Generating Tax Alpha through ROTH Optimization October 2022

To Roth or Not to Roth...

It feels as the debate around the optimization of a traditional IRA versus the ROTH IRA is as old as the chicken versus the egg. For all intents and purposes both the IRA and ROTH IRA share similar characteristics for an investor, but for two main points

Deductibility of contributions to the account

Taxability of withdrawals from the account

These two key differences have caused many tax practioners and financial advisors many of distress when it comes to providing sound financial advice to clients The goal of this paper is to show you the power of working in tandem with both your tax wealth management team and your tax team.

The Tax Equivalency Principle

We know definitively, through the work of mathematicians, that the associative property of multiplication states that the way in which factors are grouped in a multiplication problem does not change the product

Stated for our example at hand, pre tax income results in the same amount of aftertax wealth, regardless of which type of IRA is used, whenever tax rates remain the same.

1

“The hardest thing in the world to understand is the income tax.”Albert Einstein

Figure

$4,500 $12,000 $1,500 **100% Growth Rate** $9,000 $6,000 $6,000 RIRA OTH $9,000 25% 25% $3,000 $9,000

Adapting to Change

Changing Tax Rates

Sometimes driving tax alpha can be as simple as predicting your future income.

For example, if you are currently in your prime earnings years and your retirement lifestyle is one of relaxation, the chances are high that your income in future years is likely to be lower than today. That being said, you would benefit from taking the tax deduction of a traditional IRA account today and paying taxes on those dollars later due to

Assuming the same example as in Figure 1, lets assume you as the investor experience a change in tax rate. What happens to your end value of the account?

As we can see in our chart below, an investor benefits by making a pre tax contribution and subsequently being taxed in a lower bracket. However when the investors tax rate increases, they are essentially penalized for taking the earlier tax deduction

Changing Tax Laws

Recently Tax Legislation seems to be at the forefront of each parties agenda. With changing legislation, comes the need to be tactical.

As it is a focus on this paper, in December 2019 the Setting Every Community Up for Retirement Enhancement (SECURE) Act was enacted and signed into law on December 20, 2019.

The SECURE Act’s changes to the laws governing retirement accounts, both in terms of sheer volume and impact, are considered by many experts to be the most significant since the passing of the Pension Protection Act of 2006. The headline change for most financial advisors was its new rule eliminating the ‘stretch’ provision for most non spouse designated beneficiaries.

The SECURE Act’s changes to the postdeath rules for retirement account owners have massive implications for many beneficiaries who, as a result of the new rules, will generally have to distribute funds from their inherited account(s) within 10 years after the year of the owner's death. The changes, however, are perhaps just as disruptive for retirement account owners

Future Tax Rate 15% 25% 35% Traditional IRA $10,200 $9,000 $7,800 ROTH IRA $9,000 $9,000 $9,000

Finding a Solution

With continuous change and in both personal life and tax legislation, its imperative to be connected with a Tax & Accounting team who takes a proactive approach to managing your tax situation

One of the most impactful strategies that can provide tax alpha is an effective ROTH

Conversion strategy. A ROTH Conversion is taking money's allocated to a pre tax account and moving them over into a ROTH designated account.

Wealth Impact Through Tax Alpha

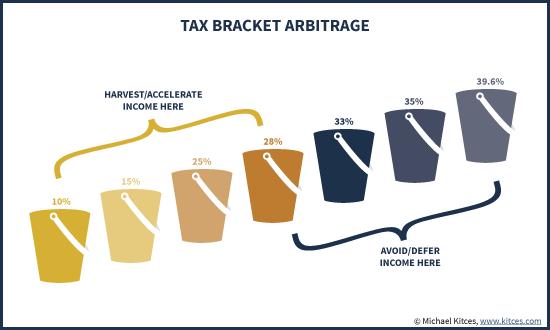

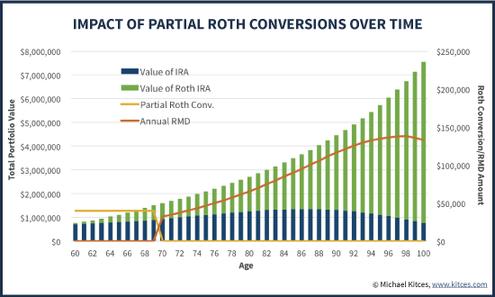

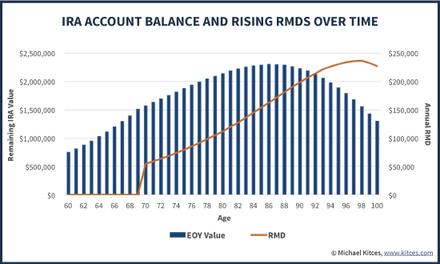

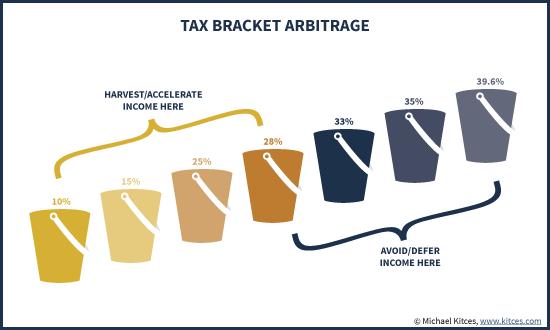

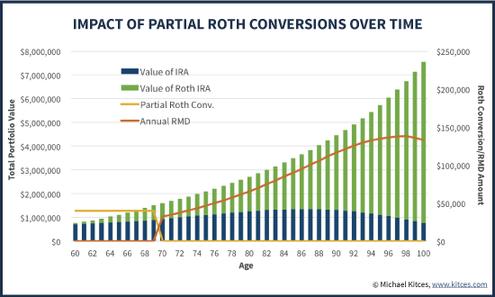

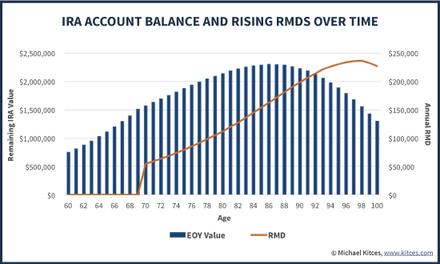

When properly executed, a plan of systematic ROTH conversions has an enormous impact on an individuals wealth. Lets take an example of a 60 year old client who recently retired with a $200,000 brokerage account, and a substantial $700,000 IRA. In a decade when her RMDs begin, the client will face RMDs of upwards of $50,000/year (assuming an 8% growth rate in the IRA between now and then), propelling her into the 28% tax bracket even after her moderate deductions; by her 80s, the RMDs are projected to be more than $100,000 per year, topping out the 28% rate and approaching the 33% bracket!

To manage this exposure, we implement a partial Roth conversion of $40,000 each year for the next 10 years, which after her deductions just barely fills up her current 25% tax bracket, but stops short of the 28% tax rate. Repeated annually, this allows the client the opportunity to decrease the overall IRA exposure. At this pace, her pre-tax IRA will still only be about $900,000 by the time her RMDs begin, which will produce RMDs of barely $35,000, allowing her to remain in the 25% tax bracket. The client will also have accumulated a tax free Roth IRA projected to have grown over $700,000 by age 70 ½.

The End Result?

By implementing a systematic Roth conversions

over the course of several years in a row,

are able to;

Effectively fully utilize lower tax brackets

Avoid higher tax rates caused the RMD dilemma

Bypass the 10 year secure act as described earlier to heirs

Not only were the

in net

856.690.9232 Sources: Kitces.com LLC

strategy

we

3 bullet points accomplished but we also saw a considerable increase

worth. 360% Increasein NetWealth Are you ready for a review of your tax plan? Reach out to a member of our team to set up a time to talk or click the calendar icon below to book your intro call! isklinger@lpats.cpa