LookUpStrata is Australia’s Top Property Blog Dedicated to Strata Living. The site has been providing reliable strata information to lot owners, strata managers and other strata professionals since 2013.

As well as publishing legislative articles to keep their audience up to date with changes to strata, this family owned business is known for their national Q&A service that provides useful responses to lot owners and members of the strata industry. They have created a national network of leading strata specialists across Australia who assist with 100s of the LookUpStrata audiences’ queries every month.

Strata information is distributed freely to their dedicated audience of readers via regular Webinars, Magazines and Newsletters. The LookUpStrata audience also has free access to The LookUpStrata Directory, showcasing 100s of strata service professionals from across Australia. To take a look at the LookUpStrata Directory, fip to the end of this magazine.

Nikki began building LookUpStrata back in 2012 and ofcially launched the company early 2013. With a background in Information Management, LookUpStrata has helped Nikki realise her mission of providing detailed, practical, and easy to understand strata information to all Australians.

Nikki shares her time between three companies, including Tower Body Corporate, a body corporate company in SEQ.

Nikki is also known for presenting regular strata webinars, where LookUpStrata hosts a strata expert to cover a specifc topic and respond to audience questions.

Liza came on board in early 2020 to bring structure to LookUpStrata. She has a passion for processes, growth and education. This quickly resulted in the creation of The Strata Magazine released monthly in New South Wales and Queensland, and bi-monthly in Western Australia and Victoria. As of 2021, LookUpStrata now produce 33 state based online magazines a year.

Among other daily tasks, Liza is involved in scheduling and liaising with upcoming webinar presenters, sourcing responses to audience questions and assisting strata service professionals who are interested in growing their business.

Liza Jovicic Sales and Content Manager

Liza Jovicic Sales and Content Manager

4

Meet Mikayla Tritico, JP

Lannock Strata Finance

6 What if owners don’t maintain their lot?

Jamie Horner, Empire Estate Agents

8 How to communicate with your strata council

Chris Irons, Strata Solve

10

Now more than ever, commercial strata communities must be informed and prepared.

Luke Downie, Realmark

12 Does a strata insurer handling a claim have a ‘duty of care’ to the lot owner?

Tyrone Shandiman, Strata Insurance Solutions

14 Can you be fned for taking a common property plant?

B Strata

16 Votes and proxies for co-owners

ESM Strata

18

Disclosure and your strata insurance policy

Leonie Milonas, Lync Insure

20 Which resolution is required for renovations afecting common property

Jamie Horner, Empire Estate Agents

22 Do we need an insurance broker?

Tyrone Shandiman, Strata Insurance Solutions

24 Insurance replacement valuations Rawlinsons WA

26 How can owners be sure the committee provides a true report for the insurance renewal?

Zac Gleeson, GQS

28 Identifying thermal loss and improving energy efciency of buildings

Edwina Feilen, Sedgwick & Stephen Thornton, Voltin

30 Unlocking WA: Navigating the New Era of Short-Term Rentals for Apartment Owners

Strata Community Association (WA)

32 The WA LookUpStrata Directory

Thanks to our sponsors

Introducing Mikayla Tritico, your WA strata fnance specialist. Mikayla brings a unique blend of experience in strata management, real estate, and strata fnance. As an owner in a strata scheme, she understands the many considerations a Council of Owners faces when unscheduled building works emerge.

In this conversation, Mikayla outlines the benefts of strata funding and shares insights on the top two reasons that Strata Companies sought strata funding in WA during 2023.

How do you support a Council of Owners with their strata fnance needs?

I take a proactive and hands-on approach in assisting a Council of Owners with strata fnance.

Engaging early and meeting with a Council of Owners is optimal. Understanding their unique requirements allows time to craft a tailored fnancial solution that’s not a one-size-fts-all. In some cases, a 100% Strata funding option to carry out building work can provide the best outcome. While in other situations, a split of equity and funding is a better choice. It all comes down to the question of how best to balance the individual interests of the owners to action required building works promptly, taking into account legislative responsibilities.

With this in mind, it’s important to highlight that Strata funding ofers a range of fexible products. Not just funding for major remedial works. This can include interest only options, various repayment periods and access to funds for smaller maintenance and upkeep projects.

In 2023, we saw a signifcant increase in funding enquiries in Western Australia. We have proudly supported strata communities in Western Australia for almost 20 years and are strongly committed to further enhancing our service and support for Western Australian Council of Owners and the broader strata management community.

What misconceptions do owners have about strata fnance?

Owners often perceive strata fnance as a traditional loan. However, a strata fnance facility is a fexible tool that functions diferently. It’s provided directly to the strata scheme, allowing works to commence without delay. Advances can be drawn as needed. Principal and Interest repayments are charged only on funds drawn, as and when used. Not on the entire amount approved. There is no charge on unused funds!

Council of Owners also have the additional fexibility to opt for an interest-only basis for up to 24 months.

From your experience as a real estate agent and strata manager, what impact does a strata fnance facility have on the sale value of a property?

Increased levies and expenses are never an owner’s frst choice. However, having a funding facility should not be seen as a detractor or deterrent that decreases the sale value of a property.

In fact, it can be quite the opposite. A funding facility can demonstrate the care and upkeep of the property, showing potential buyers that the building is wellmaintained. It can give the buyer confdence that they are investing in a property where any issues have been identifed and addressed. This means no nasty surprises down the line.

Strata funding can provide confdence and certainty for both the current owners and potential buyers. It’s all about seeing the bigger picture and making smart, informed decisions about investing in your asset.

Can you share insights on the fnancial impacts of delay in addressing building issues?

Delaying works can have a signifcant fnancial impact. For example, a building required remedial work in November 2020. However, the project was stalled and by February 2022, the cost had more than doubled. The Strata Company experienced a substantial increase to the original cost of works and the scope of required work has also expanded.

Strata fnance can help the Council of Owners access capital when needed, enabling them to address these issues promptly, protecting their properties and spreading the costs over time.

Avoiding delay will save money and headaches.

Concrete cancer was reported as a common issue in Western Australia, can you share your insights on this issue and the importance of early intervention?

Concrete cancer is common nationwide, especially in coastal areas with harsh weather conditions.

From my interactions with engineers, builders, strata managers, and owners, concrete cancer is a serious issue in Western Australia. It afects the structural integrity of buildings and can rapidly worsen and spread if left untreated.

An engineer at a recent AGM provided this simple and useful defnition, “concrete cancer is a condition where the steel reinforcing bars inside concrete structures rust and expand, causing the surrounding concrete to crack and break down. This process can continue and spread throughout the structure, leading to serious structural damage if left untreated.”

There has been an increase in funding enquiries relating to damaged and ageing facades recently. What have you seen in relation to this?

2023 saw an increase in building remediation funding for facade issues such as ageing paint, cracking render, and corroding balustrades and window frames. Builders advise these issues aren’t just aesthetic; they’re about the structural integrity of the building. Facades act as a protective layer against external elements, so addressing these issues promptly is essential to avoid potential risks and damages.

Proactively addressing facade issues, protects and preserves the value of the building.

In the end, my role is to understand the specifc needs of the Council of Owners and provide critical facts and tailored funding options, which assist owners to make informed fnancial decisions and take prompt action.

Working with strata managers and the Council of Owners is very rewarding work. I’m passionate about being available to assist my clients and delivering the highest quality service.

Mikayla TriticoBusiness Development Manager

P 0499 944 057

E mikayla@lannock.com.au

W www.lannock.com.au

QThe fooring of balconies is the responsibility of lot owners. Owners are not maintaining these foors. Should we repair the fooring using reserve funds?

Maintenance of our balconies is a strata company responsibility. The balconies need repair. However, lot owners are responsible for maintaining the balcony’s wooden fooring.

Lot owners have not been maintaining the wooden foors. How do we ensure this maintenance is carried out in the future? Should rectifcation be a lot owner cost, or should we use the reserve fund?

AStrata company funds cannot be used on works that are the responsibility of lot owners.

I suggest reviewing the strata plan in depth. If the balconies are common property and need repair, the strata scheme should be repaired from strata funds. If the wooden foors are lot owner responsibility/ownership, each owner is responsible for maintaining the fooring at their own cost.

Strata company funds cannot be used on works that are the responsibility of lot owners, so the scheme should enforce maintenance by the lot owner. If the lot owner has failed to maintain a surface they are required to maintain, and this has caused damage to common property, the strata can seek costs for the damage. If your strata plan or by-laws are unclear, a by-law could be considered that provides clarity of maintenance, responsibility and costs for lot owner’s fxtures/ improvements.

Jamie Horner | Empire Estate Agents JHorner@empireestateagents.com

Q A

As an owner, what communication approach is most efective for prompting the strata committee to respond to requests, instructions, or questions?

You need to make sure that your message to the committee is clear and it needs to be something they can make a decision on.

The clearer, the better. You need to make sure that your message to the strata council is clear, and it needs to be something they can make a decision on.

If you provide a lot of words, and include nothing that enables the strata council to make a decision, you’re just throwing out statements without any questions. That’s a mistake.

To begin with, you need to compel the strata council to take an action they can take, and strata council make decisions. You’ve got to give them a frm concept, we call it a motion, that they can decide upon. That way, they must take action.

Chris Irons | Strata Solve chris@stratasolve.com.au

Now more than ever, commercial strata communities must be informed and prepared.

In today’s ever-evolving landscape, commercial strata management is undergoing substantial shi s, driven by regulatory changes, technological advancements, ESG expectations and economic uncertainties. Now more than ever, staying informed and prepared is not just an advantage—it’s a necessity.

At Realmark Strata, we’re fully across these shi s and their implications. We’re here to help commercial strata owners as PCBU’s to fully understand their obligations, time-frames and the opportunities. We o er:

Expert guidance.

Innovative solutions.

Risk mitigation.

As industry leaders, we understand the intricacies of commercial strata like few others.

Our dedication to delivering outstanding strata services is underpinned by our tailored strategies, compliance management, modern technology solutions, and our unwavering commitment to adding value to our clients by understanding their unique needs.

Partner with Realmark Strata and navigate the complexities of today’s commercial strata environment with con dence.

Talk to Luke Downie, Head of Strata and Business Development at Realmark Strata on 0479 095 889 or 9328 0909.

WINNER. 2023 REIWA Strata Management Agency of the Year.

WINNER. 2023 SCA (Australasia) Strata Community Management Medium Business Award.

WINNER. 2022 REIWA Strata Management Agency of the Year.

WINNER. 2022 CHU SCA (WA) Strata Community Management Medium Business Award.

WINNER. 2022 CHU SCA (WA) Support Team Member Award.

Whilst we’re absolutely delighted to win awards, we judge ourselves only on our strata owners’ satisfaction. Our clear commitment to managing strata properties goes beyond the everyday practicalities and compliance of property management. It is to work with the community of strata owners and advise them on how to achieve the best of outcomes.

To learn more on how Realmark can help create a better result for strata owners, simply get in contact with Luke Downie Head of Realmark Strata Management on 0479 095 889 or 9328 0909.

Does a strata insurer handling a claim have a ‘duty of care’ to the lot owner?

Q A

The remediation of damage from an incident requires the lot owner to vacate their premises for repairs. Does the strata insurer handling the claim have a ‘duty of care’ to the afected lot owner?

In the context of an insurance claim, insurers and their contractors have a duty of care.

Duty of care is an obligation imposed on individuals and organisations to take reasonable measures to prevent foreseeable harm or injury to others.

In the context of an insurance claim, insurers and their contractors have a duty of care. Legal claims associated with duty of care and negligence can be highly nuanced and are considered on a case-by-case scenario by legal professionals and judges (if the claim ends up in court). Claims are never black and white, and legal liability will vary based on the circumstances. The outcome of such claims depends on various factors, including policy terms and conditions, foreseeability, reasonable care, proximity, breach of duty, causation, statutory duty and contributory negligence.

It’s crucial to understand that while the standard of care imposed on insurers is high, it is not unlimited. Policyholders also bear a responsibility to take reasonable measures to prevent foreseeable harm or injury and mitigate damage to the best of their ability.

If you believe the insurer has breached their duty of care, depending on the severity of the issue, you should frst raise concerns with the insurer. In some cases, referring your concerns through the dispute resolution process may be appropriate. In more complex or severe circumstances, it may be appropriate to seek legal advice.

Tyrone Shandiman | Strata Insurance Solutions tshandiman@iaa.net.au

READ MORE HERE

I dug up a plant from common property a few years ago. The council chair claims the plant's value was $5,000. If the matter goes to SAT, can I be fned?

I dug up a neglected plant from the common property a few years ago. At our recent AGM, the chair raised the issue and estimated the cost of buying, planting, and tending the plant to be about $5,000. They provided no evidence in support of the amount.

Can they take the matter to SAT for a penalty? What would the penalty range be for something like this?

I have apologised to the council in writing for digging up the plant, ofering to replace and tend to it until it is mature, but I have not received a response.

Applying to SAT usually comes after other mediation measures.

The State Administrative Tribunal (SAT), if satisfed that a person has contravened a scheme by-law, may impose a penalty of up to $2,000, as outlined in section 58 of the Strata Titles (General) Regulations 2019. However, it's important to note that applying to SAT usually comes after other mediation measures.

Typically, when a person breaches a by-law, a strata company's frst formal course of action is to issue a written breach notice. This notice is a crucial initial step in enforcing a by-law. It outlines the specifc breach and prescribes a corrective action, e.g. returning or replacing the plant removed from the common area.

It's also essential to understand that for SAT to consider imposing a penalty, the strata company must provide evidence of the breach and justify the penalty they seek. The $2,000 fgure is the maximum for a single breach, and actual penalties can vary based on the specifcs of the case.

Complying with the breach notice, such as replacing the dug-up plant, may resolve the issue without further escalation. Your proactive steps, including your written apology and ofer to replace and care for the plant, demonstrate responsibility and could positively infuence the strata company's response and potentially SAT's view of the situation.

Remember, each case is unique, and the process can vary. It's always benefcial to consult a legal professional familiar with your specifc scheme by-laws for personalised advice.

Melanie Duryea | B Strata Melanie.Duryea@bstratawa.com.auREAD MORE HERE

QA husband and wife have one vote only at an AGM. Can both parties speak to a motion?

A husband and wife own one property. While they have one vote only at an AGM, and one party will give the other their proxy to vote, can both parties speak to a motion?

Can one party give their proxy to the other owner to speak on item X, and then the proxy be passed back to the frst party to speak on item Y?

ACo-owners may only cast the vote through jointly appointing a single proxy.

Let’s look at the black and white:

Section 126(b)(iii) of the Strata Titles Act 1985 (STA) stipulates that if there are co-owners of the lot, the co-owners may only cast the vote through jointly appointing a single proxy.

Section 124(3) allows the appointer to limit the appointment of the proxy in any specifed way, so the appointer may provide the proxy direction on how to vote.

What about the grey:

While the Act is silent on invitee participation, the primary duty of the chairperson is to maintain and preserve order during the meeting. Horsley’s Meetings Procedure, Law and Practice 7th Edition notes with conditions that unless rules state otherwise, every person at the meeting (and entitled to be present) has a right to speak.

However, the chair should consider whether or not the presence of the invitee has the potential to make a material diference to the outcome of the meeting, and if so, is this diference in the best interests of all owners of the strata company.

Participation at meetings of the strata company should be controlled and managed by the chair of the meeting, including discussion points and time management.

General Meetings of the strata company are the forum for decision making, although debate may take place, it is not conversation or question time.

All Owners are given ample time to raise concerns and questions before the meeting due to the notice periods required by the STA.

I would suggest that all strata managers/strata companies ensure they have meeting rules and/ or standing orders circulated with the notice of meeting and agenda, and the chair highlights these at the beginning of the meeting.

This will ensure the chair has the ability to control the meeting to the beneft of all participants.

Like many questions relating to strata, there is no one size fts all answer.

I would suggest that positive meeting participation by all attendees is welcomed to support harmonious and modern community living. However, discussion time should be limited to avoid unnecessary disruption and to ensure the meeting is on track to make required decisions.

ESM Strata esm.support@esmstrata.com.au

When you buy insurance there are matters that may affect insurance, but unless you disclose it to the insurer, they will be unaware. As you have not clarified this matter with the insurer, you have no way of knowing that in the event of making a claim, your claim may be affected by the non-disclosure of this matter. Insurers may be able to refuse to pay a claim or part of a claim under an insurance policy if the policyholder has not complied with their duty of disclosure under certain circumstances, and then non-disclosure has prejudice the insurer. See below for a duty of disclosure statement.

An example of such a matters that relate to typical strata insurance disclosure matters include;

CLAIMS WHAT CLAIMS HAVE YOU MADE IN THE LAST 5 YEARS?

Commercial Tenancy

Construction of your building

Building condition reports

Defects that are known

Commercial tenants occupation is required to be disclosed with new business and every renewal as this can affect the risk.

Whilst commonly it might be concrete, brick, wood or other, building cladding is now very topical. The existence of any cladding of whatsoever nature should be disclosed as part of your building construction description. Non-compliant cladding is an issue for insurers, due to fire safety aspects.

Usually building reports will highlight potential maintenance issues.

> Mainly for older buildings an example is a wiring condition report that illustrates you have an issue with electrical wiring in the building.

> Roof report that states the roof timber beams have rotted.

> Concrete cancer on balconies

Any matter that highlights adverse matters about your build-ing could be considered a defect to be disclosed.

A Defect can arise in many ways, such as;

> Design – poor design can lead to issues

> Materials used – example is non-compliant cladding –the cladding used safely is okay, but not used correctly can cause major fire hazards. Other materials and products may actually be cheap and not perform well on the building

> Workmanship – poor building techniques and lack of experienced tradesman

> Serious lack of maintenance that leads to a defect

Structural Such as earth movement of movement of foundations, lead-ing to cracks in walls etc.

Disclosure around what the strata company is doing to proactively fix any known issues, such as the appointment of specialists, like engineers or specialist builders to determine the cause and what can be done to fix the matter. Scope of works and plan to attend repairs. This will have a positive effect on your insurance, by demonstrating to the insurer that the matter is not being ignored.

1. Is the Strata Community aware of any building defects?

. Has an insurer declined an application or refused to renew a policy for the Strata Community?

3. Has an insurer imposed special terms or conditions to the Strata Community insurance?

4. Has an insurer declined or refused any claims?

5. Attach the claims history to this quote (Up to 5 years)?

. Any other questions that are asked, must be answered, whether they are an application or not, but must be in writing?

*Note not are all matters that relate to disclosure are asked as questions within an application.

Before you enter into a contract of general insurance, you have a duty, under the Insurance Contracts Act 1984, to disclose every matter that you know or could be reasonably expected to know, is relevant to the underwriters’ decision whether to accept the risk of insurance and if so, on what terms. You have the same duty to disclose those matters before you renew, extend, vary or reinstate a contract of general insurance.

Your duty, however, does not require disclosure of a matter

> that diminishes the risk to be undertaken;

> that is of common knowledge;

> that the underwriters know or, in the ordinary course of business, ought to know;

> as to which compliance with our dut is wai ed b the underwriters.

If you fail to comply with your duty of disclosure, the underwriters may be entitled to reduce their liability under the contract in respect of a claim or may cancel the contract. If your non-disclosure was fraudulent, the underwriters may also have the option of avoiding the contract from its beginning.

N.B. The disclosure required is especially important in matters relating to the physical risk, past claims, declined cover at renewal leading to a cancelled policy, the imposition of increased premiums and application of higher excesses etc. and any matters that might affect the acceptance of the risk such as insolvency or criminal convictions.

General Disclosure; The information provided by Lync Insurance Brokers in this article is for general purposes only, and it is not a substitute for professional or legal advice. You should always consider the S olic wording before making a decision.

Coverage may differ based on specific clauses in individual policies. Refer to the FSG on our website or by requesting a copy of our services and remuneration details. Lync Insurance Brokers is an Authorised epresentati e of S onnect t td S o. .

team in helping those in need. I wish I had known them earlier.

Salina’s always responsive and professional. I can already vouch Empire Estate is far better (more competent; more communicative; more proactive) than the previous strata managers/ companies we’ve had. I wouldn’t hesitate to recommend Empire for strata management - keep up the great work!

I’m surprised by how actively Empire estate has replied me to on New Year’s Day and took their time out to explain to me what went wrong with my strata complex and the strata levies. They helped me to understand how levies work and especially making suggestions, even though they do not manage the strata complex. It is hard to find genuinely good people who care. I do highly recommend Jamie Horner, Salina and her team for taking the time out of their busy schedule to explain what went wrong.

Daryl moved into a volatile environment and has worked well through it all. This is where Daryl shone and I believe through that initial work our building politics will settle and 2023 will be a much more productive year for us all.

Do we need an insurance broker? What does an insurance broker do?

Insurance brokers play an important role in the arrangement and facilitation of strata insurance.

Insurance brokers play an important role in the arrangement and facilitation of strata insurance. The role of an insurance broker includes:

1. Advice – We specialise in insurance. That’s all we do! It is accepted that insurance brokers are more qualifed to give advice in relation to insurance products and we are licensed to give personal advice specifc to your individual needs and circumstances. Strata managers and insurers can only provide general advice and are unable to provide advice specifc to your needs or circumstances.

2. Broader access to insurers – Some insurers (currently fve to six) deal only with insurance brokers. Using a broker can provide broader access to more insurers.

3. Quotes at renewal – Markets change regularly in insurance. Today’s most competitive insurer may not be the most competitive insurer when your policy next renews. The broker negotiates the best terms in the market from a broad range of insurers. At renewal, brokers are responsible for conducting market checks on behalf of our clients to ensure you are getting the most competitive ofer.

4. We represent you – In the majority of cases, the role of an insurance broker is to represent the interests of the client and not the insurer. Insurance brokers guide you through a claim and advise you on how to get the maximum settlement for your claim.

5. Dispute Management – Insurance brokers should facilitate the dispute resolution process. A good insurance broker will help you make a submission to the insurer or the Australian Financial Complaints Authority.

Tyrone Shandiman | Strata Insurance Solutions tshandiman@iaa.net.auREAD MORE HERE

We are a proudly Western Australian frm that advises on strata law

Our experienced team assists strata managers, council members and individual lot owners with clear and practical advice.

Call us today to fnd out how we can help you resolve your strata issues.

Contact us

Call 9200 4900 or email Elizabeth at admin@civiclegal.com.au

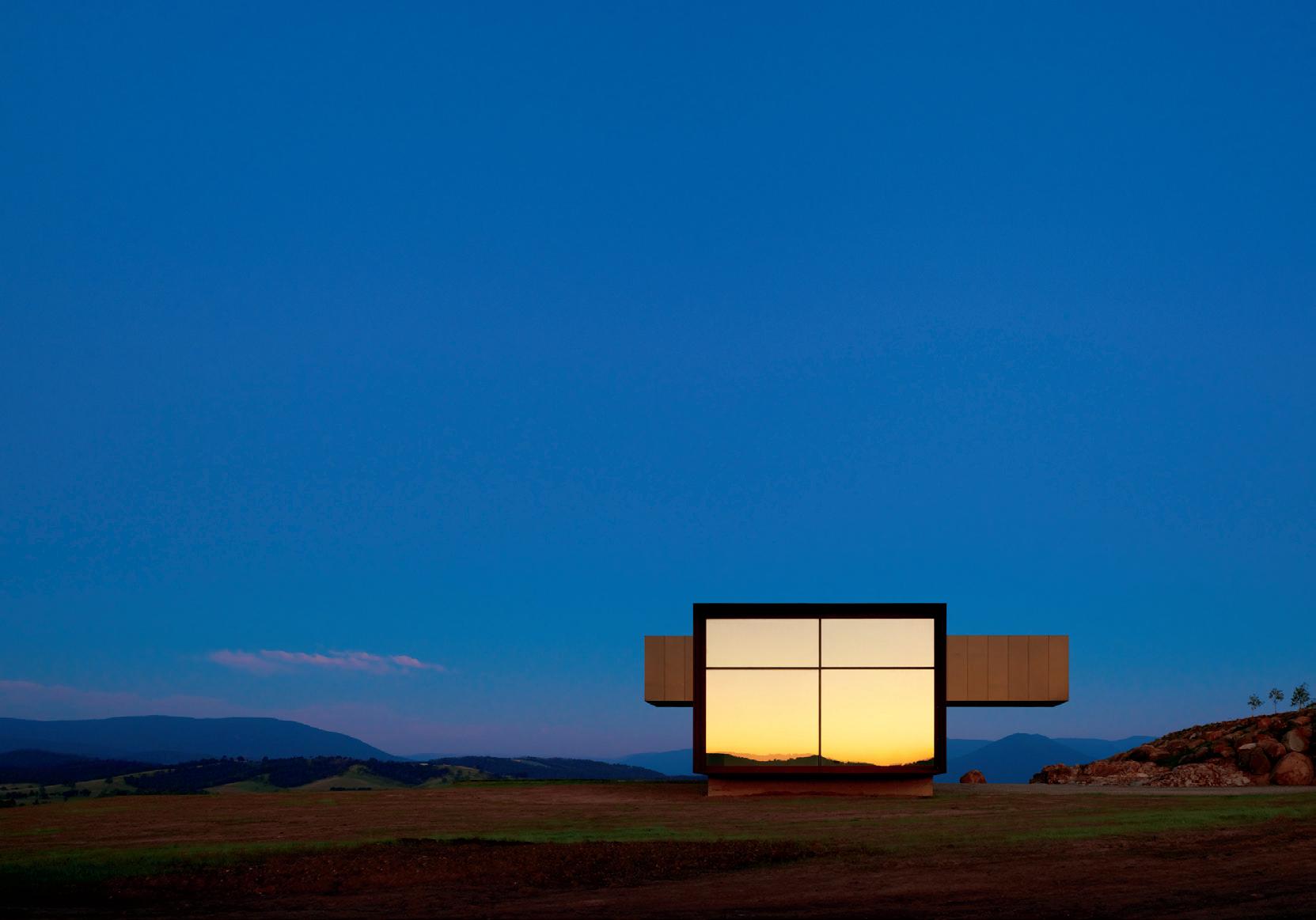

Hill View House Denton Corker Marshall Architects | Tim Griffith Architectural Photographer

Many homeowners underestimate the replacement value of their property, which can lead to hidden costs such as professional fees, demolition works, and escalation being overlooked An accurate insurance replacement valuation can give homeowners peace of mind that their property is fully covered in the event of loss or damage. This valuation ensures that the property is covered "like-forlike" in terms of both size and quality

It's recommended to review replacement values on an annual basis. Moreover, in case of any asset improvements, refurbishments, or extensions, updating the value is essential to ensure full coverage

A professional Insurance Replacement Valuation requires a deep understanding of construction costs, local legislation, and insurance requirements. The most suitable people to perform this task are professional Quantity Surveyors, who have a broad range of skills and experience. They are skilled at measuring building areas, estimating construction costs, evaluating current market conditions, and have a technical understanding of construction techniques.

An Insurance Replacement Valuation should INCLUDE the following costs:

Capital Construction Costs of Building, External Works and Services

Construction Contingency

Demolition Costs

Professional Fees

Development

Application Fees

Escalation during the Design and Documentation Period

Escalation During the Lapse Period

The following items are USUALLY NOT covered in an Insurance Replacement Valuation:

Loose furniture, fittings and equipment (contents)

Tenancy fit out costs

Loss of revenue/profit

Temporary accommodation costs during the re-building phase

Legal fees

Financing costs

Rawlinsons was established in Perth, Western Australia in 1953 and is currently situated in Rivervale. With 71 years of experience, we have played a pivotal role in developing the Western Australian built environment, and we are dedicated to providing ongoing support for the economic growth of Western Australia as a whole

As the creators and editors of the extensively circulated Rawlinsons Australian Construction Handbook and Rawlinsons Construction Cost Guide, we maintain the most comprehensive and current library of construction pricing information and data sources in Australia. Our publications are circulated nationally and utilised by a vast number of professions and trades within the construction industry.

How can owners be sure the committee provides a true report for the insurance renewal?

Can the committee be held accountable for providing an untrue report for insurance renewal? What can owners do to prevent this from happening?

Make sure the committee is not coming up with that fgure themselves.

The most important thing here is to ensure the committee is not coming up with that fgure themselves. The committee could be liable if they’ve come up with that fgure themselves.

It’s important to engage an independent professional to come up with that fgure. Also, ensuring the professional has suitable professional indemnity insurance is important. That way, even if their assessment comes up and you are underinsured, at least you are covered by that professional indemnity insurance in the worst case scenario.

Zac Gleeson | GQS zac@gqs.com.au

What are AI capabilities to identify thermal loss and improve the energy efciency of buildings?

In the not too distant future, a specialised AI-based platform will provide energy audits for building owners.

Stephen: We’re currently working with a company developing a comprehensive energy auditing system using our external thermal imaging combined with the internal thermal assessment and thermal monitoring to create a comprehensive energy auditing platform. In the not too distant future, there will be a specialised AI based platform that can provide energy audits for building owners. It’s designed primarily for the industrial and commercial space, but it will have applicability in high-rise residential, especially where the building has an integral HVAC system. It’s not that far away.

Edwina: We will see much more in this space, with environmental and social governance becoming a big part of the industry. The technology is moving that way. The government is advocating for change and for buildings to become carbon-neutral. It’s only natural that the technology will evolve in this direction.

Edwina Feilen | Sedgwick edwina.feilen@au.sedgwick.com

Stephen Thornton | Voltin Steve@voltin.com.au

READ MORE HERE

wa.strata.community

admin.wa@strata.community

Important changes are on the horizon for the Short-Term Rental Accommodation (STRA) landscape in Western Australia, and it could send waves through the strata sector in the state. Whether you’re hosting in the heart of Perth or up in Karratha, these updates have the potential to fip the script on the future of short stays.

You might not be aware, but the state government is quietly in the process of progressing the legislation in the STRA space, aiming to improve the regulation and management of the sector, and minimise its impact on the wider housing market.

In short, STRA refers to the practice of an owner renting out their property for a relatively short period of time, usually booked through online platforms for travellers and others seeking

temporary lodging. Properties can include anything from standalone homes, hotels or notably, apartments.

In fact, one of the most important areas under the spotlight of these changes is strata properties. It’s no secret that in recent years the surge of booking platforms like Airbnb and Stayz have sparked heated debates in strata communities, specifcally about the impact of short-term rentals internally on other residents and owners, and externally on Western Australia’s housing supply and critical industries.

There are several important planning and registration changes proposed by the state government, seeking to implement a more consistent set of rules across WA.

Registration Scheme: The most notable change proposed by the WA Government is the implementation of a registration scheme for short-term rental accommodation properties. The STRA register will collect information on properties, to assist the state government in informing policy and regulatory decisions.

Planning Requirements: Whilst the changes will not include caps on STRA properties, there will be new planning requirements based on the type o p ope ty that is bei o e e

Exempt from requirement to obtain development approval, as the host is on site for the duration of a visitor’s stay, and can manage any issues that may arise.

Consistent planning approval requirements will be implemented, regional areas excepted, where LGAs will determine most appropriate requirements for their areas.

Local Govt development pre-approval required for properties rented for more than 90-days within a year.

(Properties rented our for less than 90 days per year exempted)

Local Governments may individually require STRA applicants to prepare management plans to address potential impacts of STRA in communal spaces and properties (like noise, waste management, complaints, parking etc.), alongside the preparation of protocols in the event of an emergency.

Although this requirement will be subject to each individual jurisdiction, a management plan could be implemented as a condition of approval.

With the new proposed rules in play, the balancing act between the rights of individual property owners and the collective interests of strata communities takes centre stage, promising both challenges and opportunities in navigating the evolving dynamics of short-term rental accommodations within strata settings.

If you’d like more information on these changes, please visit wa.gov.au/STRA-initiatives

The implementation of the STRA legislation and register has been proposed to be implementaed via a staged approach through to 1 January 2026 as it goes through both Local Government and Parliamentary approvals.

Late 2023

Planning position statement released

Amendments to planning regulations

STRA legislation introduced to Parliament

Local Govt to include STRA in local planning schemes

STRA register opens

Registration becomes mandatory

Owner must demonstrate compliance with local planning requirements

Install My Antenna

Professional TV Antenna Service For You Today

P: 1300 800 123

W: https://www.installmyantenna.com.au/ E: info@installmyantenna.com.au

LookUpStrata

Australia’s Strata Title Information Site

W: https://www.lookupstrata.com.au/ E: administration@lookupstrata.com.au

Strata Community Association

P: (08) 9381 7084

W: https://www.wa.strata.community/ E: E: admin.wa@strata.community

Owners Corporation Network

The Independent Voice of Strata Owners

W: https://ocn.org.au/ E: enquiries@ocn.org.au

Your Strata Property

Demystifying the legal complexities of apartment living

W: https://www.yourstrataproperty.com.au/ E: amanda@yourstrataproperty.com.au

Tinworth & Co

Chartered Accountant & Strata Auditors

P: 0499 025 069

W: https://www.tinworthaccountants.com.au/ E: caren.chen@tinworth.com

Matthew Faulkner Accountancy

Strata Auditing specialists

P: 0438 116 374

W: https://www.mattfaulkner.accountants/ E: matt@mattfaulkner.accountants

Lifestyle Clotheslines

Clothesline and washing line supplier & installer

P: 1300 798 779

W: https://www.lifestyleclotheslines.com.au/ E: admin@lifestyleclotheslines.com.au

Mimor

Connecting People – Creating Communities

P: 1300 064 667

W: https://www.mimor.com.au/ E: info@mimor.com.au

Stratabox

Building Confidence

P: 1300 651 506

W: https://stratabox.com.au/ E: contact@stratabox.com.au

StrataMax

Streamlining strata

P: 1800 656 368

W: https://www.stratamax.com/ E: info@stratamax.com

MYBOS

Building Management - Residential & FM Schemes

P: 1300 912 386

W: https://www.mybos.com/ E: sam@mybos.com.au

StrataVault

Connecting people, processes, and applications

P: 1300 082 858

W: https://thestratavault.com/ E: team@thestratavault.com

Urbanise

Automate your workload to increase efficiency

P: 1300 832 852

W: https://www.urbanise.com/ E: marketing@urbanise.com

Resvu

Customer Service Software for Strata

P: 08 7477 8991

W: https://resvu.io/ E: enquiries@resvu.com.au

Onsite Building Management Software

Modern and user friendly BMS

P: 0490 091 887

W: https://onsite.fm/ E: hello@onsite.fm

Stratafy

Only Complete Cloud Strata Software ecosystem

P: 1300 414 155

W: https://stratafyconnect.com/ E: sales@stratafyconnect.com

Sedgwick

Building Consultancy Division & Repair Solutions

W: https://www.sedgwick.com/solutions/global/au

E: sales@au.sedgwick.com

QIA Group

Compliance Made Easy

P: 1300 309 201

W: https://www.qiagroup.com.au/ E: info@qiagroup.com.au

GQS

Quantity Surveyors & Building Consultants

P: 1300 290 235

W: https://gqs.com.au/ E: info@gqs.com.au

BCRC

Construction Materials & Durability Consultants

P: 02 9131 8018

W: https://bcrc.com.au/ E: sydney@bcrc.com.au

Leary & Partners

Quantity surveying services since 1977

P: 1800 808 991

W: https://www.leary.com.au/ E: enquiries@leary.com.au

BIV Reports

Specialist in Strata Compliance Reports

P: 1300 55 18 30

W: https://www.biv.com.au/ E: biv@biv.com.au

Budget Vals

Built For Strata

P: 1300 148 150

W: https://www.budgetvals.com.au/ E: reports@budgetvals.com.au

Solutions in Engineering

Quality Reports On Time, Every Time!

P: 1300 136 036

W: http://www.solutionsinengineering.com/ E: enquiry@solutionsinengineering.com

Mabi Services

Asbestos, Safety & Building Consultants

P: 1300 762 295

W: https://www.mabi.com.au/ E: info@mabi.com.au

HFM Asset Management Pty Ltd

Leaders in Building Efficiency

P: 0407 734 260

W: https://www.hfmassets.com.au/ E: david.chokolich@hfmassets.com.au

Quality Building Management

Keeping your buildings legally compliant and safe

P: 1300 880 466

W: https://qbm.com.au/ E: sales@qbm.com.au

Independent Inspections

Sinking Fund Forecast, Insurance Valuations, OHS

P: 1300 857 149

W: https://www.iigi.com.au/ E: admin@iigi.com.au

Delineation Line Marking

Perth’s Line Marking Service

P: 0497 314 758

W: https://delineationlinemarking.com.au/ E: Geoff@delineationlinemarking.com

LUNA

Building and Facilities Manager

P: 1800 00 LUNA (5862)

W: https://www.luna.management/ E: info@luna.management

RFM Facility Management Pty Ltd

Strata and Specialist Cleaners

P: 1300 402 524

W: https://www.rfmfacilitymanagement.com.au/ E: nathan@rfmfacilitymanagement.com.au

Network Pacific Strata Franchise

Join our successful team

P: 03 9999 5488

W: www.networkpacificstratafranchise.com.au/ E: networkpacific@franchisedevelopments.com.au

Armstrong Shine

Window Cleaning Specialists

P: 0429 948 070

W: https://www.armstrongshine.com.au

E: info@armstrongshine.com.au

Strata Insurance Solutions

Protecting owner assets is who we are

P: 1300 554 165

W: https://www.stratainsurancesolutions.com.au/ E: info@stratainsurancesolutions.com.au

Lync Insurance Brokers

The Lync to Safer Strata

P: 1300 127 503

W: http://www.lyncinsure.com.au/ E: info@lyncinsure.com.au

Whitbread Insurance Brokers

Empower Your Vision

P: 1300 424 627

W: https://www.whitbread.com.au/ E: info@whitbread.com.au

CHU Underwriting Agencies Pty Ltd

Specialist Strata Insurance Underwriting Agency

W: https://www.chu.com.au/ E: info@chu.com.au

Strata Community Insurance

Protection for your strata property. And you. P: 1300 724 678

W: https://www.stratacommunityinsure.com.au

E: myenquiry@scinsure.com.au

Flex Insurance

Your Cover Your Choice

P: 1300 201 021

W: https://www.flexinsurance.com.au/ E: info@flexinsurance.com.au

Driscoll Strata Consulting

Knowledge | Experience | Service

P: 0402 342 034

W: https://driscollstrataconsulting.com.au/ E: enquiries@driscollstrataconsulting.com.au

Strata Solve

Untangling strata problems

P: 0419 805 898

W: https://stratasolve.com.au/ E: chris@stratasolve.com.au

Strata Title Consult PTY LTD

E: shane.white@stratatitleconsult.com.au

Civic Legal

Bringing Clarity to Complexity

W: http://www.civiclegal.com.au/ E: admin@civiclegal.com.au

Bugden Allen Graham Lawyers

Australia’s leading strata law experts

P: 02 9199 1055

W: https://bagl.com.au/ E: info@bagl.com.au

Moray & Agnew Lawyers

Legal strategies and solutions for our clients

P: 03 9600 0877

W: https://www.moray.com.au

E: melbourne@moray.com.au

Grace Lawyers

Know. Act. Resolve.

W: https://gracelawyers.com.au/ E: enquiries@gracelawyers.com.au

Douglas Cheveralls Lawyers

The Go-To Strata Lawyers

P: 08 9380 9288

W: https://www.dclawyers.com.au/ E: office@dclawyers.com.au

StrataLoans

The Experts in Strata Finance

P: 1300 785 045

W: https://www.strata-loans.com/ E: info@strata-loans.com

Lannock Strata Finance

The Leading Strata Finance Specialist

P: 1300 851 585

W: https://lannock.com.au/ E: strata@lannock.com.au

Austrata Finance

Pay Now or Pay Later: It’s Your Choice®

P: 1300 936 560

W: https://austratafinance.com.au/ E: info@austratafinance.com.au

B Strata

Best People. Best Systems. Best Practices.

P: 08 9382 7700

W: https://www.bstratawa.com.au/ E: admin@bstratawa.com.au

Realmark Strata

Creating better result for strata.

P: 08 9328 0909

W: https://www.realmark.com.au/strata-management

E: strata@realmark.com.au

Chambers Franklyn Strata Management

Providing professional Strata Management services

P: 08 9440 6222

W: https://chambersfranklyn.com.au/

E: strata@chambersfranklyn.com.au

Empire Estate Agents

Everyday Heroes...Going Beyond

P: 08 9262 0400

W: https://www.empireestateagents.com/ E: jhorner@empireestateagents.com

ESM Strata

WA’s Largest Dedicated Strata Management Company

P: 08 9362 1166

W: https://esmstrata.com.au/ E: support@esmstrata.com.au

Oakfield

Experts in Strata

P: 08 6355 5225

W: https://oakfield.com.au/ E: admin@oakfield.com.au

Abode Strata Management

For People in WA Who Value their Property Investment

P: 08 9368 2221

W: https://www.abodestrata.com/ E: jordan@abodestrata.com.au

magixstrata

We listen!

P: 08 6559 7498

W: https://www.magixstrata.com.au/ E: info@magixstrata.com.au

Strata Links

Simplify Your Complex

P: 08 6383 9913

W: https://stratalinks.com.au/home-page/ E: info@stratalinks.com.au

Emerson Raine

Supporting you in strata

P: 08 9227 6274

W: https://www.emersonraine.com.au/ E: hello@emersonraine.com.au

Southern Strata Services

Strata Management Services in Western Australia

P: 08 9478 6881

W: https://www.southernstrataservices.com.au/ E: admin@southernstrataservice.com.au

Strata Property WA

We believe that our best asset, is yours

P: 08 9370 5339

W: https://stratapropertywa.com.au/ E: office@stratapropertywa.com.au

SVN | Strata Management

Global Strength - Local Presence

P: 08 9427 7955

W: https://svnstrata.com.au/ E: info@svnperth.com

Logiudice Property Group

Perth Strata Specialists!

P: 08 9368 5888

W: https://www.lpg.com.au/ E: admin@lpg.com.au

Cambridge Management Services WA

Strata Management

P: 0468 410 838

W: https://www.cambridgemswa.com.au/ E: nuala@cambridgemswa.com.au

Perth Strata Co.

For Better Strata Living | We get things done!

P: 6388 1189

W: https://perthstrataco.com.au/ E: hello@perthstrataco.com.au

John Dethridge Strata Services

Fremantle Is Our Territory!

P: 08 9335 5877

W: https://jdstrata.com.au/ E: info@jdstrata.com.au

Metrowest Service Pty Ltd

Single source solution for all maintenance needs

W: https://metrowest.com.au/ E: info@metrowest.com.au

TRADECOM GROUP

Innovative Commercial Building Projects

P: 1300 301 888

W: https://tradecomgroup.com/ E: Services@tradecomgroup.com

Tunnel Vision (WA) Pty Ltd

Blocked Drain and Nuflow Pipe Relining Specialists

P: 08 9417 1563

W: https://www.tunnelvision.com.au/ E: operations@tunnlevision.com.au

Strata Guardian

Fight low returns and rising levies with us.

P: 1300 482 736

W: https://www.strataguardian.com/ E: contact@strataguardian.com

Energy-Tec

Sub Meter Reading and Billing Services

P: 08 9309 0000

W: https://www.energy-tec.com.au/ E: service@energy-tec.com.au

The Green Guys Group

Australia’s Leading Energy Saving Partner

W: http://greenguys.com.au/ E: sean@greenguys.com.au

Arena Energy Consulting Pty Ltd

Independent Embedded Network Consulting Services

P: 1300 987 147

W: https://www.arenaenergyconsulting.com.au/ E: info@arenaenergyconsulting.com.au

Bright Connect

Experts in community energy technology.

P: 1300 908 760

W: https://www.brightconnect.com.au/ E: connect@brightconnect.com.au

Embedded Network Arena

Independent Embedded Network Consulting Services

P: 1300 987 147

W: https://embeddednetworkarena.com.au/ E: info@embeddednetworkarena.com.au

Energy On Pty Ltd

P: 1300 323 263

W: https://www.energyon.com.au/ E: EnergyServices@EnergyOn.com.au

Calibre Painting

Exceptional commercial painting services.

P: 0423 800 153

W: https://calibrepainting.com/ E: grant@calibrepainting.com

Higgins Coatings Pty Ltd

Specialist painters in the strata industry

W: https://www.higgins.com.au/ E: info@higgins.com.au

EYEON Property Inspections

Buy and Sell with More Confidence

P: 1300 798 274

W: https://www.eyeon.com.au/ E: info@eyeon.com.au

Rawlinsons

Calculated Confidence

P: 08 9424 5800

W: https://www.rawlinsonswa.com.au/ E: info@rawlinsonswa.com.au

Groundfloor™

Australian parcel, mail, and refrigerated lockers

P: 03 9982 4462

W: https://groundfloordelivery.com/ E: ask@groundfloordelivery.com

Adelaide StrataVal

Strata & Community Insurance Valuations

P: 08 7111 2956

W: https://www.strataval.com.au/ E: valuations@strataval.com.au

ABN Lift Consultants

A team of friendly, open minded professionals

P: 0468 659 100

W: https://www.abnlift.com/ E: andrew@abnlift.com

Innovative Lift Consulting Pty Ltd

Australia’s Vertical Transportation Consultants

P: 0417 784 245

W: https://www.ilcpl.com.au/ E: bfulcher@ilcpl.com.au

The Lift Consultancy

Trusted Specialised Advice

P: 07 5509 0100

W: https://theliftc.com/ E: sidb@theliftc.com

As of April 2022, The Strata Magazines received a national audience engagement of around 20,000 views within one month of their release.

For the Strata Magazine Media Kit

CLICK HERE

LookUpStrata’s Newsletters have a national audience of over 16,000 subscribers.

For the National Newsletter Media Kit

CLICK HERE

administration@lookupstrata.com.au