Local tax increases mean a bigger slice out of paychecks

VOLUME 1,ISSUE40—SEPTEMBER1,2023 Monmouth is giving Streetscapes ‘70s vibes p15 Mayors share road improvement concerns with legislators p8

KENTON

flying high on winning streak p16

Villa Madonna girls soccer

2 SEPTEMBER 1, 2023 LINK Partners zslaw.com / (859) 426-1300 LAW ZIEGLER & SCHNEIDER, P.S.C. We are grateful to all LINK’s Partners - those organizations in the community who believe strongly in what we are doing, and have thrown their full support behind us. These NKY institutions are helping bring a voice back to our community. PLUMBING | DRAINS | HEATING | AIR A FLUSH BEATS A FULL HOUSE TRANSPORTATION CHARTER SHUTTLE | | Shop SMART at an altafiber store near you. Did you know? altafiber customers can enjoy 24 months of interest free payments for smart home devices, conveniently added to your bill. *Cincinnati Bell Telephone Company LLC d/b/a altafiber (“altafiber”) Limited-time offer and only available to new residential customers. Availability based on service address, not available in all areas. Promotional prices shown. When bundled with a basic TV plan, altafiber’s lowest priced internet service starts at $29.99 before eBill. To qualify for $24.99 internet, you must bundle basic TV service and subscribe to eBill; eBill is required to receive the full promotional discount. Promotional price will increase $20/mo. after 12 mo. promotional period. Modem lease optional for Internet-only service, required with TV, at $9.99/mo. Set-top box required for TV service; $8.99/mo. rental fee for the 1st box, $5/mo. per box for each additional. Subscription cancellation will result in equipment charge if not returned to altafiber. Additional features, taxes, government fees and surcharges are additional to the package price. Other restrictions may apply. “Promotion” means a discount amount against the standard price of altafiber products for a promotional period. Standard prices are subject to change. “Twice as fast as Spectrum” claim based on altafiber’s fastest available internet speed of 2 Gig, compared to Spectrum’s fastest available internet speed of 1 Gig as of 7/1/2023 on spectrum.com. Call 859.999.8347 or visit getaltafiber.com/link Visit our Florence retail store: 7688 Mall Rd., Florence, KY 41042 • 513.566.4163 $2499/mo each for 1 year when bundled NEW BEST OFFER 800 Mbps Internet + TV Starting at

PRESIDENT & CEO Lacy Starling

CHIEF OPERATING OFFICER Mark Collier

MANAGING EDITOR Meghan Goth

PRINT EDITOR Kaitlin Gebby

SPORTS EDITOR Evan Dennison

The LINK nky Kenton Reader is a weekly newspaper. Application to Mail at Periodicals Postage Prices is Pending, permit number 32 in Covington, Kentucky. The LINK nky Kenton Reader office of publications and the Periodical Pending Postage Paid at 700 Scott St., Covington, KY 41011.

For mailing address or change-of-address orders: POSTMASTER: send address changes to The LINK nky Kenton Reader: 31 Innovation Alley, Covington, KY 41011 859-878-1669 | www.LINKnky.com

HAVE A TIP? News@LINKnky.com

WANT TO ADVERTISE?

Marketing@LINKnky.com

WANT TO SUBSCRIBE? Send a check for $31.80 ($25 trial rate plus 6% Kentucky sales tax) to our principle office or scan this QR code below

obscene’: Kenton tax increases rile critics, create confusion

BY NATHAN GRANGER AND KENTON HORNBECK

No part of this publication may be used without permission of the publisher. Every effort is made to avoid errors, misspellings, and omissions. If, however, an error comes to your attention, please let us know and accept our sincere apologies in advance.

on the cover

This cover photo was generated using artificial intelligentce (AI). To read more about how AI is changing the work landscape, read Kenton Hornbeck's business reporting at linknky.com.

Erlanger City Council member Tyson Hermes stood at a December 2022 Kenton County Fiscal Court meeting.

Addressing Judge/Executive Kris Knochelmann, county commissioners and staff sitting behind desks surrounding the platform where he stood, Hermes, who is also a businessman, thanked the group for his opportunity to speak.

“The reason I wanted to address the court was just to express my distaste for the process and the timing of the tax rate increase that’s recently been announced,” he said at the Dec. 13 meeting.

That increase had received a second reading at a meeting earlier that year, on Election Day.

The court cast a vote to approve an increase on both employee payroll and business net profits throughout Kenton County on that Nov. 8 evening, but it wasn’t until Hermes’ comments more than a month later that rumblings of a backlash against the increases themselves came into play – along with the manner in which the county went about passing them.

“First, the vote taking place on Election Day, especially when in Erlanger we were wasting two or three hours in lines to vote,” Hermes said at the December meeting about long wait times throughout the county during the general election. “A lot of people wouldn't have had time to be paying attention or to be showing up to voice their displeasure with that.”

Hermes questioned whether the county had acted opportunistically in passing the

increases so close to an election, such that the voters might forget when it came time for re-election. He also questioned whether the move would, in fact, uphold the fiscal court’s responsibilities to effectively manage the county’s financial health.

“Is the fiscal health in jeopardy in the county that we had to look at such substantial tax rate increases?” Hermes asked rhetorically.

Rewind to November.

“This will set up Kenton County for financial stability for decades,” Knochelmann, who is in charge of setting up the county’s financial goals, said to the commissioners on Nov. 8.

“This group will continue to work,” Kno-

SEPTEMBER 1, 2023 3 cover story

on page 4

Continues

‘It’s

Higher tax rates on employee wages and business profits in Kenton County have created a backlash. Photo by Kaitlin Gebby | LINK nky

chelmann said, before correcting himself. “Not work to … will commit to reducing tax on the rooftops” of county residents.

Knochelmann’s statements followed a presentation from Kenton County Treasurer Roy Cox, who laid out the county’s reasoning for amending its tax ordinance. He displayed charts comparing Kenton County’s revenue streams to those of the adjacent counties, pointing out that Kenton Coun-

ty was exceptionally reliant upon property taxes compared to payroll taxes.

The proposed amendment ordinance would change how employee wages and business profits were taxed from the previous year, not only in terms of rates but also in terms of the amount of wages and profits that could be taxed: The taxable cap would increase from $25,000 for the first tax tier to 50% of the federal Social Security cap, or $80,100 in 2023.

“This may go down … as the most consequential thing that we will have done to fix the long-term financial health for the county,” Knochelmann said, addressing the commissioners. “It's the right thing to do. It's a tough thing to do.”

County officials voted unanimously to enact the tax increase.

Fast-forward to January at the Kenton County Mayors Group meeting in Fort Mitchell, where mayors from most of the county’s cities – as well Knochelmann and the county commissioners – packed the city’s community center.

“There has been no discussion about how this extra money is going to be used,” Covington Mayor Joe Meyer said.

Meyer went on to say that “the stacking of the county tax on the city tax represents a major change in public policy.”

He then summarized changes that had occurred in Kentucky statute relating to city tax credits and the process behind raising business taxes. Most notably, he referenced a change that occurred in 2021 with the passage of Kentucky House Bill 249, a revenue bill that amended Kentucky statute to allow fiscal courts in counties with more than 30,000 people to increase payroll tax rates without a public referendum.

“That’s a huge public policy change,” Meyer said, “and it occurred without any discussion or notice to the public.”

In response, Knochelmann said that the issue the court was attempting to solve was the “balance of revenue generation” between payroll and property taxes.

He added that if the wage and profit caps had not been raised, “the county would long-term (and) short-term be in a very, very horrific financial condition.”

Knochelmann said he could have been more transparent with the court’s decision, but he defended the court’s actions, characterizing the previous $25,000 cap as outdated and insufficient to meet the county’s service needs.

The judge/executive also said the raised rates would not disincentivize new businesses from moving to cities in Kenton County: “It doesn’t affect economic development.”

But Meyer wasn’t buying it.

“The whole fundamental issue is that by increasing the tax and then stacking it on top of the city tax, the effective payroll tax rate for Covington workers went up to 3.36%,” Meyer told LINK nky in August.

The previous year’s combined city and county occupational tax rate for Covington residents was 3.16% for workers making under $25,000. In 2023, the combined rate jumped up to 3.36% for workers making $80,010 or less.

For years, Meyer said, the business community held it as “common wisdom” that the city payroll tax rate was already a disincentive for economic development and job growth.

Now, Meyer said, “What’s 3.36% going to do?”

Many of the city officials at the January mayors meeting shared his concerns that the new county tax rate, which would get stacked on top of municipal rates, would discourage businesses and jobs from coming into their cities. On top of that, officials said they felt uneasy about the way in which the county passed the tax ordinance on election night when everyone was busy at the polls.

Is the new tax rate excessive? What about Knochelmann’s rationale that the change was necessary to ensure the health of the county?

It’s not quite that simple. Let’s rewind back even farther.

Taxes on wages, business profits and property are among the primary means by which counties fund their operations, but Kenton County has not always had a payroll tax.

4 SEPTEMBER 1, 2023 Continued from page 3 College of Agriculture, Food and Environment JOIN OUR TEAM! CAMPBELL COUNTY EXTENSION ASSISTANT for Horticulture RE41280 The University of Kentucky is an Equal Opportunity Employer. The address of the College of Agriculture, Food and Environment EEO Officer is Room S-105 Agricultural Science Building North, University of Kentucky, Lexington, KY 40546-0091. extension.ca.uky.edu/hiring

September 6, 2023 Apply online at: https://ukjobs.uky.edu/postings/483051 For assistance call: (859)-572-2600 Cooperative Extension improves the lives of Kentuckians through practical, research-based educational programs. BENEFITS •Paid vacation and sick leave •Insurance •Retirement 200% match • Employee Education Program • Professional development opportunities CE-GCI0939179-01 Cooperative Extension Service

Deadline:

Judge/Executive Kris Knochelmann speaks to the Kenton County Mayors Group during a January meeting. Photo by Nathan Granger | LINK nky

Erlanger City Council member Tyson Hermes called the tax hikes obscene. Photo by Nathan Granger | LINK nky

Kentucky state law allowed county fiscal courts to levy occupational taxes starting in 1966. In 1978, the Kenton County Fiscal Court put a measure on the ballot asking county residents to levy an occupational tax of 0.4% on the first $25,000 of a person’s wages and the first $37,500 of a business’s net profits. The ballot measure also allowed the fiscal court to raise taxes up to 1% in the future without a vote.

Residents of Kenton County at the time voted to enact the 0.4% tax rate.

Over the years, lawsuits and legislative decisions at the state level have changed how fiscal courts can levy taxes. For a time, cities could credit occupational taxes in their municipalities toward taxes owed to the county. Likewise, counties could levy additional taxes without a vote for a time.

Fast-forward to 2021, and state law required a popular vote to increase occupational tax rates, but credits toward county taxes were valid only if cities and counties mutually agreed to them.

During the 2021 legislative session, Kentucky Sen. Chris McDaniel (R-Ryland Heights), who serves as co-chair of the state’s appropriations and revenue committee, in coordination with county officials used an amendment to House Bill 249 to strike the requirement for a public vote to increase taxes.

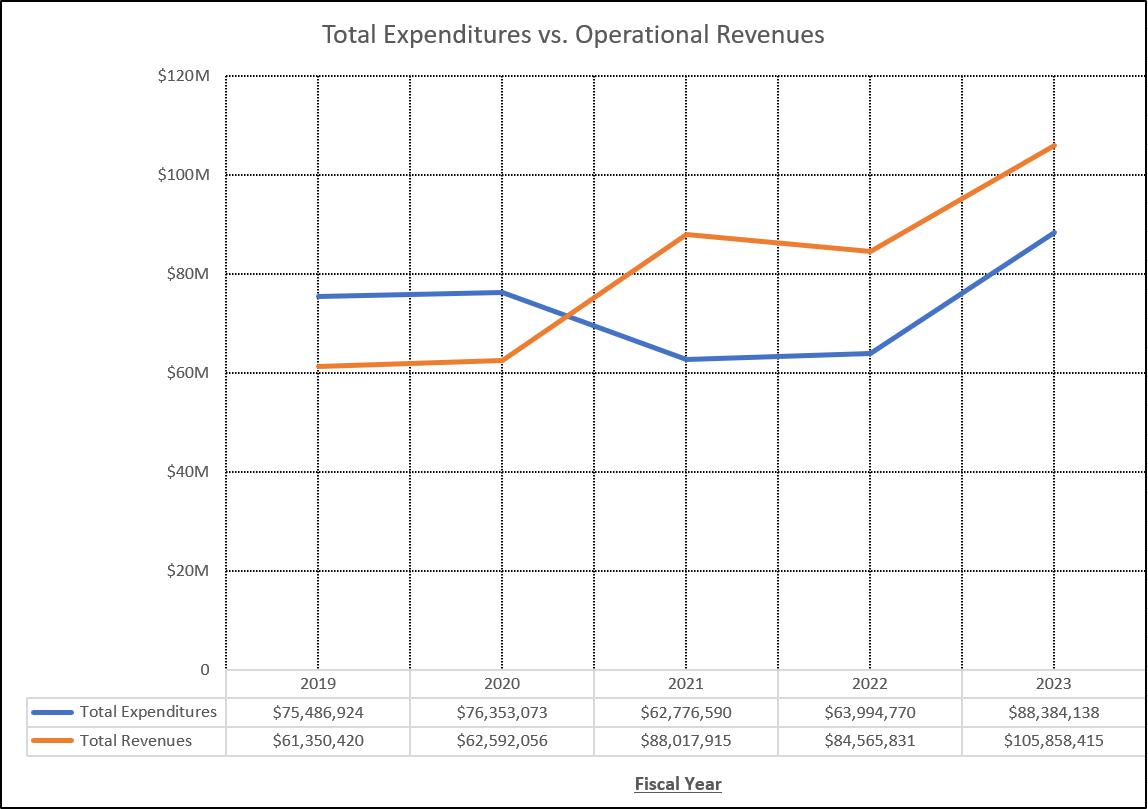

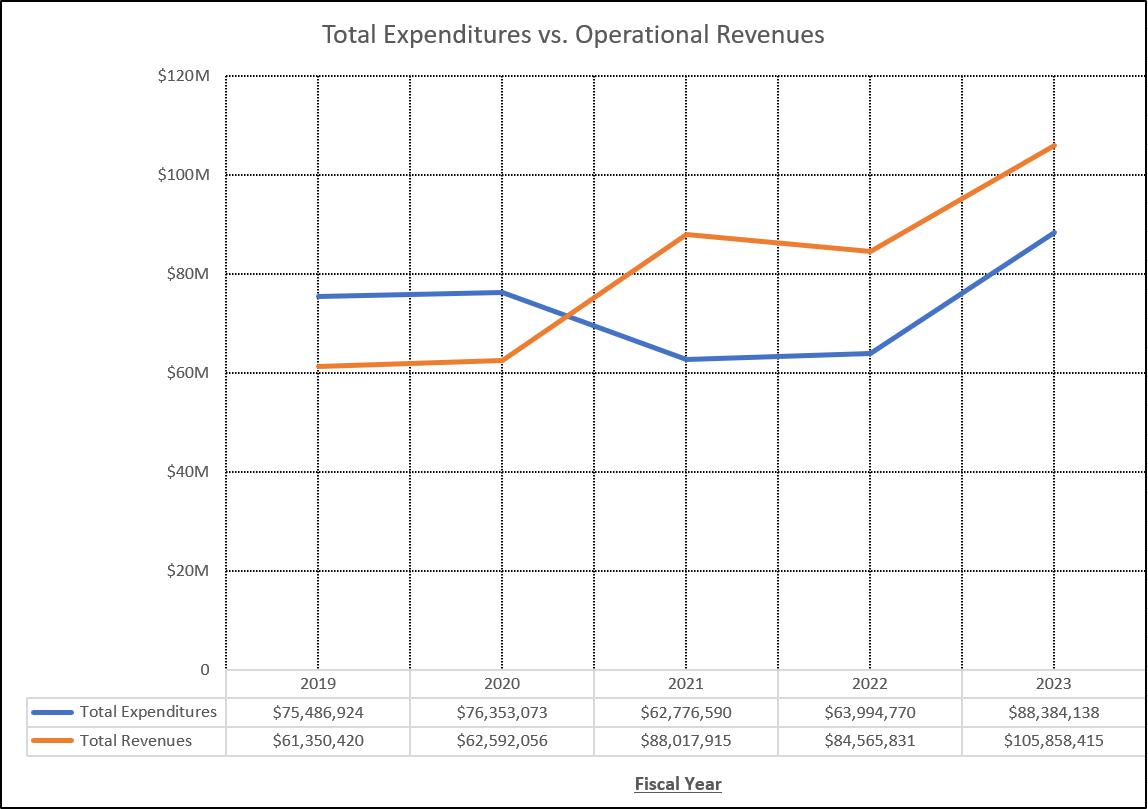

By the numbers

During his presentation in November, the Kenton County treasurer argued that about 65% of the county’s tax revenue came from property tax, with the remainder coming from occupational taxes. LINK nky’s analysis of the county’s financial statements didn’t yield quite the same percentages, but the treasurer’s contention that the county leans disproportionately on property tax revenue has been broadly true over the last

five fiscal years. With the addition of the new occupational taxes, which took effect on Jan. 1, that gap has closed a good deal.

McDaniel summarized the county’s rationale for changing the county taxes this way: ““Many” Kenton County-ians work outside of the county. … We were beginning to place a disproportionate tax burden on Kenton County residents.”

When all forms of funding are taken into account, the county rarely meets the amount of money it projects to spend. In addition, the county brought in more money than it spent in fiscal years 2021, 2022 and what’s been collected so far for 2023.

“Cities and counties, unlike the federal government, have to have a balanced budget,” Knochelmann told LINK nky in May. “But here's the caveat: By definition, your budget can be balanced by your reserves.”

A county can use its reserve cash to balance a budget if its expenditures exceed its revenue. The problem, Knochelmann said, is when a jurisdiction becomes too dependent on its reserves to keep the budget balanced. It’s unsustainable as a financial model.

“Kenton County has been squeezed financially” over the past 20 years or so through the terms of multiple judge/executives, Knochelmann said, and he witnessed the county’s attempts to rein in expenditures during his time as a county commissioner before he became judge/executive.

“We cut and we cut, and we didn't spend,” Knochelmann said. “We balanced the budget, and we got by. And so the point is, eventually you can't get down and scrape to the very bottom of the barrel forever.”

Eventually, Knochelmann said, “We've got to pay people. We’ve got to invest in our equipment.”

According to Knochelmann, the two biggest expenses for the county are the Kenton County Detention Center and the county roads. Financial statements indicate that both the county’s road fund and the jail fund usually spend more money than they make, although the gaps began to close in the last fiscal year.

Historically speaking, the roads have been funded largely with taxes on insurance, and the jail has gotten its funding from a combination of reimbursements from the state, grants and funding from other funds in the budget. The statements don’t break down exactly which funds funneled revenue into the jail, but they indicate that the jail fund got about $11 million of its $17 million total revenue from other county funds in fiscal year 2022.

Prior to July 1, occupational tax collections were shuttled into a separate fund in the budget, called the county occupational li-

cense tax, or COLT, fund.

The fiscal court recently released its budget appropriations for fiscal year 2024. The budget projections show that occupational taxes will be moved instead into the county’s general fund. Kenton County has apportioned about $24 million in occupational tax collections for the 2024 fiscal year, compared to the roughly $17 million apportioned in the previous year. Much of the money is being labeled under the “contingent appropriations” category, which usually refers to money that hasn’t yet been assigned to a specific operation.

For his part, Knochelmann defended both his coordination with McDaniel and his rationale for increasing the rates.

“It's about being an adult in the room and saying you’ve got to pay your bills,” Knochelmann said. “I don't care if you're Dem-

SEPTEMBER 1, 2023 5 WE’VE GOT YOU COVERED Hail Damage • Wind Damage Roof Repair • Roof Replacement CALL OR TEXT 859.287.2499 | WWW.TIPTOPROOF.COM Continues on page 6

A chart showing the approximate percentage breakdowns of occupational and property taxes for Kenton and surrounding counties, produced and presented to the Kenton County Fiscal Court by Treasurer Roy Cox on Nov. 8. Charts provided | Kenton County Fiscal Court

Continued from page 5

ocrat or Republican. These are basic-level services that you can't do without.”

He expounded on the sorts of services he meant: Even if the county doesn’t provide city-based policing, for example, it's still responsible for the detention center and dispatch services.

He also was skeptical of Meyer’s concern that the change would drive out potential businesses and job creators.

At the January mayors meeting, he said, “It doesn’t affect economic development.”

On the contrary, he argued. Improved financial stability across the county would do more to draw in new businesses, which would be attracted to the region’s communal stability.

And, he reiterated, the adjustments to occupational taxes would allow the county to reduce its property taxes.

Recent meetings of the Kenton County Fiscal Court seem to bear this out. At a meeting on Aug. 15, the court completed a first reading of the new fiscal year’s county property tax rate — 13.3 cents for $100 of property a resident owns. This would be a reduction from last year’s rate of 14.4 cents per $100. It’s also below the compensating rate — or the rate needed to draw in the same amount of revenue in the preceding year — of 13.4 cents per $100.

The court was scheduled to complete a second reading and vote on the new rate on Aug. 29.

“When I leave this government, this Kenton County will be in the best financial position it's been in in probably 50 years,” Knochel-

mann said. “And that's what I want.”

As it relates to both the county ordinance and state legislation, “They're definitely abiding by what I would say was the legislative intent back in the 20th century that subsequently was changed, which kind of changed the financial trajectory of the county,” McDaniel said. “I'm happy to see that they're trying to make that shift towards fairness.”

What does this mean for the future?

Knochelmann admitted that the reality of the new revenue generation won’t be truly understood for several months once collections and accounts have been reconciled, and he said that he would be open to adjusting the rate and caps in the future if warranted.

Although not every community in Kenton County will be equally affected by the tax increase, larger metro areas like Covington and Erlanger that rely on businesses for their income aren’t happy.

Meyer, for one, isn’t buying the county’s rationale that it needs the money to provide services, especially since Kenton County, compared with other counties in Kentucky, is much more carved up in terms of which jurisdictions provide which services.

“Jefferson and Fayette counties happen to be consolidated governments, where the county government is responsible for all the city services. Boone County is functionally the same way because they just have the three cities,” Meyer said. “In Kenton County, the fiscal court does not offer city services. They don't offer a single quality-of-life service. … The water district and the sanitation district are independent regional bodies that are financially self-sufficient. So they're going way beyond their role as a limited, restricted government.”

Regular people who live and work in Kenton County are already seeing their takehome finances affected.

“Roughly, somebody who makes $80,000 a year is going to pay an additional $550 in tax” per year, said Dawn Hayes, tax manager with Payroll Partners Inc., an Alexandria-based payroll processing firm.

Payroll Partners services about 500 businesses in Kenton County. Hayes offered insight into how the new taxes have affected residents and businesses, as well as observations on the county’s business landscape broadly.

Hayes put a caveat on her previous statement by saying, “Kenton County had extremely low rates and a low wage base to begin with.” In other words, the amount of money Kenton County took in from wages was low compared to other jurisdictions.

In addition, the pandemic brought changes to labor arrangements with the expansion of work-from-home policies, which had the effect of drawing payroll tax revenue out of the local area as people began generating payroll tax revenue where they were completing their work, which was often outside of the county cities, Hayes said.

Covington has already felt the pains of dwindling payroll tax generation due to work-from-home policies. The city’s largest employer, Fidelity, which employs about 5,500 people out of its Covington office, only requires its employees to be in the office five days out of the month. This means that if they’re not working in Covington’s office, the city isn’t collecting taxes on their wages. The same is true if they’re not working in Kenton County.

The changes haven’t affected Kentucky alone.

15% % %

10

6 SEPTEMBER 1, 2023 BEFORELeafFilter AFTERLeafFilter THE NA TION’ S GUTTER GUARD1 EXCLUSIVE LIMITED TIME OFFER! Promo Code: 285 FREE GUTTER ALIGNMENT + FREE GUTTER CLEANING* 1-844-691-0350 CALL US TODAY FOR A FREE ESTIMATE Mon-Thurs: 8am-11pm, Fri-Sat: 8am-5pm, Sun: 2pm-8pm EST INSTALLS ON NEW & EXISTING GUTTERS LIFETIME WARRANTY CLOG-FREE GUTTERS FOREVER **Wells Fargo Home Projects credit card is issued by Wells Fargo Bank, N.A., an Equal Housing Lender. Special terms for 24 mo. apply to qualifying purchases of $1,000 or more with approved credit. Minimum monthly payments will not pay off balance before end of promotional period. APR for new purchases is 28.99%. Effective 01/01/2023 - subject to change. Call 1-800-431-5921 for complete details.2The leading consumer reporting agency conducted a 16 month outdoor test of gutter guards in 2010 and recognized LeafFilter as the “#1 rated professionally installed gutter guard system in America.” *For those who qualify. One coupon per household. No obligation estimate valid for 1 year. Offer valid at time of estimate only. See Representative for full warranty details. Manufactured in Plainwell, Michigan and processed at LMTMercer Group in Ohio. AR #0366920922, CA #1035795, CT #HIC.0649905, FL #CBC056678, IA #C127230, ID #RCE51604, LA #559544, MA #176447, MD #MHIC148329, MI # 2102212986, #262000022, #262000403, #2106212946, MN #IR731804, MT #226192, ND 47304, NE #50145-22, NJ #13VH09953900, NM #408693, NV #0086990, NY #H-19114, H-52229, OR #218294, PA #PA069383, RI #GC-41354, TN #7656, UT #10783658-5501, VA #2705169445, WA #LEAFFNW822JZ, WV #WV056912. APR FOR 24 MONTHS** SENIORS & MILITARY! YOUR ENTIRE PURCHASE * + + 0

OFF OFF

A chart comparing the total money brought in vs. total money spent by Kenton County. Data provided | Kenton County Fiscal Court. Chart by Nathan Granger

“Cincinnati has a $9 million budget shortfall, and a lot of Cincinnati’s issues are also related to shifting to work from home,” Hayes said. Official statements from the city of Cincinnati indicate an expected $9.5 million deficit by fiscal year 2025, which officials attributed to work-from-home policies.

Other jurisdictions, such as Union in Boone County, have also instituted payroll tax increases to offset the revenue lost due to changing labor policies, Hayes said. Some jurisdictions, such as Mason County, have instituted their first occupational taxes in an effort to prevent deficits.

Payroll Partners itself offers flexible work arrangements for its people, depending on their jobs, Hayes said.

“We have businesses that are moving out of downtown, industrial areas of major cities,” Hayes said, “and they are struggling with the budget deficits that creates.”

This situation has the potential to create a grim feedback loop — changes in labor policies reduce payroll tax income, which leads to budget shortfalls, which can prompt jurisdictions to increase their tax rates to offset the losses, which can drive out more business, potentially reducing revenue even more.

2022 Rates

Even with Kenton County’s projected increase in occupational tax collections, projected overall revenues for the county are expected to decline by about $11 million in the 2024 fiscal year. The 2024 budget book suggests that property tax collections will be roughly the same as in 2023.

For many who have leveled criticism at the county, the issue is less about the numbers and more about the way in which they’ve been ramped up.

Hermes, who also spoke directly with LINK nky in August, admitted that understanding tax policies and trying to compare them across jurisdictions is difficult.

“You can’t look at one piece and say, ‘Oh, well, we’re not competitive because of this one tax,’” Hermes said. “You have to look at the whole thing, and people don’t do it typically because it’s not easy to look at.”

Hermes believed that the county’s projections were likely speculative based on conversations he’d had with leaders in his network.

Still, the overall increase, both in the cap and the rate, boggled his mind.

“It’s obscene,” Hermes said.

2023 Rates

SEPTEMBER 1, 2023 7 Julie Bishop Authorized Clearlight® Dealer | thesaunalife.com | 513-309-2527 BUY FROM A LOCAL DEALER! SCAN FOR LINK’S EXCLUSIVE INTERVIEW WITH JULIE BISHOP

Employee Withholding Employer or Business Fee License Fee Phone City Rate Wage CAP Net/Gross Rate Min Fee Max Fee Business License Renewal Fee 859 392-1440 Countywide Business License Option $225 859 392-1440 Bromley .01 Gross .00125 n/a n/a $50 859-292-2180 Covington .0245 FICA CapNet .025 n/a $40,000 $50 859 392-1440 Crescent Springs .01 Gross .00075 n/a n/a $50 859 392-1440 Crestview Hills .0115 FICA Cap Gross .00075 n/a $40,000 $50 859 392-1440 Edgewood .01 Net .0075 $50 n/a $50 859 392-1440 Elsmere .0125 Net .01 $50 $15,000 $50 859 392-1440 Erlanger .015 Gross .00075 n/a $40,000 $50 859 392-1440 Fort Mitchell .0125 Gross .00075 n/a n/a $50 859 392-1440 Fort Wright .0099 FICA CapGross .00075 n/a n/a $50 859 392-1440 Independence .0125 Gross .00075 n/a n/a $50 859 392-1440 Lakeside Park .01 Gross .0075 n/a n/a $50 859 392-1440 Ludlow .02 Gross .00132 n/a n/a $50 859 392-1440 Park Hills .015 Gross .00125 $25.00 n/a $50 859 392-1440 Ryland Heights .01 Net .01 n/a n/a $50 859-392-1440 Taylor Mill .02 Net .02 n/a n/a $50 859 392-1440 Villa Hills .015 Gross .00075 n/a n/a $50 859 392-1440 Kenton County .007097 Under $25K Net Under $37.5K .007097 n/a $266.14 n/a 859 392-1440 Kenton County .001097 Over $25K FICA Cap Net Over $37.5K .001097 n/a $120.12 n/a

Employee Withholding Employer or Business Fee License Fee Phone City Rate Wage CAP Net/Gross Rate Min Fee Max Fee Business License Renewal Fee 859 392-1440 Countywide Business License Option $225 859 392-1440 Bromley .01 Gross .00125 n/a n/a $50 859-292-2180 Covington .0245 FICA CapNet .025 n/a $40,000 $50 859 392-1440 Crescent Springs .01 Gross .00075 n/a n/a $50 859 392-1440 Crestview Hills .0115 FICA Cap Gross .00075 n/a $40,000 $50 859 392-1440 Edgewood .01 Net .0075 $50 n/a $50 859 392-1440 Elsmere .0125 Net .01 $50 $15,000 $50 859 392-1440 Erlanger .015 Gross .00075 n/a $40,000 $50 859 392-1440 Fort Mitchell .0125 Gross .00075 n/a n/a $50 859 392-1440 Fort Wright .0099 FICA CapGross .00075 n/a n/a $50 859 392-1440 Independence .0125 Gross .00075 n/a n/a $50 859 392-1440 Lakeside Park .01 Gross .0075 n/a n/a $50 859 392-1440 Ludlow .02 Gross .00132 n/a n/a $50 859 392-1440 Park Hills .015 Gross .00125 $25.00 n/a $50 859 392-1440 Ryland Heights .01 Net .01 n/a n/a $50 859-392-1440 Taylor Mill .02 Net .02 n/a n/a $50 859 392-1440 Villa Hills .015 Gross .00075 n/a n/a $50 859 392-1440 Kenton County .009097 Under $80,100 Net Under $80,100 .009097 n/a $728.67 n/a 859 392-1440 Kenton County .001097 Over $80,100 FICA Cap Net Over $80,100 .001097 n/a $87.87 n/a

Chart showing the city and county occupational tax rates for 2022 and 2023. Charts provided | Kenton County Fiscal Court

to calculate your occupational tax rate: Step 1: Add your city tax rate to your county tax rate Step 2: multiply that number by your total annual wages 1-866-503-3111 Dental50Plus.com/Linknky Product not available in all states. Contact us to see the coverage and offer available in your state. Contact us for complete details about this insurance solicitation including costs and limitations. This specific offer is not available in CO. Call 1-800-969-4781 or respond for a similar offer. In WV: To find a provider in the network visit us at https://www.physiciansmutual.com/web/dental/find-dentist Certificate C250A (ID: C250E); Insurance Policy P150; Rider Kinds B438/B439. In CA, CO, ID, KY, ME, MD, MA, MI, MO, NV, NJ, NC, ND, VA: Includes Participating Providers and Preventive Benefits Rider. Certificate C254/B465 (PA: C254PA); Insurance Policy P154/B469 (GA: P154GA; OK: P154OK; TN: P154TN). from Physicians Mutual Insurance Company. 6323 Get your FREE Information Kit DENTAL Insurance

How

Kenton County mayors tell state legislators about concerns over road improvements

BY NATHAN GRANGER | LINK nky KENTON COUNTY REPORTER

Legislators joined the Kenton County Mayors Group on Aug. 19, as the local leaders discussed the county’s need for road improvements, especially along state-controlled roads over which cities don’t have jurisdiction.

The mayors expressed to Rep. Steve Doan (R-Erlanger) and Sen. Shelley Funke Frommeyer (R-Alexandria) their concern that changes were being decided upon and implemented at the state level without local leaders’ input or knowledge.

“One of the concerns I’ve had is that the state has these plans out to do some things, but we don’t find out about them until it’s too late to stop them or too late to make any adjustments,” said Crestview Hills Mayor Paul Meier.

Fort Wright Mayor David Hatter shared Meier’s concerns.

“At one point, long before you (Doan) were involved in this job, the state just came in to block off Park Road in Fort Wright, resurfaced the thing, and it looked like something out of the back woods in West Virginia,” Hatter said. “There was no advance warning. They just did it.”

Walton Mayor Gabe Brown asked Doan if there was any discussion at the state level of breaking up District 6 of the Kentucky Transportation Cabinet, which currently spans 11 counties.

“It seems like District 6 has, you know, a lot of irons in the fire, so to speak,” Brown said.

Doan said that he was not aware of any plans to break up the district.

He said the district road plans would appear in a budget bill in January, and that representatives had received preliminary documents related to road plans in their districts. The documents had come following some early committee meetings, and had not yet been released to the public, although representatives were allowed to share them with city officials.

“We went through some of those major priorities that either I’ve heard from my mayors or my city council members,” Doan said, “or just from

our general people on the streets and things that I’ve recognized in my district.”

Doan added that representatives had to balance the need for road safety with the desire for economic development and that he had been communicating with local officials to get input before the next round of meetings in Frankfort. He encouraged the city leaders to contact their representatives with concerns.

Taylor Mill Mayor Daniel Bell asked for updated data on road improvement funding allocations.

“What kind of per capita spend are we getting in Kenton County on road improvements?” Bell asked.

He also expressed a desire for continued improvements along KY 536, which he said would serve as an alternative to Interstate 275 as an east-west corridor through the county.

“I think that needs to be done yesterday,” Bell said.

Frommeyer said that group members had been quite noisy about that topic.

“And we’re making some progress,” she said. “The right-of-way acquisition is somewhere around $26 million.”

Independence Mayor Chris Reinersman affirmed Bell’s comments about east-west access.

“We have to keep pushing 536 all the way to

Campbell County,” Reinersman said. “It’s so valuable for that cross-county access.”

Brown asked about a southern connection to Interstate 471 that was discussed during Gov. Matt Bevin’s tenure but seemed to have evaporated afterward. Bevin left office in 2019.

Frommeyer said there had been some discussion about it at the state level, but the project was contingent on commitments from Ohio.

There was also discussion about emergency services access to Interstate 75 during construction of the Brent Spence Bridge companion bridge.

Frommeyer said one of the ongoing challenges of building new roads in the region is the hilly and mountainous terrain, which carries with it safety risks and high costs.

Bell said that this justification had the potential to become a stalling tactic.

“I want to caution our representatives,” Bell said. “I was in Somerset recently, and they’re building a $750 million highway through tough topography.”

The point, Bell said, is that leaders need to buckle down and say, “No, this is where people live.”

“And this is what we need in order for us to move about our business and bring more business into the state,” Bell said. “Topography should no longer be an excuse for that.”

8 SEPTEMBER 1, 2023 Whether you are home or away, protect what matters most from unexpected power outages with a Generac Home Standby Generator. REQUEST A FREE QUOTE CALL NOW BEFORE THE NEXT POWER OUTAGE *To qualify, consumers must request a quote, purchase, install and activate the generator with a participating dealer. Call for a full list of terms and conditions. (859) 880-7361 7-year Extended Warranty* – A $735 Value! FREE Contact a Generac dealer for full terms and conditions $0 MONEY DOWN + LOW MONTHLY PAYMENT OPTIONS

The KY 8 Licking River Bridge is one of the projects that Kentucky Transportation Cabinet District 6 is prioritizing. Photo provided | KYTC

NKwhy: What are the rules for road-legal golf carts?

BY MAGGY MCDONEL | LINK nky DIGITAL EDITOR

If there’s one thing that can unite Northern Kentuckians, it’s frustrations over parking and traffic. One way local municipalities are looking to alleviate those issues is by allowing golf carts on roads.

Ordinances that allow golf carts to take to the roadways have gained popularity in the past few years, with various versions popping up in Boone, Kenton and Campbell counties.

Boone County and Fort Thomas passed ordinances in 2019. Bellevue passed an ordinance in 2022. Other cities, like Ludlow, have had them since 2012.

While some ordinances further out in the burbs allow people to travel to and from golf courses in their neighborhoods, the focus of more urban spots looks to alleviate parking and traffic congestion.

How do you become a golf cart person?

Rules around registering golf carts for the road are relatively standard for most places with golf cart ordinances on the books. The carts must have turn signals, headlights and brake lights, seat belts, mirrors, parking brakes and a horn. While there are some differences between municipalities, these rules are pretty much the norm.

In Boone County, roads and neighborhoods must register to allow for golf carts. Boone County Public Information Officer Philip Ridgell said that roads and neighborhoods must go through an “application process to

be brought before the fiscal court for that area to be designated for the use of golf carts on the roadways.” Once that approval is granted, residents can start applying for road approval for their carts.

To approve these golf cart allowances, there “has to be buy-in from the community at large,” Ridgell said. He said this is important because “one or two people can change the daily driving or the daily habits of an entire community that has tens of thousands (of people).”

However, for locations like Fort Thomas, there is a citywide allowance for all roads under 30 miles per hour.

In most places, carts must be inspected by law enforcement to ensure that they follow all the requirements. Cart drivers must follow all the rules of the road, the driver must

be licensed, and the vehicle needs to be insured. Most drivers are insured through their home insurance, Fort Thomas city council member Jeff Bezold told LINK nky.

The parking problem

Part of the appeal for road-legal golf carts is the parking. By their nature, golf carts are smaller than cars, so there are more spaces to park along popular roadways.

The original inspiration for Fort Thomas’s golf cart ordinance was to help with parking issues on one of the town’s business roads. Bezold said the “biggest complaint up there is a parking situation” regarding a section of South Fort Thomas Avenue lined with business and lacking in parking. In the future, he said Fort Thomas is looking to add permanent golf cart parking spots throughout town.

Bellevue recently amended its golf cart ordinance to allow carts on Fairfield Avenue, a main thoroughfare dotted with bars, restaurants, retailers and homes.

Previously, carts could cross Fairfield Avenue at a light in an intersection but couldn’t drive up and down the street. City Council voted at a meeting in August to amend the ordinance with no restrictions. The city could have chosen to restrict the carts on the avenue from sunup to sundown but decided not to do so.

Council member Sean Fischer mentioned the lack of parking or space for everyone to have a full-size vehicle at a July council meeting. He said the golf cart ordinance solved some urban problems and environmental challenges.

Safety concerns

Bellevue’s recent amendment wasn’t favored by all. Bellevue City Administrator Frank Warnock said at the June meeting the police and fire chiefs were against allowing golf carts on the avenue due to safety concerns.

“The police chief said, ‘No, don’t do it.’ The fire chief said, ‘No, don’t do it,’” Warnock said. “Their interest is public safety, and they don’t want to see people get hurt on Fairfield Avenue.”

On the other hand, Fischer said at the July 12 meeting that he understood the safety concerns but said when he thinks about Bellevue, it is multimodal.

SEPTEMBER 1, 2023 9

An example of the kind of cart driven around Fort Thomas. Photo provided | Unsplash

kenton county news briefs

Ludlow schools honor senior for graduation after rough year: ‘He finished; he saw it through’

program through Job Corps Cincinnati and the local trade union.

“He finished,” Caudill said. “He saw it through, just plugging away, and I’m really proud of him for doing that.”

founder Dan Cronican said in a press release. “We look forward to serving you at Keystone’s Mac Shack and our 4EG bar locations for years to come.”

Keystone Bar & Grill in Covington to close Sept. 1, plans “Last Bash” in final week

DESERVE the best

The Ludlow Independent Schools Board of Education and Ludlow High School Principal Travis Caudill honored the graduation of a senior, Colin McDaniel, who earned his diploma despite personal hardship on the last day the district could grant a diploma, July 31.

“Colin went through a rough patch this year, and he grinded for us, and he found a way to see it through. With Colin, we were able to get every single person, every single senior who started last year with us to finish the year with us, earning a diploma,” Caudill said.

Now that McDaniel has his diploma, he has enrolled in a carpentry apprenticeship

A popular comfort food restaurant in Covington is set to permanently close its doors after 16 years in business.

Keystone Bar & Grill will end operations on Sept. 1, according to the Covington Economic Development Authority. The restaurant posted a farewell message detailing its closure plans on its Facebook page.

Currently, the restaurant is advertising “Keystone’s Last Bash” on Facebook. The event will celebrate Keystone’s many years doing business in Covington’s Roebling Point district.

It will kick off on Monday, Aug. 28, and last through Friday, Sept. 1. The establishment’s

last weekend brunches are scheduled to be served on Aug. 26 and 27. The events will last from 11:30 a.m. to 10 p.m., according to the Facebook post.

Founded in 2007 by Cincinnati-based Four Entertainment Group (4EG), the restaurant operated out of its 313 Greenup St. location for 16 years. 4EG said in a press release that it is working with private-party hosts and catering customers to find alternate venues for upcoming events, which will no longer be scheduled.

Keystone is no longer listed on 4EG’s website under Northern Kentucky businesses. The other two regional establishments the group operates are The Buzz and Beeline — both in Newport on the Levee.

“Thank you again for all of your support of Keystone Bar & Grill throughout the years,”

Despite the closure, 4EG said that its signature mac-and-cheese will live on at Keystone’s Mac Shack, located on Short Vine Street in Cincinnati and South Court Street in Athens, Ohio.

In the early 2010s, Keystone expanded across the river into Cincinnati, opening a Clifton location in U Square at the Loop and another in Hyde Park. Both locations eventually closed for good.

Most recently, its Hyde Park location ceased operations in December 2021. It initially closed in 2019 but reopened to serve carryout during the COVID-19 pandemic.

Covington Police investigate stabbing near St. Elizabeth, have arrested suspect

Covington police are investigating a stabbing near St. Elizabeth Covington, according to a release from the department.

10 SEPTEMBER 1, 2023

Cincinnati Craig Reis, owners CUSTOM DESIGN SERVICES AVAILABLE

furnished model Residences at One Sundays 1-3pm 859.441.2378 • BestFurnitureGallery.com • 1123 S. Ft. Thomas Ave. • Fort Thomas, KY MONDAY 10AM-8PM | TUESDAY, THURSDAY, FRIDAY 10AM-6PM | WEDNESDAY by appointment only SATURDAY 10AM-5PM | SUNDAY closed to be with family Some items shown in ad are for example only and may not be available for purchase

Left to right: Colin McDaniel and Ludlow Independent Schools Board of Education President Wes Dorger. Photo by Nathan Granger | LINK nky

Police were called to the scene a little before 6 a.m. on Aug. 22, police said. The victim was taken to the University of Cincinnati Medical Center and is in stable condition.

A person matching the suspect’s description was located by officers near the Roebling Suspension Bridge, police said, and is currently being held for questioning.

Anyone with information is asked to contact Det. Andrews at 859-292-2271 or Cincinnati/NKY Crime Stoppers at 513-3523040.

Workforce development leaders discuss ‘social determinants of work’ during recent event

The Northern Kentucky Workforce Investment Board held its Partner for Success event on Aug. 10. Angela Jackson, founder of Future Forward Strategies — a labor market intelligence, design thinking and strategy firm — joined local workforce development stakeholders to discuss what she called the social determinants of work.

The social determinants of work consist of social and environmental conditions that influence a person’s ability to get and keep a job. In her presentation, Jackson outlined these conditions: job flexibility, healthcare, childcare, transportation, sustained education, home and community health, broadband access, and access to justice.

In addition to Jackson’s overview, several local leaders talked about addressing common barriers to employment, such as problems with stable housing, reliable transportation and employee health.

Presentation of design ideas for 4th Street Bridge project draws protesters in Covington

The Kentucky Transportation Cabinet gave a presentation on Aug. 22 on the progress of the 4th Street Bridge replacement project at a meeting of the Covington Board of Commissioners.

The meeting and presentation drew large numbers of critics from the Coalition for Transit and Sustainable Development and the Devou Good Foundation, who spent the weeks leading up to the meeting pushing for their own vision of the bridge replacement.

About 50 people, some of whom held signs

with slogans and graphics, filled the commission chambers to hear the presentation and express their concerns. As people took their seats, Mike Bezold and Cory Wilson, project managers with the cabinet, approached the podium to talk about potential designs for the new bridge.

“We’re here today to show you four concepts that Rosales + Partners have developed for the 4th Street Bridge,” Bezold said. “So we can just get you informed, keep you informed (and) get your opinions as to how you think the community needs to look and function before any kind of decision is made on these concepts.”

The current bridge is old, built in the 1930s, and connects the cities of Covington and Newport across the Licking River along KY 8. The cabinet has classified the bridge as functionally obsolete, although heavy vehicle, pedestrian and bicycle traffic continue to travel over the bridge daily.

Functionally obsolete bridges are still operational but do not conform to modern standards.

“A functionally obsolete bridge is likely not wide enough or tall enough to accommodate current vehicle sizes, weights and traffic volumes,” according to the Transportation Cabinet.

Sidewalks on the bridge are small and not up to the standards of the Americans with Disabilities Act, making crossing difficult for people who use wheelchairs or have other mobility limitations. In addition, the narrow drive lanes and concrete barriers separating the road from the walkways make the bridge dangerous for cyclists.

The cabinet formed an aesthetics committee composed of state and local public officials, historic preservation experts and representatives from the contracted businesses involved in the project earlier this year. The committee met for the first time at the end of May, but its meetings are not open to the public.

You can watch the full local meeting that drew opposition, including KYTC’s presentation and the question-and-answer portions of the meeting, at the Telecommunications Board of Northern Kentucky’s website, tbnk.org.

For more information on the 4th Street Bridge project, visit ky8bridge.org or email the Kentucky Transportation Cabinet at info@ky8bridge.org.

NOTICE OF PUBLIC HEARING

Pursuant to KRS 132.027, the City of Villa Hills will hold a public hearing on the 13th day of September 2023 at 6:30 p.m. The meeting will be held at 719 Rogers Road, (in Council Chambers) for the purpose of hearing comments from the public regarding the institution of proposed tax rates for the 20232024 Fiscal Year.

As required by law,

The City of Villa Hills proposes to exceed the compensating tax rate by levying a real property tax rate of .230 (per $100.00 of assessed value) and a personal property tax rate of .102 (per $100.00 of assessed value). The excess revenue generated will be utilized for the following purposes:

For ordinary municipal purposes and to pay the general cost of carrying on the business of government of the City of Villa Hills.

THE

GENERAL ASSEMBLY HAS REQUIRED PUBLICATION OF THIS ADVERTISEMENT AND THE INFORMATION CONTAINED HEREIN.

SEPTEMBER 1, 2023 11

KENTUCKY

H. JANSEN, MAYOR CITY OF VILLA HILLS Tax Rate Revenue (Per $100.00 of Assessed Value) .223 (real property) $1,873,372 .065 (personal property) $11,172 .222 (real property) $1,966,635 .098 (personal property) $11,730 .230 (real property) $2,037,505 .230 (real property) $96,310 .102 (personal property) $12,199 Preceding Year’s Rate & Revenue Generated Compensating Rate & Revenue Expected Tax Rate Proposed & Revenue Expected Expected Revenue Generated from New Property (Included in Revenue Expected above) Expected Revenue Generated from Personal Property Medicaid

Log onto kynect.ky.gov or call 855-4kynect and give us your current contact information so we can reach you. Stay in touch. Stay covered. Stay healthy.

HEATHER

renewals are happening.

news from other places

Soccer coach in Spain faces scrutiny for touching female assistant on chest in celebration

MADRID (AP) — The coach of Spain’s Women’s World Cup champion soccer team is facing scrutiny after footage emerged showing him touching the chest area of a female assistant while celebrating the only goal of the final.

Jorge Vilda was celebrating with three of his assistants when his hand made contact with the chest of the woman. She was wearing a coat.

Meanwhile, FIFA suspended Spanish soccer federation president Luis Rubiales while its investigates his conduct, which included kissing player Jenni Hermoso on the lips without consent after Spain's victory.

Labor Department officials cited issues at the stores, including blocked exits, unsafe storage of materials and improper access to fire extinguishers and electrical panels.

The department said that the chains operated by Dollar Tree Inc. are required to make changes to correct, within two years, violations cited by the Occupational Safety and Health Administration.

Dollar Tree and Family Dollar have also agreed to pay $1.35 million in penalties to settle existing contested and open inspections of similar alleged violations — and face hefty violations for any future offenses.

Army rescuers save 8 people trapped in cable car dangling above canyon in Pakistan

PESHAWAR, Pakistan (AP) — Army commandos using helicopters and a makeshift chairlift rescued eight people from a broken cable car as it dangled hundreds of meters (feet) above a canyon in Pakistan.

Authorities said the rescues were completed late Aug. 22 in a remote, mountainous part of the country. The six children and two adults became trapped when a cable snapped while they were crossing a river canyon. The children were on their way to school. The Pakistani prime minister congratulated rescuers for the success.

The dramatic effort transfixed the country for hours as Pakistanis crowded around televisions in offices, shops, restaurants and hospitals.

Tennis legend Serena Williams gives birth to second child, a daughter named Adira

her husband, Reddit co-founder Alexis Ohanian. Their first, Olympia, was born in 2017. Williams won 23 Grand Slam singles titles during a career that transcended her sport. She revealed at the Met Gala in May that she was pregnant.

More than 200 don inflatable T. rex costumes, run popular race at Seattle horse track

Dollar Tree, Family Dollar must improve safety, pay $1.35M fine after settlement

NEW YORK (AP) — U.S. regulators have announced a settlement with the company that runs Dollar Tree and Family Dollar, aimed at improving worker safety at thousands of the bargain stores across the country.

Serena Williams said she has given birth to a baby girl almost exactly a year after her last match as a tennis star.

Williams posted on Instagram a picture of herself, her husband, newborn Adira River Ohanian and the family’s first child.

Adira is the second child and second daughter for the 41-year-old Williams and

AUBURN, Wash. (AP) — A track for live horse racing in suburban Seattle turned prehistoric in late August as more than 200 people ran down the track cloaked in inflatable Tyrannosaurus rex dinosaur costumes.

The 2023 T-Rex World Championships at Emerald Downs on Aug. 20 ended in a photo finish, with three competitors hitting the finish line together. Ocean Kim from Kailua, Hawaii, took top honors.

The event started in 2017 as a pest control company’s team-building activity. Racers came from more than a half-dozen states to compete.

12 SEPTEMBER 1, 2023

Spain’s head coach Jorge Vilda shows his gold medal after winning the Women’s World Cup soccer final against England at Stadium Australia in Sydney on Aug. 20. Photo by Alessandra Tarantino | Associated Press

Racers, including eventual winner Ocean Kim (5), leave the gates for the championship race during the “T-Rex World Championship Races” at Emerald Downs in Auburn, Washington, on Aug. 20.

Photo by Lindsey Wasson | Associated Press

For more events, scan the QR code or visit: https://linknky.com/events/

Union City Commission meeting, 6 p.m., Union City Building, 1843 Bristow Drive, Union

Edgewood City Council meeting, 6:30 p.m., Edgewood City Building, 385 Dudley Road, Edgewood

Wilder City Council meeting, 7 p.m., Wilder City Building, 520 Licking Pike, Wilder

Kenton County Board of Education meeting, 7 p.m., Kenton County Sanitation Department, 1045 Eaton Drive, Fort Wright

Independence City Council meeting, 7 p.m., Independence City Building, 5409 Madison Pike, Independence

Florence City Council caucus meeting, 6 p.m., Florence City Building, 8100 Ewing Blvd., Florence

Covington City Commission caucus meeting, 6 p.m., Covington City Hall, 20 W. Pike St., Covington

Dayton City Council meeting, 7 p.m., Dayton Community and Meeting Center, 625 Second Ave., Dayton

Highland Heights City Council meeting, 7 p.m., Highland Heights City Building, 176 Johns Hill Road, Highland Heights

Erlanger City Council meeting, 7 p.m., Erlanger Municipal Building, 505 Commonwealth Ave., Erlanger

Campbell County Fiscal Court, 9 am., Alexandria Courthouse, 8352 E. Main St., Alexandria

Laugh and Learn, 10 a.m., Boone County Cooperative Extension Office, 6028 Camp Ernst Road, Burlington

Southgate City Council meeting, 6:30 p.m., Southgate City Building, 122 Electric Ave., Southgate

Boone County Planning Commission meeting, 7 p.m., Boone County Administration Building, 2950 Washington St., Burlington

Alexandria City Council meeting, 7 p.m., Alexandria City Building, 8236 W. Main St., Alexandria

SEPTEMBER 1, 2023 13 calendar Friday Saturday Sunday Monday Tuesday Wednesday Thursday 06 02 05 01 07 03 04

September

real estate

Historic townhome offers 3-story grand staircase, stunning bathrooms

Address: 613 Greenup St., Covington

Price: $710,000

Bedrooms: Four

Bathrooms: Four

Square feet: 3,738

School district: Covington Independent Schools

County: Kenton

Special features: Built in the 1800s, this townhome is a historic property that has been restored to include modern amenities without sacrificing its original character and charm. As soon as guests walk in the door, they are greeted by a grand staircase that spans the home’s three stories. On the main level is an open-concept kitchen and living room. The kitchen has also been refinished to include a large island in the center with quartz countertops. The primary bathroom in this three-and-a-half bathroom house has a beautiful standing shower with bold tile and dual shower heads. Outside is a backyard that leads to a detached garage with privacy fencing to divide the unit from its neighbors.

14 SEPTEMBER 1, 2023

This townhome in Covington blends modern amenities with original charm. Photo provided | Joseph Stevie via Sparen Realty

The primary bathroom has a standing shower with high-contrast herringbone tile. Photo provided | Joseph Stevie via Sparen Realty

Whitney Jolly-Loreaux 859.380.5811 Wjolly-loreaux@huff.com Jollyhometeam.com

400 Riverboat Row 904 Newport $639,000 8/17/2023 5037 Loch Drive Union $467,500 8/21/2023 4778 Woolper Road Petersburg $350,000 8/18/2023 13 Observatory Avenue Bellevue $315,000 8/21/2023 6 Sargeant Drive Dayton $270,000 8/16/2023 4178 Farmwood Court Erlanger $265,000 8/16/2023 1168 Gemstone Pointe Drive Walton $250,000 8/18/2023 1111 Mount Allen Road Park Hills $250,000 8/21/2023 3131 Riggs Avenue Erlanger $240,000 8/16/2023 58 Mccullum Road Independence $238,500 8/17/2023 846 Ridgepoint Drive Independence $215,500 8/17/2023 7485 Flintshire Drive Alexandria $215,000 8/18/2023 2662 Van Deren Drive Lakeside Park $202,000 8/17/2023 2256 Devlin Place 201 Crescent Springs $200,000 8/18/2023 613 Ivy Ridge Drive Cold Spring $193,000 8/18/2023 2357 Rolling Hills Drive Covington $188,000 8/22/2023 1180 Waterworks Road Newport $162,500 8/17/2023 431 Buckner Street Elsmere $145,000 8/21/2023 21 Dortha Avenue Florence $130,000 8/18/2023 1511 Madison Avenue Covington $70,000 8/18/2023 314 Boone Street Bromley $215,000 8/1/2023 2541 Crosshill Drive Crescent Springs $252,745 7/27/2023 2532 Crosshill Drive Crescent Springs $299,802 7/28/2023 2514 Lillywood Way Crescent Springs $560,933 7/28/2023 2529 Crosshill Drive Crescent Springs $217,376 7/31/2023 2560 Crosshill Drive Crescent Springs $214,846 8/4/2023 2554 Crosshill Drive 8-202 Crescent Springs $279,321 8/4/2023 1996 Crescent Terrace Crescent Springs $390,000 8/4/2023 2539 Crosshill Drive 7-102 Crescent Springs $231,898 8/17/2023 2256 Devlin Place 201 Crescent Springs $200,000 8/18/2023 2533 Crosshill Drive 7-102 Crescent Springs $229,056 8/18/2023 868 Cliffrose Court Crescent Springs $504,829 8/18/2023 2523 Crosshill Drive 7-101 Crescent Springs $262,000 8/21/2023 132 Lookout Farm Drive Crestview Hills $407,000 7/25/2023 2702 Main Chase Lane Crestview Hills $264,900 7/25/2023 139 Rossmoyne Drive Crestview Hills $550,000 8/2/2023 192 Shaker Heights Lane Crestview Hills $236,500 8/7/2023 2734 Chancellor Drive 212 Crestview Hills $1,200 8/11/2023 5717 Chinquapin Hill Road Petersburg $210,000 7/28/2023 4778 Woolper Road Petersburg $350,000 8/18/2023 Address City Price Sale Date Address City Price Sale Date Recent NKY

Top Sales of the Week

A wide shot of the kitchen shows its tall cabinets and center island with quartz countertops. Photo provided | Joseph Stevie via Sparen Realty

WHO YOU’RE WITH MATTERS

Home Sale Data

Streetscapes pedals down Monmouth in the name of Kentucky Derby, ‘70s aesthetic

PHOTOS AND STORY BY MARIA HEHMAN | LINK nky CONTRIBUTOR

This Streetscapes covers craft food and drinks, casual ambiance and, of course, coffee. With endless choices along this stretch of Newport, these places can get lost in the shuffle among trendy businesses, so for this Streetscapes, we head back to Monmouth Street.

Trailhead Coffee and Reser Bicycle

On the corner of Monmouth and East Seventh sits Trailhead Coffee and Reser Bicycle. Trailhead Coffee is an extension of Reser Bicycle, a cycling shop for the amateur to the novice cyclist. At Reser, guests can have cleaning and repairs done on bikes they already own or purchase a new one to best suit their needs. For bikers out on a long ride who need to refresh and relax, it’s a perfect oasis in a friendly environment.

For those who aren’t cyclists, there’s still plenty of reasons to visit. The coffee shop is possibly the best place to visit during late summer. It has a walkup window with barstool seating to order coffee, tea and pastries, along with several small tables on the sidewalk.

The walkup window makes for quick and convenient drinks on the go. Cyclists, walk-

ers or those running late to work can all enjoy this option. For people who want to fully recharge and get some work done, there’s also seating indoors. The menu covers the basics of coffee needs, so whether it’s a latte to refuel for a long bike ride or a tranquil tea to accompany a walk, Trailhead Coffee has the answer.

takes this much care in the craft of its cocktails, sometimes even the most traditional drinks are best kept simple.

Non-bourbon fans can enjoy the housemade vodka, as well as a number of outside liquors and beers. Pensive also offers tours and classes for those who really want to dive deep into distilling. On Wednesdays and Thursdays, it offers food specials, while Fridays feature live music. And no Sunday is complete without brunch. Breakfast just got better with bourbon on the menu.

Guests can rent the Pensive space for large parties. It has two indoor spaces and an outside patio available for rent.

Pepper Pod

Pensive Distilling Co. and Kitchen

Originally opened in 2019, Pensive Distilling rebranded in 2021 and has focused on bringing fine distilled spirits to the NKY area. Pensive Distilling pays homage to one of Kentucky’s greatest traditions: the Kentucky Derby. Many of its menu items are named after famous Derby horses. Ordering Justify will give guests homestyle grits with shrimp, in veggie bourbon barbecue sauce. Guests who treat themselves to the American Pharaoh will have a traditional beef burger with caramelized red onion and spicy corn salsa.

The craft drinks are even more creative and a refreshing match to the meal of choice. Since this is Kentucky, after all, there are plenty of house-made bourbon drinks, including the Kentucky-famous mint julep. The Authentic is created with its small-batch, house-made bourbon and house-made mint syrup. When a place

Pepper Pod is one of many greasy-spoon establishments along Monmouth. Since 1970, Pepper Pod has been serving diner-style foods from fried fish to Cincinnati-style chili. It has everything guests crave, and nearly everything on the menu is under $15.

Pepper Pod is a step back in time. The ’70s aesthetic, both inside and out, is practically unchanged since the restaurant’s opening, including a vintage mini-jukebox at every booth.

Pepper Pod became a landmark diner for its all-day breakfast and 24-hour dining. Like many businesses over the past three years, Pepper Pod has had to make some changes, even to decadeslong traditions.

Even with its hours being structured, Pepper Pod still serves its signature fried foods to visitors. It’s one of few places left in NKY that allows smoking inside, a well-known fact to those that frequent. It does have a nonsmoking area, but for newcomers who may want to avoid the smoke, carryout and online ordering are always an option.

What to Know If You Go:

Trailhead Coffee and Reser Bicycle

Location: 648 Monmouth St., Newport

Hours: Monday-Sunday, 8 a.m.-3 p.m.

Phone: 859-261-6187

Website: reserbicycle.com

Pensive Distilling Co. and Kitchen

Location: 720 Monmouth St., Newport

Hours: Monday and Tuesday, closed; Wednesday, 4-9 p.m.; Thursday-Saturday, noon-9 p.m.; Sunday, 10 a.m.-8 p.m.

Phone: 859-360-5579

Website: pensivedistilling.com

Pepper Pod

Location: 703 Monmouth St., Newport

Hours: Monday-Sunday, 7 a.m.-8 p.m. Phone: 859-431-7455

SEPTEMBER 1, 2023 15 features

The walkup window at Trailhead Coffee offers onthe-go orders.

A vanilla latte outside of Trailhead Coffee and Reser Bicycle, which offers both indoor and outdoor seating to relax and recharge.

Pepper Pod’s vintage-vibes exterior matches the atmosphere of the old-school diner.

Victory-filled soccer start with goals galore boosts Villa Madonna’s confidence

BY MARC HARDIN | LINK NKY CONTRIBUTOR

Coach Glenn Rice has been around female soccer players for years. Even though he’s plied his craft at a small school, Villa Madonna Academy has stocked his program with plenty of student-athletes with an array of personalities from many different backgrounds.

With more than 200 matches and 110 wins under his belt going on 12 years, Rice has learned a thing or two about what makes young high school soccer players tick. One thing he has learned is the self-perpetuating power of player confidence.

“A player’s confidence in her abilities and in the abilities of her teammates is really important, as is her familiarity with the playing styles of her teammates,” Rice said. “Players need to understand how best to complement their teammates. I think that our early-season wins built on some really good practices where that chemistry could develop.”

Building confidence and creating chemistry with young athletes is a skill. Getting young athletes to maintain confidence and chemistry through all the ups and downs is an artform. But showing confidence is quite easy, and it starts at the top. That greases the skids for team chemistry.

Rice has it figured out. He exudes confidence in his coaches and his players, and it filters all the way down to the last ones on the bench, creating a tight bond. The team has just two seniors, veteran Anna Riordan and Emma Gibbs, who had never played soccer at Villa Madonna before this year. There are seven juniors, five sophomores and four freshmen. Rice said making players feel good about themselves and their teammates is critical in the maturation process and to team success.

“My goals are improving kids as individuals and improving team play,” Rice said.

“I’ve had an outstanding team of assistants

who’ve been coaching with me for a long time. If it was just me, there’d be no way. And our kids have really been committed.”

While coaches can create confidence and boost it, there’s nothing like a wellplayed win to really rocket-fuel it. Not only have the youthful Villa Madonna players been boosted by their many coaches, but they also boosted themselves with a 5-0-1 start that featured a scoring advantage of 36-1. After six matches, the Vikings were already halfway to last season’s win total of 10.

“We’ve put a lot of focus on backing each other up,” junior goalkeeper Makena Lainhart said. “We’re pretty confident in our defense and our offense.”

With victories against Ludlow and Bellevue, the Vikings took control of Division III in the Northern Kentucky Athletic Conference and perched themselves atop the standings with a 2-0 mark, all in the first two weeks of the season. The Vikings are two-time reigning Division III champions with eight titles under Rice.

Lainhart had a hand in five consecutive shutouts in a nine-day span. Junior defender Megan Mahaney, a 2022 all-9th Region honorable mention selection, led a defense that stopped opponents cold. Lainhart didn’t have to make a single save in goal against Bellevue.

“Being able to communicate and work together as a team is really important,” said Mahaney, co-captain along with Riordan and Lainhart. “Our confidence is definitely pretty high.”

Prime beneficiaries of this wellspring of belief are sophomore Macy Gumm and freshmen Emma Tupman and Ava Swartz.

Gumm scored 15 goals in the first six matches while statistically getting better each time out over the first three matches. Gumm had 12 goals all of last year, second

to since-graduated Brooklyn Pickens (29). Villa Madonna coaches wondered to what extent Gumm would replace the firepower of Pickens, last year’s NKAC Division III player of the year.

They found out right away.

Gumm scored the first goal of the year in a 1-1 season-opening tie against Grant County. She scored three goals in the next match, a 10-0 win against St. Patrick. She exploded for four goals in the third match, a 10-0 win over Owen County. She scored a goal in each of the first six matches.

“As a striker, you have to be confident,” Gumm said. “I have so many great players to work with.”

Ten other Vikings connected in the first six matches. Gibbs scored four goals. Tupman and Swartz each had three. Riordan, Cate Gibbs, Sophie Cordonnier and Ella Burns had two each. Mahaney, Rylie Bond and Lucy Vick also scored.

Tupman and Swartz paced the Vikings in assists, both with five after two weeks of play. Gumm and Vick were next with three assists. Defensive midfielders Nora Walsh and Anna Kolar have been key cogs while disrupting the opponents’ offense. Tupman and Gumm are club teammates.

“We’ve been playing together since the eighth grade. It helps us work together to create those combinations,” Tupman said. “But it’s not only Macy. We have so many girls around her.”

16 SEPTEMBER 1, 2023

The Villa Madonna Academy girls soccer team began the season with a 5-0-1 start that featured two 10-0 wins and put the Vikings halfway to last season’s win total. Photo provided | Villa Madonna athletics.

Norse men’s basketball to face Bearcats in match at Cincinnati on Nov. 19

The Northern Kentucky University men’s basketball non-conference schedule is starting to take shape.

Another piece of the puzzle on the schedule was announced as NKU will trek across the Ohio River and take on the University of Cincinnati on Nov. 19 at Fifth Third Arena.

The meeting will be the 10th all-time, the Norse taking last season’s meeting 64-51 inside Truist Arena.

The Nov. 19 matchup is one of several non-conference matchups officially announced by the university. It has announced road games at Middle Tennessee State University to open the season on Nov. 6 and against another Power Five opponent at Washington on Nov. 9. The team will play at Illinois State on Dec. 6 and host Akron on Dec. 9.

Other games that haven’t been officially announced by the university but have been agreed to are contests with Long Island University, Texas A&M Corpus-Christi, Eastern Kentucky and Florida Atlantic in the non-conference slate.

Texas A&M Corpus-Christi and Florida Atlantic made the NCAA tournament last season, the Owls making a Cinderella run to the Final Four.

With 20 conference games scheduled in the Horizon, in April 2020, the Division I Council passed legislation that allows men’s basketball programs to schedule up to 28 regular-season games and participate in a multiteam event that has up to three games, or 29 regular-season games

while participating in an MTE that has up to two games, for a total of 31 games in either scheduling option.

The MTE the Norse will play in is with LIU and Texas A&M Corpus-Christi at Truist Arena, meaning it has two open dates left for an opponent. These two games will most likely be home games, according to a source.

The Norse are coming off a Horizon League Championship in 2022-23 and earning their fourth bid to the NCAA tournament in the last seven years. They posted a 22-13 record and return three starters in Marques Warrick, Sam Vinson and Trey Robinson.

The roster got a chance to gel with a recent trip to Italy, in which the players got to do some sightseeing and went 2-0 against overseas competition.

Highlands grad Drew Rom makes MLB debut Aug. 21 with St. Louis Cardinals

St. Louis Cardinal Drew Rom made his Major League debut on Aug. 21 against the Pittsburgh Pirates.

The 23-year-old left-hander had a rough outing, lasting just 3.2 innings and allowing six earned runs on eight hits. He struck out four and walked four. He had a nice following at PNC Park, with reportedly 40 friends and family members in attendance.

Rom was recently traded from the Baltimore Orioles to the St. Louis Cardinals in a three-player deal at the MLB trade deadline on Aug. 1.

The Highlands grad had two solid starts with the Cardinals Triple-A affiliate Memphis since the trade, pitching 11 innings and striking out 18 while allowing just one earned run. He surrendered two hits and issued four walks, going 2-0 in those starts. Rom and Cesar Prieto were traded to St. Louis in exchange for Jack Flaherty at the trade deadline. With Triple-A Norfolk in the Orioles organization this season, Rom pitched 86 innings with a 5.34 ERA. He struck out 100 and allowed 100 hits in his body of work.

The southpaw was called up to the Orioles in May but never logged any game time and was optioned back to Norfolk three days later.

Rom graduated from Highlands in 2018 and was drafted by the Orioles in the fourth round of the 2018 MLB draft. Rom was a part of three straight 9th Region championship teams at Highlands from 2016-18. He was a 2018 Mr. Baseball honoree and 9th Region tournament MVP that season as Highlands was the state runner-up.

Kentuckians can begin placing legal sports bets in the state beginning Sept. 7

Kentuckians are days away from being able to place a legal sports wager in the state.

Gov. Andy Beshear provided a timeline recently as the state gears up for the first official start date on Sept. 7 for in-person bets at licensed retail facilities.

Kentuckians were able to preregister an account with approved mobile applications starting on Aug. 28. A list of approved retail facilities and mobile applications was released Aug. 22, following the Kentucky Horse Racing Commission (KHRC) meeting.

Those retail facilities are: Churchill Downs, Louisville; Cumberland Run, coming soon to Corbin; Ellis Park, Henderson; Oak Grove Gaming and Racing, Oak Grove; The Red Mile, Lexington; Sandy’s Gaming and Racing, coming soon to Ashland; and Turfway Park, Florence.

Come Sept. 28, approved mobile applicants can start taking wagers. Mobile service providers are: Bet365, BetMGM, Caesars, Circa, DraftKings, FanDuel and Penn Sports Interactive.

Kentucky chose a tiered implementation, which has been used in multiple states and allows for testing of policies and procedures before the full rollout that includes mobile applications.

After years of pushing to get sports betting passed, on March 31, Beshear signed bipartisan legislation – House Bill 551 – legalizing sports wagering in Kentucky.

Sports betting will generate an estimated revenue increase of $23 million a year upon full implementation that will be dedicated to the Kentucky permanent pension fund, with 2.5% going to the problem gambling assistance account. The bill also established a new excise tax on sports wagering: 9.75% on the adjusted gross revenues on wagers made at a licensed facility and 14.25% on wagers placed online or on a smartphone.

SEPTEMBER 1, 2023 17 sports

Highlands grad Drew Rom made his MLB debut on Aug. 21 against the Pittsburgh Pirates.

Photo provided | St. Louis Cardinals

18 SEPTEMBER 1, 2023

Drain Clearing + Complimentary Camera Inspection DONATE TODAY help make an impact in your community Your donation will be directed to the NKY Community Journalism Fund

$99

Ludlow athlete gets her kicks on football field

BY MARC HARDIN | LINK nky CONTRIBUTOR

It was a surreal moment for Ludlow High School that captured the old, the new and the out of the ordinary.

Ludlow football coach Woody McMillen stood on the sideline at newly refurbished James Rigney Memorial Stadium, one of the few New Deal-era high school football stadiums still in use, and watched placekicker Brooklynn Huff nail an extra-point on bright red artificial turf.

“Pretty much right down the middle,” McMillen said of the 20-yard conversion.

Huff converted five more extra-point kicks in what turned out to be a perfect 6-for-6 night and a 42-6 Ludlow win against Lockland in the season opener.

Huff, a senior, scored just as many points as the opposing team in her debut football game. She’s tied for second on the team in scoring, trailing running back Dameyn Anness, who scored four touchdowns for Ludlow in the Friday opener. After one week of play, Huff was among state leaders in kick scoring with six record-breaking points.

“It was pretty cool,” Huff said. “I got nervous

halfway through the first kick. I normally try to get out of my own head.”

Getting out of the way of opposing players also is part of the plan. Although Huff is as tough as they come, the Panthers don’t want one of the most versatile Ludlow athletes getting hit. Huff not only is the Panthers’ best kicker but she’s also a goalkeeper on the girls soccer team. She’s a member of Ludlow’s track and field team as well, competing in the shot put and discus.

Huff has played soccer since was a preschooler. She denied every goal in the Panthers’ first three matches this season while making eight saves and posting a pair of shutouts.

In an effort to top her mother’s records, Huff began participating in track and field. Her mother, the former Elizabeth Blackburn, is a 2003 Ludlow graduate who once heaved the shot put almost 34 feet – a distance Huff has yet to match with one more track and field season to go – but mom never suited up for a football game.

Coach McMillen has known about Huff’s athletic prowess for quite some time. A

history teacher in the Ludlow school district, the coach had her in class as a student when she was in the eighth grade. Before becoming head football coach, McMillen was Ludlow’s special teams coach when the unit was in a bit of a roster crunch with fewer players than ideal. The coach was always on the lookout for a kicker, and he wasn’t limiting the search to boys.

“It was clear to me she could kick extra points and field goals,” McMillen said. “She’s already a better kicker than any of the coaches, so there wasn’t a lot we could teach her. We just told her a few things: ‘Don’t try to kill it and trust your skills.’ We built up her confidence and said, ‘Go out there and do your thing.’ And that’s what she’s done.”

Huff’s scores sent local historians scurrying for the record books. Former Bellevue player Kaylynn Dill, a 2011 graduate, is thought to be the last previous full-time female kicker who scored with regularity for a Northern Kentucky football team.

After a lifetime of soccer, Huff never dreamed she’d be getting reps on the football field. Converting that first extra point

against Lockland was a thrill she’ll never forget.

“It was kind of like how soccer is. The team building me up,” she said of the sudden convergence of football teammates around her. “It’s been a great experience for sure.”

Ludlow returns to action when it hosts Sayre on Sept. 1.