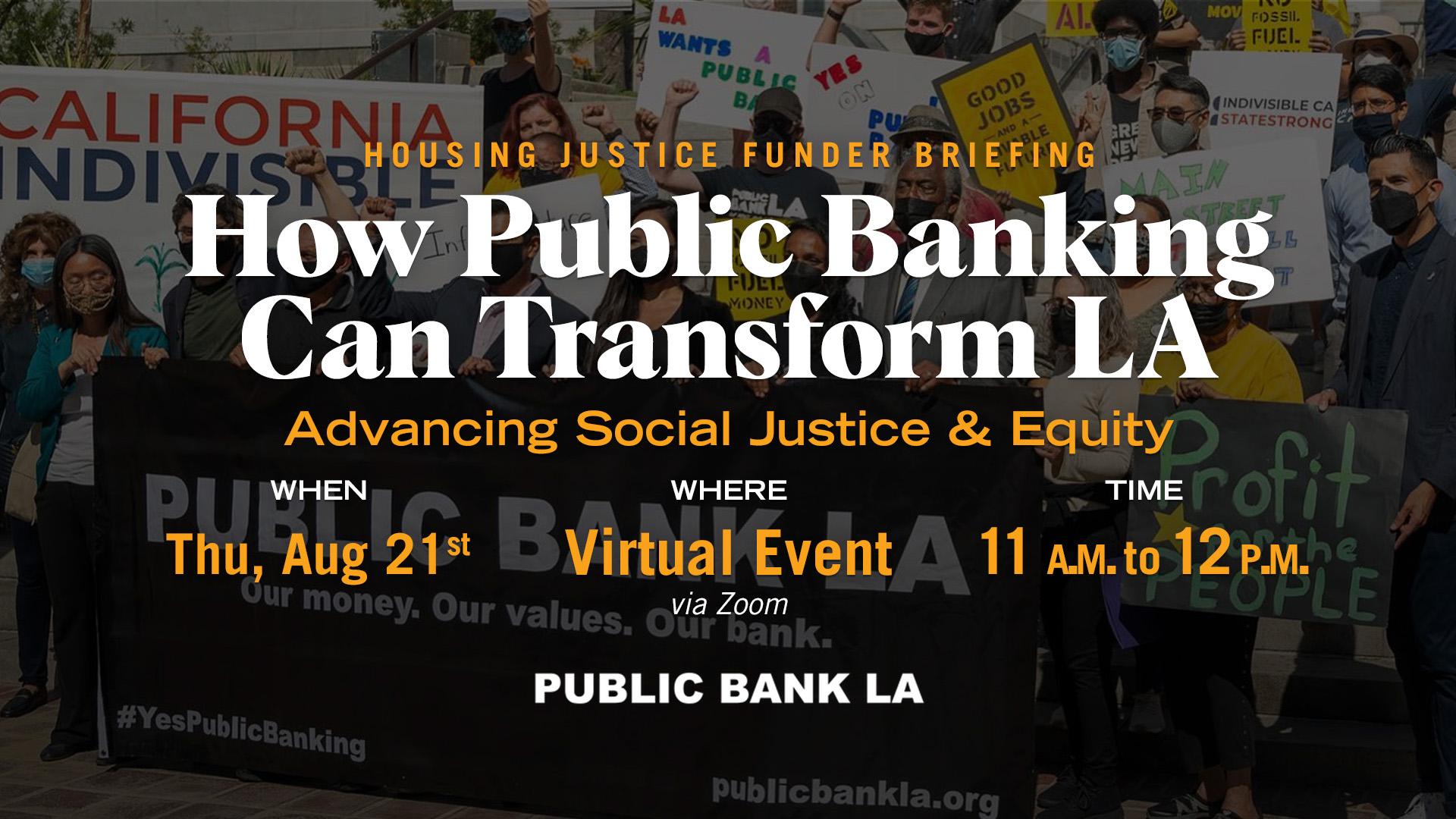

Banking for People and Planet | Presentation for Liberty Hill - August 21, 2025

We saw the root problem: Wall Street held our public funds.

So we built a movement to create banks for people and planet.

Los Angeles sends over $1.4 billion a year to Wall Street in fees and interest, money that could be used for housing, infrastructure, and public services.

Too many low-income and communities of color lack access to affordable credit and investment, deepening inequality.

City funds are invested in fossil fuel giants like Exxon and Chevron, hurting LA’s climate goals and public health.

Big banks drain public funds with high fees, while affordable housing is slowed by a complex maze of funding sources that drive up costs.

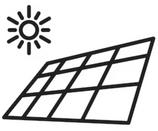

A public bank is a non-profit institution owned by local governments, and exists to serve the public, not private shareholders.

Earnings are reinvested into housing, green energy, small businesses, and infrastructure, strengthening communities and returning profits to the city.

Public banks team up with local lenders: community banks, credit unions, and CDFIs. to bring capital to underserved communities long excluded from the financial system.

Public banks exist to serve the public, like schools or fire departments.

Public banks are designed to put community needs first, reinvesting public dollars into public good, not private profit.

Power—$1 Becomes $10

A public bank leverages city funds with a 10x multiplier. $1M can generate up to $10M in community lending.

Recycling public dollars helps cities meet urgent needs without raising taxes, cutting borrowing costs by nearly 50% and doubling investment power.

Efficient and Accountable

Tax-exempt and low-cost, public banks stretch public dollars further, funding community needs with transparency and accountability.

Mobilizing public revenue to serve the public good.

City Hall puts public funds into a public bank, which lends them for local needs like housing. As loans are repaid, the money is recycled, keeping public dollars working for the community.

The public bank provides lowinterest loans and helps simplify a process that often requires 12 or more funding sources, making it easier and faster to build affordable housing.

The bank can fund clean energy, electrification, and infrastructure without relying on private lenders.

By working with local lenders, a public bank can reach small, micro, and immigrant-owned businesses that big banks ignore.

A public bank gives LA the power to quickly fund disaster relief and climate-ready infrastructure, when federal help fall short.

A public bank helps LA cut costs, move money faster, and fund housing, infrastructure, green projects, and small businesses.

LA’s public bank will partner with community lenders to expand credit in neighborhoods banks have ignored, focused on Black, Brown, and immigrant communities. CalAccount fills a major gap with no-fee banking for California’s 7+ million unbanked and underbanked residents.

The Bank of North Dakota (BND), America’s 100-year-old public bank, supports small businesses, weathers financial crises.

BND has an 18% return on investment, returns hundreds of millions in profit to the general fund annually. Provides loans for homes, students, agriculture, and infrastructure. Partners with community banks for over half its loans.

40%+ of banks worldwide are publicly owned ($55T in assets).

In 2019, California passed the nation’s first law letting cities create public banks. Regulations were finalized by the state in 2022. Now it’s time to build.

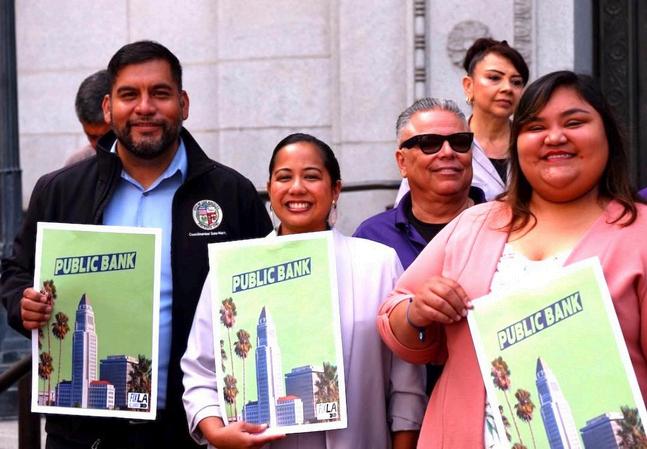

As of August 2025, six LA City Councilmembers:

Eunisses Hernandez (CD1), Bob Blumenfield (CD3), Nithya Raman (CD4), Curren Price (CD9), Hugo SotoMartinez (CD13), and Ysabel Jurado (CD14), each contributed $15K from discretionary funds toward the public bank feasibility study.

Backed by over 100 groups across labor, housing, environmental justice, small business, and community finance, the campaign has strong momentum.

Public Bank LA coalition leaders include SEIU 721, ACCE Action, Move LA, Inclusive Action for the City, Destination Crenshaw, and United Parents and Students,