Higher penetration of online insurance crossing AED 55 Bn by 2024- Which factors can help the industry achieve its targeted growth in the future?

Insurance Penetration stands at 2.9% in UAE, ahead of peer GCC countries yet lags behind avg of emerging markets at 3.2%, says a report by Ken Research

1. How big is Insurance Industry in UAE?

Other Challenges in UAE Online Insurance Industry

• Despite economic challenges, GWP collection grew owing to introduction of mandatory insurance coverage in health & motor, increased supervision by Insurance Authority & improving risk mgmt framework.

• While UAE is ahead of GCC countries in terms of Insurance penetration, it still lags behind emerging markets & global avg.

• Slowdown in Automobile sales & property prices highlight lack of demand for new assets among population; curbing demand for insurance.

• Rising awareness & addition of new segments (Cyber, Renters, Business, Home & Contents) could further increase the demand in coming years.

2. Product Segmentation of Insurance - Mandatory Insurance for Motor & Health drives the growth for non-life insurance products.

Interested to Know More about this Report, Request for a sample report

Mandatory insurance requirement of Health & Motor has led the growth of Non-Life Insurance Products.

• Individual Life and other related products are still underpenetrated with only 3% penetration among entire population.

• Brokers must strive to bridge the gap of higher upfront premiums for population and generate awareness regarding the term life insurance products.

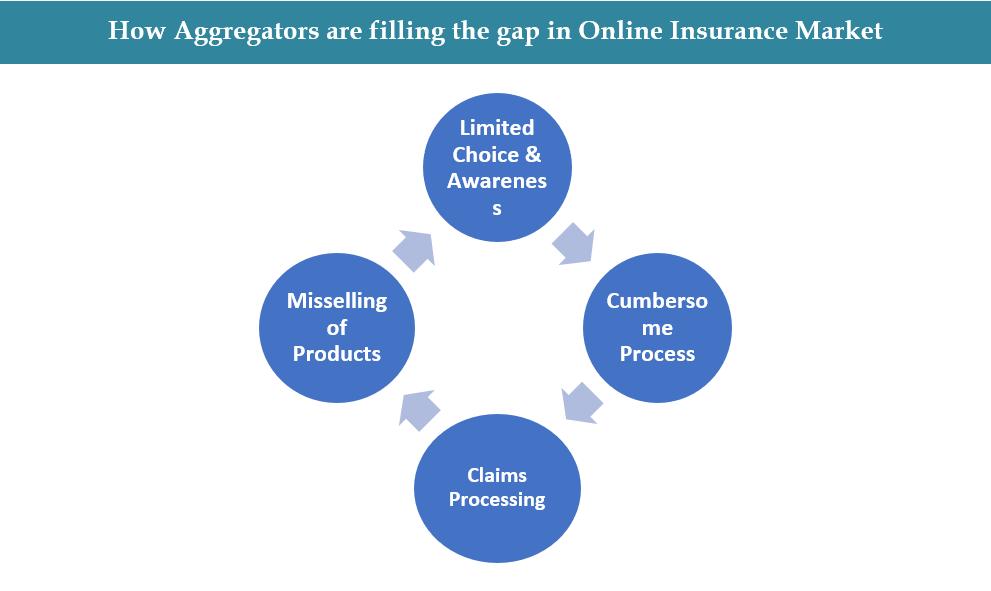

Plethora of insurance providers (Min 15+) to choose and compare policies depending on requirements. One-Stop towards customization as customer selects according to his/her criteria.

Online uploading of required documents/assistance served in case of lack of proper documents. tedious task of processing, document checking is now done by tele sales/data entry team of platform.

Explaining policies (coverages/risk factors/premium) in plain-vanilla terms. Dedicated tele-sales agent from policy selection to issuing policy.

Uploading relevant policy details at platform, quick follow-up by aggregator with insurance provider for instant processing and disbursal of claims.

Time Period Captured in the Report:

• Historical Period – 2014 -2019

• Forecast Period – 2019 – 2024E

Companies Covered:

• Yallacompare

• Souqalmal

• Bankonus

• PolicyBazaar UAE

• Compare4benefits

• Insurancemarket.ae

• Bayzat

Key Topics Covered in the Report

• Socio-Demographic and Economic Outlook of UAE.

• Insurance Industry in UAE basis Products, Distribution Channel.

• Decoding Penetration of Online Insurance with a special focus on Aggregators.

• Business Model of Aggregators (Revenue Streams, Organizational Structure, End to End Buying Process, Technology Stack).

• Market Size of Insurance Aggregators basis Revenue and Aggregators.

• Competitive Landscape among major Aggregators (Cross comparison matrices, strengths, weakness and company profiles).

• Future Outlook of the Insurance Industry.

• Potential of Insurance Aggregators in the UAE.

• Key Analyst Recommendations.

Contact Us: Ken Research

Ankur Gupta, Head Marketing & Communications support@kenresearch.com

+91-9015378249

Follow Us

Facebook | Twitter | LinkedIn | Instagram