Exploring the Benefits of Real-world Asset Backed Cryptocurrencies

Cryptocurrencies have been gaining popularity around the world as a new type of digital asset class. However, their high volatility and lack of backing have limited their mainstream adoption as a store of value. The emergence of realworld asset-backed cryptocurrencies has the potential to address these concerns and enable their use in a broader range of applications.

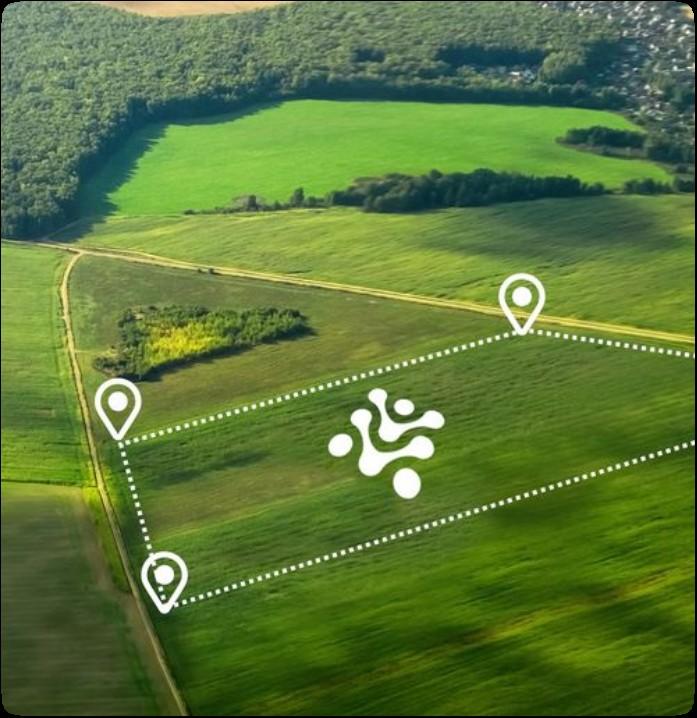

Real-world asset-backed cryptocurrencies are digital tokens that are linked to tangible assets, such as real estate, gold, or even artwork. This connection provides a level of stability and predictability to the value of the cryptocurrency that is not present in traditional cryptocurrencies like Bitcoin or Ethereum.

One of the primary benefits of real-world asset-backed cryptocurrencies is their potential to offer a more stable investment option compared to traditional cryptocurrencies. For example, if an investor purchases a real estate-backed cryptocurrency, the value of the token will be based on the underlying asset's performance, which tends to be more stable and predictable compared to the volatile market for traditional cryptocurrencies. This can provide investors with a level of confidence and security in their investment decisions.

Cryptocurrencies have been gaining popularity around the world as a new type of digital asset class. However, their high volatility and lack of backing have limited their mainstream adoption as a store of value. The emergence of realworld asset-backed cryptocurrencies has the potential to address these concerns and enable their use in a broader range of applications.

Cryptocurrencies have been gaining popularity around the world as a new type of digital asset class. However, their high volatility and lack of backing have limited their mainstream adoption as a store of value. The emergence of realworld asset-backed cryptocurrencies has the potential to address these concerns and enable their use in a broader range of applications.

Cryptocurrencies have been gaining popularity around the world as a new type of digital asset class. However, their high volatility and lack of backing have limited their mainstream adoption as a store of value. The emergence of realworld asset-backed cryptocurrencies has the potential to address these concerns and enable their use in a broader range of applications.

Cryptocurrencies have been gaining popularity around the world as a new type of digital asset class. However, their high volatility and lack of backing have limited their mainstream adoption as a store of value. The emergence of realworld asset-backed cryptocurrencies has the potential to address these concerns and enable their use in a broader range of applications.