AUDIT DISCLOURE PRACTICES

Analysis of disclosures in metropolitan municipalities

PERFORMANCE AUDITING IN SA

Key driving factors behind the ever-increasing demand

THE VITAL INTERPLAY

Tax practitioners & audit firms navigate tax terrain SHABEER

Why it is not a strategy?

Apr - Jun 2024 Edition: Vol 8 Advancing Auditing &Accountability

fit

KHAN Accountant-General The perfect

SA BANKING SECTOR

The need for platform business AUDIT COMPLACENCY

South Africa 19942 0 42

4 www.saiga.co.za Editorial Director: Kgomotso Sethusha Contibutors: Cobus Janse van Rensburg Nadia N Kganakga Danie Schutte Lorraine E Derbyshire Dr Lethiwe Nzama-Sithole Lungisani Bhengu (RGA) Richard Chambers Ashley Nyiko Mabasa Adv Annamarie van der Merwe Tumelo Letlojane Patrick Kelly Kevin Parry Kemi Mathatho Hügo Krüger Sdumo Hlope Winnie Senoamadi Christopher Vandome Julius Mojapelo Sales Director: Nardine Nelson nardine@kwedamedia.co.za Publishing Partner: Kweda Media www.kwedamedia.co.za Editorial Enquiries T: 012 004 0741 E: researcher@saiga.co.za Advertising Enquiries T: 082 739 3932 E: auditingsa@kwedamedia.co.za CONTENTS 06 CEO’s Note 08 Letter from the Editor 10 SHABEER KHAN Accountant-General - The perfect fit 16 Performance Auditing 20 Audit Committee 26 Municipal Performance 30 Tax Matters 32 Audit Complacency 36 Banking Sector 38 Corporate Governance 42 District Development Model 44 Stats SA 46 Risk Management 50 Energy Factor 54 Digital Auditing 56 2024 SA Elections 58 Public School Audits 60 IAASB 62 Trivia CONTRIBUTORS DISCLAIMER: Auditing SA is published by the Southern African Institute of Government Auditors (SAIGA): www.saiga.co.za, PO Box 36303, Menlo Park, 0102, South Africa, Tel: 012 004 0741, WhatsApp No: 069 5387276, Editor: Kgomotso Sethusha email: researcher@saiga.co.za SAIGA accepts no responsibility for any loss incurred by any individual acting or refraining from acting as a result of any material in Auditing SA. SAIGA cannot accept responsibility for any opinions expressed by contributors, nor for the accuracy of the information contained in articles, contributions, advertisements or other material. The editor reserves the right to edit material. COPYRIGHT NOTICE: All rights reserved. No part of this electronic publication may be reproduced by any means without the written permission of the publishers. This includes making photocopies or uploading portions of the publication. Extracts of reasonable length may be made for personal research purposes. ISSN: 1028-9011

WE ARE BMW KEMPTON PARK

As a BMW driver, you have certain expectations when it comes to customer service. At BMW Kempton Park, we make it our mission to exceed them every time.

All our team members are professional, passionate and friendly - and we're proud of the trust that's been placed in us by our customers and our community.

We like to go above and beyond in terms of enhancing your BMW experience. As one of our Premium Members, you can look forward to:

Invitations to exclusive events, including launches and test drives in the latest BMW models. Preferential service bookings and while you wait servicing (on request).

Competitive pricing on all BMW Lifestyle Collection items. A Sales Executive dedicated to your account. It all adds up to a superb experience, because noone is more important to us than you are.

We look forward to being of serviceSimply scan the QR Code below to become a BMW Kempton Park Premium Member.

Where to find us:

BMW Kempton Park Cnr of Brabazon & Isando Rd, Croydon

Tel: +27 11 392-6263

Web: www.bmw-autobahnbmw.co.za

Email hacking, change of bank details and malware are not the work of some super smart hacking geniuses, but rather the outcome of our own bad online habits.

These are the words of Kevin Hogan, a Fraud Risk Specialist at Investec.

You probably hear and read about cybercrime quite often and get to think that “it could never happen to me’.

But reality is that through our behaviour, we inadvertently assist the cyber criminals, who are constantly looking to exploit weaknesses in security systems.

THogan had the audience eating out of his hand at the recent SAIGA Audit and Finance Indaba with his captivating presentation, enlightening auditors, accountants and finance industry professionals about the complex nature of cybercrime, but also how easy it is for one to fall victim to an elaborate scam.

CEO's Note

Cybercriminals are particularly drawn to auditing and accounting firms and other financial institutions, and as Hogan explains, it is unsurprising that cybersecurity has become a top priority for financial institutions, as they are entrusted with safeguarding financial assets.

Even though there is a lot of risk associated with cybercrime, auditors may raise fraud awareness in their companies by empowering themselves with the necessary skills. By so doing, one might potentially prevent or reduce the impact of fraud losses.

CEO's Note

In this edition there is much to learn about cybersecurity and cybercrime for people in the accounting profession and the finance sector to prevent becoming a statistic of the rising cybercrime tide.

he basic relationship between the state and its citizens, in which the state accounts for its actions in terms of how it uses public funds and makes decisions, has broken down. At the heart of this malaise is the lack of accountability and corruption which has crippled service delivery of basic human needs.

This has led to Minister of Justice and Correctional Services Ronald Lamola tabling a bill that seeks to strengthen the National Prosecution Authority’s (NPA) independence and capacity to pursue highlevel crimes.

To illustrate his points, Hogan went further to draw many examples of how scammers were preying on unsuspecting victims as they swindle them of their hard-earned cash, be it individuals with low digital literacy and institutions with top-notch cyber security systems. Truth is, South Africa is one of the countries under cybercrime attack, and auditors are facing evolving cybersecurity challenges.

In her keynote address, Gcaleka hammered home this point even further by emphasising the crucial role auditors and accountants play in fostering openness, accountability, and public trust in institutions.

You can also read about how auditors can build skills and capacity in the digital era where these tools have become essential, and find out how technology can be used to improve performance and help municipalities achieve clean audits.

If passed, the bill will see the establishment of the Investigative Directorate Against Corruption, targeting among other cases, the ‘state capture’ crimes.

It will ensure the effective implementation of the recommendations from the State Capture Commission as it will allow the NPA to apply the experience gained from South Africa’s efforts to tackle high-level corruption.

South Africa ranked number five globally in a list of countries worst affected by cybercrime, with 56 000 out of every million internet users being a victim.

Her views are fully detailed in the cover piece of this Spring edition.

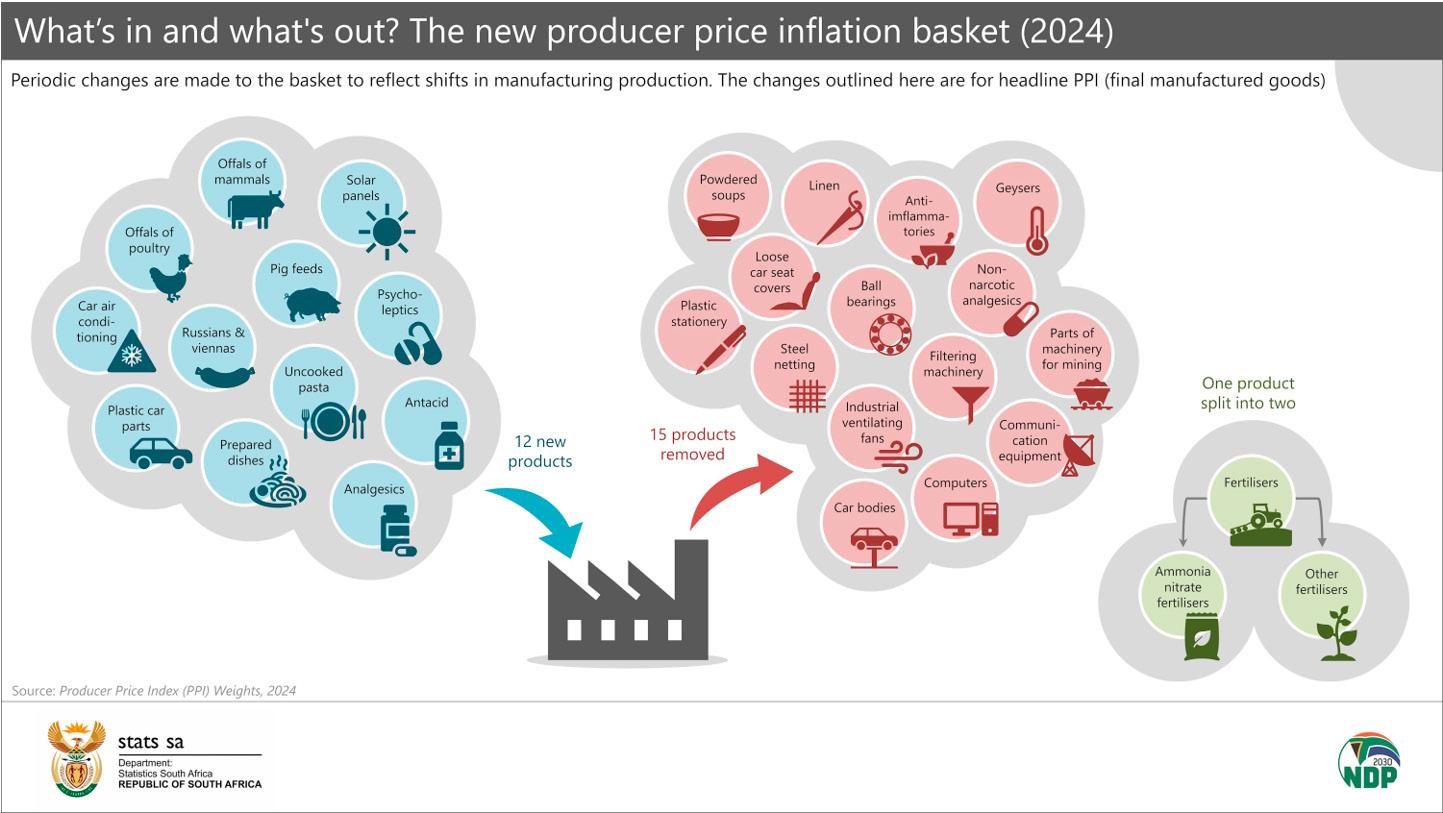

The edition also contains interesting and thoughtprovoking articles, that, however, are not limited to auditing and accounting, but also cover politics and health issues, in light of the current water crisis.

You may also read about how improving audit outcomes in South Africa is a multifaceted endeavour that requires addressing challenges, upholding independence, embracing technology and promoting transparency.

Make sure you participate in the first-ever SAIGA Anti-fraud and Corruption Dialogue later this year, where we will discuss cybersecurity-related ideas and strategies that businesses and other organisations should use in an era where one’s worst financial nightmare could be just a few minutes away.

Has the AI summer arrived? Find out why leading players in the audit sector are starting to experiment with various AI-driven tools to improve audit processes, and many more.

Enjoy your reading!

Russel Morena SAIGA CEO

All in all, this bill is an essential step in reinforcing South Africa’s anti-corruption efforts and ensuring that those suspected of corrupt activities are held accountable.

This was one of the main takeaways from Lamola’s presentation at the 3rd Annual SAIGA Conference, which was held at Emperors Palace last month.

According to a study commissioned by cybersecurity company Surfshark, 2 000 South Africans fell victim to cybercrime last year alone.

Themed “Advancing auditing and accountability for citizens and the future,” the conference, which coincided with SAIGA’s 35-year anniversary celebrations, brought together auditing and accounting professionals, politicians, opinion makers and thought leaders.

The study revealed that R2.2 billion is widely quoted as the figure for the substantial amount of money lost annually to cybercrime in South Africa, a figure from a report released by the South African Banking Risk Information Centre (Sabric) released back in 2013, but likely to have increased substantially since then.

These included among the many speakers and panelists, the Acting Public Protector, Adv Kholeka Gcaleka, Deputy Auditor-General Vonani Chauke, CEO of IRBA, Imre Nagy, Prof Mabutho Sibanda, SARS Deputy Commissioner Bridgette Backman, the CEO of PwC, Shirley Machaba and Dr Liezl Groenewald from the Ethics Institute.

It is a grim picture, one which should leave everyone concerned. Scammers become innovative just as forensic investigators work tirelessly to dismantle organised crime groups.

This year, we revisited the principles that have remained central to SAIGA’s existence as we ignited meaningful discussions around the critical role that auditors play in the public and promoted the core values of this Institute.

Russel Morena SAIGA CEO

6 www.saiga.co.za

6 www.saiga.co.za

Letter from the Editor

The month of April is no ordinary month in the history of South Africa.

This month marks exactly 30 years since the day hundreds of thousands of people stood in snaking queues under the scorching sun to cast their votes and usher in a new era of democracy in our country.

As the country celebrates 30 years of democracy, many industries and professions will naturally be reflecting on the journeys they too have travelled, many having transitioned from the dark days of apartheid to democracy thereby giving birth to what the late Archbishop Desmond Tutu termed the rainbow nation.

The auditing, accountancy and finance professions can reflect on how it has intrinsically contributed to the democracy of the country, its solidification, and how it positioned the republic as a respected global citizen.

It was not long after that the Auditor-General of South Africa (AGSA) was established as a Chapter 9 institution - one of the state institutions supporting constitutional democracy in the Republic of South Africa.

The institution underwent reforms brought about by the new constitution - enacted in 1996 – that necessitated the Auditor-General to incorporate the pre-1994 Auditor-General offices of the former Bantustan, TBVC independent states into the South African office.

The huge task, overseen by Auditor-General Henri Kluever, marked the start of the modernisation changes in the Public Finance Management Act of 1999 and the Municipal Finance Management Act of 2003.

The legislation sparked a revolution in the South African public sector and, thus, in the Office of the Auditor-General through several notable provisions, the effects of which are still being felt today.

The Public Audit Act amendment bill, signed into law by President Cyril Ramaphosa, now gives the AGSA more power to act against officials and employees who waste public funds and those who turn a blind eye to the misappropriation of taxpayers’ money instead of prosecuting them.

Before, the Act did not provide scope for auditors to focus on material irregularity, but only on audit outcomes and deviations.

You can read more about the strides of the professions in our front cover story penned by the Accountant-General of South Africa, Shabeer Khan.

Also, read about performance auditing services as it reflects the country’s ongoing efforts to enhance accountability and efficiency amid various economic, political and social challenges. The featured article examines the status of the demand for performance auditing services in South Africa, exploring the key factors driving this demand and challenges faced in meeting it.

Learn more about the challenges facing our banks which may result in them being overlooked; such as the banks’ traditional operating model, slow pace of innovation, and highly structured business approach.

Technology has become an essential part of our daily lives, affecting the way we work, communicate and the way we interact globally and there is no denying that integrating technology into municipalities in South Africa has the potential to improve local government operational efficiency. Read more about how municipal performance can be elevated through technology to achieve clean audits.

And, as South Africans prepare to go to the polls, read about how uncertainty of coalition government is a significant political risk in 2024. The article delves into the configuration of potential national and provincial coalitions as they will be determined by the number of votes and seats needed rather than ideological compatibility.

Kgomotso Sethusha Editor

8 www.saiga.co.za

Nedbank is committed to being the business banking partner for the public sector. Our bigger-picture approach to banking is designed to provide groundbreaking solutions for your municipality. With the expertise and knowledge of our community specialists, we can ensure continuity, accessibility and quick decision-making that guides your business growth.

Think bigger.

Think Nedbank Commercial Banking. For more information email us at publicsector@nedbank.co.za.

Nedbank Ltd Reg No 1951/000009/06. Licensed financial services and registered credit provider (NCRCP16). Terms and conditions apply.

Want a bank that’s serious about public sector growth?

33054/R

Commercial Banking

Advancing Auditing &Accountability COVER STORY 10 www.saiga.co.za

SOUTH AFRICA’S ACCOUNTABILITY ECOSYSTEM IS EFFICIENT

Kgomotso Sethusha Auditing SA Editor-in-Chief

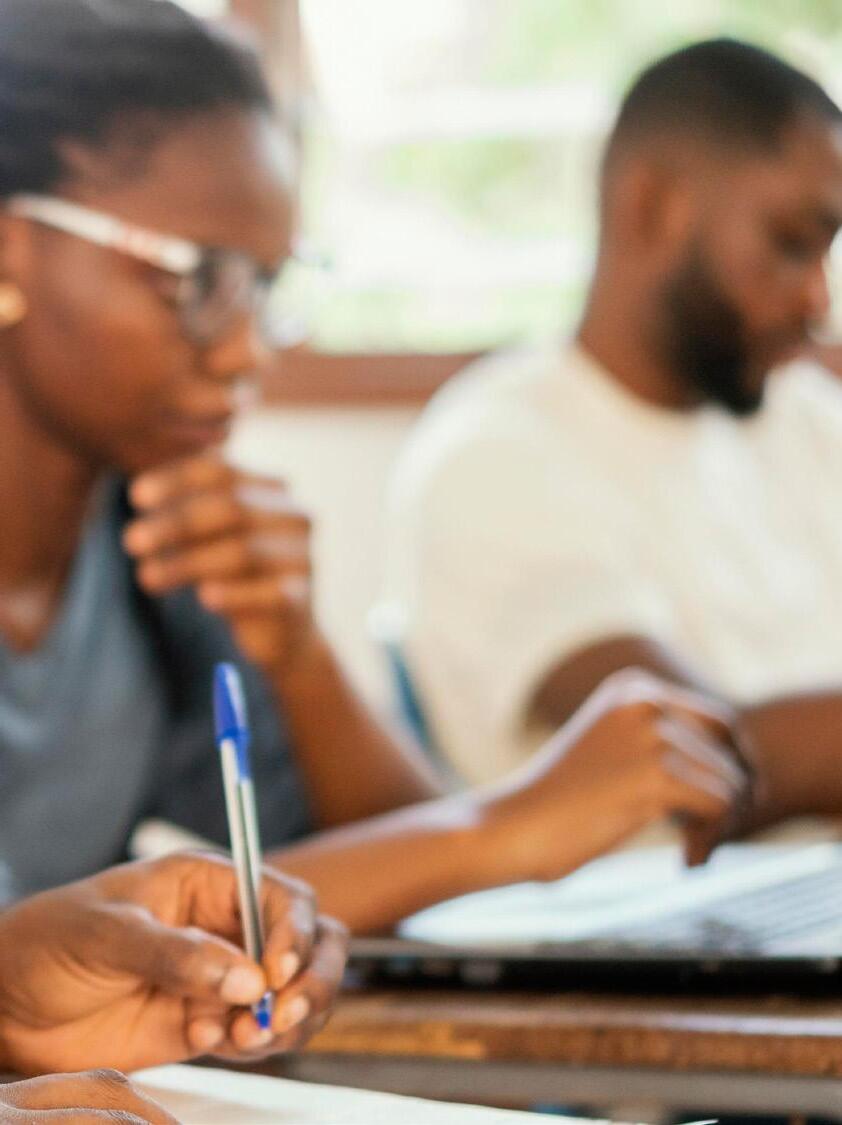

s he notches a year in office, South Africa’s Accountant-General

Shabeer Khan can reflect on his tenure with a deep sense of satisfaction.

approved the appointment of Khan to take charge of head the Office of the Accountant-General (OAG), a division within the National Treasury that derives its mandate from the republic’s constitution.

Ronald Lamola SA Minister of Justice and Correctional Services

It was in mid-2022 that cabinet

Khan was to fill one of the two vacant but crucial positions at Treasury, beginning his tenure eight months later, as government

sought to turn the tide against graft in the delivery of public service by strengthening key institutions.

Since then, Khan has not looked back. Instead, he has taken the initiative to lead and provide strategic direction to a group of competent practitioners, supporting the responsible use of public resources, forming partnership >

Advancing Auditing &Accountability

11 Auditing SA

with stakeholders as well as advocate for good public financial management.

“It has been about a whirlwind year in which there has been a lot to learn and contribute,” says Khan.

“We have made significant strides in advancing the work done in the planned legislative reforms, reignited significant relationships that will help us do our job as well as started the process of positioning the Office of the Accountant General (OAG) as the first point of call when it comes to public finance management.

“We are a long way from achieving our goals, but we are well on our way, and I believe we will achieve what we have set out to achieve.”

It is quite a considerable task for Khan, who is charged with the responsibility to facilitate accountability and governance by promoting transparent economic, efficient and effective management in respect of revenue, expenditure, assets and liabilities in the South African public sector.

Even though Khan defied the widely held assumption that public service doesn’t typically attract chartered accountants, he did so consciously and deliberately to better his country.

The National Treasury has suffered a brain drain over the last decade, the political upheavals accounting for the exodus of skilled and experienced public service officials who left government for the private sector.

Khan explains: “The perception seems to be, that working for

government can be a risky career choice but honestly, it provides an opportunity where you can enhance your skills. In fact, when I joined the Department of Trade and Industry and Competition (DTIC), I was the only chartered accountant in the whole department. I am pleased to say that more and more chartered accountants are in fact, now looking at the public sector.

“Working for government a conscious decision for me” - Shabeer Khan - Accountant General

“I am a public servant at heart, and over and above that I am an accountant. Given the trajectory that my career had taken, it was almost logical that I would end up at National Treasury or in a position in government.

“For me, the role of the accountantgeneral provided me with the opportunity to make a difference, to bring my experience to bear and to especially as a former practitioner, to influence the policy side, to simplify accounting and reporting as well as learn new lessons.”

Experience remains key

But Khan could draw on his experience in the public sector, having served as the CFO of the DTIC where he successfully managed a R10 billion budget in the execution of the department’s strategic mandate, achieved the first ever clean audit in 2015 and subsequent clean audits, provided leadership to the finance team and created a strategic risk

management and compliance function.

“My background and experience gained from my various positions at the AGSA stood me in good stead in my role as the CFO,” says the 2015 CFO of the Year Awardwinner.

“If anything, I had the benefit of knowing the other side of the accountability ecosystem. I had been involved in many audits as a trainee and later as a senior in the auditing profession and I had an idea of what to expect.

“Achieving a clean audit outcome is always a culmination of various processes, contributions from many people as well as collaborations with various role players. Obviously, as the CFO I was responsible for coordinating and guiding the team. In addition, I had to maintain strict controls and ensure that all role players comply with the policies and procedures, as well as prescripts.”

He is surrounded a similarly competent team at the OAG, a sizable staff that handles a range of legal and technical tasks to guarantee adherence to the Municipal Finance Management Act (MFMA) and Public Finance Management Act (PFMA).

Key to this is the Financial Management Capability Maturity Model (FMCMM), is a diagnostic tool that the OAG uses to measure the financial performance of departments, state owned entities and municipalities. These assessments are aimed at determining the capabilities with these organisations in PFM ‘so as to correctly prescribe the

Advancing Auditing &Accountability 12 www.saiga.co.za

COVER STORY

necessary interventions by the OAG as well as other interested parties’.

“The OAG generally has a good complement of practitioners that have a lot of experience in working in the public sector. One of the advantages we have is to be able to grow our own timber and in promoting people to higher positions within the OAG,” Khan shares.

“This guarantees continuity. There are opportunities to bolster the resources we have as well as to strike collaborative relationships with like-minded organisations to ensure that the OAG has wider reach and can be as effective as possible.”

The ecosystem of accountability in the country has since proven to be efficient, strengthened by structures such as Tri-lateral, which is comprised of the OAG, AuditorGeneral of South Africa (AGSA) and the Accounting Standards Board.

There has also been a discernible shift in the efficiency of the country’s law enforcement agencies that support the work of ensuring that those who are involved in corruption face prosecution.

Auditors and accountants are equally accountable for the economic well-being of the country. They identify corrupt practices in the public and private sector and combating graft through the advancement of efficiency and transparency.

Professional bodies also have a role to play as they are critical to holding their members accountable as well as ensuring that they

are kept abreast of the latest developments in their profession.

“Even more importantly, professional bodies should inculcate values that are true to what they profess to believe,” adds Khan, who holds a Bachelor of Commerce from the University of Witwatersrand.

As South Africa celebrates 30 years of democracy, Khan looks back at the role accountancy has played in entrenching the democracy of the republic in the country. He, too, has cause to celebrate, explaining: “The enactment of Public Finance Management Act and the Municipal Finance Management Act and related prescripts have ensured accountability and good public financial management are some

of the achievements over the years. “In addition, the regulation of the auditing industry by IRBA as well as peer-led monitoring by the professional bodies has generally given confidence to the markets as well as investors about the security of their investments.”

Is there reward in the public finance management field?

“The reward really comes from knowing that one is making a difference to the lives of ordinary people citizens of our country. Good governance contributes to accountability and ensuring that the resources of our state are utilised for the benefit of its citizens. Ultimately our role as the OAG is to make sure that the benefits of our work accrue to the people,” Khan concludes. >

13 Auditing SA Advancing Auditing &Accountability

SHABEER

Advancing Auditing &Accountability

14 www.saiga.co.za COVER STORY

SHABEER

KHAN

Cabinet appointed Mr Shabeer Khan as Accountant-General as of the 1st of January 2023.

Mr Khan has over 17 years’ experience in the public service.

Mr Khan is a Chartered Accountant and a member of the South African Institute of Chartered Accountants (SAICA).

He started his articles in 2002 as a Trainee Clerk with Fazel & Associates and then moved to the Office of the Auditor-General in 2004 where he rose through the ranks to become a Senior Manager.

Shabeer joined the Department of Trade, Industry and Competition (the dtic) as the Chief Financial Officer in 2013. He was appointed as the Acting Director-General in 2022, a position he held until he joined the National

Treasury.He is a member of the Financial Reporting Standards Council (FRSC); and has served on various boards as an Independent non-executive Director, as well as a number of audit committees.

Mr Khan has a Bachelor of Commerce Accounting from the University of the Witwatersrand and Honours Bachelor of Accounting Science (CTA) from the University of South Africa.

He has extensive experience at a senior managerial level in public sector which will benefit the National Treasury immensely.

Shabeer is a devoted family man, married and the proud father of four children. He believes in creating a healthy balance between his two passions, supervising public balance accounts and spending quality time with his family.

15 Auditing SA Advancing Auditing &Accountability

THE EVER-INCREASING DEMAND FOR PERFORMANCE AUDITING IN SA

Cobus Janse van Rensburg, Certified Internal Auditor

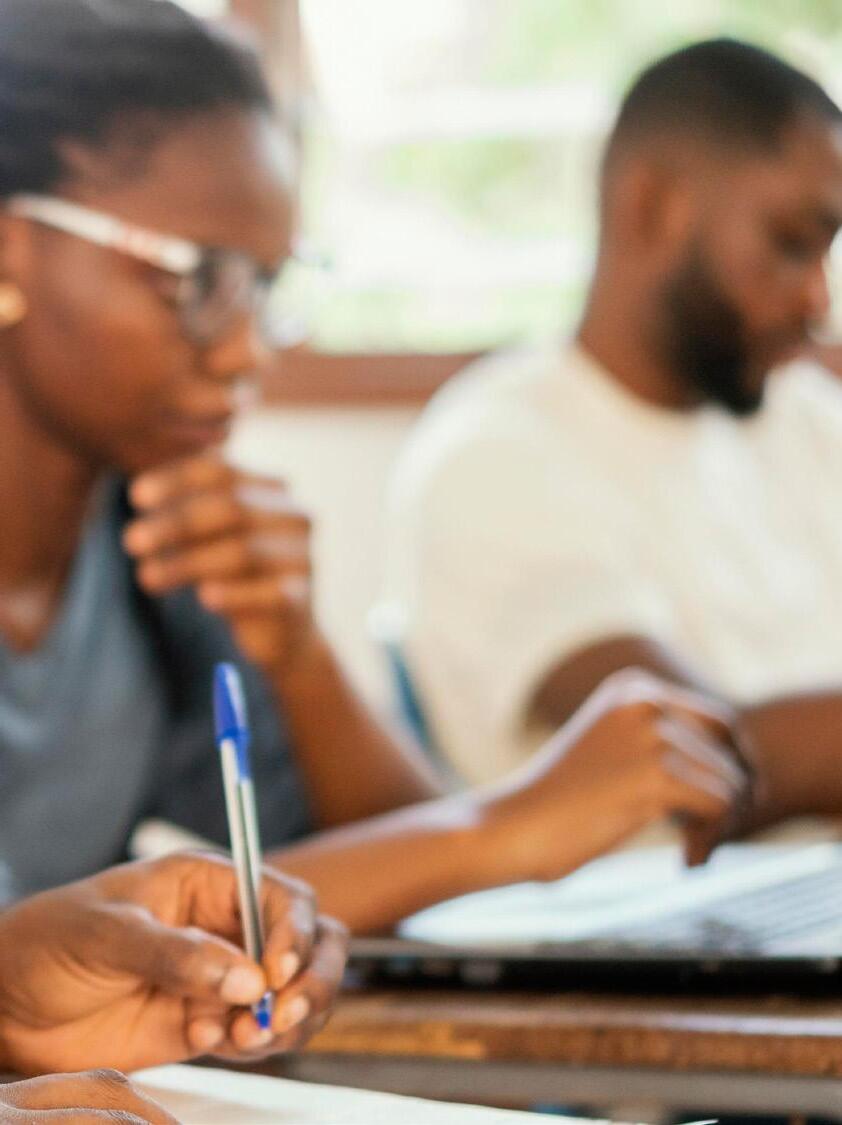

In South Africa, the demand for performance auditing services reflects the nation's ongoing efforts to enhance accountability and efficiency amid various economic, political and social challenges. This article examines the status of the demand for performance auditing services in South Africa, exploring the key factors driving this demand and challenges faced in meeting it.

Performance auditing is an essential aspect of ensuring accountability, transparency, and effective governance within public sector organisations and is distinct from financial auditing as it focuses on evaluating the so-called “Three E’s” (economy, efficiency, and effectiveness) of operations, programs, or activities.

Performance auditing aims to provide stakeholders with essential information regarding the achievement of objectives, and the prudent use of resources.

Performance auditors assess whether organisations are delivering services effectively and efficiently, identify areas for improvement, and recommend corrective actions. Although performance audits are conducted in both the public and

private sectors, this type of audit is more prevalent in the public sector. The main reason for this is because the public sector does not have the “built-in” performance measure of profit.

As the main mandate of public sector organisations relate to service delivery, performance measurement becomes more subjective and complicated. For example, different stakeholders may have different ways to define quality education, which is only one of the many public sector objectives.

Performance auditing aims to assist in overcoming this challenge by independently evaluating the measures implemented by management to ensure that government objectives are achieved (effectiveness) and that these objectives are achieved by utilising public resources in the most economical and efficient way possible.

There are many factors that drive the demand for performance auditing in South Africa. The three main drivers are briefly discussed below:

Government accountability

With a history of governance challenges, corruption scandals, state capture and inadequate service delivery, a greater emphasis is placed on enhancing accountability

within government organisations. Performance audits play a crucial role in evaluating the effectiveness of public policies and programs, ensuring that taxpayers' money is utilised efficiently.

Government organisations are also forced to account for inadequate performance, as the Auditor General of South Africa (AGSA) performance audit reports are public documents.

16 www.saiga.co.za Advancing Auditing &Accountability

PERFORMANCE AUDITING

Regulatory requirements and audit plans

Although performance auditing is not required by law like its financial audit counterpart, it is also mandated by the AGSA to assess the performance of all government departments.

Additionally, internal audit functions of public sector organisations are also including performance audits in their annual internal audit plans. Compliance with these mandates and plans drives the demand for audit services.

Economic development

As South Africa strives for economic development and social progress, there is heightened scrutiny on the performance of public services, infrastructure projects, and

development initiatives. Performance audits assist with the identification of bottlenecks and inefficiencies that hinder progress. Furthermore, one of the main objectives of public sector organisations is to achieve the largest possible outcomes with as little resources as possible.

As economy and efficiency are two of the main three pillars of performance auditing, these audits can greatly assist the public sector to achieve this.

Challenges facing the effective delivery of performance audits

Despite the increasing demand for performance auditing services, several challenges hinder their effective delivery. Firstly, as performance is defined differently

for each category of service delivery, a skill shortage of sector-specific expertise exists, especially in specialised sectors such as healthcare, education, and infrastructure. Most performance auditors come from a financial background and lacks the specific skills required to understand the intricacies of these sectors. On the other hand, sector specific experts may not always fully understand audit related processes. A clear need exists for the development of “all-rounder” performance audit professionals.

Secondly, thorough performance audits are generally quite costly. >

The demand for performance auditing services in South Africa reflects a growing recognition of the importance of accountability, transparency, and effective governance in driving socio-economic development.

17 Auditing SA Advancing Auditing &Accountability

This is due to many factors, but mainly because a performance audit is not necessarily based on a financial year and may require in-depth analysis and research processes to evaluate program effectiveness and efficiency.

Budgetary constraints within public sector organisations may limit the scope and frequency of audits.

This is true for both the AGSA and the internal audit functions of public sector organisations, such as national departments, provincial departments and municipalities. Thirdly, political interference can undermine the independence and objectivity of performance audits, especially when audits uncover irregularities or inefficiencies within government organisations. The recent allegations around state capture are sufficient proof that South Africa faces a serious risk of political interference, which can also affect audit outcomes. Safeguarding auditor independence is crucial for maintaining public trust in audit findings.

Lastly, performance audits rely on accurate and reliable data to assess organisational performance effectively. However, data availability and quality issues, including data fragmentation, outdated systems, and incomplete records, can impede the audit process and compromise the reliability of findings. For example, one of the primary challenges is the fragmentation of data across different government departments and entities in South Africa.

Government systems often operate in silos, leading to fragmented data that is dispersed across multiple databases and platforms. This makes it difficult for auditors to

access comprehensive datasets necessary for conducting thorough performance audits, hindering their ability to make informed assessments and recommendations.

Consider the government objective of public safety. The efforts of at least three government departments must be adequately coordinated to achieve this objective, namely the Police, Justice and Correctional Services. A successful performance audit of this objective will require reliable data from all three departments, which might be difficult due to fragmentation.

Addressing the demand for performance audits

To address the challenges associated with meeting the demand for performance auditing services in South Africa collaborative efforts from government, regulatory bodies, professional organisations, and audit firms are required. Strategies to enhance the effectiveness of performance auditing can include capacity building, concerted efforts to safeguard auditor independence

against political interference, leveraging technology to increase data analytics capabilities and campaigns to increase public awareness of the importance of performance auditing.

The demand for performance auditing services in South Africa reflects a growing recognition of the importance of accountability, transparency, and effective governance in driving socioeconomic development. While challenges exist in meeting this demand, concerted efforts to address capacity constraints, funding limitations, and governance issues can strengthen the effectiveness of performance audits and contribute to improved organisational performance and public trust.

By prioritising capacity building and professional investment, safeguarding of auditor independence, leveraging technology and marketing the importance of performance auditing, South Africa can greatly improve its government accountability framework and contribute to an improved public service.

18 www.saiga.co.za Advancing Auditing &Accountability

PERFORMANCE AUDITING

Together, we can build a capable, ethical & developmental South Africa.

• Service delivery

• Reputation & credibility

• Ethical practices

• Audit outcomes

• Risk identification & mitigation

• Management

• A robust ethical approach

• Stronger stakeholder relationships

• Efficient & economic ways of working

• A competitive edge

• Full control through performance measurement

Ensure Decrease

• Accountability

• Employees are highly skilled & competent professionals through up-skilling

• Costs

• Wastage

• Complexity

Assisting Local Government and Municipalities to strengthen their Procurement & Supply Chains and help deliver better services to communities. Now is the time

saenquiries@cips.org.za to find out more.

Email

AN ANALYSIS OF AUDIT COMMITTEE DISCLOSURE PRACTICES IN SOUTH AFRICAN METROPOLITAN MUNICIPALITIES

Advancing Auditing &Accountability AUDIT COMMITTEE 20 www.saiga.co.za

Nadia N Kganakga School of Accounting Science, North-West University

Danie Schutte School of Accounting Science, North-West University

Lorraine E Derbyshire School of Accounting Science, North-West University

It is common knowledge that South African municipalities are struggling to deliver basic services in accordance with the constitutional mandate.

Metropolitan municipalities are situated in densely populated areas of South Africa in accordance with section 2 of the Municipal Structures Act 117 of 1998 (RSA 1998).

The lack of service delivery by metropolitan municipalities therefore affects many stakeholders. According to Martin (2021), as many as 909 protests activities occurred between August 2020 and January 2021, expressing the public’s dissatisfaction with poor service delivery by municipalities.

The problems of South African municipalities are also evident from the Auditor-General of South Africa

(AGSA) reports (AGSA 2019a:6).

Governance is critical in ensuring that public funds are spent appropriately and that services are delivered successfully (Motubatse, Ngwakwe & Sebola 2017:91, The International Federation of Accountants (IFAC) and the Chartered Institute of Public Finance and Accountancy (CIPFA) defined “public sector governance” as the plans that are formulated to ensure that the organisation achieves its objectives and communicates the objectives to stakeholders (IFAC & CIPFA 2014:8).

The audit committee has been found to be an important governance structure (Marx 2009:31; Brennan & Kirwan 2015:466). The South African local government sector agrees that the establishment of audit committees is important and requires municipalities to establish audit committees in accordance with the Municipal Finance Management Act 56 of 2003 (MFMA) (RSA 2003).

According to Manamela (2020:21), public funds are used in the best interest of the public when appropriate governance structures are in place. Public sector audit committees also promote accountability and transparency on both financial reporting and compliance (Letsoalo & Motubatse 2019:136).

A key requirement for good governance is accountability. Accountability requires the governing body, or those charged with governance, to provide explanations for its actions to stakeholders and provide stakeholders the opportunity to express an opinion on its governing ability (Thornhill 2015:77). Shbeilat (2014:542) claimed that the audit committee is a vital role player in accountability.

Effective accountability results

not only in the effective management of public resources, but also in improved governance and satisfactory delivery of basic services (Van Niekerk & DaltonBrits 2016:118). More stakeholders are looking to the audit committee to ensure transparency and accountability. The audit committee can hold management accountable for the management of public funds when reviewing the financial reports prepared by management (Bananuka, Nkundabanyanga, Nalukenge & Kaawaase 2018:139).

Municipal audit committees also advise municipal management on public funds management, to ensure that sufficient funds are available to meet the needs of the community and the mandate as set out by the Integrated Development Plan (IDP) and Service Delivery and Budget Implementation Plan [SDBIP] (PSACF 2018:3).

The audit committee is an independent external committee which provides feedback on the stance of the municipality’s operations to the municipal management before the Annual Financial Statements are submitted to the AGSA for the annual external audit.

Another important aspect of governance is disclosure (Bagwandeen 2010:17). Sufficient disclosure of the audit committee activities allows stakeholders to determine the audit committee’s effect on the performance of the organisation (Coetzee & Msiza 2018:91). Marx (2009:35) explained that for stakeholders to have assurance in the audit committee’s operations, detailed reporting >

Advancing Auditing &Accountability

21 Auditing SA

on these operations is required. Moloi (2015:67) agreed that disclosure of additional, voluntary information will render the audit committee reports more useful, as the users will gain an understanding of the activities of the audit committee.

Adequate disclosure concerning the audit committee’s operations may influence the organisation’s financial- and reporting framework, as companies with good corporate governance practices are more likely to obtain a clean audit opinion (Sun 2019:542). Similarly, Manamela (2020:112) found that South African central government departments with more detailed audit committee disclosures were more likely to obtain a clean audit opinion.

This denotes that the reported financial information contained fewer misstatements, in cases where audit committee disclosures were more detailed. There are, therefore, benefits to comprehensive disclosure concerning the operations of the audit committee.

The AGSA reports are often headline news because it reveals the deterioration of the South African municipalities. An important disclosure report that is often not focused on, is the audit committee reports. The audit committee is an independent external committee which provides feedback on the stance of the municipality’s operations.

The audit committee provide feedback to the municipal management before the Annual Financial Statements are submitted to the AGSA for the annual external audit. It is therefore worthwhile to see what concerns the audit committee had prior to the audit of the AGSA and whether these matters were addressed or remained and were subsequently reported on by the AGSA.

Disclosure requirements of audit committees

Municipal audit committees are required to disclose matters as contained in MFMA section 121(3) (j) and MFMA Circular 65. These legislative requirements are, however, not detailed. MFMA section 121(3) (j) only requires audit committees to include its recommendations in the annual reports (RSA 2003).

When audit committees do not disclose areas of concern in the municipalityandthe efficacyofthefinance function, it raises the questiononwhether audit committees are hesitant to share their concerns with stakeholders due to the politicalenvironment theyoperateinand perhapsfearbeing removedshouldthey share their concerns.

MFMA Circular 65 states that audit committees should disclose their functions and attendance of meetings, council resolutions and implementation thereof, and additional relevant matters that could improve accountability and governance (RSA 2012:8). The last disclosure requirement, namely “relevant comments that could improve governance and accountability”, is open to interpretation.

Differences are likely to occur amongst the disclosures by different municipal audit committees, as no minimum requirements for disclosure on governance and accountability are outlined. Disclosure practices in municipalities vary in nature, as well as in the extent

of information disclosed, owing to a lack of legislative guidance on aspects required to be disclosed (Ackermann et al. 2016:49).

The limited legislative guidance on audit committee disclosure practices might therefore be contributing to the lack of accountability in the current municipal environment.

In addition to the aforementioned legislation and guidance that aim to improve governance, South African organisations, including municipalities, can apply the principles and practices contained in the King IV Report on Corporate Governance (King IV), to improve governance. The King IV Code is voluntary for the public sector, that includes municipalities. Part 6.2 of King IV contains the sector supplements for municipalities (IoDSA 2016:79). Municipalities can apply King IV Code to improve municipal governance, as the sector supplements can guide municipalities on how King IV Code must be applied and interpreted, in a municipal context (IoDSA 2016:75).

Principle 8 of King IV Code describes the disclosure requirements for audit committees (IoDSA 2016:55- 56). The King IV Code confirms the important role of the audit committee and recommends specific aspects that the audit committee should disclose (Deloitte 2018:1). Coetzee and Msiza (2018:91) suggested that King IV can provide guidance concerning best practice for audit committees, including the audit committee disclosure. Stakeholder confidence is increased when audit committees implement practices that are referred to as “best practice” (Coetzee & Erasmus 2020:37).

In a similar vein, Chauke (2021:63) asserted that adopting and applying King IV Code will create trust and build stakeholder confidence in municipalities.

Advancing Auditing &Accountability 22 www.saiga.co.za

AUDIT COMMITTEE

Since municipal audit committees have limited legislative guidance on matters to be disclosed, the authors analysed the disclosure practices of the audit committees of the metropolitan municipalities in South Africa. The authors also compared the existing disclosure practices to the King IV Code audit committee disclosure requirements.

Analysis of the audit committee disclosure practices

In terms of MFMA section 121(3) (j) and MFMA Circular 65, audit committees are required to

disclose matters in the annual reports of municipalities. The latest accessible annual reports of the metropolitan municipalities—when this analysis was performed—were those of the 2018/19 financial year (RSA 2020).

The matters disclosed by the audit committees in the “audit committee report” section of the municipal annual reports, were analysed. Short phrases (codes) were then assigned to the different matters disclosed. These codes were grouped to identify overall themes in the disclosure practices of the eight audit committees.

The results of the analysis can be seen in table 1 above.

Due to the lack of legislative guidance on matters to be disclosed by municipal audit committees the disclosure practices vary in nature, as expected. Only one audit committee disclosed areas of concern in the municipality and the efficacy of the finance function. This raises the question on whether audit committees are hesitant to share their concerns with stakeholders due to the political environment they operate in and perhaps fear being removed should they share their concerns. >

23 Auditing SA Advancing Auditing &Accountability

ITEM NO. CODE FOR ITEM NUMBER OF AUDIT COMMITTEES THAT DISCLOSED FACTS RELATED TO ITEM THEME 1 Recomendations and implementation thereof * 4 Duties 2 Roles and responsibilities * 8 3 Meetings and attendance thereof * 6 4 External invitees who attend audit committee meetings on a regular basis 4 5 Areas of concern 1 6 Fulfilment of audit committee duties 3 7 Focus areas during the reporting period 2 8 Composition 4 Composition 9 Annual financial statements 3 Reported information 10 Performance information 4 11 Risk management 4 Internal controls 12 Internal financial controls 4 13 Internal controls of municipal entities 2 14 Internal audit quality 4 Assurance arrangements 15 Effectiveness of combined assurance arrangements 3 16 External audit quality 3 17 Effectiveness of CFO and finance function 1 Efficacy of finance function 18 Information communication technology 1 Technology 19 Corrective actions 1 Accountability 20 Consequence management 1 21 Forensic investigations 1 22 Employee suspension 1 23 Governance and/or ethics 2 Governance 24 Statutory compliance 2 Legitimacy

MFMA (Source:

TABLE 1 * Legislative disclosure requirements

per

Own compilation, from collected data)

Table 1: Items and themes in audit committee disclosure practices in the municipal annual reports

Only half of the audit committees disclosed their composition which included the name, surname, and qualifications of the members. The appointment of audit committee members often lacked transparency due to the political intentions that often outweigh the financial expertise of members (Coetzee et al. 2021:7).

The non-disclosure of four audit committees therefore may attributed to the fact that members might not have the necessary expertise to serve on the audit committee. Technology has become an integral part of modern society, and it is concerning that only one audit committee disclosed matters concerning technology.

It prompts the enquiry as to whether municipalities have the necessary technology in place or do audit committee members have the knowledge to be able to report on technological matters. Roos (2021:198) confirms the

latter and found that municipalities experience challenges in recruiting audit committee members with IT expertise.

Accountability is a concept that the South African public sector is struggling with (Erasmus 2022:1). The audit committee is an independent committee, and it would be of value to get their view on the accountability in South African municipalities. An aspect of accountability that the AGSA frequently addresses is consequence management, or rather the lack thereof.

Only one audit committee addressed consequence management in their disclosure, which is concerning as this is a well-known problem in the South African local government sector. In similar vein, governance is also an important concept in municipalities. Only two audit committees disclosed governance related matters. It is concerning that audit committees do not provide

their insight into these crucial matters that the South African local government sector struggles with.

Audit committee disclosure practices compliance with the King IV Code disclosure requirements:

The King IV Code is often referred to as “best practice”. The disclosure practices of the audit committees were therefore compared to the King IV Code disclosure requirements which was used as a checklist. The results can be seen in table 2 above.

The King IV Code contains 12 disclosure requirements applicable to municipal audit committees, as seen in table 2. All 12 disclosure requirements were identified among the audit committee disclosure practices which indicates that municipal audit committees are aware of the King IV Code audit committee disclosure requirements.

As evident from table 2, the concern remains as only one audit committee disclosed their views on the effectiveness of the CFO and finance function. This is of particular concern an amount of R1.26 billion was spent by all South African municipalities on consultant costs, to offer support in preparing the financial statements, during the 2018/19 financial year (AGSA 2019b:2).

This occurred, even though the MFMA’s section 81(1)(e) determines that the CFO is responsible for the financial reporting of a municipality— signifying that the CFO and finance function should have the ability to prepare the financial statements.

Conclusion

South African municipalities are facing governance challenges which is evident by service delivery protests and the reports of the

Advancing Auditing &Accountability

24 www.saiga.co.za AUDIT COMMITTEE

Table 2:

AGSA. The audit committee is an important governance structure and stakeholders can gain insight of the audit committee’s role by analysing the disclosures of the audit committees.

It was found that South African metropolitan municipalities’ audit committees disclosures vary in nature. The identified, non-uniform disclosure practices might render it difficult for stakeholders to gain an understanding of the role that municipal audit committees

played during the financial year. Nonuniform disclosure practices could also create challenges to holding audit committees accountable as there is no consistent metric to measure performance.

It is recommended that more detailed legislative guidance on matters to be disclosed in the annual report, be provided to municipal audit committees. Matters disclosed concerning accountability are not King IV Code audit committee disclosure requirements, however,

it contributes to the transparency of the audit committee disclosures.

King IV Code audit committee disclosure requirements should be used as the minimum guide for municipal audit committee disclosures, in the annual reports. National Treasury can, furthermore, provide additional disclosure requirements for municipal audit committees.

*Lorraine Derbyshire is now with the University of Cape Town*

25 Auditing SA Advancing Auditing &Accountability ITEM NO. KING IV CODE AUDIT COMMITTEE DISCLOSURE REQUIREMENT (CHECKLIST) CODE FROM ITEM (TABLE 1) RELATING TO KING IV CHECKLIST ITEM NUMBER OF AUDIT COMMITTEES THAT DISCLOSE ITEM 1 Overall role and associated responsibilities and funcrions * Roles and responsibilities 8 2 The number of meetings held during the reporting period and attendance thereof* Meetings and attendance thereof 6 3 Composition, including each member’s qualification and experience Composition 4 4 Any external advisers or attendees who attend the committee meetings on a consistent basis External invitees who attend audit committee meetings on a regular basis 4 5 The audit committee’s views on the effectiveness of the chief audit executive and the arrangements for internal audit Internal audit quality 4 6 The audit committee’s views on the effectiveness of the design and implementation of internal financial control, and on the nature and extent of any significant weaknesses in the design, implementation or execution of internal financial controls that resulted in material loss, fraud, corruption, or error Internal financial controls 4 7 Whether the committee is satisfied that it has fulfilled its responsibilities in accordance with its terms of reference for the reporting period Fulfilment of the audit committee duties 3 8 Significant matters that the audit committee considered in relation to the annual financial statements, and how these were addressed by the committee Annual financial Statements 3 9 The audit committee’s views on the quality of the external audit External audit quality 3 10 The arrangements for combined assurance and the audit committee’s views on its effectiveness Effectiveness of combined assurance arrangements 3 11 Important areas of focus during the reporting period Focus areas during the reporting period 2 12 The audit committee’s views on the effectiveness of the CFO and finance function Effectivenes of CFO and finance function 1

TABLE 2 * Legislative disclosure requirements per MFMA (Source: Own compilation, from collected data)

Compliance with King IV code disclosure checklist

ELEVATING MUNICIPAL PERFORMANCE THROUGH TECHNOLOGY TO ACHIEVE CLEAN AUDITS

MUNICIPALITIES & TECHNOLOGY PERFORMANCE

CLEAN AUDITS

Dr Lethiwe Nzama-Sithole

Senior Lecturer: Department of Commercial Accounting

University of Johannesburg

There is no denying that integrating technology into municipalities in South Africa has the potential to improve operational efficiency. The benefits include enhanced citizen participation, advanced data management, and process automation.

Poor governance at municipalities can hinder the effective implementation and maintenance of technological solutions. In contrast, under good governance, technology can enhance transparency, efficiency, and citizen engagement.

26 www.saiga.co.za Advancing Auditing &Accountability

MUNICIPAL PERFORMANCE

However, the success of these initiatives hinges on robust governance structures. Addressing core governance issues is critical to prevent the worsening of existing challenges and to ensure progress aligns with aspirations for technological advancement.

Governance, Financial Management, Supply Chain Management (SCM) and Asset Management Challenges

South African municipalities grapple with pervasive governance issues, including transparency deficits and inadequate public participation, which hinder accountability mechanisms. Additionally, persistent financial mismanagement accompanies SCM challenges, such as poor recordkeeping and corruption further complicate matters. These systemic issues impede efficient service delivery and contribute to ongoing audit failures.

Addressing Systemic Issues

Tackling multifaceted challenges demands a comprehensive approach. It is critical to strengthen governance structures, improve transparency, and ensure compliance with the legal framework.

Improving service delivery requires municipalities to be more capable in asset management, SCM, financial management, and governance. Robust systems and competent personnel are also essential elements in overcoming these hurdles.

Municipalities in South Africa face distinct challenges at the metropolitan, district, and local

levels. Governance remains a critical hurdle, compounded by persistent financial management difficulties and operational deficits.

Rising corruption trends also make this worse, and SCM issues put a drain on resources and impede development, particularly in rural areas.

The advantages and disadvantages of technology for municipalities

Technology offers both advantages and disadvantages. However, in contexts where governance is lacking, the potential benefits of technology may not be fully realised, leading to increased vulnerability, particularly in municipalities.

Effective governance is essential for harnessing the benefits of technology in municipalities. Without proper oversight and management, technological advancements may exacerbate existing vulnerabilities rather than alleviate them. For instance, without transparent and accountable governance structures, there is a higher risk of corruption, misuse of funds, and inadequate service delivery.

Furthermore, poor governance can hinder the effective implementation and maintenance of technological solutions. This may result in inefficient use of resources, limited access to services, and disparities in technological infrastructure between urban and rural areas.

In contrast, under good governance, technology can enhance transparency, efficiency, and citizen engagement in municipalities. For example, digital

platforms can improve access to information, facilitate participatory decision-making, and streamline administrative processes.

Additionally, technologies like data analytics and remote monitoring can enable better resource allocation and proactive problemsolving.

Therefore, while technology presents opportunities for advancement, its benefits are contingent upon the presence of essential good governance practices. Without effective governance, municipalities may struggle to leverage technology effectively, leaving them more vulnerable to challenges and inequalities.

Proposed Solutions and Measures

Proposed measures include a range of strategies tailored to address specific challenges. These include establishing oversight committees, implementing performance management systems, and investing in technology infrastructure. While some initiatives have seen partial implementation, achieving clean audits remains elusive, emphasising the need to adopt proposed measures comprehensively.

Stakeholder cooperation is necessary to guarantee compliance and promote performance enhancement.

Detailed measures that may be adopted by struggling municipalities may be referred to in an article published in late November 2023 in the Journal of Local Government Research and Innovation, titled “Measures that may assist >

27 Auditing SA Advancing Auditing &Accountability

non-performing municipalities in improving their performance”.

Financial management and reporting

Among the key points to note in the journal of Local Government Research and Innovation is the financial management and reporting.

Most municipalities in South Africa are technically insolvent as the liabilities outweigh their assets and lack the liquidity to cover their operating expenditures (Ryan 2020).

Municipal deficits have worsened and prevent municipalities from progressing (Glasser & Wright 2020; Mishi et al. 2022).

The latest municipal financial sustainability index (NT Ratings Africa 2020) found that 54 municipalities had more than 5% operating deficits of total direct revenue and 146 had financial statement issues.

According to National Treasury, 82 municipalities failed to make on-time debt payments in the 2019–2020 fiscal year, indicating that some municipalities have difficulty adhering to Section 140(2) of the MFMA.

Section 140(2) of the MFMA prescribes that municipalities have a financial recovery plan to meet financial obligations to provide service delivery.

These recovery plans must include:

1. Establishing spending and income goals

2. Establishing budget parameters that bind the municipality for a length of time or until certain

circumstances are met, and 3. Determining the exact revenueraising methods required for financial recovery, including the municipal taxes or tariffs rates being set to achieve financial recovery.

There were 82 municipalities (National Treasury 2020a) that were currently functioning without recovery plans; therefore, they could neither deliver services as per mandate nor were able to meet their financial needs.

Proper financial management can be comprehensive and complicated (Laubscher 2012). Interventions from government and legislation are expected to guide financial management. Despite interventions from provincial or national domains, municipal performance did not improve significantly.

These interventions occurred in municipalities based in the North-West Province (Ditsobotla and Ngaka Modiri municipality), Mpumalanga Province (Mbombela and Pixley Seme Municipalities), Eastern Cape Province (Alfred Ndzo, Kiay-Kamma and Mnquma Municipalities), Free State Province (Mhokare and Xhariep Municipalities) and KwaZuluNatal Province (Amajuba, Umzinyathi, Newcastle and Utrecht Municipalities) (Ntonzima 2011).

The literature further indicates other financial management challenges.

Glasser and Wright identified challenges affecting municipal financial management, namely the 2018 failure of VBS Bank, which caused losses for municipalities that had illegally invested in this bank. Glasser and Wright further

indicate that some of the financial distress in municipalities is because of internal processes.

These include improper financial management processes, such as demarcation in 2000 was another issue that municipalities faced in managing budgets. There were 830 municipalities before delineation in 2000 (Laubscher 2012), whereas now there are only 257. As such, municipal boundaries are too large for effective and efficient service delivery and financial administration. Thus, municipalities cannot perform adequately in accordance with their mission and in attaining clean audit results.

Conclusion:

Setting governance as a top priority is essential to the effective use of technology to improve municipal performance. It is important for overall progress and effective service delivery to address foundational issues.

Through collaborative efforts among stakeholders, South African municipalities can navigate systemic issues and embrace opportunities for enhanced governance and technological advancement.

Municipalities may establish a foundation for sustainable development and improved quality of life for all citizens by prioritising governance.

* Dr Nzama-Sithole (PhD in Auditing and Certified Internal Auditor) is a senior lecturer and deputy head: Department of Commercial Accounting College of Business & Economics at the University of Johannesburg

28 www.saiga.co.za Advancing Auditing &Accountability

MUNICIPAL PERFORMANCE

PROGRAMME STRUCTURE

• Financial Governance & Legislative Frameworks

• Accounting & Reporting Frameworks

OCCUPATIONAL PUBLIC SECTOR AUDITOR, NGF LEVEL 8, 315 CREDITS

Registrations for second Intake now open enroll Now!

ASSESSMENTS

• Final Assessments ( FISA)

• External Integrated Summative assessments (EISA)

• Principles & Ethics of Auditing ENTRY REQUIRMENTS:

PSA QUALIFICATION (GASP)

NQF Level 7 Accounting Or Auditing

PSAAA PUBLIC SECTOR ACCOUNTANCY AND AUDIT ACADEMY Find more information at www.Psaaa.co.za

THE VITAL INTERPLAY BETWEEN TAX PRACTITIONERS AND AUDIT FIRMS TO NAVIGATE SA’S TAX TERRAIN

Lungisani Bhengu (RGA) Business Accountants in Practise (SA) Managing Director at Impulse Accountants

Lungisani Bhengu (RGA) Business Accountants in Practise (SA) Managing Director at Impulse Accountants

In the rapidly evolving and intricate world of taxation and financial compliance in South Africa, the role of tax practitioners has become increasingly indispensable.

This assertion is grounded not only in their expertise and day-to-day immersion in tax matters but also in the dynamic and often complex

tax landscape that characterizes the South African economy. The need for auditing firms to forge stronger collaborations with tax practitioners is more pronounced than ever, given the broad spectrum of tax regulations that are updated or revised with a frequency that demands constant vigilance.

South Africa's tax regime is characterized by its breadth and depth, encompassing a range of taxes from corporate and personal income tax to VAT, customs, and excise duties, each with its nuances and specifics.

This landscape is further complicated

by regular updates and changes initiated by the South African Revenue Service (SARS), which seeks to enhance efficiency, compliance, and revenue collection. The shift from manual processing to eFiling and other automated systems is a testament to SARS's commitment to leveraging technology to streamline tax administration. However, this transition has not been without its challenges, including technical errors and the need for constant system updates, areas where tax practitioners excel by virtue of their daily interactions with these systems. Tax practitioners stand at the forefront of understanding and navigating these changes, offering

30 www.saiga.co.za Advancing Auditing &Accountability

TAX MATTERS

invaluable insights and expertise that can significantly benefit auditing firms and their clients. Their continuous engagement with SARS, coupled with a deep understanding of the tax system, positions them as crucial allies in ensuring that audits are conducted with the most current and comprehensive tax compliance information at hand.

Why Auditing Firms Should Leverage Tax Practitioners' Expertise

1Up-to-Date Knowledge:

Tax practitioners are always abreast of the latest tax

legislation, rulings, and SARS directives. Their expertise is not just theoretical; it is honed through daily application, problem-solving, and interaction with tax authorities. This constant exposure ensures that they possess the most current knowledge, which is critical in an environment where tax laws and interpretations can shift significantly from one day to the next

2

Technical Error Resolution:

With the digitization of tax filings and payments, the potential for system errors, data mismatches, and processing delays has increased. Tax practitioners are adept at navigating these challenges, working closely with SARS to resolve issues promptly and efficiently. This capability is invaluable to auditing firms seeking to ensure accurate, compliant financial reporting for their clients.

3

Strategic Tax Planning and Compliance:

Beyond merely ensuring compliance, tax practitioners can offer strategic insights into tax planning and optimization, helping businesses navigate the complexities of tax laws to leverage opportunities and mitigate risks. Their involvement can transform the audit process from a compliance exercise into a strategic advantage for clients.

4

Practical Insights and Solutions:

Tax practitioners bring a wealth of practical experience, offering solutions that are not only compliant but also optimized for efficiency and effectiveness. They can identify potential tax liabilities and recommend actions that align with the latest tax laws

and SARS practices, ensuring clients are not only compliant but also positioned to take advantage of any beneficial tax provisions.

The Evolving Role of SARS and Its Implications

The evolution of SARS from manual processes to advanced digital platforms signifies a broader shift towards more efficient, transparent, and streamlined tax administration. However, this transformation also brings to light the complexities and challenges inherent in adapting to new systems and regulations. Tax practitioners, with their hands-on experience and technical expertise, are uniquely equipped to navigate these changes, providing an essential bridge between SARS's innovations and taxpayers' compliance obligations.

Conclusion

A Synergistic Approach to Tax Compliance

The collaboration between tax practitioners and auditing firms represents a synergistic relationship that can greatly enhance the quality and effectiveness of audits. By integrating the up-to-date knowledge, practical experience, and strategic insights of tax practitioners, auditing firms can offer their clients a more comprehensive audit service that not only ensures compliance but also advises on strategic tax planning and optimization. In a landscape as dynamic and complex as South Africa's tax environment, the role of tax practitioners has never been more critical. Auditing firms that recognize and leverage this expertise will not only enhance their service offerings but also provide their clients with a significant competitive advantage in navigating the challenges and opportunities of tax compliance.

31 Auditing SA Advancing Auditing &Accountability

32 www.saiga.co.za Advancing Auditing &Accountability

AUDIT COMPLACENCY

FOR INTERNAL AUDIT, COMPLACENCY IS NOT A STRATEGY

Richard Chambers

CIA, CFE, CGFM, QIAL, CRMA, CGAP, Founder and Chief Executive of Richard F. Chambers and Associates, LLC

The IIA recently launched new Global Internal Audit Standards that, for the first time, requires every internal audit function to have an internal audit strategic plan. It may be the single most important addition to the Standards.

Standard 9.2 mandates that the CAE “develop and implement a strategy for the internal audit function that supports the strategic objectives and success of the organization.” The Standard further specifies that the strategy “include a vision, strategic objectives, and supporting initiatives for the internal audit function.”

It is no secret that most internal audit functions either do not have a strategic plan or not one that would meet these new requirements. In fact, in a recent survey by Hal Garyn, only 24% of respondents indicated that they “absolutely” have a strategic plan that would meet the new standard.

I have long been an advocate for internal audit functions having a strategic plan. One of my first priorities each time I assumed the role of CAE was to lead the internal audit team through a strategic planning process. I found it to be a powerful way to get everyone aligned on the vision for internal audit and what it would take to get there. In the coming months,

I plan to share my advice on effective strategic planning techniques.

Over the years, I have encountered those who argue that a strategic plan is not necessary for internal audit success. They say their internal audit department is already highly respected and meeting stakeholder expectations. They believe that strategic planning is a “useless exercise” that diverts time and resources away from the mission.

Sadly, such resistance and complacency often lead to disaster. I once completed an external quality assessment of an internal audit function that I considered one of the best. Three years later, the CAE was fired, and the function was outsourced. When I asked why, the CEO candidly observed that internal audit had not been responsive to his or the board’s needs and needed to be “blown up.” My conclusion: complacency is not a good strategy.

Complacency in business, personal growth or any other aspect of life is often likened to standing still beside a moving walkway. The illusion of stability is just that: an illusion. As the world around you moves forward, standing still means you are effectively moving backward. Complacency is not just ineffective, it’s dangerous.

The illusion of safety

Complacency often stems from a place of comfort. The CAE of the internal audit function that was “blown up” was confident about the future because of internal audit’s success. He suffered from the “if it ain’t broke,

don’t fix it” mentality. However, in a world characterized by rapid technological advance-ments, economic shifts and evolving societal norms, what isn’t broken today might be obsolete tomorrow.

Kodak, a giant in the photography industry, became a cautionary tale for resting on its laurels; despite inventing the digital camera, it failed to capitalize on the technology, leading to its downfall. That story exemplifies how complacency, disguised as playing it safe, can lead to missed opportunities and, ultimately, irrelevance.

The peril of underestimation

Complacency also leads to underestimating both challenges and competitors. After the demise of his internal audit function, the CAE told me he never even considered that the company might outsource internal audit. Blockbuster Video’s failure to recognize the potential of streaming services is another stark example. With a business model rooted in physical video rentals, Blockbuster was slow to adapt to the digital transformation, allowing Netflix to capture the market. Underestimating change and competition out of a complacent mindset can result in business (or an internal audit function) becoming outpaced and outdated.

Stagnation of growth

Growth, both personal and professional, requires stepping out of one’s comfort zone. In the personal realm, complacency prevents individuals from achieving their full potential. It’s the barrier that stops >

33 Auditing SA Advancing Auditing &Accountability

someone from learning a new skill, improving their health or pursuing a dream. Professionally, it stunts organizational growth and innovation, making it difficult to attract and retain talent and, ultimately, it impacts the bottom line.

False sense of security

I know of several instances in which CAEs became very comfortable because of excellent working relationships they had developed with their CEOs or audit committee chairs. But when the CEO or audit committee chair departed, they were subjected to new expectations from executives with whom they had no past. The consequences often play out on a much bigger stage.

In financial markets, complacency can lead to the underestimation of risks, resulting in catastrophic losses when market conditions change unexpectedly. The 2008 financial crisis serves as a grim reminder of what can happen when complacency blinds stakeholders to the buildup of risk in the system.

Overcoming Complacency

Overcoming complacency requires a mindset shift. Change is the only constant in life. Embracing this reality is essential for survival and growth. Complacency, on the other hand, is the denial of change. It’s a static strategy in a dynamic world. The technological landscape, for instance, evolves at an unprecedented pace.

Companies that fail to innovate and adapt, thinking their current products or services will always be in demand, find themselves outpaced by more agile competitors. The same is true for internal audit functions.

Adaptability is the antithesis of complacency. It involves being vigilant, recognizing when change is on the horizon and being prepared to pivot, as necessary.

This agility allows individuals and organisations to seize opportunities, mitigate risks and continue a path of growth and success.

Adaptability requires a mindset that values continuous learning, improvement and innovation over any false comfort of the status quo. And a sound strategic plan enables adaptability. It envisions potential risks and uncertainties and positions internal audit to respond.

Being proactive is crucial to avoiding the pitfalls of complacency. This means not just reacting to changes and challenges as they arise but anticipating them and preparing in advance. For internal audit, this could involve securing talent to address tomorrow’s risks, investing early in technology or deploying new services or methodologies aligned with shifting stakeholder expectations. For individuals, it might mean continually upgrading skills, seeking feedback for improvement, or setting new goals. Proactivity ensures that you are always moving forward.

Complacency might feel comfortable in the short term, but it often leads to stagnation, irrelevance, and failure in the long term. One of my heroes in the sports world is former University of Alabama football Coach Nick Saban, who was notorious for warning his teams about complacency:

“You get up every day, you’re entitled to nothing,” Saban said. “Nobody owes you nothing. You could have talent, but if you don’t have discipline, if you don’t execute, you don’t focus, you get nothing. If you’re complacent, and not paying attention to detail, what does that get you?”

Richard Chambers has served as the President and CEO of The Institute of Internal Auditors (IIA), the global professional association and standard-setting body for internal auditors. Chambers has more than four decades of experience serving in and on behalf of the internal audit profession.

(C) 2024. Richard F Chambers and Associates, LLC (USA). Reprinted with permission.

34 www.saiga.co.za Advancing Auditing &Accountability

AUDIT COMPLACENCY

WHY THE SA BANKING SECTOR NEEDS PLATFORM BUSINESS TO UNLOCK THE FUTURE

Ashley Nyiko Mabasa Senior Management Consultant at PwC

Ashley Nyiko Mabasa Senior Management Consultant at PwC

The banking sector in South Africa makes a significant contribution to our economy and overall development through its institutions.

A robust banking sector is crucial for South Africa, as it plays a pivotal role in steering both macro- and micro development in our society. At the micro level, banks consistently lend to customers and manage their deposits, thus supporting small businesses financially. In essence,

the South African banking industry collectively boasts a combined total of $334.1bn in assets.

The relationship between South Africa's banks and customers is mutually exclusive, particularly as household credit stands out as the primary driver of bank credit growth, with a recorded compound annual growth rate of 11.7% over a certain period.

In South Africa, there are only five banks that dominate the economy, namely FNB, Absa, Standard Bank, Nedbank, and Capitec. These banks collectively held 91% of the total banking-sector assets as reported in 2017, while local branches of foreign banks held 6% of banking assets. However, banks, like any other industry, face the challenge of establishing public trust, especially since they safeguard most of the citizens' money through deposits.

Consequently, this situation offers a significant opportunity for South Africa’s banking sector to thoroughly explore platform businesses to foster trust and bolster cybersecurity. According to Camparitech, South Africa experienced approximately $5.3bn in cybercrime losses relative to its GDP.

Indeed, platform businesses aren't

prevalent in South Africa, but we do have companies engaging in platform-based services, including Microsoft, AWS, and Google. These companies' network effects have enabled them to expand widely and dominate markets in other countries, much like how Microsoft and Google have established their presence in South Africa.

This predates most of the companies we've seen mentioned. These companies, along with their predecessor traditional platform businesses like Yellow Pages, Blackberry, Motorola, and Nokia (smartphones), were overshadowed by the lack of competitiveness in transactional platform development, notably negated by the advent of the iPhone in 2007.

Yellow Pages became obsolete due to the rapid advancement of digital platform technologies such as Google Maps and Waze, the Israeli company acquired by Google.

The impact of the risk-averse approach

I am certain that by now, the imminent question is: How does this relate to banking in South Africa? Platform businesses have been introduced to South Africa, with very few local platform businesses except for

36 www.saiga.co.za Advancing Auditing &Accountability

BANKING SECTOR