EAST BAY MARKET REPORT

MAY 2024

MAY 2024

SINGLE FAMILY HOMES YEAR OVER YEAR

SINGLE FAMILY HOMES YEAR OVER YEAR

$3,500,000

$3,000,000

$2,500,000

$2,000,000

$1,500,000

$9,500,000

SINGLE FAMILY HOMES YEAR OVER YEAR

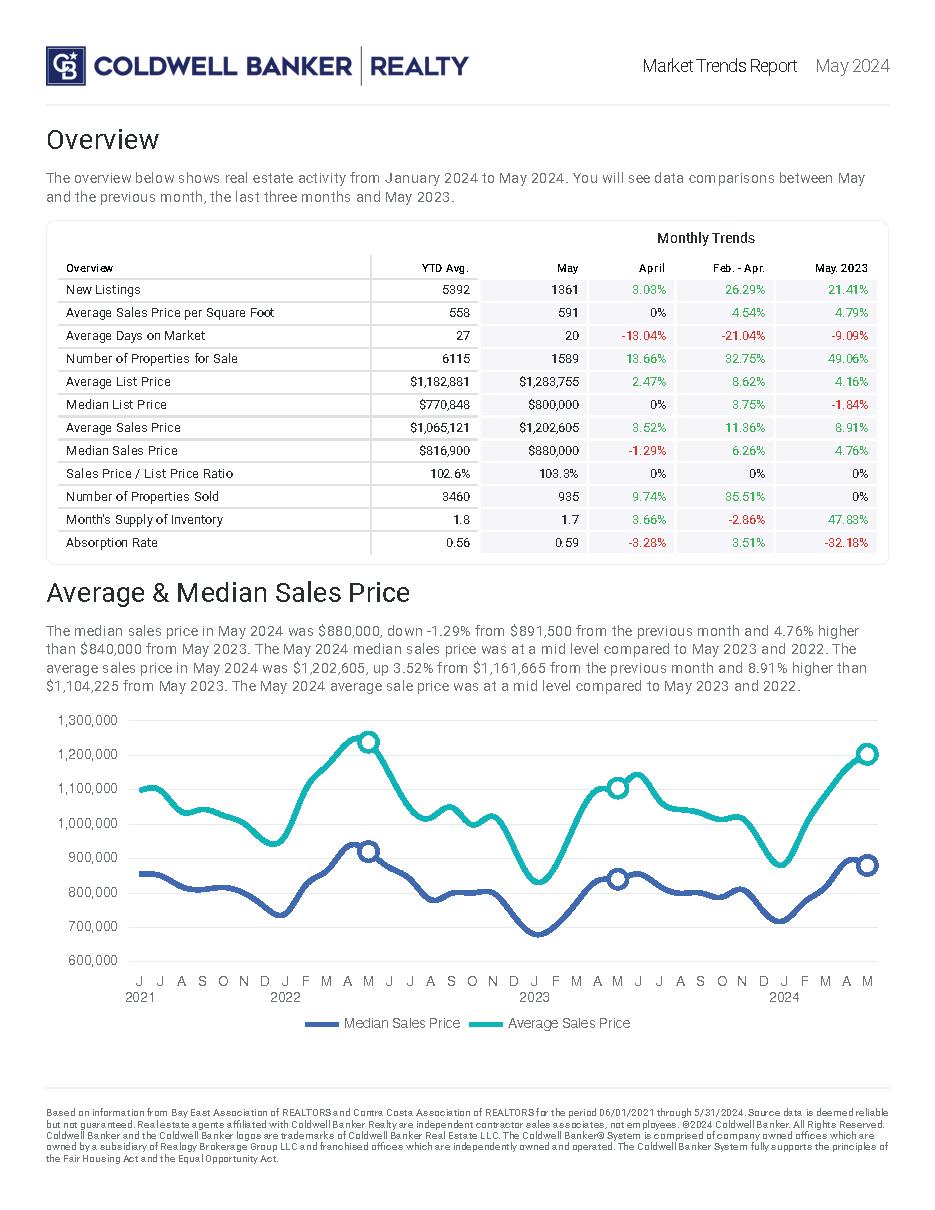

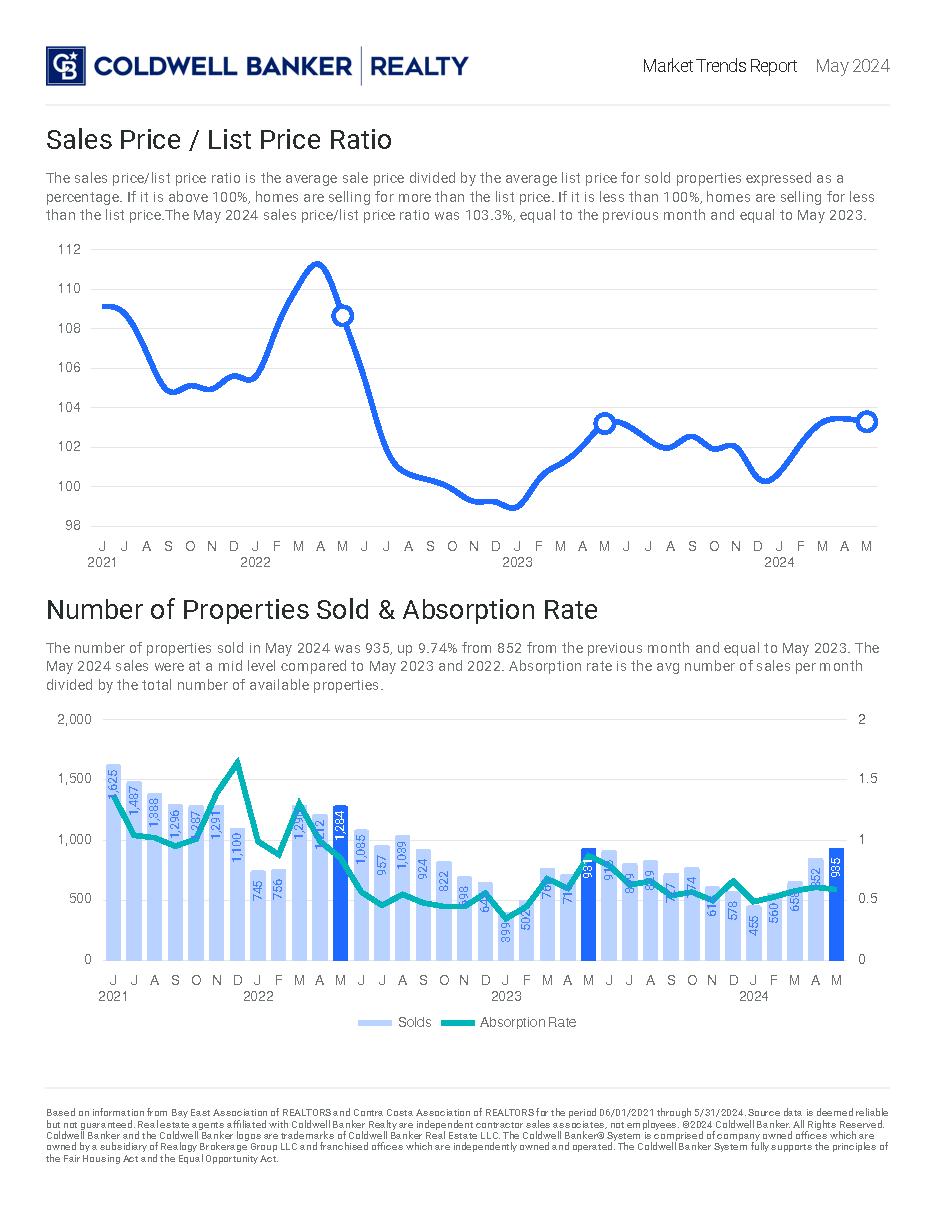

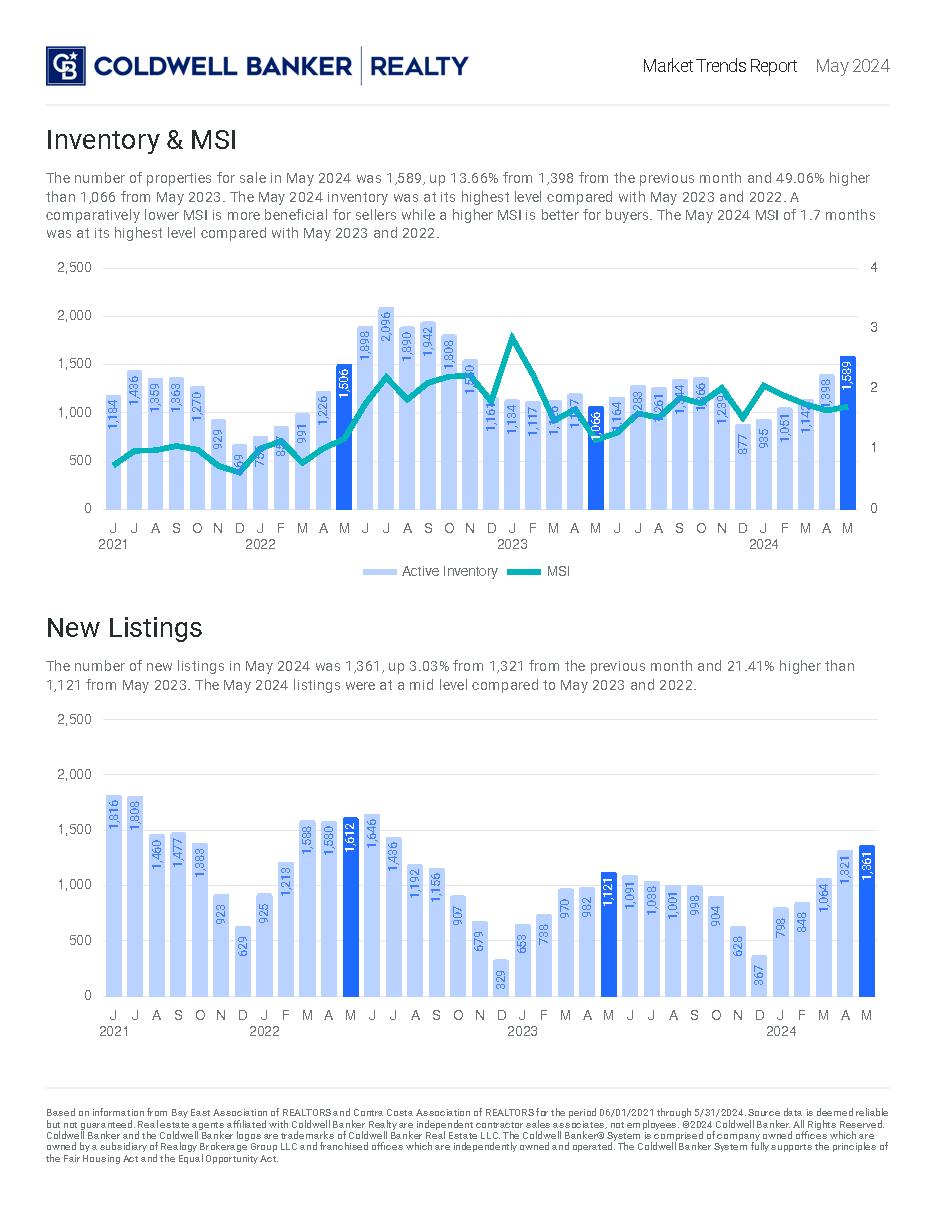

Mortgage interest rates are continuing their slow, steady decline, giving potential homebuyers some relief — and an opportunity to take advantage of rising inventory, if they can afford it.

The 30-year fixed-rate mortgage averaged 6.95% this week, according to the latest Freddie Mac data. That's down from 6.99% the week before. The 15-year rate also dropped, averaging 6.17% nearly the same level as a year ago, when it averaged 6.1%.

The initial readings from the markets following yesterday's inflation data and Fed meeting was mixed, according to Matthew Graham of Mortgage News Daily. In MND's daily survey, rates dropped significantly after the May inflation report showed a cooling economy, but bounced back a little after the Federal Reserve forecast only one rate cut for 2024

"The good times lasted, but they got less good after the afternoon's Fed announcement," Graham said in an online post about the data. Inventory keeps growing — will that accelerate demand?

For buyers who can handle the elevated mortgage rates, the market is a little friendlier than it was earlier in the year. Redfin's four-week rolling report has active listings at nearly 940,000, which is 16.7% higher than a year ago but still below pre-pandemic levels.

The share of homes that experienced a price drop during that fourweek period was 6.5%, the highest since November 2022 following the first spike in mortgage rates But given the overall rate of price growth, buyers won't necessarily find bargains or see big declines in mortgage payments.

"The latest inflation report is good for homebuyers because it has already sent mortgage rates down, though this week's Fed meeting will temper mortgage-rate declines," said Chen Zhao, Redfin's economic research lead.

"But on the other side of the coin, if lower mortgage rates bring back more demand than supply, that could erase the possibility that homeprice growth softens, and push prices up even further. Lower rates and higher prices may ultimately cancel each other out when it comes to homebuyers' monthly payments."

The chance of demand roaring back seems unlikely, given current market conditions Rates may be trending downward, but those declines probably won't overcome the mortgage rate lock-in effect until late this year or sometime in 2025, said Ralph McLaughlin, senior economist at Realtor.com.

"Anyone hoping the lock-in effect will be busted this year may be sorely disappointed," McLaughlin said.

With mortgage rates trending lower over the past two weeks, applications jumped 15.6% according to the Mortgage Bankers Association.

The refinance index increased 28% over the previous week, while purchase applications were up 9% from the previous week. Year-overyear, purchase applications were still down 12% Mike Fratantoni, MBA's chief economist, said the increase in inventory compared to a year ago has helped spur buyer interest.

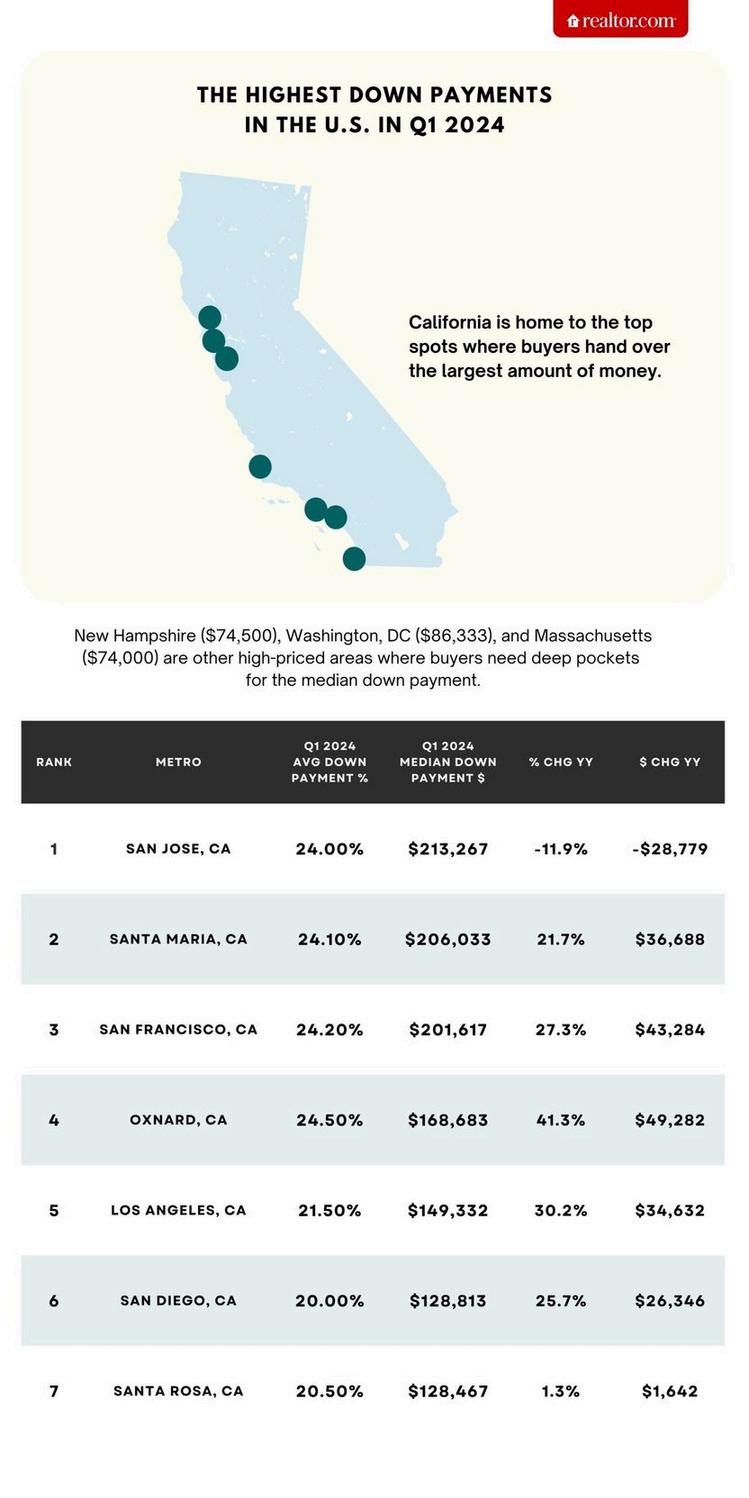

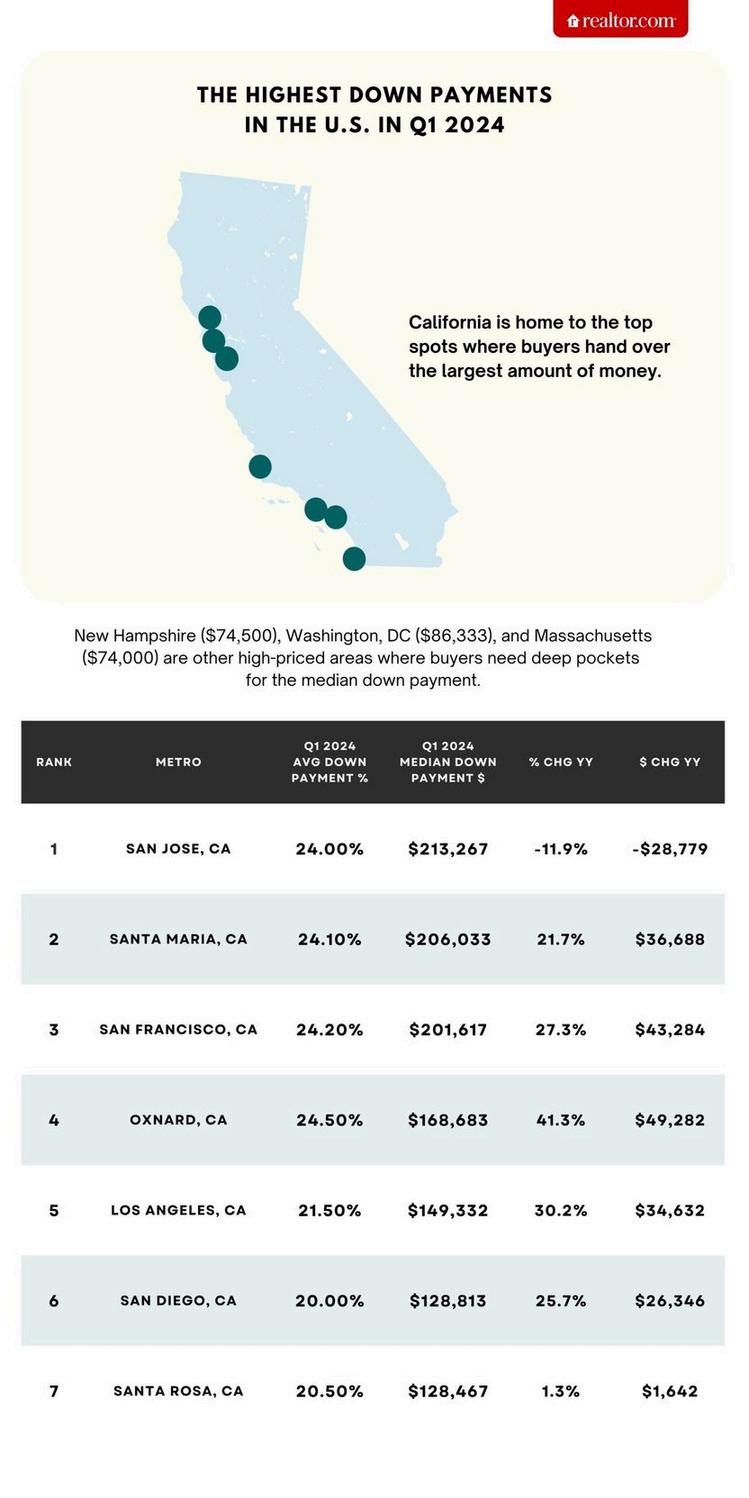

When it comes to the city where buyers shell out the highest down payment in dollars, that dubious honor belongs to San Jose, CA, where buyers put down an average of $213,000, or 24.0% of the purchase price Nestled in the heart of Silicon Valley, where Apple, Google, and Nvidia are based, it is the most expensive housing market in America, according to a Realtor.com analysis. There, the median home list price hovers around $1.46 million and homebuyers need to earn at least $361,000 to own a home

In a surprise twist, San Jose also nabbed another title: the largest annual decrease in down payments in the largest metros Down payment amounts dropped by 11.9% (or $28, 779) compared with the last quarter of 2023, highlighting how down payments are falling overall.

Source: Realtor.com

1. Has your income or financial situation changed?

2. Have you considered any renovations?

3. Do you have any concerns about the current state of the market?

4 Are you interested in investment opportunities?

5. Have you outgrown your current neighborhood?

Wherever you currently stand, always remember that we ' re here for you as a local resource and want to help you through this significant life event Contact us today to receive a free home valuation.

Cheers,

DRE# 01213582 (925) 309-0111 | www.khristajarvisteam.com

The

The