Lumi Gruppen

Presentation Q1 2023, 10 May 2023

CEO Erik Brandt and CFO Martin Prytz

Q1

Introduction

About Lumi Gruppen

Executive Summary

Financials

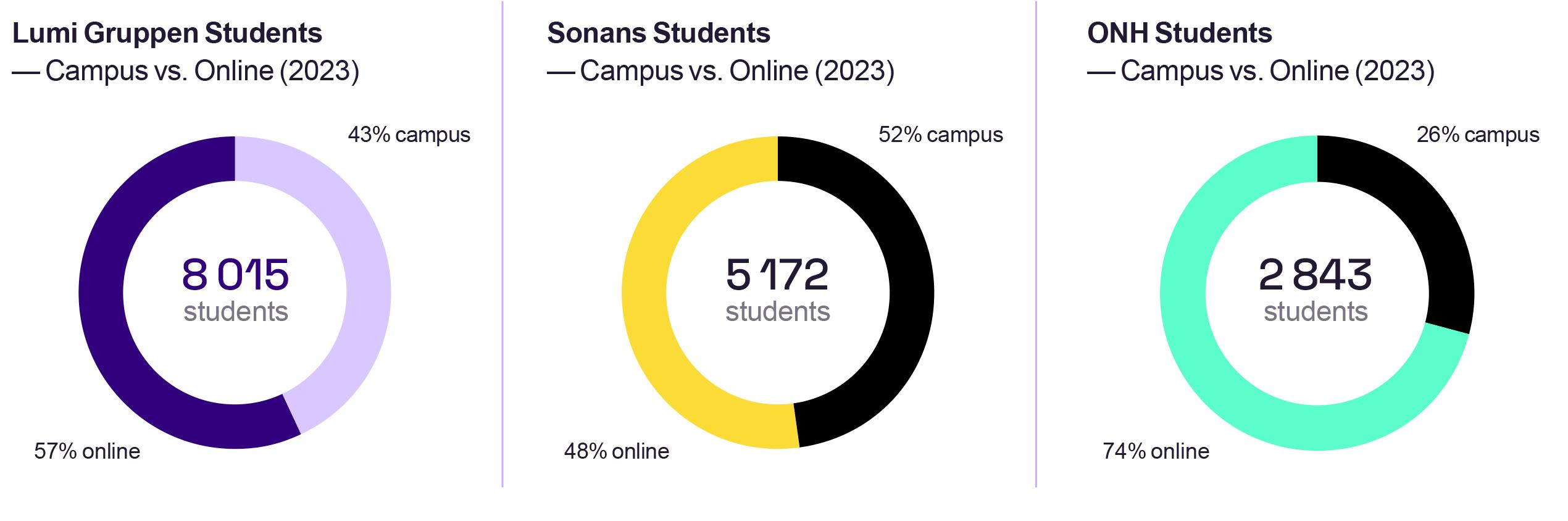

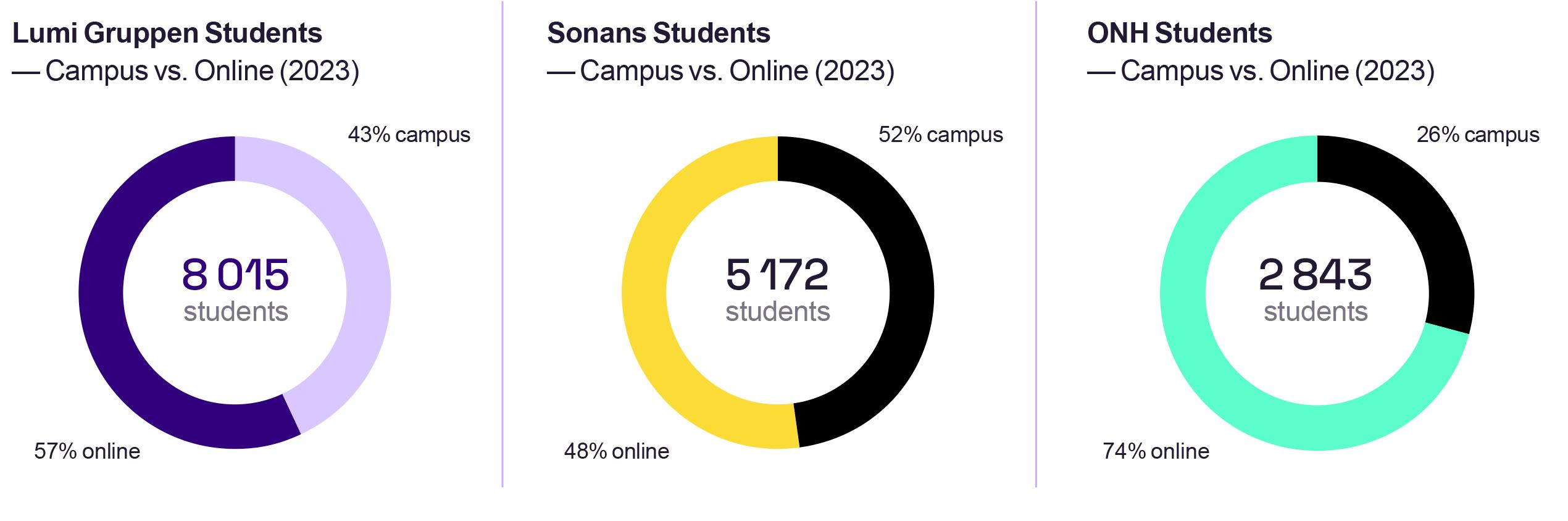

Lumi Gruppen — a leading private education provider in Norway

The group consists of two main operating segments:

Strategy & Operations

Sonans

Oslo Nye Høyskole

Outlook

Disclaimer

Sonans: Norway’s market leader within high school private candidate exam preparation courses.

ONH: Private university college, with a campus in central Oslo, and a strong online offering.

Sonans – Market leader within private candidate exams

Oslo Nye Høyskole – National Student Survey 2022:

#1

Oslo Nye Høyskole – National Student Survey 2022:

#1 5/5

in overall student satisfaction amongst multidisciplinary University Colleges, #5 of all University Colleges.

Bachelor programmes in International Studies and Political Science rated 5/5 on overall satisfaction.

LUMI GRUPPEN presentation Q1 23 3

Introduction

About Lumi Gruppen

Executive Summary

Financials

Lumi Gruppen Q1 — cost base reduced, financial position significantly improved

Oslo Nye Høyskole: Growing and gaining market share, cost development stabilized with improved EBIT margin

Strategy & Operations

Sonans

Oslo Nye Høyskole

Outlook

Disclaimer

Sonans: Revenue decline due to post-Covid market set-back. Savings from the cost programme totalling close to NOK 20 million in Q1, bad debt expenses significantly reduced from Q4 2022

NTech: Launch of marketing campaign in the first quarter, targeting first enrolment for the school year 2023/2024

Lumi Gruppen: Significantly improved financial position, cost base adjusted and aligned with current market volumes

LUMI GRUPPEN presentation Q1 23 5 Revenue Q1 (NOKm) EBIT Q1 (NOKm) Q1-22 Q1-23 132.7 107.7 -18.8% Q1-22 Q1-23 6.1 14.3 -57.3% Q1-22 Q1-23 10.8% 5.7% -5.1 pp EBIT Margin Q1 (NOKm)

Introduction

About Lumi Gruppen

Executive Summary

Financials

Strategy & Operations

Sonans

Oslo Nye Høyskole

Outlook

Disclaimer

Financials

LUMI GRUPPEN presentation Q1 23 7

Introduction

About Lumi Gruppen

Executive Summary

Financials

Strategy & Operations

Sonans

Oslo Nye Høyskole

Outlook

Disclaimer

Operating revenue NOK 107.7 million ( -18.8%)

Sonans revenue NOK 56.1 million (-35.9%) due to the post-Covid market setback

― No effect of new commercial terms for online in the first quarter, year-over-year online revenue numbers are comparable

― NOK 4.5 million in revenue not recognized and reported as result of students with full-year contracts demonstrating low payment ability

― Revenue decline of 30% when including the contracts not recognized

ONH revenue NOK 50.9 million (+13.5%) driven by new study programmes online

― Online grew 32.3%, campus down by 10.9%

Revenue in Q1 as expected, online revenue share remains above 50% in the first quarter

LUMI GRUPPEN presentation Q1 23 9

-2.1 132.7 ONH Campus Q1-22 -24.2 -4.5 Sonans Campus -2.8 SonansRevenue Adj. Sonans Online Q1-23 8.2 ONH Online 0.4 Group 107.7 132.7 Q1-22 Q1-23 107.7 -18.8%

Quarterly Revenue (NOKm) Development in Revenue (NOKm)

Introduction

About Lumi Gruppen

Executive Summary

Financials

EBIT margin decline driven by lower student volumes, partly compensated by cost programmes

Strategy & Operations

Sonans

Oslo Nye Høyskole

EBIT NOK 6.1 million (-57.3%)

EBIT margin 5.7% (-5.1 pp)

Outlook

Disclaimer

Margin negatively affected by the revenue adjustment of NOK 4.5 million

Net savings in operating expenses of NOK 17 million for the Group in Q1

Bad debt expenses slightly below last year and significantly improved from Q4

Credit control measures implemented, yielding positive impact

EBIT margin (%) Development in EBIT (NOKm)

LUMI GRUPPEN presentation Q1 23 11

5.7% Q1-22 Q1-23 10.8% -5.1 pp EBIT Q1-22 EBIT Q1-23 -27.0 Sonans Revenue -4.5 Sonans Revenue Adjustment 19.1 Sonans OpEx 6.0 ONH Revenue -1.6 ONH OpEx -0.4 Group/ NTECH 0.2 Depr. & Amortisation 14.3 6.1

Introduction

About Lumi Gruppen

Executive Summary

Financials

Significant reduction in costs for Sonans, and cost development stabilised for ONH

Strategy & Operations

Sonans

Oslo Nye Høyskole

Outlook

Disclaimer

Net savings of NOK 19.1 million for Sonans in Q1

Further reduction in the operating expenses from 2H 2023 when consolidating the Greater Oslo region by closing an additional 3 campuses

Growth in volumes for Sonans will rapidly improve profits with the new, more flexible business model with a slimmer OpEx base

Cost level at ONH stabilising, leading to expected margin expansion as volume grows

Sonans OpEx Development over the last three quarters and full year estimate

* Assumptions -

LUMI GRUPPEN presentation Q1 23 13

D&A) 56 61 65 53 234 40 49 46 39 164 Q4-22 Adj. Q2-23 FC Q1-23 Q3-22 Adj. Full Year Estimate 0 -10 Pipleline Cost Savings -27,9% -19,0% -29,4% -26,4% -29,9%

operational gearing (NOKm)

(excl.

Scenarios* for 2023/2024 illustrating

Revenue 235 for 22/23 excl.

online

new commercial terms

Assuming no changes in cost base for the interval in student volume between minus 10% to plus 10% growth vs. current volume Actual Estimate 48 71 95 -10% 10% Flat Market 212 235 259 Revenue EBITDA

~ NOK 20 million in

revenue from

-

Introduction

About Lumi Gruppen

Executive Summary

Financials

Cash flow from operations improved with limited cash impact from restructuring costs

Strategy & Operations

Sonans

Oslo Nye Høyskole

Outlook

Disclaimer

Net cash flow from operations NOK 82.7 million (114.3, down 27.6 %)

Cash position of NOK 136 million at end of Q1, strong cash flow in the first quarter due to majority of the tuition fees being paid in January

New leverage covenants agreed for Q1-23 and Q2-23, still sufficient headroom

―

Q3 2023 and onwards 3.5 is the leverage covenant

New long-term financing solution secured with Nordea

―

Three-year agreement and debt reduced from NOK 430 million to NOK 300 million

LUMI GRUPPEN presentation Q1 23 15 NIBD, ex. lease (NOKm) 70 70 165 136 235 Q1-22 Q1-23 206 275 164 Q1-23 Q1-22 Cash Revolving credit facility 114 83 Q1-23 Q1-22

Liquidity reserve (NOKm)

CF from Operations (NOKm)

Introduction

About Lumi Gruppen

Executive Summary

Financials

Strategy & Operations

Sonans

Oslo Nye Høyskole

Outlook

Disclaimer

Strategy & Operations

LUMI GRUPPEN presentation Q1 23 17

Introduction

About Lumi Gruppen

Executive Summary

Financials

Turnaround completed, cost base aligned with current market volumes

Strategy & Operations

Sonans

Oslo Nye Høyskole

Outlook

Disclaimer

― Underlying demand for education still strong, reintroduction of high school exams likely to normalise the private candidate market, although visibility for the second half of 2023 remains limited

― Expect that the proposal from the Admission Committee will be modified based on the result of the consultation process

Solid education platform ready for the autumn intake, new programme in pipeline and awaiting approval from NOKUT

Strong start to the intake for the school year 23/24

Demonstrates position as leading online player in higher education market

First two-year higher vocational education programme approved

― Marketing campaign launched in Q1 to recruit first cohort autumn 2023

New programmes will be developed, both shorter and longer

― Plans to offer both digital courses and campus

LUMI GRUPPEN presentation Q1 23 19

Introduction

About Lumi Gruppen

Executive Summary

Financials

Sonans — autumn intake started, so far neutral market indicators

Strategy & Operations

Sonans

Oslo Nye Høyskole

Most drivers affecting the education market for the school year 2022/2023 are Covid-19 related or a direct consequence of Covid-19

Neutral market indicators so far, sales progressing in line with the pre-Covid years when comparing sales value in NOK

Outlook

Disclaimer

A market recovery is likely but will take time, volume growth driven by re-introduction of exams and a softer labour market

Market

fundamentals and need for higher education still strong, positive outlook for the private candidate business

Development in sales (NOKm) for Sonans between week 17 and week 37 from 2017 to 2023 (autumn intake)

LUMI GRUPPEN presentation Q1 23

21 35 33 48 52 68 56 36 251 274 291 323 292 209 2019 2021 2017 2018 2023 2022 2020 +216 +241 +244 +271 +224 +153 Week 17 Week 37 16,4% 12,1% 14% 16,1% 23,3% 26,9% Progress as of week 17 Pre-Covid Post-Covid

Introduction

About Lumi Gruppen

Executive Summary

Financials

Sonans — the proposal from the Admission Committee likely to be modified

Key takeaways from the proposal

Strategy & Operations

Sonans

Oslo Nye Høyskole

Outlook

Disclaimer

― Grades should still be the most important method of ranking students

― The introduction of an entrance test (based on the Swedish system)

― Remove all additional points (age, military service etc) and additional points for science subjects

― Not possible to improve grades after high schools

― Remove special grade requirements for teaching and nursing programmes

Recent signals based on the public hearings indicate that the changes might be more moderate than originally proposed

Lumi Gruppen is actively planning to adapt to any changes, based on various scenarios

Public hearing respondents’ opinions on allowing re-take* of subjects

Support Re-Take Negative Re-Take

Neutral/Mixed

Respondents In %

Source: Lumi analysis of the feedback received in the consultation process (134 responses)

* Currently students are allowed to re-take all subjects in high school to improve grades. The proposal from the Admission committee suggests that this opportunity should be closed and replaced by an entrance test.

LUMI GRUPPEN presentation Q1 23

23

45 32 57 24%

34%

42%

Consultation Process (3 months) Proposition ( 1 year) Political process in parliament (6 months) Transition Period (3 years) Implemented 28/29

Introduction

About Lumi Gruppen

Executive Summary

Financials

ONH — continues to perform better than the market for the school year

2023/2024

Strategy & Operations

Sonans

Oslo Nye Høyskole

Outlook

Disclaimer

20% growth in applicants so far in the sales cycle

― 40% growth in applicants to online programmes and 3% growth for campus programmes

Strong programme portfolio both on campus and online securing flexibility in the delivery model and efficient operations

New rector appointed, Sander Sværi (vice chancellor at Kristiania) Additional growth opportunities are being explored, including:

― New Bachelor programmes and B2B opportunities

Growth in total of applicants to higher education in Norway vs. ONH

Growth in number of applicants for ONH for the school year 2023/2024

Subjects Other courses

LUMI GRUPPEN presentation Q1 23 25 NUCAS* 1,0% ONH 20,0% Master Bachelor Annual Units Single

+36,9% +22,6% +11,8% +35,0% +544,0%

* Norwegian Universities and Colleges Administration Services (Samordnet Opptak)

Introduction

About Lumi Gruppen

Executive Summary

Financials

Strategy & Operations

Sonans

Oslo Nye Høyskole

Outlook

Disclaimer

NTech

—

launch of marketing campaign in Q1, preparing for the first intake

Launched in Q1 2023 with a new website and marketing campaign

Offer the full two-year programme WebApp development and design on Sonans’ premises at Bislet

Close collaboration with the industry, including Rebel, a leading tech hub in Oslo

The offer will consist of campus programmes for full-time students and online programmes and courses Will rapidly expand the portfolio to increase student volume

LUMI GRUPPEN presentation Q1 23 27

Introduction

About Lumi Gruppen

Executive Summary

Financials

Outlook

Strategy & Operations

Sonans

Oslo Nye Høyskole

Lumi’s business model has been transformed during the last year, with a more flexible and scalable business model with a relatively lower share of fixed costs

The number of applicants to higher education reported by NUCAS is deemed to be a neutral signal for Lumi’s student volumes

Outlook

Disclaimer

The private candidate business is the most important swing factor for Lumi Gruppen’s financial development in the short to medium term

Visibility into the volume trend for Lumi Gruppen’s private candidate business in Sonans remains limited for the second half of 2023

Continued growth for ONH, ready for a further volume expansion for current programme portfolio

Launch of NTech, a new growth opportunity for the Group

Lumi Gruppen is closely following the process regarding the recommendations published by the Admission Committee in December 2022

― At this stage, these are suggestions that are likely to be modified through the political process before a potential implementation

― Recent signals based on the public hearings indicate that the changes might be more moderate than originally proposed

― Lumi Gruppen is actively planning to adapt to any changes, based on various scenarios

No changes in the revenue estimates: revenue for H1 2023 estimated to end at NOK 205-210 million

LUMI GRUPPEN presentation Q1 23 29

Introduction

About Lumi Gruppen

Executive Summary

Financials

Strategy & Operations

Sonans

Oslo Nye Høyskole

Outlook

Disclaimer

Disclaimer

This presentation includes forward-looking statements which are based on our current expectations and projections about future events. Statements herein, other than statements of historical facts, regarding future events or prospects, are forward-looking statements. All such statements are subject to inherent risks and uncertainties, and many factors can lead to actual profits and developments deviating substantially from what has been expressed or implied in such statements. As a result, you should not place undue reliance on these forward-looking statements.

The Group reports its financial results in accordance with accounting principles IFRS. However, management believes that certain alternative performance measures (APMs) provide management and other users with additional meaningful financial information that should be considered when assessing the Group’s ongoing performance. These APMs are non-IFRS financial measures, and should not be viewed as a substitute for any IFRS financial measure. Management, the board of directors and the long term lenders regularly uses supplemental APMs to understand, manage and evaluate the business and its operations. These APMs are among the factors used in planning for and forecasting future periods, including assessment of financial covenants compliance.

LUMI GRUPPEN presentation Q1 23 31

LUMI GRUPPEN presentation Q1 23 32