Property Profile HOMEBOOK

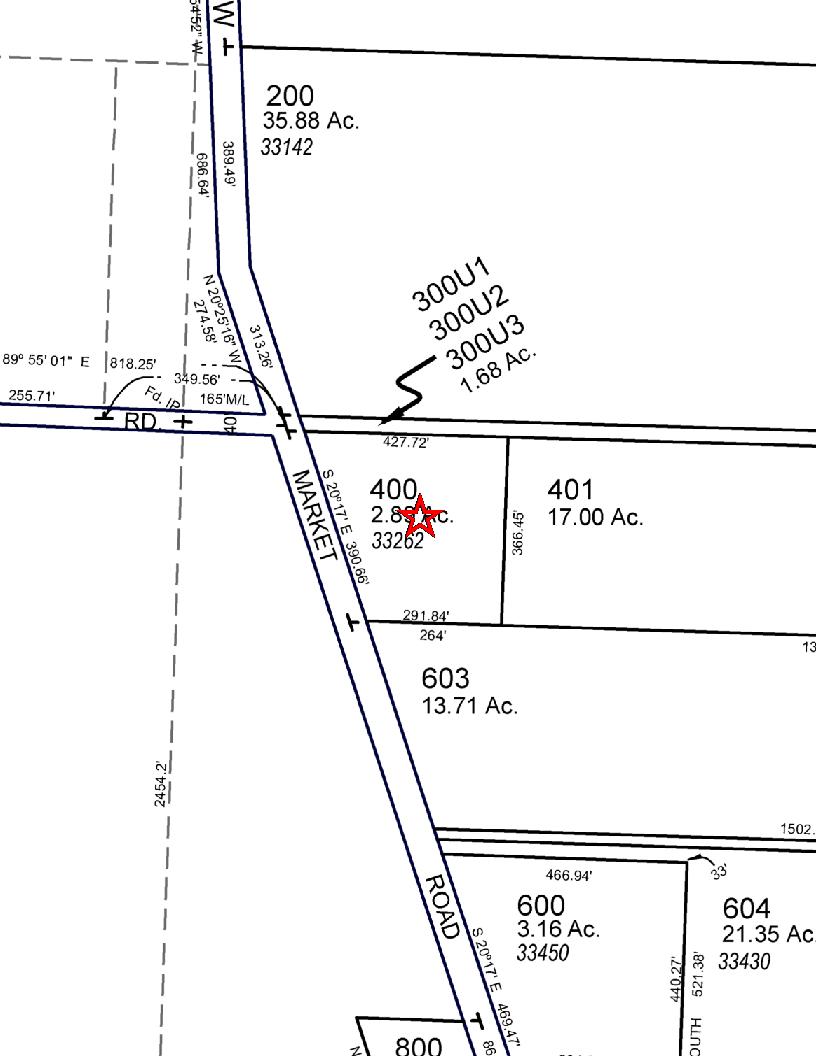

Thismap/platisbeingfurnishedasanaidinlocatingthehereindescribedLandinrelationtoadjoiningstreets,naturalboundariesandotherland,andisnotasurveyofthe landdepicted.Excepttotheextentapolicyoftitleinsuranceisexpresslymodifiedbyendorsement,ifany,theCompanydoesnotinsuredimensions,distances,locationof easements,acreageorothermattersshownthereon.

Thismap/platisbeingfurnishedasanaidinlocatingthehereindescribedLandinrelationtoadjoiningstreets,naturalboundariesandotherland,andisnotasurveyofthe landdepicted.Excepttotheextentapolicyoftitleinsuranceisexpresslymodifiedbyendorsement,ifany,theCompanydoesnotinsuredimensions,distances,locationof easements,acreageorothermattersshownthereon.

AccountNumber 01075437

GeneralInformation

AlternateProperty# 51E1900400

PropertyAddress 33262 S BARLOW RD , WOODBURN, OR 97071

PropertyDescription Section19Township5SRange1ETAXLOT00400

LastSalePrice $610,000.00

LastSaleDate 06/02/2021

LastSaleExciseNumber 392527

PropertyCategory Land&/orBuildings Status Active,LocallyAssessed,UseAssessed TaxCodeArea 086-031

Remarks

TaxRate Description Rate Total Rate 12.2143

PropertyCharacteristics

Property Tax Deferral Potential Additional Tax Liability

Neighborhood 13164: South Canby rural all other

Land Class Category 551: EFU farmland improved Building Class Category 13: Single family res, class 3

Year Built 1930 Acreage 2.89 Change property ratio 5XX

Parties

Role Percent Name Address

Taxpayer 100 TSANG JASON H 7061 SE DIVISION ST, PORTLAND, OR 97206 Tax Service Co 100 CORELOGIC TAX SERVICES UNKNOWN, MILWAUKIE, OR 00000 Owner 100 TSANG JASON H 7061 SE DIVISION ST, PORTLAND, OR 97206

Mortgage Company 100 SELENE FINANCE LP NO MAILING ADDRESS, AVAILABLE,

PropertyValues

ValueType

TaxYear 2022 TaxYear 2021 TaxYear 2020 TaxYear 2019 TaxYear 2018

AVR Total $207,044 $201,015 $195,161 $189,478 $183,960 Exempt

TVR Total $207,044 $201,015 $195,161 $189,478 $183,960

Real Mkt Land $381,102 $323,287 $293,790 $287,891 $264,293

Real Mkt Bldg $274,500 $232,110 $214,090 $210,060 $193,730

Real Mkt Total $655,602 $555,397 $507,880 $497,951 $458,023

M5 Mkt Land $208,817 $177,138 $160,976 $157,744 $144,814

M5 Mkt Bldg $274,500 $232,110 $214,090 $210,060 $193,730

M5 SAV $4,298 $4,298 $4,566 $4,584 $4,373

SAVL (MAV Use Portion) $1,985 $1,928 $1,872 $1,818 $1,766

MAV (Market Portion) $205,059 $199,087 $193,289 $187,660 $182,194 Mkt Exception

AV Exception

ActiveExemptions

No Exemptions Found

Events

Effective Date EntryDate-Time Type

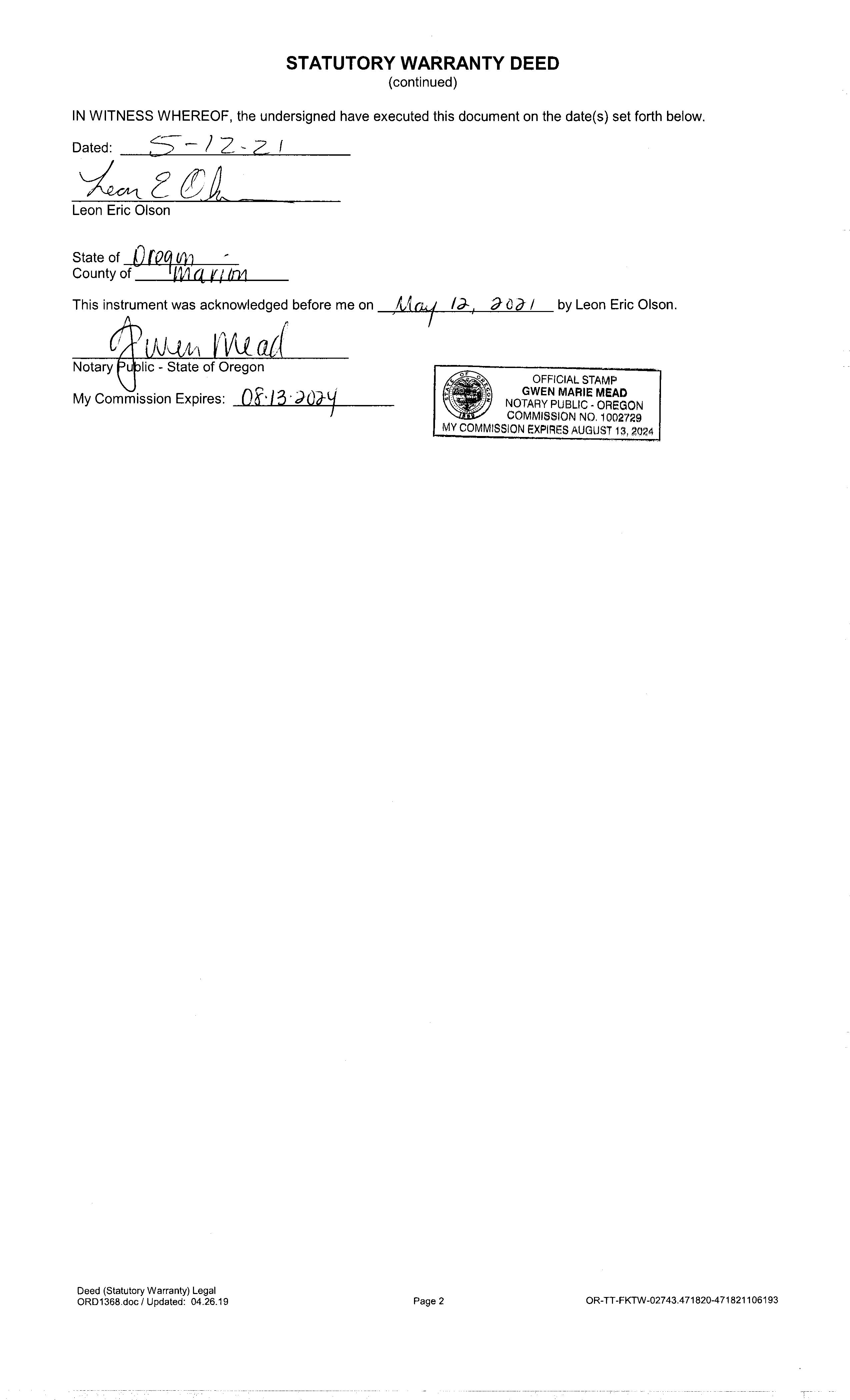

05/12/2021 06/02/2021 11:51:00

Remarks

Taxpayer Changed Property Transfer Filing No.: 392527 05/12/2021 by ACOUGHLIN

05/12/2021 06/02/2021 11:51:00 Recording Processed Property Transfer Filing No.: 392527, Warranty Deed, Recording No.: 2021-048135 05/12/2021 by ACOUGHLIN

05/12/2006 06/10/2006 11:48:00

Taxpayer Changed Property Transfer Filing No.: 141308 05/12/2006 by AMANDAOLS

05/12/2006 06/10/2006 11:48:00 Recording Processed Property Transfer Filing No.: 141308, Warranty Deed, Recording No.: 2006-043595 05/12/2006 by AMANDAOLS

08/15/2005 08/17/2005 16:24:00

Taxpayer Changed Property Transfer Filing No.: 124519 08/15/2005 by AMANDAOLS

08/15/2005 08/17/2005 16:24:00 Recording Processed Property Transfer Filing No.: 124519, Warranty Deed, Recording No.: 2005-077687 08/15/2005 by AMANDAOLS

11/03/2004 11/03/2004 14:40:00 The situs address has changed by LINDAPET

05/07/2004 05/11/2004 11:40:00 Taxpayer Changed Property Transfer Filing No.: 96412 05/07/2004 by LAURIEB

05/07/2004 05/11/2004 11:40:00 Recording Processed Property Transfer Filing No.: 96412, Warranty Deed, Recording No.: 2004-041035 05/07/2004 by LAURIEB

07/01/1999 07/01/1999 12:00:00 Ownership at Conversion Quitclaim Deed: 91-62060, 11/1/91, $ 0

TaxBalance

NoChargesarecurrentlydue Ifyoubelievethisisincorrect,pleasecontacttheAssessor'sO�ice

Receipts

Date

ReceiptNo.

5226290 (ReceiptDetail.aspx? receiptnumber=5226290)

$2,528.90 $2,528.90 $2,453.03 $0.00 03/31/2022 11:42:00 5185803 (ReceiptDetail.aspx? receiptnumber=5185803) $2,501.40 $2,501.40 $2,501.40 $0.00 11/13/2020 00:00:00 4917340 (ReceiptDetail.aspx? receiptnumber=4917340)

11/09/2022 08:50:00

$2,393.15 $2,393.15 $2,321.36 $0.00 11/15/2019 00:00:00 4745596 (ReceiptDetail.aspx? receiptnumber=4745596) $2,259.43 $2,259.43 $2,191.65 $0.00 11/13/2018 00:00:00 4519677 (ReceiptDetail.aspx? receiptnumber=4519677)

$2,259.82 $2,259.82 $2,192.03 $0.00 11/15/2017 00:00:00 4342901 (ReceiptDetail.aspx? receiptnumber=4342901) $2,205.86 $2,205.86 $2,139.68 $0.00

SalesHistory

SaleDate EntryDate Recording Date Recording Number Sale Amount Excise Number Deed Type Transfer Type Grantor(Seller) Grantee(Buyer) Other Parcels 05/12/2021 06/02/2021 05/12/2021 2021-048135 $610,000.00 392527 S OLSON LEON ERIC TSANG JASON H No 05/09/2006 06/10/2006 05/12/2006 2006-043595 $386,900.00 141308 S CHESHIRE CARRIE D OLSON LEON ERIC No 08/11/2005 08/17/2005 08/15/2005 2005-077687 $339,000.00 124519 S DEVOUR JOAN W CHESHIRE CARRIE D No

05/03/2004 05/11/2004 05/07/2004 2004-041035 $205,000.00 96412 S OUSLEY PAUL OTTO

PropertyDetails

LivingAreaSqFt ManfStructSize YearBuilt ImprovementGrade Stories Bedrooms FullBaths HalfBaths 1562 0 X 0 1930 38 1.0 4 2 0

TaxYear Category

TCA/District

Charged Minimum BalanceDue DueDate

1993 PropertyTaxPrincipal 091-001 $1,663.72 $0.00 $0.00 11/15/1993

1994 PropertyTaxPrincipal 086-031 $1,082.10 $0.00 $0.00 11/15/1994

1995 PropertyTaxPrincipal 086-031 $996.51 $0.00 $0.00 11/15/1995

1996 PropertyTaxPrincipal 086-031 $1,250.14 $0.00 $0.00 11/15/1996

1997 PropertyTaxPrincipal 086-031 $1,052.47 $0.00 $0.00 11/15/1997

1998 PropertyTaxPrincipal 086-031 $1,078.84 $0.00 $0.00 11/15/1998

1999 PropertyTaxPrincipal 086-031 $1,103.82 $0.00 $0.00 11/15/1999

2000 PropertyTaxPrincipal 086-031 $1,280.58 $0.00 $0.00 11/15/2000

2001 PropertyTaxPrincipal 086-031 $1,330.88 $0.00 $0.00 11/15/2001

2002 PropertyTaxPrincipal 086-031 $1,362.69 $0.00 $0.00 11/15/2002

2003 PropertyTaxPrincipal 086-031 $1,391.02 $0.00 $0.00 11/15/2003

2004 PropertyTaxInterest 086-031 $6.38 $0.00 $0.00 11/26/2004

2004 PropertyTaxPrincipal 086-031 $1,435.14 $0.00 $0.00 11/15/2004

2005 PropertyTaxPrincipal 086-031 $1,593.41 $0.00 $0.00 11/15/2005

2006 PropertyTaxPrincipal 086-031 $1,567.00 $0.00 $0.00 11/15/2006

2007 PropertyTaxPrincipal 086-031 $1,746.59 $0.00 $0.00 11/15/2007

2008 PropertyTaxPrincipal 086-031 $1,754.40 $0.00 $0.00 11/15/2008

2009 PropertyTaxPrincipal 086-031 $1,913.68 $0.00 $0.00 11/15/2009

2010 PropertyTaxPrincipal 086-031 $1,962.54 $0.00 $0.00 11/15/2010

2011 PropertyTaxPrincipal 086-031 $2,009.56 $0.00 $0.00 11/15/2011

2012 PropertyTaxPrincipal 086-031 $1,892.94 $0.00 $0.00 11/15/2012

2013 PropertyTaxPrincipal 086-031 $1,956.91 $0.00 $0.00 11/15/2013

2014 PropertyTaxPrincipal 086-031 $2,010.34 $0.00 $0.00 11/15/2014

2015 PropertyTaxPrincipal 086-031 $2,069.68 $0.00 $0.00 11/15/2015

2016 PropertyTaxPrincipal 086-031 $2,128.59 $0.00 $0.00 11/15/2016

2017 PropertyTaxPrincipal 086-031 $2,205.86 $0.00 $0.00 11/15/2017

2018 PropertyTaxPrincipal 086-031 $2,259.82 $0.00 $0.00 11/15/2018

2019 PropertyTaxPrincipal 086-031 $2,259.43 $0.00 $0.00 11/15/2019

2020 PropertyTaxPrincipal 086-031 $2,393.15 $0.00 $0.00 11/15/2020

2021 PropertyTaxInterest 086-031 $75.47 $0.00 $0.00 03/31/2022

2021 PropertyTaxPrincipal 086-031 $2,425.93 $0.00 $0.00 11/15/2021

2022 PropertyTaxPrincipal 086-031 $2,528.90 $0.00 $0.00 11/15/2022

TOTAL Due as of 12/20/2022 $0.00

Nearby

Nearby Neighbor #15

Address 7156 S GIBSON RD, WOODBURN, OR 97071

Owner HAMMELMAN BRIAN; HAMMELMAN MELINDA

APN 51E20 00702

Lot Size (SF/AC) 91,040/2.09

Bedrooms 3 Year Built 2010 Living Area (SF) 3,320

Bathrooms/Partial 3/1 Garage/No. of Cars Phones

Subject Property Location

Public Schools Report

Report Date: 12/20/2022

Property Address 33262 S BARLOW RD Order ID: R102627251 City, State & Zip WOODBURN, OR 97071-8715

County CLACKAMAS COUNTY Property Use Rural/Agricultural Residence Mailing Address 7061 SE DIVISION ST, PORTLAND, OR 97206-1140 Parcel Number 51E19 00400

Public School Summary

School Name Grades

MONITOR ELEMENTARY SCHOOL

Distance from Subject Property

Grade KG - Grade 8 1.95 miles

THE COMMUNITY ROOTS SCHOOL Grade 1 - Grade 3 1.95 miles

MT ANGEL MIDDLE SCHOOL Grade 6 - Grade 8 4.84 miles JOHN F KENNEDY HIGH SCHOOL Grade 9 - Grade 12 4.55 miles

MONITOR ELEMENTARY SCHOOL

Address

12465 MERIDIAN RD NE

Kindergarten 8 MT ANGEL, OR 97362-9724 Grade 1 8

Phone Number 503-634-2421 Grade 2 3

Distance from Subject Property 1.95 miles Grade 3 9 Grades Grade KG - Grade 8 Grade 4 9

Student Teacher Ratio 1:15.0 Grade 5 2

Full Time Equivalent Administrators 4.4 Grade 6 8

API Score N/A Grade 7 8 Grade 8 11 Total 66

THE COMMUNITY ROOTS SCHOOL

Address

12465 MERIDIAN RD NE Grade 1 12 MT ANGEL, OR 97362-9724 Grade 2 11

Phone Number 503-634-2440 Grade 3 6

Distance from Subject Property 1.95 miles Total 29 Grades Grade 1 - Grade 3

Student Teacher Ratio 1:29.0 Full Time Equivalent Administrators 1 API Score N/A

MT ANGEL MIDDLE SCHOOL

Address

460 EAST MARQUAM ST Grade 6 58 MT ANGEL, OR 97362-9702 Grade 7 47

Phone Number 503-845-6137 Grade 8 80

Distance from Subject Property 4.84 miles Total 185 Grades Grade 6 - Grade 8

Student Teacher Ratio 1:24.7

Full Time Equivalent Administrators 7.5

API Score N/A

JOHN F KENNEDY HIGH SCHOOL

Address 890 EAST MARQUAM ST Grade 9 56 MT ANGEL, OR 97362-9704 Grade 10 50

Phone Number 503-845-6128 Grade 11 54

Distance from Subject Property 4.55 miles Grade 12 57 Grades Grade 9 - Grade 12 Total 217

Student Teacher Ratio 1:20.7

Full Time Equivalent Administrators 10.5 API Score N/A

SCHOOL DISTRICTS

MT ANGEL SD 91

Address PO BOX 1129

MT ANGEL, OR 97362-9704

Pupil Teacher Ratio 15.6:1 No of Teacher Aids 8.2

Total Enrollment 718 No of Guidance Counselors 3.0

No of High School Graduates 64 No of School Administrators 4.0 Grades KG- 12 Number of Teachers 46.5 Number of Schools 3 SILVER FALLS SD 4J

Phone Number 503-845-2345

Address 802 SCHLADOR ST

Pupil Teacher Ratio 19.7:1 No of Teacher Aids 76.6 SILVERTON, OR 97381-1035 Total Enrollment 3,636 No of Guidance Counselors 7.3

Phone Number 503-873-5303

No of High School Graduates 246 No of School Administrators 11.2 Grades KG- 12 Number of Teachers 185.2 Number of Schools 14

About Public Schools

The Public School Report lists schools closest to the subject property. For a complete listing of schools in your area, please go to http://www.nces.ed.gov /globallocator.

API Index

The Academic Performance Index (API) measures academic performance and growth of schools, which includes results of the Stanford 9. The API reports a numeric scale that ranges from 200 to 1000. A school's score or position on the API indicates the level of a school's preformance.

Subject Property Location

Private Schools Report

Report Date: 12/20/2022

Property Address 33262 S BARLOW RD Order ID: R102627252 City, State & Zip WOODBURN, OR 97071-8715

County CLACKAMAS COUNTY Property Use Rural/Agricultural Residence Mailing Address 7061 SE DIVISION ST, PORTLAND, OR 97206-1140 Parcel Number 51E19 00400

Private

School Summary

School Name Grades

ELLIOTT PRAIRIE CHRISTIAN SCHOOL

Distance from Subject Property

Grade 3 - Grade 12 1.38 miles

ST LUKE SCHOOL Kindergarten - Grade 8 6.37 miles

ABIQUA CHILDREN'S CENTER INC Prekindergarten - Kindergarten 6.81 miles

OREGON OUTREACH - MOLALLA PRIDE Grade 10 - Grade 12 8.04 miles

SILVERTON CHRISTIAN SCHOOL Kindergarten - Grade 8 10.81 miles

ELLIOTT PRAIRIE CHRISTIAN SCHOOL

Address 5383 S SCHNEIDER ROAD Grade 3 1 WOODBURN, OR 97071-8795 Grade 5 1

Phone Number 503-634-2317 Grade 6 2

Distance from Subject Property 1.38 miles Grade 7 3

Gender Coed Grade 8 2 Grades Grade 3 - Grade 12 Grade 9 2

Affiliation Mennonite Grade 10 1 Student Teacher Ratio 1:6.3 Grade 11 1 Full Time Equivalent Administrators 2.4 Grade 12 2 Total 15

ST

LUKE

Address

SCHOOL

529 HARRISON STREET

Kindergarten 9 WOODBURN, OR 97071-4035 Grade 1 2

Phone Number 503-981-7441 Grade 2 22

Distance from Subject Property 6.37 miles Grade 3 22 Gender Coed Grade 4 15 Grades Kindergarten - Grade 8 Grade 5 18

Affiliation Roman Catholic Grade 6 18 Student Teacher Ratio 1:13.2 Grade 7 17

Full Time Equivalent Administrators 10 Grade 8 9 Total 132

ABIQUA CHILDREN'S CENTER INC

Address 6868 CASCADE HIGHWAY NE

Prekindergarten 10 SILVERTON, OR 97381-9770 Kindergarten 12

Phone Number 503-873-3697 Total 22

Distance from Subject Property 6.81 miles

Gender Coed Grades Prekindergarten - Kindergarten

Affiliation Nonsectarian Student Teacher Ratio 1:12.0

Full Time Equivalent Administrators 1

OREGON OUTREACH - MOLALLA PRIDE

Address 357 E FRANCIS STREET Grade 10 1 MOLALLA, OR 97038-9321 Grade 11 4

Phone Number 503-829-2360 Grade 12 12

Distance from Subject Property 8.04 miles Total 17

Gender Coed Grades Grade 10 - Grade 12 Affiliation Nonsectarian Student Teacher Ratio 1:8.5 Full Time Equivalent Administrators 2

SILVERTON CHRISTIAN SCHOOL

Address PO BOX 338

Kindergarten 6 SILVERTON, OR 97381-0338 Grade 1 6

Phone Number 503-873-5131 Grade 2 2

Distance from Subject Property 10.81 miles Grade 3 1

Gender Coed Grade 4 7 Grades Kindergarten - Grade 8 Grade 5 1 Affiliation Christian (no specific denomination) Grade 6 3 Student Teacher Ratio 1:10.7 Grade 7 4 Full Time Equivalent Administrators 3 Grade 8 2 Total 32

About Private Schools

As private schools are not subject to district boundaries, we list up to 15 of the schools closest to the subject property within a five mile radius of the subject property.

Disclaimer

THIS REPORT IS INTENDED FOR USE BY YOU AS AN END USER SOLELY FOR YOUR INTERNAL BUSINESS PURPOSES. YOU SHALL NOT RESELL, RELICENSE OR REDISTRIBUTE THIS REPORT, IN WHOLE OR IN PART. THE USE OF THIS REPORT BY ANY PARTY OTHER THAN YOURSELF FOR ANY PURPOSE IS STRICTLY PROHIBITED. THIS REPORT IS PROVIDED AS-IS WITHOUT WARRANTY OF ANY KIND, EITHER EXPRESS OR IMPLIED, INCLUDING WITHOUT LIMITATION, ANY WARRANTIES OF MERCHANTABILITY, NON-INFRINGEMENT, OR FITNESS FOR A PARTICULAR PURPOSE. BLACK KNIGHT SHALL HAVE NO LIABILITY IN CONTRACT, TORT, OR OTHERWISE ARISING OUT OF OR IN CONNECTION WITH THIS REPORT. BLACK KNIGHT DOES NOT REPRESENT OR WARRANT THAT THE REPORT IS COMPLETE OR FREE FROM ERROR. YOU UNDERSTAND AND ACKNOWLEDGE THAT THE AVAILABILITY, COMPLETENESS AND FORMAT OF THE DATA ELEMENTS MAY VARY SUBSTANTIANLLY FROM AREA-TO-AREA. THE INFORMATION CONTAINED IN THIS REPORT IS DERIVED FROM PUBLICLY AVAILABLE SOURCES FOR THE SUBJECT PROPERTY OR COMPARABLE PROPERTIES LISTED ABOVE AND HAS NOT BEEN INDEPENDENT VERIFIED BY BLACK KNIGHT THROUGH ANY FORM OF INSPECTION OR REVIEW. THIS REPORT DOES NOT CONSTITUTE AN APPRAISAL OF ANY KIND AND SHOULD NOT BE USED IN LIEU OF AN INSPECTION OF A SUBJECT PROPERTY BY A LICENSED OR CERTIFIED APPRAISER. THIS REPORT CONTAINS NO REPRESENTATIONS, OPINIONS OR WARRANTIES REGARDING THE SUBJECT PROPERTY'S ACTUAL MARKETABILITY, CONDITION (STRUCTURAL OR OTHERWISE), ENVIRONMENTAL, HAZARD OR FLOOD ZONE STATUS, AND ANY REFERENCE TO ENVIRONMENTAL, HAZARD OR FLOOD ZONE STATUS IS FOR INFORMATIONAL PURPOSES ONLY AND SHALL BE INDEPENDENTLY VERIFIED BY THE END USER. THE INFORMATION CONTAINED HEREIN SHALL NOT BE UTILIZED: (A) TO REVIEW OR ESTABLISH A CONSUMER'S CREDIT AND/OR INSURANCE ELIGIBILITY OR FOR ANY OTHER PURPOSE THAT WOULD CAUSE THE REPORT TO CONSTITUTE A "CONSUMER REPORT" UNDER THE FAIR CREDIT REPORTING ACT, 15 U.S.C. § 1681 ET SEQ.; OR (B) IN CONNECTION WITH CERTIFICATION OR AUTHENTICATION OF REAL ESTATE OWNERSHIP AND/OR REAL ESTATE TRANSACTIONS. ADDITIONAL TERMS AND CONDITIONS SHALL APPLY PURSUANT TO THE APPLICABLE AGREEMENT.

Copyright

CONFIDENTIAL, PROPRIETARY AND/OR TRADE SECRET. TM SM ® TRADEMARK(S) OF BLACK KNIGHT IP HOLDING COMPANY, LLC, OR AN AFFILIATE. © 2022 BLACK KNIGHT TECHNOLOGIES, LLC. ALL RIGHTS RESERVED.