GLOBAL NEWS PROJECTS MAP WIND ENERGY HYDROGEN & CCS GEOTHERMAL ELECTRIFICATION SOLAR CONTRACTS ON THE MOVE ANALYTICS EVENTS GLOBAL NEWS Cerulean Winds set out ambitions for North Sea Renewables Grid Interviews with, Proserv P.18 Ocean Winds P.20 Green Rebel P.24 Aberdeen-based Intelligent Plant secures nearly £150k funding P.8 WIND POWER HYDROGEN & CCS P.27 READ ONLINE AT RENEWABLES PUBLICATION IN ASSOCIATION WITH READ ON PAGE 4 ISSUE 4 - JUNE 2023

DAN MCGRAIL, CHIEF EXECUTIVE OFFICER, RENEWABLEUK

DAN MCGRAIL, CHIEF EXECUTIVE OFFICER, RENEWABLEUK

The big news in offshore wind for June is always the Global Offshore Wind (GOW) Conference and Exhibition – which is the largest event of its kind in the UK. We are looking forward to welcoming thousands of attendees over the two days, with organisations and individuals from more than 50 different countries coming together. Delegates will have access to hours of content delivered by over 200 speakers who are all experts in their relevant fields. There will be lively debates, detailed discussions and plenty of opportunities to connect with the global offshore wind community. Indeed, the sharing of insights from projects around the world is likely to be a key theme, as is how we build an energy secure future.

The success of this event every year confirms a stable appetite among the sector for continued and accelerated growth. Only through collaboration, innovation and investment can we drive the industry forwards and realise even the most ambitious of targets.

Among the topics of discussion during GOW23 will likely be the Government’s decision to amend Ofgem’s mandate and give it specific duties to deliver net zero. This is something that we at RenewableUK have been pushing for some time and are delighted to see the change being made. Some offshore wind projects have waited more than 10 years to be connected to the grid. It is essential that this is avoided moving forward in order to unlock massive potential – an estimated £15 billion of investment at least – and facilitate rapid growth in capacity of offshore wind across the UK.

With so much going on in the sector right now, it has never been more important to keep your finger on the pulse and really understand how your organisation or project sits in the wider industry. The innovative EnergyPulse resource is a fantastic tool that offers real-time industry data in an easyto-use platform, which can be utilised to ensure informed company decisions. Find out more by contacting the team at renewableuk.com/page/EnergyPulse.

You can find out more about this and many other pertinent topics of interest at GOW23. Be sure to download the RenewableUK event app to plan your visit and really make the most of your time in London!

COVER FEATURE GLOBAL NEWS PROJECTS MAP WIND ENERGY HYDROGEN & CCS GEOTHERMAL ELECTRIFICATION SOLAR CONTRACTS ON THE MOVE ANALYTICS EVENTS P.4 P.8 P.14 P.16 P.26 P.30 P.32 P.34 P.36 P.38 P.40 P.42

CONTENTS

WISH TO CONTRIBUTE TO OUR NEXT PUBLICATION? Contact us to submit your interest daniel.hyland@ogvenergy.co.uk

3

A Sea Change

Scotland has the power and potential to thrive as Europe’s Energy capital, but it must act now to seize the opportunity and capitalise on a new wave: floating offshore wind.

Offshore wind has come a long way since the first windfarm was commissioned off the coast of Denmark in the early 1990s. Progress back then was slow, with the UK's first fixed demonstration offshore windfarm being installed in December 2000. Early-stage wind turbines, with monopile foundations and placed less than 2km from shore, are now a far cry from the large-scale fixed offshore windfarms we see operating across the UK coastline today.

Technology continues to move on significantly, supported by a fiscal and political will to develop offshore wind industries globally and in turn, to drive energy security and net zero policy ambitions. Aberdeen, Scotland, has for decades been termed the Energy Capital of Europe, with the region’s established experience in oil and gas exploration, however now - Aberdeen wears a new crown, as the global leader in the development of floating offshore wind.

COVER FEATURE

© Newsline Media 4

Few regions compare globally, with the skills, expertise and infrastructure that the North East of Scotland offers this new and exciting industry and a just transition in skills and labour is required to protect that. The deployment of more offshore wind developments will create thousands of jobs, as well as generating opportunities across the supply chain and decreasing costs for future projects. The time to act however, is now.

Flotation Energy’s recent joint venture partnership with Vårgrønn saw the duo offered exclusivity by Crown Estate Scotland to develop a total of up to 1.9 GW of floating offshore wind capacity across two projects, Green Volt and Cenos.

With vast wind resources and well understood sea conditions, coupled with proven offshore engineering and technologies, Scotland is uniquely placed to accelerate floating offshore wind developments on a global platform. It should be noted, some of the first test and demonstrator windfarms globally were launched in Aberdeenshire. Furthermore, at Kincardine, 15km off the coast of Aberdeen, the world’s first commercial floating windfarm has been generating power since 2021.

The founders of Kincardine, Allan MacAskill and Nicol Stephen created Flotation Energy in 2018 with the ambition to advance the immense opportunities that floating offshore wind can offer globally. In November 2022, they partnered with TEPCO Renewable Power – enabling the team to both move forward quickly with existing projects and to kick start new opportunities around the world. Today, the company has a project pipeline spanning 13GW of developments in the UK and internationally. With vast experience and knowledge in floating and fixed developments, Flotation Energy is already a leading expert in offshore wind.

Flotation Energy’s recent joint venture partnership with Vårgrønn saw the duo offered exclusivity by Crown Estate Scotland to develop a total of up to 1.9 GW of floating offshore wind capacity across two projects, Green Volt and Cenos

The awards, made under Crown Estate Scotland’s Innovation and Targeted Oil and Gas (INTOG) leasing round, are for offshore wind projects that provide lowcarbon electricity to oil and gas platforms. By securing area exclusivity in the INTOG round, the Green Volt and Cenos projects will make a significant contribution to Scotland’s 2045 Net Zero target, and The North Sea Transition Deal’s goal to halve offshore emissions by 2030. INTOG also presents a huge opportunity for decades to come, as Scottish and UK supply chains develop to meet longer-term, strategic floating offshore wind developments.

Green Volt and Cenos have been in the planning for many years. The two projects have the potential to generate enough green power to electrify most of the oil and gas platforms in the Outer Moray Firth area and will also deliver renewable electricity back to the grid for consumers across the UK.

Offering affordable and reliable electrification, Green Volt and Cenos will enable oil and gas operators to play a critical role in the energy transition from 2027. The projects will dramatically reduce greenhouse gas emissions from oil and gas platforms, saving over three million tonnes of CO2 each year. Pioneering the first large-scale decarbonisation and electrification of offshore platforms, Green Volt will become a project that defines and sets standards for how the industry progresses the next generation of floating developments, helping Scotland pivot quickly into, and through, the energy transition.

Flotation Energy and Vårgrønn’s first mover status in this area places them in a unique position to deliver. The Cenos project is currently working through its remaining

offshore surveys, whilst Green Volt has completed these and already has obtained UK grid connection agreement to enable timely electrification of oil and gas assets. There is a time critical factor for decarbonisation of oil and gas, with ambitious timescales to meet, as well as providing a landmark opportunity for Scotland to lead in the global deployment of floating offshore wind.

However large the opportunity for Scotland is, there are very real challenges and barriers to success. Most importantly, how we create a just transition for those working in the traditional energy industries that have the technical and commercial skills needed to deliver these projects at pace? The reskilling and upskilling of people from oil and gas, as well as attracting a new generation of trailblazers, to write the next chapter in our global Energy industry will be key.

The scale of the prize for Scotland in floating offshore wind is potentially huge; it cannot however be complacent. Scotland is the powerhouse of offshore wind and to continue to hold this title it must be ready to scale up and be prepared for a new wave of CAPEX investment. By being agile and decisively supporting the projects that are deliverable, Scotland can build solid foundations for this new industry, to then scale it and export it globally.

COVER FEATURE

For

5

more info on Green Volt and Cenos visit: https://greenvoltoffshorewind.com/ and https://cenosoffshorewind.com/

FIBRE OPTIC TRAINING for

the onshore, offshore and renewables markets

RCP - Instrumentation and Control System specialists have made significant investment in fibre optic equipment such as fusion splicing machines, mechanical splicing kits, fibre optic ovens, optical power meters, optical microscopes and polishing equipment to terminate and test fibre optic cables, connectors junction boxes and patch panels to a very high standard.

In 2021 a dedicated fibre optic workshop was set up at our Blackburn facility to provide fibre optic training to the onshore, offshore and renewables markets.

Fibre Optic Training includes

Fusion Splicing of single mode and multimode cables using Fujikura fusion splicers, construction of bespoke fibre optic cables and connector sets, construction of circular plug/socket connectors for hazardous area use. ATEX/IECEx zone 1 connectors, cables made up with pre-potted glands and tails to facilitate ease of fitment to drilling platforms, rigs offshore and renewable assets.

Mechanical splicing – Corning and Huber + Suhner connectors, ST, SC and LC, insertion loss and cable loss measurements, testing connectors and cables for insertion loss and return loss. OTDR testing using Fujikura machines.

The format of the course starts with the theory of Fibre Optics. Safety when using Fibre Optics, FO cable selection and connector types. Stripping fibre optic cables and preparation including the use of fan out kits, the use of fibre breakout boxes and fibre optic plug socket connectors and an understanding of loss budgets for fibre optics.

Delegates will learn how to manually splice using a Corning Kit with ST, SC and LC connectors. They will learn how to measure insertion loss of splices, connectors and cables. The delegate will use a fibre optic power meter. There will also be an introduction to fusion splicing.

The training course consists of both theoretical and practical elements with approximately 75% of the course being practical exercises where the delegates get to practice the skills taught.

By the end of the course each delegate will be able to identify different types of fibre cable for use on/offshore, select the correct type of cable and connector for the application in hand, prepare and manually splice a connector onto a fibre optic core(mechanical splice), test the integrity of the connector and measure the insertion loss of the cable or cable system.

The delegates will be able to fault find and repair fibre optic cables and connectors, prepare and splice a connector onto a fibre optic core known as fusion splicing.

The course material can be created bespoke to a company’s specific requirements. The course runs over 2 days.

A certificate of competence will be issued to the delegate's employing company on successful completion of the course.

RCP provide the following site services on or offshore

Fusion Splicing of single mode and multimode cables – Fujikura fusion splicers, Construction of bespoke fibre optic cables and connector sets, Mechanical splicing –Corning and Huber + Suhner connectors, ST, SC and LC. Construction of bespoke fibre optic cables and connector sets – Insertion loss and cable loss measurement, testing connectors and cables for insertion loss and return loss.

Editorial

newsdesk@ogvenergy.co.uk

+44 (0) 1224 084 114

Advertising office@ogvenergy.co.uk

+44 (0) 1224 084 114

Design

Ben Mckay Jen McAdam

Journalist

Tsvetana Paraskova

CONTRIBUTORS

The key to faster, better decisions

RenewableUK’s EnergyPulse is the industry’s go-to market intelligence service, providing comprehensive and accurate energy data, insights, and focussed dashboards for the wind, marine, storage and green hydrogen sectors in the UK and offshore wind globally.

OUR PARTNERS

Connected to our 400+ member network our experienced team of experts research industry news, contracts, and ownership to ensure you keep grow your business agility by leveraging a suite of user-friendly, intuitive, configurable, and highly-interactive tools.

Sign up and keep your finger on the pulse of the UK and global renewable energy markets, accelerating towards a net-zero future.

We offer a wide range of competitive subscription levels that can be tailored to suit your business needs.

Contact our Head of Membership, Jeremy Sullivan or call +44(0)20 7901 3016 for a personalised consultation.

TRAVEL MANAGEMENT PARTNER

Corporate Travel Management (CTM) is a global leader in business travel management services. We drive savings, efficiency and safety to businesses and their travellers all around the world.

LOGISTICS PARTNER

Pentagon have moved freight for the oil and gas industry for nearly 50 years. This has given us an unmatched breadth of experience that allows us to implicitly understand your requirements because we know oil and gas. Whether your requirement is onshore or offshore, or drilling, oilfield services, EPC, or E&P, we can solve your logistics problem.

Disclaimer: The views and opinions published within editorials and advertisements in this OGV Energy Publication are not those of our editor or company. Whilst we have made every effort to ensure the legitimacy of the content, OGV Energy cannot accept any responsibility for errors and mistakes.

ADVERTISE WITH OGV

VIEW our media pack at www.ogv.energy/advertise-with-us or scan the QR code

OGV ENERGY

RenewableUK EnergyPulse in numbers* www.renewableuk.com *Number of projects tracked as of 04/08/2022

CORPORATE PARTNER

www.renewableuk.com

RenewableUK members are enabling a just transtion to a net zero future. Focusing on continuous improvement around the three pillars of our Just Transition Tracker - People, Place and Planet These inspiring companies are a true showcase of the best that our industry has to offer.

Cerulean Winds set out ambitions for North Sea Renewables Grid

Partnering with Frontier Power and uniting a dedicated consortium of world leading industrial partners, the development will be one of the country’s largest-scale infrastructure projects designed to deliver on the energy sector emissions reduction targets.

Founders, Dan Jackson and Mark Dixon have substantial expertise in the development and delivery of major offshore and deepwater energy projects and have founded and developed businesses in the global energy arena over 20-plus years.

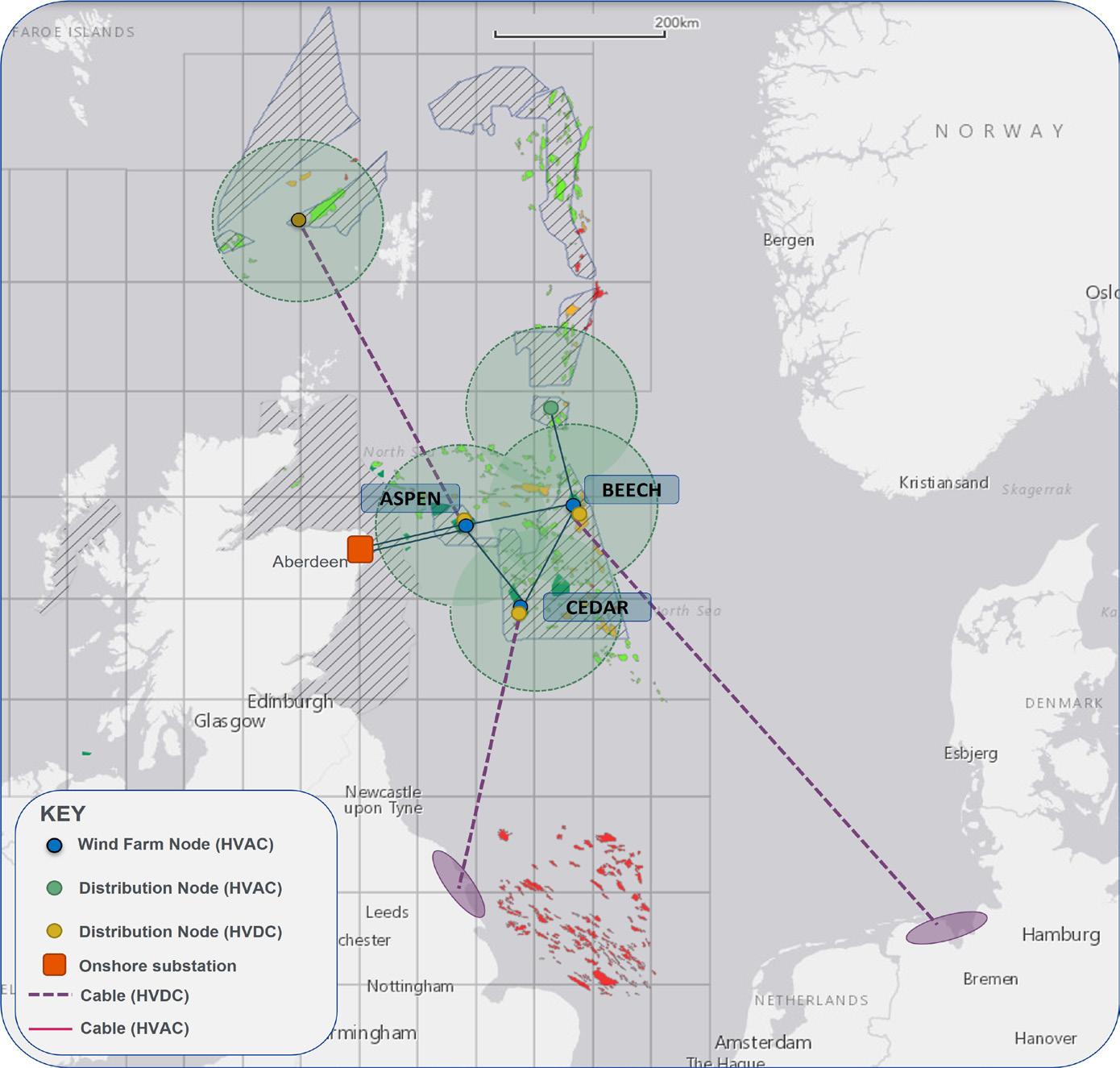

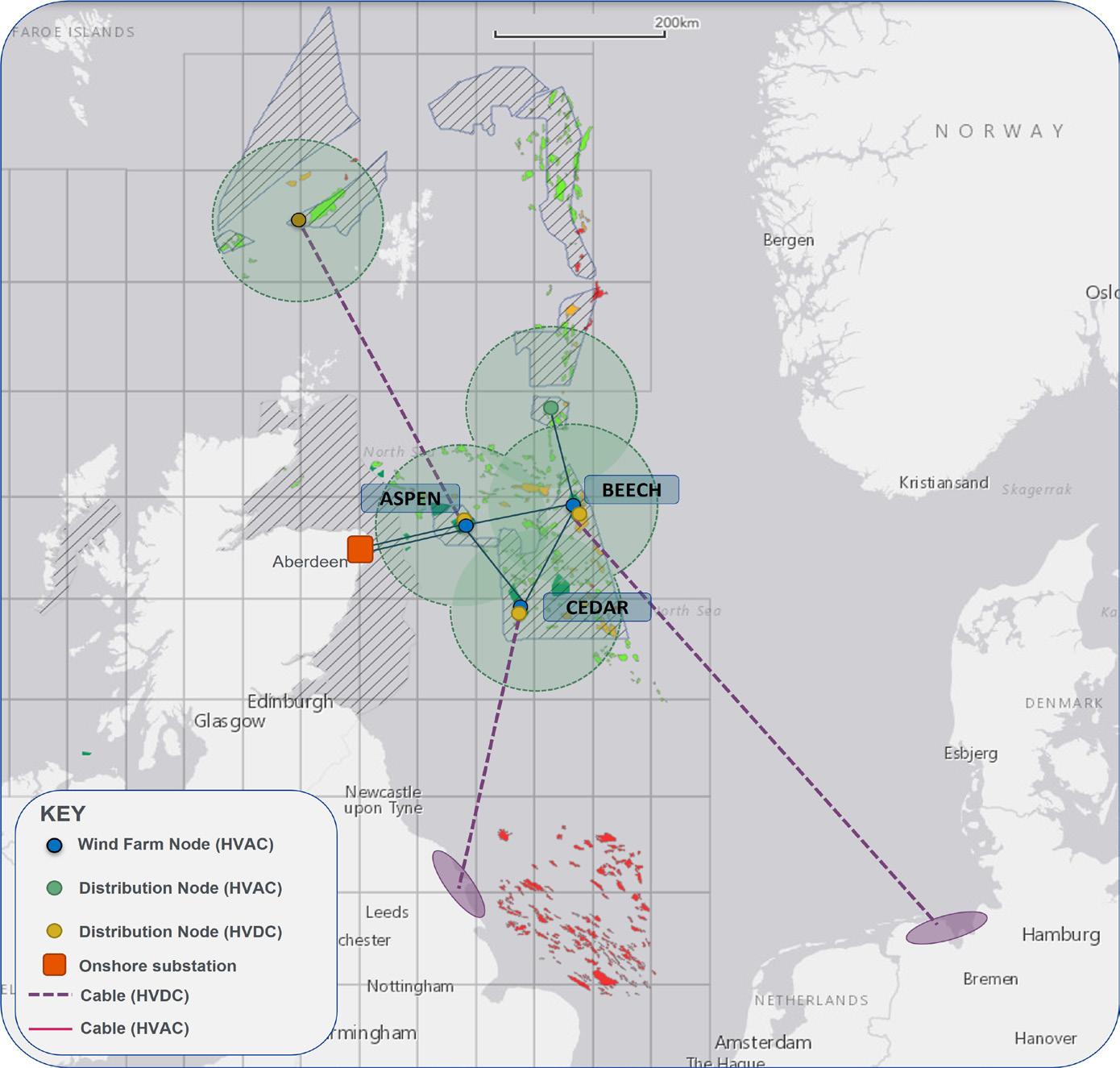

The NSRG will see Cerulean develop three 333 square kilometre sites of hundreds of floating wind turbines, producing multiple gigawatts (GW) of electricity, after being offered the lion’s share of seabed leases in the recent Crown Estate Scotland INTOG leasing round.

Dan Jackson sheds further light on the development and its implications for the sector, economy and supply chain.

What is the North Sea Renewables Grid?

The North Sea Renewables Grid is a largescale offshore renewable power grid that will have the ability to provide clean power from floating wind to oil and gas platforms anywhere in the UK Continental Shelf.

It will link hundreds of offshore turbines with high-voltage cables to transmit green energy to oil and gas production facilities in the North Sea. We plan to develop the grid in phases, with phase one focused on providing a clean power source for the North Sea’s oil and gas industry. Later phases will help to further commercially scale up renewable power for homes and businesses across the UK and beyond.

The scale and location of our three floating wind sites in the Central North Sea enables a basin-wide transmission approach, which will allow oil and gas operators a flexible option for removing millions of tonnes of production emissions by trading gas and diesel generation for a flexible, cost effective and cleaner alternative.

Each windfarm site is located within 100km of the others and will be connected together to form the offshore ring main around the Central North Sea. A High Voltage Alternating Current (HVAC) transmission will provide availability and redundancy for maximising generation uptime. The scale allows for offtake to other parts of the North Sea through a new High Voltage Direct Current (HDVC) network.

Why is basin-wide decarbonisation important?

The sector has signed up to the North Sea Transition Deal (NSTD) targets, but the challenge now is decarbonising production at scale whilst continuing to prioritise UK energy security.

The targets set by the NSTD demand urgent action. Operators have made it clear they are ready to act now to achieve these goals but cannot do so without a dependable and costeffective solution in place.

We recognise that to achieve meaningful reductions at the pace required, a basin-wide solution is necessary. By taking this integrated approach, we are offering organisations a reliable and flexible power source which they can plug into once they have completed any necessary brownfield works and are ready to make the switch to renewable power.

What is the benefit to oil and gas operators?

Currently, there are limited options for operators to reduce their production emissions and scale is required to hit the 50% reduction by 2030 target set out in the NSTD. Our goal is to provide them with a risk-free solution that will allow them to switch to renewable power as soon as they are ready through standardised Power Purchase Agreements.

Global news

8 www.ogv.energy - Issue 4

Green infrastructure developer Cerulean Winds recently unveiled plans to develop the North Sea Renewable Grid (NSRG), a £20 billion integrated green power and transmission system, powered by floating wind, that oil and gas platforms will plug into for clean power.

Having hundreds of turbines in place over three locations provides the baseline required to build out the grid with a level of consistency that is demanded by the oil and gas industry, this provides redundancy in supply. The basin-wide scale allows us to be reactive, while maintaining lower pricing and supply robustness. For the oil and gas companies, the diversity of offtake through the HDVC network provides robustness to the scheme and further lowers their offtake costs through simple economies of scale. The intent is to minimise the ‘infill’ power from the grid when the wind is not blowing, and the scale of the wind farms provides this.

What delivery partners does Cerulean have on board?

Our delivery consortium brings together a suite of tier-one industrial partners to develop, supply and install the NSRG. This includes NOV, Siemens Gamesa, Siemens Energy, DEME and Worley. Each partner brings a unique skill set to the project that will enable us to fast-track phase one of building out the grid. Never before in the UK has such a consortium been put in place at the early development stage, however this is necessary to provide the confidence the scheme can be delivered on schedule and to budget.

Each of our partners has experience delivering large-scale projects for the offshore oil and gas industry in the North Sea. Their understanding of the region and supply chain are invaluable in allowing us to deliver such an ambitious project at pace.

Why did Cerulean partner with Frontier Power?

Frontier Power was an easy first choice to partner with for this project. Their founders are both ex-National Grid senior executives and they have an impressive track record of delivering large transactions in the power sector, with over £1.5billion of offshore transmission assets under management. They have already delivered an interconnector between the UK and Germany and are developing a UK to Netherlands HVDC link.

The wealth of knowledge and experience they have accumulated assures us that they have the capabilities and prowess to facilitate power transmission on a mammoth scale.

Identifying and achieving regulatory and statutory changes, along with an in-depth insight into the UK grid access process from the team’s time working with the National Grid, provides us with great insight into how to seamlessly rollout grid access for clients across the North Sea. The strength of an integrated offshore transmission and floating wind development team is the key to success.

What timeline is Cerulean working to?

Our target is to have electrons flowing to meet the NSTD milestones for 2027 and 2030, which is crucial for both the UK and Scottish governments to demonstrate they are delivering on their climate change ambitions Further, we are aiming to build out before ScotWind developments start. This will allow the supply chain to respond, creating crucial partnering opportunities for the ports and getting the market ready to deliver floating wind at scale.

Early oil and gas electrification supports the country’s energy security, net zero action and delivers huge benefits to the supply chain and economy. We have fast-tracked phase one of the NSRG to prioritise this, to give the oil and gas operators access to green energy as quickly as we can, with flexibility and reliability. Work with end users has begun in earnest so that we can aim for the first power availability in 2027. Further phases will focus on exporting green power to the grids in UK and Europe.

What is the opportunity for Scotland and its supply chain?

It’s all about scale. The vast amounts of infrastructure required will provide a pipeline of work over many years and provide the opportunity for ports and yards to invest now in expansions ahead of ScotWind, getting the market ready to deliver.

Scotland is one of the most investable countries in the world for large-scale infrastructure in green energy because of its supply chain, which has built up an enviable legacy of expertise from responding to oil and gas projects over half a century.

By creating over 10,000 jobs, this type of ambitious renewable project will help scale Scotland’s green economy. It will make a material impact on the country’s emissions, removing millions of tonnes of CO2 a year to support a just transition. In total, the three windfarms alone will contribute over £12 billion GVA to the UK’s economy.

What’s next?

We will continue our engagement with the supply chain on the packages of work including the tri-floater and with the oil and gas operators on the impact we can make to their emissions reduction ambitions. We want to partner and help make this a smooth transition. We appreciate that the timescales are challenging for the operators and will bring our experience and flexibility to streamline this as much as possible.

Further down the line the direct export route to Europe is a huge opportunity for Scotland to be a globally leading exporter of clean energy, which will provide further economic value. Wind is a reliable source of energy in Scotland, particularly in the deeper offshore waters, so this is a real chance to set the North Sea up for providing the next half a century and beyond of secure energy production.

Global news

Renewable News SPONSORED BY 9

Dan Jackson

By Tsvetana Paraskova

UK REVIEW

UK BOOSTS EFFORTS TO DRIVE RENEWABLES INVESTMENT

Record-high wind and solar generation raised the share of renewable electricity in the UK last year, and the UK and Scottish governments are looking to further boost renewables and drive investment in green energy projects including carbon capture and storage (CCS) and green hydrogen.

The UK government also explores a major reform to the flagship renewables scheme to improve energy security and drive investment, while Ofgem is looking to reform local energy systems with the aim to establish a more decentralised, decarbonised, and dynamic energy system in Great Britain.

Record Renewable Power Generation

Production from renewable technologies in 2022 broadly matched the previous record high of 2020 and renewables share of electricity generation increased to 41.4% from 39.6% in 2021, largely due to wind and solar generation reaching new record highs, the Department for Energy Security and Net Zero said in its latest statistical release, Energy Trends, at the end of March 2023.

Wind generation hit a record high share of 24.6% of generation last year. Generation from fossil fuels fell slightly, down to a share of 40.8%, but generation from gas remained the principal form of UK generation at 38.4%, according to the government data.

Records in renewable generation were achieved in 2022 for both onshore and offshore wind, as well as solar PV. Where the previous 2020 record for renewable generation was driven by favourable weather conditions, the 2022 record was driven primarily by new capacity, especially in offshore wind, the report said.

wind speeds and sun hours were higher than in 2021.

Most notable was the spike in new capacity installation in the first quarter of 2022 when 1.5 GW was installed in offshore wind alone. New offshore wind continued to come on line in the second and third quarters before dropping off in the fourth quarter. For the year as a whole, 2.7 GW in offshore wind was installed, including key sites at Moray East (1.0 GW) and Seagreen (0.3 GW) in Scotland, as well as Hornsea Two in England (1.4 GW), according to the Energy Trends report

Plan To Bolster Clean Energy Industries

The UK outlined at the end of March steps to strengthen Britain’s long-term energy security and independence to help deliver a clean, prosperous future for the country. The plan is aimed at boosting the UK’s energy security and independence and reducing household bills for the long term while maintaining a world-leading position in achieving net-zero emissions by 2050.

“Transforming our energy system is no longer just about tackling climate change, it is also a matter of national security. To protect ourselves from future price spikes, we need to accelerate the move to cleaner, cheaper, homegrown energy.”

The measures include a commitment to carbon capture usage and storage (CCUS) with £20 billion funding. The first projects will be announced to progress to the next stage of the negotiations to roll out the first carbon capture clusters in the industrial heartlands. The round for areas to apply for two additional future clusters has also been launched and there will be an opportunity for further projects to be added to the first two clusters.

The government also looks to kick-start investment into the UK’s emerging floating offshore wind industry by launching a £160 million fund to support port infrastructure projects, securing the UK’s leadership in this new technology.

A £240 million Net Zero Hydrogen Fund will back the first tranche of new green hydrogen production projects, while the UK will also open the fifth round of the UK’s scheme to incentivise investment in renewable electricity, backed by a budget of £205 million.

The government will also launch a new competition to select the best small modular reactor technologies for development by the autumn of 2023.

The UK pledged to reform the planning process to enable the building of more energy infrastructure, including solar power and offshore wind projects, more quickly. Investments in EV charging points and infrastructure, and heat pumps will also be supported by government funding.

Chancellor of the Exchequer Jeremy Hunt said, “Transforming our energy system is no longer just about tackling climate change, it is also a matter of national security. To protect ourselves from future price spikes, we need to accelerate the move to cleaner, cheaper, home-grown energy.”

Accelerating Offshore Wind Power Deployment

The UK’s Offshore Wind Champion, Tim Pick, issued in April an independent report in which he made recommendations to accelerate the deployment of offshore wind farms in the UK.

The key recommendation in the report is that the UK needs to urgently upgrade the national grid for a world of high renewables penetration and widespread electrification of homes and businesses.

Compared to 2021, renewables generation was 10.4% higher; although weather conditions weren’t as favourable as in 2020,

The UK Government has set an ambition for 10 gigawatts (GW) of hydrogen production by 2030 – which could generate enough clean electricity to power all of London for a year.

“Grid connections are increasingly becoming the rate-limiting factor for our Offshore Wind deployment going forward,” Pick said in the report.

One particular area on which the government and the Devolved Administrations should

global news

10 www.ogv.energy - Issue 4

focus their attention is in seizing Britain’s first-mover advantage in the development of the new floating offshore wind (FLOW) industry, he noted.

To lead in this industry, the UK will need a strategy to support innovation, R&D, and industrialisation efforts as the technology transitions from bespoke demonstration projects to serial production and commercial scale deployment. Another key element of a floating offshore wind strategy should be catalysing investment in the large-scale world-class port infrastructure which will be vital to delivering projects and securing the largest possible share of supply chain jobs, growth, and know-how, the Offshore Wind Champion said.

“With bold, determined leadership we have a fantastic opportunity to lead the world in this technology, in the same way that Aberdeen has led the world in subsea Oil & Gas,” he noted.

In further developing its offshore wind industry, the UK needs to maintain focus on the competitiveness of the UK’s offer to Offshore Wind investors, while also recognising that the costs of the electricity system are ultimately borne by consumers, Pick said.

Energy Reforms

In mid-April, the UK government announced plans to explore a major reform to the government’s flagship renewables scheme, the Contracts for Difference (CfD). The reform could help drive further investment in renewable energy deployment and improve energy security.

Currently, CfD are awarded based on the bid price submitted by renewable energy generating stations, with the aim to increase deployment and ensure good value to electricity consumers and, over time, drive down costs.

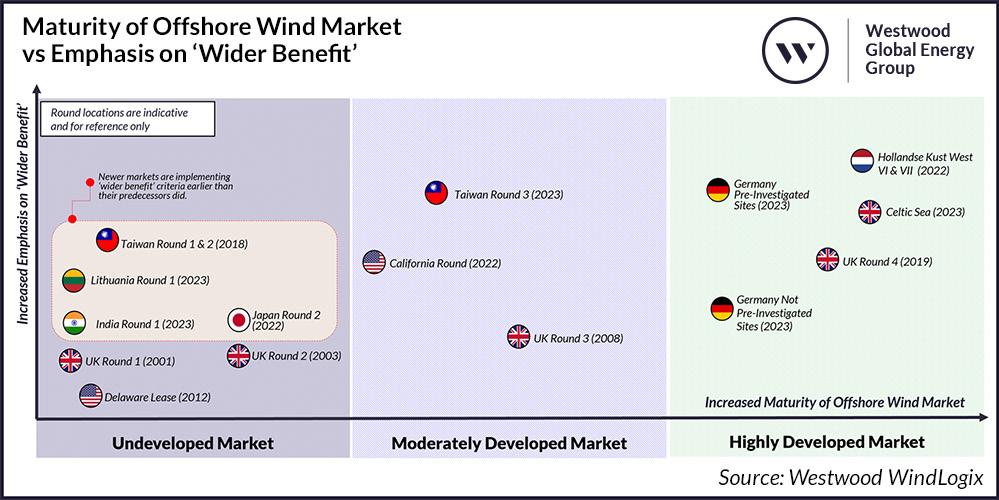

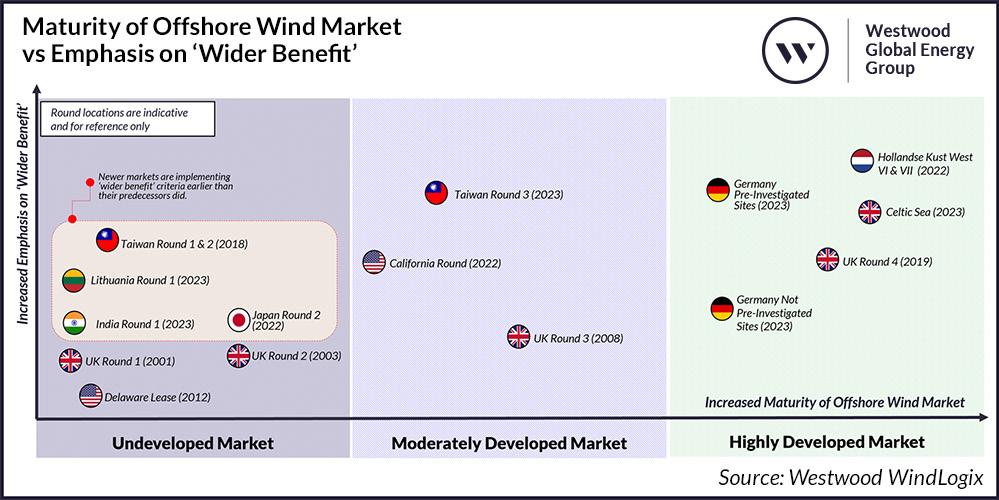

The government is now seeking evidence and views about reviewing applications not just on their ability to deliver low-cost renewable energy deployment, but also based on how much a renewable energy project contributes to the wider health of the renewable energy industry.

“These reforms could see applicants considering overall costs alongside other ‘non price factors’ - such as supply chain sustainability, addressing skills gaps, innovation and enabling system and grid flexibility and operability - when submitting their bids, which could help drive investment in the sector, grow the economy and boost the country’s energy security,” the government said.

Ofgem, the electricity market regulator, launched in March a consultation on the next steps in establishing a more decentralised, decarbonised, and dynamic energy system in Great Britain.

Akshay Kaul, Interim Director of Infrastructure and Security of Supply, said, “We need a radical rethink of the energy system, markets and grid to establish a net zero power system by 2035 and net zero economy by 2050. The role of local communities will be critical. That’s why we’re suggesting ways to make Britain’s energy systems and markets participatory and transparent.”

Referring to the future of distributed flexibility, Kaul noted, “We are setting out plans for how we can standardise and open markets – specifically by creating an ambitious vision for distributed flexibility involving a common ‘digital energy infrastructure’ which will allow more communities, businesses and organisations to buy and sell surplus renewable electricity and services when and where they need it.”

global news

Jeremy Hunt

Akshay Kaul

Renewable News SPONSORED BY 11

Tim Pick

By Tsvetana Paraskova

EUROPEAN REVIEW

EUROPE LOOKS TO ACCELERATE GREEN ENERGY ROLLOUT

The European Union is doubling down on renewables and is looking to speed up the installation of solar and wind power capacity and reform the electricity market design to protect consumers from volatile fossil fuel prices.

The EU is also looking to boost its competitiveness in clean technology manufacturing, and increased its targets for renewables share in the energy mix with recent legislation and proposed regulations.

Electricity Market Reform

The European Commission proposed in the middle of March a reform of the EU’s electricity market design to speed up renewables rollout and the phase-out of gas. The proposed legislation is also aimed at making consumer bills less dependent on volatile oil and natural gas prices and better protecting EU consumers from future price spikes and potential market manipulation. Finally, the Commission aims to make the EU’s industry clean and more competitive with the proposed reform.

The EU Council and the European Parliament will now have to discuss the proposal for a market reform and vote on a final new electricity market design later this year.

The legislation, as proposed by the European Commission, would introduce measures that incentivise longer-term contracts with non-fossil power production and bring more clean flexible solutions into the system to compete with gas, such as demand response and storage.

“This will decrease the impact of fossil fuels on the consumer electricity bills, as well as ensure that the lower cost of renewables gets reflected in there,” the Commission said.

The reform is also expected to promote open and fair competition in the European wholesale energy markets by enhancing market transparency and integrity.

Commenting on the Commission’s proposed reform, Naomi Chevillard, Head of Regulatory Affairs at SolarPower Europe, said,

“Homes and businesses will be able to access PPAs more easily. Businesses are set to benefit from new government de-risking schemes that backup their ability to sign these long-term energy supply contracts.”

The proposal “considers the role of electricity grids in facilitating access to green, lowcost, energy. Developers planning new solar projects will have more information on where, when, and how they can connect their solar to the grid,” Chevillard noted.

The WindEurope association said, “The Council and Parliament must now stick to this balanced proposal and end the current investment uncertainty caused by uncoordinated national market interventions.”

“The market design has been extremely efficient in matching supply and demand –and has given consumers years of affordable electricity prices,” said WindEurope CEO Giles Dickson.

“It’s good the Commission proposal builds on the strengths of the existing market design. What’s needed is an evolution not radical changes.”

Net-Zero Industry Act

The European Commission has also proposed the so-called Net-Zero Industry Act, aimed at scaling up the manufacturing of clean technologies in the bloc and making sure the EU is well-equipped for the clean energy transition.

The Act will improve conditions for investment in net-zero technologies by enhancing information, reducing the administrative burden to set up projects, and simplifying permit-granting processes. Under the Act, carbon dioxide capture targets are increased, to remove a major barrier to developing CO2 capture and storage as an economically viable climate solution, in particular for hard to abate energy-intensive sectors.

The Commission also presented ideas on the design and functions of the European Hydrogen Bank, an initiative to support the uptake of green hydrogen in the EU.

“This sends a clear signal that Europe is the place for hydrogen production,” the Commission said.

The first pilot auctions on renewable hydrogen production will be launched under the Innovation Fund in the autumn of 2023. Selected projects will be awarded a subsidy in the form of a fixed premium per kg of hydrogen produced for a maximum of 10 years of operation.

The Commission has also proposed a set of actions to ensure the EU’s access to a secure, diversified, affordable and sustainable supply of critical raw materials.

The Critical Raw Materials Act “will significantly improve the refining, processing and recycling of critical raw materials here in Europe. Raw materials are vital for manufacturing key technologies for our twin transition – like wind power generation, hydrogen storage or batteries,” European Commission President Ursula von der Leyen said.

“And we're strengthening our cooperation with reliable trading partners globally to reduce the EU's current dependencies on just one or a few countries.”

EU Raises Renewables Targets

At the end of March, the European Parliament and the Council reached a provisional political agreement to raise the EU’s binding renewable target for 2030 to a minimum of 42.5%, up from the current 32% target and almost doubling the existing share of renewable energy in the EU. Negotiators also agreed that the EU would aim to reach an indicative target of 45% of renewables by 2030.

The provisional agreement includes accelerated permitting procedures for renewable energy projects, with the purpose to fast-track the deployment of renewables as part of the EU’s REPowerEU plan to become independent from Russian fossil fuels, after Russia’s invasion of Ukraine.

“The agreement reaffirms the EU's determination to gain its energy independence through a faster deployment

global news

12 www.ogv.energy - Issue 4

of home-grown renewable energy, and to meet the EU's 55% greenhouse gas emissions reduction target for 2030,” the European Commission said, welcoming the deal

“A massive scaling-up and speeding-up of renewable energy across power generation, industry, buildings and transport will reduce energy prices over time and decrease the EU's dependence on imported fossil fuels,” the Commission added.

Walburga Hemetsberger, CEO of SolarPower Europe, said, commenting on the higher renewables target, “This sends a clear message to all stakeholders to prepare for system change. That means scaling investment, electricity grids, and our workforce, and of course, 45% is a floor, not a ceiling. We'll be working to deliver as much renewable energy by 2030 as possible,” Hemetsberger added.

Increased Cross-Border Cooperation

Several European countries have recently signed new agreements to deepen crossborder cooperation on clean energy and climate goals.

Norway and the EU established in April a Green Alliance to strengthen their joint climate action, environmental protection efforts, and cooperation in clean energy and the industrial transition.

“Several areas have been specifically mentioned, including carbon capture and storage, offshore wind power, hydrogen, critical raw materials, batteries and green shipping. These are areas where Norway can play a leading role,” Norwegian Prime Minister Jonas Gahr Støre said.

Norway and the EU announced the Green Alliance just before the summit on offshore wind of the leaders of countries of the North Sea. Nine Heads of State and Government and the President of the EU Commission met in Ostend, Belgium, at the end of April and agreed new commitments on the build-out of offshore wind in the North Sea.

The leaders set ambitious combined targets for offshore wind of about 120 GW by 2030 in the North Sea, with the aim to more than double the total 2030-capacity of offshore wind to at least 300 GW by 2050.

“We will continue planning for multiple energy hubs and islands as well as hybrid cooperation, multipurpose projects and increased connectivity by carrying out, where appropriate, a screening of the potential for offshore wind, and hydrogen production, in our entire North Seas,” the leaders said in the final declaration.

wind energy manufacturing capacities. The signatories stress that an expansion of offshore wind in the North Sea in line with Europe’s net-zero targets must be made in Europe.

“Major new investments are needed in manufacturing capacity and key infrastructure such as grids and ports,” the industry says.

“The North Sea is set to become Europe green powerhouse, leading the way in deploying offshore renewables to decarbonise our economies and to increase our energy security.”

European Commissioner for Energy, Kadri Simson, said at the summit, “The North Sea is set to become Europe green powerhouse, leading the way in deploying offshore renewables to decarbonise our economies and to increase our energy security.”

In an Industry Declaration, more than 100 companies representing the whole value chain of offshore wind and renewable hydrogen in Europe welcomed the reinforced offshore wind ambitions at the North Sea Summit. The Industry Declaration outlined the urgent need to strengthen Europe’s

As part of the North Sea Summit, the UK and the Netherlands jointly announced plans for a first-of-its-kind electricity link to connect offshore wind between the Netherlands and the United Kingdom. The interconnection, ‘LionLink’, aims to support decarbonisation, market integration, and strengthen security of supply. Connecting offshore wind via the first cross-border direct current cable of this size would be an important next step towards an integrated offshore grid in the North Sea, the Dutch government said. LionLink is a multi-purpose interconnector, which is designed to link a Dutch offshore wind farm of 2 GW to both countries via sub-sea interconnectors.

Norway announced at the end of March its first competitions for offshore wind areas, with which the Norwegian government takes a big step towards its ambition of allocating areas for 30,000 MW offshore wind by 2040.

“We are looking forward to receiving many good applications from relevant developers, so that we can allocate the project areas later this year,” said Norway’s Minister of Petroleum and Energy Terje Aasland

global news

"Stakeholders should prepare for system change. That means scaling investment, electricity grids, and our workforce, and of course, 45% is a floor, not a ceiling. We'll be working to deliver as much renewable energy by 2030 as possible"

Renewable News SPONSORED BY 13

Walburga Hemetsberger, CEO of SolarPower Europe image: www.solarpowereurope.org

Energy projects and business intelligence in the energy sector

The EIC is the leading Trade Association providing dedicated services to help members understand, identify and pursue business opportunities globally.

It is renowned for excellence in the provision of services that unlock opportunities for its members, helping the supply chain to win business across the globe.

The EIC provides one of the most comprehensive sources of energy projects and business intelligence in the energy sector today. www.eicdatastream.the-eic.com

DENMARK

Offshore Wind Farm Thor RWE Renewables

$2.37bn

A 1GW offshore wind farm located 20km off Nissum Fjord west of Thorsminde, in the Danish North Sea. Several major preferred suppliers have been announced for wind turbines, foundations, export and inter-array cables, and onshore and offshore substations.

The EIC delivers high-value market intelligence through its online energy project database, and via a global network of staff to provide qualified regional insight. Along with practical assistance and facilitation services, the EIC’s access to information keeps members one step ahead of the competition in a demanding global marketplace.

RENEWABLE PROJECTS

Contractors include Fred. Olsen Windcarrier, EEW SPC, Dajin Offshore, Jan De Nul, Hellenic Cables and Siemens Energy.

UNITED KINGDOM

Floating Offshore Wind Farm

Ayre

Thistle Wind Partners

$3.5bn

Development of a 1GW floating offshore wind farm off the coast of Orkney, successful through the ScotWind leasing round. Seabed surveys have commenced, which will include geophysical and metocean studies. Should consent be granted in 2025, financial close will occur in 2028.

JAPAN

Offshore Wind Farm Hibikinada

Hibiki Wind Energy

$1.5bn

Construction of a 238MW nearshore wind farm, located 10km off the Port of Kitakyushu City in Kyushu Island. Vestas has been selected to supply 25 x V174-9.5MW turbines, alongside long-term active management services for the units.

USA

Offshore Wind Farm Empire Wind II

Equinor & BP

$2bn

Proposal for an additional capacity in the lease area OCS-A 0512 14 miles south of Jones Inlet, Long Island, totalling 1,260MW. Sembcorp Marine Offshore Platforms has secured a turnkey EPC, offshore hookup and commissioning contract for the offshore substations of the Empire Wind 1 and 2 projects.

renewable PROJECTS

SPONSORED BY

renewable projects

1 1

2 2

3 3

4 4 5 9 10 11 12 6 7 8 14 www.ogv.energy - Issue 4

5

UNITED KINGDOM

Offshore Wind Farm

Hornsea Three Ørsted

$6bn

Development of a 2,852MW offshore wind farm located 120km off the coast of Yorkshire in the North Sea.

Cadeler has inked two contracts totalling between US$548m to US$768m for the installation of monopile foundations and approximately half of the project's wind turbines.

NKT has also secured a contract for the HVDC on- and offshore export cable system, estimated at around €500m.

6

BANGLADESH

Offshore Wind Farm Bay of Bengal Bangladesh

Bangladesh Ministry of Power, Energy and Mineral Resources

$3bn

26 prospective blocks have been identified in both deep and shallow seas. A site selection process for the Bay of Bengal and Bangladesh power system will be established and the two most promising blocks will be studied in greater detail during the detailed feasibility study.

7

INDONESIA

PLTP Baturaden Geothermal Power Plant

Sejahtera Alam Energy (SAE) $900m

A geothermal power plant in Baturaden, Indonesia, with a capacity of up to 2 x 110 MW. The reserves in the area can reach up to 280MW. SAE seeks to renew its exploration permit, which expired on 10 January 2023. Three exploration wells were drilled by SAE, but the results were unsatisfactory – hence the drilling of additional exploration wells.

8

UNITED KINGDOM

Westray Firth Floating Tidal Turbine Project

Orbital Marine Power $147m

Development of a 30MW tidal project consisting of 12 units of the 2MW each O2 floating tidal turbines in Westray Firth, adjacent to the European Marine Energy Centre (EMEC). The Crown Estate Scotland has awarded an option agreement to Orbital Marine Power for the project. Orbital already has a grid connection in place for the proposal.

9

NETHERLANDS

Offshore Solar Farm

Hollandse Kust Noord (North)

CrossWind $100m

Development of an offshore solar farm located around 18.5km from the coast. The farm will be positioned within the 759MW offshore wind farm Hollandse Kust Noord. Oceans of Energy was awarded the contract to install the solar plant, which will be online in 2025.

10

ISRAEL

EWP-EDF One Project

Eco Wave Power

$20m

Construction of a wave powered energy station at the Port of Jaffa in Tel Aviv. Eco Wave Power has signed a power purchase agreement (PPA) with the Israeli National Electric Company for the project. The PPA is based on the official feed-in tariff set by IEA in August 2022.

ARGENTINA –PARAGUAY

Corpus Christi Hydro Power Plant

Comisión Mixta del Río Paraná (COMIP)

$4.5bn

Development of a 2.83.1GW hydro power plant on the Paraná River, on the border between Argentina and Paraguay. The plant would feature 20-22 Kaplan turbines and concrete face rockfill dams (CFRDs). Argentina's Energy Secretary has presented the project to potential German investors.

12 NIGER

Solar Farm Niger

Savannah Energy $200m

Proposal of a 200MW solar project in southern Niger near the border with Nigeria and within 20km of the cities of Maradi and Zinder. The development consists of two solar farms with capacity between 50MW and 100MW. An MoU has been signed for the project, and feasibility studies will take place in the next 12 months.

renewable PROJECTS PROJECTS MAP SPONSORED BY

11

15

Photo credit: www.offshorewindscotland.org.uk

THE FUTURE OF RENEWABLE ENERGY

Flotation Energy and Vårgrønn are leading the way in the development of offshore wind projects. Determined to support the global movement to Net Zero and sustainable energy consumption, our core strengths lie in finding and developing sites for floating projects in deeper waters globally. Together we have harnessed our expertise to deliver reliable oil and gas electrification and decarbonisation projects that will pioneer the future of renewable energy.

Salamander signs exclusivity agreement for Scottish floating wind lease

Salamander, a joint venture between Ørsted, Simply Blue Group and Subsea7, has signed an exclusivity agreement as part of Crown Estate Scotland’s Innovation and Targeted Oil and Gas (INTOG) leasing round.

The 100 MW Salamander floating offshore wind project, located 35km off Peterhead, is designed to provide Scotland and its supply chain with an early opportunity to deliver floating offshore wind ahead of the larger-scale ScotWind buildout.

With the Exclusivity Agreement in place, the project will start offshore wind development work while Marine Scotland’s planning process for the INTOG Sectoral Marine Plan (INTOG SMP) is completed. With gigawatts of floating wind buildout expected in Scotland and the UK over the next decade, Salamander will be a valuable steppingstone to ensure local supply chains are ready and able to take full advantage of this opportunity.

Salamander will demonstrate a package of innovative technologies at commercial scale, readying them for roll out in utility-scale projects such as the ScotWind leases. These technologies will be critical to ensuring floating offshore wind energy is deliverable, affordable for consumers and contributes value to local industry and business.

The INTOG round was split into two pots – one for smaller scale innovation projects of 100 MW or less and one for larger projects linked to oil and gas infrastructure. Salamander was successful in the innovation route.

A series of public consultations are set to be held by the Salamander floating offshore wind project next month.

The in-person consultation events will take place from 2pm – 8pm on Wednesday, 7 June at Balmoor Stadium, Peterhead, and from 10am to 2pm on Thursday, 8 June at Crimond Public Hall. Each event will include a short presentation, a question-and-answer session, and opportunities to provide project feedback. The consultation will also be open virtually via the Salamander website between Monday, 5 June and Friday, 23 June.

wind

WIND ENERGY SPONSORED BY

16 www.ogv.energy - Issue 4

BlueFloat Unveils 7.5 GW of Floating Wind Projects in Philippines

On 2 June, BlueFloat Energy announced that the company had secured contracts for four (floating) offshore wind project sites in the Philippines and thus entry into the country’s offshore wind market.

On 2nd June, BlueFloat Energy announced that the company had secured contracts for four (floating) offshore wind project sites in the Philippines and thus entry into the country’s offshore wind market.

These are Wind Energy Service Contracts (WESCs), or Offshore Wind (OSW) Service Contracts (SCs), that are being awarded by the Philippines’ Department of Energy, which reported in April that it had allocated as many as 63 OSW SCs with a total potential capacity of 49.9 GW by that time.

BlueFloat Energy acquired contracts for sites that are located offshore Central Luzon, South Luzon, Northern Luzon, and Southern Mindoro.

According to the Philippine media, BlueFloat’s projects have a total capacity of 7.5 GW, with individual offshore wind farms’ capacities ranging between 1.5 and 3.5 GW.

In a press release on 2 June, the Spain-based developer said that it had been working for more than 18 months on unlocking the offshore wind potential in the country and that its plan was to leverage its floating wind expertise and global experience to develop projects along the Philippine coasts.

BlueFloat Energy also said it would work closely with the local communities, government entities, and other stakeholders to ensure that its projects comply with environmental regulations, respect local cultures, and provide long-term benefits for the communities in which it operates.

“BlueFloat Energy’s entry into the Philippine market fits well within the company’s strategy for the Asia Pacific region, with project developments already underway in Australia (first feasibility license application submitted for Greater Gippsland area in April this year), New Zealand and Taiwan. BlueFloat Energy now looks forward to supporting the Philippine government in the deployment of the cutting-edge floating wind technology and paving the way for the energy transition”, the company states in the press release.

In 2019, the World Bank published a report that estimates the Philippines’ technical offshore wind potential to be around 178 GW, with 18 GW of potential suitable for bottom-fixed and 160 GW for floating wind technology.

wind wind energy SPONSORED BY

Illustration; GustoMSC

17

Davis Larssen, Chief Executive Officer for Proserv

Interview by Moray Melhuish – Founder of Annet Consulting, an Offshore Wind and Subsea Specialist

Interview by Moray Melhuish – Founder of Annet Consulting, an Offshore Wind and Subsea Specialist

Hi Davis, can you introduce yourself and Proserv, please?

I’m Davis Larssen, Chief Executive Officer (CEO) of Proserv. We are Aberdeen and UK headquartered, traditionally within oilfield services, and a global controls technology company that has spent the last three or four years making a pivot into renewables. I have been in the business myself for 13 years across various roles and I enjoy playing a central part as CEO, driving Proserv into a new direction.

We've got 13 sites around the world, including several in the UK and a sizeable presence in Houston, Texas, two big facilities in Norway, and then four locations across the Middle East and India.

How did you find the pivot into renewables? How was the reception?

The first year or two, I would say there was a lot of 'Why are Proserv here? What do you think you can do for us?' because we were seen as an oilfield services company or a controls technology company. But I would say over the last 12 to 18 months, that view has very much changed to 'We now recognise and understand what you can do. How can you better help us to make those forward steps?' So I have personally seen a big change with that.

That's good to hear. At the end of the day, it is an energy transition. There's no point in getting rid of all the expertise from before and reinventing the wheel. Do you think the amount of capital coming in from oil and gas has helped that perception?

I think it's helped in some ways. We've seen some of the major oil and gas players over the last few years take a more visible part in renewables. So, a lot of the bigger customers from oil and gas are also pivoting into that space, doing a similar thing to what we've done. At the risk of getting into a contentious area, we have the whole political landscape that's behind it all. But certainly, as somebody who's been in the north-east of Scotland for

30 years of my life, I see a huge wealth of skill sets and expertise in this area that, if we are not careful, we could lose substantially and so not embrace the ability to transform Scotland and the UK's wider fortunes in offshore wind, and floating offshore wind specifically.

Did I read that your ECG™ holistic cable monitoring system for offshore wind had been installed at Dogger Bank?

Yes, you did. So, it's being installed on Dogger Bank A and B, hopefully it will be getting installed on Dogger Bank C and subsequent developments. It is the first of its kind and it's in the process of being installed on Equinor’s Hywind Scotland as well, which will give it another full live demonstration of its real-time monitoring capabilities on a floating asset.

How do you find the actual contracts used in offshore wind?

Right now, because they very much follow the EPC ‘lowest up-front cost wins’ model, there's very little focus on the total cost of ownership, reliability and uptime. We think that's where the significant improvements are going to come. We know, for example, through our ECG™ solution and what we're projecting through our cable monitoring and our developing wider holistic wind farm monitoring, you can effectively increase the capacity of a typical offshore wind farm by 15 to 18% - that's like the equivalent of an extra free wind turbine, essentially, if you can manage the balance between efficiency, reliability and uptime in the right way. But if operators and developers don’t think about that at the outset and new assets are approached solely from an EPC perspective, then it isn’t built into the whole design functionality. This is one of the major parameters that we feel needs to change in the industry.

Thinking about your entry into the offshore wind market and the potential for your technology, it sounds like the opportunity for that capability is massive. I would imagine that there are also considerable opportunities for potential employees too?

Any given month, we've got roughly 40 to 45 open vacancies globally across the 13 sites I referred to. Our success rate at the moment is we're probably hiring about 25 to 30 of those vacancies every month. We're hiring right across the scope, in terms of functions, so predominately engineering based and we've got everything from wind turbine controls engineers to software developers, to mechanical and hydraulic engineers, project managers - everything across that whole spectrum because obviously, we're trying to push into a new area here. So, we are looking to hire people who've got specific domain knowledge in those areas to marry them up with the existing know-how that we have internally, and those 40 to 45 jobs are effectively across the industry as well.

Given that you are headquartered in Aberdeen, Scotland, are you seeing big demand for local content?

We are seeing a lot of people ‘talk’ about local content. It's an interesting conundrum right now because if you look at a lot of the big hardware and infrastructure, you know, the turbines, the blades, the foundation systems - we're struggling from an infrastructure perspective to build that kind of stuff in Scotland and the UK in general. And typically, where we've got the capacity, we struggle to compete with other parts of the world where they have lower costs of labour.

So, I think there's a geopolitical question, or problem, that's going to come to the fore in the next few years around that. I can certainly see us being prepared to pay a premium to build that equipment in Scotland to create jobs. But I think the limitation is going to be that we'll never be in a position to export this capability to other parts of the world. With what I've been talking about and what Proserv is focused on from a software engineering and controls domain knowledge perspective, the cable monitoring perspective, we've got the ability, we think, to create a number of highly paid, highly skilled jobs and use them as an exportable trend like we did in oil and gas 50 years ago from the north-east – but not on the infrastructure side. And that's a big change that the industry will have to go through over the coming years.

wind

18 www.ogv.energy - Issue 4

Proserv is involved in both oil and gas and offshore wind, which is great. As I say, it's an energy transition, so what is a fair transition to you?

It's a very good question. Four or five years ago when we started our pivot, we recognised the transition was underway and we didn't quite know at that point where we should play in it, but it's obviously gathered pace since then. So, the transition is important. I think it's difficult for anybody to argue that we don’t need, as a society, to move to more renewable sources of energy globally, but it can't happen overnight.

We have been reliant on oil and gas for a long, long time. So, from an energy security perspective, as has been highlighted by the conflict in the last 18 months in Ukraine, that's brought added pressure to a lot of markets, including the UK, and we need to make this transition in a just and viable manner to protect the expertise and the livelihoods of people who are employed in that sector today, and to make sure that some of those people are capable of making the pivot across into the renewables sector as well.

So, I think it's a struggle to put an exact timeline on it but if you look today at the percentage of energy in the UK generated by renewables versus oil and gas – if we simply turn off oil and gas, we’d have big problems. We would struggle to function as a society, and I realise that is not necessarily a popular view with everybody, but for me it's the reality of where we are, probably for the next five to ten years.

We need to make the transition in a just manner, to protect and retain the skills sets and the knowledge base to benefit renewables, at the same time as not having to import our energy from somewhere else, potentially at much greater cost and with a bigger carbon footprint.

That's right. So, how do we accelerate that transition from your perspective and particularly, of course, the offshore wind elements which you're involved with?

I think there are a few elements to this. Part of it is adopting technology, and part of it is involving the supply chain in creating solutions. So, how do we help some of the bigger operators and developers to have an incentive to test new technologies, to accelerate that process, to try something different? So, I think there needs to be some discussion around that.

Ideally for me, I would like to see a multiyear energy policy covering the whole of the UK. So, something like a 20-year strategy that sits above the political dynamic that happens from election to election. I realise I am not in control of that, but I think that is the main element, if you could wave a wand and change one thing. To give the UK a chance to stand head and shoulders above any other country in the world.

For those who are students, and perhaps early on in their careers, would you have any advice to people considering a career in the industry.

There are probably a few aspects to this that I would reflect on. One is don't get hung up on renewables versus oil and gas. In the last few years we’ve seen some graduates and apprentices saying they don't want to come into oil and gas because it's a dead industry. The skill sets are transferable between the two. A lot of the bigger oil and gas operators are all making pivots towards renewables. If you join a company in oil and gas today, the chances are you'll be involved in renewable energy, if not tomorrow, at some point in the future.

I would say, don't be hesitant or afraid to step into roles where you don't know how you're going to be successful, or situations where you don't know what the solution is, because developing the ability to be part of a team that solves complex problems in harsh environments stands you in huge stead. If you are starting out as a graduate or an engineer, don’t always take the easy option. Sometimes, the harder option is the better long-term gain to develop you as a person.

How do you define success for Proserv?

We're very well known today in the oil and gas space, I would like to think, as the controls technology provider of choice. I would also like to think in five to ten years we are recognised as that across the broader energy space. Totally OEM agnostic, and the partner that operators come to for ‘the position of truth’, and to understand how they improve the performance, the reliability and uptime of their offshore wind or oil and gas infrastructure. That’s where we want to get to.

wind watch full interview www.ogv.energy/play OR LISTEN TO THE PODCAST

wind energy SPONSORED BY

19

A Proserv technician surveys an offshore wind farm

Adam Morrison, UK Country Manager at Ocean Winds

Interview by Moray Melhuish – Founder of Annet Consulting, an Offshore Wind and Subsea Specialist

I am delighted to be here with Adam Morrison today. Adam is UK Country Manager at Ocean Winds. Welcome to the podcast Adam. Can you introduce yourself and Ocean Winds please Adam?

I am the Country Manager for Ocean Winds UK. Ocean Winds is an international offshore wind developer, and we aim to develop, construct, and operate offshore wind assets in a number of different markets. We were formed in 2020 by EDP Renewables and ENGIE to focus on the offshore wind market and to grow, which we have done quite successfully in the last few years.

Nearly 17 gigawatts in our pipeline and around a third of that is in the UK. So, the UK and the Edinburgh office is a key hub in our business.

What can you tell us about your UK portfolio then?

We have got a really interesting portfolio now, particularly off the back of ScotWind results last year, so we have a mixture of assets in different phases. So, Moray East is operational, Scotland's largest fully operational offshore wind farm at the moment. Hot on its heels is Moray West, which is now in construction, so two projects in the Moray Firth that together will deliver nearly 2 gigawatts of power.

But we have now also got development pipeline all located in Scotland, comprised of a site called Caledonia which is predominantly fixed bottom offshore wind site near Moray East and Moray West in the outer Moray Firth, and two sites located just off Shetland. So, a very diverse portfolio, the Shetland sites will be floating. So, next year’s technology will be a mixture of different phases that all those projects are in.

Can you give us a flavour for the type of budgets, the number of people? Tell us a little bit more about what it takes to deliver windfarm projects like this.

Yeah, I think that's one of the things that's really fascinating about offshore wind in particular, the amounts is staggering. So, we're talking about £2 billion plus capital investment projects and the spend even in the development phase, you typically are looking at tens into hundreds of millions just during the development phase of these projects. It's a staggering amount of investment and we can only do that successfully with the right people to do it.

That's really the core of what we do. I would say in particular, in our hubs like Edinburgh and Fraserburgh, where we have got staff that develop and build and operate these projects.

Great. And what's the time scale like for delivery of these other projects? So, you mentioned Morey East, Caledonia.

So the next thing on the horizon in terms of operational projects is Moray West and we hope to have more that fully operational by 2025. So, it's in the middle of construction at the moment. It should start producing power next year, be fully operational by 25 and we then like to deliver Caledonia by 2030. That depends on delivery of grid connections for all the Scotland projects. But Caledonia, we want to bring forward quickly. It's one of the only fixed bottom sites that was awarded through ScotWind, and we believe we can be fast with that site.

The Shetland projects are more complex in their nature because they're very remote and so we need to work with our partners on those projects to identify the route to market and the best way to bring those projects forward, which we're working on at the moment. But we're ambitious here about getting these projects delivered quickly.

How does your supply chain look for delivering these projects? How many direct suppliers would you have for the construction of wind farm and what type of goods and services would they be for?

Traditionally in construction phase, offshore wind has been delivered on a multi contract basis, but with a small number of large contracts, so, wind turbines, foundations, cable substations. But then there's a huge number, probably into the thousands by the time you complete a project. If you go through development and construction phase into the thousands of smaller contracts that you order and the size of those. So, we're interacting with them, so another thing by offshore wind I think makes it really interesting to work in is just the breadth of different supply chain capabilities that we need to draw on from local legal services through to international fabrication manufacturing contracts. Nowadays there's been a move towards progressively more multi contracting. So that's something that we are doing, for example, at Moray West.

Okay. Can you tell me more about supply chain constraints? Are there specific areas where you see shortages, for example, or challenges?

Yes, it's complex, particularly at the moment because of world events, of course. But I think the three I would pick particularly are foundations and that that's largely driven by scale now of foundations, whether that's fixed bottom or floating offshore.

The scale is incredible. So, there are very small number of places that have the infrastructure and the people to produce, to fabricate steel work on that sort of scale.

Another example and, you know, I think that this is very much a current day issue for the industry, both for construction and operation, is large vessels have. Again, the scale of what we're installing now is enormous, wind turbine technology keeps growing, which is what's helped bring the cost of energy down. And so therefore there's quite a small range of vessels that can actually install the type of equipment that we're buying and so that is present day constraint. But there is investment going into going into that new, larger next generation class vessel appearing. Then the third, which is kind of often forgotten and it's maybe not seen as being the most exciting bit of the supply chain, but I think is absolutely crucial is electrical equipment. Even if you look away from the wind farms into our energy networks, we need to transform our energy networks around the world and the scale of investment in transmission networks, so things like cables and transformers is incredible.

So you mentioned your footprint in the northeast of Scotland, in Fraserburgh, you must have quite a considerable footprint locally there.

We do, so we have a base in Fraserburgh. We're developing a new base in Buckie as well. So, we'll have a hub across those two sites. But we've also built electrical infrastructure across two different substation sites with different cable routes as we have been present in that area now for more than ten years, either engaging through the development of our projects or by building facilities and having offices and having presence there.

Thinking about the impact off offshore winds more broadly, how do we address concerns around biodiversity?

I expect that we're going to face progressively greater scrutiny here as we deploy more and more. So, there is cumulative impacts of what we do and also floating offshore wind brings a different type of interaction with the environment in certain ways. So, we can never rest on our laurels now. But we're subject to quite a lot of scrutiny through the planning process.

So, I do feel that it's something that we as a developer do well or aim to do well. We've got a very strong team and a lot of in-house capability and we're subject to a lot of scrutiny. So, these projects have to show that they've assessed the impact that they're going to have very carefully before they're deployed.

wind

20 www.ogv.energy - Issue 4

The other thing I would say, and again, bearing in mind the planning trajectory here, we want to deploy fixed and floating offshore wind in a greater scale, we have to keep data gathering and that's connected with every project, but also just in the round as an industry we have to keep data gathering so that we are constantly able to assess what is best practice.

We work with the universities and other research institutes and consultants to make sure we're constantly evaluating our approach to this and making sure that we're adopting best practice.

Tell me about your innovation team.

Yeah, that's something we're proud of. It was formed early in the life of Ocean Winds. I think probably the core rationale is that we're constantly pushing the boundaries as a sector. If you look at some of the things we're doing in our portfolio, for example, we're using next generation wind turbine technology, pushing the boundaries of using monopiles in deeper water.

We're constantly pushing. So, it makes sense to then make sure that structurally we're looking at innovation within our business. And so that team is there to coordinate innovation activities that we're doing across the portfolio and make sure it's championed. So, it looks at all different technologies, but I think one area that's particularly interesting is floating wind, where there's a lot of innovation still to come, although we've deployed one of the largest floating projects in the world, continual innovation is going to be needed to fully commercialise floating offshore wind

What was it about the UK that made ocean wins

want to invest here?

We had a cornerstone project, so Moray East I would say is typically described as one of the cornerstone projects of the Ocean Wind's portfolio. So, we had that within the existing portfolio that was already a joint venture between EDPR and ENGIE. So, that gave us the starting point. The UK market is one of the largest and that's through relatively long-term political support for the sector, and that's crucial now, there's now ever-increasing international competition in this sector, so keeping the investment conditions right, so that international investors like us continue to spend money developing and building projects is absolutely crucial.

So, we were in the UK market because of the seabed made available and there was support and that gave us the cornerstone projects. But now to build on that, we need to make sure as a country that the investment conditions stay right and that we can keep building projects.

The UK is one of the world's largest markets for offshore wind. How do we keep the UK in that leading position and any changes that you would like to see made to enable that to h appen?

Yeah, it's really important that the UK doesn't rest on its laurels. I think make making sure investment conditions are right is one thing, but perhaps away from offshore wind project delivery, I think much greater ambition on how we deploy our energy networks is needed. We've historically taken a very precautionary approach to building new electricity networks in order to

protect the electricity consumer and that, of course, is well intentioned. But I think we need to start treating it as an emergency and building our energy networks on an emergency footing, so that's the key change.

And I'd like to find out a little bit more about you. How do you come to be UK country manager for Ocean Winds? Tell us about your career.

So I started in wave and tidal nearly 20 years ago, which was a fantastic few years and very cutting edge. And I ended up in wave and tidal almost by complete accident, but it was an amazing few years working on that that side of the sector in Edinburgh. I then did a whistle stop tour of different technology, so I moved into small onshore wind and then larger onshore wind and eventually the offshore wind sector over ten years ago. I've been here in that space since and I've been working on the Moray Firth projects actually for near enough ten years now.

Are we doing enough to get young people into our industry?

We can never do enough. I think we're doing more and more, we as a developer and I think the sector generally is doing more and more. The word collaboration can get overused sometimes, but I think there's been some good collaboration around skills and STEM initiatives. We're upping our game, but it is a challenge, the skills problem is going to bite us. I don't think it's only young people, I think we need to look broadly how we bring more people and a diverse range of skills and backgrounds into our sector.

So, we've got to sell why people would want to work in renewables. We think it comes naturally to us, we work in renewables every day and we love it. So, it's something that we take for granted, I think, but we need to we need to sell the sector and we need to make sure we commit enough time to developing our next generation of workforce or we are going to run substantially short on people.

As the country manager for the UK, how do you define success for the organization that you lead?