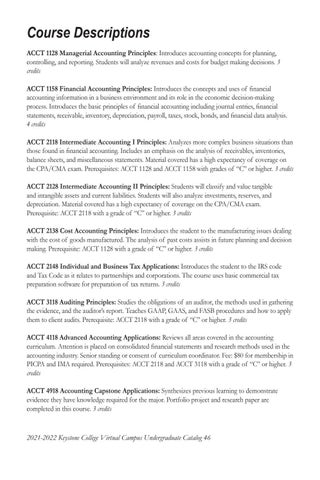

Course Descriptions ACCT 1128 Managerial Accounting Principles: Introduces accounting concepts for planning, controlling, and reporting. Students will analyze revenues and costs for budget making decisions. 3 credits ACCT 1158 Financial Accounting Principles: Introduces the concepts and uses of financial accounting information in a business environment and its role in the economic decision-making process. Introduces the basic principles of financial accounting including journal entries, financial statements, receivable, inventory, depreciation, payroll, taxes, stock, bonds, and financial data analysis. 4 credits ACCT 2118 Intermediate Accounting I Principles: Analyzes more complex business situations than those found in financial accounting. Includes an emphasis on the analysis of receivables, inventories, balance sheets, and miscellaneous statements. Material covered has a high expectancy of coverage on the CPA/CMA exam. Prerequisites: ACCT 1128 and ACCT 1158 with grades of “C” or higher. 3 credits ACCT 2128 Intermediate Accounting II Principles: Students will classify and value tangible and intangible assets and current liabilities. Students will also analyze investments, reserves, and depreciation. Material covered has a high expectancy of coverage on the CPA/CMA exam. Prerequisite: ACCT 2118 with a grade of “C” or higher. 3 credits ACCT 2138 Cost Accounting Principles: Introduces the student to the manufacturing issues dealing with the cost of goods manufactured. The analysis of past costs assists in future planning and decision making. Prerequisite: ACCT 1128 with a grade of “C” or higher. 3 credits ACCT 2148 Individual and Business Tax Applications: Introduces the student to the IRS code and Tax Code as it relates to partnerships and corporations. The course uses basic commercial tax preparation software for preparation of tax returns. 3 credits ACCT 3118 Auditing Principles: Studies the obligations of an auditor, the methods used in gathering the evidence, and the auditor’s report. Teaches GAAP, GAAS, and FASB procedures and how to apply them to client audits. Prerequisite: ACCT 2118 with a grade of “C” or higher. 3 credits ACCT 4118 Advanced Accounting Applications: Reviews all areas covered in the accounting curriculum. Attention is placed on consolidated financial statements and research methods used in the accounting industry. Senior standing or consent of curriculum coordinator. Fee: $80 for membership in PICPA and IMA required. Prerequisites: ACCT 2118 and ACCT 3118 with a grade of “C” or higher. 3 credits ACCT 4918 Accounting Capstone Applications: Synthesizes previous learning to demonstrate evidence they have knowledge required for the major. Portfolio project and research paper are completed in this course. 3 credits

2021-2022 Keystone College Virtual Campus Undergraduate Catalog 46