HOW THE

Sector SPDRs allow you to invest in pieces of the S&P 500. Like Communication Services. While adding diversification and reducing single stock risk. These ETFs combine the diversification of a mutual fund and the tracking of an index with transparency and liquidity.

COMMUNICATION SERVICES SECTOR SPDR ETF TOP 10 HOLDINGS *

*Components and weightings as of 3/31/25. Please see website for daily updates. Holdings subject to change.

An investor should consider investment objectives, risks, charges and expenses carefully before investing. To obtain a prospectus, which contains this and other information, call 1-866-SECTOR-ETF or visit www.sectorspdrs.com. Read the prospectus carefully before investing.

The S&P 500, SPDRs , and Select Sector SPDRs are registered trademarks of Standard & Poor’s Financial Services LLC. and have been licensed for use. The stocks included in each Select Sector Index were selected by the compilation agent. Their composition and weighting can be expected to di er to that in any similar indexes that are published by S&P. The S&P 500 Index is an unmanaged index of 500 common stocks that is generally considered representative of the U.S. stock market. The index is heavily weighted toward stocks with large market capitalizations and represents approximately two-thirds of the total market value of all domestic common stocks. Investors cannot invest directly in an index.

The S&P 500 Index figures do not reflect any fees, expenses or taxes. Ordinary brokerage commissions apply. ETFs are considered transparent because their portfolio holdings are disclosed daily. Liquidity is characterized by a high level of trading activity. Select Sector SPDRs are subject to risks similar to those of stocks, including those regarding short-selling and margin account maintenance. All ETFs are subject to risk, including possible loss of principal. Funds focusing on a single sector generally experience greater volatility. Diversification does not eliminate the risk of experiencing investment losses.

ALPS Portfolio Solutions Distributor, Inc., a registered broker-dealer, is distributor for the Select Sector SPDR Trust.

He remains the Pied Piper of investors – the doyen of doyens when it comes to building wealth. The average American may not know much about underlying securities or split shares, but they sure know of Warren Buffett. His name is shorthand for smart, long-term investing.

If we had a dollar for every time an advisor quoted the Oracle of Omaha, we’d be rich, although not rich enough to buy class A shares of Berkshire Hathaway, which recently reached a record high of $809,350 apiece.

The fact those shares dropped only around 5 percent after his surprise announcement of his plan to retire as CEO at the end of the year is testament to the robust conglomerate he built – and that he’ll remain as chairman as a stillsharp 94-year-old. For such a notoriously un ashy guy, the announcement was the ultimate mic drop, waiting until his nal comments at the annual shareholder meeting and without even telling his successor, Greg Abel.

It was a remarkable end to a remarkable six decades, and the numbers are staggering. Berkshire shares have increased 5,502,284 percent from 1965 through 2024, compared to the broad S&P 500, which has risen 39,054 percent during that same period. This year has been

yet another example of outperformance versus the S&P, with Berkshire rising nearly 19 percent.

Berkshire is worth almost $1.2 trillion, made up of businesses in insurance, railroad, retail, manufacturing, and energy. Famously, it has large stakes in iconic American brands including McDonald’s, the CocaCola Company, and Dairy Queen, three companies that give insight into the man himself and his attitude to money.

Conclusions? He likes consistency over surprises, sticks to what he likes, doesn’t waste a dime, and has a sweet tooth. But, rather than sacri cial dedication, there is no hint that this is anything other than who he is – a man with an unusual obsession for reading nancial statements, a supernatural memory, and an unparalleled ability to pick good companies.

“He likes consistency over surprises, sticks to what he likes, doesn’t waste a dime, and has a sweet tooth”

According to reports – and there are many out there – he drinks ve cans of Coca-Cola a day, loves snacks and ice cream, and is a stranger to the gym. As shown in the HBO documentary Becoming Warren Buffett, he gets a McDonald’s breakfast every day on the way to the of ce, with the exact change and with his choice of sandwich dependent on the previous day’s market performance. Now worth somewhere north of $160 billion, he still lives in the house he bought in 1958 for $31,500.

Over the years, Buffett has also been the source of endless nuggets of wisdom, along with his right-hand man, the late Charlie Munger. To kick off this issue, InvestmentNews salutes the career of one of the best investors there ever was and, perhaps ttingly at this time in history, leaves you with this Buffett quote: “It’s never paid to bet against America. We come through things, but it’s not always a smooth ride.”

Michael Kitces, Ben Henry-Moreland

SALES

Chief Revenue Of cer: Dane Taylor dane.taylor@keymedia.com

VP – Global Sales (Wealth): Abhiram Prabhu abhiram.prabhu@keymedia.com

Business Development Manager: Catherine Reale catherine.reale@keymedia.com

Lead - Ful llment Team: Cole Dizon Ful llment Coordinators: Cyrus Arroyo, Pauline Talosig

PRODUCTION

VP – Production: Monica Lalisan

Lead Production Editor: Roslyn Meredith

Production Editor: Christina Jelinek

Production Coordinators: Kat Guzman, Loiza Razon Designer: Joenel Salvador Art Director: Marla Morelos

Head of Event Marketing: Oliver McCourt

Awards Director: Jessica Duce

Conference Production Manager: Jesse Friedl Conference Producers: Ian Ferguson, Matthew Seely

Marketing Coordinators: Princess Capili, Ara Briones

Event Coordinators: Jed Manalili, Honey Gonzaga, Joshua Esteves, Ann Tayao, Lindsey MacRae, Penny Mungal

Team Leader – Event Design: Sheila San Miguel

MARKETING & RESEARCH

Global Director: Claire Preen

Marketing and Operations Director: Danica Mendoza

Managing Editor – Special Reports: Chris Sweeney

VP – Marketing Services: Lauren Counce

Marketing Services Manager: Nicole Chantharaj

Marketing Activation Manager: Rissa De Leon

Project Manager: Kristyn Dougall

CORPORATE

President: Tim Duce

Director, People and Culture: Julia Bookallil

CIO: Terry Szames CEO: Mike Shipley

COO: George Walmsley

KM Business Information US, Inc. 3190 S Vaughn Way, Suite 550 Aurora, CO 80014

InvestmentNews is part of an international family of B2B publications, websites, and events for the nance and insurance industries

INSURANCE BUSINESS AMERICA cathy.masek@keymedia.com

INSURANCE BUSINESS AUSTRALIA sophie.knight@keymedia.com

INSURANCE BUSINESS CANADA elijah.hoffman@keymedia.com

INSURANCE BUSINESS UK gemma.powell@keymedia.com

BENEFITS & PENSIONS MONITOR WEALTH PROFESSIONAL CANADA abhiram.prabhu@keymedia.com

With 37 percent of RIA advisors set to retire in the next decade, the need for succession planning is in uencing more decisions to join consolidators.

With both institutional and everyday investors moving away from mutual funds toward the ETF structure – chalk it up to their lower expense ratios, transparency, exibility, and tax ef ciency – active ETFs are expected to grow from $856 billion in 2024 to an $11 trillion space by the end of 2035.

of RIA advisors value succession planning services from a consolidator

of RIAs consider succession planning or exit strategies when joining a large RIA platform or aggregator

Source: Deloitte Center for Financial Services, 2025 Financial Services Industry Predictions

While expense ratios of individual mutual funds may vary, investors have experienced signi cantly lower average costs – on both a simple and asset-weighted basis – since the mid-90s, according to data from the Investment Company Institute.

of RIAs are not sure what their plan is for when they have to retire

When asked what animates their philanthropic donations, both pre-retirees and investors in retirement shared the same top motivations. Apart from the desire to make a difference, donors to charities and nonpro ts want to give back to something bigger than themselves and help solve a problem close to their hearts.

in RIA assets will be in play in the next 10 years advisors predicted to

Source: The Cerulli Report – US RIA Marketplace 2024

Source: Fidelity Charitable, Charitable Living and the New Retirement, September 2024

The giant broker-dealer network and Jim Nagengast, the former CEO of one of its biggest firms, are duking it out in public over compensation

BY BRUCE KELLY

Earning big-time pay – and then fighting over it – go together like steak and eggs on Wall Street.

Financial advisors frequently skirmish with their broker-dealers or registered investment advisors about compensation. Just think about recent lawsuits former Morgan Stanley brokers have brought against their old firm that center on who –the firm or the advisor – controls valuable deferredcompensation-plan cash.

What’s unusual in fights over money is for a senior executive, in this case a former veteran CEO, to take the dispute public. Wall Street prefers to keep such contretemps private and behind closed doors.

But not former Securities America Inc. chief executive Jim Nagengast. In April, he sued Osaic Inc., the brand name for the brokerage firm network that bought Securities America in 2020 when he was in charge.

Nagengast claims that Osaic and Artemis Holdings are in breach of contract due to the private sale of partnership units of the business to the company’s management and employees last September.

After that sale, Osaic allegedly has not paid him the full amount he is owed, and he is seeking

“A party to an agreement such as this is always going to expect fair compensation”

LOUIS TAMBARO, INDUSTRY ATTORNEY

an unknown amount of damages, according to the complaint, which was filed in April in federal court in Delaware.

The lawsuit was originally filed under seal and was later released but in a highly redacted form, which means many of the specific details

The best methods for giving to charity change over time with fluctuations in the market, the economy, and tax rules

BY GREGG GREENBERG

From tossing spare change into a red Salvation Army bucket at Christmas to donating millions of dollars’ worth of appreciated stock into a donor-advised fund at the height of a tech boom, charitable giving never goes out of style.

It’s always fashionable to dig into one’s pockets to give to a worthy cause. And the deeper the digging, the better too.

That said, the ideal methods for giving to charity do change over time, with fluctuations in the market, the economy, and tax rules. Much like Ebenezer Scrooge himself, the best ways to maximize donations during Christmases present and future do evolve.

Before being haunted by a poor charitable choice from the past, there are things to be done – and not just at Christmas time.

One of the most effective giving strategies advisors are sharing with clients right now − and especially clients with low-basis, highly appreciated, concentrated stock positions − is the charitable remainder trust (CRT).

As many tech founders, executives, and early-stage investors consider liquidity or exit events, they’re also seeking tax-efficient ways to support causes they care about. Mike Kurz, director of programs at the Investments & Wealth Institute and CEO of OverShare Advice and Planning, for one, sees CRTs offering a triple benefit: an immediate capital gains deferral, a prospective charitable deduction, and a stable income stream back to the client – while ultimately benefiting a charity with a lump sum down the road.

“The alignment between financial efficiency and philanthropic intent is what makes it so compelling in today’s environment,” Kurz says.

Elsewhere, John Nersesian, head of advisor education at PIMCO, says clients are being increasingly receptive to using qualified charitable distributions (QCDs) to effect charitable giving and to satisfy their required minimum distributions (RMDs) while avoiding an increase in their taxable income. The concept is available to clients above the age of 70½ and is currently capped at $108,000 per year.

An emerging strategy that’s gaining traction, according to Kurz, involves leveraging Section 1202 of the Internal Revenue Code, which allows for the

“The alignment between financial efficiency and philanthropic intent is what makes [CRTs] so compelling in today’s environment”

MIKE KURZ, INVESTMENTS & WEALTH INSTITUTE

exclusion of up to 100 percent of capital gains on the sale of qualified small business stock (QSBS) held for more than five years. For clients facing a significant liquidity event such as a startup exit, he says this provision can dramatically reduce or eliminate federal capital gains taxes.

“Founders should be thinking today about how to get significant tax breaks with Section 1202 that would allow the owners to potentially avoid capital gains taxes on the sale of their business, allowing them to fund

Individuals: Account for the largest share of total giving, at 67%

Foundations: Contributed 19% of total giving

Bequests: Provided 8% of total giving

Corporations: Represent the smallest source of giving at 6%, but are the fastest growing, with a 14.3% growth rate over five years

Source: Giving USA 2024 report

greater philanthropic endeavors,” Kurz says.

Finally, Nick Cherney, head of innovation at Janus Henderson Investors, offers a, well, innovative way for investors to give back. It’s called the Brighter Future Project, and it gives away 50 percent of the firm’s management fee from its government money market fund to support the American Cancer Society (ACS). The idea behind the program is to offer clients competitive yields on their cash at competitive fees and, in so doing, create long-term sustainable support for ACS, the leading organization in the world seeking to end cancer.

“It’s a pretty simple idea, really, but we are absolutely thrilled to be able to partner with clients and make it clear that our purpose as a company, investing in a brighter future together, is about helping to deliver superior financial outcomes, but also about people leading long, healthy, and rewarding lives,” Cherney says.

The most common misstep seen among advisors is approaching charitable planning too late in the conversation, or using it only as a tax tool.

“When philanthropy is siloed from the broader wealth management process, advisors miss the chance to align it with estate planning, retirement income, personal values, and legacy goals,” Kurz says.

In Kurz’s view, advisors need to navigate a client’s or family’s “cognitive dissonance” when their actions don’t align with their values. When advisors lead these alignment conversations, clients tend to light up when philanthropy is framed as a core pillar of their financial planning strategies, according to Kurz.

“It deepens trust, opens intergenerational dialogue, and often leads to more sophisticated planning opportunities,” Kurz says.

Thomas Decker, wealth advisor (CPWA) at Cerity Partners, says a common mistake he often sees advisors make when integrating philanthropy into financial plans is assuming that a client should give − or wants to give − based purely on the financials. While charitable giving can provide potential tax and estate planning benefits, it should ultimately stem

As RIA valuations rise, advisory rms are outgrowing next-generation buyers, a potentially perilous blind spot for business owners

BY JEFF BENJAMIN

Among all the challenges and responsibilities facing owners of nancial advisory rms, succession planning stands out as perhaps the biggest blind spot for the registered investment advisory industry.

According to Cerulli Associates, inside the more than 18,000 independent advisory rms serving investors across the country, nearly 40 percent of advisors are expected to retire over the next 10 years, and at least a third of those rms are operating without formal succession plans.

“So many advisors are focused on the business and they’re not planning for their own retirement,” says Stephen Caruso, associate director at Cerulli. “If they’ve been very successful, they see no reason to hang up spurs, so they are delaying succession planning.”

The success of the nancial planning industry over the past several years is a key factor behind the lack of succession planning among rm owners, according to David DeVoe, owner of the investment banking and consulting rm DeVoe & Co.

“As recently as four years ago, 40 percent of advisors said the next-generation advisors could afford to buy out the founders, but as of last year that percentage is down to 20 percent,” DeVoe says. “The state of succession planning is very bad, and planners have not been very good at planning for themselves.”

In essence, as markets climb and more investors turn to nancial advisors for help, the valuations of advisory rms move in stride. Couple that with the growing appeal of the RIA space among private equity investors, and you have a situation where fewer nextgeneration advisors can afford to buy out the retiring founders.

“The valuations keep going up while advisors are procrastinating on creating succession plans,” says DeVoe, who estimates that less than half of advisory rms have formal succession plans in place “and many of those are pretty imsy.” DeVoe says there is a “natural bias to sell internally” versus selling to outside investors, but that the rising valuations, combined with the complexity of succession planning, often lead to founders doing little or nothing.

“There are about 30 key components to developing a succession plan,” he says. “Advisors start going down the path and get overwhelmed and push it down the road.”

Charles Failla, founder and chief executive of Sovereign Financial Group, has a continuity plan in place “in case I get hit by a bus,” but he’s still working on his succession plan.

Failla is 56 and plans to stay involved in the nearly $1 billion advisory rm for another couple of decades, but he wants to start gradually moving away from daily business operations within two years. “I believe the best days are ahead for Sovereign, and I want to be a part of that,” he says.

Failla’s plan is to offer ownership stakes to key employees, which includes an initial down payment followed by payments coming from the pro ts.

“An effective approach involves bringing in the intended successor early and providing them with comprehensive training on all aspects of the business”

ANDREE MOHR, INTEGRATED PARTNERS

“We wanted a culture that felt like family, a partnership built for the future. We found that in IFG.”

“I retain 80 percent of the debt as a note that I will finance,” he says.

For example, the employee would put 20 percent down on a 10 percent ownership stake, entitling the buyer to 10 percent of the profits that will be used to service the debt.

“I’m paying myself back with my own profits because I want that next-generation person to work like they own the business,” he says.

Tim Holsworth, who retired in December as president of AHP Financial, started his succession plan a decade ago by hiring an advisor who could take over the business. The structure of the buyout has Holsworth earning income from the firm for the next 12 years.

“The key is giving the next-generation advisor all the tools and trust him,” Holsworth says. “Put him in a position where he knows the clients and the systems. Don’t hold back; tell him everything and show him everything.”

Andree Mohr, president of Integrated Partners, gives the nod toward the strategy employed by Holsworth.

“An effective approach involves bringing in the intended successor early and providing them with comprehensive training on all aspects of the business,” Mohr says.“This ensures they are well prepared to take over both client relationships and business operations.”

Martine Lellis, principal at Mercer Advisors, says one of the challenges when it comes to

“With the industry graying and client expectations growing, the window for thoughtful succession planning is shrinking. But done right, succession isn’t the end of the story – it’s the beginning of the next chapter”

MARTINE LELLIS, MERCER ADVISORS

creating succession plans is that they are not onesize-fits-all.

“Succession planning touches every part of the business: client outcomes, employee retention, growth trajectory, and even regulatory responsibility,” she says. “With the industry graying and client expectations growing, the window for thoughtful succession planning is shrinking. But done right, succession isn’t the end of the story – it’s the beginning of the next chapter.”

Greg Cornick, executive vice president of advice and wealth management at Osaic, focuses on five tips for creating a succession plan.

“Succession planning is not a quick process, so start early,” he says. “Ideally, advisors are thinking about succession planning 5−10 years before retirement or exit.”

Next, he advises ensuring business and cultural alignment. “From a business perspective, creating a formal, written succession plan is essential,” Cornick says. “Cultural alignment is just as important.”

Make sure to document everything. “Successful succession plans almost always have documented systems and processes that ensure the new advisor can easily navigate the transition,” he says.

And don’t be afraid to seek help. “From valuation and benchmarking to matchmaking and deal structuring, it’s not something you should navigate alone,” Cornick adds.

Finally, let the plan be a living document. “Succession planning is a dynamic process, not a one-time event,” he says. “The plan should be reviewed regularly to ensure it stays aligned with an evolving wealth management landscape, the firm’s goals, and the health of the business.”

IT’S LONG BEEN acknowledged that the US dominates global wealth management, but even seasoned nancial professionals may be taken aback by the sheer disparity. The American market is more than eight times the size of its closest rival, the UK, and its footprint overshadows the combined wealth management assets of every other country in the global top 10.

This supremacy shows no signs of abating. According to Natixis Investment Managers, over the past ve years, assets under management grew by 20 percent globally. The wealth management

rm’s insight also revealed that the “advisory industry was responsible for the stewardship of an estimated $159 trillion globally in 2024, and assets are estimated to grow another 10 percent by the end of the decade to reach $178 trillion in 2029.”

The rising stakes mean that only the best wealth managers will survive. In an industry where scale and service increasingly dictate survival, only the most forward-thinking rms are expected to endure. Wealth management teams who don’t adapt face being driven out of business.

PwC’s Next in Asset and Wealth Management

2025 report strikes a somber note for laggards. It reveals that more than one-third (34 percent) of wealth management CEOs believe that an average competitor will cease to exist within three years unless they change their business model.

Also featured in PwC’s analysis is what they refer to as the pursuit of “a winner takes all mentality” where rms bring assets under one roof and use partnerships to be a next-generation rm. Technology and bespoke offerings are fast becoming not just differentiators but prerequisites.

The report states, “We project that business model pressures will winnow the ranks of AWM rms, with 16 percent of rms being bought or shuttered by 2027 – twice the rate of turnover historically.”

In this climate, InvestmentNews’ 5-Star Wealth Management Teams 2025 stand out as exemplars of innovation and client-centric service. Firms were nominated by investors nationwide, with the winners honored after careful review of their industry impact and understanding of client needs, along with performance based on AUM and team results. Quite simply, these rms represent the industry’s forward edge.

Gone are the days when wealth management meant little more than portfolio performance. In its place is a model built on integrated service and proactive planning, which is in full swing at Wealth Distribution Strategies (WDS). The Wisconsin-based rm has specialist advisors in tax, health insurance, and Medicare to reduce the impact of medical expenses and income taxes in retirement.

“With the Affordable Care Act, someone could be retiring before 65, so how do they bridge the gap until Medicare?,” asks president Jeff Lamb. “That’s where our Medicare specialist gets involved and how we keep income below a certain level, so we can qualify for much more affordable health insurance.”

Lamb explains how WDS deploys its array of specialists to bene t its clients. He says, “So much of retirement income planning revolves around taxes and those medical expenses. It doesn’t matter how much money you have – it’s how much you actually get to keep after those big expenses.”

Being regarded as family by clients is the norm for Blease Financial Services. The rm adopts a

deliberate cadence to serve clients – built on trust rather than transaction.

“They can see how much we care,” explains president Drew Blease.

Of its client base, 98 percent have all their money with them, underlining the level of trust. This exists because the business has the capability to shoulder the load and serve its clients’ needs.

If someone comes to Blease Financial Services and wants to split their investments, the rm offers a choice. Blease says, “I tell them, in six months to a year, we’re going to want you to pick, and no hard feelings if you pick the other rm. We really feel they’ll be better served by one excellent rm and by that, they’ll see we’re obviously con dent in our ability.”

This statement of intentions is so powerful that rarely do investors not commit fully. Another hallmark of the Tucson, AZ, rm is it doesn’t engage for the sake of it. Many wealth managers boast of having multiple check-ins during the year, apart from during the rst six months for a new client. But for Blease, this can be super cial.

“After that, it’ll be once a year or if something comes up, but we’re not going to promise to babysit clients as there’s no reason to. What I found is that it becomes that the client is almost micromanaging the advisor, but they’re hiring us to do a job, so let us do it,” he explains.

That’s not to say clients aren’t in the loop, as they’re provided with statements and con rmation notices of any trades, along with encouragement to contact the team when needed.

“You’re not just paying us 50 basis points to manage your investments,” says Noah Hutkin of 57th Street Wealth Advisors, echoing the trend in the sector for the standout rms to go above and beyond being wealth managers.

“We act as a conduit to your accountant,” he adds. “We consult on your 401(k) or any pension plans to make sure that what you’re doing there is married to what we’re doing here in your brokerage accounts. We consult on estate planning and we run nancial plans.”

While “holistic” is on-trend jargon across the industry, it can be misleading.

Hutkin says, “It’s holistic but for many other rms, it’s add-on charges or it’s holistic with just the money that they have at that rm. For us, whatever the management fee is, you get our full range of services, full stop.”

Also bringing a comprehensive outlook to the table is Longevity Capital Management, which doesn’t just look at the portfolios it manages but at the lives it impacts.

Longevity sees itself not as an investment- rst but a planning- rst rm. Before any investment decisions are made, a meticulous, holistic planning process explores every angle of a client’s nancial life – from tax exposure to healthcare risks, estate goals to income sequencing.

Terri McGray says, “Our clients don’t need a salesman. They need a strategist, a steward, and an advocate.”

Longevity guides clients up to retirement, preparing them for the shift from accumulation to

income. This includes optimizing Social Security timing, minimizing IRMAA-related Medicare costs, planning Roth conversions while taxes are historically low, and making decisions around pension elections, executive bene ts, or business exit strategies. They analyze cash ow sustainability, portfolio readiness, and tax positioning.

This thoroughness is not theoretical. An example is a retired couple in their 70s who owned several appreciated rental properties but found them burdensome to manage and thought that selling them outright would trigger signi cant capital gains taxes.

“We helped them set up several 1031 exchanges into Delaware Statutory Trusts (DSTs), allowing them to defer taxes, eliminate active management, and convert their real estate into diversi ed, passive income-producing investments,” says McGray. “The DSTs provided steady cash ow, institutional-grade property exposure, and estate simpli cation – all while aligning with their broader retirement income and tax planning goals.”

Another case involved a widow with concerns about sustaining her income without jeopardizing the nest egg she and her late husband built, which had $3 million in total assets.

McGray says, “We structured a blend of dividendpaying blue-chip stocks, municipal bonds, and a laddered portfolio of income-oriented structured notes – with capital protection at maturity. The result was a monthly income that meets her needs, downside buffers, and peace of mind that she’s not dependent on the stock market to write her paycheck.”

Over the past year, volatility has swept through markets, testing the mettle of even the most seasoned nancial advisors. For wealth management rms, the turbulence has proved not just a challenge but a crucible, forcing reassessment and adaptation.

Female-owned Longevity provides a different outlook. McGray says, “We bring a female lens to wealth management, and that makes us better advisors for everyone, not just women. But for the women we serve, especially those who’ve been overlooked or underserved by traditional rms, it makes all the difference.”

Over the recent period of volatility, McGray and her team have seen a meaningful shift.

“High-net-worth individuals who once worked with large advisory rms or private banks are now seeking deeper, more personal guidance because they’re tired of one-dimensional service that stops at asset allocation,” she says.

Something similar is also experienced at DBS when the workload rises during uncertainty. One reason is that the team is trying to take advantage of the situation with Roth conversions or rebalancing portfolios.

Lamb says, “The other part is it’s very rewarding to show clients, after the fact when things come back up again, why we stayed with it and how our strategies are paying off.”

No matter what is thrown at them, the DBS team

• meaningful contributions to clients and the nancial industry

• deep understanding of client needs

• notable impact achieved over the past 12 months

InvestmentNews honored the top wealth management rms in America that excelled in growing and retaining clients.

Investors across the country were invited to nominate their advisory teams – de ned as groups consisting of four or more advisors – and highlight the standout services that distinguished these teams. Key areas of focus included:

• standout performance based on AUM and team results

The IN team carefully reviewed all nominations, evaluating how each advisory team made a signi cant difference for their clients and within the broader nancial services industry.

“One of the biggest pieces of advice we find ourselves giving our clients is you need to figure out how to spend more of your money, because this thing is just going to keep snowballing”

JEFF LAMB, WEALTH DISTRIBUTION STRATEGIES

is con dent that they can conjure up a solution. Lamb adds that uncertainty doesn’t paralyze WDS clients; it galvanizes the rm’s advisors.

“There’s always a smart place in the portfolio to pull from. Our strategies aren’t necessarily built to maximize returns over the next month or year; it’s designed to help them maximize their situation over the long haul. Uncertainty creates a lot of opportunities, and we’ll take advantage of them when

“We have the mindset of looking at everything we do with fresh eyes and not having tunnel vision. I really encourage that with our team”

DREW BLEASE, BLEASE FINANCIAL SERVICES

“We don’t measure performance against each other internally, but our mantra here is we outperform the market by one percent net of fees, so if the market is up 10 percent, we want to be up 11 percent net of fees”

NOAH HUTKIN, 57TH STREET WEALTH ADVISORS

they do.”

Over at 57th Street Wealth Advisors, they also understand how to navigate choppy markets. Their philosophy is grounded in long-term reassurance. The rm, which has an approximate $250,000 newaccount minimum, relies on its history and breadth of skills.

Hutkin says, “In these unprecedented times, it’s a nice feeling as some clients obviously are more nervous than others. We have clients on both sides of the aisle, as I’m sure every advisor does, but it’s nice that we know we’re helping people and giving them peace of mind.”

Proving how innovative they are, 57th Street

Wealth Advisors tells clients to keep between sixand 12-months cash in the bank and send them anything above that to put in treasuries at no risk.

“Traditional savings and checking accounts don’t earn any interest. We want them to get a return on their cash and to do it for as low of a charge as possible,” says Hutkin.

Despite the turmoil, there has been no major discontent at Blease Financial Services due to the longevity of its clients’ tenure.

“I’d say we probably have got on the high end, maybe 20 phone calls,” says Blease. “Most of our clients have been with us a while and gone through the ups and downs.”

To further enhance transparency during uncertain times, Blease is preparing to launch a new initiative: periodic video updates from the rm’s leadership, offering clients an inside look at how their advisors are interpreting the current economic landscape.

TEAM DYNAMICS

While performance metrics and AUM are important and often dominate headlines, what sets the 5-Star Wealth Management Teams 2025 apart may be less quantifiable – but no less critical. Across the board,

these firms champion a collaborative culture over hierarchical rigidity, drawing strength not from a single figurehead but from the collective.

That ethos runs deep at Blease Financial Services, where the shortest staff tenure is nine years.

“It’s my company and the buck stops with me for good and bad,” says Blease. “But we are collaborative and there’s mutual respect. It’s knowing that not one team member is any more important than another, including myself.”

He is proud to have created a positive camaraderie that is particularly important in a small of ce.

At 57th Street Wealth Advisors, being highly responsive is part of the everyday. Accessibility isn’t a promise – it’s a practice.

“We don’t let clients sit and stew with a question,” says Hutkin. “My mailbox has two voicemails in it from the last eight months and that goes for the team. We answer the phone.”

It’s also a highly collaborative culture as the whole team meets twice a day (pre-market and after the close) to discuss matters such as outstanding tasks, market conditions, client messaging, investment decisions and analysis, marketing

initiatives, and best practices.

“Whether it’s a tech executive in Seattle, a retired couple in Florida, or a business owner in the Midwest, we bring strategic precision and fiduciary care. Clients don’t want gimmicks – they want clarity, control, and results that support their real-life goals”

TERRI MCGRAY, LONGEVITY CAPITAL MANAGEMENT

Keeping it simple is fundamental at Longevity Capital Management, whose typical clientele have between $2 million and $15 million in investable assets. The rm translates complexity into clarity by combining high-level technical and computing power expertise with emotional intelligence.

McGray says, “We don’t overwhelm clients with jargon or noise. We break down decisions into clear, actionable steps that align with the life they want to live – each back- and forward-tested using sophisticated software.”

The rm’s approach extends to treating each client as an individual, not as a pro t center. All plans are tailored with precision.

“It’s aligned with an investment strategy to support it ef ciently, tax-aware, and risk-adjusted to the client’s speci c phase of life,” explains McGray.“We are feeonly duciaries by design. That means no commissions, no hidden agendas, and no product pushing.”

WDS is known for its array of specialists, which the rm employs to focus on education efforts. For the last 19 years, the rm has run a popular retirement planning course at the University of Wisconsin, equipping soon-to-retire professionals (targeted at those between the ages of 50 and 65) with the tools to make con dent decisions.

Yet for Lamb, teaching goes far beyond the lecture hall.

“I remind clients that a lot of people make me look a lot better than I would be by myself. There’s plenty of collaboration that’s happening behind the scenes and credit has to be shared,” he says. “It starts with our support staff, our client relationship managers and client support coordinators, all the way up to the nancial advisors.”

Longevity Capital Management

Phone: 805 917 6771

Email: info@longevitycapitalmgmt.com

Website: longevitycapitalmgmt.com

Integrated Equity Management

Phone: 952 854 5544

Email: iem@integratedequity.net

Website: integratedequity.net

Wealth Distribution Strategies LLC

Phone: 608 848 2389

Email: jlamb@wdstrategies.com

Website: wdstrategies.com

57th Street Wealth Advisors – LPL Financial

Academy Advisors Wealth Management – Ameriprise Financial

Adalan Private Wealth – Concurrent Investment Advisors

Adams Wealth Partners – Raymond James

AGP Wealth Advisors – Ameriprise Financial

AIRE Advisors

Alignment Wealth Management

Angeles Wealth Management

Aquest Wealth Strategies – LPL Financial

Arcadia Capital – Raymond James

ARIS Team – Evoke Advisors

Armbruster Capital Management

Armstrong Dixon

Associated Investor Services

BFSG Wealth Management – BFSG LLC

Blankinship & Foster

Blease Financial Services

Bogart Wealth

Bryn Mawr Trust – Hershey Team – Bryn Mawr Trust

Buf ngton Mohr McNeal – Buf ngton Mohr McNeal RIA

Carter Byford Wojtek Group – Raymond James

Crane Private Wealth Group – Raymond James

Denver Wealth Management Inc.

DiDonato Wealth Advisors – Ameriprise Financial

Eidlin-Kilmer & Associates – Merrill Lynch

Fiduciary Financial Group

Fortitude Family Of ce

Four Corners Wealth – Wells Fargo Advisors Financial Network

Fulton Team – Wealth Enhancement Group

Gatto, Gatto, Hughes Group – Merrill Lynch

GRANTvest Financial Group

Hahn Team – Neuberger Berman Private Wealth

Harmony Private Wealth – Steward Partners

Heritage Financial Consultants

High Bluff Private Wealth – LPL Financial

Hou Team – Evoke Advisors

InConcert Napa Valley Team – Wealth Enhancement Group

Kayne Anderson Rudnick Wealth Advisors

KPB Team – Evoke Advisors

Landmark Wealth Management LLC

Laurel Wealth Planning

LiveWell Capital – Northwestern Mutual

McLeland, Malone, Mallison and Associates – Merrill Lynch

Nottingham Advisors DB360 – Nottingham Advisors Asset Management

Nucleus Team – California Financial Advisors

BY GREGG GREENBERG

SOMEBODY NEEDS to solve the succession crisis unfolding in the financial advisory industry.

VestGen founder Josh Gerry believes it might as well be him.

In the coming decade, 105,887 financial advisors plan to retire, or about 37.4 percent of industry headcount and 41.4 percent of total assets, according to the 2024 Cerulli US Advisor Metrics report. That said, more than one-quarter (26 percent) of advisors who see themselves retiring within the next 10 years are unsure of their retirement plans, with this rate being highest among advisors who are affiliated with independent RIA firms (30 percent), the study disclosed.

Independent RIAs face a greater number of concerns associated with succession and retirement planning than affiliated wealth managers. The Cerulli study said that the most acute of those challenges are finding a qualified buyer for their practice (86 percent), structuring deal terms (63 percent), and valuing their practice accurately (53 percent).

And that’s not all the study revealed. Almost half (48 percent) of financial advisors are interested in acquiring a practice. Nearly onethird of advisors (28 percent) are open to an acquisition but not actively searching for one, while 19 percent are actively seeking acquisition opportunities, according to the study.

Enter Gerry, who for almost 20 years in his early career served as a wholesaler for financial advisors across the country, building relationships that went beyond business. Put plainly, he grew up with these people. They became close friends, almost like family members to him.

As time went on, however, Gerry’s clients started passing away. Some unexpectedly. And what made it even more painful for him was to learn that many of them hadn’t properly planned for succession, a business oversight that heavily impacted their own families.

“I studied the dilemma in the industry and became resolutely committed to solving for the wave of retiring advisors who might not have a clear succession plan. That’s why I started VestGen last year. It’s the solution for all the retiring advisors out there, and a way to bring the next generation of leaders into the industry,” Gerry says.

VestGen’s mission, according to Gerry, is to become the premier destination for advisors looking toward succession. His stated goal is to protect their legacies and the futures they care about.

“Our retiring advisors can trust VestGen’s NextGen advisors to care for their clients and loved ones well into the future,” he says.

To achieve this promise, Gerry launched VestGen late last year, recruiting 13 experienced advisors across 10 practices with assets totaling almost $5 billion.

As for VestGen’s target market, Gerry is eyeing small to mid-size wealth managers in the $100–$500 million AUM range. And, yes, he is well aware that’s a pond that most of the private equity-backed RIAs are choosing not to fish in, opting instead to roll up billion-dollar-plus advisory practices instead.

Not a problem, says Gerry. There’s plenty of value in the market’s minnows in his opinion.

“At that specific size, you have a successful business. These advisors know they are good at what they do, both as business owners and for their clients. What they also realize is that to get to the next level, there would be quite a bit of heavy lifting from an infrastructure and build-out perspective,” Gerry says.

In other words, Gerry sees it as a “firm-wide investment.”While a lot of these practice owners know that they have the capability to reach the next step, many of them would rather do it together, with other firms, to lighten the load. And especially for retiring advisors who often find it difficult to find trustworthy partners that can acquire or merge them.

“The businesses that these advisors have built are incredibly valuable, so finding someone who is reliable, trustworthy, and has the capacity to acquire or merge them can be a tall order. This is where VestGen comes into play – and executes,” Gerry says.

Starting up a new financial venture is fraught with peril even in a stampeding bull market. One would think that would have given Gerry pause late last year when he decided to press ahead with VestGen during what were clearly the tail ends of the financial and economic cycles, not to mention the start of a new presidential administration.

It’s also pretty safe to say that the first quarter of 2025 has been anything but placid for those involved with the stock market. Such a volatile environment generally causes market participants to sit on their hands. Still, Gerry remains unrelenting.

“Time waits for no one, and advisors need succession resources, regardless of the prevailing market conditions,” Gerry says. He adds that, in some regards, a volatile period of market returns also reminds advisors in the latter stage of their career that it may be a good time to hand the reins off to the next generation of talent.

Furthermore, he does not worry that the market’s recent downturn will throw him off his long-term plans.

“We don’t define ourselves per se by our assets or growth. But, due to the tremendous need for what we offer, we don’t see any limit to what our headcount or AUM size will be in the long run,” Gerry says.

Doubling or quadrulpling the firm’s AUM in less than a year is no easy feat even without the market’s current madness. One would think that would create a lot of unwanted and stifling pressure for even the steadfast enrepreneur.

Not Gerry though. He’s okay with the demands of constructing a brand-new boat, even when the waves are crashing around him.

“I get great enjoyment out of seeing the disparate pieces coming together to form something meaningful and exceptional. It is really fun to see our advisors energized and our staff and teammates driven by a common goal and cause,” Gerry says.

And when he’s not busy building VestGen from the ground up, Gerry enjoys spending time with his wife, Cindy, and their five kids, three of whom are married. He also has a granddaughter, and one on the way.

“We love being involved in our community and church, and getting out for routine bike rides, and jogs. Every day is a gift meant to be lived to its maximum! I live with intentionality and with a recognition that our days are numbered, and that every day is special,” Gerry says.

“Time waits for no one, and advisors need succession resources, regardless of the prevailing market conditions”

UCLA grad

Member of Life Agape, Wheaton Bible, and AE Boards

Former collegiate athlete – track and cross-country

Studying for masters of divinity

33 years of experience in the financial industry

Entrepreneurial love of starting and building great things

Segmentation without specialization is sinking wealth management firms faster than market volatility, says XML Financial Group’s Brett Bernstein, who believes generalists are paying the price

BY CHRIS DAVIS

Wealth management firms are failing because they confuse segmenting clients with specializing in their needs. Without deep expertise – especially for entrepreneurs and family wealth transfers – advisors are making costly mistakes that hurt clients and destabilize firms.

Brett Bernstein, CEO and co-founder of XML Financial Group, speaks from experience. After leaving Merrill Lynch and LPL Financial to build his own RIA, he now leads a firm rooted in team-based planning, deep specialization, and a relentless focus on leadership development.

For Bernstein, true client service requires a shift in mindset: advisors must think like head coaches, guiding not just investments but an entire ecosystem of legal, tax, and business strategies.

“You have to start with having a diverse, educated group of wealth advisors,” Bernstein says. “Not every wealth advisor specializes in the needs of those segments, specifically, let’s say, entrepreneurs and female investors.”

While he doesn’t believe clients should be served only by those who look like them, he stresses that skill alignment is non-negotiable. “You need to have the right skill set and understanding of the needs,” he explains.

Bernstein’s own career path and route to independence reflects that philosophy. “I was liberated. I was free,” Bernstein says of launching XML Financial Group, arguing that first-hand experience as a business owner sharpens an advisor’s value.

That real-world connection, he says, is what too many advisory models lack. Good general advice isn’t enough for entrepreneurs managing both personal and corporate finances. What’s needed is a team-based, collaborative approach.

“I’m the head coach of the football team. The client is the owner. My job is to work with the offensive coordinator, the defensive coordinator, and if we don’t have it in house, we need to make sure that we are looping in the CPA, the tax attorney, the corporate attorney,” Bernstein says.

Without that coordinated expertise, Bernstein warns, advisors risk operating with blinders on. “Otherwise, you’re going to have advisors that only focus on what they see in front of them,” he explains.

He’s equally critical of how many advisors view continuing education – as a box to check, rather than a leadership tool. “Some people might choose to just check the box and take the path of least resistance,” Bernstein says. Staying sharp means engaging deeply with legal experts, attending symposiums, and knowing when to bring in outside teams. “Rather than building it out from scratch, maybe it makes sense to hire a team or acquire a firm in totality,” he explains.

Bernstein also believes the industry too often blurs important client distinctions, particularly among business owners. Being self-employed isn’t the same as being an entrepreneur, and advisors who miss that nuance risk falling short.

“Entrepreneurs are dealing with borrowing money, managing small business loans, riding out the highs and lows,” Bernstein says. It’s a different reality that requires different expertise.

Even within the entrepreneur category, he warns against lumping clients together. “The entrepreneur of a tech startup might be different than someone who started an HVAC company in the Midwest,” he says.

Brett Bernstein, XML Financial Group

“Do you have the advisors, the COIs, or the personal experience to work with them?”

The need for a nuanced approach extends to multigenerational families. Bernstein sees a shift underway, with older generations becoming more open about wealth transfers.

“The more open communications they can have, the better strategies can be created,” he says. Increasingly, families are choosing to gift wealth now rather than waiting for estate plans to trigger distributions. “Why am I waiting to give this money to my children? You’re

all adults… I get the enjoyment of doing that now,” Bernstein says.

At every level – from entrepreneurs to families –Bernstein’s view of the modern advisor comes back to one word: leadership. It’s no longer enough to rely on credentials or traditional planning scripts.

“You can’t become an expert in something overnight,” Bernstein says. “Eight credits of a continuing education course isn’t going to cut it.”

chris.davis@keymedia.com

Asset flows over recent years are evidence of advisors’ love of ETFs, but professionals still see a place for mutual funds in client portfolios

BY JEFF BENJAMIN

From certain perspectives, it might appear as if the debate over mutual funds versus exchange-traded funds is already settled.

At about $20 trillion, the 100-year-old mutual fund industry is still twice the size of the total US ETF footprint. And there are plenty of reasons why mutual funds remain relevant, but the asset-flow patterns over the past several years have been tilting hard in favor of the 32-year-old ETF industry.

According to the Investment Company Institute, ETFs took in $1.1 trillion last year, while mutual funds suffered nearly $350 billion worth of outflows. Of those ETF inflows, $300 billion went into actively managed strategies, once seen as a stronghold category for mutual funds.

This year, through mid-April, the ICI reports $268 billion worth of net outflows from mutual funds and $340 billion worth of ETF inflows. And

that happened with a market declining toward correction territory.

“It’s been a bloodbath for mutual funds,” says Bryan Armour, director of ETF and passive strategies research at Morningstar.

But, even against that backdrop, Armour and others see various silver linings for the mutual fund industry that suggest the debate is a long way from being resolved.

For example, he expects the Securities and Exchange Commission to approve ETF share classes for mutual funds at some point this year.

With amended SEC filings coming from some of the more than 50 fund companies that have already applied for permission to introduce ETF shares classes for actively managed mutual funds, Armour says, “This could be a lifeline for mutual funds.”

Actively managed fixed income is another area where mutual funds continue to hold their own.

“People tend to prefer active managers for bond strategies, so money is still going into bond mutual funds at the same time that it’s flowing into bond ETFs,” says Todd Rosenbluth, head of research at TMX VettaFi.

“Advisors and individual investors generally find the bond market more complex and harder to navigate on their own,” he adds.“Historically, those active bond managers were primarily available in a mutual fund wrapper.”

An ICI breakdown of the past 27 months, through March, shows an uninterrupted streak of monthly outflows from equity mutual funds, while bond mutual funds suffered net outflows during just five of

“Looking ahead, I believe active ETFs are poised to win market share”

JEN WING, GEOWEALTH

those months.

Paul Schatz, president of Heritage Capital, is among the financial advisors who rely on mutual funds for some of their investment allocations.

“In our high-yield bond strategy, mutual funds trade better, trend better, and behave better than ETFs,” he says. “The active bond ETFs are typically invested in the bigger, more liquid bonds that people get in and out of quickly, so that leads to more volatility.”

Schatz, who primarily invests in ETFs and individual securities on the equity side, also uses some

As you work with clients to navigate the current markets, stay grounded in their values and priorities

Your clients rely on you for holistic guidance. Traditional notions around investing and nancial planning are evolving as they seek more tailored solutions that re ect their values, passions, lifestyles, and family dynamics. And the work you’ve been doing together prepares them to weather volatile times like these and stay focused on their long-term goals.

OPINION

GILLIAN HOWELL

We’ve witnessed drastic uctuations in global markets over a short period, and that makes it easy to focus narrowly on things like intraday movements and individual securities, forgetting the humans behind the volatility. It’s important to step back and consider the big picture. While some strategic moves may shift with the market environment, our 70-plus years of experience serving charitably inclined investors has revealed that their values and long-term priorities remain constant – and serve as opportunities to connect with your clients.

As you work with clients on navigating the markets, don’t abandon these all-important components of their nancial plans.

Whether your clients will be passing assets to their heirs and bene ciaries or receiving assets in the coming years, preparation is required. Revisit nancial plans, wills, and estate plans to ensure they re ect your clients’ current priorities, along with their key tax management and philanthropic objectives.

It’s prudent, especially in times of volatility, to revisit risk tolerance with your clients and identify portfolio adjustments that will allow them to take advantage of value investments, harvest losses, and minimize capital gains taxes. If taxes are of particular concern, it might make sense to explore a multidisciplinary tax strategy that includes investment, legal, and philanthropic elements.

As we enter the season for weatherrelated disasters, now is a good time to check in with clients who are in ood zones and areas that are prone to wild res, tornadoes, hurricanes, and other dangerous conditions. Here are a few key questions to consider:

• Have you conducted an insurance review with your clients?

• Are their physical and nancial assets adequately protected?

• Do they want to make charitable contributions in times of urgent need?

Clients dealing with chronic illnesses and short-term ailments – personally or within their extended family units – have special needs and concerns that don’t go away when the market is erratic. Now is the time to reinforce that you understand and support their priorities.

The responsibilities of business owners don’t change when the market is ckle. If anything, they get more complex and layered as the range of consumer responses emerges. Business owners may need additional services from you, such as lending or retirement planning, to help them navigate a period of uncertainty.

“Connecting with clients in dif cult times is one of the most important things an advisor can do”

Those who are considering expansion or succession initiatives that result in acquisitions and transactions will need comprehensive preparation and planning to ensure optimal outcomes. Clients who are thinking about their next chapter may want to discuss how the current environment could impact their nancial plan and their lifestyle in the coming years.

Charitable giving and overall wealth strategy go hand in hand for high-networth clients, so they expect to discuss these topics and that you will manage the intersection between the different parts of their nancial affairs. In a client survey of private foundations and donor-advised fund account holders earlier this year, 21 percent told us they were thinking about

charitable giving as part of their nancial plan, and 22 percent were considering a de ned budget for making gifts to become more effective givers. This is a key opportunity for advisors to add value.

Need typically increases everywhere during periods of nancial duress, making charitable funding and private philanthropy even more critical. Af uent households have many choices about how to make charitable gifts and, especially now, may want your guidance on nding the best solution for their objectives.

Connecting with clients in dif cult times is one of the most important things an advisor can do. It demonstrates that you are with clients through thick and thin, reinforces that you don’t shy away from dif cult conversations, and creates an opening to remind them that you’ve got your eye on their long-term objectives. The chance to support your clients in a tumultuous scal environment may be outside your comfort zone but also presents you with a unique and extraordinary opportunity to establish your value and deepen your relationships. Don’t miss it.

Gillian Howell is the national philanthropy executive and a member of the leadership team at Foundation Source.

BY GREGG GREENBERG

Are your advisory clients afraid that money will ruin their children? If so, you’re not alone.

One of the most common concerns, Jordan McFarland, certified financial planner at SageSpring Wealth Partners, hears from his wealthier clients is that significant wealth could leave their children feeling entitled, lacking the drive or resilience that the parents themselves had to develop.

Along similar lines, James Diver, partner at Procyon Partners, says many of his high-net-worth clients are concerned the significant wealth they have accumulated could give their children a lack of ambition. They worry that, without the proper values about money, they could end up thinking the wealth created is there to replace what they can do, rather than support it.

“I have helped a client who was worried that sudden wealth would negatively affect their child’s own career and success. They wanted them to be accountable and responsible for their own finances before they received significant sums of money in trusts,” Diver says.

SageSpring’s McFarland believes the best approach is to have a joint meeting with the client and their son or daughter to open communication and set expectations. “In most cases, we help by educating clients about their options for passing down wealth, how different account types work, the tax ramifications both today and upon inheritance, and how thoughtful estate planning can offer the level of control they want over their assets,” McFarland says.

For his part, Diver encourages clients to have their children reach out and engage him for financial planning conversations that are tailored to a young investor or mid-career individual.

“I make sure our clients are aware of the information we are sending their children as well so that the information does not just sit in a child’s inbox or folder. For families that want their children to be more involved, I provide

them with frequent educational material and schedule one-on-one Zoom calls to speak to them about their finances,” Diver adds.

Gregg.greenberg@keymedia.com

You deserve a provider with the nancial know-how, superior service, and streamlined experiences that strives to reduce the confusion that complicates retirement planning. With Jackson®, you get expertise you can depend on, and a partner who will help you do right by your clients. That’s clarity for a con dent future.

“With less than 20 percent of advisors actually using AI meeting note tools, there’s a lot of room for growth for both the standalone meeting note tools and built-in options”

economics perspective, Wealthbox seems unlikely to price an “add-on” AI meeting note solution higher than its core CRM price of $75 per user per month, which is already less than what most of the standalone advisor-specific AI notetakers charge.

So it is possible that the standalone AI meeting note providers will see some significant pressure on their pricing, especially if other CRM systems (e.g., Redtail, which parent company Orion has indicated also has its own AI initiatives underway) also

release their own lower-cost built-in AI notetakers.

Ultimately, it’s important to note that with less than 20 percent of advisors using AI meeting note tools, there’s a lot of room for growth for both the standalone meeting note tools and built-in options. But as investment dollars continue to flood into the space – including, in just the last few months, a $20 million funding round for Jump, a $3 million round for Zeplyn, a $2 million round for Mili, and a recently announced $13.8 million round for Zocks – more competition only

increases the pressure on each provider to grow fast enough to emerge as one of the (at most) two or three market leaders that most AdvisorTech categories tend to consolidate toward. As long as the entire category continues to grow rapidly in adoption among advisors, it might feel like there’s room for everybody in the field – but as the overall growth rate levels off in the long term, the existence of AI meeting note tools that live in the software that advisors already use could cause problems for the standalone providers who need to convince advisors to adopt a separate approach.

Ben Henry-Moreland is a senior financial planning nerd at Kitces.com, where he specializes in writing and speaking on financial planning topics including tax, practice management, and technology. He also co-authors the monthly Kitces #AdvisorTech

column. Drawing from his experience as a financial planner and a solo advisory firm owner, Ben is passionate about fulfilling the site’s mission of making financial advisors better and more successful.

Michael Kitces is the chief financial planning nerd at Kitces.com, dedicated to advancing knowledge in financial planning and helping to make financial advisors better and more successful. In addition, he is the head of planning strategy at Focus Partners Wealth, the co-founder of the XY Planning Network, AdvicePay, New Planner Recruiting, fpPathfinder, and FA BeanCounters, the former practitioner editor of the Journal of Financial Planning, the host of the Financial Advisor Success podcast, and the publisher of the popular financial planning industry blog Nerd’s Eye View.

FIDELITY BROKERAGE SERVICES is not taking the loss of its biggest broker-dealer client, Commonwealth Financial Network and its 2,900 financial advisors, lying down.

According to senior industry executives, the giant discount broker-dealer and registered investment advisor custodian is working with RIA clients who already use Fidelity as leverage to

recruit Commonwealth Financial Network reps, who were informed nearly two weeks ago that their firm was being sold to LPL Financial Holdings for $2.7 billion in cash.

With $385 billion in assets, Commonwealth was Fidelity’s biggest client for clearing and custody services. In any brokerage transaction, it’s a fight for assets.

AMERIPRISE FINANCIAL is aggressively courting top advisors from Commonwealth Financial Network in what’s shaping up to be a high-stakes recruiting battle following independent-broker dealer behemoth LPL’s $2.7 billion deal to buy Commonwealth.

A source from Ameriprise, who spoke to InvestmentNews on the condition of anonymity, explained that Ameriprise will offer

up to 125 percent up front of a Commonwealth advisor’s T12 (trailing 12 months) revenue for those producing over $1 million.

Ameriprise aims to land anywhere from 360 to 725 Commonwealth advisors out of the 2,900 transitioning through their sale to LPL, with the source adding that the firm’s realistic expectations are on the lower end.

Latest salvo in Ameriprise – LPL trade war is charge of data breach

THE LONG-RUNNING dispute between LPL Financial Holdings and Ameriprise Financial took a sharp turn in April when LPL revealed that Ameriprise had informed former customers, now with LPL, that their accounts were in danger of being hacked by financial advisors who left Ameriprise years ago. Such data breach notices are

among the most sensitive communications firms can have with clients, as customers are deathly afraid of losing control of their accounts to outside computer hackers.

Ameriprise has targeted LPL in at least four complaints since January 2024, alleging its competitor had unfairly hired its financial advisors.

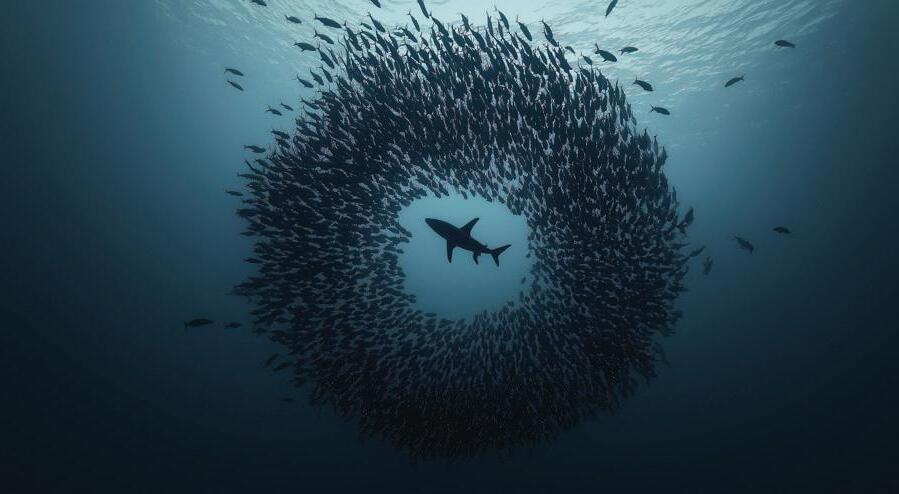

THE 60/40 portfolio is breaking down and alternatives are stepping up. With stocks and bonds increasingly moving in the same direction, investors are being forced to rethink diversification.

There are a number of reasons why alternatives have become more important in wealth management. Chief among them is the breakdown of a long-held assumption: that stocks and bonds move in opposite directions and therefore provide dependable diversification. For years, that inverse relationship propped up the 60/40 portfolio as a reliable choice, explains Ken Shoji, chief investment officer at View Capital Advisors.

For the better part of two decades, stocks and bonds maintained a negative correlation, offering investors a reliable diversification strategy. But that relationship flipped beginning in 2019, with both asset classes increasingly moving in the same direction. In 2019, 2020, 2023, and 2024, stocks and bonds rose in tandem − while in 2022, they both declined. In fact, 2022 marked the worst year for the 60/40 portfolio since 2008, with many variations declining more than

AFTER INVESTMENTNEWS earlier reported that Cetera Financial Group, a giant broker-dealer and registered investment advisor network, was expected to make job cuts to staff, it turned out the layoffs occurred on two days in April and totaled 130 to 150 employees, according to a senior industry executive who spoke

15 percent, according to Forbes

The once-stable balancing act between equities and fixed income has unraveled, leaving traditional diversification strategies struggling to deliver. This convergence has investors searching for solutions beyond the conventional.

“A lot of investors have looked to alternative investments as a way of escaping that strong correlation,” Shoji says.

Increased access and a growing menu of options have helped fuel this shift. Retail investors once barred by high capital requirements and accreditation thresholds now find themselves welcomed into the alternative space by way of interval funds and other accessible structures.

“You can just be a non-accredited investor and invest $5,000, $10,000 in these alternative products,” Shoji says. “That’s cracked open a once-exclusive space.”

And the market is expanding rapidly. Alternative assets under management are projected to reach $24.5 trillion by 2028 − up from $13.7 trillion in 2021, according to Preqin. That surge underscores just how

privately about the matter.

A Cetera spokesperson noted that there was little to no impact on advisor-facing roles regarding the recent small reduction in the firm’s workforce. InvestmentNews reported last year that Cetera had 2,400 employees. That means these cuts are roughly a 5 percent reduction in Cetera’s staff, including administrative and analytics employees.

“View Capital has leaned into specialization, offering exposure to sectors like aircraft leasing, shipping, music royalties, litigation finance, and even Mississippi barges”

KEN SHOJI, VIEW CAPITAL ADVISORS

mainstream alternatives have become for investors looking to diversify beyond traditional asset classes. But alternatives should hardly be novel.

“We’ve been investing in alternatives for over 20 years now, since our founding,” Shoji says. “While we create portfolios incorporating both traditional and alternative investments, we can tap into

Edward Jones joins the crowd to sell more alternative investments

ADD EDWARD JONES , the closely held private partnership with more than 20,000 financial advisors and $2.2 trillion in client assets, to the roll call of firms expanding or revamping

a much broader range of non-traditional investment strategies today. View Capital has leaned into specialization, offering exposure to sectors like aircraft leasing, shipping, music royalties, litigation finance, and even Mississippi barges.”

“We’ve tried to stay ahead of the pack by offering products that are more specialized, more niche,” he explains.

B. RILEY FINANCIAL is facing more scrutiny from authorities, with the company disclosing that the Financial Industry Regulatory Authority is looking into the firm’s wealth management business.

The so-called cause exam by FINRA, Wall Street’s self-regulatory watchdog, was disclosed by B. Riley Wealth Management in a filing submitted to the US Securities

and Exchange Commission. FINRA typically launches such probes based on customer complaints or regulatory tips.

Depending on what’s uncovered, these exams sometimes lead to sanctions or fines, but the existence of a probe doesn’t necessarily mean there’s been any wrongdoing. FINRA declined to comment.

GROUP, one of the last large, privately held broker-dealers to work with independent contractor advisors, last month tapped independent broker-dealer veteran Kevin Keefe as president and chief operating officer. Independent Financial Group, known as IFG, has 550 producing

its list of higher-risk alternative investments for its financial advisors to sell.

Edward Jones said last month it was starting to offer alternative investments to wealthy clients with at least $10 million in assets to invest. LPL Financial and Schwab have also revamped their sales of such investments.

Alternative investments for individual investors or families have exploded in popularity, as institutional investors such as Blackstone and Apollo have aggressively entered the retail market.

A FEDERAL judge in Brooklyn in April approved the release of $400 million in funds to some of the beleaguered investors in GPB Capital Holdings who have not seen a nickel of returns since 2018, when the private placement investment scheme began to unravel.

reps and advisors and generates about $325 million in annual revenue, said Dave Fischer, the firm’s co-founder and chief marketing officer. The firm has been searching for a president for the past few years, ever since Joe Miller stepped down in 2022.

The goal, Fischer added, is to grow the San Diego-based IFG into a firm with $1 billion in annual revenue.

Two top GPB executives in August 2024 were convicted of fraud.

The money manager sold its highrisk private placements through dozens of independent broker-dealers starting in 2013.

But when the funds’ performance lagged, the defendants tried to disguise the shortfall with fraudulent, back-dated documents and paid investor distributions out of investor capital, according to the US Attorney’s Office.

the blog post read in part.

FINRA has had an eye on updating its regulatory approach through remote work for years. In 2024, it announced a three-year pilot to assess the effectiveness of remote inspections, with 741 of its member rms signing up to participate in the rst phase.

While FINRA maintains an ongoing retrospective review program, the new effort re ects a broader, more systematic attempt to identify regulatory friction points that might hinder innovation or operational ef ciency.

Many small and mid-sized wealth rms may also bene t from expanded tools and resources under the compliance support pillar of the initiative.

According to FINRA, its median member rm has just 12 registered

representatives, while the average rm has closer to 200. The implied skew in the numbers underscores the challenge of keeping pace with compliance requirements faced by rms operating on leaner budgets.

“It is much better for us to support effective compliance up front, rather than address problems after the fact,” Cook wrote.

FINRA plans to offer more topicspeci c compliance resources, including tailored events, checklists, and tools aimed at rms with fewer internal compliance resources.

The Wednesday announcement also laid out plans to improve how lessons from exams and investigations are shared with rms, with the goal of helping members benchmark their practices and avoid preventable issues.

A DELAWARE judge has allowed a shareholder lawsuit challenging the $7 billion take-private acquisition of Focus Financial Partners to proceed to limited discovery, preserving a key disclosure claim despite dismissing allegations that the company’s longtime private-equity backer acted as a controlling stockholder.

The suit, led by Anchorage Police & Fire Retirement System and Teamsters Union No. 142 Pension Fund, targets the 2023 transaction in which Focus Financial was acquired by private equity rm Clayton, Dubilier & Rice (CD&R) for $53 per share in cash. The plaintiffs claim the sale process unfairly favored CD&R and failed to disclose material information about a competing bid from Wealth Enhancement Group (WEG), an RIA consolidator that had submitted a higher all-cash offer.

THE SIX-YEAR-LONG legal battle between Commonwealth Financial Network and the Securities and Exchange Commission over the rm’s mutual fund revenuesharing practices took a sharp turn in Commonwealth’s favor when a federal appeals court reversed a

$93 million penalty against the rm. It’s been a tumultuous time for Commonwealth Financial Network, a leading independent broker-dealer that has for decades been regarded as an elite rm and home to advisors who generate among the highest annual revenues in the industry. Its rival LPL Financial Holdings said it was buying Commonwealth for $2.7 billion in cash. The next day, the US Court of Appeals for the First Circuit in Boston vacated the district court’s grant of summary judgment for the SEC and the disgorgement order, sending the case back to lower court for further proceedings consistent with the appeals court’s opinion.

USE OF the title “advisor” or “adviser” without the required certication is now expressly prohibited by the North American Securities Administrators Association’s Conduct Rule.

The changes to NASAA’s Dishonest or Unethical Business Practices of Broker-Dealers and Agents model rule were proposed in November 2024, and members of the association have voted to adopt

the update, which aligns it more closely with the SEC’s Reg BI. NASAA is concerned that the use of advisor/adviser titles can create confusion among investors, who may mistakenly believe that they are receiving duciary advice when that is not the case. The goal is to reduce the “blurring” between broker-dealers and investment advisers, and to provide more clarity to investors.

A NEW YORK appeals court has upheld a nearly $800,000 judgment in favor of a real estate broker who alleged unpaid commissions following his departure from Helmsley Spear, LLC, reinforcing the enforceability of contractual commission rights in broker agreements.

In Bloom v. Helmsley Spear, LLC,

the plaintiffs, led by broker Scott M. Bloom, were awarded $795,480.96 by the Supreme Court, New York County, based on breach-ofcontract claims. Bloom asserted that Helmsley Spear failed to pay him his agreed share of commissions from several transactions, including deals involving 170 Broadway, China Ting, and WeWork.

“Although not guaranteed, a 65-year-old with 35 years of withdrawals is probably okay taking six, six and a half percent”

STEVE CASSADAY, CASSADAY & COMPANY

“Since timing has not been successful in navigating changing market environments, we advise our clients to remain fully invested in a portfolio that is broadly diversi ed across all asset classes and to accept returns that are pretty good most of the time.”