Expo 2025 Osaka Committees and working Groups

The Apex organ for planning and organising Kenya’s participation in the World Expo 2025 Osaka Japan is the National Coordination Committee (NCC) chaired by the Principal Secretary State Department for Trade. Membership is drawn from relevant Ministries and Departments. The role of this Committee is to provide oversight, policy and strategic direction towards the Country’s effective preparation and participation in the Expo.

The National Steering Committee (NSC) is the second tier in the hierarchy for planning, organizing, and implementing Kenya’s participation in the Expo. This Committee is chaired by the CEO of the Kenya Export Promotion and Branding Agency, who is also the Commissioner General for Kenya in the Expo and draws its membership from relevant Ministries, Departments and Agencies (MDAs) and the private sector. and reports directly to the National Coordination Committee.

The third tier in the hierarchy is the Technical Working Group (TWG) which comprises technical officers who represent MDAs that are members of the National Steering Committee. These are technical teams constituted to plan, organize, coordinate and executive Kenya’s participation in the World Expo.

KENYA’S EXPORT PERFORMANCE IN JAPAN

• Kenya’s exports to Japan since 2015 has had steady growth all decade long with lowest value being USD 40.1 million in 2016. Our best performing year was 2024 with our exports reaching USD 69.3 million.

• Kenya’s imports from Japan have been fluctuating over the last 10 years. There. The peak import value was USD 987.8 million in 2018. Imports from Japan haven’t been under USD 699.9 million throughout the decade.

• Between 2015 and 2024, Kenya’s exports to Japan averaged at USD 51.8 million while her imports from Japan averaged at USD 850.1 million.

• The balance of trade between the two countries has been in favour of Japan all through the last decade with the Peak value being USD 937.8 million which was in 2018 and the lowest being USD 637.0 million in 2023.

4TH

Source : International Trade Centre database; Compiled by KEPROBA

JAPAN

largest economy in the world (2024)

USD 69.3 Million

The value of Kenya’s exports to Japan 2024

Kenya’s principal export products to Japan in 2024

Kenya’s Top 5 export products to Japan in 2024

Source : International Trade Centre database; Compiled by KEPROBA

Kenya’s Top 3 imports from Japan in 2024

• Kenya’s imports from Japan were valued at USD 817.0 million in 2024.

• Kenya’s leading and main import products from Japan in 2022 included: Motor cars and other motor vehicles (USD 345.9 million), Flat rolled products of iron (USD 242.6 million), Motor vehicles for transport of goods (USD 60.5 million), motor vehicles for transport of >= 10 persons (USD 30.1) and parts and accessories for tractors, motor vehicles (USD 23.6 million)

KENYAN PRODUCTS WITH THE HIGHEST POTENTIAL IN JAPAN

• The top 10 products with greatest export potential from Kenya to Japan are:

• The products with greatest export potential from Kenya to Japan are Black tea, packings >3kg, cut flowers & buds, fresh and Coffee, not roasted, not decaffeinated.

• Medicaments consisting of mixed or unmixed products, for retail sale is the product that faces the strongest demand potential in Japan.

1. QUICK FACTS

Japan is an island country in East Asia that is situated in the northwest Pacific Ocean.

Japan is the eleventh most populous country in the world, with a population of 122 million.

The currency is the Japanese Yen.

The capital city is Tokyo.

Japanese Yen

Tokyo

2. JAPANESE CULTURE, ETIQUETTE & TRADITIONS

Religion & Beliefs:

Religion in Japan is manifested primarily in Shintoism and Buddhism, the two main faiths which Japanese people often practice simultaneously.

Christianity is also practiced, mostly in the Western part of the country.

Islam in Japan is mostly represented by small immigrant communities from other parts of Asia, primarily from Indonesia, Pakistan, Bangladesh, and Iran.

Other religions that are practiced in Japan include Taoism, Judaism, Confucianism, Hinduism and Jainism.

Meeting & Greeting:

A swift and simple handshake with only one hand is sufficient — avoid long ones and those using two hands that cups the other person’s hand. Be aware of the hierarchy and seniority of the business partners you are meeting as it’s one of the most important elements in Japanese business etiquette. Greet the seniors and higher-ups first and direct your attention to them, all the while keeping in mind to interact with the others too.

Traditionally, the Japanese would bow at a 45º angle as a common courtesy and respect for the other party. Do not hold eye contact as you bow because it comes off as slightly aggressive.When you initiate the bow, you bend at your waist to an angle between 30 degrees and 45 degrees. You should keep your hands by your sides while bowing. The senior person will then bow at about 15 degrees. 122 million

Communication style:

• Avoid being too direct or aggressive in your communication and try to use more indirect language.

• Politeness is one of the most important pillars of Japanese society.

• When someone makes a mistake, the tendency is not to try and openly criticize the person in public

• Remember to call a Japanese by their last name instead of their first unless they have explicitly asked you otherwise.

• Building relationships is a crucial part of doing business in Japan. The Japanese place a high value on building trust and rapport, and this often involves spending time with colleagues and clients outside of work. This may involve participating in social activities, such as going out for drinks or playing golf. Take the time to get to know your counterpart by asking generic questions and showing an interest in them personally.

• Posture is important. Standing or sitting upright denotes attentiveness and respect for others present. Conversely, people consider a slouched posture a sign of disrespect or lack of interest.

• In Japanese culture, silence plays a significant and nuanced role. It is an essential part of effective communication and a testament to one’s listening skills.

• Silence often carries various meanings. It may be a sign of respect, indicating that the listener is paying close attention to the speaker’s words. It may denote agreement, where the listener’s silence signifies their understanding and acceptance of the point.

• On the other hand, silence can also represent contemplation. When presented with a new idea or proposal, a Japanese person might take a period of silence to consider it carefully before responding. This is viewed as a thoughtful approach to decision-making and discussions.

• The Japanese are strong on group-oriented culture. They value group solidarity over individualism and it’s best to take note of that when going into any business activities.

• Demonstrate humility and give compliments to your team instead of taking credit individually.

Gift Giving:

Gift-giving is an important part of Japanese culture, and it is often used to build relationships and show respect. However, it is important to be mindful of the etiquette surrounding gift-giving. When giving gifts, make sure to use both hands, and avoid giving gifts that are too expensive or extravagant. It is also important to receive gifts with both hands, and to show appreciation.

3. MUST KNOW FOR ALL TRAVELLERS

How to travel in and around Japan

• Railways

• Buses: Buses are used for transit to remote or less traveled locations.

• Taxis: Taxis are available in most cities.

• Airplanes: Airplanes link the country for faster commuting over greater distances.

• Bicycles: Bicycles are a popular mode of transport in Japan.

By air

Japan boasts a staggering 99 airports. There are four international airports in Japan. They are Narita, Haneda (near Tokyo), Kansai (near Osaka) and Chubu (near Nagoya) and are located around three largest cities in Japan. Airplanes link the country for faster commuting over greater distances.

By rail

Japan’s rail system is among the most advanced in the world with a total length of the train lines of 30,625 km. Despite such an impressive number, the

Japanese rail system is very efficient and easy to navigate even if you visit the country for the first time. All lines with very few exceptions boast unique names, indicated on train tickets.

A comprehensive list of train routes is available online https://shorturl.at/SeUnw

By road

The road network in Japan adds up to a length of more than 1.28 million kilometers, including thousands of bridges and tunnels due to the mountainous nature of the archipelago. Roads contribute to economic activity and are indispensable for natural disaster relief. On Japanese highways, like on all other roads in Japan, there is a very important rule: You should always help traffic flow smoothly. This means driving at the same speed as others.

Accommodation

As of March 2023, about 90 thousand hotels and inns were registered in Japan. Accommodation establishments in Japan are most commonly separated into occidentalstyle hotels and traditional Japanese-style inns (ryokan) featuring rooms furnished with tatami mats.

Room occupancy in accommodation facilities

Holiday accommodations in Japan include city hotels, business hotels, resort hotels, ryokan, and group lodgings.

While ryokan offer overnight guests a unique experience with its Japanese-style rooms (washitsu), the inns are less commonly found in large city centers and are pricier than hotels, resulting in comparatively low occupancy rates. In contrast, city hotels attract tourists with their comparatively inexpensive lodging around city centers and popular sightseeing spots. Business hotels secured the highest guest room occupancy rate among accommodation facilities in Japan. ( For Hotels, check pg 26)

Health information

Before traveling to Japan, please be informed of the recommended vaccines for visitors on the Centre for Disease Control and Prevention (CDC) website https://shorturl.at/GHIKv

Telecommunications

The biggest Japanese mobile phone companies are NTT docomo, au by KDDI, Softbank (formerly Vodafone, and before that J-phone) and Rakuten Mobile. There are also several smaller companies which provide low-cost cell phone plans for residents and mobile internet products for tourists, but they typically use the networks of the big four companies. There are several ways to access the Internet in Japan. The most inexpensive method would be to use free Wi-Fi, although its availability is limited and can expose users to vulnerabilities. A SIM card for travelers or portable Wi-Fi

router comes in handy in these situations. You can rent a device or buy a plan from a mobile service provider which includes a device and data at a fee for a specified duration.

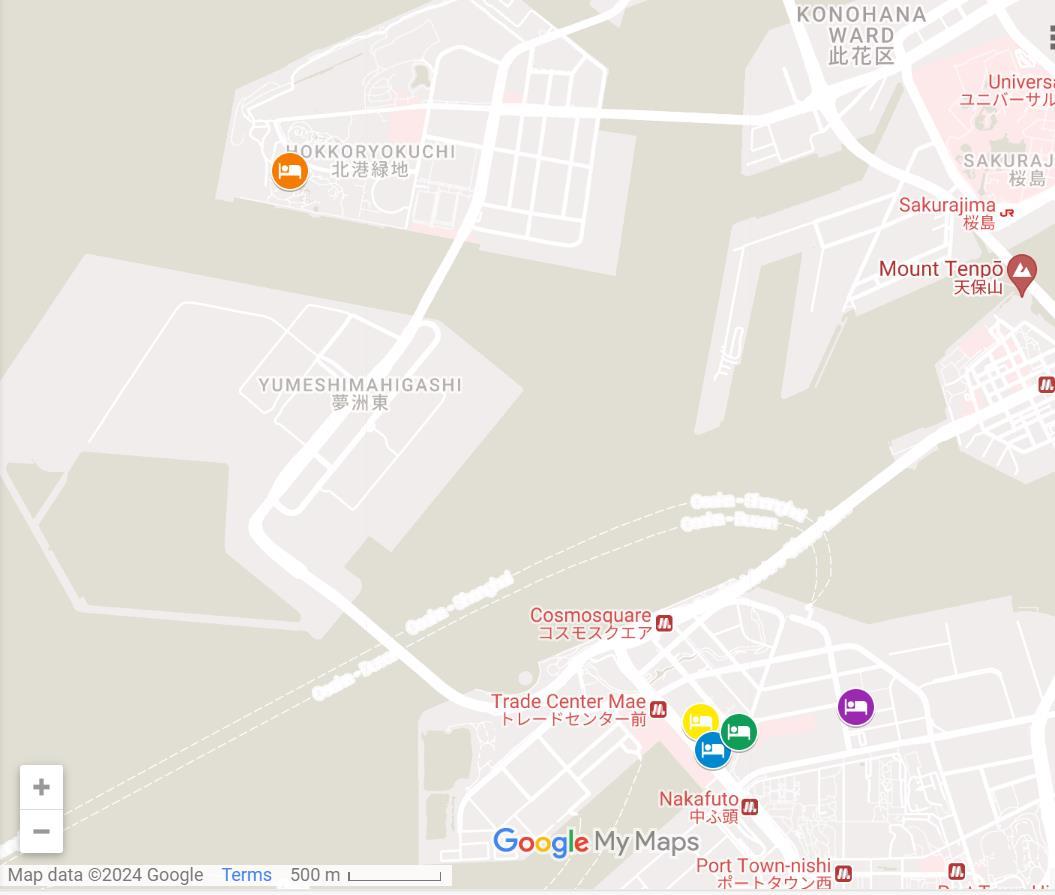

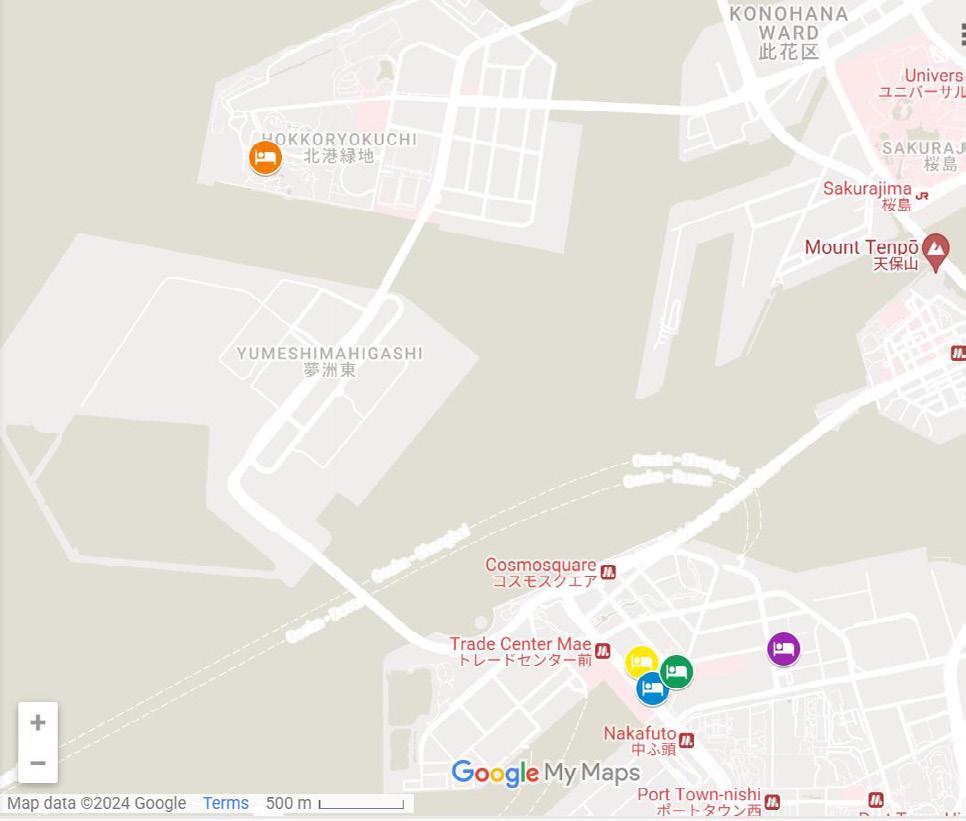

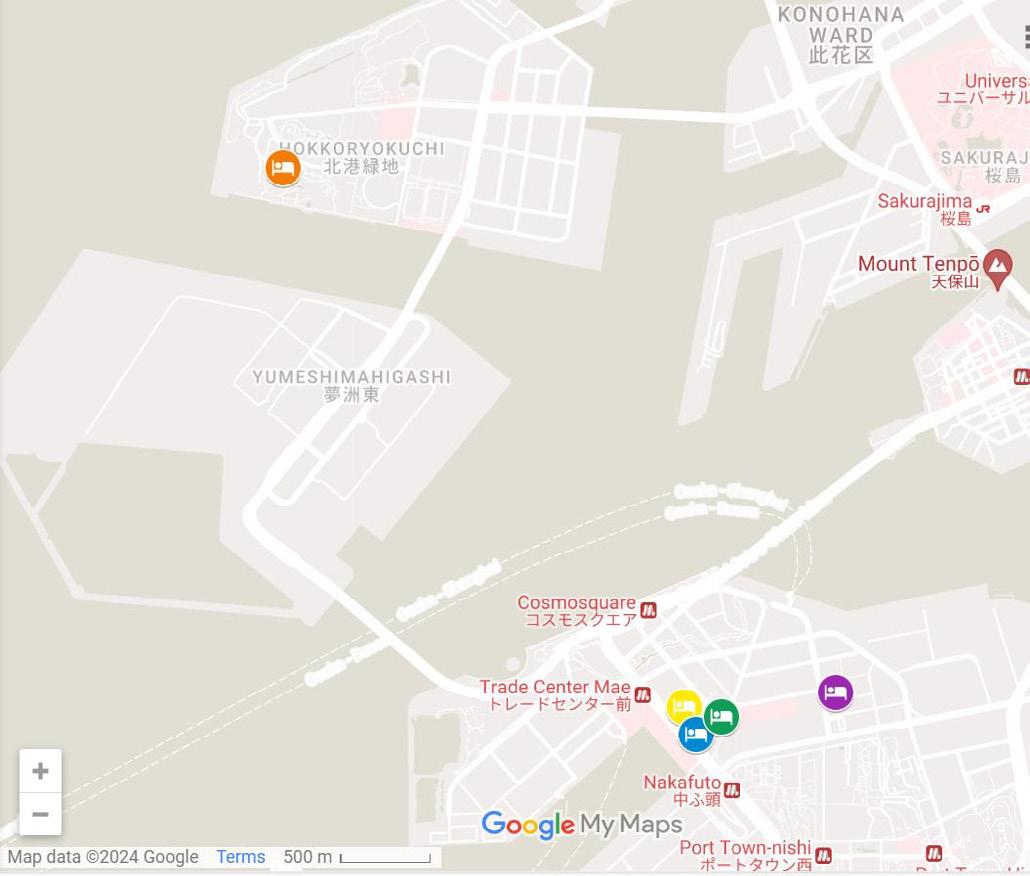

Nearest Hotels to the Expo Venue

Sakishima Cosmo Tower Hotel

Hotel Lodge Maishima

- Total: 131 rooms

Quintessa Hotel Osaka Bay

- Total: 371 rooms

- 7 minutes by Car to the Expo Venue

- 7 minutes on foot from Osaka Metro Cosmosquare Station

- 1 Chome-14-16 Nankokita, Suminoe Ward, Osaka, 5590034

+81-6-6575-7785

https://cosmotowerhotel.jp

- 10 minutes by Car to the Expo Venue

- 15 minutes by Bus from JR Sakurajima Station

(Current information)

- Total: 480 rooms

- 6 minutes by Car to the Expo Venue

- 3 minutes on foot from Osaka Metro Nakafuto Station

- 1 Chome-13-11

-Total: 190 rooms

- 6 minutes by Car to the Expo Venue

- 4 minutes on foot from Osaka Metro Nakafuto Station

- 1 Chome-13-65 Suminoe Ward, Nankokita, Osaka, 559-0034

+81-6-6613-7007

Fukuracia

Bay

https://quintessahotels.com/osaka-bay/

- Total: 320 rooms

- 2 Chome-3-75 Hokkoryokuchi, Konohana Ward, Osaka, 554-0042

+81-6-6460-6688

https://www.lodge-maishima.com/

Nankokita, Suminoe Ward Osaka, 559-0034

+81-6-6612-1234

https://www.princehotels.co.jp/osakabay/

+81-6-6614-8711

- 10 minutes by Car to the Expo Venue

-5 minutes by Bus from Osaka Metro Cosmosquare Station

- 1 Chome-7-50

Nankokita, Suminoe Ward, Osaka, 559-0034

https://www.hotel-cosmosquare.jp

Osaka/Kansai Hotel List

-The list was compiled by the Osaka Convention & Visitors Bureau and the Organiser with the aim of supporting the smooth execution of operations by providing information on accommodation facilities available during the Expo period and matters of interest to the operators and others related to the Expo (hereinafter referred to as ‘Related Persons’), including the Official Participants.

-This list shows facilities (e.g. availability of self-catering, availability of meeting rooms, etc.) that are in high demand by Related Persons to enable them to search for the hotel according to their needs.

-The Organiser is not liable for any of the information listed, which is presented exactly as informed by each hotel. Related Persons are responsible for checking the content of the information listed, and deciding which hotels are qualified to contract with.

- Please bear in mind that the Organiser will in no way participate in any dealings, as mediator or otherwise, or communications between Related Persons and the hotels listed. All contacts, contracts, corresponding negotiations, and business deals must be carried out directly between the Official Participants and the hotels.

- This information for the Official Participants is issued pursuant to Article 7.2 of the Special Regulation No. 6 for the Expo 2025 Osaka, Kansai, Japan.

Leaving Kenya, Remember …

Prepay customers

Most phones will automatically connect to a preferred network and start roaming when switched on in the visited country. If this does not happen Go to settings> Mobile Data > and select Data roaming as “ON”

Postpay customers

• Post pay customers need to activate roaming service before leaving the country. Simply dial *444# or *456#, select Global Connect and follow the prompts to “Activate Roaming Service”.

• Corporate PostPay customers will be required to contact their account manager for roaming activation.

• Should you forget to activate roaming on your PostPay line before leaving the country (Kenya) Send mail to advantage@safaricom. co.ke for roaming activation?

NB: - No deposit is required to activate roaming on both PrePay and PostPay

Roaming Data Bundles

• To buy a Roaming Bundle, dial *100# or *200# and select ‘Products & Services’. Select ‘Safaricom Roaming’ and buy any of the bundles below.

Roaming Partners

PostPay partners

• KDDI

• NTT DoComo

• J-Phone Data

• J-Phone

• NTT DoComo

• KDDI

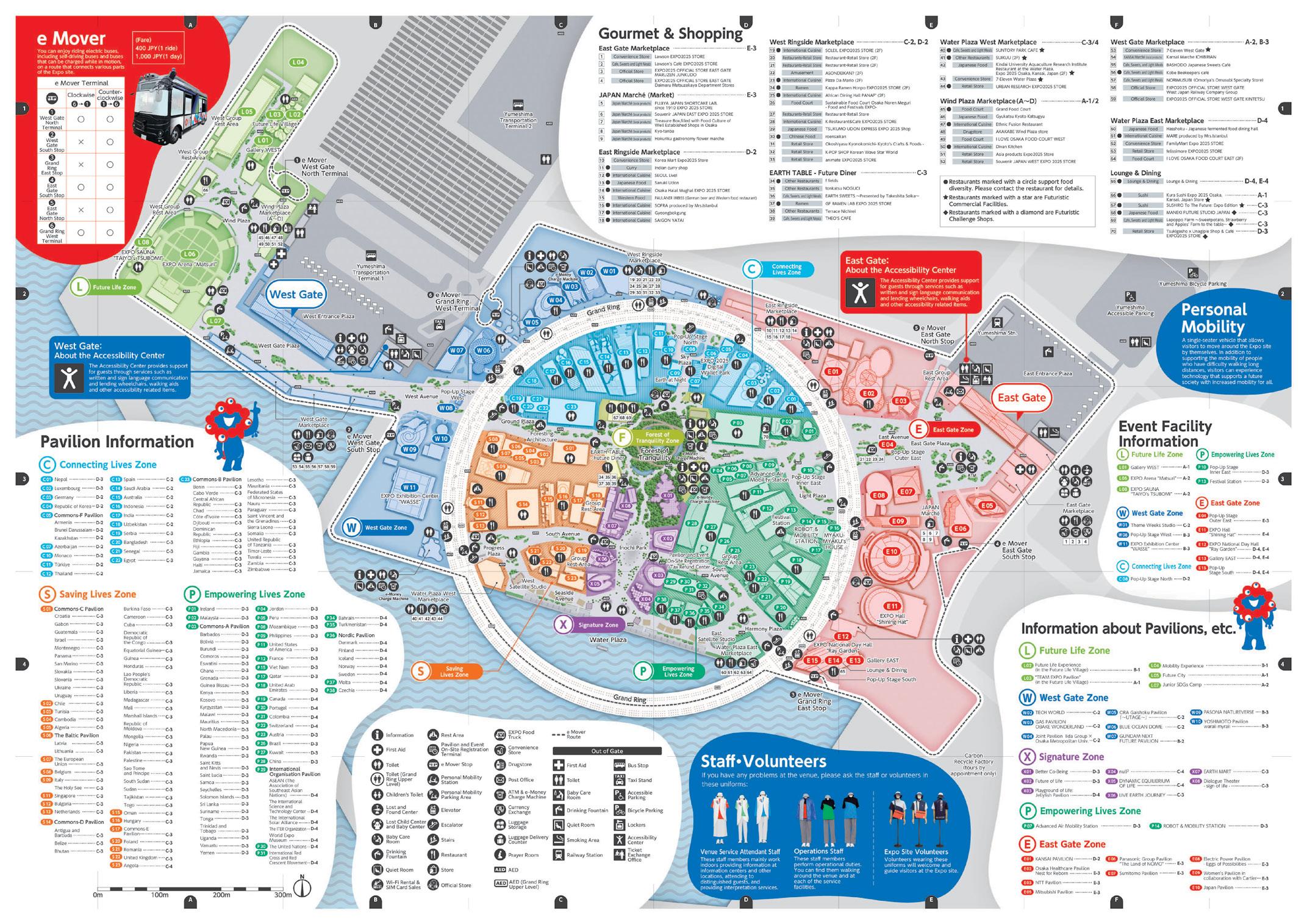

5. BUYING TICKETS

a) Can I Buy tickets for the Expo?

Advance online tickets available now, before the April 2025 start of the expo, range in price from 4,000 yen ($27) to 6,700 yen depending on the entry days.

b) What tickets are available?

Advance Ticket (One-Day Ticket)

Opening and First-Half Period Tickets that you can use in the first half of the Expo period, and Super Early Bird / Early Bird discount One-Day Tickets that allow you one admission at any time during the Expo period are both available for sale.

Opening Ticket

One entry allowed from the opening day to 26th April 2025.

First-Half Period Ticket

One entry allowed from the opening day to 18th July2025

Multiple-Entry Pass

For those would like to visit the Expo multiple times, here are 2 kinds of very affordable Multiple-Entry Passes. The season pass allows the holder multiple entries allowed from the opening day to 3rd October 2025, every day after 11:00 am. After one visit, you can book the next (fourth), and so on.

*You cannot enter in the period prior to closing: anytime from 4th October 2025.

Summer Pass allows the holder multiple entries allowed from 19th July 2025 to 31st August 2025, every day after 11:00 am. You can book up to two times before your visit. After one visit, you can book the next (third) visit, and so on.

Special Ticket (for guests with a disability certificate)

One entry is allowed and can be purchased from the advance sales period to the rest of the Expo period. A guest with a disability certificate and an accompanying guest (assistance) can enter.

Night Ticket

Sold during the Expo and can be used for one entry after 5:00 pm during the Expo

Weekday Ticket

Sold during the Expo and can be used for one entry on weekdays from 11:00 am during the Expo.

One-Day Ticket

Sold and can be used for one entry at any time during the Expo.

Group Ticket

One simultaneous entry for a group of 15 or more.

School Group Ticket

First half

One simultaneous entry for a school group from 13th April 2025 to 18th July 2025.

School Group Ticket

Second half

One simultaneous entry for a school group from 19th July to 13th October 2025.

c) How can I buy tickets for Expo?

Admission tickets will be e-tickets. You can purchase them with a smartphone or computer. If it’s difficult purchasing tickets via smartphone, tickets can also be purchased through travel agencies and various play guides.

d) How much do Expo tickets cost?

For ticket prices, please refer to the expo website https://www.expo2025.or.jp/en/tickets-index/price/

e) Prevention of Unauthorized Resale

To protect your rights, we prohibit the unauthorized resale of tickets.

The transfer of tickets is as stipulated in the Expo 2025 Osaka, Kansai, Japan Ticket Purchase and Use Policy.

If you transfer tickets to a third party in violation of the scope and conditions stipulated in the Expo 2025 Osaka, Kansai, Japan Ticket Purchase and Use Policy, the tickets will become invalid

Items not allowed at the Expo site

i. Explosives and dangerous items/materials, and other items with the risk of explosion, ignition, generation of toxic gas, etc.

ii. Weapons and deadly weapons, cutting instruments (Guns, swords, cutting instruments such as knives and scissors, rifles, handcuffs, water guns, sprayers, etc. / including manufactured items, imitations, toys, and handmade items) Any device with a laser beam/laser pointers or strobe lights

iii. Pepper spray, which can cause bodily harm or cause discomfort to others

iv. Combustible items such as fireworks, gas cylinders, large quantities of lighters and matches

v. Items that could be potentially used as lethal weapons such as golf clubs, bats and rackets

vi. Other items whose possession is prohibited by laws and regulations

The prohibited items for the Expo Site are outlined in the Guideline sections “GL13-4-2, GL10-8-2 Guideline on prohibited articles and prohibited acts”. Below is a summary of the key points that require special attention. Please review them carefully.

Articles prohibited on the site (hazardous articles, etc.

• Explosives, hazardous articles, and any other articles that could explode, burst into flame, or emit hazardous gas

• Weapons, firearms, swords, etc. (including products, counterfeit products, toys, and handmade products of guns, swords, kitchen knives, knives, scissors and

• other edged tools, rifles, handcuffs, water guns, aerosols, etc.)

• Tear gas spray or any other articles that could injure or cause discomfort to others

• Flammable articles such as fireworks, gas cylinders, and large amounts of lighters/matches

• Articles that could be used as weapons, such as golf clubs, bats, and rackets

• Other articles whose possession is prohibited by pertinent laws and regulations Articles prohibited on the site (other prohibited articles)

• All alcoholic beverages (regardless of their packages or opened/unopened)

• *Except products of concession facilities

• Canned and bottled beverages

• *Except products of concession facilities

• *Personal water bottles or vacuum flasks (thermos bottles) recommended. PET bottles acceptable.

• Animals other than partner dogs, hearing dogs and seeing-eye dogs, and plant seeds - Suitcases, carry cases, etc., which are allowed on the public transportation system (prohibited regardless of size).

• Other articles deemed by the Expo to be unsuitable from the standpoint of preserving order and safety in the site

• Other articles whose possession is prohibited by pertinent laws and regulations

Prohibited acts (dangerous acts, etc.)

• Occupation of sites, exhibitions of collective enthusiasm (making an uproar) and other acts that disturb other visitors

• Acts that block, impede, or endanger passages of people, vehicles, mobility services, etc.

• Carrying around of items that could cause injury or damage to people or objects, and acts that could cause such injury or damage

• Spraying, scattering or leaving gas, liquid, powder, or other items

The prohibited items for the Expo Site are outlined in the Guideline sections “GL13-4-2, GL10-8-2 Guideline on prohibited articles and prohibited acts”. Below is a summary of the key points that require special attention. Please review them carefully.

Entry into places where no entry is permitted

• Gliding with roller skates, roller shoes, skateboards, kick scooters, bicycles, etc. on the passages for visitors within the opening hours

*Except personal mobilities lent by the Organiser of the World Expo 2025

Prohibited acts when bringing in bicycles etc.

• Bicycles

• Job-related bicycles carried on a vehicle can be brought in to the Expo site through the administrative gate (vehicle gate). Access from other gates is prohibited.

• No entry allowed with your bicycle when riding or pushing it.

• Bringing in a folded bicycle, even if you carry it in a bag, is also prohibited.

• Articles other than bicycles (roller skates, roller shoes, skate boards, kickboards)

• Must be carried in something like a bag and completely covered up so that it will not come in sight of other visitors.

• *Secure visitors’ safety before using assisted-walking devices for elderly or physically-disabled people, even if they are not ones for gliding around the site

Prohibited acts (destructive acts, etc.)

• Damage or defacing of exhibits, facilities, equipment, or any other items used at the Expo

• Discarding of wastepaper, empty containers, or any other waste or refuse in places other than the designated ones

• Picking of plants, catching of insects, or damaging of either

• Feeding, capture, killing, or injury of wildlife (birds, animals, fish, etc.)

Prohibited acts (prohibition of usage/distribution, etc.)

*Except the acts within their own Plots

• Use of loudspeakers, megaphones, etc. that could cause noises

• Display or carrying of flags, or the equivalent

• Display or distribution of posters, handbills, leaflets, etc.

• Mercantile acts, display of products, and photography, filming or recording for commercial purposes

• Use of wireless communications equipment including those for amateur radio and for specified low power radio, and transceivers (excluding mobile phones, radios, personal computers, tablets, etc.), and radio-controlled toys

• *Regardless of inside or outside of the plots, in the Expo Site, wireless communications equipment for business use is required to apply for a permit. For the

• wireless communications equipment and its application procedure, refer to “Guidelines for Use of Radio Devices

The prohibited items for the Expo Site are outlined in the Guideline sections “GL13-4-2, GL10-8-2 Guideline on prohibited articles and prohibited acts”. Below is a summary of the key points that require special attention. Please review them carefully.

in the Expo Site (Operations)”

• *For small unmanned aircrafts including drones, refer to “Guidelines for Use of Flying Devices in the Expo Site”TBA.

Prohibited acts (other prohibited acts)

• Selling the prohibited articles (hazardous items, etc.) described in within the Expo Site

• Consumption of alcoholic beverages outside places where it is permitted to sell or provide

• Bringing wastes in the site and leaving there

• Hazardous acts from the standpoint of fire prevention (*Smoking is specified separately)

• Soliciting of donations, signatures, etc.

• Conducting surveys (sampling, questionnaires, etc.) or seeking of responses to questions outside of their own plots

• Demonstrations, assemblies, speeches, or any other acts that induce people to gather or stop

• Planting or Sowing seeds

• In addition to those in each of the preceding items, wearing clothes that are offensive to public order and morals, or acts that disrupt the order or peace on the site

Our Partners

A. PROGRESS OF KENYA VISION 2030

1. Target: Achieve and sustain an average economic growth rate of 10 percent per annum by 2030 to make Kenya and industrializing middle income country. Current- 5.6%

Kenya Vision 2030, implemented through 5-year Medium-Term Plans (MTPs) which achieved key milestones that transited from one cycle to the other, as indicated below.

1. First Medium-Term Plan (MTP I), (2008 -2012)

i. Enactment of a new Constitution of Kenya 2010

ii. The creation of the bicameral Parliament

iii. Strengthened Judiciary with supreme court establishment, created oversight institutions through chapter fifteen independent Commissions and offices

iv. Set up public finance management framework

v. Enhanced the financial inclusion in the country with the launch of M-Pesa among other innovations.

2. The Second Medium Term Plan (MTP II), (2013 -2017)

i. Kenya transitioned from a Low-Income Country status to a Lower Middle-Income Country upon attaining a Gross Domestic Product (GDP) per Capita of USD 1,430.35 in 2014, with the target being to be an upper middle-income country by 2030.

ii. Implementation of the Constitution through key offices like the Commission for Implementation of the Constitution (CIC) and Transition Authority.

iii. Operationalization of devolution

iv. Laying firm foundation for the construction of key infrastructure namely: roads, railway, including the Standard Gauge Railway (SGR), airports, including the modernization of JKIA and construction of airstrips, ICT, and innovations for sustained achievement of the Kenya Vision 2030 and the last mile connectivity to power.

v. Advent of base Titanium activities in Kenya

3. The Third Medium Term Plan (MTP III), (2018 -2022)

i. Development of the Kenya National Spatial Data Infrastructure Plan to guide spatial planning at national and county levels.

ii. Judicial transformation through constructing, equipping & staffing court buildings.

iii. Construction of 25,000 km of paved roads across the country

iv. Multi-modal Lamu Port South Sudan Ethiopia Transport (LAPSSET) Corridor-ongoing.

Expanded National Optic Fibre Backbone Infrastructure (NOFBI) network covering all regions

vi. Constructed 622 km of Standard Gauge Railway (SGR), 2,778 km of Metre Gauge Railway (MGR).

vii. Last mile connectivity project

viii. Decentralization of Government services – Huduma Centres, a Huduma Life App, and Huduma Mashinani, over 5000 Government services offered

ix. Expansion of the Mombasa Container Terminal; Kisumu; Lamu, Shimoni fishing port; Improvement of shipping and maritime facilities

x. Expansion and modernization of aviation facilities –airports, airstrips

xi. Increased national power generation capacity from 2,351MW in 2018 to 3,321.3MW

xii. Affirmative Action Funds

xiii. 7 regional stadia have been upgraded to national and competition standards.

xiv. National Library of Kenya completed in 2022.

xv. 30,000 teachers recruited

xvi. 60,000Ha of degraded natural forests were restored

xvii. Ease of doing business global ranking moved from 92 to 56.

xviii. Mwea & Thiba Dam Irrigation Development Project

xix. Mama Ngina Waterfront in Mombasa

xx. Ronald Ngala Utalii College in Kilifi County (78% complete)

xxi. The National Electronic Single Window System (NESWS)-automating imports and exports

xxii. Establishment of Kenya National Multi-Commodities Exchange (KOMEX):

xxiii. Konza City Horizontal Infrastructure, Data Centre and the Open University of Kenya (OUK)- in progress

xxiv. Export Processing Zones (EPZs) in Sagana, Del Monte, Eldoret, Busia, Athi River

xxv. One Stop Centre (OSC) at the Kenya Investment Authority (KenInvest)

xxvi. MSMEs Development Programme

xxvii. Fertilizer cost reduction programme

xxviii. Nairobi International Financial Centre Authority (NIFC) established.

xxix. Construction of fishing landing sites at the Coast and Lake Victoria

xxx. The country conducted a peaceful election and electioneering period that majorly focused on issue-based, result-oriented campaigns in line with the aspirations of the Kenya Vision 2030 that envisages issue-based, resultsoriented, and accountable democratic system.

xxxi. Trade Pacts and Treaties – National Trade Policy, AGOA has been renewed, agreement with EU, trade agreements with the AU, USA and South Korea, the AFCTA Agreement and many others

xxxii. Sports and Conference Tourism

4. The Fourth Medium Term Plan (MTP IV), (2023 -2027), focuses on:

i. Implementation of the Bottom-up Economic Transformation Agenda (BETA)

ii. Identified Sector flagship programmes and projects under the Kenya Vision 2030 the gains achieved under the previous MTP to accelerate the interventions geared towards stabilizing the economy and transforming lives.

iii. Key Pillars: Agricultural Transformation and Inclusive Growth; Micro, Small and Medium Enterprise (MSME) economy; Housing and Settlement; Healthcare; and Digital superhighway and Creative Economy will be fully implemented to lift the majority from the bottom up.

Black CTC Tea

Specialty Teas

Specialty Teas

Pekoe

Pekoe

Black CTC Tea

Black CTC is oxidized tea manufactured through cutting, tearing and curling machine. Grading is through separation of particle sizes using various meshes. Black orthodox is oxidized tea produced through rolling machines. Black Orthodox grading is by leaf size, texture and style.

Orange Pekoe A – Well rolled & curled, loosely wound, leggy, stylish for the grade, largest whole leaf grade.

Orange Pekoe 1 – Stylish, wiry well made whole leaf tea, tightly twisted depicting a high quality with food bloom.

Flowery Orange Pekoe – Well made, fairly well loosely twisted whole leaf tea.

Pekoe – Well curled, knotty, stylish, heavy pekoe teas,with good bloom.

Flowery Broken Orange Pekoe Fanning Special

Broken Pekoe 1 – Largest size of ‘grain’ particles and it produces liquors that are a bit light in body but with encouraging flavoring characteristics.

Pekoe Fanning 1

Black and grainy with particles slightly smaller in size than those of the BP1 grade.

Pekoe Dust – Black and finer than the Pekoe Fanning 1. It produces thick more pungent liquors. Dust – Its made up of the smallest particles

GO-OP1 Long

GO-FBOPFSP

Black CTC Tea

Black Orthodox Tea Green Orthodox Tea

Black CTC is oxidized tea manufactured through cutting, tearing and curling machine. Grading is through separation of particle sizes using various meshes.

Black orthodox is oxidized tea produced through rolling machines. Black Orthodox grading is by leaf size, texture and style. Black Orthodox tea includes:

Orange Pekoe A – Well rolled & curled, loosely wound, leggy, stylish for the grade, largest whole leaf grade.

Orange Pekoe 1 – Stylish, wiry well made whole leaf tea, tightly twisted depicting a high quality with food bloom.

Flowery Orange Pekoe – Well made, fairly well loosely twisted whole leaf tea.

– Well curled, knotty, stylish, heavy pekoe teas,with good bloom.

Flowery Broken Orange Pekoe Fanning Special – Stylish, short, well & evenly sized flowery Broken orange pekoe special tea, with useful tips depicting high quality.

Broken Pekoe

Pekoe Fanning 1 – Black and grainy with particles slightly smaller in size than those of the BP1 grade.

Pekoe Dust – Black and finer than the Pekoe Fanning 1. It produces thick more pungent liquors.

Dust – Its made up of the smallest particles of main grades.

GO-FOP Long loosely wirey whole teas with a light smooth, slightly floral

GO-OPA

Flowery Orange Pekoe

with particles slightly smaller in size than those of the BP1 grade.

Pekoe Dust

Fanning 1. It produces thick more pungent liquors.

Specialty Teas

White tea is tea made from very fine two leaves and a bud or the bud from specifically selected clone. The tea is manufactured through natural sun drying. When brewed the liquors are light, refreshing and flavoury.

White Tea

Purple tea is harvested from a specific purple tea plant. When brewed this yields a light refreshing and flavoury purple liquor.

Purple Tea

Green tea Is made from a finer plucked green tea leaf. Green tea is unoxidized realized through both rolling and CTC machine. Green tea is brewed at lower temperatures to realize

sweet and flavoury liquor / taste.

Green Tea GO-OP1

A. OVERVIEW

• Name: Special Economic Zones Authority (SEZA)

• Established: 2015

• Legal Framework: Special Economic Zones Act No. 16 of 2015

• Website: sezauthority.go.ke

• Headquarters: Upper Hill, Nairobi, Kenya

B. KEY HIGHLIGHTS

• 44 SEZs gazetted as of November 2024

• $2.21 Billion in projected local and foreign investment

• 26,000 jobs anticipated by 2027

• 35 private SEZs and 9 public SEZs currently active

C. MANDATE & STRATEGIC OBJECTIVES

SEZA is the national agency tasked with promoting, facilitating, and regulating Special Economic Zones across Kenya. Its strategic priorities include:

• SEZ Development: Catalyzing the establishment of SEZs throughout the country

• Investment Promotion: Attracting both domestic and international investment

• Infrastructure Delivery: Coordinating integrated infrastructure for

SEZ operations

• Oversight & Compliance: Ensuring adherence to SEZ regulations and standards by all stakeholders

D. SECTORAL FOCUS OF SEZS

Kenya’s SEZs serve a diverse range of sectors:

• Free Port Zones: Outside customs territory, ideal for warehousing and transshipment

• Free Trade Zones: For logistics operations such as offloading, repackaging, and storage

• ICT Parks: Supporting innovation, research, and technology development

• Business Service Parks: Offering turn-key services for global firms

• Industrial Parks: Manufacturing and processing hubs with ready infrastructure

• Agro & Livestock Zones: Focused on value chain development in agriculture and livestock

• Science & Tech Parks: Driving ICT and innovation-led economic growth

• Tourism & Recreation Zones: Promoting sustainable leisure and tourism

E. KEY SEZ LOCATIONS

• Naivasha (Nakuru County): Textiles and agro-processing near Olkaria geothermal

• Dongo Kundu (Mombasa): Port-integrated SEZ for logistics and manufacturing

• Konza Technopolis (Machakos): Kenya’s “Silicon Savannah” for tech and innovation

• Tatu City (Kiambu): Multi-sector, mixed-use private SEZOther Active Private SEZs: Two Rivers, Nairobi Gate, Red Lands Roses, Rock Plant, Mt. Elgon Orchards, and more

i. Fiscal Benefits

• 0% VAT, Import & Excise Duties for SEZ-dedicated goods

• Corporate Tax: 10% (Years 1–10), 15% (Years 11–20), then standard 30%

• Withholding Tax Exemption for first 10 years on foreign service payments and dividends

• Stamp Duty Exemption

• 100% Investment Deduction on capital expenditure

ii. Administrative Benefits

• One-Stop Shop for licensing and clearances (KRA, KPLC, NEMA, etc.)

• Single Operating License simplifies business processes

• Exemption from certain regulatory barriers and fees

• On-site customs support and unrestricted foreign investment

• Fast-tracked government approvals for SEZ activities

G. SECTOR SPECIFIC VALUE PROPOSITION

1. Manufacturing (Light & Heavy)

• Fiscal Incentives: 10-year corporate income tax holiday; dutyfree import of inputs and machinery.

• Ready Infrastructure: Serviced land, industrial parks, and reliable green energy (e.g., geothermal in Naivasha).

• Proximity to Markets: Access to EAC, COMESA and AFCTA (1.2+ billion consumers) with preferential trade agreements.

• Workforce & Cost Advantage: Competitive labor costs and a skilled technical workforce pipeline.

• Support Services: One-Stop-Shop for regulatory approvals and aftercare.

2. Agro-Processing

• Abundant Raw Materials: Year-round access to diverse agricultural produce from across Kenya.

• Export Focus: Access to EU, Middle East, and regional markets through certified processing zones.

• Cold Chain & Logistics: SEZs near transport corridors (SGR, airports, ports) reduce spoilage and time-to-market.

• Zero-Rated Inputs: Import of packaging and machinery at zero duty and VAT.

• Food Safety Compliance: Government and SEZA support on HACCP, ISO, and other certifications.

3. Pharmaceuticals & Health Industries

• Growing Local Demand: Expanding regional healthcare market and population growth.

• Import Substitution Opportunity: 80% of pharmaceuticals in Kenya are imported— scope for local production.

• Supportive Regulations: Fast-track licensing, land allocation, and support from the Pharmacy & Poisons Board.

• R&D Support: Collaboration with Kenyan universities and R&D tax incentives.

• Logistics Efficiency: Cold-chain infrastructure for biopharmaceuticals and vaccine production.

4. ICT & Digital Economy

• Plug-and-Play Parks: Data center-ready zones with green power (e.g., Naivasha geothermal).

• Fiber Connectivity: Redundant international submarine cables at Mombasa; local last- mile support.

• Skilled Talent: Young, English-speaking, tech-savvy population.

• Government Partnerships: Smart SEZ plans and digital infrastructure policy support.

• Innovation Ecosystems: Room for incubators, BPOs, cloud hosting,

clean energy investments.

5. Automotive & Industrial Assembly

• Strategic Location: Position SEZs as regional hubs for EAC/COMESA automotive distribution.

• CKD Incentives: Import duty exemptions for completely knockeddown kits.

• Infrastructure Backbone: Access to ports, inland container depots, and highways.

• Skilled Workforce: Partnerships for vocational and technical training (TVETs).

• Regulatory Alignment: Fast-tracked standards approvals through KEBS and SEZA.

6. Logistics & Warehousing

• Customs Control Zone: Operate bonded logistics centers and freeport facilities in SEZs.

• Time & Cost Savings: Direct clearance of goods at SEZs; bypass congested urban logistics bottlenecks.

• Strategic Corridors: Dongo Kundu, Naivasha, and Lamu SEZs are positioned on national and regional corridors.

• Digital Integration: Integrated port, rail, and customs platforms for efficient cargo tracking.

• Public-Private Collaboration: Opportunities for partnerships with KPA, KRA, and private developers.

7. Renewable Energy & Green Technology

• Green Energy Access: Sustainable energy sources like geothermal, wind, and solar.

• Incentives for Clean Projects: Support for sustainable energy initiatives and carbon credit trading.

• Integration with SEZs: Green manufacturing and data centers powered by renewable energy.

• Streamlined Regulatory Approvals: Fast-tracked permits for

8. Tourism & Hospitality

• Eco-Friendly Development: Opportunities for eco-resorts and business hotels within SEZs.

• Strategic Locations: Proximity to major tourist attractions like Maasai Mara, Lamu, and the Coast.

• Duty-Free Imports: Construction materials and luxury fittings for SEZ-based projects are zero-rated.

• Streamlined Licensing: Simplified approval processes for tourism-related ventures.

9. Education & Vocational Training (TVET)

• Specialized Training Institutions: Establishment of sectorfocused vocational training within SEZs.

• International Collaboration: Partnerships with global universities and vocational training institutes.

• Fiscal Incentives: Benefits for educational infrastructure development and training programs.

10. Financial Services & Fintech

• Special Financial Zones: Dedicated zones for international banking, insurance, and fintech solutions.

• Regional Access: Entry to East African and COMESA markets for cross-border financial services.

• Incentives for Digital Finance: Support for digital banking platforms and blockchain solutions.

11. Creative Economy (Film, Music, and Digital Content)

• Production Facilities: SEZ-based studios and digital content hubs with tax incentives.

• Global Market Access: Export-oriented creative hubs targeting global streaming platforms.

H. REGIONAL INTEGRATION & LOGISTICS

Kenya’s SEZs benefit from seamless access to regional and global markets through:

• EAC (East African Community) – Over 300 million people

• COMESA, AfCFTA, AGOA, EPA – Trade agreements providing market reach

• Efficient Transport Infrastructure:

o Mombasa Port

o Standard Gauge Railway (SGR)

o Jomo Kenyatta International Airport (JKIA)

Estimated Shipping Times:

• 11 days to Jebel Ali (UAE)

• 23 days to Shanghai (China)

• 55 days to Rotterdam (Netherlands)

Estimated Shipping Times to Japan

The estimated shipping time from Mombasa, Kenya to major ports in Japan (e.g., Tokyo, Yokohama, Osaka) typically ranges between

25 to 35 days (by sea freight) Air freight: 2–5 days I. ENERGY & SUSTAINABILITY

Kenya leads Africa in renewable energy, with over 80% of its electricity sourced from green technologies:

• Hydro (48.2%)

• Geothermal (21.3%)

• Wind (16.1%Solar (10.4%) Preferential SEZ Power Tariffs:

• KSh 10/kWh – Other SEZs

• KSh 7.62/kWh – National off-peak

J. LICENSING OPTIONS

• Developer License: For constructing SEZ infrastructure

• Operator License: For managing SEZ activities

• Enterprise License: For businesses operating within SEZs

K. RECENT MILESTONES & IMPACT

• Tatu City One-Stop Shop: Kenya’s first fully integrated SEZ facilitation center, coordinating KES 130B+ in investments

• Jobs & GDP Contribution: Over 7,000 direct jobs created; SEZs have contributed KES 91B to GDP

• Sustainable Industrialization: Strong commitment to clean energy and green manufacturing leadership in Africa

L. CONTACT SEZA

Website: www.sezauthority.go.ke

Email: info@sezauthority.go.ke

Phone: +254 20 786 3971 / +254 769 444 111

Address: UAP Old Mutual Towers, 8th Floor, Upper Hill Road, Nairobi, Kenya

Twitter: @SEZAuthority

Facebook: @sezauthoritykenya