Fundamentals of Corporate Finance 3rd Edition Parrino

Full download at: Solution Manual: https://testbankpack.com/p/test-bank-for-fundamentals-of-corporate-finance-3rd-edition-by-parrinokidwell-bates-isbn-1118845897-9781118845899/

Test bank: https://testbankpack.com/p/solution-manual-for-fundamentals-of-corporate-finance-3rd-edition-byparrino-kidwell-bates-isbn-1118845897-9781118845899/

Chapter 6: Discounted Cash Flows and Valuation

Format: True/False

Learning Objective: LO 1

Level of Difficulty: Easy

Bloomcode: Comprehension

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

1. Calculating the present and future values of multiple cash flows is relevant only for individual investors.

A) True

B) False Ans: B

Format: True/False

Learning Objective: LO 1

Level of Difficulty: Easy

Bloomcode: Knowledge

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

2. Calculating the present and future values of multiple cash flows is relevant for businesses only.

A) True

B) False Ans: B

Copyright © 2015 John Wiley & Sons, Inc.

Format: True/False

Learning Objective: LO 1

Level of Difficulty: Easy

Bloomcode: Comprehension

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

3. In computing the present and future value of multiple cash flows, each cash flow is discounted or compounded at a same rate.

A) True

B) False Ans: A

Format: True/False

Learning Objective: LO 1

Level of Difficulty: Easy

Bloomcode: Knowledge

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

4. The present value of multiple cash flows is greater than the sum of those cash flows.

A) True

B) False Ans: B

Format: True/False

Learning Objective: LO 2

Level of Difficulty: Easy

Bloomcode: Application

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

5. Jacob Oram pay the same amount every month as insurance premium for a term life policy for a period of five years, the stream of cash flows is called a perpetuity.

A) True

B) False Ans: B

Copyright © 2015 John Wiley & Sons, Inc.

Format: True/False

Learning Objective: LO 2

Level of Difficulty: Easy

Bloomcode: Application

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

6. Allen Bell pay the same amount every month on a car loan for a period of three years, the stream of cash flows is called an annuity.

A) True

B) False Ans: A

Format: True/False

Learning Objective: LO 3

Level of Difficulty: Easy

Bloomcode: Comprehension

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

7. In today's financial markets, the best example of a perpetuity is the common stock issued by firms.

A) True

B) False Ans: B

Format: True/False

Learning Objective: LO 3

Level of Difficulty: Easy

Bloomcode: Comprehension

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

8. Since the issuers of preferred stock promise to pay investors a fixed dividend, usually quarterly, forever, these are the most important perpetuities in the financial markets.

A) True

B) False Ans: A

Copyright © 2015 John Wiley & Sons, Inc.

Format: True/False

Learning Objective: LO 3

Level of Difficulty: Easy

Bloomcode: Knowledge

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

9. The present value of a perpetuity is the promised constant cash payment divided by the interest rate (i).

A) True

B) False Ans: A

Format: True/False

Learning Objective: LO 2

Level of Difficulty: Easy

Bloomcode: Knowledge

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

10. In ordinary annuities, cash flows occur at the beginning of each period.

A) True

B) False Ans: B

Format: True/False

Learning Objective: LO 3

Level of Difficulty: Easy

Bloomcode: Knowledge

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

11. In an annuity due, cash flows occur at the beginning of each period.

A) True

B) False Ans: A

Copyright © 2015 John Wiley & Sons, Inc.

Format: True/False

Learning Objective: LO 3

Level of Difficulty: Medium

Bloomcode: Comprehension

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

12. The lease payments by a business of a warehouse rental are an example of an annuity due.

A) True

B) False Ans: A

Format: True/False

Learning Objective: LO 2, LO 3

Level of Difficulty: Medium

Bloomcode: Comprehension

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

13. The present value of an annuity due is less than the present value of an ordinary annuity.

A) True

B) False Ans: B

Format: True/False

Learning Objective: LO 2, LO 3

Level of Difficulty: Medium

Bloomcode: Comprehension

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

14. The present value of an annuity due is equal to the present value of an ordinary annuity.

A) True

B) False Ans: B

Copyright © 2015 John Wiley & Sons, Inc.

Format: True/False

Learning Objective: LO 2, LO 3

Level of Difficulty: Medium

Bloomcode: Comprehension

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

15. The future value of an annuity due is greater than the future value of an ordinary annuity.

A) True

B) False Ans: A

Format: True/False

Learning Objective: LO 2, LO 3

Level of Difficulty: Medium

Bloomcode: Comprehension

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

16. The future value of an annuity due is equal to the future value of an ordinary annuity.

A) True

B) False Ans: B

Format: True/False

Learning Objective: LO 4

Level of Difficulty: Easy

Bloomcode: Knowledge

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

17. Cash flow streams that increase at a constant rate over time are called growing annuities or growing perpetuities

A) True

B) False Ans: A

Copyright © 2015 John Wiley & Sons, Inc.

Format: True/False

Learning Objective: LO 4

Level of Difficulty: Medium

Bloomcode: Application

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

18. A fertilizer manufacturing company enters into a contract with a county parks and recreation department that calls for the company to sell 10 percent more of its best lawn feed every year for the next five years. If they also agree to maintain the total price as constant over the contract period, this growth in revenue is an example of a growing perpetuity.

A) True

B) False Ans: B

Format: True/False

Learning Objective: LO 4

Level of Difficulty: Medium

Bloomcode: Application

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

19. You have received news about an inheritance that will pay you $5,000 next year. Beginning the following year, your inheritance will increase by 5 percent every year forever. This is a growing perpetuity.

A) True

B) False Ans: A

Format: True/False

Learning Objective: LO 4

Level of Difficulty: Medium

Bloomcode: Application

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

20. Natalia Greenberg opened a pizza place last year. She expects to increase her revenue from last year by 7 percent every year for the next 10 years. This is an example of a growing annuity.

A) True

B) False Ans: A

Copyright © 2015 John Wiley & Sons, Inc.

Format: True/False

Learning Objective: LO 5

Level of Difficulty: Easy

Bloomcode: Knowledge

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

21. The annual percentage rate (APR) is the annualized interest rate using compound interest.

A) True

B) False Ans: B

Format: True/False

Learning Objective: LO 5

Level of Difficulty: Medium

Bloomcode: Knowledge

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

22. The annual percentage rate (APR) is defined as the simple interest charged per period multiplied by the number of periods per year.

A) True

B) False Ans: A

Format: True/False

Learning Objective: LO 5

Level of Difficulty: Easy

Bloomcode: Knowledge

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

23. The correct way to annualize an interest rate is to compute the effective annual interest rate.

A) True

B) False Ans: A

Copyright © 2015 John Wiley & Sons, Inc.

Format: True/False

Learning Objective: LO 5

Level of Difficulty: Medium

Bloomcode: Knkowledge

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

24. The correct way to annualize an interest rate is to compute the annual percentage rate (APR).

A) True

B) False Ans: B

Format: True/False

Learning Objective: LO 5

Level of Difficulty: Medium

Bloomcode: Knowledge

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

25. The effective annual interest rate (EAR) is defined as the annual growth rate that takes compounding into account.

A) True

B) False Ans: A

Format: True/False

Learning Objective: LO 5

Level of Difficulty: Medium

Bloomcode: Knowledge

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

26. The effective annual interest rate (EAR) is the true cost of borrowing and lending.

A) True

B) False Ans: A

Copyright © 2015 John Wiley & Sons, Inc.

Format: True/False

Learning Objective: LO 5

Level of Difficulty: Easy

Bloomcode: Knowledge

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

27. The quoted interest rate is by convention a simple annual interest rate, such as the annual percentage rate (APR).

A) True

B) False Ans: A

Format: True/False

Learning Objective: LO 5

Level of Difficulty: Easy

Bloomcode: Knowledge

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

28. The quoted interest rate is by definition a simple annual interest rate, such as the effective annual interest rate (EAR).

A) True

B) False Ans: B

Format: True/False

Learning Objective: LO 5

Level of Difficulty: Easy

Bloomcode: Knowledge

AASCB: Analytic

IMA: Corporate Finance

AICPA: Legal/Regulatory Perspective

29. The Truth-in-Lending Act and the Truth-in-Savings Act require by law that the annual percentage rate (APR) be disclosed on all consumer loans and savings plans and that it be prominently displayed on advertising and contractual documents.

A) True

B) False Ans: A

Copyright © 2015 John Wiley & Sons, Inc. 6-10

Format: True/False

Learning Objective: LO 5

Level of Difficulty: Medium

Bloomcode: Comprehension

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

30. Only the annual percentage rate (APR) or some other quoted rate should be used as the interest rate factor for present or future value calculations.

A) True

B) False Ans: B

Format: True/False

Learning Objective: LO 4

Level of Difficulty: Easy

Bloomcode: Application

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

31. A car manufacturer enters into a contract for 25-years lease of warehouse rental that adjusts annually for the expected rate of inflation over the life of the contract. This is an example of growing perpetuity.

A) True

B) False Ans: B

Format: True/False

Learning Objective: LO 4

Level of Difficulty: Easy

Bloomcode: Knowledge

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

32. A growing annuity for an infinite period is called a growing perpetuity.

A) True

B) False Ans: A

Copyright © 2015 John Wiley & Sons, Inc.

Format: True/False

Learning Objective: LO 4

Level of Difficulty: Medium

Bloomcode: Comprehension

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

33. For computation of the present value of growing annuity with n periods, the cash flow for the current period is used and not the cash flow to be received in the next period.

A) True

B) False Ans: B

Format: True/False

Learning Objective: LO 4

Level of Difficulty: Easy

Bloomcode: Comprehension

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

34. Growing perpetuity is widely used in the valuation of common stock of firms that have a policy and history of paying dividends that grow at a constant rate.

A) True

B) False Ans: A

Format: True/False

Learning Objective: LO 4

Level of Difficulty: Medium

Bloomcode: Comprehension

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

35. The present value of growing perpetuity is computed as the cash flow occurring at the end of the first period divided by the difference between interest or discount rate and growth rate

A) True B) False Ans: A

Copyright © 2015 John Wiley & Sons, Inc.

Format: Multiple Choice

Learning Objective: LO 1

Level of Difficulty: Easy

Bloomcode: Knowledge

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

36. Which of the following is used as the denominator while calculating the present value for a growing perpetuity that begins next period (PVP)?

A) The difference between i (the discount or interest rate) and g (the constant rate of growth of the cash flow)

B) i (the discount or interest rate)

C) g (the constant rate of growth of the cash flow)

D) The addition of i (the discount or interest rate) and g (the constant rate of growth of the cash flow)

Ans: A

Format: Multiple Choice

Learning Objective: LO 1

Level of Difficulty: Easy

Bloomcode: Knowledge

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

37 The present value of future cash flows are computed by multiplying future value with the:

A) discounting factor

B) compound factor

C) interest rate

D) number of periods.

Ans: A

Copyright © 2015 John Wiley & Sons, Inc. 6-13

Format: Multiple Choice

Learning Objective: LO 1

Level of Difficulty: Easy

Bloomcode: Application

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

38 Nick invested $2,000 in a bank savings account today and another $2000 a year from now. If the bank pays interest of 10 percent per year, how much money will Nick have at the end of two years?

A) $4,210

B) $4,200

C) $4,000

D) $4,620

Ans: D

Feedback:

Future value of two cash flows = [PV × (1 + i)2]+ [PV × (1 + i)] = [$2,000 × (1 + 0.10)2] + [$2,000 × (1 + 0.10)] = [$2,000 × (1.10)2] + [$2,000 × (1.10)] = [$2,000 × 1.21]+ [$2,000 × 1.10] = $2,420 + $2,200 = $4,620

Format: Multiple Choice

Learning Objective: LO 1

Level of Difficulty: Easy

Bloomcode: Comprehension

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

39. Which of the following is true of discounting factor?

A) Discounting factor is the reciprocal of compounding factor.

B) Discounting factor is the sum of 1 and the rate of interest.

C) Discounting factor is period n times the rate of interest.

D) Discounting factor is computed by dividing period n by the sum of 1 and the rate of interest.

Ans: A

Copyright © 2015 John Wiley & Sons, Inc.

Format: Multiple Choice

Learning Objective: LO 1

Level of Difficulty: easy

Bloomcode: Application

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

40 William deposited $25,000 today that would earn an interest at the rate of 3% for a period of 2 years. The amount of $25,000 represents the:

A) present value of an annuity

B) future value of an annuity

C) present value

D) future value

Ans: C

Format: Multiple Choice

Learning Objective: LO 1

Level of Difficulty: Easy

Bloomcode: Comprehension

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

41. In computing the present and future value of multiple cash flows:

A) each cash flow is discounted or compounded at the same rate.

B) each cash flow is discounted or compounded at a different rate.

C) earlier cash flows are discounted at a higher rate.

D) later cash flows are discounted at a higher rate.

Ans: A

Format: Multiple Choice

Learning Objective: LO 1

Level of Difficulty: Easy

Bloomcode: Application

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

42. Anna would receive $15,000 from a bank deposit after 2 years which had an interest of 3.5%. The amount of $15,000 represents the:

A) present value of an annuity

B) future value of an annuity

C) present value

D) future value

Ans: D

Copyright © 2015 John Wiley & Sons, Inc. 6-15

Format: Multiple Choice

Learning Objective: LO 1

Level of Difficulty: Easy

Bloomcode: Comprehension

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

43 The present value of multiple cash flows is:

A) greater than the sum of the cash flows.

B) equal to the sum of all the cash flows.

C) less than the sum of the cash flows.

D) higher or lower than the cash flows depending on the interest rate

Ans: C

Format: Multiple Choice

Learning Objective: LO 1

Level of Difficulty: Easy

Bloomcode: Comprehension

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

44. The future value of multiple cash flows is:

A) greater than the sum of the cash flows.

B) equal to the sum of all the cash flows.

C) less than the sum of the cash flows.

D) higher or lower than the cash flows depending on the interest rate. Ans: A

Format: Multiple Choice

Learning Objective: LO 2

Level of Difficulty: Easy

Bloomcode: Knowledge

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

45. If your investment pays the same amount at the end of each year for a period of six years, the cash flow stream is called:

A) a perpetuity.

B) an ordinary annuity.

C) an annuity due.

D) a growing perpetuity. Ans: B

Copyright © 2015 John Wiley & Sons, Inc.

Format: Multiple Choice

Learning Objective: LO 3

Level of Difficulty: Easy

Bloomcode: Knowledge

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

46 If your investment pays the same amount at the beginning of each year for a period of 10 years, the cash flow stream is called:

A) a perpetuity.

B) an ordinary annuity.

C) an annuity due.

D) a growing perpetuity.

Ans: C

Format: Multiple Choice

Learning Objective: LO 2

Level of Difficulty: Easy

Bloomcode: Comrpehension

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

47. A preferred stock would be an ideal example of:

A) a perpetuity.

B) an ordinary annuity.

C) an annuity due.

D) a growing annuity.

Ans: A

Format: Multiple Choice

Learning Objective: LO 2

Level of Difficulty: Easy

Bloomcode: Comprehension

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

48. Cash flows associated with annuities are considered to be:

A) an uneven cash flow stream.

B) a constant cash flow stream.

C) a mix of constant and uneven cash flow streams.

D) a cash flow stream with decreasing trend.

Ans: B

Copyright © 2015 John Wiley & Sons, Inc.

Format: Multiple Choice

Learning Objective: LO 1

Level of Difficulty: Medium

Bloomcode: Comprehension

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

49 Which of the following statements is true of amortization?

A) Amortization solely refers to the total value to be paid by the borrower at the end of maturity

B) The amortization schedule represents only the interest portion of the loan

C) The computation of loan amortization is wholly based on the computation of simple interest.

D) The amortization schedule provides the data of equated monthly payments for which the classification of principal and interest along with unpaid principal balance is provided.

Ans: D

Format: Multiple Choice

Learning Objective: LO 1

Level of Difficulty: Medium

Bloomcode: Comprehension

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

50. Which of the following statements is true of amortization?

A) With an amortized loan, a periodical payment of principal portion gradually decreases over a period.

B) Amortization schedule represents only the interest portion of the loan.

C) With an amortized loan, a bigger proportion of each month's payment goes toward interest in the early periods.

D) The computation of loan amortization is wholly based on the computation of simple interest.

Ans: C

Copyright © 2015 John Wiley & Sons, Inc.

Format: Multiple Choice

Learning Objective: LO 1

Level of Difficulty: Medium

Bloomcode: Comprehension

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

51 Which of the following statements is true of amortization?

A) With an amortized loan, a bigger proportion of each month's payment goes toward interest in the early periods.

B) With an amortized loan, a bigger proportion of each month's payment goes toward interest in the later periods.

C) With an amortized loan, a smaller proportion of each month's payment goes toward interest in the early periods.

D) With an amortized loan, the interest portion of each month’s payment remains unchanged

Ans: A

Format: Multiple Choice

Learning Objective: LO 3

Level of Difficulty: Easy

Bloomcode: Comprehension

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

52. The annuity transformation method is used to transform:

A) a present value annuity to a future value annuity.

B) a present value annuity to an annuity due.

C) an ordinary annuity to an annuity due.

D) a perpetuity to an annuity.

Ans: C

Format: Multiple Choice

Learning Objective: LO 4

Level of Difficulty: Easy

Bloomcode: Knowledge

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

53. A firm receives a cash flow from an investment that will increase by 10 percent annually for an infinite number of years. This cash flow stream is called:

A) an annuity due.

B) a growing perpetuity.

C) an ordinary annuity.

D) a growing annuity.

Ans: B

Copyright © 2015 John Wiley & Sons, Inc.

Format: Multiple Choice

Learning Objective: LO 4

Level of Difficulty: Easy

Bloomcode: Knowledge

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

54 Your investment in a small business venture will produce cash flows that increase by 15 percent every year for the next 25 years. This cash flow stream is called:

A) an annuity due.

B) a growing perpetuity.

C) an ordinary annuity.

D) a growing annuity.

Ans: D

Format: Multiple Choice Learning Objective: LO 5

Level of Difficulty: Medium

Bloomcode: Comprehension

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

55. Which of the following statements is true about the effective annual rate (EAR)?

A) The effective annual interest rate (EAR) is defined as the annual growth rates that do not take compounding into account.

B) The EAR is the annualized interest rate using simple interest. It ignores the interest earned on interest associated with compounding periods of less than one year.

C) The EAR is the simple interest charged per period multiplied by the number of periods per year.

D) The EAR is the interest rate actually paid (or earned) after accounting for compounding.

Ans: D

Format: Multiple Choice Learning Objective: LO 5

Level of Difficulty: Medium

Bloomcode: Knowledge

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

56. The true cost of borrowing is the:

A) annual percentage rate.

B) effective annual rate.

C) quoted interest rate.

D) periodic rate.

Ans: B

Copyright © 2015 John Wiley & Sons, Inc.

Format: Multiple Choice

Learning Objective: LO 5

Level of Difficulty: Medium

Bloomcode: Knowledge

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

57 The true cost of lending is the:

A) annual percentage rate.

B) effective annual rate.

C) quoted interest rate.

D) interest rate per period.

Ans: B

Format: Multiple Choice

Learning Objective: LO 5

Level of Difficulty: Medium

Bloomcode: Comprehension

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

58. Which of the following statements is true of annual percentage rate (APR)?

A) The APR is similar to quoted interest rate which is a simple annual rate.

B) The APR calculation adjusts for the effects of compounding and, hence, the time value of money.

C) The APR is the true cost of borrowing and lending.

D) The APR takes compounding into account.

Ans: A

Copyright © 2015 John Wiley & Sons, Inc.

Format: Multiple Choice

Learning Objective: LO 5

Level of Difficulty: Medium

Bloomcode: Comprehension

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

59 Which of the following statements is true of annual percentage rate (APR)?

A) The Truth-in-Savings Act was passed by Congress to ensure that the true cost of credit was disclosed to consumers.

B) The Truth-in-Lending Act was passed to provide consumers an accurate estimate of the return they would earn on an investment.

C) The Truth-in-Savings Act and Truth-in-Lending Act require by law that the APR be disclosed on all consumer loans and savings plans.

D) The annual percentage rate (APR), and not the effective annual interest rate (EAR), represents the true economic interest rate

Ans: C

Format: Multiple Choice

Learning Objective: LO 5

Level of Difficulty: Easy

Bloomcode: comprehension

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

60. What is the appropriate interest rate to use when making future or present value calculations?

A) The effective annual interest rate (EAR)

B) The annual percentage rate (APR)

C) The quoted interest rate

D) The simple interest

Ans: A

Copyright © 2015 John Wiley & Sons, Inc.

Format: Multiple Choice

Learning Objective: LO 1

Level of Difficulty: Medium

Bloomcode: Application

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

61 Krysel Inc. is expecting a new project to start producing cash flows, beginning at the end of this year. They expect cash flows to be as follows:

If they can reinvest these cash flows to earn a return of 9.2 percent, what is the future value of this cash flow stream at the end of five years? (Round to the nearest dollar.)

A) $4,368,692

B) $4,429,046

C) $4,468,692

D) $4,529,046

Ans: B

Copyright © 2015 John Wiley & Sons, Inc.

Format: Multiple Choice

Learning Objective: LO 1

Level of Difficulty: Medium

Bloomcode: Application

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

62 Phosfranc Inc., is expecting the following cash flows starting at the end of the year $133,245, $152,709, $161,554, and $200,760. If their opportunity cost is 9.4 percent, find the future value of these cash flows. (Round to the nearest dollar.)

A) $734,731

B) $756,525

C) $734,231

D) $776,252 Ans:

FV4=

Copyright © 2015 John Wiley & Sons, Inc.

Format: Multiple Choice

Learning Objective: LO 1

Level of Difficulty: Medium

Bloomcode: Application

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

63 Robert White will receive from his investment cash flows of $4,450, $4,775, and $5,125. If he can earn 7 percent on any investment that he makes, what is the future value of his investment cash flows at the end of three years? (Round to the nearest dollar.)

A) $15,329

B) $15,427

C) $16,427

D) $14,427

Ans: A

Copyright © 2015 John Wiley & Sons, Inc.

Format: Multiple Choice

Learning Objective: LO 1

Level of Difficulty: Medium

Bloomcode: Application

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

64 Scottie Barnes has invested in an investment that will pay him $6,400, $6,450, $7,225, and $7,500 over the next four years. If his opportunity cost is 10 percent, what is the future value of the cash flows he will receive? (Round to the nearest dollar.)

A) $27,150

B) $32,020

C) $30,455

D) $31,770

Ans: D Feedback:

Copyright © 2015 John Wiley & Sons, Inc.

Format: Multiple Choice

Learning Objective: LO 1

Level of Difficulty: Medium

Bloomcode: Application

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

65 Global Shippers Inc. has forecast earnings of $1,233,600, $1,345,900, and $1,455,650 for the next three years. What is the future value of these earnings if the firm's opportunity cost is 13 percent? (Round to the nearest dollar.)

A) $4,214,360

B) 4,551,701

C) $3,900,865

D) $4,362,428

Ans: B Feedback:

Copyright © 2015 John Wiley & Sons, Inc.

Format: Multiple Choice

Learning Objective: LO 1

Level of Difficulty: Medium

Bloomcode: Application

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

66 Damien McCoy has loaned money to his brother at an interest rate of 5.85 percent. He expects to receive $987, $1,012, $1,062, and $1,162 at the end of the next four years as complete repayment of the loan with interest. How much did he loan out to his brother? (Round to the nearest dollar.)

A) $3,785

B) $3,757

C) $3,657

D) $3,685

Ans: C

Copyright © 2015 John Wiley & Sons, Inc.

Format: Multiple Choice

Learning Objective: LO 1

Level of Difficulty: Medium

Bloomcode: Application

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

67 Newship Inc. has borrowed from its bank at a rate of 8 percent and will repay the loan with interest over the next five years. Its scheduled payments, starting at the end of the year are as follows $450,000, $560,000, $750,000, $875,000, and $1,000,000. What is the present value of these payments? (Round to the nearest dollar.)

A) $2,735,200

B) $2,989,351

C) $2,431,224

D) $2,815,885

Ans: D

Feedback:

Copyright © 2015 John Wiley & Sons, Inc.

Format: Multiple Choice

Learning Objective: LO 1

Level of Difficulty: Medium

Bloomcode: Application

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

68 David Stephens has made an investment that will pay him $11,455, $16,376, and $19,812 at the end of the next three years. His investment was to fetch him a return of 14 percent. What is the present value of these cash flows? (Round to the nearest dollar.)

A) $37,712

B) $36,022

C) $41,675

D) $39,208

Ans: B

Feedback:

Copyright © 2015 John Wiley & Sons, Inc.

Format: Multiple Choice

Learning Objective: LO 1

Level of Difficulty: Medium

Bloomcode: Application

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

69 Nutech Corp. is expecting the following cash flows $79,000, $112,000, $164,000, $84,000, and $242,000 over the next five years. If the company’s opportunity cost is 15 percent, what is the present value of these cash flows? (Round to the nearest dollar.)

A) $429,560

B) $485,097

C) $480,906

D) $477,235

Ans: A

Feedback:

Copyright © 2015 John Wiley & Sons, Inc.

Format: Multiple Choice

Learning Objective: LO 1

Level of Difficulty: Medium

Bloomcode: Application

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

70 Helen Ashley is expecting cash flows of $50,000, $75,000, $125,000, and $250,000 from an inheritance over the next four years. If she can earn 11 percent on any investment that she makes, what is the present value of her inheritance? (Round to the nearest dollar.)

A) $361,998

B) $414,454

C) $412,372

D) $434,599

Ans: A

Feedback:

= $45,045.05 + $60,871.68 + $91,398.92 + $164,682.74 = $361,998.39

Copyright © 2015 John Wiley & Sons, Inc.

Format: Multiple Choice

Learning Objective: LO 2

Level of Difficulty: Medium

Bloomcode: Application

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

71 Ransport Company has made an investment in another company that will guarantee it a cash flow of $37,250 each year for the next five years. If the company uses a discount rate of 15 percent on its investments, what is the present value of this investment? (Round to the nearest dollar.)

A) $101,766

B) $124,868

C) $251,154

D) $186,250

Ans: B

Feedback:

Annual payment = PMT = $37,250

No. of payments = n = 5

Required rate of return = 15%

Present value of investment = PVA5

Copyright © 2015 John Wiley & Sons, Inc.

Format: Multiple Choice

Learning Objective: LO 2

Level of Difficulty: Medium

Bloomcode: Application

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

72 Ryan Campbell has invested in a fund that will provide him a cash flow of $11,700 for the next 20 years. If his opportunity cost is 8.5 percent, what is the present value of this cash flow stream? (Round to the nearest dollar.)

A) $234,000

B) $132,455

C) $110,721

D) $167,884

Ans: C

Feedback:

Copyright © 2015 John Wiley & Sons, Inc.

Format: Multiple Choice

Learning Objective: LO 2

Level of Difficulty: Medium

Bloomcode: Application

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

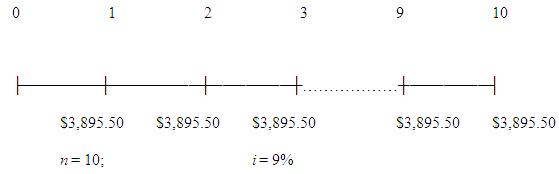

73 Moore’s Inc. will be making lease payments of $3,895.50 for a 10-year period, starting at the end of this year. If the firm uses a 9 percent discount rate, what is the present value of this annuity? (Round to the nearest dollar.)

A) $23,250

B) $29,000

C) $25,000

D) $20,000 Ans: C

Copyright © 2015 John Wiley & Sons, Inc.

Format: Multiple Choice

Learning Objective: LO 2

Level of Difficulty: Medium

Bloomcode: Application

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

74 Graciela Treadwell won a lottery. She will have a choice of receiving $25,000 at the end of each year for the next 30 years, or a lump sum today. If she can earn a return of 10 percent on any investment she makes, what is the minimum amount she should be willing to accept today as a lump-sum payment? (Round to the nearest hundred dollars.)

A) $750,000

B) $334,600

C) $212,400

D) $235,700

Ans: D

Feedback:

Copyright © 2015 John Wiley & Sons, Inc.

Format: Multiple Choice

Learning Objective: LO 2

Level of Difficulty: Medium

Bloomcode: Application

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

75 Insulor Inc. is expecting cash flows of $67,000 at the end of each year for the next five years. If the firm's discount rate is 17 percent, what is the present value of this annuity? (Round to the nearest dollar.)

A) $214,356

B) $241,653

C) $278,900

D) $197,776

Ans: A

Feedback:

Copyright © 2015 John Wiley & Sons, Inc.

Format: Multiple Choice

Learning Objective: LO 2

Level of Difficulty: Medium

Bloomcode: Application

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

76 Lloyd Harris is planning to invest $3,500 every year for the next six years in an investment paying 13 percent annually. What will be the amount he will have at the end of the six years?

(Round to the nearest dollar.)

A) $21,000

B) $29,129

C) $24,670

D) $26,124

Ans: B

Feedback:

n = 6; i = 13%

= $3,500 × (1.13)6 – 1 0.13 = $3,500 × 8.3227 = $29129.47

Copyright © 2015 John Wiley & Sons, Inc.

Format: Multiple Choice

Learning Objective: LO 2

Level of Difficulty: Medium

Bloomcode: Application

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

77 Shaun Barringer has started on his first job. He plans to start saving for retirement. He will invest $5,000 at the end of each year for the next 45 years in a fund that will earn a return of 10 percent. How much will Shaun have at the end of 45 years? (Round to the nearest dollar.)

A) $2,667,904

B) $3,594,524

C) $1,745,600

D) $5,233,442

Ans: B

Feedback:

Copyright © 2015 John Wiley & Sons, Inc.

Format: Multiple Choice

Learning Objective: LO 2

Level of Difficulty: Medium

Bloomcode: Application

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

78 John Mason decided to save $2,250 at the end of each of the next three years to pay for a vacation. If he invests it at 8 percent, how much will he have at the end of three years? (Round to the nearest dollar.)

A) $7,304

B) $7,403

C) $6,297

D) $7,010

Copyright © 2015 John Wiley & Sons, Inc.

Format: Multiple Choice

Learning Objective: LO 2

Level of Difficulty: Medium

Bloomcode: Application

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

79 Barbara Lakey is saving to buy a new car in four years. She will save $5,500 at the end of each of the next four years. If she invests her savings at 7.75 percent, how much will she have after four years? (Round to the nearest dollar.)

A) $22,000

B) $23,345

C) $27,556

D) $28,692

Ans: D Feedback:

=$5,500 × (1.0775)4 – 1 0.0775 = $5,500 × 4.4895 = $24,692.25

Copyright © 2015 John Wiley & Sons, Inc.

Format: Multiple Choice

Learning Objective: LO 2

Level of Difficulty: Medium

Bloomcode: Application

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

80 Rosalia White will invest $3,000 in an IRA for the next 30 years starting at the end of this year The investment will earn 13 percent annually. How much will she have at the end of 30 years?

(Round to the nearest dollar.)

A) $879,598

B) $912,334

C) $748,212

D) $1,233,450

Ans: A

Feedback:

Copyright © 2015 John Wiley & Sons, Inc.

Format: Multiple Choice

Learning Objective: LO 2

Level of Difficulty: Medium

Bloomcode: Application

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

81 Viviana Carroll needs to have $25,000 in five years. If she can earn 8 percent on any investment, what is the amount that she will have to invest every year at the end of each year for the next five years? (Round to the nearest dollar.)

A) $5,000

B) $4,261

C) $4,640

D) $4,445

Ans: B

Feedback:

Copyright © 2015 John Wiley & Sons, Inc.

Format: Multiple Choice

Learning Objective: LO 2

Level of Difficulty: Medium

Bloomcode: Application

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

82 Cassandra Dawson wants to save for a trip to Australia. She will need $12,000 at the end of four years. She can invest a certain amount at the beginning of each of the next four years in a bank account that will pay her 6.8 percent annually. How much will she have to invest annually to reach her target? (Round to the nearest dollar.)

A) $3,000

B) $2,980

C) $2,538

D) $2,711

Ans: C

Feedback:

Copyright © 2015 John Wiley & Sons, Inc.

Format: Multiple Choice

Learning Objective: LO 2

Level of Difficulty: Medium

Bloomcode: Application

AASCB: Analytic

IMA: Corporate Finance

AICPA: Measurement

83 Dawson Electricals has borrowed $27,850 from its bank at an annual rate of 8.5 percent. It plans to repay the loan in eight equal installments, beginning at the end of next in a year. What is its annual loan payment? (Round to the nearest dollar.)

A) $4,708

B) $5,134

C) $4,939

D) $4,748

Ans: C Feedback:

PVAn = $27,850 n = 8; i = 8.5%

Present value of annuity = PVA = $27,850

Return on investment = i = 8.5%

Payment required to meet target = PMT Using the PVA equation:

$4,938.66

Each payment made by Dawson Electricals will be $4,938.66, starting at the end of next year.

Copyright © 2015 John Wiley & Sons, Inc.