I GLOBAL NEWS I PROJECTS MAP I PODCAST I WIND ENERGY I HYDROGEN & CCS I GEOTHERMAL I ELECTRIFICATION I CONTRACTS I ANALYTICS I EVENTS READ ONLINE AT RENEWABLES PUBLICATION IN ASSOCIATION WITH READ ON PAGE 4 Pioneering floating wind COVER FEATURE Floatation Energy P.4 UK & European P.10 Callum Maxwell, Proserv P.16 With NetZero P.24 Intervention Rentals P.30 WIND P.8 GLOBAL NEWS P.8 ENERGY REVEIWS ANALYTICS P.36 ELECTRIFICATION P.32 MARINE & TIDAL P.29 PODCAST HYDROGEN & CCS GEOTHERMAL

2 www.ogv.energy - Issue 8

Dear Readers,

DIRECTOR

Welcome to the latest edition of ‘OGV Renewables Magazine’ where we explore the changing landscape of renewable energy and the ongoing energy transition. In this issue, we are thrilled to welcome Flotation Energy as our front page partner and you can read all about how they are pioneering a new era in offshore wind employment on pages 4-5 inside.

In this issue, we had the privilege of sitting down with the Business Development Manager of Proserv - Callum Maxwell, where he told us all about his journey as to how he got into offshore wind from working with ORE Catapult, to now helping to lead the organisations’ development into some of the largest offshore projects in the UK. In particular, their new ECG technology which is a holistic cable monitoring system is fascinating, so make sure and listen to the full podcast to hear how its helping their customer base!

We also have articles from Three60 energy, First Marine Services, Sustainable Solutions, Flare, the Net Zero Technology Centre, ETZ and Zestas, keeping us informed on the latest news within this emerging sector, so be sure to check them out.

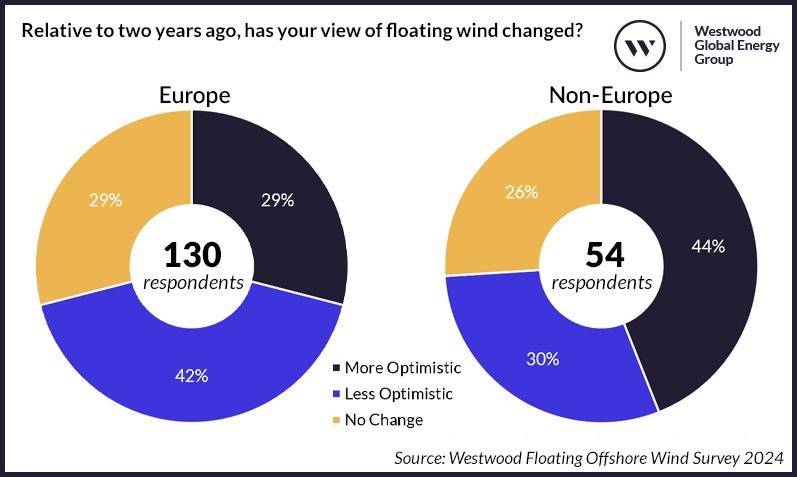

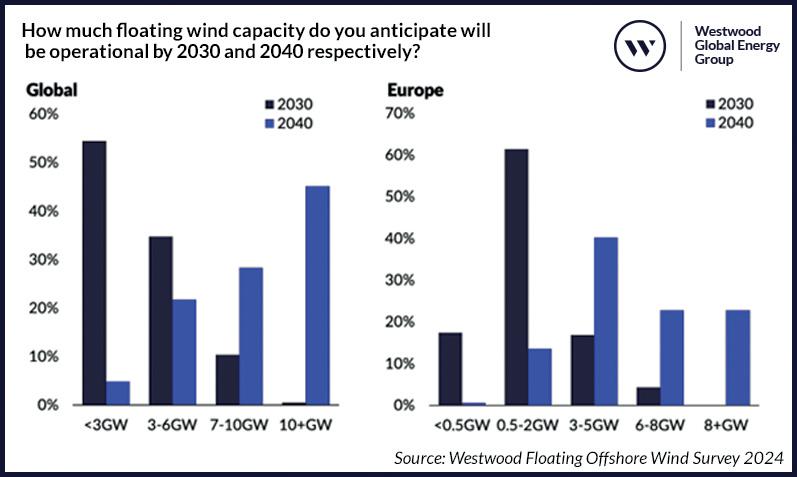

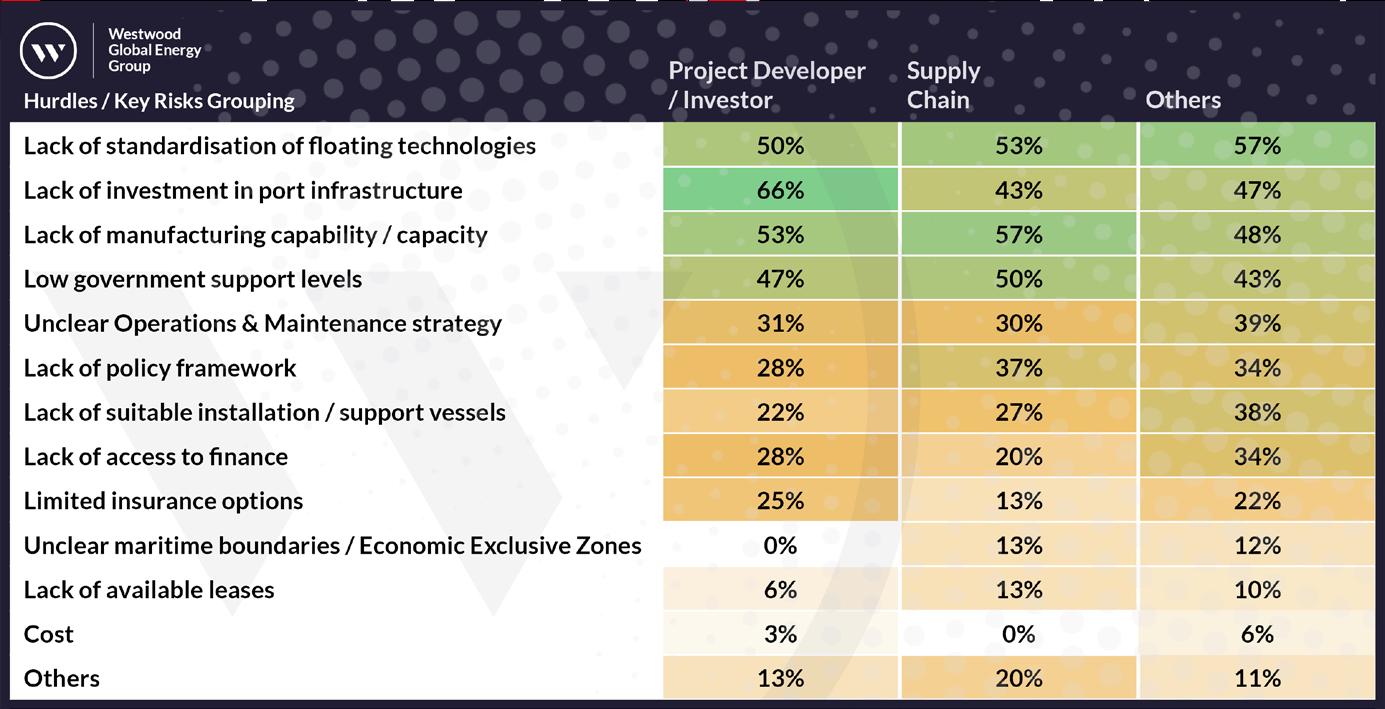

As always, we also have the latest news across Wind, Hydrogen & CCS, Geothermal and Electrification as well as analytics from Westwood Global Energy Group, project information from the EIC and contract wins from Infinity Partnership.

Warm regards,

COVER FEATURE GLOBAL NEWS PROJECTS MAP PODCASTS WIND ENERGY HYDROGEN & CCS MARINE & TIDAL GEOTHERMAL ELECTRIFICATION CONTRACTS STATS & ANALYTICS EVENTS P.4 P.8 P.14 P.16 P.20 P.24 P.27 P.30 P.32 P.34 P.36 P.38

WISH TO CONTRIBUTE TO OUR NEXT PUBLICATION? Contact us to submit your interest daniel.hyland@ogvenergy.co.uk

DAN HYLAND –

Contents 3

PIONEERING A NEW ERA OF UK OFFSHORE JOBS WITH FLOATING WIND

By Alexander Quayle, Project Director, Flotation Energy and Chris Hill, UK Managing Director, Vårgrønn

As a relatively new technology, significant parts of the supply chain for floating wind – and therefore the location of floating wind jobs – are still to be established.

While the turbine blades and towers are the same as with fixed turbines, the floating substructures, cables and moorings are all different. These come with new manufacturing and processing roles for taking. In the upcoming decades, it is predicted that 20,000 floating sub-structures will be needed globally, offering suppliers a huge potential new market with long-term growth.

Close to 30,000 people could be working in the UK floating wind industry by 2050 and at the centre of this potential sits the current oil and gas workforce. With 90% of employees in the UK oil and gas industry having the skills to transition to offshore wind, there is a skillset ready and waiting. However, the first large floating wind projects globally

will determine the supply chain structure, and the suppliers that win these contracts will create the track record required to win future work.

Close to 30,000 people could be working in the UK floating wind industry by 2050 and at the centre of this potential sits the current oil and gas workforce.

The suppliers and countries that get the first-mover advantage for job creation in this new industry will be determined this year. Several UK pole position projects will soon be ready to enter the construction phase, and seabed area has already been awarded to 24 gigawatts worth of floating wind projects in the region. Although the UK’s potential projects are more mature than those in competing markets, other countries are close behind. The global projects pipeline increased by a third from 2022 to 2023.

Developers play a critical role in supply chain development. Their selection of suppliers will sow the seeds that this burgeoning industry will grow from. Moreover, in floating wind, suppliers need to work more collaboratively within the early project stages than in traditional fixed wind developments. This is due to the higher complexities in design interfaces between different components such as cables, wind turbines, substructures and mooring lines. Developers are the crucial linchpin connecting all these suppliers, working in new, collaborative models to take floating technology to scale.

The huge scope for technology innovation that goes beyond the floating structures themselves – and beyond the construction phase.

From robotic and data-driven inspection technologies to up-tower cranes, remote monitoring, troubleshooting and machine learning, all of these need adapted to maximise the energy producing potential of floating wind

4 www.ogv.energy - Issue 8

When looking at the management, operations and maintenance of major component replacements, for example, investment in major component hubs at ports needs great consideration, as well as a suitable solution for a capable crane. In addition, technology to manage the majority of these activities in situ will also be extremely important, so that tow-to-port activities become the exception, not the norm.

Garnering investment in new technology, infrastructure, skills and manufacturing with pilot scale projects in any industry is a challenge.

Costs remains high, as the necessary scale of individual projects and volume over time is not yet there. Investment in the supply chain and the learning effects that drive down costs will only come with commercial-scale floating wind developments.

Europe’s first commercial-scale floating wind project will be Green Volt, off the coast of Scotland in the Outer Moray Firth. When complete, it will become of the world’s largest floating wind projects developed under the Crown Estate’s Innovation and Targeted Oil and Gas (INTOG) leasing round by developers Flotation Energy and Vårgrønn. The project will electrify oil and gas platforms while delivering renewable energy to the UK grid.

At 560 MW, Green Volt serves as a vital stepping stone for suppliers. It bridges the gap between the small floating installations now operating and the much larger floating projects planned for further down the project pipeline. Green Volt is committed to including local supply chain when it selects suppliers and is adopting a collaborative supply chain model required to advance floating wind technology.

2024 is set to be a pivotal year for this nascent industry. With Green Volt having achieved consent earlier this year, floating wind in the UK is primed and ready to deliver jobs and renewable energy for decades to come - but only if industry and authorities collectively step up this year. Developers have created

execution-ready projects in the UK. Now it is up to a new government and its authorities to ensure the necessary conditions are in place for industry to invest at scale in the pioneering technology.

If the UK fails to be first on floating wind, projects may have to rely on imported components, because the supply chain expertise will have developed elsewhere. While this approach might tick the box for energy security and emission cuts, it would fail to generate the employment needed to retain public buy-in for the energy transition and would leave the UK behind in terms of skills and development. And, once we reach 2030 and beyond, ready to build out full-scale under the ScotWind leasing round, the risk will be competition with other floating wind projects - potentially in the face of limited supply chain capacity - forcing developers to select international suppliers.

Local suppliers must prepare to grasp the opportunities that are uniquely available at this moment in a new industrial history, but can only do this with confidence that a supportive commercial environment is in place.

COVER STORY

5

DECADES

OF INNOVATION & EXPERTISE IN ENGINEERING AT YOUR FINGERTIPS

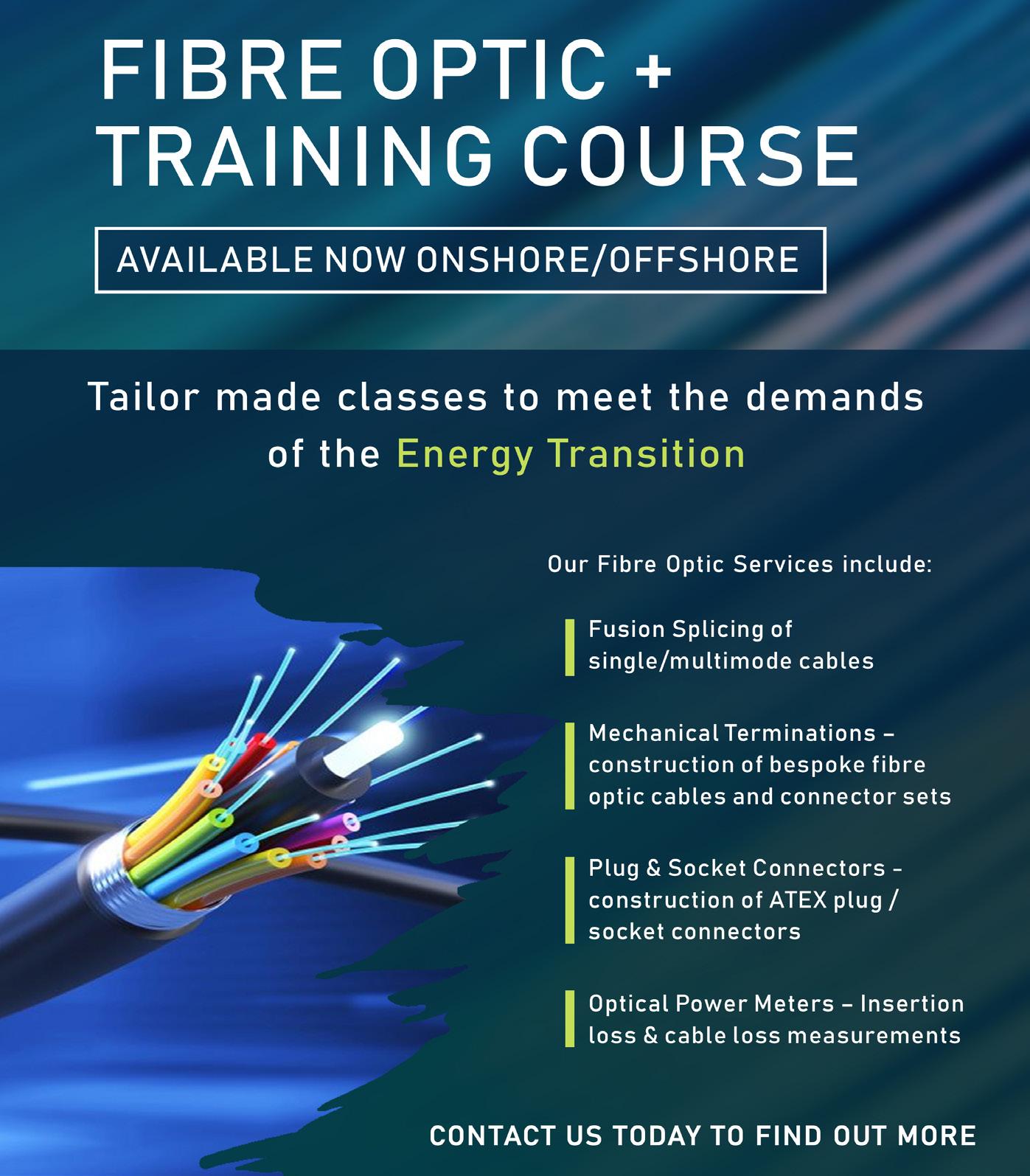

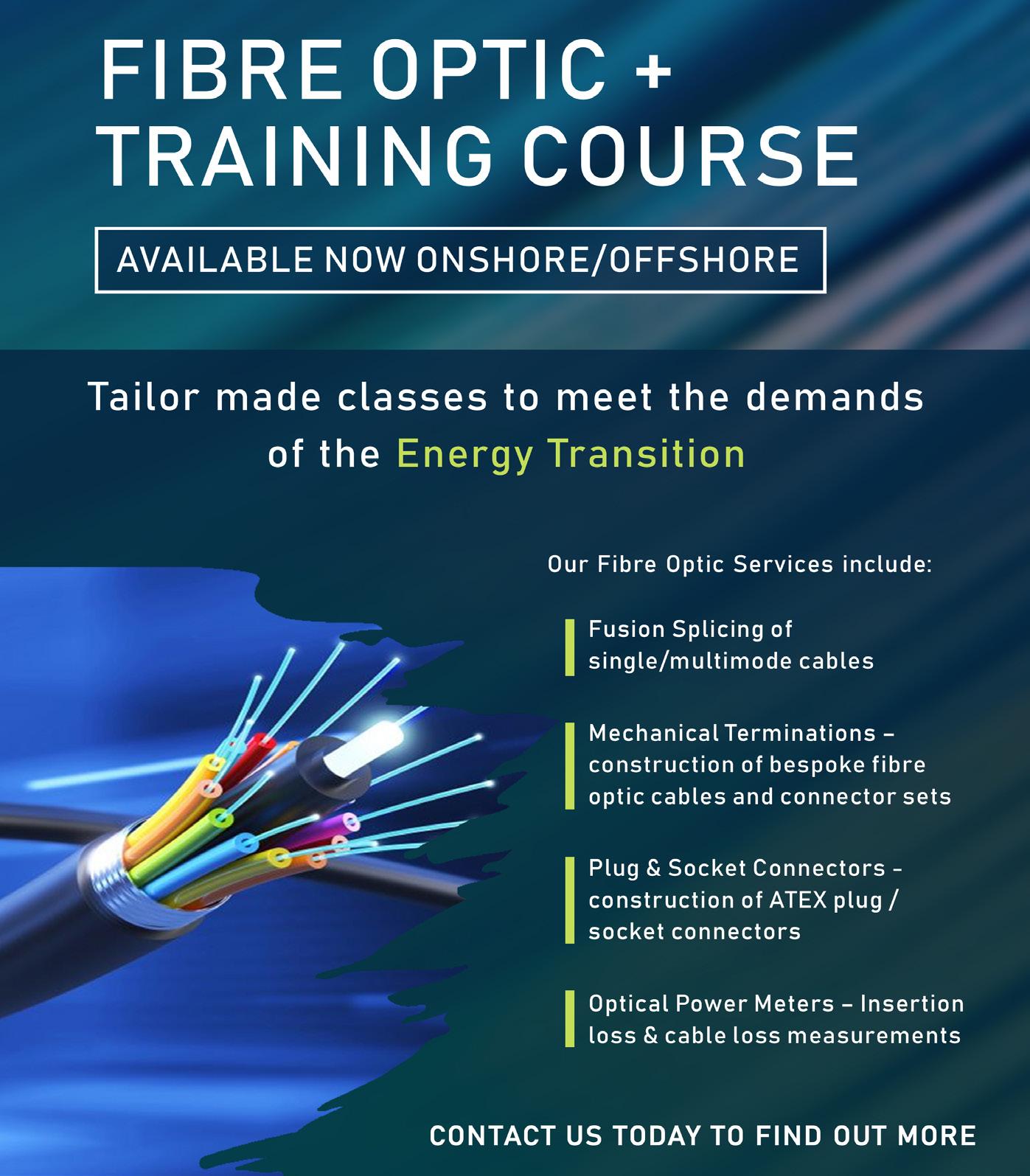

FIBRE OPTIC + TRAINING COURSE

FIBRE OPTIC TRAINING

for the onshore, offshore and renewables markets

RCP - Instrumentation and Control System specialists have made significant investment in fibre optic equipment such as fusion splicing machines, mechanical splicing kits, fibre optic ovens, optical power meters, optical microscopes and polishing equipment to terminate and test fibre optic cables, connectors, junction boxes and patch panels to a very high standard.

In 2021 a dedicated fibre optic workshop was set up at our Blackburn facility to provide fibre optic training to the onshore, offshore and renewables markets.

Fibre Optic Training includes

Fusion Splicing of single mode and multimode cables using Fujikura fusion splicers, construction of bespoke fibre optic cables and connector sets, construction of circular plug/socket connectors for hazardous area use. ATEX/IECEx zone 1 connectors, cables made up with pre-potted glands and tails to facilitate ease of fitment to drilling platforms, rigs offshore and renewable assets.

Mechanical splicing – Corning and Huber + Suhner connectors, ST, SC and LC, insertion loss and cable loss measurements, testing connectors and cables for insertion loss and return loss. OTDR testing using Fujikura machines.

The format of the course starts with the theory of Fibre Optics. Safety when using Fibre Optics, FO cable selection and connector types. Stripping fibre optic cables and

preparation including the use of fan out kits, the use of fibre breakout boxes and fibre optic plug socket connectors and an understanding of loss budgets for fibre optics.

Delegates will learn how to manually splice using a Corning Kit with ST, SC and LC connectors. They will learn how to measure insertion loss of splices, connectors and cables. The delegate will use a fibre optic power meter. There will also be an introduction to fusion splicing.

The training course consists of both theoretical and practical elements with approximately 75% of the course being practical exercises where the delegates get to practice the skills taught.

By the end of the course each delegate will be able to identify different types of fibre cable for use on/offshore, select the correct type of cable and connector for the application in hand, prepare and manually splice a connector onto a fibre optic core(mechanical splice), test the integrity of the connector and measure the insertion loss of the cable or cable system.

For

The delegates will be able to fault find and repair fibre optic cables and connectors, prepare and splice a connector onto a fibre optic core known as fusion splicing.

The course material can be created bespoke to a company’s specific requirements. The course runs over 2 days.

A certificate of competence will be issued to the delegate's employing company on successful completion of the course.

RCP provide the following site services on or offshore

Fusion Splicing of single mode and multimode cables – Fujikura fusion splicers, Construction of bespoke fibre optic cables and connector sets, Mechanical splicing – Corning and Huber + Suhner connectors, ST, SC and LC. Construction of bespoke fibre optic cables and connector sets – Insertion loss and cable loss measurement, testing connectors and cables for insertion loss and return loss.

more information please contact us at www.rcpat.com +44(0)1224 798312 I sales@rcpat.com

INSTRUMENTATION & CONTROL SYSTEMS www.ogv.energy - Issue 8

Editorial newsdesk@ogvenergy.co.uk

+44 (0) 1224 084 114

Advertising office@ogvenergy.co.uk

+44 (0) 1224 084 114

Design

Jen McAdam Cali Gallow Ben Mckay

Journalist Tsvetana Paraskova

CONTRIBUTORS

OGV ENERGY VIEW

OUR PARTNERS

TRAVEL MANAGEMENT PARTNER

Corporate Travel Management (CTM) is a global leader in business travel management services. We drive savings, efficiency and safety to businesses and their travellers all around the world.

LOGISTICS PARTNER

Pentagon have moved freight for the oil and gas industry for nearly 50 years. This has given us an unmatched breadth of experience that allows us to implicitly understand your requirements because we know oil and gas. Whether your requirement is onshore or offshore, or drilling, oilfield services, EPC, or E&P, we can solve your logistics problem.

Disclaimer: The views and opinions published within editorials and advertisements in this OGV Energy Publication are not those of our editor or company. Whilst we have made every effort to ensure the legitimacy of the content, OGV Energy cannot accept any responsibility for errors and mistakes.

The key to faster, better decisions

RenewableUK’s EnergyPulse is the industry’s go-to market intelligence service, providing comprehensive and accurate energy data, insights, and focussed dashboards for the wind, marine, storage and green hydrogen sectors in the UK and offshore wind globally.

Connected to our 400+ member network our experienced team of experts research industry news, contracts, and ownership to ensure you keep grow your business agility by leveraging a suite of user-friendly, intuitive, configurable, and highly-interactive tools.

Sign up and keep your finger on the pulse of the UK and global renewable energy markets, accelerating towards a net-zero future.

We offer a wide range of competitive subscription levels that can be tailored to suit your business needs.

Contact our Head of Membership, Jeremy Sullivan or call +44(0)20 7901 3016 for a personalised consultation.

of projects tracked as of 04/08/2022

our media pack at www.ogv.energy/advertise-with-us

scan the QR code

or

ADVERTISE WITH OGV

RenewableUK

numbers* www.renewableuk.com *Number

EnergyPulse in

www.renewableuk.com

RenewableUK members are enabling a just transtion to a net zero future. Focusing on continuous improvement around the three pillars of our Just Transition Tracker - People, Place and Planet These inspiring companies are a true showcase of the best that our industry has to offer.

NORTH STAR SECURES £425M WAR CHEST

North Star has secured further debt investment of up to £425m to accelerate its ambition to become the leading player in Europe’s offshore wind sector and add 40 hybrid SOVs to its fleet by 2040.

The committed financial package of £225m includes term facilities from existing lender, IFM Investors, and committed capex and working capital resources from banks including ABN AMRO (sustainability co-ordinator), AIB, NAB, Royal Bank of Scotland and RBC (sustainability structuring advisor).

The facilities also have accordion capacity allowing a further £200m in funding, enabling the firm the flexibility to upsize as required, removing financial risk and streamlining new business opportunities in the offshore wind sector.

RBC Capital Markets performed the lead advisory role in support of the transaction.

North Star, owned by Partners Group (a leading global private markets firm acting on behalf of its clients), has bases in Aberdeen, Lowestoft, Newcastle, and Hamburg, and operates 41 multi-purpose ships in the North Sea.

In addition, it also has three of four newbuild SOVs in operation at the Dogger Bank Wind Farm with the final asset on schedule for early delivery next year.

The firm has a further four newbuilds underway – an SOV for EnBW's He Dreiht wind farm in Germany, another for Siemens Gamesa Renewable Energy at the East Anglia THREE project, and its first two larger Commissioning SOVs to further support its offshore wind clients.

Fraser Dobbie, North Star chief financial officer, said: “This £425m strategic investment highlights the attraction of our robust business model and ESG transition journey as we push to become the leading player in Europe’s SOV sector.

"The infusion of capital from a combination of institutional and bank investors secures access to the capital required to support our continued growth, and provides validation from the lender market of the excellent progress we have made on our strategic journey to build our business for sustainable, long-term success in the offshore wind market.

"For potential clients, this committed debt package provides certainty on our ability to deliver vessels as outlined in our tender bids, financially de-risking the process completely.

"This provides us with a competitive edge and a superior ability to turnaround high quality SOV newbuild programmes more rapidly, ensuring the best value and service in the industry."

Its SOV fleet carries several VARD designs to meet clients’ offshore logistics support and operational requirements, including the accommodation of the wind farm technicians remaining and working in field.

As well as providing high quality amenities and comfort, the high-performance hybridelectric ships utilise numerous green technologies and solutions to best support the safe transfer of personnel and cargo to the offshore infrastructure through the motion compensated gangway.

North Star is at the forefront of innovations in the sector creating solutions such as decision support system to support zero carbon objectives, hybrid daughter crafts and logistics handling advances.

North Star has been operating for 137 years and employs a workforce which includes 1,400 onshore personnel and seafaring crew.

GLOBAL NEWS

CORPORATE PARTNER 8 www.ogv.energy - Issue 8

GoldenPeaks Clinches Hungarian Solar Financing

Eastern European renewables investor GoldenPeaks Capital has completed the financing of a portfolio of solar projects with a total capacity of 65MW in Hungary.

The portfolio comprises two solar projects located in north-east Hungary.

Both projects are under construction and will enter into long-term power purchase agreements (PPAs).

Erste Group and Erste Bank Hungary provided the senior financing, while the junior piece was backed by a fund managed by the French asset manager Schelcher Prince Gestion.

Vestas Scoops 6MW Austrian Turbine Order

Vestas has received a 68MW order from ImWind Erneuerbare Energie for a wind power project in Loidesthal, Austria.

The order includes supply, delivery, and commissioning of 10 V162-6.2MW wind turbines and one V150-6.0MW turbine, plus a 25-year service agreement.

The order is an extension of the existing Loidesthal wind project that consists of eight V126-3.45MW turbines.

Turbine delivery is expected to begin in 2025 with commissioning scheduled for completion in the first quarter of 2026.

Capcora acted as the exclusive financial advisor to GoldenPeaks on securing the mezzanine financing.

Having established itself as an owner of solar systems in Poland, GoldenPeaks Capital has further expanded into Hungary and secured financing in the market through a unique transaction.

Daniel Tain, President of GoldenPeaks, said: "We're delighted to have secured both senior and junior facilities for our projects in Hungary marking another milestone in our history.

“Concurrently, we're welcoming two new strategic lenders to our network, crucial for

our mission to be a leading independent power producer in the Central Eastern European market. “

Marcus Hinrich Fischer, Executive Director for Corporate Finance Solutions at Erste Group, added: “Partnering with GoldenPeaksCapital, we have worked out a financial structure which gives more time and flexibility than usual to source and negotiate power purchase agreements with off-takers as one of the major commercial pillars of the project.

“Integrating junior debt from SPG into the financing provides for further optimisation of the funding.”

“This project with our valued client, ImWind Erneuerbare Energie, enables a highly competitive business case,” said Christoph Manseder, Senior Director of Sales for Austria and Switzerland at Vestas.

He added: “We are delighted to contribute to ImWind’s renewable energy goals in Austria and look forward to deepening our collaboration.”

Georg Waldner, CEO of ImWind, said: “For this significant project, we have decided in favour of our long-standing and reliable partner Vestas.

“We are now looking forward towards a successful construction phase and commissioning of our turbines.”

GLOBAL NEWS

Renewable News SPONSORED BY 9

UK renewable energy review

By Tsvetana Paraskova

uk review

UK HOPES TO ACCELERATE RENEWABLE ENERGY ROLLOUT

As the UK heads for a general election in July, energy policy takes centre stage in the campaign. The share of renewables of UK’s power generation hit a record high in 2023, and industry expects the ongoing allocation round 6 in the flagship Contracts for Difference (CfD) scheme to award new renewables capacities that would help Britain reach its renewables and net-zero targets.

Renewables’ Share of Electricity Generation Hits Record High in 2023

Last year, power generation from renewable technologies matched the previous record high of 2022 but renewables’ share of electricity generation increased to a record 47.3 percent. Wind generation hit a record high share of 28.7 percent of generation, up from 2.7 percent back in 2010, the UK’s Department for Energy Security and Net Zero said in its latest statistics release.

The renewables share was the highest in the reported time series and 10.9 percentage points higher than the share generated by fossil fuels. Electricity generated from wind increased despite lower average wind speeds, helped by additional generation capacity, and

contributed more than a quarter of the UK’s electricity in 2023. Generation by offshore wind reached a record high of 49.5 TWh and provided 17.3 percent of the UK’s electricity.

In solar power, despite lower average daily sun hours throughout 2023, solar generation rose by 4.1 percent to 13.8 TWh, the highest in the time series, reflecting increased solar capacity.

At the same time, power generation from fossil fuels fell to a record low share of 36.3 percent. However, generation from natural gas remained the principal form of UK generation at 34.3 percent.

Low-carbon generation – including renewables and nuclear – increased to a record high share of 61.5 percent last year, the government data showed.

Britain’s flagship renewables scheme has received its biggest ever funding boost from the government, with more than £1 billion for the auction, which opened at the end of March.

Following an extensive review of the latest evidence, including the impact of global events on supply chains, the government has allocated a record £800 million for offshore wind, which has been given a separate funding pot. The funding makes this the largest round yet, with 4 times more budget available to offshore wind than in the previous round.

This follows the increase in the maximum price for offshore wind and floating offshore wind in November 2023 and will ensure Britain remains a global pioneer in wind power, the UK government said.

“We are sticking to the plan to deliver the long-term change our country needs to deliver a brighter future for Britain - securing more homegrown, green energy we can protect billpayers from volatile gas prices,” Energy Security Secretary Claire Coutinho said in March.

UK Allots Largest Ever Budget for CfD Auction Round

10 www.ogv.energy - Issue 8

UK renewable energy review

The ongoing Allocation Round 6 coincides with the election period. The AR6 is in progress and is expected to conclude at some point during the summer depending on the timeline scenario to which the round runs.

“During the election period, essential business, including routine business necessary to ensure the continued smooth functioning of government and public services, must be allowed to continue,” the government said.

“This can include a CfD allocation round that is already open, although significant decisions and announcements about the round may be subject to the latest Cabinet Office advice on the election period.”

The UK industry looks to further bolster domestic offshore wind capacities and capabilities regardless of the outcome of the election.

UK Offshore Wind Industry Set for New Age of Sustainable Growth

The UK offshore wind industry is gearing up for a new era of accelerated, sustainable growth, which will be driven by a range of new approaches and commitments introduced in 2023, The Crown Estate’s latest UK Offshore Wind Report 2023 showed in May 2024.

UK’s offshore wind is the second largest offshore wind market in the world and represents more than 40 percent of European offshore wind capacity. The UK offshore wind pipeline grew by a further 10 GW in 2023, to 93 GW, and the sector produced 49 TWh of electricity last year, enough to power the equivalent of 50 percent of UK homes, according to The Crown Estate.

Still, it is estimated that 125 GW could be needed by 2050 to meet net zero in the UK.

“Achieving this in an increasingly complex marine environment calls for a more

coordinated approach to seabed management and the delivery of transmission infrastructure, not just to support growth but also to consider the natural environment, other seabed users and to unlock the jobs and prosperity this growth can bring,” The Crown Estate said.

The UK awarded in early May another 31 licenses for North Sea exploration in the final tranche of the 33rd oil and gas licensing round. The North Sea Transition Authority (NSTA) for the first time introduced a clause for overlapping oil and gas licences and offshore wind farm leases. Some of the licences awarded are in areas previously earmarked for offshore wind power licences.

“Following discussions with our partners in The Crown Estate and Crown Estate Scotland, we have introduced a new clause for overlapping oil and gas licences and wind leases for the first time,” NSTA said.

“This will be the main commercial mechanism for these licences to resolve spatial overlaps and to support co-existence of these important industries.”

Commenting on the new clause for overlapping oil and gas licences and offshore wind farm leases, RenewableUK's Chief Executive Dan McGrail said,

“Whilst we welcome the efforts of the North Sea Transition Authority, The Crown Estate and Crown Estate Scotland to work together on reforming the rules governing oil and gas co-location with offshore wind farms, we need much greater prioritisation of renewables over oil and gas in spatial planning. Offshore wind is going to be the backbone of our future system, not fossil fuels.”

A new report by Aurora Energy Research, commissioned by RenewableUK, showed in early June that offshore wind will be crucial to safeguard consumers and ratepayers from volatility in natural gas prices.

The report identifies additional offshore wind as a key pillar of a decarbonised British power system. Renewables remain the lowest-cost forms of new electricity generation and, compared to gas generation, are less exposed to international price changes, offering greater energy independence, according to the report.

In its analysis, Aurora Energy Research modelled different energy system scenarios that the UK could pursue by 2035. The research showed that options such as relying more heavily on foreign energy imports or generating high amounts of electricity using gas turbines increase the costs of running the system, compared to a high offshore wind system.

The analysis concluded that consumers could save around £68 a year with a Net Zero 2035 electricity system predominantly powered by offshore wind versus a Net Zero system with no further CFD-backed offshore wind development.

“A power system with a substantial amount of offshore wind can provide a buffer against global gas price volatility"

“A power system with a substantial amount of offshore wind can provide a buffer against global gas price volatility,” said Malavika Gode, Senior Associate, UK & Ireland Advisory, at Aurora Energy Research.

Salman Khan, Principal, Advisory, at Aurora Energy Research, added:

“The study also found that the government support for offshore wind is important for its development in the long term and the consequential increase in consumer/ system costs is comparatively low as compared to investing in other alternative low carbon technologies.”

As energy policy emerges as a key issue in the general election campaign, RenewableUK published at the beginning of June new polling which showed overwhelming public support for a cross-party consensus on maximising investment in renewable energy projects to reduce consumer bills and boost Britain’s energy security.

Polling by Opinium of 10,021 people in the UK in April, commissioned by RenewableUK, showed that 79 percent of voters want political parties to work together to create a consensus on maximising investment in clean power. This overwhelming support exists in the current voters of all political parties, with 81 percent of Conservatives, 86 percent of Labour, 89 percent of Lib Dem, 82 percent of SNP, and 69 percent of Reform voters in support.

Renewable News SPONSORED BY

11

By Tsvetana Paraskova

By Tsvetana Paraskova

EUROPEan review

EUROPE NEEDS CRUCIAL POLICY SUPPORT TO REACH NET ZERO

Europe has made huge progress in greening its power generation in recent years. Soaring wind and solar electricity output has been displacing fossil fuels, whose share in electricity output has dropped to an all-time low.

Despite the acceleration of renewables and the EU’s efforts to create a domestic supply chain for clean energy manufacturing, Europe still needs additional crucial policy support to be able to compete with the United States and China for supply chain manufacturing and ramp up solar and wind power installations to meet its 2050 net-zero targets.

Renewables Push EU Fossil Fuel Power to All-Time Low

Earlier this year, the EU hit a major milestone in its electricity transition. For the first time ever, fossil fuels generated less than a quarter of the EU’s electricity in a single month, in April 2024, per data from think tank Ember.

During that month, the EU’s electricity generation from fossil fuels fell to a record low level of 23 percent. Despite the rise in power demand in the bloc, fossil generation fell sharply compared to April 2023.

As a result, power sector emissions declined by 22 percent year-over-year.

While the share of fossil fuels shrank to a record low, wind and solar growth and a recovery in hydropower generation contributed to the largest ever renewables share of 54 percent. Wind and solar reached a record high in April 2024, generating more than a third of EU electricity for the first time, according to Ember’s estimates.

Power generation from fossil fuels in April 2024 was down by 24 percent compared to April 2023, and as a result, EU fossil generation reached its lowest monthly level, at 46 TWh.

Both coal and natural gas generation fell sharply. Coal generation slumped by 30 percent and accounted for 8.6 percent of the EU’s electricity mix in April 2024, its lowest share ever. Natural gas-powered output dropped by 22% on the year and made up 12.1 percent of the EU’s electricity mix in April 2024, its lowest share in at least eight years, Ember noted.

In a more recent analysis in June, Ember said that wind and solar power have displaced a fifth of the EU’s fossil generation over the past five years.

Since 2019, EU wind and solar capacity has jumped by 65 percent, with wind capacity up by 31 percent to reach 219 gigawatts (GW) in 2023. Solar capacity has surged even faster, more than doubling from 120 GW to 257 GW.

euaropean renewable energy review

www.ogv.energy - Issue 8 12

This new wind and solar capacity resulted in a 46-percent combined increase in generation from 2019 to 2023 and propelled the wind and solar share in the EU electricity mix from 17 percent in 2019 to over a quarter in 2023—at 27 percent. This was the main driver behind the increase of the share of total renewables from 34 percent in 2019 to 44 percent in 2023, Ember says.

At the same time, fossil fuel generation decreased by 22 percent between 2019 and 2023, with sharp drops in both coal and gas generation. Coal generation fell by a quarter, despite a temporary uptick in 2021 in the energy crisis and the temporary postponement of some coal power plant closures. Gas generation fell for four consecutive years, ending 2023 at its lowest level since 2015, at 21 percent below its 2019 levels, according to Ember’s data.

The rise of renewables was evident in all EU member states during the period—more than half of the 27 Member States have at least doubled, and in many cases more than tripled, their wind and solar capacity from 2019 to 2023, the think tank said.

“Ambitious, world-leading climate policies, combined with targeted measures to get off Russian gas, have solidified into real and sustained momentum,” Sarah Brown, Europe Programme Director at Ember, commented.

“The EU is now in the midst of a historic, permanent shift away from reliance on fossil fuels for power.”

EU National Plans Fall Short of REPowerEU Goals

Despite the progress in clean energy generation, the EU is currently off track on its ambitious renewables targets. The draft National Energy and Climate Plans (NECPs) of the EU member states are just short of what’s needed for the EU’s energy targets. A further push is needed to close the remaining gap and accelerate deployment, Ember’s analysts Chris Rosslowe and Tom Harrison wrote in an analysis in May.

Renewable electricity is set to dominate the EU power sector by 2030. Ember has estimated that renewables are on course to generate 66 percent of EU electricity by 2030. This is a rapid and significant increase compared to 2023 levels, when renewables generated 44 percent of EU electricity, but falls short of the REPowerEU target of 72 percent.

“While significant progress has been made in raising ambition since 2019, more ambitious targets are needed to put the EU on track for a predominantly decarbonised power system in the mid 2030s, as required by global climate commitments,” Ember’s analysts commented.

EU Trails US and China in Clean Technology

Currently, the EU’s 2030 net-zero targets are out of reach as clean tech investments fall

euaropean renewable energy review

behind the US and China, Rystad Energy said in a report in early June.

According to Rystad Energy research and modelling, the European Union is set to fall far behind its ambitious energy transition targets for renewable energy, clean technology capacity, and domestic supply chain investments.

The US, with the incentives in the Inflation Reduction Act (IRA), as well as China, are beating the EU to attract investment in clean energy technologies. The EU, despite the NetZero Industry Act (NZIA) passed earlier this year, is seeing a contrasting story of ambition versus reality in cleantech investment, and another dose of reality could be coming soon, the independent research and energy intelligence company said.

“The next few years are critical, and hesitancy or a lack of cohesion could see the bloc lagging its counterparts for decades to come. As things stand, the EU is losing ground and is highly unlikely to reach its lofty goals,” said Lars Nitter Havro, Senior Energy Systems Analyst at Rystad Energy.

While the EU’s NZIA sets forth ambitious targets and provisions to accelerate the deployment of key clean technologies, including batteries, CCUS, and hydrogen electrolyzers, some European solar manufacturers and battery manufacturing companies are favouring “the greener pastures across the pond, emphasizing the need for competitive developer conditions,” Rystad Energy said.

“A power system with a substantial amount of offshore wind can provide a buffer against global gas price volatility"

The success of the EU’s efforts to have a strong domestic supply chain in clean energy technologies and reach its solar and wind capacity installation targets will depend on continued political and financial support for renewables. These technologies tend to be vulnerable to political shifts and the reliability and availability of adequate manufacturing capacity, according to the research firm.

“The EU has lost much of its manufacturing base to Chinese and US competition, and establishing a resilient supply chain in Europe is proving challenging,” Rystad Energy said.

“Key industry players are departing the bloc and relocating to regions with more attractive incentive structures, such as the US, and the EU simply cannot compete,” it noted.

“The migration of these companies not only erodes the EU's manufacturing capacity but also increases its reliance on non-European sources for essential components, making it dependent on other nations to secure its targets.”

Renewable News SPONSORED BY

13

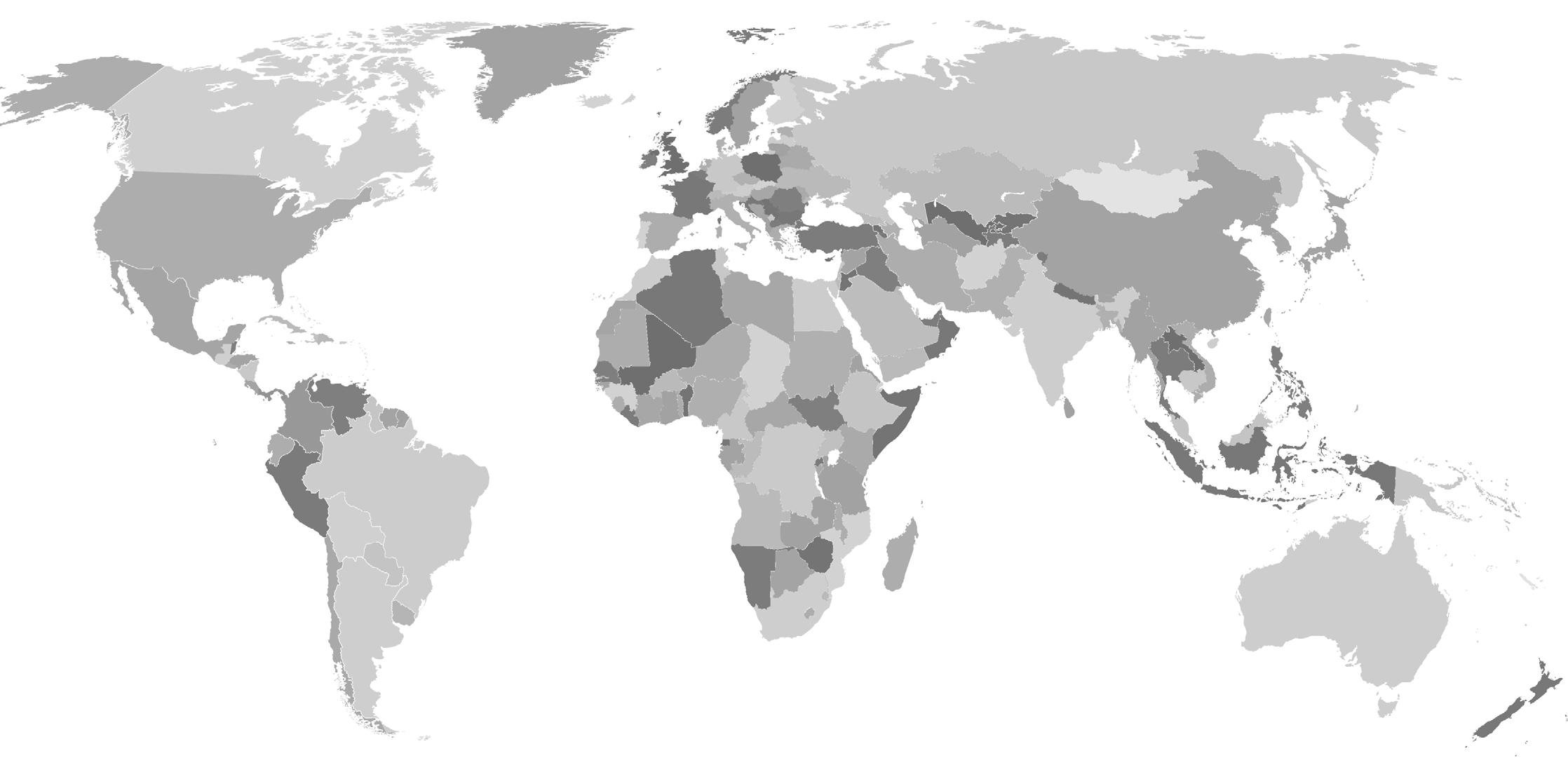

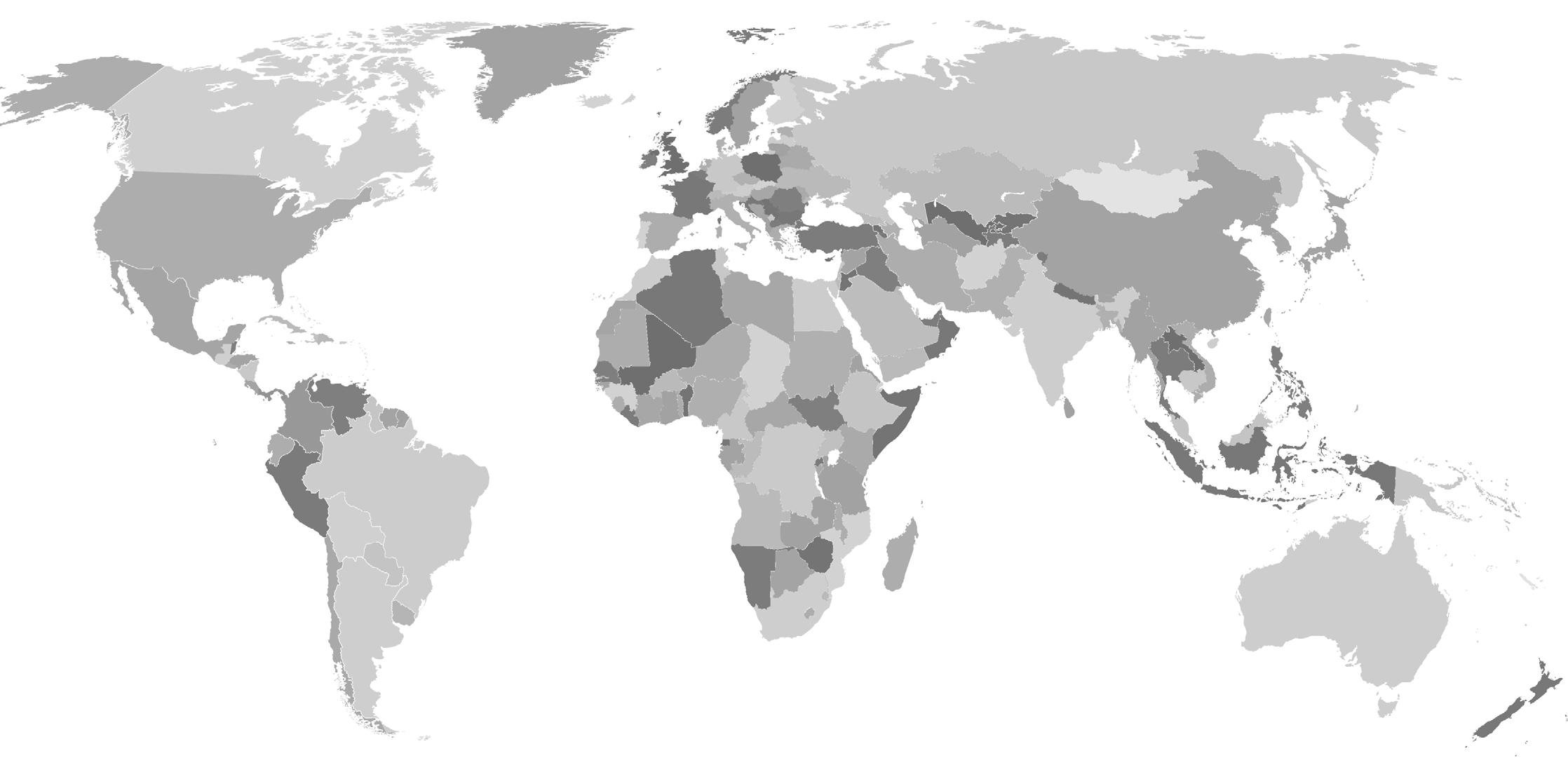

renewable projects

SPONSORED BY

www.eicdatastream.the-eic.com

Energy projects and business intelligence in the energy sector

The EIC delivers high-value market intelligence through its online energy project database, and via a global network of staff to provide qualified regional insight. Along with practical assistance and facilitation services, the EIC’s access to information keeps members one step ahead of the competition in a demanding global marketplace.

The EIC is the leading Trade Association providing dedicated services to help members understand, identify and pursue business opportunities globally.

It is renowned for excellence in the provision of services that unlock opportunities for its members, helping the supply chain to win business across the globe.

The EIC provides one of the most comprehensive sources of energy projects and business intelligence in the energy sector today.

renewable PROJECTS

Offshore Wind Farm

Nordseecluster A GERMANY

RWE Renewables

$3.19 bn

Development of a 660 MW offshore wind farm 40 km north of the island of Juist in the German North Sea. The wind farm will feature 44 x 15 MW turbines and form a part of the larger 1.6 GW Nordseecluster complex. The complex has secured a financial investment decision and has chosen Van Oord to transport and install the turbines’ monopile foundations. 1

Floating Offshore Wind Farm Erik Segersall SWEDEN

Deep Wind Offshore

$8.5 bn

Construction of an up to 4.5 GW floating offshore wind farm in the Baltic Sea, 30 km from Gotska Sandön and 74 km east of Nynäshamn. The site will comprise of 240-300 wind turbines with maximum total heights of 370 m and unit capacities of 20-25 MW. A planning application has been submitted to the Government, making it the first application for a floating farm in the country.

3

Offshore Wind Farm Caruara I BRAZIL

EDF Renewables

$5.8 bn

A proposed 2.31 GW fixed-bottom offshore wind farm located in Rio de Janeiro, off the coast of São João da Barra. The project is expected to feature 110 wind turbines with 21 MW capacity each. The wind farm is currently with Ibama, where an open environmental licensing process is ongoing.

Floating Offshore Wind Farm

SALAMANDER SCOTLAND

Ørsted, Simply Blue Group, Subsea 7

$500 m

Proposed development of an up to 100MW floating wind project, 35 km off the coast of Peterhead. The site lease was granted under the innovation arm of the Crown Estate’s INTOG (Innovation and Targeted Oil & Gas) auction process. An offshore consent application has been submitted to Scottish ministers and the onshore application is to be filed later in the year.

world projects map

1

2 2

4 4 5 9 10 11 12 6 7 8 3 14 www.ogv.energy - Issue 8

Offshore Wind Farm

Aurora Green AUSTRALIA

Iberdrola

$5 bn

Construction of a 3 GW offshore wind farm to be located 25 km from the Gippsland coastline, Victoria. Iberdrola has received preliminary approval to construct the proposal, which will be Iberdrola’s first offshore wind farm in the country.

6

Floating Offshore Wind Farm Firefly SOUTH KOREA

Equinor

$2.5 bn

Development of an up to 750 MW floating offshore wind farm in the East Sea off the coast of Ulsan. The project will be located in water depths of 200-250 metres with semi-submersible foundations. DNV has been chosen to provide verification services for the FEED of the wind farm's offshore substation.

7

Offshore Wind Farm Atlantic Shores 1 USA

EDF Renewables & Shell

$4.5 bn

A 1.5 GW offshore wind project off the coast of New Jersey, located approximately 16-32 km away from the coast. The project is associated with the lease area OCS-A 0499, which covers an area of 750 km2. BOEM has released the final Environmental Impact Statement (EIS) for the development.

8

Nage Geothermal Power Project INDONESIA

Pertamina Geothermal Energy (PGE)

$230 m

The Nage geothermal working area is located at Jerebuu District, Ngada Regency in East Nusa Tenggara (NTT) Province. The area is estimated to contain geothermal resources of 46 MW. The contract tender for the area’s auction has been reissued and a bid bond guarantee has also been set to one billion rupiah (around US$61,500).

10

9 Kambarata 1 Hydro Power Plant KYRGYZSTAN

5 Morlais Magallanes Floating Tidal Device WALES

Magallanes Renovables

$20 m

Development of an 8.62 MW tidal device to be built on the Morlais test zone as one of the first in Anglesey, North Wales. The project has been successful in the UK’s CfD Round 5 allocation. Tadek Ocean Engineering will support the proposal with detailed design involving cables, installation and mooring systems.

Kyrgyzstan Power Plants (KPP)

$4.5 bn

Construction of a 1,860 MW hydro power plant, located upstream of the Toktogul reservoir, in Kyrgyzstan. The World Bank is to provide an additional funding of $13.6 million as part of the technical support for the project.

Tunisia - Italy Electrical Interconnection Project TUNISIA & ITALY

Elmed Études Sàrl

$934 m

An interconnection project between energy networks of Tunisia and Italy. The project involves the implementation of an electrical interconnection of 600 MW through an underwater line of 192 km length, a 500 kV transmission line with 192 km of subsea cables, 32 km onshore in Sicily and 5 km of underground cable in Tunisia. The Italian Ministry of the Environment and Energy Security has given the green light for its construction.

12 Bhutan Hydropower Project BHUTAN

Druk Green Power Corporation

$110 m

The European Investment Bank (EIB) has pledged to provide financing totalling USD 160.2 million to the government of Bhutan. This funding aims to support the construction of solar and hydropower plants. The loan will finance the development of 310 MW of small to mid-size run-ofriver hydropower and solar photovoltaic projects. These developments are set to be implemented by Druk Green Power Corp.

world projects map PROJECTS MAP SPONSORED BY

11

15

by Dan Hyland – Operations and Sales Director at OGV Energy

Callum Maxwell, Business Development manager, RENEWABLES, proserv

Q. If you can give us a little bit of background on your own personal journey into offshore wind first, that would be great.

I think even when I was in school, I was interested in geography and sustainable development and that took me on a little bit of a path initially through applied chemistry at Strathclyde University. But I think my goal, my ambition was always to move into the renewables industry as it was kind of slowly developing around that time. So, I completed a master's degree in sustainable energy at Glasgow University.

Q. Time frame wise, Callum, when was that?

So that was about ten years ago now, I can't actually believe how long ago that was! Then I was working for a while at Glasgow City Council as a business analyst there, and then moved into ship management and worked for a commercial ship company, V.Ships. But the goal was always quite clear in my head that I was just slowly plotting a path towards a technical or business development type role within the offshore renewable market or offshore wind.

And after spending a little bit of time in Australia, I had the opportunity to then join the UK's leading research and technology organisation, the Offshore Renewable Energy Catapult (OREC), initially as a funding proposal specialist. It gave me a lot of opportunity to work across the supply chain.

I would probably describe myself as a little bit of a geek as well, so I like digital innovations. So then the next step into Proserv came quite organically from a collaboration project between OREC, Proserv and Proserv’s partners Synaptec and BPP Cable Solutions as they started down the development route for what has become the product and service into the market.

Q. So you were actually helping organisations at ORE Catapult to develop technology effectively for the renewable sector?

I would say I was the middleman with a really tremendous team of engineers working within the Offshore Renewable Energy Catapult. So, my role essentially at that time

was to identify funding opportunities, or collaboration opportunities, and try and link the right companies, as in, what technologies fit those briefs and where can we hope for the biggest growth with some of these organisations. So that was a tremendous time just to learn about all that kind of leading-edge development within the UK supply chain.

Q. That was quite a challenging role, because presumably everybody was looking at this going “this is a fantastic opportunity for us to make money, we've got an idea”. So you really had to separate the wheat from the chaff and decide what could be commercialised effectively?

Yes, not quite so cut-throat perhaps as that! But no matter where an organisation is in that, let’s say, technology readiness level, there is a route for them within ORE Catapult. So whether it just starts off as that conceptual great idea - how do I take it to the next level – or whether it's an organisation like Proserv, who have so much experience in the oil and gas industry and say “how can we take the skills and experience that we have, and the people that we have globally, to build and pivot into the renewables sector to enable that sustainable growth within the organisation itself?”

So, yeah, if there's a great idea out there and there's willingness from the company to move forward in the offshore wind sector, then the Offshore Renewable Energy Catapult is a great door to chap on.

Q. So then obviously Proserv approached you presumably, to come in. So if you just talk through how you took that role with Proserv and how they sold it to you and did it work out?

We’ll start with the last question. Yeah, it's absolutely working out, I love working at Proserv and the opportunity that it's given us. But to take it back to the start, I suppose you could say a bit of luck and an opportunity in that Proserv had reached out to say “we have an idea” and had been engaging with Synaptec at that time.

I hosted a meeting in the Glasgow office for Offshore Renewable Energy Catapult to talk through what, at that stage, we were defining

as the smart cable project. So, we bid for an Innovate UK Smart Grant and fortunately we were eventually successful in achieving that. Then my role at that time was, once it's moved into an active project, I'm on to the next company to try and support through that process. So, the ECG™ development project was very much alive and kicking in the background, and as it came to the end of that, I got very kindly approached by Proserv as I understood the technology, understood what they were trying to do and believed in it, and it felt like the right move at the right time for me. So, I suppose in some ways Proserv sold it to me, but I think I'd probably already sold it to myself!

Q. Your CEO, Davis Larssen kind of captained that pivot and diversification into the renewables space. So, prior to that, Proserv was largely oil and gas based, one of the leaders in subsea control systems. I presume you were probably one of the first people to come on board and help pioneer that diversification.

Yeah that makes me sound very special but I will happily take it! So I think organisationally, Paul Cook, who is my direct manager, the VP of Renewables, he'd been essentially tasked with a blank sheet of paper. We understood the skills and capability that we had within the organisation. So, it was how can we bring that subsea controls experience and that technical skill that we have, in developing control systems, and general systems, that will operate in hostile environments, and take that blank sheet of paper and say, “what is the problem that we can use these skills to try and solve in offshore wind?”

And then from that, a couple of other members of the team: Laura Carrigan, who at that stage was a graduate engineer, and Lee Davison who had been with Proserv for a long time and is now the Product Manager for the renewables as well. We are a relatively tight core team, but we can dip into that great resource and experience that we have from the oil and gas side of the business.

So perhaps I was the first what we call a purist that was in-house. But in general, there's a great core of capability that we have to enable our transition into offshore wind.

podcast interviews

16 www.ogv.energy - Issue 8

Q. On the purist side of things, it certainly was a thing once upon a time, because the renewable crowd were a little bit reticent to let the oil and gas guys come in with a lot of that technology. I think that that's kind of changed now in terms of everybody working towards the same goal, would you say that was fair?

I think that's absolutely a fair comment. I think there's kind of two elements, there's the supply chain part, which obviously Proserv is very much involved with. And then there's the development side as well. So the developers, where we've seen a lot of movement from, what we would have previously classed as kind of the oil majors, again, trying to transition and carry out that sustainable growth. And I think, initially there was a little bit of pushback, but ultimately everyone, or the goal in general, is sustainable growth, not just for the organisations but longer term for the country that we live in, for the world that we live in. So, I think that movement and that technical expertise can only be a good thing. And in the long term, I guess, time will tell if that's the case.

Q. So if we look at the technology itself, ECG™, which sounds like a heart monitoring technology - you're clearly keeping your finger on the pulse of your clients to make sure that their equipment is safe. Can you elaborate a little bit on that or how it works and the benefits to your clients?

Absolutely. We are a data focused organisation. And the challenge that I think offshore wind has a lot of the time is, “are we collecting the right data from the right places?” So when we look at some of the statistics, cable failures are very expensive when they take place, and insurance companies tend to take the brunt of that. I think the latest figures that I've seen are still up around 80% of the total value of claims within the offshore wind industry come from cable failures themselves.

So it becomes a really interesting element of why is that happening? Is it something that we're not seeing? And ECG™ very simply is trying to give insight, totally passively, using infrastructure that's already within the cables, i.e. the fibre optics within them, to try and understand within the cable section mechanically, thermally, how is it performing? How do we expect it to perform? How is it changing over 25 years of operational life?

Where Proserv is trying to push it is with our relationship with Synaptec who’ve developed a great technology, distributed electrical sensing (DES), which, to put it very, very simply, allows us to take a multimeter to some of the key connections within the cable infrastructure, which are the terminations themselves. We could also do it in the joints as well.

But what makes it interesting is once we've got the system installed and connected to the fibre optic network, then those sensors

will sit and they will monitor the current, the temperature, the voltage. We can also look at some of the mechanical properties in that offshore environment, as there's going to be a lot of fluctuations. Where the market has been for the last few years is, not a huge amount of monitoring being carried out at all on inter-array cables where there can be a lot of failures. On the export cables, the insurance company require simply a DTS system, which is purely focused on distributed temperature sensing, as the name implies, on what is the temperature and how can we infer what the conductor temperature is within that, which is a start.

However, that's only one thermal bottleneck you're going to be looking at. The other, which potentially has more risk of failure and statistically certainly is more likely to fail, are the terminations themselves, because ultimately these have to be jointed manually. And if there's any imperfection within that, over time electricity, like water, will find another path. And when that happens, it can be pretty explosive.

www.ogv.energy/play

podcast interviews watch full interview

OR LISTEN TO THE PODCAST 17

THREE60 Energy: Integrating Expertise Across the Energy Transition

Since its inception in 2016, THREE60 Energy has been on a journey of growth both organically and through strategic acquisitions.

This has driven the business to add to its technical capabilities supporting both industrial diversification and expanding its geographical footprint thus, entering new markets to support overseas customers with in-country presence.

In its inception, THREE60 was a full-service oil and gas asset life cycle business however, in recent years there has been an increased focus on the Energy Transition, looking at ways to adopt new technologies to decarbonise traditional practises, supporting not only their own, but their customers journeys to net zero. Increasing their foothold in the renewables market is one of six key strategic priorities for THREE60, in addition to continued and sustainable growth, developing people and entering the digital transformation space.

In digital, THREE60 is exploring new ways to translate data into meaningful information using bespoke digital dashboards specific to each customers requirements and to the activity at hand, whether that be for subsurface geotechnical surveys or drilling and wells activities. The adoption

Author Scott Roy Strategic Development Director, THREE60 Energy

Author Scott Roy Strategic Development Director, THREE60 Energy

of this technology significantly reduces the amount of time spent on manually parsing data, allowing customers to dedicate that time elsewhere.

Scott Roy, Strategic Development Director at THREE60, is focussed on developing a cohesive renewables strategy, combining expertise from across the business. Here he shares insight into THREE60’s journey so far, their next chapter and their role in a just energy transition.

“Energy companies now more than ever are under pressure to reduce their carbon footprint, with the UK Government aiming to reduce carbon emissions by 77% by 2035, it is up to those of us operating in the energy industry to redefine working practices and innovate to adopt new technologies to decarbonise our industry.

“Over the past three years, we as a leadership team have looked at different ways to accelerate our move into the renewables market. Having been involved in the initial phase of windfarm development with our operations geoscience expertise from our Subsurface business in SEAsia since 2018, we have simultaneously been advancing our offering through strategic acquisitions to add knowledge, expertise and technologies into our service and product portfolio, whilst also working with industry experts to decarbonise our existing operations.

“We know that we are uniquely placed to impact multiple areas of the oil and gas production process as one of only a few full service asset lifecycle solutions companies operating globally. We have the ability to work with customers across all of our service lines (subsurface, wells, subsea, EPCC, operations and product solutions) and geographies to look at ways to change standard practises.

“An area of early interest to us was exploring ways to utilise abandoned oil wells for carbon capture and storage (CCS), we know from research that CCS could account for a significant proportion of the global emissions reductions needed by 2050, according to the International Energy Agency (IEA). Using the capabilities present within our group combined with the expertise of our partners, we successfully developed a method for doing just that and have now successfully delivered a comprehensive set of solutions for several

FEATURE 18

www.ogv.energy - Issue 8

customers. Our scopes spanned reservoir storage volume estimates with probabilistic sensitivity analysis to abandonment risk assessments, pipeline running fracture risk reviews, and suitability assessments.

“Whilst our focus has always been to continue to support our customers and the industry in the best way that we can, we have always recognised that it is almost impossible to have a renewables strategy without having a presence in the wind industry. In the past 12 months, 37.9% of the UK’s energy was provided by renewable energy sources, with wind accounting for 31.8% of that. In 2021, we acquired an electrical engineering company in Orkney to add onshore wind turbine operations and maintenance, high voltage switching, grid connection support and electrical engineering solutions to our service portfolio. Most notably, our team in Orkney have been working with our long-term client, EMEC to support the development of the marine energy sector by providing essential electrical services at their wave and tidal energy test sites which will ultimately contribute to Europe’s renewable energy targets and help mitigate climate change.

“We are working with one of our digital partners on a demonstrator project across multiple onshore windfarms under our operation to optimise turbine uptime and maintenance activities. We are also working on wind turbine repowering scopes, which involves replacing older units with new,

higher capacity turbines or retrofitting them with more efficient components – in both cases, this significantly increases wind farm production and extends wind farm life.

“The natural progression for our business was to move into the offshore wind sector. With the acquisition of Pryme Group at the end of 2023, we acquired proprietary technologies in fixed bottom foundation stabilisation tooling, PileProp and Pile Fixation Tool (PFT) and in-house engineering capabilities that include subsea expertise in dynamic cable and mooring analysis. PFT and PileProp are designed to support the installation of monopile and jacketed foundations for offshore wind, by providing a localised, rigid deflection constraint – and in the case of the PileProp system independent of vessel interaction or station – prior to the critical grouting process of securing the foundations. This technology has been deployed on 62 turbines on a European offshore wind farm which completed commissioning in 2024.

“PFT is a bespoke monopile foundation installation support solution, designed to address the stabilising issues involved with monopile foundations being placed in predrilled boreholes, due to challenging seabed conditions. This proven technology has been used to support DEME with the foundation installation of 80 turbines on the St Nazaire offshore wind farm for EDF Renewables.

“We have applied our deep understanding of flexible riser solutions in oil and gas to

the offshore renewables sector to provide design, analysis and integrity management services for offshore wind power cables. This technology could prove vital with the emergence of green hydrogen where there will be a requirement to transport hydrogen to seabed level and then back onshore, this technology could be applied to both fixed bottom offshore wind turbines and floating wind.

“My focus over the next 12 months and beyond is to bring all of these services and products into a single renewables offering, to go and speak to our customers and industry stakeholders to showcase our combined industry offering. We know that there is still a long way to go but we believe that by speaking with our customers at the early stages of a project, before the final investment decision has been made, we can significantly and positively impact projects with our novel approach to decarbonisation.

“With increasing socioeconomic and political attention to the energy transition, we continue to seek to be a part of the conversation, taking part in industry messaging workshops and steering groups to put forward new ideas and understand the issues facing our industry. We will continue to innovate, adapt and adopt new technologies and play our part in contributing to a just energy transition and we look forward to taking our partners, customers and employees on that journey with us”.

19 FEATURE A leading life cycle solutions and engineering technology company - three60energy.com

THE FUTURE OF RENEWABLE ENERGY

Flotation Energy and Vårgrønn are leading the way in the development of offshore wind projects. Determined to support the global movement to Net Zero and sustainable energy consumption, our core strengths lie in finding and developing sites for floating projects in deeper waters globally. Together we have harnessed our expertise to deliver reliable oil and gas electrification and decarbonisation projects that will pioneer the future of renewable energy.

FIRST MARINE SOLUTIONS ENTERS JAPANESE FLOATING OFFSHORE WIND MARKET WITH BUSINESS COLLABORATION AGREEMENT

A landmark Business Collaboration Agreement has been agreed between global mooring solutions expert, First Marine Solutions and Horizon Ocean Management, Ltd.

(HOM) - a subsidiary joint venture between Japanese industrial giant, Mitsui and the country’s leading turbine maintenance company, Hokutaku.

The Agreement will see the development of mooring strategy-related services for the floating offshore wind power sector in Japan, providing consultancy services (installation and O&M phase), mooring installation support, and O&M services (monitoring, inspection, and repair).

FMS’ experience in the offshore wind field has included key roles in several renewable energy projects for major developers,

as well as participation in landmark projects for ORE Catapult, the UK's leading innovation and research centre for offshore renewable energy.

HOM has already established a unique position within the supply chain of offshore wind industry in Japan. Together with FMS’ position as the energy industry’s pre-eminent mooring service provider, the collaboration delivers a powerful world-class proposition to provide an integrated mooring service including design and engineering, optimisation of windfarm layout, building installation, inspection and repair strategy, and mooring procedures.

Mr. Takagi, President of HOM, commented: “We believe that floating wind will become a popular choice in Japan in the near future, with full-scale development of floating offshore wind power generation expected. In the meantime, in addition to the development of supply chains, it will be essential to acquire engineering capabilities for offshore and subsea applications. The alliance with First Marine Solutions, which already provides mooring services for floating structures across the offshore energy sector, including floating offshore wind, is indispensable in providing the capabilities demanded by the Japanese offshore wind industry. We have been in discussions with First Marine Solutions since last year and are very pleased to be working with them in Japan. We believe this alliance will help to quickly establish mooring installation and O&M capabilities to the Japanese floating offshore wind sector.”

Steven Brown, Managing Director of First Marine Solutions, commented: “We are delighted to be working with HOM and the eminent companies that it comprises. FMS has developed a strong track record in the floating offshore wind market since the inception of our dedicated renewables consultancy in 2020; this combined with our decades’ of experience in the design, supply and installation of mooring systems in the oil and gas industry makes our offering truly unique.

“The logical next step for us was to expand into new territories and we quickly identified Japan as a key market. HOM is the perfect partner for us, given the compelling combination of Mitsui and Hokutaku. The addition of our mooring design and installation services naturally complements the market leading O&M services they already supply and we are truly excited to help develop the floating offshore wind sector in Japan.”

OFFSHORE WIND

20 www.ogv.energy - Issue 8

Picture caption: Steven Brown, Managing Director, First Marine Solutions

WIND ENERGY SPONSORED BY

£86M INVESTMENT IN OFFSHORE WIND RESEARCH FACILITIES TO ACCELERATE UK DEVELOPMENT OF NEXT GENERATION OF SUPER TURBINES

Development of the world’s most advanced wind turbine blade and drive train testing assets at ORE Catapult’s National Renewable Energy Centre in Blyth, Northumberland, set to deliver major boost to UK growth from offshore wind.

Ambitious plans to keep the UK at the forefront of technology development in offshore wind have been given the green light today, with the announcement that UKRI will provide £85.6m of capital funding for the Offshore Renewable Energy (ORE) Catapult to expand and upgrade its testing facilities and enable the evolution of the next generation of wind turbines in the UK.

The late-stage research and development facilities, designed for the testing of blades up to 150m and drive trains up to 23MW, combined with ORE Catapult’s extensive expertise in test and demonstration, will ensure that turbine manufacturers can accelerate their technology development in the UK with reduced risk and enhanced reliability for a new wave of larger, more efficient machines. Both blade and drive train capabilities will have the capacity for further expansion, to 180m and 28MW respectively, to meet future industry demand.

The new facilities will enable faster product development of turbines through test, validation and certification and are expected to prevent 2.5 million tonnes of CO2 emissions by accelerating deployment by a minimum of eight-months – meaning more of the energy keeping our lights on and heating our homes is from an eco-friendly source. They will also support the growth of UK supply chains, and provide critical research infrastructure to

support inward investment into the UK wind industry. They will also create 30 new jobs in Blyth and support 5 PhDs a year.

Science, Innovation and Research Minister, Andrew Griffith, said: “Putting pioneering innovation at the heart of the UK’s transition to net zero is the key to protecting our environment in a way which continues to lift living standards.

“Our £86m funding will create highly skilled and highly paid new jobs that grow the northeast and wider UK economies while pulling investment in by marking our country as a leader on technologies of the future and unashamedly open for business.

“At the same time, it strengthens the UK’s energy security in an uncertain world and helps us pivot towards the cleaner energy that can preserve our planet for generations to come.”

Dr Adam Staines, UKRI Infrastructure Portfolio Director, said: “UKRI continues to make the vital infrastructure investments that will underpin innovation and research throughout the UK for the coming decades. The project in Blyth demonstrates that investment in the right infrastructure can reduce CO2, support greater energy independence and drive economic benefits that build world-class places to live and work, as well. Working across UKRI with Innovate UK’s Catapult

Network and the wider supply chain will help achieve these crucial objectives.”

Andrew Jamieson, ORE Catapult Chief Executive, said: “This investment in truly world-leading capability will keep the UK at the forefront of offshore wind technology development. It will enable ORE Catapult to continue to deliver the most advanced research and development infrastructure and expertise to the offshore wind industry, capturing the jobs and economic growth from the transition to a Net Zero economy”.

Richard Sandford, Co-Chair of the Offshore Wind Industry Council, said: “I’m delighted that ORE Catapult has deservedly secured this significant level of investment from UKRI’s Infrastructure Fund which will help to maintain Britain’s leading position in offshore wind. It will enable ORE Catapult to continue to develop state-of-the-art turbine technology, building on its excellent track record of leadership in innovation. The blades and drive trains which will be tested by world-class experts in Blyth are expected to make UK offshore wind projects even more cost-competitive, and see supply chain companies exporting this technology overseas, adding value to the UK’s economy and helping to accelerate the pace of global decarbonisation”.

Dan McGrail, RenewableUK CEO, said: “Investing in ground-breaking research to develop the next generation of turbines is vital if this country is to retain its position as a global trailblazer in innovative offshore wind technology in the face of strong international competition. Last month we launched an Industrial Growth Plan for offshore wind which shows how proactively focussing on high-value components such as blades will boost the UK’s economy by £25 billion and support an extra 10,000 jobs over the next ten years. We have an excellent opportunity to build up new offshore wind supply chains, and the cutting-edge work being done by our colleagues at ORE Catapult will help us to achieve this”.

Designs are well advanced with a view to commencing construction in the near future at the Catapult’s National Renewable Energy Centre in Blyth of the new blade testing facility, alongside the existing 100m blade test hall, and the major upgrade to its 15MW drive train test facility, with both expected to be fully commissioned by 2028.

OFFSHORE WIND wind energy SPONSORED BY

21

Cetegra Virtual Data Rooms

Smart and secure virtual data rooms to support the full spectrum of M&A activities across the Energy sector.

Global reach

Significantly reduce decision making time and environmental footprint by promoting assets to a global audience.

Secure and robust access control

Keep user permissions, access and privileges under control. Increase efficiency and security by streamlining account and group management.

Keep your deals under control.

Administration Dashboard

Manage permissions for users, groups and documents in real-time.

Multi-access

Unlimited number of users and companies.

Flexible invoicing

Pay-as-you-use model, invoiced on a weekly or monthly basis.

Scan

Petrotechnical data and software support

Gain access to multiple petrotechnical platforms from anywhere and benefit from Cegal’s unique knowhow during the duration of your data room.

Quick deployment

Configure and provision data rooms in minimum time, from anywhere in the world.

Confidentiality and security

Protect confidential data against unsolicited viewing. Secure access through multi-factor authentication.

Customization

Configure and customize to fit your needs. Create a familiar collaborative workspace for all users.

cegal.com

learn more. www.ogv.energy - Issue 8

the QR code to

Flare’s award winning services support the UK Energy Transition.

Focused on delivering outstanding customer service and unrivalled technical expertise, Flare continue to expand into evolving global markets and have established a recognised track record in the Offshore Wind sector.

When the UK announced its’ ambitious Net Zero target by 2050, Flare proactively reviewed their commercial portfolio and identified key service, hire and product deliverables that would support the UK’s energy transition strategy and directly migrate their current offerings to the Renewables Industry. With wind farms rapidly developing across the nation and worldwide, Flare have emphasized the importance of providing job security to their workforce with diversification initiatives, reinvestment and involvement in the local communities to help empower the future of clean energy. Flare continuously review their business infrastructures to explore new and innovative practices demonstrating commercial conviction, agility and ambition. They now offer a variety of sustainable project packages with reduced man hours, remote service optimisation and digitisation to help support the growth of this vital sector.

“As members of the OEUK, we agree it is critical to prioritise a homegrown energy transition in the UK first. This will help provide a boost to local businesses and communities across the region as well as support opportunities to upskill our teams and foster transitional talent wherever possible to safeguard careers in the industry. With Offshore Wind, Carbon Capture & Storage and Decarbonisation projects well underway, organisations must continue to collaborate to unlock key

opportunities and resources with added backing and support from the government and stakeholders in the UK offshore sector to facilitate data-sharing and breakdown existing barriers to market.”

Flare have successfully partnered with industry leading Wind Farm operators and with safety at the forefront of everything they do, they hope to inspire like-minded businesses to look at ways they can transition into clean energy and optimise their own service offerings to support this shared objective.

“Our core service & maintenance projects not only support 360 degrees of safety onboard Windfarm substations but also the safety of marine & sea-going vessels that are critical to the supply, transport and maintenance of optimal operational capacity for wind farms.”

Flare provide an extensive range of specialist services to this sector ranging from DIFFS/FIFI testing, Inergen & Argonite system testing, Helideck foam system testing and verification, fire detection system testing and lifesaving equipment inspections and recertification with preventative maintenance & design packages tailored to meet specific requirements.

“We are looking to the UK leaders to help provide inroads for supply chain companies like Flare, who are eager and ready to support a safe and realistic energy transition.”

Flare is a trusted global partner delivering critical safety services: www.flarefse.com 23

HYDROGEN & CCS

IN ASSOCIATION WITH

www.netzerotc.com

TURNING TALK INTO TERAWATTS: ELEVATING THE ELECTROLYSER

World leaders have put their bets on green hydrogen, but in order to scale the global market, improvements in electrolyser technologies will be critical.

Here, Harriet Fox-Bekerman, Senior Project Engineer, at the Net Zero Technology Centre (NZTC) considers the opportunities around clean hydrogen growth and the innovation required to turn reverie into reality.

The hype

Political leaders around the world under pressure to decarbonise their energy sources have published ambitious green hydrogen plans to help their nations meet looming netzero targets.

At the start of this year, the UK government announced a £21million boost to accelerate key low carbon hydrogen projects across Aberdeen, Tees Valley and Suffolk. This followed a further government pledge of over £2billion for several other green hydrogen production projects.

In the global race for clean and green, the U.S. Department of Energy (DOE) declared a $750million allocation to significantly reduce the cost of clean hydrogen. This commitment was made to support the advancement of electrolysis technologies that make green hydrogen production possible.

Whilst Green hydrogen, touted as the 'new oil’, is rarely out of the media, turning talk into terawatt hours requires the scaling of existing and new projects. To make this possible, electrolyser technologies need to be more efficient and costeffective. Without a coordinated effort to do this, is hydrogen all hype?

The hurdles

The challenges of scaling commercially available electrolyser technologies such as PEM and AELgo beyond economics, although inflation, rising energy costs and political

uncertainty haven’t helped matters. Global supply chain delays, a reliance on rare and expensive elements, and manufacturing inefficiencies also create hurdles when it comes to scaling.

The proton exchange membrane (PEM) electrolyser for example, relies on platinum and palladium, as well as the extremely rare metal iridium. There is a concern that the production of these electrolysers could become compromised if the supply of these essential minerals is disrupted. A significant spike in demand for these precious metals would drive up their market price.

Another challenge is that electrolyser manufacturers must continue expanding

production capacity to allow gigawattscale orders to be met, however if capacity outstrips demand, manufacturers face losing money. As a result, we risk manufacturers putting the brakes on electrolyser production which could lead to a shortage of these essential technologies when projects commence, jeopardising the long-term growth of the global green hydrogen market.