2023 Q1 Jackson Hole

As the world's largest brokerage, Keller Williams dominates the landscape in real estate with its global reach. With a marketing platform that touches hundreds of thousands of potential clients each day, our clients can be assured that their listings are reaching qualified buyers around the globe.

Yet, what matters most when selling and buying real estate is in-depth market knowledge, market history and trends that only informed, local real estate professionals can provide. Our Keller Williams office is the fastest growing brokerage in Jackson Hole Why? We are locally owned with seasoned local leadership and a dedicated support team Our agents all share a passion for empowering their clients with up-to-date information and guidance that allows them to make the best real estate decisions possible.

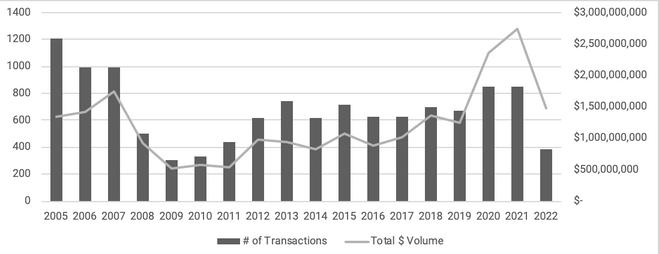

Welcome to our Q1 2023 Jackson Hole Market Report! Our local team has pulled and analyzed the following data, providing insight not only on the past year but historical data that helps identify local trends in the market For a deeper insight into these numbers, our local team here at Keller Williams Jackson Hole is always available to discuss.

In the prior year, a significant transformation was observed in the real estate sector on both a national and local level. The rapid escalation of interest rates coupled with the prevailing economic uncertainty had a dampening effect on buyers' sentiment, ultimately leading to a slowdown in the real estate market. The beginning of 2023 is witnessing a continuation of this trend, characterized by reduced transactions, price levels maintaining their gains from prior years, and a modest increase in available inventory. Despite these fluctuations, many are finding investment in real estate is a viable option in a turbulent and high-inflation environment.

The overall Jackson Hole real estate market, which includes all property types, experienced a modest decrease in transactions, down 8% compared to the first quarter of 2022. Nonetheless, the average sale price increased nearly 20% to just under $4 million. The drop in transactions led to the total dollar volume falling about 22%. The number of active listings available jumped over 120% compared to levels seen a year ago. This additional inventory is a welcome sign of a more stable market, however still at historically low levels The number of pending listings dropped significantly, down 42% year over year, signaling that low transaction levels could persist through the year On the plus side for buyers, properties took about 86% longer to sell, giving buyers an opportunity to be more selective and navigate the transactional process more easily

Number of Sales

77

8%

19%

Total Dollar Volume

$308,418,041

22%

Active Listings

128

121%

AT A GLANCE YEAR OVER YEAR $3,954,614 All data is for Teton County, Wy areas 1-10 and is sourced through Teton Board of Realtors MLS and internal proprietary data All data is deemed reliable but is not guaranteed Each office is independently owned and operated

2023 Q1

In the initial quarter of 2023, the single-family segment of the real estate market remained unchanged with respect to transaction levels, as compared to the same period last year. Notably, the demand for single-family homes persisted to be the strongest among all market segments, reflected by a surge in the average sale price by more than 20%. This resulted in a corresponding increase in the total dollar volume. However, it is important to note that a single ultra-luxury home sale, listed at $48 million, has skewed the limited dataset. In contrast, the median sale price actually witnessed a decrease of approximately 27%. Mirroring the overall market, there is now slightly more inventory available, up 88% compared to a year ago. The number of homes under contract dropped about 26% and homes are staying on the market a little longer. The average days on market jumped over 30%.

CONDO

2023 Q1

The condo and townhome market in Jackson Hole witnessed a modest decline in the number of transactions this year, dropping by around 21% in comparison to the first quarter of 2022. With the bulk of these transactions falling into the $2 million to $3 million range and only a couple of entry-level condo sales, the average and median sale prices jumped 22% and 80%, respectively. The price distribution of these sales boosted the total dollar volume enough to make up for a lack of transactions and remain on par with the same period last year. While the statistical figure for active listings appears staggering, up 333% from last year, the inventory level of condos and townhomes is still woefully low. This scarcity of inventory is no doubt contributing to the persistent price levels seen in Jackson Hole's real estate market. Pending listings dropped about 50% and the average condo or townhome is on the market about 203 days, up over 150% from the same period last year.

Transaction levels for vacant land and ranches in Jackson Hole remained flat compared to the first quarter of 2022. What changed, however, is a marked shift in the type of land that was traded. Overwhelmingly, the land transactions so far in 2023 included lower-priced, smaller acreage properties. This shift resulted in a dramatic decrease in average and median sale prices, down about 57% and 46% respectively. Owing to the price distribution of these sales, the total dollar volume also declined approximately 57% compared to the same period last year. Following suit with all other segments of the market, vacant land inventory is on the rise, up over 120%, pending listings are nearly 65% fewer, and the average property has been on the market about 150% longer than last year.

The luxury segment of the market, defined as residential and land sales over $5 million, followed the broader market trends closely. The number of trades decreased (-23%), the average sale price increased (+64%), inventory jumped (+114%), and pending listings dropped (-25%). So, what does all this mean? Despite these fluctuations, the data indicates that there continues to be a strong demand for luxury properties, attracting both full-time residents and second-home buyers. The current environment, marked by economic uncertainties and high inflation, has further reinforced the appeal of investing in real estate as a stable and potentially lucrative option.