WWW.FLORACULTUREINTERNATIONAL.COM

APRIL 2024

EURO PLANT TRAY

Working on a universally accepted solution

FLOWERTRIALS

Showcase of purposedriven plant breeding

FLORANOW

Dubai's B2B e-commerce creates its online marketplace

How the industry is taking bold steps to combat plastic pollution PACKAGING

ENTER IGOTY 2025!

2025

Scan for entry details

Established in 2009, the AIPH International Grower of the Year (IGOTY) Awards celebrate best practice and recognise the top ornamentals producers in the industry.

GREENWOOD PLANTS, UK, WINNER OF International Grower of the Year 2024

Partners of FloraCulture International

FloraCulture International encourages the pursuit of joint activities in areas of mutual interest with national, and international societies, and organisations. Agreements have been reached between FCI and leading growers and trade associations worldwide. FCI is proud to work in collaboration with:

Ron van der Ploeg

Ron van der Ploeg

Bold steps to address plastic waste

Our April issue revolves around the ‘Packaging’ theme and is jam-packed with stories about how the industry is embarking on different paths to tackle plastic waste.

Nadiya den Haan of Den Haan Plant Export at Royal FloraHolland Naaldwijk graces this issue's cover. Recently, she took to LinkedIn to reduce the company's massive use of single-use plant trays. The second-generation exporter sells quality plants predominantly to Ukraine, with Phalaenopsis being their flagship product.

With unrivalled Ukrainian hospitality, Kyiv-born Nadiya and her husband Dennis welcomed me at their premises at Royal FloraHolland Naaldwijk to see how plastic waste impacts their day-to-day operations. Using the most common 12cm pot size and 60cm length as an example, Nadiya explained that ten plants sit in a tray, with five trays loading onto a single Danish trolley layer. If there are three layers per trolley, the total number of trays is 15 trays per Danish trolley (150 plants per trolley).

Considering the up to 10,000 Phalaenopsis the company sources each week, it is no surprise that single-use trays weigh on operation costs. Dennis estimates they cost them approximately €40,000 per year. Moreover, they consume valuable space when stocked in the processing area.

Plants plus trays remain commonly united when loaded onto a Danish trolley. That is when the Dutch export them to neighbouring countries such as Germany. However, Ukraine as a core market comes, of course, with serious challenges these days.

With the terrible ongoing war transportation costs to Ukraine spiral out of control. Also, angry Polish have blocked Poland-Ukraine borders since November, with lorries being held up for some days.

To save transportation costs, which are currently 220 dollars/trolley and 350 dollars per trolley, Den Haan Plant Export repacks Phalaenopsis, conifers, Zamioculcas, and Spathiphyllum. Plants are taken out of their tray and put in boxes of 40 pieces, with a total of nine boxes (360 plants) loading onto a Danish trolley.

Exporters such as Den Haan Plant Export pay between 0.40 and 0.60 cents per tray, which is basically a throwaway when left to the auction’s rubbish collection.

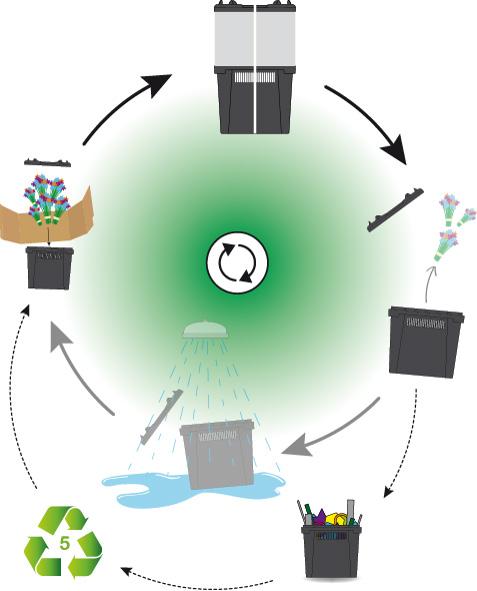

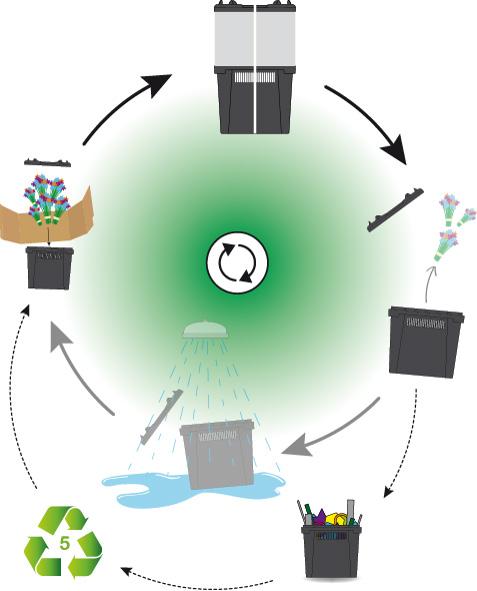

Nadiya’s call on LinkedIn led to a recycling company proposing €250 per 1,000kg. Trays are lightweight, so you need many of them to make such a system work. Doing her maths, Nadiya found that five full Danish trolleys with single-use trays would yield around 120 euros. In turn, costly staff is required to collect, stack, and prepare them for transport. Meanwhile, Den Haan Plant Export has started a trial with their trusted orchid supplier, The Orchid Growers. The latter will take in and clean the trays, after which these will be reused an anticipated 4-5 rounds more. Placing three times an order for full trolleys with Phalaenopsis at Ter Laak will entitle Den Haan to free trays while ordering a full trolley the fourth time.

The bottom line is that, apart from big corporations, individuals can also have a major impact, especially when they converge into collective action.

FROM THE EDITOR FLORACULTURE INTERNATIONAL APRIL 2024 4 17

31

20

FCI Editor

CONTENTS 48 40 52 APRIL 2024 VOLUME 34 NUMBER 04 COVER STORY 17 PACKAGING ‘Desch pots are made of recycled materials and can be recycled again—so, let’s do that’ 20 PACKAGING DOPA pot - sustainably grown and presented perennials 22 PACKAGING Eco-consciousness combines in flower and plant sleeves 26 PACKAGING Emotions hinder rational thinking in plant pot manufacturing FEATURES 31 MIDDLE EAST B2B e-commerce platform Floranow carves its place in the global cut flower market 40 FLOWERTRIALS An invitation to see beyond the plants 44 AIPH SPRING MEETING New Members and more news at this year's meeting in Doha Qatar 48 BREXIT How efficient are the new border checks? VOICES 04 FROM THE EDITOR 07 COLLABORATING WITH BREEDERS IS ESSENTIAL 15 PPWR IS CLOSE TO BECOMING A LAW 50 NATIVE PLANTS IN THE USA IN EVERY ISSUE 06 WORLD NEWS 0 8 VIS A VIS 3 6 GREEN CITY POST 42 SAVE THE DATE 52 EXPO-SURE WWW.FLORACULTUREINTERNATIONAL.COM 5 FloraCulture International (FCI) is an independent trade magazine with the largest circulation for a world publication of its kind. FCI is free and published for the ornamental horticulture industry by the International Association of Horticultural Producers (AIPH). It is published 11 times per year worldwide. Contributing writers for April 2024: Rachel Anderson, Martin Deasy, Colin Fernandes, Anisa Gress, Debbie Hamrick, Regina Mestre, Hannah Pinnells, Ron van der Ploeg, Audrey Timm, Brand Wagenaar, and Rachel Wakefield. Contact: fcimedia@aiph.org. Address: FloraCulture International, Horticulture House, Chilton, Didcot, Oxfordshire, OX11 0RN, United Kingdom. FCI Team: Editor: Ron van der Ploeg, ron@floracultureinternational.com, T: +31 6 404 99 269; Associate Editor and Designer: Rachel Wakefield, rachel.wakefield@aiph.org, T: +44 1235 776 160; Senior Media Account Manager: Angie Duffree, angie.duffree@aiph.org, T: +31 6 403 277 35. Cover image: Nadiya den Haan of Den Haan Plant Export by Ron van der Ploeg. AIPH ©2024 FloraCulture International magazine. All rights reserved. Publisher is not liable for the content of the advertisements. Photographs by permission of copyright owners.

Collective move by the floriculture sector on sustainability

Starting January 1st, 2026, the Royal FloraHolland platform will require its members and suppliers who offer, trade and invoice flowers and plants to be certified according to the Floriculture Sustainability Initiative (FSI basket of standards). All members and suppliers will need to be fully FSI compliant by 2027.

This decision was taken to encourage growers to take responsibility for sustainability and to comply with future-proofing of the sector and legislation requirements. The Floriculture Accelerators and FSI Accelerator Group have committed to buying 100 per cent certified by 2027, and the sector organisation VGB is encouraging its

members to follow suit. The VBN board has also discussed and agreed to these regulations, which apply to members and non-member suppliers who deliver to Plantion.

For more information, visit www.royalfloraholland.com / en/press-releases/floriculturejoins-hands-towards-100sustainability-certification

Reimagining the Logistics Value Chain for Africa's Flower Trades

The sixth edition of Flower Logistics Africa occurred in Nairobi, Kenya, on 27 March. The theme was Reimagining the Logistics Value Chain for Africa's Flower Trade.

The Keynote speaker was Lina Jamwa, Membership, Advocacy and Communications Manager of Kenya Flower Council, who spoke about the state of the industry.

Among the many informative panel sessions was an inspiring session celebrating

AIPH signs MoU with Korea aT

AIPH and the Korea Agro-Fisheries and Food Trade Corporation (aT) signed a Memorandum of Understanding. Yuk-Teak Lim, President of the Korea Flower Cultivate Association and an AIPH member, invited AIPH’s Secretary General, Tim Briercliffe, to a meeting at the aT Center in Yangjae-dong, Seoul with the aT President, Choon Jin Kim, to discuss ways to stimulate and promote the ornamental horticulture industry in South Korea.

RHS People Awards

AIPH Secretary General, Tim Briercliffe, received the Veitch Memorial Medal from the UK’s Royal Horticultural Society (RHS) for having made ‘an outstanding contribution to the advancement of the science and practice of horticulture’. RHS President Keith Weed CBE presented the award to him at the RHS People Awards in London on 26 March.

the success of women-led flower businesses. It highlighted the incredible strides made by women entrepreneurs in the floral sector here, from innovative supply chain solutions to sustainable practices. Watch the meeting recordings at www.statmedia.events/fla/

Expo 2024 Chengdu

The International Horticultural Exhibition 2024 Chengdu, is set to open on 26th April and will continue for 186 days until 28th October. For more information, visit www.cdhortiexpo2024.com/

SOUTH KOREA

(Left to right) Yuk Teak Lim, President of the KFCA and Choon-Jim Kim, President of aT.

KENYA

NETHERLANDS

UNITED KINGDOM

(Left to right) Tim Briercliffe, AIPH Secretary General and Keith Weed, RHS President

CHINA

WORLD NEWS FLORACULTURE INTERNATIONAL APRIL 2024 6

COLLABORATING WITH BREEDERS IS ESSENTIAL TO OUR SUCCESS

Colin Fernandes was crowned AIPH Young International Grower of the Year 2024 at IPM Essen, Germany in January. This category celebrates vibrant individuals, aged 25-40, who will lead the industry into the future. The nominations were assessed and selected from the participants attending Jungle Talks' Pro Manager Mastercourse. Fernandes is the Trial Site Coordinator for Marginpar in Kenya. He manages a team of 25 people across sites in Kenya and Ethiopia. His role focuses on introducing new and improved product varieties into the commercial market. His biggest achievement in horticulture so far has been the introduction of a crop called Sanguisorba - Red Dream, to the commercial market for Marginpar.

The foundation of our success lies in collaborating with a network of exclusive breeders. Through transparent communication and knowledge sharing, we strive to achieve optimal results in the challenging task of growing niche varieties that set us apart in the market.

Marginpar thrives on trialling unconventional varieties, recognising the value of embracing challenges in cultivation. Our commitment to providing customers with extraordinary flowers is evident in the fact that some of our crops take up to 15 years to develop.

The decision to conclude a trial is a delicate balance, considering factors such as sustainability, length, productivity, vase life, and resistance to diseases and pests.

Focusing solely on unique summer flower varieties allows us to narrow down our selection, seeking exclusivity in the products we bring to market.

The trials extend beyond experimentation, carefully selecting varieties tested in an African climate.

Collaborating with our breeders, we emphasise the importance of choosing disease- and pest-resistant varieties and those that are more sustainable to grow. Climate variability, particularly in the face of climate change, has required a strategic approach to our production.

With longer dry spells and intensified wet periods in recent years, we have adapted to become more efficient in water usage and storage, ensuring the resilience of our crops. Every step in the flower-growing process is scrutinised, from selecting strong plant material and refining propagation

techniques to ensuring optimal growth speed and overall plant quality. Each unique variety demands its own specialised treatment, reflecting our dedication to our vision of creating the world’s most unique summer flowers. Our main target market is international florist shops. Stem length is one of the many crucial considerations, offering florists greater freedom in crafting their own flower arrangements.

At the core of our success are the relationships with our breeders. Marginpar,

not being a breeder itself, places importance on collaborating with dedicated partners. Continuously working with breeders is essential to developing new, more productive, resistant, and sustainable flowers to stay ahead of the competition. In the world of Marginpar, where “We grow people, our people grow unique summer flowers,” we acknowledge that our people are the driving force behind our success and emphasise the cultivation of not only flowers but also a dedicated community.

WWW.FLORACULTUREINTERNATIONAL.COM 7 VOICES

‘ ‘’

FLORACULTURE INTERNATIONAL APRIL 2024 8 VIS-À-VIS

Dirk Bansemer, CEO of Euro Plant Tray.

‘WITH MULTI-USE EURO PLANT TRAY, THE INDUSTRY CAN MOVE AWAY FROM SINGLE-USE, THROWAWAY PLASTIC’

The European cooperative Euro Plant Tray eG is a cross-industry initiative that brings the entire horticulture community together to significantly reduce the number of single-use plant trays in the sector. It started with Germany and the Netherlands and is now developing into a truly European endeavour, taking bold steps. Euro Plant Tray’s boss Dirk Bansemer and Euro Plant Tray board member and VGB (the Dutch Association of Wholesalers in Floricultural Products) representative Flora Späth strongly believe in the long-term impact of a more eco-friendly and reusable plant tray but candidly admit that Euro Plant Tray’s success and tangible results will not happen overnight.

Euro Plant Tray’s ‘Improve together for more sustainability’ tagline leaves little room for misinterpretation. The multi-use Euro Plant Tray is here to reduce the ornamental plant sector’s environmental impact and increase loading efficiency.

DUH (German Environmental Agency aka Deutsche Umwelthilfe), the Berlin-based Stiftung Initiative Mehrweg SIM (Reusables Initiative Foundation), growers, wholesalers, garden centres, and the wider industry have been working since 2021 to tackle plastic pollution.

All production and trading have an environmental cost, and the growing and marketing of ornamental plants is no different. It is safe to say that plastic trays (and the pots that sit in them naturally) have become a serious waste problem.

If the multi-use Euro Plant Tray were rolled out on a European scale and backed with sufficient funding, quality trays, and a willingness to collaborate, it would ultimately be a win-win for all stakeholders. But even if it is widely accepted that standardising plant trays and switching from single-use to multi-use trays is a common-sense change, the challenges involved in developing and implementing the Euro Plant Tray are not something to sneeze at.

FCI magazine discusses the roadblocks to the Euro Plant Tray: defining the problem and the solution, the need for sustained engagement with stakeholders and

users, prototyping/piloting the solution and planning for implementation.

At the same time, two models of the EPT 400 series made their debut. These and an additional two models of the EPT 200 series -approved by Euro Plant Tray members in the early weeks of 2024 – are currently available for supplies from the producer via wholesalers to garden centres, DIY stores, and the retail trade.

AUTHOR: RON VAN DER PLOEG PHOTO: EURO PLANT TRAYS

VIS-À-VIS WWW.FLORACULTUREINTERNATIONAL.COM 9

Euro Plant Tray board member Flora Späth.

FloraCulture International: First, it is important to understand the numbers. On average, how many single-use plant trays does the industry use?

Flora Späth: “The DUH estimates an average use of 300 million trays annually in Germany alone, 500-700 million in Europe. In this context, it is important to note that Germany imports a sizeable number of potted plants from the Netherlands. According to our information, around 90 to 95 per cent of total used plant trays are single-use ones.”

Single-use plant trays are not all the same. However, a big portion of these represent the Normpack brand, am I right?

Flora Späth: “There is no doubt that Normpack is the best-known and most widely used. Previous reusable systems like Floratino or Palletino (both not water-holding like the Euro Plant Tray) have only been established in very small numbers and are being traded locally.”

Ultimately, what is the goal behind the Euro Plant Tray?

Flora Späth: “Job number one is to reduce one-way plastic packaging in our industry and thus save up to 40,000 tons CO2 equivalent per year - based on the estimated use of one-way trays from DUH. Equally important is the cross-supply chain cooperation to be done across Europe to ensure that the new system

is embraced as a standard industry solution, adding efficiency for all. Working together with partners from the whole supply chain (growers, wholesalers, retailers, auctions, branch organisations), all input is valued and considered in tray design and services, ensuring the best possible product fit for all stakeholders.”

‘EURO PLANT TRAY, THE INDUSTRY’S LARGEST COLLABORATIVE PROJECT TO BOOST MULTI-USE PLANT TRAYS, LAUNCHED BEFORE THE REGULATORY FRAMEWORK WAS IN PLACE. CONSIDER IT AS A DECLARED WAR ON PLASTIC WASTE’

Euro Plant Tray is arguably the industry’s largest collaborative project to boost multi-use plant trays.

FLORACULTURE INTERNATIONAL APRIL 2024 10 VIS-À-VIS

Within the Euro Plant Tray organisation, what has been the role of the Berlin-based Stiftung Initiative Mehrweg (SIM), established in 1996 under German civil law as a legally responsible foundation?

Dirk Bansemer: “After DUH (Environmental Action Germany) invited around 80 parties to discuss ‘how green the green industry is’, the group decided to look into establishing a company producing a reusable tray in the future. This was the so-called Flower Tray Project, started in 2021. It evolved into the Euro Plant Tray, launched in August 2022. SIM has led the Flower Tray Project as a neutral coordinator, and SIM people are still involved in moderating Euro Plant Tray work.”

As SIM was among the driving forces behind Euro Plant Tray, green professionals would easily tout it as a German initiative, while the plant trade is mainly a European affair. How European is Euro Plant Tray, and are countries such as the UK and France also involved?

Dirk Bansemer: “Today, the 30 members of Euro Plant Tray come from Germany, Austria, Switzerland, The Netherlands, France, and Norway. Talks are ongoing with potential partners also in other countries. The UK is indeed a bit special even though it is closely connected to the Netherlands via trade. We have one member from France right now, but the interest in Euro Plant Tray is considerable, and several talks are ongoing, as well as some testing of our trays, so we trust we will welcome more French and Scandinavian partners shortly.”

Many regulations and action plans exist for plastics, such as Plastic Pacts. What regulations, (EU) laws, and action plans have urged the sector most to launch the Euro Plant Tray?

Dirk Bansemer: “Euro Plant Tray, the industry’s largest collaborative project to boost multi-use plant trays, launched before the regulatory framework was in place. Consider it as a declared war on plastic waste. Meanwhile, new rules to dramatically reduce packaging waste have become relevant, proof that with Euro Plant Tray, the industry is heading in the right direction.

“I believe we have to look at two things. EU-wide, the Packaging and Packaging Waste Regulation (PPWR) is to be finalised in Brussels within the next couple of weeks. It will have the biggest impact as this will tell us which share of reuse transport packaging has to be used by all of us — not just in the flower and plant industry — latest as of 2030. Secondly, we have local laws. Germany, for example, is introducing a one-way plastic tax at the beginning of 2025, which will make the use of existing one-way trays 10-20 cents more expensive - depending on their weight. Spain has been handling such a tax for years already. Here, a one-way tray can be up to 45 cents more expensive. So, from a financial point of view, the move to reuse also depends on the market you are active in – not even considering your moral compass to avoid single-use plastics for the sake of a more sustainable planet.”

In August 2022, wholesale trade bodies VGB en BGI, floral wholesalers FleuraMetz, Markenverband Bremen and Sagaflor and retailers OBI, BAUHAUS and Hornbach put their signatures to the founding act of the European cooperative Euro Plant Tray eG. In 2022, the Austrian garden centre chain Bellaflora, Vahldiek and Royal FloraHolland joined Euro Plant Tray. At the recently held IPM Essen, you showcased test trays for different pot sizes. Flora Späth: “As we speak, we have 30 members. Our website, Euro Plant Tray eG - Improving Together for More Sustainability, provides a comprehensive overview of members and company profiles. During IPM Essen, we showcased four models: size-wise and comparable to Normpack 400 (five per CC Euro Container layer), we have EPT 775 carrying pots from 10.5 to 13cm, and EPT 777, which carries ten 12cm pots. The latter has been developed especially in association with orchid and Bromelia growers. These represent a very large group in potted plant sales, accounting for an estimated 200 million plants per year. As these plants are relatively tall and have a very high centre of gravity, they would not be 100 per cent stable in the multi-use trays carrying pots up to 13cm. One could argue that the pot hole is “too big”. Yet, this category is so important that it deserves a special tray ensuring safe transport and point-of-sale presentation. Next, two sizes are matching Normpack 200 series (six per CC Euro Container layer): EPT 769 carries pots from 9-10.5cm, and EPT 568 carries pots from 10.5-13cm. We aim to have as few trays as possible and use them efficiently. So, these multi-use trays fit that goal perfectly. They can be used for different plant types. A grower potentially needs one tray size to fit his year-round production in different pot sizes.”

How would you describe the current state of the Euro Plant Tray?

Dirk Bansemer: “Its commercial launch happened last autumn, with the very first decision of members to launch the two models of the 400 series. Production will start this summer, so from autumn 2024, you should find the first Euro Plant Trays in the stores…. with increasing numbers obviously in the spring season of 2025 and the time after that. Production for the 200 series should start shortly afterwards. We are currently collecting the respective orders.”

‘PRODUCTION WILL START THIS SUMMER, SO FROM AUTUMN 2024, YOU SHOULD FIND THE FIRST EURO PLANT TRAYS IN THE STORES’

WWW.FLORACULTUREINTERNATIONAL.COM VIS-À-VIS 11

How many Euro Plant Trays do you actually need?

Dirk Bansemer: “It is not what we need but what the market needs. We have first confirmed the need for five million trays in the currently existing sizes, but these are indications of members who are obviously the front runners of the introduction. This said, ordering Euro Plant Trays is open to everybody, independent of membership, and non-members will for sure make up another big part of users in the future. We expect the pool to ramp up to at least 10-20 million units in the next two, three years.”

The Normpack single-use trays are produced by a consortium comprising Bachmann, Desch, Modiform and Teku Poppelmann, of which Royal FloraHolland granted a license. Which company produced your first two Euro Plant Trays, which were shown at IPM Essen?

Dirk Bansemer: “We work with different producers for different models; we speak with three right now. This ensures production capacity and the independence of Euro Plant Tray from just one producer.”

It is safe to say that Normpack has extensive expertise and experience in plant trays. Will the same four packaging companies produce the future Euro Plant Trays?

Dirk Bansemer: “There is definitely a lot of expertise in the Normpack group, and we are in contact with most of the companies you mentioned. However, we produce injection mould trays, while the mentioned companies have a big/biggest production in thermoformed products.”

I am unfortunately old enough to remember how, in 1994, Bloemenveiling Aalsmeer and Bloemenveiling Holland teamed up in SIVEPO, a packaging scheme partially based on a deposit return for plant trays and boxes. Launching the same year was the auction line of terracotta-coloured multi-use trays. These trays never really carved their place in the market.

Flora Späth: “Yes, local schemes never really established. That is why we took an international approach, covering all steps of the green supply chain. On what authority do we believe the Euro Plant Tray will be more successful, and what are the lessons learned from other multi-use trays? Vital is the support of members from across the supply chain and the willingness to work on a solution that is supported and accepted by all. The retailer plays a major role in the acceptance, especially as they are the ones requesting certain packaging at the end. And if they all request the same, this makes life much easier for wholesale and growers as they only have to stock one item! This is certainly a lesson learned from the past, which led to the common approach – more efficiency within the chain also saves costs and is more sustainable in the production and use of any material.”

Next to Royal FloraHolland multi-use trays, there are Floratino trays (also owned by RFH) and Palettino and Floritrays. How do we get all these different brand names in the same Euro Plant Tray row if every tray and the owners behind them have a business model relying on it?

Flora Späth: “FloraHolland is a member of Euro Plant Tray and brings their knowledge and experience to get a common system on its way. Floritray is a product of Landgard, one of our members. Landgard has transferred the Intellectual Property rights of Floritray to Euro Plant Tray to support a quick introduction without a long development phase and to work together for one established system.”

Phalaenopsis could be a good product to start with as it is available yearround, enabling indoor plant department staff and suppliers to learn together.

VIS-À-VIS

FLORACULTURE INTERNATIONAL APRIL 2024 12

There’s a Dutch saying that you cannot build Aachen and Cologne in one day (in the UK, we say, ‘Rome wasn’t built in a day’); in other words, what plant category would be the ideal candidate for the inaugural Euro Plant Trays?

Flora Späth: “As Euro Plant Trays is versatile, you cannot say there is one plant to start with. It is rather up to the different supply chains: When do I want to start? What is my assortment at that time? Where are my growers/wholesalers? How big are my stores, and what is my experience with reusing items?

“If you have a small store, informing all your employees that trays must be collected for re-use will be easier. Suppose you have only one or a few suppliers. In that case, it will be easier to set up a joint return system than to inform multiple suppliers and start with all of them simultaneously. Regular supplies from one or two parties, even different assortments, are a good way to start building experience and learning for your rollout with others. The same goes for the regional setup of stores. My advice would be to focus on one or two regions in the first place and see how it goes, how employees react and what goes wrong. Learn from this and improve your introduction scenario and training for the next step.”

It is safe to say that for a successful rollout of Euro Plant Trays, you should start with higher-value plants such as Phalaenopsis. What is your opinion?

Flora Späth: “Phalaenopsis could be a good product to start with as it is available year-round, enabling indoor plant department staff and suppliers to learn together.”

What would you say are the main obstacles to overcome for Euro Plant Tray?

Flora Späth: “Within the green industry, we tend not to work ahead a lot. Day-to-day business often takes all our attention and is weather-sensitive, putting high pressure on all involved. However, the changes set in the EU’s 2030 Packaging and Packaging Waste Regulation (PPWR) are underway, and no one should wait until the very last moment to order their Euro Plant Trays. You will need time to establish your setup, your IT system, and your transport, with much ‘last minute demand’. If you want to work efficiently, you must start thinking about this now.

“All Euro Plant Trays will also be equipped with RFID (radio frequency identification) next to the barcode and 2D Datamatrix Code. This gives you additional opportunities for automated processing in handling and registration. However, setting this up will also require time-consuming IT adjustments.”

Critics (read plant retailers) say that they have no space to stock Euro Plant Trays. Also, the open structure of Paletinnos, for example, facilitates easy watering in supermarkets, DIY stores, and discounters. How do we counteract these critics?

Flora Späth: “Well, it is up to the retailer to agree with their supplier when items shall be returned. Today, CC Containers are also returned regularly. You can decide to return any number of Euro Plant Trays as soon as they

are empty at the store, which increases the rotation per tray per year. Or you can return only full CC Containers with full stacks of Euro Plant Trays. This depends on the size between 300 and 400 Euro Plant Trays and it takes longer to collect that many empty Euro Plant Trays, hence lower rotation per year. But it is more efficient in terms of return transport space and costs involved. Making this call highly depends on the distance between retail and supplier and delivery frequency. If a supplier delivers regularly, say once or twice a week, but is quite far away, you will probably go for full-stack Euro Plant Trays on a CC Container. If you are a once-off supplier with a special promotion, you probably already want to swap one-by-one upon delivery, as it would not make sense to come only to pick up empties a few weeks later.

“Regarding watering… during the Flowertray project, 350 parties have been interviewed. The bottom line was they prefer a closed watering system. It allows for a better supply of plants during transport and presentation, greatly increasing the plant quality and reducing product shrinkage. Also, open systems produce unwanted dirt in the stores.”

The success of Euro Plant Trays will depend highly on its deposit scheme. How ready is it?

Dirk Bansemer: “From Euro Plant Tray, we will not charge a deposit. Users pay rent to use the item for the time they want to use it, one, three, five, or ten years. We keep the contracted quantities on our systems and expect these to be returned to us should the contract not be prolonged after expiry. In the case of shortfalls, we have agreed on a loss fee with members/tenants. However, members have agreed on a common deposit fee should they want to use a deposit in addition to balance registration with their partners.”

How much rent would traders pay for Euro Plant Trays, and how does this relate to the rent for single-use trays?

Dirk Bansemer: “The hire rate differs for the 400 and 200 models as well as the duration of hire. Another difference is that members get a discounted price compared to non-members, with a price advantage of 10 cents per tray per year. Giving a complete rundown of price options is too complex – especially when compared to single-use. More generally speaking, one can say that the price for a 3-year contract with an annual payment is 69 cents/year/tray. This means that even without taking into account legal requirements and new taxes, at least three to four cycles are enough to be economically more favourable than with disposable trays.”

How important is it that Euro Plant Trays rolls out in tandem with the Hortifootprint calculator?

Flora Späth: “It's not important. Transport is only a part of a plant's footprint, which the Hortifootprint is looking at. Yes, using reused plastic makes a difference, but the influence on the total is limited. Plenty of research shows that reuse has a lower footprint when rotating at least five times per year. It all depends on the specific setup.”

WWW.FLORACULTUREINTERNATIONAL.COM 13 VIS-À-VIS

THE PROCONA SYSTEM:

Transporting cut flowers sustainably and cost-effectively for 30 years

Developed by Pagter over 30 years ago, the Procona system can be reused up to 100 times, making it a reliable option.

It’s time to stop wasting time looking for alternatives. Choose the Procona system today for sustainable and costeffective transportation of cut flowers.

Due to their square shape and stackability, Procona also provides better loading than round buckets. Cut flowers in Procona’s are also well supplied with water and ventilation during transport on the road and by air, resulting in better quality and less waste of flowers.

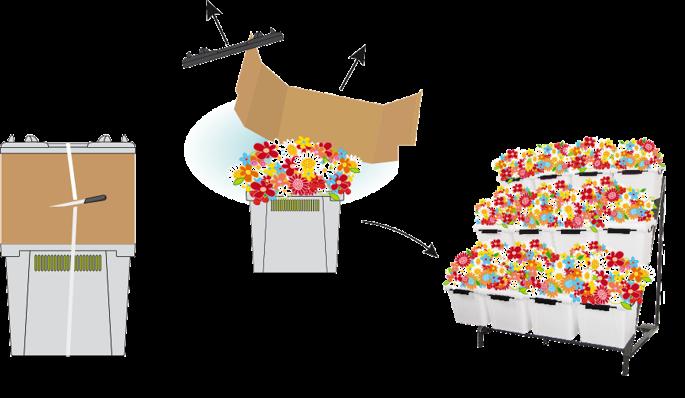

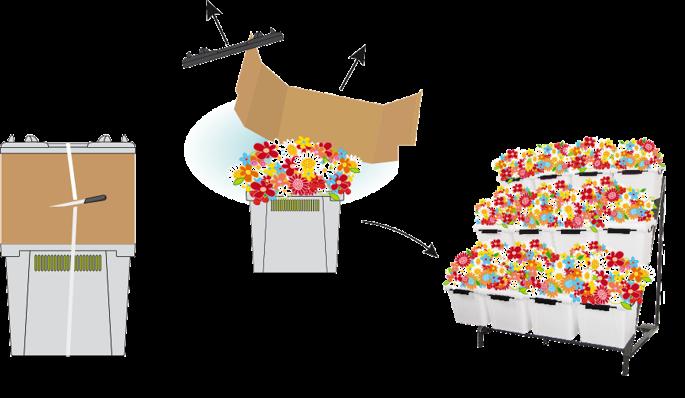

Upon arrival at the store, the collar and lid of the Procona are removed, and the flowers can be placed directly in the display. In that sense, Procona is ‘retail ready’. The flowers are supplied with water throughout the journey and do not require repacking or cutting.

Pagter also supplies displays for Procona. Our displays are designed in such a way that the flowers face the customer. This results in an attractive presentation that enhances sales. With a number of basic elements, Pagter can design (with 3D visualization) a perfect presentation for any sales area, which is also suitable for potted plants and can be easily adapted to changing requirements.

The reuse of Procona containers is managed through a pooling system. Supermarkets in Europe have developed their own pooling systems. There are also flower suppliers and exporters who own a pool of Procona’s and reuse the containers and lids. When using a plastic collar, the whole package is reusable!

Procona can be tracked and traced by printing a unique barcode/QR code on the flower buckets. Billing can also be conducted by scanning the codes on the Procona.

With Pagter’s innovative, high-quality, and sustainable packaging, we make a clear contribution to your sustainability goals. Our reusable packaging not only has a positive impact on the sustainability of your organisation but also on costs! With our returnable0 packaging, CO2 emissions and costs go down, as well as the amount of waste produced. Pagter:

ADVERTORIAL FLORACULTURE INTERNATIONAL APRIL 2024 14

different,

different, reliably different Pagter | Emmerblok 32 | 4751 XE Oud Gastel | Netherlands | T +31 (0) 165 39 55 00 | E info@pagter.com | www.pagter.com

meaningfully

qualitatively

THE EU’S PACKAGING AND PACKAGING WASTE REGULATION IS CLOSER TO BECOMING LAW: WHAT’S IN THE LATEST PROPOSAL?

Regina Mestre is an Analyst in packaging and logistics for Rabobank RaboResearch. Here, she discusses the EU Commission's proposal for a Packaging and Packaging Waste Regulation (PPWR), which will have far-reaching implications for the packaging sector and the management of packaging waste.

The EU’s Packaging and Packaging Waste Regulation (PPWR) has reached a crucial stage of its legislative process.

The European Parliament and European Council have reached a provisional agreement on the text of the regulation, which aims to reduce the environmental impact of packaging and increase its circularity. The next step for the regulation is getting approval from the council’s representatives and the parliament’s environmental committee (ENVI). Once both institutions formally adopt the regulation, it will be published in the Official Journal of the European Union and will take effect 18 months later.

This tentative deal is a significant achievement, as the PPWR has faced some challenges and controversies along the way. For example, some member states and packaging producers have expressed concern about the feasibility and costs of achieving the targets for packaging reuse, recycling, and the use of recycled content. Others have questioned the coherence and clarity of the criteria for defining reusable and recyclable packaging. By reaching a compromise, the council and the parliament have given more certainty to the regulation, which is eagerly awaited by many industries and actors in the packaging value chain. The PPWR will have far-reaching implications for the packaging sector and the management of packaging waste in the EU. The parliament and council’s provisional deal preserves most requirements from the original PPWR proposal and introduces some modifications and new exemptions to them. Key requirements from the new agreement,

including updates and changes, include:

• Recyclability of packaging: Packaging must be recyclable, and recyclability will be measured using a grading system. Specific rules will be developed in secondary legislation.

• Minimum recycled content in plastic packaging: The agreement outlines goals for the minimum required amount of recycled content in plastic packaging. Compostable plastic packaging and packaging with less than five per cent plastic by weight are exempt from this requirement.

• Minimum recycling targets: The agreement maintains national recycling target requirements for each material. Targets will be measured by the weight of packaging placed on the market compared to the weight of recycled materials.

• Substances of concern and PFAS: The deal maintains the obligation to limit and control the use of substances of concern in packaging. It also keeps the ban on the use of food contact packaging containing PFAS. The European Commission will evaluate the ban on PFAS over the next four years.

• Reuse and refill targets: The council and parliament agreed on a 10% goal for reusable packaging for alcoholic and non-alcoholic beverages. By 2030, establishments selling food and drinks to go must allow customers to bring their own containers and offer 10% of their products in reusable packaging. Deposit return systems (DRS): Countries must set up DRSs, where customers pay a deposit on top of the price of a beverage and can return plastic and metal drink containers to get their deposit back. This requirement is expected to keep 90 per cent of applicable beverage containers from

ending up in the trash by 2029.

• Restrictions on certain packaging formats: The agreement restores limits on certain packaging formats. These include single-use plastic packaging for unprocessed fruit and vegetables and, in the hospitality sector, packaging for food and drinks that are filled and consumed on the premises, individually packed condiments and sauces, and small toiletry products. Limits on these packaging formats will start from 2030.

These provisions will require packaging producers and users to adapt their material choices and processes and invest in innovation and infrastructure. For example, packaging makers may need to replace certain materials with more sustainable alternatives or redesign their packaging to make it lighter, simpler, and more durable. Packaging users, such as retailers and manufacturers, may need to change their packaging strategies and preferences or cooperate with packaging suppliers and waste operators to ensure the proper collection and sorting of packaging waste. Governments may need to provide support and guidance to these players, increase investment in waste management and recycling infrastructure, and also enforce compliance with the regulation and monitor its progress and impact.

This new agreement on the PPWR is an important step in the legislative process, giving the regulation greater certainty and bringing it closer to its final form. While more clarity about the PPWR’s requirements is still expected, it is essential that all the relevant actors prepare for the changes and challenges that the regulation will entail. www.rabobank.com/knowledge

WWW.FLORACULTUREINTERNATIONAL.COM 15 VOICES

‘ ‘’

‘Desch pots are made of recycled materials and can be recycled again—so, let’s do that’

UK-based Desch Plantpak Ltd— celebrating 60 years in business this year—takes pride in manufacturing pots made of recycled plastics, and they were doing it long before ‘plastic panic’ ruled the world. In speaking with the sales manager for the UK and Ireland, Phil Griffiths, it is apparent that the UK desperately needs a nationwide and consistent approach to collecting and recycling plastic waste.

AUTHOR: RON VAN DER PLOEG PHOTOS: DESCH PLANTPAK

Desch Plantpak manufactures highquality thermoformed pots and containers, transport trays, seedling trays, transplant trays and bedding packs. Trading under the EPLA brand name is a versatile range of injection moulded decorative pots, hanging pots, trays and accessories. All ranges are proving popular in different markets. Sales in both thermoformed and injectionmoulded containers are strong. Their square-round injectionmoulded range is also currently enjoying a revival.

It is estimated that 500 million plastic pots are used to grow ornamental plants every year in the UK alone.

The company was founded in 1964 in Congleton, Cheshire, as Congleton Plastic Co. Ltd, which became Cookson Plastic Products in 1988. It then transitioned through Cookson Plantpak in 1990 and Synprodo Plantpak in 1988 before finally becoming Desch Plantpak Ltd in 2003.

Asked about the company’s biggest strength today, Phil Griffiths, Desch Plantpak's UK and Ireland Sales Manager, says, “It boils down to having manufacturing and sales bases both in the UK and the EU, an extensive product portfolio, and a staff with extensive horticulture industry knowledge.”

WWW.FLORACULTUREINTERNATIONAL.COM 17

PACKAGING

PLASTIC PANIC

It is estimated that 500 million plastic pots are used to grow ornamental plants every year in the UK alone. Desch Plantpak Ltd predominantly produces for the domestic market while also contributing a portion of its business to export sales to Ireland. On the continent, it runs several factories, catering for the majority of non-British sales. Today, plastic panic seems everywhere and frequently has gone off track following images of garbage patches in the ocean and marine animals entangled in plastic debris. The debate is complex, and the primary question is whether to prioritise material, economy or society. Griffiths says, “Regarding the plastics debate, I believe it is very much customer responsibility and how you deal with the products during their life cycle. This should be done responsibly. All products are made of recycled materials and can be recycled again, so let’s do that.”

CONFUSION AND APATHY

Narrowing the topic down to the UK, Desch’s sales manager thinks the question is not if but how to achieve more sustainability in horticultural pots and containers. “In the UK, we need a nationwide, consistent approach to collecting and recycling waste. We have too many local variables, leading to confusion and apathy. Money needs to be invested in a credible collection and re-processing system that is standardised throughout the UK. Our products are all “ready to go” for that.”

The role of the UK waste industry in a more recyclable plastics economy is vital. “The circular system cannot exist if there is insufficient means to reprocess any waste that may be captured for recycling.” In daily practice, it is not easy to persuade UK city councils to recycle plastic horti pots from the kerbside. Griffiths explains, “It is purely down to financials. Councils do not have the financial resources made available to them to establish and maintain an effective collection and recycling service.”

REGULATIONS AND ACTION PLANS

Plastics are subject to extensive regulation and action plans, such as WRAP and Eliminating Problem Plastics, and last but not least, the UK Plastic Pact. Desch Plantpak endorses the Packaging Covenant III, which includes arrangements to reduce the environmental impact of packaging and combat litter. Griffiths notes, “As a longestablished consumer and manufacturer of recycled plastic materials, we were ahead of the game with the UK Plastic Pact – our products have complied with its requirements for a percentage of recycled content for many years.” He doesn’t think the urgency for more sustainable pots and trays intensified in the light of national taxes on plastics containing less than 30 per cent recyclate. “It had little impact for Desch as we have been using recycled material for many, many years. Though, over the past four years, we have undergone a massive transition to products that are detectable by recycling companies. This makes it possible to separate materials from the rest of the waste efficiently. It improves the quality of recycled products and significantly reduces the amount of waste that goes to incinerators or landfills.”

Ideally, plant pots should be recovered in yellow bags.

A MINI-LESSON IN PRIMARY MATERIALS

Plastic is not all the same; there are hundreds of types. Desch Plantpak’s primary materials used in the UK are recycled polystyrene, recycled polypropylene, and recycled polyethylene terephthalate (r-pet). Griffiths adds, “Assuming a system exists for collection, virtually all are recyclable.”

When asked about supply constraints on recycled plastic, Griffiths comments, “Supplies vary from week to week, from month to month to be honest. But more generally speaking, there is an adequate supply. It is true to say that recycled material is less freely available than before the plastic tax issues because a lot of the blue-chip companies who used to work exclusively with virgin materials have now moved to the good quality recycled alternatives – previously taken by our industry. However, it is important to note that there is a difference between the sources of recycled materials; post-consumer waste is not always available in the required quantities.”

FLORACULTURE INTERNATIONAL APRIL 2024 18 PACKAGING

(Below) Phil Griffiths, sales manager in the UK and Ireland at Desch Plantpak Ltd.

INNOVATION

At the same time, the company redesigns some of its products to reduce material use. Griffiths elaborates, “We innovate by continually making products lighter by designing them ‘smarter’ so they have the same mechanical strength with less weight. Desch was also the first company to employ PP thermoforming technology to produce flowerpots. These products weighed less than half of the traditional injection-moulded products in the market. We are also making significant strides. We are re-engineering some of our injection moulds to lighten the weight of many of our container pots to 20-35 per cent lighter than two years ago.”

BIOPOTS

In the meantime, an endless range of biopots and biobased materials are available. What is the difference, and where should a grower begin?

Griffiths says, “In the world of Desch, a biopot should consist of natural elements only. So, it is made of fibres, pressed green

waste, or biopolymers - this should always be a given. We call this biobased. Bioplastic is often referred to as a plastic material that is in some way compostable. Some will turn in water and CO2 only; others will only fragment and leave macro or nanoparticles, which is highly undesirable. Virgin plastic is hardly used for pots (sometimes for very bright colours or transparent products). Bioplastic is not used a lot as it is mostly compostable in an industrial way, which is undesirable. The search is for home compostable or soil-degradable biopolymers that keep well during plant production and break down quickly when required. We have done lots of work with industrially compostable, bio-based materials –however, the Holy Grail would be to develop a stable, home-compostable substrate... we aren’t there yet.”

The single best piece of advice to growers is to research the marketplace. “And test, test, test! Look for products that can be grown in instead of using plastic pots that are replaced by biopots just before delivery to the customers.”

Griffiths ensures that Desch’s product range is backed by independent research and trialling. “We use leading universities for product development, including Wageningen University in the Netherlands, and test centres to judge the products and compare them to others.”

Ultimately, the grower should opt for the most efficient solution, that is, pots that allow the plant to grow well and also fit full horti robotisation. “Then, pick the product with the lowest weight and the guarantee of recyclability. This

Desch Plantpak innovates by continually making products lighter by designing them smarter, so they have the same mechanical strength and less weight.

can also be reflected in a Life Cycle Analysis (LCA) value.”

Critics tend to say that biopots risk becoming brittle and require more watering. Griffiths: “Depending on the type, the products can break and need more water. Desch D-Grade BIO does not break and does not absorb water.”

COMPETITIVENESS

Biopots are more expensive than the conventional plastic pot. So, the pertinent question is, how long will it take before they become competitive? “As soon as “the holy grail” has been developed, price will be dictated by volume (and vice versa) – sufficient people need to “buy in” to the idea and increased volumes sold will increase efficiencies and drive down the price. Several pots are not 3 but 10 times more expensive now.”

The manufacturing of biobased pots that a grower can use throughout the entire production process: pots used to grow on plants into finished pots ready for retail is a work in progress. “We aim to develop products that are detectable and recyclable. Also, it is important to develop products that are compostable in a way that benefits the environment. We are researching new materials that are not based on fossil resources and working on easily degradable solutions at the end of their life cycle. These trials are ongoing and not yet at a marketable stage. Further product development is taking place with our D-grade and EVO pots – we are not yet ready to go to market with these—watch this space!”

WWW.FLORACULTUREINTERNATIONAL.COM 19 PACKAGING

Putting sustainably grown and presented perennials on the map

AUTHOR: RACHEL ANDERSON PHOTOS: RIJNBEEK PERENNIALS/DOPA/MARTINE

AUTHOR: RACHEL ANDERSON PHOTOS: RIJNBEEK PERENNIALS/DOPA/MARTINE

Dutch-based Rijnbeek Perennials aims to make the horticultural supply chain more environmentally friendly by going 100 per cent peat-free. As it continues its sustainability journey, the Rijnbeek team is busy working with Plantics BV, a producer of homecompostable, plastic-free DOPA pots.

The arrival of spring in Europe has Marcel van Vemde, director of Rijnbeek Perennials, feeling positive about the coming season. “There’s more demand; people are keen to order plants. However, April and May are crucial months in the horticultural calendar, so we must wait and see what happens next month. That said, we’re fully prepared—we’re putting in a lot of energy to have our company name and our products on everyone’s radar.”

THERE IS MUCH TO SHOUT ABOUT THIS YEAR

Rijnbeek certainly has a lot to shout about this year. As part of its promotional activity, the nursery business attended this year’s Garden Press Event in February (2024) in London, UK. There, it announced its involvement in a meadow-style field at the worldfamous Keukenhof Gardens in Lisse, the Netherlands.

The Boskoop (NL)-based perennials specialist, which proudly boasts a product range of more than 5,000 perennials, has

teamed up with bulb supplier JUB Holland and garden and landscape designer Carien van Boxtel to create a meadow-style display at Keukenhof, which this year celebrates its 75th anniversary. When this spring’s eight-week display ends, the new perennial border (a blend of early-flowering plants, perennials, and spring bulbs) will remain in the ground rather than being dug up and replanted in time for next year – as is the usual tradition.

Notably, this sustainable display complements JUB Holland’s and Rijnbeek’s aim to help the horticultural supply chain become more environmentally friendly.

WORKING

100 PER CENT PEAT-FREE IN THE ENTIRE RANGE

Van Vemde recalls how, for Rijnbeek, this journey began more than a decade ago when owner Arno Rijnbeek took the initiative

20

VAN WENT

PACKAGING

FLORACULTURE INTERNATIONAL APRIL 2024

Rijnbeek Perennials, in association with JUB Holland and landscape designer Carien van Boxtel, built a meadow-style field at the world-famous Keukenhof Gardens in Lisse, the Netherlands.

and started developing and trialling peat-free growing media mixes.

Van Vemde says: “In those days, everybody thought we were crazy. People would ask: ‘If you’re not obliged to do this by law [in the NL], then why would you do it?’ We are an innovator in that sense. We have gone peat-free not because our government told us to do so but because we wanted to because of our principles. Of course, we had to put in a lot of effort in the beginning – it has been quite a serious investment. But ten or so years later, we’re seeing the rewards – people are very enthusiastic about what we do.”

The nursery has now fine-tuned its peat-free substrate mixed by Lensli Substrates (based in Bleiswijk, NL) and learned how best to work with what is now a dependable, highperforming blend of sustainably sourced growing media substrates. Moreover, Rijnbeek claims to be the only commercial perennial nursery in the Netherlands that is fully peat-free. “That’s a great achievement,” states van Vemde. “Our customers are very much surprised by the quality and uniformity of our assortment and the fact that we can work 100 per cent peat-free in our entire range.”

HOME-COMPOSTABLE, PLASTICFREE DOPA POTS

As its sustainability journey continues, the Rijnbeek team is busily working with Martin Lekkerkerk, a business developer for Plantics BV– the Arnhem (NL)-based producer of homecompostable, plastic-free DOPA pots.

Lekkerkerk explains that these DOPA pots are made from recycled paper reinforced with Plantics’ patented, thermoset, bio-based resin (made from agricultural by-products).

He says: “We – the horticulture industry – are making nature. So, we need to work as close to nature as possible. The DOPA pots are helping to achieve this aim –leaving no microplastics in your garden, for example, which is very important.”

Lekkerkerk adds that DOPA pots

differ from other paper/pulp-based pots because their bio-resin gives them extra strength and longevity. Indeed, van Vemde notes that the Rijnbeek team has been testing the durability of the DOPA pots and has been pleased with the results. He says: “Other paper-based pots we’ve trialled in the past reacted very quickly to the outdoor environment in which they’re placed. However, we’ve had DOPA pots on our terrace for months, and they still look perfect. They’ve not fallen apart or become dirty –they’ve remained in good shape.”

Gardeners can also choose to plant their DOPA pot(s) (along with the plants and the growing media) directly into the soil after “cracking” the pot a bit to stimulate the plants’ roots, explains Lekkerkerk. The DOPA pot will then gradually biodegrade into the soil.

He says: “They have a decorative value, but when the consumer is ready to plant them in the soil, they can do so and then enjoy watching their plants continue to grow.”

A NEW OFFERING

Lekkerkerk reports that, to date, DOPA pots are mainly being used by bulb producers in the Netherlands to house potted bulbs. But this season is set to see the DOPA pots used to contain mixes of Rijnbeek’s perennials. In fact, Rijnbeek has already discussed this offering with several garden centres and large retailers in Europe.

Van Vemde reports: “There is really a lot going on. Everybody has been searching for an option like this biodegradable, durable DOPA pot, but it seems that nothing has been available until now. As you can imagine, there’s been much interest in them already this year.”

Van Vemde expects Rijnbeek’s DOPA pot range to be available on a limited scale this season so that the nursery can see how the public reacts to it. This will also give Plantics and Rijnbeek time to steadily scale up production for what will hopefully be a bigger DOPA pot-perennials programme next year.

The grower envisions Rijnbeek’s perennials being sold in the DOPA pots in unique combinations of five or so perennials that will ensure year-round performance for years to come and offer climate-adaptive solutions. This concept is similar to those offered in the company’s Climate Gardeners brand, which was developed last year. This brand includes, for instance, an Urban Jungle mix designed for shady, wet conditions early in the year and a Drought Resistant Mix for a waterwise, low-maintenance border in hot summers.

WANTED: PARTNERS TO JUMP ON THE DOPA BANDWAGON

Potted Hyacinths grown in DOPA pots sitting in a moulded pulp tray.

Van Vemde and Lekkerkerk are keen to find partners to help increase the production volume of the DOPA pots and, in turn, reduce their price so that they are closer to the cost of recycled plastic pots. The pair are also keen to find partners worldwide who are as enthusiastic as they are in finding solutions for bringing the DOPA pot to consumers.

Clearly, this could be the dawn of a new era for horticultural pots, so watch this space – and, of course, watch the perennials grow in the DOPA pot.

WWW.FLORACULTUREINTERNATIONAL.COM 21 PACKAGING

Versatility and eco-consciousness combine in flower and plant sleeves

It is a delicate balancing act to address customers’ needs—who predominantly keep asking for reliable plastic BOPP sleeves—while saving the planet and its people. On-trend packaging expert Koen Pack addresses the issue of eco-consciousness by participating in several corporate sustainability programmes and the HSPI (Horticultural Sustainability Packaging Initiative).

AUTHOR: RON VAN DER PLOEG PHOTOS: KOEN PACK

Located opposite the flower auction Royal FloraHolland Aalsmeer, on the outskirts of Amstelveen, the industrial park De Loeten is home to Koen Pack, a supplier of flower and potted plant packaging. Its extensive range of sleeves takes pride of place.

Koen and Cristol Broekhuizen started their company in 1996 from the kitchen table because they realised how things could be done differently, better, and more personally.

Today, Koen Pack is an international company that

employs nearly 100 staff members. The company has subsidiaries in the USA, Canada, Ecuador, Colombia and China and says its greatest strength is bespoke packaging solutions for its customers.

Koen Pack takes the environment and its responsibilities seriously, whether it concerns manufacturing sleeves, bags, gift boxes or decorations. A significant part of these are sold to auction-based wholesalers in Aalsmeer and Westland, then used to pack, protect and beautify the flowers and plants mainly destined for retailers across Europe.

PACKAGING CONSOLIDATION

The consolidation of packaging companies is a hotly debated issue in the global ornamental horticulture industry. The market is increasingly dominated by big players such as Paardekooper Group (Dillewijn/Zwapak and Broekhof).

However, Koen Pack is certainly not a small company that should be overlooked. It compares itself with a speedboat navigating between mammoth tankers, manoeuvring, and adapting to changing business environments with agility and proactivity.

PACKAGING FLORACULTURE INTERNATIONAL APRIL 2024 22

SLEEVES SERVE FOR MULTIPLE TASKS

In ornamental horticulture, millions of sleeves are used. These are primarily blank, unprinted and made in the Far East.

In the Netherlands alone, Koen Pack sells more than 200 million sleeves per year. Ultimately, the company aims to help customers enhance the visual appeal of their flowers and plants while also providing protection, convenience, quality and eco-friendliness.

HORTICULTURAL SUSTAINABILITY PACKAGING INITIATIVE (HSPI)

Koen Pack and eleven other horticultural suppliers are participating in HSPI (Horticultural Sustainability Packaging Initiative).

HSPI working groups focus on three themes: supply chain transparency, footprinting, and materials. This team effort should help the industry comply with EU legislation.

EU lawmakers have agreed to a new law. Its goal is for all packaging to be fully recyclable by 2030. The new agreement includes a reduction target, outlining that the portion of recycled material in plastic sleeves should be a minimum of 30 per cent.

The Dutch government aims for a 55 per cent reduction in CO� emissions by 2030 compared to 1990. So, Koen Pack has teamed up with Pickler to calculate the CO� footprint of sleeve manufacturing and address the demand for science-based sustainability. These calculations are shared with Koen Pack’s customers to help them comply with the Corporate Sustainability Reporting Directive (CSRD). Under CSRD, companies must publicly disclose environmental matters, including carbon emissions and biodiversity, and how they impact social factors such as human rights, working conditions, equality, and nondiscrimination in the value chain. Approximately 130 factors must be checked and measured, which requires much paperwork.

Koen Pack’s ‘Bubblicious’ theme builds on the cocooning trend as seen in fashion and interior design.

EDUCATING CUSTOMERS AND CONSUMERS

Koen Pack believes informing customers about available choices is vital to achieve more sustainability. Logos and QR codes on sleeves can help educate consumers on which bin sleeves should be disposed of for recycling. The Dutch waste industry is working hard on systems to turn waste back into raw material. Particularly in cardboard, a collection system exists to recycle collected cardboard into new boxes. Plastic waste can be collected in special bags and used to make new products.

COMPENDIUM OF PLASTICS

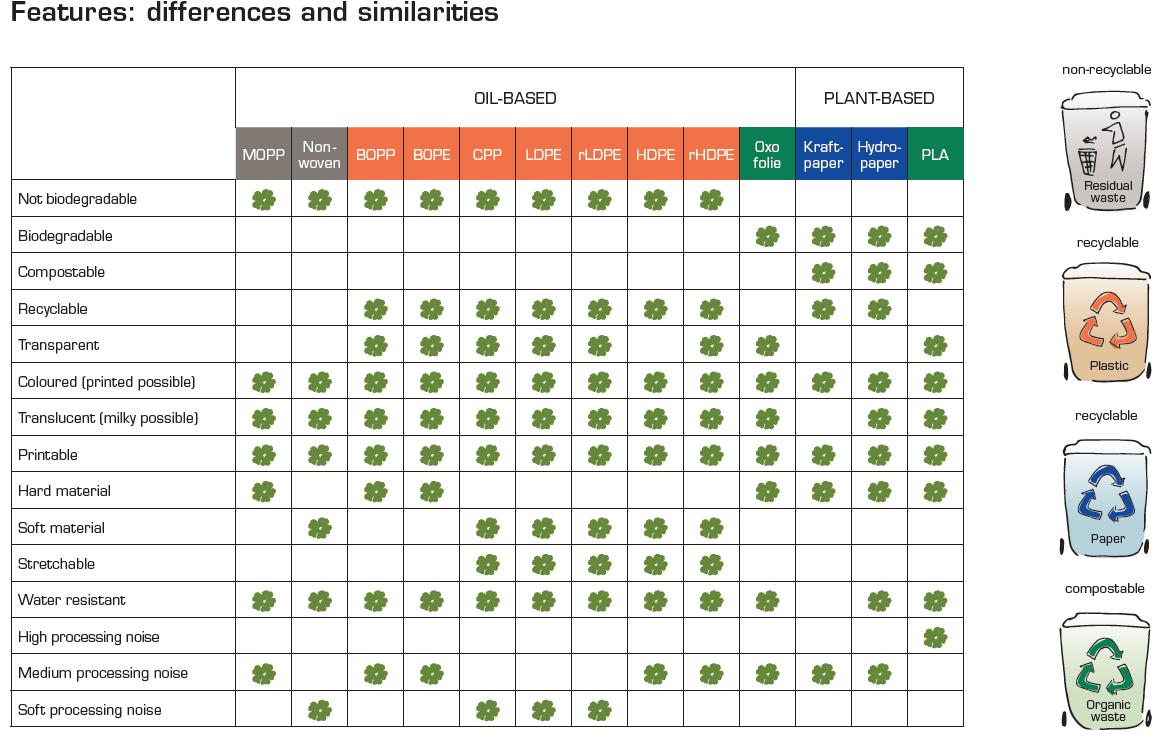

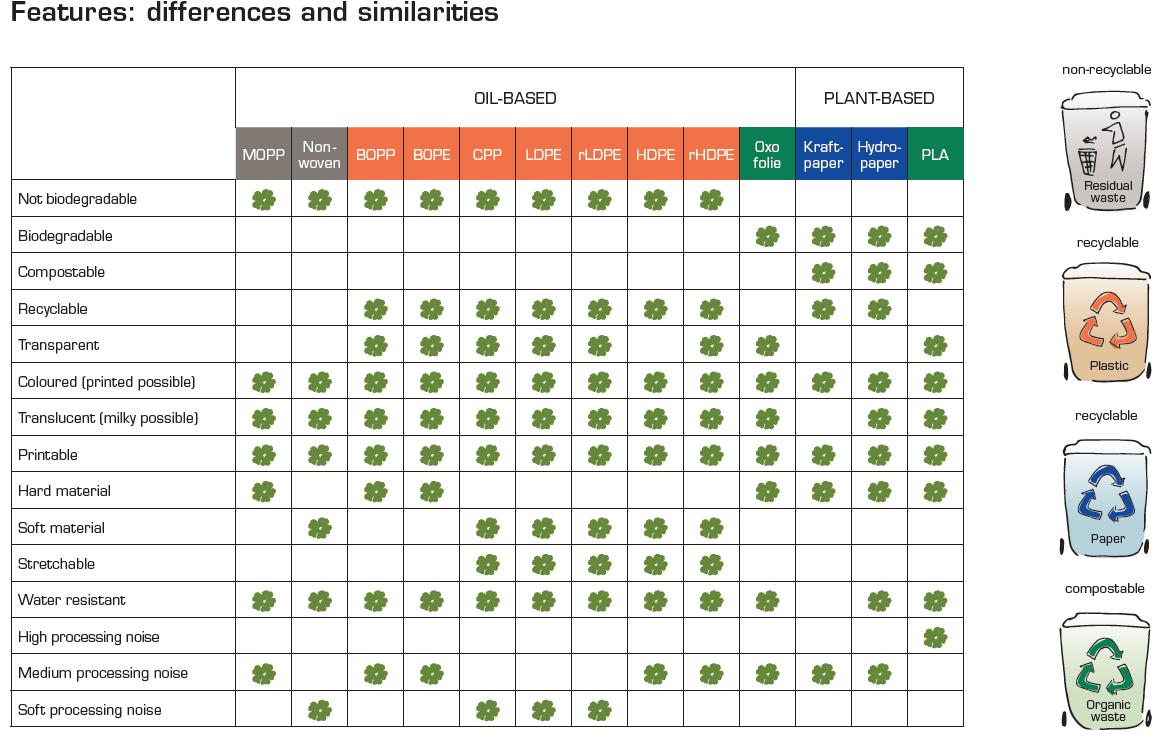

Plastic is not all the same. Koen Pack’s comprehensive compendium of plastics, as featured on the corporate website, provides customers guidance on the materials used and their recyclability and biodegradability. In addressing the needs of its customers, the biggest portion of sold sleeves is still made of BOPP (recycled biaxially oriented polypropylene), some kind of polypropylene (PP), and virgin plastic.

Yet, Koen Pack’s account managers also propose alternatives such as sleeves made of rBOPP or

UPTREND SLEEVES

Prints, not the material itself, drive the trends in flower and plant sleeves. Koen Pack trialled bio-based PLA sleeves but stopped offering them because there was little to no demand.

This year’s collection evolves around the 'Bubblicious' theme, building on the cocooning trend seen in fashion and interior design. Cocooning finds its roots in an uncertain world plagued by social, economic, and political tensions, with consumers tending more to family, friends, and the home and garden.

PACKAGING WWW.FLORACULTUREINTERNATIONAL.COM 23

rLDPE (recycled low-density polyethylene) with 80 per cent PCR (Post Consumer Recycled).

Suppliers in the Far East are increasingly incorporating recycled plastic into flower and plant sleeves. PCR is used to produce quality sleeves with no difference in clarity and strength. Koen Pack’s product development department also investigates sustainability-driven product design, focusing on thinner sleeves without affecting quality. Where once the thickness was 40 mu, 35 mu is now the standard. Another option is to use shorter sleeves that protect only the most important part of the bouquet. Potted plant growers also tend to wrap plastic or paper around the tray instead of individually sleeving their plants.

Figure 1 comprehensively overviews the nonbiodegradable, biodegradable, compostable, and recyclable properties of the different materials used in flower and plant sleeves.

BIO-BASED PLASTICS ARE NOT THE SINGLE BEST SOLUTION

Bioplastics are often referenced as being bio-based, biodegradable, or both. Compostable plastics - a subset of biodegradable plastics –are believed to biodegrade under composting conditions, that is, at specific temperatures, humidity, and oxygen levels. See Koen Pack and Figure 1 for more information. However, Koen Pack does not see bio-based plastics as the holy grail. The company explains that the lead time in composting installations is so short (between one to two weeks) that bio-based plastics do not qualify for this as they biodegrade too slowly in the installation, let alone in nature or on the streets.

Bio-based plastics are, therefore, not the single best answer to the environmental impact of plastic waste. Moreover, if

bio-based plastics decay at all in a composting machine, they do not produce compost but disintegrate into water and CO2. In the bestcase scenario, if fermented first, they produce a little energy. They also decay slowly on the compost heap at home or in the landfill. Koen Pack’s key conclusion is that at the front end, things are going pretty well, as packaging companies use renewable raw materials. However, bio-based plastics should be thrown away with the residual waste downstream of the supply chain. On the other hand, power plants are happy with it because renewable materials such as PLA have a high energy value when burned. Koen Pack says plastic is not so bad as long as it is put in the correct bin, which allows recycling. The company is a strong advocate for recycling.

PACKAGING FLORACULTURE INTERNATIONAL APRIL 2024 24

GOOD PACKAGING = SUSTAINABLE PACKAGING: 7 TIPS

1

Always prioritise the packaging's functionality. The product almost always has a greater impact on the environment than the packaging itself. Good packaging protects the product against damage and deterioration and helps consumers get the maximum return from the product.

Intended effect: the valuable product is not lost.

2

Avoid harmful substances in packaging. For example, avoid using inks with mineral oils and other harmful substances.

Intended effect: prevent hazardous substances from ending up in the living environment and (recycled) materials.

3

Be economical with materials. Use as little material as possible or ensure that the packaging can be reused. Also, ensure that as little material as possible is lost during production.

Intended effect: more efficient use of raw materials to limit the amount of waste.

4

Ensure a clean material flow that can be properly recycled. Where possible, use one material type per packaging component and ensure that consumers can easily separate the different components from each other. Also, consumers should be able to empty the packaging properly so that no product residues remain after use.

Intended effect: good separation and recycling of packaging waste, which yields raw materials for new packaging and products.

5

Use recycled or renewable raw materials where possible. This ensures that materials can be used for as long as possible and that fewer virgin materials are needed.

Intended effect: further closing the material chain.

6

When developing the packaging, consider efficient logistics. Provide as little void space in the transport units as possible so that transport costs as little energy per product. Design packaging that minimises the risk of product damage.

Intended effect: less energy consumption, pollution and product loss during transport.

7

Clearly communicate on the packaging how consumers can dispose of it. Make sure consumers know how to dispose of their packaging waste properly. You can use a disposal guide from the internet for this.

Intended effect: good waste separation by consumers makes it easier to reuse and recycle packaging waste.

PACKAGING WWW.FLORACULTUREINTERNATIONAL.COM 25

Emotions hinder rational thinking in plant pot manufacturing

Soparco, a French manufacturer of horticultural pots and containers, acknowledges that the environmental impact of plastic waste has become a growing concern. However, in keeping with a glass-half-full approach, it would also like to emphasise that sustainable products for the horticultural market have already been on the radar for many years. The industry has since taken bold steps to reduce plastic waste.

AUTHOR: BRAND WAGENAAR

In France, the market for horticultural pots represents around 770 million units/ year or 20,000 tonnes/ year. Compared with its neighbouring markets, the French market has some very specific characteristics due to the typical structure of national production: a few large uniform monocultures and many small companies growing a wide range of plants in different pots with as many different sizes, shapes, and colours as possible. This variety presents a real challenge for pot manufacturers in France.

THE SOLUTIONS EXIST AND ARE READY TO BE IMPLEMENTED

Since early in the 1970s, Soparco has specialised in manufacturing pots and containers for horticultural professionals. It is a 100 per cent family business with a more than 25 per cent market share in the French market. The company attributes 60 per cent of its output to export sales in many countries.

Soparco’s position in the plastics debate is far from being hazy. According to the company’s managing director, Mr Cohu, it is a complex issue often distorted by virulent attacks from environmental stakeholders in France and Europe. “Plastic pollution is real and obvious, but the opinions put forward are often radical, extremist, often unfounded and very little sciencebased. The solutions exist and can be implemented collectively at the European level if they are applied rationally and not emotionally.”

PROCESSES AHEAD OF TIME

At the same time, he emphasises that industrial processes are far ahead. Cohu says, “Manufacturers of horticultural plastic pots have not waited for the current threats to find solutions. For over twenty

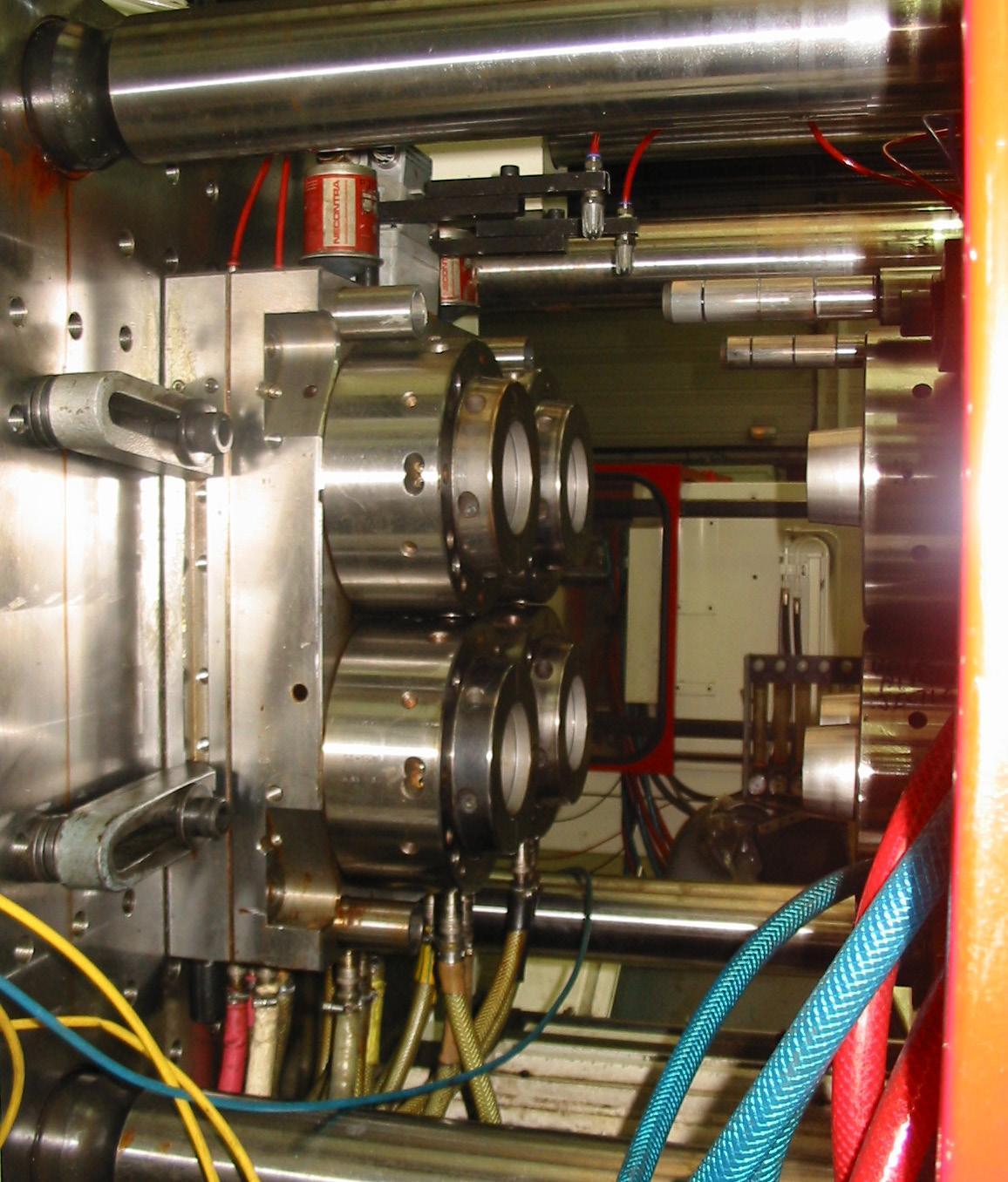

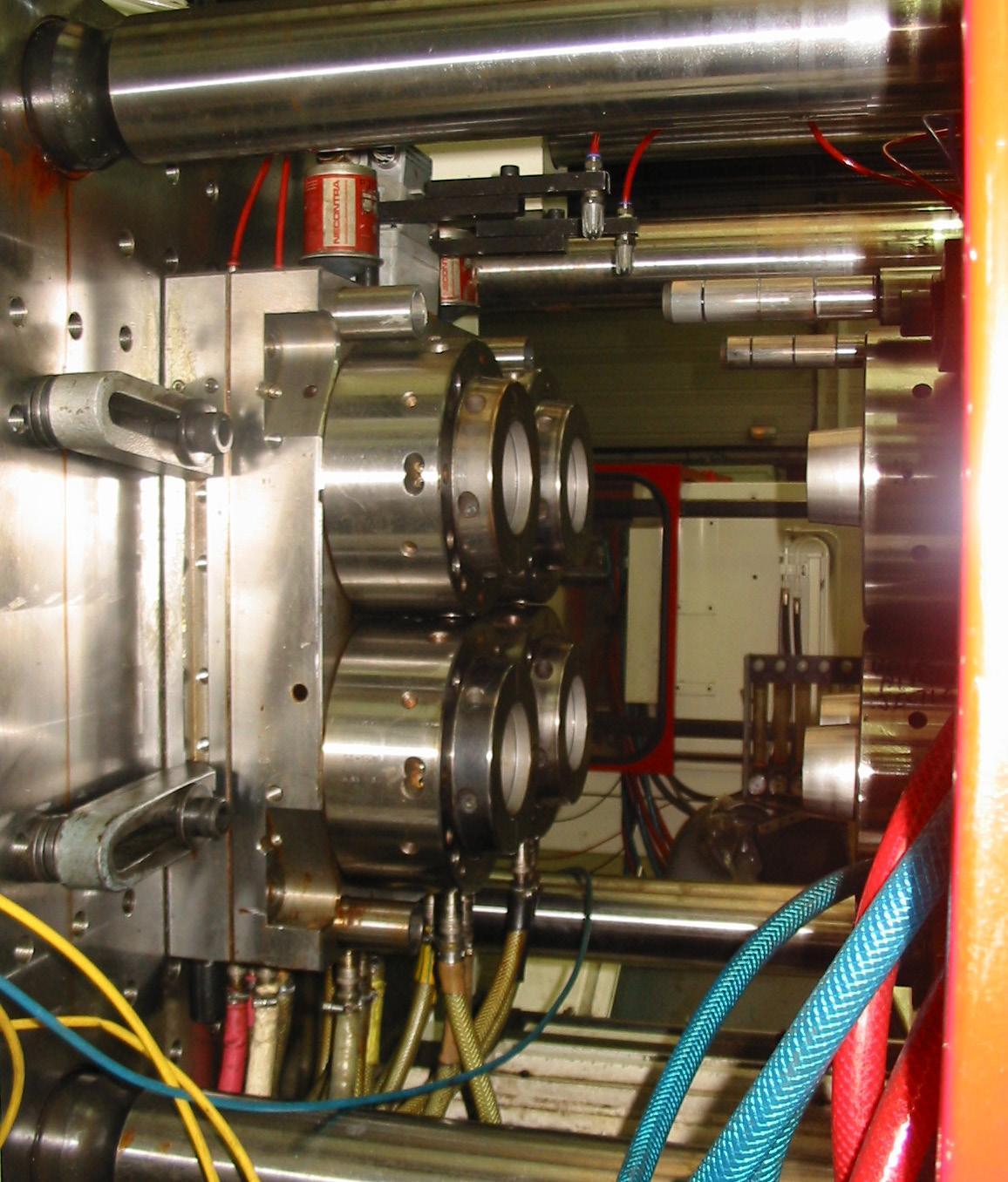

Machine for manufacturing plastic plant pots by the injection moulding process.

years, Europe's leading plastic pot manufacturers have made considerable progress in improving the techniques used to manufacture more robust, thinner pots and plant trays, which use a third less material.”

Work has been done to increase product detectability and improve the recyclability rate. Cohu notes, “So much so that the horticultural plastic pot industry is regarded as exemplary in the wider plastics industry and considered to be the best and most virtuous branch member in terms of progress and improvement. It already meets 100 per cent of regulatory requirements and obligations.”

In the slipstream of CITEO*, horticultural pot manufacturers in France have responded to the ecological emergency and accelerated the transition into a circular economy.

THE ROLE OF INTERPROFESSIONAL ORGANISATIONS

In 2021, VALHOR, the umbrella organisation for ornamental horticulture in France (regrouping all trade unions from the ornamental sector, from growers to retailers, landscapers, and florists), signed a commitment paper by French and European plastics manufacturers, including Soparco. Together, they have been working (some of them for many years already) on the development of plastic materials and additives

19cm Fuji plant with thin sides.

FLORACULTURE INTERNATIONA L APRIL 2024 26 PACKAGING

for making pots as well as on likely alternatives to plastic. They have tailored their offer, and new materials, such as pots made with recycled or bio-sourced materials, have arrived on the market.

A CAPABLE INDUSTRY

Today, the horticultural pot manufacturing industry is capable of reaching 100 per cent of recycled material reused in its production. An estimated 95 per cent of horticultural pots used by the sector are made of polypropylene (PP), a recyclable material.

Furthermore, three-quarters of horticultural pots placed on the French market contain 60 to 100 per cent recycled plastic derived from industry scrap or from postconsumer waste.

As such, it is one of the few industries capable of reincorporating 100 per cent recycled material into its production and, in turn, of manufacturing new products that do not use any virgin raw material of fossil origin.

Some manufacturers have also worked on reducing the plastic content of horticultural containers by 30 to 40 per cent, thanks to technological breakthroughs and innovations in equipment and materials. The share of nondetectable PS pots decreases rapidly year on year.

CONSTANTLY EVOLVING REGULATIONS

Many organisations in France and Europe are concerned about plastics. Regulations and legislative decisions evolve rapidly, with trade associations regularly updating their members. Regarding horticultural pots, the current question being debated with European authorities is to determine whether the pot is part of the plant from the cradle to the grave or whether it is considered packaging. Taxation could be very different depending on the EU Commission’s answer expected this month (April 2024).

HACKING THROUGH A JUNGLE OF DENOMINATIONS

Regarding bio-pots, some manufacturers have developed product ranges that comprise biosourced materials such as coconut fibre, wood fibre, potato starch, rice husk, etc. These novel product ranges are currently undergoing technical testing to ensure they can be used for plant cultivation and marketing. Their life cycle will also be analysed because the actual environmental benefits remain to be proven. Soparco’s product portfolio includes bio-pots, but it remains a niche product that costs four to five times the price of a plastic pot. The term 'bio-sourced' refers to the category of bioplastics, dealing with the composition of the

material rather than the fate of the waste produced. "Bio-sourced" means that the material has been partly or entirely manufactured from biomass resources such as agricultural crop residues, sugar cane, or starch.

This characteristic in no way prejudges the end-of-life fate of the waste, which may well not be biodegradable.

So, vigilance is required when

REGULATORY FRAMEWORK

• AGEC (Anti-gaspillage pour une économie circulaire). The anti-waste law for a circular economy aims to accelerate the change of production and consumption model to limit waste and preserve natural resources, biodiversity and climate.

• European Directive on single-use plastics (2019)

• French Circular Economy Act (2020)

• 3R plastics strategy in France (reduce, reuse, recycle) for 2025, 2030 and 2040

• CITEO’s eco-modulations impose penalties on specific plastics that are non-sortable/ non-recyclable, non-recycled or do not contain recycled material; the extension of sorting guidelines to all plastics

• EPR is the 2025 introduction of extended producer responsibility in professional packaging. This regulation is designed, in particular, to increase the material reuse and recycling of packaging.

Soparco, in Condé-surHuisne, halfway between Paris and Le Mans, is a third-generation family business. (Left to right: Adrien Cohu, Philippe Cohu, and Romain Cohu.)

PACKAGING WWW.FLORACULTUREINTERNATIONAL.COM 27

FRENCH TRADE ORGANISATIONS

A.D.I.VALOR

As part of their commitment to the development of sustainable agriculture that respects the environment, the organisations representing the plant protection industry, agricultural cooperatives, agricultural traders and farmers are A.D.I.VALOR’s founding members and shareholders.

CITEO

Pioneer of sustainable development since the early 1990s in France, Citeo has developed its expertise by creating a new future for household packaging and graphic papers. Citeo has developed eco-design, collection, sorting and recycling services within the framework of Extended Producer Responsibility (EPR), thanks to the joint action of its corporate customers, who are at the heart of its development, as well as in partnership with local authorities along with sorting and recycling professionals.

COTREP

Technical Committee for the Recycling of Plastic Packaging created in 2001 by Citeo, Elipso, and Valorplast. It assists manufacturers in developing recyclable plastic packaging solutions in France.

VALHOR

In January 2023, the umbrella organisation for ornamental horticulture in France, VALHHOR (regrouping all trade unions from the ornamental sector, from growers to retailers, landscapers, and florists), signed a charter of commitment towards eco-designing horticultural pots and containers with eight French and European plastics manufacturers, including Bachmann, Plantec AG, CEP, Chapelu Frères, Desch Plantpak, Modiform, Pöppelmann, Soparco, Tarpin Chavet (household waste collection company) Suez France (an expert in water and waste professions), Paprec France (global waste management), and

VEOLIA

Together, they have been working (some of them for many years already) on eliminating carbon black by 2024, eliminating polystyrene by 2025, reaching a minimum of 75 per cent recycled plastic materials in every pot by 2030 and seeking the best eco-friendly solutions. The manufacturers have tailored their offer, and new materials, such as pots made with recycled or bio-sourced materials, have arrived on the market. One of the signatories to the Charter, Veolia, wants to become the benchmark company for ecological transformation and is present on five continents with nearly 213,000 employees in 2023. The Group designs and deploys useful, practical, and concrete solutions for water, waste, and energy management.

VADEHO

At the time of printing, news broke that a new organisation, VADEHO, had been set up under the umbrella of VALHOR and eight professional organisations representing the horticulture, flowering and landscape sectors and in association with the eco-organisation ADIVALOR. It provides a solution throughout France to companies in the #plant sector and to the services of the #greenspaces of local authorities for the #collection and #recycling of their used #polypropylene plastic pottery.

speaking about 'organic', 'plantbased' or 'degradable' alternatives in comparison with conventional plastics.

THE SINGLE BEST SOLUTION (S)