THE E.I.C. PROJECTS P.20 THEME INTRO P.22 CEGAL P.24 FLARE FSE P.25 PROSERV P.26 AMPELMANN P.28 QHSE ABERDEEN P.29 THE IMPULSE GROUP P.30 INTERVENTION RENTALS P.31 BRODIES LLP P.32 LEYTON P.33 ATPI P.42 READ ONLINE AT In this issue... JUNE 2024 - ISSUE 81

ENERGY NEWS

PROJECTS MAP OFFSHORE WIND LEGAL RENEWABLES CONTRACT AWARDS DECOMMISSIONING STATS & ANALYTICS

OFFSHORE WIND

GLOBAL

ENERGY

EVENTS READ ON PAGE 4

A WORD FROM OUR EDITOR

Welcome to the June issue of OGV Energy Magazine! This month we explore the theme of ‘Offshore Wind’

A big thank you to our front cover partner Rotech Subsea. On pages 4-5, Global Business Development Director, Stephen Cochrane, tells us how Rotech Subsea, is enjoying a period of increasing global demand for its trenching and excavation solutions to the renewables, oil & gas, decommissioning and energy sectors.

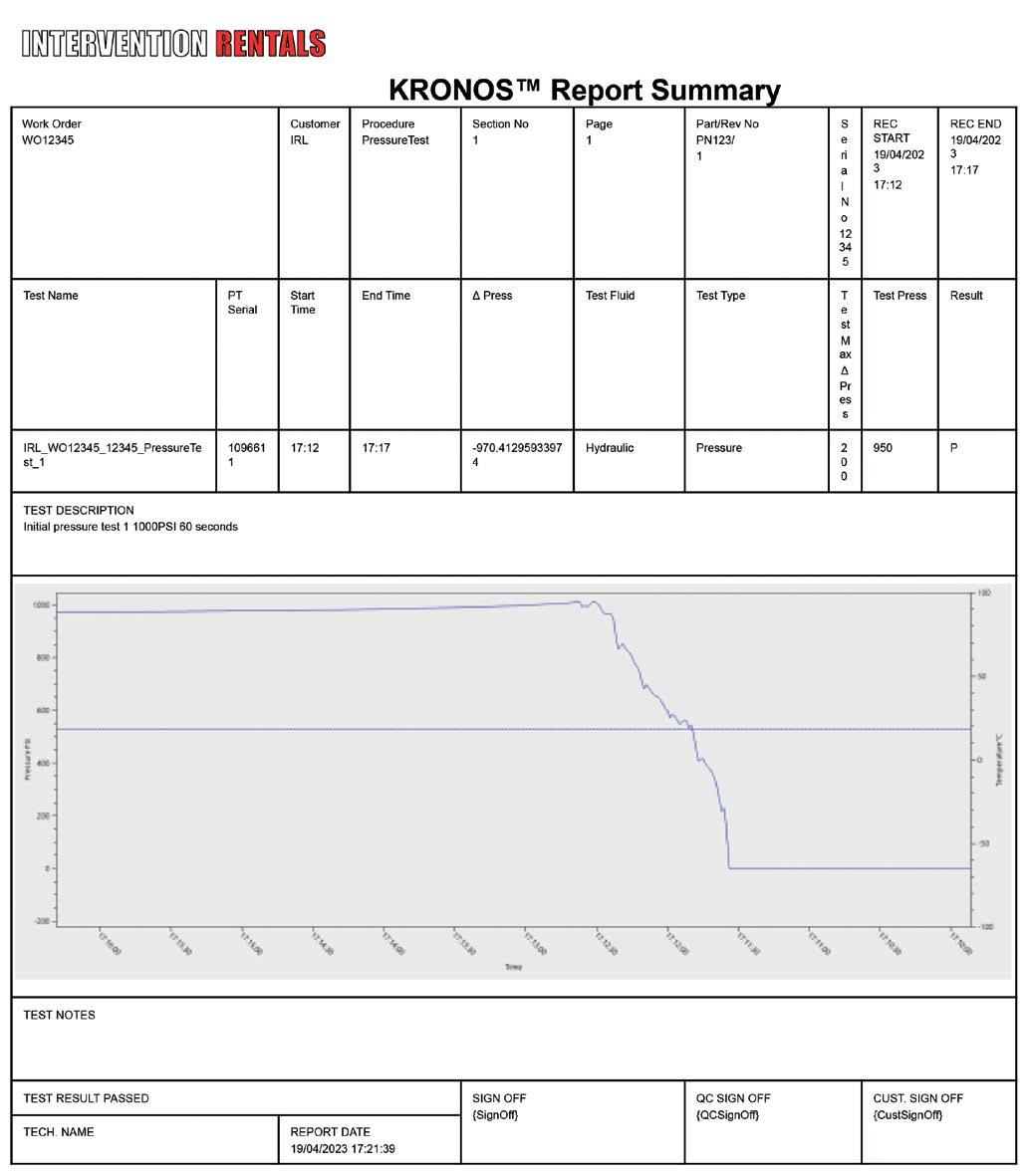

Also in this edition we have contributions from Flare FSE, Cegal, Proserv, QHSE Aberdeen, Intervention Rentals, Ampelmann along with our monthly contributions from Brodies and Leyton. The rest of this month’s magazine as always provides you with a review of the Energy sector in the North Sea, Europe, Middle East and the USA, along with industry analysis and project updates from Westwood Global Energy Group and The EIC.

Warm regards Dan Hyland - Director

3 CONTENTS FOLLOW US @OGVENERGY OGVENERGY @OGVENERGY OGV-ENERGY OGV COMMUNITY NEWS GLOBAL ENERGY NEWS ENERGY PROJECTS MAP MONTHLY THEME LEGAL INNOVATION RENEWABLES CONTRACT AWARDS DECOMMISSIONING STATS & ANALYTICS EVENTS P.08 P.10 P.20 P.22 P.32 P.33 P.34 P.36 P.38 P.40 P.42 4 8 22 26 29 34 36 32 10 VIEW THE OGV MAGAZINE ONLINE AT www.ogv.energy/magazine

25

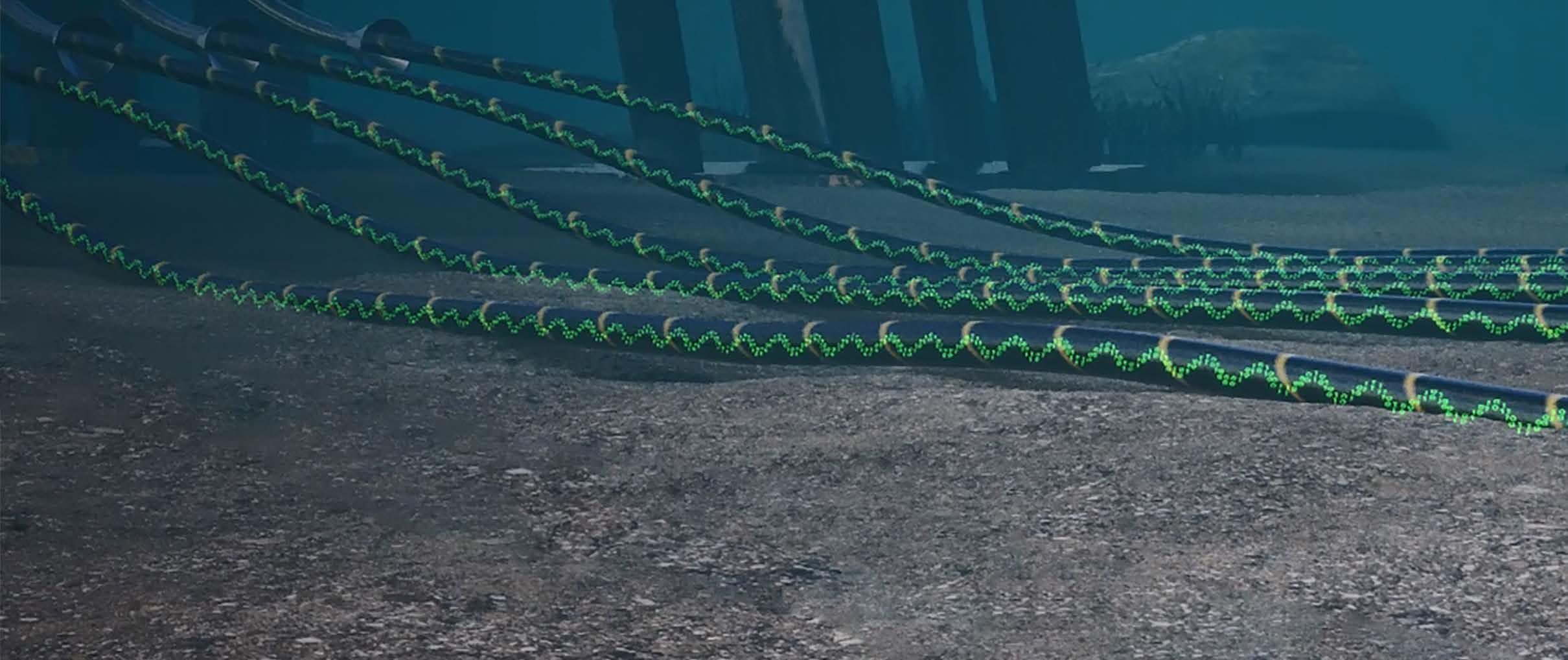

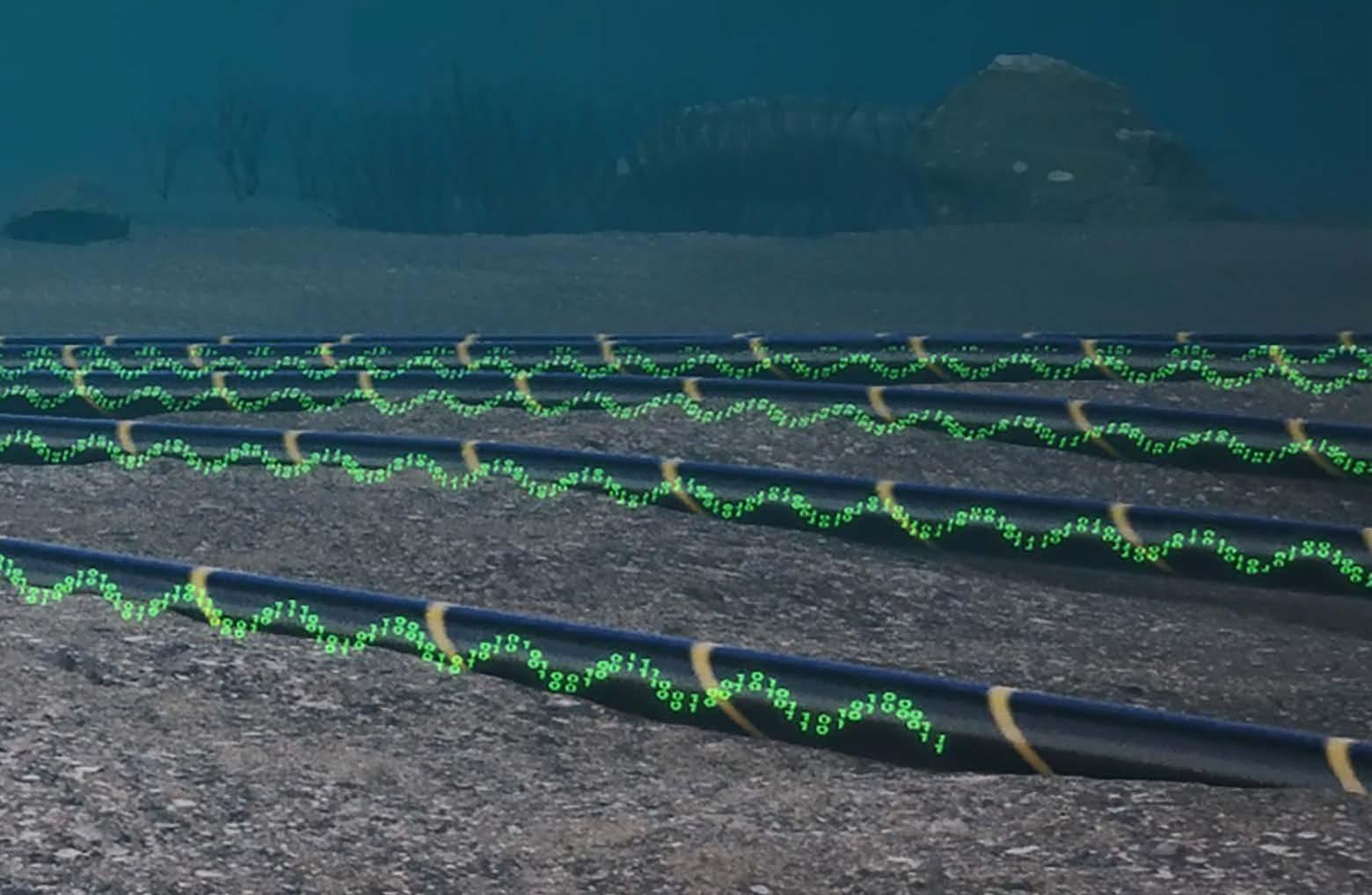

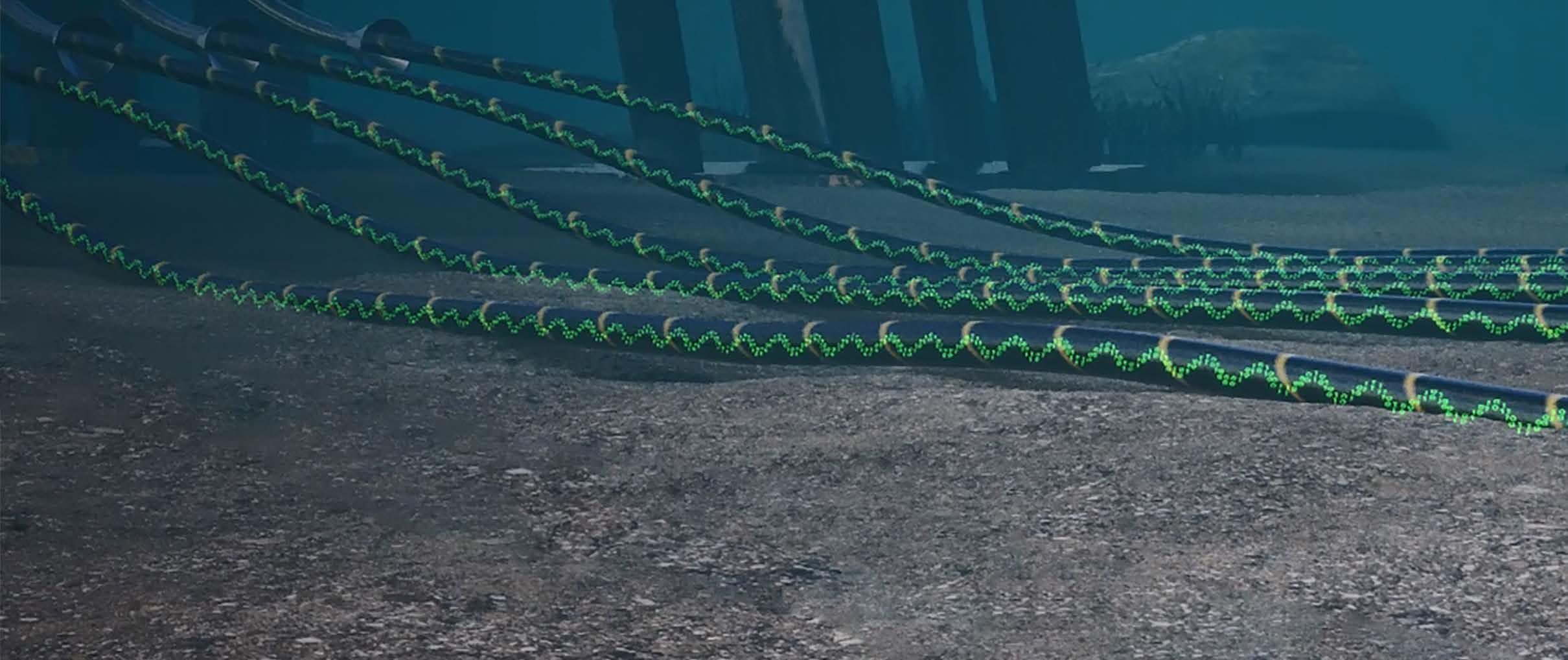

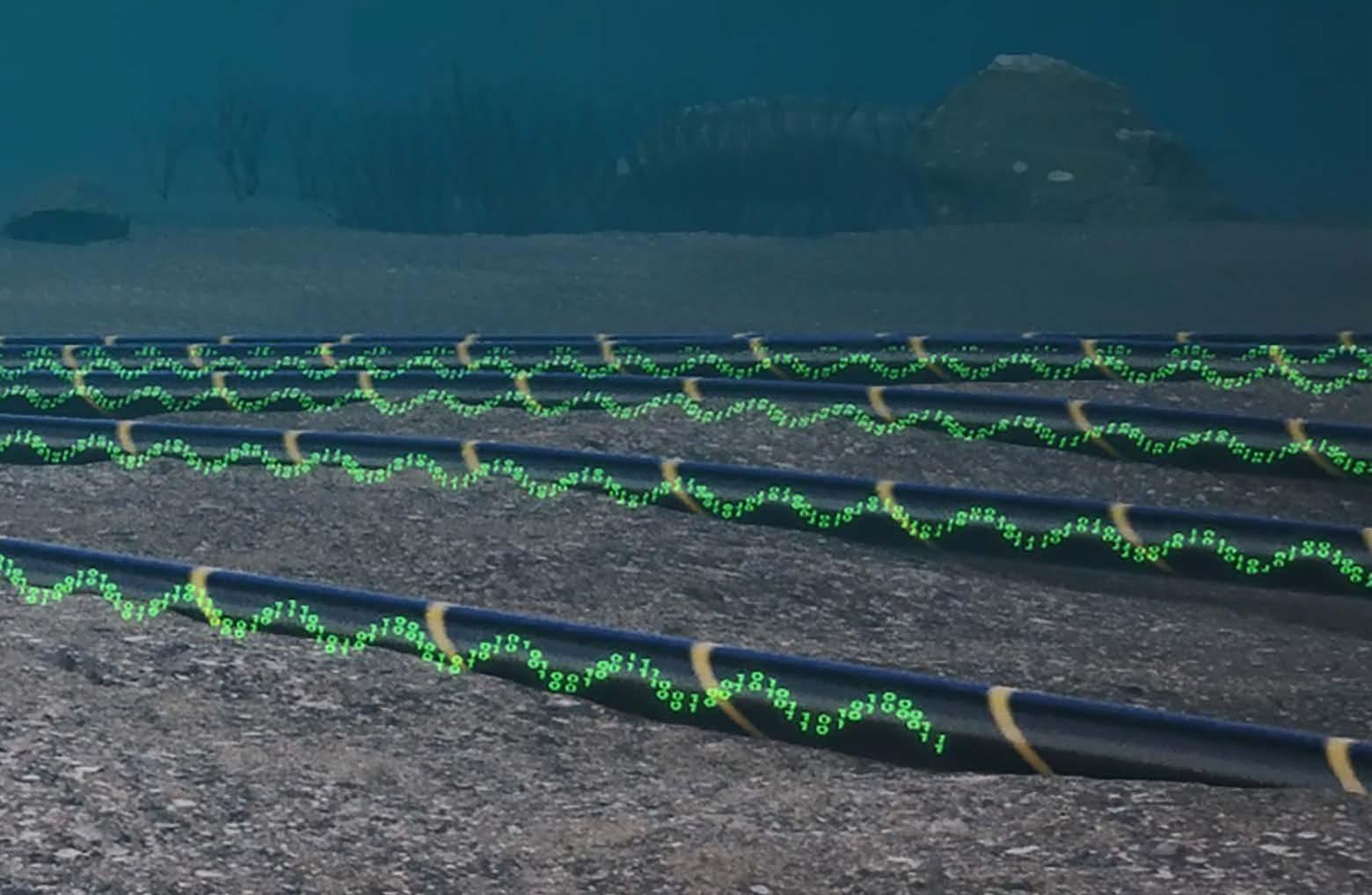

Rotech Subsea steps up for international growth

With sector-leading controlled flow excavation (CFE) and suspended jet trenching technology - and a reputation to match - Rotech Subsea, is enjoying a period of increasing global demand for its trenching and excavation solutions to the renewables, oil & gas, decommissioning and energy sectors.

4 www.ogv.energy I June 2024

Rotech Subsea - whose in-house research, development and engineering team has created a suite of cuttingedge non-contact trenching, excavation and cable/boulder grab & cutting tools - has long been the partner of choice for European operations in pre-commissioning, commissioning and IRM. Increasingly, however, the contractor is experiencing demand from clients across Asia, the Americas, the Middle East and beyond.

“Rotech is growing, and as such we are adding additional talent, and resource to our team,” explains Subsea’s Global Business = Development Director, Stephen Cochrane.

“In April, we took our headcount past the 80 mark, with the addition of Ross Johnston and James Skinner to our business development team. Ross spent over 10 years in strategic business development and marketing roles across the marine, aviation and energy sectors. Ross will lead our BD efforts in Europe and north eastern USA. James spent 4 years as an Analyst at investment bank Piper Sandler within its Energy and Power division, and holds a First Class BA (Hons) degree in Management with Marketing from Robert Gordon University.

In May we welcomed Bill Hare as our business development representative for Australia. Bill has built a solid reputation and extensive professional network in the energy sector over his 16 years as the organiser of AOG Energy, Australia’s largest energy event. During this time Bill was Chair of the AOG Energy Subsea Conference Committee (a collaboration with the Society for Underwater Technology, Subsea Energy Australia and Global Underwater Hub). Bill introduced a Decommissioning Hub in collaboration with the Centre of Decommissioning Australia and established the Future Energy Forum along with the Western Australian Government, major energy operators, project developers and service providers.

Kevin Ingram continues to focus on our business development interests in the UK, Gulf of Mexico and into the Middle East, while Alasdair MacLean has transitioned into Technical Sales Management.”

With a strong order book running well into 2025, Taiwan and the USA have fast become

a happy hunting ground for Rotech. So much so, that after a series of successful cable trenching and seabed levelling campaigns in the offshore wind sector, the company is on track to establish new entities in both countries. Major umbilical post trenching scopes off Australia’s south coast have also confirmed Rotech’s prominence in Oceania.

This global expansion has been precipitated by the evolution of a suite of 32 trenching, excavation, cable grab, cutting and boulder removal tools which have successfully completed over 600 jobs between them. New to the portfolio is the unrivalled ‘RS3’, which was purpose-designed and built for cutting narrow trenches in harder soils and has soil cutting capabilities of 350 kpa. The RS3 can be paired with Rotech’s wide range of tooling, providing hybrid solutions tailored to clients’ needs.

“We have always listened to the market to deliver the most efficient and effective tools” continues, Stephen Cochrane. “Like our other trenching and excavation tools, the RS3 fluidises and excavates soils on the seabed in a controlled manner with powerful jet trenchers allowing us to cut deep and very narrow trenches. The flexibility to have a hybrid tool set up increases productivity.”

2024 is set to be Rotech’s busiest on record, with Cochrane describing the spike in global demand as ‘phenomenal’. After Asia, the Americas - where the company has been awarded several US offshore wind farm cable trenching contracts, as well as servicing clients in the Caribbean - offer another huge opportunity for growth.

Mobilising from Rhode Island since 2022 to support the South Fork and Vinyard wind developments with cable trenching, cable repair and remedial operations, Rotech are putting down roots. With a newly incorporated US entity, Rotech Subsea LLC, based in Providence RI, Rotech can now support clients with equipment based in country.

“Breaking into the Americas with the major subsea cable installation and maintenance operators is a huge coup for us,” adds Cochrane. “The offshore wind sector in North America is in its infancy compared to Europe so we expect to see our activity grow exponentially as the market there gathers pace.”

For more information visit: www.rotech.co.uk 5 COVER FEATURE

James Skinner

Kevin Ingram

Ross Johnston

Ali MacLean

Bill Hare

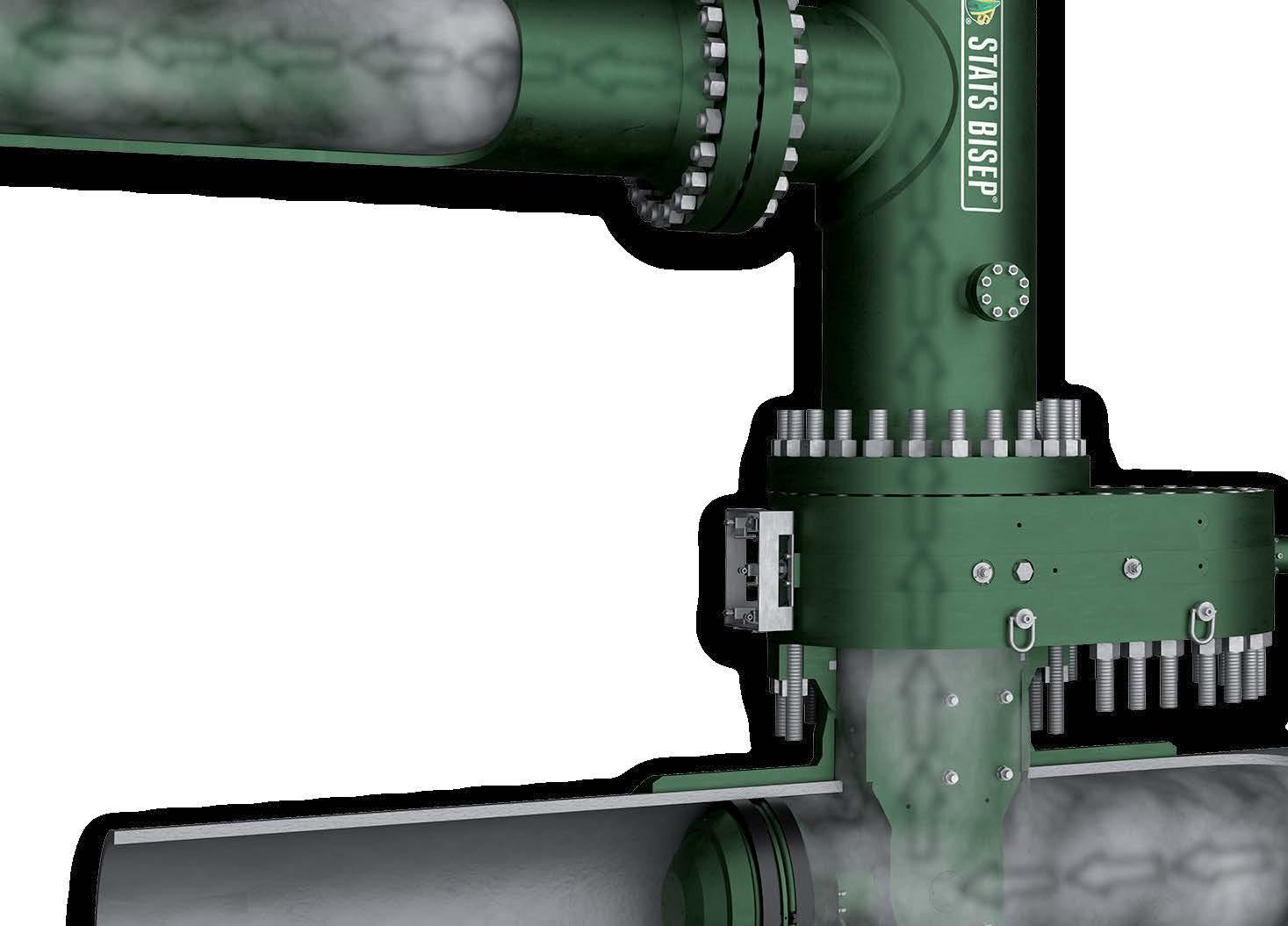

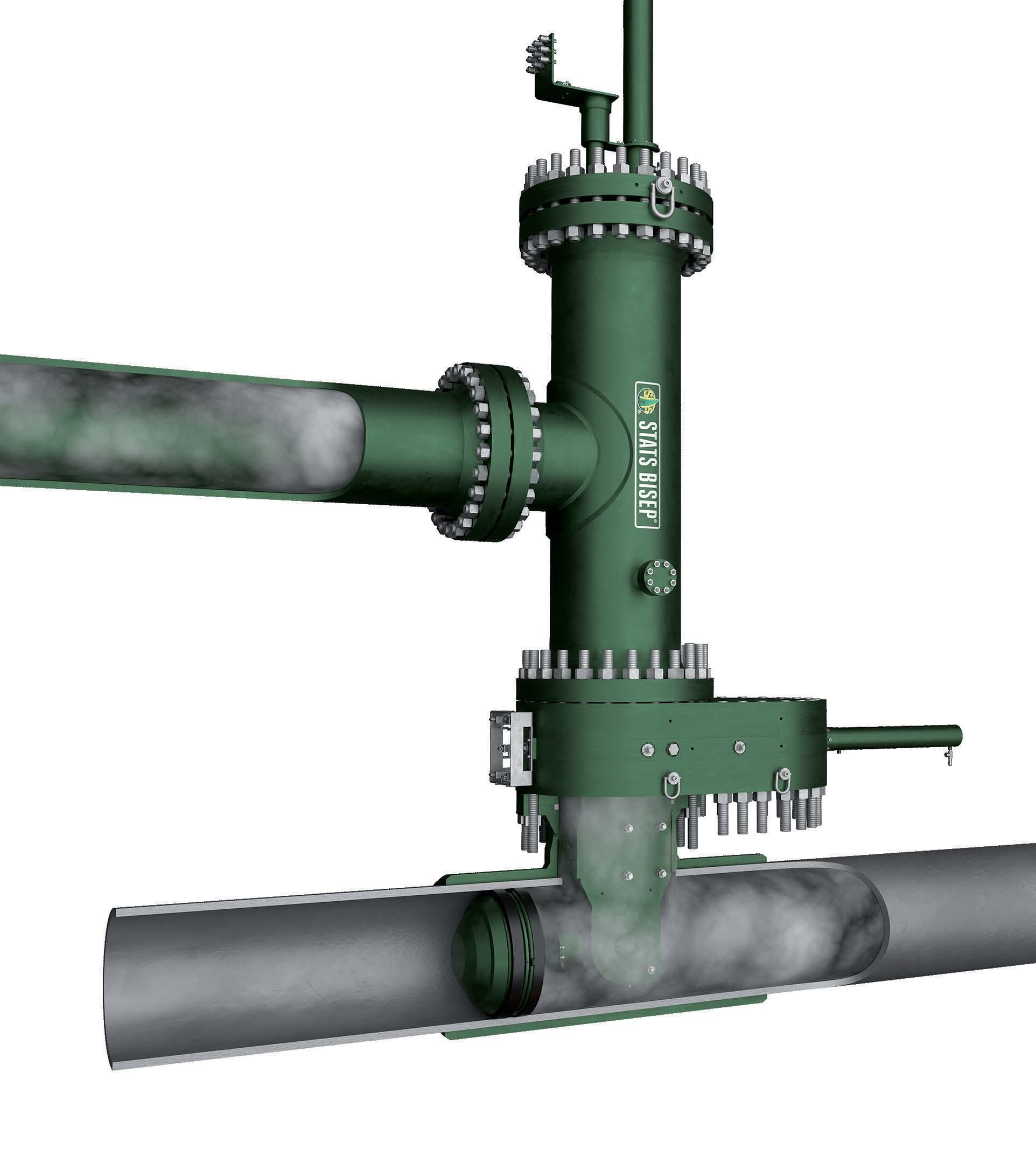

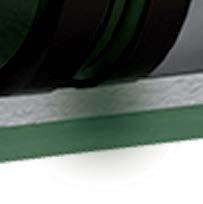

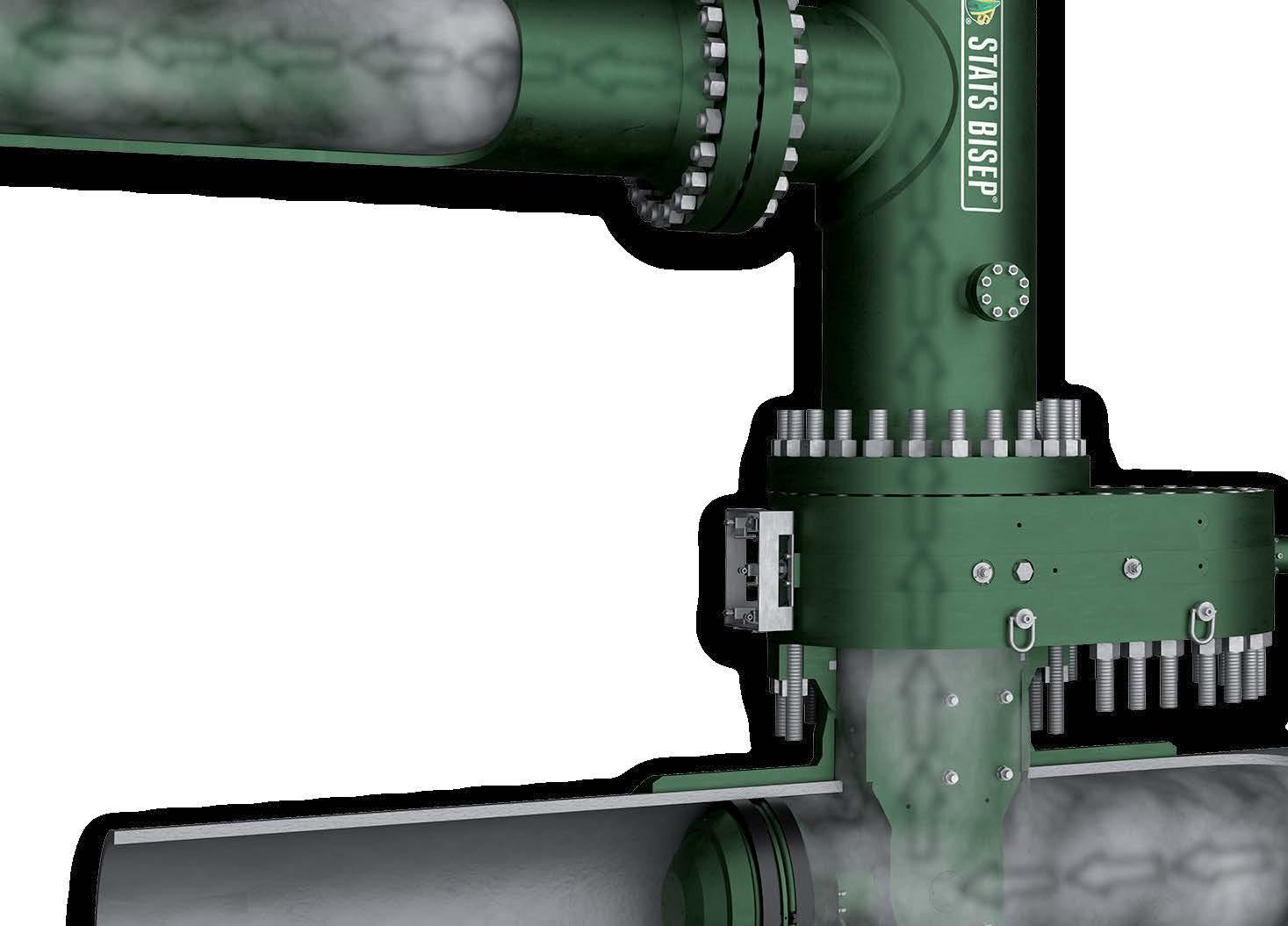

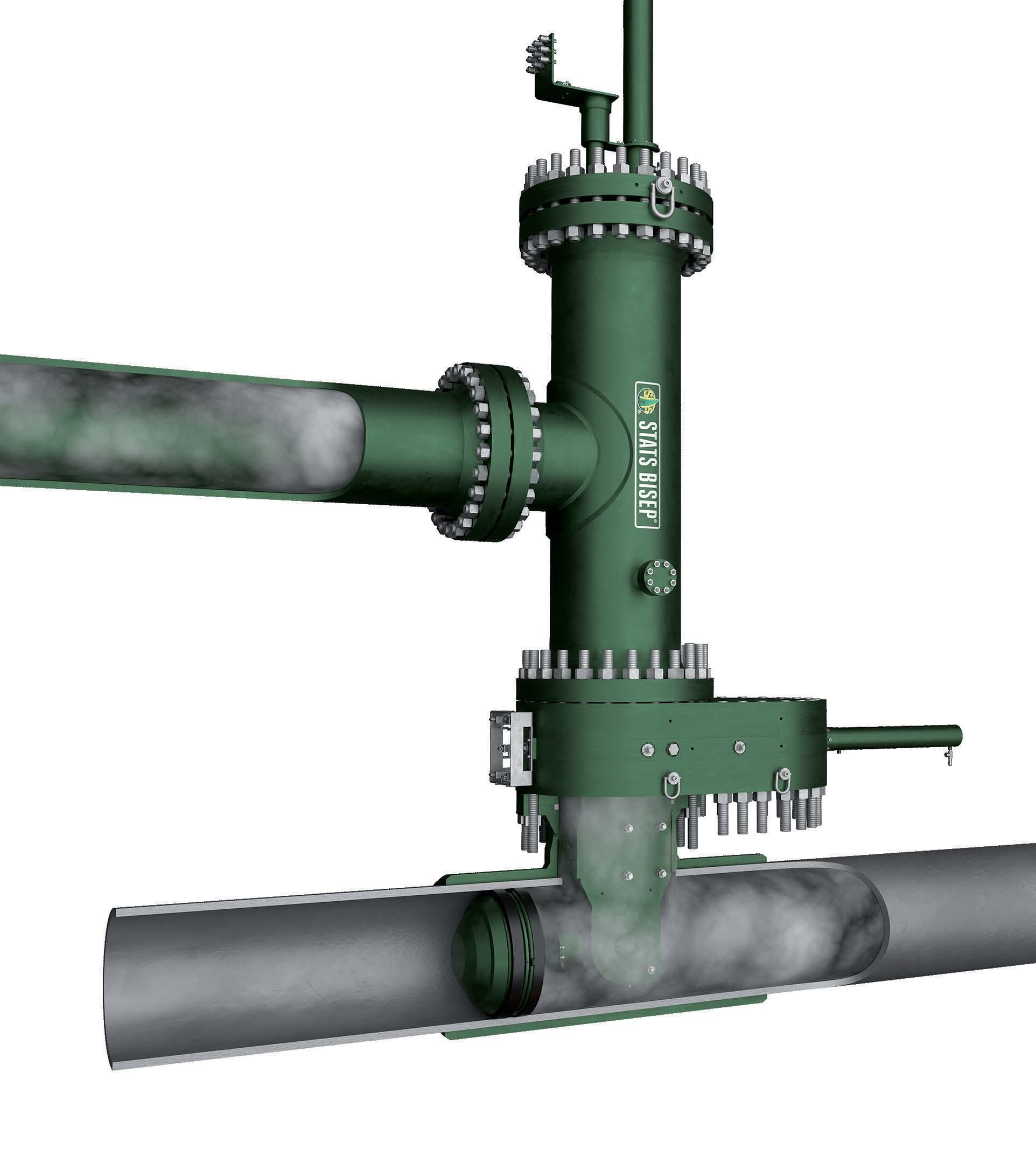

integrated bypass maintains production during isolation

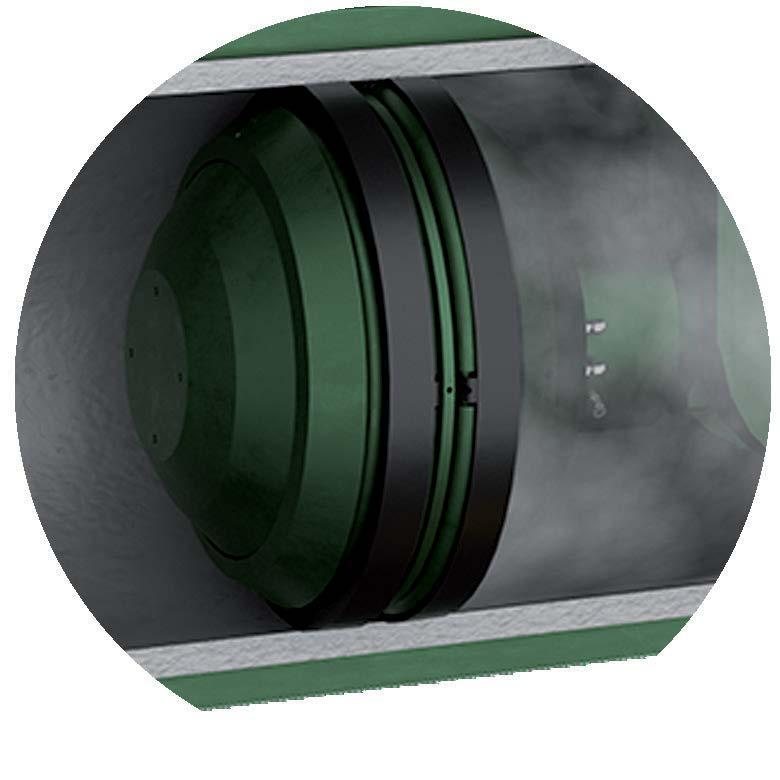

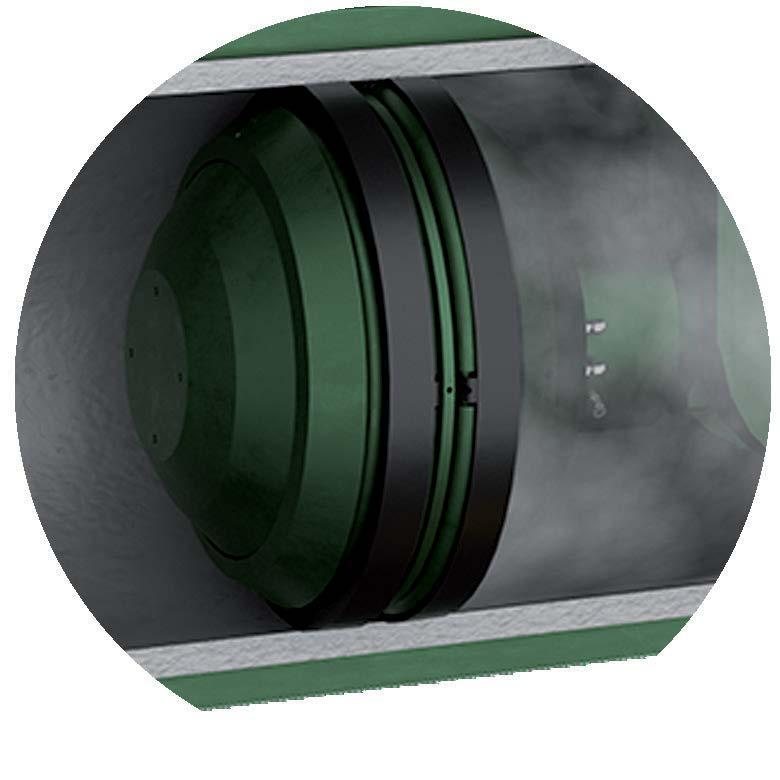

Dual Leak-Tight Seals

Double Block & Bleed Isolation

Isolated Pipeline

Monitored Zero-Energy Zone

The BISEP® has an ex tensive track record and provides pioneering double block and bleed isolation while

dual seals provide tested, proven and fully monitored leak-tight isolation, ever y time, any pressure.

Editorial newsdesk@ogvenergy.co.uk

+44 (0) 1224

Advertising office@ogvenergy.co.uk

+44 (0) 1224 084

Design

Editorial

7 HEADER www.quanta-epc.co.uk YOUR ASSET IN SAFE HANDS Safe, efficient and low-cost delivery of Asset Management projects, ensuring best value every time. Operations Maintenance Repair orders Technical support

The views and opinions published within editorials and advertisements in this OGV Energy Publication are not those of our editor or company. Whilst we have made every effort to ensure the legitimacy of the content, OGV Energy cannot accept any responsibility for errors and mistakes. OUR PARTNERS FEATURING TRAVEL MANAGEMENT PARTNER LOGISTICS PARTNER

provider of logistics services to this industry, offering its customers airfreight, road freight, sea freight, project forwarding, customs compliance, training and consultancy, packing, crating, lashing & securing services warehousing, distribution, freight management, rig relocation and mobilisation services and offshore logistics. The ATPI Group delivers world-leading corporate travel and events solutions to organisations operating in a variety of specialist sectors around the world.

Disclaimer:

Leading

114

084

114

Jen McAdam

Gallow Ben Mckay

Cali

Paraskova VIEW our media pack at www.ogv.energy/advertise-with-us or scan the QR code ADVERTISE WITH OGV

Tsvetana

COMMUNITY news

ANYbotics and Rever

Announce Partnership in Chile

Scaling autonomous inspection for large facility operations in Chile in the mining, metals, and minerals sectors.

ANYbotics and Rever have joined forces in Chile to transform industrial inspection. This partnership introduces the ANYbotics advanced robotic solution ANYmal, engineered to meet the inspection needs of Chilean mining, metals, and minerals operations. Rever's local expertise and experience in inspection solutions ensure successful deployment and support, representing a step change in the regional inspection ecosystem.

Chile is a world leader in important minerals such as copper, molybdenum, silver, and gold. The partnership between Rever and ANYbotics underlines the growing demand for automated, robotic inspection in the mining, metals, and minerals sectors.

Aberdeen based OSSO completes significant decommissioning project, preventing 4,340m3 of crude oil sludge being sent to incineration

OSSO, specialists in fluid temperature control and separation solutions, announce the successful completion of a significant decommissioning project at a Scottish oil terminal for a multinational energy company. OSSO worked in partnership with another contractor to mitigate the need for 4,340 cubic metres of crude oil sludge to be tankered to incineration, achieve a cost saving exceeding seven figures and recover 1,280 cubic metres of usable oil. The project centred on the full decommissioning of an oil tank at the terminal, necessitating the complete removal of all hydrocarbons. OSSO’s separation capabilities allowed water to be introduced to the tank, enabling efficient pumping and significantly expediting the process by eliminating the need for manual waste removal.

Hydraulics Specialist Announces Key Appointments in Aberdeen & Dundee

A leading hydraulics specialist has unveiled key appointments at its recently launched integrity division in Aberdeen, and at its Dundee headquarters.

Saturn Fluid Engineering recently announced plans to invest more than £500,000 in the creation of its new integrity division, Saturn Integrity Management Ltd which is based in 2000 sq. ft of warehouse and office space at Dyce Farm on the outskirts of Aberdeen.

Newly appointed Technical Manager Gerald Forbes has been involved with hydraulic and industrial hose and fittings since leaving college over 35 years ago while General Manager Les Brown brings 25 years of experience in hydraulic hose manufacturing and inspections services to his new role with the company.

ASCO wins major contract to provide services to the UK’s biggest freeport

Global integrated logistics and materials management specialist, ASCO, has been awarded a major contract to provide a range of services at Teesworks in North East England, the UK’s largest freeport.

The contract, which will run for an initial term of three years, represents a significant move forward for the company, which is building on its existing oil and gas and wider energy expertise to grow its footprint in new energy markets around the world.

The work, which will include quayside planning and scheduling, operations coordination, vessel scheduling, stevedoring and internal distribution services, will focus on Teesworks’ South Bank Heavy Lift Quay, which incorporates a new 450-metre quay to service the offshore energy sector.

3t secures $100 million of financing to drive ambitious growth trajectory

• 3t, the market-leading provider of safetycritical sector training, learning technology, and simulation solutions, achieves a significant milestone by raising USD $100mn through a successful bond issuance.

• The new funding will enable 3t to pursue planned strategic acquisitions designed to boost its growth trajectory, competitiveness and its continuing commitment to innovation.

• "Our successful bond issuance marks a pivotal moment for 3t as we continue to pursue our ambitious growth objectives through 2024, and beyond," said Kevin Franklin, CEO of 3t.

3t, a pioneering leader in the provision of training, learning technologies and simulation solutions for safety-critical industries, has achieved a significant milestone in its growth trajectory by successfully issuing bonds on the Norwegian Stock Market, raising USD $100mn in financing to aid planned strategic acquisitions.

AquaTerra Group secures decommissioning projects worth seven figures

Aberdeenshire headquartered integrated services provider, AquaTerra Group, has announced four significant decommissioning contract wins totalling a seven-figure sum. These latest projects represent a notable increase in AquaTerra’s roster of decommissioning projects between 2023 and 2025.

While late life and decommissioning services are not new areas of work for AquaTerra, the past year has marked several firsts including the first time that the company has been subcontracted by Dutch offshore contractor, Allseas.

Allseas has entrusted AquaTerra with a contract on Enquest’s Heather Alpha platform supporting the EPRD project through the provision of engineering, fabrication, access, and construction teams to complete underdeck preparation scopes for topside removal.

www.ogv.energy I June 2024 COMMUNITY NEWS

FIND ALL THE FULL COMMUNITY NEWS ARTICLES ON THE OGV ENERGY WEBSITE DO YOU WANT YOUR NEWS FEATURED ON OUR MAGAZINE, WEBSITE & DIGITAL PLATFORMS? JOIN THE OGV COMMUNITY TODAY!

8

Sonihull: The world’s leading ultrasonic antifouling specialist KAE-Logo-Colour-1700x1700

Wherever there is unwanted marine biofouling. From tugboats to oil tankers, wind farms to fish farms, Sonihull is working with industry leaders to create cost-effective ultrasonic antifouling solutions that reduce drag, cut fuel consumption, increase service intervals and leave no poisonous environmental legacy.

www.sonihull.com

As a trusted global partner with 26 years of experience, we have worked on more than 700 assets globally. With a focus on Health, Safety, Environment and Quality (HSEQ), we are dedicated to helping our clients achieve their goals of maximum production uptime, zero harm and operational efficiency.

www.axessgroup.com/

Cygnus Instruments Ltd is the leading manufacturer of multiple-echo ultrasonic thickness gauges used for measuring remaining metal thickness without the need to remove protective coatings.

www.cygnus-instruments.com

Field Engineering Services LTD Value and supply to meet customers’ requirements. From Hire, Sales Service along with all works designed and supplied, through to Installation and commissioning of complete turnkey generator packages from 5kVA till 2000kVA packaged projects by our team.

www.field-engineering-services.co.uk

Rampart Products was born from a desire to provide great customer service with a reasonable delivery time to those in need of HPHT electrical connectors. Rampart Products’ team is comprised of individuals who offer decades of engineering experience in the oil and gas industry. Skill sets range from designing complete downhole tool systems to creating efficient manufacturing processes, along with in-depth knowledge of engineering design and manufacturing of HPHT electrical connectors.

www.rampartproducts.com

Our customers are facing a challenging future. They want a flexible and viable partner to support them in a world of changing expectations. EthosEnergy turns on potential to deliver services and solutions globally for rotating equipment to make energy affordable, available and sustainable.

www.ethosenergy.com

We are an Aberdeen-based valve maintenance and testing facility, providing the highest levels of expertise and service to ensure your probes are repaired and returned with minimum disruption to your operations. We have the facility to carry out a thorough test and inspection of your probes and have access to a robust supply chain should any replacement parts be required.

www.valvetec-services.com

Ampelmann is the leading offshore access provider that delivers safe and efficient access solutions to the global offshore energy sector. Its innovative approach to offshore access has propelled the company forwards as a key global player with strong local presences in Europe, Africa, Asia Pacific, Middle East and the Americas.

www.ampelmann.nl

KYSTDESIGN delivers a wide range of products for various industries as oil & gas, survey, fish farming, ocean research, search/rescue and navy.

Our strength is multidisciplinary knowledge of technical issues at every level, from system level down to component level, from definition and design to prototyping and qualification.

www.kystdesign.no

LATEST OGV COMMUNITY SIGN-UPS

North Sea Energy Review UK

By Tsvetana Paraskova

The latest offshore licence awards, the potential of the energy supply chain, a major acquisition, and field development updates featured in the UK North Sea oil and gas sector in the past month.

The North Sea Transition Authority (NSTA) offered in early May a further 31 licences in the latest and final phase of the 33rd oil and gas licensing round.

A total of 82 offers to 50 companies have now been made in the round which attracted 115 bids from 76 companies across 257 blocks and part-blocks.

The licences offered in the round would be expected to add an estimated 600 mmboe up to 2060, or 545 mmboe by 2050. The first tranche offered 27 licences in October 2023, with the second offering 24 licences in January 2024.

“The North Sea is an important resource for energy security and net zero delivery, so it’s vital that sectors collaborate to ensure those systems can co-exist,” NSTA said.

“Following discussions with our partners in The Crown Estate and Crown Estate Scotland, we have introduced a new clause for overlapping oil and gas licences and wind leases for the first time. This will be the main commercial mechanism for these licences to resolve spatial overlaps and to support co-existence of these important industries,” it added.

NSTA is currently giving further consideration to a small number of remaining applications and a few more licences may be offered at a later date.

The licences awarded in the final phase of the 33rd round are chiefly for gas extraction from the southern North Sea, with the potential to come on stream to power and heat the UK’s businesses and homes within the next five years, Offshore Energies UK noted.

The licence offer “strengthens energy security and business confidence across all sectors as the expansion into wind, hydrogen and carbon capture and storage accelerates,” the main UK offshore industry body said.

RenewableUK, however, believes that the UK should prioritise offshore wind farms over oil and gas projects in the overlapping areas.

“Whilst we welcome the efforts of the North Sea Transition Authority, The Crown Estate and Crown Estate Scotland to work together on reforming the rules governing oil and gas co-location with offshore wind farms, we need much greater prioritisation of renewables over oil and gas in spatial planning. Offshore wind is going to be the backbone of our future system, not fossil fuels,” said RenewableUK's Chief Executive Dan McGrail.

“Prioritising offshore wind over oil and gas isn’t just the right choice for the planet, but given renewables are the lowest cost means of generating power, we should be doing this for billpayers.”

NSTA said in a separate report in May that North Sea oil and gas operators could invest up to £3 billion in 14 major projects capable of cutting up to 32 million tonnes of lifetime CO2e emissions from their production activities, a quantity greater than London’s estimated annual emissions in 2021. NSTA analysed the annual performance review of the UK’s top 20 operators and found that their

projects involve using low-carbon power on platforms, installing technologies designed to eliminate routine flaring and venting, and hydrogen. They could potentially go live between 2024 and 2030 on new and existing projects, making a significant contribution to achieving the sector’s emissions reduction targets.

However, final investment decisions have been secured for fewer than half of these projects to date, highlighting that there is still work to do, the industry regulator said.

The UK’s oil and gas sector supply chain possesses between 60 percent and 80 percent of the capabilities required to develop the UK’s low carbon energies, but targeted investment is vital to capture the potential of an estimated £150 billion opportunity, independent research and business intelligence company Rystad Energy said in a new report commissioned by OEUK.

New data reveals the urgent need for strategic action to help supply chain companies seize the potential of a projected 4-percent yearly increase in spending in real terms across offshore and onshore activity. Forecasts indicate this major growth phase will occur across the UK’s floating wind farms, new hydrogen schemes, and carbon capture and storage projects from 2023 to 2040. The successful delivery of these emerging low carbon energies will hinge on the existing oil and gas supply chain delivering into them, Rystad Energy’s analysis found.

“We are in a global race for energy investment and the jobs this represents so we need long-term policies and a globally competitive tax system to make this happen,” said Katy Heidenreich, OEUK’s Supply Chain and People Director.

“That means wider recognition of our supply chain’s strategic strengths and of the capital expenditure required for companies to scale up capabilities to secure this huge opportunity.”

According to OEUK, strategic investment now will prevent erosion of the UK’s worldclass capabilities, which have a pivotal role in supporting the build-out of low carbon energies.

www.ogv.energy I June 2024

UK NORTH SEA REVIEW SPONSORED BY

Data science company Empirisys and member-led safety organisation Step Change in Safety (SCIS) have launched their Process Safety Workforce Survey, which showed a confident and reflective industry. And “among a series of well-performing themes, competency is an industry-wide strong point with some of the highest scores in the survey,” according to responses from more than 450 senior leaders from 73 companies.

In company news, Italy’s Eni SpA announced at the end of April it had reached an agreement on the combination of substantially all of its upstream assets in the UK, excluding East Irish Sea assets and CCUS activities, with Ithaca Energy, marking a strategic move to significantly strengthen its presence on the UK Continental Shelf. Under the terms of the agreement, Eni and Ithaca will combine the Eni UK Business with the existing Ithaca business. The economic effective date for the combination will be 30 June 2024, while completion of the deal is expected in Q3 2024, subject to the satisfaction of certain regulatory and other customary conditions, Eni said.

Hartshead Resources has announced that the P2607 Joint Venture (JV) is continuing work on the Phase 1 Gas Field Development of the Anning and Somerville Gas Fields, assuming various possible fiscal scenarios. The JV is committed to progressing the project, subject to receiving certainty regarding future fiscal policy and confirms that the current 2024 JV budget remains in place.

Gas producer Kistos has become the sole owner of two fast-cycle gas storage sites in the UK, after it paid EdF £25 million for the assets, one of which is inactive. The transaction marks Kistos’ entry into the gas storage sector providing business diversity to its upstream portfolio. The deal also provides business diversity and would be valuable as the UK relies more on intermittent renewable energy. One of the assets, Hill Top, has a working gas capacity of 17.8 million therms, with an ongoing programme to increase this volume to 21.2 million therms in the short term. Hill Top currently accounts for 3.1 percent of the UK's total available onshore gas storage capacity and, due to the fast cycle nature of the facility, can deliver up to 11 percent of the UK's flexible daily gas capacity if called upon, Kistos said.

The other facility, Hole House, at which operations have been suspended since 2018, provides an option to increase the Kistos’ proportion of the UK's total onshore gas storage materially with reactivation. Delivering a plan to get these facilities back online is a priority, the company said.

Petrofac said in the middle of April that it had been awarded a contract extension by bp, continuing support across its North Sea portfolio. Under the terms of the three-year, multi-million-dollar contract, Petrofac will provide maintenance and engineering services for bp.

Two weeks later, Petrofac announced a delay to its audited full year 2023 results which it expects to publish by 31 May 2024. The company also reported the progress made with creditors on its financial restructuring.

As part of the group’s ongoing financial restructuring, an ad-hoc group of senior secured noteholders have made a non-binding proposal to provide further credit to the business of up to US$300 million, comprising US$200 million of new funds and US$100 million of credit support to help secure performance guarantees for certain of its existing contracts.

Petrofac is in active discussions with credit providers to obtain the required guarantees, which would also release more than US$200 million of collateral and retentions.

Balmoral Comtec, a Balmoral Group company and a major provider of buoyancy, protection, and insulation services to the global offshore energy market, has secured a multi-million-pound contract from TechnipFMC to supply more than 600 buoyancy modules for Equinor’s Rosebank project. The company will provide engineering, design, and manufacture of buoyancy modules from its base in Aberdeen and the modules will be installed on flexible risers and umbilicals.

Deltic Energy Plc said at the end of April that following commitment to the appraisal well in December 2023, operational planning for the Pensacola appraisal well has continued to progress according to plan. In anticipation of drilling the Pensacola appraisal well, long lead items have been ordered, the geophysical site survey over the proposed well location has been completed and the final geotechnical site survey is scheduled to take place in May/June 2024, the company said.

PBS has secured an extension to the General Maintenance and Operations Contract (GMOC) awarded by TotalEnergies in 2020 to cover its North Sea assets. With over a year still to serve on the existing five-year contract, PBS were already making plans for continued safe and efficient delivery into mid-2025. After 2023 concluded with a positive performance outcome for PBS across the range of services covered under the contract, PBS are pleased to announce that TotalEnergies has chosen to initiate this extension of the original contract, extending the GMOC services through to May 2026.

Shelf Drilling has announced that a subsidiary of Shelf Drilling (North Sea), Ltd secured a contract for the Shelf Drilling Fortress jack-up rig with a North Sea operator for operations in the UK Continental Shelf. The estimated duration of the contract is 400 days with contract value of approximately US$54 million. The planned start-up of operations is August 2024 in direct continuation of the rig’s current contract.

Wood has been awarded a new decarbonisation contract by TotalEnergies (TEPUK) to support flare gas recovery in the North Sea. The 23-month contract, part of the Elgin-Franklin Flare Gas Recovery System Project, follows Wood’s successful completion of a field study and frontend engineering design (FEED) and includes the coordination of operations, procurement and design aspects for the Elgin asset. Led by Wood’s team in Aberdeen, this contract will see the company create 40 new positions on and offshore.

11 UK ENERGY REVIEW

Europe Energy Review

By Tsvetana Paraskova

Production starts, new field development plans, and discoveries offshore Norway, Scotland’s emissions targets, and a growth plan for a strong UK offshore wind supply chain were some of the major headlines in the European energy sector in the past month.

Oil & Gas

At the end of April, Norwegian Energy Minister Terje Aasland received the field development plan for a new North Sea oil and gas field that will be tied back to an existing platform and is expected to cost 6.3 billion Norwegian crowns, or around $576 million.

The field operator, OKEA, has submitted the plan for development and operation (PDO) of the oil and gas field Bestla, to be tied back to the Brage platform, which would extend the life of the Brage field, the Norwegian Energy Ministry said.

Earlier in April, OKEA and its partners in the Brasse field renamed it Bestla and took the final investment decision to proceed with the Bestla development in a tie-back to the nearby production facilities of the Brage field. Bestla’s was the first field development plan submitted to the minister this year.

Aker BP announced that production had started from the Hanz field in the North Sea. Hanz, operated by Aker BP, with Equinor and Sval Energy as partners, is a subsea field development tied into the Ivar Aasen platform about fifteen kilometres further south.

Total investments are estimated at close to NOK 5 billion (around $457 million) and total reserves are around 20 million barrels of oil equivalent.

In another first production, the licensees of the Eldfisk Field, operated by ConocoPhillips Skandinavia AS, announced in early May successful first oil production on the Eldfisk North Project in the Greater Ekofisk Area in the

North Sea. The project comprises three 6-well subsea templates located approximately seven kilometers from the Eldfisk Complex and will use available capacity at Eldfisk 2/7 S for processing and transportation, utilizing existing infrastructure in the Greater Ekofisk Area. Eldfisk North has a total resource potential in the range of 50-90 million barrels of oil equivalent.

Vår Energi has confirmed the discovery of oil in the Balder area in the Central North Sea. The latest Ringhorne North exploration well in production license (PL 956) was successful with estimated recoverable resources of between 13 and 23 million barrels of oil. Vår Energi, as operator, considers the discovery a potential commercial candidate to be tied into nearby existing infrastructure in the Balder area.

Low Carbon Energy

The Scottish Government in April abandoned its key interim target on its road to 2045 net zero by scrapping a goal to reduce emissions by 75 percent by 2030.

The UK’s Climate Change Committee said in March that “Scotland’s 2030 climate goals are no longer credible.”

The committee no longer believes that the Scottish Government will meet its statutory 2030 goal to reduce emissions by 75%, it said in March, citing continued delays to the updated climate change plan and further slippage in promised climate policies.

Now the Scottish government announced new legislation would be brought forward

www.ogv.energy I June 2024

Credit: Zachary Theodore on Unsplash

to introduce multi-year ‘Carbon budgets’ replacing the current, annual targets. In light of the UK-wide Climate Change Committee’s recent rearticulation that the 2030 target for emissions reduction is not achievable, this will no longer be a statutory target, the government said.

In April, RenewableUK, the Offshore Wind Industry Council, The Crown Estate, and Crown Estate Scotland published a detailed Industrial Growth Plan, setting out how to triple offshore wind manufacturing capacity over the next ten years that would help firmly establish the UK as a leader in a surging global market.

“The measures set out in the Industrial Growth Plan (IGP) would support an additional 10,000 jobs a year and boost the UK’s economy by a further £25 billion between now and 2035, if we accelerate offshore wind deployment in line with our net zero targets to 5-6 gigawatts a year,” the industry associations said.

The report found that co-locating solar projects with battery storage could reduce the cost of building and running battery projects by 50 percent.

RenewableUK’s EnergyPulse database shows that at present only 12 percent of wind and solar farms in the UK are co-located with batteries or hydrogen electrolysers, but the report states that has the potential to surge in the years ahead to meet the expected increase in electricity demand if the right policy framework is put in place.

“The UK has the second largest global pipeline of offshore wind projects at all stages of development at nearly 100GW - more than six times our current capacity.”

“The UK has the second largest global pipeline of offshore wind projects at all stages of development at nearly 100GW - more than six times our current capacity.”

The plan has identified five key technology areas in which the UK should prioritise investment to secure value for UK industry. These include the design and manufacture of offshore wind blades and turbine towers, foundations, cables and other key components and services for projects here and abroad.

National Grid is inviting communities in East Lindsey, Boston and South Holland in Lincolnshire, and King’s Lynn and West Norfolk, to view proposals for two new primarily offshore electricity infrastructure projects. Eastern Green Link 3 (EGL 3) and Eastern Green Link 4 (EGL 4) will be able to transport enough clean energy generated in Scotland to power up to four million homes in the Midlands and South of England, according to National Grid.

The projects form part of The Great Grid Upgrade, the largest overhaul of the grid in generations, with new infrastructure across England and Wales helping the UK to meet its net zero ambitions, reduce its reliance on fossil fuels, and contribute to lower energy bills over the long-term.

Building more energy storage projects alongside onshore wind and solar farms reduces electricity system costs, benefitting billpayers in the long term, a new report by RenewableUK showed in April.

The report also sets out the case for reforming the planning system and introducing financial support mechanisms to encourage more battery storage and green hydrogen projects to “co-locate” at sites where clean electricity is generated throughout the UK.

In another report, RenewableUK said that the UK pipeline of battery projects has grown by two-thirds in capacity over the last year. The organisation’s latest EnergyPulse Energy Storage report showed that the total pipeline of battery projects –including operational, under construction, consented or being planned – has increased from 57.1 gigawatts (GW) a year ago to 95.6 GW, which is enough to fully charge more than 2.6 million electric vehicles. Operational battery storage capacity has grown to 4.4 GW, and the capacity of projects under construction has reached 4.3 GW. A further 30.4 GW has been consented, 26 GW has been submitted in the planning system, and 30.4 GW is at an early stage of development but yet to be submitted, RenewableUK said.

The European Commission is awarding nearly 720 million euros to seven renewable hydrogen projects in Europe, selected through the first competitive bidding process under the European Hydrogen Bank.

The winning bidders will produce renewable hydrogen in Europe and will receive a subsidy to bridge the price difference between their production costs and the market price for hydrogen, which is currently driven by non-renewable producers. The renewable hydrogen they produce will be used in sectors such as steel, chemicals, maritime transport, and fertilisers.

Denmark has announced the largest procurement procedure for offshore wind power, aiming to enable the establishment of at least 6 GW offshore wind power, to be completed in 2030. The tenders will be held for six sites in the areas North Sea I, the Kattegat, Kriegers Flak II, and Hesselø.

In Germany, the federal network agency Bundesnetzagentur announced at the end of April the successful bids in the auction that ended on 1 March 2024 for groundmounted solar photovoltaic (PV) installations. The auction round was “very significantly oversubscribed,” the agency said.

The statutory expansion targets meant that the auction volume had increased from 1,611 megawatts (MW) in the previous round to 2,231 MW. There were 569 bids with a combined volume of 4,100 MW. A total of 326 bids with a combined volume of 2,234 MW were successful, Bundesnetzagentur said.

In company news, Octopus Energy has invested in Ocergy, which is disrupting the floating offshore wind market with an innovative approach to designing and manufacturing floating foundations, drastically reducing the time and cost of building them.

Ocergy, headquartered in the US and with operations in France, is pioneering a hyperlocal supply chain approach, working with local manufacturers and creating green jobs in the areas where the turbines are installed, Octopus Energy said.

Flotation Energy and Vårgrønn, a joint venture between Plenitude (Eni) and HitecVision, have announced that their pioneering floating offshore wind project, Green Volt, has been granted offshore planning approval. When completed, Green Volt will include up to 35 floating wind turbines, providing up to 560 MW of renewable energy capacity. As part of Crown Estate Scotland’s Innovation and Targeted Oil & Gas (INTOG) leasing round, the project will deliver renewable electricity to oil and gas platforms, replacing existing natural gas and diesel power generation.

The Port of Blyth has announced record financial performance for the third consecutive year as it continued to excel as a leading offshore energy support base, mobilising two of the world’s largest offshore windfarms and providing significant vessel and onshore handling activity.

Drax has said it would invest £80 million in a major refurbishment of its ‘Hollow Mountain’ Cruachan pumped storage hydro power station in Scotland, increasing its capacity and supporting UK energy security. The project will see the generating capacity of two of the plant’s four units increased by a combined 40 MWs to raise the facility’s total generating capacity to 480 MWs.

BW Ideol, a floating offshore wind firm, and Holcim, a provider of innovative and sustainable building solutions, have signed a Memorandum of Understanding (MoU) for a feasibility study on supplying beneficial lowcarbon concrete for the floating offshore wind industry, with particular reference to Scotland. The collaboration includes developing specific durable maritime low-carbon concrete mixes with enhanced mechanical performance perfectly suited to slipform application.

RWE is progressing proposals to develop a green hydrogen production facility on its land adjacent to Pembroke Power Station in South Wales. RWE’s plans include a circa 110Mwe electrolysis green hydrogen production facility and a 1.5-km pipeline running west to connect to nearby industry. Once operational, the site will be capable of producing two metric tonnes of hydrogen every hour with oxygen as the only significant by-product from the plant.

13 EUROPEAN ENERGY REVIEW EUROPE NEWS SPONSORED BY

Energy Review USA

By Tsvetana Paraskova

While the US upstream oil and gas sector saw a record start to a year for mergers and acquisitions, the industry criticized, again, new rules and regulations of the Biden Administration to limit access to federal drilling and impose strict environmental rules on coal and new natural gas-fired power plants.

mergers and acquisitions (M&As) in the US upstream sector, with a total of $51 billion in announced deals in the first quarter, Enverus Intelligence Research (EIR) said in a report at the end of April.

The Permian Basin drove most of the dealmaking in Q1 2024, but the pace slowed in March and the second-quarter appears to have lost momentum, according to EIR.

Consolidation in Q1 was mostly driven by the sale of privately held Endeavor Energy Resources to publicly held Diamondback Energy in a $26 billion buyout sale, which was the biggest sale of a private company Enverus has tracked.

The acquisition of Endeavor puts Diamondback in the front row among Permian-centric exploration and production companies, giving it a scale comparable to Pioneer Natural Resources prior to its sale to ExxonMobil, Enverus noted.

APA also expanded in the Permian, through a public merger with its purchase of smaller company Callon Petroleum for $4.5 billion.

Those two deals, plus a few smaller bolt-on acquisitions, gave the Permian a 60-percent share of total transacted upstream value in the first quarter, EIR’s analysis showed.

“Deals at the start of 2024 were driven by the same factors that led to last year’s marathon

available,” said Andrew Dittmar, principal analyst at EIR.

“Most of that inventory is going to be found in the Permian, so it is unsurprising the prolific basin was yet again the primary driver for M&A within oil and gas,” Dittmar added.

With high Permian values and increased regulatory scrutiny after the megadeals announced at the end of 2023, companies could start looking for acquisition targets beyond the Permian because of both higher fragmentation in other plays and lower prices, EIR reckons.

The evolving M&A landscape could include private companies taking the opportunity to reload portfolios after heavy selling to public exploration and production firms, the Enverus analysts say.

“Opportunities are still there for private equity, but they may need to get more creative,” Dittmar said.

“That could include exploring more secondary targets like deep intervals in the Permian or pushing into areas like the Central Basin Platform.”

European Majors Expand Exposure to US LNG

European majors have also made deals in the US oil and gas sector, particularly in natural gas, and the market could see further

www.ogv.energy I June 2024 Your Global Procurement Partner - Procurement Services - Spend Analysis - Cost + - Vendor Consolidation - Specification Sourcing - E-procurement ESWL Ltd, 4 Prospect Place, Westhill, Aberdeenshire, AB32 6SY ESWL Americas Inc, 1010 Goodnight Trail, Houston, TX 77060 sales@eswl-ltd.com | houston@eswl-ltd.com www.eswl-ltd.com SPONSORED BY

Getty IMages

Photo:

acquisitions of US assets by European companies, as they position themselves for long-term demand for oil and gas, Ed Crooks, Vice-Chair, Americas, at Wood Mackenzie commented on two recent transactions.

One of these was France’s TotalEnergies buying the 20-percent interest held by Lewis Energy Group in the Dorado leases operated by EOG Resources (80 percent) in the Eagle Ford shale gas play.

“This acquisition strengthens our production of natural gas in the United States, contributing to reinforce TotalEnergies' LNG integration with a low cost and low emission upstream gas feed,” said Nicolas Terraz, President, Exploration & Production at TotalEnergies.

Norway’s Equinor, for its part, agreed with US natural gas giant EQT Corporation to swap Equinor’s operated position in the Marcellus and Utica shale formations in Ohio for a stake in EQT’s non-operated interest in the Northern Marcellus formation. Under the agreement, Equinor will sell 100 percent interest in and operatorship of its onshore asset in the Appalachian Basin in southeastern Ohio, in exchange for 40 percent of EQT’s nonoperated working interest in the Northern Marcellus shale formation in Pennsylvania.

“While the deals are relatively small in terms of the assets changing hands, they point to an important trend: European companies want more upstream US gas production, in part, to support their LNG export positions,” WoodMac’s Crooks said.

Additionally, TotalEnergies and Vanguard Renewables, a organics-to-renewable natural gas production and a portfolio company of a fund managed by BlackRock’s Diversified Infrastructure business, have signed an agreement to create an equally owned joint venture to develop, build, and operate farm-powered renewable natural gas (RNG) projects in the United States.

New Biden Regulations Anger US Oil and Gas Industry

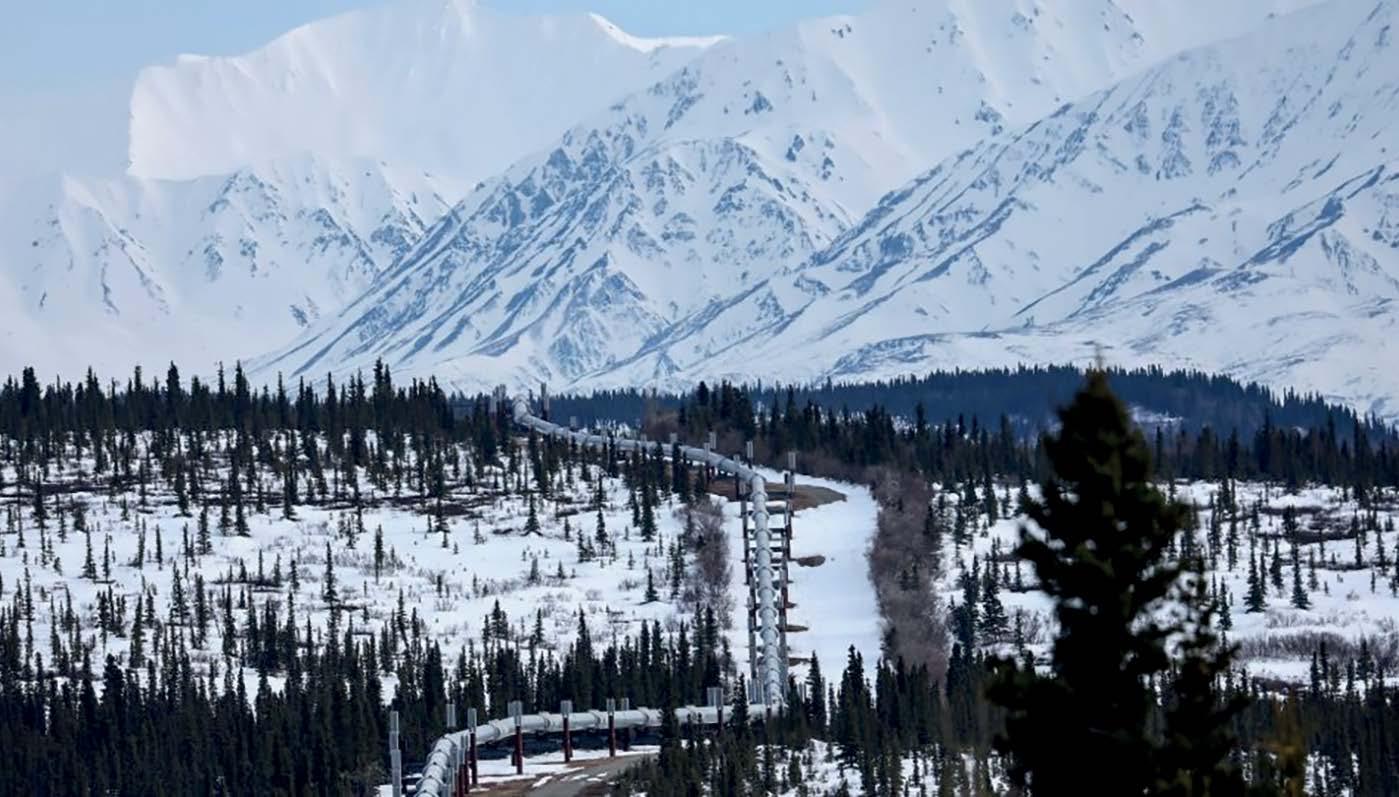

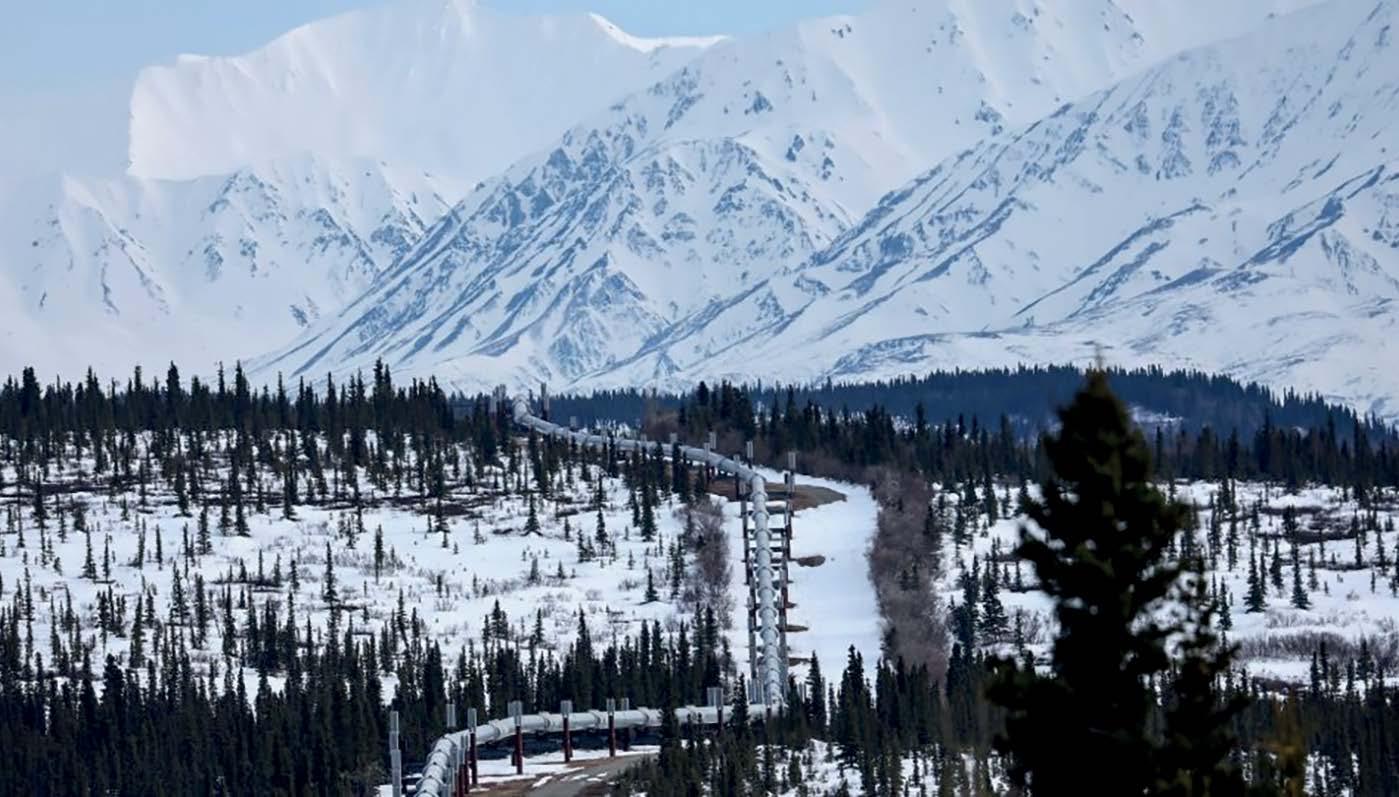

The US Administration finalised in April a strategy to help protect federal lands, including restricting access to drilling and mining in a large part of the National Petroleum Reserve in Alaska (NPR-A).

The Bureau of Land Management updated its regulations for the management and protection of the NPR-A for the first time in over 40 years to balance development of oil and gas with protection of the other natural resources in the Reserve. BLM published a final rule to maximise protections for more than 13 million acres in the western Arctic.

The rule does not apply to existing developments and projects, including the Willow oil project led by ConocoPhillips, which the Biden Administration approved last year, angering environmentalists and some of the Democrat base.

US Senators Lisa Murkowski and Dan Sullivan (both R-Alaska) and Representative Mary Sattler Peltola (D-Alaska) slammed President Joe Biden and his administration for making two more major adversarial decisions that will prevent responsible resource development in Alaska.

“Shutting down two of the world's most important energy and critical mineral developments in our country sends this message to the dictators in Iran, China and Russia: We won't use our resources to strengthen America, but we’ll become more dependent on yours,” Senator Sullivan said.

“Closing off NPR-A is a huge step back for Alaska, failing to strike a balance between the need for gap oil and natural gas and legitimate environmental concerns, and steamrolling the voices of many Alaska Natives in the decisionmaking process,” said Representative Peltola.

The American Petroleum Institute (API) said, via Senior Vice President of Policy, Economics and Regulatory Affairs Dustin Meyer, “At a time when the world is looking for American energy leadership, this is yet another step in the wrong direction.”

In another regulation, the US Environmental Protection Agency (EPA) announced at the end of April final rules on emissions reductions of power plants which would force coal-fired power plants that plan to run in the long-term and all new gas-fired plants to capture most of their carbon emissions.

“We remain concerned that EPA’s final rule fails to properly consider grid reliability and the need for new natural gas plants to maintain that reliability.”

The Administration needs to focus on removing barriers to building new generation capacity and fixing the broken permitting process to allow for the development of critical infrastructure – including carbon capture and hydrogen technologies, according to the API.

The Biden Administration also finalised in April a rule to reform the federal environmental review process under the National Environmental Policy Act (NEPA), which, the White House says, would pave the way for more efficient and effective federal permitting processes for clean energy and infrastructure.

The White House Council on Environmental Quality (CEQ) finalised a Bipartisan Permitting Reform Implementation Rule that includes setting clear deadlines for agencies to complete environmental reviews, requiring a lead agency and setting specific expectations for lead and cooperating agencies, and creating a unified and coordinated federal review process.

At a time when the world is looking for American energy leadership, this is yet another step in the wrong direction.”

While existing natural gas-fired plants will be exempted from the final rules, new gas plants, as well as coal-fired power plants that would run in the long term, need to control 90 percent of their carbon pollution, EPA’s rule says.

API’s Meyer commented,

The administration of former president Donald Trump reversed in 2020 some NEPA provisions for the first time in decades.

API criticised the new Biden Administration rule on some NEPA provisions, too.

“This final rulemaking is the opposite of what is needed to create a durable and predictable permitting review process to unleash energy investment in America,” Dustin Meyer said.

“NEPA will continue to be the most litigated environmental statute, resulting in more uncertainty, more stalled projects, and more taxpayer dollars drained from agencies and the courts.”

15 USA ENERGY REVIEW

USA NEWS Sponsored by:

MIDDLE EAST Energy Review

By Tsvetana Paraskova

Tensions in the Middle East Ebb and Flow

The headlines in the Middle East oil and gas industry in recent weeks included a standoff between Iran and Israel that led to a brief oil price spike, OPEC expecting strong summer oil demand, the OPEC+ group continuing work with Iraq and Kazakhstan on their plans to compensate for overproduction in the OPEC+ deal, and Saudi Aramco reporting first-quarter profits and being named a disruptor in the AI field.

The geopolitical premium in oil and commodity prices jumped in early April, only to subside by the end of the month after Israel and Iran backed off from a major escalation in tensions. The market continues to be on edge as the risk premium, although faded, has not entirely vanished. Brent oil prices reached their highest level so far this year, at just above $90 per barrel, prompting some analysts to forecast $100 a barrel oil in the summer. The eased tensions in the Middle East, however, led to a drop in prices in early May, with traders and speculators shifting their attention back to fundamentals and the next moves from the OPEC+ group led by the Middle Eastern producers and the Fed and other central banks. The prospect of OPEC+ continuing its cuts into the second half of the year and the Fed holding the key interest rates higher for longer capped oil price gains after the tensions in the Middle East eased.

OPEC Sees Robust Summer Oil Demand

OPEC expects global oil demand in the summer to be strong as consumption of transportation fuels is set to increase across the board and across regions with summer travel picking up, the organization said in its April Monthly Oil Market Report (MOMR). The group holds a “robust oil demand outlook for the summer months.”

OPEC continues to expect global oil demand growth of 2.2 million barrels per day (bpd) for 2024, broadly unchanged from the previous month’s assessment. The organization still sees “robust growth” of 1.8 million bpd in 2025 compared to 2024.

“Despite some downside risks, the continuation of the momentum seen in the beginning of the year could result in further upside potential for global economic growth in 2024,” OPEC said in its report.

“In the OECD, the US continues with steady momentum that may outperform the current annual growth forecast.”

The group held in early May a workshop between Iraq, Kazakhstan, and secondary sources on compensation plans for the two OPEC+ members that have been producing oil above their respective quotas in the OPEC+ deal.

The constructive exchange aimed to share compensation plans for Iraq and Kazakhstan for their outstanding overproduced volumes for the months of January, February, and March 2024, which totaled about 602,000 bpd for Iraq and for 389,000 bpd for Kazakhstan. The plans shared by both countries suggest that the entire over-produced volumes will be fully compensated for by the end of this year. Moreover, any overproduction that may arise in the month of April 2024 for these countries will be accommodated in the respective compensation plans over the remaining months in 2024, OPEC said.

Saudi Aramco Keeps Dividend despite Lower Earnings

Aramco, the state oil giant of Saudi Arabia and the world’s largest oil company, booked a net income of $27.3 billion for the first quarter of 2024, down from $31.9 billion for the same period of 2023, amid lower crude volumes sold and lower production royalties. Free cash flow dropped to 22.8 billion from $30.9 billion in Q1 2023.

The company expects total dividends of $124.3 billion to be declared in 2024, including base dividend of $81.2 billion and performance-linked dividend of $43.1 billion.

Aramco “made significant progress on expanding our gas business and growing our globally-integrated downstream value chain, while maintaining our focus on consistently delivering value for our shareholders,” the company’s President and CEO, Amin H. Nasser, said in a statement.

“Looking ahead, I expect our portfolio to continue to evolve as we aim to contribute to an energy transition that offers solutions to climate challenges, but at the same time recognizes the need for affordable, reliable, and flexible energy supplies,” Nasser added.

www.ogv.energy I June 2024

Separately, Aramco raised its official selling prices (OSPs) of all its crude grades loading for Asia in June, in a move that was widely expected by the market as Middle Eastern crude benchmarks strengthened in April and early May. The higher selling prices could also suggest Saudi Arabia’s view that demand will strengthen in the summer, but they would reduce refining margins for Chinese producers, analysts say.

Saudi Aramco Leads in AI Innovation

Saudi Aramco is leading innovation in the energy industry by embracing cutting-edge technologies like artificial intelligence (AI), both within its core operations and beyond, which places the company ahead of the curve, GlobalData said in a recent report.

The Saudi oil giant has significantly invested in research and development (R&D) compared to its industry peers. Aramco allocated about $3.5 billion on R&D in 2023, representing a 15-percent annual increase despite global challenges. This investment is reflected in its innovative efforts, which extend beyond its primary operations, GlobalData added.

“Aramco is also betting on futuristic technologies. The company is closely monitoring the startup ecosystem and has in the recent past invested in several companies such as Pragmatic, which develops flexible semiconductor chips, and Sunrate, a fintech company,” Sourabh Nyalkalkar, Practice Head of Innovation Products at GlobalData, commented on the report.

“From the perspective of industry watchers and stakeholders, Saudi Aramco’s initiatives in adopting cutting-edge technologies, particularly AI, provide valuable insights into strategic navigation within a disruptive environment,” Nyalkalkar added.

“For startups and other vendors developing industry-specific solutions, the insights gained from the in-depth innovation analysis of Aramco and its peers can assist in prioritizing areas that can enhance the value proposition.”

Also in the AI field in the Middle East, ADNOC, the state energy company of the United Arab Emirates (UAE), announced with G42 and Presight AI Holding PLC new shareholding structure for AIQ. Under the agreement, Artificial Intelligence (AI) and Big Data Analytics leader Presight will acquire a 51 percent stake in AIQ with ADNOC retaining a 49-percent shareholding. Previously, G42 held 40 percent and ADNOC 60 percent in AIQ.

“The UAE has embraced AI to drive productivity, economic growth and social advancement, with ADNOC laser-focused to become the world’s most AI-enabled energy company, delivering smarter, cleaner and safer energy to the world”

AIQ will continue as a standalone company, leveraging data to deliver transformational AI-powered solutions to the energy sector. The transaction is subject to Presight’s shareholder and regulatory approval, ADNOC said.

“The UAE has embraced AI to drive productivity, economic growth and social advancement, with ADNOC laser-focused to become the world’s most AI-enabled energy company, delivering smarter, cleaner and safer energy to the world,” said Sultan Ahmed Al Jaber, Minister of Industry and Advanced Technology and ADNOC Managing Director and Group CEO.

In Oman, TotalEnergies has launched the Marsa LNG project and deployed its multienergy strategy in the Sultanate. TotalEnergies chairman and CEO Patrick Pouyanné met with His Majesty Sultan Haitham bin Tariq Al Said and Salim bin Nasser Al Aufi, Minister of Energy & Minerals, to reaffirm the long-term partnership between TotalEnergies and the Sultanate of Oman.

Pouyanné and Mulham Basheer Al Jarf, Chairman of OQ, the Oman National Oil Company, announced the Final Investment Decision (FID) of the Marsa LNG project. TotalEnergies had signed a Sale and Purchase , Agreement (SPA) with Oman LNG to offtake 0.8 Mtpa of LNG for ten years from 2025, making the Company one of the main offtaker of Oman LNG's production.

In addition, TotalEnergies and OQ Alternative Energy, the national renewable energy firm, have confirmed they were at an advanced stage of discussions to jointly develop a portfolio of up to 800 MW of renewables, including the 300 MWp solar project that will supply Marsa LNG.

Wellpro Group & Omega Well Intervention provide a complete Thru Tubing, Inflatable Packer & Well Intervention portfolio including operational design, project management, service, rental & sales.

17 MIDDLE EAST ENERGY REVIEW 17 Middle East Review SPONSORED BY

The AI Hub at Aramco

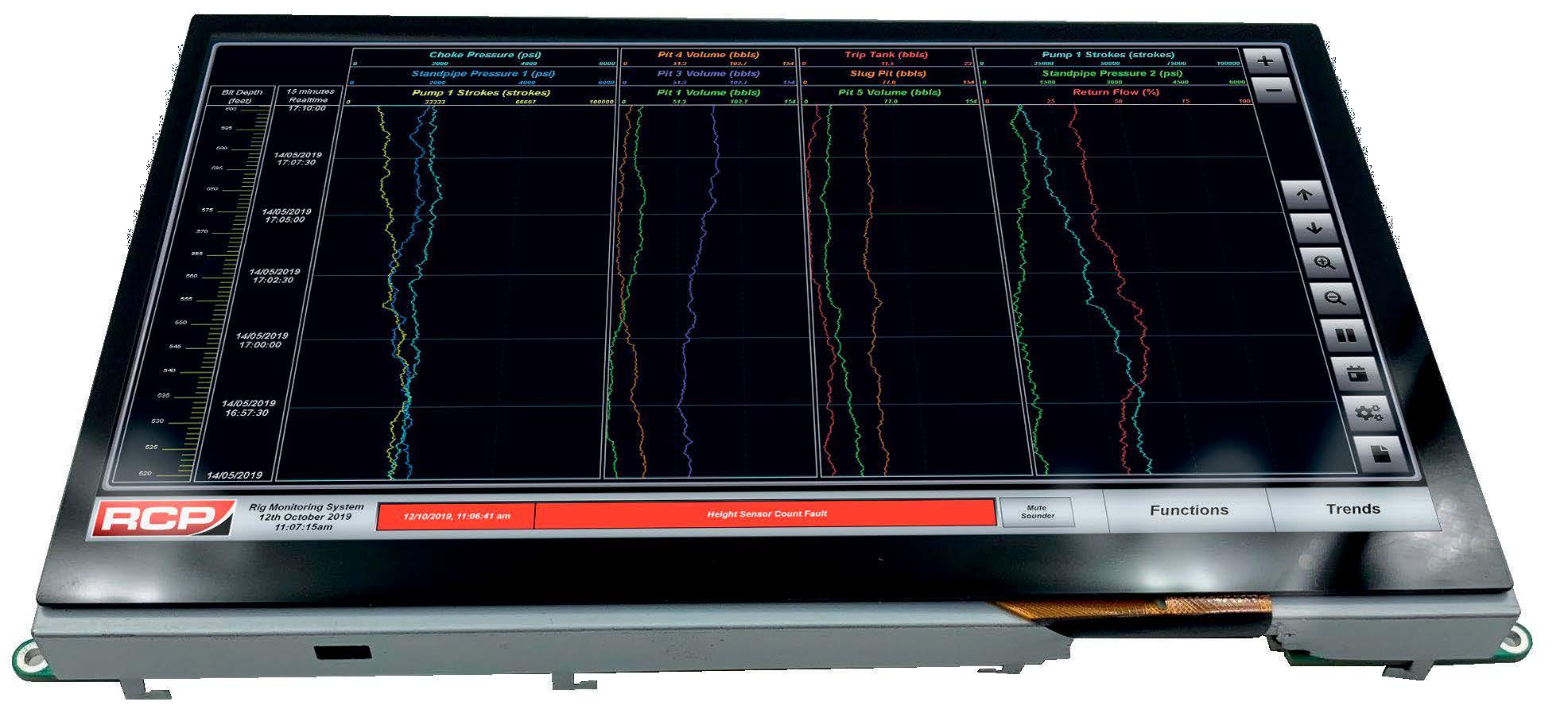

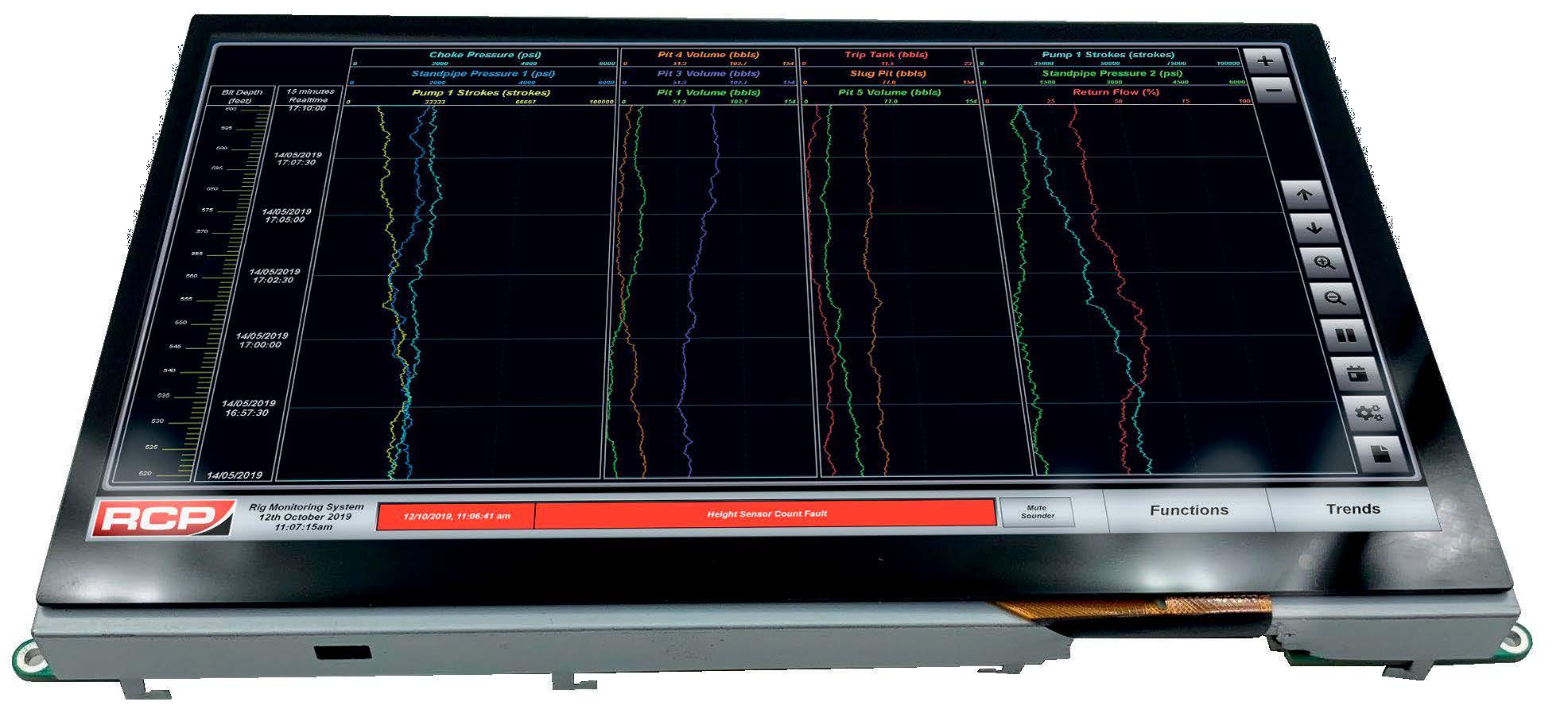

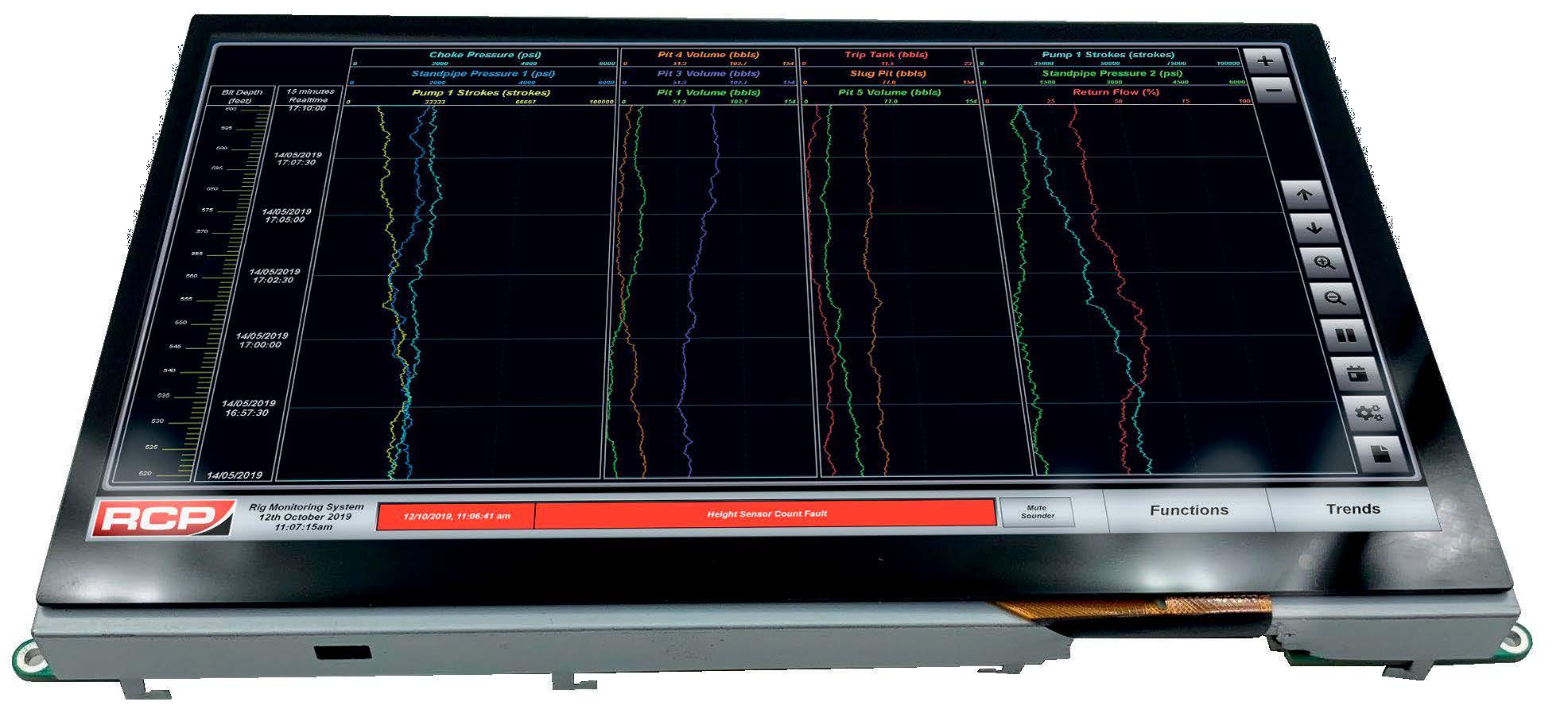

RCP-EDR

ELECTRONIC DRILLING RECORDER

The new RMS is designed to give operators a clear, unambiguous overview of critical drilling and mud data processes. The system has been developed by RCP to greatly improve how information is presented using the latest industrial technologies and user-friendly interfaces

The RCP EDR offers a quick and cost-effective solution for clients considering a new installation or a partial upgrade to their existing drilling instrumentation systems Our highly experienced engineers and software developers allows us to tailor each new system to meet your exact needs meaning that you do not pay for functionality you will never use

The RCP EDR utilizes a variety of sensing technologies to monitor the drilling processes, (typically: Level, Pressure, Height, Temperature and Flow). Sensor output signals are received by the distributed I/O racks and are then processed by the EDR.

Processed information is then transmitted through network communication modules to each of the user interfaces including remotely networked PC’s and local HMI’s System and operator interface communications may utilize either: Fibre-Optic, Profinet, Profibus or Industrial Ethernet connection

w w w. r c p a t . c o m + 4 4 ( 0 ) 1 2 2 4 7 9 8 3 1 2 s a l e s @ r c p a t . c o m

PRODUCT INFORMATION SHEET

Brent Oil Column June 2024 Today's Price $82.40

1 YEAR AGO

1 year ago - $76.76

The price of Brent crude rose after Saudi Arabia agreed to cut its output to firm up oil prices following a weekend of tense talks. Saudi ministers agreed to cut 1 million barrels per day from its output at a seven hour meeting of the OPEC group of oil-producing nations.

5 YEARS AGO

5 years ago - $63.35

Shell removed a second platform from its iconic Brent field in the North Sea. Brent Bravo produced its first oil in 1976 and at its peak in 1982, the four platforms in the field were producing more than half a million barrels of oil a day.

10 YEARS AGO

10 years ago - $114.02

The price of Brent crude rose to $114 a barrel as Sunni militants pushed forward in northern Iraq, striking the country’s biggest refinery and creating worries about oil exports as some firms pulled foreign workers out of the country. Iraq’s oil output target of 4 million barrels per day looked increasingly at risk.

BRENT OIL PRICES OVER THE YEARS

WEST AFRICAN ENERGY SUMMIT E A S #WAES2024 3rd - 5th September 2024 Accra International Conference Centre, Accra Contact: daniel.hyland@ogvenergy.co.uk kwasi.senya@petrocom.gov.gh www.waesummit.com SIGN UP TODAY!

SPONSORED BY

www.eicdatastream.the-eic.com

Energy projects and business intelligence in the energy sector

The EIC delivers high-value market intelligence through its online energy project database, and via a global network of staff to provide qualified regional insight. Along with practical assistance and facilitation services, the EIC’s access to information keeps members one step ahead of the competition in a demanding global marketplace.

The EIC is the leading Trade Association providing dedicated services to help members understand, identify and pursue business opportunities globally.

It is renowned for excellence in the provision of services that unlock opportunities for its members, helping the supply chain to win business across the globe.

The EIC provides one of the most comprehensive sources of energy projects and business intelligence in the energy sector today.

20 ENERGY PROJECTS MAP

2 11 12 5 7 1 9 World Projects Map 4 6 3 www.ogv.energy I June 2024 8 10

GUYANA

$12.7

WHIPTAIL OIL FIELD

A final investment decision was reached on the project in April 2024. A number of contracts were subsequently confirmed including: Saipem for the SURF work; SBM Offshore for the FPSO; TechnipFMC for the subsea trees and manifolds; Vallourec for line pipe; and Strohm for supply of jumpers.

INDIA

$665 million

KG-D5 – CLUSTER I

The operator has awarded a contract to Nauvata Energy Transition (NET Enterprise) and PERC Engineering for the pre-FEED/FEED of Cluster-1 Development. This contract includes concept studies, preparation of tender bid packages, and project management consultancy (PMC) services for two developments in the KG Basin.

AUSTRALIA

$5 billion Woodside Energy

GREATER SUNRISE GAS AND CONDENSATE FIELD

Wood Australia has been awarded the concept study on the project. The study will examine requirements for developing, processing, and marketing gas and condensate from the fields. Its scope will include engineering, financial assessment and financing aspects, local content, strategy and security, HSE, and socioeconomic analysis to determine the optimum benefit for the population of Timor-Leste.

USA

$200 million Talos Energy 4 SUNSPEAR SUBSEA TIE-BACK

Subsea7 has been awarded a SURF EPCI contract, valued between US$50mn and US$150mn, related to the Sunspear project. The company will install the flowline and related subsea equipment in a water depth of around 500 metres. The contractor will oversee the progress of the initiative through its Houston office, and offshore work is expected to begin later in 2024.

8

$2.6

NAHR BIN UMAR FIELD

Baker Hughes has signed an MoU with Halfaya Gas Company (HGC) to collaborate for a gas flaring reduction project at the Bin Umar gas processing plant. This involves supplying critical turbomachinery and process equipment, conducting a pre-FEED study of modular gas processing skids, and aiding the project’s selected FEED contractor in developing the plant design.

BUNGA ASTER OIL DISCOVERY

The operator announced a new discovery through the drilling of the Bunga Aster-1 well. The well encountered 17.5 metres of oil bearing sandstone, and marks the second discovery within a 12-month period in the PM3 CAA PSC. The well was drilled form the existing Bunga Orkid-D platform and is set to brought into production in May 2024.

RINGHORNE NORTH OIL DISCOVERY

A new oil discovery was made in April 2024 by the Ringhorne North wildcat and two additional sidetrack/appraisal wells in PL856, 8 kilometres north of the Ringhorne field in the Balder area. Estimated recoverable resources range from 13 to 23 MMbbl. The discovery is being considered as a potential candidate for integration with nearby infrastructure serving the Balder area.

WEST DELTA DEEP MARINE (WDDM)PHASE 10 & 11

The operators JV partners have signed an agreement to begin the development of Phase 11 in Egypt's WDDM concession. The project involves drilling three development wells using the Scarabeo 9 offshore drilling rig. The drilling rig has commenced operations on three wells within the Phase 10 development project, which received sanction from the WDDM partners in 2023.

BP and Woodside have issued an FID on the project. The project will comprise of a two-well tieback to the Atlantis platform via the existing DC1 manifold over the southwestern part of the field.

MOPANE-1X OIL DISCOVERY

Phase one of the exploration campaign has been completed by Galp and the company is now evaluating the commerciality of the discovery. The operator confirms that Mopane has the potential to hold hydrocarbonin-place resources of 10 billion barrels of oil equivalent.

DUYUNG PSC

The operator announced that the procurement for major contracts and services is ongoing and expected to finish in Q2 2024, with some tender closing dates extended at the request of bidders. Cost estimates will be updated once procurement is done. An independent review of costs and schedules is planned for Q2 2024 to support the FID.

(PHASE 6, 7 AND 8)

SLB has been awarded three contracts by Petrobras for completion equipment and services for up to 35 wells at the Búzios field. The contract scope includes the supply of full bore electric interval control valves and electric subsurface safety valves. A significant portion of the technology employed was developed at SLB's Taubaté Engineering Center in Brazil, in cooperation with Petrobras' CENPES R&D centre.

21 ENERGY PROJECTS MAP WORLD PROJECTS SPONSORED BY

billion ExxonMobil 1

ONGC

2

3

IRAQ

billion Basra Oil Company 5

6

7

MALAYSIA $50 million Hibiscus Petroleum NORWAY $150 million Vår Energi AS INDONESIA $325 million Conrad Petroleum 12

BUZIOS OIL FIELD

9

10 ATLANTIS DRILL CENTER

EXPANSION

1

11

EGYPT $277 million Burullus Gas Company USA $250 million BP NAMIBIA $2 billion Galp Energia BRAZIL $15 billion Petrobras

OFFSHORE WIND LOOKS TO SHAKE OFF PAST WOES

By Tsvetana Paraskova

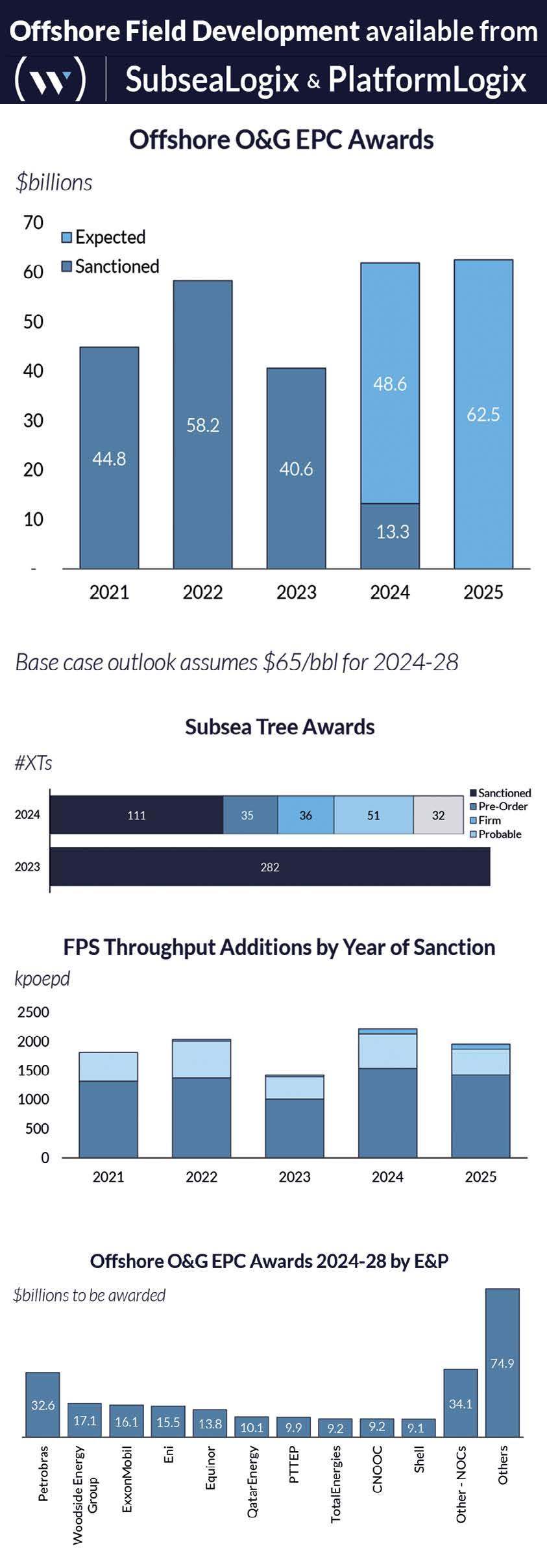

The offshore wind industry is looking to put a difficult year behind and regain momentum after several months of heightened uncertainty amid rising interest rates, soaring project costs, and cancellation of developments.

Analysts and industry officials are hopeful that recent policy changes and higher maximum prices in the upcoming auctions would attract bidders to accelerate the build-out of offshore wind farms that would further help raise the share of renewables in the electricity mix as developed nations look to become net-zero economies by 2050.

Capacity Installations Set To Jump in 2024

World Forum Offshore Wind (WFO) published at the end of April the Global Offshore Wind Report 2023, which showed that 25 new offshore wind farms with a total capacity of 9.8 gigawatts (GW) were taken into operation in 2023, increasing the global offshore wind capacity to a total of 67.4 GW.

Worldwide, 282 offshore wind farms are currently in operation, 158 of which are in Asia, 122 in Europe, and 2 in the USA.

The average size of a newly added offshore wind farm in 2023 was 392 MW, up from 225 MW in 2022.

Last year, China added nearly 5 GW of newly installed capacity, increasing its total installed capacity to 31.5 GW. The Netherlands completed two offshore wind farms, Hollandse Kust Noord, of 759 MW, and Hollandse Kust Zuid, 1.5 GW. Floating offshore wind turbines were also successfully installed in Norway (88 MW), China (7.5 MW), and Spain (2 MW), according to the report.

“Yet, 2023 was not an easy year for the industry: increased costs, supply chain struggles, delayed or even cancelled projects –we all remember the headlines,” said Managing Director Gunnar Herzig.

“However, scaling up offshore wind is not optional; it is crucial to decarbonize our economies,” Herzig added.

Governments awarded a total of 42 GW of offshore wind lease capacity in 2023, while 2024 awards are expected to exceed 70 GW, according to the report prepared in collaboration with Westwood Global Energy Group.

Westwood expects more than 70 GW of lease capacity to be awarded in 2024, which would be a 67-percent annual rise. This year’s capacity is expected to come from a mixture of incumbent as well as new markets such as Australia (at least 9.2 GW), India (4.6 GW), and Portugal (3.5 GW). The US is also anticipated to award at least 16.8 GW of capacity, with nearly 2.7 GW of this coming from floating wind sites located offshore Oregon.

“Westwood estimates over half of 2024’s lease capacity will include some form of project benefit criteria alongside a price element, or they will just be selected via non-price criteria,” the report said.

In the offshore wind turbine market, a total of 22.9 GW worth of turbine contracts were awarded in 2023, of which Siemens Gamesa won 33 percent of the total.

This year’s Global Wind Report from the Global Wind Energy Council (GWEC) showed that total wind power installations, including onshore and offshore wind, rose by 50 percent year-on-year to a record 117 GW in 2023.

GWEC has revised its 2024-2030 growth forecast upwards by 10 percent, “in response to the establishment of national industrial policies in major economies, gathering momentum in offshore wind and promising growth among emerging markets and developing economies,” the council said.

Despite the record wind energy additions last year, the wind industry must roughly triple its annual growth from a level of 117 GW in 2023 to at least 320 GW by 2030 to meet the COP28 and 1.5C degree pathway targets, GWEC said.

“Geopolitical instability may continue for some time. But as a key energy transition technology, the wind industry needs policymakers to be laser-focused on addressing growth challenges such as planning bottlenecks, grid queues and poorly designed auctions,” Ben Backwell, CEO of GWEC, said.

“Enhanced global collaboration is essential to fostering the conducive business environments and efficient supply chains required to accelerate wind and renewable energy growth in line with a 1.5C pathway.”

UK Looks to Boost Offshore Wind Development

The UK aims to accelerate offshore wind development with policy changes and a higher maximum price in this year’s sixth Contracts for Difference (CfD) Allocation Round, which opened at the end of March.

At the end of 2023, the UK government increased the maximum price for offshore wind projects in its flagship renewables scheme, CfD, for 2024.

“The CfD scheme ensures renewable energy projects receive a guaranteed price from the government for the electricity they generate, encouraging continued investment in the UKwhich is already home to the world’s 5 largest operational offshore wind farm projects,” the government said in November.

The maximum strike price has been increased by 66 percent for offshore wind projects, from £44/MWh to £73/MWh, and by 52 percent for

www.ogv.energy I June 2024

22 OFFSHORE WIND

floating offshore wind projects, from £116/ MWh to £176/MWh ahead of Allocation Round 6 (AR6).

According to the government, “This will help ensure projects are sustainably priced and economically viable to compete in AR6, building on the success of previous CfD auctions. These have so far awarded contracts totalling around 30GW of new renewable capacity across all technologies since 2014.”

In AR6, offshore wind will also be given a separate funding pot in recognition of the high number of projects ready to participate, ensuring competition among a strong pipeline of projects.

The entire CfD scheme received in March 2024 its biggest ever funding boost from the government, with more than £1 billion for its upcoming auction, including a record £800 million for offshore wind. The increased funding makes this the largest round yet, with 4 times more budget available to offshore wind than in the previous round.

Dan McGrail, Chief Executive of RenewableUK, commented,

“We welcome this budget increase, as it recognises that global economic conditions have changed, and it will secure a significant amount of new offshore wind capacity and private investment, as well as creating thousands of new jobs.”

The higher maximum price in the CfD auction has the potential to restore confidence in the UK’s offshore wind sector, and “the UK now looks like it will remain Europe’s largest offshore wind market,” the WindEurope association said earlier this year.

“Things are looking up again on offshore wind in the UK. The Government have fully corrected

the mistake not to index their auctions prices properly,” WindEurope CEO Giles Dickson said.

is set to rise to over 100,000 by 2030 and investment in new offshore wind projects will create an economic opportunity worth up to £92 billion for the UK by 2040, the industry organisations said in the plan.

The measures set out in the Industrial Growth Plan would support an additional 10,000 jobs a year and boost the UK’s economy by a further £25 billion between now and 2035, if the UK accelerates offshore wind deployment in line with the net zero targets to 5-6 GW a year.

“The plan charts a clear course for us to ensure that we seize that massive economic opportunity and maximise our opportunities to manufacture those towers here, along with more blades, cables, foundations and a whole range of other products,” RenewableUK’s Chief Executive Dan McGrail said.

Sian Wilson, Director of Marine (interim), Crown Estate Scotland, commented,

“Things are looking up again on offshore wind in the UK. The Government have fully corrected the mistake not to index their auctions prices properly”

“Stalled projects are now going ahead. And we can look forward to a bumper auction this year. The UK should be congratulated also for the good progress they’re making on interconnectors to their neighbours in the North Seas.”

UK Offshore Wind Supply Chain Aims to Triple Manufacturing Capacity

RenewableUK, the Offshore Wind Industry Council, The Crown Estate, and Crown Estate Scotland published in April 2024 a detailed Industrial Growth Plan, setting out how to triple offshore wind manufacturing capacity over the next ten years, to establish the UK as a leader in the surging global market.

The Plan identifies strategic new factories and manufacturing capabilities which the UK should build up to protect against supply chain risks and boost economic growth. The Industrial Growth Plan also highlights five key technology areas in which the UK should prioritise investment to secure value for UK industry. These include the design and manufacture of offshore wind blades and turbine towers, foundations, cables and other key components, and services for projects in the UK and abroad.

The plan envisages mobilising nearly £3 billion of funding nationwide, with private finance doing the heavy lifting. This will bring a return to the UK economy of just under £9 for every £1 invested.

The UK offshore wind industry already employs 32,000 people, while employment

“This Industrial Growth Plan is central to coordinating effective collaboration of innovation and investment effort, all of which are important for successfully developing and delivering a supply chain system which can fulfil the needs of ScotWind and other offshore leasing programmes, which are essential to achieve a green energy future.”

As part of a scheme to support the floating offshore wind supply chain, the UK government advanced in March 2024 two ports in the UK – Port Talbot in Wales and the Port of Cromarty Firth in Scotland – to the Primary List phase of the Floating Offshore Wind Manufacturing Investment Scheme (FLOWMIS).

“The FLOWMIS award, alongside significant ABP investment of more than £500 million, will begin to unlock a projected £1 billion of investment in Port Talbot and the surrounding area,” said Henrik L. Pedersen, CEO of Port Talbot operator Associated British Ports (ABP).

ABP’s Future Port Talbot project would see the port transformed into a major hub for the manufacturing, assembly, and integration of Floating Offshore Wind (FLOW) components for projects in the Celtic Sea.

“We already have one of the biggest pipelines of floating wind projects in the world - now we need to ensure we take advantage of this global leadership position by building a flourishing supply chain for the sector in the UK,” said RenewableUK’s Chief Executive and Co-Chair of the Floating Offshore Wind Taskforce Dan McGrail.

“We need to upgrade and upscale our ports so that they’re able to manufacture and assemble the large components of floating offshore wind turbines which will be over 250 meters tall on platforms the size of football pitches”.

23 OFFSHORE WIND

Cetegra Virtual Data Rooms

Smart and secure virtual data rooms to support the full spectrum of M&A activities across the Energy sector.

Global reach

Significantly reduce decision making time and environmental footprint by promoting assets to a global audience.

Secure and robust access control

Keep user permissions, access and privileges under control. Increase efficiency and security by streamlining account and group management.

Petrotechnical data and software support

Gain access to multiple petrotechnical platforms from anywhere and benefit from Cegal’s unique knowhow during the duration of your data room.

Keep your deals under control.

Administration Dashboard

Manage permissions for users, groups and documents in real-time.

Multi-access

Unlimited number of users and companies.

Flexible invoicing

Pay-as-you-use model, invoiced on a weekly or monthly basis.

Scan the QR code to learn more.

Quick deployment

Configure and provision data rooms in minimum time, from anywhere in the world.

Confidentiality and security

Protect confidential data against unsolicited viewing. Secure access through multi-factor authentication.

Customization

Configure and customize to fit your needs. Create a familiar collaborative workspace for all users.

cegal.com

Flare’s award winning services support the UK Energy Transition.