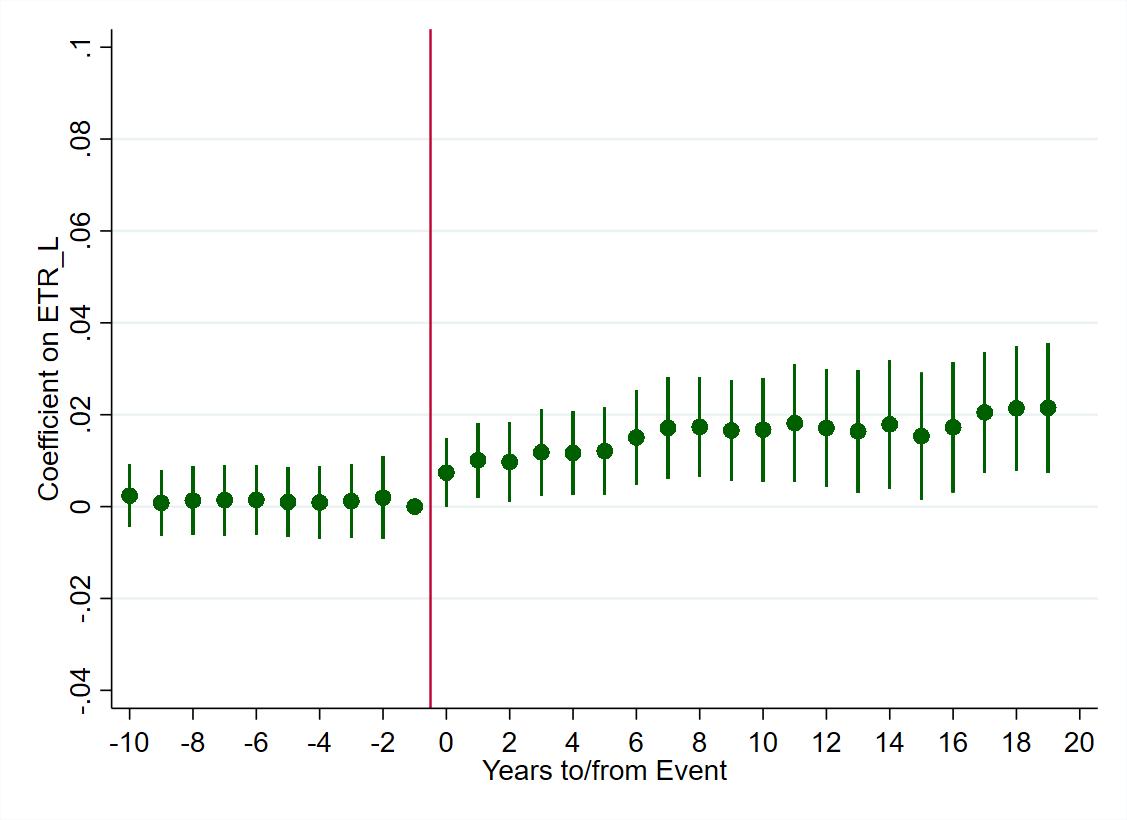

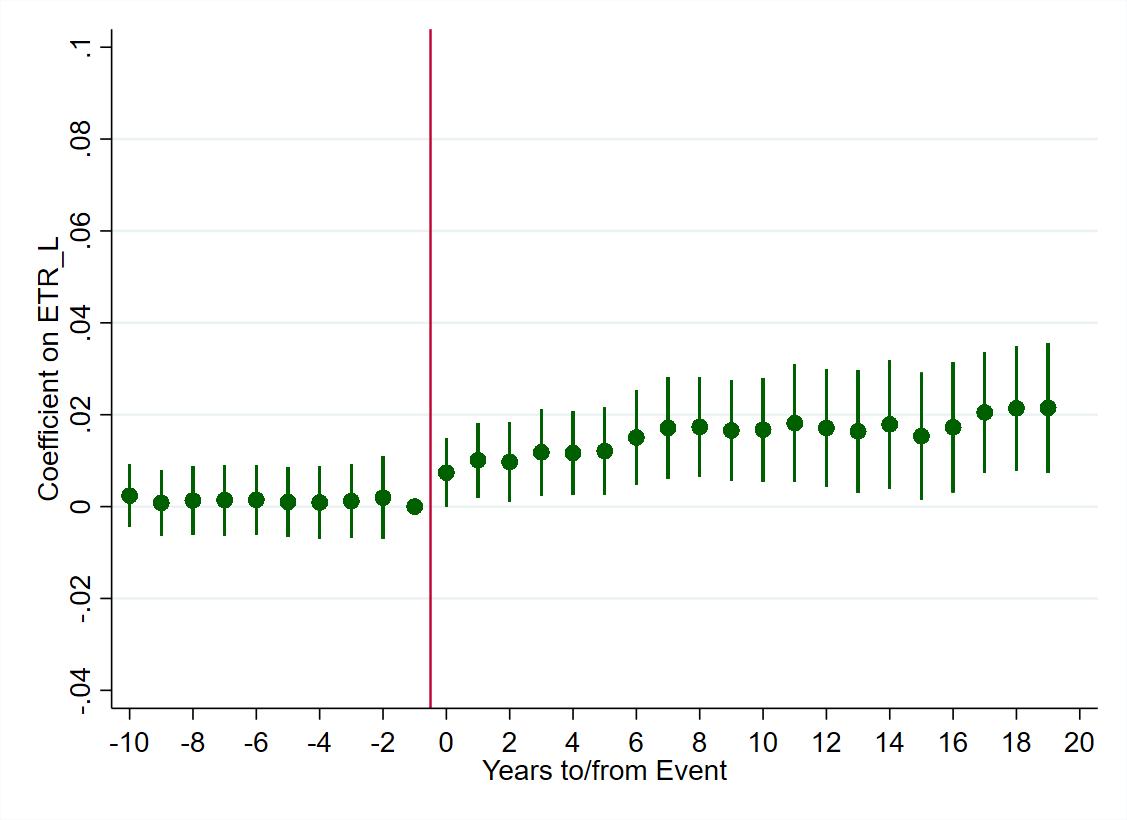

Figure 6 displaystheeventstudiesinlevels(left-handpanels)andthedynamicregression coefficients(right-handpanels).Thetoppanelsshowthat,asexpected,tradeopenness

26Thereductionsintradebarriersaresometimesimplementedoverseveralyears.Tobeconservative,we focusontheearlieststartyearforeacheventasdefinedinpublishedstudies.

27Foreachcountry-event,wecanincludeeventually-treatedcountriesinthedonor-pool(excludingthose withtreatmentwithin5yearsoftheevent);theresults,availableuponrequest,aresimilar.

28The supp.appendix liststhecountriesincludedinthesyntheticcontrolforeacheventandeachoutcome.

yct = 10 e= 10,e= 1 βe 1(e = t)t Dc + θt + κc + πYear(t) + ϵct (4)

17

risesintheyearspost-eventby10percentagepoints,anditstrendchangesinpost-reform yearscomparedtopre-liberalizationyears.29 Themiddlepanelsshowthat ETRK followed stablepre-trendsandsharplyrisespost-liberalization,by4to5percentagepoints.The bottompanelsshow ETRL alsorose,butonlyby2percentagepoints.Despitethesmall samplesize,thedynamicpost-treatmentcoefficientsforeachperiodareoftensignificant atthe5%level.Thep-valuesforthejointsignificanceofallpost-reformdummiesare wellbelow5%.Table A1,PanelA,reportstheDiDresults,whicharemarginallymore significantwhenestimatedfromimputedtreatmenteffects.PanelBshowsthatresultsare comparablewhenwejointlymatchonalloutcomesforeachcountry-event.

Theidentifyingassumptionisthattherearenochangesinconfoundingdeterminants of ETR thatcoincidewiththeliberalizationevents.Thebreaksfromstablepre-trends implythatconfoundingchangeswouldhavetosharplycoincidewiththeeventonset. Narrativeanalysesofthetimingforeachevent(Appendix C.1)donotsuggestobvious concurrentchanges.Moreover,usingdatafrom WacziargandWallack(2004), weverify thatothercross-borderreforms(e.g.capitalliberalization)ordomesticreforms(e.g.privatization)donotoccurinthesameyearasthetradeevents.30 However,reformssometimes occurafewyearsafter:forexample,MexicojoinedNAFTAandremovedcapitalinflow restrictions,ArgentinaandBraziljoinedMERCOSUR,andIndialiberalizeditsFDIrules (Appendix C.1).Thesereformsoccurredseveralyearspost-tradeliberalization,but ETRs sharplyriseintheimmediatepost-eventyears.Thisdiscussionhighlightsthatthecausal interpretationoftrade-centeredmacroeconomicreformsrequirescaution.Aplausible interpretationisthattheshort-runrisein ETRswithsharpbreaksfromstablepre-trends reflectstheimpactoftradereforms,butthatthemedium-runcoefficientsalsoreflectthe impactsofadditional,mainlycross-border,reforms.

Ourresultsarebasedona(small)sampleofliberalizationeventsthatsatisfiedspecific criteria.InAppendix C.3,westudytherobustnesstousingverydifferentselection criteriafortradeliberalization.Specifically,were-estimatetheevent-studyusingthe68 liberalizationeventsinLMICsfrom WacziargandWelch(2008). Wefindverysimilar impactsoftradeon ETR usingthisalternativeandexpandedsetofliberalizationevents.

Wefurtherprobetheidentificationandrobustnessofourresults.First,giventhe limitednumberofliberalizationevents,weinvestigateiftheaverageeffectsareinfluenced byoneparticularevent.Removingonetreatedcountryatatime,wefindthedynamic treatmenteffectsforallsubsetsofeventsaresimilartothefullsample(supp.appendix).

29Theabsenceofapre-reformdiplimitsconcernsaboutinter-temporalsubstitution,althoughsomeofthe liberalizationeventsmayhavebeenpredictable,includingChina’sWTOaccession.

30OnlyMexicohadaconcurrentdomesticreform,andresultsholdwithoutit:see supp.appendix.

18

Second,Table A1 addressesconcernsrelatedtothecontrolgroup.Wefindsimilarresults whenweremovefromthedonorpooleachliberalizingcountry’s5majorexportand importtradingpartners(measuredintheimmediatepre-eventyears),alleviatingconcerns ofspilloverstocountriesinthecontrolgroup.31 Resultsarealsocomparablewhenthe donorpoolexcludescountriesthathavealreadyliberalized (basedonWacziarg&Welch, 2008), toguardagainsttheconcernthatthetrendsinthesyntheticcontrolgroupreflect thelonger-runeffectsofthetreatment(liberalization).Finally,tolessentheconcernthat treatedandcontrolcountriesexperiencedifferentunobservableshocks,wefindsimilar resultswhenthedonorpoolforeachtreatedcountryisrestrictedtothesameregion(or toLMICsonly).

5.2Regressionswithinstrumentalvariablesfortrade

5.2.1Empiricaldesign

Ourseconddesignemploysinstrumentalvariablesfortrade.Oneattractivefeatureis thattheIVprovidescausalestimatesunderdifferentidentifyingassumptionsthanthe event-study.Weestimatethefollowingmodelindevelopingcountries:

where yct isthe ETR (oranotheroutcome)incountry c inyear t, tradect istheshareof importsandexportsinNDP,and πc and πt arecountryandyearfixedeffects.32 Wecluster ϵct atthecountrylevel. Xct containsconfoundingdeterminantsof ETR:theexchange rate,grosscapitalformation,logofpopulation,andcapitalopenness (Chinn&Ito,2006 Rodrik, 1998). ETR timeseriesaresometimesvolatile(Figure 4),sowewinsorize ETR atthe5%-95%levelbyyearseparatelyforLMICsandHICs.

OLSestimationofequation(5)maybebiasedduetoreversecausalityandunobservable confoundingfactorsthatcorrelatewithtrade.Totrytoaddresstheseissues,weusethe twoinstrumentsfortradefrom Eggeretal.(2019). Thefirstinstrument,denoted Zgravity , reliesonthestructureofgeneralequilibriummodelsoftrade.Underthestandardgravity modelassumptions,itusestheaveragebilateraltradefrictionsbetweenexportingand importingcountriesasvariation(aggregatedtothecountry-yearlevel).Thisinstrument

31Wealsoverifythatnoneofthemaincountriesinthesyntheticcontrol(supp.appendix)hadexternalor domesticreformsintheevent-yearorinthepost-eventperiods (usingthedatainWacziarg&Wallack, 2004). Consistentwiththis,thelevelsoftheoutcomesinthesyntheticcontrolarerelativelystable throughouttheeventperiods.Finally,notethatifthespilloverscorrespondtocoordinationofpolicies, thiswouldlikelybiasourestimationtowardsfindingnulleffects.

32Weincludefixedeffectsforimputedandinterpolatedvalues,aswellasforeachtaxandnationalaccount datasource(Section 3.2),toensureresultsarenotdrivenbychangestodataquality.Resultsalsohold withoutimputedvaluesandwithineachdatasource(Table A3).

yct = µ · tradect +Θ · Xct + πc + πt + ϵct (5)

19

isvalidifthedistribution(notthelevel)oftradecostsamongindividualcountry-trading pairsisnotinfluencedby ETRsintheimportorexportcountry.Thesecondinstrument, denoted Zoil distance,interactstime-seriesvariationinglobaloilpriceswithacountryspecificmeasureofaccesstointernationalmarkets.Accessiscapturedbythevariance ofdistancetotheclosestmaritimeportforthethreemostpopulatedcities.Thistimeinvariantmeasurecapturestheinternalgeographyofacountryandimpactstransportation costs:followingaglobalshocktooilprices,transportationcostswillbehigherincountries withlessconcentratedaccesstoports,leadingtoalargerdropinimportsandexports. Thisinstrumentisvalidiftheinteractionbetweenglobaloilpricesandcountry-specific measuresofspatialconcentrationisuncorrelatedwithchangesin ETRs.Conceptually, bothinstrumentscapturevariationintradecostsdrivenbyeconomicforcesthatare plausiblyexogenousto ETRsandtheirdeterminants(detailsin supp.appendix).

InLMICs,the 1st-stageisstrongerinthe2000sandathigherincomelevelsfor Zoil,and inearlierperiodsandatlowerincomelevelsfor Zgravity (supp.appendix).Restrictingthe analysistosub-sampleswhereoneoftheinstrumentshasastrongfirst-stageintroduces bias(Mogstad,Torgovistky,&Walters,2021).Instead,wecombinethetwoinstruments toestimatealocalaveragetreatmenteffectthatisrepresentativeofLMICsacrossincome levelsandtimeperiods.Table A2 showsthe 1st-stage.33

5.2.2Instrumentalvariableresults

Table 1 presentstheresultsinLMICsfor ETRK inPanelA,and ETRL inPanelB.34 In column(1),theOLSuncoverspositive,significantassociationsbetweentradeandboth ETRs.Incolumn(2),weemploythetwoinstruments.The 1st-stageKleibergen-Paap F-statisticis24.59.TheIVshowsthattradecausesanincreaseinbotheffectivetaxrates, andthecoefficientfor ETRK (0.151)isthreetimeslargerthanfor ETRL (0.047).These magnitudesareeconomicallymeaningful:movingfromthe 25th tothe 75th percentileof tradeopennessinLMICswouldcausea8.9percentagepointsincreasein ETRK .

TheremainingcolumnsofTable 1 presentthreesetsofrobustnesschecks.Inthefirst set(Columns3to7),wemodifythespecification.Themostnotabledifferenceisthat thecoefficienton ETRK increases(to0.211)whenweweightheregressionusingNDP (Column4),puttingthusmoreweightonthevariationinlargerdevelopingcountries. Theresultshardlychangewhenwe:usenon-winsorized ETRs(Column3);include

33Table D1 showstheinstrumentsimpactimportsandexports,andtradeinintermediategoods-services (G-S)andfinalG-S.Thus,ourIV-estimatescomprehensivelyreflecttheimpactsoftradethroughrisesand fallsinfinalandintermediategoodsandservicesthatflowbothinandoutofthecountry.

34Relativeto ETR coverage,thesamplesizedropsby4.5%duetodata-availabilityofinstruments.

20

controls(Column5);35 allowoil-richcountriestobeonaseparatenon-parametrictime path(Column6),whichaddressestheconcernthattheidentifyingvariationfor Zoil dist iscorrelatedwithtrendsin ETRsspecifictooil-richcountries(Figure 4);winsorizetrade openness(Column7).

Inthesecondsetofrobustnesschecks,weimplementthealternativecapitalandlabor assignmentstoPITandmixed-income,describedinSection 4.2.Inourbenchmark,the capitalshareofmixedincomeistime-invariant,yettrademaycausefactorsharesto change.Incolumns(8)-(9),weallowfactorsharestorespondtotradebyimplementing thetwomethodswhichcreatecountry-yearvaryingcapital-sharesofmixedincome:the resultsarecomparable.TheyalsoremainsimilarwhenwefixthecapitalshareofPITat 0%(column10)orat30%(column11)inallcountriesovertime.Inthethirdrobustnessset (columns12-13),weestimateIVsusingeachinstrumentseparately.The 1st-stageF-statistic is45.13for Zgravity and10.75for Zoil.TheIVestimatesarecomparable,thoughlargerwhen basedon Zoil.Leveragingtheoppositesigneffectsofthetwoinstrumentsontrade,the reducedformresults(Table A2)suggestthatopennesseffectsaresymmetric:increased tradeincreasesboth ETRL and ETRK ,whilereducedtradedecreasesboth ETRs.

Finally,ourresultsarebasedonanunbalancedpanelcombiningseveraldatasources (Section 3.2- 3.3).Table A3 showsthattheresultsarequalitativelysimilarwithineach data-sourcefortaxes(newlydigitizedgovernmentrecords;OECD;ICTD)andnational accounts(SNA1968;SNA2008),aswellasinbothquasi-balancedpanels(preandpost1994)andinastronglybalancedpanel(1965-2018).36

Quantifyingtheroleoftrade Howmuchofthe ETRK riseinLMICssince1989canbe accountedforbyrisingtrade?Between1989and2018,theweighted ETRK inLMICsrose by8.7ppt(Section 4.2)andtradeopennessby13.6ppt.TheNDP-weightedIVfortrade’s impact(col.4ofTable1)isarguablythemostcomparable,sincethe ETRK trendsinSection 4 arealsoweighted.Usingthisestimatewouldimplythattradeopennessaccountsfor 33%oftherisein ETRK (0.211 ∗ 0.136/0.087=0.329).ConsideringallestimatesinTable 1 generatesarangeof21-42%.37

5.3Impactsoftradeopennessontotaltaxrevenues

Wefindpositiveeffectsoftradeoncapitalandlabortaxation,buthowdoestradeimpact overall taxrevenues,includingindirecttaxes?Thisisarelevantquestion,astrade-induced taxlossesfromliberalizationremainanimportantconcernforpolicymakers(Hallaert,

35ResultsalsoholdwhencontrollingforGDPpercapita(notshown).

36Variationbetweencoefficientsmayreflectdataqualityor 1st-stageandtreatmentheterogeneity.

37Forreasonsdiscussedin 5.1.2,wedonotusetheevent-studyestimatesforthisexercise.

21

2010;WorldBank,2020).Table 2 presentstheOLSandtheIVestimationoftheeffectof tradeontotaltaxes(%ofNDP),inLMICs,aswellasonindividualtaxrevenuestreams. Totaltaxesincludedirecttaxesoncapitalandlabor,aswellasindirecttaxes(sumoftaxes ontradeanddomesticconsumption).38

ThetradecoefficientfortotaltaxcollectionispositiveandsignificantinboththeOLS andtheIV.TheIVcoefficient(0.101)iseconomicallylarge:movingfromthe 25th tothe 75th percentileofopennessinLMICswouldcausea5.9pptincreaseintotaltaxes(the unweightedaveragetax/NDPratioinLMICsis17.6%).Thisresultismainlydrivenby highercorporateincometaxes,whichaccountforjustoverhalfoftheincreaseintotal taxes,andtoalesserextentbysocialsecurityandpersonalincometaxes.39 Tradehasa positive,butstatisticallyinsignificant,effectonindirecttaxes.

Trade’simpactontotaltaxesisrobusttousingNDP-weights;includingcontrols; winsorizingtrade;andusingeachinstrumentseparately(Table A4).

WecanalsostudytheimpactofthetradeliberalizationeventsfromSection 5.1 ontotal taxrevenue.Usingtheevent-studymethodology,Figure A3 showsthatthetradeevents ledtoanincreaseinoveralltaxcollection,withabreakfromthestablepre-trend.

Onelimitationisthatwedonotseparatelystudytrade’simpactontariffrevenues versusdomesticconsumptiontaxes,asourdatadoesnotcontainasystematicbreakdown betweenthesetwoindirecttaxes.Thisreflectsourinitialfocusondirectcapitalandlabor taxes,butadditionaldataworkwouldpermitaseparationoftheseindirecttaxes.

40

BoththeeventstudyandtheIVindicatethattradeleadstohigheroveralltaxationin LMICs.Thisfindingrelatestotheliteratureonthenetimpactofopennessontaxrevenues, whichfindsmixedresultsduetodifferencesinsample,empiricalstrategyanddefinitionof openness(Section 2);41 moreover,someofthesestudiesfocusonthenetimpactoftradeon indirecttaxesandabstractfromdirectdomestictaxes.Wecontributebycomprehensively studyingthetotaltaximpactofopenness,basedonimplementingseveralidentification strategiesinthelargestsampleofdevelopingcountriestodate.

6Mechanisms

Thissectioninvestigatesmechanismsfortrade’simpactontaxes,especially ETRK

38Long-runtrendsintaxationbytypeanddevelopmentlevelareinthe supplementaryappendix

39CITgrewsignificantly,asashareofNDP,between1989and2018:seeFigure A2

40Whilethesignofopenness’impactontariffrevenuecouldinprincipledifferdependingonwhetherthe reductionintradecostsisinitiallyduetoeconomicforces(asintheIV)orpolicychanges(asintheevent study),wefindpositiveimpactsinbothcasesondomesticcapitalandlabortaxes,andontotaltaxes.

41Animportantstudyinthisliterature, BaunsgaardandKeen(2009) writesintheconclusion:"itispossible thatindirecteffectsoperatingthroughhigherlevelsofopennessandincomeconsequentupontradereform havemorethanoffsetthedirectlossofrevenueidentifiedhere."

22

6.1Outliningthetaxcapacitymechanism

The taxcapacity mechanismcombinestwodistinctinsightsfromthetradeandpublic financeliterature(Section 2):first,tradeexpandsactivityincorporatestructuresand largerfirmsrelativetosmallerbusinessesandself-employment;second,effectivetaxation increaseswithfirmsize.Tofixideas,considerthefollowingdecompositionof ETRK :

Thisdecompositionshowsthattheeffectivetaxrateoncapital ETRK iscomposedof twoparts.42 Thefirstpartcapturescapitaltaxationwithinthecorporatesector.Itisthe productofthecorporatesector’sshareofNDP, µK C ,andtheaverageeffectivetaxrate oncapitalinthecorporatesector, ETRK C .Theformerisdirectlymeasuredinnational accounts(employeecompensationpluscorporateprofitsnetofdepreciation),whilethe latteriscomputedastheratioofcorporateincometaxrevenuetocorporateprofits.Inthe secondpart, ETRK NC measurestheeffectivetaxrateoncapitalinthenon-corporatesector; itismultipliedbythenon-corporatesector’sincomeshare, 1 µK C ,whichincludesmixed incomeofunincorporatedenterprisesandhouseholdsurplus(rentsandimputedrents).43 InLMICs, ETRK C is50%largerthantheoverall ETRK (19.9%versus13.3%).This stemsfrombothstrongerenforcementandhigherstatutorytaxburdensinthecorporate sector.44 Hence,theexpansionofthecorporatesectorrelativetothenon-corporatesector (i.e.anincreasein µC )couldincrease ETRK .

Theconjecturethattradeexertsataxcapacityeffectisrootedintheliteratureon tradeandfirmsize (describedinDix-Carneiroetal., 2021). First,tradecanleadto increasedmarketopportunitiesthatdisproportionatelybenefitlargeexporters(Melitz, 2003).Second,tradecanexpandtheavailabilityofintermediategoodsandlowertheir prices,whichcoulddisproportionatelybenefitinitiallylargerfirms (forexampledueto fixedcostsasinKugler&Verhoogen, 2009). Throughthesetwochannels,tradecould expandthecorporatesector’sshareofnationalincome(µC ),aslargerfirmsaremore likelytobeincorporated.Moreover,bybenefitinginitiallylargerfirmsorleadingtofirm

42Inthissection,capitaltaxationisdenotedwitha K-superscripttoaccommodateadditionalnotation.

43ETR K NC ismeasuredastheratiooftaxrevenuefrompropertyandwealth,self-employment,andthePIT assignedtocapital,overcapitalmixed-incomeandthesurplusofthehouseholdsector.Itisthuscomposed ofamixofvariables,whicharearguablynotaswellmeasuredasthosefromthecorporatesector.

44Theabilitytolevyhighertaxratesisendogenoustoenforcement (Bergeron,Tourek,&Weigel, 2024). Our notionoftaxcapacityisthattheseco-determinedforcesjointlycontributetoeffectivetaxation.

ETRK = i∈C ETRK i f (i) di + i∈NC ETRK i f (i) di (6) = µ K C · ETRK C +(1 µ K C ) · ETRK NC (7)

23

sizegrowthwithinthecorporatesector,tradecouldalsoincreasetheaverageeffective corporatetaxrate, ETRK C .Thiseffectwouldbedrivenbyapositivefirmsize-ETRK i gradient,wheresizeismeasuredasfirmrevenue.Thepositivegradientarisesbecause complianceandenforcementincreasewithsize.45 Italsoarisesbecausethetaxcodein LMICsoftenleadstohigherstatutorytaxburdensforlargerfirms (R.Kumar&James, 2022): usingadministrativetaxdata,Bachasetal.(2023)findapositiveassociationbetween firmsizeandthestatutoryeffectivetaxrateforcorporatefirmsin15LMICs.46

6.2Resultsonmechanisms:Taxcapacityandracetothebottom

Weinvestigatemechanismsrelatingtradeto ETR,focusingonthetaxcapacityand’race tothebottom’channels.Intheracetobottom,internationaltaxcompetitionleadsgovernmentstoreducestatutorycorporatetaxrates,whichwouldreduce ETRK C (Section 2). WestudybothmechanismsinLMICswiththeempiricalstrategiesofSection 5.

Table 3 showstheOLS(PanelA)andtheIV(PanelB)fromequation 5.Consistent withrace-to-bottom,column(1)showsthattradecausesadecreaseinthestatutoryCIT rate(significantat10%).47 TheCITrateisanimperfectproxyoffirms’taxincentivesasit ignoresthetaxbase (Abbas&Klemm, 2013), butitcanbemeasuredinourfullsample.

Inlinewiththetaxcapacitymechanism,traderaisesthecorporateshareofdomestic output(µC ),andreducesmixedincomebyanequivalentmagnitude.48 Thisisconsistent withtheconjecturethattradedisproportionatelybenefitslargerfirms,whicharemore likelytobeincorporated.Tradealsoraises ETRK C (column6),consistentwiththetradeinducedcorporateoutputaccruingtofirmswhose ETRK -sizegradientispositive.

Howistheadditionalincomeofthecorporatesectorallocatedbetweencapitaland labor?Columns(4)-(5)showthatthecorporatesectorriseisentirelydrivenbyhigher corporateprofits,whilethechangeinemployeecompensationgrowthissmallandsta-

45SeestudiescitedinSection 2.Forexample, Bestetal.(2021) uncoveranegativesize-evasiongradientusing randomizedauditdataonfirmsinPakistan,findingalsothatfirm-sizeisthemostsignificantpredictor ofevasion.Modelsoftaxcomplianceprovidemicro-foundationsforthenegativesize-evasiongradient (includingKlevenetal., 2016;Kopczuk&Slemrod, 2006).

46Thegradientispositiveeverywhereexceptattheverytopofthesize-distribution,whereitbecomes negative.Thegradientisdrivenbypreferentialtaxtreatmentsthatincreasewithfirmsizeandwith characteristicsthatcorrelatewithsizesuchastotalprofits.Thegradientcanalsoreflectavoidance behavior,iflargerfirmsareonaveragelessabletotakeactionsthatreducetheirlegaltaxliability.

47Theoutcomeisthefirst-differencedtaxrate(Romer&Romer,2010).Table A4 showsresultswiththelevel oftheCITrate.WecombinedatafromVéghandVuletin(2015), Eggeretal.(2019), TaxFoundation (link) andcountry-specificsources.Anextstepcouldbetostudytrade’simpactonthemoredetailedstatutory measures(Section 2).ThedownwardtrendinCITratesinLMICs(supp.appendix)isrelatedto,butdoes notfullycapture,changesovertimeinthedetailedstatutorymeasures.

48Thequalityofdata-sourcesusedbynationalstatisticsofficescanaffectthemeasurementofmixedincome inLMICs,butwefindnoimpactoftradeoncountries’statisticalcapacity (WorldBanklink).

24

tisticallyinsignificant.49 This,inturn,causestradetoexpandthecapitalshare,bothof nationalincomeandofthecorporatesector(columns7-8).50

ThemechanismIV-resultsarerobusttoseveralchecks(Table A4):usingNDPweights; includingcontrols;winsorizingthetradevariable;and,estimatingIVsseparatelybased oneachinstrument.TheCITrateresultremainslessrobustthanthetaxcapacityresults.

Figure A3 studiesthesamemechanism-outcomesbutusingtheevent-studydesign (Section 5.1).ThetradeliberalizationeventsledtoadecreaseintheCITrateandraised bothcorporateincome(µC )andtheeffectivecorporatetaxrate(ETRK C ).Someindividual event-timecoefficientsarelesspreciselyestimated,butthepost-eventdummiesarejointly statisticallysignificantforalloutcomes.Althoughtheyarebasedondifferentidentifying variationintrade,theevent-studyandIVresultsarethereforebothconsistentwiththe existenceofthetax-capacityandrace-to-bottommechanismsindevelopingcountries.

6.3Firm-levelinvestigationoftaxcapacitymechanism

Thetaxcapacitymechanismisbasedonafirmlevelchannel,combiningapositiveimpact oftradeonfirmsizewithapositivefirmsize-ETRK gradient.Whilethemacro-results on µC and ETRK C intheprevioussubsectionareconsistentwithit,inthissubsectionwe directlyinvestigatethetaxcapacitymechanismatthefirmlevel.

WeconducttheanalysisinRwandabetween2015and2017,whereweleveragemultiple administrativedatasetstoobserveeachformalRwandanfirm’sexposuretotradeand domestictaxpayments.Toourknowledge,thereislimitedfirmlevelevidenceinLMICs onhowtradeimpactsafirm’sdomesticeffectivetaxrate.Rwandaisaninteresting settingasthecorporatesector,startingfromacomparativelylowoutputshare,hasgrown significantlysincethe1990s,intandemwithariseintradeopennessandtaxrevenues.

Weusecorporateincometaxreturnstomeasureeachfirm’seffectivetaxrate ETRK i as theratioofcorporatetaxespaiddividedbyreportednetprofit.Netprofitisrevenueminus material,labor,operational,depreciationandfinancialcosts.InRwanda,thisfirm-level ETRK i variesduetofirmcharacteristics(includingrevenue,ourproxyforsize),reduced ratesandexemptions(Mascagni,MonkamandNell,2016).This ETRK i canalsovarydue totaxavoidancebut,sincethedenominatorisbasedontaxreturns,itwillnotcapture

49Thereisalsoanulleffectoftradeonhouseholds’operatingsurplus OSHH (resultnotshown).

50Thiscouldoccurduetoanincreaseinmarkups. DeLoeckerandEeckhout(2021) findthatmarkupshave riseninmostregionsoverthepast40years. DeLoecker,Goldberg,Khandelwal,andPavcnik(2016) and Goldberg(2023) studytheimpactoftradeonmarkups. Gupta(2023) andAtkinetal.(2015)findthat markupsincreasewithfirmsize,respectivelyinIndiaandPakistan.Theriseincorporateprofitsand limitedchangeinemployeecompensationmayalsoariseiftraderaisesfirms’labormarketpower (Felix, 2022). Finally,itmayariseiftradebenefitsmorecapital-intensiveproductionindevelopingcountries, includingthroughareductioninCITrates(KaymakandSchott,2023).

25

outrightevasion.51 Thecorporate ETRK i inRwandaiseverywherepositivelyassociated withsize(proxiedbyfirmrevenue),apartfrominthetoppercentile (Bachasetal., 2023). Outsideoftheverytop,anincreaseinfirm i’ssizemaycause ETRK i torise. WemergetheCITreturnswithcustomsdatatorecordfirms’directexposuretotrade. Followingrecentwork(reviewedin AtkinandKhandelwal, 2020, Bernard&Moxnes, 2018),wemeasureafirm’stotalexposuretotradebyalsoaccountingforthefirm’s indirectexposureviaitslinkagestodomesticsuppliersthatusetradedgoodsintheir production.52 Wemergeadministrativedatathatrecordtransactionlinkagesbetween formalfirms(detailsondataandsampleinAppendix D.1).Tomeasureafirm’stotaltrade exposureinanetworksetting,wefollowthemethodologyin Dhyne,Kikkawa,Mogstad, andTintelnot(2021) thatusessimilardatasetstomeasureBelgianfirms’exposureto trade.Specifically,wedefinefirm i’stotalforeigninputshareastheshareofinputsthat itdirectlyimports(sFi),plustheshareofinputsthatitbuysfromitsdomesticsuppliers l (sli),multipliedbythetotalimportsharesofthosefirms:

where Vi isthesetofdomesticsuppliersoffirm i,and Vl isthesetofdomesticsuppliers offirm l.Thedenominatoroftheinputsharesisthesumofimportsandpurchasesfrom otherfirms.Welimittherecursivecalculationin(8)toinputsfromafirm’simmediate suppliers l andthesupplierstotheirsuppliers r (addingmorelevelsonlymarginallyraises sTotal i ).53 Inspecting sTotal i and sFi revealsthatwhilejustunder30%ofRwandanformal firmsimportdirectly,93%relyontradedirectlyorindirectlythroughsupplierswhich useforeigninputsintheirproduction.Mostfirmsarethereforedependentonforeign trade,butonlyalimitednumbershowthatdependencethroughthedirectforeigninputs observedincustomsdata.Themediantotalforeigninputshareis48%.

Weestimateregressionsinthesampleofcorporatefirmsoftheform:

51Forthisreason, ETR K C measuredinnationalaccountsdiffersfromthe(appropriatelyweighted)corporate ETRK i measuredintaxreturns.Theyalsodifferbecauseofconceptualdifferencesinthemeasurementof profits:seethe supplementaryappendix foradetaileddiscussion.

52RecentpapersstudydomesticlinkagesinLMICsandtheirroleinpropagatingtradeshocks (including Almunia,Hjort,etal., 2023;Fieler,Eslava,&Xu, 2018;Javorcik, 2004).

53Wefocusonfirms’exposuretoimportsthroughtheirsuppliernetwork;wefindqualitativelysimilar resultswhenwestudyfirms’exposuretoexportsthroughtheirclientnetwork(resultsavailable).

s Total i = sFi + l∈Vi sli [sFl + r∈Vl srl (sFr + )] (8)

ETRK it = µ s Total it +Θ Xit + πt + πi + ϵit (9)

26

where ETRK it and sTotal it arethecorporateeffectivetaxrateandtotaltradeexposureoffirm i inyear t,and πt and πi areyearandfirmfixedeffects. Xit includesnumberofemployees andnumberofclientsandsuppliers,and ϵit isclusteredatthefirmlevel.

InTable4,theOLSestimationof(9)showsthatawithin-firmincreaseintradeexposure isassociatedwithahighercorporateeffectivetaxrate.Thisresultholdswithonlyyear fixedeffects πt (column1);withindustry-geographyfixedeffects(column2);withfirm controls Xit (column3);withfirmfixedeffects πi (column4).

InTable 4,column(5),weimplementanIVthatgeneratesfirm-levelvariationin tradeexposureusingtheshift-sharedesignfrom Hummelsetal.(2014). Theidentifying variationistradeshocksfromchangesintheworldexportsupplyofspecificcountryproductcombinationsinwhichaRwandanfirmhadapreviousimportrelationship. Specifically,thedirectimporttradeshockforfirm i inyear t is:

where sa,M ic,t 1 istheshareofimportsoffirm i inyear t 1 thatfallsonproduct a from country c,and WESa,c,t istheworldexportsupply(excludingsalestoRwanda)ofcountry c forproduct a.Product a ismeasuredatthedetailedsix-digitHSlevel.Rwandanfirms importover3,510distinctproductsfrom174differentcountriesoforigin.

TheshockstoRwandanfirms’tradingenvironmentaretime-varyingandspecificto eachpartner-country × productbeingtraded.Theycapturetransportationcostsand worldwideshockstoexportsupplyfortherelevantcountry × product,andcontain granularvariationacrossproductsandcountries.Theidentificationstrategyrestson thejointhypothesesthattheseshocksareplausiblyexogenoustoRwandanfirms’trading environmentandthattheycreatevariedimpactsacrossfirmsbecauseRwandanimporters havefewimportedinputsincommon.Indeed,thecustomsdatashowsthatthemedian numberofuniqueimportingfirmsinagivenHS6product × countryandtimeperiodis 1;the 95th percentileis3.Hence,ifonlyoneRwandanfirmimportsmetalcoredwires fromTurkey,anidiosyncraticshocktoTurkey’sglobalexportsupplyofthosewireswill affectjustonefirminRwanda.Notealsothat,toconstructthetradeshocks,werely onpriorinformationaboutimporters’sourcingpatterns,whichremovesconcernsover contemporaneousshocksaffectingboththechoiceofimportedgoodsandfirmoutcomes.

Webuildthetradeshocksforallfirms.Inturn,the 1st-stageinstrumentsarethefirm’s owntradeshocks,aswellasthetradeshockstoitssuppliersandtothesuppliersofits suppliers.Specifically,the 1st-stageregressionis:

logM

a,M ic,t 1 · WESa,c,t (10)

D it = log a,c s

s Total it = β1 logM D it + β2 logM S it + β3 logM SS it + κt + κi + ϵit (11) 27

where logM D it , logM S it ,and logM SS it arethetradeshockstofirm i,tofirm i’ssuppliers,and tothesuppliersoffirm i’ssuppliers.Weconstructweightedaveragesoftradeshocksin thesuppliernetworkusingtherecursiveformulationin(8)(detailsinAppendix D.1).

Wefindthatbothdirecttradeshockstoafirm’sownimportsandindirectshocksto afirm’snetworkofsupplierscausesignificantchangestothefirm’stotalexposure sTotal it , generatingastrong 1st-stage(Kleibergen-PaapF-statisticof18.17).

TheIVspecificationshowsthattradecausesanincreaseintheindividualfirm’seffectivetaxrateoncapital(column5).InPanelB,theIVrevealsthattradecausesanincrease infirmsize(proxiedbyrevenue).PanelCshowsapositiveOLSassociationbetweenfirm sizeand ETRK i (wecannotusetheIVinthispanelduetotheexclusionrestriction).

InAppendixD.1,wefindthatthemainresultsarerobusttocontrollingfortradeshocks tofirm i’spotentialsuppliers(firmsthatoperateinthesameindustryandgeographical areaas i’scurrentsuppliersbutarenotcurrentlysupplyingto i)andhorizontalsuppliers (firmsthataresupplierstofirm i’scurrentclients).Theseresultsprovideadditional supportfortheexogeneityassumption.54

ThoughtheanalysisinRwandaisbasedwithinasinglecountryoveralimitedtime range,itsupplementsthemacro-levelresultsintwoways.First,itprovidesfirm-level identifiedevidencethattradeexertsapositiveimpactoneffectivecorporatetaxationina developingcountry,whichcomplementsthecountry-levelresultsinLMICs.Second,by showingthattradeincreasesfirmsizeandthatsizeispositivelyassociatedwith ETRK , itsupportsthetaxcapacitymechanisminterpretationthattrade’simpacton ETRK is mediatedbyapositivesize-ETRK gradient.

Discussion:Linkstotrade-formalityliterature Atthefirm,sectorandcountrylevel,we findpositiveeffectsoftradeonoutcomesrelatedtoformalization.Recentstudiesfocused onthenumberofformalversusinformalfirmsorformalversusinformalworkers,and foundmixedevidencethattradeincreasesformalitybythesemeasures (reviewsinEngel &Kokas, 2021;Ulyssea, 2020).55 Onewaytoreconcileourresultswiththesestudiesisto notethatourfocusisontheshareofoutputproducedinlargerandformalfirms:output expansioninthesefirmsmayoccurwithoutchangestothenumberofformalorinformal firms,anddoesnotimplyanincreaseinthenumberofformalworkers,sinceinformal workersmayworkinformalfirmsandcontributetotheiroutput (Ulyssea, 2018). In 6.4, wealsoshowthatopenness’impactonourformal-outcomesdependsonthenatureofthe tradeshock,consistentwithrecenttheoreticalworkintrade (Dix-Carneiroetal., 2021).

54Inanextension,wefindthatincreased output exposuretoimportsthroughtheclientnetworkhaspositive effectson ETRK ,thoughthisaverageeffectcouldmaskheterogeneityacrossfirms.

55GoldbergandPavcnik(2003),Boschetal.(2012),Crucesetal.(2018),Dix-CarneiroandKovak(2019).

28

6.4Sourcesofheterogeneityintrade’spro-taximpacts

Wereturntothecountry-levelIV(equation 5)tostudysourcesofheterogeneityintrade’s pro-taximpactsonthetaxcapacitymechanismand ETR.

Heterogeneity:Domesticenforcementreforms Overoursampleperiod,LMICshave implementedtaxenforcementpolicies.Achallengeforthemechanisminterpretation isthattrade,potentiallyduetorevenueconcerns,mayhavepromptedgovernmentsto implementthesepoliciesthatincrease ETRK .Toinvestigatethis,wemeasuretheyear ofadoption(ifany)inLMICsoffourpoliciesthatincreasedomestictaxenforcement:(i) largetaxpayerunit;(ii)organizationalintegrationofcustomsanddomestictaxauthorities; (iii)VAT;(iv)internationalaccountingstandards(IAS).56 WeestimateheterogeneousIV effectsbyincludinganinteractiontermbetweentradeandthepolicyadoptionvariablein (5).57 Table A5 showsapositiveeffectoftradeon ETRK withoutthesepolicies,though theeffectislargerfollowingtheiradoption.Tradehasasimilarimpactonthecorporate income-share(µC )withandwithouttheenforcementpolicies,buttrade’spositiveimpact on ETRK C issignificantlyamplifiedwhenenforcementpoliciesareinplace.58 Thatis,the trade-inducedexpansionofthecorporatesectorseemstooccurregardlessofenforcement policies,buttheextenttowhichtheadditionalcorporateoutputtranslatesintohigher effectivecorporatetaxationisreinforcedwhensuchpolicieshavebeenenacted.59 GovernmentsinLMICsmayhavesoughttoraisedomesticrevenue,possiblyinresponsetoopenness,throughotherchannelsapartfromthesespecificenforcementpolicies. WeinvestigatethisinTable A6,findingthattrade’spositiveimpactonthetaxcapacity mechanismand ETRK holdoutsideofperiodsofsignificantrevenueloss,whendefined invariouswaysincludingtheepisodesoftraderevenuelossin CagéandGadenne(2018). Thus,trade’spro-taximpactsappeartobebroadlypresentintheglobalizationprocessin LMICs,anddonothingeongovernment’srevenueneedorenforcementinvestments.

Heterogeneity:Natureoftradeshock Tradetheorieshighlightthattheimpactsoftrade onformality-relatedoutcomesdependonthenatureofthetradeshock.InAppendix D.2,weusebothinstrumentsandequation(5)inLMICstoinvestigateifthe ETR and

56Theenforcementfocusonlargefirmsincreasescollection (Almunia&Lopez-Rodriguez, 2018;M.C. Basri,Felix,Hanna,&Olken, 2021). Thecustoms-taxunificationimprovesdomesticauditcapacity(IMF, 2022).TheVATcreatesinformationtrails (Almunia,Henning,Knebelmann,Nakyambadde,&Tian, 2023; Waseem, 2020). IASdeepenaccountingrequirementsfortaxreporting(Barthetal.,2008).

57Thetimingofadoptionforeachreformisendogenous;however,ourfocusisonthetradecoefficientswith andwithoutthesereformsinplace,whichareidentified(BunandHarrison,2019).

58OnlytheVATwasadoptedinallliberalizingcountriesbythetimeoftheeventsstudiedinSection 5.1

59Intuitively,theenforcementpoliciesalldisproportionatelyraiseenforcementonlargerfirms,thereby furtherincreasingtheslopeofthe ETRK -sizegradientinsidethecorporatesector.Whethertheseenforcementpoliciesarethemselvesdrivenbyglobalizationisatopicforfutureresearch.

29