Rooftop reduction

Reimagining a HQ or major campus

Cost savings

Right-sizing the portfolio

ESG

Hybrid work

Talent strategy

Supply chain optimization

Sublease opportunities

Building in flexibility

Continued focus on talent location strategy and workforce / labor markets

Businesses reevaluating the value of the workplace

Portfolio and footprint strategy are being reimagined for hybrid work

Pandemic affect still causing changes in pricing

Flexible workspace solutions have dramatically increased options

Consistent Transaction Negotiation Strategy

Single Point of Contact

Consistent Process Across Every Location

Leverage Spend / Commission Generation

More Savings

Reduction in Internal Resources and Management Effort

Risk Mitigation

Reduced Fees and More Rebates

Palm Beach, Memphis, Dallas, Savannah

Lehigh Valley, Las Vegas, Atlanta, Miami, Seattle

Jacksonville, Philadelphia, Charleston, Fort Lauderdale

Key Moment

Rental rates growth slowing Rental rates falling

Austin, Cincinnati, Kansas City

Notes:

1. Q4 2022 figures

2. The chart assesses market prospects over the next 12-18 months.

3. In simple terms, markets on the left of the chart favor landlords, while those on the right favor tenants.

San Francisco, Salt Lake City, Tampa Bay, Reno/Sparks, Phoenix, Inland Empire

Rental rates growth accelerating

Rental rates bottoming out

Nashville, Indianapolis, Detroit, Portland, Milwaukee

Fort Lauderdale, Miami

Sacramento, Denver, Washington DC

Atlanta, Orlando, Phoenix, Silicon Valley

Key Moment

St. Louis, Denver, Cleveland

Chicago, San Francisco

Houston, Portland, Seattle

Austin, Dallas, Los Angeles, Minneapolis, New York, Philadelphia, Washington D.C.

Boston, Charlotte, Denver, Detroit, New Jersey, Raleigh, San Diego

Subject matter expertise spanning the real estate lifecycle

Technology Advisory

Focus on strategic advisory

Transaction Advisory & Management

Workplace Advisory

Expertise built in to our delivery model

Portfolio Strategy

Project Management

Location Strategy, Labor Analytics, Incentives

Negotiation

Comprehensive Advisory Services for Occupier Clients

Flexible

Workplace Consulting Lease Administration

FM Advisory

ESG Advisory

Engineering & Design Supply Chain & Logistics

Corporate Capital Solutions

Consulting

Transaction Advisory and Management

Globally consistent processes and tools

Advising 800+ multi-market clients

Our POV

Transaction Advisory and Management is the bridge that connects high-level strategy and on-theground outcomes.

Proactive portfolio strategy

Expert local market knowledge

Advanced analytics and decision support

Focus on bringing innovation and best practices

Our POV Lease Administration is the foundation of a successful portfolio—built on reliable, consistent, and accurate data.

Continued evolution of best practices

Teams set up to ensure service continuity Database management, abstraction, rent payments, audits

200+dedicated Lease Administration professionals globally

Automated document management and abstraction tracking

Our POV Change is constant. We provide advisory services that reduce complexity and shape your approach to every real estate decision.

Portfolio Strategy

Portfolio assessments and benchmarking to drive cost savings

Workforce Analytics Aligning people strategy with key talent and labor markets

Supply Chain Solutions Network analysis that aligns supply chain to business objectives

Workplace Advisory

Workplace assessments to rightsize and future-proof your workplace

We offer real estate solutions for business challenges.

ESG Strategy, Organizational Design, Hybrid Work Change Management, Large Campus Restructuring

Flexible Workspace

Portfolio diagnostic identifying possible business cases for flexibility

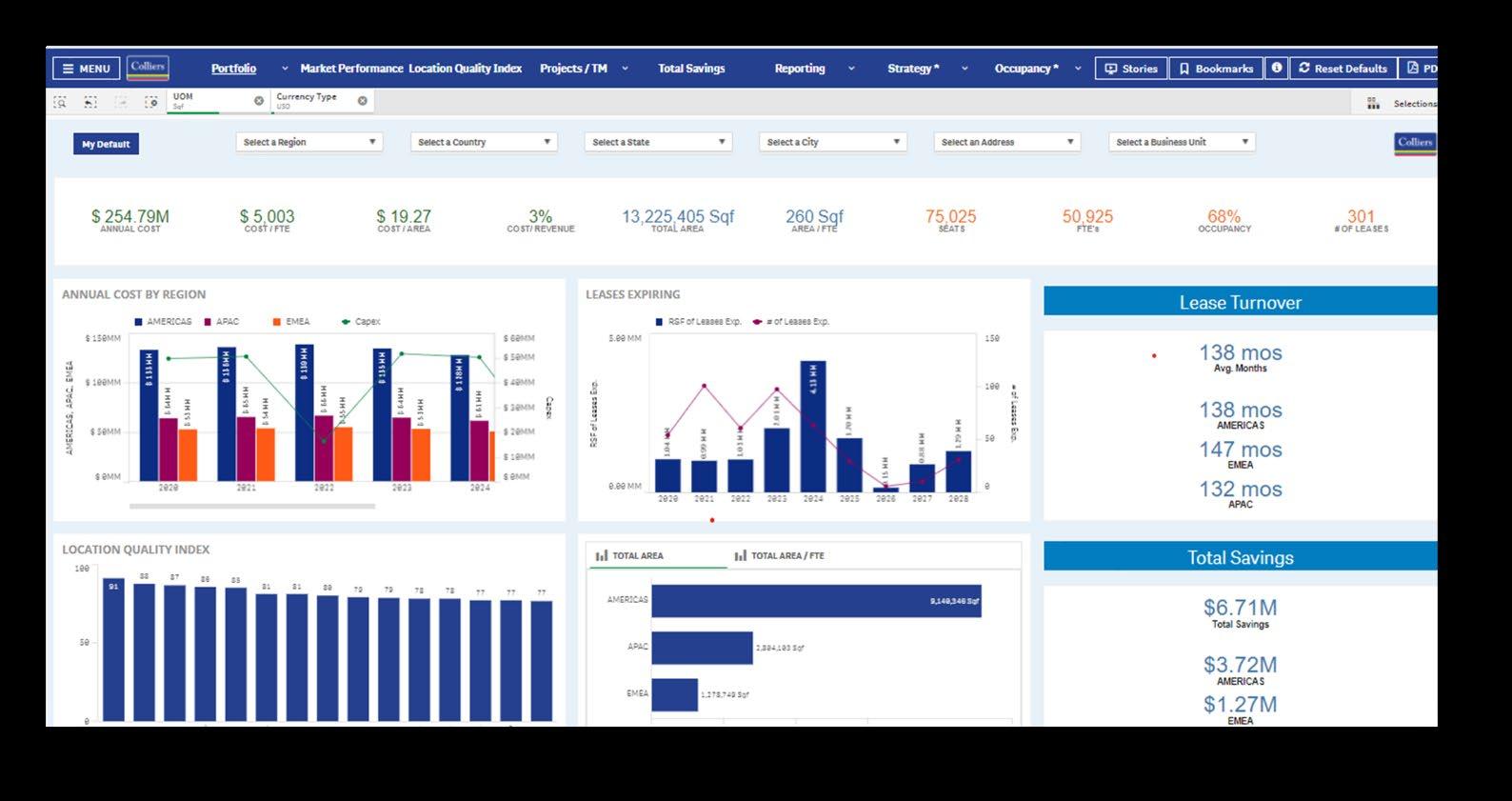

Our POV Technology should be intuitive, enabling better decisions, selectively automating tasks, and working in tandem with the power of human expertise.

Technology environment that integrates best-in-class tools

Business intelligence analytics and customized reporting

Focus on technology as a service

Deployment within 90 Days

Fast setup and seamless implementation

Consultative, unbiased, and client-first approach

Short-term, Flex Options

Leveraging

Multiple-Site Landlords

Market

Cycles / Timing

Co-working Providers to Take Excess Space

Bring Partner Companies in to License Vacant Seats

Workforce

Maximizing

Negotiating Leverage

to optimize talent strategy

Analyze Landlord

Debt Positions

New Lease Accounting Strategies

Understanding CFO’s strategy on Real Estate / Capital

Space Optimization / Workplace Strategy

Portfolio Strategy, Consolidations, etc.

Government

Incentives

Lease/Operating Expense Audits

Advanced transaction advisory services - brings the unique combination of expertise in real estate strategy, capital markets, corporate finance and accounting.

A custom approach - financially engineering and analyzing alternative transaction structures to achieve optimal outcomes, evaluating options related to macro corporate strategy, financial and credit strength, and operational requirements..

• Asset and Portfolio Strategy

• Acquisitions

• Disposals

• Sale and Leaseback

• Purchase to Leaseback

• Debt Advisory

• Build-to-Suit

• Mergers and Acquisitions

• Surplus Asset and Liability Management

Our clients get more significant and positive outcomes, faster.

Our enterprising culture empowers and pushes our people to listen, be change agents and proactive advisors, and to avoid being order-takers.

Our target clients are motivated to make change, want innovation, new ideas, and an account team that is proactive.

• New Leases, Renewal Leases, Expansion LeasesCommissions are paid by the Landlord and are based on local market custom/standard in each market.

• Lease Administration Services, if required, will be priced based on the scope of services required by Lennar and the fees will be determined and agreed upon prior to engagement for Lease Administration Services.

• Subleases, Early Terminations – Commissions are paid by the Tenant/Sublandlord and negotiated on a deal-by-deal basis based on local market custom/standard in each market (i.e. Lennar would pay the commissions for any subleases or early terminations in which Colliers is involved).

• Financial Modeling, GIS Mapping, Colliers 360 Database Management are part of Colliers’ overall services which are compensated through Commissions paid as described above.

• Project Management Fees – Sliding scale from 5% to 1% at thresholds to be agreed upon by Colliers and client

• Consulting Services, if required, will be priced on the scope of services required by Lennar and the fees will be determined and agreed upon prior to engagement for those services.

• Acquisition/Disposition Services – TBD but generally 1%- 1.5% of acquisition or disposition value and often paid for by a seller

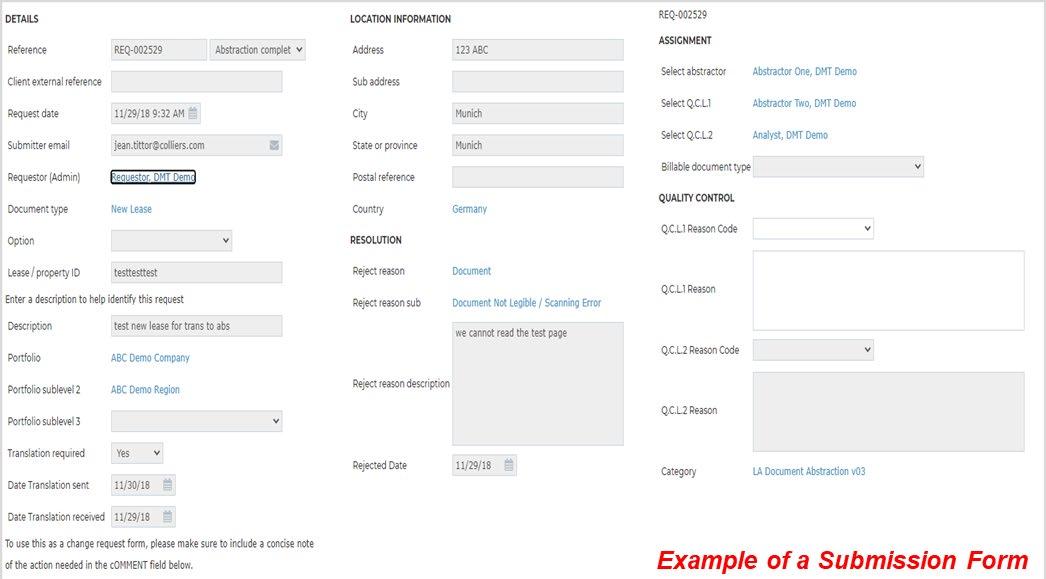

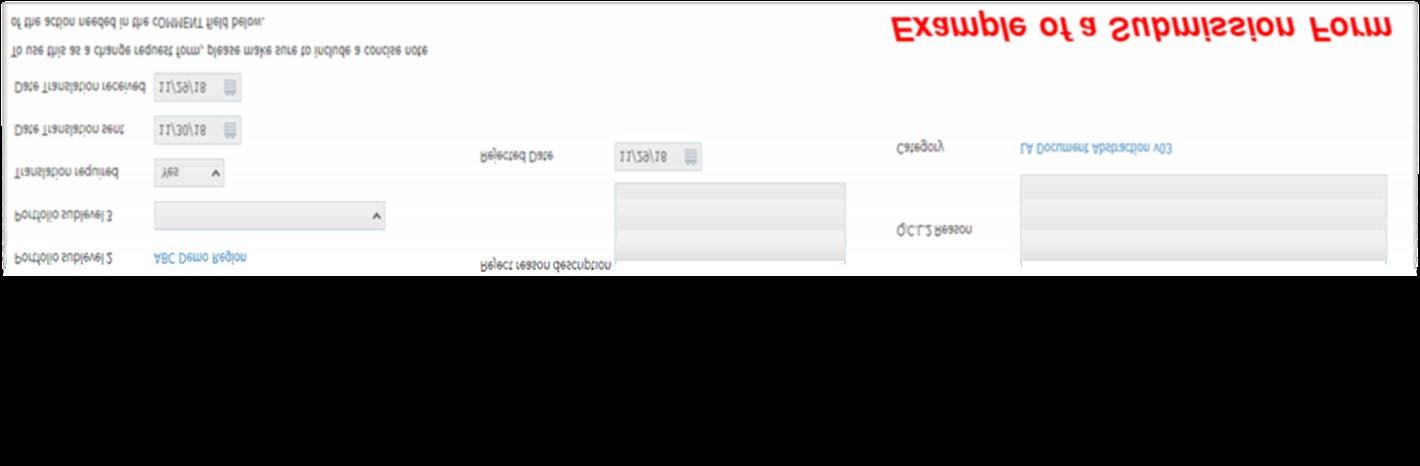

Document Management Tool (DMT)

All documents tracked and automated within the tool

All documents entered and validated by the team

Accurate and timely

DMT Process

Transparent and trackable end-to-end to both Lennar and Colliers

Automated exception reporting and notifications

Compatible with all lease administration databases and used for all clients

Score each portfolio site according to customized metrics

Assess each location relative to standard market rates

1 Client Service Evaluation Score (1-5)

Negotiated Savings Final NPV

Did Colliers negotiate materials amount of savings considering all of the factors that were involved in this transaction? NPV Savings

2

Savings Captured

Did Colliers do everything possible to meet the targeted completion date given the factors within Colliers control? Sector

RFS submittal date

Targeted lease execution date

Actual lease execution date

How many days did the transaction take from RFS to lease execution?

Comments:

4

5

A1

Client Contact

Transaction Manager

Total # of "YES" Responses

Total # of Applicable Categories

% YES, out of Applicable Categories

Negotiated Options/Rights Total TQI Score

Considering the circumstances, did Colliers do everything possible to maximize flexibility?

How many of the standard provisions were successfully (renewal, expansion, termination, sublease/assignment)?

Comments:

Market Comparable

Did Colliers provide valuable market comparable and market intelligence to support your business decision?

Starting rental rent compared to Published Data?

Total TI Allowance, free rent and other concession (aggregate PSF):

Comments:

If applicable in this case, did Colliers identify back-up alternatives and pursue such alternatives to create sufficient leverage in the final transaction?

*Lease term must be the same

TOTAL SCORE 4.76