S T A R V A L L E Y MARKET REPORT

As the world's largest brokerage, Keller Williams dominates the landscape in real estate with its global reach.Withamarketingplatformthattoucheshundreds ofthousandsofpotentialclientseachday,ourclientscan beassuredthattheirlistingsarereachingqualifiedbuyers aroundtheglobe.

Yet,whatmattersmostwhensellingandbuyingrealestate isin-depthmarketknowledge,markethistoryandtrends that only informed, local real estate professionals can provide.OurKellerWilliamsofficeisthefastestgrowing brokerage in Jackson Hole. Why? We are locally owned with seasoned local leadership and a dedicated support team.Ouragentsallshareapassionforempoweringtheir clients with up-to-date information and guidance that allowsthemtomakethebestrealestatedecisionspossible.

Ourrealestateexpertshavepulledandanalyzedthefollowingdata,providinginsightinto thepastquarterandhistoricaldatathathelpsidentifytrendsinthemarket.Foradeeper understandingofthesenumbers,ourlocalteaminStarValleyisalwaysavailabletodiscuss further.

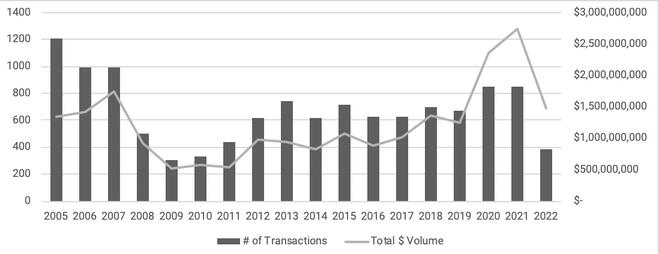

TheStarValleyrealestatemarketcontinuedtocooloffinthe first half of 2023, with more indications of returning to a "normalmarket"inStarValley.Transactionsdecreasedby56% compared to the same period in the previous year, and dollar volumedroppedby63%.

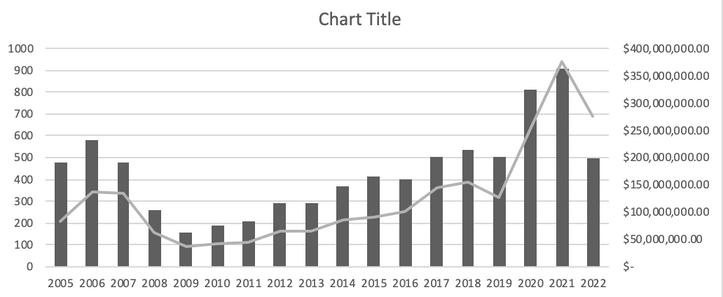

Inthefirsthalfof2023,thecooldownoftherealestatemarket became more evident as we saw inventory increase and the averagesalespricedecreasedby16%.Buyersstartedseeingmore choices, with inventory up 15% at mid-year compared to the previous year The Star Valley real estate market experienced unprecedentedgrowthin2020and2021,fueledbyrecordlow interest rates, the pandemic, and people's desire for a better qualityoflife,butthemarketbegantoshiftin2022aspeople returnedtotheoffice,interestratesincreased,andtheeconomy slowed In 2022 transactions and dollar volume decreased; however, persistent low inventory, down 41%, and continued demandfortheStarValleylifestylehelpedmaintainpriceswitha 33%increaseinaveragehomepricein2022.Overall,themarket's slowdown in 2023 indicates a return to a more balanced real estateenvironmentcomparedtotheboomingconditionsseenin 2020and2021.

ALTHOUGH A MAJORITY OF DEVELOPERS MAY BE ON THE SIDELINES, ALPINE HAS SEEN SOME RENEWED INTEREST IN PRIME COMMERCIAL PROPERTY AT THE JUNCTION, MOST LIKELY BY THE LONGTERM INVESTOR WHO UNDERSTANDS ALPINE GROWTH.

56%

16% Average Sale Price $441,207

15% Active Listings 357

63% Total Dollar Volume $53,386,004

IAN OSLER, ASSOCIATE BROKERHalfwaythrough2023,therewere138activeresidentiallistings,15listings undercontract,and63closingintheStarValleymarket.Theaveragelistprice wasjustoveronemilliondollars,whiletheaveragesoldpricewas$547,029. Transactionsweredown38%,andtheaveragesalespricewasdown29%.

As interest rates increased and secondary homebuyers decreased from previousyears,residentialsalesunder$500,000surged,accountingfor59%of residentialsalescomparedto24%thelastyear.Incontrast,theluxurymarket declined significantly, with only two residential sales of over one million dollarscomparedto15mid-yearin2022.

"THE RESIDENTIAL MARKET HAS BEEN PARTICULARLY IMPACTED BY HIGHER INTEREST RATES. THE RAPID APPRECIATION IN SALES PRICE HAS SLOWED AT BIT AND THE SELLERS ARE NO LONGER REACHING FOR OR ACHIEVING “PIE IN THE SKY” PRICES. PERHAPS WITH LESS UNCERTAINTY OUT THERE SURROUNDING THE REAL ESTATE MARKET, ITS A GREAT TIME TO BE A BUYER!"KELSEY SPAULDING, ASSOCIATE BROKER 290 Cedar Creek Drive, List Price: $945,000

38% 29% 9%

Therewere195buildingsitesandvacantlandactivelylistedmidyearinStar Valley,a22%increaseininventoryfrom2022.Thenumberofvacantland transactionsisdown65%fromthepreviousyear,with56vacantlandsalesin StarValley.Transactiondollarvolumealsoexperiencedasignificantdecline, down70%comparedwiththeyearearlier.Whilethemediansalespricerose 30%,theaveragesalespricedeclined16%.Eighty-twopercentofsaleswere undertheaveragesalespriceof$295,771,indicatingmostmarketactivityis concentratedinthelowerend,similartotheresidentialmarket.

22%

L A N D + R A N C H E S

"THE LAND MARKET IN STAR VALLEY IS STARTING TO BECOME SATURATED AS LINCOLN COUNTY’S PLANNING DEPARTMENT CONTINUES TO WORK THROUGH IT’S BACKLOG OF SUBDIVISION APPLICATIONS THAT HAVE PILED UP OVER THE PAST 2 YEARS COUPLED WITH A SHARP DECLINE IN SALES THERE IS A LOT OF NEW INVENTORY EXPECTED TO BECOME AVAILABLE SOON AND THIS WILL PROMOTE COMPETITIVE PRICING OVER THE NEXT YEAR."REBEKKAH KELLEY, ASSOCIATE BROKER