THE PROPERTY CHRONICLE

March2023

DRURY Page 3 5 CONTENTS Letter from Principal (Brent Worthington) LJHooker Home Smart REINZ -Press Release 8 • Market Snapshot 10 • Annual Median Price Change Map 11 REINZ –Monthly House Price Index 12 REINZ –Monthly Property Report (just use link) 26 REINZ & Tony Alexander Survey 27 Property Management -Rent Exchange 34 • Newsletter –Making a Smart Financial Move –refinancing your mortgage 35 LJHooker Drury -Properties • Our Current Upcoming Auctions 38 • Our Current Listings 40 • Our Recent Sales 42 Salesperson Profile • Brent Worthington 44 • Nav Johnson 45 Loan Market Information –Keith Jones 46 Hot Tips to Prep Your Property for an Autumn Sale 47

22 March 2023

Hi,

RealestatesalespeopleacrossNewZealandareseeingachangeinbuyers,andaftera significantperiodwherehighinterestrateswereobstructing“wanttobebuyers”accessing financeisnolongeramajorroadblock.

The latest Real Estate Institute of New Zealand (REINZ) survey of real estate agents, conducted by independent economist Tony Alexander, noted a return of first home buyers to the market who are not as worried about accessing finance.

With the median property price down, stabilising interest rates and a significant number of properties on the market, property buyers have an opportunity to find their perfect home.

Despite the survey results, a portion of buyers are still concerned about the terms they need to meet to access a loan. While interest rates are higher than they have been in recent years, there are signs they are on the downward trend with some banks offering heavy discounts on their fixed rates.

This survey comes on the back of the February property market figures released by REINZ. Although February did not have its typical real estate spark, it showed a stabilisation month-onmonth with prices holding steady and more homes sold when compared to January.

Ongoing economic headwinds and extreme weather across parts of the North Island had impacted property sales, with sales and listings significantly down in affected areas, REINZ chief executive Jen Baird said.

“WemaycontinuetoseethisforsometimeinpartsofNorthland,Auckland,Gisborne,Hawkes BayCoromandelandBayofPlenty",BairdSaid.

Whilepropertypriceshavebeenstabilizing,followingsignificantfalls,Alexandernotedtwotrends thatwillseethepropertymarketbounceback.Thesearenetgainsinmigrationandreduced pressureoninterestraterises.

Brent Worthington Principal and Licensee Agent

LJ Hooker Drury & Property Management

1/233 Great South road, Drury

09 294 75 00 0292 965 362

continued over...

D RURY

“

Continued

“Justsixmonthsago,thenetannualmigrationflowforNewZealandwasalossofover13,000 people.Nowthattheflowhasswitchedtoanetgainof33,000fortheyeartoJanuary,” Alexandersaid.

“Wehaveseenthissortofradicalflowchangebefore,suchasattheendof2001andthe housingmarketimplicationsarefairlyobvious.Acceleratingpopulationgrowthmeansmore demandforrentalaccommodationandhousestoown.”

WiththeUSgovernmenttakeoverofSiliconValleyBank,interestratesforbankshavecome back,whichcouldleadtoafreshroundoffixedmortgageratecuts.

“Growingdiscussionofmonetarypolicytighteningslowingisgoingtoencouragemore potentialhousebuyerstobackawayfromworst-casescenariosofraterises,evenif believingrateswillfallrapidlyisnotjustifiedforthisyear,”Alexandersaid.

He suspects, with these factors and following the results from his survey, the bottom of this cycle for the property market could be reached by the middle of the year.

As always I trust you enjoy this month's publication.

Kind regards

Brent

Brent Worthington Principal and Licensee Agent

D RURY

LJ Hooker Drury & Property Management 1/233 Great South road, Drury 09 294 75 00 0292 965 362

StagingYourHometoSell–HowtoGetAttentionina CompetitiveMarket

Sellingahomeisabigdecision,andit’simportanttomaximiseyourchancesofsellingquicklyandat thebestpossibleprice.That’swherehomestagingcomesin.

Homestagingistheprocessofpreparingahomefor saletomakeitmoreattractivetopotentialbuyers.It involvesdecluttering,depersonalising,andorganising thespacetocreateanemotionalconnectionwiththe buyer.

Whyishomestagingimportant?

Homestagingisessentialbecauseithelpspotential buyersenvisionthemselveslivinginthespace.Awellstagedhomeallowsbuyerstoseethepotentialof eachroomandvisualisetheirownfurnitureand belongingsinthespace.Itcanalsomakethehome looklarger,brighter,andmoreinviting.Infact, accordingtoasurveybytheNationalAssociationof Realtors,stagedhomessell73percentfasterinthe UnitedStatesthannon-stagedhomes.

Althoughit’spracticallyimpossibletohavereliable statisticsonhowmuchfasterahousesellswith staging,itdoeshelpthesellerstandoutina competitivemarket.Withsomanyhomesonthe market,it’simportanttomakeyourhomestandout fromtherest.Bystagingyourhome,youcanmakeit lookmoreappealingandmemorabletopotential buyers.

Howtostageyourhomeforsale?

Declutteranddepersonalise:Thefirststepinstaging yourhomeistodeclutteranddepersonalisethespace. Removeanyexcessfurniture,knick-knacks,and personalitems.Thiswillmakethespacelooklarger andallowpotentialbuyerstoenvisiontheirown belongingsinthespace.Makesuretoalsoremoveany familyphotos,religiousitems,orpoliticalmemorabilia, asthesecandistractpotentialbuyers.Considerrenting astorageunittotemporarilystoreitemsthatyoudon’t needinyourhome.

Cleanandorganise

Onceyouhavedeclutteredanddepersonalised,it’s timetocleanandorganisethespace.Clean everythingthoroughly,includingwindows,floors,and surfaces.Makesuretoalsoorganiseallwardrobes, drawers,andcabinets.Thiswillmakethespacelook morespaciousandappealingtopotentialbuyers.

Useneutralcolours

Whenitcomestostaging,it’simportanttouseneutral coloursthroughoutthehome.Neutralcolourssuchas beige,grey,andwhitearemoreappealingtopotential buyersandmakeiteasierforthemtoenvisiontheirown furnitureandbelongingsinthespace.Avoidusingbold coloursorpatterns,asthesecanbedistracting.

Createafocalpoint

Ineachroom,createafocalpointthatdrawstheeye andshowcasesthebestfeaturesofthespace.This couldbeafireplace,apieceofartwork,orastatement pieceoffurniture.Awell-placedfocalpointcanmake theroomlookmoreinvitingandmemorable.

Letinnaturallight

Naturallightcanmakeahugedifferenceinhowaroom looksandfeels.Makesuretoopenallcurtainsand blindstoletinasmuchnaturallightaspossible.Ifthe roomdoesn’thaveenoughnaturallight,addsome artificiallightingtobrightenupthespace.

ljhooker.co.nz

Rearrangefurniture

Rearrangingfurnitureisacost-effectivewaytomake aroomlooklargerandmoreinviting.Removeany excessfurnitureandarrangetheremainingpiecesto createacleartrafficflowandopenupthespace. Makesureyouplacefurnitureinawaythathighlights thebestfeaturesoftheroom.

Enhancecurbappeal

Theexteriorofthehomeisthefirstthingpotential buyerswillsee,soit’simportanttoenhancethecurb appeal.Makesurethelawnandgardenarewellmaintained,thefrontdooriscleanandinviting,and theexteriorofthehomeisfreeofanydamageor wearandtear.Consideraddingsomepottedplants oroutdoorfurnituretocreateaninvitingatmosphere. Consideraddingafreshcoatofpainttoyourhome’s exteriorifit’slookingwornoroutdated.

Createawelcomingentryway

Yourhome’sentrywayisthefirstthingthatpotential buyerswillsee,somakesureitcreatesapositivefirst impression.Removeanyclutterandaddafreshcoat ofpainttothefrontdoor.Addawelcomemat,potted plants,andattractivelightingtomakethespacemore inviting.

Makenecessaryrepairs

Ifthereareanyobviousrepairsthatneedtobemade, suchasaleakytaporacrackedtile,takecareof thembeforeputtingyourhomeonthemarket. Potentialbuyersmaybeputoffbyahomethatneeds obviousrepairs.

Setthemood

Whenpotentialbuyerscometoviewyourhome,you wanttocreateawarmandinvitingatmosphere. Considerplayingsoftmusic,lightingcandles,and usingairfreshenersordiffuserstocreateapleasant scent.

Byfollowingthesetips,youcanstageyourhometo sellandincreaseyourchancesofgettingtopdollar foryourproperty.Remember,thegoalistocreatea spacethatpotentialbuyerscanenvisionthemselves livingin,sokeepthingssimple,organised,andneutral.

Theinformationcontainedinthispublicationisgeneralinnatureandisnotintendedtobepersonalisedrealestateadvice. Beforemakinganydecisions,youshouldconsultalegalor professionaladvisor.LJHookerNewZealandLtdbelievestheinformationinthispublicationiscorrect,andithasreasonablegroundsforanyopinionorrecommendationcontainedinthis publicationonthedateofthispublication. Nothinginthispublicationis,orshouldbetakenas,anoffer,invitationorrecommendation.LJHookerNewZealandLtdacceptsnoresponsibilityfor anylosscausedasaresultofanypersonrelyingonanyinformationinthispublication. ThispublicationisfortheuseofpersonsinNewZealandonly.Copyrightinthispublicationisownedby LJHookerNewZealandLtd. Youmustnotreproduceordistributecontentfromthispublicationoranypartofitwithoutpriorpermission.

ljhooker.co.nz

Youmaywanttoconsiderremoving heavydrapesandreplacethemwith light-colouredcurtainsorblindsthat allownaturallighttofilterin.Clean yourwindowsinsideandoutto maximisetheamountoflightthat entersyourhome.

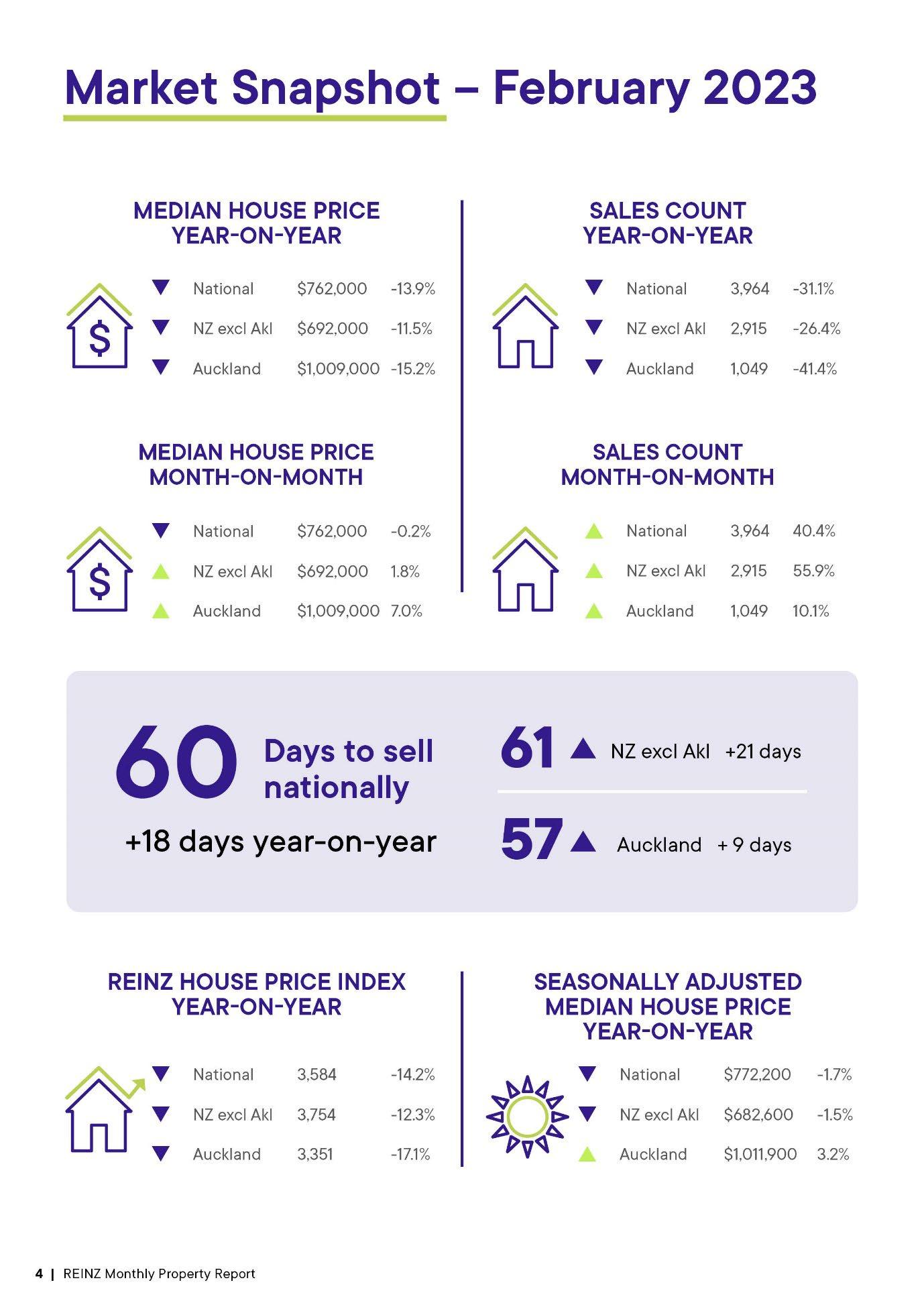

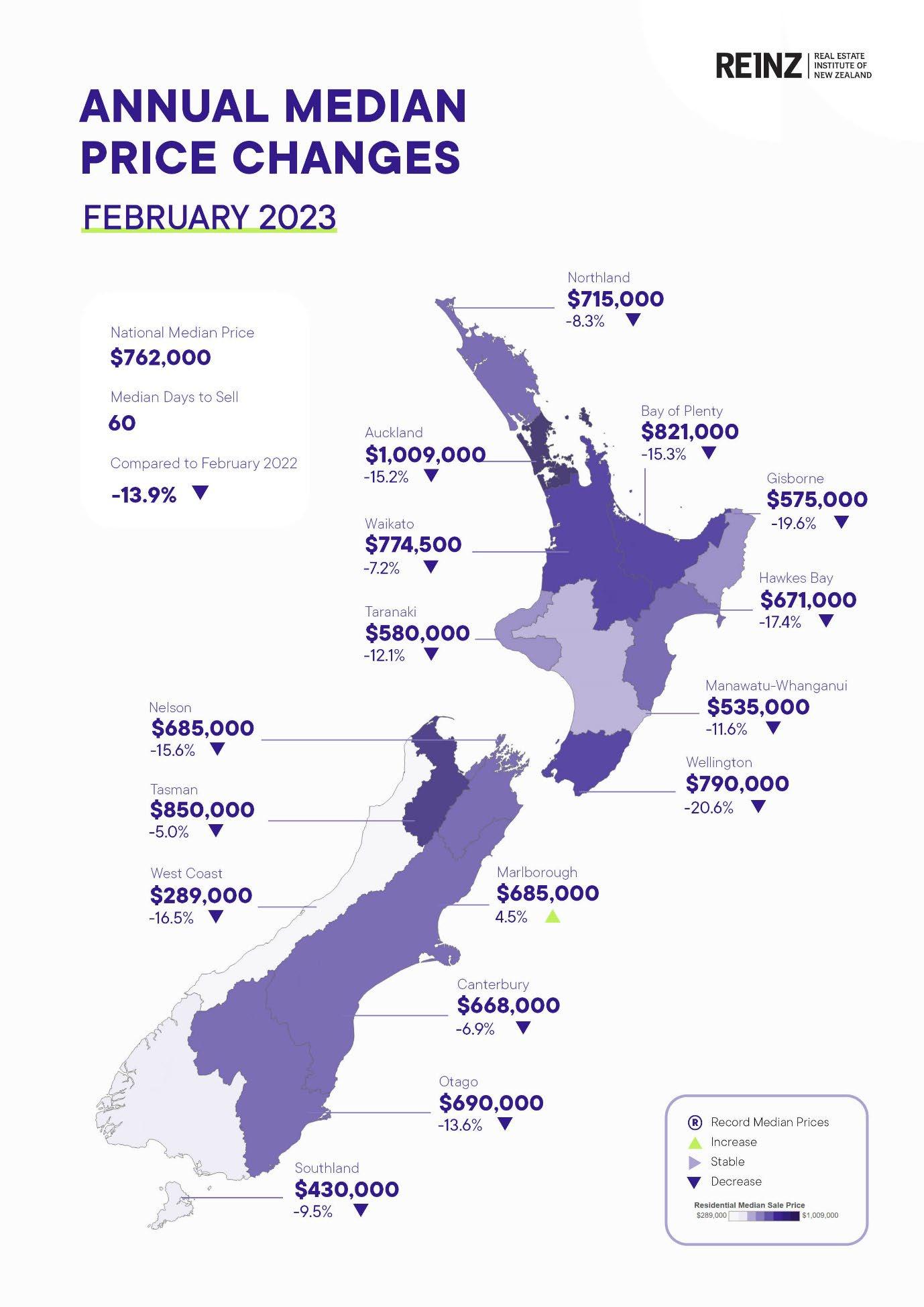

REINZFebruarydata:Activityremainsslow, housingstocklevelsreturntoregularlevels

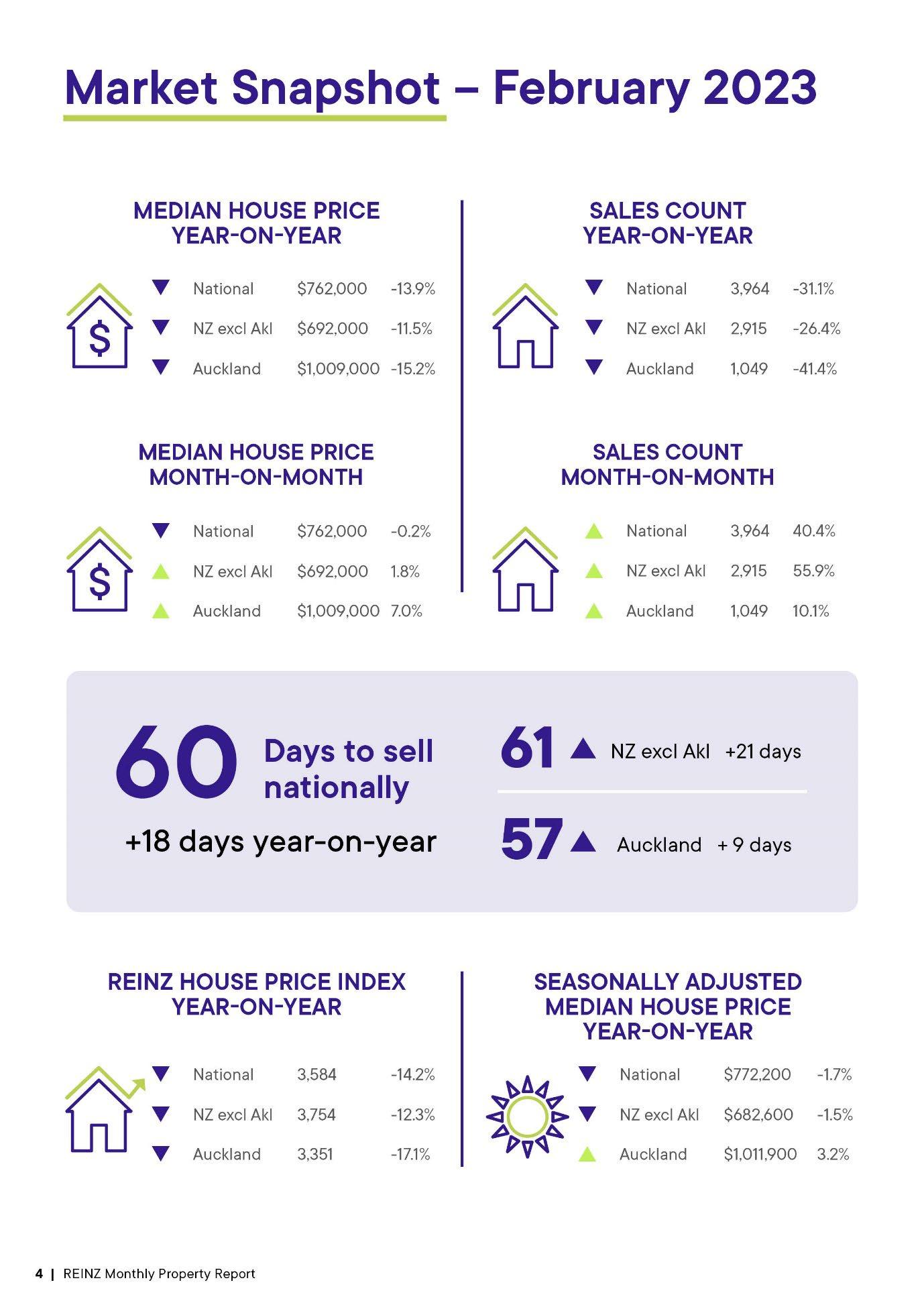

The Real Estate Institute of New Zealand’s (REINZ) February 2023 figures show a lesser rate of decline in annual median prices and sales counts, with stock levels returning to normal levels.

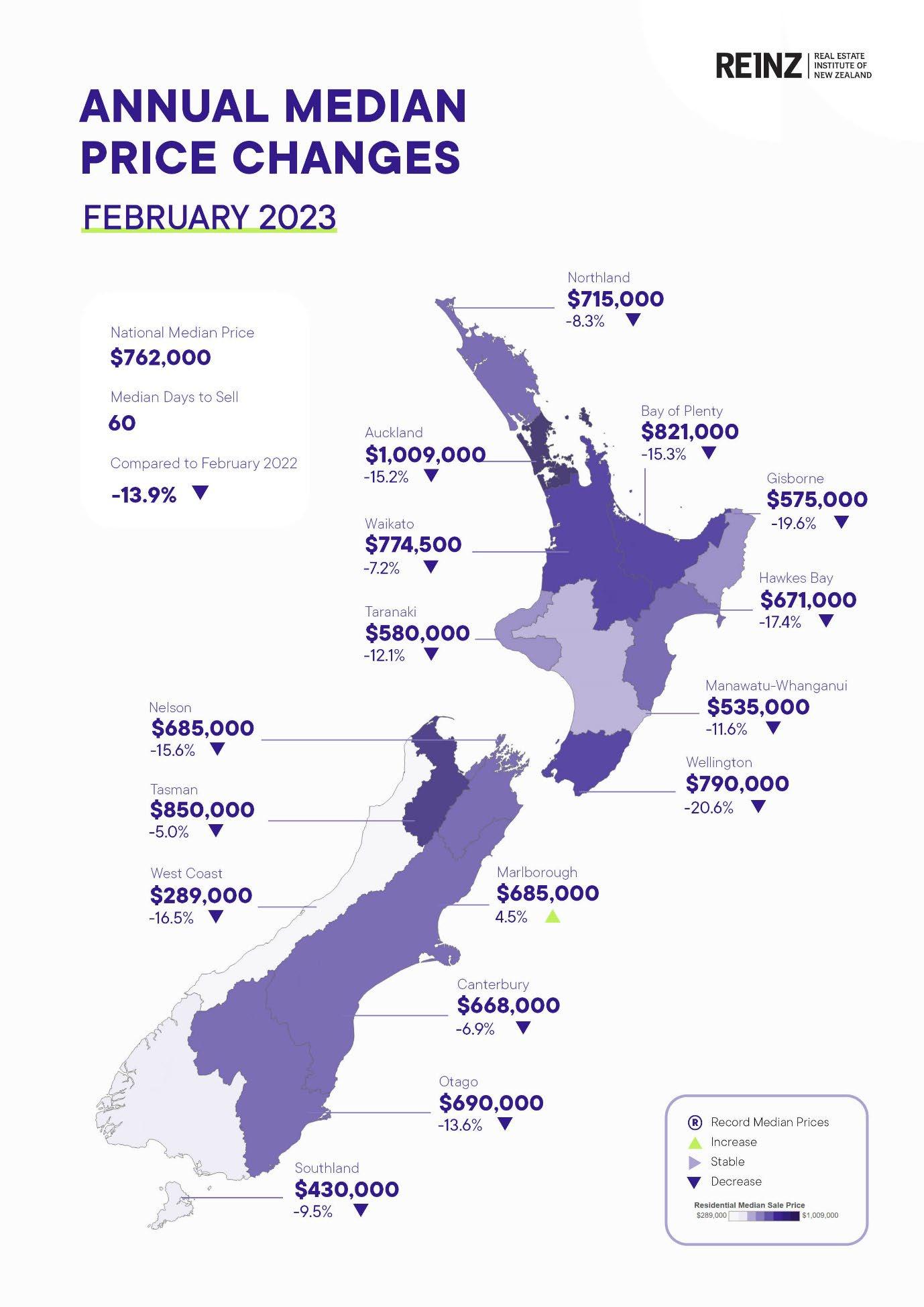

REINZ Chief Executive Jen Baird, says the impact of ongoing economic headwinds and Cyclone Gabrielle is reflected in the numbers, but some data in the housing market returns to ‘normal’ amidst a big clean-up job across the upper north and eastern North Island.

“February traditionally shows a reasonable month of activity but the impact of extreme and devastating weather over the start of 2023 is certainly showing in the data with sales and listings significantly down in affected areas. We may continue to see this for some time in parts of Northland, Auckland, Tairāwhiti Gisborne, Hawke’s Bay, Coromandel and Bay of Plenty.”

Auckland’s listings were down 36.9% from 4,365 to 2,755 year on year, and Tairāwhiti’s down 54.4% year-on-year from 68 to 31 new listings. Nationally, new listings decreased by 29.5%, from 11,545 listings in February 2022 to 8,143 listings in February 2023.

“Even though new listings are down as communities respond to the weather and the anticipation of economic adjustments ahead, inventory levels are now showing a return to standard levels after a few years at historically low levels.

REINZPressRelease-14March2023

“When we looked at the trend over a ten-year period, we can definitely see the return to normal stock levels,” suggests Baird.

At the end of February, the total number of properties for sale across New Zealand was 29,083, up 5,813 properties (+25.0%) year-on-year, and up 4.9% from 27,732 month-on-month. New Zealand excluding Auckland was also up from 13,253 to 18,656, an increase of 5,403 properties (+40.8%). Month-onmonth, inventory was also up 4.9% from 17,781 properties. This means there is plenty of choice for buyers in the market today.

The number of residential property sales across New Zealand eased annually by 31.1% from 5,750 in February 2022 to 3,964 February 2023. Month-onmonth there was an increase of 40.4%.

Across New Zealand, median prices decreased by 13.9% year-on-year to $762,000. However, when comparing to January, the median sale price increased across most of the regions. Auckland saw a 7.0% increase, tipping back over the $1 million price point.

Median days to sell were at 60 days for February 2023 — up 18 days annually compared to February 2022 and had a small increase of 6 days from 54 when compared to January 2023.

“Our seasonally adjusted data shows that when compared to what is typically observed moving from the month of January to the month of February, all regions except Taranaki and Tasman had smaller gains in sales count monthon-month than what would be expected. In other words, even though the sales count change from January to February looks significant, we would typically expect greater increases based on what has been observed historically.”

Rising interest rates, increased cost of living and inability to secure finance are still having an impact on buyers, but REINZ members are telling of returned activity at open homes in areas that weren’t as impacted by Cyclone Gabrielle,” add Baird.

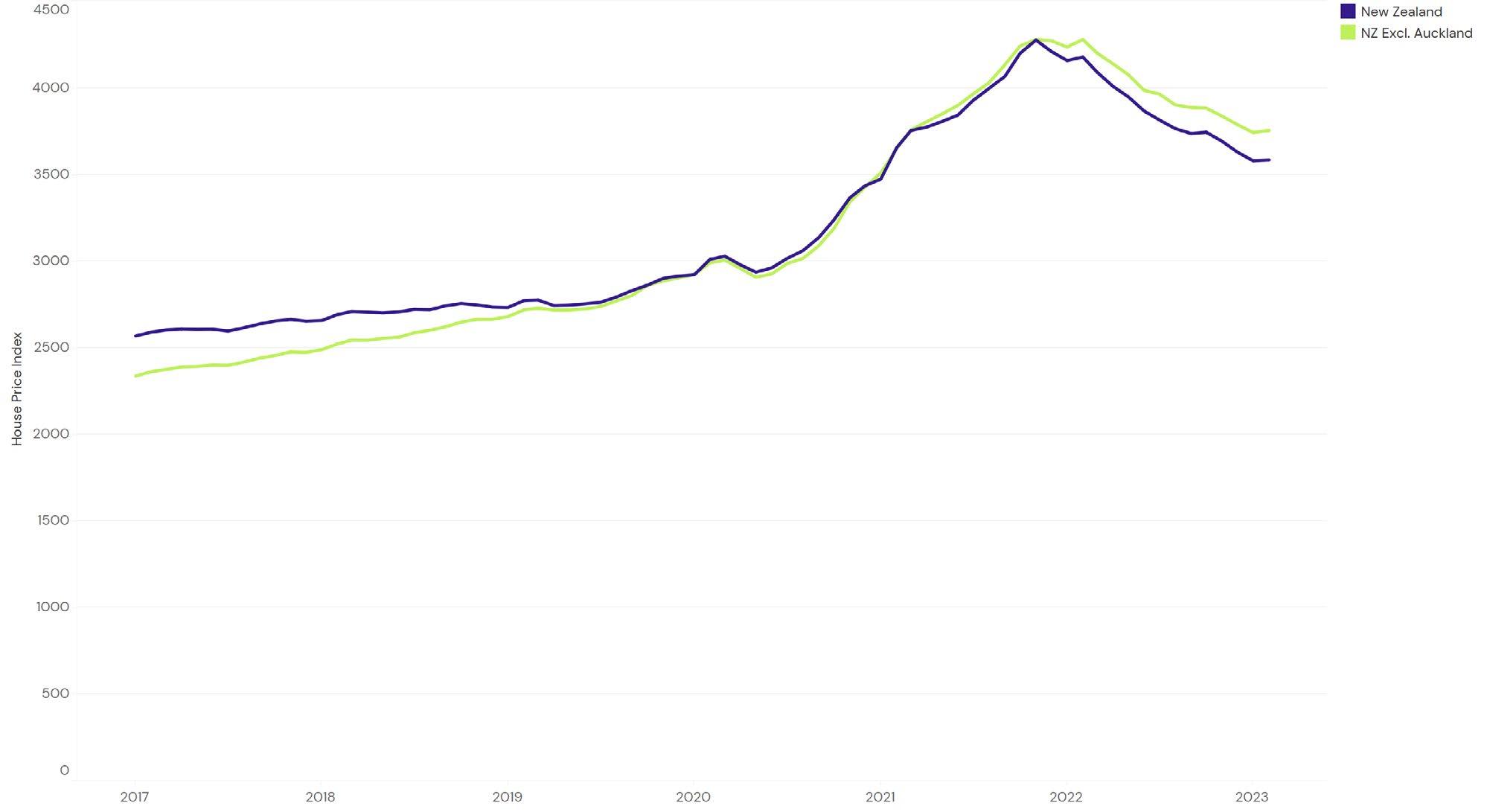

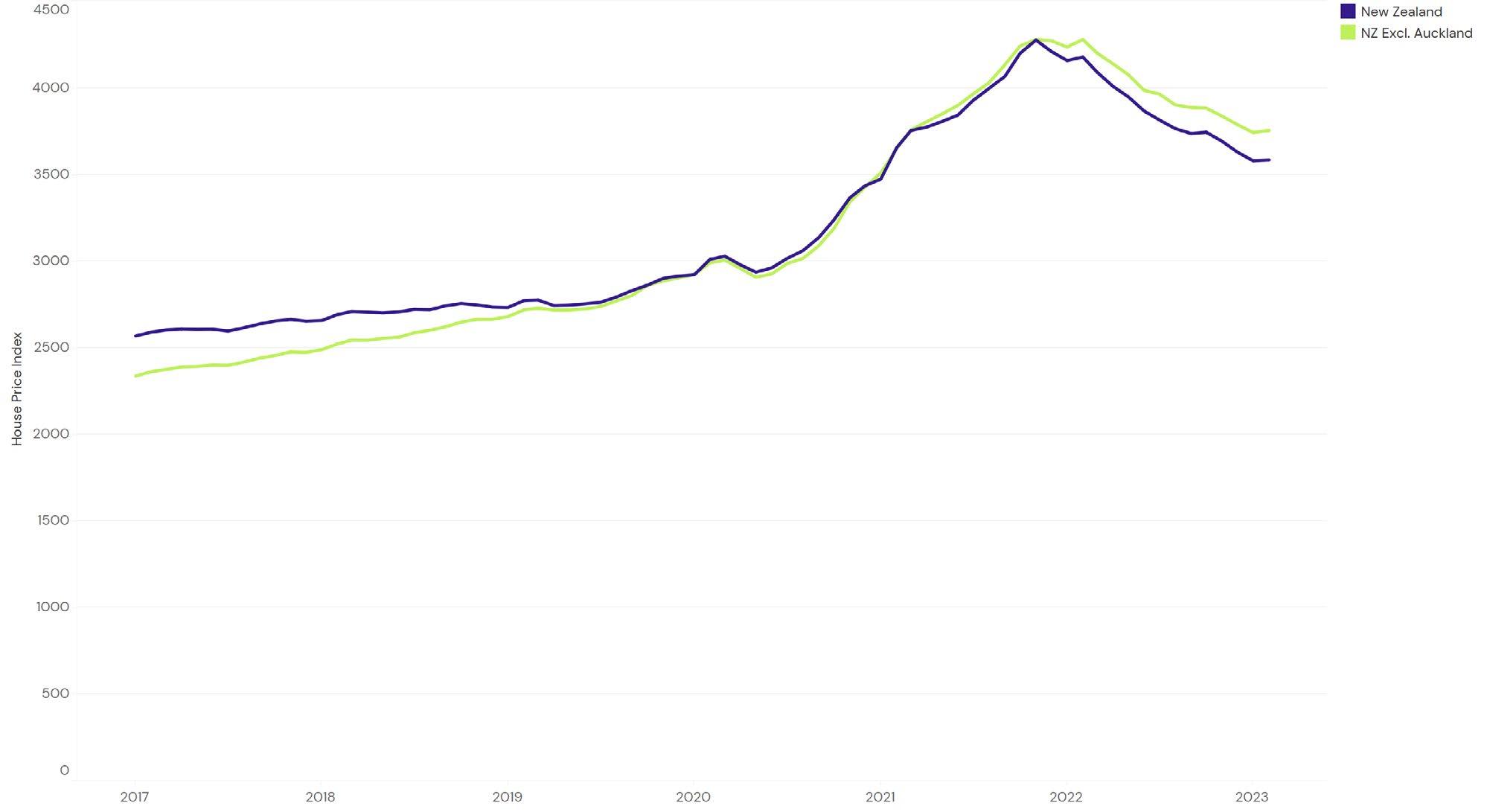

The REINZ House Price Index (HPI) for New Zealand which measures the changing value of residential property nationwide showed an annual decrease of 14.2% for New Zealand and a 12.3% decrease for New Zealand excluding Auckland. This is a small increase from last month, 0.1% and 0.3% respectively.

The Real Estate Institute of New Zealand (REINZ) has the latest and most accurate real estate data in New Zealand.

© REINZ - Real Estate Institute of New Zealand Inc. MONTHLY HOUSE PRICE INDEX REPORT 14 March 2023

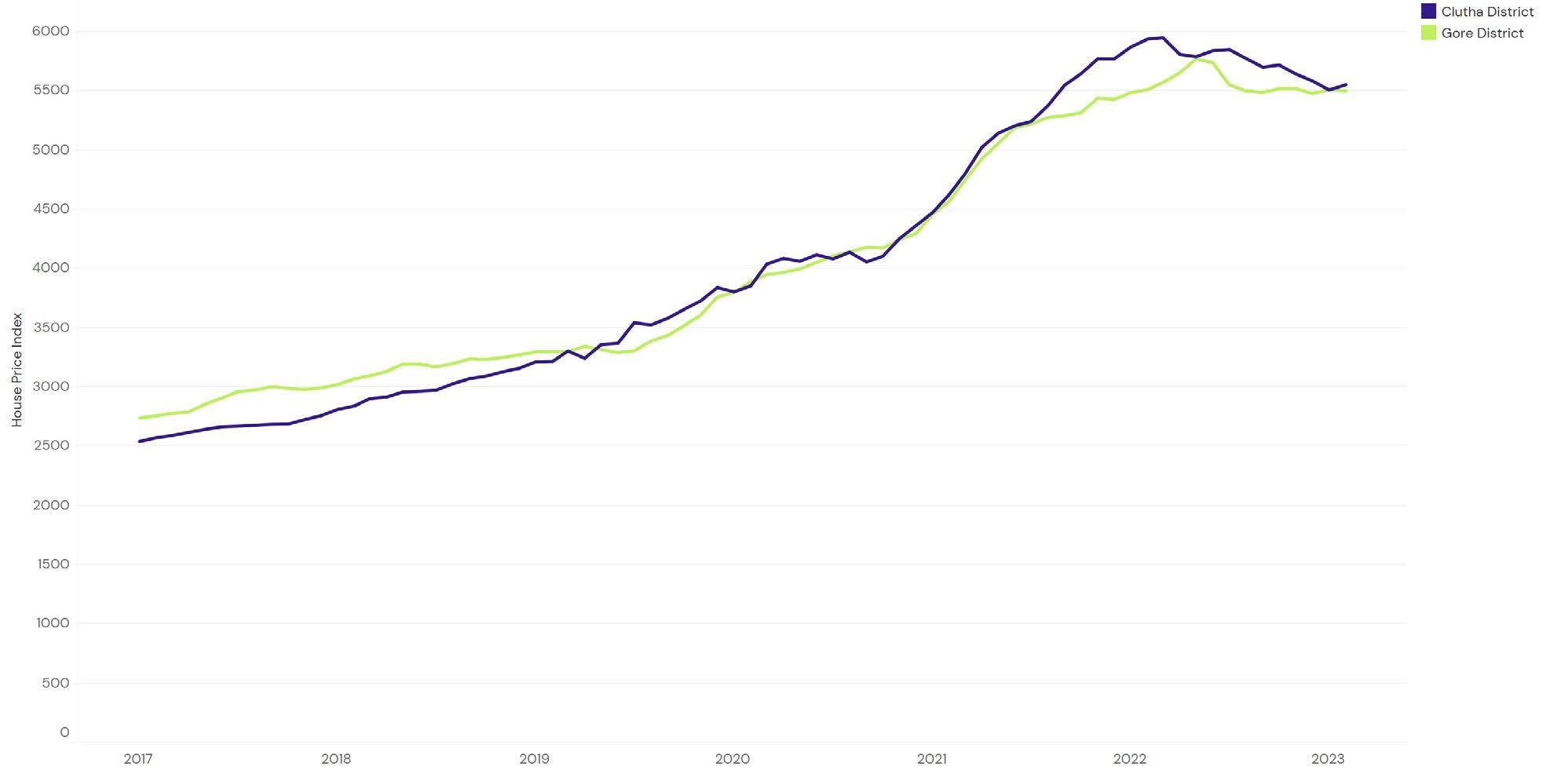

REINZ House Price Index (HPI)

As one of the country’s foremost authorities on real estate data, we are proud to bring you the REINZ HPI (House Price Index). It provides a level of detail and understanding of the true movements of housing values over time to a higher standard than before. The REINZ HPI was developed in partnership with the Reserve Bank of New Zealand and provides a more complete picture of the New Zealand housing market.

BENEFITS OF THE REINZ HPI

Data on median and average house prices is open to being skewed by market composition changes. This means observed changes in these values could be almost entirely due to the changed nature in the underlying sample (e.g. an unusually large representation of high end housing sales) rather than changes in the true market value. The REINZ HPI takes many aspects of market composition into account resulting in greater accuracy.

ABOUT REINZ HPI

The REINZ HPI is based on the SPAR methodology and has been proven to be the most comprehensive tool to understand the housing market for four main reasons:

• Timeliness - This is the number one advantage of REINZ HPI. REINZ data is based on sales as they occur (unconditional) so is the most up to date data source in NZ.

• Accuracy - REINZ data is supplied by the actual sales prices supplied by its members so has a high level of accuracy.

• Stability - REINZ has the most data available to it so can provide the most stable and complete one month indices.

• Disaggregation - Indices can be disaggregated to a lower level than before. Disaggregation means you can focus on a smaller data set, allowing comparison of building typology and suburbs, i.e. Three bedroom houses in Manukau.

EXPERT INDUSTRY FEEDBACK

“I have had the opportunity to utilise the REINZ HPI website, and have been involved in advising on the HPI’s preparation. The new index fills a gap in providing reliable up to date information on house price developments across all of New Zealand’s local authorities. It’s wonderful to see REINZ providing this level of detailed data for wider public use. I am already planning to use this data in my own research.”

Dr Arthur Grimes Senior Fellow, Motu Research; and Adjunct Professor, Victoria University of Wellington

“Accuracy and timeliness of information on house price movements is vital for home buyers, sellers, agents, and analysts such as myself. The data from REINZ meets both requirements and gives New Zealand a collection of house price series comparable with the best overseas.”

Tony Alexander Independent Economist and Speaker

“The Real Estate Institute of New Zealand’s Market Intelligence portal opens up to users the ability to interactively compare price trends amongst a wide range of local council regions. Users can pick and choose regions of interest and use the chart tools to instantly compare price performances. For those wanting to look at house prices in more depth there is the capability to download the data in spreadsheet format all the way back to 1992 when the Institute started recording sales price information.”

Nick Tuffley Chief Economist, ASB

The number one advantage between REINZ data and other housing data on the market is that REINZ has access to sales data from the time the price is locked in (unconditional data) as opposed to when the house changes hands (settlement date) which can often be weeks/months later. Therefore, the REINZ HPI is the best and most timely measure of recent housing market activity.

2 | REINZ Monthly House

Index Report

Price

For more information visit: reinz.co.nz/reinz-hpi

FEBRUARY 2023 RESULTS REINZ HOUSE PRICE INDEX

Looking at the REINZ HPI for February 2023, the ‘gold standard’ for New Zealand house price analysis, Jen Baird, Chief Executive at REINZ, says:

The REINZ House Price Index was developed in partnership with the Reserve Bank of New Zealand.

Already being used by the Reserve Bank’s forecasting and macro financial teams, plus the major banks, the REINZ HPI provides a level of detail and understanding of the true movements of housing values over time. It does this by analysing how prices in a market are influenced by a range of attributes such as land area, floor area, number of bedrooms etc. to create a single, more accurate measure of housing market activity and trends over time. Using the Reserve Bank’s preferred Sale Price to Appraisal Ratio (SPAR) methodology, the REINZ HPI uses unconditional sales data (when the price is agreed) rather than at settlement, which can often be weeks later. It is therefore more accurate and timely.

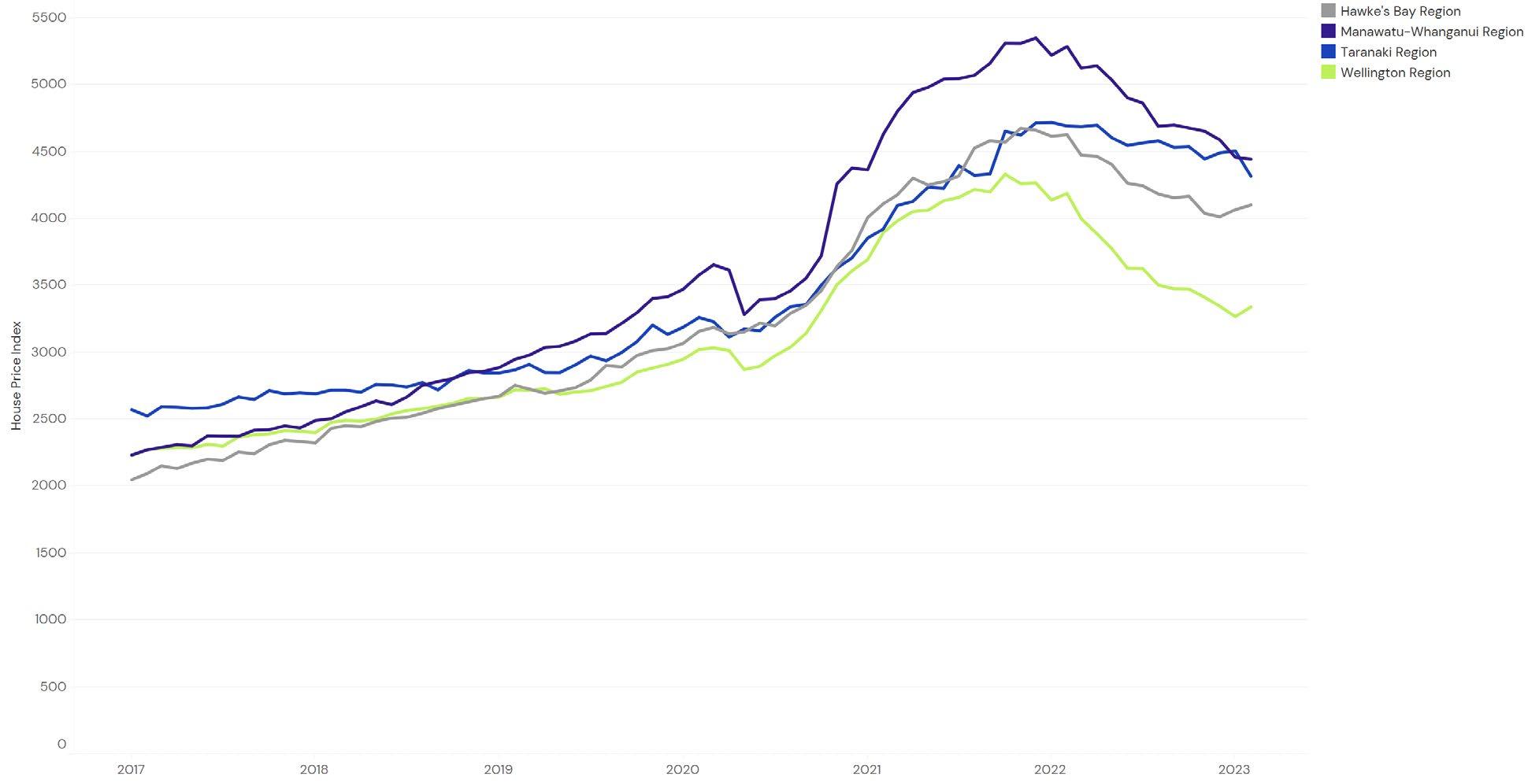

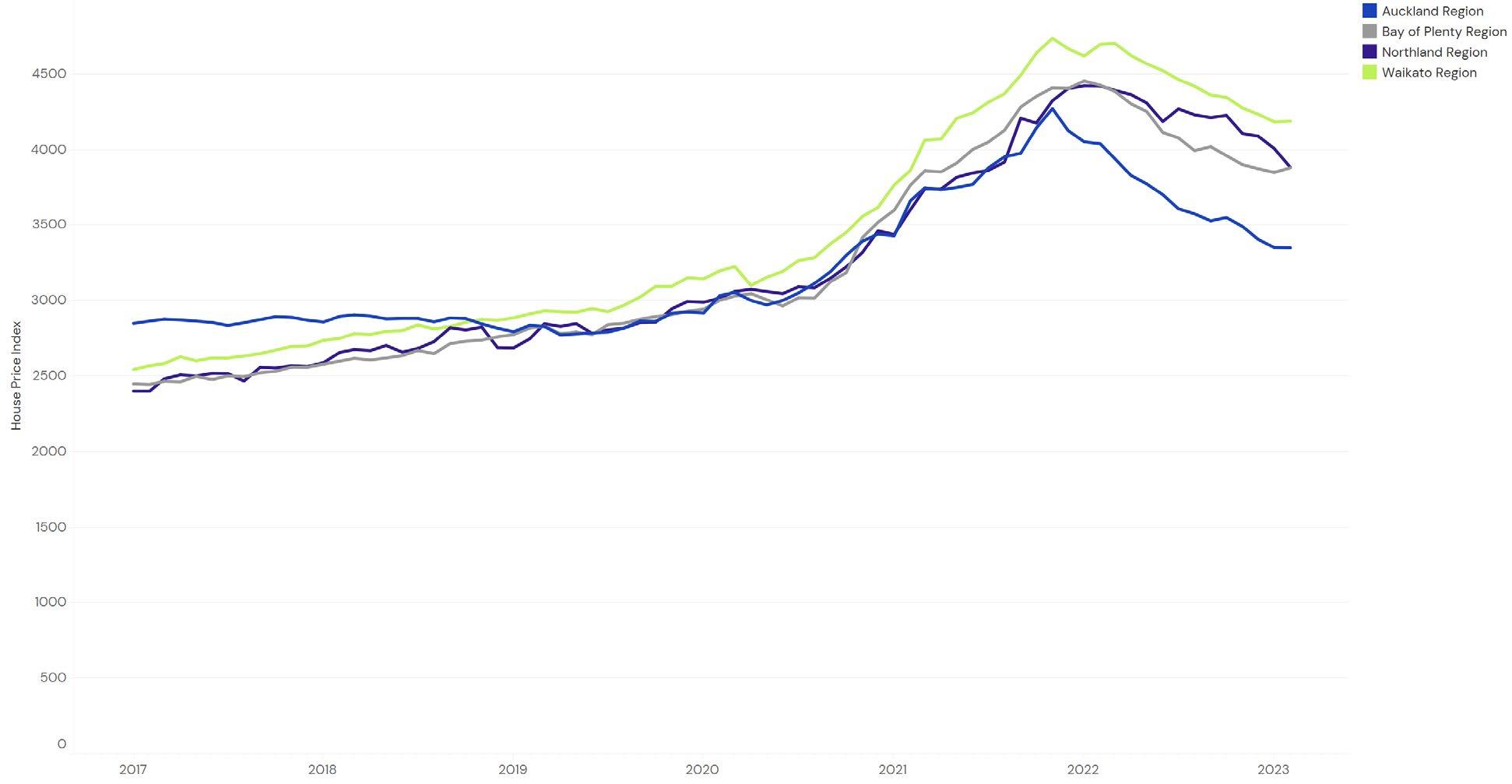

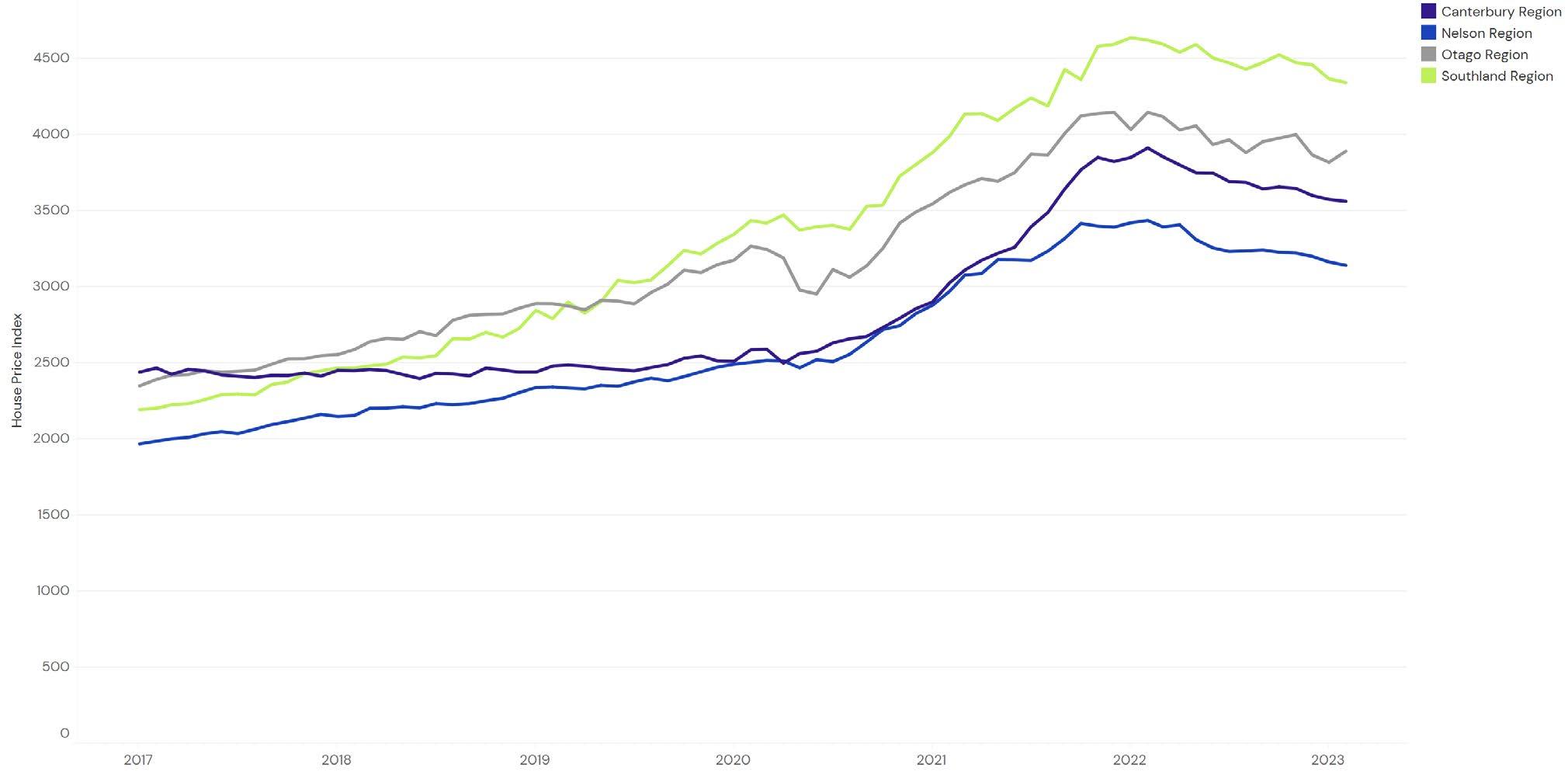

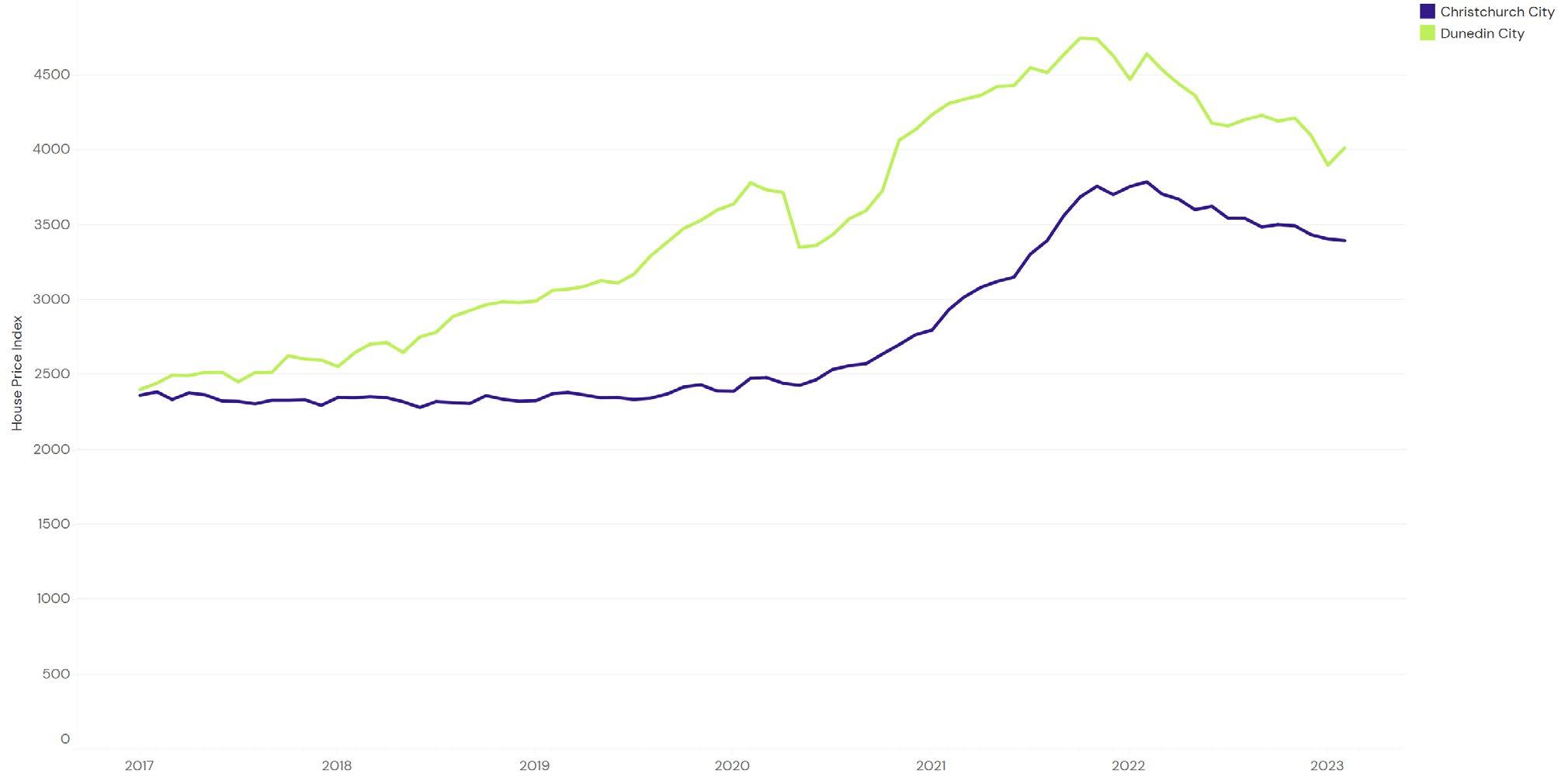

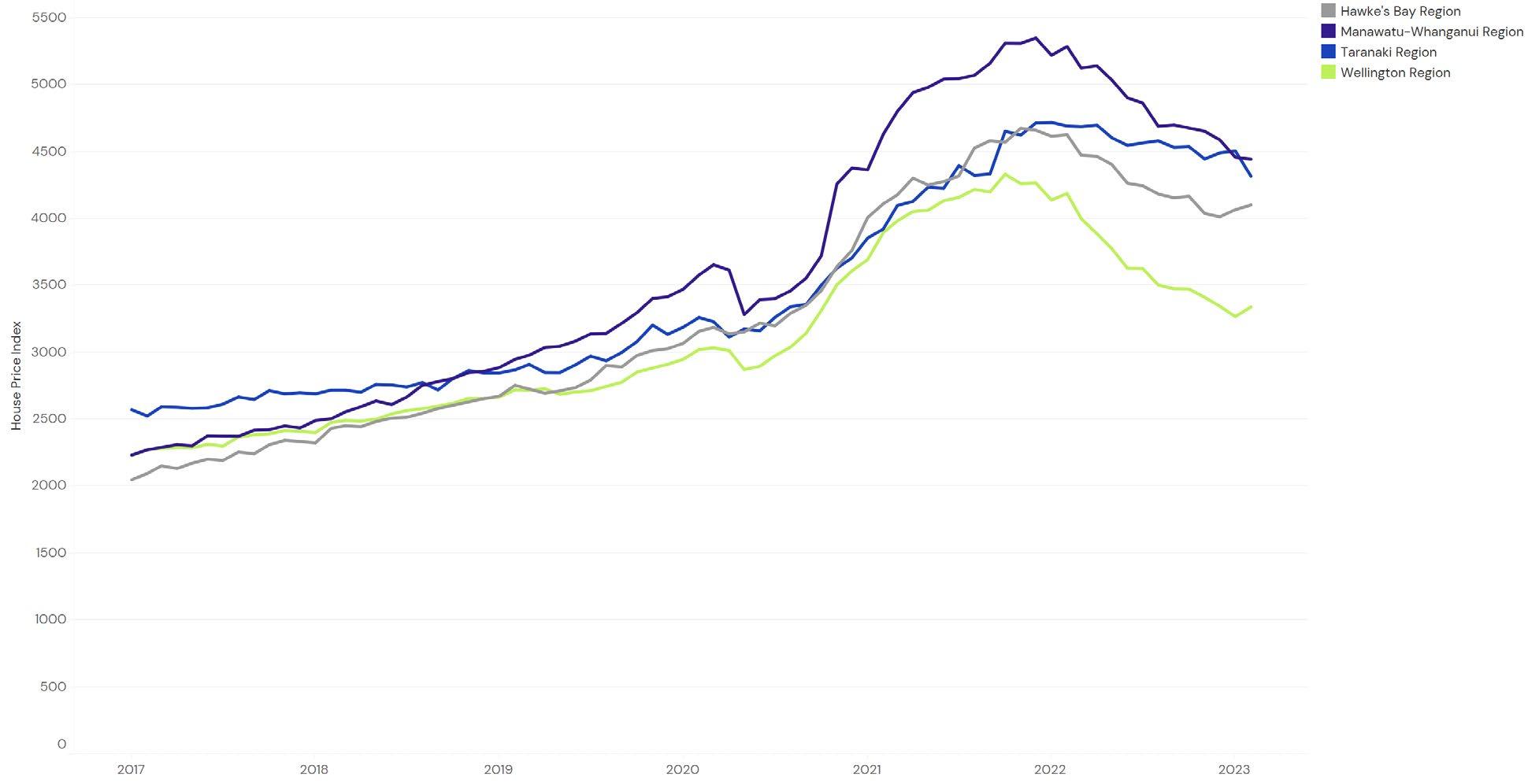

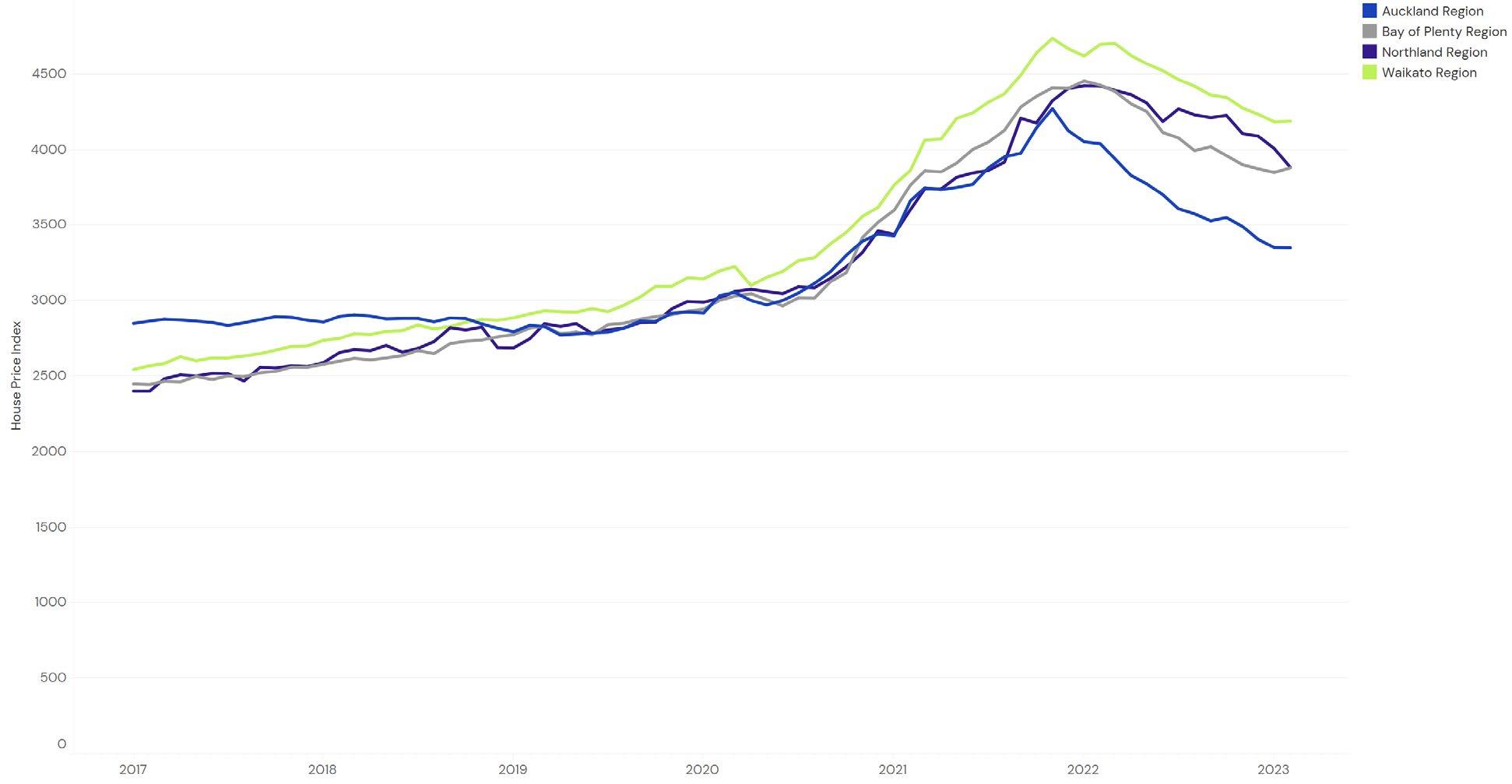

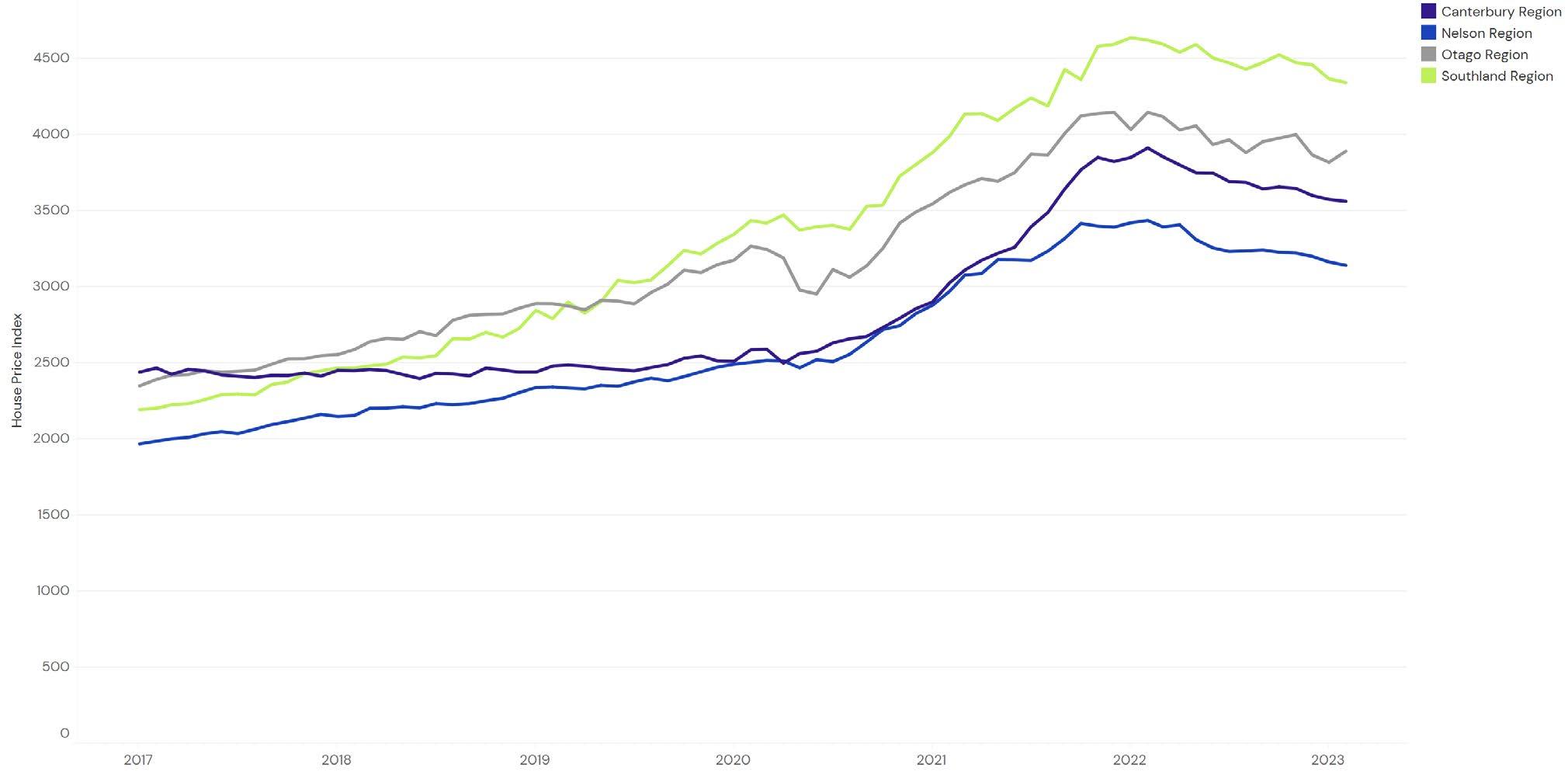

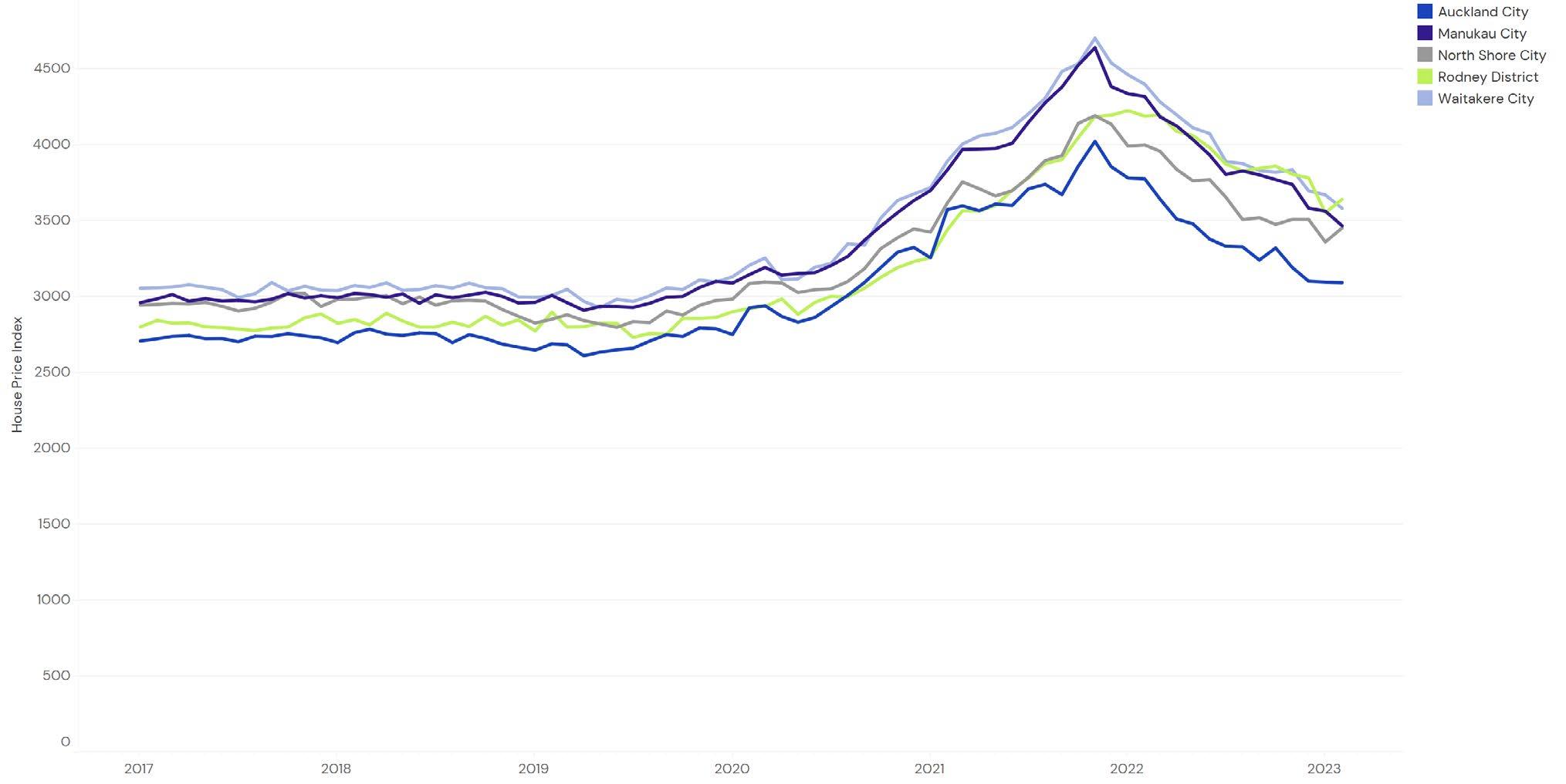

“The REINZ HPI takes many aspects of market composition into account and thus provides more accurate results. When applied to the February data, the HPI indicates that the housing market value nationwide has dropped 14.2% year-onyear. In Auckland, the value decreased by 17.1% and decreased by 12.3% outside of Auckland. Southland takes the top spot in the 12-month ending percentage changes. Otago and Taranaki came second and third, respectively, for annual percentage movement.

“The importance of the HPI is evident in the Otago region this month, where the median sale price tells a different story to the HPI.

“The median sale price in the region decreased 13.6% over the past year, a ‘middle-of-the-road’ return compared to the other regions. This suggests a market where value growth is approximately positioned in the ‘middle of the pack’ in the longer term compared to other regions.

“However, the Otago region had the second strongest annual performance of all regions in HPI over the past year with a decrease of 6.2%. Sample composition changes — such as the size of properties or the underlying value of properties sold — can change statistics, such as median, that are purely based on price. However, because the underlying value of each property sold is considered by the HPI, such sample changes have little effect on HPI results. In summary, long-term property value growth in Otago is decreasing at a slower rate than most other regions, a fact that would have remained hidden from those monitoring statistics without access to the HPI.”

3 | REINZ Monthly House Price Index Report

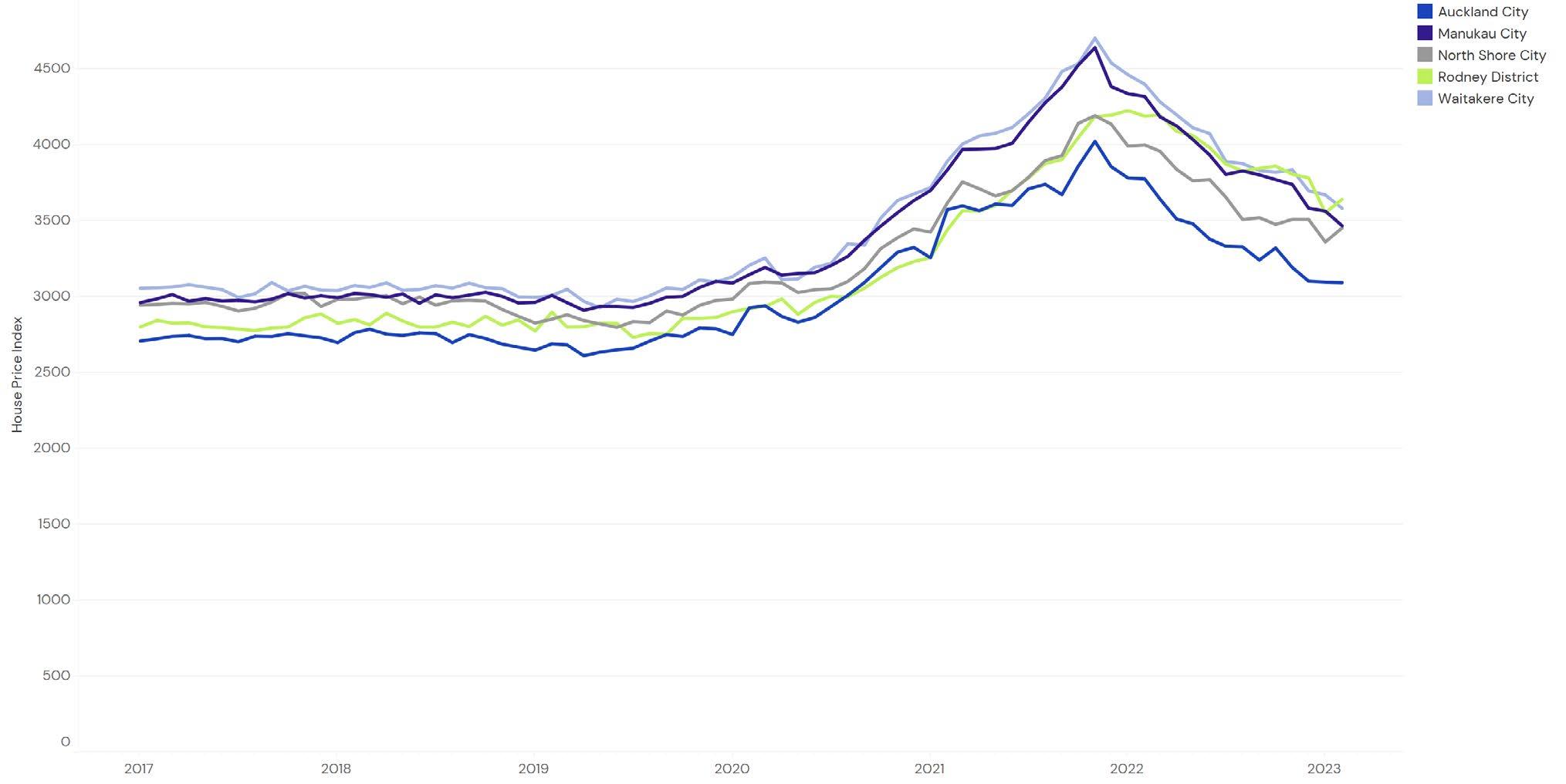

Year-on-year, the HPI indicates that housing market value nationwide has fallen 14.2%, down in Auckland by 17.1% and down outside Auckland by 12.3%.

NEW ZEALAND HOUSE PRICE INDICIES

4 | REINZ Monthly House Price Index Report

National House Price Index Figures

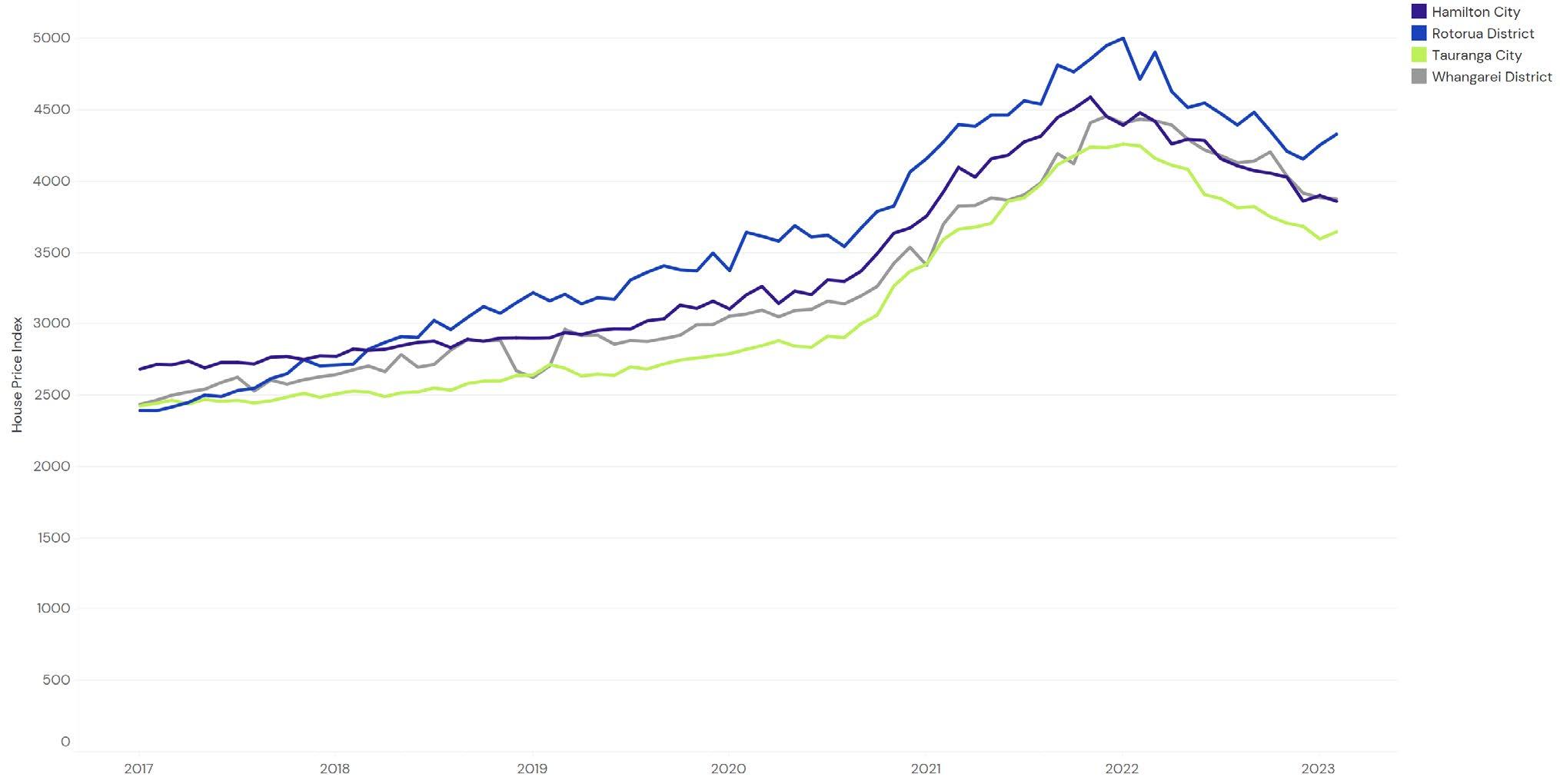

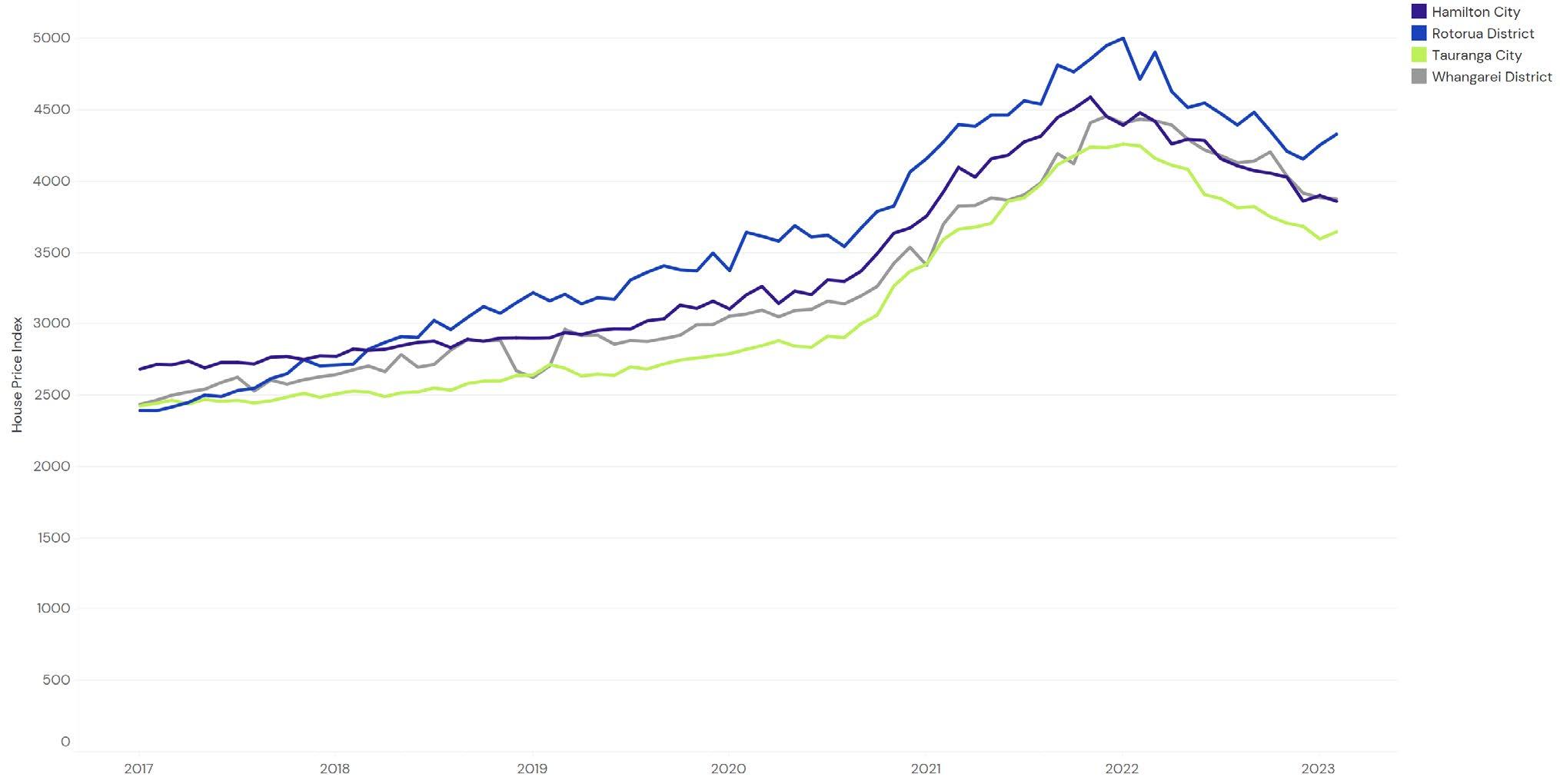

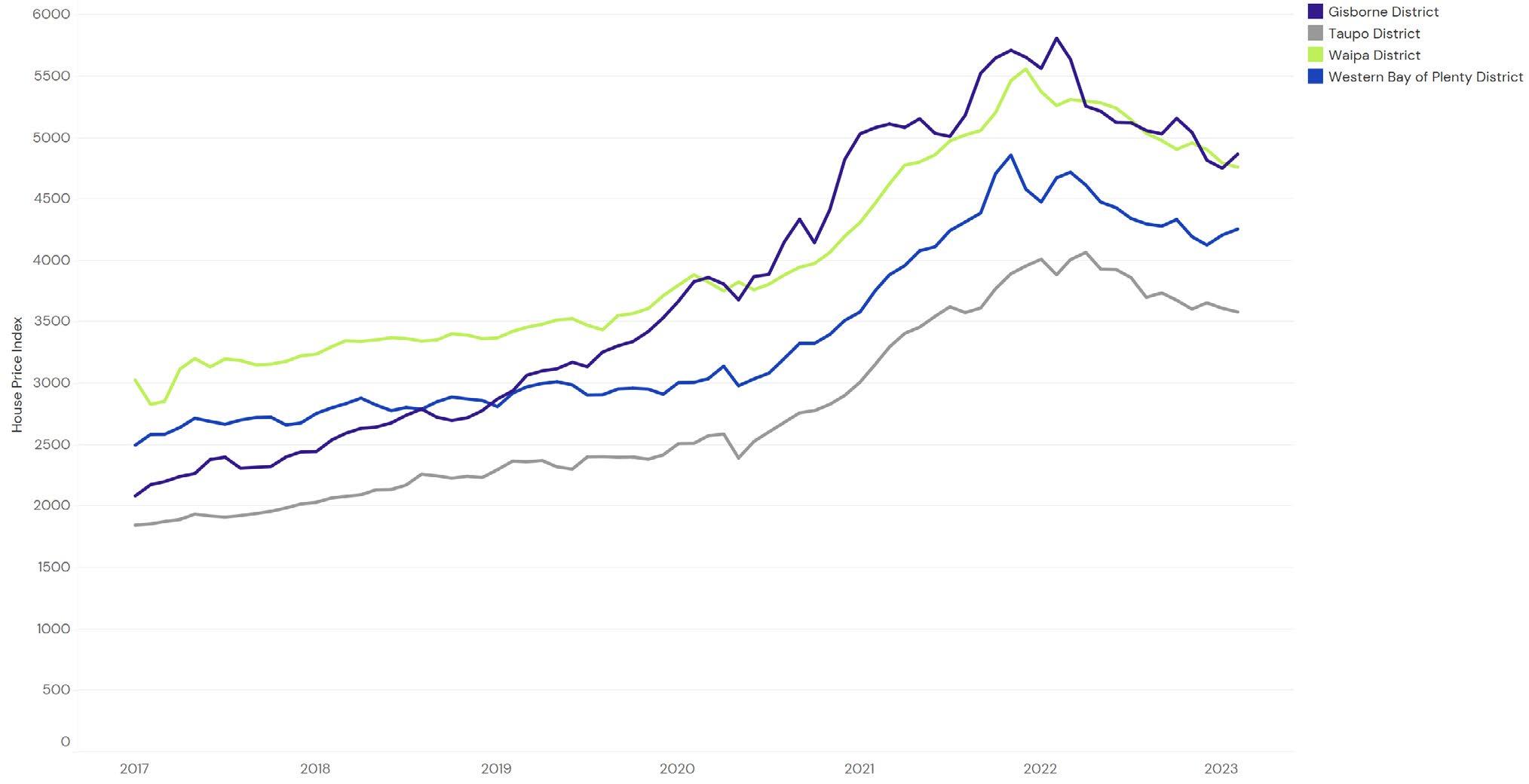

UPPER NORTH ISLAND

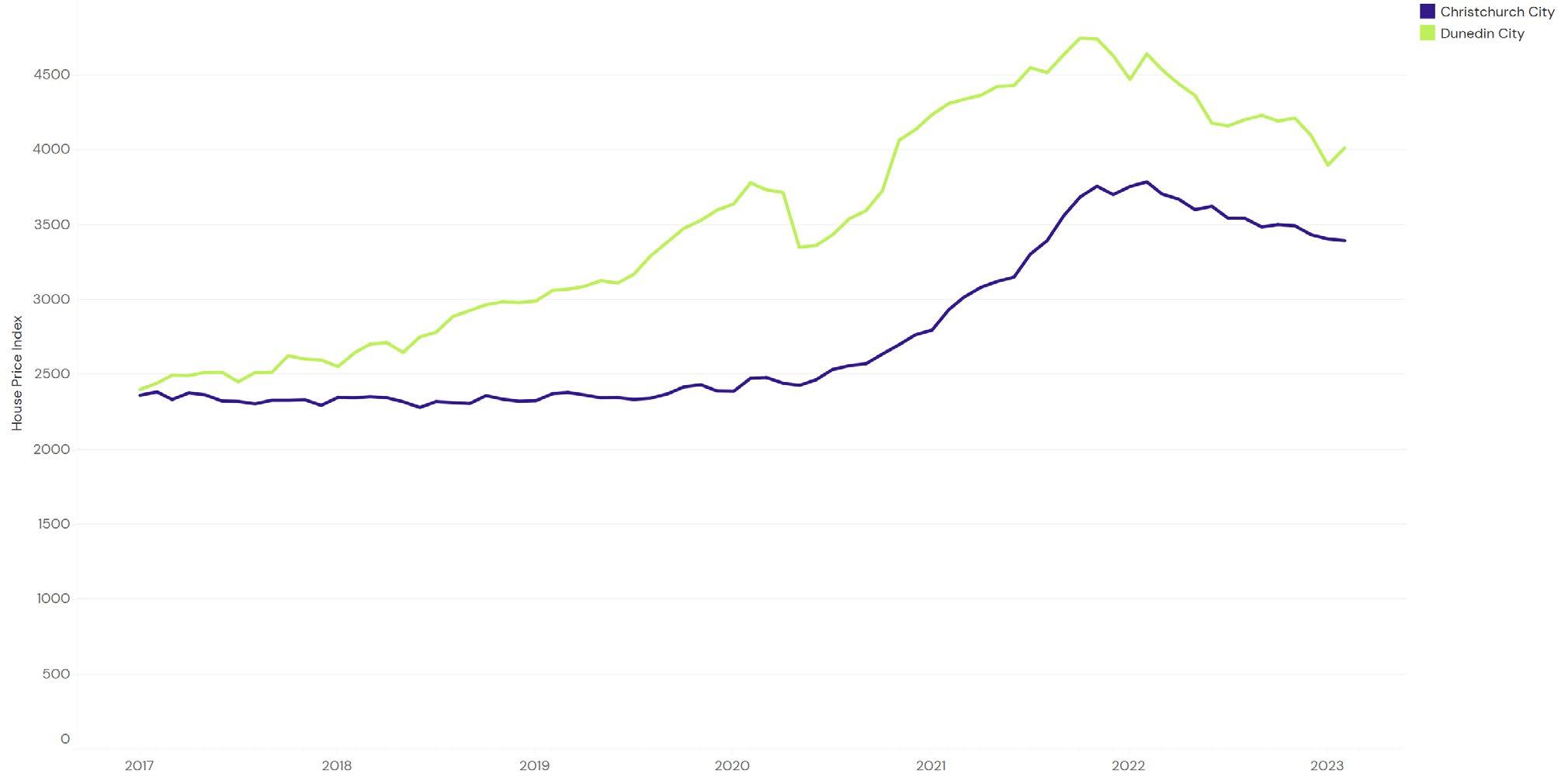

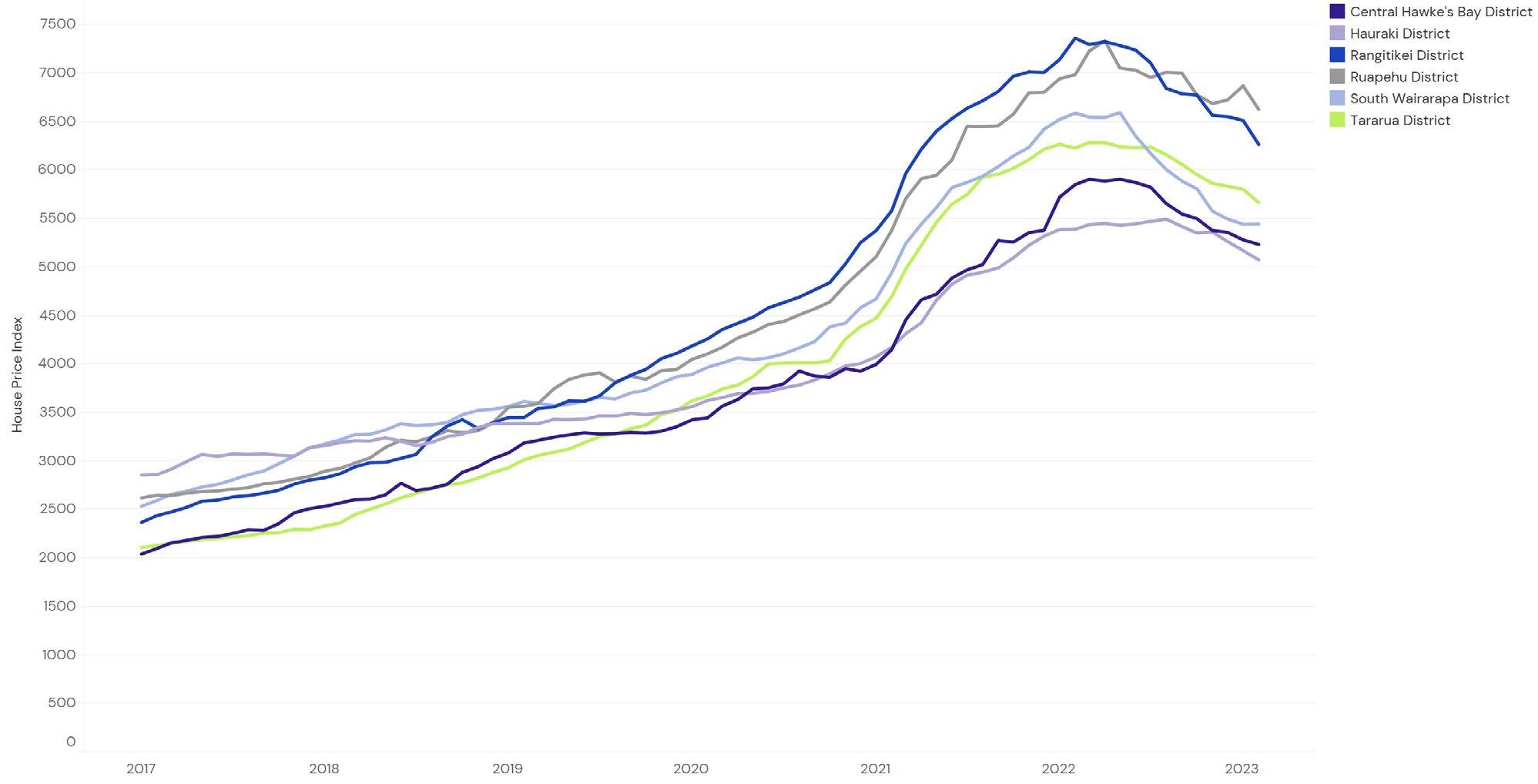

REGIONAL HOUSE PRICE INDICIES

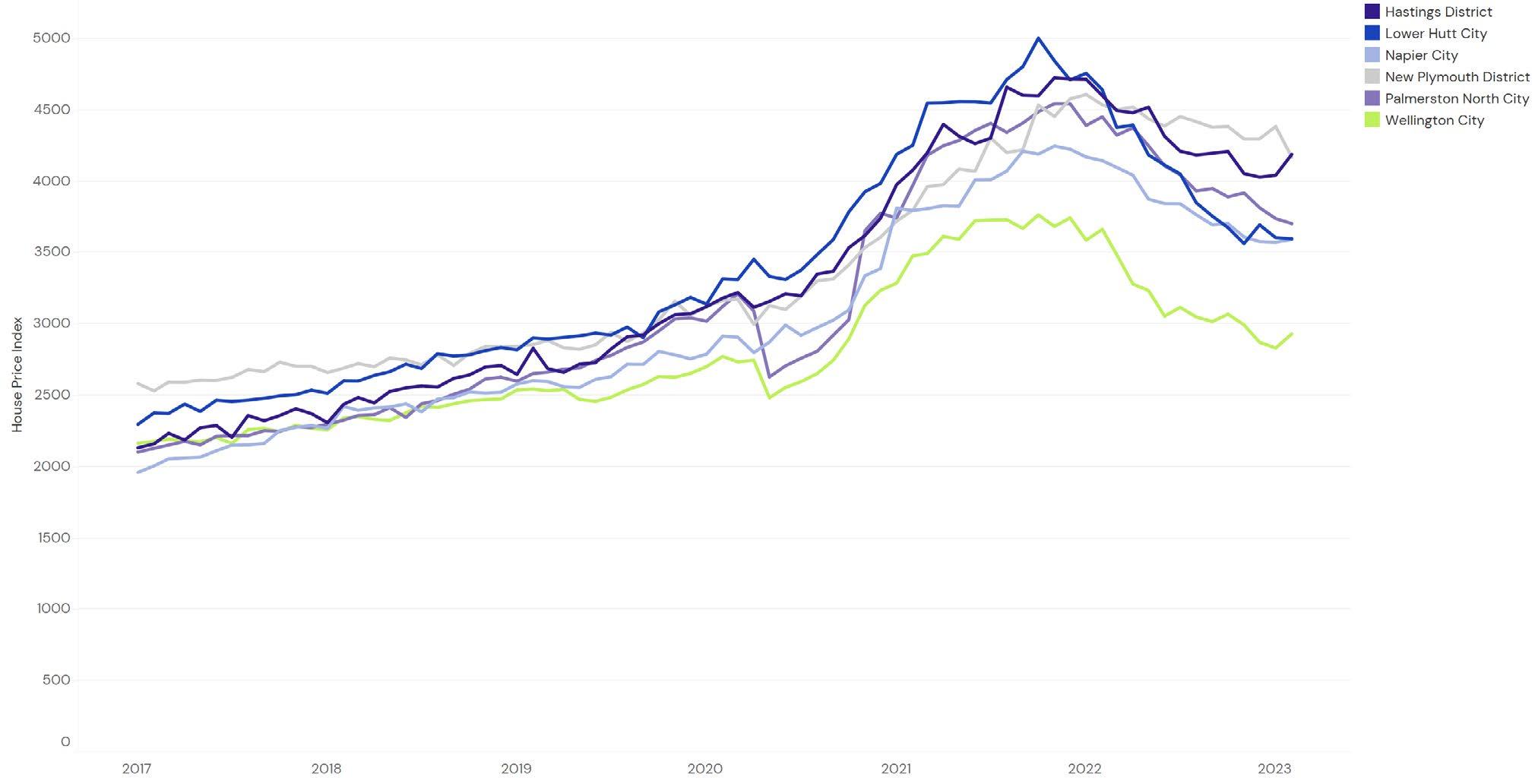

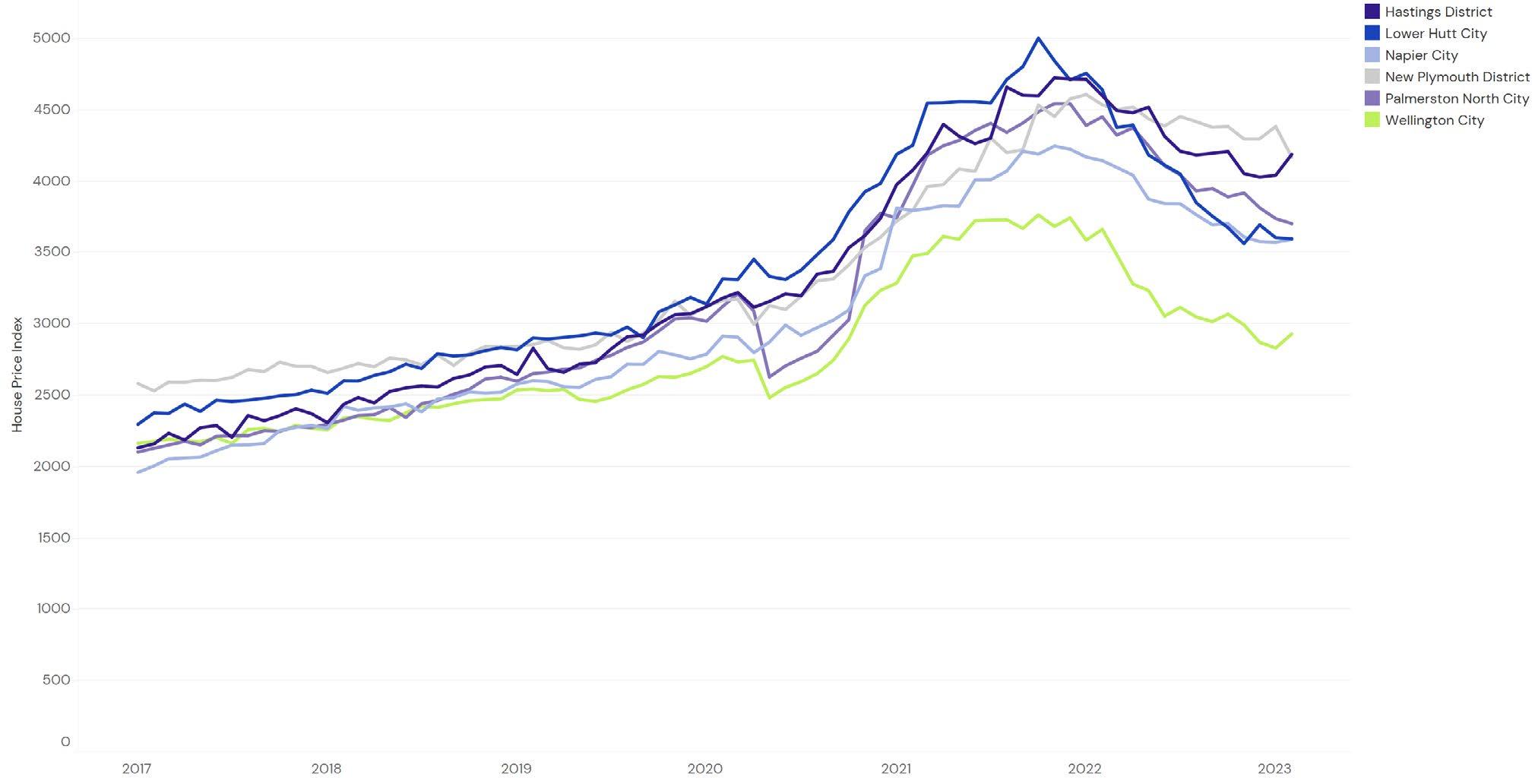

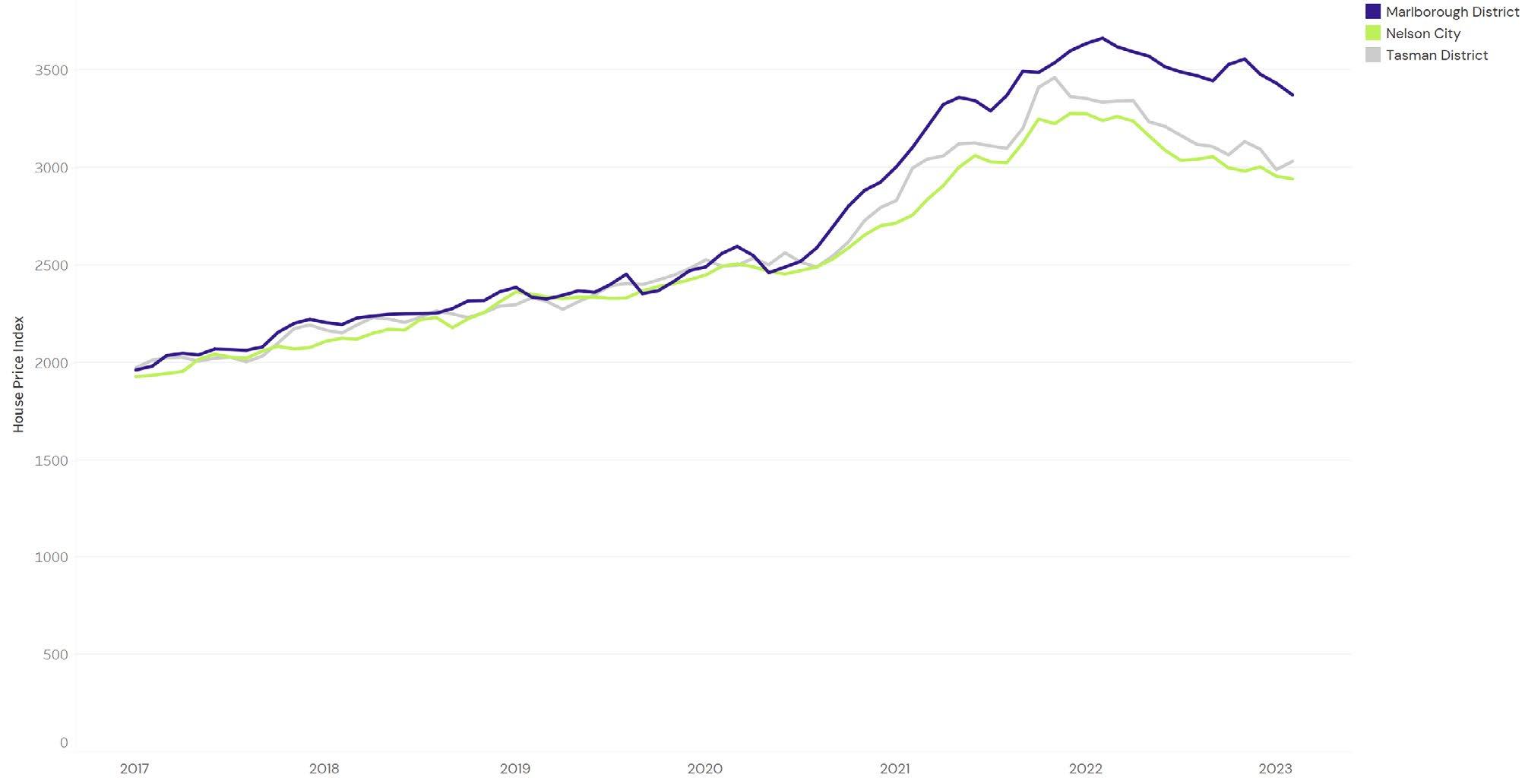

LOWER NORTH ISLAND REGIONAL HOUSE PRICE INDICIES

5 | REINZ Monthly House Price Index Report

Regional House Price Index Figures

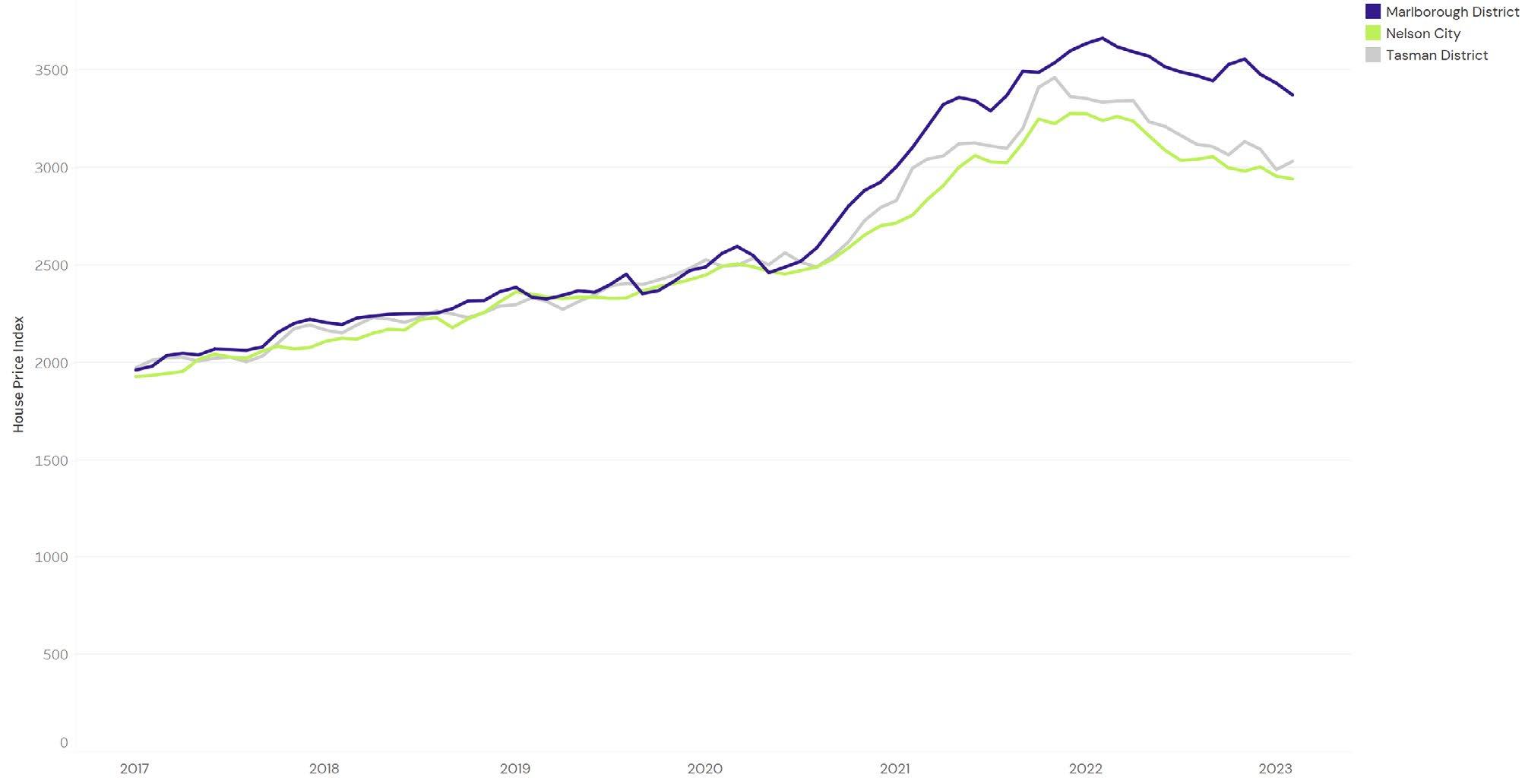

SOUTH ISLAND REGIONAL HOUSE PRICE INDICIES

SUMMARY OF MOVEMENTS

Source: REINZ *=Compound Growth Rate

6 | REINZ Monthly House Price Index Report

Regional House Price Index Figures House Price Index Index level One Month Three Months One Year Five Years* House Price Index Index level One Month Three Months One Year Five Years* New Zealand 3,5840.1%-2.9%-14.2%5.9% NZ excl. Auckland 3,7540.3%-2.2%-12.3%8.3% Auckland 3,351-0.1%-4.1%-17.1%2.9% Rodney District 3,6402.5%-4.3%-13.1%5.0% North Shore City 3,4522.8%-1.6%-13.7%3.0% Waitakere City 3,581-2.4%-6.6%-18.6%3.1% Auckland City 3,092-0.1%-3.1%-18.1%2.3% Manukau City 3,466-2.7%-7.3%-19.7%2.8% Papakura District 3,764-2.2%-4.2%-18.4%4.6% Franklin District 4,2241.7%-1.9%-11.0%6.4% Other North Island Whangarei District 3,879-0.2%-4.0%-12.6%7.7% Hamilton City 3,863-1.1%-4.2%-13.8%6.4% Tauranga City 3,6491.4%-1.6%-14.2%7.6% Rotorua District 4,3331.8%2.8%-8.2%9.7% Hastings District 4,1903.6%3.3%-9.0%11.4% Napier City 3,5940.6%-0.5%-13.3%8.2% New Plymouth District 4,170-4.9%-3.0%-8.1%9.1% Palmerston North City 3,705-0.9%-5.5%-16.8%9.7% Wellington 3,3402.2%-2.1%-20.2%6.2% Porirua City 3,299-2.4%-7.4%-23.4%6.2% Upper Hutt City 3,8524.9%-3.3%-20.8%7.9% Lower Hutt City 3,599-0.2%1.0%-22.5%6.7% Wellington City 2,9323.5%-2.1%-20.0%4.6% South Island Nelson City 2,9130.4%-2.7%-9.4%7.0% Christchurch City 3,397-0.3%-2.8%-10.3%7.7% Queenstown-Lakes District 3,6551.2%-1.8%0.8%7.9% Dunedin City 4,0162.9%-4.7%-13.5%8.7% Invercargill City 4,173-1.9%-3.0%-8.6%12.1%

AUCKLAND COUNCILS HOUSE PRICE INDICIES

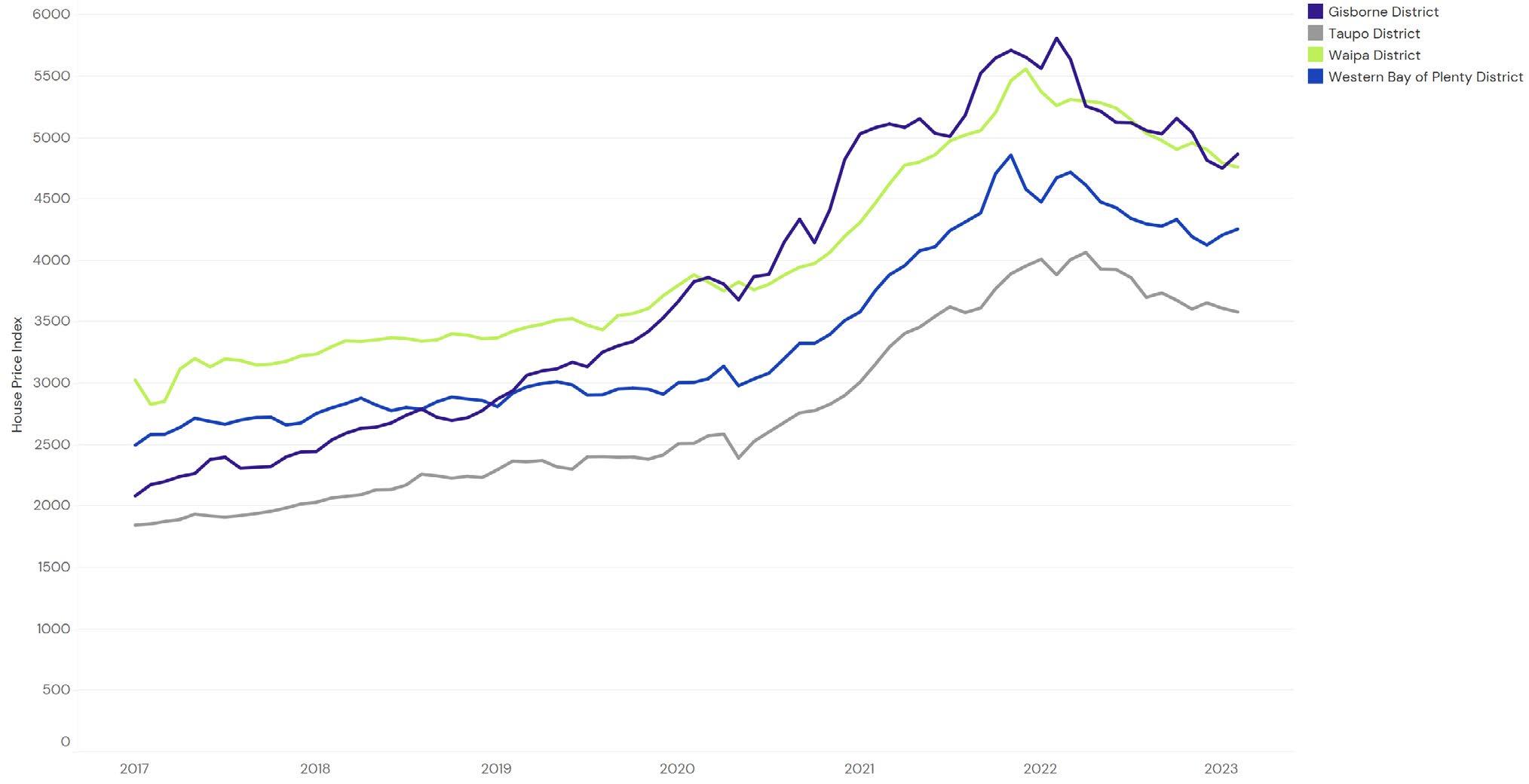

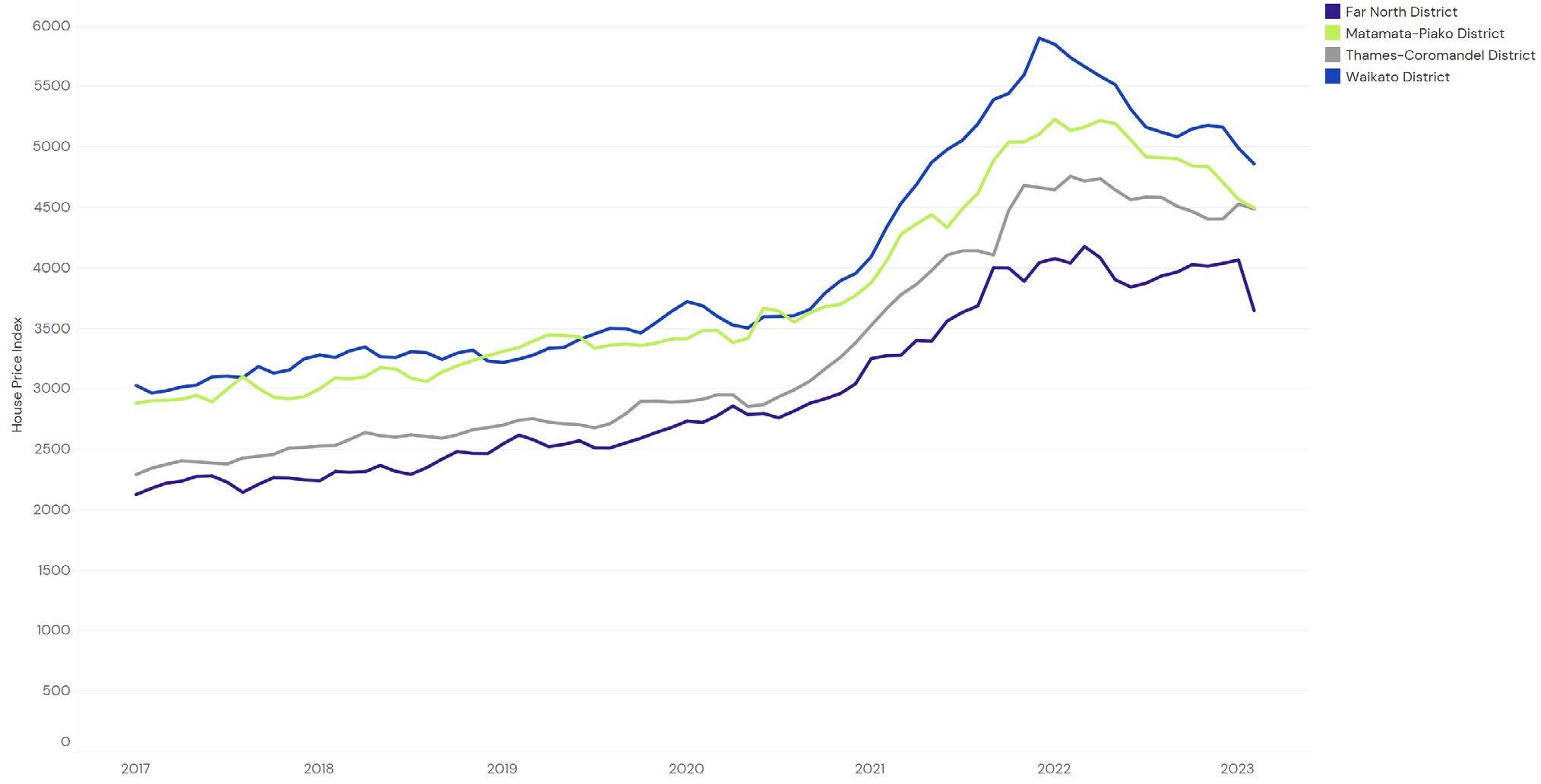

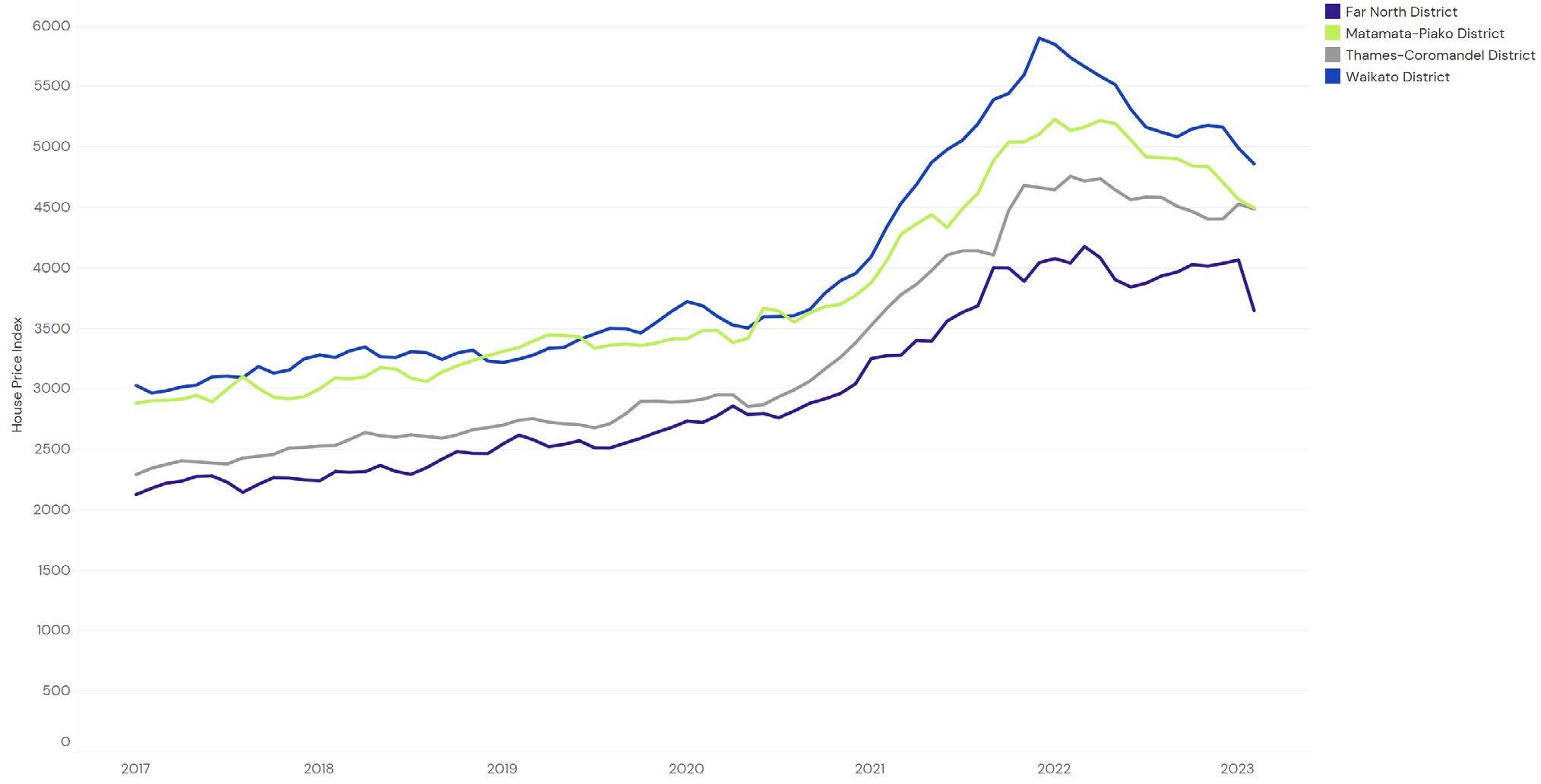

UPPER NORTH ISLAND (EX-AUCKLAND)

COUNCIL HOUSE PRICE INDICIES

7 | REINZ Monthly House Price Index Report

Monthly Calculated House Price Index Figures For Councils

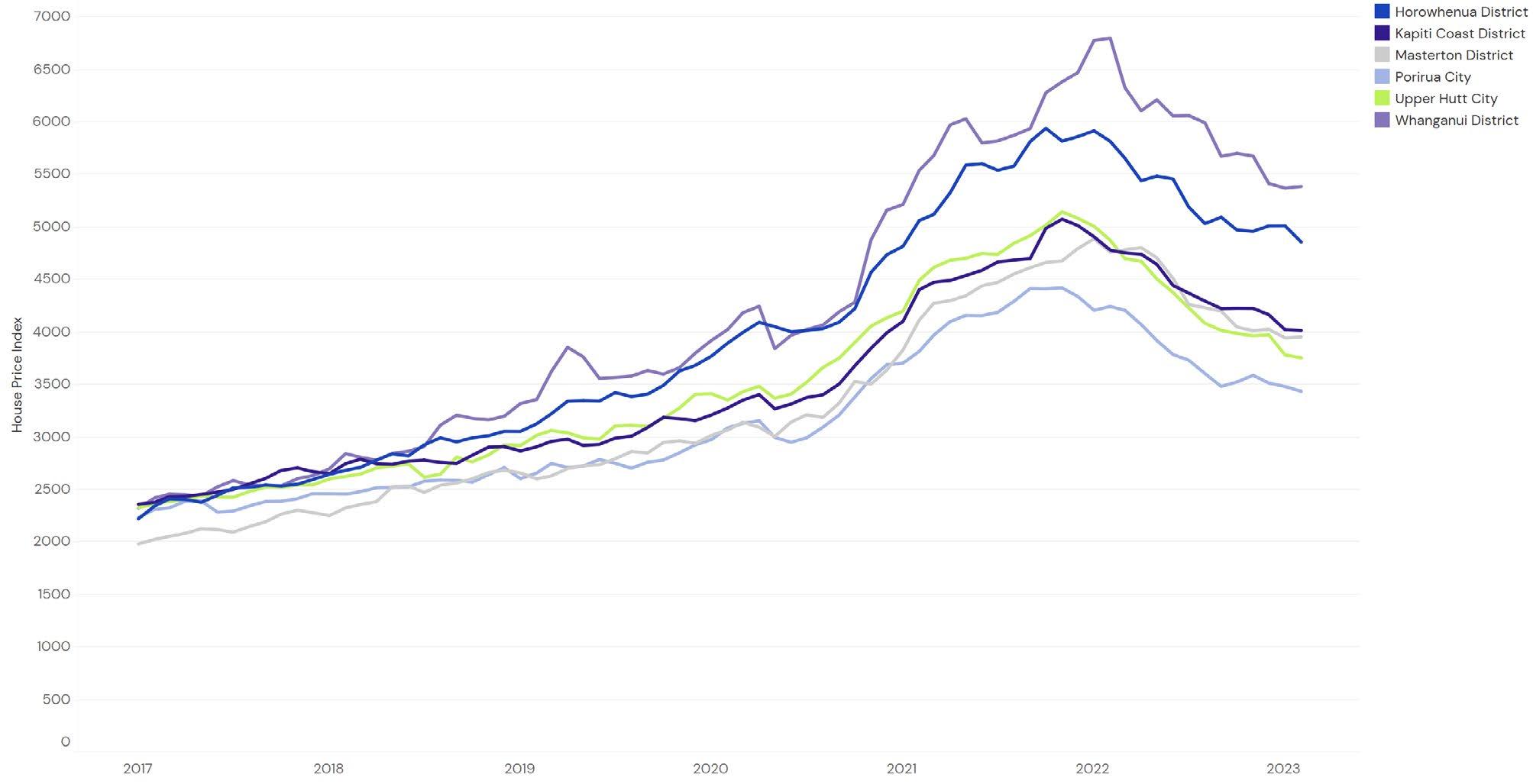

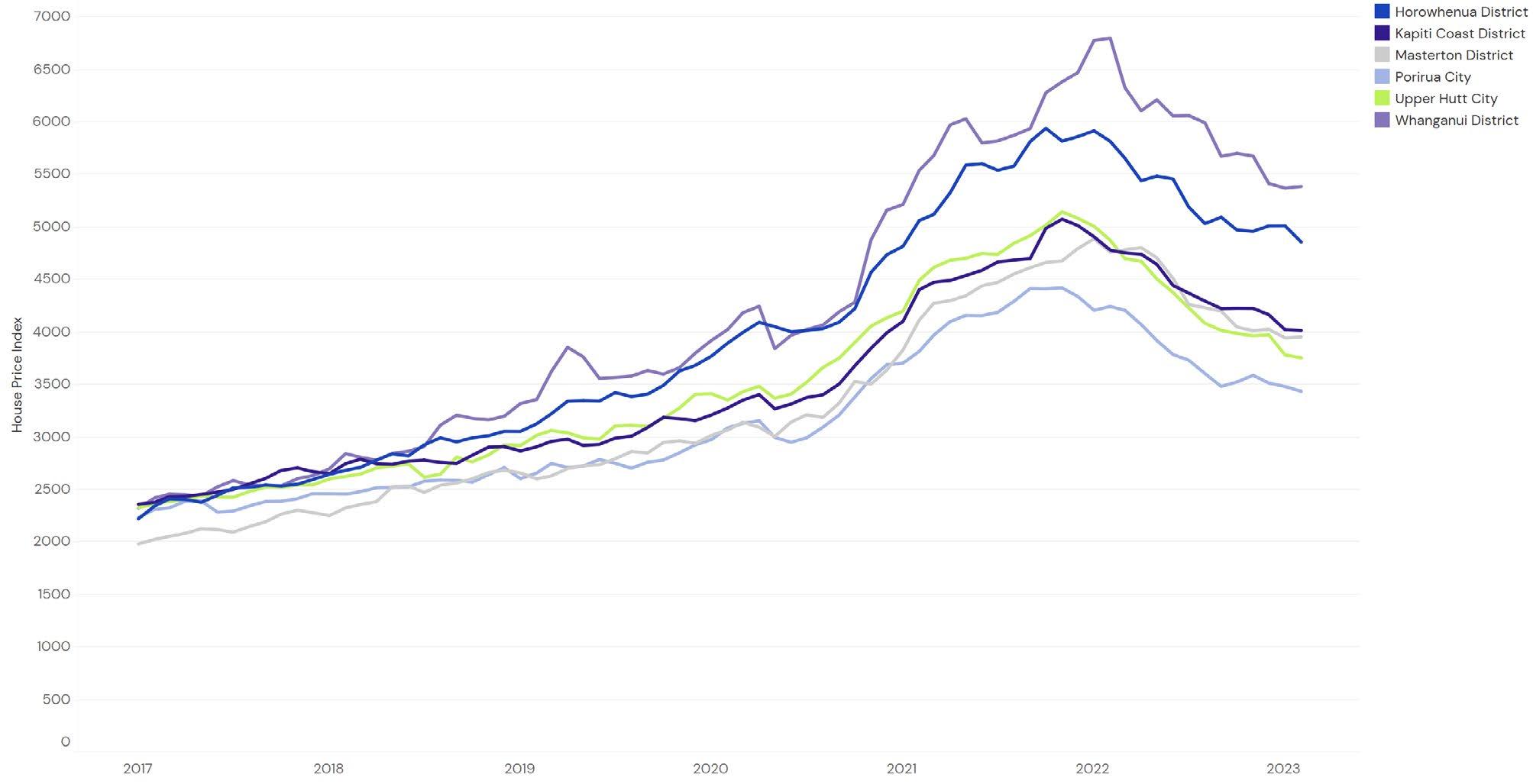

LOWER NORTH ISLAND COUNCILS HOUSE PRICE INDICIES

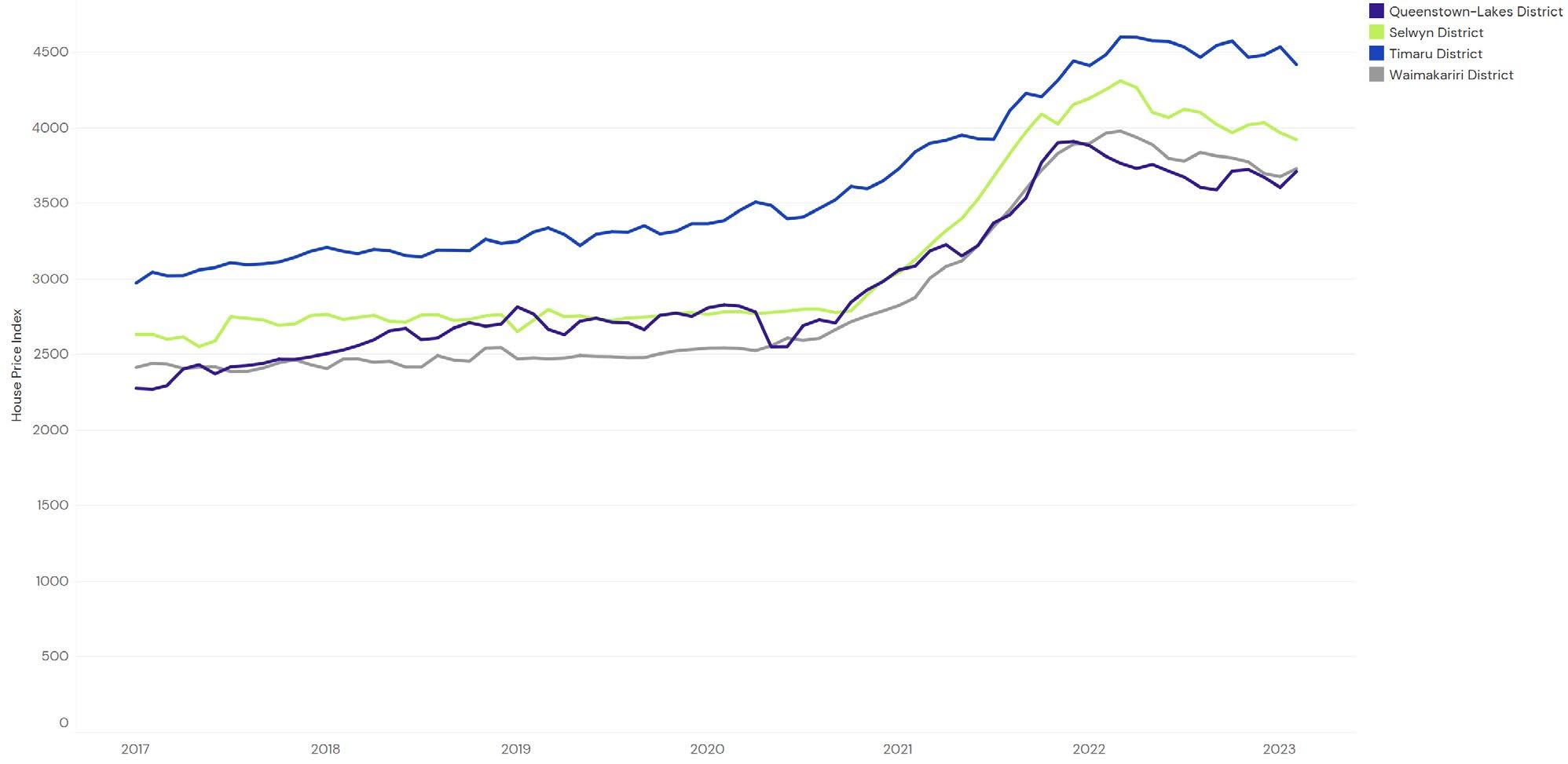

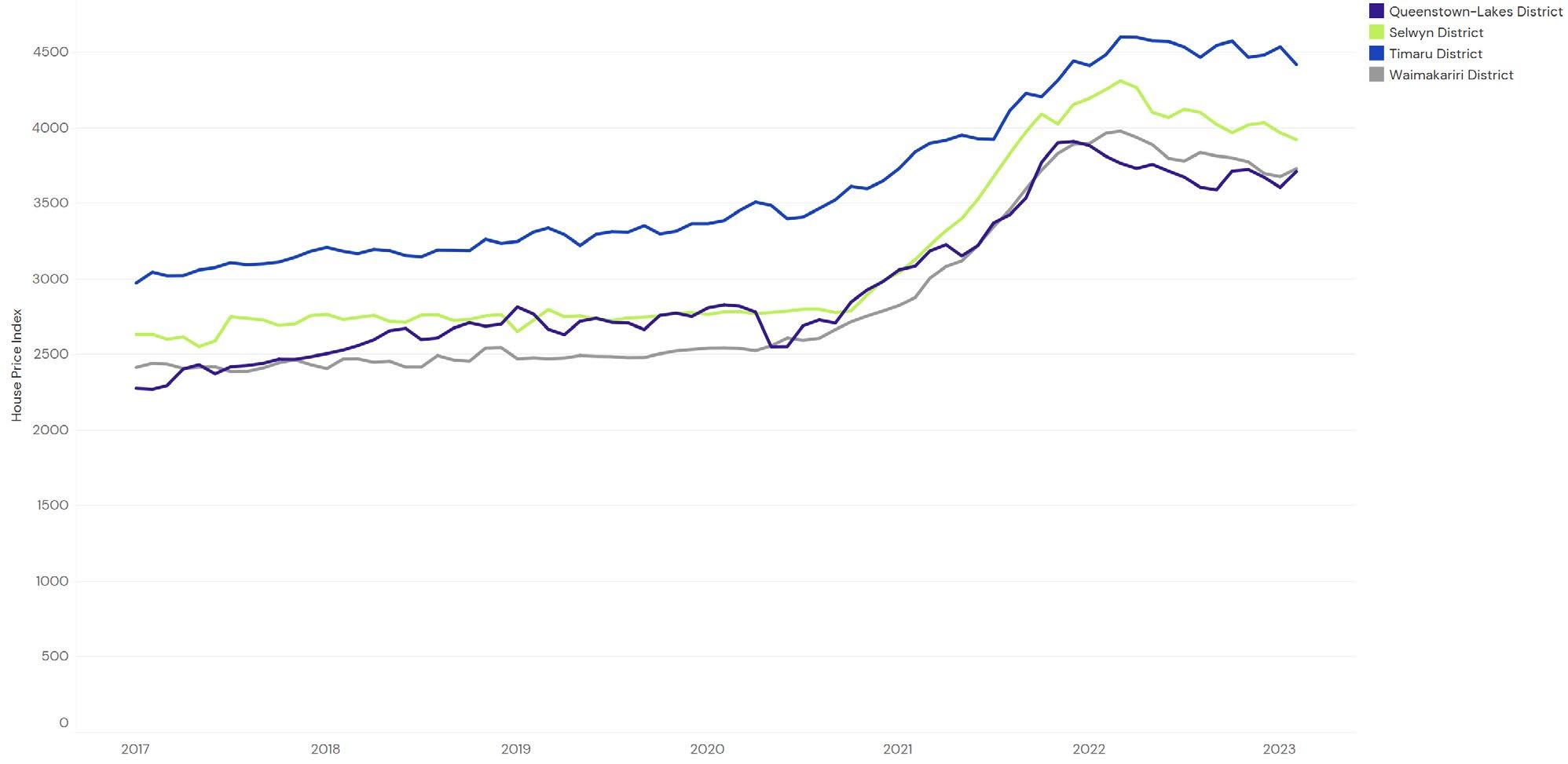

SOUTH ISLAND COUNCIL HOUSE PRICE INDICIES

8 | REINZ Monthly House Price Index Report

Monthly Calculated House Price Index Figures For Councils

UPPER NORTH ISLAND

(EX-AUCKLAND) COUNCILS HOUSE PRICE INDICIES

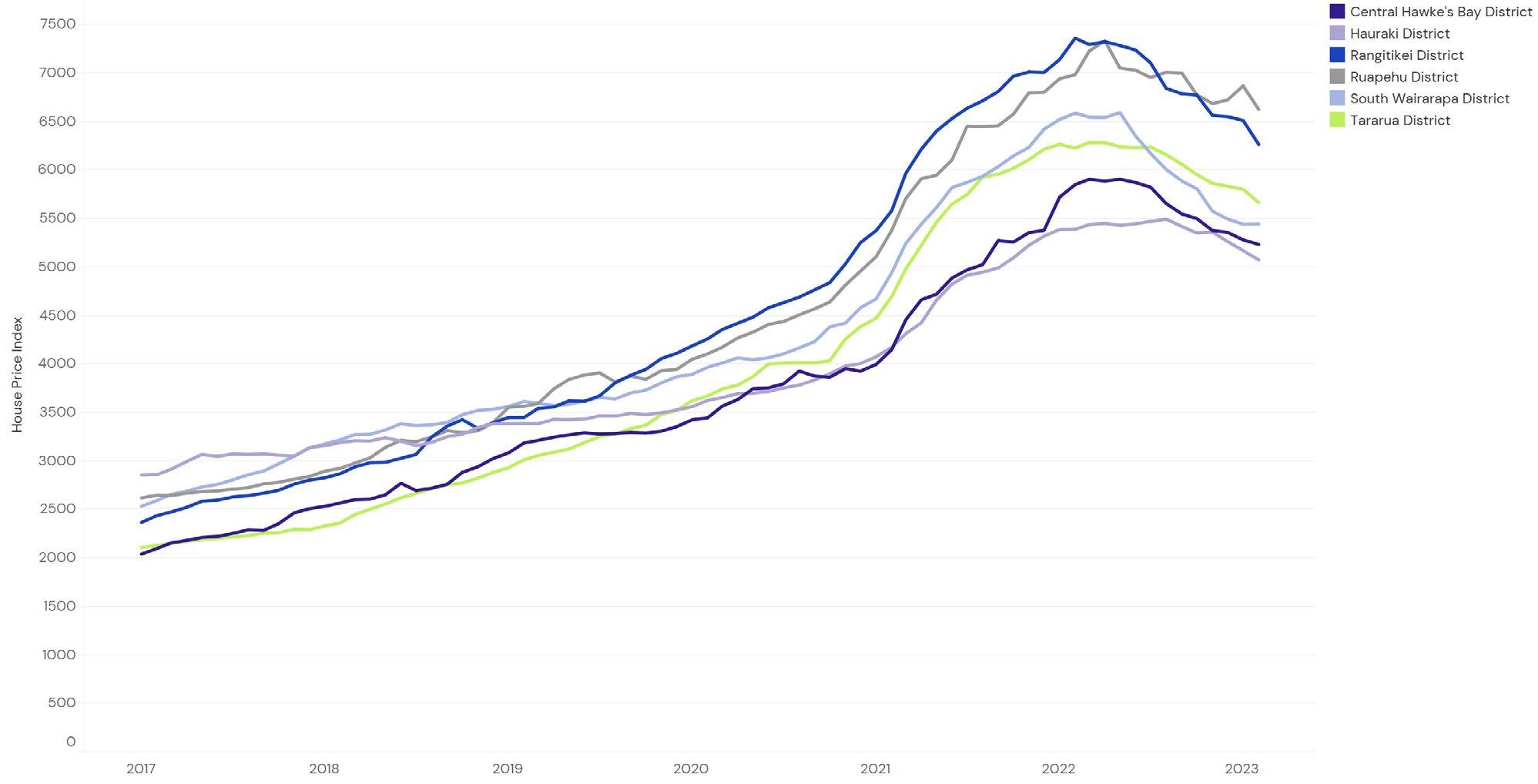

MID NORTH ISLAND COUNCIL HOUSE PRICE INDICIES

9 | REINZ Monthly House Price Index Report Two Month Rolling Calculated House Price Index Figures For Councils

LOWER NORTH ISLAND COUNCILS HOUSE PRICE INDICIES

UPPER SOUTH ISLAND COUNCIL HOUSE PRICE INDICIES

10 | REINZ Monthly House Price Index Report Two Month Rolling Calculated House Price Index Figures For Councils

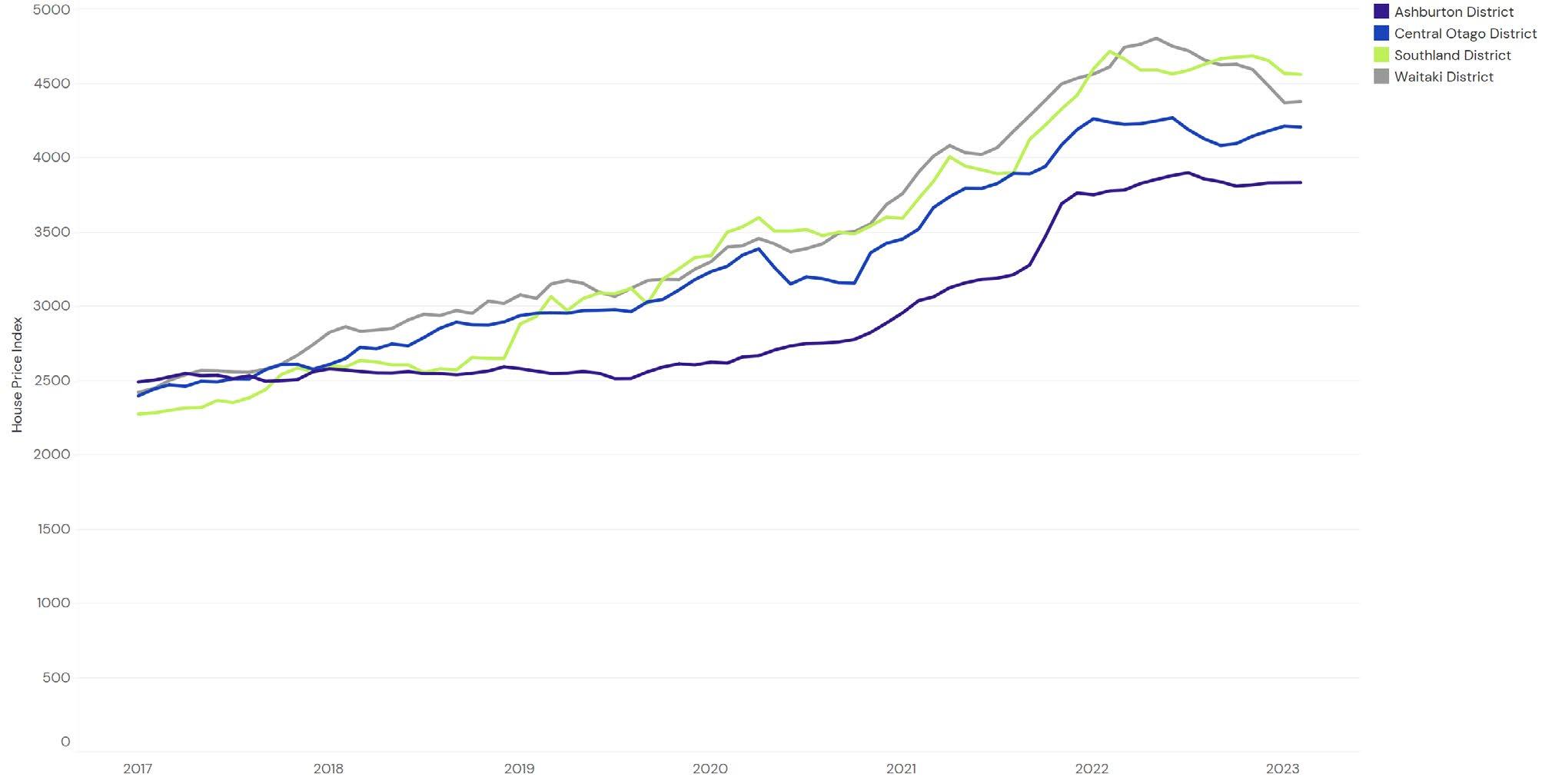

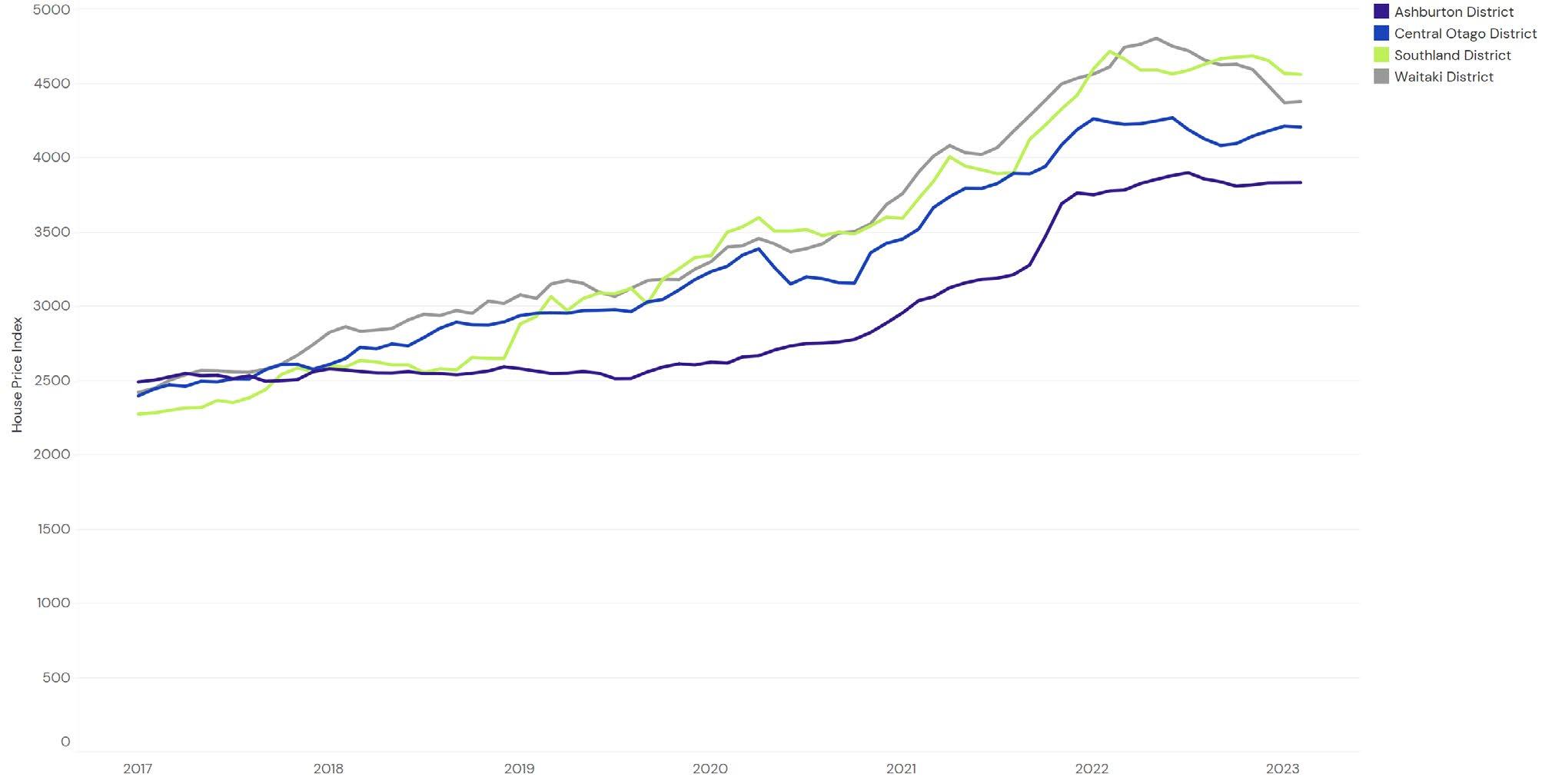

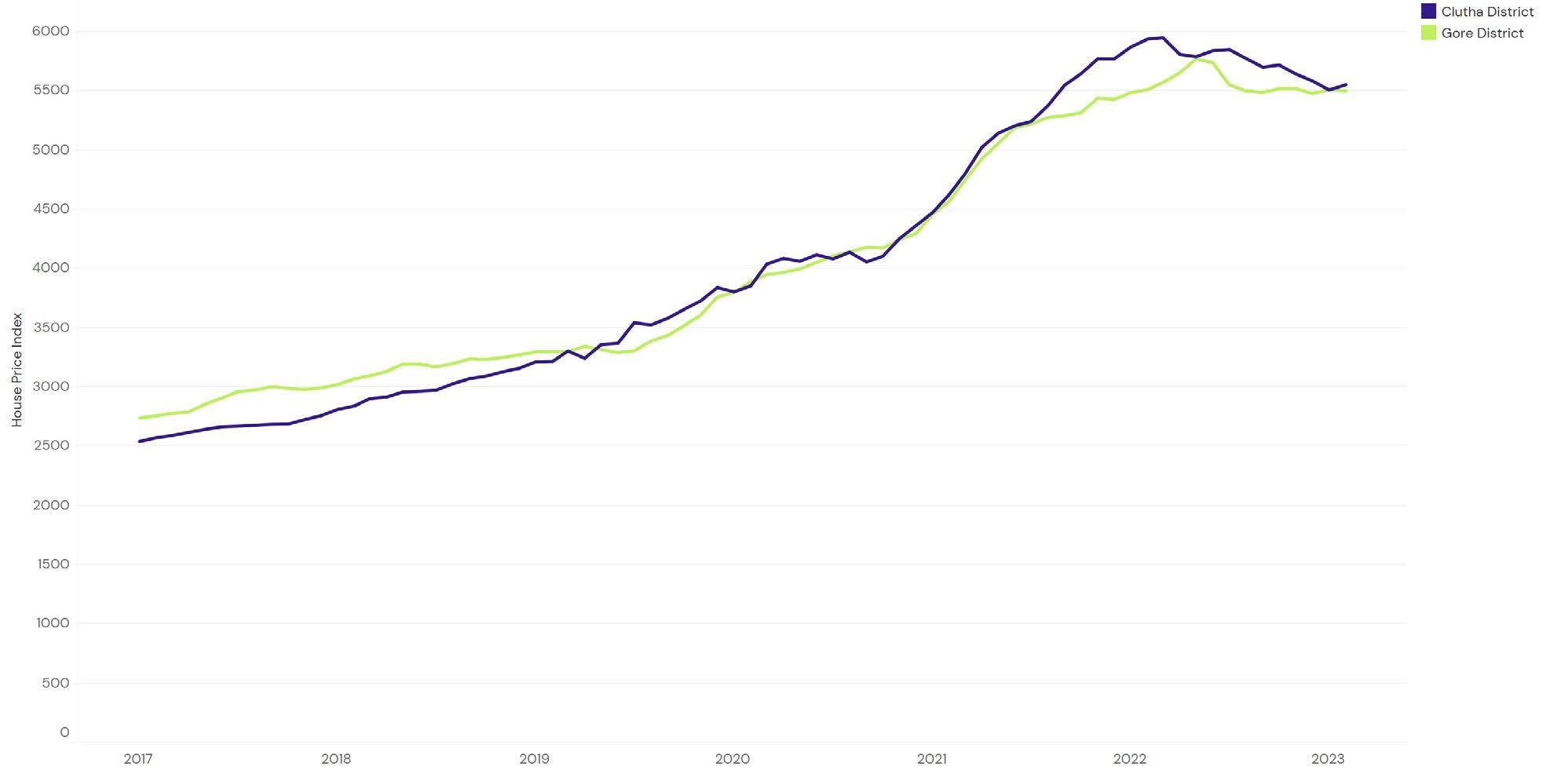

LOWER SOUTH ISLAND

COUNCIL HOUSE PRICE INDICIES

11 | REINZ Monthly House Price Index Report Two Month Rolling Calculated House Price Index Figures For Councils

NORTH ISLAND COUNCILS HOUSE PRICE INDICIES

SOUTH ISLAND COUNCIL HOUSE PRICE INDICIES

12 | REINZ Monthly House Price Index Report Three Month Rolling Calculated House Price Index Figures For Councils

NORTH ISLAND COUNCILS HOUSE PRICE INDICIES

SOUTH ISLAND COUNCIL HOUSE PRICE INDICIES

13 | REINZ Monthly House Price Index Report Six Month Rolling Calculated House Price Index Figures For Councils

TERRITORIAL AUTHORITY HPI VALUES

DISCLAIMER

This report is intended for general information purposes only. This report and the information contained herein is under no circumstances intended to be used or considered as legal, financial or investment advice. The material in this report is obtained from various sources (including third parties) and REINZ does not warrant the accuracy, reliability or completeness of the information provided in this report and does not accept liability for any omissions, inaccuracies or losses incurred, either directly or indirectly, by any person arising from or in connection with the supply, use or misuse of the whole or any part of this report. Any and all third party data or analysis in this report does not necessarily represent the views of REINZ. When referring to this report or any information contained herein, you must cite REINZ as the source of the information. REINZ reserves the right to request that you immediately withdraw from publication any document that fails to cite REINZ as the source.

14 | REINZ Monthly House Price Index Report

Council CalculatedHPI Ashburton District 3 month rolling3,837 Auckland City Actual Month3,092 Buller District 6 month rolling4,163 Carterton District 6 month rolling4,598 Central Hawke’s Bay District 6 month rolling5,237 Central Otago District 3 month rolling4,212 Christchurch City Actual Month3,397 Clutha District 6 month rolling5,554 Dunedin City Actual Month4,016 Far North District 2 month rolling3,652 Franklin District 2 month rolling4,051 Gisborne District 2 month rolling4,868 Gore District 6 month rolling5,504 Grey District 6 month rolling3,919 Hamilton City Actual Month3,863 Hastings District Actual Month4,190 Hauraki District 6 month rolling5,078 Horowhenua District 2 month rolling4,859 Hurunui District 6 month rolling4,515 Invercargill City Actual Month4,173 Kaikoura District 3 month rolling3,172 Kaipara District 2 month rolling4,422 Kapiti Coast District Actual Month4,072 Kawerau District 3 month rolling6,575 Lower Hutt City Actual Month3,599 Mackenzie District 6 month rolling7,479 Manawatu District 3 month rolling4,719 Manukau City Actual Month3,466 Marlborough District 2 month rolling3,375 Masterton District 2 month rolling3,956 Matamata-Piako District 2 month rolling4,500 Napier City Actual Month3,594 Nelson City 2 month rolling2,944 New Plymouth District Actual Month4,170 North Shore City Actual Month3,452 Opotiki District 6 month rolling4,684 Council CalculatedHPI Otorohanga District 6 month rolling4,899 Palmerston North City Actual Month3,705 Papakura District 2 month rolling3,787 Porirua City 2 month rolling3,437 Queenstown-Lakes District 2 month rolling3,713 Rangitikei District 6 month rolling6,268 Rodney District Actual Month3,640 Rotorua District Actual Month4,333 Ruapehu District 6 month rolling6,629 Selwyn District 2 month rolling3,924 South Taranaki District 3 month rolling5,090 South Waikato District 3 month rolling7,499 South Wairarapa District 6 month rolling5,448 Southland District 3 month rolling4,566 Stratford District 6 month rolling6,194 Tararua District 6 month rolling5,669 Tasman District 2 month rolling3,034 Taupo District 2 month rolling3,584 Tauranga City Actual Month3,649 Thames-Coromandel District 2 month rolling4,491 Timaru District 2 month rolling4,420 Upper Hutt City 2 month rolling3,757 Waikato District 2 month rolling4,864 Waimakariri District 2 month rolling3,732 Waimate District 6 month rolling6,233 Waipa District 2 month rolling4,763 Wairoa District 6 month rolling5,156 Waitakere City Actual Month3,581 Waitaki District 3 month rolling4,383 Waitomo District 6 month rolling5,335 Wellington City Actual Month2,932 Western Bay of Plenty District 2 month rolling4,258 Westland District 6 month rolling4,996 Whakatane District 3 month rolling4,233 Whanganui District 2 month rolling5,389 Whangarei District Actual Month3,879

MONTHLY PROPERTY REPORT. 14 March 2023 Click Here To ViewThisReport

REINZ & TONY ALEXANDER

REAL ESTATE SURVEY

March 2023

CONTENTS

Page 1

• Are more or fewer people showing up at auctions?

• Are more or fewer people attending open homes?

Page 2

• How do you feel prices are generally changing at the moment?

• Do you think FOMO is in play for buyers?

• Are you noticing more or fewer first home buyers in the market?

• Are you noticing more or fewer investors in the market?

Page 3 Page 4

• Are you receiving more or fewer enquiries from offshore?

• Are property appraisal requests increasing or decreasing?

• What are the main concerns of buyers?

Page 5

• Are investors bringing more or fewer properties to the market to sell than three months ago?

• What factors appear to be motivating investor demand?

• Regional results

This survey gathers together the views of licensed real estate agents all over New Zealand regarding how they are seeing conditions in the residential property market in their areas at the moment. We asked them how activity levels are changing, what the views of first home buyers and investors are, and the factors which are affecting sentiment of those two large groups.

to friends and clients wanting independent economic commentary.

Disclaimer: This report is intended for general information purposes only. This report and the information contained herein is under no circumstances intended to be used or considered as legal, financial or investment advice. The material in this report is obtained from various sources (including third parties) and REINZ does not warrant the accuracy, reliability or completeness of the information provided in this report and does not accept liability for any omissions, inaccuracies or losses incurred, either directly or indirectly, by any person arising from or in connection with the supply, use or misuse of the whole or any part of this report. Any and all third party data or analysis in this report does not necessarily represent the views of REINZ. When referring to this report or any information contained herein, you must cite REINZ as the source of the information. REINZ reserves the right to request that you immediately withdraw from publication any document that fails to cite REINZ as the source. ISSN: 2703-2825 This publication is written by Tony Alexander, independent economist. Subscribe here https://forms.gle/qW9avCbaSiKcTnBQA To enquire about having me in as a speaker or for a webinar contact me at tony@tonyalexander.nz Back issues at www.tonyalexander.nz Tony’s Aim To help Kiwis make better decisions for their businesses, investments, home purchases, and people by writing about the economy in an easy to understand manner. Feel free to pass on

FIRST HOME BUYERS BACK

Welcome to the REINZ & Tony Alexander Real Estate Survey. This survey gathers together the views of licensed real estate agents all over New Zealand regarding how they are seeing conditions in the residential property market in their areas at the moment. We ask them how activity levels are changing, what the views of first home buyers and investors are, and the factors which are affecting sentiment of those two large groups.

The key results from this month’s survey include the following.

• An above average net proportion of agents report that they are seeing more first home buyers in the market — but investors remain solidly absent.

• A still high proportion of agents report that prices are continuing to decline in their location.

• Buyer concerns about accessing finance are high but on a downward trend. Few agents feel that buyers have concerns about their employment income.

ARE MORE OR FEWER PEOPLE ATTENDING OPEN HOMES?

In contrast to the continuing deterioration in auction attendance observations, there is a small improvement underway in open home visitations. A net 4% of agents have reported seeing more people at open homes. The result is low but it confirms the improvement seen in the previous month. There are some more people kicking the tyres of properties they might potentially buy — an early indicator of a turning in the residential real estate cycle but by itself not strong enough to allow one to say such a turning is imminent.

ARE MORE OR FEWER PEOPLE SHOWING UP AT AUCTIONS?

This month’s survey continues to show that real estate agents around the country are observing low attendance at auctions. A net 17% have reported seeing fewer people in attendance. This is better than a net 33% at the end of January but still well away from positive territory. Attendance has been viewed as weakening ever since early-2021 when LVRs returned and tax rules were changed for investors.

1

HOW DO YOU FEEL PRICES ARE GENERALLY CHANGING AT THE MOMENT?

There is no sign that prices for residential property around New Zealand have bottomed out let alone turned upward. A still very strong net 57% of agents have reported that prices are going down in their area. This is statistically unchanged from 59% a month ago and as the graph shows is in line with the weakness in place since the turning of 2021-22.

ARE YOU NOTICING MORE OR FEWER FIRST HOME BUYERS IN THE MARKET?

This is the strongest result from this month’s survey. A net 22% of agents have reported that they are seeing more first home buyers. This is the strongest result since the end of September just before the higher than expected inflation number and upward lift in monetary policy tightening expectations. First home buyers are likely responding to signs of banks becoming more willing to lend, rising rents, the extent to which house prices have declined, good job security, strong wages growth, and discounted interest rates.

DO YOU THINK FOMO IS IN PLAY FOR BUYERS?

FOMO = Fear of missing out

There continues to be no sign of FOMO returning to the real estate market in New Zealand. Only a gross 5% of agents have reported seeing FOMO, statistically the same result as for every other month in the past year.

ARE YOU NOTICING MORE OR FEWER INVESTORS IN THE MARKET?

As observed in all of my other surveys, there is no indication that investors are returning to the market. They have been absent since early-2021 and that reflects the return of LVRs, their strengthening for investors (40% deposit) in May, and tax changes from March that year.

2

ARE YOU RECEIVING MORE OR FEWER ENQUIRIES FROM OFFSHORE?

It has been a long time since there has been discussion of people located offshore flocking in to buy NZ residential property. Even in the heights of the pandemic frenzy over late-2020 and early-2021 there were only mild signs of offshore interest. A net 38% of agents this month have reported seeing reduced offshore interest.

WHAT ARE THE MAIN CONCERNS OF BUYERS?

Buyers have worries that prices will fall after they make a purchase, access to finance, and the level of interest rates. Very few feel that there are insufficient listings and worries about employment are minimal.

The light blue line in the following graph shows that concerns about access to finance are declining slowly as each month goes by. Worries about prices falling remain high but are edging slightly lower.

ARE PROPERTY APPRAISAL REQUESTS INCREASING OR DECREASING?

The net proportion of agents reported an increase in requests for property appraisals has eased this month to 22% from 31% a month ago. This reading is above the three year average of 11% but not suggestive of a wave of property hitting the market. In fact, the number of fresh listings of properties with realestate.co.nz has been falling steadily for over a year now. While rising interest rates are a source of budgeting pressure, job security is strong along with wages growth.

Concerns about rising interest rates might also be easing but it seems too early to definitively conclude that on the basis of our survey’s results.

3

ARE INVESTORS BRINGING MORE OR FEWER PROPERTIES TO THE MARKET TO SELL THAN THREE MONTHS AGO?

As has been the case for some time now there remains no evidence that investors are bringing extra properties to the market. It has been tempting to think they would following the tax changes of early-2021 and the way removal of ability to deduct interest expenses gets more onerous as each year passes. But the tax changes appear to have largely affected willingness to buy rather than willingness to sell.

Hopes of finding a bargain have recovered slightly after taking a dip late last year. Of interest perhaps is the slight rise in interest rate levels as an investor demand motivator. This might reflect the availability of specials or more likely the passage of time making people used to where interest rates are at. Reduced fears of further interest rate rises are also likely to be in play.

WHAT FACTORS APPEAR TO BE MOTIVATING INVESTOR DEMAND?

For those investors who are thinking about buying, the main motivation remains hopes of finding a bargain.

4

REGIONAL RESULTS

The following table breaks down answers to the numerical questions above by region. No results are presented for regions with fewer than 7 responses as the sample size is too small for good statistical validity of results. The three top of the South Island regions are amalgamated into one and Gisborne is joined with Hawke’s Bay.

Best use of the table is achieved by picking a variable and comparing a region’s outcome with the national result shown in bold in the bottom line. For instance, nationwide a net 4% of agents say that more people are attending open homes. But in Auckland this is 13% and Canterbury -16%.

The table shows net percentages apart from the FOMO question in column F. The net percent is calculated as the percentage of responses saying a thing will go up less the percentage saying it will go down.

If anyone is interested, I can make available time series for each measure shown here. Contact me at tony@alexander.nz

A. # of responses

B. Are property appraisal requests increasing or decreasing?

C. Are more or fewer people showing up at auctions?

D. Are more or fewer people attending open homes?

E. How do you feel prices are generally changing at the moment?

F. Do you think FOMO is in play for buyers?

G. Are you noticing more or fewer first home buyers in the market?

H. Are you noticing more or fewer investors in the market?

I. Are you receiving more or fewer enquiries from offshore?

J. Are investors bringing more or fewer properties to the market to sell than three months ago?

5 A #obs B Appraisals C Auctions D Open H. E Prices F FOMO G FHBs H Invest. I O/seas J Inv.selling Northland 27 44 -26 -37 -74 4 -15 -70 -44 -11 Auckland 198 17 -1 13 -61 4 27 -36 -33 -3 Waikato 63 24 -41 -13 -71 6 25 -52 -44 8 Bay of Plenty 50 34 -26 12 -56 4 28 -30 -24 6 Hawke's Bay 20 -20 -30 5 -35 15 35 -15 -50 -10 Taranaki 9 56 -22 11 -22 11 11 -33 -56 -22 Manawatu-Wanganui 22 14 -9 9 -68 0 55 -41 -45 0 Wellington 41 15 -5 44 -56 2 32 -59 -49 -10 Nelson/Tasman 23 26 -30 -26 -61 4 13 -39 -22 -13 Canterbury 50 18 -34 -16 -42 4 22 -40 -36 6 Queenstown Lakes 9 67 0 44 11 11 -11 11 -22 0 Otago exc. Q'town 10 50 -20 -10 -30 10 -10 -100 -40 40 Southland 10 40 -40 -40 -40 0 -40 -40 -70 10 New Zealand 534 22 -17 4 -57 5 22 -41 -38 -1

Property Management

Onthefollowingpagesyouwillfindour Property ManagementNewsletter.

on’thesitatetocontactDebbieHarrisonwhocanably assist you with any Property Management issues you may have or if you have any questions about anything in the Newsletterorpropertymanagementingeneral

Email: debbie.harrison@ljhooker.co.nz

Phone:021303864

Makingasmartfinancialmove–refinancingyour mortgage

Refinancingyourhomeloancanbeasmartfinancialmove.Movingyourmortgageto anotherbankcouldbeasolutiontoreduceyourmonthlymortgagepaymentsorpayoffyour loanfaster.

WhatisRefinancing?

Refinancingahomeloanistheprocessofreplacing yourexistingmortgagewithanewone,usuallywith bettertermsorinterestrates.Thistypicallymeans movingyourmortgagetoadifferentbankorloan provider.Theprimarygoalofrefinancingistosave moneyonyourmonthlymortgagepayments,reduce thelengthofyourloanterm,orboth.

Whenyourefinanceyourhomeloan,youmaybeable totakeadvantageoflowerinterestrates,switchtoa fixedorvariableratemortgage,consolidateyour debts,oraccesstheequityinyourhome.By refinancing,youcouldpotentiallysavethousandsof dollarsoverthelifeofyourloan.

HowtoRefinanceYourHomeLoan

Herearethegeneralstepsinvolvedinrefinancing yourhomeloan:

CheckYourCreditScore

Wedon’thearmuchaboutcreditscoresinNew Zealand,buttheyaredefinitelyusedbylenders,which iswhyit'simportanttocheckyourcreditscore. Lenderswilllookatyourcredithistorytodetermine youreligibilityforanewhomeloanandtheinterest rateyouqualifyfor.Ahighercreditscorecanresultin betterloantermsandlowerinterestrates.

Acreditscoreisanumberbetween0and1,000which indicateshowcreditworthyyouare.Thisscoreis influencedbywhetheryoupayyourbillsontime. Generally,agoodcreditscoresitsbetween500and

700.Butthehigher,thebetter.

Youcancheckyourcreditscoreforfreewithcredit reportingagencieslikecreditsimple.co.nz

CompareHomeLoanRatesandFees

Onceyouknowyourcreditscore,it'stimetostart shoppingaroundforanewhomeloan.Compare theinterestrates,fees,andloantermsofferedby variouslendersinNewZealand.Someofthetop lendersincludeANZ,Westpac,BNZ,Kiwibank,and ASB.Butdon’tunderestimatethesmaller,local banks,suchasHeartlandandTSB,astheytendto haveverycompetitiverates.

Considerbothfixedandvariableratemortgages andweightheprosandconsofeachoption.A fixed-ratemortgagemayoffermorestabilityand predictabilityinyourmonthlypayments,whilea variableratemortgagemayoffermoreflexibility andlowerinterestratesovertime.

ApplyforaNewHomeLoan

Onceyou'vefoundahomeloanthatfitsyour needs,youcanapplyforanewloanwiththe lender.You'llneedtoprovidedocumentationof yourincome,expenses,andassets,aswellasyour credithistoryandcurrentmortgagedetails.

Thelenderwillreviewyourapplicationand determineyoureligibilityforthenewhomeloan.If approved,theywillprovideyouwithaloan contractoutliningthetermsandconditionsofthe newloan.

ljhooker.co.nz

PayOffYourExistingMortgage

Ifyournewhomeloanisapproved,you'llneedto usethefundstopayoffyourexistingmortgage.This mayinvolvepayingearlyrepaymentfees,break fees,orothercostsassociatedwithterminatingyour existingmortgage.

Yournewlenderwillworkwithyouroldlenderto ensurethatyourexistingmortgageispaidoffand thatthenewloanisestablished.

StartRepayingYourNewLoan

Onceyournewhomeloanisinplace,you'llstart makingrepaymentsbasedonthetermsoftheloan. Thismayinvolvesettingupautomaticpaymentsor makingmanualpaymentswhentheyaredue.

RefinancingTips

Herearesometipstokeepinmindwhen refinancingyourhomeloan:

ShopAroundfortheBestDeal

Don'tsettleforthefirsthomeloanyoucomeacross. Shoparoundandcomparerates,fees,andterms frommultiplelenderstofindthebestdealforyour financialsituation.Dependingonthemarkets,the bankmightbeabletoofferyouabetterratethan whattheyhavelistedonline.Makesureyouask what’sthebestinterestratetheycanprovide.

ConsiderAllCosts

Whenrefinancingyourhomeloan,considerallthe costsinvolved,includingearlyrepaymentfees, breakfees,applicationfees,andotherexpenses.

Makesureyouunderstandthefullcostof refinancingbeforemakingadecision.

CheckYourLoanTerm

Whenrefinancing,it'simportanttochecktheloan termofthenewmortgage.Youmaybeableto savemoneyonyourmonthlypaymentsby extendingthetermofyourloan,butthismayalso resultinpayingmoreinterestoverthelifeofthe loan.

ConsiderYourFinancialGoals

Beforerefinancing,consideryourfinancialgoals andhowtheyalignwiththenewloanterms.Do youwanttosavemoneyonmonthlypaymentsor payoffyourloanfaster?Considerthesegoals whenselectingthenewloanterms.

ConsultaMortgageBrokerorFinancialAdvisor

Ifyou'renotsureaboutrefinancingorneedhelp selectinganewloan,considerconsultinga mortgagebrokerorfinancialadvisor.These professionalscanhelpyounavigatethe refinancingprocessandfindthebestloanforyour financialsituation.

Refinancingyourhomeloancanbeasmart financialmove,especiallyifyou'relookingtosave moneyonyourmonthlymortgagepaymentsor payoffyourloanfaster.Byfollowingthesteps outlinedhereandconsideringthesetips,youcan makeaninformeddecisionaboutrefinancingyour homeloan.Remembertoshoparound,consider allcosts,andconsultwithaprofessionalifneeded.

Theinformationcontainedinthispublicationisgeneralinnatureandisnotintendedtobepersonalisedrealestateadvice. Beforemakinganydecisions,youshouldconsultalegalor professionaladvisor.LJHookerNewZealandLtdbelievestheinformationinthispublicationiscorrect,andithasreasonablegroundsforanyopinionorrecommendationcontainedinthis publicationonthedateofthispublication. Nothinginthispublicationis,orshouldbetakenas,anoffer,invitationorrecommendation.LJHookerNewZealandLtdacceptsnoresponsibilityfor anylosscausedasaresultofanypersonrelyingonanyinformationinthispublication. ThispublicationisfortheuseofpersonsinNewZealandonly.Copyrightinthispublicationisownedby LJHookerNewZealandLtd. Youmustnotreproduceordistributecontentfromthispublicationoranypartofitwithoutpriorpermission.

ljhooker.co.nz

PROPERTIES

D RURY

Upcoming Auction!

Click here to view this property on our website

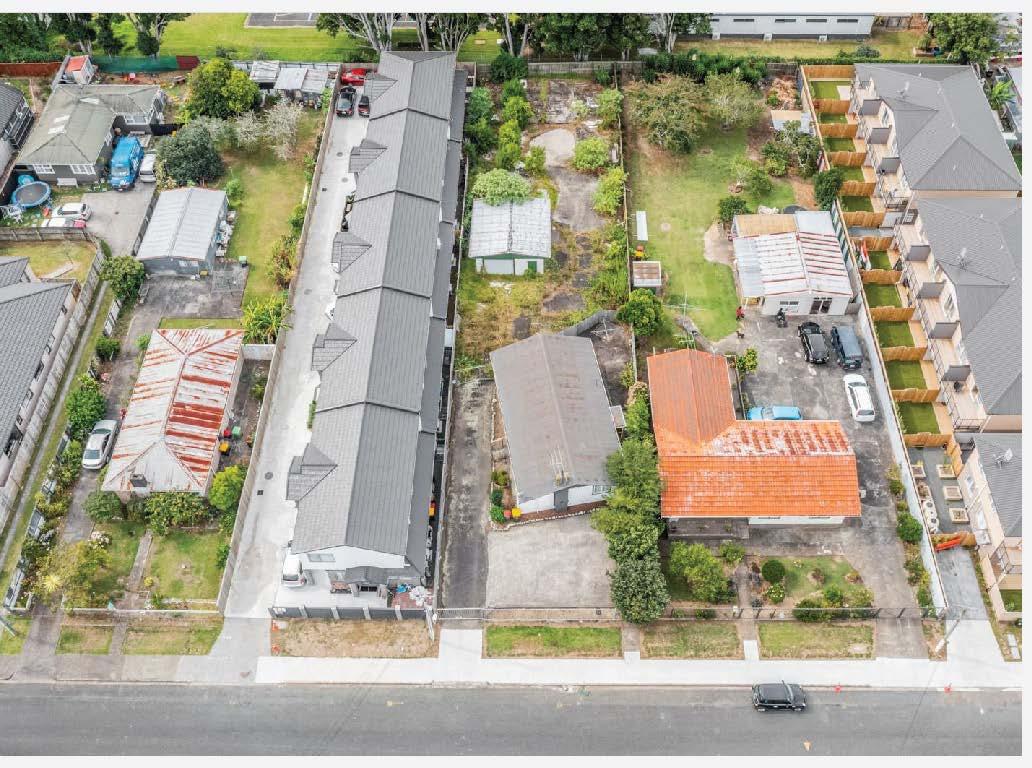

102MountainRoad

Mangere Bridge

FIRSTTIMEONTHEMARKET-EVER!

Position perfect, embrace this golden opportunity to acquire a rock solid investment property situated on 857m2 (more or less) of valuable land, currently zoned Residential-Mixed Housing Suburban Zone.

Close to all amenities, Mangere Bridge has come into its own. Nearby schools and early childhood centres, shops, cafes and close proximity to Auckland's International and Domestic Airport Terminals will appeal to those seeking location, peace, privacy and a little bit of history.

2 1

Auction

Sunday 26th March at 12noon (unless sold prior)

On Site View Sundays 11am - 11.45am

(2008)

brent.worthington@ljhooker.co.nz

Contact 1

Sited for all day sun, the grounds have been carefully planned to ensure minimal care while the rear of the property offers a safe and secure haven for children and pets.

Upcoming Auction!

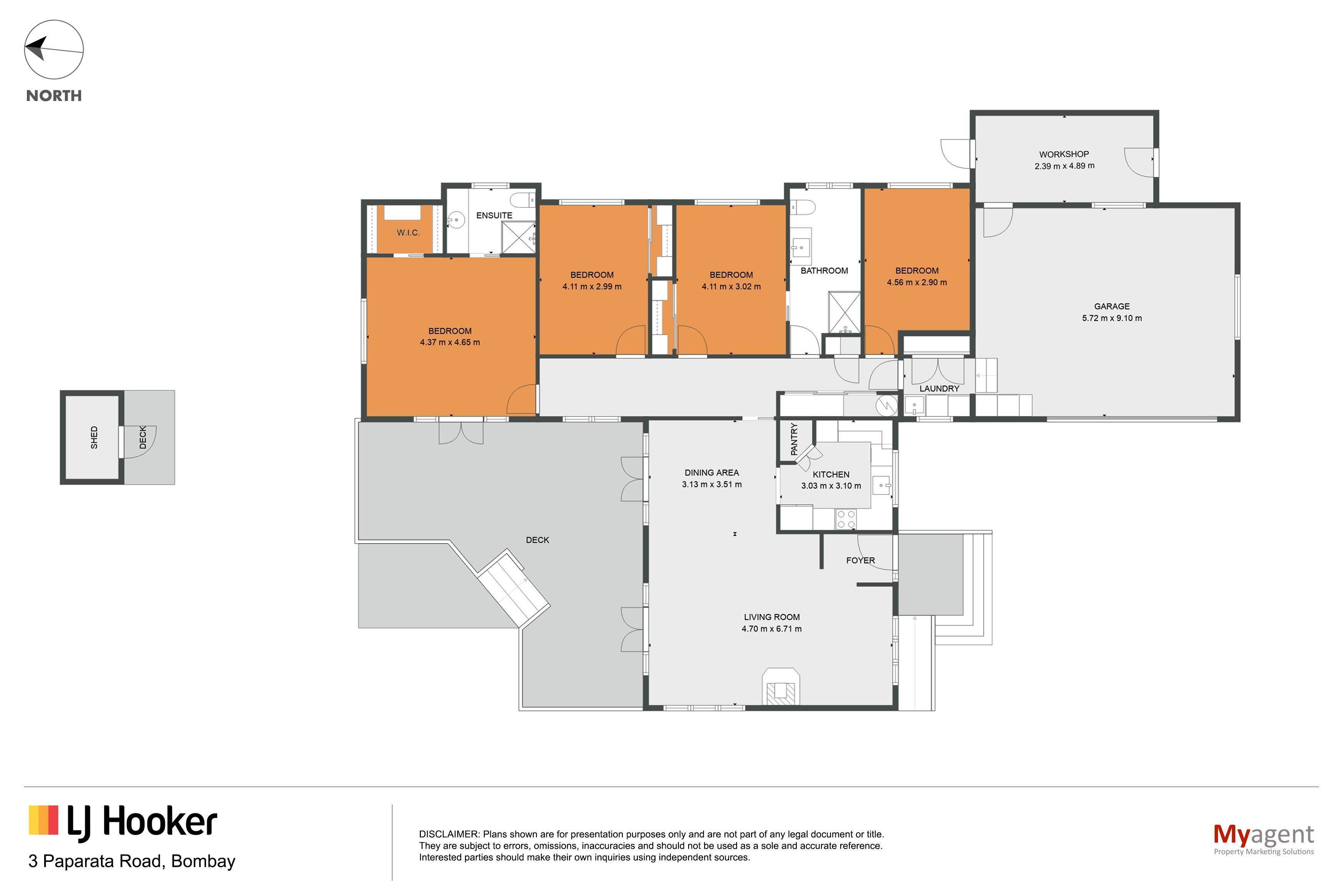

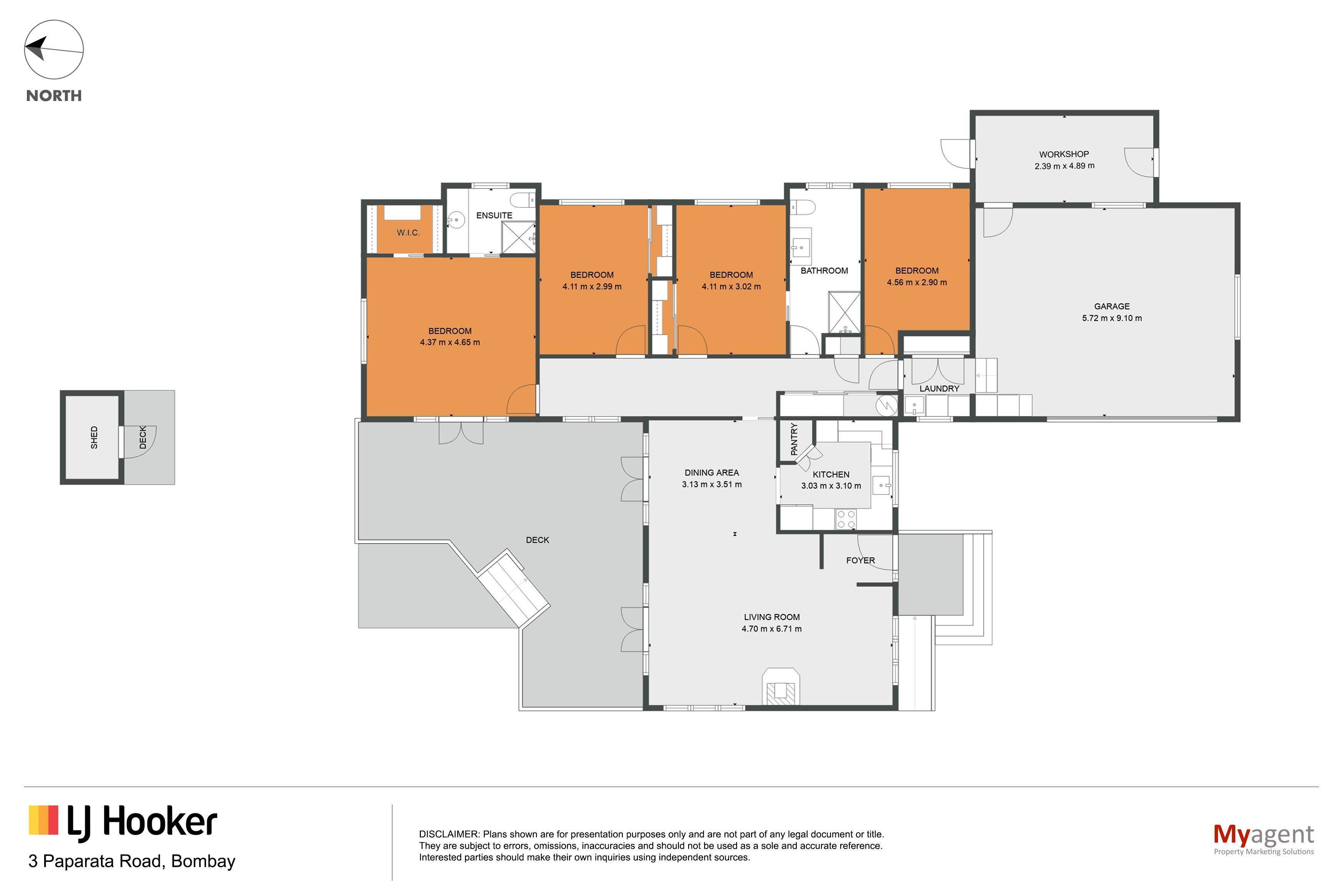

3PaparataRoad

BOMBAY POSITIONPERFECT

Sited for all day sun and situated close to so many amenities and locations!

•3-4 Bedrooms

•2 Bathrooms incl Ensuite

•Walk-in robe

•Large office-fourth bedroom

*Separate Laundry

*Large Double Garage with Internal Entry

Minimal care grounds with safe and secure rear for children and pets.

Auction

uesday 4th April 23 at 6pm(unless sold prior)

In Rooms 1/233 Great Sth Rd, Drury

View Sundays 1:15-2:00pm

Contact

2 2

(2008)

Click here to view this property on our website

LJHooker

OURCURRENTLISTINGS

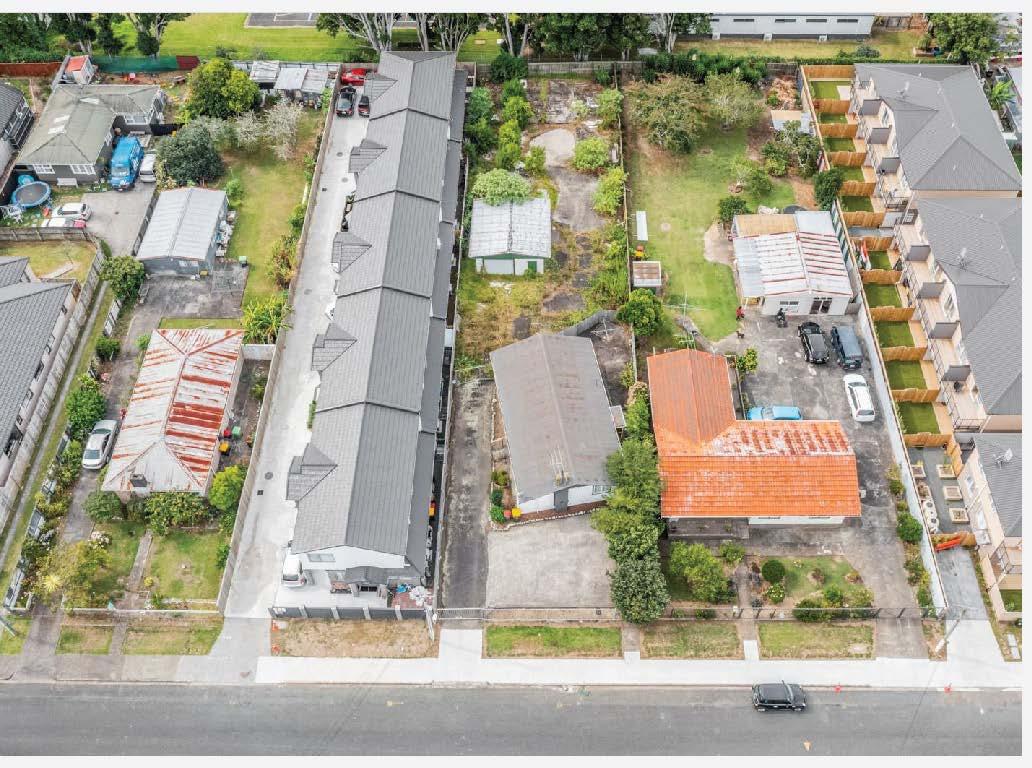

30 Franklyne Road, Otara NZ

§3 bl �1

URGENTSALE-MAKE AN OFFER

Currently tenanted, this 985m2 site (more or less) is a developers dream. Zoned Residential (9D), re...

ForSale By Negotiation

View By Appointment

Brent Worthington 029 296 5362

brent.worthington@ljhooker.co.nz

https://drury.ljhooker.co.nz/

1 Luke Place, Otara NZ §5 b2 �2

URGENTSALE-MAKE AN OFFER

* Prominent site

* Prime Location

* Huge developmentpotential

14 Toscana Drive, Karaka NZ §4 b2 �4

HOME ISWHERE THE HEART IS

If a beautifully presented family home is on your 'wish list' then this darling is a 'must view'.

ForSale Price By Negotiation

View ByAppointment

Nav Johnson 027 827 2213

nav.johnson@ljhooker.co.nz

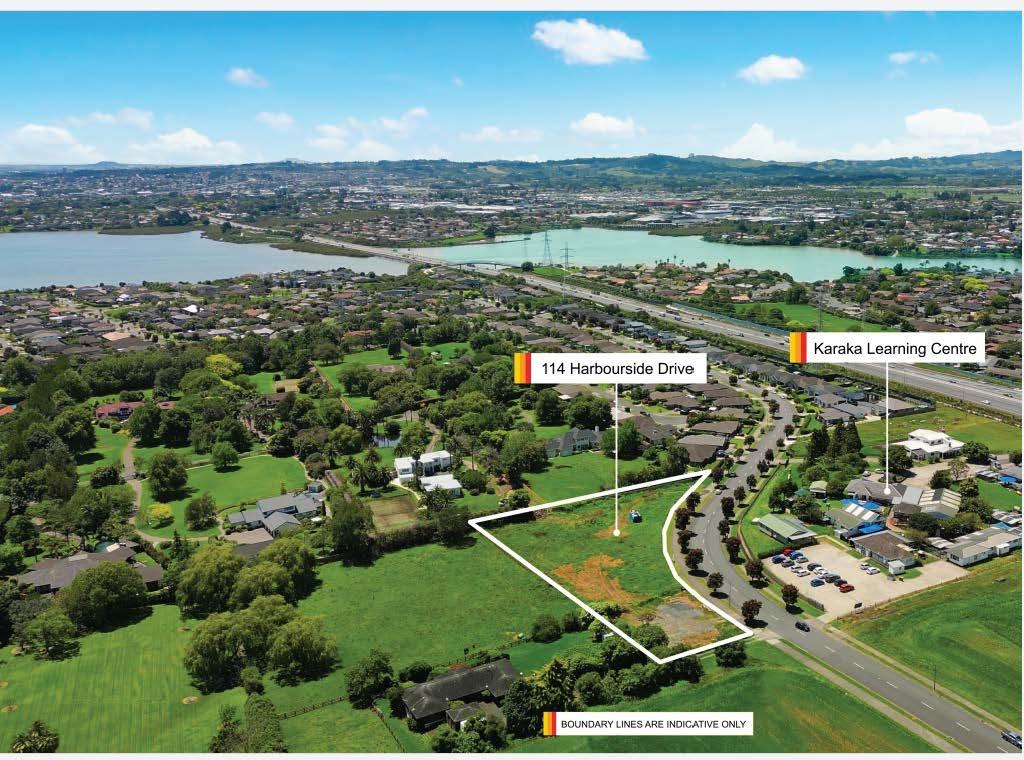

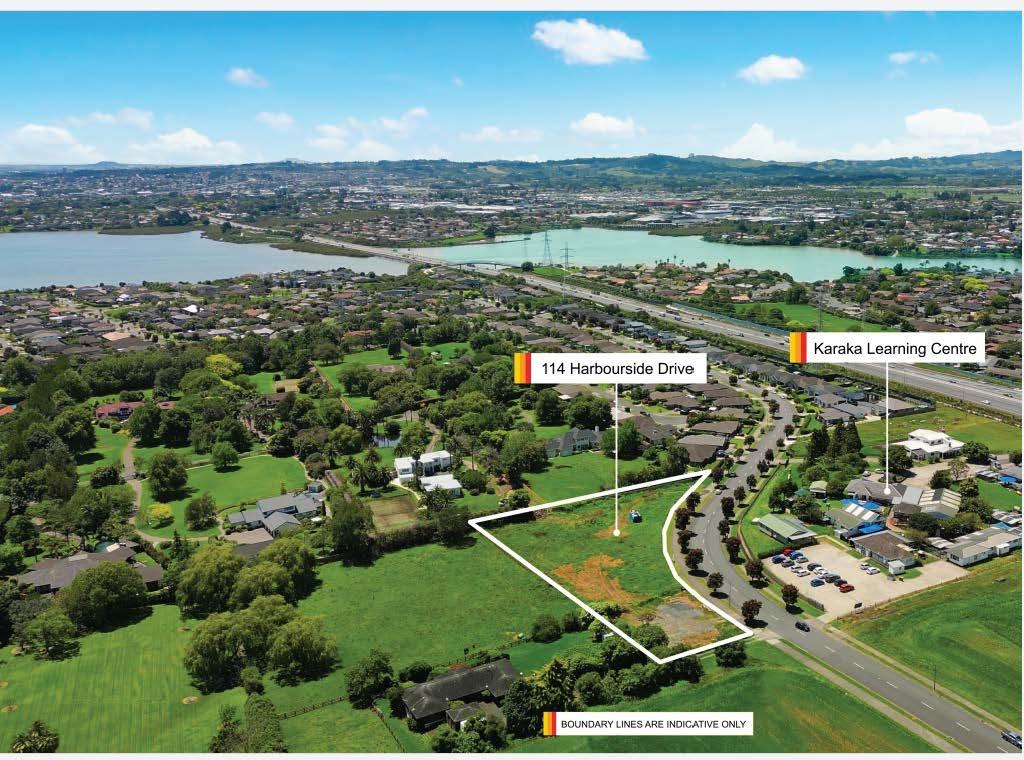

114 Harbourside Drive, Karaka NZ

§- b-�-

RIPE FOR DEVELOPMENTin KARAKA

Located in the "sought after" Karaka Harbourside Estate, the opportunity to purchase another land ho...

ForSale Price By Negotiation

View By Appointment

Nav Johnson 027 827 2213

nav.johnson@ljhooker.co.nz

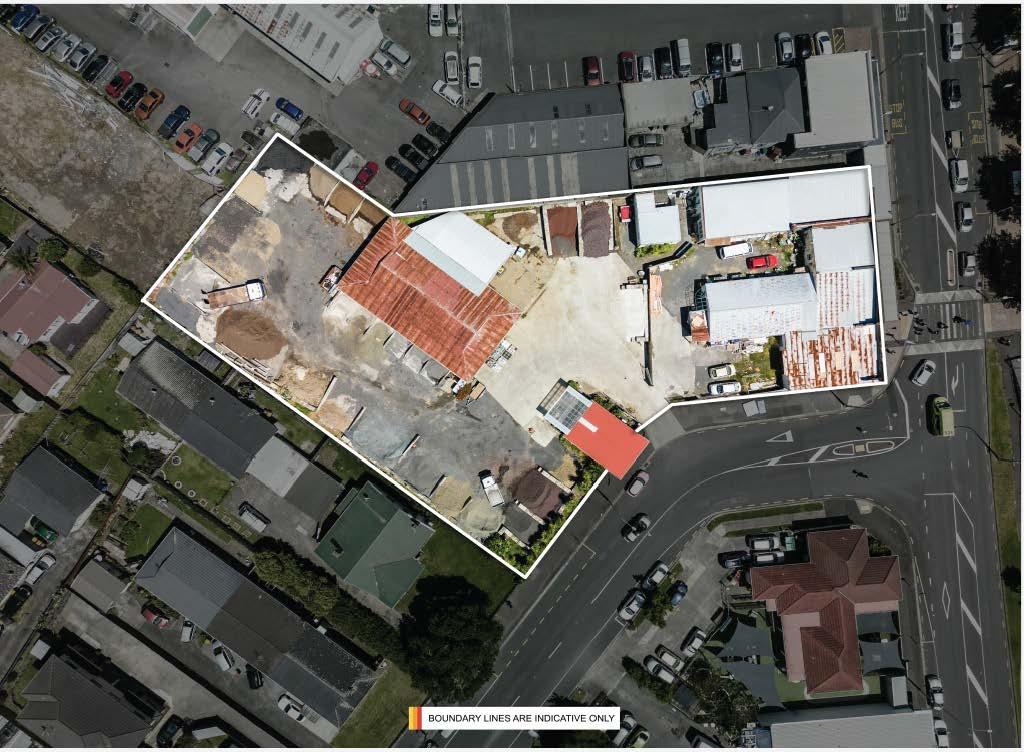

5 Coronation Road, Papatoetoe NZ

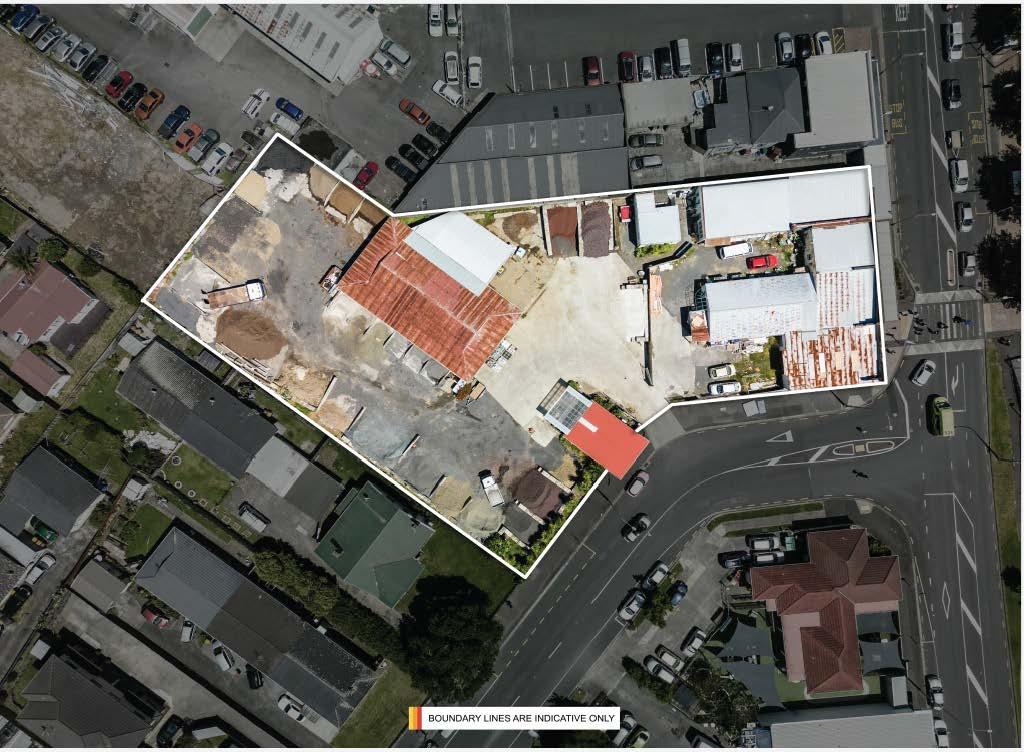

PRIME COMMERCIAL BLOCK.

Set in the heart of Old Papatoetoe's commercial hub, theopportunitytoacquire blocks of this size

ForSale By Negotiation

View By Appointment

Brent Worthington 029 296 5362

brent.worthington@ljhooker.co.nz

102 Mountain Road, Mangere Bridge NZ

§2 bl �1

FIRST TIME ON THE MARKET- EVER!

Position perfect, embrace this golden opportunity to acquire a rock solid investment property situat...

ForSale By Negotiation

View ByAppointment

Brent Worthington 029 296 5362

brent.worthington@ljhooker.co.nz

ForAuction

Auction Sunday March 26th, 12:00PM

View Sunday March 26th, 11:00AM 11:45AM

Brent Worthington 029 296 5362

brent.worthington@ljhooker.co.nz

09 294 7500

20th, Mar2023

1/233 Great South Road Drury NZ 2113 drury@ljhooker.co.nz

LJHooker

3 Paparata Road, Bombay NZ

§3 b2 �s

POSITION PERFECT!

It certainly is! 150 meters up the road you have the Decile 9 Bombay Primary School, the Bombay Rug...

ForAuction

Auction TuesdayApril 4th, 06:00PM

View Sunday March 26th, Ol:15PM

02:00PM

Brent Worthington 029 296 5362 brent.worthington@ljhooker.co.nz

https://drury.ljhooker.co.nz/

09 294 7500

20th, Mar2023

1/233 Great South Road Drury NZ 2113 drury@ljhooker.co.nz

LJHooker

https://drury.ljhooker.co.nz/

Recent Sales

35 Briody Terrace, Stonefields NZ

4 bed, 3 bath

STAND ALONE IN STONEFIELDS

Set on a 372m2 site (more or less) this 243m2 Fletcher designed and built dwelling will definitely i ...

91 Beatty Road, Pukekohe NZ

§8 b7 �

uNuM1TEo POTENTIAL

On the market for the first time in 43 years. The 630m2 dwelling is set on a 2,379m2 site (more or I...

Sold Brent Worthington 0292 965 362

brent.worthington@ljhooker.co.nz

16 Stellata Court, Randwick Park NZ

§3 b2 �2

Brick&Tile Beauty In The Park. If it's the easy care of a brick and tile home you're after, then this one's for you.

Situat

87 Beatty Road, Pukekohe NZ

5 bdrm 4 bathrm 2 vehicles

Perfect Home and Income

The 262m2 (more or less) main dwelling is set on a 949m2 site (more or less) and offers the perfect ...

Sold Brent Worthington 0292 965 362

brent.worthington@ljhooker.co.nz

Sold Nav Johnson 027 827 2213 nav.johnson@ljhooker.co.nz

Sold Brent Worthington 0292 965 362

brent.worthington@ljhooker.co.nz

09 294 7500

LJ HookerDrury

1/233 Great South Road Drury NZ 2113 drury@ljhooker.co.nz

Whenyouknowthe changeofseason istimefora

BRENTWORTHINGTON

BrentWorthington LicensedAgent&Principal

0292965362

Brent.worthington@ljhooker.co.nz

There’s not much Brent doesn’t know when it comes to selling real estate. This town and country agent has had a successful career in the property market and is now the proud owner of his own business. Definitely a quality over quantity man, when you bring Brent on board, you’ll find that accumulating listings is far less important to him than making each one as good as it can get. He prides himself on telling it like it isknowing you’ll be able to make better decisions with a person and information you can trust.

Complementing Brent’s practical

and credible approach is a background full to the brim of industry knowledge and business expertise from 30 years working within the construction industry. His capabilities have been well proven as a highly successful business owner.

A family man, with a proven track record of success, Brent has earned an excellent reputation and the trust of his local community and business colleagues.

He places huge emphasis on customer satisfaction, attention to detail and conducting his business with a genuine duty of care. Brent has gained many awards as a business leader during his 12-year tenure in Real Estate.

His entrepreneurial style ensures he reaches out and connects people with like minds. He imparts his wisdom in a warm and friendly manner and helps people to make wise and right decisions before investing in the property market, Auckland wide.

If you are considering a lifestyle change, investing for your future or simply wanting to know the worth of your property in this fluctuating market, feel welcome to call or email Brent to receive the latest updates on the trends and statistics in your area.

When

™ TNB Property Services Limited, Licensed REAA (2008)

youknow,youknow.

NAVJOHNSON

NavJohnson LicenseeSalesperson

0278272213 nav.johnson@ljhooker.co.nz

With more than 17 years customer service experience, Nav's clients all echo the same sentiments about him. Punctual, honest, softly spoken, understanding, calming in difficult and stressful situations. All qualities and attributes essential in Nav's previous employment as a driving instructor for 6 years. Now, these same qualities and attributes are what Nav delivers for his clients in the world of real estate.

By his own admission, Nav's driven by the pleasure of assisting his clients to reach their goals while delivering a great experience and outcome. "I like to work with you and not for you".

Fluent in English, Hindi, Punjabi and Urdu, away from real estate Nav enjoys the pleasures of family time with his wife, two children a cat and four budgies. He's also an ardent cricket fan, has played representative cricket abroad and is currently involved in coaching at the Howick Pakuranga Cricket Club.

TNB Property Services Limited, Licensed REAA (2008 drury@ljhooker.co.nz

//drury.ljhooker.co.nz)

https:

When you know, you know. ™

March 2023

It’s rare in life that we get something for nothing with no strings attached, especially if it genuinely adds value. Nevertheless, that’s precisely I will give you. Expert home loan advice which has reliably proven to offer significant long-term financial advantage. I keep strict tabs on the country’s largest network of banks plus numerous smaller and second-tier lenders, so you don’t have to. What’s more, this comes at no cost to you because your chosen bank pays for the privilege. You have nothing to lose, yet have a higher chance of securing better terms. Rest assured - if there’s a superior deal out there for you, I’ll find it.

In the typically stoical world of finance, I offer a point of difference. Not only will you receive excellent independent and impartial advice, but you’ll have fun doing it. Even after 15 years in the mortgage arena, my enthusiasm for objectives and commitment to clients shines through at every turn. Endorsement comes from countless glowing testimonials and in my own words: “I’m at my happiest helping people navigate through difficult situations, giving hope and concrete opportunity where they previously had none.”

Prior experience as sales manager in the fields of telecommunications and pharmaceuticals, then later, a small business owner and private property investor, provided me with considerable business acumen across many industries. My customer-focused approach and personable demeanor also reflect a lifetime of experience in client relations. I credit travel to distant locations for creating an enduring interest in different cultures and honing my ability to relate well to the needs of the broader population. In particular, I soundly empathise with people relocating from other countries to make New Zealand their home.

To continue giving my professional best, I maintain balance by travelling and participating in seasonal sports such as paddle boarding and skiing. I enjoy indulging in my creative side; with landscaping, painting watercolours or improving my guitar playing prowess. Additionally, I actively support my community through Christians Against Poverty (CAPNZ), but above all, my wife and our five shared children always take centre stage.

There's little that I haven't seen in my time in the industry, priding myself on an ability to deal with the trickiest of scenarios, never turning anyone away. My philosophy of treating people how I'd like to be treated results in a 360-degree perspective which sets myself apart.

Get in touch if you need any expert guidance.

Regards

Keith Jones 021 849 767

keith.jones@loanmarket.co.nz

loanmarket.co.nz/keith-jones

View Website

Hot Tipsto Prep Your Property for an Autumn Sale

Autumn is a great time to sell. Buyers have well and truly settled into the year, most people are back at work, kids are in their school routine and those who have made a new year ’ s resolution to buy a new home, are eager and ready to home hunt. But as the weather starts to shift, how do you make the most of your property?

Here are 7 jobs to ensure your home is ready for sale in rain, hail or shine.

1. Create autumn curb appeal

This step is important no matter what time of year you are selling. Why? Because potential buyers often do a ‘drive past’ of a property before they come in for an inspection – they are seeing if the property looks good and worth their time. This means that first impressions are critical and this starts at the curb.

Here are some simple jobs to help enhance your curb appeal:

• Water blast the path out the front of the property and along the entry way

• Tidy up the front garden – keep it neat and trim, weed your garden beds, remove dead plants, keep the lawn mown – and yes even the strip out the front of your home, if you have one, should be mowed.

• Remove fallen leaves – If have an excessive amount of fallen leaves are in your front garden, rake these up, as leaving big piles can make the home feel unloved.

• Just because the leaves are starting to change colour and falling off the trees, it doesn't mean your garden needs to be void of colour. Head to your local flower market and pick up some seasonal flowering plants and either add them to your front entrance area in pots or if you feel really inspired plant them around your garden beds.

2. Check gutters and drainage

If you are surrounded by deciduous trees you wouldd know that this time of year your gutters start to fill up with dead leaves. Buyers do not want to see a roof line overflowing as it gives the impression the home is unloved.

It is a good idea to get a professional to help you here to clean the gutters and make sure there are no drainage issues. As autumn can bring heavy rain, you do not want to have to deal with damp or mould issues during open homes.

3. Check your roof

It is probably best to get an expert to help you with this job as it can be dangerous. But getting up and checking that the tiles on the roof are all in good condition and not damaged is an important job to do before you open your home for inspections. In most cases, serious buyers will organize for a property inspection to be carried out and if the report

highlights issues with the roof it may turn buyers off.

If you have any broken tiles get them fixed by an expert as leaving them can result in more extensive damage to your property especially if water gets in. Also ask the roofer to check the seals around vents and chimneys are not worn out and if they are seal them up.

4. Tidy up the garden

Water the lawn each day or every second day leading up to the inspections (just make sure you comply with water restriction laws), remove any dead or dying plants and replace with fresh flowering autumn plants. Rake up any leaves and trim larger bushes and shrubs.

5. Check heating systems

Make sure your home feels warm and inviting when buyers are inspecting it, you want buyers to see that it stands up to the cold but not steaming hot. Put your heating on a timer so it switches on an hour before they arrive. If it is cold and you have a fire place or a gas fire ensure these are lit just before the agent arrives. The flickering of a fire can totally change the atmosphere of a room.

Some additional ways to ensure your home feels warm is to ensure there are no cracks around doors and windows and fill in any cracks. Watch out for any older windows as these are the worst offenders for letting in drafts. So spend an hour or so checking and fixing these before the first open home.

6. Lighting

As the days get shorter and the sun drops down to a lower angle, you will need to rely on your internal lights to create the feeling of light and space.

Pull back all the blinds, open the shutters and ensure all curtains are

open. Turn on every light in the house, including table lamps and if you have a dark room consider adding spotlights behind furniture.

7. Bring the season indoors

Autumn is a favourite season for many, so embrace the season and add subtle reminders of autumn around your home to make it seem more inviting. If your home has a fireplace, have a low burning fire during the open home can help to create an inviting autumn atmosphere. Potential buyers will love to envisage themselves lounging by the fire after a long day.

Get your golden opportunities now supergold.govt.nz SuperGold welcome here 0011 MSD SuperGold Counter Card A4_2_LB_FA.indd 1 13/09/19 10:58 AM

When you know, you know. ™