R³S Non-Life Standard Code

Simplif ying the complexit y of actuarial, regulator y and risk-based implementations.

Simplif ying the complexit y of actuarial, regulator y and risk-based implementations.

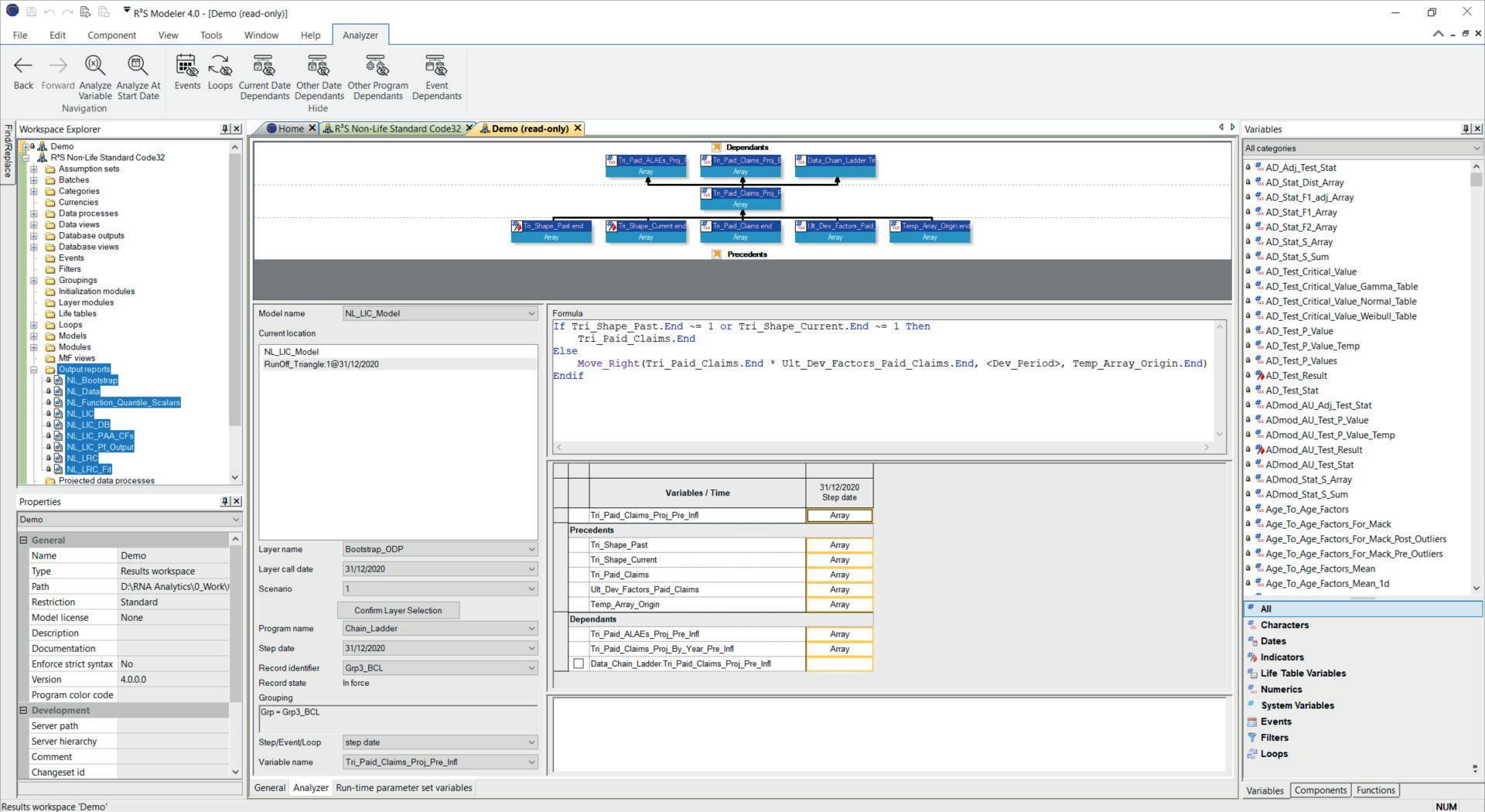

Non-Life Standard Code combines a variety of actuarial reserving methods and our powerful modeling platform (R³S Modeler) to make it a fully modular, highly flexible and transparent integrated solution that goes beyond other black-box style tools.

It brings together the LIC (Liability for Incurred Claims) and LRC (Liability for Remaining Coverage) models and makes them available on a single, convenient platform that provides valuable new insights into your business.

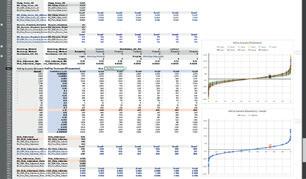

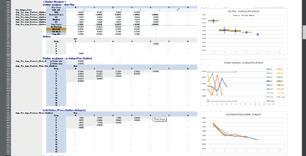

In LIC model, deterministic results are combined with distributions of possible outcomes from stochastic methods. This can provide you with an understanding of where within percentile ranges your estimates might fall, as well as a measure of the potential variability in your estimates.

In LRC model, using the distribution fitting approach, you can calculate a distribution of your future expected losses. This can produce estimates of future cash flows for your remaining coverage (i.e. unexpired risk).

Ultimately, Non-Life Standard Code can be used to model the nuances of your particular business and provide actionable information that can be used to support complex business decisions.

Also, it can dramatically reduce the time and effort required for companies to prepare data and models; therefore, this allows you to focus more on analysing the model results.

It can be used for core reserving applications as well as in conjunction with our other R³S packages, such as the R³S IFRS 17 Package and/or the R³S Solvency II Package.

RNA Analytics has extended its established expertise in risk modeling and data management to the non-life industry with R³S Non-life Standard Code.

R³S is the brand name of our software suite and R³S Modeler is an actuarial modeling software platform that enables users to build their own model. It comes with an extensive library called Standard Code for various calculations and processes.

The R³S Non-life Standard Code is a collection of the loss reserving calculation modules for Non-life (re) insurers.

Key Benefits:

No need for extra/external actuarial calculation tools from outside of R³S.

Comprehensive library of pre-built components are ready to use.

Programmable anywhere as needed;Can be connected with any other models;

Framework based on modules; and Easy customisation.

Any R³S user can see the actual codes behind the model.

Fully automated process from data to output:

• increase process efficiency and speed; and

• reduce operational risk significantly.

Regular updates will be provided not only for enhancements but also for changes in standards and regulations.

Read in historical data for LIC & LRC models

■ Transforms record level claim data into Run-off triangles for LIC

• Triangle shape

• Extended triangle shape

• Parallelogram

Liability for Incurred Claims (LIC)

■ Perform Data Analysis (Optional)

• Outlier analysis

• Trend analysis

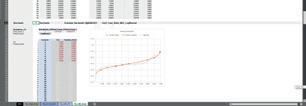

■ Loss Development - Claims Reserving Process:

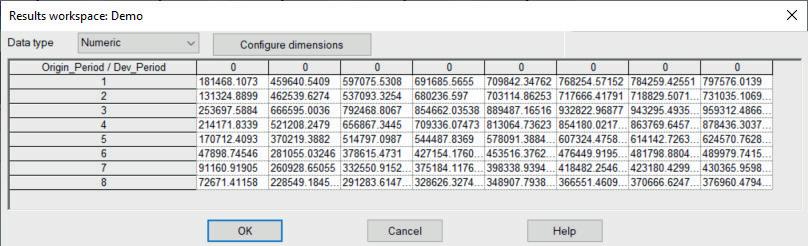

• Deterministic Reserving Methods for Best Estimate Liability

• Basic Chain Ladder

• Cape-Cod

• Link Ratio (average / worst case / weighted average)

• Grossing Up (standard / average /worst case)

• Loss Ratio

• Bornhuetter-Ferguson

• Paid Loss Development (PLDM) / Incurred Loss Development (ILDM)

• (Optional) Log Normal distribution

• (Optional) ALAE/ULAE Development

• (Optional) Average Cost

• (Optional) Inflation Adjustment

• Stochastic Reserving Methods for Reserve Variation (Optional)

• Mack Bootstrapping

■ Risk Adjustment

• Confidence level (VaR)

• ODP Bootstrapping

• (Optional) Conditional Tail Expectation (CTE; TVaR)

• (Optional) Cost of Capital (CoC)

■ Historic claim array for LRC

• Amounts by year (premium, claim, expense, etc.)

• Ratios by year (loss ratio, expense ratio, combined ratio, etc.)

Liability for Remaining Coverage (LRC)

■ Fit Distributions to Historical Data:

• Normal

• Log Normal • Gamma

• Pareto • Weibull

■ Parameter Fitting Method:

• MME (Method of Moments)

• MLE (Maximum Likelihood Estimate)

■ Automated Goodness of Fit Test:

• Chi-Square

• Kolmogorov-Smirnov

• Anderson-Darling (standard and modified)

• Akaike Information Criterion

■ Auto Best Fit Selection Process (Optional)

■ Stochastic Realisations of Selected Distribution(s)

■ Risk Adjustment

• Confidence level (VaR)

• (Optional) Conditional Tail Expectation (CTE; TVaR)

• (Optional) Cost of Capital (CoC)

Headquarters UK RNA Analytics Limited

Ground Floor

Bancroft Place 10 Bancroft Road

Reigate RH2 7RP

United Kingdom

email: training@rnaanalytics.com

rnaanalytics.com