County Name: Washington

APN / Parcel Number: R1016974

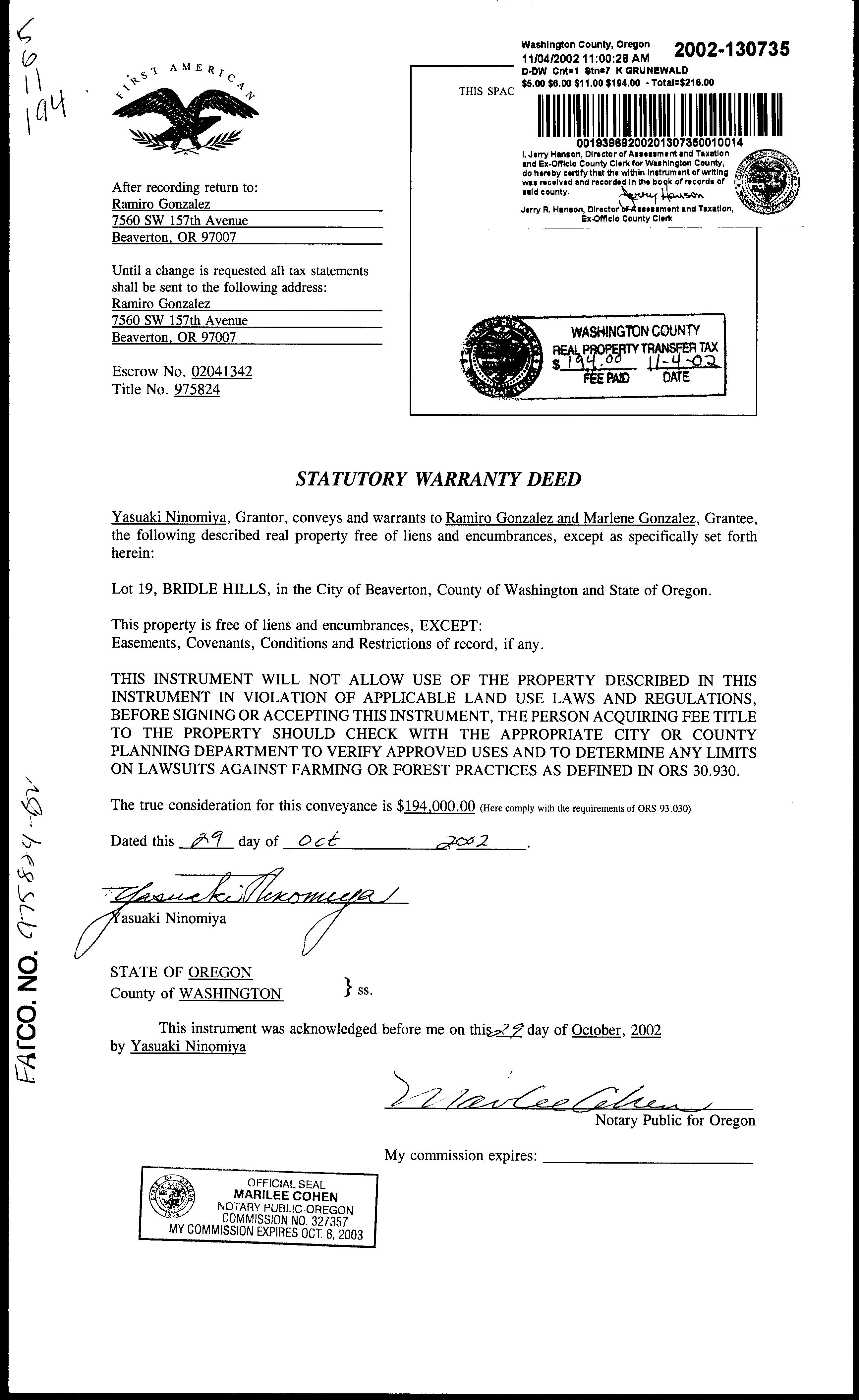

Current Ownership: Ramiro & Marlene Gonzalez

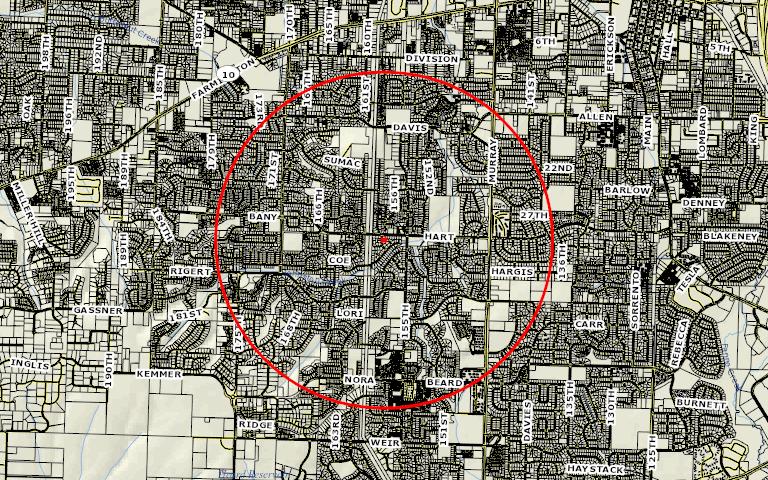

Site Address: 7560 SW 157th Ave, Beaverton OR 97007

Mail Address: 7560 SW 157th Ave, Beaverton OR 97007 *Owner Occupied

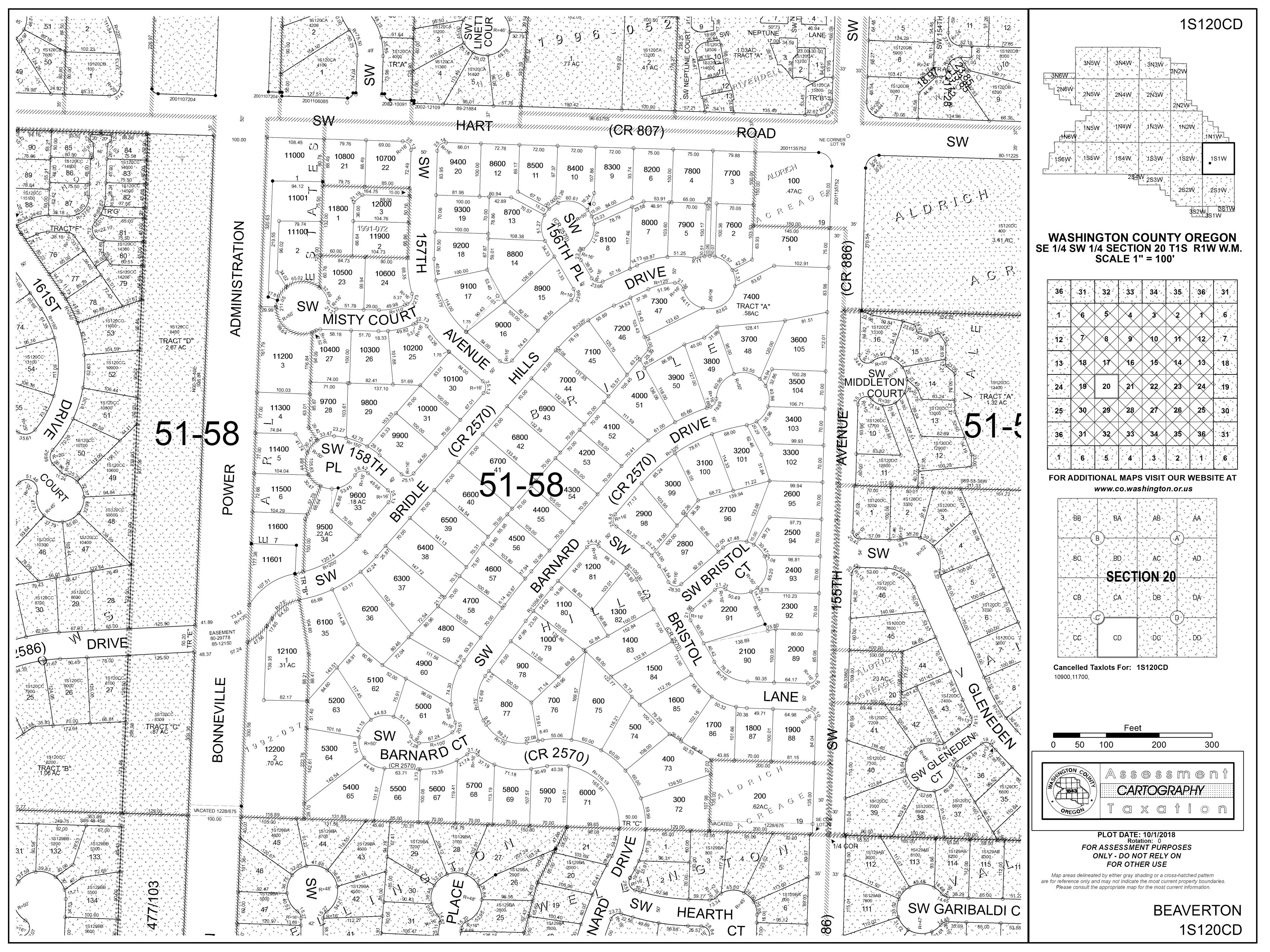

Tract / Subdivision: / Bridle Hills

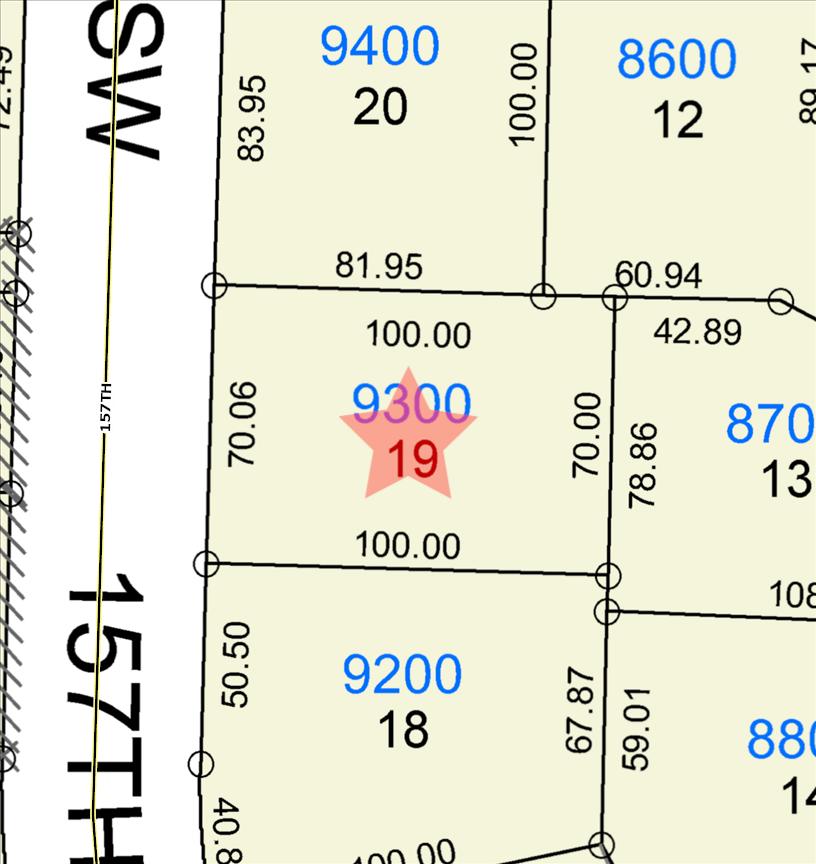

Census Tract / Block: 031814 / 2000 Lot / Block: 19 Twn / Rng / Sec / Qtr:

Property Characteristics

ParcelID:R1016974

SentryDynamics,Inc anditscustomersmakenorepresentations,warrantiesor conditions,expressorimplied,astotheaccuracyorcompletenessofinformation containedinthisreport

ParcelID:R1016974

SiteAddress:7560SW157thAve

SentryDynamics,Inc anditscustomersmakenorepresentations,warrantiesor conditions,expressorimplied,astotheaccuracyorcompletenessofinformation containedinthisreport

ParcelID:R1016974

SiteAddress:7560SW157thAve

SentryDynamics,Inc anditscustomersmakenorepresentations,warrantiesor conditions,expressorimplied,astotheaccuracyorcompletenessofinformation containedinthisreport

R1016974 GONZALEZ,RAMIRO& GONZALEZ,MARLENE

Details Bills PaymentHistory

2025GENERALINFORMATION

PropertyStatus AActive

PropertyType Residential

LegalDescription BRIDLEHILLS,LOT19,ACRES0.16

AlternateAccountNumber -

Neighborhood HRTSHARTROADSOUTHWEST

MapNumber 1S120CD09300

PropertyUse 1010:RESIDENTIALIMPROVED

LevyCodeArea 051.58

2024Certi�edTaxRate 21.7312

2025OWNERINFORMATION

OwnerName GONZALEZ,RAMIRO&GONZALEZ, MARLENE

MailingAddress 7560SW157THAVEBEAVERTON,OR 97007

7560SW157THAVE, BEAVERTON,OR

RELATEDPROPERTIES

LinkedPropertiesPropertyGroupIDGroupedPropertiesSplit/MergeDateSplit/MergeAccountsSplit/MergeMessage -

2024IMPROVEMENTS Expand/CollapseAll

Improvement#1 ImprovementType Beds/Baths - Single-FamilyResidence 3/3

2024LANDSEGMENTS

CERTIFIED/INPROCESSVALUES

SALESHISTORY

10/29/2002 NINOMIYA, YASUAKI GONZALEZ, RAMIRO& GONZALEZ, MARLENE

4/17/1997 SMITH,CLARENCE ANDY&KARENY NINOMIYA, YASUAKI

3/11/1991 BROWN,GENEG SMITH,CLARENCE ANDY&KARENY

5/29/1990 BOBGSMITH BUILDERINC BROWN,GENEG 1990027866 $19,000

BUILDERINC

Sketch

TAXSUMMARY

Breakdown

Age Distribution

Assigned School

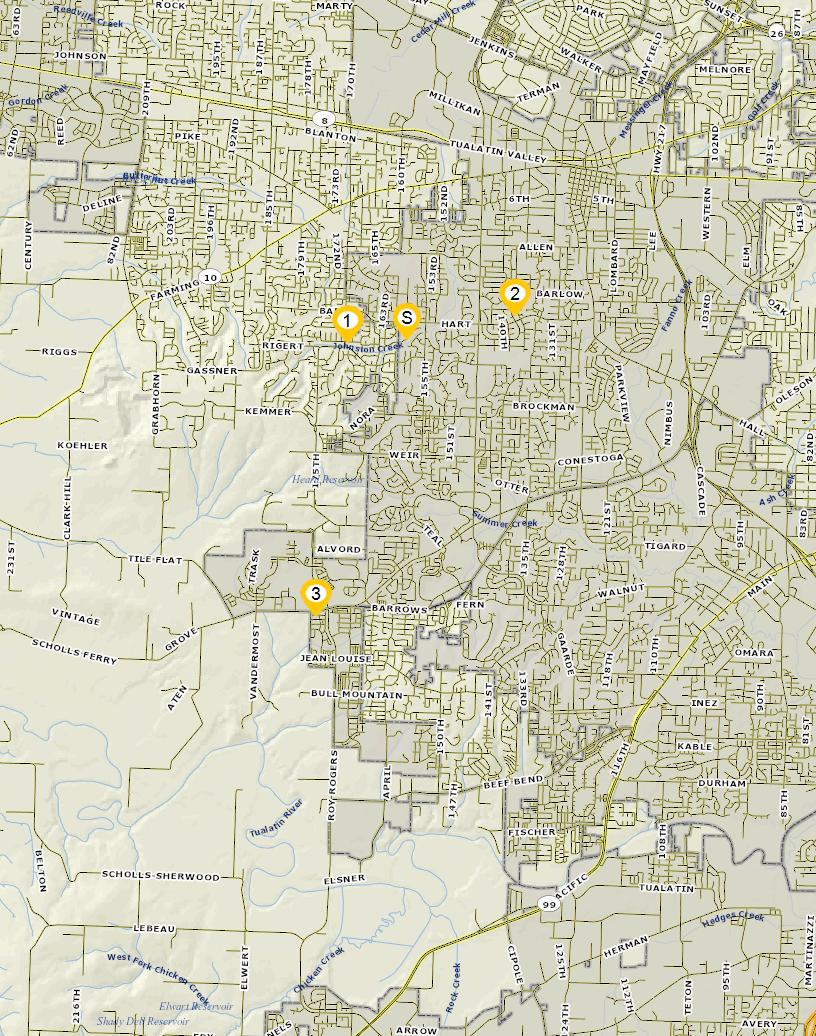

Primary School: Cooper Mountain Elementary School

Middle School: Highland Park Middle School

High School: Mountainside High School

Primary School

Cooper Mountain Elementary School 1

Middle School

Highland Park Middle School 2

High School

Mountainside High School 3

Other School

1 Cooper Mountain Elementary School

Distance: 0 56 mile(s)

Address: 7670 Sw 170Th Ave District: Beaverton Sd 48J Type: 1-Regular school

Charter: No

Title 1 Elig: 2-No

Male / Female: 194 / 203

2. Highland Park Middle School

Title 1: 6-Not a Title I school

Students: 398

1.03 mile(s)

Address: 7000 Sw Wilson Ave District: Beaverton Sd 48J Type: 1-Regular school

Charter: No

Title 1 Elig: 2-No

Title 1: 6-Not a Title I school

Students: 652

- 8th Grade

Male / Female: 360 / 292 Distance: 2 73 mile(s)

3 Mountainside High School

Address: 12500 Sw 175Th Ave District: Beaverton Sd 48J

1-Regular school Charter: No

Title 1 Elig: 2-No Title 1: 6-Not a Title I school

Male / Female: 875 / 843

1,722

Levels: 9th Grade - 12th Grade

Scan QR Code for CC&Rs

CC&Rs: Bridle

Hills

STEPS IN A REAL ESTATE TRANSACTION

1

What is an Escrow?

THE LISTING AGREEMENT

The property owner (Seller) initiates a contract, or a listing agreement, with a licensed Real Estate Agent.

2

THE SALE

Property owner (Seller) enters into a purchase contract, typically referred to as an Earnest Money Agreement, with a Buyer.

3

ESCROW

As part of the purchase contract, Seller agrees to purchase a title insurance policy for the Buyer and both agree to close the transaction with a licensed escrow company. In Oregon, most title insurance companies also offer escrow services to facilitate a convenient “one-stop” approach to closing real estate transactions.

An escrow is a neutral third party depository for legal documents and funds necessary to complete a real estate transaction. The escrow agent will disburse funds and record documents for the proper recipients according to their written instructions.

What title insurance and escrow costs are incurred in a real estate sale?

The fee for escrow services is based on the sales price of the property. This fee is typically split equally between the Seller and Buyer. However, Buyers should check with their lenders if financing is involved because some federally insured lending programs do not allow borrowers to pay this fee. The Seller typically pays for a standard owner’s policy of title insurance which names the Buyer as the insured. Charges for this policy are based on the sales price of the property. The Buyer typically pays for a lender’s policy of title insurance and any required endorsements if s/he is obtaining a new loan to purchase the property. Charges for this policy are based on the loan amount.

What services does an escrow agent perform on behalf of the Seller and Buyer?

• Upon opening of escrow, escrow agent will order a preliminary title report, which will be sent to all interested parties involved in the transaction. The report will detail the current ownership, liens and encumbrances of the property.

• Closing statements will be prepared for each party, showing all credits and debits. The escrow agent will schedule appointments for all parties to sign their final necessary documents, including any funds needed to be deposited, to complete the transaction.

• Signed loan documents are returned to the Lender, for final review and funding approval.

• Recordable documents are released to the County Clerk’s office for recording.

• Once recorded, all funds are disbursed per written instructions.

• Final title policies are issued to the insured parties.

ESCROW FLOW CHART

Receive and review Earnest Money Agreement and Broker’s instructions.

Open escrow. Order title report.

Determine financing.

Information gathering from Buyer and Seller.

Receive title report. Send copies to all parties in the transaction.

Resolve any title issues. Order any payoff demands.

Review file. Are conditions satisfied? Contingencies removed?

Prepare closing statement, closing instructions and transfer deed

Obtain signatures on all escrow and loan documents. Collect any funds due from Buyer and/or Seller

Record applicable documents with the County Recorder's office.

Close file. Prepare final statements. Disburse funds.

Forward final documents to all interested parties - Buyer, Seller, Real Estate Agents, Lender, Broker, Attorney, etc.

NEW LOAN

Notify Escrow with name of new lender and loan officer.

Send title report to lender.

Notification of final loan approval. Are repairs complete?

Deliver Seller & Buyer Closing Disclosures. Buyers’ consummation 3-6 days.

Loan documents delivered to escrow.

Return loan documents for final approval to fund and record.

Order loan funds.