That's the question you should be asking yourself.

Our market is incredibly diverse and rapidly changing. Values vary not just by neighborhood but by street. Your home isn't necessarily worth what your neighbors' home is. It's the current market that sets the value of your home.

So, do you know what your home is worth in today's market?

Contact me for a confidential, no obligation assessment of your home's value.

If you’re hoping to buy a home this year, you’re probably paying close attention to mortgage rates. Since mortgage rates impact what you can afford when you take out a home loan – and affordability is a challenge today – it’s a good time to look at the big picture of where mortgage rates have been historically compared to where they are now. Beyond that, it’s important to understand their relationship with inflation for insights into where mortgage rates might go in the near future.

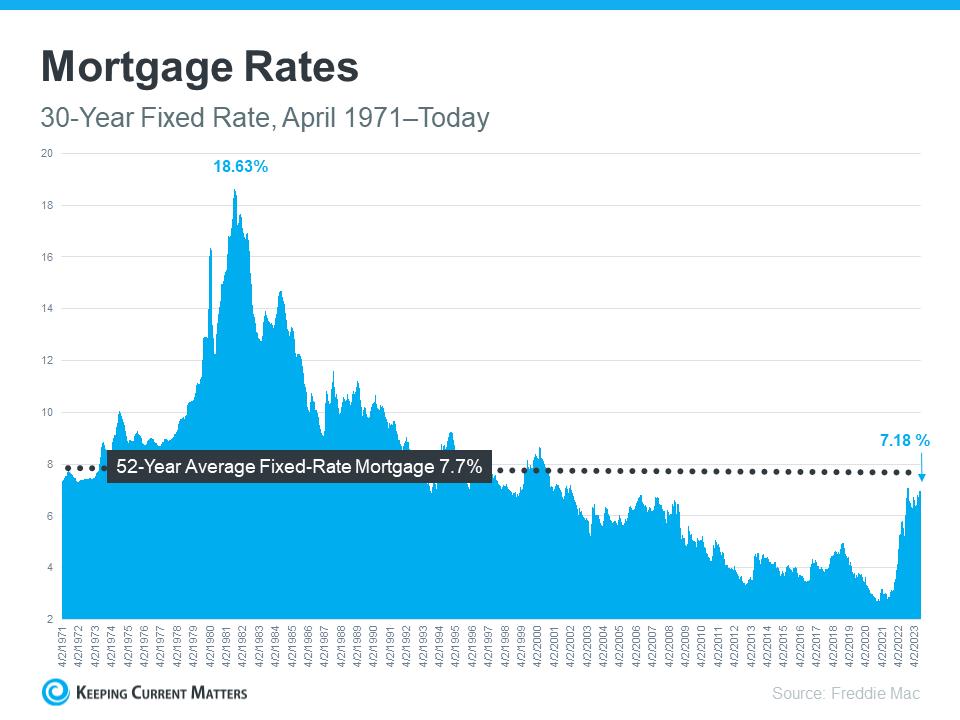

Freddie Mac has been tracking the 30-year fixed mortgage rate since April of 1971. Every week, they release the results of their Primary Mortgage Market Survey, which averages mortgage application data from lenders across the country (see graph below):

Looking at the right side of the graph, mortgage rates have increased significantly since the start of last year. But even with that rise, today’s rates are still below the 52-year average. While that historical perspective is good context, buyers have gotten used to mortgage rates between 3% and 5%, which is where they’ve been over the past 15 years.

That’s important because it explains why the recent jump in rates might have you feeling sticker shock even though they’re close to their long-term average. While many buyers have adjusted to the elevated rates over the past year, a slightly lower rate would be a welcome sight. To determine if that’s a realistic possibility, it’s important to look at inflation

The Federal Reserve has been working hard to lower inflation since early 2022. That’s significant because, historically, there’s been a connection between inflation and mortgage rates (see graph below):

This graph shows a pretty reliable relationship between inflation and mortgage rates. Looking at the left side of the graph, each time inflation moves significantly (shown in blue), mortgage rates follow suit shortly after (shown in green).

The circled portion of the graph points out the most recent spike in inflation, with mortgage rates following closely behind. As inflation has moderated a bit this year, mortgage rates haven’t yet made a similar move. That means, if history is any guide, the market is waiting for mortgage rates to follow inflation and head back down. It’s impossible to accurately predict where mortgage rates will go for sure, but moderating inflation means mortgage rates going down in the near future would fit a well-established trend.

Source: Keeping Current Matters

$310,717Profit

702%Return

Home Concierge's secret weapon is our local project directors, who visit and personally manage each of our projects. When the agent reached out with a tight deadline, project director Azary Khalfan took it in stride and immediately called on her local vendors and subcontractors. Our in-house designer, Samantha Black, worked quickly over the holidays to design a new kitchen while Azary ordered finishes for other parts of the home. Ingenuity, strong vendor connections, and hard work transformed the kitchen in 17 days! The home sold for over $400,000 over asking in just one week.

Home Concierge scope of work for this project included:

Kitchen design services with plan drawings

Entire kitchen replacement, including the floor New light fixtures throughout the home

Refresh bathrooms

KitchenDesignBoards

WANT TO KNOW HOW HOME CONCIERGE CAN HELP WITH YOUR LISTING? CONTACT ME TODAY!

Source: Cal Fire

Build your roof or re-roof with materials such as composition, metal, clay, or tile Remove any vegetative debris from the roof.

Remove all openings with 1/16-inch to 1/4-inch metal mesh Do not use fiberglass or plastic mesh because they can melt and burn

Eaves should be boxed in and protected with ignition-resistant or non-combustible materials.

Install dual-paned windows with one pane of tempered glass to reduce the chance of breakage in a fire.

Use ignition-resistant materials, such as stucco, fiber cement, wall siding, fire retardant, treated wood, etc.

Create an ember-resistant zone around and under all decks and clear debris from under your deck.

Separate your fences from your house or upgrade the last 5 feet of the fence to a non-combustible material.

Close the fireplace during fire season when the chimney is not being used.

Keep rain gutters clear or enclose rain gutters to prevent accumulation of plant debris

Use the same ignitionresistant materials for patio coverings as a roof

Driveways should be built and maintained in accordance with state and local codes to allow fire and emergency vehicles to reach

Have a fire extinguisher and tools such as a shovel, rake, bucket, and hose available for fire

IS YOUR HOMEOWNER’S INSURANCE COVERAGE UP TO DATE? I CAN CONNECT YOU WITH WITH MY INSURANCE SPECIALIST AT GREYSTONE.

CALL ME TODAY!

There were 510 providing 1.7 mo new listings, and price of $583k. T was 100%, with market.

There were 57 c sale, providing 2 were 38 new list price of $360k. T was 100%, with market

omes

246 Sold Listings

$583K

Median Sale Price

28 Avg Days on Market

The data, sourced from InfoSparks, includes all single-family homes, condos and townhomes in the California Area above from August 2022 to August 2023. This may include preliminary data, and may vary from the time the data was gathered. All data is deemed reliable but not guaranteed. DRE# 01995149. Copyright KW Advisors San Francisco | Napa Valley 2023. Each office is independently owned and operated.

38 New Listings

22 Sold Listings

2.4 Months of Inventory

$360K Median Sale Price

100% Median Sale vs List

31 Avg Days on Market

AUGUST 2022 - AUGUST 2023

Single-Family Homes

Last 12 months, year-over-year.

Condos & Townhomes

Last 12 months, year-over-year

Single-Family Homes

The median sales price has decreased from $600k last August 2022, to $583k as of August 2023

Condos & Townhomes

The median sales price has increased from $359k last August 2022, to $360k as of August 2023.

The average time spent on the market went down from 38 days last August 2022, to 28 days as of August 2023

The average time spent on the market went down from 37 days last August 2022, to 31 days as of August 2023

Single-Family Homes

The overbid percentage has remained at 100% since last August 2022

Condos & Townhomes

The overbid percentage has decreased from 100% last August 2022, to 99.7% a year later.