Editor: Lindsey Anderson

517-420-0918

lindsey.anderson@khl.com

Group editors:

Andy Brown, D.Ann Shiffler, Leila Steed, Euan Youdale

Director of content: Murray Pollok

Client success & delivery manager: Charlotte Kemp

charlotte.kemp@khl.com

Client success & delivery team: Ben Fisher, Alex Thomson

Media production manager, Americas: Brenda Burbach brenda.burbach@khl.com

Group design manager: Jeff Gilbert

Group designer: Jade Hudson

Event manager: Steve Webb

Event design manager: Gary Brinklow

Creative designer: Kate Brown

Audience development manager: Anna Philo

anna.philo@khl.com

Circulation executive: Vicki Rummery vicki.rummery@khl.com

Admin assistants: James Dick-Cleland, Maria McCarthy, Hannah Parry

Vice president sales –global rental and access division

Tony Radke 480 478 6302

tony.radke@khl.com

Vice president global sales: Alister Williams 843 637 4127 alister.williams@khl.com

Accounts assistant: Emily Roberts

Client success & digital director: Peter Watkinson peter.watkinson@khl.com

Facilities & HR administrator: Philippa Smith philippa.smith@khl.com

Chief executive officer: James King

Chief financial officer: Paul Baker

Chief operating officer: Trevor Pease

Adecade ago we launched the very first ALH Conference & Awards. Don Ahern was the keynote speaker, followed by talks from MEC's President David White, Acme Lift's Founder and CEO Woody Weld, Acme's President and COO Mike Crouch (now Presidnet of RMC Consults,) IPAF's Tony Groat, NES Rentals' Mike Disser, Terex AWP's Brad Allen, JLG's Tim Morris, Genie's Scott Owyen, Rouse Services' EVP Gary McArdle (now EVP of RB Global,) Skyjack's then-President Brad Boehler, renowned economist Scott Hazelton and many more.

The Coneference & Awards fared well during its in-person lifespan and its virtual spree, especially with the help of our partner, IPAF, which aligned its Innovate workshop with the ALH Conference & Awards.

But it was time for a change.

Through a joint partnership with IPAF, we are thrilled to announce the first-ever Working at Height Conference & Awards, set for Nov. 20 in Nashville. By working together with IPAF, we have worked to combine the best of the best - industry expert presentations, work-at-height trends and topics, top-notch networking events, and an evening awards dinner that will rival the IAPAs. (Sorry, Euan.)

Speakers will be announced soon, but attendees can expect to hear presentations that cover: Growing markets and trends in rental, Training and technology, How to cultivate a safety culture, How tech impacts working at height, The human factor (labor, mental health, etc.,) How to select the proper PPE, and more.

The event kicks off with a networking reception on the evening of Nov. 19 with the conference and an awards dinner taking place Nov. 20 at Music City Center in Nashville. Registration will open soon, and even sooner you'll hear more about our awards (and how to enter.)

The day-long conference is for buyers and users of aerial platforms, including rental companies and contractors, and will champion the safe and effective use of mobile elevating work platforms through the latest industry innovations, technology and best practices. These include: Equipment rental managers and owners, safety professionals in the construction industr, access rental specialists, afety consultants, MEWP OEMs and distributors and anyone else who has a toe in the work-atheight pond.

So spread the word and mark your calendars for November 19 and 20. You won't want to miss it. For more information, visit www. workingatheightevent.com or www.accessbriefing.com. Thanks for reading.

With light weight and compact size, it can be used both indoor and outdoor.

Self-leveling chain system, and each mast can rise and fall synchronously.

Hinged double opening cover for easier maintenance.

Standard with extension deck and large working capacity.

REIC Founder Kevin Fitzgerald talks with KHL Editor Jenny Lescohier about REIC’s increased focus on specialty renta and what the company is planning for in the future.

While it’s not the double-digit growth of 2023, this year’s Telehandler30 still shows a market experiencing strong demand. Lindsey Anderson dissects the data and provides the latest.

JLG provides outlook on Mexico; Altec acquires Teupen; Magni opens new HQ, expands product lines; Terex Utilities debuts new machine; All Access Equipment develops dual-purpose MEWP; Rental and OEM quarterly results, plus Share Index and more.

Mollo to up investment in green equipment' Platform Basket launches France-friendly lift; Falcon soars to new heights with launch; Sinoboom introduces first diesel articulated boom to Europe.

Through a joint venture with the Scaffold & Access Industry Association, KHL Group acquired Scaffold & Access Magazine in late 2021. Readers will find SA as a standalone publication located within the middle of Access, Lift & Handlers

Fueled by favorable market headwinds, construction activity across the U.S. has created a growing demand for telehandlers. Lindsey Anderson provides an in-depth update.

The RT scissor market is holding strong across North America, with multiple factors fueling demand. ALH takes a look at the market and rounds-up recent product news and debuts.

Sam Wyant, president of international sales at Ritchie Bros., reveals his take on the used equipment and auction markets, progress for Rouse and SmartEquip and the company’s approach to technology. KHL Editor Lewis Tyler reports.

IPAF North America welcomes new members; MEWP Rental Report 2024; IPAF Accident Reporting; IPAF 2023 annual report available.

To subscribe to Access, Lift & Handlers or any magazine in the KHL portfolio, go to: www.khl.com/subscriptions.

Manitou debuted its latest compact telehandler, the MTA 519, earlier this year. To read about the compact telehandler market, turn to page 23.

Sept. 11-12

VERTIKAL DAYS

Newark Showground, UK

www.vertikaldays.net

Sept. 30 – Oct. 4

SAIA ANNUAL CONVENTION & EXPOSITION

Denver, CO

www.saiaonline.org

Oct. 1-2

POWER PROGRESS SUMMIT

Chicago, IL

www.dieselprogresssummit.com

Nov. 19-20

WORKING AT HEIGHT

CONFERENCE & AWARDS

Nashville, TN

www.workingatheightevent.com

Nov. 25

IRC ASIA

Shanghai, China

www.khl-irc.com

JLG Q1 sales for the three months ending March 31 increased 3.7 percent to $1.24 billion as a result of higher sales volume in North America, but was offset in part by lower sales volume in Europe, the OEM’s parent company Oshkosh Corp. reported.

Access segment operating income in the first quarter increased 54.1 percent to $208.1 million, or 16.8 percent of sales, compared to $135 million, or 11.3 percent of sales, in the first quarter of 2023.

“Demand for aerial work platforms and telehandlers in North America continues to be solid, supported by infrastructure investments, mega projects and industrial onshoring projects as well as elevated fleet ages,” said John C. Pfeifer, Oshkosh president, CEO and director.

The company also marked its first anniversary of its Mexico warehouse, aimed at the growing Mexico and Latin America markets.

Altec has acquired Germany-based spider lift OEM Teupen.

The acquisition by U.S.-based, vehicle-mount producer Altec will allow the company to expand its footprint worldwide and provides a complementary offering to its line of products and services, which are designed for the utility, telecommunications, tree care and lights and signs markets.

Martin Borutta, who owned Teupen before the sale, will continue to oversee the business.

It is also understood that before the deal was signed Teupen bought back the stake that Dingli had made in the company in 2020. As well as its manufacturing HQ

Teupen debuted its new Leo 27GT Plus at Intermat this year.

PHOTO: TEUPEN

According to Mike Brown, vice president of sales and market development in Latin America for JLG, Mexico’s construction market is witnessing a significant surge, establishing itself as a major hotspot for global manufacturers; “As a strategically located manufacturing powerhouse, Mexico is living a unique moment, bolstered by global ‘nearshoring’

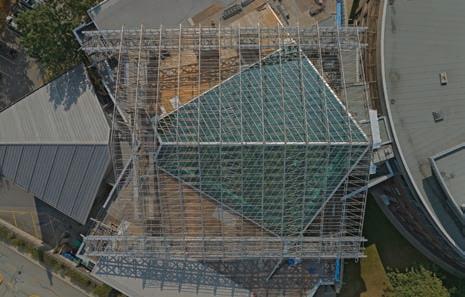

In less than five weeks’ time, Magni debuted a new compact telehandler and a new rotating telehandler while also kicking off construction on its new headquarters in New Jersey while signing on a new U.S. dealer. also signed on Cat dealer MacAllister to expand its footprint. The company’s new American headquarters, located in

Kenilworth, NJ, will be “a testament” to its commitment to sustainability and environmental responsibility, Magni said. Drawing inspiration from its parent company in Italy, Magni America is poised to set new standards in ecofriendly corporate infrastructure.

The company’s new RTH 10.37 rotating telehandler model, a 22,700-pound-capacity behemoth, features a lifting height of 120 feet, 5 inches where its max capacity will

Magni’s new 22,700-pound rotating telehandler, the RTH-10.37.

towards the world’s largest marketplace, the U.S.”

The company also said the market in Mexico has grown to a size that rivals Brazil’s, sparking optimism within JLG about the future of their business there. Brown said that JLG will continue investing to expand its presence in Mexico, underlining its unwavering commitment to this rapidly developing market. ■

in Germany, Teupen has a U.S. stock and service base in Charlotte, NC.

“Altec is excited to be offering the Teupen product to customers across several of the company’s core industries,” said Paul Crane, MD of Altec Worldwide. “These products are designed with bestin-class reliability, durability and versatility in mind. They will allow us to provide our customers with a new type of equipment while still receiving the Altec experience they know and expect.” ■

Construction has kicked off for Magni’s new headquarters in New Jersey.

■ EquipmentShare could go public as early as next year (2025), according to a report by Bloomberg. The business is at the early stages of exploring an initial public offering sources told the news service. Any IPO for the business, could see a first-time share sale within 12-18 months.

■ MEC has announced the appointment of Rick Penkert as national account manager. In this role, Penkert will be responsible for overseeing and nurturing relationships with key accounts across North America.

■ Revenue at Manitou rose 3 percent in the first quarter of 2024 to €685 million, despite an environment of slowing markets, said the company, with an ease in the supply chain also having a significant impact.

■ Haulotte has reported a drop in revenue in the first quarter of 2024, set against a particularly successful first three months in 2023, said the company. Haulotte posted overall sales of €157 million in the first quarter of 2024, compared to €196 million in the same period last year.

The TL45l launched through the Terex Utilities and SDP Manufacturing partnership.

Terex Utilities has introduced a new track-based lift in partnership with chassis provider SDP Manufacturing.

The 47-foot working height TL45 articulated telescopic aerial platform with a jib, is installed by SDP Manufacturing on its rubber tracked chassis. The chassis has a hydraulic track drive that extends from 31.1 inches wide to 55 inches, making the unit ideal for working on sensitive terrain, such as backyards or sidewalks, or for accessing tight spaces, such as alleys.

Featuring a 900-pound capacity jib, the TL45 is designed to be a

flexible option for contractors that need to lift materials in difficult to access areas. Being insulated to 46 KV Category C, it is also an option for rental companies to offer to homeowner, as well as contractors, said the company. Other features include full continuous rotation, unlimited work zone, and corded remote drive and outrigger controls. The unit is also stable when driving on side slopes up to 20 degrees.

“We are seeing high demand for this specialty personnel and material handling equipment in the East and Midwest,” said Bradd Weibel, Terex/Genie services,

strategic account manager. Units are now available for delivery at various Terex Service Centers in these regions. ■

All Access Equipment/CMC has developed a new truck-mount system that allows a CMC Tracked Lift (up to 100 feet of working height) to operate as both a selfpropelled lift that can drive through a 36-inch gate and also as a rearmount forestry bucket truck/rearmount aerial lift on an under-CDL

truck, such as a Ford F550/F600.

The All Access Equipment Track Lift Truck Mount & Transport Deck system provides “two lifts for the price of one” solution.

According to All Access Equipment, “many very serious injuries occur to workers while climbing on/off/into high, truck-

hold up to 17,600 pounds.

Magni also announced its new partnership with MacAllister, a Cat dealer and provider of heavy construction equipment. The deal will see Magni grow its presence throughout Indiana and Michigan. The announcement came following Magni’s newest launches at Intermat 2024, including its first compact telehandler. (See our story on compacts in this issue for more.)

mounted aerial work platforms. This certified and proven truckmount system meets and exceeds both OSHA and DOT safety standards by providing a new and safer way to enter an aerial work platform without the need to climb up/down the top of a truck with unprotected cab guards.” ■

The All Access Equipment track lift truck-mount and transport deck.

Ashtead Group unveiled its new Sunbelt 4.0 five-year plan at an analysts meeting in Atlanta this May. The plan details its financial and operational targets, including an ambition to become a $14 billion business in North America by the 2029 financial year.

The company foresees compound annual growth rates in revenue of 6 to 9 percent in the U.S, 9 to 12 percent in Canada and 2 to 5 percent in the UK over the five year period.

Supporting that growth will be between 300 and 400 greenfield openings, comprising between 180 and 240 specialty locations and 120 to 160 general stores.

These new locations will generate up to 30 percent of the growth anticipated in the five year period.

Key to the plan is to further expand the density of locations, or clusters, within key rental markets in the U.S. It has already accomplished this for 21 of the top 25 market areas, and sees most opportunity to establish new clusters in the next seventy five largest markets, growing the number of clusters in these areas from 35 now to as many as 50.

United Rentals has upgraded its forecast for the 2024 financial year to the tune of $300 million, reflecting its acquisition of Yak Access and Yak Mat earlier this year.

The company had initially predicted revenues of between $14.6 and $15.1 billion.

The company said that it could now reach as much as $15.4 billion, buoyed by the completion of the purchase of the temporary

roadway rental business.

Matthew Flannery, chief executive officer of United Rentals, said the company is pleased with its start to 2024.

“Our acquisition of Yak last month provides another excellent example of our strategy to grow our specialty rental business, differentiate our one-stop-shop capabilities and capitalize on both secular growth and cross-selling opportunities,” he said. ■

Herc Rentals has reported record first quarter total revenues of $804 million for the three months that ended March 31, 2024, an increase of 9 percent compared to $740 million in the prior year. Rental revenues were up 10 percent for Q1 at $719 million for the same period.

Sunstate Equipment Co. is expanding its industrial solutions division with the opening of two new locations in Louisiana, its first in the state. The location in Saint Gabriel, serving the greater Baton Rouge area, is now open, while a second facility in Sulphur (Lake Charles) is set to start business in May.

Both will hold a fleet that is suitable for construction and industrial projects, including an expansion of pumps in a range of sizes.

The company said a third location in La Porte, TX, will open in the summer.

“We are off to a strong start in 2024, achieving record firstquarter revenue and adjusted EBITDA margin as we continue to capitalize on key growth markets, like semiconductor, data centers, renewables and public infrastructure, while also investing in our network scale through greenfields and acquisitions, and elevating our higher-return specialty product lines,” said Larry Silber, president and chief executive officer of Herc Rentals.

“Once again, our teams are delivering for customers both in the local markets and at the national level, capitalizing on our broad geographic coverage and

Japan-based rental company Kanamoto is exploring a move into North America, as it aims to break into the top five rental companies in the world.

Speaking to IRN, Tetsuo Kanamoto, president and CEO, said the market is a promising region to expand in and will support its goals to increase revenues from overseas; “We’ve already begun a feasibility study to look into that and we’re looking into the U.S. in depth. We can’t say right now if we are interested in any particular region, but we’re taking a deep dive into the market.”

The company ALH that its plans for global markets would see it more than double sales over the next six years.

⊲ For more on this story, see www.accessbriefing.com.

strong demand for our products and services.”

Herc also reported that it completed four acquisitions in Q1, adding 11 locations while additionally opening four greenfield locations for a total of 15 new locations.

As of March 31, the company’s total fleet was approximately $6.4 billion at OEC, an increase of 10 percent over 2023 Q1, and its average fleet age was 47 months.■

Nano electrophoretic paint: Exceptional precision and quality

World-class components

Versatile certified product line for both indoor and outdoor use

Maintenance free batteries

Comprehensive features included as standard for peak performance

A product line offering both diesel and electric options

Best In Class After-Sales Support

Smart Training Eco-System

Sinoboom has launched the AB15J Plus boom lift, representing the company’s first dieselpowered articulating boom that is available in the European market.

Based on the AB15J model, the new AB15J Plus includes a range of new features and upgrades including an increased platform loading capacity, now 300kg compared to 250kg, allowing operators to carry more tools and materials.

Sinoboom’s upgraded AB15J Plus.

Italian company Mollo Group has said that it intends to increase investment on fleet to €120 million over the next two years, as it aims to hit €150 million in revenue by the end of 2024.

The company said much of the investment will focus on adding hybrid and electric equipment to its Blue & Green range of environmentally friendly equipment launched in 2022.

Meanwhile, the company said it intends to continue a number of employee support initiatives, including fuel vouchers, contribution to expenses incurred by employees in the medical,

social and recreational fields, and contribution to expenses related to education.

The announcement was made during the 13th Mollo Group Convention in Alba, Italy, where the company revealed a 22 percent increase in turnover for the 2023 financial year (up to €127 million.)

The company also grew its depot network to 57 in the year, including its Manetta Noleggi operation which it gained through the acquisition of Manetta Noleggi.

For 2024, the company said it will expand its coverage again, adding a further eight depots across Italy.

■ Manitou Group has agreed to buy the assets of its South African dealer Dezzo Equipment. The investment will enable the group to sustain its activities and strengthen its service to customers in the region. The deal will be finalized in the third quarter of 2024.

■ Skyjack has appointed Andreas Stumpf to the position of Vice President Sales & Operations for Europe, Middle East and Africa.

■ LGMG has debuted its new hybrid boom lift, the articulating AR65JE-H. The new articulating unit is based on the manufacturer’s existing AR65JE electric boom lift and can be switched quickly between hybrid and pure electric mode using a clutch.

■ Axolift has reached an agreement with TSK Maskin to become the manufacturer’s distributor in Norway.

Efficiency is also enhanced by the introduction of an active oscillation function which operates in both stowed and raised positions and enhances climbing ability and continuous turntable rotation.

Under the hood, the function pump has been exchanged from a gear to a piston pump, enabling increasing oil flow and higher oil pressure, improving the function of the multi-boom and enhance operational efficiency and flexibility.

Falcon Lifts has unveiled the latest addition to its lineup, an electricpowered spider lift on wheels.

The new Falcon 330 Wheel builds on the manufacturer’s Falcon 290 Wheel (FS290), with a working height of 33m and an enhanced outreach of 14m.

Designed with indoor use in mind, the electric unit is powered by a 180 Ah AGM battery pack, charged using DC 220V/110V mains supply, offering enough power for one day’s work. Optionally, it can also be equipped with a 2.2kW AC motor or lithium battery pack for a faster charging time.

Platform Basket has launched a new version of its Heren 10 vertical mast lift at Intermat, designed for the French market, which is the birth country of the product type.

Since the sale of the intellectual rights of France-based vertical mast manufacturer ATN, there has been a gap in the market that Platform Basket aims to fill, said the company.

The Italian manufacturer

Basket’s new Heron 10 SB.

■ UK-based GTAccess has taken on the BigChange job management system. Running more than 3,000 powered access platforms nationwide, GTAccess said it had achieved 10 percent growth, doubled its depots and introduced paperless mobile working since implementing BigChange.

launched into vertical mast production only last year with the bi-energy Heron 10, available as diesel or battery powered, with a tracked undercarriage and light and compact design.

Both versions offer 9.6m working height and 3.45m maximum outreach, with an 8.3m height at the maximum outreach and a maximum platform capacity of 230kg with two persons. A key feature is the automatic stabilization with the push of a button, incorporating four independent outriggers.

The new Heron 10 SB, updated for the French market, has seen the stabilization system, radio control, interchangeable battery and winch stripped out of its sister Heron 10 product. ■

Five new MTA telehandlers — designed from the ground up and made in the USA — o er lifting heights of 19 to 55 feet and lifting capacities of 5,500 to 12,000 pounds. The new design o ers improved visibility around the machine and to the attachment, enhanced comfort and performance, and a lower total cost of ownership. The new driver’s station features an interactive intuitive dashboard, single joystick operation and noise pollution is greatly reduced to less than 80 dBA inside the cab.

Go Big. Go E cient. Go Quiet. With Manitou.

See

Miami-based Rental Equipment Investment Corp. (REIC) is a holding company made up of acquired independent rental companies which still operate under their original brands. The business model was founded by Kevin Fitzgerald, who saw it as a way for smaller companies to benefit from the availability of corporate funding while holding onto the legacies they’ve built over decades. The current business climate in equipment rental shows the big getting bigger, but there remains a place for independents. REIC offers itself as a hybrid of the two worlds, but also as a poster child for what an investment in specialty rental can do for cash flow and increased valuation.

To find out how it all works, we sat down with Kevin Fitzgerald, executive chairman of REIC, at The ARA Show in New Orleans this year. Here’s what he had to say about his company and where it’s headed, as well as the future of the industry.

Tell us about your role in the history of REIC.

Fitzgerald: I started advising Neff Corp. as an investment banker in ‘93-’94. That’s where I was first introduced to the rental business. I was hired as CEO of Neff Corp. in 1995 and I proceeded to execute a business plan; we bought 13 companies and did 26 green fields in five years. We took the company public in ‘98.

I left Neff in 2000 and went on to do business elsewhere, but decided to get back into rental in 2013. Then in 2014, I came up with a plan to start Rental Equipment Investment Corp.

The idea was to form a holding company and acquire rental assets under one umbrella, with different brand names underneath. I knew at the time I would never become United Rentals or Sunbelt, so I needed to distinguish myself in some other way. I decided the best way of doing that was to buy other companies, keep the brand names in place, and amalgamate them under one holding company with one bank source, one back office, etc.

I started the business in 2014 with my own money, along with some friends and investors. We put our pool of money together and proceeded to go online to look at companies to buy. We came across Midway Rental, based in Kalispell, MT, a four-store group. We closed the deal in December of 2014.

I think we’ll see some consolidation among the top five to 10 companies. The big guys will get bigger and bigger, and then there will be a bunch of us after that, and we will also get bigger and bigger.

KEVIN FITZGERALD, Executive chairman, REIC.

That gave me a mini platform with the back office. We now have acquired 19 companies and opened five green fields. We currently have 52 locations, 30 of which are what I call general rental, 22 are specialty rental. Specialty rental was a big move for us in 2020.

EBITDA and they’ll say fine, but what’s your maintenance CapEx?

How much of REIC’s business is focused on specialty rentals?

In 2021, specialty was still only 5 to 10 percent of our business. It was then that our shareholders decided they wanted more liquidity, so at the end of ‘21, we consummated a sales transaction with a private equity group in New York called Kinderhook Industries.

We ended up selling the business to them in December, 2021, seven years after I started REIC. We rolled over some of our equity into the new company and I remained as CEO until this year when I became executive chairman.

The majority of the company is owned by Kinderhook Industries.

By the end of 2023, specialty was around 45 percent of our business, and by the end of this year, it’ll be over 50 percent of our revenue stream.

We’re still growing general rental, of course, but specialty has become a big part of our business. Right now, we have HVAC and compressors, as well as some specialty hybrid light towers, direct-fire and indirect-fire heaters, chillers and dehumidifiers.

It seems obvious to me when running a rental business that you need to diversify and bring in assets that have a longer life and less maintenance CapEx. The flip side is if you want to buy those companies at higher multiples, then you need to have a lot of equity to do that.

A lot of individuals and sole proprietors don’t have that equity to put back in, but we do because we have our partners at Kinderhook who can provide, as appropriate, all the funding we need. To really grow in the rental industry, you need a large, well-funded equity partner. REIC has that in Kinderhook Industries.

Where do see this trend going for REIC?

If you were to look at us three to four years from now, I’d say REIC will probably be 60 to 65 percent specialty, with the remainder being general rental.

What prompted the move to get into specialty rental?

I knew specialty was an important way for a company like ours to get more long-lived assets. The maintenance CapEx is much less with specialty equipment, which is key to free cash flow, and therefore, the ability to fund is much easier and the multiples are higher on acquisition for specialty, compared to general rental.

Specialty rental/longer-lived assets don’t get beat up as much as construction assets, the dollar utilization for specialty is higher, and the CapEx is considerably less. The maintenance side is a key thing, particularly when it comes to financing. A lot of lenders will look at your

I think for REIC, we will continue to be acquisitive, and we will continue to add fleet to our existing stores for organic growth.

We’ll look very carefully at green fields. They’re tougher these days because you need to get a property location, which is expensive or not available. And the people issue... when you look at risk factors and things that are issues for the industry, it’s people. Finding and retaining people remains a key to growing the rental business.

When you talk about opening a new location, you need a whole team and that’s hard to find. That’s why it makes sense to buy companies... because you are essentially getting an assembled group of people.

Founded in 2014 and headquartered in Kalispell, MT, REIC is a regional rental equipment services company that has developed a reputation as a leading consolidator in the industry. REIC’s general rental fleet includes aerial, earthmoving, power, compressors and other small equipment pieces, while the specialty fleet focuses on HVAC equipment. The company services its customers from 46 strategic locations, comprised of 27 general rental and 19 strategic rental branches, covering the Pacific Northwest, upper Midwest and Northeast. Supported sequentially by institutional investors NewSpring Capital and Cyprium Partners, REIC completed 12 acquisitions between December 2014 and December 2021.

The firm was acquired by Kinderhook Industries in January 2022 via a partnership with management to orchestrate the next phase of growth. Under Kinderhook’s ownership, REIC has made four strategic acquisitions in 12 months, which included Total Construction Rentals, Cahill Services, Blackout Energy Services and Industrial Drying Solutions. These acquisitions demonstrate a shift from a Pacific Northwest M&A strategy toward a more geographically expansive approach focused on specialty rental. Kevin Fitzgerald, executive chairman of REIC, said, “Partnering with Kinderhook will allow us to accelerate our organic growth plan and further penetrate underserved markets. In addition, I’m very excited to pursue strategic add-on acquisitions and continue opening new specialty greenfield sites which will help grow our business and increase market share.”

In 2022, REIC achieved significant topline growth in the first year of Kinderhook’s ownership and, in 2023, added several general rental greenfield locations, while continuing to make strategic acquisitions that enhanced the company’s general rental and specialty rental divisions.

Here were some of the biggest acquisitions REIC made in 2023.

In January 2023, REIC acquired dehumidification and heating specialist Industrial Drying Solutions (IDS.) IDS is based in Franklin Park, IL and is a subsidiary of Power Rental Solutions.

It provides dehumidification, climate control and power generation rental products to multiple sectors, including industrial, construction, manufacturing, marine and emergency response.

In February 2023, REIC added Wyoming-based Black Mountain Rental (BMR) to its portfolio. Financial terms of the deal were not disclosed. Founded in 1997, BMR provides general rental

equipment, including excavators, haul trucks and garden tools to residential contractors, homeowners and commercial contractors from two locations in Alpine and Pinedale.

In May 2023, REIC acquired Midstream Equipment Corp, a specialty oil and gas rental and asset management business located in Calgary, Canada. The price was not disclosed.

Founded in 2015, Midstream rents equipment for critical applications in oil and gas and large industrial sites, including compressors, generators, process equipment modules (skids) and vapor recovery units.

It was REIC’s sixth acquisition since it was acquired by private equity firm Kinderhook in early 2022, and its 18th since its founding in 2014 by CEO Kevin Fitzgerald.

Fitzgerald said, “Midstream’s product offering and technical knowledge lead the market and we look forward to helping Kyle Twa and Jay Formenti grow the business.”

Twa and Formenti, who are co-presidents of Midstream, said they were looking forward to leading the company “to the next phase of our growth and we are delighted at the opportunity to join the REIC/Kinderhook portfolio.

“Increasing our access to the additional resources of REIC will help scale our business and, most importantly, continue to service our customers.”

In June 2023, REIC bought Colorado-based Aim High Equipment Rental.

Aim High, which was established in 1999, provides rental, sales and servicing for a range of general construction equipment, boom lifts, scissors lifts and forklifts, serving customers across the Denver area and beyond.

Amy Sepin, owner of Aim High, said, “We are elated to complete the sale of the company to REIC. Our combined teams have a common mission of providing exceptional services, and our customers and employees will benefit tremendously.”

“Aim High has established a strong reputation of providing high quality rental equipment and services that will fit seamlessly with our existing geographic footprint for our general rental division,” Fitzgerald added. “The addition of this location in Colorado will enable us to better serve our customers with additional equipment.”

The takeover deal, which was agreed for an undisclosed amount, was described as a strategic move designed to increase REIC’s footprint in the North America region.

In early 2023, REIC added Wyoming-based Black Mountain Rentals, which also specializes in access equipment like this Genie boom lift.

Where do you see the industry going

I think we’ll see some consolidation among the top five to 10 companies. The big guys will get bigger and bigger, and then there will be a bunch of us after that, and we will also get bigger and bigger.

For example, REIC is only in seven states in general rental. We can be across the country with the same model, so we have a lot of places we can go. I believe we have a lot of runway left at REIC to grow both specialty and general rental significantly.

Capital is the key growth driver now. The big guys have it, but a lot of companies do not. They’re individually owned, and they just don’t have the capital.

Rental has always been a cyclical business because it’s construction based, so it can be very volatile. This has traditionally been viewed as a negative in the public markets.

But Covid came and this industry did just fine. Most of us went down 5 to 10 percent, that’s it. It’s a capital-intensive industry, but it’s primarily discretionary capital expenditure. If we don’t want to spend capital, we don’t have to.

The levers that we have to control capital are very good, and I think the public markets have figured this out. Coupled with the fact that the big guys are in so many industrial businesses now, not as much tied to construction, these factors are making the industry trade higher.

The stigma of this industry being very cyclical will always be there, but I think it will be less so going into the future. And I think that’s an important point to drive home, because it’s one of the reasons why the industry is trading higher than it has been.

Five years from now, I think the industry will continue to trade higher, and the big guys will get bigger. There will continue to be Mom and Pops springing up all over the place. It’s all because the demand is there, and we’re still only at around 55% rental penetration in the U.S. ■

We currently have

52 locations, 30 of which are what I call general rental, 22 are specialty rental.

Pettibone has long set the standard for material handling equipment, a tradition that carries on with our next-gen X-Series Traverse and Extendo telehandlers.

» Tried-and-true hydraulics deliver efficient performance.

» Formed boom plates offer greater strength with less weight.

» Side pod engine provides easy service access and visibility.

» X-Command® telematics is standard for 2 years.

See the X-Series lineup at gopettibone.com

We’re continually updating your favorite workhorses to meet the demands of today’s most demanding worksites. And the newly remastered 8042 SkyTrak® Telehandler is built to deliver. Its redesigned build bears the same SkyTrak-strong reliability but is now more cost-efficient to transport. Enhanced tech options and improved cab styling heighten focus and productivity. All this and more without an ounce of compromise to its 8,000–lb capacity. In other words, you can work with confidence in a machine just as driven as you.

his year’s T30 ranking of North American telehandler rental fleets showcases steady growth for the industry, with every company listed – save one – adding units to their fleets.

This year’s T30 tops out 92,893 total units – a record number for our annual ranking – and is up 6.67 percent compared to last year’s total of 87,086. Looking at our top five, we see 6.75 While it’s not the double-digit growth of 2023, this year’s TELEHANDLER30 still shows a market that is experiencing strong demand. ALH reports on the data and provides an update from rental and OEMs. >

Michigan-based AeroLift says the opportunities for telehandler growth and use are aplenty.

percent growth in fleet sizes, with our top 10 pulling in the most growth at 6.77 percent.

This demand for one of construction’s most versatile pieces of machinery falls in line with current market drivers: infrastructure, mega projects, onshoring and aging fleet replacement.

According to a recent study published by OffHighway Research (OHR,) 2023 was a banner year for construction equipment sales in the U.S., with telehandler sales coming out on top.

“In the U.S., growth was robust and most of the individual product categories saw increased sales,” says OHR Global Managing Director Chris Sleight. “But the standout in terms of both

growth and volume was the telehandler.”

and

Total construction machinery sales for the year topped 305,000 units, up 8 percent yearover-year, marking the third consecutive record >

first time ever that more than 300,000 construction machines were sold in the U.S. According to OHR, telehandler sales rose by

Life is full of shortcuts. But operating mobile elevating work platforms without properly trained, tested operators is a dead end decision. Train right. Insist on the PAL Card as proof. A valid PAL Card proves the holder has passed an approved and audited IPAF theory and practical test, compliant to industry standards. Find an IPAF-approved training center near you at IPAF.org or scan here

more than a third, with 30,000 units coming to market, representing nearly 10 percent of total machine sales, which aligns with recent OEM quarterly results.

For its Q1, JLG reported telehandler sales of $373.4 million, a 9.37 percent increase yearover-year. JLG’s total access equipment sales for the quarter amounted to $1.24 billion, with aerials seeing $591 million in sales, and the company’s “other” category pulling in $273.1 million. When we remove “other” from JLG’s two core access categories, telehandler sales amounted to 38.7 percent of JLG’s sales.

“Demand for aerial work platforms and telehandlers in North America continues to be solid, supported by infrastructure investments, mega projects and industrial onshoring projects as well as elevated fleet ages,” said John C. Pfeifer, Oshkosh president, CEO and director. “We’re really pleased with the market in access. We see continued demand drivers going forward. We talked about the Q4 order book was really strong. The $940 million that we just booked was better than our expectations. So we’re booked well through 2024 right now.”

Speaking directly to the telehandler market, John Boehme, JLG’s senior product manager –telehandlers, said, “The overall market demand for smaller, versatile equipment like compact telehandlers is very robust right now with all

Research for the TELEHANDLER30 was carried out during the Spring of 2024. Where companies were unwilling to provide figures, we made our own estimates based on data from annual reports and advice from industry contacts. Thank you to everyone who contributed.

If you would like to be included in next year’s list or would like to get a head start on our upcoming AERIALS20 list, please contact editor Lindsey Anderson by emailing lindsey.anderson@khl.com. Please include the size of your current aerial or telehandler fleet, last year’s number and your company’s website address.

H&E Equipment Services grew its telehandler fleet by more than 12 percent.

PHOTO: H&E EQUIPMENT SERVICES

the infrastructure projects starting up this spring and summer. This means that the largest user of telehandlers continues to be general construction contractors.”

For OEM Manitou, the same sentiments are echoed. “We see excellent demand with these machines in homebuilding and related industries, such as concrete contractors,” says Steve Kiskunas, product manager — telescopic handlers, Manitou. “Overall demand is increasing — more telehandlers are being sold into the North American region across a number of markets. Part of the increased demand is because these units make telehandlers much more accessible – contractors who previously thought they could not afford a telescopic telehandler now realize it can be more practical and affordable than ever before.”

says the overall market demand for telehandlers is robust.

held its fleet at the same level as ’23 – Founder Jim Koontz says the telehandler’s adaptability and flexibility are what keep these machines in demand.

“We recognize that some of the most impressive percentage growth comes in the mini and maxi versions of telehandlers,” Koontz says. “The telehandler market in North America, and locally, continues to mature and incrementally grow. More and more trades see the benefit of this amazing tool. And the attachments that make it more versatile.”

Looking to rental, United’s Matt Flannery said the world’s largest construction equipment rental firm saw growth – and demand - across both construction, led by non-res, and industrial end markets, with particular strength in manufacturing, utilities and downstream.

“We are continuing to see solid demand across a variety of end markets, customer segments, and geographies in 2024,” Flannery told investors recently. “This diversification provides for growth and resiliency.”

United, however, which ranks number one on this year’s T30, grew its telehandler fleet minimally over the last 12 months, increasing its total number of units by 2.29 percent to 35,800.

Sunbelt, Herc Rentals and H&E Equipment Services, on the other hand, all saw double-digit growth in their telehandler fleets, with H&E expanding by more than 12 percent to a total of 8,300 units.

On the independent side, Michigan-based AeroLift – the aforementioned company that

New to this year’s list is Canada’s Cooper Equipment Rentals, which joined the T30 in 11th place, with an estimated 875 telehandlers in its fleet.

In 2022, Cooper invested CAD$175 million on fleet, and it expects that investment to continue, but with a flexible approach, says company CEO Doug Dougherty.

“When it was uncertain whether we could get equipment, we stocked up and said, lets buy,” Dougherty says. “Let’s keep it coming because we don’t know when it’s going to land, and we’ve landed a lot of equipment in the last two years. Now I think we can take a flexible approach to CapEx planning and say, OK, if we see the opportunity let’s write the cheque because we know we can get the equipment.

“We recognize that some of the most impressive percentage growth comes in the Mini and Maxi versions of telehandlers. The Rotators also have a greater presence. Currently those markets do not interest us as they do not suit our needs.” ■

For more on the telehandler market across North America, turn to our article on compact units in this issue.

Sign up for our Rental Briefing today and gain access to high-quality analysis of key issues and global best practices. Our briefing is designed to help you make the best decisions for your business and stay ahead of the competition.

Don’t miss out on this valuable resource that will help your business thrive!

SIGNING UP IS QUICK, EASY AND FREE... JUST SCAN THIS QR CODE

Innovation

PROJECT OF THE YEAR

Supported scaffold COUNCIL UPDATES Fall Protection | Canadian

FOR ALL YOUR SPECIALIZED PROJECT NEEDS

Quality and performance make PCI a trusted industry leader. Our knowledgeable experts help determine the most effective scaffold system to fit your specifications.

• Power Plants

• Chemical Plants

• Refineries

• Paper Mill

• Bridges

• Shoring

• Roof Systems

• Exterior Walls

• High Rise

• Auditoriums

• Stadiums

• Weather Enclosures

EXPLORE SINGLE SOURCE CONTRACTING WITH PCI.

Streamline projects with PCI’s integrated services, reducing delays and duplication while improving efficiency and scheduling. Experience the PCI difference today.

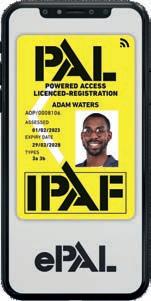

In 2022, nearly 1 in 5 workplace deaths happened in the construction industry – and 38.4 percent of these deaths were due to falls, slips and trips, a new report from The Center for Construction Research and Training (CPWR) shows.

CPWR’s Fatal and Nonfatal Falls in the U.S. Construction Industry, 2011-2022 study also highlighted that from 2011 to 2022, the number of fatal falls to a lower level increased 52.7 percent. And, for the 13th consecutive year in a row, the construction industry’s fall protection standard topped OSHA’s most-frequently cited list last year, with a total of 7,188 violations being recorded (dwarfing the second-highest citation, hazard communication, which had 3,227.)

This all comes despite ongoing efforts to provide workers with proper PFPE training and educational opportunities such as OSHA’s National Safety Stand-Down to Prevent Falls in Construction, which celebrated its 12th anniversary this May.

With ‘construction season’ in full swing, it’s imperative that companies promote the importance of safety, training and certification to our employees – our workers are our most valuable assets, after all.

If you’re scratching your head wondering where to start, a good first step would be reviewing and/or writing and revising any safety plans and programs your company has in place. It’s important to continually develop a safety culture, as it ensures your systems are up-to-date and meet relevant standards and requirements.

Next, verify your employees’ training and

WELCOME TO OUR NEW MEMBERS

A Buck Scaffolding

Michael Mcknight mmcknight@abuckscaffolding.com

Access Systems & Solutions

dba Scaffold Inspection & Testing Co.

Joan DeJesus joan@sit-co.com

BGB Renewables LLC

Benjamin Badham helen@bgbrenewablesllc.com

Coastal Industrial Services, Inc.

Mark Sonnier msonnier2@coastaltxs.com

“With

‘construction season’ in full swing, it’s imperative that companies promote the importance of safety, training and certification – our workers are our most valuable assets, after all.”

TRACY DUTTING-KANE

certification. Do they need any renewals? Has a long time passed since their last refresh? Are there new standards or requirements that need to be addressed? Make sure your people are properly trained for their given tasks, and know how to properly fit, wear and use PPE and PFPE.

For day-to-day operations, companies can host toolbox talks each morning that discuss specific safety topics. These aren’t marathon sessions, just 5- to 10-minute-long briefs that keep workers engaged.

Lastly, take the time to participate in safetyfocused programs and initiatives. As I mentioned above, OSHA’s annual National Safety Stand-Down to Prevent Falls in Construction is a yearly event where employers focus on talking directly to employees about safety, specifically fall hazards and the importance of fall prevention.

For resources and more information, visit OSHA’s website www.osha.gov/stop-falls-standdown.

Stay safe.

Independent Scaffold Inspections LLC

Timothy King info@isinspections.com

RAXTAR Inc.

Joanna Tomczyk joanna.tomczyk@raxtar.com

SafeCru Academy LLC

Dean Kinslow info@safecru.com

San Diego Scaffold Company

Desiree Daniels sandiegoscaffold@gmail.com

Tracy Dutting-Kane, P.E.

President

Layher, Inc.

Mike Bredl

President-Elect

Universal Manufacturing Corp.

Frank Frietsch

Vice President

Layher, Inc.

Matt Morgan

Treasurer

Mdm Scaffolding Services, Inc.

James Gordon

Secretary

Klimer Platforms, Inc.

Amy Johnson

Member at Large

SkyLine Scaffold, Inc.

Tom Brewer

Board Appointee

Brewer Equipment Co.

Chris Moody

Board Appointee

Direct Scaffold Supply (DSS)

Michael Paladino

Immediate Past President

Eagle Scaffolding Services,

Editor: Lindsey Anderson 517-420-0918 lindsey.anderson@khl.com

Director of content: Murray Pollok murray.pollok@khl.com

Client success & delivery manager: Charlotte Kemp charlotte.kemp@khl.com

Client success & delivery team: Ben Fisher | ben.fisher@khl.com Alex Thomson | alex.thomson@khl.com

Media production manager, Americas: Brenda Burbach brenda.burbach@khl.com

Group design manager: Jeff Gilbert

Group designer: Jade Hudson

Creative designer: Kate Brown

Event manager: Steve Webb

Event design manager: Gary Brinklow

Audience development deputy manager: Anna Philo anna.philo@khl.com

Circulation executive: Vicki Rummery vicki.rummery@khl.com

Admin assistants: James Dick-Cleland, Maria McCarthy

SALES

Associate publisher: Tony Radke 480 478 6302 | tony.radke@khl.com

VP global sales: Alister Williams 843 637 4127 | alister.williams@khl.com

Accounts assistant: Emily Roberts

Client success & digital director: Peter Watkinson peter.watkinson@khl.com

Facilities & HR administrator: Philippa Smith philippa.smith@khl.com

Chief executive officer: James King

Chief financial officer: Paul Baker

Chief operating officer: Trevor Pease

With ‘construction season’ in full swing, it’s imperative that companies promote the importance of safety, training and certification to our employees. Here are some top tips for conducting tool box talks, providing proper PFPE training, and more.

ScaffSource opens new HQ; A92.9 and A92.10 standards to undergo changes; Peri debuts new formwork system; Podcast with Harold Gidish; Doka aids in urban build; Registration open for SAIA Annual; plus OSHA news and more.

In an effort to educate the industry on the importance of fall protection equipment –including proper fit and use – the SAIA’s Fall Protection Council looks to expand its webinar series, as well as offer additional resources. Lindsey Anderson reports.

Scaffold & Access makes every effort to ensure that editorial and advertising information carried in the magazine is true and accurate, but KHL Group Americas LLC cannot be held responsible for any inaccuracies and the views expressed throughout the magazine are not necessarily those of the publisher. KHL Group Americas LLC cannot be held liable for any matters

Skyline Scaffold Ltd. took home the SAIA Project of the Year AwardInnovation for its work on the Justice Institute of British Columbia. Read the full story on page 24.

Scaffold Resource won the SAIA’s Supported Scaffold Project of the Year Award for its pivotal role in restoring one of Maryland’s National Treasures. SA reports.

Rick McKinlay provides an update on a new gaps analysis tool in development that will address the requirements for various types of scaffold and access equipment across Canada’s provinces. SA reports.

David Glabe addresses why falls from heights consistently remain a primary cause of injuries in the construction industry.

resulting from the use of information within the magazine. The publisher is not liable for any costs or damages should advertisement material not be published.

Scaffold & Access is published six times a year by KHL Group Americas LLC 14269 N 87th Street, Suite 205, Scottsdale, AZ 85260, USA.

SUBSCRIPTIONS: Annual subscription rate for non-qualified readers is $160. Free subscriptions are given on a controlled circulation basis to readers who fully complete a Reader Subscription Form and qualify under our terms of control. The publisher reserves the right to refuse subscription to nonqualified readers.

Scaffolding and shoring provider ScaffSource has opened a new headquarters just outside of Houston in Deer Park, TX, the company announced.

Compromising seven acres of land, the new facility is ScaffSource’s largest yard out of its nine current locations across the U.S. and will be capable of storing up to one million pieces of scaffold and/or shoring materials at any time, the company said. Additionally, more than 60 of the company’s employee’s will begin to work out the new office.

Formerly United Scaffolding, ScaffSource rebranded in 2022, and the new headquarters will serve “as a continuation of the productive road ahead for the company as it continues to stake its claim as one of the most reliable and comprehensive scaffolding and shoring solutions providers within the oil & gas and industrial sectors widespread throughout the competitive Houston and Gulf Coast markets,” it said.

“The new facility is ideal to support the volume of business demand that we are experiencing, and it also has spare capacity for storage, more truck lands and excess office space for customer-support functions,” said Justin Anderson, president of products group.

“Given the recent rebrand, we were looking to find a place that not only matched our growth trajectory, but one that would also be a good fit for our team and keep us strategically placed in the markets we serve,” said Jordan Narramore, ScaffSource’s business operations and marketing specialist. “Additionally, a new site like this gives us a boost – allowing us to enhance and expand on the opportunities we already have.”

Five GEDA 1500 Z/ZP transport platforms and three GEDA Maxi 120 S units were installed for a Prague apartment construction project recently. The five GEDA 1500 Z/ZP transport platforms were installed at a height of 34 meters and serve 15 floors. They are fitted with GEDA Comfort doors to ensure smoothness and safety when moving from the platform to the scaffolding. With a platform size of 1.45 m by 3.3 m and a load capacity of 2,000 kg, “the GEDA 1500 Z/ZP BS platform is ideally suited for the transport of heavy materials. But workers can also be brought to where they need to be without any problems because the GEDA 1500 Z/ZP can carry up to seven people,” the company said.

GEDA supplied the job with five GEDA 1500 Z/ZP transport platforms and three GEDA Maxi 120 S units. PHO-TO: GEDA GMBH

for welding work.

VIENNA TWENTYTWO – one of Vienna’s largest urban development projects – is being built in the 22nd district of Vienna’s Donaustadt.

Two diagonally positioned tower blocks and four lowrise buildings form a varied ensemble, with formwork and scaffolding solutions from Doka on site.

Developed by ARE Austrian Real Estate, the project’s design

included a multitude of modern details – from generous open spaces to fine-tuned wind optimization. Once completed, the tallest tower in the VIENNA TWENTYTWO multi-purpose ensemble will have an impressive height of 153 meters.

In addition to formwork solutions from Doka, the V22 HABAU-DYWIDAG consortium is also using Doka’s Ringlock modular scaffolding for the steel

“Rezidence Nuselsky Pivovar” was built to address the area’s growing population - and need for housing.

Doka says its formwork solutions helped construction work on the tower to progress rapidly.

Compromising seven acres of land, ScaffSource’s new HQ is home to the company’s largest yard out of its nine current locations across the U.S.

construction.

With the help of the preassembled Xclimb 60 protection screen from Doka, the tallest tower in the ensemble is growing upwards safely and quickly, according to the company.

The hydraulic climbing system with the Xbright frame enclosure protects against the effects of weather at great heights, thus ensuring stable working conditions.

Outriggers, a set of structural

Peri Formwork Systems, Inc. has launched the Alpha Column, a new formwork solution that caters to various size ranges for wall, column and slab formwork.

“In response to the growing U.S. construction market, Peri USA has identified a surge in demand for user friendly formwork solutions that cater to expansive size ranges for wall, column, and slab formwork,” said Francisco Gonzalez, product manager at Peri USA . “As a result, our team is continuously pushing the envelope, always looking at ways to empower construction professionals to do their jobs more safely and efficiently. Alpha Column is the most recent example of that ongoing endeavor.”

The new imperial Alpha Column is a column system

targeted to achieving tieless rectangular and square columns up to 36-inch by 36-inch. “The robust column system features

integrated accessories that reduce material on site and increase safety during assembly,” according to Peri.

It’s been more than three decades years since the training program for suspended scaffold in the U.S. has been updated. But that’s due to change as the Scaffold & Access Industry Association’s (SAIA) Suspended Scaffold Council finalizes a completely new program, manual and training materials. Head over to www.scaffoldmag.com for an exclusive podcast interview between SA Magazine and industry veteran and SAIA Suspended Scaffold Chair Harold Gidish. A

steel trusses to provide stability and connect the building core to vertical components while concealed from the outside, were installed on levels 16/17.

Doka’s Ringlock capitalized on its flexibility to fit around the steel structure.

Access for workers between levels was facilitated through a combination of staircases and ladder hatch decks.

The completion of the tallest part of the building is scheduled for the end of 2025.

Registration is officially open for this year’s Scaffold & Access Industry Association Annual Convention & Exposition. Set for Sept. 30-Oct. 4 in Denver at the Hyatt Regency Denver, the event brings together the largest gathering of scaffold and access industry professionals. For those interested in registering, don’t delay: an early bird rate is available until May 31.

This yearly event features industry-focused educational sessions and showcases the nation’s top scaffold and access exhibitors (see photo for floorplan and full list,) while also offering training and certification, a golf tournament, networking events and an awards ceremony.

To see the schedule of events, register for training or various networking events, visit www.saiaonline.org.

The Scaffold & Access Industry Association (SAIA) has announced that the A92 Main Committee has approved the splitting of A92.9 and A92.10 into two parts – Design and Safe Use/Training. The news comes just one year following the final approval of the new standards, which went into effect on March 1.

The changes will impact the ANSI/SAIA A92.92023 for Mast-Climbing Work Platforms Standard by splitting into A92.9A Establishing Design, Calculations, Safety Requirements and Test Methods for Mast Climbing Work Platforms (MCWPs), and A92.9B Safe Use and Establishing Training Content and Administrative Requirements for MCWPs. Additionally, the ANSI/SAIA A92.10-2023 for Transport Platforms standard will be splitting

Two contractors are facing Occupational Safety and Health Administration fines following the deaths of workers who fell from height.

A Georgia construction contractor’s failure to enforce safety regulations at a worksite led to a 31-year-old steel erector suffering fatal fall injuries, an incident caused by the same workplace safety violations for which federal inspectors cited the employer just 10 months earlier.

A U.S. Department of Labor OSHA investigation determined a three-person crew employed by Georgia-based Landmark Erecting Inc. of Hahira was installing metal roofing sheets on a building in November 2023, when one worker fell 12 feet onto a concrete slab below and suffered traumatic head injuries.

OSHA cited the employer for a repeat violation for again not ensuring a worker used fall protection as they walked along a roof frame. The agency cited the company for a similar violation at a Tallahassee workplace in January 2023.

“Landmark Erecting’s repeated failure to follow required safeguards to protect employees from falls, especially after we cited the company less than a year earlier for exposing workers to this potentially deadly hazard, is inexcusable,” said OSHA Area Director Danelle Jindra. “All employers – construction industry employers included – are legally obligated to provide workers with a safe and healthy work environment.”

Additionally, Sky Safety Inc. of East Boston faces $447,087 in OSHA penalties after a window cleaner’s fatal 29-story fall from a building in downtown Boston’s financial district, the agency announced May 2.

into two and changing the name from Transport Platforms to Mast Climbing Transport Platforms (MCTPs) to consistent with the ISO and CSA standards. These two proposed standards will be A92.10A Establishing Design, Calculations, Safety Requirements and Test Methods for Mast Climbing Transport Platforms (MCTPs) and A92.10B Safe Use and Establishing Training Content and Administrative Requirements for MCTPs will also look to be portioned into from its current ANS into two ANS, Design and Safe Use/Training.

Visit www.scaffoldmag.com for an update as soon as it becomes available.

Changes could be coming soon for MCWP and TP standards. PHOTO: ALIMAK

The window cleaning company failed to inspect and replace damaged or defective equipment, according to OSHA. Agency inspectors determined that Sky Safety willfully exposed employees to fall hazards by not ensuring personal fall protection systems and a rope descent system workers used were in proper working condition. Investigators learned the company hadn’t adequately inspected the rope and equipment for damage and other deterioration and hadn’t removed or replaced defective components from service before each work shift.

Six executives and employees, as well as the company they worked for –Valor Security and Investigations (Valor) – were charged with providing unearned certifications to thousands of New York construction workers, and the New York County District Attorney’s office alleged that one of those workers, named Ivan Frias, lost his life in 2022, as a result.

According to the charges, the company claimed it trained approximately 20,000 construction workers between December 2019 and April 2023. Valor said certificate holders received 40 hours of instruction and were trained on all aspects of construction safety inspection, planning, and security services.

Instead, the DA’s office alleged, the six Valor personnel and an additional 19 individuals brokered deals with certification seekers to circumvent the education by paying a fee, instead.

“The defendants issued cards for a fee certifying the required 40 hours of safety training… without providing training,” explained a statement from the DA’s office. “Valor charged anywhere from US$300 to $600 per filing for a basic safety training card.”

Certificate seekers paid for fake licenses, claimed the DA.

Valor’s more than one dozen alleged cohorts worked across several segments and businesses including Flow Right Pluming & Heating Corp., KCM Plumbing & Heating Co., DeMar Plumbing Corp., Alpha Construction Services, and the New York City Housing Authority (a public development corporation). They’ve been charged with Criminal Possession of a Forged Instrument in the Second Degree and Offering a False Instrument for Filing in the First Degree.

In an effort to educate the industry on the importance of fall protection – including proper fit and use – the SAIA’s Fall Protection Council looks to offer additional resources. Lindsey Anderson reports.

The mission of the Scaffold & Access Industry Association (SAIA) Fall Protection Council is to make a positive difference throughout the industry for both companies and the employees of those companies in their understanding, education and application of working at height issues.

Using research, guidelines, standards and regulations to recommend the best practices possible for the safety and wellbeing of SAIA members and non-members alike.

COUNCIL GOALS:

Work jointly with aerial lift manufacturers and fall protection manufacturers to come to a conclusive and definitive answer as to exactly what type of connecting device is best used in an aerial work platform.

Continue to educate the members of the SAIA and the industry in general on the most up to date working at heights practices and regulations.

Continue to develop and document standard operating procedures for different working at height applications/scenarios.

Falls from height, one of the industry’s “fatal four” safety hazards is the leading cause of death for construction workers. According to Bureau of Labor Statistics (BLS) data, there are more than 350 fatalities and 20,000 serious injuries annually, and in 2022, falls from heights took 395 construction workers’ lives.

Despite ongoing efforts to provide workers with proper PFPE training and educational event opportunities – one example being the Occupational Safety and Health Administration’s (OSHA) National Safety Stand-Down to Prevent Falls in Construction, which celebrated its 12th anniversary this year – the construction industry’s fall protection standard again topped OSHA’s most-frequently cited list in 2023 (for the 13th year in a row.) And even more concerning is that from 2011 to 2022, the number of fatal falls to a lower level increased 52.7 percent, while the rate increased 13.3

FallTech introduced the FT-One Fit full-body harness for women in 2021.

percent, according to data from the Center for Construction Research and Training (CPWR.) These preventable deaths, and increasing fatality numbers year-over-year, spurred the U.S. Department of Labor (DoL), OSHA, the American National Standards Institute (ANSI) and the Scaffold & Access Industry Association (SAIA) – and many more – to take action.

In May 2023, the DoL and OSHA formed a National Emphasis Program focusing on falls, and two months later, the DoL announced a potential rulemaking change to clarify the personal protective equipment standard for the construction industry, specifically pointing out that the current standard does not clearly state that PPE must fit each affected employee properly. And in August 2023, ANSI’s revised ANSI/ASSP Z359.14 standard for safety requirements on self-

The best way to identifying the proper protection needed is following the hierarchy of fall protection.

ACCESS

ADOBE.STOCK.COM

OSHA’S TOP 10 MOST-CITED STANDARDS

■ Standard/Number of Violations

■ Fall Protection – General Requirements: 7,188

■ Hazard Communication (1910.1200): 3,227

■ Ladders (1926.1053): 2,950

■ Scaffolding (1926.451): 2,835

■ Powered Industrial Trucks (1910.178): 2,550

■ Lockout/Tagout (1910.147): 2,539

■ Respiratory Protection (1910.134): 2,493

■ Fall Protection – Training Requirements (1926.503): 2,109

■ Personal Protective and Lifesaving Equipment

– Eye and Face Protection (1916.102): 2,064

■ Machine Guarding (1910.212): 1,635

Source: Occupational Safety and Health Administration

retracting devices (SRDs/SRLs) became effective following its approval in 2021.

In response to this evolving PFPE landscape, the SAIA’s Fall Protection Council convened during Committee Week 2023 and took the initiative to equip the industry with valuable resources.

During Committee Week, SAIA members were asked to write down the top three things they wanted to see more

There are several ways to protect workers that are working at heights. All too often personal fall arrest systems are automatically chosen, however the best way to identifying the proper protection is following the hierarchy of fall protection.

Eliminating the fall hazard or preventing exposure to a fall hazard is the most effective control measure. Preventing exposure may include modifying structure, isolating the worker from the hazard, changing a process, substituting equipment, or using work procedures organized in such a manner that the worker is not exposed to the fall hazard.

Passive fall protection methods are generally considered a higher level of protection than active systems since there is little or no reliance on the worker. Examples of passive protection include guardrails, which provide a physical barrier between the worker and the fall hazard, covers over holes which provide a load bearing barrier, scaffolds and working platforms with guardrails or barrier protection.

Fall restraint systems, involve the use of equipment assembled in such a manner that the worker cannot fall. Restraint systems are characterized by the worker remaining on the same surface they were working on if a fall should occur. Restraint systems do not allow a worker to free fall, therefore restraint systems do not generate the same amount of energy as fall arrest systems, reducing the risk of injury.

Personal fall arrest systems (PFAS) involve the use of personal fall protection equipment assembled in such a manner that an authorized person can fall. Fall arrest systems are characterized by the worker free falling some distance and the fall being arrested by the fall protection equipment. Fall arrest systems create additional concerns regarding the amount of force that the worker’s body will experience during the event, contacting structure and requiring rescuing the worker after the fall has been arrested. No matter what systems are chosen, detailed education should be given to the worker ensuring that employees know how to properly inspect, use and store the equipment, the SAIA says. If a personal fall arrest system is chosen, education on proper fit is key in protecting the worker from further injury.

information provided on, and PFPE was the most-brought-up topic.

SAIA Fall Protection Chair Becky Danielson (Ergodyne) and Co-Chair Micah Turner (Trekker Group) thus began working to develop a four-part webinar series on fall protection inspections and proper fit.

The series kicked off in October 2023 and wrapped this May. Topics included: harness inspections, lanyards/connectors, SRLs and vertical lifelines and anchorage connectors. (For anyone interested in viewing the webinars, visit the SAIA’s YouTube page.)

“We really like the webinar series, including providing supporting documentation,” Danielson tells SA. “We will likely continue [developing] those, as well as look at creative ways to support and

educate our members.”

Danielson also adds that the “Fall Protection Council is here to help,” and urges SAIA members and Councils to reach out for collaboration or information. sa For more on the SAIA Fall Protection Council, visit its dedicated website: www.saiaonline.org/fallprotection.

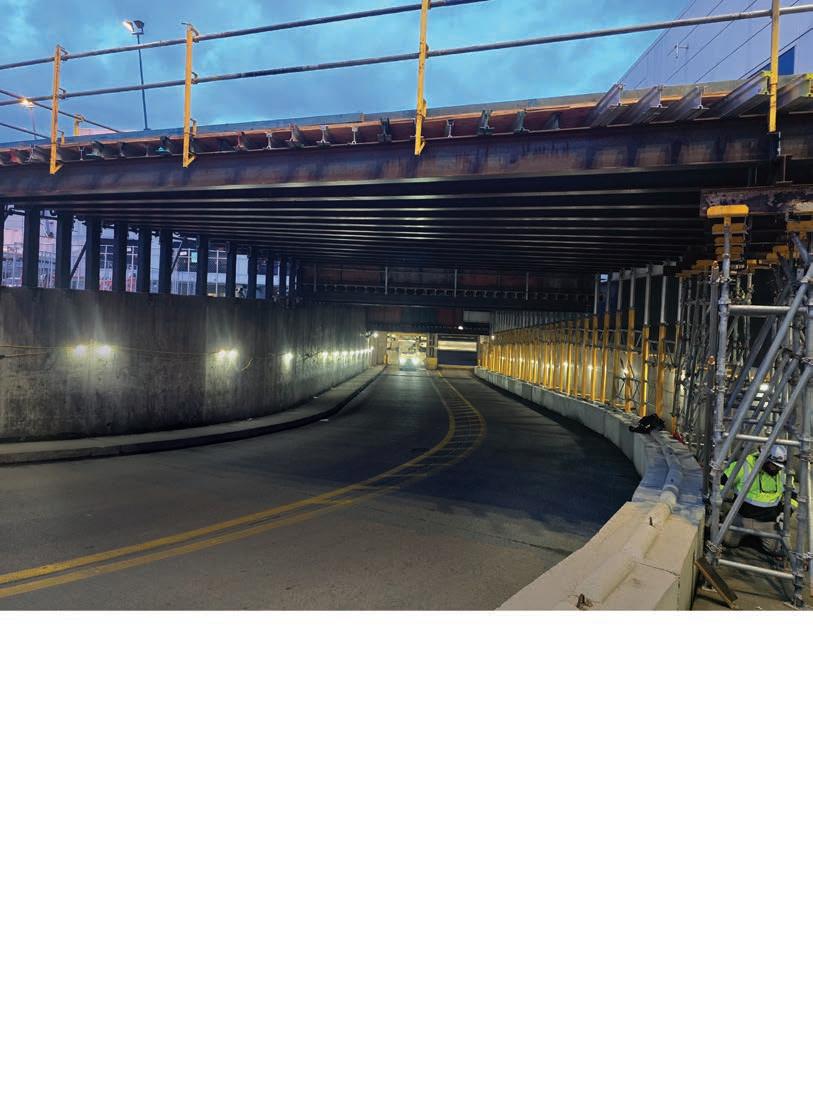

Scaffold Resource won the SAIA’s Supported Scaffold Project of the Year Award for its pivotal role in restoring one of Maryland’s National Treasures. SA reports.

Constructed in 1772, Maryland’s State House is one of our nation’s most historical legislative buildings. Not only is it listed on the National Register of Historic Places as well as being crowed a National Treasure to the State, it is also the oldest U.S. state capitol still being actively utilized for legislative work.

Atop the Annapolis-based structure rests a large, wooden dome that measures 121 feet tall and 40 feet in diameter – and at more than 252 years old, it was due for a bit of TLC.

Enter Scaffold Resource.

Maryland-based access subcontractor, Scaffold Resource was contacted by The Christman Company, alongside the Department of General Services and the Maryland Historical Trust, to create a proposal that would see the company provide engineering, complete access installment and safety assessments throughout project’s duration.

The team at Scaffold Resource thus began its close collaboration and discussion with the general contractor to design and configure the best way to tackle the required work on the building while keeping its historical fabric intact.

“The first step that Scaffold Resource took to ensure the safety of the building, its occupants and the general public was to properly stabilize the structure by installing 16 modular braces within the dome through its hatch to the existing attic,” the company told SA. “This was a vital part of the process as the structure needed to withstand

Scaffolding covered 110,000 vertical square feet of the State House.

■ Collaborative efforts and teaming with general contractor superintendent to ensure proper access and equipment needed to facilitate required work.

■ Provide and install system scaffold at south side of structure by way of stair tower and runway to grant access where lower roof adjoins with base of dome.

■ System scaffold and stair tower were engineered and installed around exterior of dome (128 feet).

■ 16 modular braces installed to stabilize the dome during extensive reconstruction and spread load bearings from scaffold and personnel.

■ Trolley beam system with a leo cable hoist installed along exterior of dome for easy material removal and transfer to and from ground.

■ Debris containment/tan scrim wrap was designed to support wind loads and installed around scaffold to help contain loose materials from blowing into public space.

■ Overhead protection installed at stair tower location and integrated within design to accommodate safety of staff utilizing the access.

TYPE OF CONSTRUCTION

Historic renovation/stone removal access

SIZE OF PROJECT

110,000 square feet of exterior vertical work

CONTRACT VALUE

$771,000

CALENDAR

LENGTH OF PROJECT 10 months

PROJECT COMPLETION April 2022

PERCENTAGE OF WORK

SELF-PERFORMED 100%

the scaffold load, the various crews and materials, and any disturbance from the weather that could cause movement and shifting of the scaffolding.”

Scaffold Resource employed a crew of 10 OSHA-30-certified trained scaffold erectors to install industrial systems scaffold. Access from ground to roof, 10 level work decks to access each section of the dome, a Beta Max Maxial hoist and scrim were added to the scaffold. In order to such, the company had to build a 61-foot-tall access scaffold stair tower at the south side of the building up to the structure’s roof with approximately 14 linear feet of integrated overhead protection at the base.

Following the install, a scaffold runway from the stair tower across the lower roof to the base of dome at 42 linear feet was incorporated to accommodate the flow of work from ground to structure. Lastly, the dome access required precision, engineering, and site investigations before erecting a scaffolding system with stair tower access measuring 128 feet tall and encompassing an area 40 feet in diameter. The stair tower was to be “stepped in” as required by design to allow trades a flush access point to the dome façade at each deck level.

In total, Scaffold Resource provided about

Scaffold Resource faced many uphill battles during its time working on the Maryland State House dome rehabilitation. “These challenges were faced and overcome, making this the perfect project to submit and showcase our expertise in the construction industry,” the company said.

A few of the challenges:

■ Tight lay down area for materials led our team to build a delivery ramp across sidewalks and landscape to designated parking area for delivery trucks.

■ The Maryland State House remained opened and functional (including tours) during the restoration process, leading crews to work meticulously to resolve real-time access limitations and frequent work stoppages.

■ The scaffold team followed behind the millwork subcontractors to install tie-ins as each window was removed to ensure the historic fabric of the structure was not disturbed as no penetration to the façade was permissible.

■ Due to the historic nature of the building special measures were taken when anchoring and tying off the scaffold stair tower and dome system. Many days were spent restructuring the work decks as the job progressed to take into account the changing sequence of trades accessing the equipment.

110,000 square feet of scaffolding on the project.

The close relationship between the various tradesmen, the GC and Scaffold Resource was “imperative when it came to delivery and scheduling of the materials utilizing the Beta Maxial Hoist our crew installed,” Scaffold Resource said. “This system moved vertically along the scaffold to carry material up and down safely while the designated subcontractor utilized the stair tower.”

The engineering and planning that went into the installation had to consider the various weights of the materials being transferred and the impact it would have on the structure.