WIN OUR BIGGEST GIVEAWAY EVER!

OVER $95,000 IN PRIZES!

DRIVE YOUR DREAMS SWEEPSTAKES

WIN A 2023 DODGE RAM 1500 REBEL 4X4 OR CASH PRIZES

LAST CHANCE!

Each LAPFCU Visa® Platinum credit card purchase = ONE sweepstakes entry through 8/31.

The more you use your card, the better your chances of winning! Plus, each Platinum card purchase earns you rewards points all year long.

*ODDS OF WINNING AND COMPLETE RULES

GO PLATINUM!

Apply for a Platinum card and get:

n Grand Prize: 2023 Dodge Ram 1500 REBEL CREW CAB 4X4 (with almost $12,000 worth of options)

n 2nd Place: $10,000 cash

n 3rd Place: $5,000 cash (3 prizes available)

n No balance transfer fees plus 0% APR for 6 months, followed by a variable rate as low as 13.40% to 17.90% APR thereafter

LAPFCU’s Drive Your Dreams Sweepstakes is the best part of summer! Don’t miss your chance to win an amazing prize. APPLY NOW

n Rewards points redeemable for cash, travel, name-brand merchandise, and more when you make purchases with your card

n FREE fraud prevention, ID-theft protection, and other valuable benefits

LATE OPENING AND HOLIDAY CLOSURES

Branches will open late at 11:00 a.m. Wednesday, August 9 . Branches will be closed Monday, September 4 for Labor Day. ATMs, online and mobile banking available. 24/7 assistance at (877)

WONDERING ABOUT INVESTING OR RETIREMENT? WE CAN HELP!

MAKE AN APPOINTMENT

Maximize your chances of financial success with help from our in-house CUSO Financial Services, L.P., Financial Advisor, Patrick Infante. He creates custom financial strategies for law enforcement personnel and their families. He can explain your options and help you create a long-term investment strategy that matches your needs, risk tolerance, and timeframe.

Patrick can help you:

n Identify or review financial goals

n Plan or rethink investment/retirement strategies

n Plan for important milestone events

n Navigate DROP rollover options

n Choose life and healthcare insurance options that best protect you

Contact Patrick at pinfante.cfsinvest@lapfcu.org or (818) 464-2071. Or call us at (877) 695-2732, option 4, and press 2 for Investment Services.

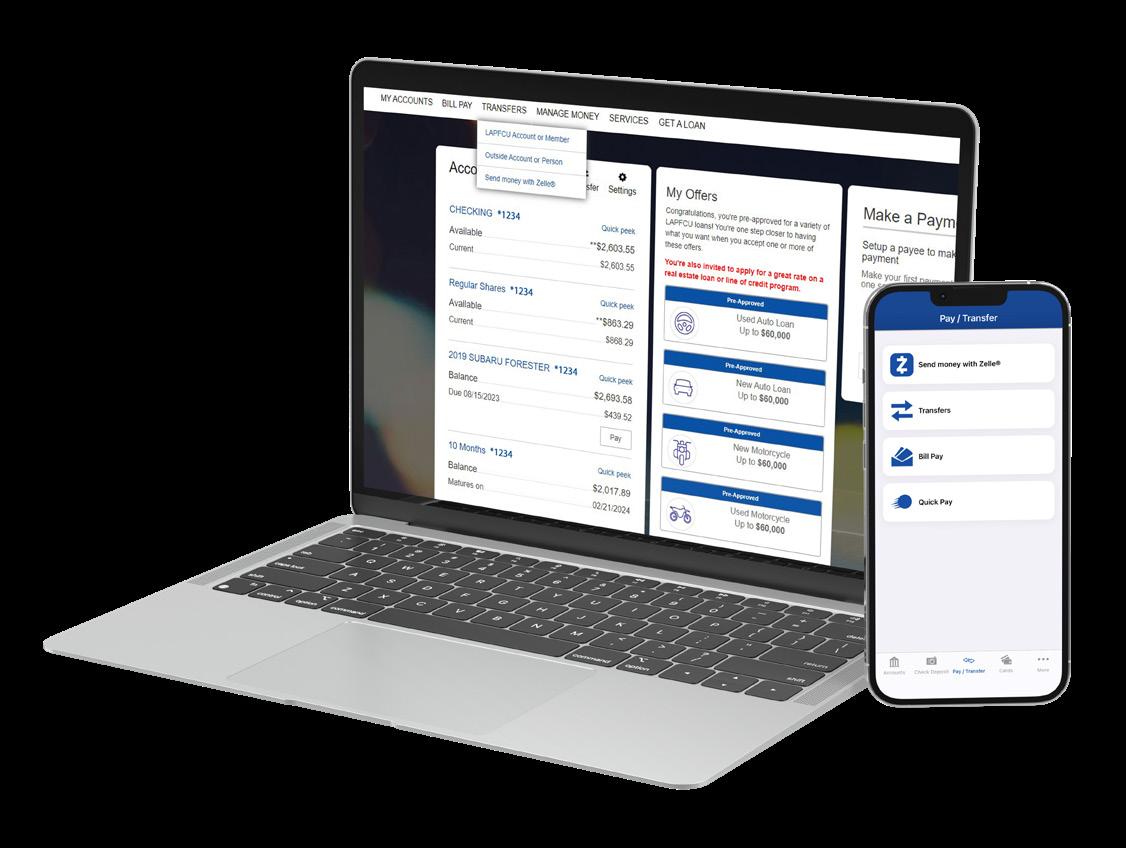

MANAGE YOUR MONEY ANYTIME, ANYWHERE!

The LAPFCU app is like having a branch in your pocket! Manage your accounts, view balances, pay bills, transfer funds, deposit checks, and more on your smartphone! Download the LAPFCU app today and log in using your online banking credentials.

Not set up yet? Visit lapfcu.org, click LOGIN, and select Enroll.

LAPFCU MOBILE APP PATROL ONLINE BANKING

We also offer thousands of CO-OP Shared Branches and ATMs nationwide.

>> FIND A CO-OP ATM / SHARED BRANCH

You can also call us at (877) 695-2732 for 24/7 assistance or phone banking or make a virtual appointment with an LAPFCU Associate.

VIRTUAL APPOINTMENT

HAVE SOMETHING YOU WANT TO TELL US?

EMAIL US AT MARKETING@LAPFCU.ORG . WE’D LOVE TO HEAR FROM YOU! (877) 695-2732

DID YOU KNOW?

Our sworn law enforcement members are eligible for LEO Web Protect, a free online privacy solution exclusively for LEOs (active duty and retired). This service is available free with our Guardian Checking Account

ALREADY HAVE AN LAPFCU CHECKING ACCOUNT?

To upgrade your existing LAPFCU checking account to Guardian Checking, call us at (877) 695-2732 or visit a branch for assistance. For more information about Guardian Checking and LEO Web Protect, click below.

FIND OUT MORE

NEED A CHECKING ACCOUNT?

If you’re new to LAPFCU or need a checking account, click below.

OPEN A GUARDIAN CHECKING ACCOUNT

STAY AHEAD OF EMERGING SECURITY THREATS

Keep your accounts safe and secure. Watch out for these and other scams.

MONEY MULE SCAM

Never accept money from an unknown source or for someone else. Scammers deposit money in your account and ask you to send the money back to them, but deposits won’t clear or will be declined by their bank, leaving you with the loss.

IMPERSONATION SCAM

Never provide your personal information or transfer money to someone claiming to be a financial institution associate, tech support, IRS representative, or even your electric company. Call the company directly at a verified number to confirm any request.

ONLINE PURCHASE SCAM

When responding to ads on social media marketplaces, research sellers and products independently and compare prices with other websites to ensure legitimacy. Use an insured payment service like PayPal.

BUSINESS EMAIL COMPROMISE

Don’t click on anything in an unsolicited email or text message asking you to update or verify account information. Never send money to a merchant unless you confirm the request to change a payment destination is legitimate, like a statement from them or a verified customer service phone number.

FAKE TEXT MESSAGES & WEBSITES

Fraudulent text messages contain links to spoofed websites made to look like a bank’s or credit union’s legitimate websites. Don’t click on links or share confidential information such as username, passwords, or 2-factor authentication passcodes.

Report fraudulent activity regarding LAPFCU accounts at (877) 695-2732.

FROM OUR MEMBERS

“I wouldn’t bank with anyone else! I’m a 53-year LAPFCU member and I’m always totally satisfied.”

-Peter W.

NOW AVAILABLE:

There’s a better, faster way to send and receive money. Zelle® is now available in the LAPFCU app and online banking.

Get started:

n LAPFCU APP: Open and tap on “Pay/Transfer” near the bottom of your screen

n ONLINE BANKING: Open a browser, log in to online banking, and hover over “Transfers”

n SEND MONEY: Link Zelle® to your checking account, and send money instantly to anyone with an email address or U.S. mobile number tied to a U.S. bank account

n RECEIVE MONEY: Anyone can send you money if they have your email address or mobile number

SAFETY TIPS

You don’t need to share sensitive financial or personal information when sending or receiving money with Zelle®. Authentication and monitoring features help make your payments secure.

1. Only send money to those you know and trust.

2. Confirm a new recipient’s contact information before sending money. Make sure you have the correct U.S. mobile phone number or email address for the person you want to send money to.

3. Treat Zelle® like cash. If you’re sending money to a new person or sending a large amount, first send $1.00 and verify that the money is going to the correct person. You can’t cancel a payment once it’s been sent if the recipient is already enrolled in Zelle®.

4. Beware of payment scams. Watch out for scams, such as a stranger selling online concert tickets at a steep discount and insisting you pay with Zelle® or someone threatening negative action on your account unless you make a payment.

5. Understand your payment options. If you don’t know a person or aren’t sure you’ll get what you paid for, you may want to use your credit card or PayPal, which might offer built-in buyer protections. Zelle® doesn’t offer a protection program for any authorized payments – for example, if you do not receive the item or the item is not as described or expected.