Lumi Gruppen

Presentation Q2 2023, 16 August 2023

CEO Erik Brandt and CFO Martin Prytz

Introduction

About Lumi Gruppen

Executive Summary

Financials

Presentation Q2 2023, 16 August 2023

CEO Erik Brandt and CFO Martin Prytz

Introduction

About Lumi Gruppen

Executive Summary

Financials

The group consists of three main operating segments from Q3-23:

Strategy & Operations

Sonans

Oslo Nye Høyskole

NTech

Outlook

Disclaimer

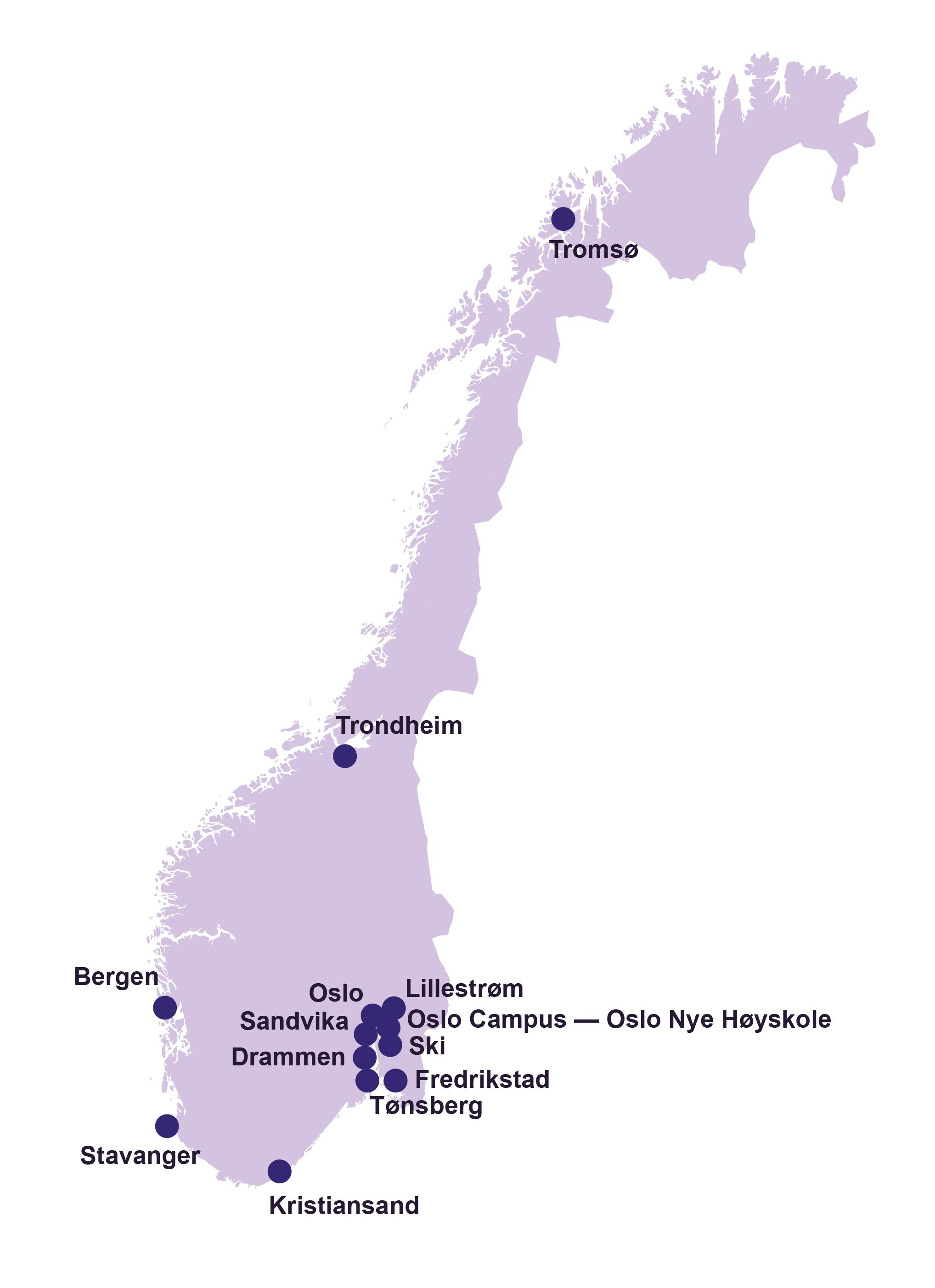

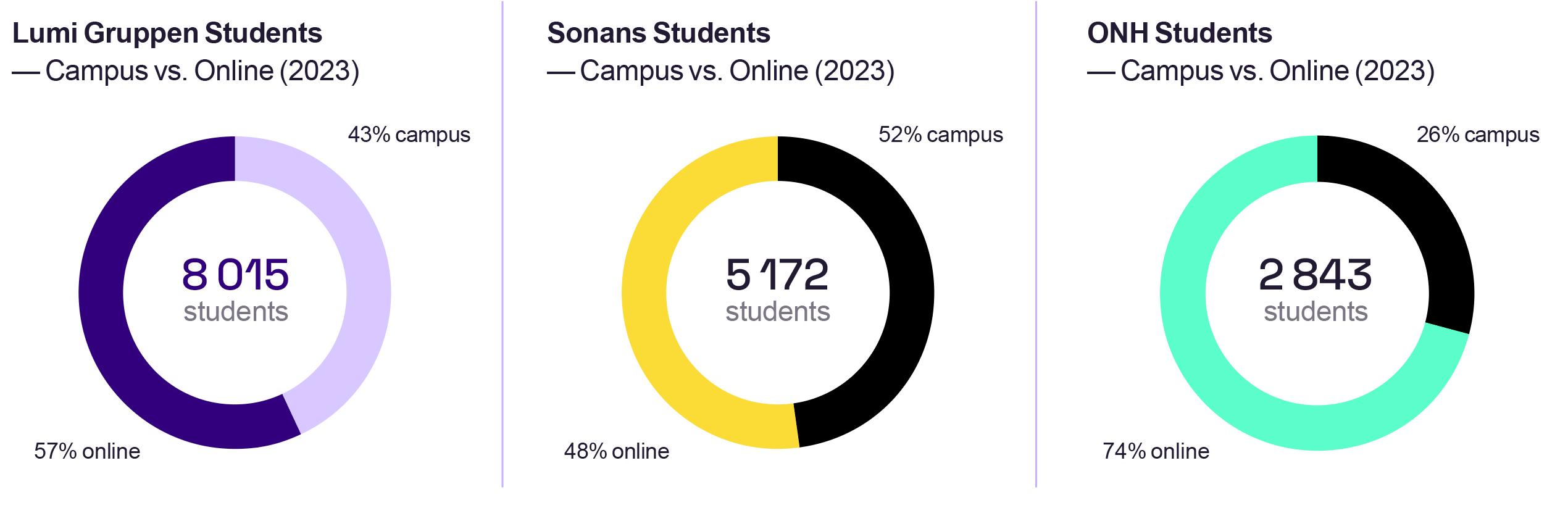

Oslo Nye Høyskole (ONH): Private university college, with a campus in central Oslo, and a strong online offering.

Sonans: Norway’s market leader within high school private candidate exam preparation courses.

Norwegian School of Technology (NTech): New vocational trade school launched 1H of 2023, offering IT study programmes at campus and online from the school year 2022/2023

Introduction

About Lumi Gruppen

Executive Summary

Financials

Oslo Nye Høyskole: Growing and gaining market share, cost development stabilized with improved EBIT margin

Strategy & Operations

Sonans

Oslo Nye Høyskole

NTech

Outlook

Disclaimer

Sonans: Continued revenue decline due to the post-Covid market set-back. Savings from the cost programme totalling close to NOK

17 million in Q2 and NOK 36 million for 1H 2023. A further 10 million in savings from the autumn

NTech: Marketing campaign for programmes and courses launched, enrolment from the coming school year 2023/2024

Based on the Sonans intake, more cost measures are being prepared for implementation from the third quarter

* Impairment of NOK 270 million related to goodwill allocated to the operating segment Sonans

Introduction

About Lumi Gruppen

Executive Summary

Financials

Strategy & Operations

Sonans

Oslo Nye Høyskole

NTech

Outlook

Disclaimer

Introduction

About Lumi Gruppen

Executive Summary

Financials

Strategy & Operations

Sonans

Oslo Nye Høyskole

NTech

Outlook

Disclaimer

Operating revenue NOK 104.7 million (-22.0%)

Sonans revenue NOK 54.6 million (-38%) due to the post-Covid market setback

― No effect of new commercial terms for online in the second quarter, year-over-year online revenue numbers are comparable

― NOK 4.5 million not recognized in the second quarter as a result of students with full-year contracts demonstrating low payment ability. Total of NOK 9 million not recognized for 1H 2023

ONH revenue NOK 50.0 million (+8%) driven by new study programmes online

― Online grew 31.7%, campus down by 17.8%

Revenue in Q2 as expected, online revenue share remains above 50% in the second quarter

Introduction

About Lumi Gruppen

Executive Summary

Financials

EBIT excl. impairment NOK 16.1 million (30.7)

Strategy & Operations

Sonans

Oslo Nye Høyskole

NTech

Outlook

Disclaimer

EBIT margin excl. impairment 15.4% (-7.4 pp)

Margin negatively affected by the revenue adjustment of NOK 4.5 million in the quarter, a total of NOK 9 million for the 1H of 2023

Net savings in operating expenses of NOK 20 million for the Group in Q2 when excluding transaction costs related to the Hanover voluntarily cash offer

Bad debt expenses slightly below last year and significantly improved from Q4-22 and back to normal levels

Credit control measures implemented, positive impact on credit quality. Will reduce online sales, but expect net positive or at least neutral effect on profit

Introduction

About Lumi Gruppen

Executive Summary

Financials

Strategy & Operations

Sonans

Oslo Nye Høyskole

NTech

Outlook

Disclaimer

Net savings of NOK 16 million for Sonans in Q2 and NOK 36 million for the 1H of 2023

Further reduction of NOK 10 million in operating expenses from 2H 2023 from consolidating the Greater Oslo region and closing 3 campuses

More cost measures being prepared for Sonans based on the expected result of the 2023/2024 intake

Cost level at ONH stabilising and reduced compared to Q2 (and 1H) last year, leading to a margin expansion back to levels prior to the ramp-up in OpEx and expansion of study programmes at ONH

Introduction

About Lumi Gruppen

Executive Summary

Financials

Net cash flow from operations minus NOK 80.5 million ( -71.9)

Strategy & Operations

Sonans

Oslo Nye Høyskole

NTech

Outlook

Disclaimer

Cash position of NOK 62 million at end of Q2-23

New leverage covenants was agreed for Q1-23 and Q2-23

― Covenant was 5.0 for Q2-23, reported covenant was 2.9

― Covenant Q3 2023 and onwards 3.5

New financing agreement with Nordea was signed in Q2-23

― Three-year agreement and debt reduced from NOK 430 million to NOK 300 million

― Hanover passed 50 per cent ownership on 11 August 2023

― CoC waiver fee of NOK 5.2 million to be paid

― The Group is obliged to agree on new financing terms before 31 August 2023

Introduction

About Lumi Gruppen

Executive Summary

Financials

Strategy & Operations

Sonans

Oslo Nye Høyskole

NTech

Outlook

Disclaimer

Introduction

About Lumi Gruppen

Executive Summary

Financials

Sonans has continued to execute on its turnaround strategy to adapt cost base and operations to current market conditions

Strategy & Operations

Sonans

Oslo Nye Høyskole

NTech

Outlook

Disclaimer

― No firm evidence that a normalisation will occur in the 2023/2024 school year, as the post covid effects are still affecting the private candidate market in Norway.

Underlying demand for education still strong and would expect that the private candidate market will recover over time

― Expect that the proposal from the Admission Committee will be modified based on the result of the consultation process

Demonstrates position as a leading online player in the higher education market

Solid education platform with strong growth for online programmes

― Successful launch of new programmes last years, investments are now paying off Strong intake for the school year 23/24 so far with close to 10 per cent growth in signed contracts vs. flat sales last year

― Attractive growth opportunities ahead, ONH well positioned

First two-year higher vocational education programme approved Marketing campaign launched in 1H to recruit first cohort autumn 2023

― New programmes will be developed, both shorter and longer

Plans to offer both digital courses and campus

Attractive market with strong growth over the last years, but will take some time to establish the new brand/school

Introduction

About Lumi Gruppen

Executive Summary

Financials

per cent below last year

Strategy & Operations

Sonans

Oslo Nye Høyskole

NTech

Outlook

Disclaimer

Continued decline in the number of registered private candidate exams, sales development for Sonans is in line with this decline

Market position still strong and Sonans has maintained its position as the market leader with lower decline compared to the market decline

A market recovery is likely but will take time, volume growth driven by re-introduction of exams and a softer labour market

Market fundamentals and need for higher education still strong, positive outlook for the private candidate business in the mid- to long term

*Forecast for the autumn student intake per week 32

** Estimate NOK 20 million in spring sales and total revenue is then expected to end at NOK 170 million (range NOK 165-180 million)

*Source: Utdanningsdirektoratet and 2022/2023 is estimated based on information from the county's examination offices in Norway

Introduction

About Lumi Gruppen

Executive Summary

Financials

Strategy & Operations

Sonans

Oslo Nye Høyskole

NTech

Outlook

Disclaimer

Strong results for Sonan’s in the alumni survey, demonstrates that quality of service have been maintained despite a challenging market situation

Of the students, 86 per cent will recommend Sonans to others and a significant share of students are satisfied with their exams results

Sonans students in average, achieve 1.3 in grade improvement

Introduction

About Lumi Gruppen

Executive Summary

Financials

2023/2024

Strategy & Operations

Sonans

Oslo Nye Høyskole

12 per cent growth in new students (signed contracts) per week

32

Strong programme portfolio both on campus and online, securing flexibility in the delivery model and efficient operations

NTech

Outlook

Disclaimer

Additional growth opportunities are being explored, including:

― New Bachelor programmes and annual units

― Vocational courses

― B2B opportunities

22.0%

Solid growth in signed contracts per week

12%

1.0%

NUCAS* ONH

* Norwegian Universities and Colleges Administration Services (Samordnet Opptak)

Signed Contracts

Introduction

About Lumi Gruppen

Executive Summary

Financials

Launch of NTech in 1H 2023 with new website and marketing campaign

Strategy & Operations

Sonans

Oslo Nye Høyskole

First year of operations will partly be used to test and develop the concept and fully establish the school. The two-year programme

WebAppdevelopmentanddesign will start in 24/25

NTech

Outlook

Disclaimer

Three new courses for upskill and reskill in Frontend, AI and Product design planned to be started the coming school year

The offer will consist of programmes for full-time students and more flexible courses both online and physical

Will rapidly expand the portfolio to increase student volume

Introduction

About Lumi Gruppen

Executive Summary

Financials

Strategy & Operations

Sonans

Oslo Nye Høyskole

NTech

Outlook

Disclaimer

Lumi’s business model has been transformed during the last year, with a more flexible and scalable business model with a relatively lower share of fixed costs

For ONH, the trend is positive, with applicants trending clearly higher than last year, in line with indications given when the first quarter was presented

For Sonans, the sales for the autumn intake per week 32 are expected to end around 30 per cent below the autumn intake last school year

Profitability for Sonans is expected to be weak in the 2023-2024 school year, ONH profitability will continue to improve

Launch of NTech, a new growth opportunity for the Group. Limited financial impact in the school year 2023/2024

Revenue estimates for the school year 2023/2024

Sonans: 165-180 million

ONH: 225-235 million

Based on the student intake for Sonans, more cost measures are being prepared for implementation from the third quarter

Introduction

About Lumi Gruppen

Executive Summary

Financials

Strategy & Operations

Sonans

Oslo Nye Høyskole

NTech

Outlook

Disclaimer

This presentation includes forward-looking statements which are based on our current expectations and projections about future events. Statements herein, other than statements of historical facts, regarding future events or prospects, are forward-looking statements. All such statements are subject to inherent risks and uncertainties, and many factors can lead to actual profits and developments deviating substantially from what has been expressed or implied in such statements. As a result, you should not place undue reliance on these forward-looking statements.

The Group reports its financial results in accordance with accounting principles IFRS. However, management believes that certain alternative performance measures (APMs) provide management and other users with additional meaningful financial information that should be considered when assessing the Group’s ongoing performance. These APMs are non-IFRS financial measures, and should not be viewed as a substitute for any IFRS financial measure. Management, the board of directors and the long term lenders regularly uses supplemental APMs to understand, manage and evaluate the business and its operations. These APMs are among the factors used in planning for and forecasting future periods, including assessment of financial covenants compliance.