Committed to bringing you the most professional, informative, trustworthy & dedicated service.

My responsibility is protecting the interests of my clients in every transaction.

Committed to bringing you the most professional, informative, trustworthy & dedicated service.

My responsibility is protecting the interests of my clients in every transaction.

Lauer Realty Group is a full-service residential brokerage, specializing in home sales in the most desirable neighborhoods in Madison, Dane County and beyond. It takes more than a computer and MLS access to move you when and where you want to go. The best real estate transactions happen with a great realtor at your side, and gives you the edge in the process. We bring our clients the latest information, technology, and our mastery of the industry In using our expertise, you ’ re tapping into the top performing 1% of realtors in Dane County for over a decade.

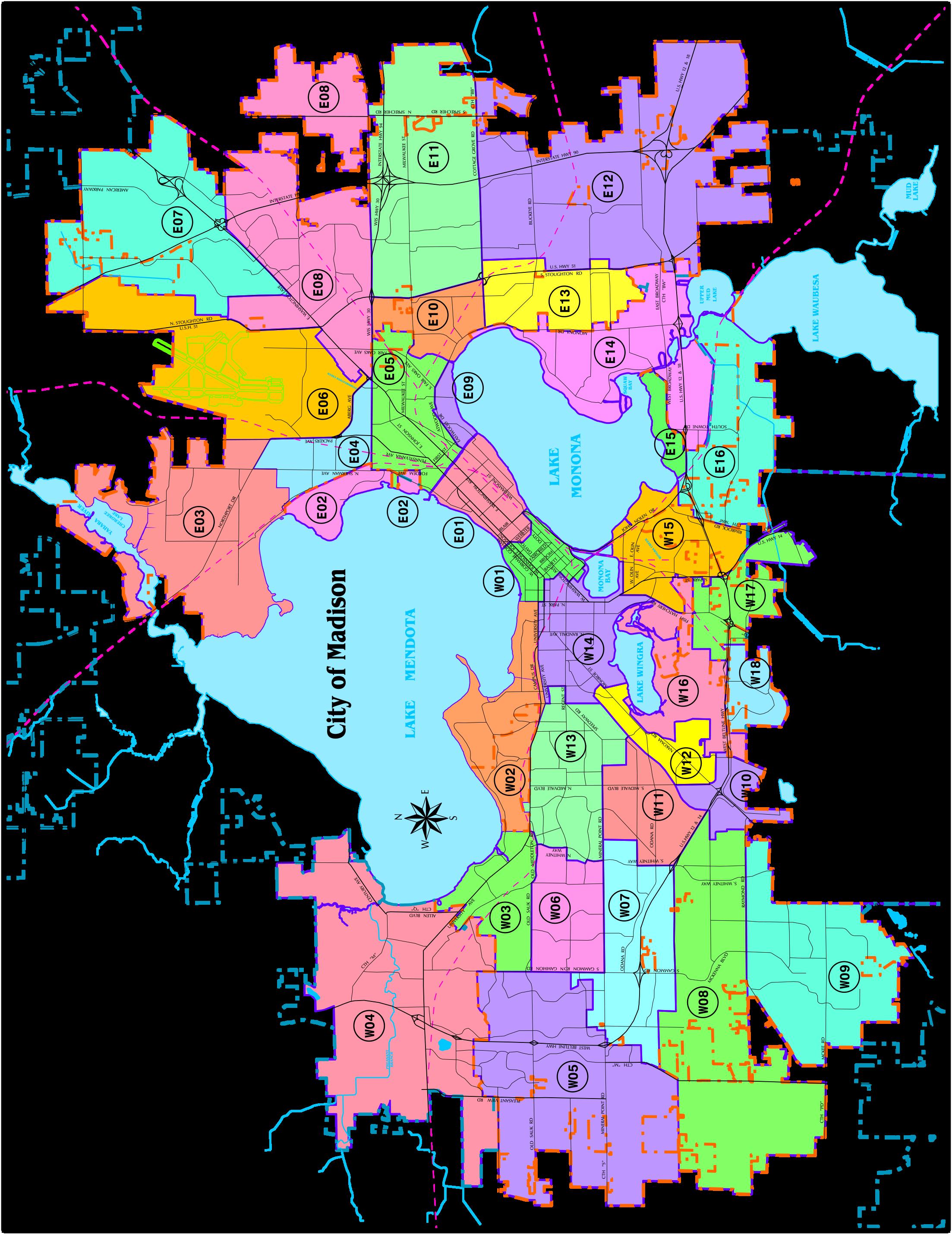

At your side and on your side Our Madison real estate agents live, work, and play right here in the Madison area and are deeply tied to the communities where you ’ re looking to purchase. We know the perks and quirks of each neighborhood, and we’ll work hard to honor the unique hopes and dreams you bring to the table when searching for a home.

At Lauer Realty Group we believe that being the best isn’t something you say, it’s something you are. We believe the most important thing is that we listen to our clients’ wants, needs, and expectations and deliver on them every single time Thank you for your interest in our firm and we look forward to delivering a superior real estate experience that exceeds your every expectation.

Cheers,

Liz Lauer

HOMEBUYINGPROCESS

FINDTHERIGHTAGENT

CHOOSEALENDER

STARTHOMESHOPPING

MAKEANOFFER

ORDERANINSPECTION

NEGOTIATEFINALOFFER

APPRAISALORDERED

SCHEDULETHEMOVE

CLOSINGDAY

Select an agent that is knowledgeable, caring and understanding It’s important to have an agent that is compatible with you so that you can fully trust them to give you the best advice and look out for your best interest It is crucial to work with a Buyer’s Agent as he/she is required to put your needs and concerns above all others

It is important to work with a reputable Lender Meeting with a Lender should really take place prior to looking at properties so you know what you can comfortably afford The Lender will also give you a preapproval letter that is sent with the offer to purchase so the Seller is reassured you are a serious Buyer that can afford a home

This is where you really put your Buyer’s Agent to work so be sure to let the Agent know exactly what you are looking for in a home Buyer’s Agents have multiple methods of searching and have the tools necessary to find you the right house at the right price Buyer’s Agents have the ability to schedule multiple properties for a tour that saves you time, and they will keep you up to date on new listings that match your specific criteria

Once you ’ ve decided on a home you, the next step is to write an offer to purchase A Buyer’s Agent will review comparable sold properties, discuss any concerns and draft the offer with your best interests in mind They will explain the offer to purchase in layman’s terms and will be there to answer any questions you may have There are 3 key items in an offer: Earnest Money, Inspection, and Financing

Earnest money essentially shows good faith that you are going to do you best to follow through on this binding contract It is usually delivered within 3 days of the accepted offer and the amount is typically 1-2% of the purchase price, or $1,000 (whichever is greater) The offer to purchase goes into great detail about earnest money technicalities

A home inspection is a crucial step in the buying process It typically takes place within 10 days of acceptance of the offer A licensed Wisconsin Home Inspector of your choice completes the inspection and the Buyer should be in attendance as this is the best time to really get up close and personal with your home If any major defects are found in the inspection that were not disclosed on the condition report the Buyer and Seller may negotiate the terms of the defects

Upon acceptance of the offer, your Buyer’s Agent will deliver a copy of the offer to your Lender The Lender will then ask you for any required paperwork you may need to submit, order the appraisal and send everything to underwriting Typically 30-45 days after the accepted offer the Lender will then deliver a financing commitment letter to you that guarantees the money will be there at closing on your behalf The letter will be delivered to the Seller and removes your financing contingency

The Buyer is responsible for obtaining a year of homeowner’s insurance prior to closing Insurance companies are all different and competitive in pricing You will be required to obtain at least coverage of the mortage amount

This guarantees the Seller has legal and “marketable” title to the property Should a problem arise, the Title Insurer pays any legal damages

Buyer will need to make sure to contact local utlities prior to closing Ask your Agent to provide you with this information if needed

Up to 3 days prior to closing Buyer can revisit the home to make sure it is in the same condition as when the offer was accepted and that all work that may have been agreed to from the inspection is in fact done

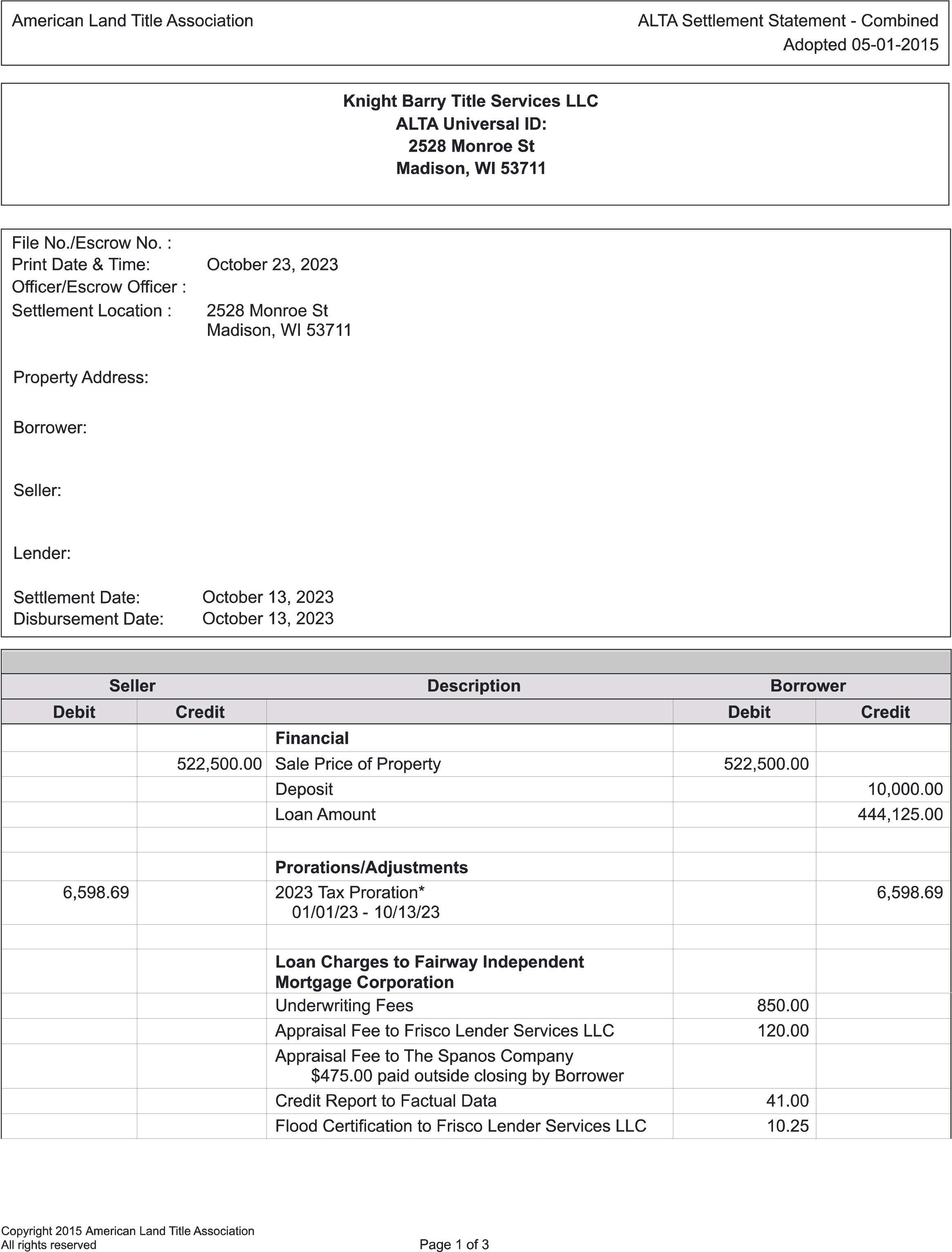

The final step is closing! Typically held at a Title Company chosen by the Seller, Buyer will need to bring ID and a cashier’s check made payable to the Title Company for the amount shown on the ALTA statement The ALTA statement is usually received by the Buyer 3 days prior to closing and either the Buyer’s Agent or Lender will discuss it with them

Buying a home is one of the most significant purchases in a lifetime. It is essential to have an experienced agent in your corner, always looking out for your best interest A buyer agent’s fiduciary responsibility is to represent the buyer and to ensure that they are protected

After all, a seller has someone in their corner. A listing agent has an allegiance to the seller Their goal is to get the seller top dollar for their home. There is incredible value in having someone working for YOUR best interests when buying a home.

Wewillnarrowdownthehomesthatfityouruniquewantsandneedsandgetyouinthedoor!Ilookatdozensofhomesevery week,andIcanhelpyouidentifypotentialproblemswithinahome

Whenrepairsorchangesinpriceneedtobemade,Iwillbeyourguideandhandlerequestinganyrepairsorchangesinpriceto thesellers

Buyingahomeinvolvesmanytypesofdocumentation.Ihavetheexperienceandknowledgetonavigaterealestatecontracts. Ensuringthatnothingisoverlooked,andthatyoutrulyunderstandwhatapapermeansbeforeeversigningonthedottedline

Abuyer’sagentwillrepresentyourbestinterests.Withapulseonthelocalmarketandasoundunderstandingofhowvarious amenitieseffectthevalueofahome,wewillmakesurewesubmitacompetitiveofferontherighthouseforyou.

Iworkdailyinneighborhoodswithinspectors,contractors,andnegotiatingwithsellers Ihavethemarketknowledgeyouneedtoget youthehomeofyourdreamsatthebestprice!Understandingthelocalrealestatemarketisessentialwhenitcomestimetomakean offeronahouse

Iwillworkhardtoprotectallofyourinterestsandtakeonanyissuesthatmayarisethroughouttheentireprocess Iwork tirelesslytomakesurebuyingahomeisafunandstress-freeprocess

Thesellertypicallypaysthecommissionforboththeseller’sagentandthebuyer’sagent

Services&DutiesProvided

Arrange Property Showings

Assists with Financing

Provides Accurate Information

Explains Forms and Agreements

Monitors Escrow and Closing

Provides Information about Listed and Unlisted Properties

Gives Advice in Your Best Interest

Completes a Thorough Analysis of the Property You’re Interested In

Promotes and Protects Your Best Interest

Negotiates the Best Price and Terms For You

Points Out Reasons Not to Buy Specific Properties

Writes the Offer With Your Best Interest In Mind

100% of the commision is paid by the Seller at closing.

The Listing Agent charges a fee to the list the home on the MLS. The Listing Agent typically splits this fee with the Buyer’s Agent

*Typically there is no Listing Agent involved in a flat fee listing transaction

Sellers will usually pay 100% of the commission to the Buyer’s Agent. Some Sellers will pay 50% of the Buyer’s Agent comission and ask the Buyer to pay the other 50%

A few will not pay any part of the Buyer’s Agent commission and even fewer are not willing to work with any Realtor at all

*Most For Sale By Owners appreciate the work the Buyer’s Agent does to facilitate a smooth and successful sale of their home

Once you have a Buyer Agency Agreement signed and completed with a Buyer’s Agent, YOU SHOULD ONLY SEE HOMES WITH YOUR AGENT Seeing homes with another Agent may affect your Agent’s ability to receive compensation Attending open houses is an exception and you are welcome to inform the Agent hosting the open house of your Buyer Agent’s contact informaiton.

C H O O S E A l e n d e r

The following Lenders are recommended by previous clients. You are not required to choose from this list and are encouraged to do your own research to determine the best Lender for you

Johnson Financial Group

Office: 608-250-7234

Mobile: 608-225-0642

Email: mlandphier@johnsonfinancialgroup.com

Summit Credit Union Office: 608-243-5000 x2611

Mobile: 608-234-1632

Email: cody.zach@summitcreditunion.com

Stampfli Mortgage Office: 608-572-7111

Mobile: 608-213-2008

Email: jason@stampflimortgage.com

One Community Bank Office: 608-835-2415

Mobile: 608-501-4820

Email: tlong@onecommunity.bank

UW Credit Union Office: 608-232-5000 x2107

Mobile: 608-514-2268

Email: abergren@uwcu.org

Bell Bank Mortgage Office: 608-598-2283

Mobile: 608-234-0689

Email: adenoble@bell.bank

One Community Bank Office: 608-825-2330

Mobile: 608-576-2483

Email: rstafslien@onecommunity.bank

Summit Credit Union Office: 608-243-5000 x1511

Mobile: 920-342-3091

Email: ed.garcia@summitcreditunion.com

DON’T buy or lease a new vehicle.

DON’T quit your job to change industries, start a company or go into business for yourself.

DON’T switch from a salaried job to a commission job or a 1099 independent contractor position.

DON’T transfer large sums of money between bank accounts.

DON’T forget to pay your bills, even ones in dispute

DON’T open new credit cards.

DON’T make big purhcases on existing credit cards. (Buy furniture and appliances AFTER you own the home.)

DON’T close any credit card accounts.

DON’T accept a cash gift without filing the proper “gift” paperwork.

DON’T make random, undocumented deposits into your bank account

DON’T spend the money you have set aside from closing.

DON’T omit debts or liabilities from your loan application.

DON’T do things that cause inquiries into your credit score This includes test driving cars (they sometimes pull your credit)!

DON’T co-sign a loan for someone. This debt will change the ratios that qualified you for your loan.

Should circumstances arise where you need to engage in these activities, consult your Lender first.

S T A R T s h o p p i n g

Time to start shopping! We will take notes on all the homes we visit It can be hard to remember all the details of each home, so take pictures or video to help you remember each home, and review the notes you have written Once we have found THE house for you, we will present an appropriate offer based off of recent sales and current buyer activity in the area, as well as the value of the property in it’s current condition Negotiations may take place after the offer is presented

Evaluate the neighborhood and surrounding areas

•Are the surrounding homes well maintained to your liking?

•How much traffic is on the street, does it matter to you?

•Is it conveniently located to schools, shopping, restaurants, & parks?

M A K E A N o f f e r

WHENTOMAKEANOFFER:

So you have found THE house! Congrats! In today’s market when the demand is higher than the amount of homes available it is important to act fast!

HOWMUCHTOOFFER:

We will sit down and look at recent sales and current buyer activity in the area, as well as the value of the property in it’s present condition Putting all this information together, we will determine the price that you would like to offer

SUBMITTINGANOFFER

There are some components to an offer that makes it more appealing to the sellers

•PutYourBestFootForward

We will work together to discuss your options and create your very best offer Depending on the circumstances, you may have only one chance to make a good impression

•PutDownanEarnestDeposit

A healthy earnest money deposit written into the offer shows the seller you are serious

•CashTalks

A transaction that is not dependent on receiving loan approval is often more attractive to a seller

•ShorterInspectionPeriods

Try shortening the inspection period to 10 days

•Contingencies

If the market is very competitive we may discuss the needed contingencies vs what to expect if you choose to exclude any

•OffertoCloseQuickly

Many sellers prefer to close within 30 days

AFTERYOUSUBMITANOFFER

THESELLERCOULD

•ACCEPTTHEOFFER

•DECLINETHEOFFER

This happens if the seller thinks your offer isn’t close enough to their expectations to further negotiate

•COUNTER-OFFER

A counter-offer is when the seller offers you different terms If this happens, you can:

•ACCEPTTHESELLER’SCOUNTER-OFFER

•DECLINETHESELLER’SCOUNTER-OFFER

•COUNTERTHESELLER’SCOUNTER-OFFER

You can negotiate back and forth as many times as needed until you reach an agreement or someone chooses to walk away

OFFERISACCEPTED-CONGRATS!

You will sign the purchase agreement and you are now officially under contract! This period of time is called the contingency period Now inspections, appraisals, or anything else built into your purchase agreement will take place

During the inspection period, you will schedule an inspection with a reputable home inspector to do a thorough investigation of the home. Once this is complete, the inspector will provide us with a list of their findings You can take the issues as-is or request the seller to address some or all of the findings We will be mindful and reasonable on smaller items, while being very cautious and vigilant of potentially significant issues

Issues typically arise after the home inspection, and those issues tend to result in another round of negotiations for credits or fixes.

1. Ask for a credit for the work that needs to be done. Likely, the last thing the seller wants to do is repair work.

2. Think “big picture” and don’t sweat the small stuff. Tile that needs some caulking, or a leaky faucet can easily be fixed Repairs are still up for negotiation and perhaps a small credit would help with closing costs.

3.Keep your poker face. Typically it's just you and the inspector present during inspections, however occasionally the seller and/or list agent may be present. Revealing your comfort level with the home could come back to haunt you in further discussions or negotiations

Your lender will arrange for a third party appraiser to provide an independent estimate of the value of the house you are buying The appraisal lets all parties involved know that the price is fair The loan file then moves on to the mortgage underwriter

If approved you will receive your final commitment letter that includes the final loan terms & percentage rates

This ensures that the seller truly owns the property, and that all existing liens, loans or judgments are disclosed

You'll need insurance for the new home prior to closing This will protect against things like fire, storms and flooding

When you are purchasing a property we highly recommend that you have a Professional Home Inspector conduct a thorough inspection

The inspection will include the following:

*Appliances

*Plumbing

*Electrical

*Air Conditioning (weather permitting) and Heating Systems

*Ventilation

*Roof and Attic (if accessible)

*Foundation

* General Structure

The inspection is not designed to identify every minor problem or defect in the home. It is intended to report on defects that, at the time of the inspection, are identified as causing health or safety risks, or that affect the resale value of the property Should serious problems be found, the Inspector will recommend that an additional inspection be done by a Qualified Professional (i e Electrician, Plumber, Roofer, ect)

Your home cannot “pass or fail” an inspection and your Inspector will not tell you whether they think the home is worth the money you are offering, or if you should or should not buy the home. The Inspector’s job is to make you aware of repairs that are recommended or necessary.

As a guideline, the Seller may be willing to negotiate;

a.)The completion of repairs

b )A credit for the completion of repairs

In addition to the overall inspection, you may wish to have separate tests conducted (i e well water, septic system or the presence of Radon gas).

When choosing a Home Inspector, be sure to select one that has been certified as a qualified and experienced member by a Trade Association.

We strongly recommend being present at the inspection. This is to your advantage, as you will be able to clearly understand the inspection report and know exactly which areas need attention. Plus, you can get answers to many questions, tips for maintenance, and general information that will help you once you move into your new home. Most importantly you will see the home through the eyes of an independent third party.

The following inspectors again are recommended from previous clients, as well as being inspectors we know are thorough and professional. Again, you are not required to use an inspector on this list and are welcome to do your own research and pick an inspector of your choice.

HomeStart Inspections

Cell: 608-609-0369

Email: kyle@homestart.pro

Madison Home Inspection Office: 608-395-9689

Email: madisonhomeinspectionllc@gmail com

Southern WI Home Inspection Office: 608-575-0371

Email: swhi0371@gmail.com

New Roots Home Inspection Office: 608-354-5366

Email: newrootshomeinspection@gmail.com

AmeriSpec

Office: 608-276-8060

Email: btschumper@amerispec.net

Pillar to Post Office: 608-438-7499

Email: madisonpillartopost@gmail com

Inspection Pros

Office: 608-492-0360

Email: pjskeffinton@gmail.com

R E A C H I N G D A Y c l o s i n g

•FINALIZE MORTGAGE

•SCHEDULE HOME INSPECTION

•Declutter! Sort through every drawer, closet, cupboard & shelf, removing items you no longer need or like. Donate or sell items that are in good condition

•Make sure to have copies of all important documents and have them safely stored to easily find when needed

•Create an inventory of anything valuable that you plan to move

•Get estimates from moving companies

WEEKS

•Give 30 days notice if you are currently renting

•Schedule movers/moving truck

•Buy/find packing materials

•START PACKING

WEEKS TO MOVE 2 WEEKS TO MOVE

•ARRANGE APPRAISAL

•COMPLETE TITLE SEARCH (TITLE COMPANY WILL DO THIS)

•SECUREHOMEWARRANTY

•GETQUOTESFORHOMEINSURANCE

•SCHEDULETIMEFORCLOSING

•Contactutilitycompanies(water,electric,cable)

•Changeaddress:mailing,subscriptions,etc.

•Minimizegroceryshopping

•Keeponpacking

1 WEEKS TO MOVE

•OBTAINCERTIFIEDCHECKSFORCLOSING

•SCHEDULEANDATTENDFINALWALKTHROUGH

•Finishpacking

•Clean

•Packessentialsforafewnightsinnewhome

•Confirmdeliverydatewiththemovingcompany Writedirectionstothe newhome,alongwithyourcellphonenumber

Closing is when you sign ownership and insurance paperwork and you receive your new home’s keys! Typically, closing takes four to six weeks During this time, make sure to make no big purchases or job changes that could affect your loan approval prior to closing day. Funds are brought the day of to complete the purchase.

Lenders are required to provide you with a closing disclosure, at least three days before closing This will show you what your final loan terms and closing costs will be. You will have three days to review the statement. This is done to ensure that there are no surprises at the closing table. If there is a significant discrepancy between the loan estimate and the closing disclosure, we must notify your lender and title company immediately.

We will do a final walk through the home within 3 days of closing to check the property’s condition. This final inspection takes about an hour. We will make sure any repair work that the seller agreed to make has been done

We will be sure to:

• Make sure home is clean

• Seller removed any and all personal property that was not discussed in offer

• Any included items in offer have remained on property

Who will be there:

• Your agent

• The seller

• The seller’s agent

• A title company representative

• Your loan officer

• Any real estate attorneys involved in the transaction

The closing typically happens at the title company You will be signing lots of paper work so get your writing hand warmed up! Some of the papers you will be signing include: the deed of trust, promissory note, and other documents.

Closing costs can vary depending on your home’s purchase price and where you are located Your lender should be able to help determine the closing costs as well You can generally expect your closing costs to be around 2% to 5% of the home’s sales price.

• Government-issued photo ID

• Homeowner’s insurance certificate

• A certified check for the rest of your down payment and closing cost (personal checks are not accepted at closings)

Congratulations! It was a lot of hard work but you are now officially home owners!! Time to throw a party and get to know your new neighbors!

R E S O U R C E S & M O R E

Madison is one of the top bicycling cities in the Nation! In 1972, Madison began the move to make our city a bicyclist’s community We now have a network of off-street paths and bike lanes, road signals and more With off-road and on-road bike paths, there’s plenty to choose from, whether young and inexperienced, or the seasoned cyclist

Here, bicyclists are expected to obey rules of the road just like any motorist In return, we pay them the same respect: bike paths get plowed after snow storms (yes, we even have Winter Cyclists!) and debris is actively cleared. As a very bike-friendly city, motorists and pedestrians are actively aware and considerate of the bicyclists whereabouts

Traveling long distance across this isthmus-city can be difficult Catch the bus and plop your bike on the front! Free to use, buses accommodate up to two bikes

CityofMadison.com/metro/planyourtrip/bikeracks.cfm

Rent bicycles through affordable and convenient means! At any number of locations, available bicycles are lined up and ready to use all over town. Look out for racks full of red bikes. You can buy a membership for 1 day, 1 month, or 1 year After 30 minutes of free use, small fees will apply Don’t want to pay the hourly fee? Just return your bike and pick up a new one!

Bike Features:

Skirt and chain guards

Handle bar baskets

Automatic lights

3-speed

Ironman Wisconsin

Madison.BCycle.com

Madison takes the Ironman Triathalon seriously and is a great location for cheering crowds to watch the particpants compete www.ironman.com/triathalon/events/americas/ironman/wisconsin Walk and Roll

Twice a year, this car-free event makes streets open to cyclists, walkers, rollerbladers, and more. Bringing over 20,000 people out,there’s live music, food, and activities! it was previously known as “Ride the Drive ” CityofMadison.com/Parks/Activities/WalkandRoll.cfm Bike to Work Week

This event gets Madison residents out of their cars and on to 2 wheels Save gas and get fit! www.wisconsinbikefed.org/events/bike-to-work-week/ Safe Routes to School

Our schools teach students the rules of the road, bicyle safe and proper bike gear www.wisconsinbikefed.org/for-your-community/bike-and-walk-to-school/

With over 40 State Trails to choose from, there is a never ending selection of routes and scenery you can see!

Did you know some of these trails require a bicycle pass?

Annual Pass: $25

Daily Pass: $5

TRAIL FEES GO TOWARDS:

Trail Maintenance

Debris Pick Up

Path Clearing

Safety Monitoring And More!

DON’T GET CAUGHT WITHOUT ONE!

If you’re riding the trail without pass, you will earn yourself a $5 fee on top of purchasing the trail pass.

STATE PARKS, FORESTS, AND RECREATION AREA TRAILS THAT REQUIRE A PASS:

Black River State Forest

Blue Mound State Park

Brule River State Fores

Flambeau River State Forest

Governor Dodge State Park

Governor Knowles State Forest

Hartman Creek State Park

Hoffman Hills State Recreation Area

STATE TRAILS THAT REQUIRE A PASS:

400 State Trail

Badger State Trail

Bearskin State Trail

Buffalor River State Trail

Capital City State Trail

Chippewa River State Trail

Elroy-Sparta State Trail

Gandy Dancer State Trail

Glacial Drumlin State trail

Great River State Trail

Hillsboro State Trail

Lapham Peak Unit Kettle Moraine State Forest

Northern Highlight American Legion State Forest

Northern Unit Kettle Moraine State Forest

Peninusla State Park

Perrot State Park

Richard Bong State Recreation Area

Southern Unit Kettle Moraine State Forest

Wildcat Mountain State park

LaCrosse River State Trail

Military Ridge State Trail

Mountain Bay State Trail

Old Abe State Trail

Pecatonia State Trail

Red Cedar State Trail

Stower Seven State Trail

Sugar River State Trail

Tomorrow River State Trail

White River State Trail

Resource

Alliant Energy (Gas/Electric)

AT&T (Internet/Phone/TV)

Spectrum (Internet/Phone/TV)

Community Action Coalition

CSA (Community Supported Agriculture)

Farmer’s Markets

Habitat Restore

Madison Gas & Electric

Madison Property Assessor

Madison School District

Madison Neighborhoods

Madison Zoning

Madison Metro Bus

Madison Libraries

Madison Permit

US Postal Service- Address Change Water/Sewer

www.alliantenergy.com

www.att.com

www.spectrum.com

www.CACSCW.org

www.csacoalition.org

www.dcfm.org

www.restoredane.org

www mge com

www.cityofmadison.com/assesor/ property/

www.madison.k12.wi.us

www.cityofmadison.com/neighborhoods

www.cityofmadison.com/ dpced/bi/zoning/14

www cityofmadison com/metro

www.madisonpubliclibrary.org

www cityofmadison com/ developmentcenter/permitfees/ permits.cfm

moversguide usps com

A B O U T U S

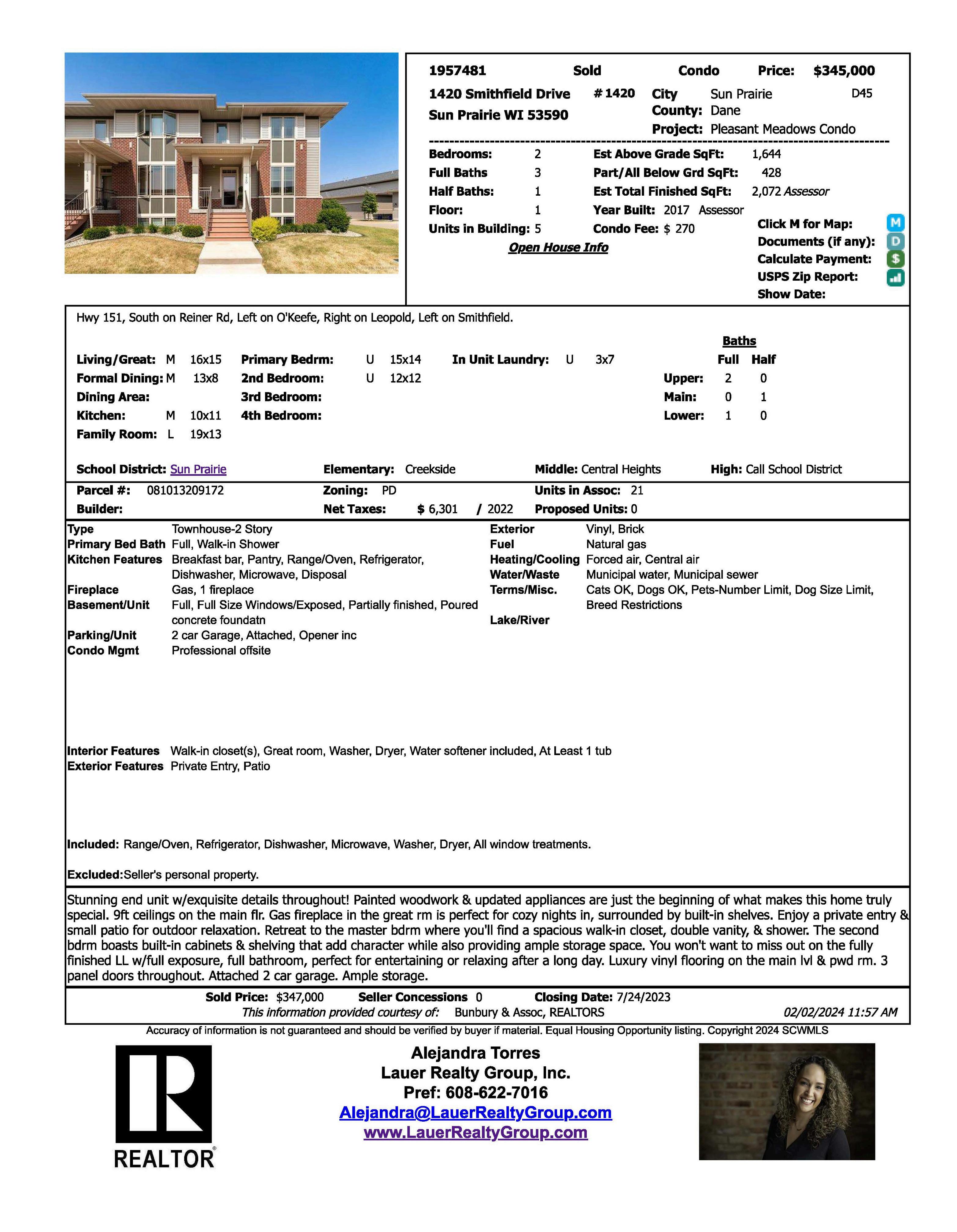

With a background in hospitality and dedication for working with clients to achieve their goals, Alejandra Torres made the move towards Real Estate when she received her license in 2014. After several years in the business and her enthusiasm for it growing, she decided to expand her knowledge to better aid her clients and became a Real Estate Broker in 2017. Alejandra’s passion for people, knowledge of the real estate market, and determination to ensure her clients have the best experience have allowed her to continue to succeed in this industry. The people she works with are more than just clients, Alejandra exceeds at building deep relationships and bonds that go beyond their real estate journey. She takes the time to really understand them and their stories so she can ensure their goals are achieved and is always committed to her clients’ best interests. A strong understanding of the way our current market works and what it takes to win at negotiations makes her an ideal Listing and Buyer Specialist.

As a Wisconsin transplant, hailing from Miami, Florida with roots in the beautiful country of Nicaragua, Alejandra is fluent in Spanish. She graduated from UW La Crosse with her Bachelor’s in Public Relations and then continued on to the Florida International University to earn her Master’s in Early Childhood Education. After living in Florida for a few years post college, Alejandra found herself settling in Madison, where she discovered her love for Real Estate. She has since made this city her home. With 2 young children, she loves what Madison has to offer culturally and geographically. You’re likely see her around town, discovering great local eateries, enjoying some time on the lakes, or biking the network of paths throughout the city.

Liz Lauer

BROKER/OWNER

Tobi Silgman

REALTOR®

Rachel Whaley

REALTOR®

Asher Masino

REALTOR®

Kate Weis

BROKER ASSOCIATE

Lindsey Cooper

REALTOR®

Jon Millard

MARKETING COORDINATOR

Brian Rea

AGENT ENGAGEMENT LAISON

ADMINISTRATIVE ASSISTANT

Tamara McDougal

REALTOR®

Ben Anton

BROKER ASSOCIATE

Tina Rogers-Frisch

EXECUTIVE ASSISTANT COMPLIANCE BROKER

Brett Larson

BROKER ASSOCIATE

Mark Gladue

BROKER

Renee Heine

Lindsey DeFlorian

Tom Syring

REALTOR® Cristina Daza

Minh Nguyen

Toni Kraile

We believe in and are committed to staying connected and involved with our local community. We love to give back and throughout the year we participate, contribute, sponsor, and donate time and resources to many wonderful organizations and causes. You’ll be sure to find us volunteering in neighborhood festivals, walking in a community parade, and supporting local artists. Whether it’s fundraising with the Goodman Center for the Annual Thanksgiving Drive, or working with GSAFE to ensure LGBTQ+ youth and families thrive, we are dedicated and passionate about the community we live in.

R E V I E W S & M O R E

“Alejandra was very pleasant to work with and was attentive to our needs She always answered messages and emails promptly. She was professional, yet extremely personal We felt confident that she was helping us get the perfect house We also appreciated that she didn’t just want us to settle on a house that just wasn’t right ”

“Alejandra was particularly effective in showing us properties we liked and helping us get to know more of Madison. She was consistently professional, easy-going and has a great sense of humor. She guided us through the entire process with grace and flexibility I would highly recommend her ”

“As first time home buyers, Alejandra made finding an affordable and quality home SO easy and smooth She taught us a lot about the market and how to make a strong offer She was quick to answer all of our questions and discuss strategy in such a competitive market She also connected us with a very helpful mortgage company that was able to help us get affordable financing!”

“Alejandra was absolutely amazing! I was able to contact with her at any time She even changed her plans to come and show us a house at the last minute and we are in that house right now thanks to her great advice and quick service There wasn’t one thing that was difficult with this house purchase. Thank you Alejandra and team!”

"Working with Alejandra was a delight She was always available for questions, and she worked diligently to ensure that we were getting a deal we were happy with We especially valued Alejandra's critical eye; she is quick to note both what is good and what is less desirable about a property or what might present a headache down the road, and it's clear she has a great deal of experience both in showing homes and in managing properties herself. And every time we spoke with another agent, inspector, or our loan officer, we were met with the same response: "Oh, you're working with Alejandra? She's great!"

"Alejandra is very patient and responsive, she guided us through the process and helped us find the house that we like In this competitive market, her skills and strategies made it possible to secure a house within a month and in a very desirable location She is full of ideas when it comes to writing a strong offer During showings, she would spend time with us not only showing the property but explaining some of the very important details about the property, she has a keen eye when it comes to spotting any possible issues and points of concern All these definitely made it possible to get a great house at a great location and a great price. Highly recommended."

These terms represent a small portion of the jargon used in describing the purchase process for Real Estate. An important part of our relationship is making you more familiar with how these terms are part of your puchase and ownership of Real Estate We have provided here a simplified, common language explanation of these terms limited to how they will most likley be used in your home puchase process

Appraisal-An estimate of the quanitity, quality or value of something The process through which conclusions of property value are obtained; also refers to the report that sets forth the process of estimation and conclusion of value (Most Lenders require an appraisal of a property before giving you a loan to confirm that the sale price reflects the market value of the home )

Assessment-The imposition of a tax, charge or levy, usually according to established rates (In Dane County, Real Estate taxes are based on the Municipality’s assessment or financial value assigned to a home and land. Ask us for the current tax rates in the areas you are looking.)

Buyer Agency Agreement-An agreement which allows a REALTOR® to represent the best interests of a Buyer throughout the search, negotiations, and purchase process

Capital Gain-Profit earned from the sale of an asset

Closing Statement-A detailed accounting of a Real Estate sale showing all cash received, all charges and credits accounted for, and all cash paid out in the transaction This is the standardized form which is used as the final accounting at time of closing to determine the amount of funds due at the time of closing (Also known as a Settlement Statement or ALTA )

Competitive Market Analysis (CMA)-A comparison of the prices of recently sold homes that are similar to a particular home in terms of location, style and amenities (When we find you a home that you are going to make an offer on, we will look at the sale prices of comparable properties to help determine an offer price )

Earnest Money-Money paid by a Buyer under the terms of an offer contract, held by the Listing Broker during the term of the contract, and credited back to the Buyer at time of closing. This money is understood to be forfeited if the Buyer defaults on their offer contract.

Easement-A right to use the land of another for a specific purpose, such as for a right-of-way or utilities. An easement can stay in place beyond the sale of a property, therefore any Buyer will receive Title Insurance to discover any recorded easements that will stay with the property

Equity-The interest or value that the owner has in proeprty over and above any indebtedness

Escrow-The closing of a transaction through a third party called an Escrow Agent, or escrowee, who receives certain funds and documents to be delivered upon the performance of certain conditions outlined in the escrow instructions (Brokerage companies, i e Lauer Realty Group Inc, acts as an Escrow Agent while holding earnest money )

Fixture-An item of personal property that is attached to the Real Estate property or function of the property in such a way that it is considered part of that Real Estate (i e light fixtures, floorboards, furnace, water heater, doorknobs

Lien-A right given by law to certain creditors to have their debts paid out of the debtor’s property This is a debt that must be paid by the Seller prior to receiving any proceeds on the sale of a home and includes any debts for which the property is put up as collateral (a mortgage).

PITI-Principle, Interest, Taxes and Insurance. This amount makes up the monthly payment normally due monthly to the home owner’s mortgage company.

Private Mortgage Insurance (PMI)-Insurance provided by private carrier that protects a Lender against a loss in the event of a foreclosure and defi ciency. This is usually required when a loan amount exceeds 80% of the value of the property Ask about loan program options that avoid PMI

Special Assessment-A tax or levy customarily imposed against only those specific parcels of Real Estate that will benefit from a proposed public improvement like a street or sewer (It is important in a Real Estate transaction to determine who will be paying the balance if a special assessment is upcoming or currently due )

Title Insurance-A policy insuring the owner or mortgagee against loss by reasons of defects in the title (ownership) of a parcel of Real Estate, other than encumbrances, defects and matters specifically excluded by the policy It is also provided as proof of ownership of the property, usually provided by the Seller to a Buyer, which also shows any other liens or encumbrances which are attached to a property