2022 Jackson Hole

As the world's largest brokerage, Keller Williams dominates the landscape in real estate with its global reach. With a marketing platform that touches hundreds of thousands of potential clients each day, our clients can be assured that their listings are reaching qualified buyers around the globe.

Yet, what matters most when selling and buying real estate is in-depth market knowledge, market history and trends that only informed, local real estate professionals can provide. Our Keller Williams office is the fastest growing brokerage in Jackson Hole Why? We are locally owned with seasoned local leadership and a dedicated support team Our agents all share a passion for empowering their clients with up-to-date information and guidance that allows them to make the best real estate decisions possible.

Happy New Year and welcome to our 2022 year-end market report Jackson Hole real estate has always been interesting and 2022 was no exception. Our local team has pulled and analyzed the following data, providing insight not only on the past year but historical data that helps identify local trends in the market. For a deeper insight into these numbers, our local team here at Keller Williams Jackson Hole is always available to discuss.

In 2022, the tide turned in Jackson Hole’s real estate market. After two years of explosive transaction levels and price growth following the pandemic, the real estate market reacted to a new set of economic conditions by cooling its heels. Interest rate increases, while still at historically lower levels, have caused some pause in the market, mostly in the primary home market. Second and vacation home buyers are less affected by rising rates, but all buyers have become more price-sensitive and more selective. Sellers today must be agile – but if the price is appropriate to condition and location, the demand is still strong.

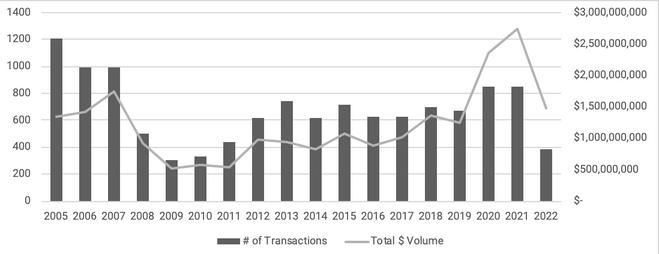

The overall market had 51% fewer transactions in 2022 compared to 2021 which appears to be more on par with the volume seen in 2018 Despite sales activity slowing, prices remained strong with the average sale price up 5% and the median sale price up 30%. The number of active listings at year-end 2022 increased 68% compared to the prior year, yet inventory levels remain near historical lows. The imbalance of supply and demand, which is characteristic of Jackson Hole, maintains pricing levels gained from the past two years. That said, a leveling of price growth is a sign of a more balanced real estate market.

The single family segment of the market fared the best of all property types in terms of the number of transactions, but still down 44% year over year. Total dollar volume of the homes sold in 2022 was down over 45% compared to the record-breaking volume of 2021. Still, this volume is actually 36% higher than in 2019. With most homes selling in the $2-$5 million dollar category, the median home price increased 14%. With fewer luxury sales weighing in, the average home price fell 7% compared to 2021. Home buyers have more options than a year ago with active inventory up 63%.

Sales of condos and townhomes in 2022 were cut in half compared to 2021. The total dollar volume didn’t drop as steeply as other segments (-28%) due to the robust number of luxury condos and townhomes sold. This distribution drove the average and median sale prices up 47% and 36%, respectively. The number of active listings jumped up 169% compared to year-end 2021, which was a healthy respite from the nearly non-existent inventory levels of late 2021.

The vacant land segment of the market incurred the largest drop in transactions, down 70% compared to 2021. The total dollar volume dropped over 60% compared to 2021 and is on par with the volume seen in 2019. Thanks to several ultra-high-dollar land sales, the average and median sale prices experienced robust increases, up 28% and 13% respectively. Inventory for vacant land increased modestly, up about 20% from the previous year.

Not immune to outside economic factors, the luxury segment also experienced a large decrease in transactions, down over 40% in 2022 vs. 2021. The luxury segment was less affected by the increasing interest rates, but other economic factors such as volatility in the stock market created hesitation. Unabated price appreciation in the luxury market that was seen in the past two years slowed, evidenced by decreasing average and median sale prices, down 10% and 18% respectively. Luxury buyers will have a few more properties to choose from in 2023 with inventory up nearly 30%.