Lomond Quarterly Insights

Property wisdom at work

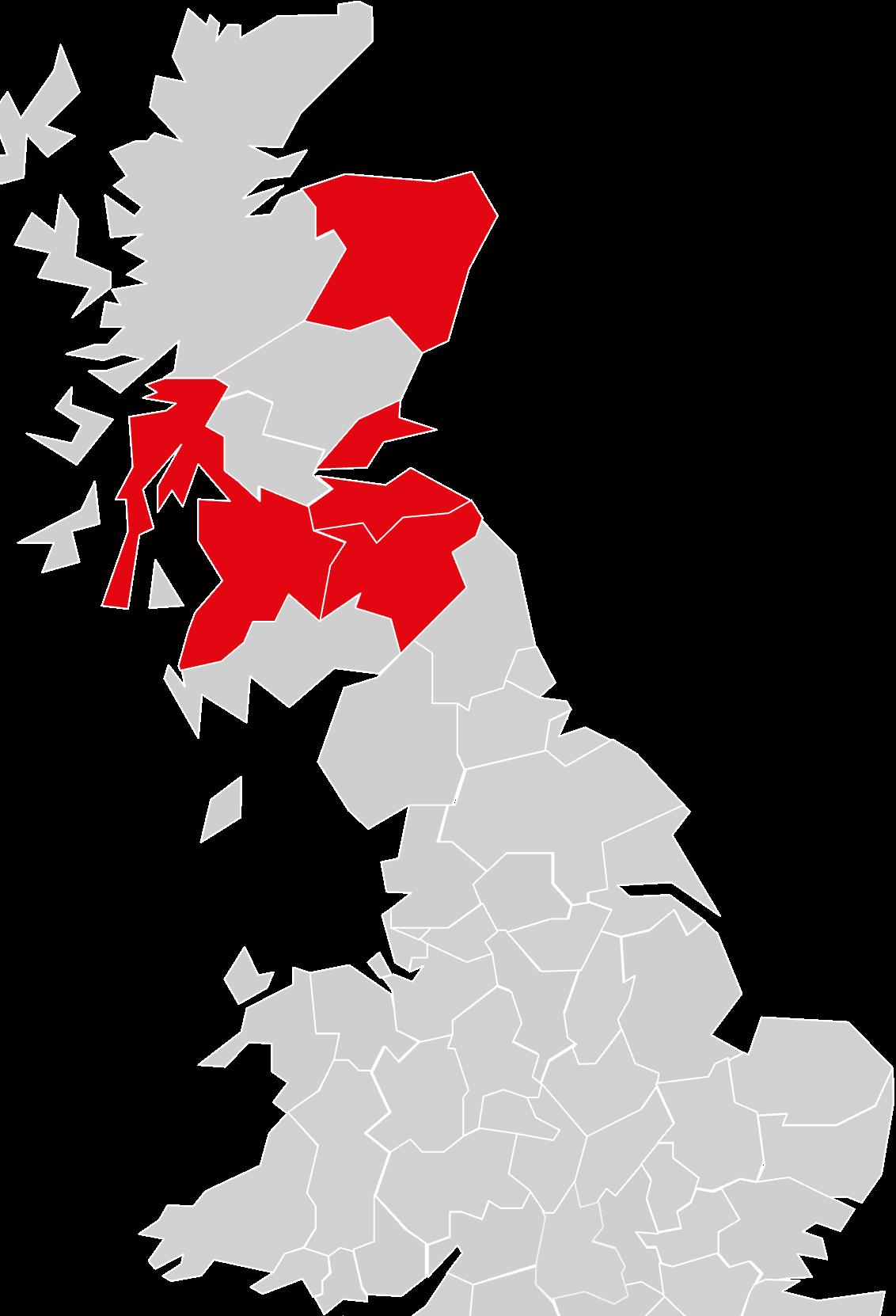

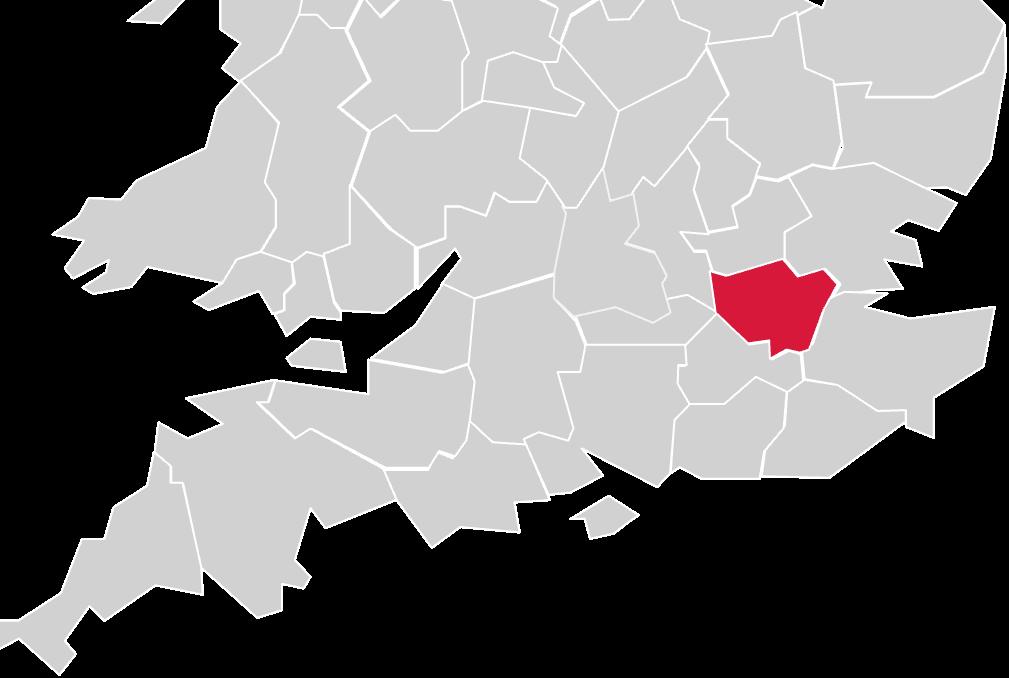

Our Network

Excellence in property services

Lomond is an established network of high quality regional sales and lettings agents spanning length and breadth of the UK.

At the core of our success is our commitment to wisdom, investing in talented professionals whose expertise and ambition enable our clients to make smarter property decisions. We uphold the highest standards of integrity, fostering transparency and trust in every interaction. Our brands consistently achieve success, delivering exceptional results and industry-leading customer satisfaction. Through continuous evolution, we embrace innovation and strategic growth, ensuring we remain at the forefront of the property sector. These form our WISE values, something everyone at Lomond strive to uphold.

With a proven track record of acquiring and transforming independent agencies, we provide the resources, technology and operational expertise to enhance performance and accelerate growth. Our ambition is to expand our footprint across the UK, strengthening existing markets and unlocking new opportunities.

Head Office

70 St. Mary Axe, London, EC3A 8BE info@lomond.group

Table of Contents

Introduction

Ed Phillips, Group Chief Executive

National Lettings

Enhancing market stability

Market dynamics and legislative changes

National Sales

A return to normal service

Stability returns: A more predictable market

Scotland

A promising outlook

Major cities driving market trends | Listings upwards trajectory

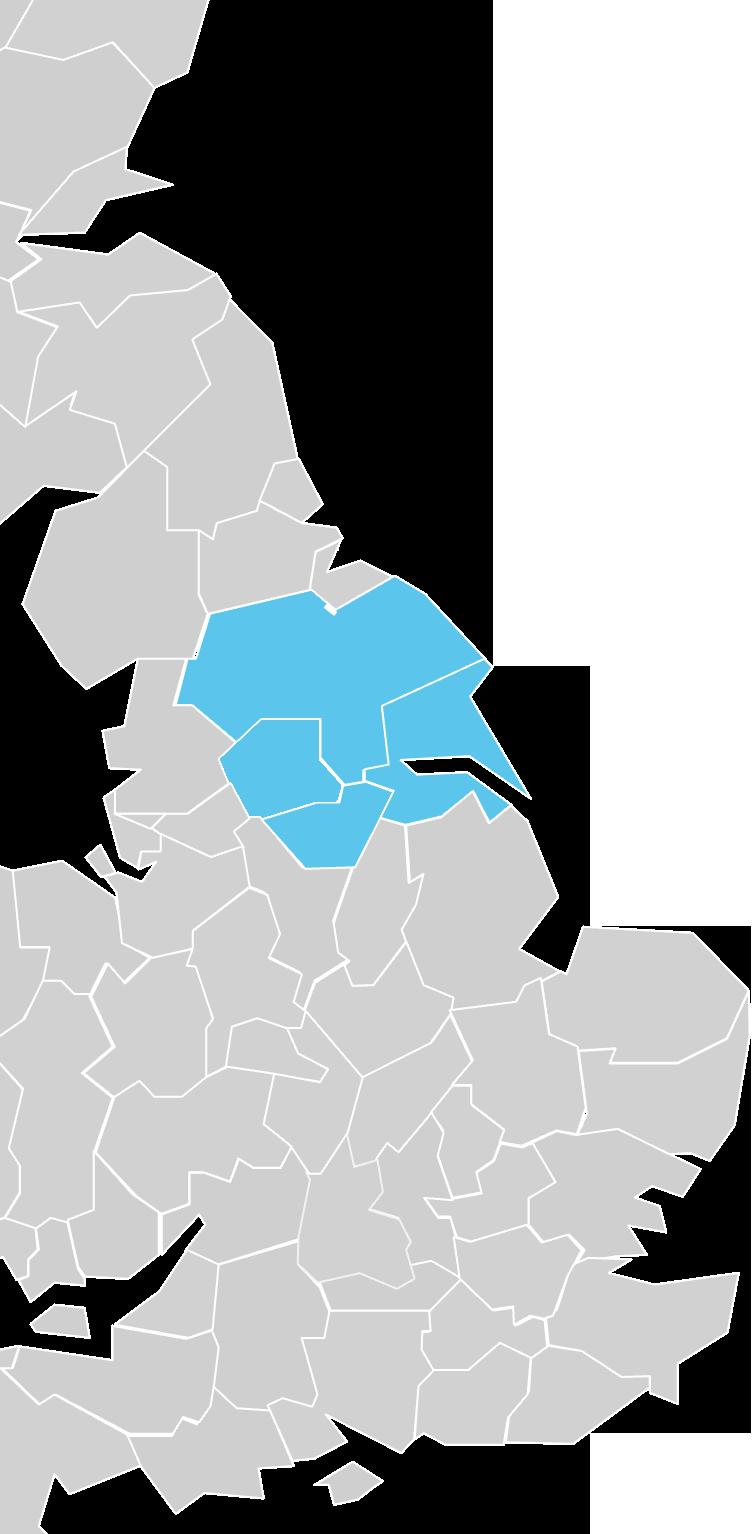

Yorkshire

A market in balance

Market sentiment sensing stability | Strong demand, steady growth

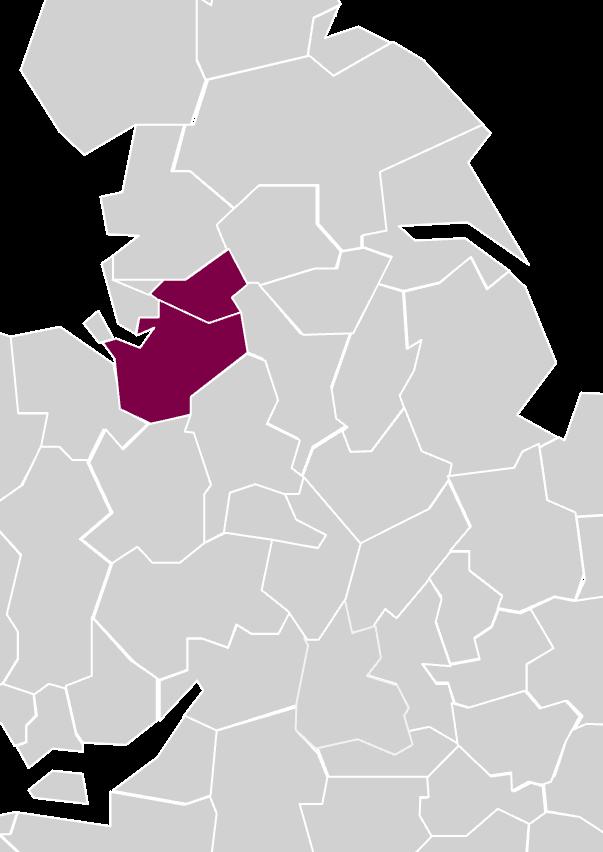

North West

Improving market sentiment

Market challenges and regional focus | Broad based sales activity

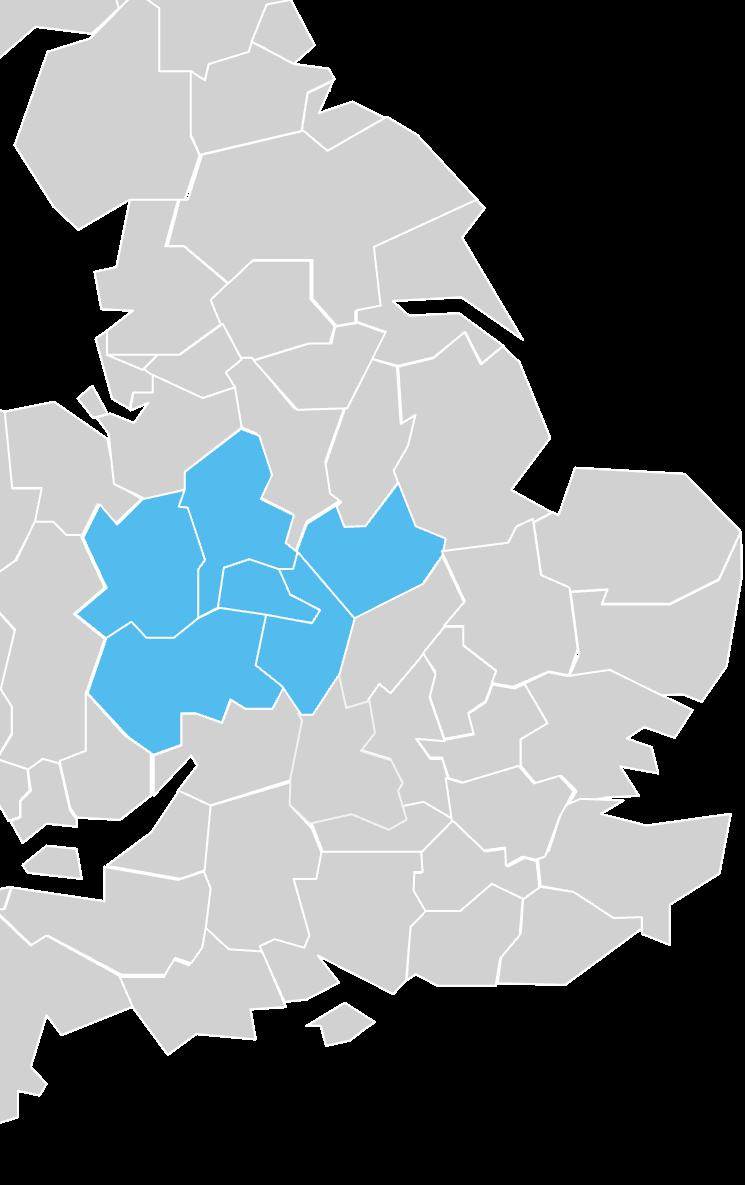

Midlands

Evolving demand

Strengthening the Midlands foothold | Strong demand & evolving expectations

London and International

Lomond expands in London

The crest of the wave | Cladding challenges persist | Adapting to legislative change

Kent

Stability meets momentum

A strong start to 2025 | Equilibrium expected | Stability prevails

South Coast East

The dynamics of demand

Resilience amidst changing conditions | High demand meets shifting dynamics

South Coast Central

Professional proactivity

Signs of renewed momentum | A shift towards professionalisation

Lomond Investment Management

Cities with strong demographics

Local nuances important | Demographics and rents | Growing BTR sector

Lomond Leadership

Meet our Senior Leadership Team

Introduction

“For our clients and partners, we provide a long-term perspective grounded in market intelligence.”

We are delivering on our commitment to the leveraging the efficiencies of centralised systems, governance and leadership, while capitalising on the regional strength of our brands and the expertise of the talented professionals across our network. Our presence in 15 of the UK’s major cities is entirely

Lomond: a strong growth story

Equipped for expansion, on solid foundations

Our recent partnership with ICG, the acquisition of Kinleigh Folkard & Hayward, which formally completed in January, and a further 5 acquisitions in the first quarter of this year have set us on a strong trajectory. We continue to achieve key milestones, including reaching nearly 3,000 employees, operating across 8 regions and expanding our headquarters at 70 St. Mary Axe, where our central group functions now consist of close to 100 team members.

intentional, aligning with our strategic focus on Private Rented Sector (PRS) hotspots. Success is measured not only by growth but also by employee satisfaction, a key benchmark demonstrated by our Great Places to Work accreditation, which we have now held for two consecutive years.

While expanding at pace, we maintain rigorous evaluation and due diligence when considering acquisitions. This same

approach applies to how we manage our client relationships - we enable smarter property decisions, not just faster ones, by leveraging our collective expertise. This insight informs our perspective on the evolving market landscape. The sector is undergoing significant legislative change, which we welcome and are poised to adapt to. The Renters’ Rights Bill will drive greater professionalism, fostering trust and eliminating the limited instances of unethical practices that have tarnished the industry’s broader reputation.

The PRS is set for sustained growth, particularly as the UK’s proportion of renters remains considerably lower than that of comparable European markets. Changing lifestyle preferences prioritising flexibility, reduced maintenance and shorter-term commitments over traditional 30 year mortgages - continue to drive demand.

Capital growth forecasts remain positive with recent projections estimating a 3.1% rise in 2025 according to a Reuters survey of 21 sector experts, subject to key regional variations. Portfolio and professional landlords will find compelling opportunities within this landscape.

Lomond Quarterly Insights

“Lomond is fully aligned on our growth journey, supported by strategic investments in technology and talent.”

Our newly trademarked Propertycloud platform exemplifies our commitment to innovation, while our investment in people is equally significant; 250 of our high-potential employees are currently undergoing management training with FranklinCovey, a global leader in professional development.

While it may seem like a period of rapid change, every investment, initiative and acquisition is designed to equip us for future growth. We are positioned to navigate geopolitical, regulatory and market shifts while strengthening our reputation as the partner of choice in the property space.

Our service offering is extensive, yet our client relationships remain personal, safeguarded by strong leadership and a steadfast commitment to attracting and retaining the industry’s top talent. The year ahead is looking promising, that much is certain.

Ed Phillips Group Chief Executive

Lettings

Enhancing market stability

Buy-to-let Mortgage Interest Rates

Market dynamics and legislative change

The lettings market has always been particularly sensitive to the laws of supply and demand, more so than the sales sector. This has played out throughout Q1, with demand consistently outstripping supply across most regions we operate in, nudging up prices and consolidating the sense of a fundamental shortage of homes.

Alongside the typical seasonal market fluctuations, the industry is preparing for the introduction of the Renters’ Rights Bill. Lomond is

at the forefront of supporting clients in anticipating and adapting to these changes, culminating in our hosting of five landlord events across the country.

These events, featuring industry experts from Rightmove and Goodlord, as well as senior leaders from within our business, are designed to equip landlords with the insight and strategies needed to navigate the evolving regulatory landscape – our ethos centres on working with, rather than around, these reforms.

Despite prevailing media narratives around landlords exiting the market, the reality tells a different story. In Q1 alone, the percentage of mortgages agreed for buy-to-let (BTL) were on the rise demonstrating continued investor confidence.

Landlords with a long-term perspective, attracted by capital growth projections and strong yields, are expanding their

Source: Bank of England: Two year 75% LTV buy-to-let fixed rate mortgages

Buy-to-let Mortgages

Source: FCA Percentage of

Market Metrics

portfolios rather than exiting the market - particularly when supported by a trusted agency partner.

Regulatory compliance should not be viewed as a burden by reputable landlords. Greater professionalism enhances market stability, fosters predictability and ultimately safeguards returns.

As the sector continues to evolve, those who embrace these changes will be best placed to capitalise on the opportunities ahead.

A return to normal service

Bank of England Base Rate

Stability returns: A more predictable market

To say the sales market has faced significant turbulence in recent years is a reality that cannot be overstated. From the global pandemic triggering legislative interventions such as Stamp Duty Land Tax holidays and first-time buyer incentives, fluctuating Base Rate adjustments driving mortgage rates up and down, outbreaks of war contributing to fiscal uncertainty across the globe and of course the arrival of a new UK Government at the end of last year; the sector has navigated considerable peaks and troughs which have generated surges and droughts in activity.

*Source: Nationwide

However, Q1 has shown clear progress towards stability, with market activity reflecting a gradual return to more predictable conditions.

The factors that previously accelerated or delayed people’s home related decision-making have largely subsided, and we anticipate a return to consistency and the traditional seasonality that has long defined the sales housing market.

As economic and political uncertainties ease, families and first-time buyers are once again making decisions to upsize, downsize and relocate at familiar levels - a return to normal service.

While external pressures will always play a role, it is fundamental lifestyle needs that ultimately drive the market. Stability may be the new normal, but demand will continue to shape the sector, ensuring sustained movement and opportunity.

6,823

38,081

4,563

5.5

Scotland

Operating the largest lettings agency in Scotland, our branch network covers the strategic locations of Edinburgh, Glasgow, St Andrews, Aberdeen & Dundee.

Founded in 1982, DJ Alexander has been a trusted name in residential sales and lettings across Edinburgh, Glasgow, Dundee, Aberdeen and St. Andrews. DJ Alexander has expanded significantly, now managing over 10,000 properties across Scotland, supported by a team of over 200 professionals.

SALES

A healthy influx of properties coming to the market with subdued buyer demand affecting activity. Sales agreed

LETTINGS

The traditional seasonal trends saw less interest from tenants and reduced activity as predicted.

“Seasonality remains a key factor north of the border, with winter typically slowing market activity before spring renews momentum.”

Kevin Fraser Managing Director

A promising outlook

Major cities driving market trends

Rental prices have steadily increased across Scotland’s major cities in recent years, driven by sustained demand outstripping supply. Several years of rent controls imposed by the Scottish Government - including wholesale rent freezes during the pandemic, have created artificial inconsistencies in the market which are ripe for readjustment.

With restrictions lifting as of 1st April, landlords regain the ability to adjust rents to market value, a shift expected to bolster confidence and improve overall sentiment in the sector.

Seasonality remains a key factor in Scotland, with winter typically slowing market activity before Spring renews momentum. While demand continues to exceed supply, tenants remain price-sensitive, and there is scope for negotiation on the expected rental increases. Many landlords prioritise long-term, reliable tenants over short-term gains.

High-quality properties - whether centrally located apartments or suburban homes with gardenscontinue to attract strong interest. Meanwhile, build-to-rent (BTR) investment remains on hold pending

Year on Year House Prices

driver rather than location, with properties in the £150,000–£300,000 range experiencing the highest levels of interest.

Higher mortgage rates and the recent increase in Additional Dwelling Supplement (ADS) - rising from 6% to 8% following the Scottish Budget - have led to a more cautious approach from investors, with cash flow considerations taking precedence. However, market expectations remain optimistic, with strong sales activity forecast for 2025.

further clarity on the Scottish Housing Bill, with expectations that a more defined regulatory framework will trigger renewed activity.

For landlords with a long-term outlook, capital appreciation remains particularly strong in Edinburgh and Glasgow as these major cities attract popularity.

Listings upwards trajectory

The first quarter of 2025 has seen an increase in property listings, though demand remains slightly subdued. In the current climate, price is the primary

5.7% price growth in Scotland over the last year

2023 2024 2025

Data to January 2025 landregistry.data.gov.uk

From Harrogate and York to Leeds and Sheffield, our branches span the breadth and depth of Yorkshire.

Whether you’re a seasoned landlord with an extensive portfolio or a first-time investor, a buyer or a seller, our expertise ensures your property is handled with professionalism and attention to detail. Thousands trust us for seamless tenant placement, proactive support and management.

SALES

Interest from first-time buyers and families is keeping demand for available properties high.

LETTINGS

The number of tenants looking for properties remains high and supply is steadily increasing to meet demand.

“The market presents an attractive opportunity for landlords partnered with agents who are equipped to navigate the anticipated changes to regulations.”

David Mear Managing Director

A market in balance

Strong demand, steady growth

Demand in the lettings market remains high, particularly for smaller two to three bedroom terraces, with family homes seeing somewhat less interest. However, the supply of rental properties is steadily increasing, especially as higher-priced build-torent (BTR) developments are brought to market.

Landlords are advised to remain conservative on pricing, although a 5% growth is expected on top of the steady price increases experienced over the past two years. Lifestyle factors associated with city centre living remain a key driver for demand.

There has been some price sensitivity at the more expensive end of the market, possibly influenced by previous quarters where wage growth was being outpaced by inflation, however the tide is turning on that metric contributing to the return of positive sentiment in the market.

Returns for landlords have remained strong and capital value increases show no sign of slowing, consolidating a trend of strong investment performance. The market presents an attractive opportunity for landlords

partnered with agents who are equipped to navigate the anticipated changes to regulations.

Market sentiment sensing stability

As seen across much of the UK, the Yorkshire market is trending towards a return to normality, following a turbulent period over the past two years. Sentiment is increasingly positive and while some landlords are choosing to sell, approximately 20% of those listings are being acquired by other landlords, including a number of first-time landlords recognising the considerable opportunities presenting themselves in the current market.

Supply and demand across the region

are largely in equilibrium, with notable exceptions in York and North Leeds, where demand remains particularly high, driven by both first-time buyers and family demographics seeking homes that meet their evolving requirements. Similarly, Skipton has seen strong year-on-year growth in regards to both capital appreciation and demand, reflecting a degree of market confidence not observed through 2024.

Looking ahead to the summer months, stock levels are slightly down, which could create a favourable environment for vendors, offering the potential for an appetising sellers’ market.

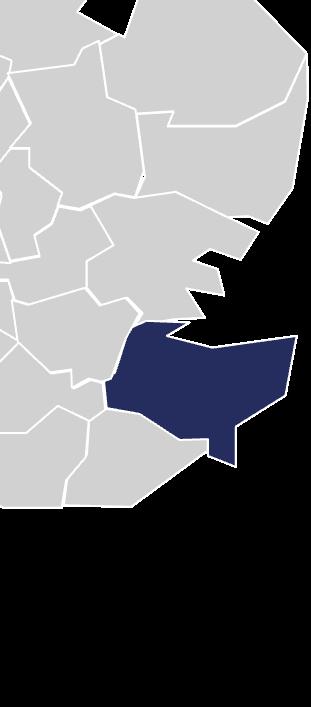

North West

Covering Manchester, Stockport and Chester, our local experts have an unrivalled depth of knowledge in key cities in this region.

SALES

Market sentiment is improving, with location a key factor driving high demand from buyers.

LETTINGS

New tenancies down slightly year on year, however no signs of a mass landlord exodus due to legislation.

Managing thousands of properties in the greater Manchester area, providing expert services in property sales, lettings, and management. Using advanced technology, our teams deliver seamless and flexible service to landlords and homeowners across the region.

“Media narratives suggesting a mass landlord exodus have not been reflected in Q1 activity. However, demand for Rent and Legal Protection (RLP) products has risen, indicating that landlords are proactively safeguarding their investments.”

Matthew Smith Managing Director

Improving market sentiment

Strong demand and evolving market conditions

Tenant demand remains strong across the North West, compounded by an increase in tenancy renewals. Hesitancy or reluctance to move is being amplified by uncertainty surrounding the Renters’ Rights Bill.

The city centre rental market is experiencing a slightly different trend due to an increase in new build stock being sold to investors, alongside the completion of build-to-rent developments. This has resulted in higher rental unit availability, easing supply constraints and shifting the balance slightly in favour of tenants.

Media narratives suggesting a mass landlord exodus have not been reflected in Q1 activity. However, demand for Rent and Legal Protection (RLP) products has risen, indicating that landlords are proactively safeguarding their investments. Similarly, the adoption of Goodlord’s enhanced referencing solutions has significantly streamlined the tenancy application process, improving

Annual % Change Rents

North West

+5%

efficiency whilst maintaining thorough scrutiny. The outlook for both sales and lettings suggests a period of consistency, with a steady flow of movers expected across both sectors in the coming months.

Market challenges and regional focus

The sales market in the North West has been affected by lenders’ slow response to Base Rate reductions in Q1. Buyers seeking preferential mortgage rates below 4% are often required to procure high loan-to-value (LTV) ratios, which is tempering transaction volumes.

Market conditions vary across the region, with buyers focusing on areas experiencing strong capital growth, such as Stockport and Prestwich.

Auctions continue to perform well, notably for properties requiring refurbishment or those in less soughtafter locations, as investors take advantage of attractive pricing opportunities.

Overall market sentiment is improving, with activity driven by homeowners reaching the end of their mortgage rate terms and those reassessing their lifestyle and space requirements. Investors are increasingly weighing capital growth potential alongside rental yields, recognising the value in possibly lower-yield, yet high capital growth locations.

While location remains the key factor driving demand, exemplified in soughtafter areas such as Didsbury, well presented properties requiring minimal upgrades are moving quickly irrespective of postcode.

Midlands

Our newly-expanded region extends our reach from Birmingham to Nottingham and Derby.

With over 8,000 properties under our care across the Midlands, we’re trusted by landlords to deliver the best service possible. Whether you are a professional landlord or are thinking about renting out your own home, our expert team are here to help.

SALES

Sales increase and landlords expand their portfolios, with buyer demand outstripping supply.

LETTINGS

Tenant demand outpacing supply, should provide confidence to landlords in this transitional period.

“Quality property management and professional advice are becoming not only a premium, but an essential service.”

Richard Crathorne Managing Director

Evolving demand

Strong demand and evolving expectations

Over the course of Q1, the Midlands region has experienced high demand from tenants across the major cities in the region, where the supply of new properties coming to the market to rent has not kept pace with the demand. Tenants are simultaneously becoming increasingly discerning in terms of property quality and expectations. These high demand levels should provide confidence to landlords in this transitional legislative period.

City centre living remains an attractive option for tenants in both Birmingham and Nottingham, while Solihull is emerging as a growing hotspot, offering many of the same advantages and attractions of larger cities. Capitalrich landlords are recognising opportunities in the market, though it is essential to partner with the right agent to navigate the complexities afoot in regard to the Renters’ Rights Bill.

Quality property management and professional advice are becoming not only a premium but an essential service, with clients assessing the net-benefit of expert guidance and insurances. We anticipate an increase in supply

over the summer months, so landlords would be wise to secure tenants for their properties in advance to avoid potential void periods.

Strengthening the Midlands foothold

Lomond’s expansion into Nottingham has strengthened its position within the Midlands, further solidifying the region as a key focus. Sales activity has performed strongly in the last quarter, following a more challenging 2024, with positive sentiment surrounding a stabilising market prevailing. This has led to an increase in activity levels.

In line with the trends observed in the Manchester, Auctions have seen

growing interest, with clients appreciating the speed of sale and the predictable timelines offered.

Contrary to reports of landlords exiting the market, many in the Birmingham and Nottingham markets are actually expanding their portfolios, with professional landlords remaining undeterred by the approaching increased compliance requirements, especially when afforded the benefit of a reputable managing agent.

Many first-time buyers have moved to complete transactions ahead of the SDLT changes expected from April, fuelled by improved affordability with falling borrowing rates.

Family movers are also increasingly relocating from larger urban areas to more rural hotspots. Despite high demand continuing to outstrip supply, conveyancing delays remain a key challenge as regards deal progression.

However, the market is demonstrating more stability than it has in the past two years, with strong yield hotspots like Nottingham seeing increased demand. In Birmingham, a new phase of construction is underway, with several build-to-rent (BTR) schemes expected to complete by the summer.

London & International

Expanding our foothold in the capital, with our flagship brands affording access to global as well as local investors.

SALES

London remains a preferred destination for overseas investors, who view property in the Capital as a stable, reliable asset.

Adam Holden Managing Director - Chase Evans

LETTINGS

On market listings are gradually increasing in KFH areas, helping to ease the extreme competition and price surges that have defined the past two years.

Esmee Jones Lettings Director - KFH

We deliver a comprehensive range of estate agency and property services across London, priding ourselves on providing unrivalled service, communication and results.

*Lettings Data from KFH Q1

Lomond expands in London

Adapting to legislative change

Portfolio landlords remain largely steady in anticipation of the Renters’ Rights Bill, while many accidental landlords are opting to sell, further tightening supply amid consistently high tenant demand.

International lets continue to represent a significant portion of the market, particularly within the Chase Evans portfolio, where seasonal surges align with the academic calendar - peaking in summer and again in October, with particular demand in Zones 1 and 2. However, uncertainties surrounding the anticipated ban on the ability to pay rent in advance as part of the Renters’ Rights Bill, present a challenge for landlords who have historically relied on this approach to secure tenancies.

In contrast, rental stock is gradually increasing in KFH areas, helping to ease the extreme competition and price surges that have defined the past two years. With tenants facing less urgency, expectations around property condition are rising and requests for upgrades are becoming more commonplace.

The interplay between accidental landlords exiting the market and the resulting reduction in available stock could place renewed upward pressure

% Change Rents

London

+1.1%

on rents, potentially driving increased yields for those who remain in the PRS. Across the sector, landlords are increasingly seeking agency partnerships to navigate evolving compliance requirements, as well as exploring insurance products and management services to safeguard their investments.

The crest of the wave

Following on from an exceptionally strong year for sales in the London market, 2025 began with similarly high levels of activity. Despite economic and political headwinds, demand for quality stock in prime locations remains robust. The slight shortfall in expected interest rate reductions has not deterred buyers, who continue to see London as a secure long-term investment.

School catchment areas remain a key driver of demand across the Capital, with substantial deposits from the ‘Bank of Mum and Dad’ continuing to support transactions in sought-after South London boroughs. Established areas such as Dulwich, Putney, and Battersea remain highly desirable, while emerging hotspots like Elephant & Castle are seeing significant surges in activity. Capital Gains Tax efficiency techniques are further fuelling movement in the market.

In East London, new build developments and residential blocks continue to attract strong interest, particularly from international buyers. London remains a preferred destination for Turkish investors, who view property in the Capital as a stable, reliable asset. Meanwhile, secondhand stock in the 8 to 15 year range is entering the market in increasing volumes, with an average completion time of 16 weeks.

Cladding challenges persist

The Building Safety Act and ongoing cladding issues continue to create obstacles for certain developments, causing delays in sales and stagnation within affected segments of the market. These regulatory complexities are particularly impacting second steppers, who face difficulties in selling and progressing onto their next home.

The ever popular ‘Garden of England’, Kent is a property hotspot serviced by our team at Miles & Barr.

With over 25 years’ experience in helping people in Kent sell and let properties, our aim is help clients achieve their property goals with service and expertise that exceeds expectations.

SALES

A notable surge in activity during the first few months of the year, especially at the high end of the market.

Steady lettings volumes, consistent tenant applications and a balanced supply and demand dynamic.

“Professional, long-term landlords remain focused on the region’s strong capital growth and increasing demand for high-quality homes”

Mark Brooks Managing Director

Stability meets momentum

Stability prevails

The lettings market in Kent remains stable, with steady volumes, consistent applicant activity and a balanced supply and demand dynamic. However, the upcoming Renters’ Rights Bill is contributing to wider market uncertainty. In response, the region has seen an increase in the number of Section 21 notices served, leading to strong demand for rental properties and likely driving rental prices upwards.

In terms of property types, the two bedroom flats and three bedroom semi-detached homes are attracting the most interest, particularly in trendy, sought-after locations such as Margate, Folkestone and more traditional seaside towns like Broadstairs and Whitstable.

Investment on hold

Landlords in the region are currently in a holding pattern as they await further clarity on the implications of the Renters’ Rights Bill. While some may be cautious, professional, long-term landlords remain focused on the region’s strong capital growth and increasing demand for high-quality

homes, confident that the market will continue to present valuable opportunities in the near future.

A strong start to 2025

The sales market has experienced a notable surge in activity during the first few months of the year, driven by multiple factors. Stamp Duty deadlines have provided significant momentum, complemented by the typical seasonal uptick seen in January following the key decision-making period over the festive season.

Of particular note has been the increased demand at the higher end of the Kent sales market, where wellpriced, high-quality homes in good condition continue to attract sustained interest, particularly in popular seaside towns.

Sales agreed for Q1 have exceeded target, with results significantly ahead of the same period in 2024, reflecting a broader sense of market confidence. This trend is also evident in the new homes sector, where new developments are selling rapidly. The area’s appeal is further enhanced by high-speed train links to London in just over an hour, adding to the attractiveness of this coastal location.

Equilibrium expected

Q1 has seen a balanced market, with supply and demand in relative equilibrium, making for a more predictable environment than in recent years. This stability is expected to continue into the summer months. Notably, the primary driver of buyer activity has shifted from internal movements within Kent to those relocating to the area, further emphasising the growing allure of a seaside lifestyle. This trend indicates that many buyers are leaving major cities or are seeking to divide their time between locations.

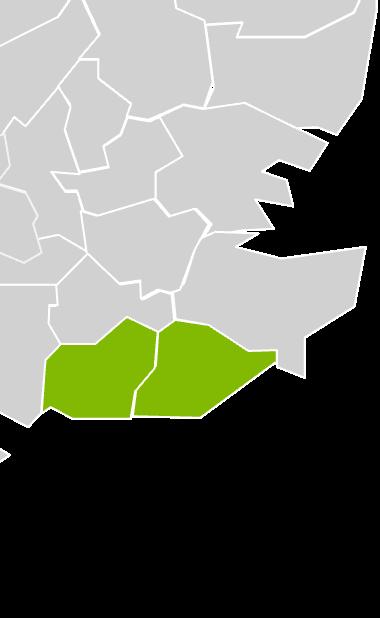

South Coast East

Reaching from Brighton to Worthing, our branches in the South Coast East region are market leaders for sales and lettings.

SALES

Brighton and Worthing remain popular with buyers commuting to London, fueling the sales market.

We’ve called West Sussex home for decades. Our team is built on strong local roots, offering honest advice and real support to help you find the right property or make the best decision for your future. We’re not just about transaction volumets, we’re connected the people and places we know.

LETTINGS

Despite falling tenant demand, landlords should have no concerns about the ability to let their

“While buy-to-let investment activity has slowed, institutional and portfolio landlords remain active, responding to opportunities in the sales market.”

Paul Broomham Managing Director

The dynamics of demand

High demand meets shifting dynamics

The supply and demand imbalance in the region remains firmly in favour of demand, with a surplus of tenants seeking accommodation across the South Coast.

There is growing speculation that the ban on bidding wars, as part of the forthcoming Renters’ Rights Bill, may lead to upward pressure on rental prices. Professional landlords continue to show sustained interest in typical investment properties, although some first-time buyers are capitalising on opportunities to purchase ex-rental properties as they come to market. Properties in excellent condition continue to draw strong interest.

While buy-to-let investment activity has slowed, institutional and portfolio landlords remain active, responding to opportunities in the sales market. Market concerns are centred around the implications of the end of Rent in Advance for the significant numbers of international students along the South Coast, alongside students’ increasing demand for secure, long-term housing

Annual House Price Growth

+2.1% Brighton & Hove

+1.4% Worthing

Year on year sales Annual House Price change to Feb 2025

Source: Land Registry Feb 2025

for the duration of their academic year. Overall, the market in this sought-after region of Southern England remains relatively steady.

Resilience amidst changing conditions

Stability is very much the story in the region, with robust buyer activity supported by higher volumes of properties entering the market in Q1. Sales progression timelines have accelerated, benefitting from the urgency around changes to SDLT, effective from April.

Despite some disappointment surrounding Base Rate reductions, buyer interest remains strong, with families and second steppers continuing their search for new properties. First-time buyers are increasingly active, as the previously high mortgage rates delayed their entry onto the property ladder in the past year.

The demand for properties in desirable school catchment areas remains high, with the recent VAT levy on private schools further intensifying interest in state schools with strong Ofsted ratings.

Commutability to London, particularly along the fast train lines to London Bridge and Victoria, continues to be a key factor for many buyers. Areas outside these direct commuter routes are attracting ‘empty-nesters’ and those nearing retirement, who are reassessing their priorities; downsizing is not always the goal, rather, lifestyle considerations are playing a more significant role in these decisions.

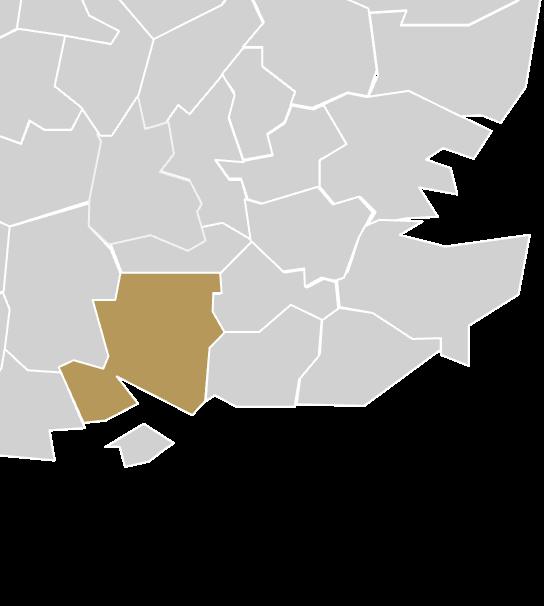

South Coast Central

Stretching along the coast from Portsmouth to Southampton and up the M3 corridor all the way to Winchester and Farnham.

At Charters, we are proud to employ the finest creative property experts who deliver a truly bespoke service tailored to meet our clients’ unique needs. Our exceptional track record speaks for itself - we are proud to hold a market-leading position bolstered by an abundance of glowing reviews on Google and Trustpilot, reflecting our unrivalled standards in the industry.

SALES

An increase in sales, new listings and continued house price growth reinforcing buyer and vendor confidence.

*Sales Data from Charters Q1

A strong regional lettings performance, despite excess tenant demand has starting to

“The build-to-rent sector continues to gain momentum, particularly in Southampton’s Bargate Quarter.”

Rob Mott Managing Director

Professional proactivity

A shift towards professionalisation

The excess in tenant demand that defined the past six months has begun to rebalance in the first quarter of the year. While some landlords have exited the market, they are being succeeded by a new generation of investors drawn to the increasing professionalisation of the sector under the forthcoming Renters’ Rights Bill. As a result, rental supply is beginning to rise.

Buy-to-let investors remain engaged, showing interest in expanding their portfolios, while the build-to-rent sector continues to gain momentum, particularly in Southampton’s Bargate Quarter, where over 500 units are set to enter the market. Developers are also focusing on repurposing vacant sites, such as the Maritime Gateway and disused commercial spaces, with a growing trend towards retaining a proportion of units for rental following construction. Overall, the lettings market is becoming more structured and predictable, fostering a positive outlook for the months ahead.

Annual % Change Rents

South East

+3.8%

Year on year % change to rents March 2025

Source: Zoopla

Signs of renewed momentum

Key market indicators reflect a notable resurgence in the first quarter of the year. An increase in agreed sales, new listings and continued house price growth have reinforced buyer and vendor confidence, creating a more dynamic market environment.

The settling in of the new Labour government and recent Base Rate reductions have contributed to a growing sense of stability. While lenders continue to adjust their rates and expectations have tempered around the extent of further Base Rate cuts this year, property investment

remains attractive - particularly for buy-to-let landlords and developers looking to capitalise on improving conditions.

Buyer activity is strong across the region, with the impending April Stamp Duty deadline driving heightened interest in properties below £500,000, a segment typically dominated by first-time buyers. Overall, demand continues to outstrip supply, with stock levels struggling to keep pace, further reinforcing upward pressure on house prices.

The South Coast Central region is now prepared for a period of significant growth. After the merger of two brands within the region, as our Beals offices became known as Charters - the foundations are in place to offer our cleints and customers an improved level of service. With the key components now in place, such as a new look website, Propertycloud launched to offer an improved digital offering for the region, combine this with our enduring, exceptional stand out brand, increased results in the region expected to follow.

LOMOND Investment Management

Investment trends and market performance

In 2024, the UK build-to-rent (BTR) sector attracted a total investment of £4.1 billion, reflecting a 6% decline compared to the previous year. Despite this dip, the sector continues to demonstrate resilience, underpinned by strong demand for professionally managed rental housing. Single-family housing remains a crucial and expanding segment within the UK residential market, securing £1.2 billion in investment capital. As this segment matures, it is expected to generate increasing volumes of new supply, reinforcing its importance to the broader BTR landscape.

Supply and demand dynamics

A total of 18,000 new BTR homes were completed in 2024, marking a 17% increase from the previous year. This growth highlights the sector’s ongoing efforts to address the rental housing shortfall. However, while the gap between supply and demand has narrowed, rental market constraints are

“As we move through 2025, investor sentiment may increasingly shift towards de-risked, stabilised assets, ensuring continued momentum in this vital segment of the housing market.”

Brent Stojanovic Managing Director

anticipated to persist throughout 2025, with no significant surge in supply on the horizon.

The rise of co-living

Co-living continues to emerge as a viable and increasingly popular residential typology. Completed co-living schemes are reporting strong occupancy levels, indicating that this model effectively addresses a growing demand within the UK’s housing market. The typical length of stay for co-living residents averages around 12 months, suggesting a stable and sustained interest in this format.

Investment outlook and market challenges

Despite ongoing challenges in delivering new BTR assets, ranging from planning constraints to policy uncertainties and cost inflationinvestment activity in the sector remains broadly stable. However, forward commit transactions remain subdued, as investors seek improved return profiles to offset development risks.

This trend may drive increased interest in 2025 toward high-quality, stabilised BTR assets, as investors look to capitalize on proven and incomegenerating properties.

An evolving outlook

The UK BTR market continues to evolve, with single-family housing and co-living emerging as notable growth areas. While challenges persist in new developments, the sector’s ability to attract investment and deliver new housing underscores its long-term viability. As we move through 2025, investor sentiment may increasingly shift towards de-risked, stabilised assets, ensuring continued momentum in this vital segment of the housing market.

Lomond Investment Management is well-placed to steer and assist clients in navigating the changing marketplace.

Contact: lim@lomond.group

Lomond Senior Leadership

Our culture and our values of - Wisdom, Integrity, Success & Evolution are embodied and underpinned by our Senior Leadership Team.

Ed Phillips Group Chief Executive

John Ennis Chief Revenue Officer London & Kent

Lucy Jones Chief Operating Officer

David Alexander Chief Revenue Officer Scotland & Yorkshire

Ian Sutherland Chief Financial Officer

Robert Mott Chief Revenue Officer South Coast

Clare Wakeford Chief People Officer

Paul Clarke Chief Revenue Officer Midlands & North West